Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OPPENHEIMER HOLDINGS INC | opy-20201030.htm |

Oppenheimer Holdings Inc. Third Quarter 2020 Investor Update

Safe Harbor Statement This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. (the “company”) may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the company’s current beliefs, expectations and assumptions regarding the future of the company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the company’s control. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forwarding-looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on March 2, 2020 (the “2019 10-K”). In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements include those factors discussed in Part I, “Item 2. Management’s Discussion & Analysis of Financial Condition and Results of Operations – Factors Affecting ‘Forward- Looking Statements’” and Part II, “Item IA. Risk Factors” of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 filed with the SEC on October 29, 2020 (“2020 10-Q3”). Any forward-looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2019 10-K, the 2020 10-Q3 and the company’s other SEC filings. There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. Therefore, you should not rely on any of these forward-looking statements. Any forward-looking statement made by the company in this presentation is based only on information currently available to the company and speaks only as of the date on which it is made. The company does not undertake any obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. 2

Business Overview Oppenheimer is a leading investment bank and full-service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. Oppenheimer Snapshot (as of 9/30/20) $775.8 million $41.1 million Revenue for YTD 9/30/20 Net Income for YTD 9/30/20 Listed NYSE Ticker: OPY Shareholders’ Equity ($M): $615.2 Market Cap ($M): $280.4 Book Value per Share: $49.20 Tangible Book Value per Share: (1) $35.61 Share Price (As of 10/29/20): $26.11 Employees: 2,907 # of Financial Advisors: 1,010 Retail Branches in the US: 93 Client Assets under Administration ($B): $94.3 ° London, UK ° Tel Aviv, Israel ° Hong Kong, ° Geneva, China Switzerland Assets Under Management ($B): $34.5 ° St. Helier, Isle of Jersey ° Frankfurt, Germany (1) Represents book value less goodwill and intangible assets divided by number of shares outstanding. 3

Summary Operating Results: 3Q-20 (Unaudited) ($000’s) For the 3-Months Ended Highlights REVENUE 9-30-20 9-30-19 % Change Commissions $ 92,241 $ 78,627 17.3% ° Increased revenue of 17.7% due to significantly higher underwriting Advisory fees 88,595 80,887 9.5% revenue, large M&A fees, increased Investment banking 66,245 21,798 203.9% institutional equities sales and trading activity, higher retail participation, and Bank deposit sweep income 4,619 28,894 -84.0% higher advisory fees Interest 7,540 12,344 -38.9% ° The Investment Banking Division had its best ever revenue quarter helping to Principal transactions, net 7,703 7,606 1.3% drive a record revenue quarter for the Other 9,316 4,637 100.9% Capital Markets segment Total Revenue 276,259 234,793 17.7% ° Lower short-term interest rates negatively impacted bank deposit sweep income EXPENSES ° Compensation expense as a percentage of revenue was higher at 68.7% during Compensation and related expenses 189,654 151,284 25.4% the current period versus 64.4% the Non-Compensation related expenses 64,887 77,013 -15.7% same period last year due to substantially lower bank deposit sweep Total Expenses 254,541 228,297 11.5% income which has no associated Pre-tax Income 21,718 6,496 234.3% compensation costs ° Non-compensation expenses were Net income $ 15,639 $ 3,949 296.0% 15.7% lower primarily due to lower interest, travel and entertainment, and Earnings per share (Basic) $ 1.25 $ 0.31 303.2% conference costs partially offset by charges related to the refinancing of the Earnings per share (Diluted) $ 1.19 $ 0.29 310.3% Company's long-term debt 4

