Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Arrival Vault US, Inc. | d40716d8k.htm |

Exhibit 99.1 Arrival Business Update November 2020 NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVALExhibit 99.1 Arrival Business Update November 2020 NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL

2 We have exciting news! NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL2 We have exciting news! NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL

WHAT’S BEEN GOING ON 3 Arrival has officially entered into a definitive business combination agreement with CIIG Merger Corp. What does this mean? — CIIG is our chosen SPAC partner — The process of becoming a public company is one step closer — We will lift the media embargo at 1pm UK time today - do not — post about it until after this time please -and only share posts from Arrival’s channels - do not comment on the news and ask anyone else to share What happens next? — In the next few weeks we will submit all paperwork to the SEC — who will then review the transaction - this usually takes around 90 days We are expecting to complete the transaction and list on the — Nasdaq with the ticker ARVL in Q1 2021 No-one to trade CIIG stock or their direct friends and family — -please see letter to follow this meeting NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVALWHAT’S BEEN GOING ON 3 Arrival has officially entered into a definitive business combination agreement with CIIG Merger Corp. What does this mean? — CIIG is our chosen SPAC partner — The process of becoming a public company is one step closer — We will lift the media embargo at 1pm UK time today - do not — post about it until after this time please -and only share posts from Arrival’s channels - do not comment on the news and ask anyone else to share What happens next? — In the next few weeks we will submit all paperwork to the SEC — who will then review the transaction - this usually takes around 90 days We are expecting to complete the transaction and list on the — Nasdaq with the ticker ARVL in Q1 2021 No-one to trade CIIG stock or their direct friends and family — -please see letter to follow this meeting NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL

4 Who is CIIG? NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL4 Who is CIIG? NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL

WHAT’S COMING UP 5 CIIG Merger Corp CIIG comprises a board of individuals with extensive — backgrounds in a variety of industries and professions The main leadership team: — Peter Cuneo, former CEO of Marvel — Gavin Cuneo, former COO & CFO of Valiant — Entertainment Mike Minnick, previous positions at J.P. Morgan — & RBS NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVALWHAT’S COMING UP 5 CIIG Merger Corp CIIG comprises a board of individuals with extensive — backgrounds in a variety of industries and professions The main leadership team: — Peter Cuneo, former CEO of Marvel — Gavin Cuneo, former COO & CFO of Valiant — Entertainment Mike Minnick, previous positions at J.P. Morgan — & RBS NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL

6 The financials NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL6 The financials NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL

