Attached files

Exhibit 3.4

| STATE OF NEVADA | ||

| BARBARA K. CEGAVSKE |  |

Commercial Recordings & Notary Division |

| Secretary of State | 202 N. Carson Street | |

| Carson City, NV 89701 | ||

| Telephone (775) 684-5708 | ||

| Fax (775) 684-7138 | ||

| North Las Vegas City Hall | ||

| KIMBERLEY PERONDI | 2250 Las Vegas Blvd North, Suite 400 | |

| Deputy Secretary for | OFFICE OF THE | North Las Vegas, NV 89030 |

| Commercial Recordings | SECRETARY OF STATE | Telephone (702) 486-2880 |

| Fax (702) 486-2888 |

| Kathleen Keller | Work Order #: W2020080501263 |

| 1600 NE Loop 410 Suite 126 | August 5, 2020 |

| San Antonio, TX 78209, USA | Receipt Version: 1 |

| Special Handling Instructions: | Submitter ID: 71057 | ||||||||||||||

| Charges | |||||||||||||||

| Description | Filing Number | Filing Date/Time | Filing Status | Qty | Price | Amount | |||||||||

| Amended Certification of Stock Designation After Issuance of Class/Series | 20200834426 | 8/5/2020 1:43:09 PM | InternalReview | 1 | $ | 175.00 | $ | 175.00 | |||||||

| Total | $ | 175.00 | |||||||||||||

| Payments | ||||||||

| Type | Description | Payment Status | Amount | |||||

| Credit Card | 5966601772646553303063 | Success | $ | 175.00 | ||||

| Total | $ | 175.00 | ||||||

| Credit Balance: | $ | 0.00 | ||||||

Kathleen Keller

1600 NE Loop 410 Suite 126

San Antonio, TX 78209, USA

| STATE OF NEVADA | ||

| BARBARA K. CEGAVSKE |  |

Commercial Recordings Division |

| Secretary of State | 202 N. Carson Street | |

| Carson City, NV 89701 | ||

| Telephone (775) 684-5708 | ||

| Fax (775) 684-7138 | ||

| North Las Vegas City Hall | ||

| KIMBERLEY PERONDI | ||

| Deputy Secretary for | OFFICE OF THE | 2250 Las Vegas Blvd North, Suite 400 |

| Commercial Recordings | SECRETARY OF STATE | North Las Vegas, NV 89030 |

| Telephone (702) 486-2880 | ||

| Fax (702) 486-2888 |

Business Entity - Filing Acknowledgement

| 08/05/2020 | |

| Work Order Item Number: | W2020080501263 - 746883 |

| Filing Number: | 20200834426 |

| Filing Type: | Amended Certification of Stock Designation After Issuance of |

| Class/Series | |

| Filing Date/Time: | 08/05/2020 13:43:09 PM |

| Filing Page(s): | 11 |

| Indexed Entity Information: | |

| Entity ID: C27974-2003 | Entity Name: DIGERATI TECHNOLOGIES, INC. |

| Entity Status: Active | Expiration Date: None |

Commercial Registered Agent

CORPORATION SERVICE COMPANY

112 NORTH CURRY STREET, Carson City, NV 89703, USA

The attached document(s) were filed with the Nevada Secretary of State, Commercial Recording Division. The filing date and time have been affixed to each document, indicating the date and time of filing. A filing number is also affixed and can be used to reference this document in the future.

