Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PRICE T ROWE GROUP INC | pressrelease.htm |

| 8-K - 8-K - PRICE T ROWE GROUP INC | trow-20201119.htm |

T. ROWE PRICE INVESTMENT MANAGEMENT November 19, 2020 A copy of this presentation, which includes additional information, is available at investors.troweprice.com. Data as of September 30, 2020, unless otherwise noted. Material intended for investment professional use only.

Creation of T. Rowe Price Investment Management OBJECTIVE Our core mission is to help clients around the globe Maximize our achieve their investment goals. We constantly assess our ability to deliver superior investment results for our clients including continuous long-term ability reviews of people, process, and culture. to generate alpha We enjoy the benefits of scale such as deep financial resources, the ability to attract top talent, and unsurpassed for our clients access to portfolio company management teams. Using the long-term lens that has always guided our decision-making, we believe creating a separate SEC- registered U.S. adviser will allow us to generate new capacity while retaining our scale benefits and position our investment teams for continued success. 2

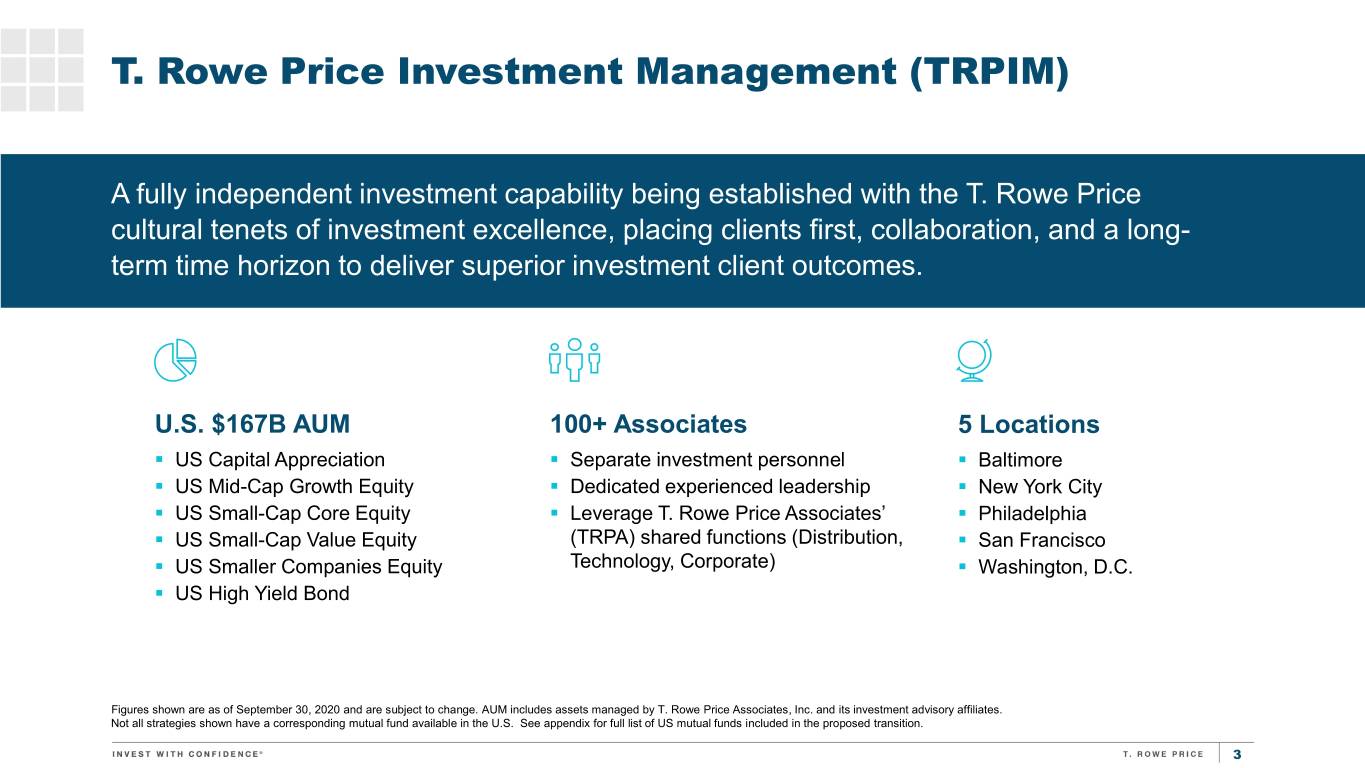

T. Rowe Price Investment Management (TRPIM) A fully independent investment capability being established with the T. Rowe Price cultural tenets of investment excellence, placing clients first, collaboration, and a long- term time horizon to deliver superior investment client outcomes. U.S. $167B AUM 100+ Associates 5 Locations . US Capital Appreciation . Separate investment personnel . Baltimore . US Mid-Cap Growth Equity . Dedicated experienced leadership . New York City . US Small-Cap Core Equity . Leverage T. Rowe Price Associates’ . Philadelphia . US Small-Cap Value Equity (TRPA) shared functions (Distribution, . San Francisco . US Smaller Companies Equity Technology, Corporate) . Washington, D.C. . US High Yield Bond Figures shown are as of September 30, 2020 and are subject to change. AUM includes assets managed by T. Rowe Price Associates, Inc. and its investment advisory affiliates. Not all strategies shown have a corresponding mutual fund available in the U.S. See appendix for full list of US mutual funds included in the proposed transition. 3

