Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BrightSphere Investment Group Inc. | bsig-20201029.htm |

Contact: Elie Sugarman ir@bsig.com (617) 369-7300 Exhibit 99.1 BrightSphere Reports Financial and Operating Results for the Third Quarter Ended September 30, 2020 • U.S. GAAP earnings per share of $0.46 for the quarter, compared to $0.84 for Q3'19 • ENI earnings per share of $0.47 for the quarter, compared to $0.42 for Q3'19 • Net client cash flows (“NCCF”) for the quarter of $(1.5) billion; excluding Barrow Hanley, NCCF of $(0.5) billion • AUM of $184.8 billion at September 30, 2020 compared to $181.0 billion at June 30, 2020, driven by market appreciation in the second quarter; AUM of $140.2 billion at September 30, 2020 excluding Barrow Hanley compared to $135.2 billion at June 30, 2020 excluding Barrow Hanley and Copper Rock • Net leverage ratio reduced to 1.5x as of September 30, 2020 from 1.7x as of June 30, 2020; the Company paid down a portion of its revolver and fully paid down its seed capital facility BOSTON - October 29, 2020 - BrightSphere Investment Group Inc. (NYSE: BSIG) reports its results for the third quarter ended September 30, 2020. Suren Rana, BrightSphere’s President and Chief Executive Officer said, “BrightSphere produced ENI earnings per share of $0.47 for the quarter compared to $0.42 in the third quarter of 2019 reflecting our expense management and share repurchase activity which more than offset the impact of reduced AUM and revenue from COVID-19 related market decline in the first half of this year and large reallocations in the Liquid Alpha segment in Q4’19. Our ENI earnings per share of $0.47 in the quarter also increased from $0.41 in the second quarter of 2020 reflecting the increase in AUM and revenue from continuing market recovery.” “Earlier in the quarter, we announced divestitures of our Barrow Hanley and Copper Rock affiliates. We completed the sale of Copper Rock in July 2020 and we continue to expect the sale of Barrow Hanley to be completed in the fourth quarter of 2020. We expect these divestitures to enhance the company’s organic growth profile and to use the sale proceeds to further pay down debt and repurchase our shares.” “Our total net client cash flows in the quarter on a pro forma basis, i.e. excluding Barrow Hanley and Copper Rock Affiliates, were $(0.5) billion, as net client cash flows of $0.7 billion in Alternatives and $1.1 billion in pro forma Liquid Alpha (excluding Barrow Hanley) were offset by net client cash flows of $(2.3) billion in Quant & Solutions primarily driven by two sizeable re-balancing withdrawals. On an annualized revenue basis, the $(0.5) billion of net client cash flows represent revenue increase of $1.4 million as the fee on inflows was higher than the fee on outflows.” “Our investment performance remains generally stable though there are meaningful headwinds impacting our value-focused strategies in the current growth focused market.” “In our Alternatives segment, the $0.7 billion of net inflows in Q3‘20 reflect modest pickup in the pace of fundraising activity though we continue to expect pandemic- driven delay in the timing of fundraises.” “We believe we continue to be on track to achieve our targeted annualized cost savings of over $20 million by Q1’21 in our corporate center through the implementation of an affiliate-led distribution approach.” “On the capital management front, in the third quarter we reduced the borrowings on our corporate revolver to $80 million from $130 million at the end of Q2’20, reducing our Net Debt / Adjusted EBITDA ratio to 1.5x as of the end of the third quarter compared to 1.7x at the end of the second quarter. Additionally, we fully paid- off the remaining $22 million outstanding amount on our non-recourse seed facility.” 1

Dividend Declaration The Company’s Board of Directors approved a quarterly interim dividend of $0.01 per share payable on December 29, 2020 to shareholders of record as of the close of business on December 11, 2020. Conference Call Dial-in The Company will hold a conference call and simultaneous webcast to discuss the results at 11:00 a.m. Eastern Time on October 29, 2020. To listen to the call or view the webcast, participants should: Dial-in: Toll Free Dial-in Number: (844) 445-4807 International Dial-in Number: (647) 253-8636 Conference ID: 9674856 Link to Webcast: https://event.on24.com/wcc/r/2633843/B920194825D2ACAB4684F3E841BD0C34 Dial-in Replay: A replay of the call will be available beginning approximately one hour after its conclusion either on BrightSphere’s website, at https://ir.bsig.com or at: Toll Free Dial-in Number: (800) 585-8367 International Dial-in Number: (416) 621-4642 Conference ID: 9674856 About BrightSphere BrightSphere is a diversified, global asset management company with approximately $140 billion(1) of assets under management as of September 30, 2020. Through its five(1) world-class investment management Affiliates, BrightSphere offers sophisticated investors access to a wide array of leading quantitative and solutions-based, private and public market alternative, and liquid alpha strategies designed to meet a range of risk and return objectives. For more information, please visit BrightSphere’s website at www.bsig.com. Information that may be important to investors will be routinely posted on our website. __________________________________________________________ (1) In July 2020, BrightSphere completed sale of Copper Rock and announced divestiture of Barrow Hanley expected to close in Q4’20. These figures give effect to these divestitures. 2

Forward Looking Statements This communication includes forward-looking statements which may include, from time to time, information relating to after-tax proceeds from our dispositions of Barrow Hanley and Copper Rock, the expected closing of the Barrow Hanley disposition, anticipated revenues, margins, operating expense and variable compensation ratios, cash flows or earnings growth profile, anticipated performance of the Company’s business or particular segments, expected future net cash flows, share repurchases, debt paydowns and expected ENI per share accretion, anticipated AUM growth, expense levels and cost savings, capital management, benefits and timing of our recent repositioning of our corporate center and/or expectations regarding market conditions. The words or phrases ‘‘will likely result,’’ ‘‘are expected to,’’ ‘‘will continue,’’ ‘‘is anticipated,’’ ‘‘can be,’’ ‘‘may be,’’ ‘‘aim to,’’ ‘‘may affect,’’ ‘‘may depend,’’ ‘‘intends,’’ ‘‘expects,’’ ‘‘believes,’’ ‘‘estimate,’’ ‘‘project,’’ and other similar expressions are intended to identify such forward-looking statements. Such statements are subject to various known and unknown risks and uncertainties and readers should be cautioned that any forward-looking information provided by or on behalf of the Company is not a guarantee of future performance. Actual results may differ materially from those in forward-looking information as a result of various factors, some of which are beyond the Company’s control, including but not limited to those discussed above and elsewhere in this communication and in the Company’s most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 2, 2020, Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on May 11, 2020, and subsequent SEC filings, including risks related to the disruption caused by the COVID-19 pandemic, which has and is expected to materially affect our business, financial condition, results of operations and cash flows for an extended period of time. Due to such risks and uncertainties and other factors, the Company cautions each person receiving such forward-looking information not to place undue reliance on such statements. Further, such forward-looking statements speak only as of the date of this communication and the Company undertakes no obligations to update any forward looking statement to reflect events or circumstances after the date of this communication or to reflect the occurrence of unanticipated events. This communication does not constitute an offer for any fund managed by the Company or any Affiliate of the Company. Non-GAAP Financial Measures This communication contains non-GAAP financial measures. Reconciliations of GAAP to non-GAAP financial measures are included in the Reconciliations and Disclosures section of this communication. Additional reconciliations with respect to certain segment measures are included in the Supplemental Information section of this communication. 3

Q3 2020 EARNINGS PRESENTATION October 29, 2020 4

Q3’20 Highlights BrightSphere Highlights • U.S. GAAP EPS of $0.46 for Q3'20 compared to $0.84 for Q3'19 • ENI earnings per share of $0.47 for the quarter compared to $0.42 for Q3'19 • Announced divestiture of Barrow Hanley and Copper Rock for $335 million in expected after-tax proceeds including seed capital; Copper Rock sale closed in July 2020; Barrow Hanley sale expected to close in Q4 • NCCF(1) of $(1.5) billion for Q3'20; NCCF of $(0.5) billion(2) excluding Barrow Hanley for Q3'20 (2) ◦ Annualized revenue impact of positive $1.4 million excluding Barrow Hanley for Q3'20 ◦ NCCF of $0.7 billion in Alternatives and $1.1 billion in Liquid Alpha (excluding Barrow Hanley) offset by NCCF of $(2.3) billion in Quant & Solutions primarily driven by two sizable re-balancing withdrawals • Alternatives segment generated $0.7 billion of inflows in Q3'20 reflecting some pickup in the pace of fundraising activity; continue to expect pandemic driven delay in the timing of fundraises • Quant and Solutions investment performance continued to be strong with 45%, 49% and 88% of strategies by revenue beating their benchmarks over the prior 3-, 5-, and 10-year periods at September 30, 2020 • Revolver borrowing reduced to $80 million at September 30, 2020 compared to $130 million at June 30, 2020 and outstanding amount of $22 million on the non-recourse seed facility fully paid off; net leverage ratio reduced to 1.5x at September 30, 2020 from 1.7x at June 30, 2020 __________________________________________________________ Please see Definitions and Additional Notes (1) NCCF and revenue impact of NCCF for all periods includes reinvested income and distributions, and excludes realizations. (2) Pro forma for divestiture of Barrow Hanley and Copper Rock for the three months ended September 30, 2020. 5

