Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MIDDLEFIELD BANC CORP | d195421d8k.htm |

Middlefield Banc Corp. 2020 Third Quarter Investor Presentation (Nasdaq: MBCN) Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 concerning Middlefield Banc Corp.’s plans, strategies, objectives, expectations, intentions, financial condition and results of operations. These forward-looking statements reflect management’s current views and intentions and are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause the actual results to differ materially from those contemplated by the statements. The significant risks and uncertainties related to Middlefield Banc Corp. of which management is aware are discussed in detail in the periodic reports that Middlefield Banc Corp. files with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” section of its Annual Report on Form 10-K and its Quarterly Report on Form 10-Q. Investors are urged to review Middlefield Banc Corp.’s periodic reports, which are available at no charge through the SEC’s website at www.sec.gov and through Middlefield Banc Corp.’s website at www.middlefieldbank.bank on the “Investor Relations” page. Middlefield Banc Corp. assumes no obligation to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this presentation. www.middlefieldbank.bank

Middlefield Banc Corp. Middlefield Banc Corp. (Nasdaq: MBCN) Providing financial services throughout Central and Northeast Ohio Profitably serving its communities, customers, employees, and shareholders by its commitment to quality, safety and soundness, and maximizing shareholder value www.middlefieldbank.bank

www.middlefieldbank.bank Middlefield: A community bank that is safe, strong and committed Highlights Strategic Strengths People: Average tenure at Middlefield of leadership team is 13 years Strong bench with new management talent added over the past three years Communities: Serving two of Ohio's most attractive banking markets Optimally positioned between rural and metropolitan communities Customers: Balanced mix of retail and commercial customers Geauga County is the center of the 4th largest Amish population in the world Community Banking Values and Focus: Providing superior and responsive financial services since 1901 Committed to quality, safety and soundness Financial Strength: Profitable throughout the economic cycle Never reported a quarterly loss Maintained dividend during 2008 to 2009 financial crisis 16 Branches 119 Years of Service 2 Strong Ohio Markets #1 Community Bank in Core Market 3.0% Increase in 2019 Book Value per Share

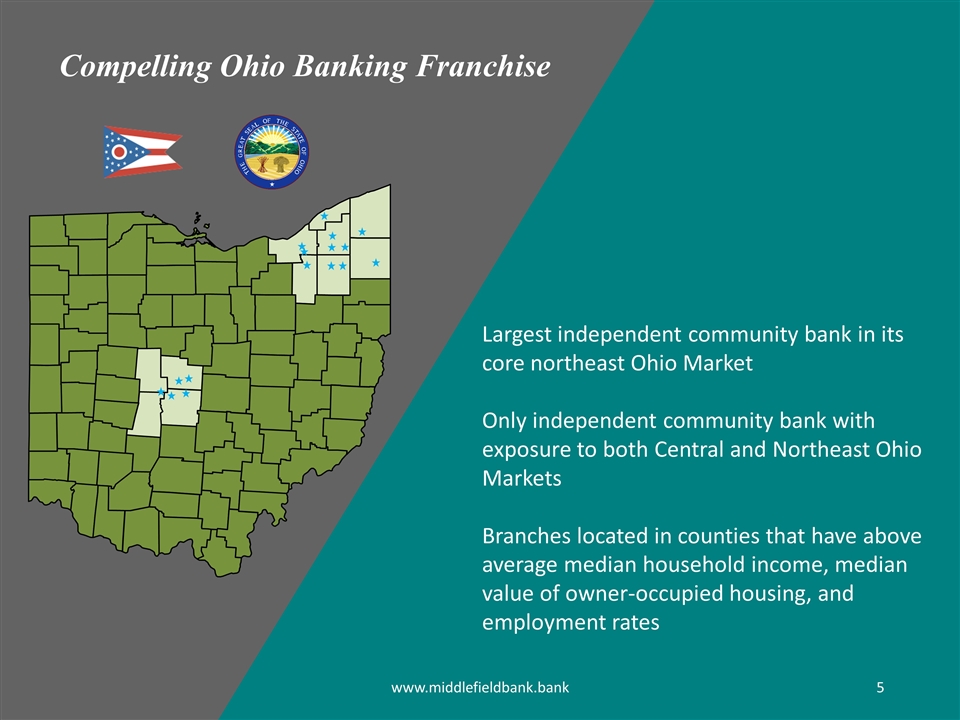

Largest independent community bank in its core northeast Ohio Market Only independent community bank with exposure to both Central and Northeast Ohio Markets Branches located in counties that have above average median household income, median value of owner-occupied housing, and employment rates www.middlefieldbank.bank Compelling Ohio Banking Franchise

