UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act

Date of Report (Date of earliest event reported): November 13, 2020

NEW CONCEPT ENERGY, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada |

000-08187 |

75-2399477 | |

|

(State or other jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) | |

|

1603 LBJ Freeway, Suite 800 Dallas, Texas |

75234 | ||

| (Address of principal executive offices) | (Zip Code) | ||

Registrant’s telephone number, including area code 972-407-8400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on which Registered |

|

Common Stock, par value $0.01 |

GBR |

NYSE American |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

| 1 |

Section 2 – Financial Information

Item 2.02. Results of Operations and Financial Condition

On November 13, 2020, New Concept Energy, Inc. (“GBR” or the “Company”) announced its operational results for the quarter ended September 30, 2020. A copy of the announcement is attached as Exhibit “99.1.”

The information furnished pursuant to Item 2.02 in this Form 8-K, including Exhibit “99.1” attached hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, unless we specifically incorporate it by reference in a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934. We undertake no duty or obligation to publicly update or revise the information furnished pursuant to Item 2.02 of this Current Report on Form 8-K.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is furnished with this Report:

Exhibit No. Description

99.1* Press release dated November 13, 2020

_________________________

* Furnished herewith

| 2 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: November 17, 2020

| NEW CONCEPT ENERGY, INC. | |||

| By: | /s/ Gene S. Bertcher | ||

| Gene S. Bertcher | |||

| President and Chief Financial Officer |

| 3 |

|

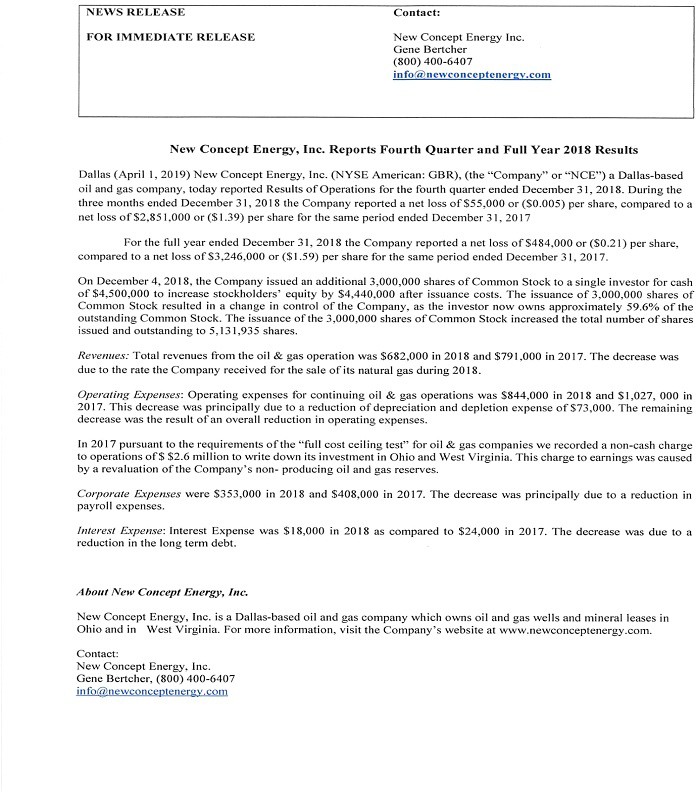

NEWS RELEASE

FOR IMMEDIATE RELEASE |

Contact:

New Concept Energy Inc. Investor Relations Gene Bertcher, (800) 400-6407 info@newconceptenergy.com |

New Concept Energy, Inc. Reports Third Quarter 2020 Results

DALLAS (November 13, 2020) - New Concept Energy, Inc. (NYSE American: GBR), (the “Company” or “NCE”) a Dallas-based company, today reported net income for the three months ended September 30, 2020 of $2,182,000 or ($0.43) per share, compared to a net loss of $2,320,000 or ($0.45) per share for the three months ended September 30, 2019.

For the three months ended September 30, 2020, the Company recorded net revenue from continuing operations of $82,000 and net income from discontinued operations of $2,100,000. For the three months ended September 30, 2019, the Company recorded $22,000 from continuing operations and a loss of $2,342,000 from discontinued operations.

On August 31, 2020 the Company sold its entire oil and gas operation for $85,000 to an independent third party. In prior years the Company has accrued a liability of $2,745,000 to plug and abandon the existing wells. This obligation was assumed by the buyer. Upon the sale of the wells the Company recorded a gain of $2,138,000.

In September 2019 the Company wrote down the accounting value of its oil and gas reserves by $2,285,000.

For the three months ended September 30, 2020 the Company reported other income of $84,000 which represents a tax refund for taxes paid in prior years.

