Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - ShiftPixy, Inc. | tm2034731d1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - ShiftPixy, Inc. | tm2034731d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - ShiftPixy, Inc. | tm2034731d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - ShiftPixy, Inc. | tm2034731d1_ex31-1.htm |

| EX-4.2 - EXHIBIT 4.2 - ShiftPixy, Inc. | tm2034731d1_ex4-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended August 31, 2020 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _____________ to _____________ |

SEC File No. 024-10557

| SHIFTPIXY, INC. |

| (Exact name of registrant as specified in its charter) |

| Wyoming | 47-4211438 | |

| (State of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 501 Brickell Key Drive, Suite 300, Miami, FL 33131 | 92618 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number:(888) 798-9100

Securities to be registered pursuant to Section 12(b) of the Act:

| Common Stock, par value $0.0001 per share | Trading

Symbol(s) |

The NASDAQ Stock Market LLC | ||

| Title of each class registered | PIXY |

Name

of each exchange on which |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |

| Non-accelerated filer | x | Smaller reporting company | x | |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. §7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter ($7.33 on February 28, 2020) was approximately $3,682,000.

The number of outstanding shares of Registrant’s Common Stock, $0.0001 par value, was 20,902,146 shares as of November 30, 2020.

TABLE OF CONTENTS

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This Annual Report on Form 10-K, the other reports, statements, and information that we have previously filed or that we may subsequently file with the Securities and Exchange Commission (“SEC”), and public announcements that we have previously made or may subsequently make, contain “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. Unless the context is otherwise, the forward-looking statements included or incorporated by reference in this Form 10-K and those reports, statements, information and announcements address activities, events or developments that ShiftPixy, Inc. (referred to throughout this Annual Report as “we,” “us,” “our,” the “ Company” or “ShiftPixy”), expects or anticipates will or may occur in the future. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Form 10-K include, but are not limited to, statements about:

| · | our future financial performance, including our revenue, costs of revenue and operating expenses; |

| · | our ability to achieve and grow profitability; |

| · | the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs; |

| · | our predictions about industry and market trends; |

| · | our ability to expand successfully internationally; |

| · | our ability to manage effectively our growth and future expenses; |

| · | our estimated total addressable market; |

| · | our ability to maintain, protect and enhance our intellectual property; |

| · | our ability to comply with modified or new laws and regulations applying to our business; |

| · | the attraction and retention of qualified employees and key personnel; |

| · | the effect that the novel coronavirus disease (“COVID-19”) or other public health issues could have on our business and financial condition and the economy in general; and |

| · | our ability to be successful in defending litigation brought against us. |

We caution you that the forward-looking statements highlighted above do not encompass all of the forward-looking statements made in this Form 10-K.

We have based the forward-looking statements contained in this Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section of this Form 10-K entitled “Risk Factors” and elsewhere. Moreover, we operate in a very competitive and challenging environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Form 10-K. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Form 10-K to reflect events or circumstances after the date of this report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, other strategic transactions or investments we may make or enter into.

The risks and uncertainties we currently face are not the only ones we face. New factors emerge from time to time, and it is not possible for us to predict which will arise. There may be additional risks not presently known to us or that we currently believe are immaterial to our business. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner.

The industry and market data contained in this report are based either on our management’s own estimates or, where indicated, independent industry publications, reports by governmental agencies or market research firms or other published independent sources and, in each case, are believed by our management to be reasonable estimates. However, industry and market data are subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. We have not independently verified market and industry data from third-party sources. In addition, consumption patterns and customer preferences can and do change. As a result, you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such data, may not be verifiable or reliable.

3

Item 1. Description of Business

Company Information

We were incorporated under the laws of the State of Wyoming on June 3, 2015. Our principal executive office is located at 501 Brickell Key Drive, Suite 300, Miami, FL 33131, and our telephone number is (888) 798-9100. Our website address is www.shiftpixy.com. Our website does not form a part of this Form 10-K and listing of our website address is for informational purposes only.

Business Overview

Our market focus is to use a traditional staffing services business model, coupled with developed technology, to address underserved markets containing predominately lower wage employees with high turnover, including the light industrial, services, and food and hospitality markets. In addition, we have begun to expand our services into other industries that utilize higher paid employees on a temporary or part-time basis, including the medical/nurse staffing industry. We provide human resources, employment compliance, insurance, payroll, and operational employment services solutions for our business clients (“clients” or “operators”) and shift work or “gig” opportunities for worksite employees (“WSEs” or “shifters”). As consideration for providing these services, we receive administrative or processing fees as a percentage of a client’s gross payroll, process and file payroll taxes and payroll tax returns, provide workers’ compensation insurance, and provide employee benefits. We have built a substantial business on a recurring revenue model since our inception in 2015. For Fiscal 2020, we processed approximately $186.2 million in total payroll billings, which includes $120.7 million attributable to clients transferred to Vensure Employer Services, Inc. (“Vensure”), and therefore included in our discontinued operations related to the Vensure Asset Sale (defined below). When these discontinued operations are excluded, we processed over $65 million in payroll billings. We expect to continue to experience significant customer growth; however, we have experienced operating losses to date, including approximately $35 million of operating losses for the last two fiscal years combined, as we have invested in both our technology solutions as well as the back-office operations required to service a large employee base under our staffing model.

Although we have recently expanded into other industries, as noted above, our current primary focus continues to be on clients in the restaurant and hospitality industries, traditionally market segments with high employee turnover and low pay rates. We believe that these industries will be better served by our Human Resources Information System (“HRIS”) technology platform and related mobile application, which provide payroll and human resources tracking for our clients and we believe will result in lower operating costs, improved customer experience and revenue growth acceleration. All of our clients enter into service agreements with us or our wholly owned subsidiary, ReThink Human Capital Management, Inc. (“ReThink”).

Our revenues for Fiscal 2020 primarily consisted of administrative fees calculated as a percentage of gross payroll processed, payroll taxes due on WSEs billed to the client and remitted to the applicable taxation authority, and workers’ compensation premiums billed to the client for which we facilitate workers’ compensation coverage. Our costs of revenues consisted of accrued and paid payroll taxes and our costs to provide the workers’ compensation coverage including premiums and loss reserves. A significant portion of our assets and liabilities is for our workers’ compensation reserves. Our cash balances related to these reserves are carried as assets and our estimates of projected workers’ compensation claims are carried as liabilities. Since Fiscal 2019, we have provided a self-funded workers’ compensation policy for up to $500,000 and purchased reinsurance for claims in excess of $500,000. We actively monitor and manage our clients’ and WSEs’ workers’ compensation claims, which we believe allows us to provide a lower cost workers’ compensation option for our clients than they would otherwise be able to purchase on their own.

