Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRIGGS & STRATTON CORP | brhc10017681_8k.htm |

Exhibit 99.1

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MISSOURI

SOUTHEASTERN DIVISION

|

§

|

Chapter 11

|

|

|

In re:

|

§

|

|

|

§

|

Case No. 20-43597-399

|

|

|

BRIGGS & STRATTON

|

§

|

|

|

CORPORATION, et al.,

|

§

|

(Jointly Administered)

|

|

§

|

||

|

Debtors.

|

§

|

|

|

§

|

NOTICE OF FILING OF PLAN SUPPLEMENT

IN CONNECTION WITH AMENDED JOINT CHAPTER 11

PLAN OF BRIGGS & STRATTON CORPORATION AND ITS AFFILIATED DEBTORS

PLEASE TAKE NOTICE THAT:

1. On July 20, 2020 (the “Petition Date”), Briggs & Stratton Corporation and its debtor affiliates in the above-captioned cases, as debtors and debtors in possession (collectively, the “Debtors”), commenced cases under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”)

in the United States Bankruptcy Court for the Eastern District of Missouri (the “Bankruptcy Court”).

2. On October 9, 2020, the Debtors filed the Joint Chapter 11 Plan of Briggs & Stratton Corporation and its Affiliated Debtors [Docket

No. 1066].

3. On November 9, 2020, the Debtors filed

the Amended Joint Chapter 11 Plan of Briggs & Stratton Corporation and its Affiliated Debtors [Docket No. 1226] (the “Plan”).1

4. On November 10, 2020, the Bankruptcy

Court entered the Order (I) Approving Disclosure Statement; (II) Establishing Notice and Objection Procedures for Confirmation of Plan; (III) Approving Solicitation Packages and

Procedures for Distribution Thereof; (IV) Approving the Form of Ballots and Establishing Procedures for Voting on the Plan; and (V) Granting Related Relief [Docket No. 1233] (the “Solicitation Procedures Order”).

1 Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the Plan.

5. In accordance with the Plan and

Solicitation Procedures Order, the Debtors hereby file this Plan Supplement consisting of the following documents:

|

Exhibit A

|

Amended Organizational Documents

|

|

Exhibit B

|

Plan Administrator Agreement (Substantially Final Version)

|

|

Exhibit C

|

Assumption Schedule

|

|

Exhibit D

|

Section 1129(a)(5) Disclosure

|

|

Exhibit E

|

Retained Causes of Action

|

6. The documents contained in this Plan

Supplement are integral to, and are considered part of, the Plan. If the Plan is approved, the documents contained in this Plan Supplement will be approved by the Bankruptcy Court pursuant to the order confirming the Plan.

7. A hearing to consider confirmation of

the Plan is scheduled to begin on Friday, December 18, 2020 at 9:00 a.m. (Prevailing Central Time)

before the Bankruptcy Court (the “Confirmation Hearing”).

8. The form of the documents contained in

this Plan Supplement filed herewith reflects the latest draft of each document as of December 4, 2020. The Debtors reserve all of their respective rights with respect to the form of documents filed herewith and such documents remain subject in

all respects to revision by the Debtors.

9. Copies of the exhibits contained in this Plan Supplement and all documents filed in these chapter 11 cases are available free of charge by visiting http://www.kccllc.net/briggs. You may also obtain copies of the pleadings by visiting the Bankruptcy Court’s website at https://www.moeb.uscourts.gov in accordance with the procedures and fees set forth therein.

2

Dated: December 4, 2020

St. Louis, Missouri

|

Respectfully submitted,

|

||

|

CARMODY MACDONALD P.C.

|

||

|

/s/ Robert E. Eggmann

|

||

|

Robert E. Eggmann, #37374MO

|

||

|

Christopher J. Lawhorn, #45713MO

|

||

|

Thomas H. Riske, #61838MO

|

||

|

120 S. Central Avenue, Suite 1800

|

||

|

St. Louis, Missouri 63105

|

||

|

Telephone: (314) 854-8600

|

||

|

Facsimile: (314) 854-8660

|

||

|

Email:

|

ree@carmodymacdonald.com

|

|

|

cjl@carmodymacdonald.com

|

||

|

thr@carmodymacdonald.com

|

||

|

Local Counsel to the Debtors and

|

||

|

Debtors in Possession

|

||

|

-and-

|

||

|

WEIL, GOTSHAL & MANGES LLP

|

||

|

Ronit J. Berkovich (admitted pro hac vice)

|

||

|

Debora A. Hoehne (admitted pro hac vice)

|

||

|

Martha E. Martir (admitted pro hac vice)

|

||

|

767 Fifth Avenue

|

||

|

New York, New York 10153

|

||

|

Telephone: (212) 310-8000

|

||

|

Facsimile: (212) 310-8007

|

||

|

Email:

|

Ronit.Berkovich@weil.com

|

|

|

Debora.Hoehne@weil.com

|

||

|

Martha.Martir@weil.com

|

||

|

Counsel to the Debtors

|

||

|

and Debtors in Possession

|

||

3

Exhibit A

Amended Organizational Documents

ARTICLES OF AMENDMENT

OF

ARTICLES OF INCORPORATION

OF

BRIGGS & STRATTON CORPORATION

December [●], 2020

Briggs & Stratton Corporation, a corporation organized and existing under the laws of the State of Wisconsin (the “Corporation”), hereby certifies as follows:

1. The name of the Corporation is Briggs &

Stratton Corporation.

2. The Articles of Incorporation of the Corporation

shall be amended by adding a new Tenth Article as follows:

“ARTICLE X

Issuance of Non-voting Equity Securities

To the extent provided by Section 1123(a)(6) of chapter 11 of title 11 of the United States Code, the Corporation shall not be permitted to issue

any non-voting equity securities.”

3. The Articles of Incorporation of the Corporation

shall be amended by deleting Section (a) of Article V and replacing it in its entirety with the following:

“(a) The authorized number of directors of the corporation which shall constitute the entire Board of Directors shall be one (1). At each annual

meeting of shareholders, the holders of shares entitled to vote in the election of directors shall elect the director to hold office until the next succeeding annual meeting, the director’s successor has been selected and qualified, or the

director's earlier death, resignation or removal.”

4. These Articles of Amendment were adopted pursuant to

the Amended Joint Chapter 11 Plan of Briggs & Stratton Corporation and Its Affiliated Debtors, dated [●], 2020 In re Briggs & Stratton Corp., et al., Case No. 20-43597 (Docket No. [●]) (as may be altered, amended, or modified from time to time, and including all appendices exhibits,

schedules and supplements thereto, the “Plan”), which was confirmed by order of the United States Bankruptcy Court for the Eastern District of Missouri (the “Bankruptcy Court”) entered [●], 2020 In re Briggs & Stratton Corp., et al., Case No.

20-43597 (Docket No. [●]), and thereby has been approved pursuant to Section 180.1008 of the Wisconsin Business Corporation Law.

5. The Bankruptcy Court had jurisdiction of the Plan

under title 11 of the United States Code, 11 U.S.C. § 101 et seq.

[Signature page follows.]

IN WITNESS WHEREOF, the undersigned has duly executed these Articles of Amendment of Articles of Incorporation as of the date first written above.

|

Name:

|

Kathryn M. Buono | ||

|

Title:

|

Vice President and Secretary | ||

This document was drafted by Robert Sevalrud, Weil, Gotshal & Manges LLP, 767 Fifth Avenue, New York, NY 10153.

[Articles of Amendment of Articles of Incorporation of Briggs & Stratton Corporation]

ARTICLES OF AMENDMENT

OF

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

BILLY GOAT INDUSTRIES, INC.

December [●], 2020

Billy Goat Industries, Inc., a corporation organized and existing under the laws of the State of Missouri (the “Corporation”), hereby certifies as follows:

1. The name of the Corporation is Billy Goat

Industries, Inc.

2. The Amended and Restated Articles of Incorporation

of the Corporation shall be amended by adding a new Article VI as follows:

“ARTICLE VI

To the extent provided by Section 1123(a)(6) of chapter 11 of title 11 of the United States Code, the corporation shall not be permitted to issue

any non-voting equity securities.”

3. These Articles of Amendment were adopted pursuant to

the Amended Joint Chapter 11 Plan of Briggs & Stratton Corporation and Its Affiliated Debtors, dated [●], 2020 In re Briggs & Stratton Corp., et al., Case No. 20-43597 (Docket No. [●]) (as may be altered, amended, or modified from time to time, and including all appendices exhibits,

schedules and supplements thereto), which was confirmed by order of the United States Bankruptcy Court for the Eastern District of Missouri entered [●], 2020 In

re Briggs & Stratton Corp., et al., Case No. 20-43597 (Docket No. [●]).

[Signature page follows.]

IN WITNESS WHEREOF, the undersigned has duly executed these Articles of Amendment of Amended and Restated Articles of Incorporation as of the date

first written above.

|

Name:

|

Kathryn M. Buono | ||

|

Title:

|

Vice President and Secretary | ||

[Articles of Amendment of Articles of Incorporation of Billy Goat Industries, Inc.]

ARTICLES OF AMENDMENT

OF

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

ALLMAND BROS., INC.