Summary Operating Results: YTD 9/30/20 (Unaudited) ($000’s) For the 9-Months Ended Highlights REVENUE 9-30-20 9-30-19 % Change Commissions $ 297,126 $ 238,932 24.4% ° Revenue increased 5.2% during the period driven by robust underwriting revenue, Advisory fees 250,740 235,241 6.6% increased institutional equities and fixed Investment banking 138,159 81,847 68.8% income sales and trading activity, higher retail investor participation, and higher Bank deposit sweep income 30,567 94,692 -67.7% advisory fees Interest 24,650 38,621 -36.2% ° Investment banking had a record first nine months of the year driven by higher equity Principal transactions, net 18,899 22,089 -14.4% underwriting revenue ° Lower short-term interest rates negatively Other 15,618 26,076 -40.1% impacted bank deposit sweep income Total Revenue 775,759 737,498 5.2% ° Other revenue decreased primarily due to a lower increase in the value of assets supporting company-owned life insurance EXPENSES policies used to hedge deferred compensation obligations Compensation and related expenses 526,924 467,422 12.7% ° Compensation expense as a percentage of Non-Compensation related expenses 193,630 230,137 -15.9% revenue was higher at 67.9% during the current period versus 63.4% during the same Total Expenses 720,554 697,559 3.3% period last year due to substantially lower bank deposit sweep income which has no Pre-tax Income 55,205 39,939 38.2% associated compensation costs Net income $ 41,106 $ 27,518 49.4% ° Non-compensation expenses were 15.9% lower primarily due to lower costs associated with travel and entertainment, conferences, Earnings per share (Basic) $ 3.24 $ 2.13 52.1% interest, and legal and regulatory partially offset by charges related to the refinancing Earnings per share (Diluted) $ 3.12 $ 1.99 56.8% of the Company’s long-term debt 5