As of August 31, 2020, the Company had 78 clients with over 3,100 WSEs, and processed payroll of over $65 million during Fiscal 2020, an increase of nearly 61% over Fiscal 2019 after adjusting for Fiscal 2019 terminations. Of these WSEs, approximately 95% represent workers in the restaurant industry. In addition, as of August 31, 2020, there were an additional 38,000 inactive WSEs in our HRIS technology platform who are available for gig opportunities.

4

The COVID-19 pandemic has had a significant impact upon and delayed our expected growth, which we have observed through a decrease in our billed customers and WSEs beginning in mid-March 2020, when the State of California first implemented “lockdown” measures. Significantly, substantially all of our February 29, 2020 billed WSEs worked for clients located in Southern California, and many of these clients were required to furlough or layoff employees or, in some cases, completely close their operations. However, during the six month period beginning March 1, 2020, (immediately before the COVID-19 pandemic had widespread impact throughout the economy), and through the end of Fiscal 2020, (as the pandemic took hold), we continued to close new customer opportunities. The combination of our sales efforts and the opportunities our services provide to businesses impacted by the COVID-19 pandemic resulted in additional business opportunities for new client location additions, but our WSE billings per client location decreased as many clients were shut down, or reduced staffing during the quarter ended May 31, 2020. For the month of May 2020, our billed client count decreased to 81 clients, but client locations increased by 24% to over 300 client locations compared to the month of February 2020. The Southern California economy experienced a modest recovery in June and through mid-July. On July 13, 2020, the Governor of the State of California re-implemented certain COVID-19 related lockdown restrictions in most of the counties in the state, including those located in Southern California where most of our clients reside. Since that time, the fluid nature of the pandemic has resulted in the issuance of additional health orders by county health authorities, resulting in uneven patterns of business openings and closings throughout the state but due to the fluid nature of the pandemic, we are unable to evaluate fully the probable impact of this lockdown development on our overall customer base. We believe that our business will be impacted based upon the negative effect on those clients that rely more heavily upon in-person dining to the extent that in-person dining restrictions are required. We observed this through the loss of several restaurant clients during our fiscal quarter ended August 31, 2020, of which two closed their doors due to the pandemic.

In July 2020, we signed our first healthcare client, representing a potential gain of 8,000 WSEs, and began to onboard these WSEs in late July and into August on a very limited basis. We expect these new healthcare WSEs to earn an average of 2 to 3 times more than the average restaurant WSE we have typically onboarded in the past, which should yield higher gross profits per healthcare WSE compared to a restaurant or other lower-wage worker.

Despite the impact of the pandemic and the churn of the economic recovery and restrictions, for the fourth quarter of Fiscal 2020, quarterly billings increased 23.7% over the quarterly billings for the pre-pandemic second fiscal quarter ending February 29, 2020. We saw quarterly and monthly declines in billings for the third fiscal quarter with substantial recovery in the fourth quarter and continuing into the first two months of the quarter ending November 30, 2020. For the month of August, our monthly billings increased 24.4% over our May 2020 monthly billings and, for the month of October, our unaudited gross monthly billings increased nearly 55% over the May 2020 levels. We ended October 2020 with 90 clients, 744 client locations, (many of which are single person healthcare locations), and nearly 3,500 billed WSEs. As we continue into Fiscal 2021, we believe that our business will continue to be impacted based upon the negative effect on those clients that rely more heavily upon in-person dining, but due to the fluid nature of the pandemic, as noted above, we are unable to evaluate fully its probable impact on our overall customer base as of the date of this Form 10-K.

5

We believe that our customer value proposition is to provide a combination of overall net cost savings to the client as follows:

| · | Payroll tax compliance and management services |

| · | Governmental HR compliance such as for Patient Protection and Affordable Care Act (“ACA”) compliance requirements |

| · | Reduced client workers’ compensation premiums or enhanced coverage |

| · | Access to an employee pool of potential applicants to reduce turnover costs |

| · | Offset by increased administrative fee cost to the client payable to us |

Our Company founders and management believe that providing this baseline business, coupled with a technology solution to address additional concerns such as employee scheduling and turnover, provides a unique, cost effective solution to the HR compliance, staffing, and scheduling problems that businesses face. Our next goal, currently underway, is to match the needs of small businesses with paying “gigs” with a fully compliant and lower cost staffing solution. For this, we need to acquire a significant number of WSEs to provide our clients with a variety of solutions for their unique staffing needs and to facilitate the employment relationship.

Managing, recruiting, and scheduling a large number of low wage employees can be both difficult and expensive. The acquisition and recruiting of such an employee population is highly labor intensive and costly in part due to high onboarding and maintenance costs such as tax information capture or I-9 verification. Early in our history, we evaluated these costs and determined that proper process flows, automated with blockchain and cloud technology and coupled with access to lower cost workers’ compensation policies resulting from economies of scale could result in a profitable and low-cost scalable business model. Over the past four years, we have invested heavily in a robust, cloud-based HRIS platform in order to:

| · | reduce WSE management costs, |

| · | automate new WSE and client onboarding, and |

| · | provide additional value-added services for our business clients resulting in additional revenue streams to us. |

Beginning in 2017, we began to develop our HRIS database and front-end desktop and mobile phone application to facilitate easier WSE and client onboarding processes as well as to provide additional client functionality and the opportunity for WSEs to find shift work. Beginning in March 2019, we transitioned the development of our mobile application from a third party vendor in house and launched in 2019. As of August 31, 2019, we had completed the initial launch using mobile applications developed by the third party vendor and begun to provide some of the HRIS and application services to select legacy customers on a test basis. Our in-house engineers, along with a new third party vendor, are continuing to implement additional HRIS functionality in delivery, gig intermediation services, and scheduling through our mobile phone application. We see these technology-based services as multiple potential revenue drivers with limited additional costs.

Our cloud-based HRIS platform captures, holds, and processes HR and payroll information for our clients and WSEs through an easy to use customized front end interface coupled with a secure, remotely hosted database. The HRIS system can be accessed by either a desktop computer or an easy to use electronic mobile application designed with HR workflows in mind. Once fully implemented, we expect to reduce the time, expense, and error rate for onboarding our client employees into our HRIS ecosystem. Once onboarded, the client employees are included as our WSEs and are included as available for shift work within our business ecosystem. This allows our HRIS platform to serve as a gig marketplace for WSEs and allows for client businesses to better manage their staffing needs.

6

Our Services

Our core business is to provide regular payroll processing services to clients under an employment administrative services (“EAS”) model in addition to individual services, such as payroll tax compliance, workers’ compensation insurance, and employee HR compliance management. In addition, in November 2019, we launched our employee onboarding function and employee scheduling functions to our customers in our mobile application. With the full commercial launch of our mobile application software in the future, we expect to provide additional services including “white label” food delivery functionality.