December [●], 2020

Allmand Bros., Inc., a corporation organized and existing under the laws of the State of Nebraska (the “Corporation”), hereby certifies as follows:

1. The name of the Corporation is Allmand Bros., Inc.

2. The Amended and Restated Articles of Incorporation

of the Corporation shall be amended by adding a new Article Seven as follows:

“ARTICLE SEVEN

To the extent provided by Section 1123(a)(6) of chapter 11 of title 11 of the United States Code, the corporation shall not be permitted to issue

any non-voting equity securities.”

3. These Articles of Amendment were adopted pursuant to

the Amended Joint Chapter 11 Plan of Briggs & Stratton Corporation and Its Affiliated Debtors, dated [●], 2020 In re Briggs & Stratton Corp., et al., Case No. 20-43597 (Docket No. [●]) (as may be altered, amended, or modified from time to time, and including all appendices exhibits,

schedules and supplements thereto), which was confirmed by order of the United States Bankruptcy Court for the Eastern District of Missouri entered [●], 2020 In

re Briggs & Stratton Corp., et al., Case No. 20-43597 (Docket No. [●]), and thereby has been approved pursuant to the Nebraska Business Corporation Law.

[Signature page follows.]

IN WITNESS WHEREOF, the undersigned has duly executed these Articles of Amendment of Amended and Restated Articles of Incorporation as

of the date first written above.

|

Name:

|

Kathryn M. Buono

|

||

|

Title:

|

Vice President and Secretary

|

||

[Articles of Amendment of Amended and Restated Articles of Incorporation of Allmand Bros., Inc.]

ARTICLES OF AMENDMENT

OF

ARTICLES OF INCORPORATION

OF

BRIGGS & STRATTON INTERNATIONAL, INC.

December [●], 2020

Briggs & Stratton International, Inc., a corporation organized and existing under the laws of the State of Wisconsin (the “Corporation”), hereby certifies as follows:

1. The name of the Corporation is Briggs &

Stratton International, Inc.

2. The Articles of Incorporation of the Corporation

shall be amended by adding a new Article 7 as follows:

“Article 7. To the extent provided by Section 1123(a)(6) of chapter 11

of title 11 of the United States Code, the corporation shall not be permitted to issue any non-voting equity securities.”

3. These Articles of Amendment were adopted pursuant to

the Amended Joint Chapter 11 Plan of Briggs & Stratton Corporation and Its Affiliated Debtors, dated [●], 2020 In re Briggs & Stratton Corp., et al., Case No. 20-43597 (Docket No. [●]) (as may be altered, amended, or modified from time to time, and including all appendices exhibits,

schedules and supplements thereto, the “Plan”), which was confirmed by order of the United States Bankruptcy Court for the Eastern District of Missouri (the “Bankruptcy Court”) entered [●], 2020 In re Briggs & Stratton Corp., et al., Case No.

20-43597 (Docket No. [●]), and thereby has been approved pursuant to Section 180.1008 of the Wisconsin Business Corporation Law.

4. The Bankruptcy Court had jurisdiction of the Plan

under title 11 of the United States Code, 11 U.S.C. § 101 et seq.

[Signature page follows.]

IN WITNESS WHEREOF, the undersigned has duly executed these Articles of Amendment of Articles of Incorporation as of the date first

written above.

|

Name:

|

Kathryn M. Buono

|

||

|

Title:

|

Vice President and Secretary

|

||

This document was drafted by Robert Sevalrud, Weil, Gotshal & Manges LLP, 767 Fifth Avenue, New York, NY 10153

[Articles of Amendment of Amended and Restated Articles of Incorporation of Briggs & Stratton

International, Inc.]

Exhibit B

Plan Administrator Agreement (Substantially Final Version)

PLAN ADMINISTRATOR AGREEMENT

This Plan Administrator Agreement (“Agreement”) is made this day of December, 2020 (the “Effective Date”), by and among Briggs & Stratton

Corporation, Billy Goat Industries, Inc., Allmand Bros., Inc., Briggs & Stratton International, Inc., and Briggs & Stratton Tech, LLC (collectively, the “Debtors”)

and Alan D. Halperin as Plan Administrator under the Amended Joint Chapter 11 Plan of Briggs & Stratton Corporation and its Affiliated Debtors, dated November 9, 2020 [In re Briggs &Stratton Corp., et al.,

Case No. 20-43597 (Docket No.1226)], as the same has and may from time to time be amended or modified (the “Plan”). Capitalized terms used herein but not otherwise

defined shall have the meanings set forth in the Plan.

RECITALS:

(A) On July 20, 2020, (the “Petition Date”) the Debtors commenced voluntary cases under chapter 11 of title 11 of the United States Code (the “Bankruptcy

Code”) in the United States Bankruptcy Court for the Eastern District of Missouri (the “Court”).

(B) On December __, 2020, the Court entered an order

confirming the Plan (the “Confirmation Order”).

(C) The Plan appoints a Plan Administrator who shall,

as of the Effective Date, have the powers and duties set forth in the Plan and this Agreement. The Parties hereto acknowledge that the Plan Administrator shall have the powers and duties set forth in the Plan and this Agreement and succeed to

the rights and obligations of the Debtors as set forth in the Plan and this Agreement.

NOW, THEREFORE, in consideration of the foregoing and the covenants and agreements set forth herein, the parties hereto agree as follows:

ARTICLE I

ACCEPTANCE OF POSITION

1.1 Acceptance.

By signing this Agreement, Alan D. Halperin accepts appointment as the Plan Administrator and agrees to observe and perform all duties and

obligations imposed upon the Plan Administrator under the Plan, this Agreement, the Confirmation Order, other orders of the Court, and applicable law.

ARTICLE II

THE PLAN ADMINISTRATOR

2.1 General Powers, Rights and Responsibilities.

On the Effective Date, the Plan Administrator shall become the exclusive representative of the Wind-Down Estates. The Plan Administrator shall

have the authority on behalf of each of the Debtors or the Wind-Down Estates, as applicable, without the need for Bankruptcy Court approval (unless otherwise indicated), to carry out and implement all provisions of the Plan, including, without

limitation, to:

(a) subject to Section 7 of the Plan, except to the

extent Claims have been previously Allowed, control and effectuate the Claims reconciliation process in accordance with the terms of the Plan, including to object to, seek to subordinate, estimate, compromise or settle any and all Claims

against the Debtors or the Wind-Down Estates;

(b) subject to Section 6 of the Plan, make

Distributions to holders of Allowed Claims in accordance with the Plan;

(c) subject to Section 7.10 of the Plan, determine the

amount of the individual SERPs Claims according to the individual actuarial calculations performed by Mercer;

(d) exercise its reasonable business judgment to

direct and control the Wind-Down under the Plan and in accordance with applicable law as necessary to maximize Distributions to holders of Allowed Claims;

(e) create and maintain reserves (including, but

not limited to, reserves for Disputed Claims);

(f) sell, abandon or otherwise dispose of any

property that, in the Plan Administrator’s sole judgment, is burdensome to the Wind-Down Estates;

(g) prepare, file, and prosecute any necessary

filings or pleadings to carry out the duties of the Plan Administrator as described in the Plan and herein;

(h) other than any Causes of Action released by the

Debtors pursuant to the Plan, the Confirmation Order, the Sale Order, or by another order of the Bankruptcy Court, prosecute all Causes of Action on behalf of the Debtors, elect not to pursue any Causes of Action, and determine whether and when

to compromise, settle, abandon, dismiss, or otherwise dispose of any such Causes of Action, as the Plan Administrator may determine is in the best interests of the Debtors and their Estates;

(i) maintain the books and records and accounts of

the Debtors and the Wind-Down Estates, as applicable;

(j) retain professionals or consultants to assist

in performing its duties under the Plan and this Agreement;

(k) incur and pay reasonable and necessary expenses

in connection with the performance of duties under the Plan or this Agreement, including the reasonable fees and expenses of professionals and consultants retained by the Plan Administrator;

(l) administer the tax obligations of each Debtor or

Wind-Down Estate, as applicable, including (i) filing tax returns and paying tax obligations, (ii) requesting, if necessary, an expedited determination of any unpaid tax liability of each Debtor or Wind-Down Estate, as applicable, or their

estate under Bankruptcy Code section 505(b), for all taxable periods of such Debtor ending after the Petition Date through the liquidation of such Debtor as determined under applicable tax laws, and (iii) representing the interest and account

of each Debtor or Wind-Down Estate, or their estate under Bankruptcy Code section 505(b), before any taxing authority in all matters including, without limitation, any action, suit, proceeding or audit;

(m) prepare and file any and all informational

returns, reports, statements, returns or disclosures relating to the Debtors or the Wind-Down Estates, as applicable, that are required hereunder, by any Governmental Unit or applicable law;

(n) use reasonable best efforts to ensure that the

Qualified Pension Plan Documents are stored and preserved until the PBGC has completed its review regarding the Qualified Pension Plan and, upon reasonable notice, make such documents available to PBGC for inspection and copying; provided, however, that such obligations herein shall expire twelve (12) months following the Effective Date, at which time the Plan Administrator may dispose

of or destroy the Qualified Pension Plan Documents in its sole and absolute discretion;

2

(o) determine whether to create a liquidating trust

for the assets of a Debtor and which assets to transfer to such liquidating trust, appoint a trustee, enter into any related agreements or documents and effectuate the terms thereof;

(p) pay statutory fees in accordance with Section 12.1 of the Plan;

(q) take all actions that the Plan Administrator

reasonably deems necessary to protect and preserve the value of Debtors’ Assets and perform other duties and functions that are consistent with the implementation of the Plan;

(r) perform all duties and functions of the

Disbursing Agent as set forth in the Plan; and

(s) seek entry of an order or orders of the Court

closing the Chapter 11 Cases.

