Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TAILORED BRANDS INC | tm2034631-1_8k.htm |

Exhibit 99.1

MOR-1 UNITED STATES BANKRUPTCY COURT CASE NAME: Tailored Brands, Inc.PETITION DATE: 08/02/20CASE NUMBER:20-33900DISTRICT OF TEXAS: SouthernPROPOSED PLAN DATE:10/6/2020DIVISION: HoustonMONTHLY OPERATING REPORT SUMMARY (Amounts in Thousands)MONTH Aug-20 Sep-20 Oct-20 REVENUES (MOR-6) 99,860 146,130 OPERATING INCOME (LOSS) (MOR-6) (37,748) (27,332) NET INCOME (LOSS) (MOR-6) (55,808) (33,507) PAYMENTS TO INSIDERS (MOR-9) 385 385 PAYMENTS TO PROFESSIONALS (MOR-9) 259 2,246 TOTAL DISBURSEMENTS (MOR-7) (548,839) (195,319)***The original of this document must be filed with the United States Bankruptcy Court and a copy must be sent to the United States Trustee***REQUIRED INSURANCE MAINTAINED Are all accounts receivable being collected within terms? AS OF SIGNATURE DATE EXP. Are all post-petition liabilities, including taxes, being paid within terms?CHECK ONE Yes No Yes NoDATE Have all tax returns and other required government filings been timely paid?Yes NoUMBRELLA D&O PROPERTY WORKERS COMP VARIOUSYES YES YES YES YES05/01/21 Have any pre-petition liabilities been paid? 12/31/20 If so, describe Payments made consistent with First Day Orders 05/01/21 Are all funds received being deposited into Debtor in Possession bank accounts? 05/01/21 Were any assets disposed of outside the normal course of business? 05/01/21 If so, describe Are all U.S. Trustee Quarterly Fee Payments current?Yes NoYes No Yes NoYes NoWhat is the status of your Plan of Reorganization?Amended Plan Filed 10/6/20ATTORNEY NAME: FIRM NAME: ADDRESS:CITY, STATE, ZIP:Matthew D. Cavenaugh Jackson Walker LLP 1401 McKinney St. Suite 1900 Houston, Texas 77010INITIALS DATEI certify under penalty of perjury that the following complete Monthly Operating Report (MOR), consisting of MOR-1 through MOR-9 plus attachments, is true and correct.SIGNED /s/ Holly Etlin Chief Restructuring OfficerTELEPHONE/FAX:713-752-4200 / 713-752-4221UST USE ONLY (ORIGINAL SIGNATURE) TITLE Holly Etlin 10/29/2020MOR-1(PRINT NAME OF SIGNATORY) DATE [1]A complete list of each of the Debtors in these chapter 11 cases may be obtained on the website of the Debtors’ claims and noticing agent at http://cases.primeclerk.com/TailoredBrands. The location of the Debtors’ service address in these chapter 11 cases is: 6100 Stevenson Boulevard, Fremont, California 94538.Page 1 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900Notes to the Monthly Operating ReportINTRODUCTION: This monthly operating report is unaudited and does not purport to represent financial statements prepared in accordance with GAAP nor are they intended to fully reconcile to the financial statements prepared by the Debtors. Unlike the consolidated financial statements, the MOR reflects the assets and liabilities of the