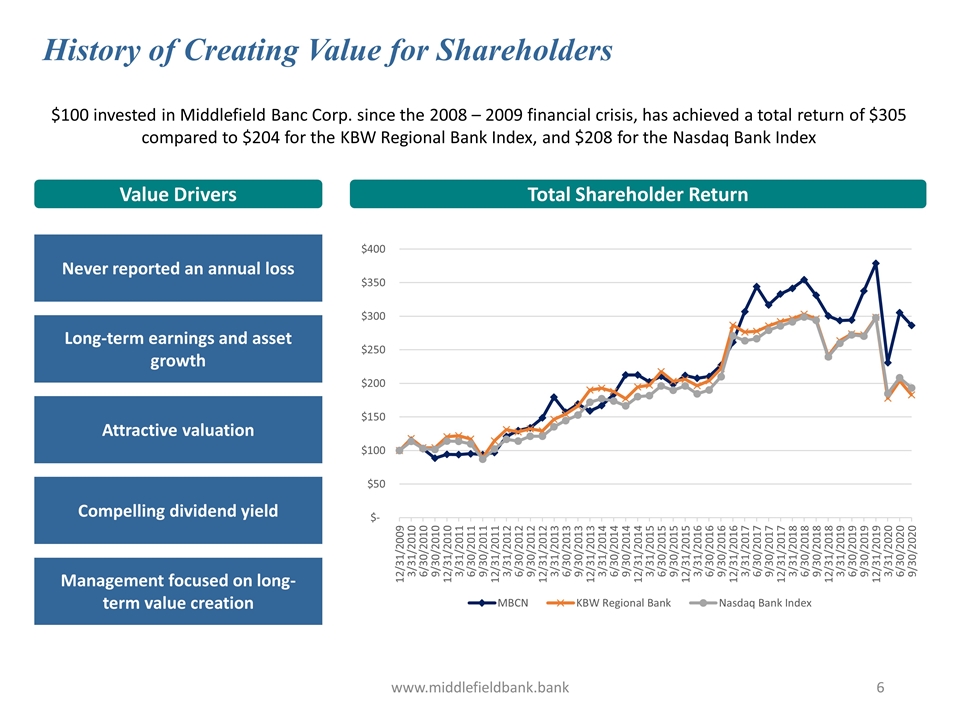

www.middlefieldbank.bank History of Creating Value for Shareholders Total Shareholder Return Value Drivers $100 invested in Middlefield Banc Corp. since the 2008 – 2009 financial crisis, has achieved a total return of $305 compared to $204 for the KBW Regional Bank Index, and $208 for the Nasdaq Bank Index Never reported an annual loss Compelling dividend yield Attractive valuation Long-term earnings and asset growth Management focused on long-term value creation

www.middlefieldbank.bank COVID-19 Operational Update and Response We are focused on managing all aspects of the business that are under our control as we navigate the COVID-19 crisis, while supporting our customers, employees, communities, and shareholders. This includes pursuing near-term strategies that protect the health and safety of our employees and customers, control risk, proactively manage expenses, and support our dividend policy Committed to providing customers with trusted and essential financial advice, services, and products After temporarily restricting walk-in transactions in our bank lobbies in late March, all our branches reopened for lobby banking during the second quarter Implemented safeguards to ensure we are doing our part to protect the health and well-being of our communities All employees required to wear masks Limiting the number of customers allowed in our branches at one time, and encouraging customers to social distance Installed partitions to limit exposure and increased cleaning of all office locations Offering special lobby hours for at-risk customers Staggering in-office employees and allowing employees to work from home Implemented programs to provide relief to our customers including deferring payments, modifying loans, and waiving late payments and other fees As a community-oriented financial institution, we quickly added resources to help current and potential customers apply for the Payroll Protection Program Dedicated to supporting all customers throughout this challenging period Supporting local COVID-19 relief programs Committed to supporting dividend policy Temporarily suspended stock repurchase program Prudently increased our allowance for loan losses at September 30, 2020, and incurred a year-to-date provision for loan losses of $7.7 million to account for the economic uncertainty caused by the COVID-19 crisis and the resolution of an isolated commercial loan