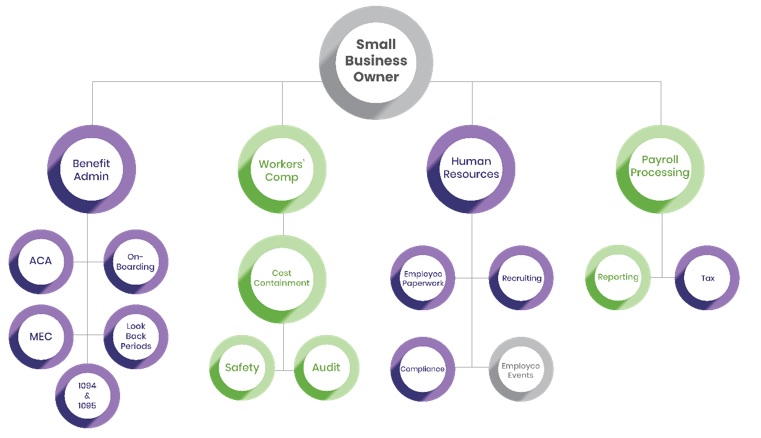

Figure 1

Our core EAS are typically provided to our clients for one-year renewable terms. As of the date of this Form 10-K, we have not had any material revenues or billings generated within our HRIS from additional services. We expect that our future service offerings, including technology-based services provided through our HRIS system and mobile application, will provide for additional revenue streams and support cost reductions for existing and future clients. We expect that our future services will be offered through “a la carte” pricing via customizable on-line contracts.

The new Gig Economy has grown dramatically in recent years, and is projected to continue to grow well into the future. According to various industry publications, as of 2019, 41.1 million workers in the United States were self-employed, (a number expected to grow to 52% by 2023), while, according to data published by Statista, an estimated 25.66 to 28.28 million U.S. workers were employed only part-time during 2019. Further, per various industry reports, as of 2019, 24% of U.S. workers were using on-line platforms in connection with their work, including 38% of the millennials in the workforce. We are targeting employers of this population of part-time, computer savvy workers through our business model and technology.

The new Gig Economy has created legal issues regarding the classification of workers as independent contractors or employees. In addition, the rising trend of predictive scheduling creates logistical issues for our clients regarding workers’ schedules. We provide solutions to businesses struggling with these compliance issues primarily by absorbing our clients’ workers, whom we refer to as WSEs but are also referred to as “shift workers,” “shifters,” “gig workers,” or “assigned employees.” WSEs are included under our corporate employee umbrella and we handle certain employment-related compliance responsibilities for our clients as part of our services. This arrangement benefits WSEs by providing additional work opportunities through access to our clients. WSEs further benefit from employee status benefits through our benefit plan offerings, including minimum essential health insurance coverage plans and 401(k) plans, as well as enjoying the protections of workers’ compensation coverage. For providing these services, once our platform is fully functional and commercialized, we expect to bill annual gross wages of $20,000 per WSE, yielding a gross profit of $1,200 per restaurant and hospitality WSE each year.

7

Technological Solution

| At the heart of our EAS solution is a secure, cloud-based HRIS database accessible by a desktop or mobile device through which our WSEs will be able to find available shift work at our client locations. This solution solves a problem of finding available shift work for both the WSEs seeking additional work and clients looking to fill open shifts. For new WSEs, the mobile application includes an easy to use WSE onboarding functionality which we believe will increase our pool of WSEs and provide a deep bench of worker talent for our business clients. The onboarding feature of our software enables us to capture all application process related data regarding our assigned employees and to introduce employees to and integrate them into the ShiftPixy Ecosystem. The mobile application features a chatbot that leverages artificial intelligence to aid in gathering the data from workers via a series of questions designed to capture all required information, including customer specific and governmental information. Final onboarding steps requiring signatures can also be prepared from the HRIS onboarding module. | Figure 2

|

8

In 2019, we implemented additional functionality to provide a scheduling component to our software, which enables each client worksite to schedule workers and to identify shift gaps that need to be filled. We utilize artificial intelligence to maintain schedules and fulfillment, using an active methodology to engage and move people to action. We began using this functionality at the end of Fiscal 2019 on a test basis.

One of the final phases of our initial platform consists of our “shift intermediation” functionality, which is designed to enable our WSEs to receive information regarding and to accept available shift work opportunities at multiple worksite locations. The intermediation functionality becomes useful only to the extent that we have meaningful numbers of WSEs and client shift opportunities in the same geographic region. We continued our customer testing efforts and rollout during Fiscal 2020 and added significant functionality to our platform, including: (i) scheduling and time and attendance components; (ii) a “white label” customer ordering application geared to QSRs; and (iii) customer loyalty tracking and remarketing capabilities. We expect all of these features, including shift intermediation, to be available for commercial distribution to our clients during Fiscal 2021.

Our goal is to have a mature and robust hosted cloud based HRIS platform coupled with a seamless and technically sophisticated mobile application that will act as both a revenue generation system as well as a “viral” customer acquisition engine through the combination of the scheduling, delivery, and intermediation features and interactions. We believe that once a critical mass of clients and WSEs is achieved, additional shift opportunities will be created in the food service, hospitality, and other industries. Our approach to achieving this critical mass is currently focused on marketing our services to restaurant owners and franchisees, focusing on specific brands and geographic locations. We expect critical mass to be a function of both geography, such as in Southern California, for viral adoption by WSEs and clients, or by adoption within franchise brands.

Markets and Marketing

Our current primary market focus on the food service and hospitality industries was chosen based on our understanding of the issues and challenges facing Quick Service Restaurants (“QSRs”), including fast food franchises and local restaurants. To this end, we have chosen to invest in two key features of our mobile application consisting of: i) scheduling functionality, which is designed to enhance the client’s experience through scheduling of employees and reducing the impact of turnover, and ii) delivery functionality, which is designed to increase revenues through “in house” delivery fulfillment, thereby reducing delivery costs.

| One of the most recent significant developments in the food and hospitality industry is the rapid rise of third-party restaurant delivery providers such as Uber EatsTM, GrubHubTM, and DoorDashTM. These providers have successfully increased QSR revenue in many local markets by providing food delivery to a wide-scale audience using contract delivery drivers. We have observed two significant issues impacting our clients and third-party delivery providers that are increasingly being reported in the news media. The first issue is the large revenue share typically being paid to third-party delivery providers as delivery fees. These additional costs erode the profit for the QSRs from additional sales made through the delivery channel. The second issue is that our QSR customers have encountered logistical problems with food deliveries - late deliveries, cold food, missing accessories, and unfriendly delivery people. This has caused significant “brand erosion” and has caused these clients to reconsider third-party delivery. | Figure 3

|

9

We provide a solution to the third-party delivery issues. We designed our HRIS platform to manage food deliveries by the QSRs using internal personnel and a customized “white label” mobile application. Our recently released delivery feature links this “white label” delivery ordering system to our delivery solution, thereby freeing the QSR to have their own brand showcasing an ordering mobile application but retaining similar back-office delivery technology including scheduling, ordering, and delivery status pushed to a customer’s smart phone. Our technology and approach to human capital management provides a unique window into the daily demands of QSR operators and the ability to extend our technology and engagement to enable this self-delivery proposition. Our new driver management layer for operators in the ShiftPixy Ecosystem will allow clients to use their own team members to deliver a positive customer experience. Our mobile application already provides the HR compliance, management and insurance solutions necessary to support a delivery option and create a turnkey self-delivery opportunity for the individual QSR operator. Our solution saves delivery costs to the QSR client and allows them to retain the customer information and quality control over the food delivery. We are marketing this solution to our clients under the ZiPixy brand.