Debtor(s), except where otherwise indicated. Information contained in the MOR has been derived from the Debtor’s books and records. Therefore, in order to comply with their obligations to provide monthly operating reports currently during these Chapter 11 Cases, the Debtors have prepared this monthly operating report using the best information presently available to them, which has been collected, maintained, and prepared in accordance with their historical accounting practices. This monthly operating report is, thus, true and accurate to the best of the Debtors’ knowledge, information and belief based on current available data. The results of operations and financial position contained herein are not necessarily indicative of results that may be expected for any other period or for the full year and may not necessarily reflect the consolidated results of operations and financial position of the Debtors in the future.GENERAL METHODOLOGY: The Debtors prepared this Monthly Operating Report relying primarily upon the information set forth in their books and records. Consequently, certain transactions that are not identified in the normal course of business in the Debtors’ books and records may not be included in this Monthly Operating Report. Nevertheless, in preparing this Monthly Operating Report, the Debtors made best efforts to supplement the information set forth in their books and records with additional information concerning transactions that may not have been identified therein. All numbers are rounded to thousands, which may cause slight differences to totals. The Debtors' fiscal periods do not align with calendar months. The fiscal period reported for August 2020 is August 2 - August 29. The fiscal period for September is August 30, 2020 - October 3, 2020. RESERVATION OF RIGHTS: Given the complexity of the Debtors’ business, inadvertent errors, omissions or over inclusion of contracts or leases may have occurred. Accordingly, the Debtors hereby reserve all of their rights to dispute the validity, status, enforceability, or executory nature of any claim amount, representation or other statement in this Monthly Operating Report and reserve the right to amend or supplement this Monthly Operating Report, if necessary, but shall be under no obligation to do so.Notes to MOR-1: The August MOR inadvertently listed the expiration date of the D&O insurance as 11/15/20. The correct expiration date of 12/31/20 is now listed.Notes to MOR-2: Balance sheet is presented as the combined total of Debtor entities in these cases and does not include eliminating accounting entries prepared in accordance with GAAP. Furthermore, this information is based on unaudited information, which may not reconcile to the Debtors' final consolidated financial statements for the period. Cash balances in balance sheet include cash not included in bank