Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99-1 - CF Industries Holdings, Inc. | tm2034564d1_ex99-1.htm |

| 8-K - FORM 8-K - CF Industries Holdings, Inc. | tm2034564-1_8k.htm |

Exhibit 99.2

1 CF Commitment to Clean Energy Economy Clean Fuels for a Sustainable World October 29, 2020 NYSE: CF

2 Safe harbor s tatement All statements in this communication, other than those relating to historical facts, are forward - looking statements, including, but not limited to, statements as to strategic plans and management’s expectations with respect to the production of green and low - carbon ammonia, t he development of carbon capture and sequestration projects, the transition to and growth of a hydrogen economy, greenhouse gas reduction ta rge ts, projected capital expenditures, and other items described in this communication. Forward - looking statements can generally be identified by their use of terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” or “wou ld” and similar terms and phrases, including references to assumptions. Forward - looking statements are not guarantees of future performance and are subjec t to a number of assumptions, risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materi all y from such statements. Important factors that could cause actual results to differ materially from our expectations include, but are not li mited to, the failure of cost competitive global renewable energy capacity to increase significantly; realization of technological improvements requir ed to increase the efficiency and lower the costs of production of green and low - carbon ammonia; development and growth of end market demand and ap plications for low - carbon hydrogen and ammonia; government regulation, incentives, and initiatives; cost overruns; performance of third parties ; permitting matters; and other unforeseen difficulties. Important factors that could cause actual results more generally to differ mater ial ly from our expectations are discussed in our filings with the Securities and Exchange Commission, including our most recent annual and quarterly repo rts on Form 10 - K and Form 10 - Q, which are available in the Investor Relations section of the CF Industries web site. It is not possible to predict or identify all risks and uncertainties that might affect the accuracy of our forward - looking stat ements and, consequently, our descriptions of such risks and uncertainties should not be considered exhaustive. There is no guarantee that any of the e ven ts, plans or goals anticipated by these forward - looking statements will occur, and if any of the events do occur, there is no guarantee what effect they will have on our business, results of operations, cash flows, financial condition and future prospects. Forward - looking statements are given onl y as of the date of this communication and the company disclaims any obligation to update or revise the forward - looking statements, whether as a res ult of new information, future events or otherwise, except as required by law.

3 Executive summary : c ommitment to clean energy economy • Hydrogen has emerged as a leading clean energy source to help the world achieve net - zero carbon emissions by 2050 • Ammonia is one of the most efficient ways to transport and store hydrogen and is also a fuel in its own right • CF is the world’s largest producer of ammonia and is uniquely positioned, with an unparalleled asset base and technical knowledge, to serve this anticipated demand • Company is announcing commitment to decarbonize the world’s largest ammonia production network, positioning CF at forefront of clean hydrogen supply • New green ammonia project announced at Donaldsonville Nitrogen Complex today expected to fit within normal $400 - 450 million annual capex budget • Establishing carbon emissions reduction targets of: • 25 % reduction by 2030 • net - zero carbon emissions by 2050 • Clear pathways to growth in clean energy: • Green ammonia production - ammonia produced through a carbon - free electrolysis process using renewable electricity • Renewable electricity accounts for approximately 25% of CF’s total system consumption • Low - carbon ammonia - ammonia produced by conventional processes but with CO 2 removed through carbon capture and sequestration (CCS) and other certified carbon abatement projects • Board has established a new Environmental Sustainability and Community Committee and is aligning executive compensation directly to ESG objectives

4 Investment thesis: l ow - carbon ammonia • The global focus on climate change and GHG emissions has created a push to decarbonize economies. To accomplish this, the world needs a clean energy/fuel source • Renewable energy (solar and wind) are growing rapidly, supported by governmental incentives • However , renewable energy is not consistently available and somewhat unpredictable creating the need to have a clean energy source that can be stored and transported • Hydrogen has emerged as a clean energy source • Hydrogen can be produced with zero carbon emissions through the electrolysis of water, using renewable energy • However , hydrogen is difficult to store and transport given its combustible nature and extremely low boiling point temperature ( - 423 F) • Ammonia (NH3 ) has a much higher boiling point ( - 28 F ), is an efficient storage and transport medium for hydrogen • Significantly higher energy density than hydrogen and considerably more efficient than lithium ion batteries • Infrastructure to store and transport ammonia already exists with a presence in 120 seaports globally and seaborne trade of ~20 million tons annually • Ammonia can be used directly as a fuel, in addition to serving as a storage and transport medium for hydrogen • The solution: produce low - carbon ammonia for use as a fuel and a hydrogen storage and transportation medium to assist decarbonizing economies • Green ammonia is produced through electrolysis of water to produce carbon free hydrogen and synthesis to ammonia • L ow - carbon ammonia can be produced by either carbon c apture and sequestration where process - gas CO2 is removed and injected into geological storage , or through utilizing certified carbon abatement credits to offset produced CO2 The result: exponential growth in low - carbon ammonia