2.2 No Other Duties.

Other than the duties and obligations of the Plan Administrator specifically set forth in this Agreement, the Plan, or the Confirmation Order, the

Plan Administrator shall have no duties or obligations of any kind or nature with respect to his position as such.

2.3 Professional Fee Escrow.

On the Effective Date, the Plan Administrator shall maintain the Professional Fee Escrow Account established pursuant to Section 2.2 of the Plan

with funds sufficient to satisfy all Allowed Fee Claims provided, that when all Allowed Fee Claims have been paid in full, the Plan Administrator shall

release any remaining funds in the Professional Fees Escrow Account and such funds shall revert to, and ownership thereof shall vest in, the Wind-Down Estates.

2.4 Distributions.

Following the Effective Date, and subject to the availability of free cash and establishment and funding of the appropriate reserves,

Distributions shall be made by the Plan Administrator as follows:

(a) Initial Distributions: As of the Initial Distribution Date, the Plan Administrator, as Disbursing Agent, shall, pursuant to the terms of the Plan, make Distributions to holders of Allowed Class 1(a) – Class 1(e)

Priority Tax Claims, Allowed Class 2(a) – Class2(e) Priority Non-Tax Claims, Allowed Class 3(a) – Class 3(e) Other Secured Claims, and/or Allowed Class 4(a) – Class 4(e) General Unsecured Claims all in accordance with Section 3 of the Plan.

(b) Subsequent Distributions: Subsequent to the Initial Distribution Date, the Plan Administrator, as Disbursing Agent, shall make subsequent Distributions at the Plan Administrator’s sole and absolute discretion

pursuant to Section 4 of the Plan.

(c) Delivery of Distribution of Unsecured Notes Claims: Except as otherwise reasonably requested by the Unsecured Notes Indenture Trustee, all Distributions to holders of Unsecured Notes Claims shall be deemed completed

when made by the Plan Administrator, as Disbursing Agent, to the Unsecured Notes Indenture Trustee. If the Unsecured Notes Indenture Trustee is unable to make, or consents to the Plan Administrator making, such Distributions through DTC or

directly to the Holders of the Unsecured Notes Claims, the Plan Administrator, with the Unsecured Notes Indenture Trustee’s cooperation, shall make such Distributions through DTC or directly to the holders Unsecured Notes Claims to the extent

practicable to do so. The Unsecured Notes Indenture Trustee shall have no duties or responsibility relating to any form of Distribution that is not DTC eligible and the Wind-Down Estate or the Plan Administrator, as applicable, shall seek the

cooperation of DTC so that any distribution on account of an Unsecured Notes Claim that is held in the name of, or by a nominee of, DTC, shall be made through the facilities of DTC as soon as practicable thereafter. The Plan Administrator

shall have the right to seek Court approval for a distribution process and/or mechanics to the extent the Plan Administrator is required to make direct distributions.

3

(d) Undeliverable Distributions: In the event that any distribution to any holder or permitted designee is returned as undeliverable, no further distributions shall be made to such holder or such permitted designee

unless and until such Disbursing Agent is notified in writing of such holder’s or permitted designee’s, as applicable, then-current address, at which time all currently-due, missed distributions shall be made to such holder as soon as

reasonably practicable thereafter without interest. Undeliverable distributions or unclaimed distributions (including distribution checks that have not been negotiated) shall remain in the possession of the Wind-Down Estates until such time as

a distribution becomes deliverable or the holder accepts or otherwise negotiates the distribution, or such distribution reverts back to the Wind-Down Estates and shall not be supplemented with any interest, dividends, or other accruals of any

kind. Such undeliverable distributions or unclaimed distributions shall be deemed unclaimed property under section 347(b) of the Bankruptcy Code at the expiration of three hundred and sixty-five (365) days from the date of distribution. After

such date all unclaimed property or interest in property shall irrevocably revert to the Wind-Down Estates and the Claim of any other holder to such property or interest in property shall be discharged and forever barred. Nothing herein shall

require the Disbursing Agent to attempt to locate holders or permitted designees, as applicable, of undeliverable distributions and, if located, assist such holders or permitted designees, as applicable, in complying with Section 5.7 of the Plan.

(e) Reserves: Prior to making any Distributions under the Plan, including the Initial Distribution, the Plan Administrator shall reserve an amount sufficient to pay holders of Disputed Administrative Expense Claims,

Disputed Priority Tax Claims, Disputed Priority Non-Tax Claims Disputed Other Secured Claims, and Disputed General Unsecured Claims, in each case, the amount such holders would be entitled to receive under the Plan if such Claims were to become

Allowed Claims. After the resolution of any Disputed Administrative Expense Claim, Disputed Priority Tax Claims, Disputed Priority Non-Tax Claims, Disputed Other Secured Claims, and Disputed General Unsecured Claims, the Plan Administrator

shall treat any amounts that were reserved on account of such Disputed Claims that are Disallowed or do not become Allowed Claims as Net Cash Proceeds for purposes of distributions pursuant to the Plan.

(f) Forms: Any party entitled to receive any property or Distribution under the Plan shall, upon request, deliver to the Plan Administrator or the Wind-Down Estates, or such other Person designated by the Plan

Administrator or the Wind-Down Estates, Form W-9 or, if the payee is a foreign Person, an applicable Form W-8, unless such Person is exempt under the Tax Code and so notifies the Plan Administrator. If such request is made by the Plan

Administrator or the Wind-Down Estates, or such other Person designated by the Plan Administrator or the Wind-Down Estates, and the holder fails to comply within ninety (90) days after not less than two (2) requests have been made, the amount

of such distribution shall irrevocably revert to the applicable Wind-Down Estate and any Claim in respect of such distribution shall be expunged without need of further order of the Court and the holder thereof shall be forever barred from

asserting such Claim against any Debtor, the applicable Wind-Down Estate and their respective assets and property.

4

2.5 Wind-Down.

(a) After the Effective Date, pursuant to the Plan, the

Plan Administrator shall effectuate the Wind-Down in accordance with the Wind-Down Budget without any further approval by the Bankruptcy Court and free of any restrictions of the Bankruptcy Code or Bankruptcy Rules.

(b) The Plan Administrator shall periodically review

the Wind-Down Budget and make any necessary adjustments to the Wind-Down Budget to maintain sufficient funds to properly fund the Wind-Down; provided,

that if the Plan Administrator concludes at any time that the Wind-Down Budget exceeds the amounts necessary to properly fund the Wind-Down, the Plan Administrator shall be authorized to move any excess amounts out of the Wind-Down Budget

reserves and consider them Net Cash Proceeds; provided, further, that if any Sale Transaction Proceeds or other funds are received by the Wind-Down

Estates or the Plan Administrator, as applicable, after the Effective Date, the Plan Administrator shall allocate any portion of such proceeds for the Wind‑Down Budget reserves as it deems necessary to properly fund the Wind-Down and the rest

of the proceeds shall be considered Net Cash Proceeds.

(c) The Plan Administrator shall keep good records

of: (a) the funds that are in the Wind-Down Budget reserves, (b) Net Cash Proceeds for each Debtor, (c) the Administrative Expense Reserve, and (d) any Disputed Claims Reserve; provided, that the Plan Administrator shall not be required to keep Cash in separate accounts or reserves for such purposes except for the Professional Fee Escrow.

(d) The Wind-Down (as determined for federal income

tax purposes) shall occur in an expeditious but orderly manner after the Effective Date.

2.6 Dissolution.

After the Effective Date, the Plan Administrator shall be authorized to take, in his

or her sole and absolute discretion, subject to applicable non-bankruptcy law and consistent with the implementation of the Plan and this Agreement, all actions reasonably necessary to merge, dissolve, liquidate, or take such other similar action

with respect to each Debtor (including the cancellation of all interests in a Wind-Down Estate) and complete the winding up of such Wind-Down Estate as expeditiously as practicable, without the necessity for any other or further actions to be

taken by or on behalf of such Wind-Down Estate or its shareholders or members, as applicable, or any payments to be made in connection therewith. To the extent reasonably practicable, such actions by the Plan Administrator shall include, but not

be limited to, the Plan Administrator filing with the Secretary of State or other appropriate Governmental Unit for the relevant jurisdiction of each Debtor’s organization the appropriate articles, agreements, certificates, and other documents of

cancellation or dissolution. Upon the filing of such articles, agreements, certificates, or other documents of cancellation or dissolution, each such Debtor entity immediately shall cease to be, and not continue as, a body corporate or

unincorporated entity, as applicable, for any purpose whatsoever; provided, however, that the foregoing does not limit the Plan Administrator’s ability to otherwise abandon an interest in a Wind-Down Estate. The Plan Administrator may, to the

extent required by applicable non-bankruptcy law, maintain a Wind-Down Estate as a corporate entity in good standing until such time as such Wind-Down Estate is dissolved or merged out of existence in accordance with the Plan. All applicable

Governmental Units shall accept any such certificates or other documents filed by the Plan Administrator and shall take all steps necessary to allow and effect the prompt dissolution and/or winding-up of the Debtors as provided herein.

