Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PILGRIMS PRIDE CORP | ppc-20201028.htm |

Financial Results for Third Quarter Ended Sep 27, 2020 Pilgrim’s Pride Corporation (NASDAQ: PPC)

Cautionary Notes and Forward-Looking Statements Statements contained in this press release that state the intentions, plans, hopes, beliefs, anticipations, expectations or predictions of the future of Pilgrim’s Pride Corporation and its management are considered forward-looking statements. Without limiting the foregoing, words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “should,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include: the impact of the COVID-19 pandemic, efforts to contain the pandemic and resulting economic downturn on our operations and financial condition, including the risk that our health and safety measures at Pilgrim’s Pride production facilities will not be effective, the risk that we may be unable to prevent the infection of our employees at these facilities, and the risk that we may need to temporarily close one or more of our production facilities; the risk that we may experience decreased production and sales due to the changing demand for food products; the risk that we may face a significant increase in delayed payments from our customers; and additional risks related to COVID-19 set forth in our Form 10-Q filed with the SEC; matters affecting the poultry industry generally; the ability to execute the Company’s business plan to achieve desired cost savings and profitability; future pricing for feed ingredients and the Company’s products; outbreaks of avian influenza or other diseases, either in Pilgrim’s Pride’s flocks or elsewhere, affecting its ability to conduct its operations and/or demand for its poultry products; contamination of Pilgrim’s Pride’s products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; management of cash resources; restrictions imposed by, and as a result of, Pilgrim’s Pride’s leverage; changes in laws or regulations affecting Pilgrim’s Pride’s operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause the costs of doing business to increase, cause Pilgrim’s Pride to change the way in which it does business, or otherwise disrupt its operations; competitive factors and pricing pressures or the loss of one or more of Pilgrim’s Pride’s largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channel, including anti-dumping proceedings and countervailing duty proceedings; and the impact of uncertainties of litigation and other legal matters described in our Quarterly Report on Form 10-Q, including the In re Broiler Chicken Antitrust Litigation, as well as other risks described under “Risk Factors” in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and subsequent filings with the Securities and Exchange Commission. The forward-looking statements in this release speak only as of the date hereof, and the Company undertakes no obligation to update any such statement after the date of this release, whether as a result of new information, future developments or otherwise, except as may be required by applicable law. Actual results could differ materially from those projected in these forward-looking statements as a result of these factors, among others, many of which are beyond our control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any factor in future filings or communications regarding our business or results, and we are not undertaking to address how any of these factors may have caused changes to information contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk factors, we must caution investors and others that other factors may in the future prove to be important and affecting our business or results of operations. This presentation may include information that may be considered non-GAAP financial information as contemplated by SEC Regulation G, Rule 100, including EBITDA, Adjusted EBITDA, LTM EBITDA, Net Debt, Free Cash Flow, Adjusted EBITDA Margin and others. Accordingly, we have provided tables in the accompanying appendix and in our previous filings with the SEC that reconcile these measures to their corresponding GAAP-based measures and explain why these measures are useful to investors, which can be obtained from the Consolidated Statements of Income provided with our previous filings with the SEC. Our method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the consolidated statements of income and consolidated statements of cash flows included in our financial statements.. 2

Pullet Placements Up 1.1% Driven by September Placements 10,000 Intended Pullet Placements 9,000 8,000 7,000 6,000 5,000 4,000 3,000 Thousand Head 2,000 1,000 - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 2020 5 Yr. Avg. . Trailing 8-Month placements up +1.1% vs. year ago. . Pullet growth in 2019 and early 2020 mostly to support new capacity that has come online. Source: USDA 3

Hatching Layer Flock and Egg Productivity Modestly Up, Increasing Availability of Eggs Broiler Type Hatching Layers Eggs/100 64,000 1,950 1,900 62,000 1,850 60,000 1,800 58,000 1,750 Eggs 56,000 1,700 Head (000) Head 1,650 54,000 1,600 52,000 1,550 50,000 1,500 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 2020 5 Yr. Avg. 2019 2020 5 Yr. Avg. . Increased broiler layer flock, improvements in eggs/100, and reduced egg exports are contributing to growth in domestic egg supply. . Eggs/100 productivity in Q3 improved 1.2% and remains near 5 year average. Source: USDA 4

Hatchery Utilization Partially Recovered but Remained Below 2019 Levels Since April 94.0% 92.0% 90.0% % 88.0% 86.0% 84.0% 82.0% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 2020 5 Yr. Avg. Source: Agristats 5

