Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - AZEK Co Inc. | d37420dex322.htm |

| EX-32.1 - EX-32.1 - AZEK Co Inc. | d37420dex321.htm |

| EX-31.2 - EX-31.2 - AZEK Co Inc. | d37420dex312.htm |

| EX-31.1 - EX-31.1 - AZEK Co Inc. | d37420dex311.htm |

| EX-23 - EX-23 - AZEK Co Inc. | d37420dex23.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2020

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-39322

The AZEK Company Inc.

(Exact name of Registrant as specified in its Charter)

| Delaware | 90-1017663 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1330 W Fulton Street, Suite 350, Chicago, Illinois | 60607 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (877) 275-2935

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which | ||

| Class A Common Stock, par value $0.001 per share | AZEK | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

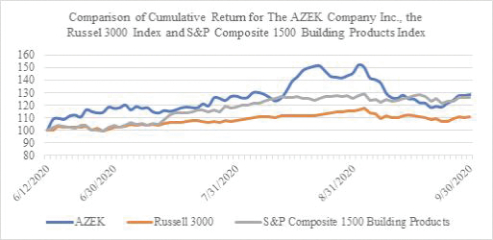

As of March 31, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public trading market for the registrant’s equity securities. The registrant’s Class A common stock began trading on the New York Stock Exchange on June 12, 2020.

As of November 30, 2020, the registrant had 154,637,240 shares of Class A Common Stock, $0.001 par value per share, and 100 shares of Class B Common Stock, $0.001 par value per share, outstanding.

Portions of the registrant’s definitive proxy statement for its 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year ended September 30, 2020 are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

| Page | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

17 | |||||

| Item 1B. |

51 | |||||

| Item 2. |

51 | |||||

| Item 3. |

51 | |||||

| Item 4. |

52 | |||||

| Item 5. |

53 | |||||

| Item 6. |

55 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

61 | ||||

| Item 7A. |

87 | |||||

| Item 8. |

88 | |||||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

88 | ||||

| Item 9A. |

88 | |||||

| Item 9B. |

92 | |||||

| Item 10. |

93 | |||||

| Item 11. |

93 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

93 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

93 | ||||

| Item 14. |

93 | |||||

| Item 15. |

94 | |||||

| Item 16 |

94 | |||||

i

Table of Contents

General

The AZEK Company Inc. (the Company, which may be referred to as AZEK, we or us) is an industry-leading designer and manufacturer of beautiful, low-maintenance residential and commercial building products and is committed to innovation, sustainability and research & development. Our predecessor was formed on August 15, 2013, and, in connection with our initial public offering, or our IPO, we became a Delaware corporation and changed our name to The AZEK Company Inc. on June 11, 2020. Our principal executive offices are located at 1330 W Fulton Street, Suite 350, Chicago, Illinois 60607, and our telephone number is 877-275-2935. AZEK operates highly automated manufacturing and recycling facilities in Ohio, Pennsylvania and Minnesota. Our website address is www.azekco.com.

Environmental and Social Responsibility; Corporate Governance

One of our core values is to “always do the right thing”. We make decisions according to what is right, not what is the cheapest, fastest or easiest, and we strive to always operate with integrity, transparency and with the customer in mind. In furtherance of that value, we are focused on sustainability across our operations and have adopted strategies to enable us to meet the growing demand for environmentally friendly products.

Under the direction of our chief executive officer and the board of directors, we are focused on achieving a high level of environmental and social responsibility and strong corporate governance. The Nominating and Corporate Governance Committee of our board of directors is responsible for overseeing our strategy on corporate social responsibility and sustainability, including environmental, social and governance, or ESG matters and related policies and communications. Additionally, we have established an internal ESG Steering Committee comprised of cross-functional leaders from across our organization that is focused on implementing ESG strategies and policies and reports directly to our chief executive officer.

Our corporate values serve as a belief system that guides how we work. These values influence our decisions, our interactions with colleagues and customers, and our standards for behavior. Our core value of “always do the right thing” is the foundation of our overarching commitment to ESG stewardship. In accordance with this commitment, we are a signatory to the United Nations Global Compact, a global initiative focused on advancing sustainable and responsible business practices related to human rights, labor, the environment and anti-corruption.

We operate our business in a manner that is centered on sustainability and promotes environmental stewardship across our value chain from product design to raw material sourcing and manufacturing to employee, customer and stakeholder communications and engagement. As part of the building materials industry, we believe that we can play a role in advancing the circular economy to create a more sustainable future by increasing the recycling of wood, plastic and water, monitoring our product lifecycle, reducing our carbon footprint and encouraging those in our supply chain to do the same. To demonstrate our commitment to sustainability, some of our actions include investing in a state-of-the-art recycling facility, increasing the amount of recycled content in our products, repurposing the scraps from our board-making process back into production, and deliberately sourcing and reusing hard-to-recycle materials that would traditionally end up in landfills.

We are also committed to social responsibility within our workforce and our community. We have evaluated and adopted certain human capital and human rights management policies to further our commitment to social responsibility. Our culture is driven by a shared passion for our values, mission and performance. It is an inclusive culture of innovative, growth-minded individuals committed to always doing the right thing, continuous improvement and solving problems for our customers and partners. We are focused on hiring and retaining diverse and highly talented employees and empowering them to create value. In our employee selection

1

Table of Contents

process and the operation of our business we adhere to equal employment opportunity policies and encourage the participation of our employees in training programs that will enhance their effectiveness in the performance of their duties. Our chief executive officer periodically leads employee meetings intended to encourage employees to understand why sustainability matters and regularly meets with small groups of employees to receive their feedback on the business. We also conduct employee engagement surveys annually. The results of these surveys allow us to identify areas of strength and opportunities for improvement to ensure continued satisfaction and retention of our employees. We provide attractive benefits that promote the health of our employees and their families and design compelling job opportunities, aligned with our values and mission, in an energizing work environment. We compensate our employees according to our fair remuneration policies and believe deeply in paying for performance. Therefore, employees generally receive a portion of their compensation in the form of share grants tied to performance. In conjunction with our 2020 initial public offering, we provided all employees an opportunity for ownership in our company by granting them shares of our Class A common stock.

Our Environmental, Health and Safety, or EHS Policy outlines our management programs and expectations throughout our operations and businesses. We manage operational hazards and risks to provide workplaces that are safe and healthy for our employees, visitors, contractors, customers, and the communities in which we operate. We train our employees, so they have the awareness, knowledge and skills to work in a safe and environmentally responsible manner. We continually are reviewing and improving our EHS performance through ongoing training, objectives and management systems.

As a company, we are committed to being responsible and respected citizens in the communities in which we live and work. We are dedicated to supporting organizations that help people live more productive, educated and enriched lives and encourage our employees to contribute their time to support various community and charitable activities in alignment with their values.