5

2.7 Liquidating Trust.

In the event the Plan Administrator determines that the Wind-Down of a Debtor shall take the form of a liquidating trust, (1) the terms of the

liquidating trust shall be set forth in a liquidating trust agreement, (2) the liquidating trust shall be structured to qualify as a “liquidating trust” within the meaning of Treasury Regulations section 301.7701-4(d) and in compliance with

Revenue Procedure 94-45, 1994-2 C.B. 684, and, thus, as a “grantor trust” within the meaning of sections 671 through 679 of the Tax Code of which the holders of Claims who become the liquidating trust beneficiaries (as determined for U.S. federal

income tax purposes) are the owners and grantors, consistent with the terms of the Plan, (3) the sole purpose of the liquidating trust shall be the liquidation and distribution of the assets transferred to the liquidating trust in accordance with

Treasury Regulations section 301.7701-4(d), including the resolution of Claims, with no objective to continue or engage in the conduct of a trade or business, (4) all parties (including the Debtors, holders of Claims, and the trustee of the

liquidating trust) shall report consistently with such treatment (including the deemed receipt of the underlying assets, subject to applicable liabilities and obligations, by the holders of Allowed Claims, as applicable, followed by the deemed

transfer of such assets to the liquidating trust), (5) all parties shall report consistently with the valuation of the assets transferred to the liquidating trust as determined by the trustee of the liquidating trust (or its designee), (6) the

trustee of the liquidating trust shall be responsible for filing returns for the trust as a grantor trust pursuant to Treasury Regulations section 1.671-4(a), and (7) the trustee of the liquidating trust shall annually send to each holder of an

interest in the liquidating trust a separate statement regarding the receipts and expenditures of the trust as relevant for U.S. federal income tax purposes. Subject to definitive guidance from the Internal Revenue Service or a court of

competent jurisdiction to the contrary (including the receipt by the trustee of the liquidating trust of a private letter ruling if the trustee so requests one, or the receipt of an adverse determination by the Internal Revenue Service upon audit

if not contested by the trustee), the trustee of the liquidating trust may timely elect to (y) treat any portion of the liquidating trust allocable to Disputed Claims as a “disputed ownership fund” governed by Treasury Regulations section

1.468B-9 (and make any appropriate elections) and (z) to the extent permitted by applicable law, report consistently with the foregoing for state and local income tax purposes. If a “disputed ownership fund” election is made, (i) all parties

(including the Debtors, holders of Claims, the Creditors’ Committee, and the trustee of the liquidating trust) shall report for U.S. federal, state, and local income tax purposes consistently with the foregoing, and (ii) any tax imposed on the

liquidating trust with respect to assets allocable to Disputed Claims (including any earnings thereon and any gain recognized upon the actual or deemed disposition of such assets) will be payable out of such assets and, in the event of

insufficient Cash to pay any such taxes, the trustee of the liquidating trust may sell all or part of such assets to pay the taxes. The trustee of the liquidating trust may request an expedited determination of taxes of the liquidating trust,

including any reserve for Disputed Claims, under section 505(b) of the Bankruptcy Code for all tax returns filed for, or on behalf of, the liquidating trust for all taxable periods through the dissolution of the liquidating trust.

2.8 Conversion of Assets to Cash.

Pursuant to section 1123(a)(5) of the Bankruptcy Code and subject to the terms of this Agreement and the Plan, as soon as is reasonably

practicable following the Effective Date, the Plan Administrator shall sell or otherwise dispose of, and liquidate or otherwise convert to Cash, any non-Cash assets of the Wind-Down Estates in such manner as the Plan Administrator shall determine

in its best judgment is in the best interests of the Wind-Down Estates.

2.9 Investment of Cash.

The Plan Administrator may invest Cash, including, but not limited to Cash held in any Reserve in (A) direct obligations of the United States of

America or obligations of any agency or instrumentality thereof which are guaranteed by the full faith and credit of the United States of America; (B) money market deposit accounts, checking accounts, savings accounts or certificates of deposit,

or other time deposit accounts that are issued by a commercial bank or savings institution organized under the laws of the United States of America or any state thereof; or (C) any other investments that may be permissible under (i) Section 345

of the Bankruptcy Code or (ii) any order of the Bankruptcy Court. Such investments shall mature in such amounts and at such times as the Plan Administrator, in the Plan Administrator’s sole and absolute discretion, shall deem appropriate to

provide funds when needed to transfer funds or make payments in accordance with the Plan and this Agreement. The interest or other income earned on the investments of the Cash in any given Reserve established pursuant to this Agreement, the Plan,

or any order of the Bankruptcy Court shall constitute a part of such Reserve, unless and until transferred or distributed pursuant to the terms of the Plan, this Agreement, or order of the Bankruptcy Court.

6

2.10 Tax Requirements for Income Generated by Disputed Claims.

The Plan Administrator may pay, or cause to be paid, out of the funds held in reserve for the Disputed Claims, any tax imposed by any federal,

state, or local taxing authority on the income generated by the funds or property held in any reserve for the Disputed Claims. The Plan Administrator may file, or cause to be filed, any tax or information return related to any reserve for the

Disputed Claims that may be required by any federal, state, or local taxing authority.

2.11 Preservation of Documents.

The Plan Administrator shall preserve, for the benefit of the Wind-Down Estates, all documents and files, including electronic data hosted on

remote servers, that are necessary to the prosecution of the Causes of Action preserved for the benefit of the Wind-Down Estates and claims resolution process.

2.12 Post-Confirmation Reports and Fees.

Following the Effective Date and until the Chapter 11 Cases are closed the Plan Administrator shall be responsible for the filing of all

post-‑Effective Date quarterly reports required during such periods by the U.S. Trustee and payment from the Debtors’ Estates of all post-Effective Date fees charged or assessed against the Estates under 28 U.S.C. §1930 during such periods,

together with applicable interest pursuant to 31 U.S.C. § 3717.

2.13 Reliance by Plan Administrator.

The Plan Administrator may rely, and shall be fully protected in acting or refraining from acting if it relies, upon any resolution, statement,

certificate, instrument, opinion, report, notice, request, consent, order, or other instrument or document that it reasonably believes to be genuine and to have been signed or presented by the proper party or parties or to have been sent by the

proper party or parties, and the Plan Administrator may conclusively rely as to the truth of the statements and correctness of the opinions expressed therein. The Plan Administrator may consult with counsel and other professionals with respect to

matters in their area of expertise, and any opinion of counsel shall be full and complete authorization and protection in respect of any action taken or not taken by the Plan Administrator. The Plan Administrator shall be entitled to rely upon

the advice of such professionals in acting or failing to act and shall not be liable for any act taken or not taken in reliance thereon. The Plan Administrator shall have the right at any time to seek and rely upon instructions from the Court

concerning this Agreement, the Plan, or any other document executed in connection therewith, and the Plan Administrator shall be entitled to rely upon such instructions in acting or failing to act and shall not be liable for any act taken or not

taken in reliance thereon. The Plan Administrator may accept and rely upon any accounting made by or on behalf of the Debtors and any statement or representation made by the Debtors or its agents and professionals on, prior to, or after the

Effective Date, and shall not be liable for having accepted and relied in good faith upon any such accounting, statement or representation if it is later proved to be incomplete, inaccurate or untrue. The provisions of this Section 2.12 shall

survive the death, dissolution, resignation or removal, as may be applicable, of the Plan Administrator and Plan Administrator Parties and shall inure to the benefit of their respective heirs and assigns.

7

2.14 Reliance by Persons Dealing with the Plan Administrator.

In the absence of actual knowledge to the contrary, any person dealing with the Wind‑Down Estates shall be entitled to rely on the authority of

the Plan Administrator to act on behalf of the Debtors and Wind-Down Estates, and shall have no obligation to inquire into the existence of such authority.

2.15 Service of Plan Administrator.

The Plan Administrator shall serve until (a) the termination of this Agreement, (b) the Plan Administrator resigns or (c) Plan Administrator has

discharged, or is discharged of, its duties under the Plan and this Agreement. The Plan Administrator may not be removed or terminated for any reason without approval of the Court. The Court shall retain jurisdiction to enforce this provision

upon a motion and proper notice to the Plan Administrator and its counsel. The Plan Administrator will continue to serve after its removal or resignation until the earlier of (i) the time when appointment of a successor Plan Administrator becomes

effective; or (ii) such date as the Court otherwise orders.

2.16 Succession Matters.

If the Plan Administrator is removed as set forth herein, resigns its position, or upon its death or incompetency, counsel to the Plan

Administrator shall inform the Court and the U.S. Trustee. The U.S. Trustee may appoint and shall designate a successor Plan Administrator upon notice and a hearing. Any party in interest may object to the U.S. Trustee’s appointment. Upon

approval of the Court, such successor Plan Administrator shall be deemed to succeed the Plan Administrator in all respects, including, but not limited to all litigation and other matters related to prosecution of the Causes of Action, without

need for further order of the Bankruptcy Court. In the event of resignation or removal of the Plan Administrator, the Plan Administrator or its counsel (as applicable) shall promptly (a) execute and deliver such documents, instruments and other

writings as reasonably requested by the successor Plan Administrator or as ordered by the Bankruptcy Court; (b) turn over to the successor Plan Administrator all property of the Wind-Down Estates in its possession, custody and control, including,

but not limited to all funds held in bank accounts, and all files, books and records and other documents and information related to the Wind-Down Estates; and (c) otherwise assist and cooperate in effecting the assumption of its obligations and

functions by the successor Plan Administrator. The successor Plan Administrator may, in its sole and absolute discretion, retain such professionals as it deems necessary, including the professionals of the departing Plan Administrator. If the

Plan Administrator is replaced, the professionals retained by the Plan Administrator shall be entitled to payment of their reasonable, undisputed fees and expenses through the date of the Plan Administrator’s replacement or otherwise allowed by

order of the Bankruptcy Court.