The first phase of this component of our platform is the driver onboarding functionality, which was completed in 2019 by the initial third party vendor. The enhanced features under development will “micro meter” the essential commercial insurance coverages required by our operator clients on a delivery-by-delivery basis (workers’ compensation and auto coverages) which has been a significant barrier for some QSRs to provide their own delivery services. We began using the “delivery features” of our mobile application for selected customers on a trial basis in the fourth quarter of Fiscal 2019 and are continuing to work toward full deployment of this solution, with wide-scale commercial rollout expected during Fiscal 2021.

10

A significant problem for small businesses, particularly in the food service industry, such as QSRs, involves compliance with employment related regulations imposed by federal, state and local governments. Requirements associated with workers’ compensation insurance, and other traditional employment compliance issues, including the employer mandate provisions of the ACA, create compliance challenges and increased costs. The compliance challenges are often complicated by “workaround” solutions that many employers resort to in order to avoid characterizing employees as “full-time” and requires increased compliance to avoid fines and penalties. As of the date of this Form 10-K, the United States Congress has considered but not passed legislation replacing the ACA, with the exception that the individual mandate provision was removed in 2017. Despite the removal of the individual mandate, employers still face regulatory issues and overhead costs for which we believe our services are a cost-effective solution.

Other regulation is prevalent at the state and local levels. Recently in California, where most of our WSEs currently reside, legislation was passed that more clearly defines gig workers for companies such as Lyft or Uber as employees rather than their previous classification as independent contractors. We believe that legislation such as this is a direct response to a considerable loss of tax revenue from the gig companies’ contract employees. In November, 2020, California voters passed Proposition 22, which had the effect of repealing this legislation and restoring independent contractor status with respect to “app-based drivers.” Nevertheless, Proposition 22 also instituted various labor and wage policies that are specific to app-based drivers and their employers that do not apply to other independent contractors, including: (i) minimum wage requirements; (ii) working hours limitations; (iii) requiring companies to pay healthcare subsidies under certain circumstances; and (iv) requiring companies to provide or make available occupational accident insurance and accidental death insurance to their app-based drivers. We believe that, within the next few years, there is an increasing likelihood that workers in other states will have to be treated in a manner more similar to traditional employees than independent contractors, which will likely include, at a minimum, wage and benefit provisions similar to those guaranteed by Proposition 22. Our business model provides a solution to this likely regulatory change by absorbing workers for these types of gig economy companies as our employees, eliminating any risk of litigation, fines and other worker misclassification problems for these types of gig economy companies to the extent they become our clients.

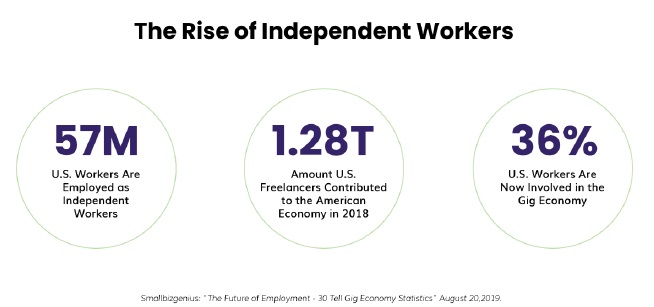

Figure 4

The worldwide trend toward a gig economy is a result of the market adoption of smart phones and mobile telephones, and remote office workers moving away from the traditional office or factory workplace. For our target WSE audience, as of February 2019, over 92 % of 18-30-year-old workers have, or use, a smart phone. This development has created opportunities for companies catering to the use of these devices. We have designed our mobile application to utilize the smartphone adoption to create an easy to use on-boarding tool for potential employees. The migration towards a gig economy trend is also significant. According to a 2016 study conducted by Ardent partners, nearly 42% of the world’s total workforce is now considered ‘non-employee,’ which includes contingent/contract workers, temporary staff, gig workers, freelancers, professional services, and independent contractors. Our initial focus in the marketing of our product to the larger gig economy is to small and medium sized businesses with high worker turnover such as the restaurant and hospitality industries that have high turnover and often contract with independent contractor workers to perform less than full-time gig engagements, primarily in the form of shift work.

The impact of the COVID-19 pandemic on the gig economy and gig workers appears to be mixed. According to The AppJobs Institute, which conducts research on the gig economy, the pandemic has caused an increase in global demand for certain jobs such as delivery, online surveys and market research, while there has been a 36% drop in demand for other jobs that require entry into the home, such as house-sitting, babysitting and cleaning. Similarly, we observed a significant decline in our food and hospitality WSEs located in our Southern California markets during mid-March, which coincided with the shutdown of many of our QSR clients’ dining locations. Nevertheless, our number of WSEs began to rebound in early May, as various lockdown measures were relaxed and many restaurant operators created “work-around” solutions to new health and safety regulations, including improved takeout and delivery, as well as limited in-person dining. We believe that our HRIS platform provides long-term benefits to our clients that will outlast the COVID-19 pandemic. We do not believe that the post-pandemic employment environment will decrease the migration of workers towards a gig economy, and we expect that the demand for services that match those workers with gig opportunities will continue to increase.

11

Figure 5

We believe we will experience business and revenue growth in the gig economy from the following factors:

| · | Large Potential Market. Current statistics show that there are over 15.1 million employees working in our initial target market--the restaurant and hospitality industries -- representing over $300 billion of annual revenues. Compared to the total workforce in all industries, workers in the restaurant industry have a notably higher percentage of part-time workers. At our current monetization rate per employee, this represents an annual gig economy revenue opportunity of over $9 billion per year for the United States. Our intention is to expand both our geographic footprint and our service offerings into other industries, particularly where part-time work is a significant component of the applicable labor force, including the retail and health care sectors. |

| · | Rapid Rise of Independent Workers. The number of independent workers, totaling approximately 41 million in 2018, is expected to increase to 40% of the private, non-farm U.S. workforce by 2021. As of early 2019, approximately 48% of the U.S. workforce has worked as an independent employee as either part time or on a contract basis. We do not expect this shift to independent workers to change as a result of the COVID-19 pandemic. |

| · | Technology Affecting Attitudes towards Employment Related Engagements. Gig-economy platforms have changed the way part-time workers can identify and connect to work opportunities, and millennials and others have embraced such technologies as a means to secure short-term employment related engagements. The significant increase in the adoption of smart phone devices has provided the “last mile” platform to enable technology solutions such as ours to provide a gig economy platform. Most importantly, as of February 2019, an estimated 92% of our target audience of 18-35 year old workers regularly used a smart phone. |

| · | New ShiftPixy Mobile App is Designed to Provide Additional Benefits to Employers and Shift Workers. Millennials represent approximately 40% of the independent workforce who are over the age of 21 and who work 15 hours or more each week. Mindful that we anticipate most of our shifters will be millennials who connect with the outside world primarily through a mobile device, we are poised to significantly expand our business through our mobile app. Our mobile app is a proprietary application downloaded to mobile devices, allowing our shifters to access shift work opportunities at all of our clients, not just their current restaurant or hospitality provider. Our intermediation feature, which we anticipate will be widely available in the near future, will also allow shift employees not currently working at our clients to access shift work opportunities across our entire client platform. |