accounts, such as cash on hand, cash in transit and other accruals.Notes to MOR-3: Balance sheet is presented as the combined total of Debtor entities in these cases and does not include eliminating accounting entries prepared in accordance with GAAP. Furthermore, this information is based on unaudited information, which may not reconcile to the Debtors' final consolidated financial statements for the period. Accounts payable accruals may include invoices that had not been evaluated as liabilities subject to compromise as of month end. In this report these amounts are assumed to be post-petition obligations, pending the Debtors' normal-course invoice processing assessment.Page 2 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900Notes to the Monthly Operating ReportNotes to MOR-4: The Debtors have sought to allocate liabilities between the prepetition and postpetition periods based upon the information available at the time of, and research conducted in connection with, the preparation of this MOR. As additional information becomes available and further research is conducted, the Debtors’ allocation of liabilities between the prepetition and postpetition periods may change. The liability information, except as otherwise noted, is listed as of the close of business as of the end of the month. Accordingly, the Debtors reserve all rights to amend, supplement or otherwise modify this MOR as necessary and appropriate. Accrued expenses have not been evaluated as liabilities subject to compromise and are subject to material change.Notes to MOR-5: Aging represents open and outstanding invoices that have been entered into the Debtors' accounts payable system. The aging does not include accruals for invoices not yet received or approved and is aged based on due date.Accounts receivable aging only represents trade receivables. The balance of accounts receivable primarily consists of credit card receivables, and credit card reserves.Notes to MOR-6: All amounts are for the entire fiscal month, as described in the general methodology note. Fiscal September consists of 5 weeks.Notes to MOR-7: Although payment of prepetition claims is generally not permitted, the Bankruptcy Court has authorized the Debtors to pay certain prepetition claims in designated categories and subject to certain terms and conditions. This relief generally was designed to preserve the value of the Debtors’ business and assets. The Debtors have paid and continue to pay undisputed post petition obligations in the ordinary course of business.Intercompany receipts and disbursements are excluded from this report. Based on centralized cash management practices, non-Debtor entities may make payments on behalf of other Debtor entities. To conform to U.S. Trustee disbursement reporting requests to track disbursements by Debtor and for purposes of quarterly fee