Our corporate governance policies set clear expectations and responsibilities for our leaders, employees and business partners to ensure we conduct our operations in a manner that is consistent with the highest standards of business ethics and accountability and is based on maintaining a close alignment of our interests with those of our stakeholders. Notable features of our corporate governance structure include the following:

| • | Eleven of our twelve directors have been determined to be independent for purposes of the New York Stock Exchange, or NYSE corporate governance listing standards and Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. |

| • | Our non-executive chairperson of the board of directors convenes and chairs executive sessions of the independent directors to discuss certain matters without executive officers present. |

| • | Three of our directors qualify as an “audit committee financial expert” as defined by the Securities and Exchange Commission, or the SEC. |

| • | Two of our directors, including the chairperson of our Audit Committee, are women, and another three of our directors are considered of diverse ethnicity and race, constituting approximately 33% of our board of directors in furtherance of our board diversity policy. |

| • | Our Corporate Governance Guidelines provide for a target retirement age of 75 for our directors. |

| • | Our Insider Trading Policy prohibits the purchase or sale of our securities by any of our directors, officers, employees and consultants on the basis of material nonpublic information, and also prohibits our directors and officers from hedging our equity securities, holding such securities in a margin account or pledging such securities as collateral for a loan. |

| • | We have adopted a Clawback Policy whereby we are able to recoup performance- or incentive-based compensation in the event of an accounting restatement due to material noncompliance with any financial reporting requirements under the securities laws. |

| • | Our Nominating and Corporate Governance Committee oversees and directs our ESG strategies, activities, policies and communications. |

2

Table of Contents

In order to foster the highest standards of ethics and conduct in all business relationships, we have adopted a Code of Conduct and Ethics policy, or the Code of Conduct. This policy covers a wide range of business practices and procedures and applies to our officers, directors, employees, agents, representatives, and consultants. In addition and as a part of the Code of Conduct, we have implemented whistleblowing procedures that allow covered persons to report, on a confidential basis, concerns regarding, among other things, any questionable or unethical accounting, internal accounting controls or auditing matters with our Audit Committee as well as any potential Code of Conduct or ethics violations with our Nominating and Corporate Governance Committee or our Chief Legal Officer. We review all of these policies on a periodic basis with our employees.

Our business is managed by our executive officers, subject to the supervision and oversight of our board of directors. Our directors stay informed about our business by attending meetings of our board of directors and its committees and through supplemental reports and communications.

Business and Growth Strategies

We are an industry-leading designer and manufacturer of beautiful, low-maintenance and environmentally sustainable products focused on the highly attractive, large and fast-growing Outdoor Living market. Homeowners are continuing to invest in their outdoor spaces and are increasingly recognizing the significant advantages of long-lasting products, which are converting demand away from traditional materials, particularly wood. Our products transform those outdoor spaces by combining highly appealing aesthetics with significantly lower maintenance costs compared to traditional materials. Our innovative portfolio of Outdoor Living products, including decking, railing, exterior trim and accessories, inspires consumers to design outdoor spaces tailored to their unique lifestyle needs. We are well known in the industry, and we generally hold one of the top two market share positions by revenue in our product categories. In addition to our leading suite of Outdoor Living products, we sell a broad range of highly engineered products that are sold in commercial markets, including partitions, lockers and storage solutions. We are a leader in our product categories because of our significant scale, vertically-integrated manufacturing capabilities, extensive material science expertise and execution-focused management team.

Over our more than 30-year history, we have developed a reputation as a leading innovator in our markets by leveraging our differentiated manufacturing capabilities, material science and research and development, or R&D, expertise to capitalize on favorable secular growth trends that are accelerating material conversion from traditional materials such as wood, to sustainable, low-maintenance engineered materials, and to expand our markets. We believe our core competency of consistently launching new products into the market, combined with our recent investments in sales, marketing, R&D and manufacturing, will continue to solidify our incumbent position as a market leader and enable us to generate long-term demand for our products through economic cycles. Throughout our history, we have introduced numerous disruptive products and demonstrated our ability to drive material conversion and extend our portfolio, addressing consumer needs across a wide range of price segments. We have achieved a premium brand reputation through our unwavering commitment to our customers and developing innovative new products that combine the latest style and design trends with our differentiated material science expertise and proprietary production technologies. For example, we have launched products that take premium flooring trends, such as wire-brushed and hand-scraped finishes and multiple widths, into the decking market. Our competitive advantages enable us to create award-winning products and back them with some of the industry’s longest warranties, such as the 50-year fade & stain warranty that we offer on our TimberTech AZEK decking product line.

We have created an operating platform that is centered around sustainability, one of our core strategic pillars, which extends across our value chain from product design to raw material sourcing and manufacturing, and we increasingly utilize plastic waste, recycled wood and scrap in our products. We have also made significant recent investments in our recycling capabilities, including our recent acquisition of Return Polymers, which further enhance the sustainability of our manufacturing operations and reduce our costs. In fiscal year 2019, we opened a new polyethylene recycling facility that utilizes advanced technologies to transform a broad

3

Table of Contents

range of plastic waste into raw material used in our products. Today, our TimberTech PRO and EDGE decking lines offer high-quality products made from approximately 80% recycled material. Through our recycling programs, approximately 400 million pounds of waste and scrap were diverted from landfills in fiscal year 2020. Furthermore, approximately 98% of scrap generated is re-used, and the majority of our TimberTech, AZEK Exteriors and Versatex products are recyclable at the end of their useful lives.

We believe our multi-faceted growth and margin expansion strategy positions us to drive profitable above-market growth in the markets we serve. This strategy includes initiatives to:

| • | Accelerate market conversion by capitalizing on downstream investments across professional and retail channels; |

| • | Build the leading consumer brand in outdoor living; |

| • | Introduce innovative new products that expand our markets; |

| • | Expand margins through enhanced recycling capabilities and productivity initiatives; and |

| • | Execute strategic acquisitions that broaden our platform and enhance our manufacturing operations. |

Our Industry

Our products are widely used across several large, attractive markets, including residential and commercial end markets. We primarily serve the Outdoor Living market, which we define as the market for decking, railing, trim, wood and wood-look siding, porches, pavers, outdoor furniture, outdoor cabinetry and outdoor lighting designed to enhance the utility and improve the aesthetics of outdoor living spaces, with our highly-engineered decking, railing and exteriors products, which have benefitted from increased investment as homeowners choose to spend more leisure time outdoors and as the appeal of low- to no-maintenance building and home products gains momentum. We believe that consumers are increasingly environmentally-conscious in their purchasing behaviors and that our sustainable manufacturing practices and the high recycled content of our products address evolving consumer preferences.

Based on data provided by Principia Consulting, LLC, a third-party industry research and consulting firm, or Principia, the total U.S. market sales of residential decking, railing and exterior trim products were $7.6 billion in 2019 and grew at a 6.5% compound annual growth rate, or CAGR, from 2014 to 2019 on a linear foot basis. With respect to the individual components of the Outdoor Living market, the decking, railing and exterior trim markets were approximately $3.3 billion, $2.2 billion and $2.1 billion, respectively, in 2019. In terms of volume, the decking, railing and exterior trim markets were approximately 3.3 billion, 160.0 million and 2.0 billion linear feet, respectively, in 2019.

Composite decking (which includes wood composite and cellular PVC decking), railing and exterior trim products have continued to increase market share relative to other materials due to their superior and low-maintenance product qualities. Based on data provided by Principia, between 2014 and 2019, composite decking, composite and aluminum railing and PVC trim products collectively grew at a CAGR of 10.0% as compared to decking, railing and trim manufactured from wood, which grew at a CAGR of 5.8%, in each case measured in terms of linear feet. We believe the market for composite products will continue to increase at an above-market growth rate as it benefits from material conversion.