12

Figure 6

The ShiftPixy Ecosystem Solution

We have developed an HRIS Ecosystem comprised of a closed proprietary operating and processing information system that provides a tool for businesses needing staffing flexibility to schedule existing employees and to post open schedule slots to be filled by an available pool of shift workers (the “ShiftPixy Ecosystem”). The ShiftPixy Ecosystem provides the following benefits to our clients:

| 1. | Compliance: We assume a substantial portion of responsibility for a business’s employment regulatory compliance issues by having all client shifter employees become employees of us. Through the ShiftPixy Ecosystem, we can assist our clients with the staffing of their shift employee requirements by providing a qualified pool of potential applicants as shift workers. The individual WSE is a legal employee of ours and we thereby provide employment regulatory compliance reporting, taking this burden away from our clients. The client’s management time spent on compliance issues is substantially reduced and allows client management to focus on their business. | |

| 2. | Operational improvements: Our service can reduce the impact of high turnover, which is a consistent problem across the restaurant industry and a significant issue to our clients. Our service provides pre-screened applicants for permanent positions as well as access to the ShiftPixy Ecosystem population of potential shift workers. The flexibility inherent in the ecosystem approach can better tailor the staffing needs of a client to the talent pool available. | |

| 3. | Cost Savings: The payroll and related costs associated with WSEs such as workers’ compensation and benefits are consolidated and charged, in effect, in conjunction with the shifters’ applicable rates of pay, allowing the clients to fund the employment related costs as the services are used, thereby avoiding various lump sum employment-related cost impositions. Cost savings for our clients can vary but they typically experience cost reductions in reduced overhead costs related to HR compliance, payroll processing, and elimination of non-compliance fines and related penalties. Clients also experience reduced turnover and the related costs. We exploit economies of scale in purchasing employer related solutions such as workers’ compensation and other benefits and can provide a WSE to a business at a lower cost than the business can otherwise typically staff a particular position. |

13

| 4. | Improved human resources management: By having access to our entire part-time workforce, a client business is enabled to scale up or down more rapidly, making it easier to contain and manage operational costs. The two largest costs for a restaurant are food and labor. We charge a fixed percentage on wages that allows the client business to budget and plan more effectively without the full weight associated with the threats of penalties or missteps in dealing with employment law compliance related issues. |

14

ShiftPixy Labs

On July 29, 2020, we announced the launch of ShiftPixy Labs, a new suite of marketing and support services for QSRs. Through ShiftPixy Labs, we expect to further promote our brand and provide additional layers of services and engagement, from business startup clear through to customer meal delivery. We anticipate that this new functionality will build on our traditional platform that empowers restaurant operators to take advantage of their human capital with tools to handle payroll, compliance and native delivery. On August 11, 2020, we announced the addition of our “Ghost Kitchen Incubator Project” to ShiftPixy Labs, which we believe represents an opportunity for aspiring restaurant operators to gain valuable information and insights on how to launch their new businesses, as well as how to build and optimize around delivery and off-premise dining from the ground up. We believe that, by building these relationships with budding restauranteurs, we will forge lasting partnerships that could open the door to further business opportunities. As part of these efforts, we are in the process of starting a new contest program, which will offer qualified chefs and operators the chance to earn a spot in our “incubator” by pitching and testing new ideas with fully simulated ghost kitchen and delivery experiences. We intend to stream the contest, as well as the Incubator Project, on social media outlets such as YouTube, providing the Company and all participants with an elevated platform for a global audience.

Alliance With US Wellness

On August 24, 2020, we announced a nationwide alliance with US Wellness, a provider of employee wellness programs with a comprehensive suite of services designed to engage and inspire employees toward achieving their wellness goals, that could potentially result in the placement of thousands of nurses on our HRIS platform. We believe that this alliance represents an important expansion opportunity beyond our historical focus on the QSR and hospitality industries, into a more highly compensated labor pool that has the potential to yield increased revenues and profits per WSE. We have begun to onboard nurses through US Wellness since the end of Fiscal 2020, and we expect this onboarding to accelerate throughout the fiscal year ending August 31, 2021.

Competition

We have two primary sources of competition. Competitors to our gig business model include businesses such as ShiftGig, Instawork, Snag, Jobletics and other comparable businesses that seek to arrange short-term work assignments for both employees and independent contractors. Competitors to our HRIS system include businesses such as Kelly Services, ManpowerGroup, and Barrett Business Services, which provide human resource software solutions.

We believe our service offering competes effectively based on our strategy of combining an ecosystem of employment services with the individualized ability to link trained workers to specific shift-work opportunities.

Governmental Regulation

Our business operates in an environment that is affected by numerous federal, state and local laws and regulations relating to labor and employment matters, benefit plans and income and employment taxes. Moreover, because our client engagements involve some form of overlapping employer relationship with regard to the employees who provide services in employment to our clients, the application of such laws to these non-traditional employer relationships can become complex. Nearly all states have adopted laws or regulations regarding the licensure, registration or certifications of organizations that engage in co-employer relationships. While our model is currently not included in such regulations, we may become subject to such laws and regulations if we are deemed to have entered into co-employer relationships with regard to employees providing services in the jurisdictions where such laws and regulations apply.

Additionally, due to the COVID-19 crisis, government agencies have declared a state of emergency in the U.S., and some have restricted movement, required restaurant, bar and hotel closures, advised people not to visit restaurants or bars, and otherwise restricted non-essential travel. In some jurisdictions, people have been instructed to shelter in place to reduce the spread of COVID-19, in response to which restaurants have temporarily closed and have shifted operations at others to provide only take-out and delivery service.