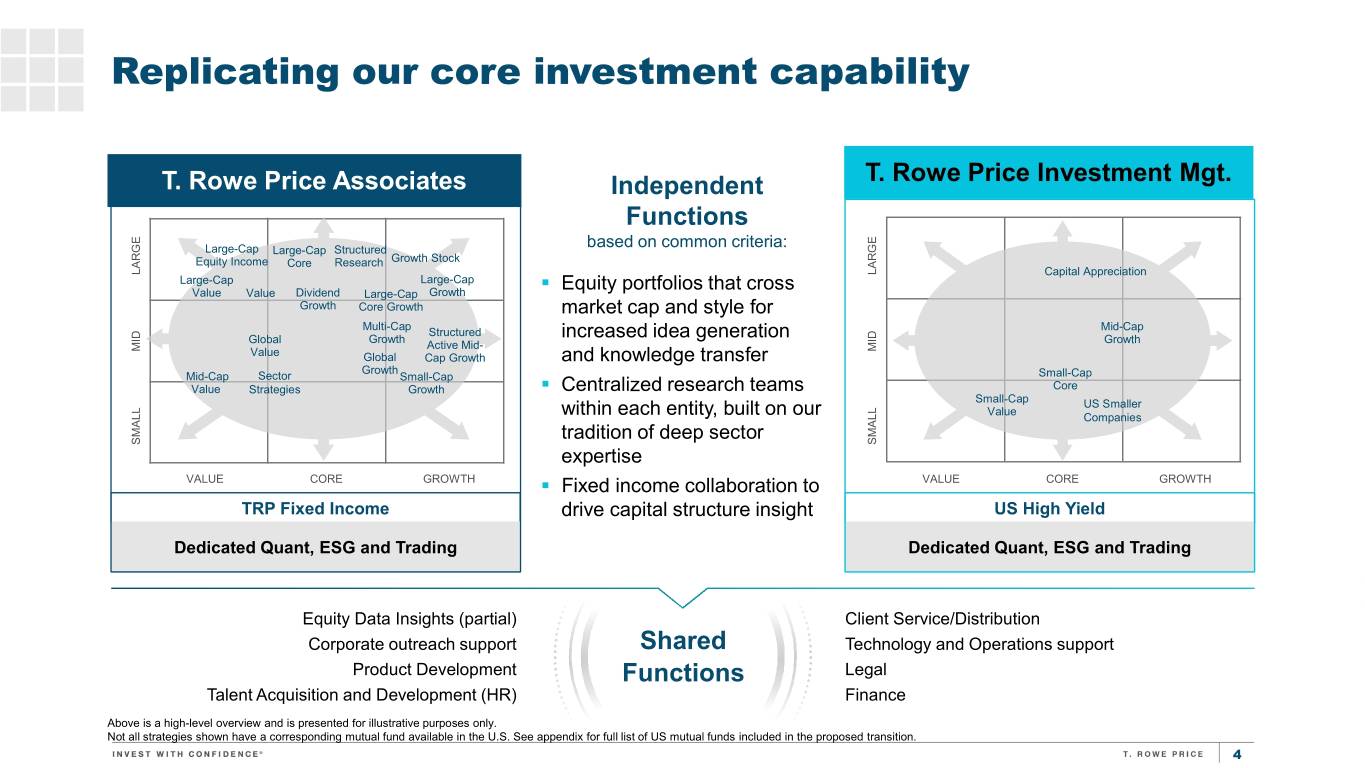

Replicating our core investment capability T. Rowe Price Investment Mgt. T. Rowe Price Associates Independent Functions Large-Cap Large-Cap Structured based on common criteria: Equity Income Core Research Growth Stock LARGE LARGE Capital Appreciation Large-Cap Large-Cap . Value Value Dividend Large-Cap Growth Equity portfolios that cross Growth Core Growth market cap and style for Multi-Cap Mid-Cap Structured Global Growth increased idea generation Growth MID Active Mid- MID Value Global Cap Growth and knowledge transfer Growth Mid-Cap Sector Small-Cap Small-Cap Value Strategies Growth . Centralized research teams Core Small-Cap US Smaller Value within each entity, built on our Companies SMALL tradition of deep sector SMALL expertise VALUE CORE GROWTH . Fixed income collaboration to VALUE CORE GROWTH TRP Fixed Income drive capital structure insight US High Yield Dedicated Quant, ESG and Trading Dedicated Quant, ESG and Trading Equity Data Insights (partial) Client Service/Distribution Corporate outreach support Shared Technology and Operations support Product Development Functions Legal Talent Acquisition and Development (HR) Finance Above is a high-level overview and is presented for illustrative purposes only. Not all strategies shown have a corresponding mutual fund available in the U.S. See appendix for full list of US mutual funds included in the proposed transition. 4

Leadership that brings experience and passion Stephon Jackson, CFA Head of TRPIM Years at T. Rowe Price: 13 Years of Industry Experience: 33 Ric Weible, CPA Tammy Wiggs Steven Krichbaum, CFA Thomas Watson, CFA Director of Operations Head of Equity Trading Director of Research Director of Research Years at T. Rowe Price: 18 Years at T. Rowe Price: 13 Years at T. Rowe Price: 13 Years at T. Rowe Price: 13 Years of Industry Experience: 18 Years of Industry Experience: 19 Years of Industry Experience: 13 Years of Industry Experience: 13 Data as of September 30, 2020 CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute. 5