| Respectfully, | ||

| ||

| BARBARA K. CEGAVSKE | ||

| Secretary of State |

Page 1 of 1

Commercial Recording Division

202 N. Carson Street

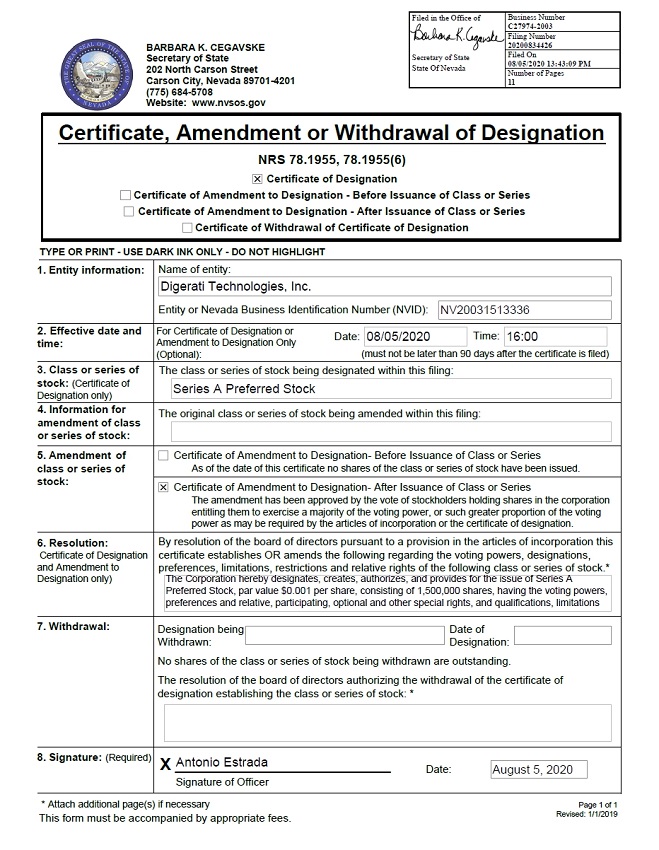

| Filed in the Office of | Business Number | ||

|

C27974-2003 | ||

| Filing Number | |||

| 20200834426 | |||

| Secretary of State | Filed

On 08/05/2020 13:43:09 PM |

||

| State Of Nevada | Number

of Pages 11 |

EXHIBIT “E”

CERTIFICATE OF THE DESIGNATION, PREFERENCES,

RIGHTS AND LIMITATIONS OF SERIES A

CONVERTIBLE PREFERRED STOCK OF

DIGERATI TECHNOLOGIES, INC.

RESOLVED, that pursuant to the authority conferred upon the Corporation by its Articles of Incorporation, the series A preferred stock (“Series A Preferred Stock”) is hereby authorized and created, said series to consist of up to 1,500,000 shares;

FURTHER RESOLVED, that the preferences and relative, optional and other special rights, and the qualifications, limitations or restrictions of such Series A Preferred Stock shall be as follows:

1. Dividends on Series A Preferred Stock.

a. The holders of the Series A Preferred Stock shall be entitled to receive, out of the funds of the Corporation legally available therefor, cumulative cash dividends at the annual rate of eight percent (8%) per share, based on the Series A Original Issue Price (as defined below), payable quarterly during each calendar year on March 31, June 30, September 30 and December 31 (each a dividend payment date), commencing on March 31, 2019 (unless such day is a non-business day, in which event on the next business day). Dividends on each share of Series A Preferred Stock shall begin to accrue and shall cumulate from the date of original issue of such share (“Issue Date”), whether or not declared, and shall be payable to the holder of such share on the record date. Dividends on account of arrears for any past dividend periods may be declared and paid at any time, without reference to any regular dividend payment date, to holders of record on a record date fixed for such payment by the Board of Directors of the Corporation or by a committee of such Board duly authorized to fix such date by resolution designating such committee. Dividend payments may, in the sole discretion of the Corporation, be made in fully paid and non-assessable shares of the Corporation’s common stock, par value $.001 per share (“Common Stock”), at a price valued at the Current Market Price (as defined in Section 2, and calculated from each dividend payment date in lieu of a Conversion Date as defined in paragraph 2a below). The “Series A Original Issue Price” shall mean $1.00 per share, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series A Preferred Stock.

b. Dividends on the Series A Preferred Stock shall be payable to holders of record as they appear on the books of the Corporation as of the close of business on any record date for payment of dividends. The record dates for payment of dividends shall be the fifteenth day of each respective dividend payment date month.

Page 1

c. Dividends payable on the date of any conversion or redemption of the Series A Preferred Stock not occurring on a regular dividend payment date shall be calculated on the basis of the actual number of days elapsed (including the date of conversion or redemption).

d. No dividends shall be declared or paid or set apart for payment on, and no payment shall be made on account of the purchase, redemption or retirement of, any other series of capital stock of the Corporation (excluding options or shares of Common Stock repurchased from consultants or employees in connection with the termination of such employment or consultancy), for any period unless full cumulative dividends have been or contemporaneously are declared and paid (or declared and a sum sufficient for the payment thereof set apart for such payment) on the Series A Preferred Stock for all dividend payment periods terminating on or prior to the date of payment of dividends on such stock or other payment date resulting from the repurchase or retirement of such stock. Accumulations of dividends on the Series A Preferred Stock shall not bear interest.