2.17 Retention of Counsel and Agents.

The Plan Administrator shall hire counsel to advise it in connection with its duties, powers and rights under this Agreement and may hire such

additional attorneys, accountants, financial advisors, consultants and other professionals as may be required or appropriate in connection with its duties herein and under the Plan. The Plan Administrator shall be entitled to retain

professionals in his or her sole and absolute discretion, including any professional employed by the Debtors or the Creditors’ Committee in the bankruptcy cases. The provisions of services by a professional to the Debtors or the Creditors’

Committee shall not disqualify such professional from employment by the Plan Administrator.

8

2.18 Compensation of Plan Administrator.

The Plan Administrator shall be compensated in full, in cash from the Wind-Down Budget Reserve. The Plan Administrator’s compensation shall be at

its customary hourly rate, which is currently $625 per hour and which is subject to adjustment from time to time. The above fees are within industry and market rates, and have been negotiated to reflect the facts specific to this engagement.

As such, the fee structure is reasonable in lights of the serviced requested. The Plan Administrator has incurred time prior to the effective date in connection with this Agreement and preparation for the Effective Date, and shall be entitled to

compensation for such work upon rendition of invoices on or after the Effective Date.

Any professionals retained by the Plan Administrator, including counsel, shall be entitled to reasonable compensation for services rendered and

reimbursement of reasonable fees, costs and expenses incurred by such professional, on a monthly basis. The payment of the fees and expenses of the Plan Administrator and the Plan Administrator’s retained professionals shall be made from the

Wind-Down Budget Reserve and shall not be subject to the approval of the Bankruptcy Court; provided, however, that any disputes related to such fees, costs and expenses shall be brought before the Court.

2.19 Cooperation and Access to Information.

Prior to the Effective Date, the Debtors shall designate one or more representatives to assist with transitioning access to books, records,

electronic data, and other forms of information of the Debtors to the Plan Administrator to enable the Plan Administrator to perform its tasks and duties under this Agreement and the Plan (the “Retained Information”). After the Effective Date, the representative(s) designated by the Debtors will provide assistance to the Plan Administrator as necessary on an agreed upon consulting basis. In connection with

this engagement, upon reasonable request, the Plan Administrator shall have complete and full access to all company information that the Plan Administrator deems appropriate. In addition, the Plan Administrator will have reasonable access to the

Debtors’ employees, counsel and other representatives necessary to perform the services as outlined in this Agreement. It is understood that the Plan Administrator (a) is relying solely upon the information supplied by the Debtors and their

representatives without assuming any responsibility for independent investigation or verification thereof, and (b) shall have the absolute and unconditional right to rely on the information provided by the Debtors and their representatives and

shall incur any liability by relying on such information.

9

ARTICLE III

LIMITATION OF LIABILITY, INDEMNIFICATION, AND INSURANCE

3.1 Limitation of Liability.

The Plan Administrator, and any of its respective members, officers, designees, employees, agents, consultants, lawyers, advisors, professionals

or representatives and each of their respective representatives (collectively, the “Plan Administrator Parties”) shall not be liable for any post-Effective Date act or

omission taken or omitted to be taken in their respective capacities, with or without the advice of counsel, accountants, appraisers, and other professionals retained by the Plan Administrator Parties, other than for acts or omissions resulting

from gross negligence, wilful misconduct, or criminal conduct as determined by a Final Order. The Plan Administrator may, in connection with the performance of its functions hereunder and under the Plan, and in its sole and absolute discretion,

consult with attorneys, accountants, financial advisors, agents and other professionals, and shall not be liable for any act taken, omitted to be taken, or suffered to be done in accordance with advice or opinions rendered by such professionals

or any Final Order. Notwithstanding such authority, the Plan Administrator shall not be under any obligation to consult with any attorneys, accountants, financial advisors, agents or other professionals, and its determination not to do so shall

not result in the imposition of liability, unless such determination is based on gross negligence, wilful misconduct, or criminal conduct as determined by a Final Order; provided, that in no event will any such person be liable for punitive, exemplary, consequential, or special damages under any circumstances. Any action taken or omitted to be taken by the Plan Administrator Parties after the

Effective Date on the advice of counsel or with the approval of the Court will conclusively be deemed not to constitute gross negligence, wilful misconduct, or criminal conduct. The provisions of this Section 3.1 shall survive the death,

dissolution, resignation or removal, as may be applicable, of the Plan Administrator and Plan Administrator Parties and shall inure to the benefit of their respective heirs and assigns.

3.2 Indemnification.

Each of the Wind-Down Estates shall, to the fullest extent permitted by law, indemnify and hold harmless the Plan Administrator and each Plan

Administrator Party, solely in their respective capacities as such (collectively, the “Indemnified Persons”) from and against any and all pending or threatened claims,

demands, suits, investigations, proceedings, judgments, awards, liabilities, losses, damages, fees and expenses paid or incurred by any Indemnified Person in connection with, arising out of or related to (whether from direct claims or third party

claims) the Wind-Down, the Debtors or the Wind-Down Estates, or otherwise in connection with the Plan or this Agreement (including, but not limited to, any Indemnified Person’s reasonable counsel fees and expenses). The foregoing indemnification

obligations shall not apply in the event that a court of competent jurisdiction finally determines that such claims resulted directly from the Indemnified Person’s gross negligence, wilful misconduct, or criminal conduct. The Indemnified Persons

shall be entitled to request advances from the Wind-Down Estates to cover reasonable fees and necessary expenses incurred in connection with defending themselves in any action brought against them as a result of the acts or omissions, actual or

alleged, of an Indemnified Person; provided, however, that the Plan Administrator shall not be required to make any such advances; provided further, however, that any

Indemnified Person receiving such advances shall repay the amounts so advanced to the Wind-Down Estates upon the entry of a Final Order finding that such Indemnified Person was not entitled to any indemnity under the provisions of this Section 3.2. This indemnification shall survive the death, dissolution, resignation or removal, as may be applicable, of the Indemnified Persons and shall inure to the

benefit of the Indemnified Persons’ heirs and assigns.

10

3.3 Insurance.

The Plan Administrator shall be authorized to obtain and pay for out of the Wind-Down Estates all reasonably necessary insurance coverage,

including for all Plan Administrator Parties, including, but not limited to, coverage with respect to (i) any property that is or may in the future become the property of the Wind-Down Estates and (ii) the liabilities, duties, and obligations of

the Plan Administrator Parties in the form of an errors and omissions policy or otherwise, the latter of which insurance coverage may, at the sole option of the Plan Administrator remain in effect for a reasonable period (not to exceed seven

years) after the termination of this Agreement.

ARTICLE IV

TERMINATION

4.1 Termination.

This Agreement shall terminate upon the later of (a) thirty (30) days after the distribution of all of the assets of the Debtors’ Estates in

accordance with the Plan and (b) the closing of the Chapter 11 Cases.

4.2 Obligations of the Plan Administrator upon Termination.

The Plan Administrator shall preserve the Retained Information, including all documents and files retained under Section 2.11 hereunder, until the

date that is one (1) year following the closing of the Chapter 11 Cases. Except as otherwise specifically provided herein, after the termination of this Agreement pursuant to section 4.1 above, the Plan Administrator shall have no further duties

or obligations hereunder.

ARTICLE V

MISCELLANEOUS PROVISIONS

5.1 Descriptive Headings.

The headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this

Agreement.

5.2 Amendment and Waiver/Assignment.

This Agreement may not be amended or assigned except by order of the Court.

5.3 Governing Law.

This Agreement shall be governed by and construed in accordance with the laws of the State of Missouri without regard to the rules of conflict of

laws of the State of Missouri or any other jurisdiction.

5.4 Dispute Resolution.

Without permission of the Court, no judicial, administrative, arbitral or other action or proceeding shall be commenced against the Plan

Administrator in its official capacity as such, with respect to its status, duties, powers, acts or omissions as Plan Administrator in any forum other than the Court.

11

5.5 Counterparts; Effectiveness.

This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original but all of which shall constitute one

and the same agreement. This Agreement shall become effective when each party hereto shall have received counterparts thereof signed by all the other parties hereto.

5.6 Severability; Validity.

If any provision of this Agreement or the application thereof to any person or circumstance is held invalid or unenforceable, the remainder of

this Agreement, and the application of such provision to other persons or circumstances, shall not be affected thereby, and to such end, the provisions of this Agreement are agreed to be severable.

5.7 Notices.

Any notice or other communication hereunder shall be in writing and shall be deemed to have been sufficiently given, for all purposes, if by

electronic mail, by hand delivery, confirmed overnight mail service or if deposited, postage prepaid, in a post office or letter box addressed to the person for whom such notice is intended at such address as set forth below (or such other

address for a party as shall be specified by like notice):

If to the Plan Administrator:

Alan D. Halperin

Debra Cohen

Julie Goldberg

Halperin Battaglia Benzija, LLP

40 Wall Street, 37th Floor

New York, NY 10005

Telephone: (212) 765-9100

Email: ahalperin@halperinlaw.net

dcohen@halperinlaw.net

jgoldberg@halperinlaw.net

If to the Debtors:

Briggs & Stratton Corporation

12301 West Wirth Street,

Wauwatosa,

Wisconsin 53222

Attn: Kathryn M. Buono

Telephone: 414-259-5308

Email: buono.kathryn@basco.com

- and -

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, New York 10153

12

Attn: Ronit J. Berkovich

Debora A. Hoehne

Martha E. Martir

Telephone: (212) 310-8000

Email: Ronit.Berkovich@weil.com

Debora.Hoehne@weil.com

Martha.Martir@weil.com

- and -

Carmody MacDonald P.C.