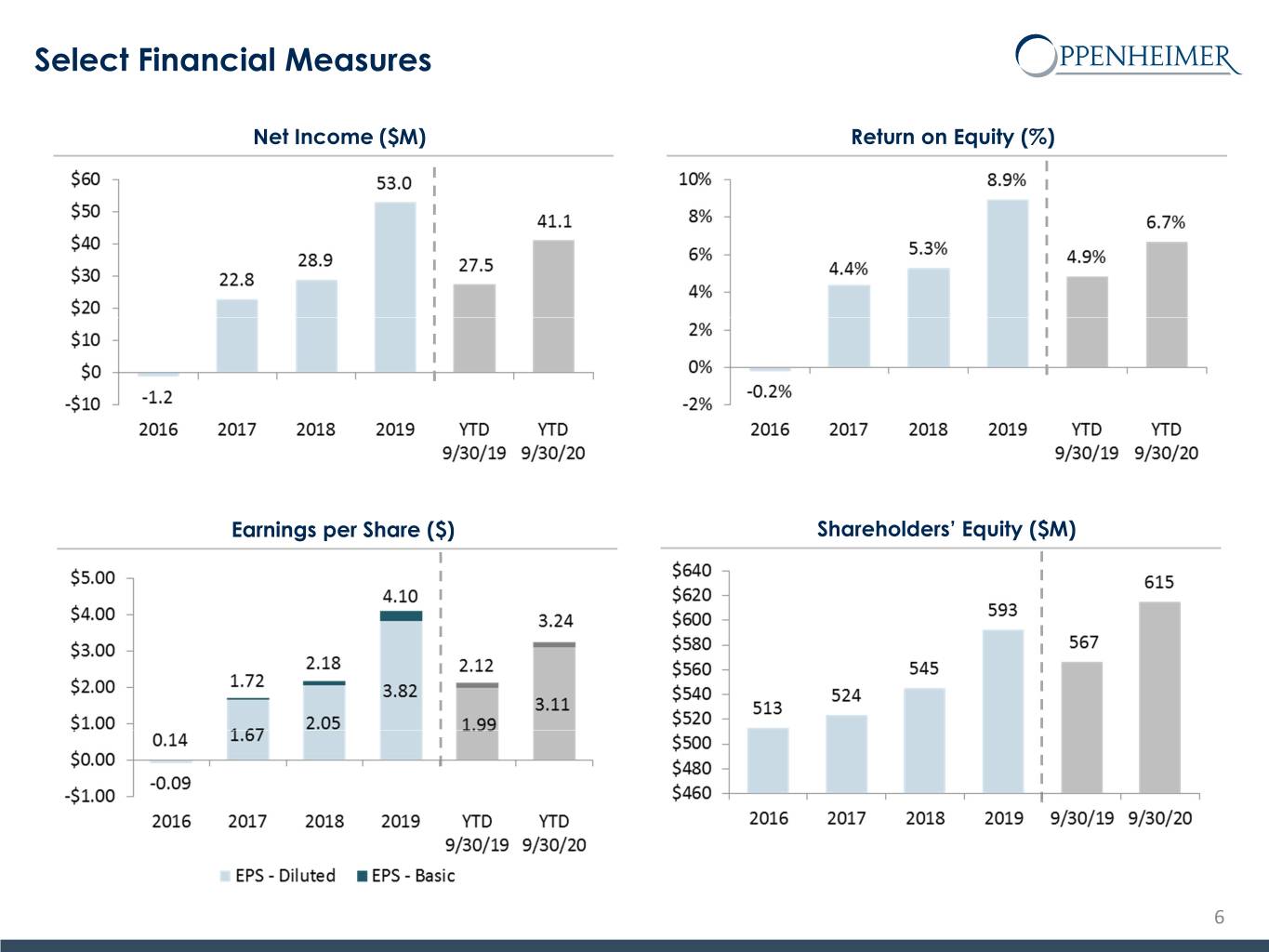

Select Financial Measures Net Income ($M) Return on Equity (%) Earnings per Share ($) Shareholders’ Equity ($M) 6

Wealth Management* Well recognized brand and one of the few independent, non-bank broker-dealers with full service capabilities RETAIL SERVICES ADVISORY SERVICES ALTERNATIVE INVESTMENTS – Full-Service Brokerage – Investment Policy Design & – Hedge Funds and Fund-of-Funds – Private Equity – Financial Planning, Retirement Services, Implementation – Private Market Opportunity (Qualified Corporate & Executive Services, and – Asset Allocation & Portfolio Construction Investors only) recently launched to source Trust Services – Research, Diligence & Manager Selection investments across the private markets – Margin & Securities Lending – Portfolio Monitoring & Reporting continuum Wealth Management Revenue ($M) Pre-Tax Income ($M) and Pre-Tax Margin (%) (1) (1) 1,010 $94.3B $34.5B $583 million Financial Advisors Assets under Assets under Net Positive Client Administration Management Asset Inflows At 9/30/20 At 9/30/20 At 9/30/20 TTM 9/30/20 * Wealth Management includes both Private Client and Asset Management business segments. (1) Lower due to lower bank deposit sweep income as a result of lower short-term interest rates partially offset by higher retail commissions and advisory fees, as well as increases in the value of company owned life insurance policies. 7