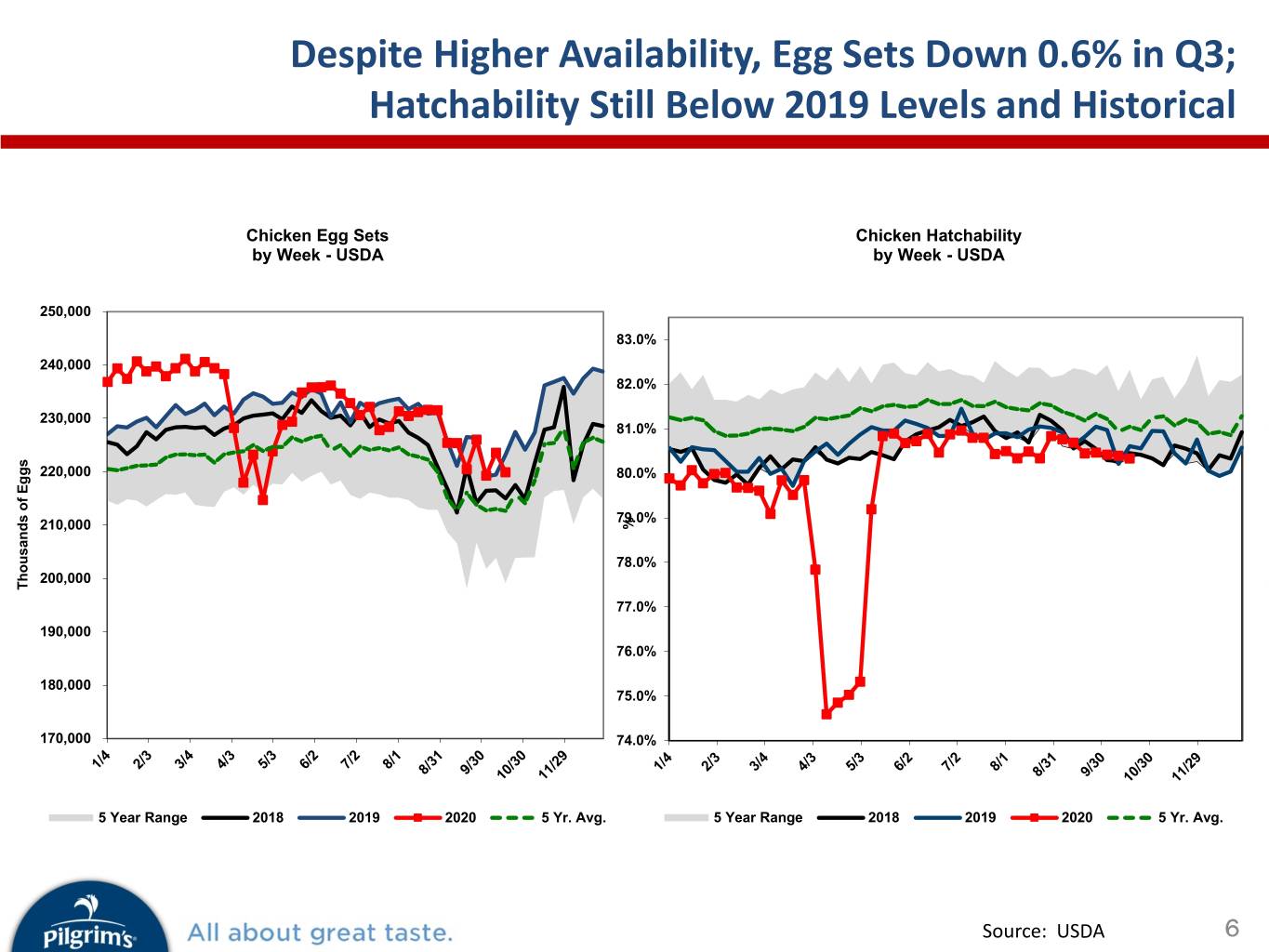

Despite Higher Availability, Egg Sets Down 0.6% in Q3; Hatchability Still Below 2019 Levels and Historical Chicken Egg Sets Chicken Hatchability by Week - USDA by Week - USDA 250,000 83.0% 240,000 82.0% 230,000 81.0% 220,000 80.0% 79.0% 210,000 % 78.0% 200,000 Thousands of Eggs of Thousands 77.0% 190,000 76.0% 180,000 75.0% 170,000 74.0% 5 Year Range 2018 2019 2020 5 Yr. Avg. 5 Year Range 2018 2019 2020 5 Yr. Avg. Source: USDA 6

Total Placements Also Down 0.6% in the Quarter Chicken Broiler Placed by Week- USDA 195,000 190,000 185,000 180,000 175,000 Head (000) 170,000 165,000 160,000 5 Year Range 2018 2019 2020 5 Yr. Avg. Source: USDA 7