U.S. GAAP Statement of Operations ($ in millions, unless otherwise noted) Three Months Ended Q3'20 vs. Q3'19 September 30, September 30, June 30, Increase 2020 2019 (Decrease) 2020 • Total revenue decreased (7.8)% from Management fees $ 178.2 $ 196.4 (9.3) % $ 170.7 Q3'19 primarily due to lower Performance fees 1.2 (1.9) n/m 0.3 management fees which were Other revenue 1.6 1.4 14.3 % 2.0 impacted by a decline in Q1’20 equity Consolidated Funds’ revenue 1.4 1.9 (26.3) % 1.7 markets and decline in average AUM Total revenue 182.4 197.8 (7.8) % 174.7 in 2020. Compensation and benefits 109.7 108.0 1.6 % 116.9 • Operating expenses decreased (2.7)% General and administrative 25.4 31.7 (19.9) % 24.5 from Q3'19 primarily due to a Amortization of acquired intangibles 1.6 1.6 — % 1.9 reduction in fixed compensation and Depreciation and amortization 5.2 4.4 18.2 % 5.1 G&A expense as a result of cost saving Consolidated Funds’ expense — 0.2 (100.0) % 0.1 initiatives Total operating expenses 141.9 145.9 (2.7) % 148.5 Operating income 40.5 51.9 (22.0) % 26.2 • Gain on sale of Affiliate of $7.2 million Investment income (loss) 3.9 2.3 69.6 % 6.6 in Q3'20 represents the pre-tax gain Interest income — 0.4 (100.0) % 0.2 from the sale of our equity interests in Interest expense (6.9) (8.3) (16.9) % (7.4) Copper Rock that closed in July 2020 Gain on sale of Affiliate 7.2 — n/m — • Income tax expense changed from a Net consolidated Funds’ investment gains (losses) 2.1 4.7 (55.3) % 35.6 benefit of $(32.0) million in Q3'19 to Income from continuing operations before taxes 46.8 51.0 (8.2) % 61.2 expense of $12.8 million primarily due Income tax expense (benefit) 12.8 (32.0) n/m 7.3 to benefits in 2019 from reductions in Income from continuing operations 34.0 83.0 (59.0) % 53.9 the liabilities for uncertain tax Gain (loss) on disposal of discontinued operations, net of tax — — — — positions and the revaluation of Net income 34.0 83.0 (59.0) % 53.9 certain deferred tax assets in Net income (loss) attributable to non-controlling interests (3.2) 7.6 n/m 35.0 connection with the Redomestication Net income attributable to controlling interests $ 37.2 $ 75.4 (50.7) % $ 18.9 in 2019 that has not recurred in 2020 Earnings per share, basic, $ $ 0.46 $ 0.84 (45.2) % $ 0.23 Earnings per share, diluted, $ $ 0.46 $ 0.84 (45.2) % $ 0.23 • U.S. GAAP net income attributable to Basic shares outstanding (in millions) 80.0 90.0 80.4 controlling interests decreased Diluted shares outstanding (in millions) 80.9 90.0 80.4 (50.7)% from the year ago quarter primarily due to the change in income U.S. GAAP operating margin 22 % 26 % (403) bps 15 % tax explained above Pre-tax income from continuing operations attributable to controlling interests $ 50.0 $ 43.4 15.2 % $ 26.2 Net income from continuing operations attributable to controlling interests $ 37.2 $ 75.4 (50.7) % $ 18.9 • Diluted earnings per share decreased Please see Definitions and Additional Notes (45.2)% from the year ago quarter due to lower Q3'20 earnings described above 6

Disciplined Execution of Long-Term Growth Strategy Focus on High- • Quant & Solutions Demand Quant & ◦ Leveraging broad quant capabilities to provide exposures and solutions sought by clients Solutions and • Alternatives Alternatives Diverse secondaries private market strategies attracting growing investor allocations (1) ◦ Strategies (87% • Liquid Alpha of Pro Forma ◦ Differentiated fundamental strategies with strong long-term alpha generation remain attractive Segment ENI) ◦ Evolving product mix in higher fee strategies Support • Product innovation Affiliates’ ◦ Support Affiliate-led extensions of investment strategies into high-demand areas through ongoing Growth seeding program Strategies • Affiliate-led distribution enhancements ◦ Support Affiliate expansion of distribution teams including entry into new markets and channels Drive • Strong free cash flow from diversified revenue streams; 29% of pro forma revenue(1) from long- Shareholder term contracts Value • Manage leverage using free cash flows from the business • Anticipate continuing repurchases as long as it remains value accretive • Ongoing expense discipline __________________________________________________________ Please see Definitions and Additional Notes (1) Pro forma for divestiture of Barrow Hanley and Copper Rock for the three months ended September 30, 2020. 7

Pro Forma Business Mix Positioned to Generate Organic Growth • 87%(1) of Segment ENI in high-demand Quant & Solutions and Alternatives Segments Quant & Solutions(2) Alternatives(2) Liquid Alpha(2) • Highly scalable offerings with • Diverse secondaries private • Demonstrated long-term alpha substantial capacity and growing market strategies in private generation across diverse, long- global demand equity, real estate and real assets only international and domestic • Leveraging data and technology • Predominately private market, public securities strategies in computational factor-based with selected differentiated including equities and fixed income investment process liquid strategies • Strong performance over market • More than 90% of revenue cycles driven by consistent • Versatile, highly-tailored, investment discipline outcome-driven investing to comprising management fees achieve client-specific goals from long-term committed • Expansion into in-demand, higher capital fee offerings support healthy • Ongoing product innovation • Long-dated investment periods operating margins responds to evolving client needs provide long-term committed • Disciplined adherence to • Multi-Asset Class capability assets investment processes across meeting increased demand for • Growing global investor base and market cycles broad-based, bespoke substantial capacity investment solutions ___________________________________________________________ Please see Definitions and Additional Notes (1) Pro forma for divestiture of Barrow Hanley and Copper Rock for the three months ended September 30, 2020. (2) Certain smaller Acadian strategies are included in Alternatives and certain TSW strategies are included in Quant & Solutions where the classification is more appropriate. 8

More Attractive Pro Forma Business Mix - by Earnings Metrics(1) ENI Revenue Economic Net Income(2) Adjusted EBITDA(2) Alternatives Alternatives Alternatives 18% 17% 24% Quant & Liquid Liquid Quant & Solutions Alpha Quant & BrightSphere Alpha Solutions 49% 26% Solutions Liquid 28% 54% Alpha 56% 27% Alternatives Alternatives Alternatives 22% 21% 29% Liquid Liquid Alpha Alpha Pro Forma 13% 12% Liquid Quant & Alpha Solutions Quant & Quant & 12% 59% Solutions Solutions 65% 67% ___________________________________________________________ Please see Definitions and Additional Notes (1) Pro forma for divestiture of Barrow Hanley and Copper Rock for the three months ended September 30, 2020. (2) Represent percentage of segment pre-tax economic net income and adjusted EBITDA, and excludes economic net income and adjusted EBITDA of the corporate head office included in ‘other’ as reflected in segment information. 9