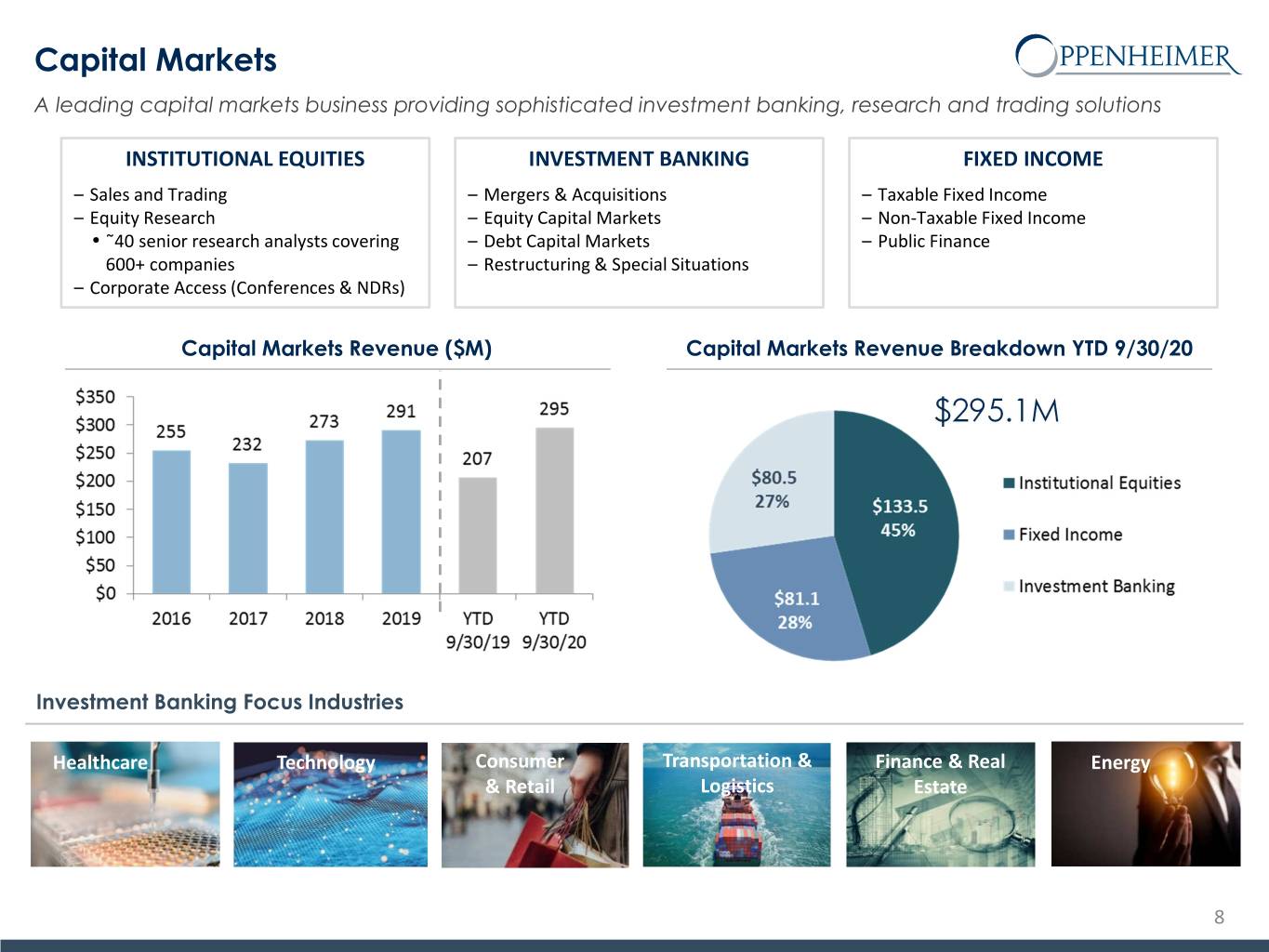

Capital Markets A leading capital markets business providing sophisticated investment banking, research and trading solutions INSTITUTIONAL EQUITIES INVESTMENT BANKING FIXED INCOME – Sales and Trading – Mergers & Acquisitions – Taxable Fixed Income – Equity Research – Equity Capital Markets – Non-Taxable Fixed Income • ˜40 senior research analysts covering – Debt Capital Markets – Public Finance 600+ companies – Restructuring & Special Situations – Corporate Access (Conferences & NDRs) Capital Markets Revenue ($M) Capital Markets Revenue Breakdown YTD 9/30/20 $295.1M Investment Banking Focus Industries Healthcare Technology Consumer Transportation & Finance & Real Energy & Retail Logistics Estate 8