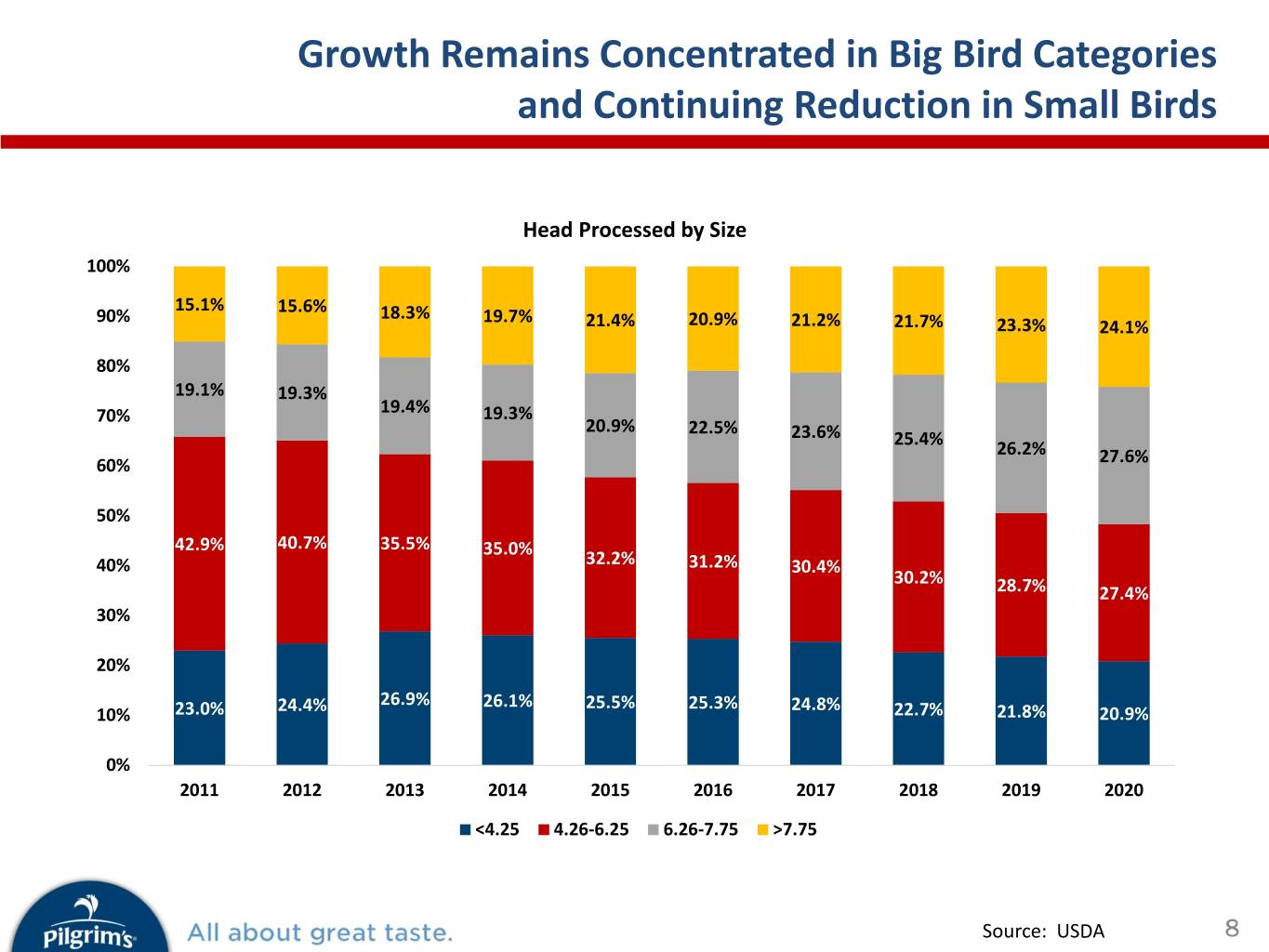

Growth Remains Concentrated in Big Bird Categories and Continuing Reduction in Small Birds Head Processed by Size 100% 15.1% 15.6% 90% 18.3% 19.7% 21.4% 20.9% 21.2% 21.7% 23.3% 24.1% 80% 19.1% 19.3% 70% 19.4% 19.3% 20.9% 22.5% 23.6% 25.4% 26.2% 60% 27.6% 50% 42.9% 40.7% 35.5% 35.0% 40% 32.2% 31.2% 30.4% 30.2% 28.7% 27.4% 30% 20% 24.4% 26.9% 26.1% 25.5% 25.3% 24.8% 10% 23.0% 22.7% 21.8% 20.9% 0% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 <4.25 4.26-6.25 6.26-7.75 >7.75 Source: USDA 8

September Freezer Inventory Down 2.7% vs. Year Ago Total Chicken Inventories 1,100,000 1,000,000 900,000 800,000 LBS (000) 700,000 600,000 500,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2018 2019 2020 5 Yr. Avg. . Breast meat inventories are moving seasonally, but remain above year ago levels. . LQ inventories up Y/Y but remain well below historical average. . Wing inventories maintain levels well below 2019 and historical average. . “Other” inventory continues to trend below 2019 levels, with most recent month 11.2% below Sep 2019. Source: USDA 9