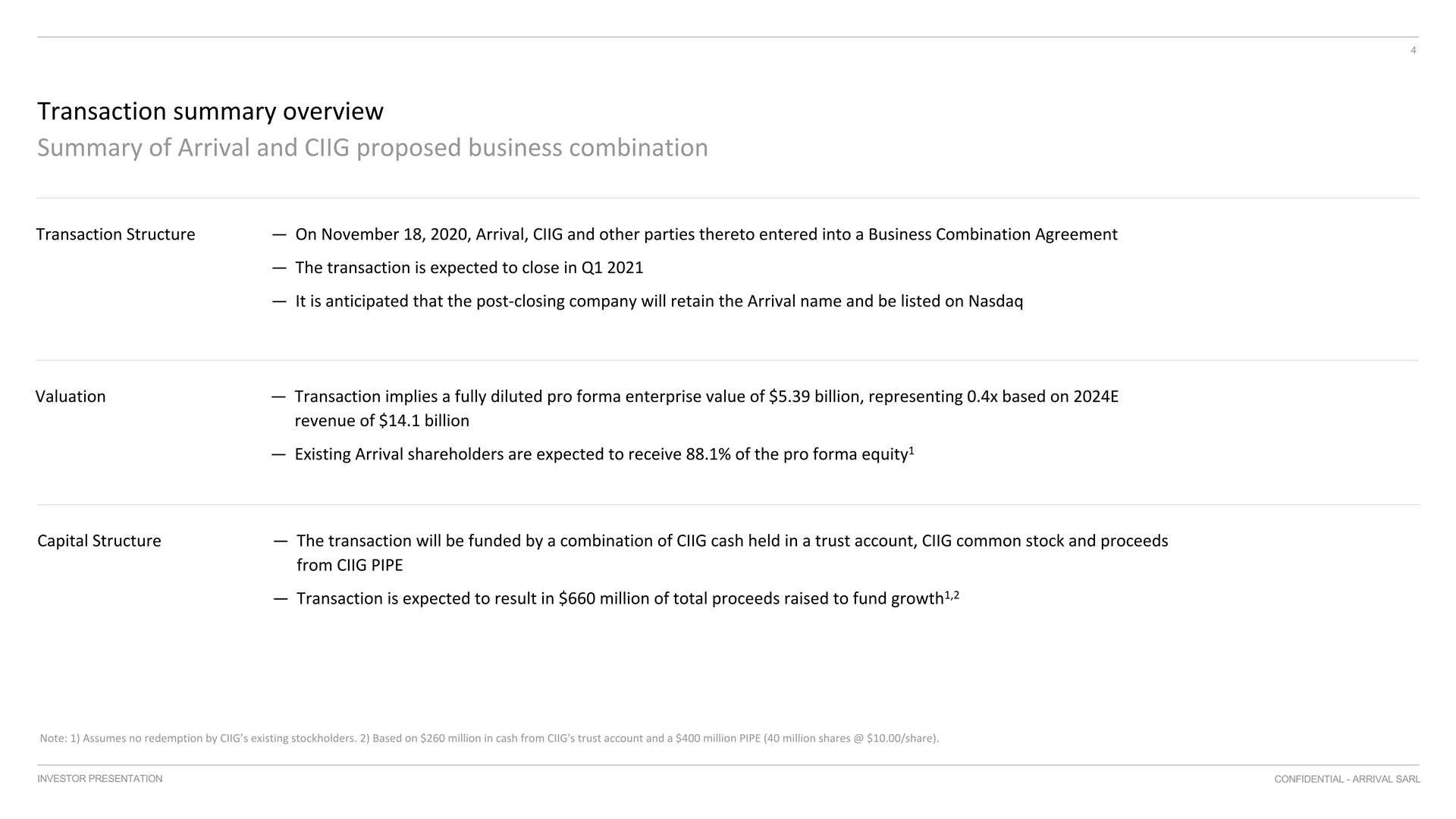

4 WHAT’S COMING UP 7 Transaction summary overview Transaction Overview Summary of Arrival and CIIG proposed business combination Mention pipe investors too — Transaction Structure — On November 18, 2020, Arrival, CIIG and other parties thereto entered into a Business Combination Agreement — The transaction is expected to close in Q1 2021 — It is anticipated that the post-closing company will retain the Arrival name and be listed on Nasdaq Valuation — Transaction implies a fully diluted pro forma enterprise value of $5.39 billion, representing 0.4x based on 2024E revenue of $14.1 billion 1 — Existing Arrival shareholders are expected to receive 88.1% of the pro forma equity Capital Structure — The transaction will be funded by a combination of CIIG cash held in a trust account, CIIG common stock and proceeds from CIIG PIPE 1,2 — Transaction is expected to result in $660 million of total proceeds raised to fund growth Note: 1) Assumes no redemption by CIIG’s existing stockholders. 2) Based on $260 million in cash from CIIG's trust account and a $400 million PIPE (40 million shares @ $10.00/share). INVESTOR PRESENTATION NOVEMBER 2020 CONFIDENTIAL - ARRIVAL SARL PRIVATE & CONFIDENTIAL - ARRIVAL4 WHAT’S COMING UP 7 Transaction summary overview Transaction Overview Summary of Arrival and CIIG proposed business combination Mention pipe investors too — Transaction Structure — On November 18, 2020, Arrival, CIIG and other parties thereto entered into a Business Combination Agreement — The transaction is expected to close in Q1 2021 — It is anticipated that the post-closing company will retain the Arrival name and be listed on Nasdaq Valuation — Transaction implies a fully diluted pro forma enterprise value of $5.39 billion, representing 0.4x based on 2024E revenue of $14.1 billion 1 — Existing Arrival shareholders are expected to receive 88.1% of the pro forma equity Capital Structure — The transaction will be funded by a combination of CIIG cash held in a trust account, CIIG common stock and proceeds from CIIG PIPE 1,2 — Transaction is expected to result in $660 million of total proceeds raised to fund growth Note: 1) Assumes no redemption by CIIG’s existing stockholders. 2) Based on $260 million in cash from CIIG's trust account and a $400 million PIPE (40 million shares @ $10.00/share). INVESTOR PRESENTATION NOVEMBER 2020 CONFIDENTIAL - ARRIVAL SARL PRIVATE & CONFIDENTIAL - ARRIVAL

WHAT’S COMING UP 8 What this means for Arrival employees Through this merger new shares will be issued. Arrival — shares are converted into new shares with a coefficient of 0.5581634737. For your employee incentive plan your number of shares — and strike price will convert to the new shares, but the overall value will remain the same. It will be calculated as follows: Your new number of shares is your existing no. of shares * — 0.5581634737 Current strike price: 3.40909 EUR — New Strike Price: 3.40909/0.5581634737 = 6.10769 Eur. — As we will be a US- listed company, this will be converted to — a USD value at the time of closing. NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVALWHAT’S COMING UP 8 What this means for Arrival employees Through this merger new shares will be issued. Arrival — shares are converted into new shares with a coefficient of 0.5581634737. For your employee incentive plan your number of shares — and strike price will convert to the new shares, but the overall value will remain the same. It will be calculated as follows: Your new number of shares is your existing no. of shares * — 0.5581634737 Current strike price: 3.40909 EUR — New Strike Price: 3.40909/0.5581634737 = 6.10769 Eur. — As we will be a US- listed company, this will be converted to — a USD value at the time of closing. NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL

WHAT’S COMING UP 9 What this means for Arrival employees Thank you to everyone involved over the past 5 years — We will be sending an email following this all hands with all — the information It will also contain information with regards to trading — restrictions on stock - both stock of a newly formed holding company and your employee share options Confidentiality - the email also covers this but it is even more — important to be highly confidential about anything that is not public facing Business as usual - we still need to be laser focused on — execution across the business - now we will be a public company there will be additional scrutiny NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVALWHAT’S COMING UP 9 What this means for Arrival employees Thank you to everyone involved over the past 5 years — We will be sending an email following this all hands with all — the information It will also contain information with regards to trading — restrictions on stock - both stock of a newly formed holding company and your employee share options Confidentiality - the email also covers this but it is even more — important to be highly confidential about anything that is not public facing Business as usual - we still need to be laser focused on — execution across the business - now we will be a public company there will be additional scrutiny NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL

10 Thanks and Questions NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL10 Thanks and Questions NOVEMBER 2020 PRIVATE & CONFIDENTIAL - ARRIVAL