5 Source: IEA, Wood Mackenzie, Bernstein: Hydrogen Highway 2020: Ready for Prime Time Deloitte: Australian and Global Hydrogen Demand Growth Scenario Analysis, prepared for COAG Energy Council – National Hydrogen Strategy Ta skforce, November 2019 (1) Deloitte (DT) Scenarios: Energy of the Future – Hydrogen demand where all aspects of industry development are favorable for Hydro gen; Targeted Deployment – Countries adopt a targeted approach which aims to maximize economic value in the development of Hydrogen; (2) IRENA is the International Renewable Energy Agency; (3) Each st of ammonia contains 17.65% hydrogen by mass. 5.67 st of ammonia are required for each st of hydrogen 0 500 1,000 1,500 2,000 2,500 3,000 3,500 0 100 200 300 400 500 600 700 Million ST Hydrogen Potential long - term demand for hydrogen Million ST NH3 Equivalent (3) 2018 Demand 2050 Demand Estimates 85% 230% 345% 150% 660% % Growth from 2018 4 45% Avg. 335M st Hydrogen – 360% growth over 2018 310% 19.4x 16.7x 13.9x 11.1x 8.3x 5.6x 2.8x Potential NH3 Demand Growth Today’s global ammonia consumption of ~180M ST, CF Industries supplies ~6% 4 70% Hydrogen demand projected to grown exponentially • Hydrogen has emerged as a leading clean energy source to achieve global GHG emission reductions and energy stability • Development of the clean energy economy is expected to receive significant levels of investment by governments, global organizations, and private industry • Global ammonia demand will increase substantially over the current annual demand of ~180M ST if only a portion of the growth in hydrogen demand is supported by low - carbon ammonia

6 Low - carbon ammonia : the key e nabler f or c lean h ydrogen e nergy • 180 million tons of ammonia safely produced, stored, transported and consumed globally • Ammonia’s energy density is ~1.5x that of liquid hydrogen, ~3.0x that of gaseous hydrogen, and ~14.0x that of lithium ion batteries, allowing for more economic transport and storage of energy • Global ammonia transportation and storage infrastructure already exists with a presence in 120 seaports globally • Ammonia disassociation to create pure hydrogen is a mature technology • Ammonia can be used directly as a fuel in addition to a storage and transport medium for hydrogen • Used directly for power generation in ammonia - fired turbines, engines, marine vessels and mixed with coal in power plants Ammonia is the solution for storage & transportation Source: The Royal Society

7 CF has the leading asset base Ideally positioned to lead h ydrogen economy by leveraging existing network • 10 million tons produced annually • 9 manufacturing complexes • 23 distribution facilities • 1.5 million tons of storage • 5 deep water docks able to load ocean - going vessels • Additional shipping capacity via pipeline, barge, rail, truck CF has the world’s largest and most integrated ammonia production and distribution network CF nitrogen complex CF owned distribution facility NuStar Pipeline Ammonia Export Capability UK