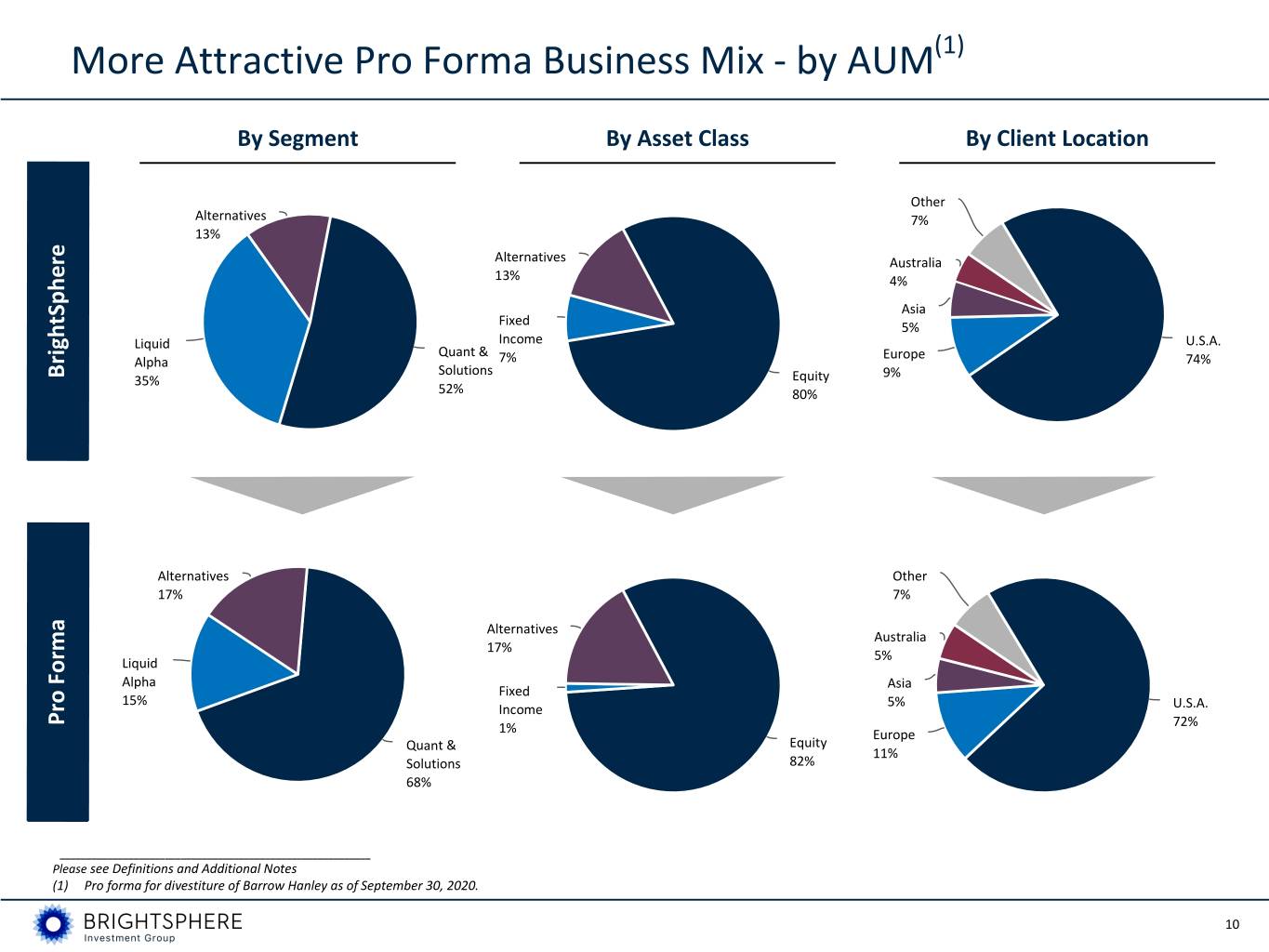

More Attractive Pro Forma Business Mix - by AUM(1) By Segment By Asset Class By Client Location Other Alternatives 7% 13% Alternatives Australia 13% 4% Asia Fixed 5% Liquid Income U.S.A. Quant & Europe Alpha 7% 74% BrightSphere Solutions 9% 35% Equity 52% 80% Alternatives Other 17% 7% Alternatives Australia 17% 5% Liquid Alpha Asia Fixed 15% 5% Income U.S.A. Pro Forma 72% 1% Europe Quant & Equity 11% Solutions 82% 68% ___________________________________________________________ Please see Definitions and Additional Notes (1) Pro forma for divestiture of Barrow Hanley as of September 30, 2020. 10

Segment Highlight: Quant & Solutions • Segment NCCF of $(2.3) billion for Q3'20 compared to $0.1 billion for Q3'19 driven by re-balancing of select clients; AUM decreased 0.1% from Q3'19 • Investment performance continues to be stable • Segment ENI increased 3.1% in Q3'20 compared to Q3'19 and operating margin increased 200 bps to 38.0% in Q3'20 compared to Q3'19 mainly due to cost management Key Performance Metrics Three Months Ended September 30, Three Months Ended June 30, 2020 2019 Increase (Decrease) 2020 Increase (Decrease) Operational Information AUM $b $ 95.4 $ 95.5 (0.1) % $ 92.0 3.7 % Average AUM $b $ 95.7 $ 96.0 (0.3) % $ 86.9 10.1 % NCCF $b $ (2.3) $ 0.1 $ (2.4) $ 0.3 $ (2.6) Annualized Revenue Impact of NCCF $m $ (11.0) $ (1.9) $ (9.1) $ (6.8) $ (4.2) ENI management fee rate (bps) 37 38 (1) 38 (1) Economic Net Income Basis ENI Revenue $m $ 89.0 $ 93.1 (4.4) % $ 82.8 7.5 % Segment Economic Net Income $m $ 33.0 $ 32.0 3.1 % $ 28.8 14.6 % ENI Operating Margin 38.0 % 36.0 % 200 bps 36.4 % 160 bps Adjusted EBITDA $m $ 37.4 $ 35.9 4.2 % $ 33.4 12.0 % Segment Performance - Quant & Solutions Revenue-Weighted (1) Equal-Weighted Asset-Weighted 100% 100% 100% 50% 50% 88% 50% 89% 82% 49% 59% 45% 44% 38% 43% 0% 0% 0% 3-Year 5-Year 10-Year 3-Year 5-Year 10-Year 3-Year 5-Year 10-Year Q2'20 47% 48% 88% Q2'20 52% 62% 89% Q2'20 40% 41% 83% Q3'19 48% 90% 89% Q3'19 60% 81% 95% Q3'19 42% 87% 87% ___________________________________________________________ Please see Definitions and Additional Notes (1) As of September 30, 2020, Quant & Solutions assets representing 57% of revenue were outperforming benchmarks on a 1- year basis, compared to 56% at June 30, 2020 and 27% at September 30, 2019. 11

Segment Highlight: Alternatives • Segment NCCF of $0.7 billion for Q3'20 compared to $0.5 billion for Q3'19; AUM increased to $23.9 billion at September 30, 2020 compared to $23.2 billion at September 30, 2019 • Alternatives revenue increased 17.1%, and segment ENI increased 30.6% in Q3'20 compared to Q3'19, mainly due to positive NCCF and change in net catch-up fee Key Performance Metrics Three Months Ended September 30, Three Months Ended June 30, 2020 2019 Increase (Decrease) 2020 Increase (Decrease) Operational Information AUM $b $ 23.9 $ 23.2 3.0 % $ 24.1 (0.8) % Average AUM $b $ 23.9 $ 23.2 3.0 % $ 24.3 (1.6) % NCCF $b $ 0.7 $ 0.5 $ 0.2 $ — $ 0.7 Annualized Revenue Impact of NCCF $m $ 6.0 $ 1.4 $ 4.6 $ — $ 6.0 ENI management fee rate (bps) (1) 72 64 8 69 3 Economic Net Income Basis ENI Revenue $m $ 43.8 $ 37.4 17.1 % $ 42.5 3.1 % Segment Economic Net Income(2) $m $ 11.1 $ 8.5 30.6 % $ 10.2 8.8 % ENI Operating Margin 42.0 % 36.1 % 590 bps 40.2 % 180 bps Adjusted EBITDA(2) $m $ 11.6 $ 8.8 31.8 % $ 10.5 10.5 % Alternative Assets Overview Alternative Assets by Strategy Alternative Assets Breakout Real Assets: 24.7% Liquid Alternatives: 3.8% Real Estate: 21.8% Fund of One: 31.3% (Institutional client can Private Equity: 49.8% Commingled: 68.7% maintain Alternative exposure beyond terms of (typically 8-12 typical fund) year lockup) __________________________________________________________ Please see Definitions and Additional Notes (1) Excluding net catch-up fees, the weighted average fee rate for alternatives would be 72 bps in Q3'20, 74 bps in Q3'19, and 71 bps in Q2'20. (2) Segment ENI and Adjusted EBITDA include net placement agent fees of $0.0 million in Q3'20, $(5.9) million in Q3'19, and $(1.2) million in Q2'20. 12

Segment Highlight: Liquid Alpha • Segment NCCF of $0.1 billion for Q3'20 compared to $(6.8) billion for Q3'19; Pro Forma NCCF (excl. Barrow Hanley and Copper Rock) of $1.1 billion for Q3'20 • Decline in segment AUM to $65.5 billion at September 30, 2020 compared to $98.1 billion at September 30, 2019 driven by Vanguard reallocation of $22.8 billion in Q4’19 at Barrow Hanley and the impact of Q1’20 market decline; pro forma AUM of $20.9 billion at September 30, 2020 down from $22.2 billion at September 30, 2019 partly due to market depreciation • 5-year underperformance driven by cyclical impacts to value strategies Key Performance Metrics Three Months Ended September 30, Three Months Ended June 30, 2020 2019 Increase (Decrease) 2020 Increase (Decrease) Operational Information AUM $b $ 65.5 $ 98.1 (33.2) % $ 64.9 0.9 % Average AUM $b $ 65.2 $ 99.8 (34.7) % $ 63.2 3.2 % NCCF $b $ 0.1 $ (6.8) $ 6.9 $ (2.0) $ 2.1 Annualized Revenue Impact of NCCF $m $ 4.5 $ (15.7) $ 20.2 $ (6.6) $ 11.1 ENI management fee rate (bps)(1) 30 27 3 31 (1) Economic Net Income Basis ENI Revenue $m $ 47.9 $ 65.2 (26.5) % $ 47.1 1.7 % Segment Economic Net Income $m $ 17.2 $ 25.0 (31.2) % $ 15.7 9.6 % ENI Operating Margin(2) 42.0 % 47.7 % (570) bps 39.3 % 270 bps Adjusted EBITDA $m $ 17.3 $ 25.1 (31.1) % $ 15.8 9.5 % Segment Performance - Liquid Alpha(4) (3) Revenue-Weighted Equal-Weighted Asset-Weighted 100% 100% 100% 50% 50% 79% 77% 65% 80% 47% 54% 54% 21% 26% 0% 0% 0% 3-Year 5-Year 10-Year 3-Year 5-Year 10-Year 3-Year 5-Year 10-Year Q2'20 41% 44% 83% Q2'20 52% 57% 81% Q2'20 48% 52% 85% Q3'19 59% 48% 79% Q3'19 66% 61% 81% Q3'19 60% 48% 73% ___________________________________________________________ Please see Definitions and Additional Notes (1) Pro forma ENI management fee rate of 38 bps, 38 bps, and 40 bps as of September 30, 2020, September 30, 2019, and June 30, 2020, respectively. Pro forma for the divestiture of Barrow Hanley and Copper Rock. (2) Pro forma ENI Operating Margin of 49.2%, 50.7%, and 45.5% as of September 30, 2020, September 30, 2019, and June 30, 2020, respectively. Pro forma for the divestiture of Barrow Hanley and Copper Rock. (3) As of September 30, 2020 Liquid Alpha assets representing 40% of revenue were outperforming benchmarks on a 1- year basis, compared to 39% at June 30, 2020 and 35% at September 30, 2019. (4) As of September 30, 2020 pro forma Liquid Alpha assets representing 62%, 41%, 19%, and 93% of revenue were outperforming benchmarks on a 1-, 3-, 5-, and 10- year basis, respectively. Pro forma for the divestiture of Barrow Hanley and Copper Rock. 13