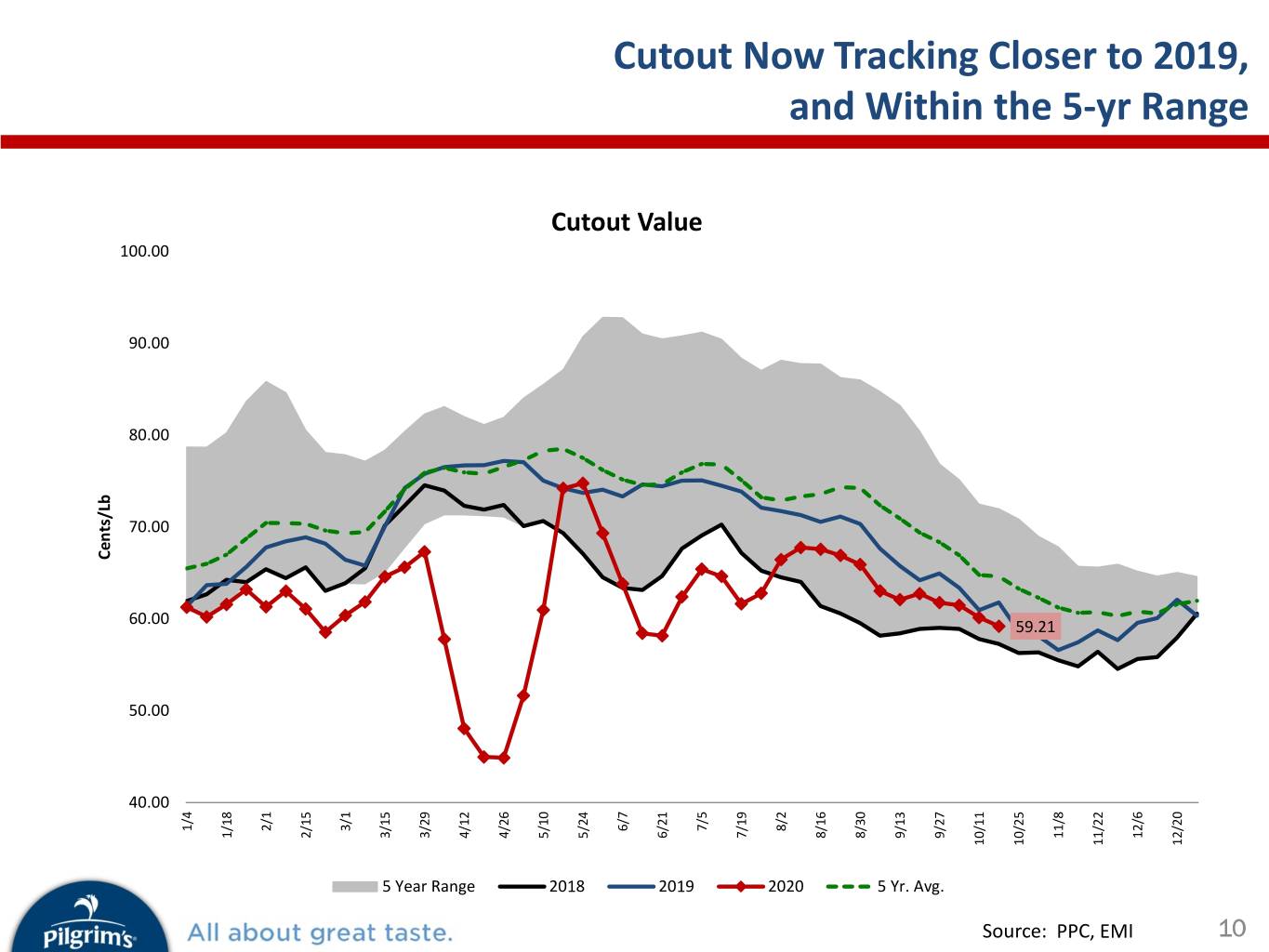

Cents/Lb 100.00 40.00 50.00 60.00 70.00 80.00 90.00 1/4 1/18 2/1 2/15 3/1 5 Year Range 5 Year 3/15 3/29 4/12 4/26 2018 5/10 ValueCutout 5/24 Cutout 6/7 2019 6/21 7/5 7/19 Now Tracking Closer to2019, 2020 8/2 5- the Within and 8/16 8/30 5 Yr. Avg. 5 Yr. 9/13 9/27 Source:PPC, EMI 10/11 10/25 59.21 11/8 11/22 yr Range 12/6 12/20 10

Wings Remaining Strong, BSB and Tenders In-line with Seasonality, LQs Started to Recover USDA Boneless/Skinless Breast NE USDA Tenders NE 175.00 235.00 215.00 155.00 195.00 135.00 175.00 155.00 115.00 145.12 Cents/Lb Cents/Lb 135.00 115.00 95.00 87.58 95.00 75.00 75.00 1/5 2/4 3/6 4/5 5/5 6/4 7/4 8/3 9/2 1/5 2/4 3/6 4/5 5/5 6/4 7/4 8/3 9/2 10/2 11/1 12/1 10/2 11/1 12/1 5 Year Range 2018 2019 2020 5 Year Average 5 Year Range 2018 2019 2020 5 Year Average USDA Leg Quarters NE USDA Whole Wings NE 50.00 230.00 219.51 45.00 210.00 40.00 190.00 35.00 170.00 30.00 150.00 Cents/Lb Cents/Lb 25.00 25.83 130.00 20.00 110.00 15.00 90.00 1/5 2/4 3/6 4/5 5/5 6/4 7/4 8/3 9/2 1/5 2/4 3/6 4/5 5/5 6/4 7/4 8/3 9/2 10/2 11/1 12/1 10/2 11/1 12/1 5 Year Range 2018 2019 2020 5 Year Average 5 Year Range 2018 2019 2020 5 Year Average Source: USDA 11

Cents/Lb. 100.0 110.0 120.0 40.0 50.0 60.0 70.0 80.0 90.0 1/3 1/17 1/31 2/14 2/28 5 Year Range 5 Year 3/13 3/27 4/10 4/24 2018 5/8 WOG 2.5 EMI 5/22 and Is Now Reaching the 5- the Reaching Now Is and 6/5 Seasonally Improving Pricing WOG 2019 6/19 - 4.0 LBS 7/3 7/17 2020 7/31 8/14 5 Year Average Year 5 8/28 9/11 9/25 Source:EMI 10/9 69.6 10/23 yr Range 11/6 11/20 12/4 12/18 12

Corn Stocks Remain at High Levels . USDA lowered U.S. corn ending stocks for both 2019 and 2020, yet supply remains ample . The market continues to watch export impacts with the Phase 1 trade deal with China Source: USDA 13