2. Conversion of Series A Preferred Stock into Common Stock.

a. Optional Conversion. Each holder of shares of Series A Preferred Stock may, at holder’s option and commencing on April 30, 2020, convert any or all such shares, on the terms and conditions set forth herein, into fully paid and non-assessable shares of the Corporation’s Common Stock. The number of shares of Common Stock into which each share of Series A Preferred Stock may be converted shall be determined by dividing the Original Issue Price of each share of Series A Preferred Stock, plus accrued and unpaid dividends through the Conversion Date, to be converted by the Conversion Price (as defined below) in effect at the time of conversion. The “Conversion Price” at which shares of Common Stock shall be issuable upon conversion of any shares of Series A Preferred Stock shall initially be the greater of (i) $0.40 per share, (ii) a 30% discount to the offering price of the Common Stock (or Common Stock equivalent) in a $10 million or greater equity financing that closes concurrently with an up-listing of the Company Common Stock on the NYSE American or Nasdaq, in the event of such up-listing, and (iii) a 30% discount to the average closing price per share of the Common Stock for the 5 consecutive trading days commencing upon the date the Common Stock is up-listed on either the NYSE American or Nasdaq in which there is no concurrent $10 million equity financing, in the event of such up-listing, subject to adjustment as provided below.

Page 2

To exercise holder’s conversion privilege, the holder of any shares of Series A Preferred Stock shall surrender to the Corporation during regular business hours at the principal executive offices of the Corporation or the offices of the transfer agent for the Series A Preferred Stock or at such other place as may be designated by the Corporation, the certificate or certificates for the shares to be converted, duly endorsed for transfer to the Corporation (if required by it), accompanied by written notice stating that the holder irrevocably elects to convert such shares. Conversion shall be deemed to have been effected on the date when such delivery is made, and such date is referred to herein as the “Conversion Date.” Within three (3) business days after the date on which such delivery is made, the Corporation shall issue and send (with receipt to be acknowledged) to the holder thereof or the holder’s designee, at the address designated by such holder, a certificate or certificates for the number of full shares of Common Stock to which the holder is entitled as a result of such conversion, and cash with respect to any fractional interest of a share of Common Stock as provided in paragraph 2(c). The holder shall be deemed to have become a stockholder of record of the number of shares of Common Stock into which the shares of Series A Preferred Stock have been converted on the applicable Conversion Date unless the transfer books of the Corporation are closed on that date, in which event holder shall be deemed to have become a stockholder of record of such shares on the next succeeding date on which the transfer books are open, but the Conversion Price shall be that in effect on the Conversion Date. Upon conversion of only a portion of the number of shares of Series A Preferred Stock represented by a certificate or certificates surrendered for conversion, the Corporation shall within three (3) business days after the date on which such delivery is made, issue and send (with receipt to be acknowledged) to the holder thereof or the holder’s designee, at the address designated by such holder, a new certificate covering the number of shares of Series A Preferred Stock representing the unconverted portion of the certificate or certificates so surrendered.

b. Mandatory Conversion. Each share of Series A Preferred Stock shall automatically convert into shares of Common Stock, as described in paragraph 2a, at the then applicable Conversion Price, upon the earlier of (i) the closing of a public or private offering (or series of offerings within a 90-day period) of Corporation equity or equity equivalent securities placed by a registered broker-dealer resulting in minimum gross proceeds to the Corporation of $10 million, (ii) commencing on April 30, 2020, if the Common Stock shall close (or the last trade shall be) at or above 150% of the Conversion Price per share for 20 out of 30 consecutive trading days, and (iii) the uplisting of the Corporation’s Common Stock to a national securities exchange or the Nasdaq stock market ((i), (ii) and (iii) are collectively referred to as “Mandatory Conversion Event”). The Corporation will provide notice to holder within 20 days of the occurrence of a Mandatory Conversion Event (failure of the Corporation to timely give such notice does not void the mandatory conversion). Holder shall surrender to the Corporation, within 10 days of receiving such notice, the certificate(s) representing the shares of Series A Preferred Stock to be converted into Common Stock. In the event holder does not surrender such certificate(s) within 10 days of receiving such notice, the Corporation shall deem such certificate(s) cancelled and void. As soon as practicable, after the certificate(s) are either surrendered by the holder or cancelled by the Corporation, as the case may be, the Corporation will issue and deliver to holder a new certificate for the number of full shares of Common Stock issuable upon such mandatory conversion in accordance with the provisions hereof and cash as provided in paragraph 2(c) in respect of any fraction of a share of Common Stock otherwise issuable upon such mandatory conversion, unless fractional shares are rounded up to the next whole share. Holder will be deemed a Common Stock holder of record as of the date of the occurrence of a Mandatory Conversion Event.