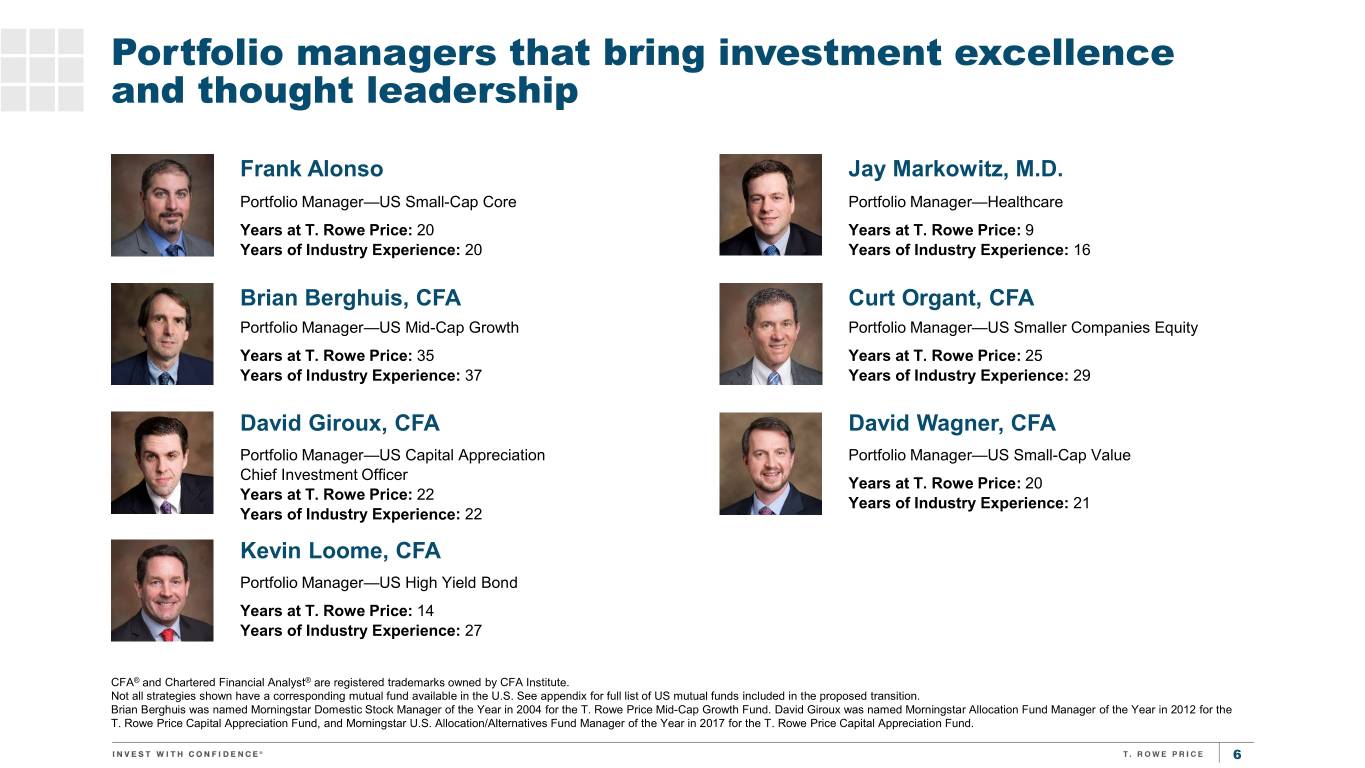

Portfolio managers that bring investment excellence and thought leadership Frank Alonso Jay Markowitz, M.D. Portfolio Manager—US Small-Cap Core Portfolio Manager—Healthcare Years at T. Rowe Price: 20 Years at T. Rowe Price: 9 Years of Industry Experience: 20 Years of Industry Experience: 16 Brian Berghuis, CFA Curt Organt, CFA Portfolio Manager—US Mid-Cap Growth Portfolio Manager—US Smaller Companies Equity Years at T. Rowe Price: 35 Years at T. Rowe Price: 25 Years of Industry Experience: 37 Years of Industry Experience: 29 David Giroux, CFA David Wagner, CFA Portfolio Manager—US Capital Appreciation Portfolio Manager—US Small-Cap Value Chief Investment Officer Years at T. Rowe Price: 20 Years at T. Rowe Price: 22 Years of Industry Experience: 21 Years of Industry Experience: 22 Kevin Loome, CFA Portfolio Manager—US High Yield Bond Years at T. Rowe Price: 14 Years of Industry Experience: 27 CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute. Not all strategies shown have a corresponding mutual fund available in the U.S. See appendix for full list of US mutual funds included in the proposed transition. Brian Berghuis was named Morningstar Domestic Stock Manager of the Year in 2004 for the T. Rowe Price Mid-Cap Growth Fund. David Giroux was named Morningstar Allocation Fund Manager of the Year in 2012 for the T. Rowe Price Capital Appreciation Fund, and Morningstar U.S. Allocation/Alternatives Fund Manager of the Year in 2017 for the T. Rowe Price Capital Appreciation Fund. 6