Net Client Cash Flows Breakdown AUM Net Client Cash Flows (“NCCF”)(1) Revenue Impact of NCCF(1)(2) $b 42.9 $m $2 $14 $12 38.8 $6.0 $1.1 38 $10 $1 $6.0 30 $8 $0.1 $6 72 $0.7 72 $0.7 $4 $0 $6.5 $2 $4.5 $0 $-2 $-1 37 $(2.3) $(2.3) 37 $-4 $-6 $(11.0) $(11.0) $-2 $-8 $-10 $-12 $-3 Q3 2020 Pro forma excluding Q3 2020 Pro forma excluding (5) (5) Revenue BHMS and CRC BHMS and CRC Impact as a % of BOP Run (0.1)% 0.2% Rate Total $(1.5) $(0.5) Management NCCF Fees(4) Q3 2020 (3) Bps inflows 42 Quant & Solutions Alternatives Liquid Alpha Avg. Fee Rate (bps) Bps outflows 34 __________________________________________________________ (1) NCCF and revenue impact of NCCF for all periods includes reinvested income and distributions, and excludes realizations (please see Definitions and Additional Notes). (2) Annualized revenue impact of net flows represents annualized management fees expected to be earned on new accounts and net assets contributed to existing accounts (inflows), less the annualized management fees lost on terminated accounts or net assets withdrawn from existing accounts (outflows), plus revenue impact from reinvested income and distribution. Annualized management fee for client flow is calculated by multiplying the annual gross fee rate for the relevant account with the inflow or the outflow, including equity-accounted Affiliates. In addition, reinvested income and distribution for each segment is multiplied by average fee rate for the respective segment to compute the revenue impact. (3) Average fee rate represents the average blended fee rate on assets for each segment for the three months ended September 30, 2020. (4) Percentage is equal to the annual revenue impact of NCCF divided by run rate management fees based on beginning of year AUM. (5) BrightSphere has announced divestiture of Barrow Hanley and Copper Rock. 14

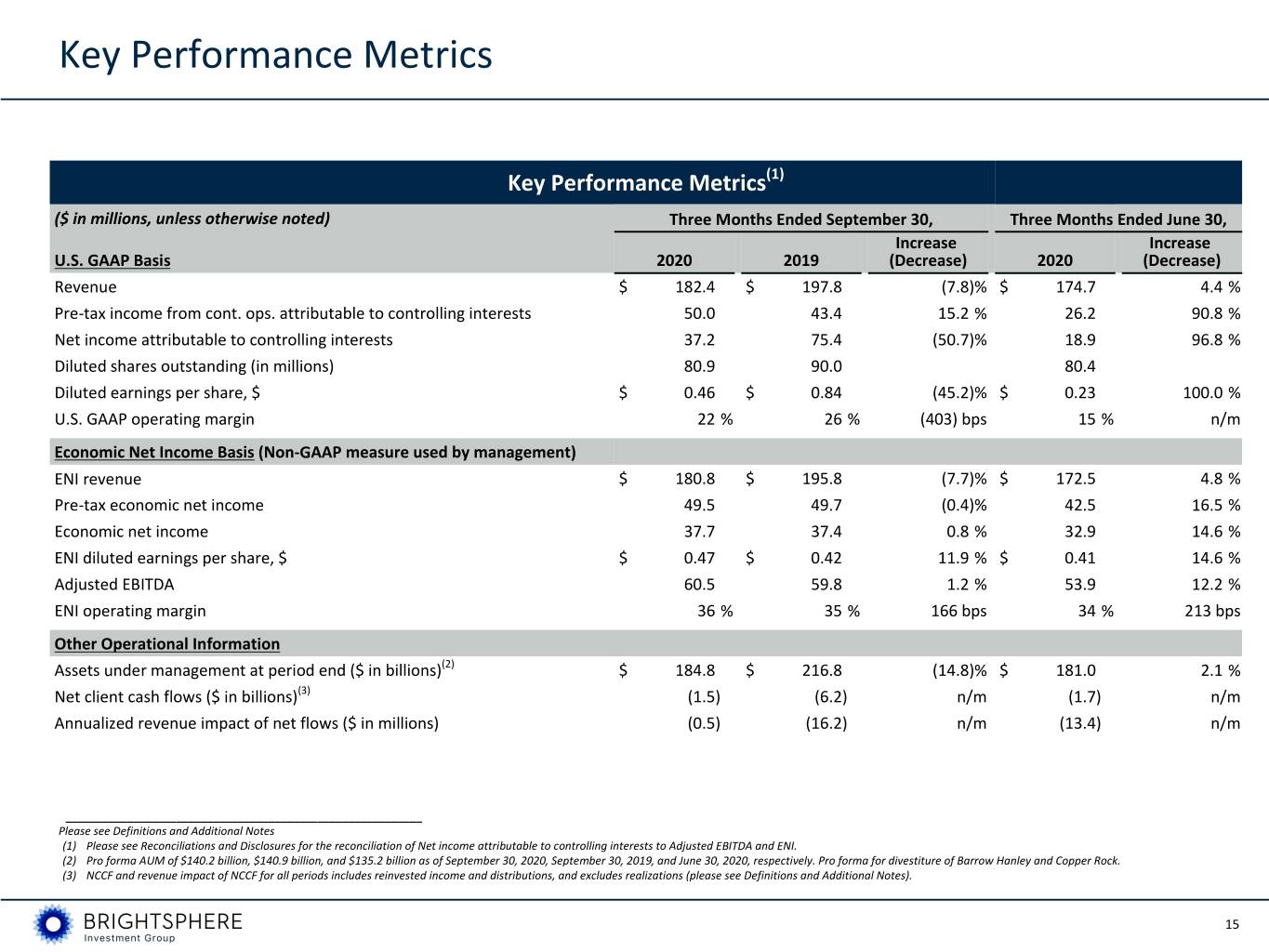

Key Performance Metrics Key Performance Metrics(1) ($ in millions, unless otherwise noted) Three Months Ended September 30, Three Months Ended June 30, Increase Increase U.S. GAAP Basis 2020 2019 (Decrease) 2020 (Decrease) Revenue $ 182.4 $ 197.8 (7.8) % $ 174.7 4.4 % Pre-tax income from cont. ops. attributable to controlling interests 50.0 43.4 15.2 % 26.2 90.8 % Net income attributable to controlling interests 37.2 75.4 (50.7) % 18.9 96.8 % Diluted shares outstanding (in millions) 80.9 90.0 80.4 Diluted earnings per share, $ $ 0.46 $ 0.84 (45.2) % $ 0.23 100.0 % U.S. GAAP operating margin 22 % 26 % (403) bps 15 % n/m Economic Net Income Basis (Non-GAAP measure used by management) ENI revenue $ 180.8 $ 195.8 (7.7) % $ 172.5 4.8 % Pre-tax economic net income 49.5 49.7 (0.4) % 42.5 16.5 % Economic net income 37.7 37.4 0.8 % 32.9 14.6 % ENI diluted earnings per share, $ $ 0.47 $ 0.42 11.9 % $ 0.41 14.6 % Adjusted EBITDA 60.5 59.8 1.2 % 53.9 12.2 % ENI operating margin 36 % 35 % 166 bps 34 % 213 bps Other Operational Information Assets under management at period end ($ in billions)(2) $ 184.8 $ 216.8 (14.8) % $ 181.0 2.1 % Net client cash flows ($ in billions)(3) (1.5) (6.2) n/m (1.7) n/m Annualized revenue impact of net flows ($ in millions) (0.5) (16.2) n/m (13.4) n/m __________________________________________________________ Please see Definitions and Additional Notes (1) Please see Reconciliations and Disclosures for the reconciliation of Net income attributable to controlling interests to Adjusted EBITDA and ENI. (2) Pro forma AUM of $140.2 billion, $140.9 billion, and $135.2 billion as of September 30, 2020, September 30, 2019, and June 30, 2020, respectively. Pro forma for divestiture of Barrow Hanley and Copper Rock. (3) NCCF and revenue impact of NCCF for all periods includes reinvested income and distributions, and excludes realizations (please see Definitions and Additional Notes). 15