calculations, the Debtors have made a reasonable effort to assign these disbursements to the entity on whose behalf the payment was made. However, this assignment may differ from the final intercompany accounting. Both Receipts and Disbursements are provided on book basis.Notes to MOR-8: The Debtors perform all bank account reconciliations in the ordinary course of business. Copies of the bank account statements and reconciliations are available for inspection upon request by the Office of the United States Trustee. Balances represent book balance.Notes to MOR-9: The list of insiders is consistent with public disclosures of Tailored Brands, Inc. and other filings associated with this Chapter 11 case. Payments to ordinary course professionals or consultants are not included in MOR-9.Page 3 of 13

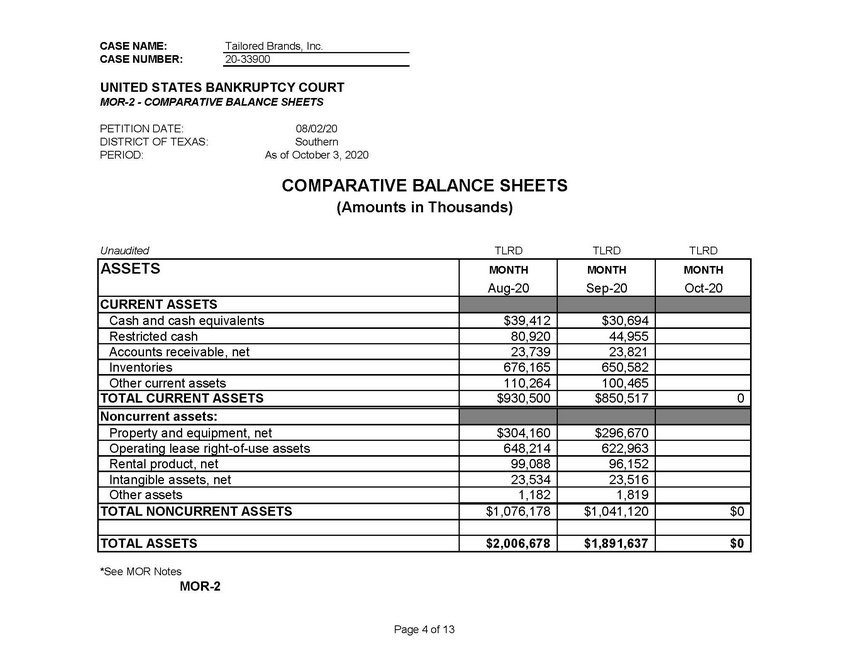

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-2 - COMPARATIVE BALANCE SHEETSPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: As of October 3, 2020COMPARATIVE BALANCE SHEETS (Amounts in Thousands)Unaudited TLRD TLRD TLRD ASSETS MONTH MONTH MONTH Aug-20 Sep-20 Oct-20CURRENT ASSETS Cash and cash equivalents $39,412 $30,694 Restricted cash 80,920 44,955 Accounts receivable, net 23,739 23,821 Inventories 676,165 650,582 Other current assets 110,264 100,465 TOTAL CURRENT ASSETS $930,500 $850,517 0 Noncurrent assets: Property and equipment, net $304,160 $296,670 Operating lease right-of-use assets 648,214 622,963 Rental product, net 99,088 96,152 Intangible assets, net 23,534 23,516 Other assets 1,182 1,819 TOTAL NONCURRENT ASSETS $1,076,178 $1,041,120 $0TOTAL ASSETS $2,006,678 $1,891,637 $0*See MOR Notes MOR-2Page 4 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-3 - COMPARATIVE BALANCE SHEETSPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: As of October 3, 2020COMPARATIVE BALANCE SHEETS (Amounts in Thousands)Unaudited LIABILITIES MONTH MONTH MONTH Aug-20 Sep-20 Oct-20LIABILITIES POST-PETITION LIABILITIES (MOR-4) $1,308,480 $1,226,342LIABILITIES SUBJECT TO COMPROMISE (LSTC) *See MOR Notes TOTAL LIABILITIES SUBJECT TO COMPROMISE 1,268,100 1,268,506 $0TOTAL LIABILITIES $2,576,580 $2,494,848 $0 EQUITY Common stock 512 512 Capital in excess of par 518,322 518,891 Accumulated deficit (1,077,515) (1,111,021) Accumulated other comprehensive loss (1,221) (1,593) Treasury stock, at cost (10,000) (10,000) TOTAL STOCKHOLDERS' DEFICIT ($569,902) ($603,211) $0TOTAL LIABILITIES & EQUITY $2,006,678 $1,891,637 $0*See MOR NotesMOR-3Page 5 of 13

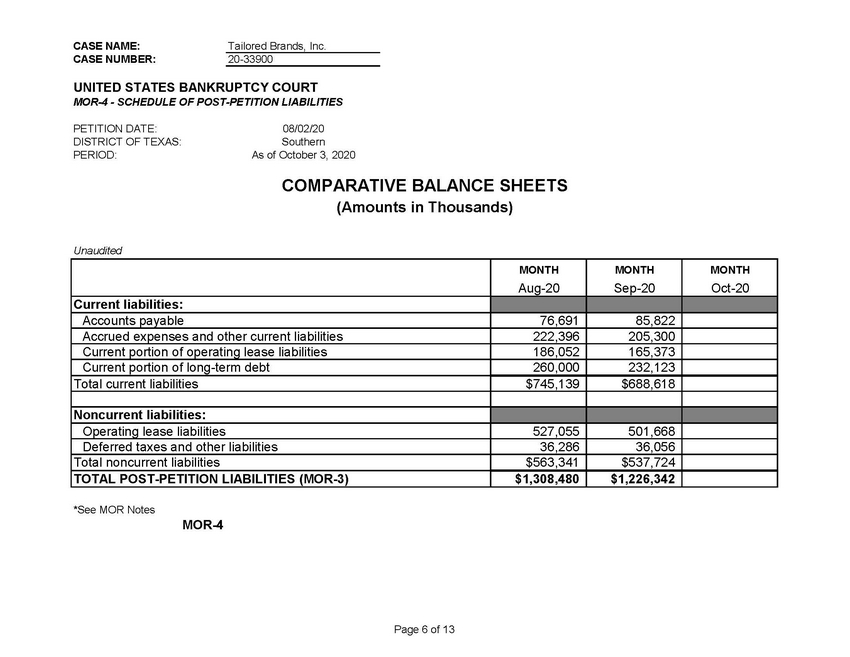

