Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | pnw-20201030.htm |

| EX-99.2 - EX-99.2 - PINNACLE WEST CAPITAL CORP | a3q2020earningsslides.htm |

| FOR IMMEDIATE RELEASE | October 30, 2020 | |||||||

| Media Contact: Analyst Contact: | Alan Bunnell (602) 250-3376 Stefanie Layton (602) 250-4541 | |||||||

| Website: | pinnaclewest.com | |||||||

PINNACLE WEST REPORTS 2020 THIRD-QUARTER EARNINGS

•Record summer heat drives quarter-over-quarter earnings improvement

•Strong customer growth of 2.3% underscores Arizona’s expanding economy

•Operating performance, reliability remain strong

PHOENIX – Pinnacle West Capital Corp. (NYSE: PNW) today reported consolidated net income attributable to common shareholders for the 2020 third quarter of $346.4 million, or $3.07 per diluted share. This result compares with net income of $312.3 million, or $2.77 per share, for the same period a year ago.

For a second consecutive quarter, hotter-than-normal weather was the primary driver in the quarter-over-quarter improvement, increasing revenues, net of fuel and purchased power costs, by $29.3 million (after-tax), or $0.26 per share, compared to 2019’s third-quarter. Strong customer growth of 2.3% also contributed to the company’s revenues and bottom line.

“The third quarter picked up right where the second quarter left off – with a historic run of record heat that contributed to the hottest July and August on record. In fact, this summer proved to be the hottest ever,” said Pinnacle West Chairman, President and Chief Executive Officer Jeff Guldner. “As a result, our customers used more energy to cool their homes and businesses than under normal weather conditions. The resulting increase in retail sales, taken together with our growing customer base, led to stronger financial results.” Summer 2020: The Hottest on Record According to the National Weather Service, the average high temperature in the third quarter was 108.2 degrees – an increase of 2.7% over 2019’s quarter and 3.9% over 10-year historical averages. |  | ||||

The number of residential cooling degree-days (a utility’s measure of the effects of weather) increased 15.9% over the same period in 2019 and was 24.7% higher than historical 10-year averages. Moreover, residential cooling degree-days for both July and August were the highest of any year since data tracking began in 1974. Similarly, September had the third-highest cooling degree-days of any year during this time span, with only 2001 and 2018 recording higher numbers.

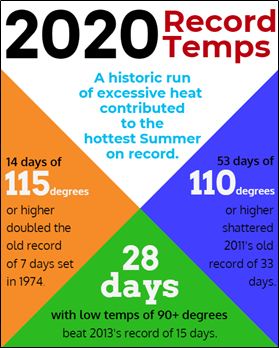

In addition to being the hottest summer on record, 2020 daily temperatures set records across both the second and third quarters including:

•14 days at or above 115 degrees, doubling the old record of 7 days set in 1974;

•53 days at or above 110 degrees, which crushed 2011’s prior record of 33 days;

•28 days of overnight low temperatures of 90 degrees or higher. This beat the prior record of 15 days set in 2013.

As previously reported, customers set an all-time record peak demand of 7,660 megawatts on July 30, eclipsing the previous record set in 2017 by nearly 300 megawatts. Customer peak load on six other days this summer also surpassed 2017’s previous record peak.

Operating Performance and Reliability Remain Strong

The Company’s third-quarter operating performance and reliability remained strong despite the extreme heat and regional demand for energy that, in some cases, exceeded supply. APS, however, was well prepared.

“Our employees continued to do what they do best: maintain reliable electric service for our 1.3 million customers,” Guldner said. “Our field crews consistently performed under extreme conditions, and our essential mix of baseload power plants operated exceptionally well. That execution was especially critical when this summer’s record heat strained regional energy markets, causing other utilities and system operators across the west to declare energy emergencies.”

Looking to the future, Guldner said that solid long-term planning, operational efficiencies and responsible energy policy will be increasingly critical as additional people and businesses choose to make Arizona their home. With one of the fastest growing markets in the country, the company remains focused on building a strong, sustainable energy future for Arizona that includes executing on several key initiatives. Top priorities include enhancements to customers’ direct customer care experience; execution of its clean energy commitment; and resolution of the company’s rate case filed in 2019 at the direction of the Arizona Corporation Commission.