ENI Revenue Commentary • ENI Revenue includes management fees, performance fees, and our share of earnings from equity-accounted Affiliates • Q3'20 ENI revenue of $180.8 million decreased from Q3'19 by (7.7)% primarily due to a decrease in management fees • Management fees decreased (9.3)% from Q3'19 primarily due to a decrease in average AUM driven by equity market decline and the $(22.8) billion of Vanguard-related reallocations in Q4’19 ENI Revenue ($M) Three Months Ended September 30, Three Months Ended June 30, Increase Increase 2020 2019 (Decrease) 2020 (Decrease) Management fees $ 178.2 $ 196.4 (9.3)% $ 170.7 4.4% Performance fees 1.2 (1.9) n/m 0.3 300.0% Other income, including equity-accounted Affiliates 1.4 1.3 7.7% 1.5 (6.7)% ENI revenue $ 180.8 $ 195.8 (7.7)% $ 172.5 4.8% ___________________________________________________________ Please see Definitions and Additional Notes 16

ENI Operating Expenses Commentary • Total ENI operating expenses reflect Affiliate operating expenses and Center expenses (excluding variable compensation) • ENI Operating expenses reduced to $73.8 million in Q3'20 from $83.7 million in Q3’19 reflecting expense discipline and Center restructuring, while Q3'20 Operating Expense Ratio(1) decreased to 41.4% for the period due to lower expenses • Full-year Operating Expense Ratio(1) expected to be in the range of 43-46% if the equity market remains at the same level; ratio is subject to fluctuations as assets and ENI management fees change (3) ◦ Pro Forma full-year Operating Expense Ratio is also expected to be in the range of 43-46% ◦ Ratio expected to trend down once the annual savings from Center restructuring is fully realized by Q1’21 ENI Operating Expenses Three Months Ended September 30, Three Months Ended June 30, ($M) 2020 2019 2020 Increase Increase $M % of MFs(2) $M % of MFs(2) (Decrease) $M % of MFs(2) (Decrease) Fixed compensation and benefits $ 42.8 24.0 % $ 46.7 23.8 % (8)% $ 42.8 25.1 % —% G&A expenses (excl. sales-based compensation) 23.8 13.4 % 29.9 15.2 % (20)% 24.0 14.1 % (1)% Depreciation and amortization 5.2 2.9 % 4.4 2.2 % 18% 5.1 3.0 % 2% Core operating expense subtotal $ 71.8 40.3 % $ 81.0 41.2 % (11)% $ 71.9 42.1 % —% Sales-based compensation 2.0 1.1 % 2.7 1.4 % (26)% 2.1 1.2 % (5)% Total ENI operating expenses $ 73.8 41.4 % $ 83.7 42.6 % (12)% $ 74.0 43.4 % —% Note: ENI Management fees $ 178.2 $ 196.4 (9)% $ 170.7 4% __________________________________________________________ Please see Definitions and Additional Notes (1) Operating Expense Ratio reflects total ENI operating expenses as a percent of management fees. (2) Represents reported ENI management fee revenue. (3) Pro forma for divestiture of Barrow Hanley and Copper Rock. 17

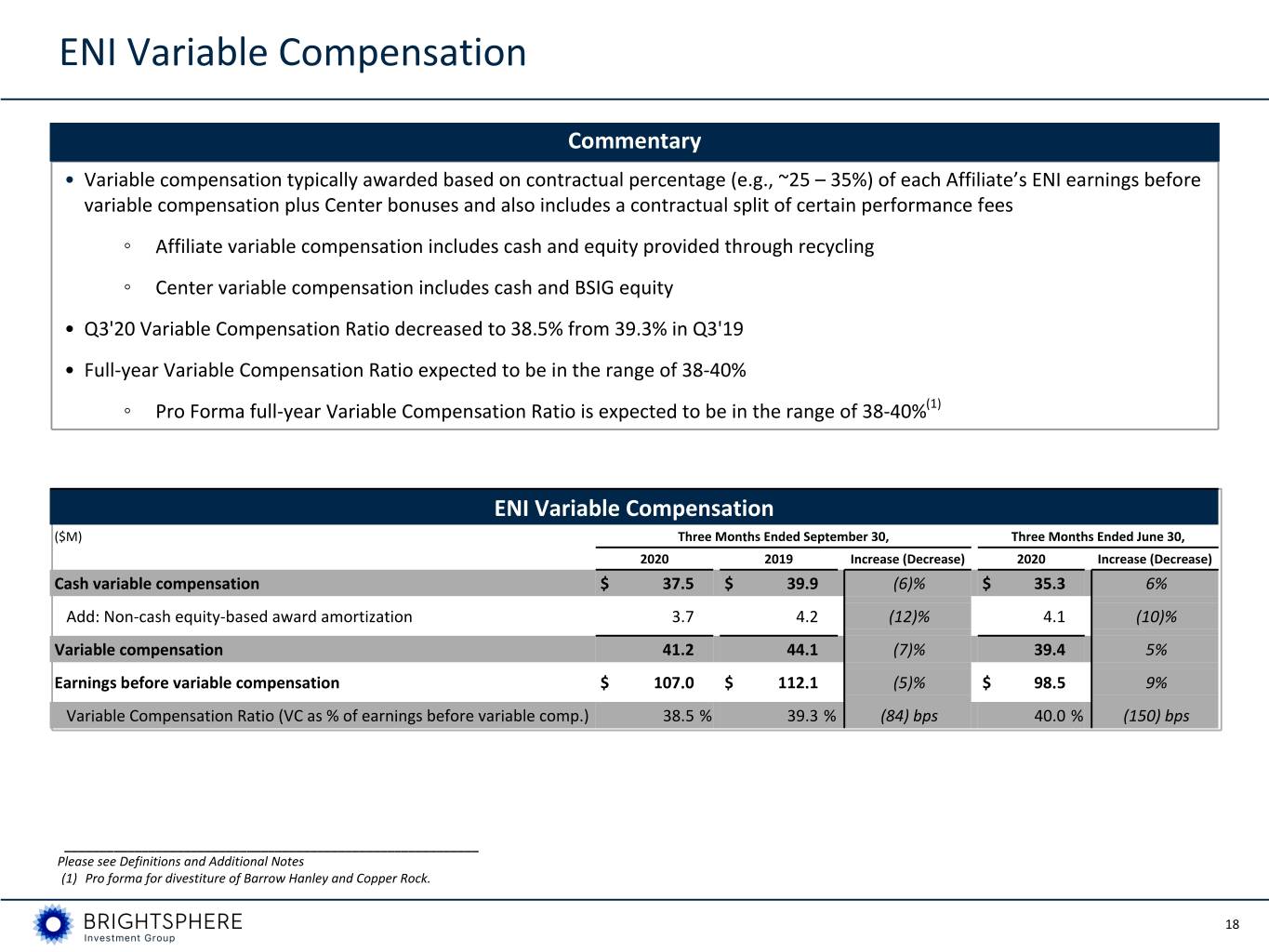

ENI Variable Compensation Commentary • Variable compensation typically awarded based on contractual percentage (e.g., ~25 – 35%) of each Affiliate’s ENI earnings before variable compensation plus Center bonuses and also includes a contractual split of certain performance fees ◦ Affiliate variable compensation includes cash and equity provided through recycling ◦ Center variable compensation includes cash and BSIG equity • Q3'20 Variable Compensation Ratio decreased to 38.5% from 39.3% in Q3'19 • Full-year Variable Compensation Ratio expected to be in the range of 38-40% (1) ◦ Pro Forma full-year Variable Compensation Ratio is expected to be in the range of 38-40% ENI Variable Compensation ($M) Three Months Ended September 30, Three Months Ended June 30, 2020 2019 Increase (Decrease) 2020 Increase (Decrease) Cash variable compensation $ 37.5 $ 39.9 (6)% $ 35.3 6% Add: Non-cash equity-based award amortization 3.7 4.2 (12)% 4.1 (10)% Variable compensation 41.2 44.1 (7)% 39.4 5% Earnings before variable compensation $ 107.0 $ 112.1 (5)% $ 98.5 9% Variable Compensation Ratio (VC as % of earnings before variable comp.) 38.5 % 39.3 % (84) bps 40.0 % (150) bps ___________________________________________________________ Please see Definitions and Additional Notes (1) Pro forma for divestiture of Barrow Hanley and Copper Rock. 18

Affiliate Key Employee Distributions Commentary • Represents employees’ share of profit from their respective Affiliate, in some cases following an initial preference to BSIG(1) • Q3'20 Distribution Ratio of 16.7% lower than Q3'19 mainly due to the change in mix of earnings • Full-year Distribution Ratio expected to be in the range of 17-18%; mix of Affiliate earnings will have significant impact to the ratio (2) ◦ Pro Forma full-year Distribution Ratio is expected to be in the range of 19-20% Affiliate Key Employee Distributions Three Months Ended September 30, Three Months Ended June 30, ($M) Increase Increase 2020 2019 (Decrease) 2020 (Decrease) A Earnings after variable compensation (ENI operating earnings) $ 65.8 $ 68.0 (3)% $ 59.1 11% B Less: Affiliate key employee distributions (11.0) (12.6) (13)% (11.0) —% Earnings after Affiliate key employee distributions $ 54.8 $ 55.4 (1)% $ 48.1 14% Affiliate Key Employee Distribution Ratio ( / )B A 16.7 % 18.5 % (181) bps 18.6 % (190) bps __________________________________________________________ Please see Definitions and Additional Notes (1) For consolidated Affiliates. (2) Pro forma for divestiture of Barrow Hanley and Copper Rock. 19