Based on data provided by Principia, there were approximately 58 million decks in the United States as of 2019, of which approximately 5.5 million were built in 2019, up from approximately 4.1 million in 2014, representing a CAGR of 5.8%. Based on the same industry data, wood represented approximately 65% of the total U.S. decking, railing and trim markets based on 2019 linear feet sold. With respect to the individual components of these markets, based on this data, composite decking represented approximately 20% of the decking market, composite and aluminum railing represented approximately 16% of the railing market and PVC trim products represented approximately 11% of the trim market, each in terms of linear feet.

4

Table of Contents

Our Brands and Products

We currently operate in two reportable segments: Residential and Commercial. We leverage a shared material technology and U.S.-based manufacturing platform to create an extensive range of long-lasting and low-maintenance products that convert demand away from traditional materials. Our Residential segment serves the high-growth Outdoor Living market by offering products that inspire consumers to design outdoor spaces tailored to their individual lifestyles. Our innovative portfolio of Outdoor Living products, including decking, railing, exterior trim and accessories, are sold under our TimberTech, AZEK Exteriors, VERSATEX and ULTRALOX brands. Our Commercial segment addresses demand for low-maintenance, highly engineered products in a variety of commercial and industrial markets, including the outdoor, graphic displays and signage, educational and recreational markets, as well as the food processing and chemical industries. Products sold by our Commercial segment include highly engineered polymer sheeting as well as partitions, lockers and storage solutions.

Residential Segment

In our Residential segment, we design and manufacture engineered Outdoor Living products, including decking, railing, trim and moulding and accessories that drive conversion away from wood and other traditional materials. These products are primarily capped wood composites and PVC that are aesthetically similar, yet functionally superior, to finished wood, as they require less maintenance, do not rot or warp, are resistant to water, insects, stains, moisture, mold, mildew, scuffs and scratching, and do not require painting or staining for protection. Many of our products are also designed to ease installation for contractors and builders and reduce lifetime maintenance costs for consumers, without sacrificing aesthetics. We believe these factors, combined with some of the industry’s longest warranties and a comprehensive range of on-trend color palettes and styles, drive contractor loyalty and offer a compelling choice for consumers looking to reinvent their outdoor living spaces and the exteriors of their homes.

In fiscal year 2020, our Residential segment generated net sales of $771.2 million, representing approximately 86% of our total net sales. Our Residential segment consists of Deck, Rail & Accessories which is approximately 62% of total consolidated net sales and Exteriors which is approximately 24% of total consolidated net sales. Demand for our Residential segment products is largely driven by repair and remodel activity, which we estimate accounted for approximately 80% of our Residential segment net sales in fiscal year 2020 with the remaining sales attributable to new construction activity.

Decking

We are one of the only decking manufacturers to offer both capped wood composite and PVC decking products, and we believe we are the only manufacturer to offer narrow and wide-width PVC deck boards. Our decking products transform consumers’ outdoor areas into aesthetically appealing spaces, while reducing lifetime maintenance costs as compared to those made with traditional materials. These high-quality, innovative products are artfully crafted with a broad range of design options and distinguishing features, such as cascading or variegated tones to emulate the natural look and finish of wood. Our products are long lasting and often a more cost-effective alternative over time than products made of traditional materials such as wood, which can fade quickly, require frequent sanding, staining and maintenance and are prone to rot, splinter and crack. In addition, our decking products span a wide range of entry-level to premium price points and are covered by some of the industry’s longest warranties. We are also committed to sustainability and to manufacturing our products with recycled waste and scrap. The wood used in the core of our decking products is 100% recycled, and we do not use any virgin timber. We continue to expand our use of recycled materials in our decking products, such as in our TimberTech PRO and EDGE decking product lines, which offer products made from approximately 80% recycled material.

5

Table of Contents

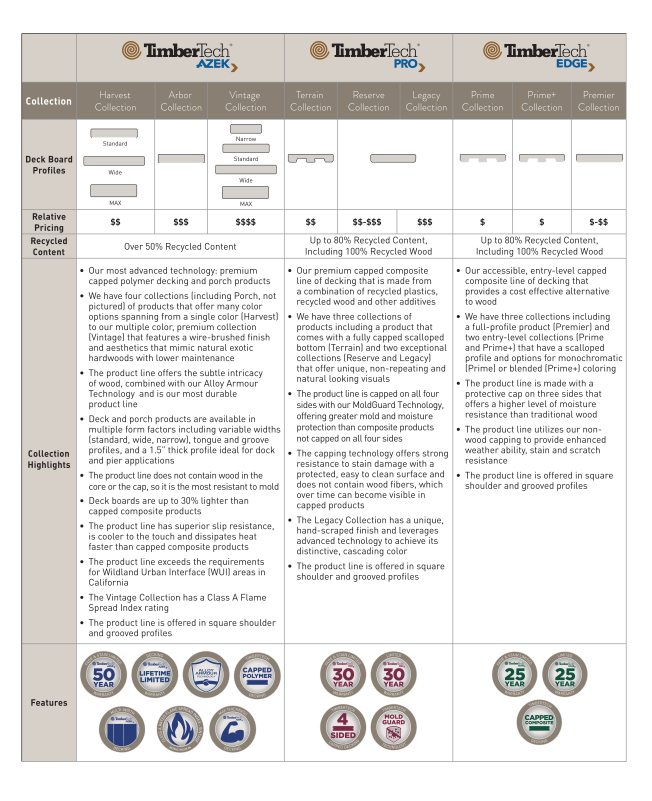

Through our three primary decking product lines—TimberTech AZEK, TimberTech PRO and TimberTech EDGE—we offer a broad range of colors, textures and styles to provide consumers with a myriad of design options at a variety of price points.

6

Table of Contents

Our decking product lines are complemented by our porch collection as well as our broad range of decking accessories, including in-deck and riser lighting, risers for use on stairs, fascia, end coating, flashing and joist tape and our TimberTech Deck Cleaner. Our growing portfolio of porch board products leverages the same materials and production technologies as our industry-leading decking products and allows us to deliver similar design aesthetics and low-maintenance benefits across a variety of textures. Our composite pavers provide a lightweight and easy-to-install alternative to traditional pavers and are available in a variety of colors and styles for landscaping, resurfacing and rooftop patio applications. We offer a broad range of high-quality fasteners that enable an efficient installation, safe fastening and superior aesthetics, including traditional fasteners, which are color-matched to the decking product and are offered in both coated carbon steel and stainless steel; concealed fasteners, which are covered with a color-matching cap to blend into the associated decking product; and hidden fasteners, which are fastened out of sight under the decking boards.

Railing

Our railing solutions enable consumers to accent their outdoor living spaces with attractive, high-quality, low-maintenance composite and aluminum railing products, which we offer through our TimberTech and ULTRALOX brands. Our railing products reduce the need for ongoing maintenance by eliminating many of the major functional disadvantages of traditional materials, such as warping and rust, and thus are often a more cost effective alternative over time. For example, our TimberTech composite railing products are covered by a four sided cap, which eliminates the need for annual sanding, staining, sealing and painting, and our TimberTech aluminum railing products feature a powder coated surface, which produces a long-lasting, color-durable, moisture-resistant finish.