The following summarizes what we believe are the most important legal and regulatory aspects of our business:

15

Federal Regulations

Employer Status

We sponsor certain employee benefit plan offerings as the “employer” of our shift workers under the Internal Revenue Code of 1986 (the “Code”) and the Employee Retirement Income Security Act of 1974 (“ERISA”). The multiple definitions of “employer” under both the Code and ERISA are not clear and are defined in part by complex multi-factor tests under common law. We believe that we qualify as an “employer” of our shift workers under both the Code and ERISA, as well as various state regulations, but this status could be subject to challenge by various regulators. For additional information on employer status and its impact on our business and results of operations, refer to the section entitled “Risk Factors,” under the heading “If we are not recognized as an employer of WSEs under federal and state regulations, or we are deemed to be an insurance agent or third-party administrator, we and our clients could be adversely impacted.”.

Affordable Care Act and Health Care Reform

The ACA was signed into law in March 2010. The ACA implemented substantial health care reforms with staggered effective dates continuing through 2020, and many of its provisions require the issuance of additional guidance from applicable federal government agencies and the states. There could be significant changes to the ACA and health care in general, including the potential modification, amendment or repeal of the ACA. For additional information on the ACA and its impact on our business and results of operations, refer to the section entitled “Risk Factors,” under the heading, “Failure to comply with, or changes in, laws and regulations applicable to our business, particularly potential changes to the ACA, could have a materially adverse effect on our marketing plan as well as our reputation, results of operations or financial condition, or have other adverse consequences.” As of the date of this Form 10-K, the ACA has not been formally amended or repealed; however, the Tax Cuts and Jobs Act of 2017 effectively eliminated the individual mandate provisions of the ACA, beginning in 2019.

16

Health Insurance Portability and Accountability Act

Maintaining the security of information regarding our employees is important to us as we sponsor employee benefit plans and may have access to personal health information of our employees. The manner in which we manage protected health information (PHI) is subject to the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), and the Health Information Technology for Economic and Clinical Health Act (the “HITECH Act”). HIPAA contains substantial restrictions and health data privacy, security and breach notification requirements with respect to the use and disclosure of PHI. Further, under the HITECH Act there are steep penalties and fines for HIPAA violations. Our health plans are covered entities under HIPAA, and we are therefore required to comply with HIPAA’s portability, privacy, and security requirements. For additional information regarding the information we collect, how we maintain the confidentiality of our clients’ and employees’ confidential information and the potential impact to our business if we fail to protect the confidentiality of such data, refer to the section entitled “Risk Factors,” under the heading, “We collect, use, transmit and store personal and business information with the use of data service vendors, and a security or privacy breach may damage or disrupt our businesses, result in the disclosure of confidential information, damage our reputation, increase our costs or cause losses.”

State Regulations

Many states have adopted provisions for licensing, registration, certification or other formal recognition of co-employers. Such laws vary from state to state but generally provide for monitoring or ensuring the fiscal responsibility of a co-employer, and in some cases codify and clarify the co-employment relationship for unemployment, workers’ compensation and other purposes under state laws. The scope of the laws and regulations of states is such that it may encompass our activities. In addition, many state laws require guarantees by us of the activities of our subsidiary, ReThink, and in some states we may seek licensure, registration or certification, as applicable, together with our subsidiary, ReThink, because the financials for both organizations are consolidated. We believe that we are in compliance in all material respects with the requirements in the states where we are conducting business.

We must also comply with state unemployment tax requirements where our clients are located. State unemployment taxes are based on taxable wages and tax rates assigned by each state. The tax rates vary by state and are determined, in part, based on our prior years’ compensation and unemployment claims experience in each state. Certain rates are also determined, in part, by each client’s own compensation and unemployment claims experience. In addition, states have the ability under law to increase unemployment tax rates, including retroactively, to cover deficiencies in the unemployment tax funds.

In addition, we are subject to Federal and state laws and regulations regarding privacy and information security. California recently enacted legislation, the California Consumer Privacy Act of 2018, (the “CCPA”), that went into effect on January 1, 2020. The CCPA affords consumers expanded privacy protections, including individual rights to access, to require deletion of personal information, to opt out of certain personal information sharing, and to receive detailed information about how personal information is used. The CCPA also provides for civil penalties for violations, as well as a private right of action for data breaches that may increase data breach litigation. There are also a number of other pending U.S. state privacy laws that contain similar provisions to the CCPA, although in some cases prescribing stricter and potentially conflicting requirements.

17

Intellectual Property

We have registered seven trademarks, consisting of three names (ShiftPixy, ZiPixy, and ShiftPixy Labs) and four logos (the Pixy image, the Pixy wings image and wings/name logo, and the ShiftPixy Labs logo). In addition, we have patents pending for certain features of our mobile application in the United States, Australia, Brazil, European Union, India, Japan, Korea and Hong Kong. We have other intellectual property and related rights as well, particularly in connection with our software. We believe that our intellectual property is of considerable importance to our business.

Human Capital

As of August 31, 2020, we employed 46 people on a full-time basis in our corporate offices, and we served approximately 3,100 active, paid WSEs with an additional 38,000 inactive WSEs carried within our HRIS platform. Effective as of January 1, 2020, we assigned client contracts representing approximately 70% of our billable clients which comprised approximately 88% of our quarterly revenue as of November 30, 2019 as part of the Vensure Asset Sale, (accounting for approximately 2,700 billed WSEs transferred), and we transferred 21 of our 64 corporate employees. We retained all WSEs in our HRIS system. Our billed WSE count decreased from the February 2020 quarter due to the COVID-19 pandemic. The billed WSE count increased to approximately 3,500 in October 2020 as the Southern California economy re-opened.

Diversity and Inclusion

We strive to maintain a diverse and inclusive workforce in our corporate offices, and we encourage our clients to support diversity and inclusion in the workplace as well. Approximately 35% of our corporate employees are women, (including our Director of Operations, who is a member of our board of directors), and approximately 43% of our corporate employees are non-white. Further, although we do not directly control our clients’ hiring decisions, we estimate that approximately 79% of WSEs currently on our platform are women, and over 90% are non-white. Our diversity and inclusion principles are reflected in our employee manual and training programs, including our policies against harassment and bullying and the elimination of bias in the workplace, which we provide to all of our corporate employees and encourage our clients to follow for WSEs as well.

Workforce Compensation and Pay Equity

We provide robust compensation and benefits programs to help meet the needs of our corporate employees, and we provide the means for our clients to provide significant benefits to WSEs, many of which have traditionally been unavailable to gig workers and others filling lower wage positions in the QSR and food industry. We provide our corporate employees with highly competitive salaries, as well a 401(k) Plan, healthcare and insurance benefits, paid time off, and family leave. We also provide all of our corporate employees with targeted equity-based grants with vesting conditions designed to facilitate the retention of personnel and the opportunity to benefit financially from the Company’s growth and profitability. Further, through the implementation of our business model and rollout of our HRIS platform, we are providing the means for our clients to provide significant benefits to WSEs that they would likely not otherwise enjoy, including access to healthcare and insurance benefits and 401(k) Plans.