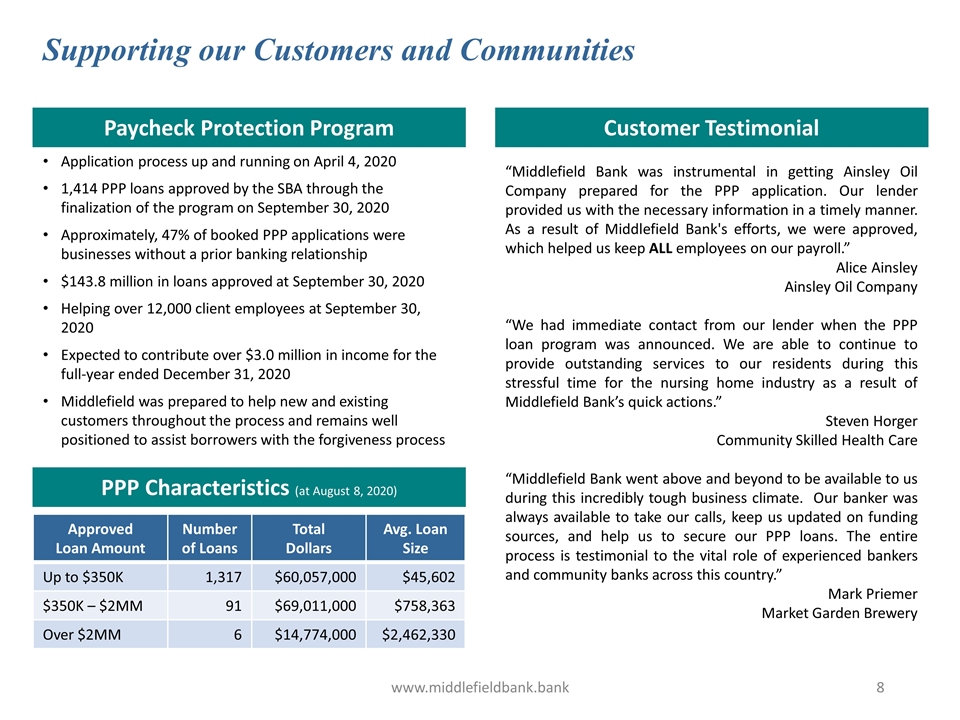

www.middlefieldbank.bank Supporting our Customers and Communities Paycheck Protection Program Application process up and running on April 4, 2020 1,414 PPP loans approved by the SBA through the finalization of the program on September 30, 2020 Approximately, 47% of booked PPP applications were businesses without a prior banking relationship $143.8 million in loans approved at September 30, 2020 Helping over 12,000 client employees at September 30, 2020 Expected to contribute over $3.0 million in income for the full-year ended December 31, 2020 Middlefield was prepared to help new and existing customers throughout the process and remains well positioned to assist borrowers with the forgiveness process PPP Characteristics (at August 8, 2020) Approved Loan Amount Number of Loans Total Dollars Avg. Loan Size Up to $350K 1,317 $60,057,000 $45,602 $350K – $2MM 91 $69,011,000 $758,363 Over $2MM 6 $14,774,000 $2,462,330 “Middlefield Bank was instrumental in getting Ainsley Oil Company prepared for the PPP application. Our lender provided us with the necessary information in a timely manner. As a result of Middlefield Bank's efforts, we were approved, which helped us keep ALL employees on our payroll.” Alice Ainsley Ainsley Oil Company “We had immediate contact from our lender when the PPP loan program was announced. We are able to continue to provide outstanding services to our residents during this stressful time for the nursing home industry as a result of Middlefield Bank’s quick actions.” Steven Horger Community Skilled Health Care “Middlefield Bank went above and beyond to be available to us during this incredibly tough business climate. Our banker was always available to take our calls, keep us updated on funding sources, and help us to secure our PPP loans. The entire process is testimonial to the vital role of experienced bankers and community banks across this country.” Mark Priemer Market Garden Brewery Customer Testimonial