Our railing products are available in various materials and in a broad range of colors, finishes and styles, including traditional, modern and minimalist designs, and we offer a wide selection of infill options, such as composite and aluminum balusters, cable rails and glass channel kits. Our aluminum railing products are lighter weight and easier to install than other metal railing materials, and their sleek, minimalistic designs allow unobstructed views, especially when coupled with a glass or cable infill option. Our railing products are diverse and highly customizable, and, in addition to complementing our decking product lines, they also appeal to a broader, stand-alone market, such as for use on decks constructed from traditional materials and in commercial applications.

We believe we are particularly well positioned to serve the fast growing aluminum railing market following our 2017 acquisition of Ultralox Technology, LLC, or Ultralox, which significantly expanded our aluminum railing product capabilities. Using Ultralox’s proprietary Interlocking Machine, a dealer or contractor can create a customized aluminum, pre-panelized, interlocking railing system on site. This facilitates faster and easier assembly and installation without special tools, mechanical fasteners or welding for both residential and commercial applications and overcomes the design limitations of pre-fabricated railing products. Our TimberTech brand also sells a pre-panelized version of the Ultralox railing kit branded as Impression Rail Express.

To complement our railing products, we offer an array of functional and decorative accessories, including drink railings, mounting posts, under-rail lights and lighted island caps and gate kits. Our decking, railing and related accessory products are frequently used in combination in order to enable consumers to create their own highly customized outdoor living spaces.

Trim and Moulding

We are the leading designer and manufacturer of PVC trim and moulding products for the Outdoor Living market. We operate two large PVC trim manufacturing plants and offer a diverse portfolio of PVC trim and moulding products through our AZEK Exteriors and VERSATEX brands. Our trim and moulding products are aesthetically similar to wood and can be easily milled, routed or shaped for use in almost any application. Our

7

Table of Contents

products are moisture- and insect-resistant and are more durable and require less maintenance than traditional wood products. Contractors and homeowners can use our products in conventional applications, to express their creativity through unique home exteriors, and to complement our decking and railing products. For example, two-story decks are often paired with column wraps, canvas porch ceilings and other trim and moulding accents. Our trim and moulding products are also increasingly utilized within the home, including as wainscot trim or as shiplap, which originated to protect the exteriors of homes in harsh climates, but is now a popular way to create unique interior spaces. Our products are also used by mill shops and OEM fabricators, who rely on our products due to their consistent formulation, dimensional accuracy and precision and high machinability, to manufacture a wide range of other Outdoor Living products such as pergolas, arbors and flowerbeds.

In 2018, we acquired Versatex, which significantly expanded our existing trim product portfolio with a broad range of premium cellular PVC trim and moulding products. It also complements our established PVC trim and moulding capabilities with an organization dedicated to service, customer responsiveness and innovation. Particularly known for its customer-focused approach, Versatex has differentiated itself through its history of quickly addressing special requests from customers, developing cutting-edge products that focus on the needs of builders, architects, fabricators and consumers and rapidly bringing these innovative new products to market. Our full line of AZEK Exteriors and VERSATEX products includes trim and moulding, fabricated products, paintable trim and specialty solutions:

| Boards and Sheets |

Time-Saving Products |

Aesthetic Details |

Paintable Trim | |||

| • Boards—Manufactured with sealed edges and shipped with a protective film, our trim board is highly versatile and can be milled, routed, or heat formed to be used in many different applications.

• Sheet—Our sheets provide a clean backdrop over an expansive area and can be used for large scale fabrication such as pergolas and arbors.

• Skirt Boards—Designed to provide moisture resistance at ground contact and help direct water away from the structure. These products are easy to install with fiber cement, vinyl, or wood siding. |

• Column Wraps—Our column wraps are offered in multiple styles and can quickly and easily improve the aesthetics of a standard wood post with minimal labor.

• Corner Boards—Our one-piece corner boards are easy to install, feature smooth, outside edges and are aesthetically superior to two-piece corners, which can gather dirt along their edges.

• J-Channel and Stealth Products—Designed to complement siding and for easy installation around windows and corners. |

• Mouldings—Used to enable customizations, cover transitions or provide crisp, architectural style elements to home exteriors.

• Tongue & Groove Profiles—Easily add the classic style of beadboard, nickel gap, and shiplap in horizontal or vertical orientation to complement housing exteriors.

• Canvas—Designed to add contrast to porch ceilings and interior trim projects, these products deliver the look of rich hardwoods without knots or labor intensive staining requirements.

• TimberTech AZEK Cladding—Combines premium natural hardwood aesthetics and the durability of advanced polymer technology for use as a cladding rain screen for premium curb appeal.

• Shingle Siding—The most authentic looking shingle siding, with variable-width tabs and keyways, made with our moisture resistant advanced polymer in a panel format, making it easy for contractors to install. |

• PaintPro—Innovative cellular PVC trim that has the same high- performance and low-maintenance benefits of traditional AZEK trim, but can be painted any color. PaintPro trim offers quick drying times with no priming needed and superior paint adhesion. |

8

Table of Contents

In addition to the products described above, we offer custom milled solutions for builders and a number of accessories such as fastening systems, adhesives, sealants and bonding solutions.

Commercial Segment

Leveraging our shared U.S.-based manufacturing platform and material technology, we bring low-maintenance products with superior aesthetics to a variety of commercial and industrial markets. Our Residential and Commercial segments operate synergistically, primarily through our ability to utilize new materials, technologies and products developed by one segment across an array of manufacturing processes and products in our other segment. Our Commercial segment includes our Vycom and Scranton Products product lines. Vycom manufactures a comprehensive line of highly engineered polymer materials designed to offer sustainable, low-maintenance and long-lasting solutions for applications for a variety of commercial and industrial markets, including the markets for outdoor living, graphic displays and signage, recreation and playground equipment and the food processing, marine and chemical industries. Scranton Products manufactures sustainable, low-maintenance privacy and storage solutions primarily for schools, stadium arenas and recreational and commercial facilities. Within our Commercial segment, demand for our products is driven by commercial construction activity, material conversion and favorable secular trends such as an increased emphasis on privacy. In fiscal year 2020, our Commercial segment generated net sales of $128.1 million, which represented approximately 14% of our total net sales.

Vycom

Vycom manufactures a comprehensive line of highly engineered polymer materials designed to replace wood, metal and other traditional materials in a variety of applications. Vycom’s products are used in a broad range of commercial end markets, are durable, strong and lightweight and can be ordered in a wide range of sizes, thicknesses and colors. These products provide superior performance compared to traditional materials and are resistant to corrosive chemicals, scratches, flames, odors, moisture, bacteria, rotting, delaminating, chipping and swelling. Vycom’s products are also easier to fabricate, decorate, laminate, weld, machine or form than many traditional materials, which makes them attractive to original equipment manufacturers, or OEMs, that have specialized requirements for fabrication, physical properties or chemical resistance. Vycom’s highly engineered solutions are often developed in consultation with OEMs and, as a result, in certain cases are specified into OEM products and applications.