Customer Support Broadened to Include Energy Efficiency

The challenges of 2020, from summer heat to COVID-19, led APS to further increase direct assistance to customers struggling to pay their bills.

In addition to already having pledged $8 million in pandemic relief – among the largest commitments of any utility in the country – the company extended its voluntary moratorium on service disconnections for non-payment through year-end 2020. This decision came on the heels of APS applying an automatic $100 bill credit to nearly 13,500 of its most vulnerable customers with delinquent balances -- without them needing to take any action. As of October 21, the company’s Customer Support Fund has provided APS customers with $4.3 million in bill relief.

With support of the Arizona Corporation Commission, APS also recently expanded energy efficiency programs to help customers lower their energy bills and ease the burden of unexpected costs. These programs include smart energy and weatherization improvement rebates, as well as emergency HVAC assistance.

A full list of the company’s actions in response to the pandemic is available on the Pinnacle West website, and APS customers are encouraged to visit aps.com/COVID19 for up-to-date details on available resources and support.

Financial Outlook

Given the impacts from significantly above-average weather year to date, the company increased its 2020 consolidated earnings guidance to $4.95 to $5.15 per diluted share from a previously disclosed range of $4.75 to $4.95 per share.

Key factors and assumptions underlying the 2020 outlook can be found in the third-quarter 2020 earnings presentation slides at pinnaclewest.com/investors.

Conference Call and Webcast

Pinnacle West invites interested parties to listen to the live webcast of management’s conference call to discuss 2020 third-quarter results, as well as recent developments, at noon ET (9 a.m. Arizona time) today, October 30. The webcast can be accessed at pinnaclewest.com/presentations and will be available for replay on the website for 30 days. To access the live conference call by telephone, dial (877) 407-8035 or (201) 689-8035 for international callers. A replay of the call also will be available at pinnaclewest.com/presentations or by telephone until 11:59 p.m. ET, Friday, Nov. 6, 2020, by calling (877) 481-4010 in the U.S. and Canada or (919) 882-2331 internationally and entering passcode 37822.

General Information

Pinnacle West Capital Corp., an energy holding company based in Phoenix, has consolidated assets of approximately $20 billion, about 6,300 megawatts of generating capacity, and 6,200 employees in Arizona and New Mexico. Through its principal subsidiary, Arizona Public Service, the company provides retail electricity service to nearly 1.3 million Arizona homes and businesses. For more information about Pinnacle West, visit the company’s website at pinnaclewest.com.

Earnings per share amounts in this news release are based on average diluted common shares outstanding. For more information on Pinnacle West’s operating statistics and earnings, please visit pinnaclewest.com/investors.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements based on our current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project,” "anticipate," "goal," "seek," "strategy," "likely," "should," "will," "could," and similar words. Because actual results may differ materially from expectations, we caution readers not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to:

•the potential effects of the continued COVID-19 pandemic, including, but not limited to, demand for energy, economic growth, our employees and contractors, supply chain, expenses, capital markets, capital projects, operations and maintenance activities, uncollectable accounts, liquidity, cash flows, or other unpredictable events;

•our ability to manage capital expenditures and operations and maintenance costs while maintaining high reliability and customer service levels;

•variations in demand for electricity, including those due to weather, seasonality, the general economy or social conditions, customer and sales growth (or decline), the effects of energy conservation measures and distributed generation, and technological advancements;

•power plant and transmission system performance and outages;

•competition in retail and wholesale power markets;

•regulatory and judicial decisions, developments and proceedings;

•new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric markets;

•fuel and water supply availability;

•our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investment;

•our ability to meet renewable energy and energy efficiency mandates and recover related costs;

•risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty;

•current and future economic conditions in Arizona, including in real estate markets;

•the direct or indirect effect on our facilities or business from cybersecurity threats or intrusions, data security breaches, terrorist attack, physical attack, severe storms, droughts, or other catastrophic events, such as fires, explosions, pandemic health events, or similar occurrences;

•the development of new technologies which may affect electric sales or delivery;

•the cost of debt and equity capital and the ability to access capital markets when required;

•environmental, economic and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions;

•volatile fuel and purchased power costs;

•the investment performance of the assets of our nuclear decommissioning trust, pension, and other post-retirement benefit plans and the resulting impact on future funding requirements;

•the liquidity of wholesale power markets and the use of derivative contracts in our business;

•potential shortfalls in insurance coverage;

•new accounting requirements or new interpretations of existing requirements;

•generation, transmission and distribution facility and system conditions and operating costs;

•the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region;

•the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or continue or discontinue power plant operations consistent with our corporate interests; and

•restrictions on dividends or other provisions in our credit agreements and Arizona Corporation Commission orders.