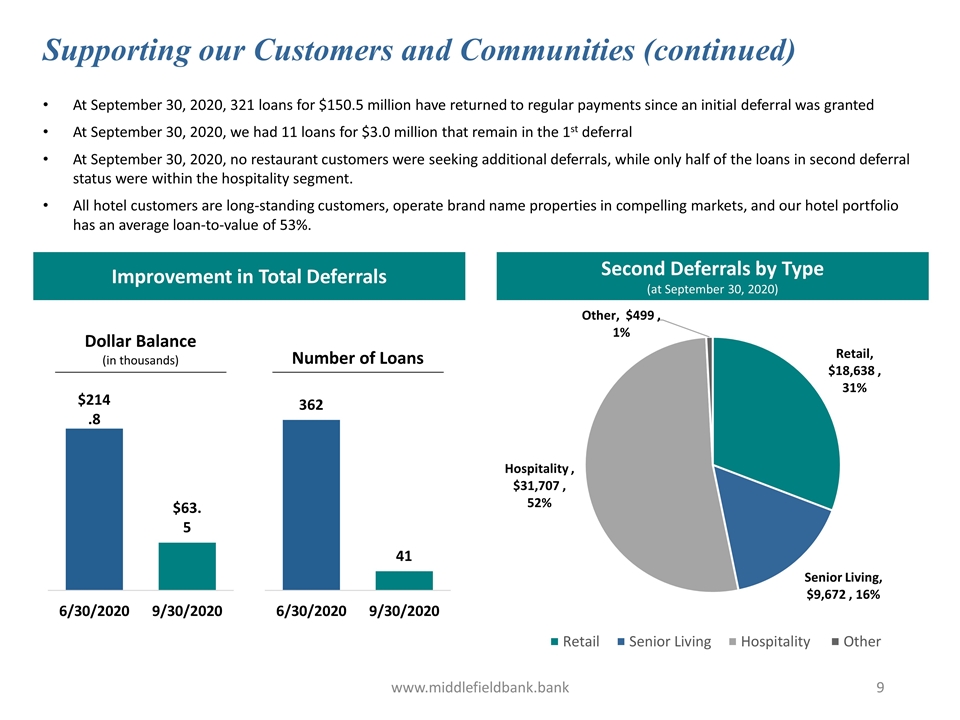

www.middlefieldbank.bank Supporting our Customers and Communities (continued) Improvement in Total Deferrals Second Deferrals by Type (at September 30, 2020) At September 30, 2020, 321 loans for $150.5 million have returned to regular payments since an initial deferral was granted At September 30, 2020, we had 11 loans for $3.0 million that remain in the 1st deferral At September 30, 2020, no restaurant customers were seeking additional deferrals, while only half of the loans in second deferral status were within the hospitality segment. All hotel customers are long-standing customers, operate brand name properties in compelling markets, and our hotel portfolio has an average loan-to-value of 53%. Dollar Balance (in thousands) Number of Loans

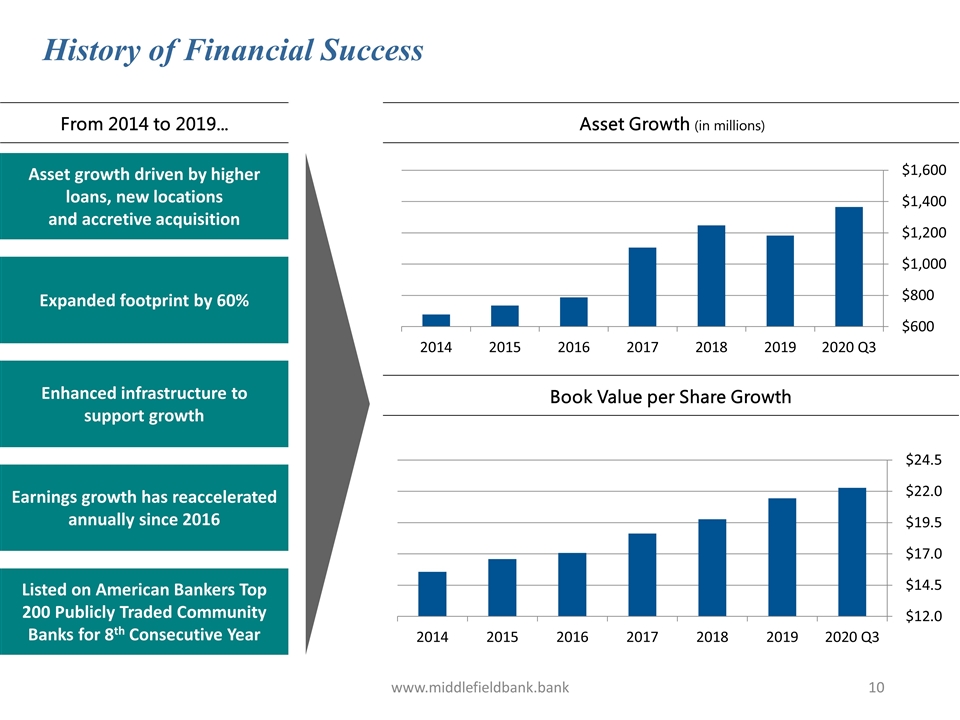

www.middlefieldbank.bank History of Financial Success Asset growth driven by higher loans, new locations and accretive acquisition Expanded footprint by 60% Enhanced infrastructure to support growth Earnings growth has reaccelerated annually since 2016 Listed on American Bankers Top 200 Publicly Traded Community Banks for 8th Consecutive Year From 2014 to 2019... Asset Growth (in millions) Book Value per Share Growth

