Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Lyra Therapeutics, Inc. | d65078dex991.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 7, 2020

LYRA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39273 | 84-1700838 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

480 Arsenal Way

Watertown, MA 02472

(Address of principal executive offices) (Zip Code)

(617) 393-4600

(Registrant’s telephone number, include area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, $0.001 par value per share | LYRA | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 8.01. | Other Events. |

On December 7, 2020, Lyra Therapeutics, Inc. (the “Company”) reported positive top-line results from its Phase 2 LANTERN clinical trial, a randomized, controlled, patient blinded clinical trial designed to evaluate safety and efficacy in chronic rhinosinusitis (“CRS”) patients both with and without nasal polyps who have failed previous medical management but have not undergone endoscopic sinus surgery. The trial was designed to enroll 99 evaluable patients with the potential to increase to up to 150 patients and was initiated in May 2019 at sites in Australia, Austria, Czech Republic, New Zealand and Poland. In December 2019, the U.S. Food and Drug Administration (the “FDA”) authorized the Company’s investigational new drug application, and, prior to the COVID-19 global pandemic, the Company planned to enroll patients in the United States. However, in light of developments relating to the COVID-19 global pandemic, the Company discontinued enrollment at 67 patients in its Phase 2 LANTERN clinical trial and did not enroll any patients in the United States.

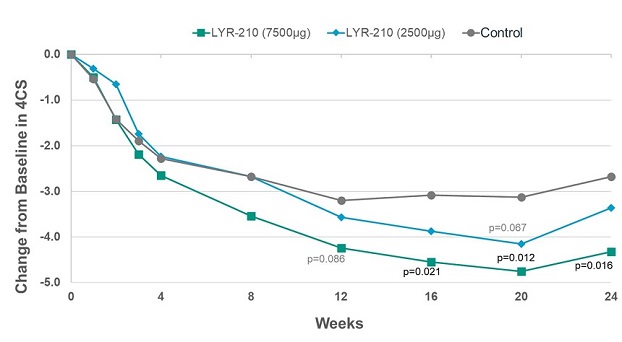

In its readout of top-line results, the Company reported that, at the 7,500 µg dose, LYR-210 achieved statistically significant improvement in the composite four cardinal symptoms score (“4CSS”) in favor of the treatment arm as measured by the change from baseline at week 16 (-1.47) (p=0.021), week 20 (-1.61) (p=0.012) and week 24 (-1.64) (p=0.016) (see Figure 1, below). However, although a strong treatment effect was observed at week 4, LYR-210 did not achieve the primary endpoint of change from baseline in 4CSS at week 4 at either the 7,500 µg dose (-0.36) (p=0.306) or 2,500 µg dose (0.04) (p=0.525). The Company believes this was due primarily to the discontinuation of enrollment related to the COVID-19 global pandemic. As a result of the decrease in the number of patients enrolled from planned (99 evaluable) to actually enrolled (67), a greater magnitude of change from baseline in 4CSS at week 4 and/or a smaller standard deviation associated with the change from baseline was required in order to achieve statistical significance for the primary endpoint at week 4.

Figure 1. Total Symptom Improvement by 4CSS for Phase 2 LANTERN Clinical Trial.

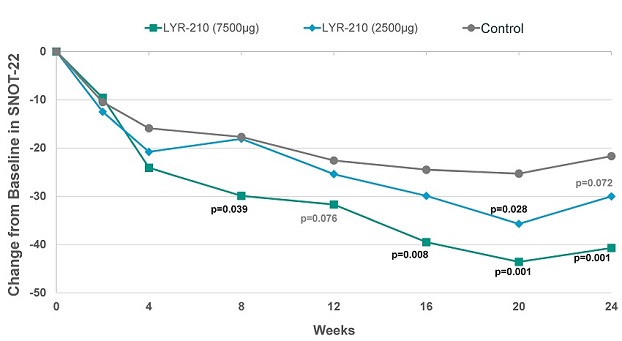

Furthermore, at the 7,500 µg dose, LYR-210 achieved statistically significant improvement in SinoNasal Outcome Test (“SNOT-22”) score in favor of the treatment arm as measured by the change from baseline at week 8 (-12.2) (p=0.039), week 16 (-15.0) (p=0.008), week 20 (-18.4) (p=0.001) and week 24 (-19.0) (p=0.001) (see Figure 2, below). In particular, the improvement of the 7,500 µg dose of LYR-210 at week 24 over the control group (-19.0) was over two times the minimal clinically important difference of -8.9.