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-4 - SCHEDULE OF POST-PETITION LIABILITIESPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: As of October 3, 2020COMPARATIVE BALANCE SHEETS (Amounts in Thousands)UnauditedCurrent liabilities:MONTH MONTH MONTH Aug-20 Sep-20 Oct-20Accounts payable 76,691 85,822 Accrued expenses and other current liabilities 222,396 205,300 Current portion of operating lease liabilities 186,052 165,373 Current portion of long-term debt 260,000 232,123 Total current liabilities $745,139 $688,618Noncurrent liabilities: Operating lease liabilities 527,055 501,668 Deferred taxes and other liabilities 36,286 36,056 Total noncurrent liabilities $563,341 $537,724 TOTAL POST-PETITION LIABILITIES (MOR-3) $1,308,480 $1,226,342*See MOR NotesMOR-4Page 6 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-5 - POST-PETITION AP/AR AGINGPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: As of October 3, 2020AGING OF POST-PETITION PAYABLES (Amounts in Thousands)UnauditedDAYS Aug-20 Sep-20 Oct-20 Current $6,519 $22,425 1-30 29,207 9,661 31-60 5,205 (479) 61+ 1,114 5,627 TOTAL $42,045 $37,234AGING OF ACCOUNTS RECEIVABLES (Amounts in Thousands)UnauditedDAYS Aug-20 Sep-20 Oct-20 Current $77 $65 1-30 85 44 31-60 16 53 61+ 249 84 TOTAL $426 $246 *See MOR NotesMOR-5Page 7 of 13

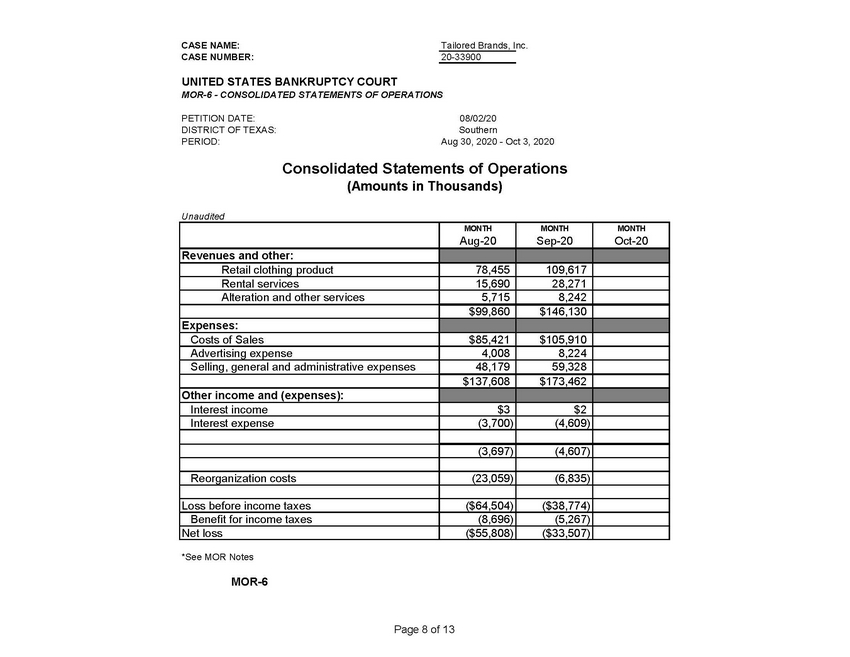

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-6 - CONSOLIDATED STATEMENTS OF OPERATIONSPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: Aug 30, 2020 - Oct 3, 2020Consolidated Statements of Operations (Amounts in Thousands)UnauditedRevenues and other:MONTH MONTH MONTH Aug-20 Sep-20 Oct-20Retail clothing product 78,455 109,617 Rental services 15,690 28,271 Alteration and other services 5,715 8,242 $99,860 $146,130Expenses: Costs of Sales $85,421 $105,910 Advertising expense 4,008 8,224 Selling, general and administrative expenses 48,179 59,328 $137,608 $173,462Other income and (expenses): Interest income $3 $2 Interest expense (3,700) (4,609) (3,697) (4,607) Reorganization costs (23,059) (6,835)Loss before income taxes ($64,504) ($38,774) Benefit for income taxes (8,696) (5,267) Net loss ($55,808) ($33,507)*See MOR NotesMOR-6Page 8 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-7 - CASH RECEIPTS AND DISBURSEMENTSPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: Aug 30, 2020 - Oct 3, 2020Cash Receipts and Disbursements (Amounts in Thousands)Company NameCase NumberCash Receipts Cash DisbursementsJA Apparel Corp. 20-33901 $- $ (0)Jos. A. Bank Clothiers, Inc. 20-33903 26,253 (557) Joseph Abboud Manufacturing Corp 20-33904 - - K&G Men's Company Inc. 20-33902 19,517 (23,884) Moores Retail Group Corp. 20-33906 0 (75) Moores The Suit People Corp. 20-33910 11,061 (15,718) MWDC Holding Inc. 20-33908 - - Nashawena Mills Corp. 20-33905 - - Renwick Technologies, Inc. 20-33909 - - Tailored Brands Gift Card Co LLC 20-33914 - - Tailored Brands Purchasing LLC 20-33912 - - Tailored Brands, Inc. 20-33900 300 - Tailored Shared Services, LLC 20-33913 11,738 (9,677) TB UK Holding Limited 20-33917 - - The Joseph A. Bank Mfg. Co., Inc. 20-33915 - - The Men's Wearhouse, Inc. 