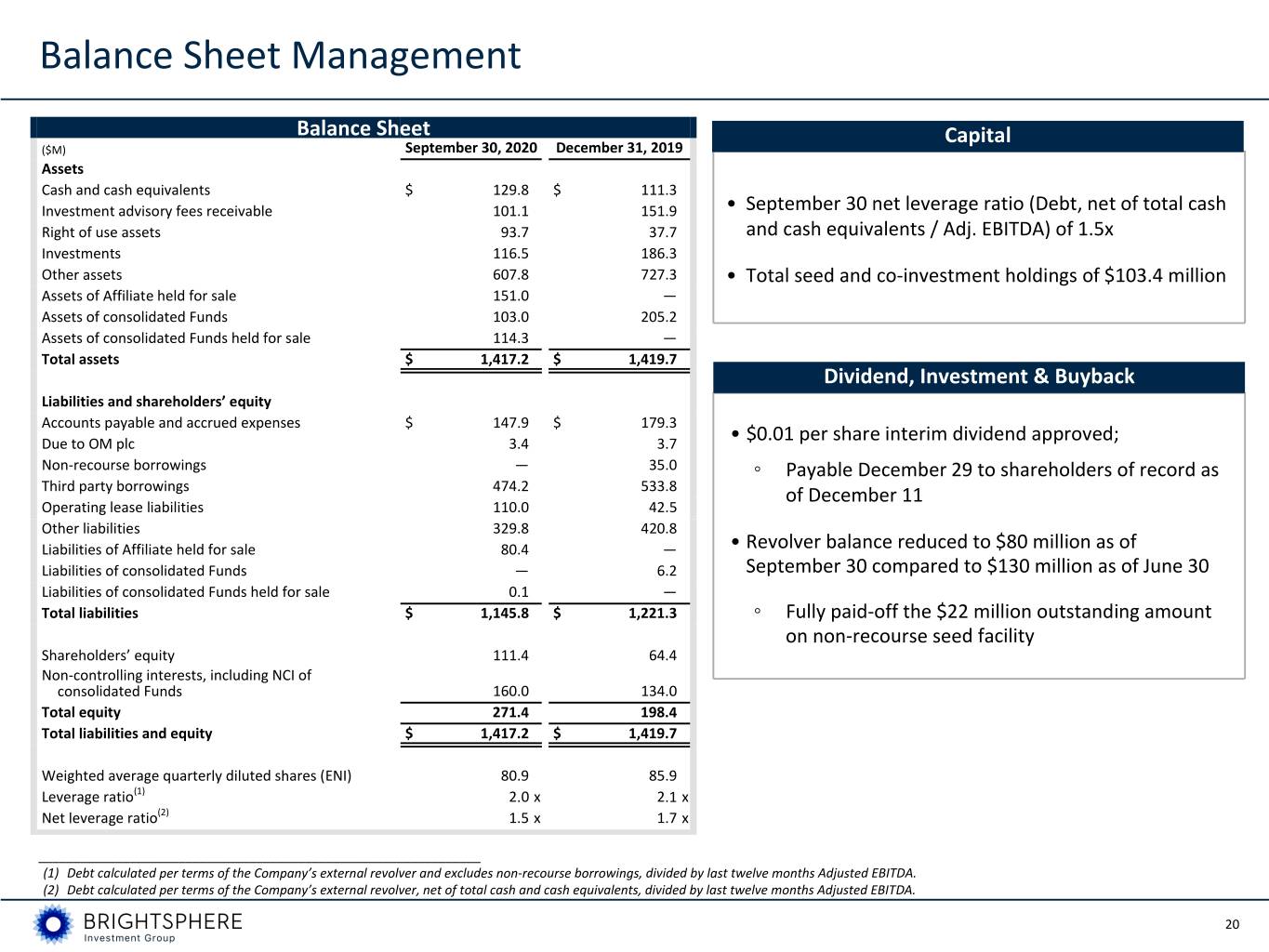

Balance Sheet Management Balance Sheet Capital ($M) September 30, 2020 December 31, 2019 Assets Cash and cash equivalents $ 129.8 $ 111.3 Investment advisory fees receivable 101.1 151.9 • September 30 net leverage ratio (Debt, net of total cash Right of use assets 93.7 37.7 and cash equivalents / Adj. EBITDA) of 1.5x Investments 116.5 186.3 Other assets 607.8 727.3 • Total seed and co-investment holdings of $103.4 million Assets of Affiliate held for sale 151.0 — Assets of consolidated Funds 103.0 205.2 Assets of consolidated Funds held for sale 114.3 — Total assets $ 1,417.2 $ 1,419.7 Dividend, Investment & Buyback Liabilities and shareholders’ equity Accounts payable and accrued expenses $ 147.9 $ 179.3 Due to OM plc 3.4 3.7 • $0.01 per share interim dividend approved; Non-recourse borrowings — 35.0 ◦ Payable December 29 to shareholders of record as Third party borrowings 474.2 533.8 of December 11 Operating lease liabilities 110.0 42.5 Other liabilities 329.8 420.8 Liabilities of Affiliate held for sale 80.4 — • Revolver balance reduced to $80 million as of Liabilities of consolidated Funds — 6.2 September 30 compared to $130 million as of June 30 Liabilities of consolidated Funds held for sale 0.1 — Total liabilities $ 1,145.8 $ 1,221.3 ◦ Fully paid-off the $22 million outstanding amount on non-recourse seed facility Shareholders’ equity 111.4 64.4 Non-controlling interests, including NCI of consolidated Funds 160.0 134.0 Total equity 271.4 198.4 Total liabilities and equity $ 1,417.2 $ 1,419.7 Weighted average quarterly diluted shares (ENI) 80.9 85.9 Leverage ratio(1) 2.0 x 2.1 x Net leverage ratio(2) 1.5 x 1.7 x _______________________________________________________________ (1) Debt calculated per terms of the Company’s external revolver and excludes non-recourse borrowings, divided by last twelve months Adjusted EBITDA. (2) Debt calculated per terms of the Company’s external revolver, net of total cash and cash equivalents, divided by last twelve months Adjusted EBITDA. 20

Supplemental Information 21

Segment Information for Q3'20 and Q3'19 Three Months Ended September 30, 2020 Three Months Ended September 30, 2019 Quant & Reconciling Total U.S. Quant & Reconciling Total U.S. ($ in millions, unless otherwise noted) Solutions Alternatives Liquid Alpha Other Items(1) GAAP (3) Solutions Alternatives Liquid Alpha Other Items(1) GAAP (3) ENI Revenue $ 89.0 $ 43.8 $ 47.9 $ 0.1 $ 1.6 $ 182.4 $ 93.1 $ 37.4 $ 65.2 $ 0.1 $ 2.0 $ 197.8 ENI Operating Expenses 37.2 15.3 15.5 5.8 12.6 86.4 40.8 16.1 18.5 8.3 5.5 89.2 Earnings before variable compensation 51.8 28.5 32.4 (5.7) (11.0) 96.0 52.3 21.3 46.7 (8.2) (3.5) 108.6 Variable compensation 18.0 10.1 12.3 0.8 3.3 44.5 18.8 7.8 15.6 1.9 — 44.1 Earnings after variable compensation 33.8 18.4 20.1 (6.5) (14.3) 51.5 33.5 13.5 31.1 (10.1) (3.5) 64.5 Affiliate key employee distributions 0.8 7.3 2.9 — — 11.0 1.5 5.0 6.1 — — 12.6 Earnings after Affiliate key employee distributions 33.0 11.1 17.2 (6.5) (14.3) 40.5 32.0 8.5 25.0 (10.1) (3.5) 51.9 Net interest income (expense) — — — (5.3) (1.6) (6.9) — — — (5.7) (2.2) (7.9) Net investment income (loss) — — — — 6.0 6.0 — — — — 7.0 7.0 Gain on sale of Affiliate — — — — 7.2 7.2 — — — — — — Net (income) loss attributable to non- controlling interest — — — — 3.2 3.2 — — — — (7.6) (7.6) Income tax (expense) benefit — — — (11.8) (1.0) (12.8) — — — (12.3) 44.3 32.0 Economic Net Income $ 33.0 $ 11.1 $ 17.2 $ (23.6) $ (0.5) $ 37.2 $ 32.0 $ 8.5 $ 25.0 $ (28.1) $ 38.0 $ 75.4 Adjusted EBITDA(2) $ 37.4 $ 11.6 $ 17.3 $ (5.8) $ (23.3) $ 37.2 $ 35.9 $ 8.8 $ 25.1 $ (10.0) $ 15.6 $ 75.4 Segment Assets Under Management ($b) $ 95.4 $ 23.9 $ 65.5 $ — $ — $ 184.8 $ 95.5 $ 23.2 $ 98.1 $ — $ — $ 216.8 __________________________________________________________ Please see Definitions and Additional Notes (1) For further information and additional reconciliations between GAAP and non-GAAP measures, refer to the Reconciliations and Disclosures section of this presentation and the Company’s Quarterly Report on Form 10-Q. (2) Please see Reconciliations and Disclosures for the reconciliation of net income attributable to controlling interests to Adjusted EBITDA and ENI. (3) Represents U.S. GAAP equivalent of non-GAAP segment information presented. The most directly comparable U.S. GAAP measure of ENI revenue is U.S. GAAP revenue. The most directly comparable U.S. GAAP measure of ENI operating expenses is U.S. GAAP operating expenses, which is comprised of Operating expenses, Variable compensation and Affiliate key employee distributions above. The most directly comparable U.S. GAAP measure of Earnings after Affiliate key employee distributions is U.S. GAAP Operating Income. The U.S. GAAP equivalent of Economic Net Income is U.S. GAAP Net Income attributable to controlling interests. The U.S. GAAP equivalent of Adjusted EBITDA is U.S. GAAP Net Income attributable to controlling interests. 22