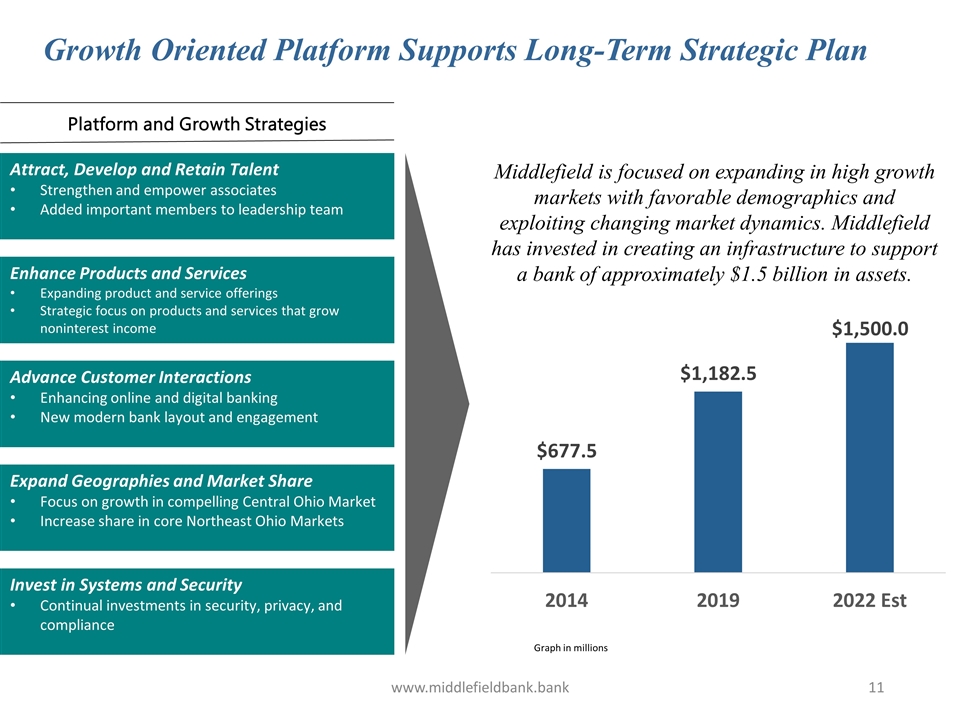

www.middlefieldbank.bank Growth Oriented Platform Supports Long-Term Strategic Plan Middlefield is focused on expanding in high growth markets with favorable demographics and exploiting changing market dynamics. Middlefield has invested in creating an infrastructure to support a bank of approximately $1.5 billion in assets. Attract, Develop and Retain Talent Strengthen and empower associates Added important members to leadership team Enhance Products and Services Expanding product and service offerings Strategic focus on products and services that grow noninterest income Advance Customer Interactions Enhancing online and digital banking New modern bank layout and engagement Expand Geographies and Market Share Focus on growth in compelling Central Ohio Market Increase share in core Northeast Ohio Markets Invest in Systems and Security Continual investments in security, privacy, and compliance Platform and Growth Strategies Graph in millions

www.middlefieldbank.bank “In 2008 I put together an aggressive growth strategy for my business Exscape Designs. The need for a local relationship-based approach made clear sense. In my experience over the years with Middlefield Bank we have been able to achieve a lot of growth together. With Middlefield you're not just numbers, it's the relationship and community that matters to them.” “Ease Logistics was looking for a small community bank to help us grow our business. We needed a credit line to support our 40% growth. Middlefield bank was able to step up and provide us the working capital we needed, and the process was seamless. When Ease Logistics needed a mortgage for their new headquarters in Dublin, Middlefield Bank was there. We love the staff too!” “It has been a pleasure to do business with Middlefield Bank for these past 20 years. When all of the other local major banks turned away from the business, Middlefield Bank welcomed it with open arms. This relationship started with trust and that trust is the foundation in which we continue to use Middlefield for all of our banking needs.” Strategy Dependent on Customers and Communities Local Strong Committed

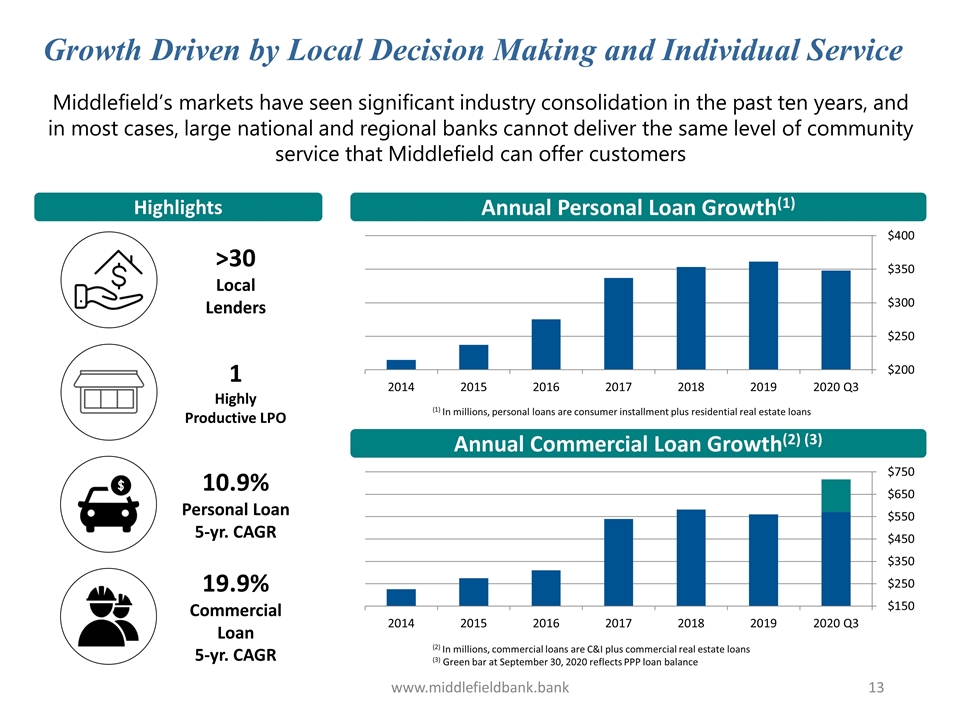

www.middlefieldbank.bank Growth Driven by Local Decision Making and Individual Service Middlefield’s markets have seen significant industry consolidation in the past ten years, and in most cases, large national and regional banks cannot deliver the same level of community service that Middlefield can offer customers Highlights Annual Personal Loan Growth(1) Annual Commercial Loan Growth(2) (3) (2) In millions, commercial loans are C&I plus commercial real estate loans (3) Green bar at September 30, 2020 reflects PPP loan balance (1) In millions, personal loans are consumer installment plus residential real estate loans >30 Local Lenders 1 Highly Productive LPO 19.9% Commercial Loan 5-yr. CAGR 10.9% Personal Loan 5-yr. CAGR