Select 3Q-20 Investment Banking Transactions $1,566,000,000/ $150,000,000 $147,593,444 $2,000,000,000 $3,864,000,000 BlackRock Capital Allocation Trust Technology Healthcare Business Combination with Velodyne Concurrent Public Offerings of Financial Institutions Technology LiDAR / PIPE Common Stock & Convertible IPO IPO Financial Advisor / Sole Placement Preferred Stock Co-Lead Manager Co-Manager Agent Lead Manager September2020 September 2020 September 2020 September2020 $115,000,000 $143,750,000 $1,150,000,000 $259,612,500 Healthcare Financial Institutions Technology Healthcare Confidentially Marketed Public 6.00% Series C Mandatory Convertible Senior Notes Follow-On Offering Convertible Preferred Stock Offering Co-Manager Co-Manager Lead Bookrunner Senior Co-Manager August 2020 August2020 August 2020 August 2020 $100,000,000 $689,999,868 $366,850,000 $125,000,000 Republic of Suriname Debt Capital Markets Healthcare Technology Debt Capital Markets Senior Secured Notes Follow-On IPO Sovereign Bond Global Bookrunner & Lead Manager Co-Manager Co-Manager Sole Bookrunner & Lead Manager July 2020 July2020 July 2020 July 2020 9