120 S. Central Avenue, Suite 1800

St. Louis, Missouri 63105

Attn: Robert E. Eggmann

Christopher J. Lawhorn

Thomas H. Riske

Telephone: (314) 854-8600

Email: ree@carmodymacdonald.com

cjl@carmodymacdonald.com

thr@carmodymacdonald.com

5.8 Relationship to Plan.

The principal purpose of this Agreement is to aid in the implementation of the Plan and, therefore, this Agreement incorporates and is subject to

the provisions of the Plan. To that end, the Plan Administrator shall have full power and authority to take any action consistent with the purposes and provisions of the Plan. In the event that the provisions of this Agreement are found to be

inconsistent with the provisions of the Plan, the provisions of the Plan shall control; provided, however, that provisions of this Agreement adopted by

amendment and approved by the Bankruptcy Court following substantial consummation (as such term is used in Section 1127(b) of the Bankruptcy Code) shall control over provisions of the Plan.

5.9 Retention of Jurisdiction.

As provided in Section 11 of the Plan, the Court shall retain jurisdiction over this Agreement and the Wind-Down Estates to the fullest extent

permitted by law, including, but not limited to, for the purposes of interpreting and implementing the provisions of this Agreement.

5.10 Effective Date.

This Agreement shall become effective on the Effective Date of the Plan.

[remainder of page intentionally left blank]

13

IN WITNESS WHEREOF, the parties have either executed and

acknowledged this Agreement or caused it to be executed and acknowledged on their behalf by their duly authorized officers at of the date first above written.

|

Briggs & Stratton Corporation

|

||

|

Billy Goat Industries, Inc.

|

||

|

Allmand Bros., Inc.

|

||

|

Briggs & Stratton International, Inc.

|

||

|

Briggs & Stratton Tech, LLC

|

||

|

By:

|

||

|

[NAME]

|

||

|

[POSITION]

|

||

|

Alan D. Halperin

|

||

|

By:

|

||

|

|

[____________________]

|

|

14

Exhibit C

Assumption Schedule

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MISSOURI

SOUTHEASTERN DIVISION

|

§

|

Chapter 11

|

|

|

In re:

|

§

|

|

|

§

|

Case No. 20-43597-399

|

|

|

BRIGGS & STRATTON

|

§

|

|

|

CORPORATION, et al.,

|

§

|

(Jointly Administered)

|

|

§

|

||

|

Debtors.

|

§

|

NOTICE OF PROPOSED ASSUMPTION OF

EXECUTORY CONTRACTS AND UNEXPIRED LEASES OF DEBTORS

PLEASE TAKE NOTICE OF THE FOLLOWING:

On July 20, 2020, Briggs & Stratton Corporation and its affiliated debtors in the above-captioned chapter 11 cases, as debtors and debtors

in possession (collectively, the “Debtors”), commenced voluntary cases under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Eastern District of Missouri (the “Bankruptcy Court”).

On September 21, 2020, the Debtors sold substantially all of the Debtors’ assets and equity interests in the Debtors’ non-Debtor subsidiaries

and certain joint venture equity interests held by the Debtors to Bucephalus Buyer, LLC (the “Purchaser”).1

On October 9, 2020, the Debtors filed their Joint Chapter 11

Plan of Briggs & Stratton Corporation and its Affiliated Debtors (Docket No. 1066) (as amended by Docket Nos. 1211 and 1226 and as may be further amended, modified, or supplemented in accordance with the terms therein, the “Plan”).2 A hearing to consider confirmation of the Plan is scheduled to be held on December 18, 2020 at 9:00 a.m. (prevailing Central Time) (the “Confirmation Hearing”), before the Honorable Barry S.

Schermer, in the United States Bankruptcy Court for the Eastern District of Missouri, 5th Floor, North Courtroom, Thomas F. Eagleton United States Courthouse, 111 South Tenth Street, St. Louis, Missouri.

| 1 |

See Order (I) Authorizing the Sale of the Assets and Equity Interests to the Purchaser Free

and Clear of Liens, Claims, Interests, and Encumbrances; (II) Authorizing the Assumption and Assignment of Certain Executory Contracts and Unexpired Leases (authorizing

sale to Purchaser); and (III) Granting Related Relief (Docket No. 898);

Notice of (I) Filing of Amendment to Stock and Asset Purchase Agreement, and (II) the Occurrence of Closing of the Sale Transaction (Docket No. 964) (announcing the sale closing occurred on September 21, 2020).

|

| 2 |

Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the Plan.

|

You are receiving this Notice because you or an affiliate

may be a party to one or more executory contracts or unexpired leases (each, a “Contract”) that may be assumed by the Debtors (each, an “Assumed Contract”). The Assumed Contracts are set forth on Exhibit 1 hereto.3 You are advised to carefully review the information contained herein and the related provisions of the Plan.

Section 365(b)(1)(A) of the Bankruptcy Code requires that the Debtors cure or provide adequate assurance that they will promptly cure defaults

under the Assumed Contracts at the time of assumption. The Debtors’ determination of the amounts required to cure any prepetition defaults under the Assumed Contracts (the “Cure Amount”) is set forth on Exhibit 1.

Pursuant to Section 8.1 of the Plan, executory contracts and unexpired leases (i) by and between the Debtors and the Purchaser and (ii) deemed

assumed pursuant to Section 8.3 of Plan (including the Debtors’ insurance policies), are deemed assumed by the Debtors and are not listed in Exhibit 1.

Objections

Any objection (each, an “Objection”) to the proposed

assumption, including the proposed Cure Amount identified on Exhibit 1 (“Cure Objection”), or adequate assurance of future performance (“Adequate Assurance Objection”) of an Assumed Contract must:

| (i) |

be in writing;

|

| (ii) |

comply with the Bankruptcy Code, the Federal Rules of Bankruptcy Procedure, and the Local Rules of the Bankruptcy Court for the Eastern District of Missouri;

|

| (iii) |

state, with specificity, the legal and factual basis thereof, including, if applicable, what Cure Amount the objecting party believes is required;

|

| (iv) |

include any appropriate documentation in support thereof;

|

| (v) |

be filed with the Bankruptcy Court by no later than December 11, 2020 at 5:00 p.m.

(prevailing Central Time) (the “Objection Deadline”); and

|

| (vi) |

be served on the following parties (collectively, the “Objection Notice Parties”):

|

| a. |

the Debtors (Attn: Kathryn Buono (buono.kathryn@basco.com));

|

| b. |

counsel for the Debtors, Weil, Gotshal & Manges LLP, (Attn: Ronit J. Berkovich, Esq., Debora A. Hoehne, Esq., and Martha E. Martir, Esq. (ronit.berkovich@weil.com,

debora.hoehne@weil.com, and martha.martir@weil.com)) and Carmody MacDonald P.C., (ree@carmodymacdonald.com, cjl@carmodymacdonald.com, and

thr@carmody macdonald.com));

|

| 3 |

Previously in the chapter 11 cases, the Debtors filed various notices providing for the assumption and assignment of certain executory contracts and unexpired leases to the

Purchaser (Docket Nos. 513-516, 537, 879, 965, 1040, 1162, and 1323). This Notice is separate from those prior notices. This Notice pertains to Contracts being assumed by the Debtors for wind-down operations.

|

2

| c. |

counsel to the Official Committee of Unsecured Creditors appointed in the Debtors’ chapter 11 cases, Brown Rudnick LLP, (Attn: Robert J. Stark, Esq., Oksana P. Lashko, Esq.,

and Andrew Carty, Esq. (rstark@brownrudnick.com, olashko@brownrudnick. com, and acarty@brownrudnick.com));

|

| d. |

counsel for the ABL Agent and DIP Agent, Latham & Watkins LLP (Attn: Peter P. Knight and Jonathan C. Gordon (peter.knight@lw.com and jonathan.gordon@lw. com));

|

| e. |

counsel for Wilmington Trust, N.A., as successor indenture trustee under the Senior Notes, Pryor Cashman LLP (Attn: Seth H. Lieberman, Esq. and David W. Smith, Esq.

(slieberman@pryorcashman.com and dsmith@pryorcashman.com));

|

| f. |

counsel for the United States Trustee for the Eastern District of Missouri (Attn: Sirena T. Wilson, Esq. (sirena.wilson@usdoj.gov)); and

|

| g. |

the United States Attorney’s Office for the Eastern District of Missouri (Attn: Jeffrey B. Jensen, Esq., 111 S 10th St., 20th Fl. Thomas Eagleton US Courthouse, St. Louis, MO

63102).

|

If you have more than one Contract identified on Exhibit 1,

an Objection with respect to one Contract shall have no impact on the other Contract(s) to which you are a party for which no Objection has been filed and served. If a timely Objection is received and such Objection cannot otherwise be

resolved by the parties, such Objection shall be heard at the Confirmation Hearing or such later date as the Debtors determine.