Scranton Products

Scranton Products provides low-maintenance bathroom partitions, shower and dressing stalls, lockers and other storage solutions. We market our partitions under the Aria, Eclipse and Hiny Hiders brands and our lockers under the TuffTec and Duralife brands. Our primary customers are schools, parks, recreational facilities, stadium arenas, industrial plants and retail and commercial facilities, and we continue to expand rapidly into the commercial repair and remodel market primarily through sales of our high-privacy bathroom partitions. Products sold by Scranton Products are designed to replace traditional materials such as metal, wood and baked enamel with more durable, long-lasting, low-maintenance and more aesthetically pleasing materials. These products are highly resistant to rust, dents, scratches and graffiti and are easily cleaned. We offer an extensive array of attractive colors, textures and finishes that replicate more traditional materials. As compared to metal and wood alternatives, our partitions and locker products sell at premium prices but deliver significantly reduced life-cycle costs through increased durability and lower maintenance expenses. In fiscal year 2020, approximately half of Scranton Products’ net sales were attributable to the education market. We expect to continue experiencing significant growth in Scranton Products’ sales in the commercial markets, which we believe is driven primarily by an increased focus on bathroom privacy considerations, design and aesthetics.

Product Research and Development

Over the past 30 years, we have built an R&D organization with significant expertise in material science and production process technologies. We leverage our R&D and U.S.-based manufacturing capabilities

9

Table of Contents

to deliver innovative new products to market that address evolving customer needs. We have made substantial investments in our R&D organization, which, as of September 30, 2020, consisted of over 30 team members, including approximately 20 engineers. We are committed to continuing to invest in our R&D capabilities to further strengthen our ability to regularly introduce new products that set us apart from our competition and accelerate future growth.

Our product managers and marketing team actively analyze proprietary consumer research and work with architects, contractors and consumers to identify and develop new products that incorporate consumer feedback, expand our portfolio and extend the range of style and design options we offer. Our R&D team then designs, prototypes and tests these new products prior to full scale production. Our rigorous R&D process incorporates in-house analytical capabilities and comprehensive product testing with more than 260 distinct tests, such as accelerated weathering.

We believe our focus on innovation allows us to bring on-trend products to market rapidly. For example, we were able to leverage our proprietary color pigmentation technology to adapt quickly to lighter color decking trends and introduce our whitewashed cedar products. Similarly, in response to popular flooring trends, our technological and material science expertise enables us to manufacture wide-width and multi-width decking products that we believe will help accelerate conversion from wood decking products. Our ability to innovate has also helped us introduce opening price point products such as TimberTech EDGE. In our Commercial segment, the introduction of our Aria partitions responds to demand for increased privacy and the introduction of our TimberLine products addresses the adjacent market demand for beautiful, low-maintenance engineered products with a wood-like look in outdoor furniture, cabinetry and other applications.

We currently have a broad portfolio of ongoing development projects across our core product categories as well as certain adjacent products and markets. We continue to leverage our acquisition of Ultralox to develop additional aluminum and steel railing products. In addition, we are constantly evaluating opportunities to use our technological and U.S.-based manufacturing capabilities to expand into new markets where we believe there is an opportunity to drive material conversion or otherwise broaden our market reach.

Distribution

Within our Residential segment, we sell our products through a network of more than 4,200 professional dealers and thousands of home improvement retail outlets, including both stocking and special order locations. These outlets are served by more than 35 distributors with over 150 branch locations enabling us to effectively serve contractors and customers throughout the United States and Canada. Within our Commercial segment, we sell our products through a widespread distribution network, as well as directly to OEMs. Our products are generally sold through both one-step and two-step distribution channels. Our distribution network has broad geographic coverage and benefits from the logistics capabilities of our distributors as well as the ability of our distributors and dealers to help generate demand for our products through direct sales, merchandising and marketing. In fiscal year 2020, approximately 99% of our gross sales came from the United States and Canada. Our distributors in locations outside of the United States and Canada are responsible for marketing and selling our products in other countries to which our products are exported. We are continually evaluating our distribution strategy to ensure that we can meet the demands of our consumers in the most effective ways.

Residential Segment

We distribute the majority of our Residential segment products through more than 35 distributors, who in turn sell our products to dealers. Our distributors also maintain an inventory of our products and support our dealers by managing shipping logistics. We have exclusive relationships with our distributors for decking and trim with respect to specified geographies, and, although some legacy distributors are permitted to carry only certain of our products, many of our distributors are required to carry a comprehensive selection of our TimberTech and AZEK products. Our top ten distributors for the year ended September 30, 2020, accounted for a majority of our total net sales during that period.

10

Table of Contents

Through our distributors, our products are sold to more than 4,200 professional dealers and lumber yards. Additionally, we have special order and stocking relationships with certain home improvement retailers with thousands of locations across the United States and Canada. We attempt to drive sales to our dealers and retailers through digital tools and extensive marketing directed at consumers who can help create pull-through demand for our products among influencers and decision makers such as architects, builders and contractors. Our dealers typically exhibit high brand loyalty and are incentivized to consolidate the manufacturers from which they purchase to maximize early buy discounts and annual volume rebates.

Contractors purchase our products through dealers and retailers. We believe contractors are typically loyal to brands and products they trust because they are a direct point of contact for consumers and are most likely to receive feedback and feel responsible for product performance. We consider the needs of and feedback from contractors in designing and manufacturing new products, and we invest in strengthening our relationships with these contractors as we believe they significantly influence decisions regarding material and brand selection for the types of products we produce. The graphic below illustrates the distribution channels for the Outdoor Living market in which we sell our Residential composite decking, composite and aluminum railing and PVC trim products.

We allocate significant sales force resources to support our dealers, and we believe our strong relationships with dealers and contractors are driven by the trust and reliability that we have generated through product innovation, superior quality and performance and the continuing support that we offer. Such support includes specialized training opportunities such as AZEK University and sales support initiatives such as digital lead generation, joint marketing funds, new sample kits, display kiosks, enhanced product literature, print, TV and radio advertising and social media initiatives. AZEK University provides training for contractors and customers installing and using TimberTech and AZEK Exteriors products. We have recently invested and upgraded our AZEK University programming to include virtual trainings and on-demand digital tools that have enabled us to reach a larger audience in an efficient manner. Additionally, our AZEK Pro Rewards program leverages our new website and digital capabilities to share curated digital leads with our contractors.

Parksite Inc., who distributes our Residential segment products, accounted for approximately 20.3% of our net sales for the year ended September 30, 2020.

Commercial Segment

Our Vycom products are primarily sold through approximately 130 engineered product distributors across the United States, Canada and Latin America, who in turn sell full sheet and/or fabricated products that have been converted into a wide variety of components or items for various industrial uses primarily to OEMs. We also sell certain Vycom products directly to OEMs.

Our Scranton Products bathroom partition and locker systems are sold through a network of approximately 900 dealers who sell to industrial and commercial customers across the United States and in Canada. We market the benefits of our bathroom partition and locker systems directly to architects and facilities managers, who frequently specify products by name and material in their designs.