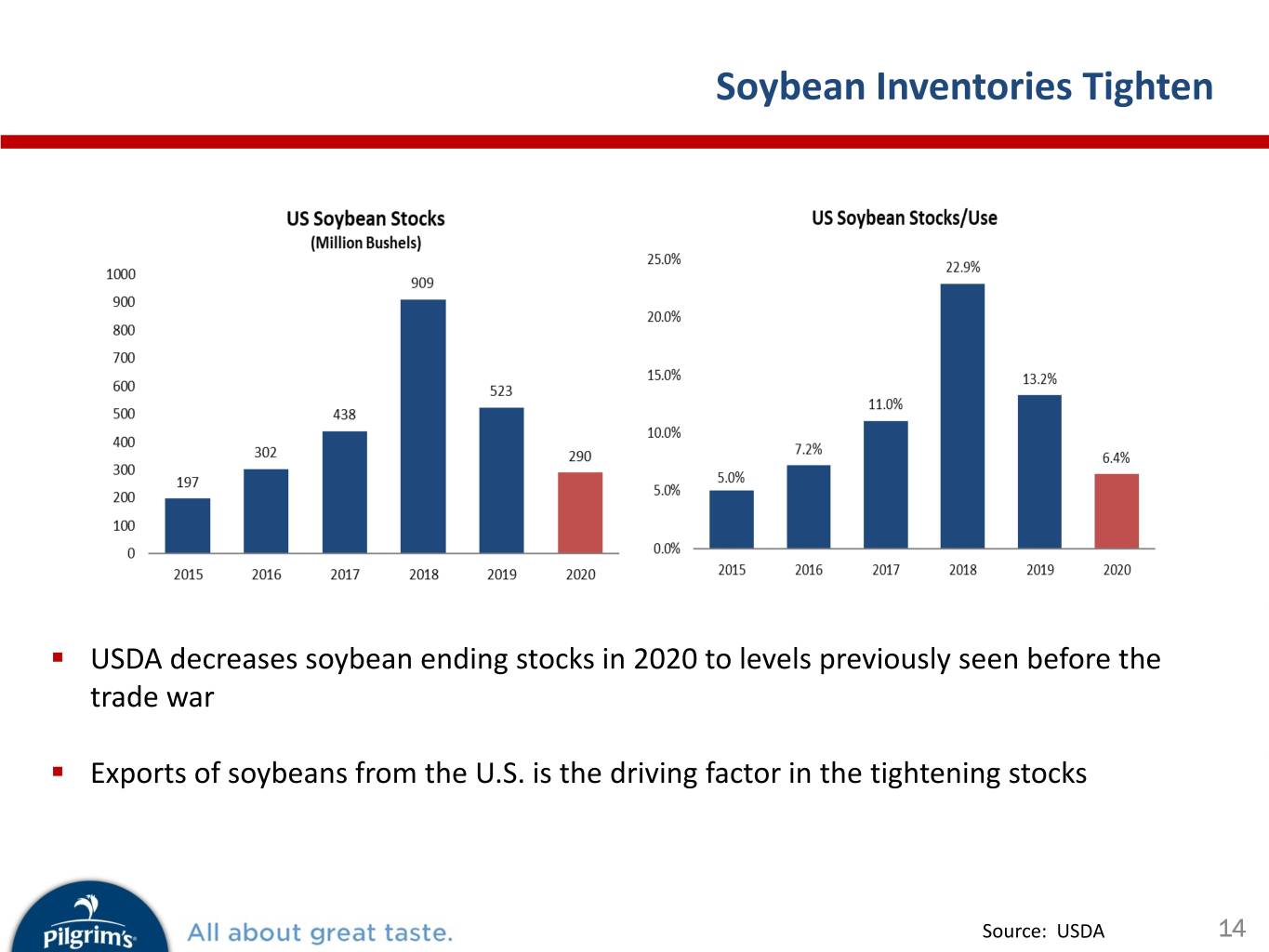

Soybean Inventories Tighten . USDA decreases soybean ending stocks in 2020 to levels previously seen before the trade war . Exports of soybeans from the U.S. is the driving factor in the tightening stocks Source: USDA 14

Third Quarter 2020 Financial Review . U.S.: Performance recovering, diversified portfolio and Key Customer strategy Main Indicators ($M) Q3-20 Q3-19 minimized channel demand disruption; MX: Strong rebound on much more Net Revenue 3,075.1 2,778.0 balanced supply/demand conditions, Gross Profit 313.8 282.2 improving macro; UK/Europe: Legacy SG&A 219.5 94.0 operations improving, new assets continue to generate increasingly positive EBITDA. Operating Income 94.3 188.2 . SG&A higher on more brand investments Net Interest 28.8 27.3 in U.S. and MX, Community Initiatives and Net Income 33.4 109.8 addition of new Europe operations. Earnings Per Share 0.14 0.44 . Adjusted Q3-20 EBITDA reflects portfolio, (EPS) Key Customer strategy, and geographical Adjusted EBITDA* 305.0 258.3 diversification. Adjusted EBITDA 9.9% 9.3% Margin* In $M U.S. EU MX * This is a non-GAAP measurement considered by management to be Net Revenue 1,894.2 845.7 335.2 useful in understanding our results. Please see the appendix and most recent SEC financial filings for definition of this measurement and Operating Income 2.5 29.9 61.7 reconciliation to GAAP. Operating Income 0.1% 3.5% 18.4% Margin Source: PPC 15