Talent Acquisition and Retention

We continually monitor corporate employee turnover rates, as our success depends upon retaining our highly trained and dedicated operating personnel. We believe that our philosophy of providing highly competitive compensation, along with significant opportunities for career growth and development opportunities, encourage a high level of corporate employee tenure and low level of voluntary turnover. Given our limited operating history and significant rate of growth, we are not currently able to produce meaningful statistics related to employee turnover and tenure on a macro level, but based on feedback we receive both informally and through periodic formal reviews and evaluations, we believe that the Company’s relationship with its corporate employees is excellent.

Company Culture

We expect all of our corporate employees to observe the highest levels of business ethics, integrity, mutual respect, tolerance, and inclusivity, and encourage our clients to demand the same from WSEs. Our Corporate Employee Manual, and those employee manuals that we prepare on behalf of our clients, set forth detailed provisions reflecting these values, and also provide direction for registering complaints, (including through an anonymous hotline jointly administered by our General Counsel and the Chair of our Audit Committee), in the event of violations of our policies. Our executive officers and supervisors maintain “open door” policies, and any form of retaliation is strictly prohibited.

Development and Training

We invest significant resources in developing and retaining the talent needed to achieve our business goals. We maintain a relatively “flat” corporate organizational structure, whereby our employees benefit from training and mentoring by individuals filling a variety of different functions within our Company. We believe that this highly dynamic environment provides the hands-on training necessary for our employees to achieve their career goals, build management skills, and advance within the Company.

Oversight and Governance

Our board of directors takes an active role in overseeing the management of our human capital, which includes reviewing, approving, and implementing policies and procedures governing the administration of the workplace, such as policies related to compensation, ethics, and elimination of workplace bias and harassment. Our Director of Operations, who is also a member of our board, and has been employed by the Company since its inception, is responsible for the day-to-day administration of these policies and procedures, receiving input and assistance from the Company’s General Counsel as necessary and appropriate. Both our Director of Operations and General Counsel regularly report to the board on issues relate to corporate oversight and governance.

Employee Engagement and Wellness

The success of our business is fundamentally connected to the well-being of our people. Accordingly, we are committed to the health, safety and wellness of our corporate employees, and we encourage our clients to make this a priority for WSEs. We provide our corporate employees, and facilitate our clients providing WSEs with a wide range of benefits, including benefits directed to their health, safety and long-term financial security. In response to the COVID-19 pandemic, we have implemented significant changes that we determined were in the best interest of our employees, as well as the communities in which we operate, and which comply with government regulations. This includes allowing our corporate employees to work remotely as appropriate, while implementing significant safety measures designed to protect the health of all those entering our facilities.

18

Our operations and financial results are subject to various risks and uncertainties, including those described below, that could adversely affect our business, financial condition, results of operations, cash flows, and the trading price of our common stock. Some statements in this Form 10-K, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Statement Regarding Forward-Looking Statements” for more information.

Summary of Material Risk Factors

| § | We have limited operating history, which makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of future performance. |

| § | The COVID-19 pandemic, or another widespread public health epidemic, catastrophic or geopolitical event, might create additional liabilities, risks and exposures which could negatively impact our current business, growth prospects and cash flows, and future profitability. |

| § | We maintain limited self-insurance for workers’ compensation services that we provide to our clients. |

| § | There is no guarantee that our current cash position, expected revenue growth and anticipated financing transactions will be sufficient to fund our operations for the next twelve months. |

| § | Our success depends on adoption of our products and services by our various types of customers. |

| § | We assume the obligation to make wage, tax, and regulatory payments for WSEs, and, as a result, are exposed to client credit risks. |

| § | We operate in an immature and rapidly evolving industry and have a relatively new business model, which makes it difficult to evaluate our business and prospects. We face intense competition across all markets for our services, which may lead to lower revenue or operating margins. Our targeted customer base is diverse, and we face a challenge in meeting each group’s needs. |

| § | Providing specialized Gig Economy oriented staffing management products and services is an emerging yet competitive business, and many of our competitors have greater resources that may enable them to compete more effectively. |

| § | We have claims and lawsuits against us that may result in adverse outcomes. |

| § | We have identified material weaknesses in our internal control over financial reporting. |

| § | If we are unable to secure or pay for the insurance coverage required for our business operations, or if we lose any existing coverage, we may not be able to offer some of our services and our revenues could be reduced. |

| § | We may be subject to penalties and interest payable on taxes as a result of data entry in our software or manual error. |

| § | Our ability to adjust and collect service fees for increases in unemployment tax rates may be limited. |

| § | We may never successfully commercialize ShiftPixy Labs. |

| § | We may have outages, data losses, and disruptions of our online services if we fail to maintain and adequate operations infrastructure. Because we store data in the cloud with providers such as Microsoft and Amazon, any disruptions in our ability to access this data or any breach of security concerning this data in the cloud could have a materially adverse effect. |

| § | Software products we use in our business may contain defects which will make it more difficult for us to establish and maintain customers. |

| § | If a contract relating to our mission critical software that we use in our business is terminated or not renewed, our business could be seriously disrupted and our revenues significantly reduced. |

| § | We may not be able to protect our source code from copying in the event of an unauthorized disclosure. |

| § | We intend to use open source blockchain technology in our technology platform, which has been scrutinized by regulatory agencies and therefore we may be impacted by unfavorable regulatory action. |

| § | We use and leverage open source technology in our technology platform which may create security risks. |

| § | We depend heavily on Scott W. Absher, our Chief Executive Officer and a director. The loss of his services could harm our business, and his limited experience managing a public company, which may inhibit our ability to implement successfully our business plan. |

| § | If we are not recognized as an employer of WSEs under federal and state regulations, or we are deemed to be an insurance agent or third-party administrator, we and our clients could be adversely impacted. |

| § | We are in the business of providing employees to our clients, and there is a risk that we will be sued and/or held liable for claims resulting from action by or against our employees, including Private Attorney General’s Act (“PAGA”) claims which may require additional capital to defend. |

| § | Failure to comply with, or changes in, laws and regulations applicable to our business, particularly potential changes to the ACA, could have a materially adverse effect on our business. |

| § | Failure to secure any necessary registrations or licensure could affect our ability to operate certain segments of our business in certain jurisdictions. |

| § | Laws related to the classification of Gig Economy workers are changing, and we may be subject to state and local regulations impacting how we classify our workers. |

| § | Our common stock is thinly traded, which can cause volatility in its price. If we are unable to continue to meet the listing requirements of Nasdaq, our common stock will be delisted. |

| § | A majority of our common stock is closely held by our founders which may limit a minority shareholders from influencing corporate governance. |

| § | We are an “emerging growth company” under the JOBS Act, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors. |

19

Risks Relating to Our Business

We have limited operating history, which makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We are an emerging business and are in the process of developing our products and services. We have been in business since July 2015. Although our continuing business processed gross billings of over $65 million for Fiscal 2020, it is still difficult, if not impossible, to forecast our future results based upon our limited historical operating data. Because of the related uncertainties, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in sales, revenues or expenses. If we make poor budgetary decisions as a result of unreliable data, our gross billings in the future may decline, which may result in a decline in our stock price.