Operations and Manufacturing

We are a vertically-integrated, U.S-based manufacturer, delivering superior quality products with a competitive cost position. Our competitive cost position, including our relatively low transportation costs resulting from us being a U.S.-based manufacturer, provides us with a competitive freight advantage relative to imported products. Our versatile, process-oriented manufacturing operations are built on a foundation of extensive material development and processing capabilities. Approximately 90% of our gross sales are attributable to products that are manufactured through an extrusion process that contains a blend of virgin polymers and recycled materials. Our proprietary production technologies, material blending proficiency and

11

Table of Contents

range of extrusion capabilities enable innovation and facilitate expansion into new markets. We have deep experience working with multiple technologies that enable us to provide some of the industry’s most attractive visuals through advanced streaking and multi-color technologies. Our manufacturing footprint includes eight facilities across five geographic locations totaling approximately 2 million square feet, and we have made significant investments in people, processes and systems to increase our manufacturing scale and productivity. We recently expanded our vertical manufacturing capabilities with the addition of our 100,000 square foot polyethylene recycling facility in late 2018 and our acquisition of PVC recycling operation Return Polymers in early 2020. In addition, we are implementing a multi-year, $180.0 million capital investment program to increase capacity and further support our future growth.

In 2017, we introduced our continuous improvement program known as the AZEK Integrated Management System to manage and monitor operations, and in 2018, we implemented Lean Six Sigma tools and techniques at all our manufacturing facilities to reduce material waste and improve manufacturing efficiency.

We have integrated manufacturing operations and differentiated technical expertise in utilizing recycled materials to develop sustainable, cutting-edge products. Sustainability is one of our core strategic pillars, and we are committed to introducing sustainable products that utilize recycled materials, reduce deforestation and are versatile and recyclable at the end of their useful lives. We are dedicated to expanding our recycling capability and investing in the use of reclaimed materials in our manufacturing processes.

Facilities Overview

We are headquartered in Chicago, Illinois and operate eight manufacturing and recycling facilities in the United States. In alignment with our sustainability values, our Chicago corporate office is located in a 2019 LEED-Certified building. Currently, we produce our AZEK, Scranton and Vycom products primarily at our manufacturing facilities in Scranton, Pennsylvania, our TimberTech products primarily at our manufacturing facilities in Scranton, Pennsylvania and Wilmington, Ohio, all of our VERSATEX trim products at our manufacturing facility in Aliquippa, Pennsylvania and all of our ULTRALOX railing products through our manufacturing facility in Eagan, Minnesota. In 2019, we opened our state-of-the-art polyethylene recycling facility in Wilmington, Ohio. The acquisition of Return Polymers in 2020 enhanced our PVC recycling capabilities and is located in Ashland, Ohio. We are implementing a multi-year $180.0 million capital investment program to support our future growth. As a part of that program and to address increased demand, we plan to add a new manufacturing facility.

Sales and Marketing

Residential Segment

Our Residential segment sales organization is organized under our AZEK, TimberTech, VERSATEX and ULTRALOX product lines and is composed of a general sales organization, which is primarily geographically based, and also includes specialty sales organizations who focus on exterior trim, railing, retail and key accounts. Our sales organization is primarily focused on generating downstream demand with contractors, architects and builders as well as maintaining relationships with and educating influencers. We believe we can continue to leverage our downstream investments to accelerate material conversion in our markets, strengthen our position in the pro channel and enhance our retail presence.

We maintain a national sales organization that works with builders and supports certain national or large regional dealers with multiple locations and/or buying groups to provide a single point of contact and more effectively serve these customers. Our national sales organization is focused on increased penetration into these accounts by working with corporate decision makers and with buyers at the local level. We have also enhanced our retail-focused sales team, who is focused on supporting individual retail locations, training pro desk associates within retail locations and facilitating deliveries for special orders placed at home improvement retailers.

12

Table of Contents

In 2019, we unified our decking and railing product portfolio under our leading TimberTech brand with a differentiated “Go Against the Grain” marketing campaign. TimberTech has strong market awareness, and unifying our decking and railing products under the TimberTech brand allows us to highlight product differentiation, while maintaining brand identity across multiple price points. In 2020, we debuted our new “Better Tech, Better Deck” marketing campaign which emphasized the technological superiority and design versatility of TimberTech’s product portfolio and is meant to inspire homeowners looking to build, renovate and remodel their outdoor living spaces. Following the repositioning of our AZEK decking product lines under the TimberTech brand, we are focused on leveraging the AZEK brand as our exteriors brand due to the significant brand recognition for AZEK trim and moulding products.

We maintain comprehensive marketing campaigns using various media in support of our brands, targeted towards our growing dealer base, as well as architects, builders, remodelers and consumers. We continue to invest in our marketing organization and alongside our channel partners to increase consumer awareness and preference for our products. Our focused digital strategy, enhanced media presence and differentiated marketing campaigns drive increased engagement with consumers as well as key influencers such as architects, builders and contractors. Our new digital platform facilitates the consumer journey from inspiration and design through installation. The experience educates consumers on the features and benefits of our products versus traditional materials, utilizes digital visualization tools to allow consumers to re-imagine their outdoor living spaces and directly connects them to a pre-qualified local contractor. We enjoy strong preference for our products among contractors, who typically purchase our products at dealers, and we are investing in order to increase our presence within retailers as the majority of consumers include visits to home improvement retailers in their research of decking products. These consumer engagement strategies are focused on creating additional pull-through demand and accelerating our growth. In addition, we have augmented our advertising efforts by developing instructive, educational and visually appealing product displays, marketing tools and sample kits to market our products. We have also invested in digital, print, TV and radio advertising and display kiosks which enhance our dealers’ and home improvement retailers’ ability to exhibit and promote our products.

We also provide frequent demonstrations, education, product training and other sales support and loyalty initiatives to help drive awareness of and demand for our products. In 2010, we established AZEK University to educate dealers, contractors, architects and builders on our product offering and value proposition through training that includes classroom tutorials, hands-on sessions and plant tours. In addition, through our AZEK Pro Rewards program, we seek to secure preferred brand status with contractors by providing contractors with marketing tools, leads and various other rewards in connection with increased purchases of our products. We believe these efforts increase our market position because many buying decisions involve input from both the contractor and consumer, with consumers frequently relying on contractor recommendations.

Commercial Segment

Our Vycom sales organization focuses on providing engineered polymer solutions for a wide variety of Industries, including the graphic displays and signage, semiconductor, marine, chemical and corrosion, recreation and playground and food processing markets. Our Vycom products are sold to plastics distributors in the United States, Canada and Latin America, who sell primarily to OEMs, and in certain cases are sold directly to OEMs. The Vycom sales force is made up of a combination of direct territory managers and manufacturing representatives focused on increasing market penetration by working with printers, fabricators, OEMs and end-users to generate demand for Vycom materials.

As of September 30, 2020, Scranton Products utilized direct sales and regional manufacturers’ sales representatives to provide coverage to a network of approximately 900 dealers who sell to institutional and commercial customers across the United States and in Canada. The Scranton Products’ sales force and agents service architects and facility managers to create pull-through demand in traditional institutional markets, such as schools, universities and stadium arenas, and in targeted new markets, such as retail stores, commercial and professional buildings, industrial facilities and food processing plants. Our Scranton Products sales force has

13

Table of Contents

leveraged a leading market position, enhanced promotional materials and specialized products to develop close relationships with architects and assist them in designing products and has enhanced awareness of the benefits of our products through targeted efforts to educate architects and designers.