The Company continues to own approximately 190 acres of land located in Parkersburg West Virginia. Located on the land are four structures totaling approximately 53,000 square feet. Of this total area the main industrial / office building contains approximately 24,800 square feet of which approximately 16,000 square feet is leased at a rate of $101,000 per annum.

| Contact: New Concept Energy, Inc. | |

| Gene Bercher, (800) 400-6407 | |

| info@newconceptenergy.com |

| 4 |

| NEW CONCEPT ENERGY, INC. AND SUBSIDIARIES | ||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||

| (unaudited) | ||||||||

| (dollars in thousands, except par value amount) | ||||||||

| September 30, 2020 | December 31, 2019 | |||||||

| (unaudited) | (audited) | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 42 | $ | 22 | ||||

| Current portion notes receivable (including $3,578 and 4,005 due to related parties in 2020 and 2019) | 3,618 | 4,046 | ||||||

| Other current assets | 104 | — | ||||||

| Total current assets | 3,764 | 4,068 | ||||||

| Property and equipment, net of depreciation | ||||||||

| Land, buildings and equipment | 659 | 668 | ||||||

| Assets held for sale | — | 840 | ||||||

| Other assets | 181 | 214 | ||||||

| Total assets | $ | 4,604 | $ | 5,790 | ||||

| The accompanying notes are an integral part of these consolidated financial statements. | ||||||||

| 5 |

| NEW CONCEPT ENERGY, INC. AND SUBSIDIARIES | ||||||||

| CONSOLIDATED BALANCE SHEETS - CONTINUED | ||||||||

| (unaudited) | ||||||||

| (dollars in thousands, except par value amount) | ||||||||

| September 30, 2020 | December 31, 2019 | |||||||

| Liabilities and stockholders' equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable (includes $32 and $180 due to related parties in 2020 and 2019) | $ | 39 | $ | 226 | ||||

| Accrued expenses | 18 | 20 | ||||||

| Current portion of long term debt | 40 | 44 | ||||||

| Total current liabilities | 97 | 290 | ||||||

| Long-term debt | ||||||||

| Notes payable less current portion | 150 | 177 | ||||||

| Liabilities of assets held for sale | — | 2,914 | ||||||

| Total liabilities | 247 | 3,381 | ||||||

| Stockholders' equity | ||||||||

| Preferred stock, Series B | 1 | 1 | ||||||

| Common stock, $.01 par value; authorized, 100,000,000 | ||||||||

| shares; issued and outstanding, 5,131,934 shares at | ||||||||

| September 30, 2020 and December 31, 2019 | 51 | 51 | ||||||

| Additional paid-in capital | 63,579 | 63,579 | ||||||

| Accumulated deficit | (59,274 | ) | (61,222 | ) | ||||

| Total Shareholder Equity | 4,357 | 2,409 | ||||||

| Total liabilities & equity | $ | 4,604 | $ | 5,790 | ||||

| The accompanying notes are an integral part of these consolidated financial statements. | ||||||||

| 6 |

| NEW CONCEPT ENERGY, INC AND SUBSIDIARIES | ||||||||||||||||

| CONSOLIDATED STATEMENT OF OPERATIONS | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| (amounts in thousands, except per share data) | ||||||||||||||||

| For the Three Months ended September 30, | For the Nine Months ended September 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Revenue | ||||||||||||||||

| Rent | $ | 25 | $ | 25 | $ | 76 | $ | 76 | ||||||||

| Operating expenses | ||||||||||||||||

| Operating expenses | 15 | 17 | 46 | 53 | ||||||||||||

| Corporate general and administrative | 65 | 92 | 296 | 314 | ||||||||||||

| Total operating expenses | 80 | 109 | 342 | 367 | ||||||||||||

| Operating loss | (55 | ) | (84 | ) | (266 | ) | (291 | ) | ||||||||

| Other income (expense) | ||||||||||||||||

| Interest income from related parties | 54 | 60 | 172 | 180 | ||||||||||||

| Interest Income from third parties | 3 | 3 | 12 | 12 | ||||||||||||

| Interest expense | (3 | ) | (3 | ) | (9 | ) | (12 | ) | ||||||||

| Income other | 83 | 46 | 83 | 199 | ||||||||||||

| Other income | 137 | 106 | 258 | 379 | ||||||||||||

| Net income (loss) from continuing operations | 82 | 22 | (8 | ) | 88 | |||||||||||

| Discontinued Operations | ||||||||||||||||

| Gain (loss) from discontinued operations | (38 | ) | (2,342 | ) | (182 | ) | (2,423 | ) | ||||||||

| Gain (loss) from disposal of Oil & Gas Operations | 2,138 | — | 2,138 | — | ||||||||||||

| 2,100 | (2,342 | ) | 1,956 | (2,423 | ) | |||||||||||

| Net income (loss) applicable to common shares | 2,182 | (2,320 | ) | 1,948 | (2,335 | ) | ||||||||||

| Net income (loss) per common share-basic and diluted | $ | 0.43 | $ | (0.45 | ) | $ | 0.38 | $ | (0.45 | ) | ||||||

| Weighted average common and equivalent shares outstanding - basic | 5,132 | 5,132 | 5,132 | 5,132 | ||||||||||||

| The accompanying notes are an integral part of these consolidated financial statements. | ||||||||||||||||