20-33911 92,979 (135,578) TMW Merchants LLC 20-33916 - - Tailored Brands Worldwide Purchasing Co. 20-33907 - (9,830)Total$ 161,847 $(195,319)*See MOR NotesMOR-7Page 9 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-8 - CASH RECONCILIATIONPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: As of October 3, 2020Bank Account Information (Amounts in Thousands)BANK NAME COMPANY NAME ACCOUNT NUMBER ENDINGBANK BALANCEBANK OF AMERICA JA Apparel Corp. 0812 8 BANK OF AMERICA JA Apparel Corp. 6780 - BANK OF AMERICA JA Apparel Corp. 1966 - BANK OF AMERICA JA Apparel Corp. 1882 151 BANK OF AMERICA Jos. A. Bank Clothiers, Inc. 6750 53 BANK OF AMERICA Jos. A. Bank Clothiers, Inc. 9015 264 BANK OF AMERICA Jos. A. Bank Clothiers, Inc. 9028 - BANK OF AMERICA Jos. A. Bank Clothiers, Inc. 9031 - BB&T Jos. A. Bank Clothiers, Inc. 1413 3 BBVA COMPASS Jos. A. Bank Clothiers, Inc. 5091 5 FIFTH THIRD Jos. A. Bank Clothiers, Inc. 4544 8 JPMORGAN CHASE Jos. A. Bank Clothiers, Inc. 5203 13 KEY BANK Jos. A. Bank Clothiers, Inc. 1787 4 M&T BANK Jos. A. Bank Clothiers, Inc. 4286 4 PNC BANK Jos. A. Bank Clothiers, Inc. 0275 16 REGIONS BANK Jos. A. Bank Clothiers, Inc. 2665 9 TD BANK Jos. A. Bank Clothiers, Inc. 5063 5 US BANK Jos. A. Bank Clothiers, Inc. 9441 9 WELLS FARGO Jos. A. Bank Clothiers, Inc. 1077 57 BANK OF AMERICA K&G Men's Company Inc. 5103 (232) BANK OF AMERICA K&G Men's Company Inc. 5111 158 BANK OF AMERICA K&G Men's Company Inc. 1178 - BANK OF AMERICA K&G Men's Company Inc. 4984 - BANK OF AMERICA K&G Men's Company Inc. 3284 552 BANK OF AMERICA K&G Men's Company Inc. 3297 361 BANK OF AMERICA K&G Men's Company Inc. 3307 882 FIFTH THIRD K&G Men's Company Inc. 6978 490 BANK OF MONTREAL Moores The Suit People Corp. -521 28 CIBC Moores The Suit People Corp. 7119 38 JPMORGAN CHASE Moores The Suit People Corp. 0751 4,200 RBC Moores The Suit People Corp. 25-3 34 SCOTIA BANK Moores The Suit People Corp. 2418 259Page 10 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-8 - CASH RECONCILIATIONPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: As of October 3, 2020SCOTIA BANK Moores The Suit People Corp. 2612 46 SCOTIA BANK Moores The Suit People Corp. 2817 1,729 SCOTIA BANK Moores The Suit People Corp. 8815 - SCOTIA BANK Moores The Suit People Corp. 5914 141 SCOTIA BANK Moores The Suit People Corp. 6015 738 SCOTIA BANK Moores The Suit People Corp. 0414 75 SCOTIA BANK Moores The Suit People Corp. 9912 209 TD CANADA TRUST Moores Retail Group Corp. 3655 50 BANK OF AMERICA Nashawena Mills Corp. 5907 8 BANK OF AMERICA Renwick Technologies, Inc. 1262 - BANK OF AMERICA Tailored Brands, Inc. 5974 - BANK OF AMERICA Tailored Brands, Inc. 6241 - BANK OF AMERICA TB UK Holding Limited 5802 1 BANK OF AMERICA Tailored Brands Worldwide Purchasin 5381 346 BANK OF AMERICA Tailored Shared Services, LLC 5958 230 BANK OF AMERICA Tailored Shared Services, LLC 