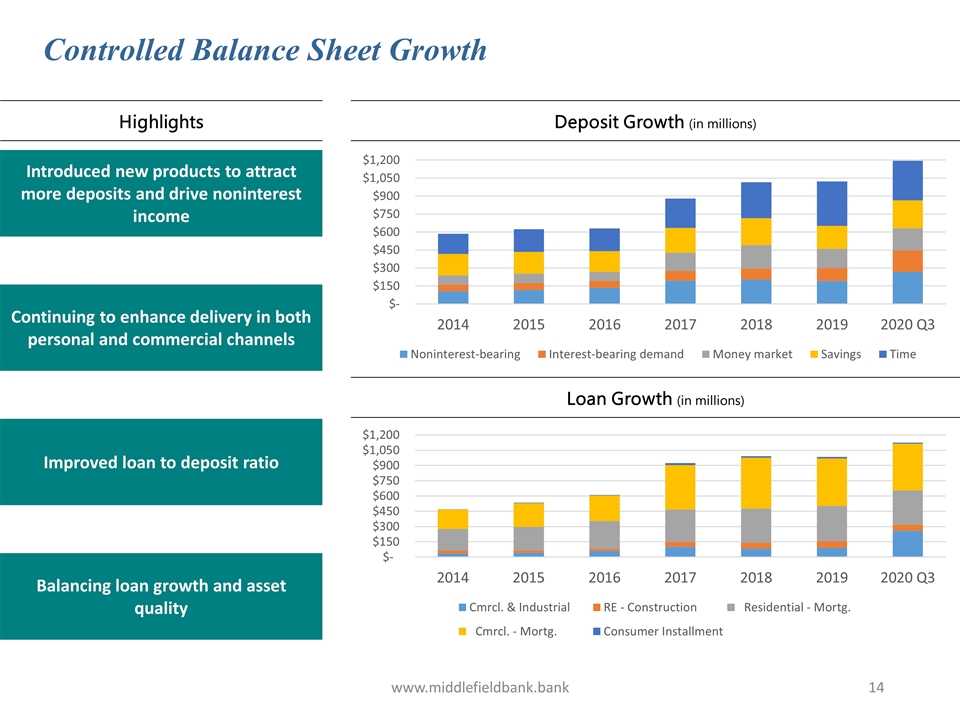

www.middlefieldbank.bank Controlled Balance Sheet Growth Highlights Deposit Growth (in millions) Loan Growth (in millions) Introduced new products to attract more deposits and drive noninterest income Improved loan to deposit ratio Balancing loan growth and asset quality Continuing to enhance delivery in both personal and commercial channels

Annual Supplemental Data (Nasdaq: MBCN)