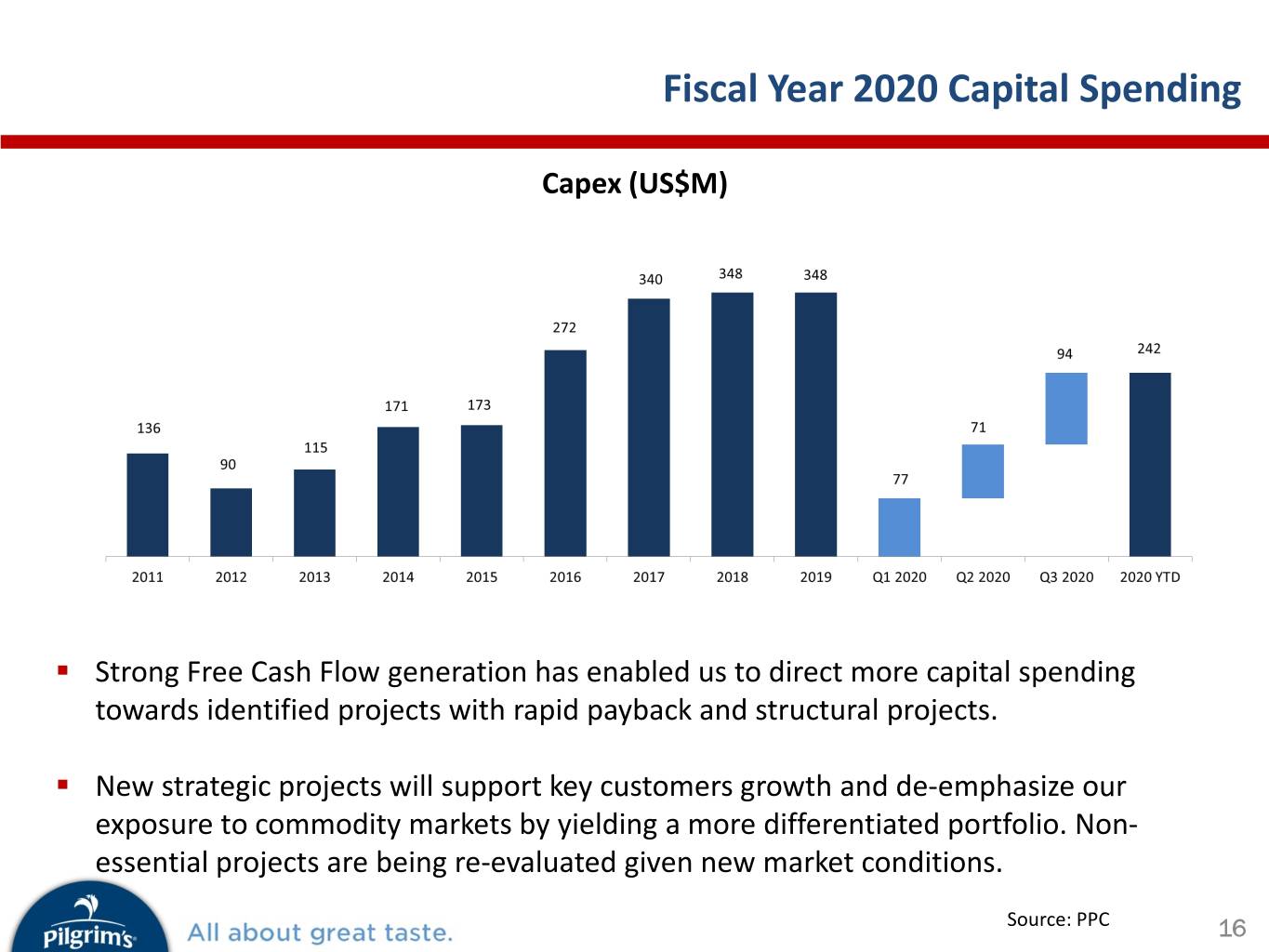

Fiscal Year 2020 Capital Spending CapexCapex (US$M)(US$M) . Strong Free Cash Flow generation has enabled us to direct more capital spending towards identified projects with rapid payback and structural projects. . New strategic projects will support key customers growth and de-emphasize our exposure to commodity markets by yielding a more differentiated portfolio. Non- essential projects are being re-evaluated given new market conditions. Source: PPC 16

Investor Relations Contact Investor Relations: Dunham Winoto Investor Relations E-mail: IRPPC@pilgrims.com Address: 1770 Promontory Circle Greeley, CO 80634 USA Website: www.pilgrims.com 17

APPENDIX 18

Appendix: Reconciliation of Adjusted EBITDA “EBITDA” is defined as the sum of net income (loss) plus interest, taxes, depreciation and amortization. “Adjusted EBITDA” is calculated by adding to EBITDA certain items of expense and deducting from EBITDA certain items of income that we believe are not indicative of our ongoing operating performance consisting of: (1) income (loss) attributable to noncontrolling interests, (2) charges or income from restructuring activities, (3) reorganization items, (4) transaction costs related to acquisitions, (5) gain on bargain purchase and (6) foreign currency transaction losses (gains). EBITDA is presented because it is used by management and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with accounting principles generally accepted in the U.S. (“U.S. GAAP”), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA. The Company also believes that Adjusted EBITDA, in combination with the Company’s financial results calculated in accordance with U.S. GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP. They should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with U.S. GAAP. PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Three Months Ended Nine Months Ended September 27, September 29, September 27, September 29, 2020 2019 2020 2019 (In thousands) Net income $ 33,691 $ 110,096 $ 94,740 $ 364,301 Add: Interest expense, net 28,801 27,330 90,964 87,703 Income tax expense 22,344 46,365 57,900 142,328 Depreciation and amortization 84,265 71,851 248,641 210,381 EBITDA 169,101 255,642 492,245 804,713 Add: Foreign currency transaction losses (gains) 9,092 3,027 (3,768) 7,923 Transaction costs related to acquisitions — — 134 — DOJ agreement 110,524 — 110,524 — Restructuring activity — (20) — (90) Hometown Strong commitment 14,506 — 14,506 — Minus: Negative adjustment to previously recognized gain on bargain purchase (2,006) — (3,746) — Shareholder litigation settlement — — 34,643 — Net income attributable to noncontrolling interest 245 331 62 457 Adjusted EBITDA $ 304,984 $ 258,318 $ 582,682 $ 812,089 Source: PPC. Source: PPC 19

Appendix: Reconciliation of LTM Adjusted EBITDA The summary unaudited consolidated income statement data for the twelve months ended September 27, 2020 (the LTM Period) have been calculated by subtracting the applicable unaudited consolidated income statement data for the nine months ended September 29, 2019 from the sum of (1) the applicable audited consolidated income statement data for the year ended December 29, 2019 and (2) the applicable audited consolidated income statement data for the nine months ended September 27, 2020. PILGRIM'S PRIDE CORPORATION Reconciliation of LTM Adjusted EBITDA (Unaudited) Three Months Ended LTM Ended December 29, March 29, June 28, September 27, September 27, 2019 2020 2020 2020 2020 (In thousands) Net income $ 92,235 $ 67,449 $ (6,400) $ 33,691 $ 186,975 Add: Interest expense, net 30,650 30,998 31,165 28,801 121,614 Income tax expense 18,681 38,512 (2,956) 22,344 76,581 Depreciation and amortization 76,849 79,773 84,603 84,265 325,490 EBITDA 218,415 216,732 106,412 169,101 710,660 Add: Foreign currency transaction losses (gains) (1,006) (18,385) 5,525 9,092 (4,774) Transaction costs related to acquisitions 1,239 215 (81) — 1,373 DOJ agreement — — — 110,524 110,524 Restructuring activity 6 — — — 6 Hometown Strong commitment — — — 14,506 14,506 Minus: Gain on bargain purchase 56,880 (1,740) — (2,006) 53,134 Shareholder litigation settlement — 34,643 — — 34,643 Net income attributable to noncontrolling interest 155 181 (364) 245 217 Adjusted EBITDA $ 161,619 $ 165,478 $ 112,220 $ 304,984 $ 744,301 Source: PPC. Source: PPC 20