5961 - BANK OF AMERICA The Men's Wearhouse, Inc. 2871 (4,334) BANK OF AMERICA The Men's Wearhouse, Inc. 2905 54 BANK OF AMERICA The Men's Wearhouse, Inc. 3053 378 BANK OF AMERICA The Men's Wearhouse, Inc. 0835 5,076 BANK OF AMERICA The Men's Wearhouse, Inc. 1110 - BANK OF AMERICA The Men's Wearhouse, Inc. 1123 - BANK OF AMERICA The Men's Wearhouse, Inc. 4447 470 BANK OF AMERICA The Men's Wearhouse, Inc. 4450 726 BANK OF AMERICA The Men's Wearhouse, Inc. 4463 299 BANK OF AMERICA The Men's Wearhouse, Inc. 4942 2,261 BANK OF AMERICA The Men's Wearhouse, Inc. 3590 2,056 BANK OF AMERICA The Men's Wearhouse, Inc. 3600 - BANK OF AMERICA The Men's Wearhouse, Inc. 7313 - BANK OF AMERICA The Men's Wearhouse, Inc. 6010 5 BANK OF HAWAII The Men's Wearhouse, Inc. 5567 2 BB&T The Men's Wearhouse, Inc. 1391 14 FIFTH THIRD The Men's Wearhouse, Inc. 9738 24 HSBC The Men's Wearhouse, Inc. 9585 2 JPMORGAN CHASE The Men's Wearhouse, Inc. 9762 11,276 JPMORGAN CHASE The Men's Wearhouse, Inc. 3698 152 KEY BANK The Men's Wearhouse, Inc. 2689 11 PNC BANK The Men's Wearhouse, Inc. 5202 96Page 11 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR-8 - CASH RECONCILIATIONPETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: As of October 3, 2020REGIONS BANK The Men's Wearhouse, Inc. 4418 20 TD BANK The Men's Wearhouse, Inc. 1533 20 US BANK The Men's Wearhouse, Inc. 1130 132 WELLS FARGO The Men's Wearhouse, Inc. 0476 281 JPMORGAN CHASE The Men's Wearhouse, Inc. 9722 44,955 Total 74,925*See MOR NotesMOR-8Page 12 of 13

CASE NAME: Tailored Brands, Inc. CASE NUMBER: 20-33900UNITED STATES BANKRUPTCY COURT MOR - 9 - PAYMENTS TO INSIDERS AND PROFESSIONALS [1]PETITION DATE: 08/02/20 DISTRICT OF TEXAS: Southern PERIOD: Aug 30, 2020 - Oct 3, 2020PAYMENTS TO INSIDERS AND PROFESSIONALS (Amounts in Thousands)Of the total disbursements shown for the month, list the amount paid to insiders (as defined in Section 101(31)(A)-(F) of the U.S. Bankruptcy Code) and the professionals. Also, for insiders, identify the type of compensation paid (e.g., salary, commission, bonus, etc.) (Attach additional pages as necessary).PERIOD MONTH INSIDERS: NAME/COMP TYPE 8/2/2020 - 8/29/2020 8/30/2020 - 10/3/2020Ask, Carrie Ann Salary$ 54$54Bragg II, James R Salary 37 37 Hansen II, Richard B Salary 34 34 Lathi, Dinesh Subhash Salary 77 77 Neutze, Mark Salary 31 31 Ricci, Steven James Salary 28 28 Rhodes, Archibald Alexander Salary 35 35 Sherman, Boris Peter Salary 38 38 Smith, Michael Shane Salary 33 33 Vazquez, John Salary 19 19TOTAL INSIDERS (MOR-1)$ 385$385PERIOD MONTH PROFESSIONALS 8/2/2020 - 8/29/2020 8/30/2020 - 10/3/2020Morgan Lewis$ 155 $387Mourant (Cayman Counsel) Winstead (Local Counsel) BRG Claims Agent (Prime Clerk) Gibson Dunn Houlihan Lokey100 0 4 15 - 94 - 863 - 506 - 300McMillan - 81TOTAL PROFESSIONALS (MOR-1)$ 259 $2,246*See MOR NotesMOR-9Page 13 of 13