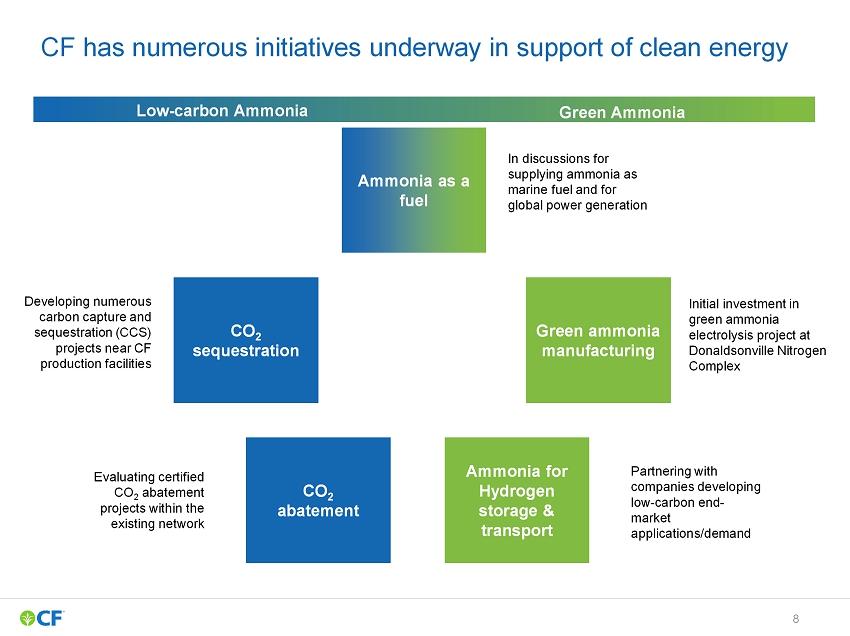

8 Ammonia as a fuel CF has numerous initiatives underway in support of clean energy Developing numerous carbon capture and sequestration (CCS) projects near CF production facilities In discussions for supplying ammonia as marine fuel and for global power generation Evaluating certified CO 2 abatement projects within the existing network Partnering with companies developing low - carbon end - market applications/demand L ow - carbon Ammonia Green Ammonia Initial investment in green ammonia electrolysis project at Donaldsonville Nitrogen Complex CO 2 s equestration Green ammonia manufacturing CO 2 a batement Ammonia for Hydrogen storage & transport

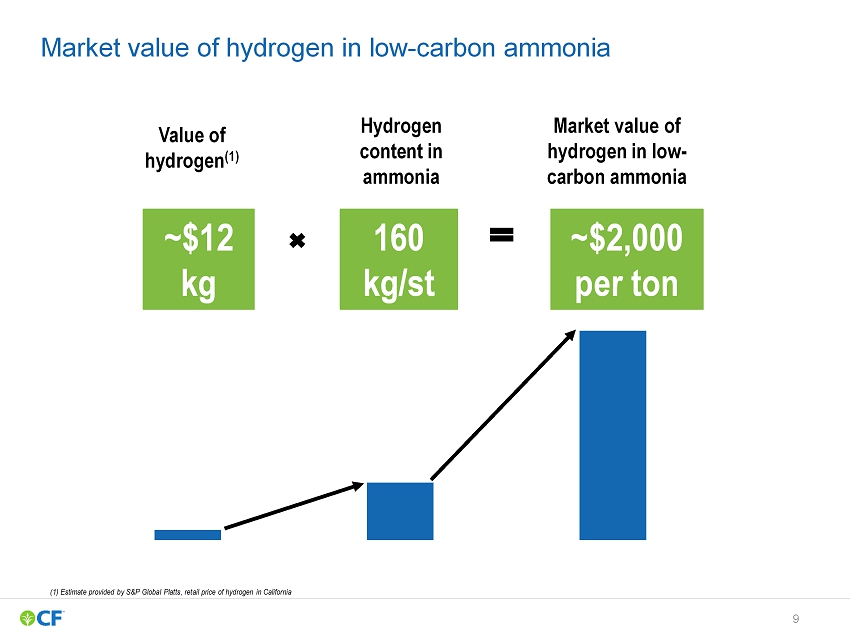

9 Market value of hydrogen in low - carbon ammonia (1) Estimate provided by S&P Global Platts , retail price of hydrogen in California Value of hydrogen (1) Hydrogen content in ammonia Market v alue of hydrogen in low - carbon ammonia ~$12 kg 160 kg/ st ~$2,000 per ton

10 C F $/st 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 • Production of blue ammonia achieved through carbon capture and sequestration or certified carbon abatement projects expected to have similar production costs as conventional ammonia • U.S . tax credits expected to offset CF’s incremental costs • Green ammonia project is based on water electrolysis system capable of producing ~20K tons per year • CF expects the initial green ammonia project at Donaldsonville to require capex of ~$100 million and be NPV positive (1) Average US Gulf production costs @ $3.00 mmbtu natural gas (2) Electricity cost of $40/MW assumed (3) Estimate provided S&P Global Platts , retail price of hydrogen in California, multiplied by 160 kg/ton ammonia Conventional (1) Blue (1) Green (2) Market value of hydrogen in low - carbon ammonia (3) CF’s long - term growth trajectory dramatically enhanced with c lean energy CF focused on the hydrogen clean f uel value of a mmonia rather than its nutrient value Ammonia cash costs ~$2,000 $465 $140 $140