There is uncertainty regarding our ability to implement our business plan and to grow our business to a greater extent than we can with our existing financial resources without additional financing. Except from the proceeds of our October 2020 public offering ($10.6 million net of costs), May 2020 public offering and subsequent overallotments ($10.3 million net of costs and $1.2 million net of costs, respectively), our initial public offering ($11.2 million net of costs) and private placements of senior secured convertible notes to institutional investors raising $13 million of gross proceeds ($11.9 million net of costs), we have no binding agreements, commitments or understandings to secure additional financing at this time. We have no binding agreements, commitments or understandings to acquire any other businesses or assets. Our long-term future growth and success are dependent upon our ability to generate cash from operating activities. There is no assurance that we will be able to generate sufficient cash from operations, to borrow additional funds or to raise additional equity capital. Our inability to obtain additional cash could have a material adverse effect on our ability to fully implement our business plan as described herein and grow our business to a greater extent than we can with our existing financial resources.

The COVID-19 pandemic might create additional liabilities, risks and exposures which could negatively impact our current business, growth prospects and cash flows, and future profitability, while also requiring us to increase our workers’ compensation reserve to protect against additional liabilities, all of which could negatively impact our ability to raise additional capital.

Our business has been significantly impacted by the COVID-19 pandemic. Our employee billings per capita have decreased more than 20% from pre-pandemic reporting periods. In particular, most of our clients are currently in the restaurant and hospitality business sector and concentrated in Southern California. The vast majority of these clients have been negatively impacted by the lockdown measures imposed in the State of California since March, which have required them to limit hours of operation, eliminate in-person dining, restrict food services to takeout and delivery, and, in some cases, cease operations altogether. Although lockdown measures were relaxed somewhat throughout Southern California beginning in May 2020, the Governor reinstated many of these restrictions on July 13, 2020, in response to a surge in the number of COVID-19 cases reported throughout the state. As long as these directives remain in place, they are likely to negatively impact our clients’ business and operations, which, in turn, will likely have a negative impact on our business prospects and operating results. As we expand our business into new geographic areas, and seek to enlist clients outside the QSR and hospitality industries, we may encounter similar obstacles to achieving growth and profitability resulting from the spread of COVID-19 and resulting governmental regulations or restrictions that negatively impact these areas and industries.

20

Further, our workers’ compensation policy limits our liability to $500,000. Accordingly, our profitability depends on collecting sufficient premium payments to offset this potential liability to be profitable. In March 2020, the Governor of the State of California issued Executive Order N-62-20, which creates a rebuttable presumption for workers’ compensation claims that an employee’s COVID-19 related illness arose out of the course of their employment if (i) such infection occurred between March 19 and July 5, 2020, and (ii) the employee was diagnosed with COVID-19 or tested positive within 14 days after performing work for the employer at a location other than the employee’s home. While we have not observed direct additional expenses as a result of any such claims to date, our workers’ compensation rates have increased significantly since the beginning of the pandemic. We have also increased our workers’ compensation reserve estimates for Fiscal 2020, and we continue to closely monitor all workers’ compensation claims made during the COVID-19 pandemic. While we believe that the steps we have taken are sufficient to protect against any increased level of workers’ compensation claims related to the pandemic, there can be no guarantee that this will be the case, or that our premium collections will be sufficient to offset our liabilities and achieve profitability should such an increase in claims materialize in the future.

We maintain limited self-insurance for the workers’ compensation services that we provide to our clients. If we experience claims in excess of our collected premiums, we might incur additional losses, higher costs, and reduced margins, resulting in a need for more liquidity.

We are responsible for and pay workers’ compensation costs for our shift workers. As noted above, we are currently self-insured for up to $500,000 per occurrence and we purchase reinsurance for claims in excess of $500,000. Our workers’ compensation billings are designed to cover expected claims based on insurance annuity calculations. These calculations are based on our claims experiences during our limited operating history. At times, these costs have risen substantially as a result of increased claims and claim trends, general economic conditions, changes in business mix, increases in healthcare costs, and government regulations. Although we carry insurance and believe that we currently have reserves sufficient to insulate us against projected losses, any unexpected changes in claim trends, including the severity and frequency of claims, actuarial estimates, and medical cost inflation, could result in costs that increase significantly above current projections. If future claims-related liabilities increase due to unforeseen circumstances, or if new laws, rules, or regulations are implemented, costs could increase significantly. There can be no assurance that we will be able to increase the fees charged to clients in a timely manner and in a sufficient amount to cover increased costs as a result of any changes in claims-related liabilities.

Our business, results of operations and financial condition have been and will likely continue to be materially adversely impacted in the event of a widespread public health epidemic, including the recent COVID-19 outbreak.

Our business, results of operations and financial condition have been, and will likely continue to be, materially adversely affected by any widespread public health epidemics, such as the COVID-19 outbreak first identified in Wuhan, China in December 2019. On March 11, 2020, the World Health Organization declared COVID-19 a pandemic disease. Potential impacts of the spread of COVID-19 include disruptions or restrictions on our employees’ and WSEs’ ability to travel, and temporary closures of our clients’ facilities. For example, many of our WSEs perform services in the restaurant and hospitality industries, which have experienced significant declines in traffic since early March 2020. Various states and municipalities throughout the United States have since declared a state of emergency and imposed substantial restrictions on movement, required restaurants, bars and hotels to close, and advised people not to patronize restaurants or bars or otherwise engage in non-essential travel. In some areas, residents have been instructed to shelter in place to reduce the spread of COVID-19, resulting in many restaurants either closing or limiting their operations to take-out and delivery service. Similarly, travel and tourism across the globe have significantly decreased, causing a significant number of temporary hotel closures and furloughed employees. Given that most of our clients are businesses in the hospitality and restaurant industry, our results of operations are likely to continue to be negatively impacted as long as restrictions arising from the COVID-19 pandemic continue.

Additionally, we have operations located in Miami, FL (Miami-Dade County), and Irvine, CA (Orange County), regions that have seen a recent rise of confirmed cases of COVID-19. We are continuing to monitor and assess the effects of the COVID-19 outbreak on our commercial operations, including any potential impact on our revenue in Fiscal 2020 and beyond. Nevertheless, we cannot at this time predict with any degree of certainty the precise impact these adverse conditions will ultimately have on our operations due to a variety of unknown factors, including the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of time that travel restrictions and business closures imposed by the governments of impacted countries remain in place. Further, any future significant outbreak of contagious diseases could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could affect demand for our products and likely negatively impact our operating results.

21

There is no guarantee that our current cash position, expected revenue growth and anticipated financing transactions will be sufficient to fund our operations for the next twelve months.