Page 3

c. No fractional shares of Common Stock or scrip shall be issued upon conversion of shares of Series A Preferred Stock. If more than one share of Series A Preferred Stock shall be surrendered for conversion at any one time by the same holder, the number of full shares of Common Stock issuable upon conversion thereof shall be computed on the basis of the aggregate number of shares of Series A Preferred Stock so surrendered. Instead of any fractional shares of Common Stock which would otherwise be issuable upon conversion of any shares of Series A Preferred Stock, the Corporation shall make an adjustment in respect of such fractional interest (i) equal to the fair market value of such fractional interest, to the nearest 1/100th of a share of Common Stock, in cash at the Current Market Price (as defined below) on the business day preceding the effective date of the conversion, or (ii) by rounding the fractional share up to the next whole share. The “Current Market Price” of publicly traded shares of Common Stock or any other class of Common Stock or other security of the Corporation or any other issuer for any day shall be deemed to be the average of the daily “Closing Prices” for the 5 consecutive trading days preceding the Conversion Date. The “Current Market Price” of the Common Stock or any other class of capital stock or securities of the Corporation or any other issuer which is not publicly traded shall mean the fair value thereof as determined by an independent investment banking or appraisal firm experienced in the valuation of such securities or properties selected in good faith by the Board of Directors of the Corporation or a committee thereof or, if no such investment banking or appraisal firm is, in the good faith judgment of the Board of Directors of the Corporation or such committee, available to make such determination, as determined in good faith judgment of the Board of Directors of the Corporation or such committee. The “Closing Price” shall mean the last reported sales price on the principal national securities exchange on which the Common Stock is listed or admitted to trading or, if not listed or admitted to trading on any national securities exchange, on Nasdaq, or, if the Common Stock is not listed or admitted to trading on any national securities exchange or quoted on Nasdaq Stock Market, the average of the closing bid and asked prices in the over-the-counter market as furnished by any New York Stock Exchange member firm selected from time to time by the Corporation for that purpose.

d. The Corporation shall pay (i) any and all accrued and unpaid dividends on the Series A Preferred Stock and (ii) issue and other taxes that may be payable in respect of any issue or delivery of shares of Common Stock on conversion of Series A Preferred Stock pursuant hereto, other than any taxes payable with respect to income by the holders thereof.

e. The Corporation shall at all times reserve for issuance and maintain available, out of its authorized but unissued Common Stock, solely for the purpose of effecting the conversion of the Series A Preferred Stock, the full number of shares of Common Stock deliverable upon the conversion of all Series A Preferred Stock from time to time outstanding. The Corporation shall from time to time (subject to obtaining necessary director and stockholder action), in accordance with the laws of the State of Nevada, increase the authorized number of shares of its Common Stock if at any time the authorized number of shares of its Common Stock remaining unissued shall not be sufficient to permit the conversion of all of the shares of Series A Preferred Stock at the time outstanding.

Page 4

f. If any shares of Common Stock to be reserved for the purpose of conversion of shares of Series A Preferred Stock require registration or listing with, or approval of, any governmental authority, stock exchange or other regulatory body under any federal or state law or regulation or otherwise, including registration under the Securities Act of 1933, as amended (the “Act”), and appropriate state securities laws, before such shares may be validly issued or delivered upon conversion, the Corporation will in good faith and as expeditiously as possible meet such registration, listing or approval, as the case may be.

g. All shares of Common Stock which may be issued upon conversion of the shares of Series A Preferred Stock will upon issuance by the Corporation be validly issued, fully paid and non-assessable and free from all taxes, liens and charges with respect to the issuance thereof.

h. The Conversion Price in effect shall be subject to adjustment from time to time as follows:

i. Stock Splits, Dividends and Combinations. In the event that the Corporation shall at any time subdivide the outstanding shares of Common Stock, or shall pay or make a dividend or distribution on any class of capital stock of the Corporation in Common Stock, the Conversion Price in effect immediately prior to such subdivision or the issuance of such dividend shall be proportionately decreased, and in case the Corporation shall at any time combine the outstanding shares of Common Stock, the Conversion Price in effect immediately prior to such combination shall be proportionately increased, effective at the close of business on the date of such subdivision, dividend or combination, as the case may be.

ii. Non-Cash Dividends, Stock Purchase Rights, Capital Reorganization and Dissolutions. In the event:

A. that the Corporation shall take a record of the holders of its Common Stock for the purpose of entitling them to receive a dividend, or any other distribution, payable otherwise than in cash; or

B. that the Corporation shall take a record of the holders of its Common Stock for the purpose of entitling them to subscribe for or purchase any shares of stock of any class or other securities, or to receive any other rights; or

Page 5

C. of any (1) capital reorganization of the Corporation, reclassification of the capital stock of the Corporation (other than a subdivision or combination of its outstanding shares of Common Stock), consolidation or merger of the Corporation with or into another corporation, unless the shareholders of the Corporation immediately prior to such transaction own 50% of the entity resulting from the transaction, or (2) sale, lease or transfer of all or substantially all of the assets or shares of the Corporation to another corporation in one or a series of transactions (collectively (C)(1) and (C)(2) are referred to as a “Reorganization”); or

D. of the voluntary or involuntary dissolution, liquidation or winding up of the Corporation;

then, and in any such case, provision shall be made so that the holders of the Series A Preferred Stock shall be entitled, upon conversion, to receive the number and kind of securities of other property of the Corporation, or successor corporation, to which holder would have been entitled to receive had holder converted immediately prior to such event. Furthermore, the Corporation shall cause to be mailed to the holders of record of the outstanding Series A Preferred Stock, at least 10 days prior to the date hereinafter specified, a notice stating the date on which (x) a record is to be taken for the purpose of such dividend, distribution or rights, or (y) such reclassification, reorganization, consolidation, merger, share exchange, conveyance, dissolution, liquidation or winding up is to take place and the date, if any is to be fixed, as of which holders of Corporation securities of record shall be entitled to exchange their shares of Corporation securities for securities or other property deliverable upon such reclassification, reorganization, consolidation, merger, share exchange, conveyance, dissolution, liquidation or winding up.

i. The Corporation will not, by amendment of its Articles of Incorporation or through any reorganization, transfer of assets, consolidation, merger, share exchange, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation, but will at all times in good faith assist in the carrying out of all the provisions of paragraph 2(h) and in the taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the holders of the Series A Preferred Stock against impairment. Without limiting the generality of the foregoing, the Corporation (a) will not increase the par value of any shares of stock receivable on the conversion of the Series A Preferred Stock above the amount payable therefor on such conversion, (b) will take all such action as may be necessary or appropriate in order that the Corporation may validly and legally issue fully paid and nonassessable shares of stock on the conversion of all Series A Preferred Stock from time to time outstanding, and (c) will not consolidate with or merge into any other person or permit any such person to consolidate with or merge into the Corporation (if the Corporation is not the surviving person), unless such other person shall expressly assume in writing and will be bound by all of the terms of the Series A Preferred stock set forth herein.

Page 6

j. Upon the occurrence of each adjustment or readjustment of the Conversion Price pursuant to paragraph 2(h), the Corporation at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof, and prepare and furnish to each holder of Series A Preferred Stock a certificate signed by the president and chief financial officer (or, in the absence of a person designated as the chief financial officer, by the officer serving in an equivalent or similar financial capacity) of the Corporation setting forth (i) such adjustment or readjustment, (ii) the Conversion Price at the time in effect, and (iii) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of such holder’s shares.

k. In case any shares of Series A Preferred Stock shall be converted pursuant to Section 2 hereof, the shares so converted shall be restored to the status of authorized but unissued shares of preferred stock, without designation as to class or series, and may thereafter be reissued, but not as shares of Series A Preferred Stock.

3. Voting. Unless otherwise required by the Nevada Revised Statutes, the shares of Series A Preferred Stock shall not be entitled to vote on any matter presented at any annual or special meeting of stockholders of the Corporation, or through written consent.

4. Liquidation Rights.

a. A “Liquidation” shall mean a dissolution or winding up, voluntary or involuntary, of the Corporation. If, in such event, any of the consideration payable to the Corporation or its stockholders is other than cash, the value thereof will be deemed to be its fair market value, as determined by the Corporation’s board of directors.

b. In the event of any Liquidation, the holders of shares of Series A Preferred Stock then outstanding shall be entitled to receive out of assets of the Corporation available for distribution to stockholders, before any distribution of assets is made to holders of any other class of capital stock of the Corporation, an amount equal to the Series A Original Issue Price plus accumulated and unpaid dividends thereon to the date fixed for distribution (the “Base Liquidation Preference”). If upon any Liquidation, the amounts payable with respect to the Series A Preferred Stock and any other shares of stock of the Corporation ranking as to any such distribution on a parity with the Series A Preferred Stock are not paid in full, the holders of the Series A Preferred Stock and of such other shares shall share ratably in any such distribution of assets of the Corporation in proportion to the full respective preferential amounts to which they are entitled. After the payment of the Base Liquidation Preference shall have been made in full to the holders of the Series A Preferred Stock or funds necessary for such payment shall have been set aside by the Corporation in trust for the account of holders of the Series A Preferred Stock so as to be available for such payments, the holders of Series A Preferred Stock shall have no further right to participate in any remaining assets of the Corporation legally available for distribution to its shareholders.