11 Clean Fuel: The growth platform for long - term s hareholder v alue • Clean energy production significantly enhances CF’s long - term growth trajectory • Ability to achieve higher margins over time by capturing clean energy value of ammonia rather than the nutrient value of ammonia • Projected demand for low - carbon ammonia will significantly exceed current global ammonia capacity • To meet anticipated demand, the value for green ammonia must satisfy cost of capital hurdles to incentivize the construction of new greenfield production facilities • CF’s existing asset base provides brownfield expansion opportunities, placing CF years and billions of dollars of investment ahead of greenfield projects • CF green ammonia production advantages: • Hydrogen from electrolysis can be fed into existing ammonia synthesis unit, displacing hydrogen from steam methane reformer • Existing logistics infrastructure available to store and deliver green ammonia efficiently • Unparalleled technical expertise exists within CF network • ~25% of total system electricity usage already from renewable resources • CF blue ammonia production advantages: • Existing CO 2 header and collection systems • Several production sites near CO 2 pipelines • Numerous CO 2 sequestration projects under development near our sites • Government incentives in place with 45Q credits ($31/ton, increasing to $45/ton by 2026)

12 ESG priorities and goals

13 Clean e nergy enhances c omprehensive ESG p riorities • We have identified 16 ESG issues that are material to our business based on potential for material financial or reputational impact, alignment with our mission, values and strategy, relevance across our industry, importance to internal and external stakeholders, and our ability to control or influence the topic. • Our commitment to a clean energy economy reflects the integration of ESG considerations into our strategy for long - term value creation Committed to decarbonizing the world’s l argest a mmonia p roduction n etwork

14 Dimension Material Issue Goal UN Sustainable Development Goals GHG EMISSIONS; ENERGY MANAGEMENT; CLIMATE CHANGE Reduce carbon emissions • During 2021, develop and prioritize a list of viable GHG reduction capital projects • Reduce total CO 2 equivalent emissions by 25% per ton of product by 2030 (2015 baseline year) • Achieve net - zero carbon emissions by 2050 CLIMATE CHANGE Begin to report and disclose Company data in accordance with the Task Force on Climate - related Financial Disclosures (TCFD) framework for climate - related risks and opportunities, in addition to the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) WATER MANAGEMENT Ensure sustainable management of water (availability, use, and discharge) for all manufacturing operations: • During 2021, identify and evaluate a list of viable water reuse/reduction projects • Develop integrated water resource management plans to ensure sustainable withdrawals and discharges Energy, Emissions and Climate Change Goals aligned with material ESG issues

15 Dimension Material Issue Goal UN Sustainable Development Goals WORKFORCE HEALTH & SAFETY Strengthen and improve behavioral safety practices that support the commitment to safety excellence • At least 95% of the aggregated safety grades of all employees at manufacturing and distribution sites must be a "B" or better for the year • Safety critical equipment inspections completed per schedule • Management of changes in current year closed within 90 days of pre - startup review DIVERSITY & INCLUSION Continue to improve the inclusiveness and diversity of the Company and the Culture • Increase representation of females and people of color in senior leadership roles (director level and above) to at least 30% by end of 2025 • Implement a program to create additional pathways to long - term professional growth for traditionally underrepresented employee groups by end of 2021 with the ultimate goal of increasing the hiring and promotion of minority and female candidates COMMUNITY RELATIONS Increase engagement and support with our local communities and expand the corporate giving philosophy to include environmental sustainability, food access and security, STEM education and first responders within our local communities Implement a Volunteer Time Off (“VTO”) program by the end of 2021 which provides paid time off for employees to volunteer in their communities with organizations that are part of the Company ’s giving campaign. Achieve 25% employee participation in VTO program by the end of 2025 Our Workplaces and Communities Goals aligned with material ESG issues (cont’d)

16 Dimension Material Issue Goal UN Sustainable Development Goals FOOD SECURITY; ENVIRONMENTAL COMPLIANCE Be a driving force to increase adoption of enhanced conservation practices and nutrient management practices that promote sustainable agriculture • Reach 90,000 farmers with 4R Plus program by 2023 • Expand partnerships to achieve 60 million acres of farmland using sustainable practices by 2030 SAFETY & ENVIRONMENTAL STEWARDSHIP OF CHEMICALS Receive the “Protect & Sustain” certification (or equivalent environmental/product stewardship certification) for 100% of manufacturing sites by 2030 MANAGEMENT OF LEGAL & REGULATORY ENVIRONMENT Engage suppliers and service providers annually representing 50% of the Company ’s total procurement and supply chain expenditures and assess their commitment to and performance in key ESG areas ETHICS • Annually require 100% of employees to be trained on and certify compliance with the Code of Corporate Conduct • Annually require 100% of employees to be trained on and certify compliance with the Environmental, Health, Safety, and Security Policy • Annually require 100% of employees to be trained on diversity and inclusion matters • Annually require 100% of employees to be trained on and certify compliance with Anti - corruption Compliance Policy Food Security and Product Stewardship Ethics and Governance Goals aligned with material ESG issues (cont’d)