Figure 2. Total Symptom Improvement by SNOT-22 for Phase 2 LANTERN Clinical Trial.

LYR-210 was observed to be safe and well-tolerated at all doses in the trial. There was one reported serious adverse event, which was deemed to be unrelated to LYR-210. No treatment-related serious adverse events were reported. Treatment-related adverse events included epistaxis, rhinitis, rhinorrhea and headache. All treatment-related adverse events were generally mild to moderate in nature, other than one incident of increased viscosity of upper respiratory secretion in the 2,500 µg dose treatment arm, and in line with the known safety profile of mometasone furoate.

Full results from the Company’s Phase 2 LANTERN study will be submitted for future presentation at a scientific meeting. Given the comparable safety profile of LYR-210 at both 2,500 µg and 7,500 µg doses, the Company anticipates progressing the LYR-210 program at the 7,500 µg dose level, and plans to initiate a pivotal Phase 3 study for LYR-210 in CRS for both non-polyp and polyp patients following the Company’s expected end of Phase 2 meeting with the FDA in mid-2021.

On December 7, 2020, the Company issued a press release in connection with the foregoing, which is furnished as Exhibit 99.1 to this Current Report on Form 8-K (the “Current Report”). Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Current Report that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding the Company’s lead product candidate LYR-210, the presentation of top-line results relating to the Company’s Phase 2 LANTERN clinical trial for LYR-210 and the Company’s plans to initiate a pivotal Phase 3 study for LYR-210 in CRS for both non-polyp and polyp patients.

These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause the company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the fact that the company has incurred significant losses since inception and expects to incur losses for the foreseeable future; the company’s need for additional funding, which may not be available; the company’s limited operating history; the fact that the company has no approved products; the fact that the company’s product candidates are in various stages of development; the fact that the Company may not be successful in its efforts to identify and successfully commercialize its product candidates; the fact that clinical trials required for the company’s product candidates are expensive and time-consuming, and their outcome is uncertain; the fact that the FDA may not conclude that certain of the company’s product candidates satisfy the requirements for the Section 505(b)(2) regulatory approval pathway; the Company’s inability to obtain required regulatory approvals; effects of recently enacted and future legislation; the possibility of system failures or security breaches; effects of significant competition; the fact that the successful commercialization of the company’s product candidates will depend in part on the extent to which governmental authorities and health insurers establish coverage, adequate reimbursement levels and pricing policies; failure to achieve market acceptance; product liability lawsuits; the fact that the company relies on third parties for the manufacture of materials for its research programs, pre-clinical studies and clinical trials; the company’s reliance on third parties to conduct its preclinical studies and clinical trials; the company’s inability to succeed in establishing and maintaining collaborative relationships; the company’s reliance on certain suppliers critical to its production; failure to obtain and maintain or adequately protect the company’s intellectual property rights; failure to retain key personnel or to recruit qualified personnel; difficulties in managing the company’s growth; effects of natural disasters; the fact that the global pandemic caused by COVID-19 could adversely impact the company’s business and operations, including the company’s clinical trials; the fact that the price of the company’s common stock may be volatile and fluctuate substantially; significant costs and required management time as a result of operating as a public company and any securities class action litigation. These and other important factors discussed under the caption “Risk Factors” in the Company’s Quarterly Report on Form 10-Q filed with the SEC on November 10, 2020 and its other filings with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While the company may elect to update such forward-looking statements at some point in the future, it disclaims any obligation to do so, even if subsequent events cause its views to change.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits relate to Item 8.01, and shall be deemed to be furnished, and not filed:

| Exhibit |

Description | |

| 99.1 | Press Release issued by Lyra Therapeutics, Inc. on December 7, 2020 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| LYRA THERAPEUTICS, INC. | ||||||

| Date: December 7, 2020 | By: | /s/ R. Don Elsey | ||||

| R. Don Elsey | ||||||

| Chief Financial Officer | ||||||