Segment Information for Q2'20 Three Months Ended June 30, 2020 Reconciling (1) ($ in millions, unless otherwise noted) Quant & Solutions Alternatives Liquid Alpha Other Items Total U.S. GAAP (3) ENI Revenue $ 82.8 $ 42.5 $ 47.1 $ 0.1 $ 2.2 $ 174.7 ENI Operating Expenses 35.0 15.7 17.4 5.9 16.4 90.4 Earnings before variable compensation 47.8 26.8 29.7 (5.8) (14.2) 84.3 Variable compensation 17.7 9.7 11.2 0.8 7.7 47.1 Earnings after variable compensation 30.1 17.1 18.5 (6.6) (21.9) 37.2 Affiliate key employee distributions 1.3 6.9 2.8 — — 11.0 Earnings after Affiliate key employee distributions 28.8 10.2 15.7 (6.6) (21.9) 26.2 Net interest income (expense) — — — (5.6) (1.6) (7.2) Net investment income (loss) — — — — 42.2 42.2 Net (income) loss attributable to non-controlling interest — — — — (35.0) (35.0) Income tax (expense) benefit — — — (9.6) 2.3 (7.3) Economic Net Income $ 28.8 $ 10.2 $ 15.7 $ (21.8) $ (14.0) $ 18.9 Adjusted EBITDA(2) $ 33.4 $ 10.5 $ 15.8 $ (5.8) $ (35.0) $ 18.9 Segment Assets Under Management ($b) $ 92.0 $ 24.1 $ 64.9 $ — $ — $ 181.0 __________________________________________________________ Please see Definitions and Additional Notes (1) For further information and additional reconciliations between GAAP and non-GAAP measures, refer to the Reconciliations and Disclosures section of this presentation and the Company’s Quarterly Report on Form 10-Q. (2) Please see Reconciliations and Disclosures for the reconciliation of net income attributable to controlling interests to Adjusted EBITDA and ENI. (3) Represents U.S. GAAP equivalent of non-GAAP segment information presented. The most directly comparable U.S. GAAP measure of ENI revenue is U.S. GAAP revenue. The most directly comparable U.S. GAAP measure of ENI operating expenses is U.S. GAAP operating expenses, which is comprised of Operating expenses, Variable compensation and Affiliate key employee distributions above. The most directly comparable U.S. GAAP measure of Earnings after Affiliate key employee distributions is U.S. GAAP Operating Income. The U.S. GAAP equivalent of Economic Net Income is U.S. GAAP Net Income attributable to controlling interests. The U.S. GAAP equivalent of Adjusted EBITDA is U.S. GAAP Net Income attributable to controlling interests. 23

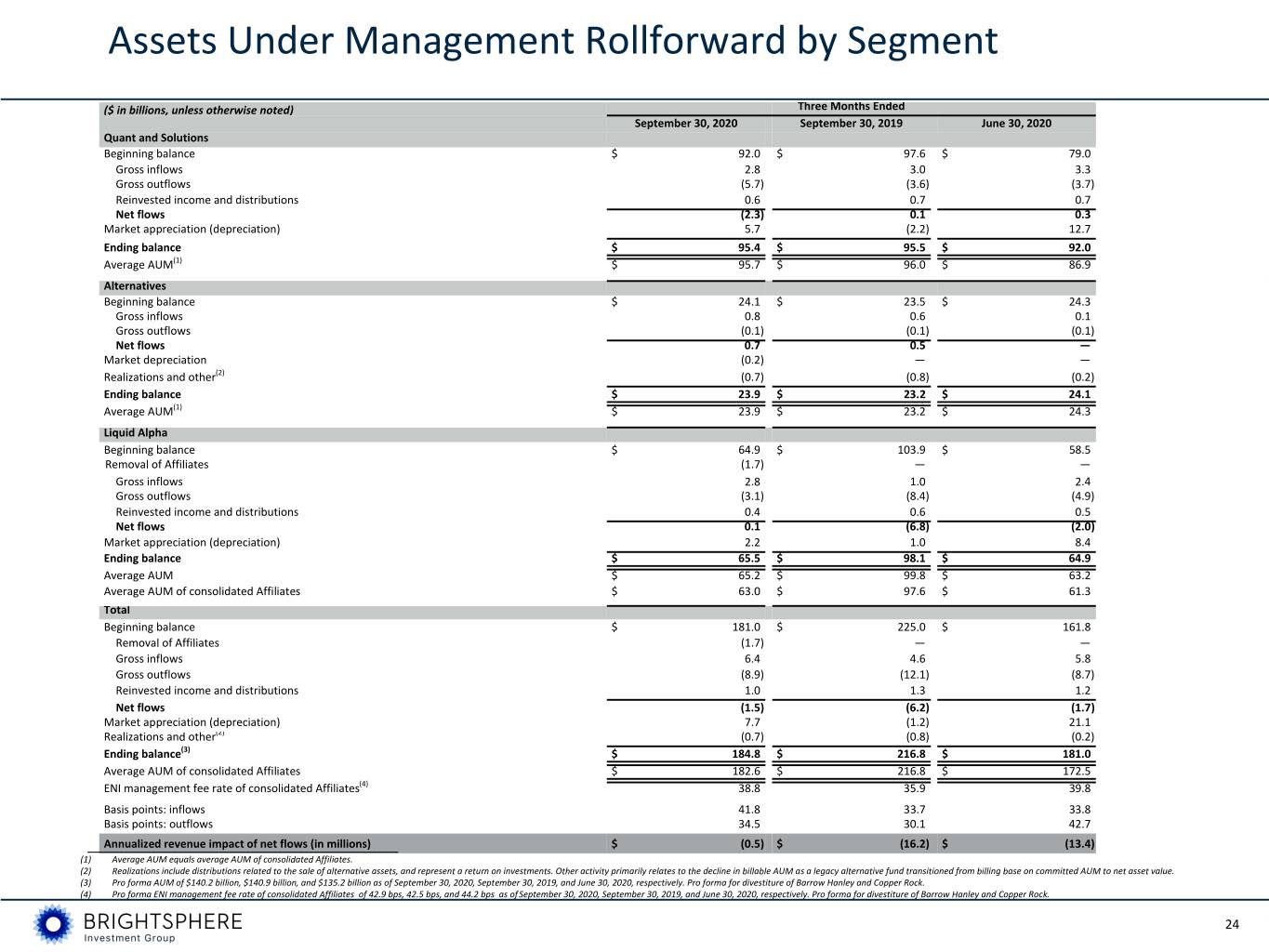

Assets Under Management Rollforward by Segment ($ in billions, unless otherwise noted) Three Months Ended September 30, 2020 September 30, 2019 June 30, 2020 Quant and Solutions Beginning balance $ 92.0 $ 97.6 $ 79.0 Gross inflows 2.8 3.0 3.3 Gross outflows (5.7) (3.6) (3.7) Reinvested income and distributions 0.6 0.7 0.7 Net flows (2.3) 0.1 0.3 Market appreciation (depreciation) 5.7 (2.2) 12.7 Ending balance $ 95.4 $ 95.5 $ 92.0 Average AUM(1) $ 95.7 $ 96.0 $ 86.9 Alternatives Beginning balance $ 24.1 $ 23.5 $ 24.3 Gross inflows 0.8 0.6 0.1 Gross outflows (0.1) (0.1) (0.1) Net flows 0.7 0.5 — Market depreciation (0.2) — — Realizations and other(2) (0.7) (0.8) (0.2) Ending balance $ 23.9 $ 23.2 $ 24.1 Average AUM(1) $ 23.9 $ 23.2 $ 24.3 Liquid Alpha Beginning balance $ 64.9 $ 103.9 $ 58.5 Removal of Affiliates (1.7) — — Gross inflows 2.8 1.0 2.4 Gross outflows (3.1) (8.4) (4.9) Reinvested income and distributions 0.4 0.6 0.5 Net flows 0.1 (6.8) (2.0) Market appreciation (depreciation) 2.2 1.0 8.4 Ending balance $ 65.5 $ 98.1 $ 64.9 Average AUM $ 65.2 $ 99.8 $ 63.2 Average AUM of consolidated Affiliates $ 63.0 $ 97.6 $ 61.3 Total Beginning balance $ 181.0 $ 225.0 $ 161.8 Removal of Affiliates (1.7) — — Gross inflows 6.4 4.6 5.8 Gross outflows (8.9) (12.1) (8.7) Reinvested income and distributions 1.0 1.3 1.2 Net flows (1.5) (6.2) (1.7) Market appreciation (depreciation) 7.7 (1.2) 21.1 Realizations and other(2) (0.7) (0.8) (0.2) Ending balance(3) $ 184.8 $ 216.8 $ 181.0 Average AUM of consolidated Affiliates $ 182.6 $ 216.8 $ 172.5 ENI management fee rate of consolidated Affiliates(4) 38.8 35.9 39.8 Basis points: inflows 41.8 33.7 33.8 Basis points: outflows 34.5 30.1 42.7 ___________________________________________________________Annualized revenue impact of net flows (in millions) $ (0.5) $ (16.2) $ (13.4) (1) Average AUM equals average AUM of consolidated Affiliates. (2) Realizations include distributions related to the sale of alternative assets, and represent a return on investments. Other activity primarily relates to the decline in billable AUM as a legacy alternative fund transitioned from billing base on committed AUM to net asset value. (3) Pro forma AUM of $140.2 billion, $140.9 billion, and $135.2 billion as of September 30, 2020, September 30, 2019, and June 30, 2020, respectively. Pro forma for divestiture of Barrow Hanley and Copper Rock. (4) Pro forma ENI management fee rate of consolidated Affiliates of 42.9 bps, 42.5 bps, and 44.2 bps as of September 30, 2020, September 30, 2019, and June 30, 2020, respectively. Pro forma for divestiture of Barrow Hanley and Copper Rock. 24