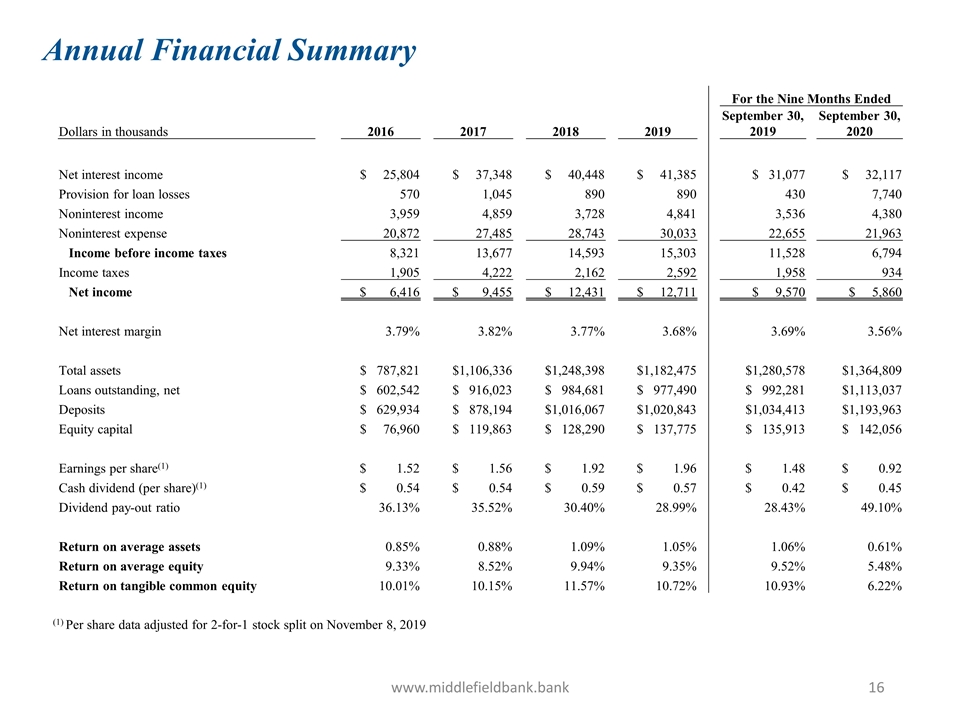

Annual Financial Summary www.middlefieldbank.bank For the Nine Months Ended Dollars in thousands 2016 2017 2018 2019 September 30, 2019 September 30, 2020 Net interest income $ 25,804 $ 37,348 $ 40,448 $ 41,385 $ 31,077 $ 32,117 Provision for loan losses 570 1,045 890 890 430 7,740 Noninterest income 3,959 4,859 3,728 4,841 3,536 4,380 Noninterest expense 20,872 27,485 28,743 30,033 22,655 21,963 Income before income taxes 8,321 13,677 14,593 15,303 11,528 6,794 Income taxes 1,905 4,222 2,162 2,592 1,958 934 Net income $ 6,416 $ 9,455 $ 12,431 $ 12,711 $ 9,570 $ 5,860 Net interest margin 3.79% 3.82% 3.77% 3.68% 3.69% 3.56% Total assets $ 787,821 $1,106,336 $1,248,398 $1,182,475 $1,280,578 $1,364,809 Loans outstanding, net $ 602,542 $ 916,023 $ 984,681 $ 977,490 $ 992,281 $1,113,037 Deposits $ 629,934 $ 878,194 $1,016,067 $1,020,843 $1,034,413 $1,193,963 Equity capital $ 76,960 $ 119,863 $ 128,290 $ 137,775 $ 135,913 $ 142,056 Earnings per share(1) $ 1.52 $ 1.56 $ 1.92 $ 1.96 $ 1.48 $ 0.92 Cash dividend (per share)(1) $ 0.54 $ 0.54 $ 0.59 $ 0.57 $ 0.42 $ 0.45 Dividend pay-out ratio 36.13% 35.52% 30.40% 28.99% 28.43% 49.10% Return on average assets 0.85% 0.88% 1.09% 1.05% 1.06% 0.61% Return on average equity 9.33% 8.52% 9.94% 9.35% 9.52% 5.48% Return on tangible common equity 10.01% 10.15% 11.57% 10.72% 10.93% 6.22% (1) Per share data adjusted for 2-for-1 stock split on November 8, 2019