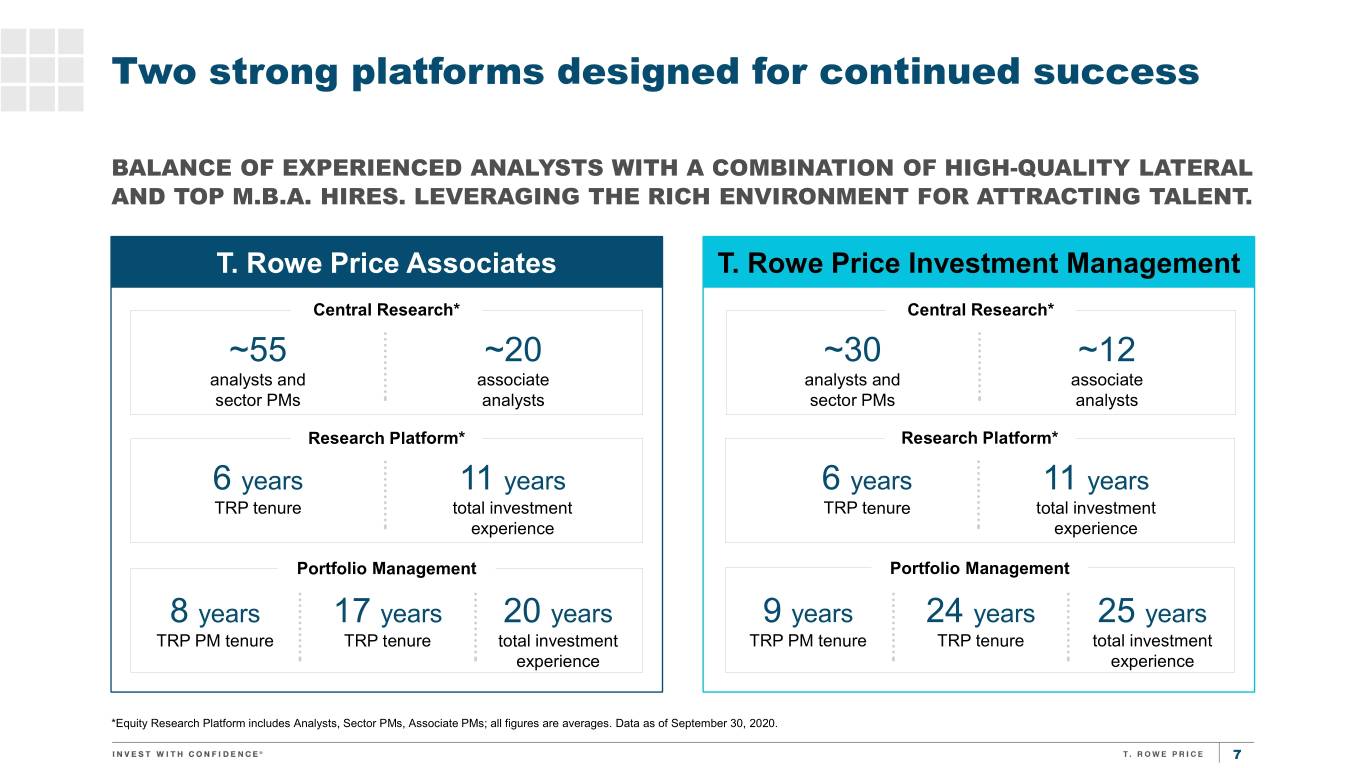

Two strong platforms designed for continued success BALANCE OF EXPERIENCED ANALYSTS WITH A COMBINATION OF HIGH-QUALITY LATERAL AND TOP M.B.A. HIRES. LEVERAGING THE RICH ENVIRONMENT FOR ATTRACTING TALENT. T. Rowe Price Associates T. Rowe Price Investment Management Central Research* Central Research* ~55 ~20 ~30 ~12 analysts and associate analysts and associate sector PMs analysts sector PMs analysts Research Platform* Research Platform* 6 years 11 years 6 years 11 years TRP tenure total investment TRP tenure total investment experience experience Portfolio Management Portfolio Management 8 years 17 years 20 years 9 years 24 years 25 years TRP PM tenure TRP tenure total investment TRP PM tenure TRP tenure total investment experience experience *Equity Research Platform includes Analysts, Sector PMs, Associate PMs; all figures are averages. Data as of September 30, 2020. 7