These and other factors are discussed in Risk Factors described in Part 1, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2019; in Part II, Item 1A in of the Pinnacle West/APS Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, June 30, 2020 and Sept. 30, 2020, which readers should review carefully before placing any reliance on our financial statements or disclosures. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

# # #

PINNACLE WEST CAPITAL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(dollars and shares in thousands, except per share amounts)

| THREE MONTHS ENDED | NINE MONTHS ENDED | |||||||||||||||||||||||||

| SEPTEMBER 30, | SEPTEMBER 30, | |||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||||||

| Operating Revenues | $ | 1,254,501 | $ | 1,190,787 | $ | 2,846,021 | $ | 2,800,818 | ||||||||||||||||||

| Operating Expenses | ||||||||||||||||||||||||||

| Fuel and purchased power | 353,171 | 344,862 | 780,074 | 817,672 | ||||||||||||||||||||||

| Operations and maintenance | 236,971 | 238,582 | 677,681 | 711,759 | ||||||||||||||||||||||

| Depreciation and amortization | 152,696 | 149,450 | 459,257 | 445,531 | ||||||||||||||||||||||

| Taxes other than income taxes | 54,978 | 53,809 | 168,514 | 163,989 | ||||||||||||||||||||||

| Other expenses | 1,677 | 794 | 3,191 | 1,904 | ||||||||||||||||||||||

| Total | 799,493 | 787,497 | 2,088,717 | 2,140,855 | ||||||||||||||||||||||

| Operating Income | 455,008 | 403,290 | 757,304 | 659,963 | ||||||||||||||||||||||

| Other Income (Deductions) | ||||||||||||||||||||||||||

| Allowance for equity funds used during construction | 8,144 | 5,917 | 24,652 | 24,677 | ||||||||||||||||||||||

| Pension and other postretirement non-service credits - net | 14,118 | 5,752 | 42,171 | 17,240 | ||||||||||||||||||||||

| Other income | 13,881 | 15,191 | 42,888 | 35,245 | ||||||||||||||||||||||

| Other expense | (5,838) | (5,740) | (14,426) | (14,448) | ||||||||||||||||||||||

| Total | 30,305 | 21,120 | 95,285 | 62,714 | ||||||||||||||||||||||

| Interest Expense | ||||||||||||||||||||||||||

| Interest charges | 61,497 | 57,481 | 183,421 | 175,599 | ||||||||||||||||||||||

| Allowance for borrowed funds used during construction | (4,663) | (3,486) | (13,488) | (14,645) | ||||||||||||||||||||||

| Total | 56,834 | 53,995 | 169,933 | 160,954 | ||||||||||||||||||||||

| Income Before Income Taxes | 428,479 | 370,415 | 682,656 | 561,723 | ||||||||||||||||||||||

| Income Taxes | 77,234 | 53,266 | 98,086 | 72,764 | ||||||||||||||||||||||

| Net Income | 351,245 | 317,149 | 584,570 | 488,959 | ||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 4,873 | 4,873 | 14,620 | 14,620 | ||||||||||||||||||||||

| Net Income Attributable To Common Shareholders | 346,372 | 312,276 | 569,950 | 474,339 | ||||||||||||||||||||||

| Weighted-Average Common Shares Outstanding - Basic | 112,679 | 112,463 | 112,639 | 112,408 | ||||||||||||||||||||||

| Weighted-Average Common Shares Outstanding - Diluted | 112,987 | 112,746 | 112,912 | 112,739 | ||||||||||||||||||||||

| Earnings Per Weighted-Average Common Share Outstanding | ||||||||||||||||||||||||||

| Net income attributable to common shareholders - basic | 3.07 | 2.78 | 5.06 | 4.22 | ||||||||||||||||||||||

| Net income attributable to common shareholders - diluted | 3.07 | 2.77 | 5.05 | 4.21 | ||||||||||||||||||||||