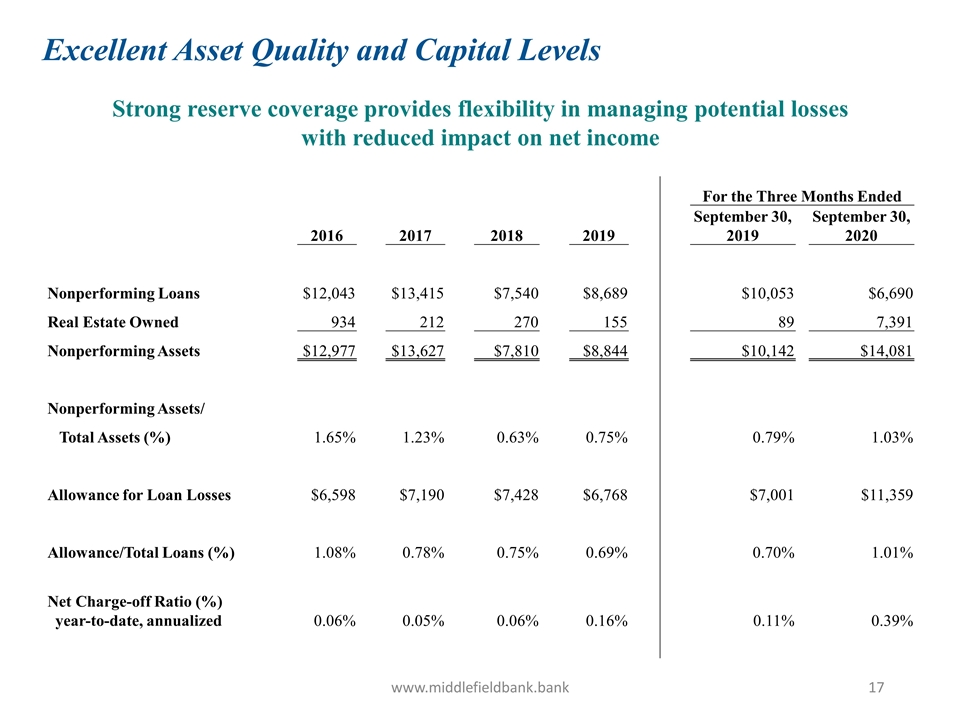

Excellent Asset Quality and Capital Levels www.middlefieldbank.bank Strong reserve coverage provides flexibility in managing potential losses with reduced impact on net income For the Three Months Ended 2016 2017 2018 2019 September 30, 2019 September 30, 2020 Nonperforming Loans $12,043 $13,415 $7,540 $8,689 $10,053 $6,690 Real Estate Owned 934 212 270 155 89 7,391 Nonperforming Assets $12,977 $13,627 $7,810 $8,844 $10,142 $14,081 Nonperforming Assets/ Total Assets (%) 1.65% 1.23% 0.63% 0.75% 0.79% 1.03% Allowance for Loan Losses $6,598 $7,190 $7,428 $6,768 $7,001 $11,359 Allowance/Total Loans (%) 1.08% 0.78% 0.75% 0.69% 0.70% 1.01% Net Charge-off Ratio (%) year-to-date, annualized 0.06% 0.05% 0.06% 0.16% 0.11% 0.39%

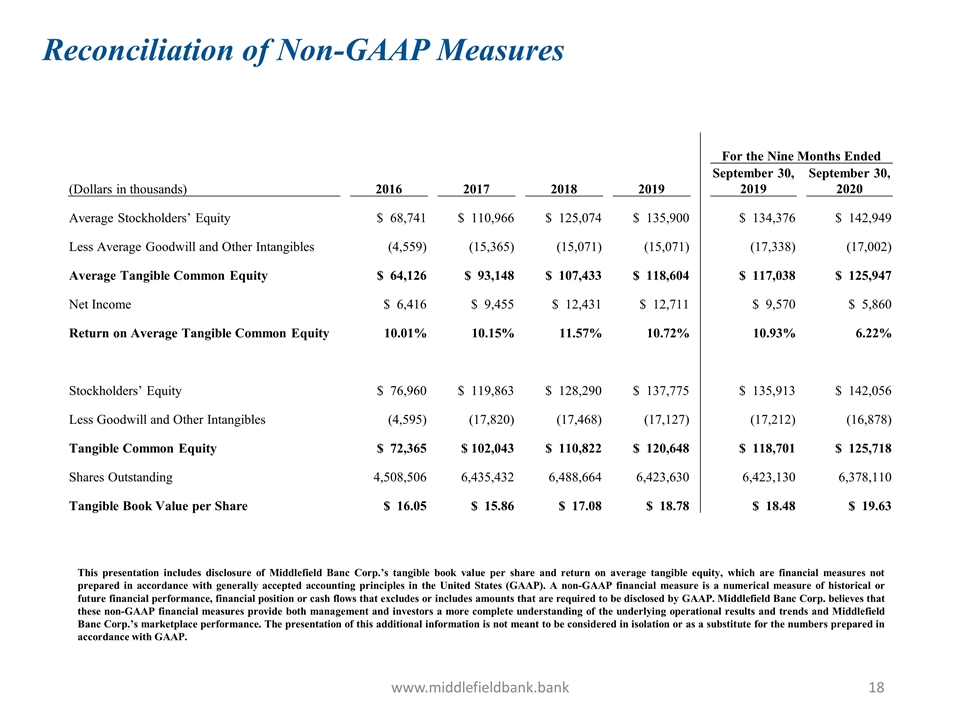

Reconciliation of Non-GAAP Measures www.middlefieldbank.bank For the Nine Months Ended (Dollars in thousands) 2016 2017 2018 2019 September 30, 2019 September 30, 2020 Average Stockholders’ Equity $ 68,741 $ 110,966 $ 125,074 $ 135,900 $ 134,376 $ 142,949 Less Average Goodwill and Other Intangibles (4,559) (15,365) (15,071) (15,071) (17,338) (17,002) Average Tangible Common Equity $ 64,126 $ 93,148 $ 107,433 $ 118,604 $ 117,038 $ 125,947 Net Income $ 6,416 $ 9,455 $ 12,431 $ 12,711 $ 9,570 $ 5,860 Return on Average Tangible Common Equity 10.01% 10.15% 11.57% 10.72% 10.93% 6.22% Stockholders’ Equity $ 76,960 $ 119,863 $ 128,290 $ 137,775 $ 135,913 $ 142,056 Less Goodwill and Other Intangibles (4,595) (17,820) (17,468) (17,127) (17,212) (16,878) Tangible Common Equity $ 72,365 $ 102,043 $ 110,822 $ 120,648 $ 118,701 $ 125,718 Shares Outstanding 4,508,506 6,435,432 6,488,664 6,423,630 6,423,130 6,378,110 Tangible Book Value per Share $ 16.05 $ 15.86 $ 17.08 $ 18.78 $ 18.48 $ 19.63 This presentation includes disclosure of Middlefield Banc Corp.’s tangible book value per share and return on average tangible equity, which are financial measures not prepared in accordance with generally accepted accounting principles in the United States (GAAP). A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes or includes amounts that are required to be disclosed by GAAP. Middlefield Banc Corp. believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the underlying operational results and trends and Middlefield Banc Corp.’s marketplace performance. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the numbers prepared in accordance with GAAP.