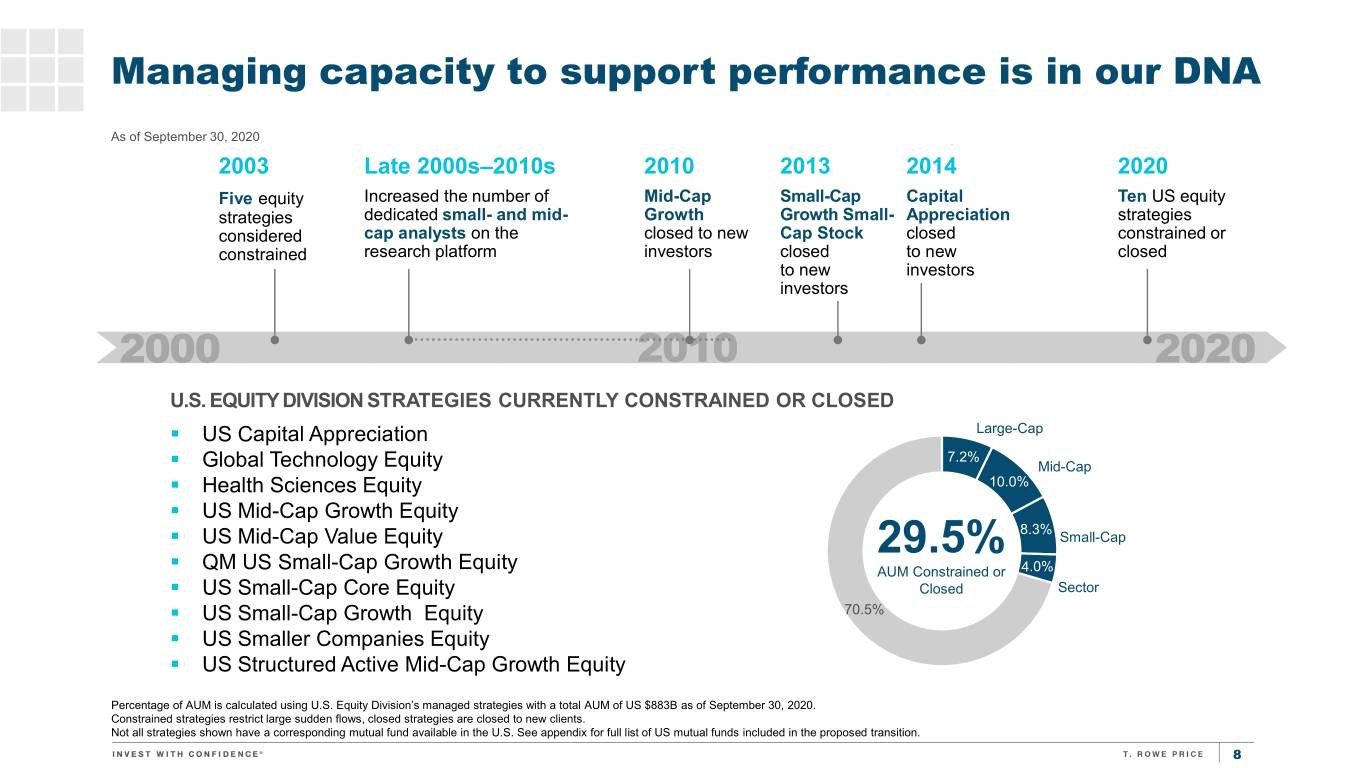

Managing capacity to support performance is in our DNA As of September 30, 2020 2003 Late 2000s–2010s 2010 2013 2014 2020 Five equity Increased the number of Mid-Cap Small-Cap Capital Ten US equity strategies dedicated small- and mid- Growth Growth Small- Appreciation strategies considered cap analysts on the closed to new Cap Stock closed constrained or constrained research platform investors closed to new closed to new investors investors U.S. EQUITY DIVISION STRATEGIES CURRENTLY CONSTRAINED OR CLOSED . US Capital Appreciation Large-Cap 7.2% . Global Technology Equity Mid-Cap . Health Sciences Equity 10.0% . US Mid-Cap Growth Equity 8.3% . US Mid-Cap Value Equity Small-Cap . 29.5% QM US Small-Cap Growth Equity AUM Constrained or 4.0% . US Small-Cap Core Equity Closed Sector . US Small-Cap Growth Equity 70.5% . US Smaller Companies Equity . US Structured Active Mid-Cap Growth Equity Percentage of AUM is calculated using U.S. Equity Division’s managed strategies with a total AUM of US $883B as of September 30, 2020. Constrained strategies restrict large sudden flows, closed strategies are closed to new clients. Not all strategies shown have a corresponding mutual fund available in the U.S. See appendix for full list of US mutual funds included in the proposed transition. 8