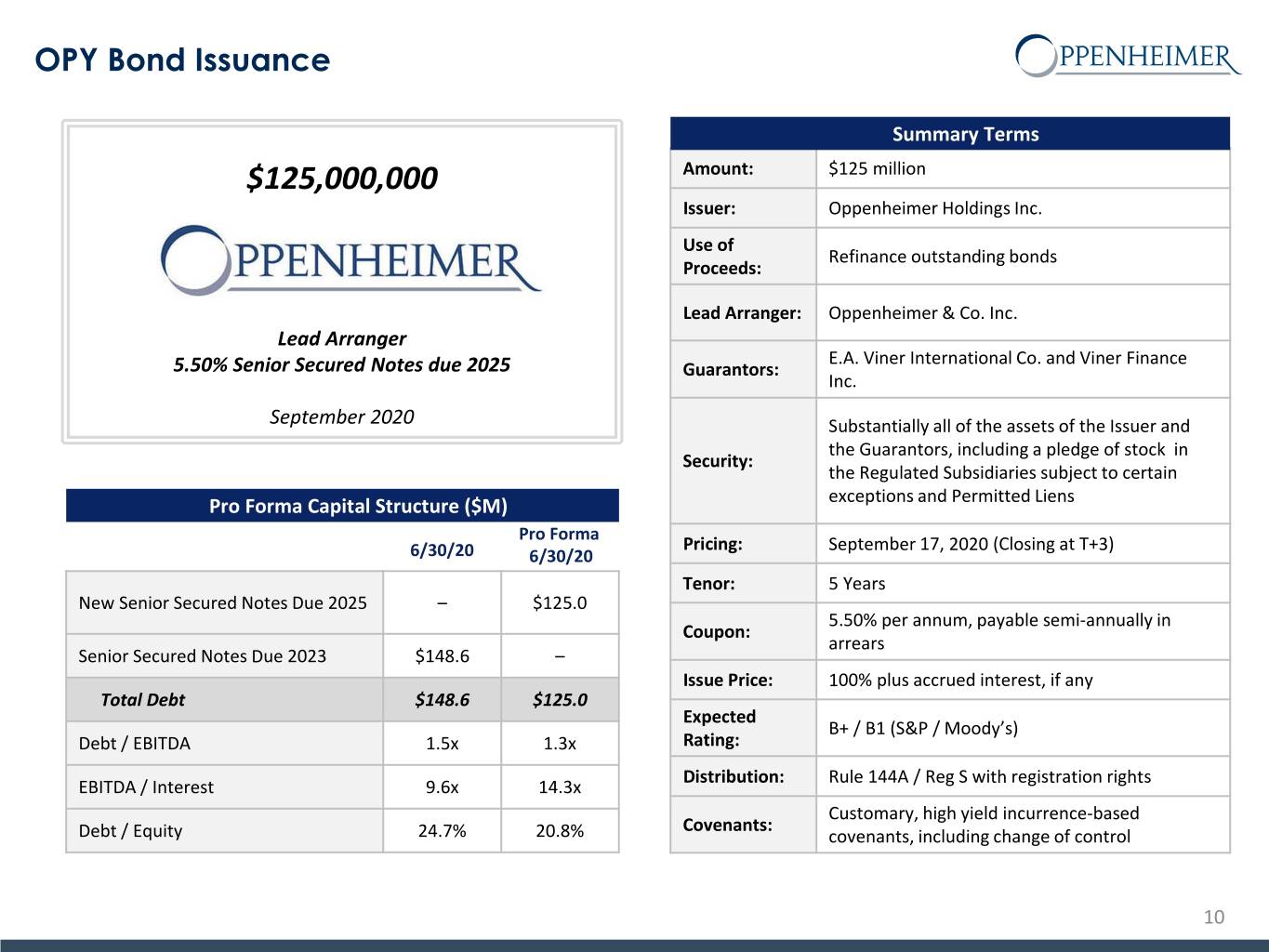

OPY Bond Issuance ° Summary Terms $125,000,000 Amount: $125 million Issuer: Oppenheimer Holdings Inc. Use of Refinance outstanding bonds Proceeds: Lead Arranger: Oppenheimer & Co. Inc. Lead Arranger E.A. Viner International Co. and Viner Finance 5.50% Senior Secured Notes due 2025 Guarantors: Inc. September 2020 Substantially all of the assets of the Issuer and the Guarantors, including a pledge of stock in Security: the Regulated Subsidiaries subject to certain exceptions and Permitted Liens ° Pro Forma Capital Structure ($M) Pro Forma Pricing: September 17, 2020 (Closing at T+3) 6/30/20 6/30/20 Tenor: 5 Years New Senior Secured Notes Due 2025 – $125.0 5.50% per annum, payable semi-annually in Coupon: arrears Senior SecuredNotes Due 2023 $148.6 – Issue Price: 100% plus accrued interest, if any Total Debt $148.6 $125.0 Expected B+ / B1 (S&P / Moody’s) Debt / EBITDA 1.5x 1.3x Rating: Distribution: Rule 144A / Reg S with registration rights EBITDA / Interest 9.6x 14.3x Customary, high yield incurrence-based Covenants: Debt / Equity 24.7% 20.8% covenants, including change of control 10

Capital Structure Conservative risk profile with strong balance sheet Liquidity & Capital As of September 30, 2020 ($ in thousands) ° Shareholders’ equity reached a record high $615.2 million on September 30, 2020 Total Assets: $2,608,618 ° Book value and tangible book value per share reached record levels at September 30, 2020 ° The Company refinanced its outstanding long-term debt during Shareholders’ Equity: $615,216 the period which resulted in a one-time charge of $2.8 million. Long-Term Debt: $125,000 Going forward, the Company will save $3.3 million in interest costs on an annual basis Total Capitalization: $740,216 ° The Company bought back a total of 84,290 shares of its Class A Non-Voting Common Stock for $2.0 million (average price of $23.28 per share) during the 3Q-20 ° Level 3 assets were $30.7 million as of September 30, 2020 Debt to EquityRatio: 20.3% Book & Tangible Book Value per Share ($) Gross Leverage Ratio (1) : 4.2x Broker-Dealer Regulatory Capital ($ in thousands) Regulatory Net Capital: $268,681 Regulatory Excess Net Capital: $242,887 (1) Total Assets divided by Total Shareholders’ Equity. 11

Historical Financial Ratios Consolidated Adjusted EBITDA ($M) Long-Term Debt to Consolidated Adjusted EBITDA (x) 1.8x* Consolidated Adjusted EBITDA Margin (%) Interest Coverage (x) 6.3x 12

For more information contact Investor Relations at info@opco.com