Appendix: Reconciliation of EBITDA Margin EBITDA margins have been calculated by taking the relevant unaudited EBITDA figures, then dividing by net sales for the applicable period. EBITDA margins are presented because they are used by management and we believe it is frequently used by securities analysts, investors and other interested parties, as a supplement to our results prepared in accordance with U.S. GAAP, to compare the performance of companies. PILGRIM'S PRIDE CORPORATION Reconciliation of EBITDA Margin (Unaudited) Three Months Ended Nine Months Ended Three Months Ended Nine Months Ended September 27, September 29, September 27, September 29, September 27, September 29, September 27, September 29, 2020 2019 2020 2019 2020 2019 2020 2019 (In thousands) Net income $ 33,691 $ 110,096 $ 94,740 $ 364,301 1.10 % 3.96 % 1.06 % 4.37 % Add: Interest expense, net 28,801 27,330 90,964 87,703 0.94 % 0.98 % 1.01 % 1.05 % Income tax expense 22,344 46,365 57,900 142,328 0.73 % 1.67 % 0.65 % 1.71 % Depreciation and amortization 84,265 71,851 248,641 210,381 2.74 % 2.59 % 2.77 % 2.53 % EBITDA 169,101 255,642 492,245 804,713 5.51 % 9.20 % 5.49 % 9.66 % Add: Foreign currency transaction losses (gains) 9,092 3,027 (3,768) 7,923 0.29 % 0.11 % (0.04)% 0.10 % Acquisition charges — — 134 — — % — % — % — % DOJ agreement 110,524 — 110,524 — 3.59 % — % 1.23 % — % Restructuring activity — (20) — (90) — % — % — % — % Hometown Strong commitment 14,506 — 14,506 — 0.47 % — % 0.16 % — % Minus: Negative adjustment to previously recognized gain on bargain purchase (2,006) — (3,746) — (0.07)% — % (0.04)% — % Shareholder litigation settlement — — 34,643 — — % — % 0.39 % — % Net income (loss) attributable to noncontrolling interest 245 331 62 457 0.01 % 0.01 % — % 0.01 % Adjusted EBITDA $ 304,984 $ 258,318 $ 582,682 $ 812,089 9.92 % 9.30 % 6.49 % 9.75 % Net sales $ 3,075,121 $ 2,777,970 $ 8,974,072 $ 8,345,730 $ 3,075,121 $ 2,777,970 $ 8,974,072 $ 8,345,730 Source: PPC. Source: PPC 21

Appendix: Reconciliation of Adjusted Operating Income Adjusted Operating Income is calculated by adding to Operating Income certain items of expense and deducting from Operating Income certain items of income. Management believes that presentation of Adjusted Operating Income provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of GAAP operating income to adjusted operating income as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Operating Income (Unaudited) Three Months Ended Nine Months Ended September 27, 2020 September 29, 2019 September 27, 2020 September 29, 2019 (In thousands) GAAP operating income (U.S. operations) $ 2,451 $ 125,168 $ 126,951 $ 426,968 DOJ agreement 110,524 — 110,524 — Hometown Strong commitment 14,506 — 14,506 — Adjusted operating income (U.S. operations) $ 127,481 $ 125,168 $ 251,981 $ 426,968 Adjusted operating income margin (U.S. operations) 6.7 % 6.5 % 4.5 % 7.4 % Source: PPC. Source: PPC 22

Appendix: Reconciliation of GAAP Operating Income Margin to Adjusted Operating Income Margin Adjusted Operating Income Margin for the U.S. is calculated by dividing Adjusted operating income by Net Sales. Management believes that presentation of Adjusted Operating Income Margin provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of GAAP operating income margin for the U.S. to adjusted operating income margin for the U.S. is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP Operating Income Margin to Adjusted Operating Income Margin (Unaudited) Three Months Ended Nine Months Ended September 27, 2020 September 29, 2019 September 27, 2020 September 29, 2019 (In percent) GAAP operating income margin (U.S. operations) 0.1 % 6.5 % 2.2 % 7.4 % DOJ agreement 5.8 % — % 2.0 % — % Hometown Strong commitment 0.8 % — % 0.3 % — % Adjusted operating income margin (U.S. operations) 6.7 % 6.5 % 4.5 % 7.4 % Source: PPC. Source: PPC 23

Appendix: Reconciliation of Adjusted Net Income Adjusted net income attributable to Pilgrim's Pride Corporation ("Pilgrim's") is calculated by adding to Net Income attributable to Pilgrim's certain items of expense and deducting from Net Income attributable to Pilgrim's certain items of income. Management believes that presentation of Adjusted net income attributable to Pilgrim's provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of net income attributable to Pilgrim's per common diluted share to adjusted net income attributable to Pilgrim's per common diluted share is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Net Income (Unaudited) Three Months Ended Nine Months Ended September 27, September 29, September 27, September 29, 2020 2019 2020 2019 (In thousands, except per share data) Net income attributable to Pilgrim's $ 33,446 $ 109,765 $ 94,678 $ 363,844 Adjustments: Acquisition charges and restructuring activity — 43 134 (26) DOJ agreement 110,524 — 110,524 — Hometown Strong commitment 14,506 — 14,506 — Foreign currency transaction losses (gains) 9,092 3,027 (3,768) 7,923 Net tax expense (benefit) of adjustments(a) (5,916) (747) (9,158) (1,923) Adjusted net income attributable to Pilgrim's $ 161,652 $ 112,088 $ 206,916 $ 369,818 Weighted average diluted shares of common stock outstanding 244,376 249,729 248,308 249,652 Adjusted net income attributable to Pilgrim's per common diluted share $ 0.66 $ 0.45 $ 0.83 $ 1.48 (a) Net tax expense (benefit) of adjustments represents the tax impact of all adjustments shown above with the exclusion of the DOJ antitrust fine as this item is non-deductible for tax purposes. Source: PPC. Source: PPC 24