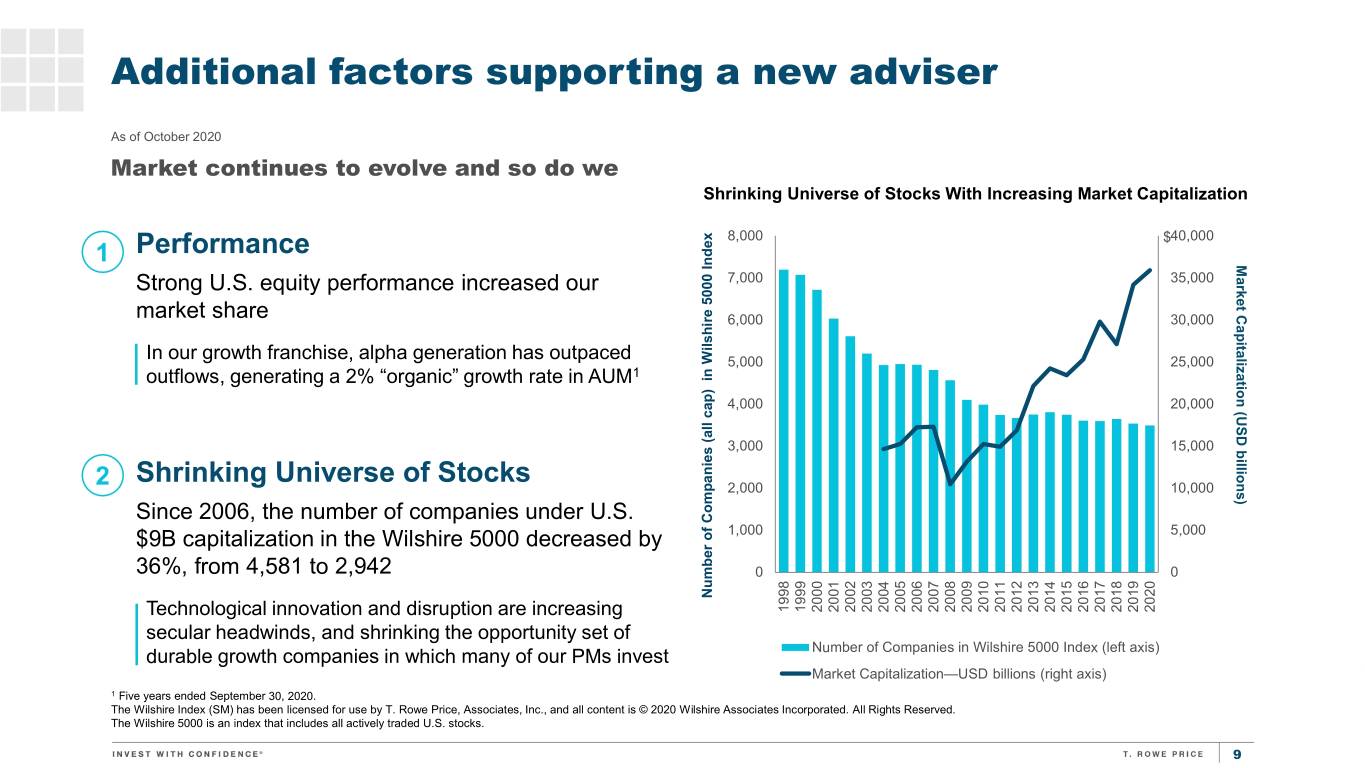

Additional factors supporting a new adviser As of October 2020 Market continues to evolve and so do we Shrinking Universe of Stocks With Increasing Market Capitalization Performance 8,000 $40,000 1 Market Capitalization (USD billions) Strong U.S. equity performance increased our 7,000 35,000 market share 6,000 30,000 In our growth franchise, alpha generation has outpaced 5,000 25,000 outflows, generating a 2% “organic” growth rate in AUM1 4,000 20,000 3,000 15,000 2 Shrinking Universe of Stocks 2,000 10,000 Since 2006, the number of companies under U.S. $9B capitalization in the Wilshire 5000 decreased by 1,000 5,000 36%, from 4,581 to 2,942 0 0 NumberCompanies of in (all Wilshire cap) 5000 Index Technological innovation and disruption are increasing 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 secular headwinds, and shrinking the opportunity set of durable growth companies in which many of our PMs invest Number of Companies in Wilshire 5000 Index (left axis) Market Capitalization—USD billions (right axis) 1 Five years ended September 30, 2020. The Wilshire Index (SM) has been licensed for use by T. Rowe Price, Associates, Inc., and all content is © 2020 Wilshire Associates Incorporated. All Rights Reserved. The Wilshire 5000 is an index that includes all actively traded U.S. stocks. 9

Why is a new adviser the best course of action? It leverages our strengths Increases our capacity: Establishes a new research Organic growth at both ability, overtime, to continue platform that utilizes our entities will be instilled with to select the right strength in identifying and the same foundational securities, in the right growing investment talent investment culture amounts, at the right time, while reducing the while adhering to risk complexity of management and regulatory communication across rules a single, larger platform It provides Multi-asset products Provides US High Increases career additional expected to Yield Bond with opportunities for benefits continue to benefit access to equity top talent from alpha generation insights and at both entities + corporate access + 10

What to expect next: communicating as we progress IN KEEPING WITH T. ROWE PRICE’S PHILOSOPHY OF EARLY CLIENT COMMUNICATIONS WE ARE ANNOUNCING THIS WELL AHEAD OF TRANSITION . Over the next 18 months we will monitor progress to determine readiness to transition. – Complete hiring of remaining investment personnel – Finalize technology and operations work to ensure necessary data restrictions – Request necessary approvals for adviser change . In 2021 as sector teams and investment tools are developed, we will begin to transition to the two-adviser platform structure, ensuring smooth operations in order to change adviser in early 2022. We control