Raw Materials and Suppliers

The primary raw materials used in our products are various petrochemical resins, including polyethylene, polypropylene and PVC resins, reclaimed polyethylene and PVC material, waste wood fiber and aluminum. We also utilize other additives, including modifiers, titanium dioxide, or TiO2, and pigments. Our contracts with key suppliers are typically short term in nature, with terms generally ranging from one to three years. We have not entered into hedges of our raw material costs at this time, but we may choose to enter into such hedges in the future, and our supply contracts with our major vendors do not contain obligations to sell raw materials to us at a fixed price. Prices for spot market purchases are negotiated on a continuous basis in line with current market prices. Other than short term supply contracts for resins with indexed based pricing and occasional strategic purchases of larger quantities of certain raw materials, we generally buy materials on an as-needed basis.

The cost of petrochemical resins used in our manufacturing processes has historically varied significantly and has been affected by changes in supply and demand and in the price of crude oil. Substantially all of our resins are purchased under supply contracts that average approximately one to two years, for which pricing is variable based on an industry benchmark price index. The resin supply contracts are negotiated annually and generally provide that we are obligated to purchase a minimum amount of resins from each supplier. In addition, the price of reclaimed polyethylene material, waste wood fiber, aluminum, other additives (including modifiers, TiO2 and pigments) and other raw materials fluctuates depending on, among other things, overall market supply and demand and general economic conditions. We seek to mitigate the effects of fluctuations in our raw material costs by broadening our supplier base, increasing our use of recycled material, increasing our use of scrap and reducing waste and exploring options for material substitution without sacrificing quality. For example, between fiscal year 2017 and fiscal year 2020, we have invested nearly $60.0 million to enhance our recycling capabilities and have increased our use of “regrind,” through the collection and reprocessing of scrap generated in our manufacturing processes.

Although we do not rely on any single supplier for the majority of our raw materials, we do obtain certain raw materials from single or a limited number of suppliers. In particular, we rely on a single supplier for certain critical capped compounds used in our decking and railing products. If one or more suppliers were unable to satisfy our requirements for particular raw materials, we believe alternative sources of supply would be available, although we could experience a disruption to our operations as alternative suppliers are identified and qualified and new supply arrangements are entered into.

Environmental Sustainability

We have created an operating platform that is centered around sustainability, one of our core strategic pillars, which extends across our value chain from product design, to raw material sourcing and U.S.-based manufacturing, and we increasingly utilize plastic waste, recycled wood and scrap in our products. We believe that our responsibility is not only to our customers, but also to the environment. This commitment is evident through our continued effort to introduce sustainable products, products with life spans that are significantly longer than the life spans of the traditional materials they replace (including exotic hardwoods cut from rainforests) with very little need for maintenance or cleaning chemicals, products that reduce deforestation and products that are versatile and recyclable at the end of their useful lives. We estimate that since 2015 more than one million trees have been saved because our customers chose our decking products over wood. The wood used in the core of our composite decking products is 100% recycled from sources that include, but are not limited to, facilities that manufacture wood mouldings, flooring, windows, doors and other products. Through our recycling programs, approximately 400 million pounds of scrap and waste were diverted from landfills in fiscal year 2020.

14

Table of Contents

In addition to the sustainability of our products, we have implemented energy-efficient manufacturing processes in our business operations. For example, our facilities in Wilmington, OH and Scranton, PA employ closed-loop water filtration systems that recycle approximately 96% of water used annually, and our polyethylene recycling facility utilizes energy-efficient systems for power, water, heating, cooling and lighting.

Our dedication to expanding our recycling capabilities and to increasing the use of reclaimed materials is also a critical part of our sustainability commitment. Approximately 54% of all of our extruded materials were manufactured from recycled materials in fiscal year 2020, an increase from approximately 44% in fiscal year 2019, and we believe there is an opportunity to increase this percentage in the future. Currently, AZEK pavers are made from approximately 95% recycled material, and we estimate that approximately every 500 square feet of AZEK pavers diverts up to 250 passenger vehicle tires and 7,500 plastic containers from landfills. Additionally, through Vycom, we sell effectively 100% post-consumer recycled polymer sheet products used in the manufacturing of outdoor furniture.

Competition

We compete with multiple companies, including divisions or subsidiaries of larger companies and foreign competitors. We compete on the basis of a number of considerations, including service, quality, performance, product characteristics, brand recognition and loyalty, marketing, product development, sales and distribution and price. We believe we compete favorably with respect to these factors.

Residential Segment

Our residential products compete primarily with products made from wood, aluminum and engineered wood that our products are designed to replace. We also compete with other manufacturers of engineered products designed to replace wood and other traditional materials, including Trex Company Inc., Fiberon, LLC, which was acquired by Fortune Brands Home & Security, Inc. in August 2018, Deckorators, a subsidiary of UFP Industries, Inc., Oldcastle Architectural, Inc., Royal Group, Inc., Kleer Lumber LLC and CertainTeed Corporation.

Commercial Segment

Our Vycom products compete in a highly fragmented market. Manufacturers generally focus on a few core materials sold to narrow sub-segments through a specialized distribution network. Competitors for other non-fabricated products include other national and regional manufacturers like Mitsubishi Chemical Advanced Materials (formerly Quadrant EPP), Rochling Engineering Plastics, 3A Composites USA Inc., Simona AG and Kommerling Plastics USA.

The bathroom partition and locker market is also highly fragmented and is addressed by manufacturers producing products in a variety of different materials and at varying price ranges. Scranton Products’ primary plastic bath and locker competitors are Global Partitions Corp. (d/b/a ASI Global Partitions), Hadrian Manufacturing Inc. and Bradley Corporation.

Seasonality

Although we generally experience demand for our products throughout the year, our sales have historically experienced some seasonality. We have typically experienced moderately higher levels of sales of our residential products in the second fiscal quarter of the year as a result of our “early buy” sales and extended payment terms typically available during the second fiscal quarter of the year. As a result of these extended payment terms, our accounts receivable have typically reached seasonal peaks at the end of the second fiscal quarter of the year, and our net cash provided by operating activities has typically been lower in the second fiscal quarter relative to other quarters. In addition, our sales are affected by the individual decisions of distributors and

15

Table of Contents

dealers on the levels of inventory they carry, their views on product demand, their financial condition and the manner in which they choose to manage inventory risk. Our sales are also generally impacted by the number of days in a quarter or a year that contractors and other professionals are able to install our products. This can vary dramatically based on, among other things, weather events such as rain, snow and extreme temperatures. We have generally experienced lower levels of sales of our residential products in the first fiscal quarter due to adverse weather conditions in certain markets, which typically reduces the construction and renovation activity during the winter season. In addition, we have experienced higher levels of sales of bathroom partition products and our locker products during the second half of our fiscal year, which includes the summer months during which schools are typically closed and are more likely to undergo remodel activities.