Page 7

5. Redemption of Series A Preferred Stock at Option of Corporation.

a. Subject to the provisions of this Section 5, the Series A Preferred Stock shall be redeemable in whole or in part, at the option of the Corporation by resolution of its Board of Directors, at any time on or prior to April 30, 2020 at 100% of the Series A Original Issue Price, plus all dividends accrued and unpaid on such Series A Preferred Stock up to the date fixed for redemption upon giving the notice hereinafter provided.

b. Not less than thirty nor more than forty days prior to the date fixed for redemption of the Series A Preferred Stock, a notice in writing shall be given by mail to the holders of record of Series A Preferred Stock at their respective addresses as the same shall appear on the stock books of the Corporation. Such notice shall state: (i) the redemption date; (ii) the redemption price and the amount of dividends on the Series A Preferred Stock that will be accrued and unpaid to the date fixed for redemption; (iii) the place or places where certificates for shares are to be surrendered for payment of the redemption price; (iv) that the dividends on shares to be redeemed will cease to accrue on such redemption dates; (v) the conversion rights of the shares to be redeemed; (vi) the period within which the conversion rights may be exercised; and (vii) the Conversion Price and the number of shares of the Common Stock issuable upon conversion of a share of Series A Preferred Stock at the time. If the Corporation calls for redemption the Series A Preferred Stock, it shall reserve sufficient shares of Common Stock for the purpose of issuing such shares of Common Stock to holders of Series A Preferred Stock that determine to convert such shares of Series A Preferred Stock into Common Stock prior to the close of business on the business day prior to the date of redemption.

c. After giving notice of redemption and prior to the close of business on the business day prior to the redemption date, the holders of Series A Preferred Stock so called for redemption may convert such stock into Common Stock in accordance with the conversion privileges set forth in Section 2 hereof. Unless (i) the holder of shares of Series A Preferred Stock to whom notice has been duly given shall have exercised its rights to convert in accordance with Section 2 hereof or (ii) the Corporation shall default in the payment of the redemption price as set forth in such notice, upon such redemption date such holder shall no longer have any voting or other rights with respect to such shares, except the right to receive the moneys payable upon such redemption from the Corporation, without interest thereon, upon surrender (and endorsement, if required by the Corporation) of the certificates, and the shares represented thereby shall no longer be deemed to be outstanding as of the redemption date. In the event a holder of Series A Preferred Stock provides the Corporation with notice of conversion of all or a portion of such Series A Preferred Stock into shares of Common Stock on or after any notice of redemption is provided, the holder shall have been deemed to convert as of the redemption date provided, however, that in the event the Corporation shall default in the payment of the redemption price as set forth in such redemption notice, the conversion shall not be effective unless the holder of Series A Preferred Stock electing to convert provides written notice to the Corporation within 20 days of the purported redemption date of this desire to effect such conversion.

Page 8

d. The Series A Preferred Stock may not be redeemed and the Corporation may not purchase or otherwise acquire any shares of Series A Preferred Stock unless full cumulative dividends on all outstanding shares of Series A Preferred Stock shall have been paid in full or contemporaneously are declared and paid in full for all past dividend periods.

e. All shares of Series A Preferred Stock so redeemed shall have the status of authorized but unissued preferred stock, but such shares so redeemed shall not be reissued as shares of the series of Series A Preferred Stock created hereby.

f. No holder of shares of Series A Preferred Stock shall have the right to require the Corporation to redeem all or any portion of such shares.

6. Notice. All notices required to be delivered hereunder to the holders of the Series A Preferred Stock shall be sent by email or facsimile transmission (such notice shall be deemed received by the recipient on the first business day following transmission and electronic confirmation of receipt if sent via facsimile), prepaid overnight courier or first class or registered or certified mail, return receipt requested, with postage prepaid thereon, to the holder at holder’s last address shown on the records of the Corporation for the Series A Preferred Stock.

Page 9