when we transition 2018 2019 Today 2021 Q2 2022 Analysis Review increased recruitment Majority of Monitor analyst hiring and coverage Anticipated program team and design of potential additional transitions; investors begin using new date of adviser assembled Operations and Technology analysts hired tools and processes change changes Timeline is for informational purposes only and subject to change, pending necessary approvals. 11

Confidence to proceed: Guiding investors for 80 years OUR THOUGHTFUL ANALYSIS VALIDATES THAT WE ARE WELL POSITIONED TO EXECUTE Continuing our tradition of a Acting now, from a Our investment managers Leadership commitment long-term, thoughtful position of strength believe that now is the time to is unwavering and approach to business and act enthusiastic capacity management “Seasoned investment “We have taken a very “Making this move now, while “Leadership and the investment managers will ensure that the thoughtful and deliberate further building out our research team are confident that both T. Rowe Price investment approach to deciding which teams and capabilities across entities have the right mix of process; culture; and long- strategies are shifting to the investment platforms, will also investment professionals to term, client-first orientation new platform and which are protect and enhance our ability to continue delivering the will be foundational to staying within TRPA and attract and retain top investment investment excellence that is T. Rowe Price Investment have focused on ensuring talent.” the bedrock of our culture.” Management.” each has a strong platform.” —Rob Sharps, Head of Investments —Steph Jackson, Head of T. Rowe Price Investment Management —Bill Stromberg, President and —Eric Veiel, Co-head of Equity, and Group CIO CEO Head of U.S. Equity 12

THANK YOU

Important Information Certain statements in this presentation may represent “forward-looking information,” including information relating to the timing and nature of the transitions, and the potential benefits to be realized The timing and details regarding the formation and implementation of T. Rowe Price Investment Management are based on current expectations and plans and are subject to change. For a discussion concerning risks and other factors that could affect future results, see the firm's Form 10-Q for the third quarter of 2020 and 2019 Annual Report on Form 10-K. This material is provided for informational purposes only and not intended to be investment advice or a recommendation to take any particular investment action. Information and opinions, including forecasts and forward-looking statements, presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision. T. Rowe Price Associates, Inc. © 2020 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. 14