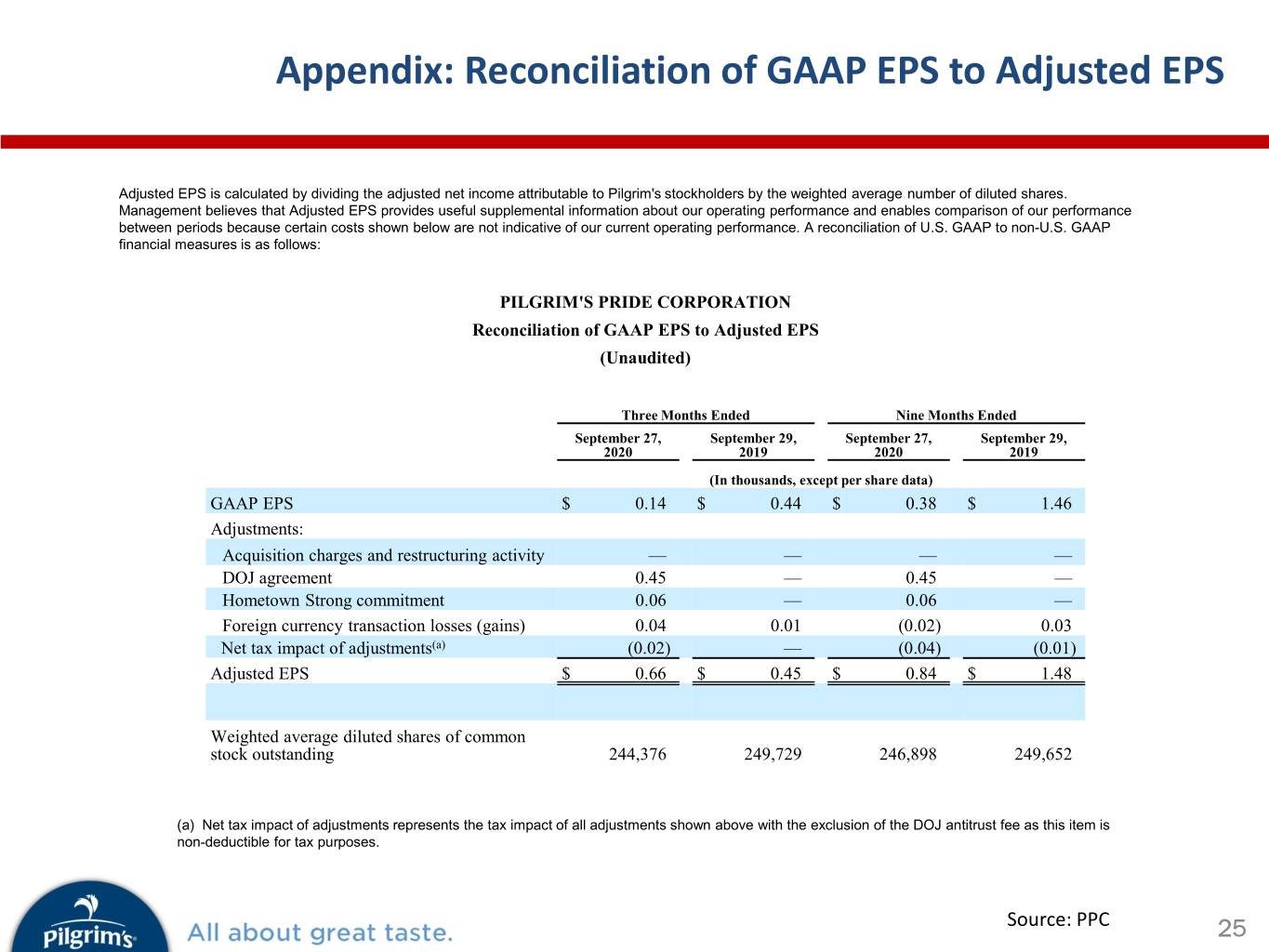

Appendix: Reconciliation of GAAP EPS to Adjusted EPS Adjusted EPS is calculated by dividing the adjusted net income attributable to Pilgrim's stockholders by the weighted average number of diluted shares. Management believes that Adjusted EPS provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of U.S. GAAP to non-U.S. GAAP financial measures is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP EPS to Adjusted EPS (Unaudited) Three Months Ended Nine Months Ended September 27, September 29, September 27, September 29, 2020 2019 2020 2019 (In thousands, except per share data) GAAP EPS $ 0.14 $ 0.44 $ 0.38 $ 1.46 Adjustments: Acquisition charges and restructuring activity — — — — DOJ agreement 0.45 — 0.45 — Hometown Strong commitment 0.06 — 0.06 — Foreign currency transaction losses (gains) 0.04 0.01 (0.02) 0.03 Net tax impact of adjustments(a) (0.02) — (0.04) (0.01) Adjusted EPS $ 0.66 $ 0.45 $ 0.84 $ 1.48 Weighted average diluted shares of common stock outstanding 244,376 249,729 246,898 249,652 (a) Net tax impact of adjustments represents the tax impact of all adjustments shown above with the exclusion of the DOJ antitrust fee as this item is non-deductible for tax purposes. Source: PPC. Source: PPC 25

Appendix: Supplementary Selected Segment and Geographic Data PILGRIM'S PRIDE CORPORATION Supplementary Selected Segment and Geographic Data (Unaudited) Three Months Ended Nine Months Ended September 27, 2020 September 29, 2019 September 27, 2020 September 29, 2019 (In thousands) Sources of net sales by geographic region of origin: US $ 1,894,222 $ 1,931,657 $ 5,619,791 $ 5,732,201 Europe 845,677 517,531 2,425,140 1,568,396 Mexico 335,222 328,782 929,141 1,045,133 Total net sales $ 3,075,121 $ 2,777,970 $ 8,974,072 $ 8,345,730 Sources of cost of sales by geographic region of origin: US $ 1,711,089 $ 1,739,474 $ 5,210,534 $ 5,123,278 Europe 785,347 474,490 2,256,034 1,452,254 Mexico 265,078 281,833 897,163 901,271 Elimination (235) (24) (459) (72) Total cost of sales $ 2,761,279 $ 2,495,773 $ 8,363,272 $ 7,476,731 Sources of gross profit by geographic region of origin: US $ 183,133 $ 192,183 $ 409,257 $ 608,923 Europe 60,330 43,041 169,106 116,142 Mexico 70,144 46,949 31,978 143,862 Elimination 235 24 459 72 Total gross profit $ 313,842 $ 282,197 $ 610,800 $ 868,999 Sources of operating income by geographic region of origin: US $ 2,451 $ 125,168 $ 126,951 $ 426,968 Europe 29,949 25,325 76,324 62,233 Mexico 61,653 37,668 2,229 115,503 Elimination 235 24 459 72 Total operating income $ 94,288 $ 188,185 $ 205,963 $ 604,776 Source: PPC. Source: PPC 26