The Debtors request that if you (i) dispute the assumption of

an Assumed Contract, (ii) have a Cure Objection or an Adequate Assurance Objection with respect to an Assumed Contract, or (iii) otherwise dispute the treatment of your Contract(s), you contact the Debtors prior to the Objection Deadline to

attempt to resolve such dispute consensually. The Debtors’ contact for such matters is Martha E. Martir, Esq., at (212) 310-8228, or by email at martha.martir@weil.com. If such dispute cannot be resolved consensually prior to the

Objection Deadline, you must file and serve an Objection by the Objection Deadline in accordance with the procedures set forth in this Notice to preserve your right to object.

If a non-Debtor party to an Assumed Contract has objected solely to the proposed Cure Amount, the Debtors may pay the undisputed portion of such

Cure Amount and reserve an amount sufficient to pay the disputed amount pending further order of the Bankruptcy Court or mutual agreement of the parties. So long as such disputed amount is reserved for, the Debtors may, without delay, assume

such Assumed Contract. Under such circumstances, the objecting non-Debtor counterparty’s recourse is limited to the reserved disputed amount.

3

IF A COUNTERPARTY FAILS TO FILE WITH THE BANKRUPTCY COURT AND

SERVE ON THE OBJECTION NOTICE PARTIES A TIMELY OBJECTION WITH RESPECT TO AN ASSUMED CONTRACT, THE COUNTERPARTY SHALL BE DEEMED TO HAVE CONSENTED TO THE ASSUMPTION OF THE CONTRACT BY THE DEBTORS AND SHALL BE FOREVER BARRED FROM ASSERTING ANY

OBJECTION WITH REGARD TO SUCH ASSUMPTION, INCLUDING THE AMOUNT TO CURE ANY DEFAULT UNDER THE APPLICABLE ASSUMED CONTRACT AND ADEQUATE ASSURANCE OF FUTURE PERFORMANCE OF THE APPLICABLE ASSUMED CONTRACT. THE CURE AMOUNT SET FORTH ON EXHIBIT 1 HERETO SHALL BE CONTROLLING AND WILL BE THE ONLY AMOUNT

NECESSARY TO CURE OUTSTANDING DEFAULTS UNDER THE APPLICABLE ASSUMED CONTRACT UNDER BANKRUPTCY CODE SECTION 365 NOTWITHSTANDING ANYTHING TO THE CONTRARY IN THE ASSUMED CONTRACT OR ANY OTHER DOCUMENT, AND THE APPLICABLE COUNTERPARTY SHALL BE

FOREVER BARRED FROM ASSERTING ANY ADDITIONAL CURE OR OTHER AMOUNTS WITH RESPECT TO SUCH ASSUMED CONTRACT AGAINST THE DEBTORS OR THE WIND-DOWN ESTATES OR THE PROPERTY OF ANY OF THEM. THE DEBTORS OR THE WIND-DOWN ESTATES SHALL BE DEEMED TO HAVE PROVIDED ADEQUATE ASSURANCE OF FUTURE PERFORMANCE WITH RESPECT TO THE APPLICABLE

ASSUMED CONTRACT IN ACCORDANCE WITH BANKRUPTCY CODE SECTION 365 NOTWITHSTANDING ANYTHING TO THE CONTRARY IN THE ASSUMED CONTRACT OR ANY OTHER DOCUMENT.

Additional Information

Copies of the Plan, the Plan Supplement, the Bidding Procedures Motion, the Bidding Procedures Order, and the Sale Order, as well as all related

exhibits, including the Purchase Agreement and all other agreements filed with the Bankruptcy Court, may be obtained free of charge at the website dedicated to the Debtors’ chapter 11 cases maintained by their claims and noticing agent,

Kurtzman Carson Consultants LLC, located at http://www.kccllc.net/Briggs or can be requested by e-mail at BriggsInfo@kccllc.com.

Reservation of Rights

The Debtors reserve the right to remove any Contract on Exhibit

1 until the occurrence of the effective date of the Plan.

The inclusion of any Contract on Exhibit 1

shall not constitute or be deemed a determination or admission by the Debtors that such Contract or other document is, in fact, an executory contract or unexpired lease within the meaning of the Bankruptcy Code (all rights with respect thereto

being expressly reserved). References to any Contract are to the applicable agreement and other operative documents as of the date of this Notice, as they may have been amended, modified, or supplemented from time to time and as may be further

amended, modified, or supplemented by the parties thereto.

As a matter of administrative convenience, in certain cases the Debtors may have listed the original parties to the Contracts listed on Exhibit 1 without taking into account any succession of trustees or any other transfers or assignments from one party to another. The fact that the

current parties to a particular Contract may not be named in Exhibit 1 is not intended to change the treatment of such contract.

4

To the extent that there are any inconsistencies between Exhibit

1 and the Plan, the provisions of the Plan shall govern.

|

Dated: December 4, 2020

|

|

|

|

St. Louis, Missouri

|

|

|

|

/s/ Robert E. Eggmann

|

||

|

CARMODY MACDONALD P.C.

|

||

|

Robert E. Eggmann, #37374MO

|

||

|

Christopher J. Lawhorn, #45713MO

|

||

|

Thomas H. Riske, #61838MO

|

||

|

120 S. Central Avenue, Suite 1800

|

||

|

St. Louis, Missouri 63105

|

||

|

Telephone: (314) 854-8600

|

||

|

Facsimile: (314) 854-8660

|

||

|

Email:

|

ree@carmodymacdonald.com

|

|

|

cjl@carmodymacdonald.com

|

||

|

thr@carmodymacdonald.com

|

||

|

-and-

|

||

|

WEIL, GOTSHAL & MANGES LLP

|

||

|

Ronit J. Berkovich (admitted pro hac vice)

|

||

|

Debora A. Hoehne (admitted pro hac vice)

|

||

|

Martha E. Martir (admitted pro hac vice)

|

||

|

767 Fifth Avenue

|

||

|

New York, New York 10153

|

||

|

Telephone: (212) 310-8000

|

||

|

Facsimile: (212) 310-8007

|

||

|

Email:

|

Ronit.Berkovich@weil.com

|

|

|

Debora.Hoehne@weil.com

|

||

|

Martha.Martir@weil.com

|

||

|

Counsel to the Debtors

|

||

|

and Debtors in Possession

|

||

5

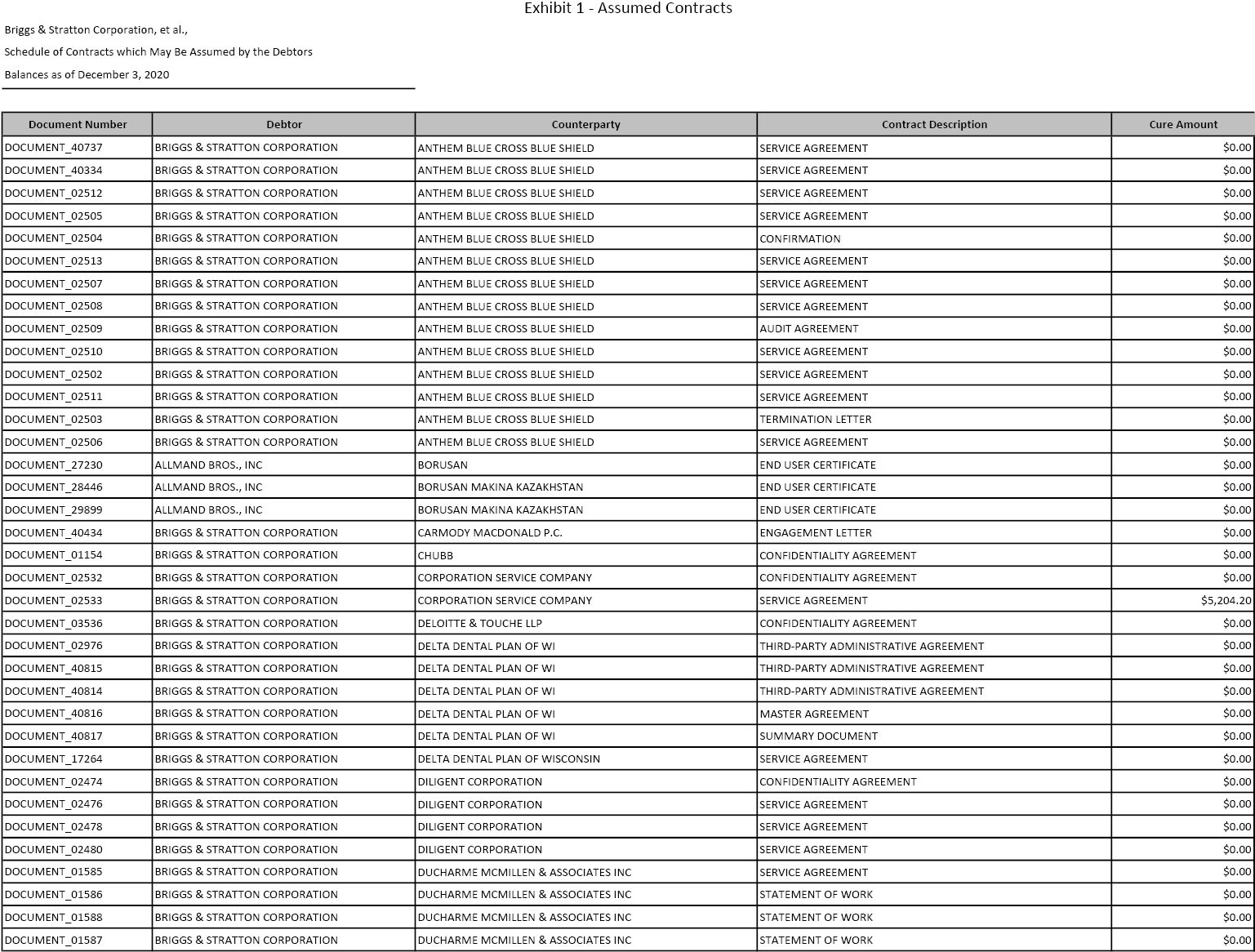

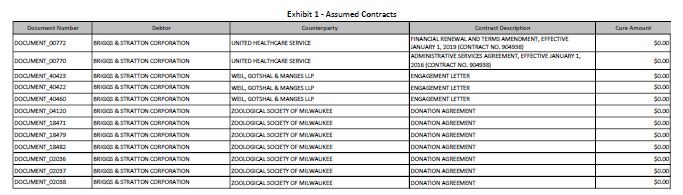

Exhibit 1

Contracts to be Assumed by the Debtors

Exhibit 1 - Assumed Contracts Briggs & Stratton Corporation, et al., Schedule of Contracts which May Be Assumed by the Debtors