Intellectual Property

We rely on trademark and service mark protection to protect our brands, and we have registered or applied to register many of these trademarks and service marks. In particular, we believe the AZEK and AZEK Exteriors brands, the TimberTech brand and the VERSATEX brand are significant to the success of our business. We also rely on a combination of unpatented proprietary know-how and trade secrets, and to a lesser extent, patents to preserve our position in the market. As of September 30, 2020, we had approximately 320 trademark registrations and 134 issued patents and pending patent applications in the United States and other countries. As of September 30, 2020, we had approximately 101 issued U.S. patents and 3 U.S. patent applications pending. The majority of our issued U.S. patents expire between 2026 and 2037. We also had approximately 23 issued foreign patents and 7 foreign patent applications pending. As we develop technologies and processes that we believe are innovative, we intend to continually assess the patentability of new intellectual property. In addition, we employ various other methods, including confidentiality and nondisclosure agreements with third parties and employees who have access to trade secrets, to protect our trade secrets and know-how. Our intellectual property rights may be challenged by third parties and may not be effective in excluding competitors from using the same or similar technologies, brands or works.

Employees

Our culture is driven by a shared passion for our values, mission and performance. It is an inclusive culture of innovative, growth-minded individuals committed to always doing the right thing, continuous improvement and solving problems for our customers and partners, which ultimately drives our differentiation and competitiveness.

As of September 30, 2020, we had 1,663 full-time employees. Our workforce is not unionized, and we are not a party to any collective bargaining agreements. We believe we have satisfactory relations with our employees.

Legal Proceedings

From time to time, we may be involved in litigation relating to claims arising out of our operations and businesses that cover a wide range of matters, including, among others, contract and employment claims, personal injury claims, product liability claims and warranty claims. Currently, there are no claims or proceedings against us that we believe will have a material adverse effect on our business, financial condition, results of operations or cash flows. However, the results of any current or future litigation cannot be predicted with certainty and, regardless of the outcome, we may incur significant costs and experience a diversion of management resources as a result of litigation.

Environmental Laws and Regulations

Our operations and properties are subject to extensive and frequently changing federal, state and local environmental protection and health and safety laws, regulations and ordinances. These laws, regulations and

16

Table of Contents

ordinances, among other matters, govern activities and operations that may have adverse environmental effects, such as discharges to air, soil and water, and establish standards for the handling of hazardous and toxic substances and the handling and disposal of solid and hazardous wastes.

Some of the environmental laws applicable to us provide that a current or previous owner or operator of real property may be liable for the costs of removal or remediation of environmental contamination on, under, or in that property or other impacted properties. Accordingly, such liability could apply to us in connection with any of our current or former manufacturing plants or other properties. In addition, some of these laws provide that persons who arrange, or are deemed to have arranged, for the disposal or treatment of hazardous substances may also be liable for the costs of removal or remediation of environmental contamination at the disposal or treatment site, regardless of whether the affected site is owned or operated by such person. Environmental laws, in general, often impose liability whether or not the owner, operator or arranger knew of, or caused, the presence of such environmental contamination. Also, third parties may make claims against owners or operators of properties for personal injuries, for property damage and/or for clean-up associated with releases of hazardous or toxic substances pursuant to applicable environmental laws and common law tort theories, including strict liability. Failure to comply with environmental laws or regulations could result in severe fines and penalties.

We are also subject to permitting requirements under environmental, health and safety laws and regulations applicable in the jurisdictions in which we operate. Those requirements obligate us to obtain permits from one or more governmental agencies in order to conduct our operations. Such permits are typically issued by state agencies, but permits and approvals may also be required from federal or local governmental agencies. The requirements for such permits vary depending on the location where our regulated activities are conducted. As with all governmental permitting processes, there is a degree of uncertainty as to whether a permit will be granted, the time it will take for a permit to be issued and the conditions that may be imposed in connection with the granting of the permit.

We are not aware of any environmental liabilities that would be expected to have a material adverse effect on our business, financial condition or results of operations. We believe we comply in all material respects with environmental laws and regulations and possess the permits required to operate our manufacturing and other facilities. Our environmental compliance costs in the future will depend, in part, on the nature and extent of our manufacturing activities, regulatory developments and future requirements that cannot presently be predicted.

Health and Safety Matters

Our health and safety policies and practices include an employee training and competency development program to regularly train, verify and encourage compliance with health and safety procedures and regulations. We regularly monitor our total recordable incident rate, or TRIR, and as a result of our commitment to continuously improve our health and safety policies and practices, our TRIR has improved 45% from 4.02 in fiscal year 2016 to 2.22 in fiscal year 2020. We employ an environmental, health and safety director whose responsibilities include managing, auditing and executing unified, company-wide safety and compliance programs. The environmental, health and safety director reports directly to the Senior Vice President of Operations and also provides monthly updates to the Chief Executive Officer.

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the following risks and uncertainties, together with all of the other information contained in this Annual Report on Form 10-K, or this Annual Report, including our Consolidated Financial Statements and related notes included elsewhere in this Annual Report, before making an investment decision. In addition to the risks relating to the COVID-19 pandemic that are specifically described in these Risk Factors, the effects of the COVID-19 pandemic may also have the effect of significantly heightening many of the other risks associated with our business and an investment in our Class A common stock, including the other risks described in this Annual

17

Table of Contents

Report. The occurrence of any of the following risks, or additional risks not presently known to us or that we currently believe to be immaterial, could materially and adversely affect our business, financial condition, results of operations and prospects. In such case, the trading price of our Class A common stock could decline, and you may lose all or part of your investment.

Summary Risk Factors

The risks described below include, but are not limited to, the following:

| • | the fact that the COVID-19 public health pandemic is adversely affecting, and is expected to continue to adversely affect, certain aspects of our business; |

| • | demand for our products is significantly influenced by general economic conditions and trends in consumer spending on outdoor living and home exteriors, and adverse trends in, among other things, the health of the economy, repair and remodel and new construction activity, industrial production and institutional funding constraints; |

| • | we compete against other manufacturers of (i) engineered and composite products; and (ii) products made from wood, metal and other traditional materials; |

| • | the seasonal nature of certain of our products and the impact that changes in weather conditions and product mix may have on our sales; |

| • | our ability to develop new and improved products and effectively manage the introduction of new products; |

| • | our ability to effectively manage changes in our manufacturing process resulting from cost savings and integration initiatives and the introduction of new products; |

| • | risks related to our ability to accurately predict demand for our products and risks related to our ability to maintain our relationships with key distributors or other customers; |

| • | risks related to shortages in supply, price increases or deviations in the quality of raw materials; |

| • | our ability to retain management; |

| • | risks related to acquisitions or joint ventures we may pursue; |

| • | our ability to maintain product quality and product performance at an acceptable cost, and potential exposures resulting from our product warranties; |

| • | our ability to ensure that our products comply with local building codes and ordinances; |

| • | risks arising from the material weaknesses we have identified in our internal control over financial reporting and any failure to remediate these material weaknesses; |

| • | our ability to maintain an effective system of internal controls and produce timely and accurate financial statements or comply with applicable regulations; |

| • | our ability to protect our intellectual property rights; |

| • | risk of disruption or failure of our information technology systems or failure to successfully implement new technology effectively; |

| • | cybersecurity risks and risks arising from new regulations governing information security and privacy; |

| • | the increased expenses associated with being a public company; |