Balances as of December 3, 2020 Document Number Debtor Counterparty Contract Description Cure Amount DOCUMENT_40737 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_40334 BRIGGS & STRATTON

CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_02512 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_02505 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE

SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_02504 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD CONFIRMATION $0.00 DOCUMENT_02513 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00

DOCUMENT_02507 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_02508 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_02509 BRIGGS & STRATTON

CORPORATION ANTHEM BLUE CROSS BLUE SHIELD AUDIT AGREEMENT $0.00 DOCUMENT_02510 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_02502 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE

SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_02511 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_02503 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD TERMINATION LETTER $0.00

DOCUMENT_02506 BRIGGS & STRATTON CORPORATION ANTHEM BLUE CROSS BLUE SHIELD SERVICE AGREEMENT $0.00 DOCUMENT_27230 ALLMAND BROS., INC BORUSAN END USER CERTIFICATE $0.00 DOCUMENT_28446 ALLMAND BROS., INC BORUSAN MAKINA KAZAKHSTAN END USER

CERTIFICATE $0.00 DOCUMENT_29899 ALLMAND BROS., INC BORUSAN MAKINA KAZAKHSTAN END USER CERTIFICATE $0.00 DOCUMENT_40434 BRIGGS & STRATTON CORPORATION CARMODY MACDONALD P.C. ENGAGEMENT LETTER $0.00 DOCUMENT_01154 BRIGGS & STRATTON

CORPORATION CHUBB CONFIDENTIALITY AGREEMENT $0.00 DOCUMENT_02532 BRIGGS & STRATTON CORPORATION CORPORATION SERVICE COMPANY CONFIDENTIALITY AGREEMENT $0.00 DOCUMENT_02533 BRIGGS & STRATTON CORPORATION CORPORATION SERVICE COMPANY

SERVICE AGREEMENT $5,204.20 DOCUMENT_03536 BRIGGS & STRATTON CORPORATION DELOITTE & TOUCHE LLP CONFIDENTIALITY AGREEMENT $0.00 DOCUMENT_02976 BRIGGS & STRATTON CORPORATION DELTA DENTAL PLAN OF WI THIRD-PARTY ADMINISTRATIVE

AGREEMENT $0.00 DOCUMENT_40815 BRIGGS & STRATTON CORPORATION DELTA DENTAL PLAN OF WI THIRD-PARTY ADMINISTRATIVE AGREEMENT $0.00 DOCUMENT_40814 BRIGGS & STRATTON CORPORATION DELTA DENTAL PLAN OF WI THIRD-PARTY ADMINISTRATIVE AGREEMENT

$0.00 DOCUMENT_40816 BRIGGS & STRATTON CORPORATION DELTA DENTAL PLAN OF WI MASTER AGREEMENT $0.00 DOCUMENT_40817 BRIGGS & STRATTON CORPORATION DELTA DENTAL PLAN OF WI SUMMARY DOCUMENT $0.00 DOCUMENT_17264 BRIGGS & STRATTON

CORPORATION DELTA DENTAL PLAN OF WISCONSIN SERVICE AGREEMENT $0.00 DOCUMENT_02474 BRIGGS & STRATTON CORPORATION DILIGENT CORPORATION CONFIDENTIALITY AGREEMENT $0.00 DOCUMENT_02476 BRIGGS & STRATTON CORPORATION DILIGENT CORPORATION

SERVICE AGREEMENT $0.00 DOCUMENT_02478 BRIGGS & STRATTON CORPORATION DILIGENT CORPORATION SERVICE AGREEMENT $0.00 DOCUMENT_02480 BRIGGS & STRATTON CORPORATION DILIGENT CORPORATION SERVICE AGREEMENT $0.00 DOCUMENT_01585 BRIGGS &

STRATTON CORPORATION DUCHARME MCMILLEN & ASSOCIATES INC SERVICE AGREEMENT $0.00 DOCUMENT_01586 BRIGGS & STRATTON CORPORATION DUCHARME MCMILLEN & ASSOCIATES INC STATEMENT OF WORK $0.00 DOCUMENT_01588 BRIGGS & STRATTON

CORPORATION DUCHARME MCMILLEN & ASSOCIATES INC STATEMENT OF WORK $0.00 DOCUMENT_01587 BRIGGS & STRATTON CORPORATION DUCHARME MCMILLEN & ASSOCIATES INC STATEMENT OF WORK $0.00 1

1

Exhibit 1 - Assumed Contracts Document Number Debtor Counterparty Contract Description Cure Amount DOCUMENT_04150 BRIGGS & STRATTON

CORPORATION DUCHARME MCMILLEN & ASSOCIATES INC SERVICE AGREEMENT $0.00 DOCUMENT_04149 BRIGGS & STRATTON CORPORATION DUCHARME MCMILLEN & ASSOCIATES INC SERVICE AGREEMENT $0.00 DOCUMENT_04148 BRIGGS & STRATTON CORPORATION

DUCHARME MCMILLEN & ASSOCIATES INC SERVICE AGREEMENT $0.00 DOCUMENT_04147 BRIGGS & STRATTON CORPORATION DUCHARME MCMILLEN & ASSOCIATES INC STATEMENT OF WORK $0.00 DOCUMENT_01589 BRIGGS & STRATTON CORPORATION DUCHARME MCMILLEN

& ASSOCIATES INC STATEMENT OF WORK $0.00 DOCUMENT_16898 BRIGGS & STRATTON CORPORATION DUDLEY VENTURES, L.L.C. CONFIDENTIALITY AGREEMENT $0.00 DOCUMENT_40426 BRIGGS & STRATTON CORPORATION ERNST & YOUNG LLP LETTER AGREEMENT

$0.00 DOCUMENT_40427 BRIGGS & STRATTON CORPORATION ERNST & YOUNG LLP STATEMENT OF WORK $0.00 DOCUMENT_40435 BRIGGS & STRATTON CORPORATION ERNST & YOUNG LLP STATEMENT OF WORK $0.00 DOCUMENT_40436 BRIGGS & STRATTON

CORPORATION ERNST & YOUNG LLP STATEMENT OF WORK $0.00 DOCUMENT_01101 BRIGGS & STRATTON CORPORATION EXPRESS SCRIPTS, INCORPORATED BUSINESS ASSOCIATE AGREEMENT $0.00 DOCUMENT_16292 BRIGGS & STRATTON CORPORATION FIDELITY

INVESTMENTS/FIDELITY WORKPLACE SERVICES LLC SERVICE AGREEMENT $0.00 DOCUMENT_01182 BRIGGS & STRATTON CORPORATION FIDELITY MANAGEMENT TRUST COMPANY SERVICE AGREEMENT $0.00 DOCUMENT_14502 BRIGGS & STRATTON CORPORATION FIDELITY STOCK

PLAN SERVICES LLC SERVICE AGREEMENT $0.00 DOCUMENT_12410 BRIGGS & STRATTON CORPORATION FIDELITY STOCK PLAN SERVICES LLC SERVICE AGREEMENT $0.00 DOCUMENT_12498 BRIGGS & STRATTON CORPORATION FIDELITY STOCK PLAN SERVICES, LLC SERVICE

AGREEMENT $0.00 DOCUMENT_01166 BRIGGS & STRATTON CORPORATION FIDELITY STOCK PLAN SERVICES, LLC SERVICE AGREEMENT $0.00 DOCUMENT_11701 BRIGGS & STRATTON CORPORATION FIDELITY WORKPLACE SERVICES LLC CONSULTING AGREEMENT $0.00

DOCUMENT_01181 BRIGGS & STRATTON CORPORATION FIDELITY WORKPLACE SERVICES LLC SUMMARY DOCUMENT $0.00 DOCUMENT_01180 BRIGGS & STRATTON CORPORATION FIDELITY WORKPLACE SERVICES LLC CONSULTING AGREEMENT $49,208.00 DOCUMENT_16362 BRIGGS

& STRATTON CORPORATION FOLEY & LARDNER BUSINESS ASSOCIATE AGREEMENT $0.00 DOCUMENT_01866 BRIGGS & STRATTON CORPORATION FOLEY & LARDNER ENGAGEMENT LETTER $0.00 DOCUMENT_40439 BRIGGS & STRATTON CORPORATION FOLEY &