Reconciliations and Disclosures 25

Reconciliations from U.S. GAAP to Non-GAAP Measures(1) Three Months Ended ENI Adjustments ($ in millions) September 30, September 30, June 30, 2020 2019 2020 1i. Exclude non-cash expenses representing changes in the value of Affiliate equity and U.S. GAAP net income attributable to controlling interests $ 37.2 $ 75.4 $ 18.9 profit interests held by Affiliate key employees Adjustments to reflect the economic earnings of the Company: 2ii. Exclude non-cash amortization or impairment Non-cash key employee-owned equity and profit interest expenses related to acquired goodwill and 1 (2) revaluations 6.6 (14.7) 10.9 other intangibles, as well as the amortization of the value of employee equity owned prior Goodwill impairment and amortization of acquired intangible assets 2 (2) to acquisitions. Please note that the and pre-acquisition employee equity 3.2 17.2 3.7 revaluations related to these acquisition- 3 Capital transaction costs(2) 0.1 0.9 0.3 related items are included in (1) above 3iii.Exclude capital transaction costs including the 4 Seed/Co-investment (gains) losses and financings(2) (8.2) 1.9 (6.7) costs of raising debt or equity, gains or losses realized as a result of redeeming debt or 5 Tax benefit of goodwill and acquired intangible deductions 2.2 2.4 2.3 equity and direct incremental costs Discontinued operations, restructuring and the impact of a one-time associated with acquisitions of businesses or 6 compensation arrangement that includes advances against future assets (2)(3) compensation payments (2.2) 1.0 8.1 4iv.Exclude gains/losses on seed capital and co- investments, as well as related financing Total adjustment to reflect earnings of the Company $ 1.7 $ 8.7 $ 18.6 costs 7 Tax effect of above adjustments(2) 0.1 (1.8) (4.4) 5v. Include cash tax benefits related to tax amortization of acquired intangibles ENI tax normalization (1.3) (44.9) (0.2) 6vi.Exclude results of discontinued operations as Economic net income $ 37.7 $ 37.4 $ 32.9 they are not part of the ongoing business, ENI net interest expense to third parties 5.3 5.7 5.6 restructuring costs incurred in continuing operations and the impact of a one-time Depreciation and amortization(4) 5.7 4.4 5.8 compensation arrangement entered into that Tax on Economic Net Income 11.8 12.3 9.6 includes advances against future Adjusted EBITDA $ 60.5 $ 59.8 $ 53.9 compensation payments 7 ___________________________________________________________ vii. Exclude one-off tax benefits or costs Please see Definitions and Additional Notes unrelated to current operations (1) For further information and additional reconciliations between U.S. GAAP and non-GAAP measures, see the Company’s Quarterly Report on Form 10-Q. (2) Tax-affected items for which adjustments are included in “Tax effect of above adjustments” line, excluding the discontinued operations component of item 6; taxed at 27.3% U.S. statutory rate (including state tax). (3) The three months ended September 30, 2020 includes restructuring at the Center and Affiliates of $1.4 million, costs associated with the transfer of an insurance policy from our former Parent of $0.4 million, $3.2 million relating to the impact of a one-time compensation arrangement entered into that includes advances against future compensation payments, and the gain on sale of Copper Rock of $7.2 million. The three months ended September 30, 2019 includes restructuring costs at the Center of $0.1 million, and costs associated with the redomicile to the U.S. of $0.9 million. The three months ended June 30, 2020 includes restructuring costs at the Center and Affiliates of $3.0 million, costs associated with the transfer of an insurance policy from our former Parent of $0.3 million, and $4.7 million relating to the impact of a one-time compensation arrangement entered into that includes advances against future compensation payments. (4) The three months ended September 30, 2020 and June 30, 2020 includes non-cash equity-based award amortization expense. 26

Reconciliations from U.S. GAAP to Non-GAAP Measures(1) (cont.) Reconciliation of per-share U.S. GAAP Net Income to Economic Net Income ($) Three Months Ended September 30, September 30, June 30, 2020 2019 2020 U.S. GAAP net income per share $ 0.46 $ 0.84 $ 0.23 Adjustments to reflect the economic earnings of the Company: i. Non-cash key employee-owned equity and profit interest revaluations 0.08 (0.16) 0.14 ii. Goodwill impairment and amortization of acquired intangible assets and pre- acquisition employee equity 0.04 0.19 0.05 iii. Capital transaction costs — 0.01 — iv. Seed/Co-investment (gains) losses and financing (0.10) 0.02 (0.08) v. Tax benefit of goodwill and acquired intangibles deductions 0.04 0.03 0.03 vi. Discontinued operations, restructuring and the impact of a one-time compensation arrangement that includes advances against future compensation payments(2) (0.03) 0.01 0.10 vii. ENI tax normalization (0.02) (0.50) — Tax effect of above adjustments, as applicable — (0.02) (0.06) Economic net income per share $ 0.47 $ 0.42 $ 0.41 Reconciliation of U.S. GAAP Revenue to ENI Revenue ($ in millions) Three Months Ended September 30, September 30, June 30, 2020 2019 2020 U.S. GAAP revenue $ 182.4 $ 197.8 $ 174.7 Include investment return on equity-accounted Affiliates 0.9 0.8 0.6 Exclude revenue from consolidated Funds (1.4) (1.9) (1.7) Exclude fixed compensation reimbursed by customers (1.1) (0.9) (1.1) ENI revenue $ 180.8 $ 195.8 $ 172.5 ___________________________________________________________ Please see Definitions and Additional Notes (1) For further information and additional reconciliations between U.S. GAAP and non-GAAP measures, see the Company’s Quarterly Report on Form 10-Q. (2) Item vi. includes an adjustment to exclude $0.09 per share relating to the U.S. GAAP gain on sale of Copper Rock for the three months ended September 30, 2020. 27

Reconciliations from U.S. GAAP to Non-GAAP Measures(1) (cont.) Reconciliation of U.S. GAAP Operating Expense to ENI Operating Expense ($ in millions) Three Months Ended September 30, September 30, June 30, 2020 2019 2020 U.S. GAAP operating expense $ 141.9 $ 145.9 $ 148.5 Less: items excluded from ENI Amortization of pre-acquisition employee equity(2) (1.6) (15.6) (1.8) Non-cash key employee-owned equity and profit interest revaluations (6.6) 14.7 (10.9) Goodwill impairment and amortization of acquired intangible assets (1.6) (1.6) (1.9) Capital transaction costs — (0.9) (0.2) Restructuring costs and the impact of a one-time compensation arrangement that includes advances against future compensation payments(3) (5.0) (1.0) (8.1) Compensation reimbursed by customers (1.1) (0.9) (1.1) Funds’ operating expense — (0.2) (0.1) Less: items segregated out of U.S. GAAP operating expense Variable compensation(4) (41.2) (44.1) (39.4) Affiliate key employee distributions (11.0) (12.6) (11.0) ENI operating expense $ 73.8 $ 83.7 $ 74.0 ___________________________________________________________ Please see Definitions and Additional Notes (1) For further information and additional reconciliations between U.S. GAAP and non-GAAP measures, see the Company’s Quarterly Report on Form 10-Q. (2) Reflects amortization of pre-acquisition equity owned by employees, associated with the Landmark acquisition. Revaluation of the Landmark interests is included in “Non-cash key employee-owned equity and profit interest revaluations” above. (3) The three months ended September 30, 2020 includes restructuring at the Center and Affiliates of $1.4 million, costs associated with the transfer of an insurance policy from our former Parent of $0.4 million, and $3.2 million relating to the impact of a one-time compensation arrangement entered into that includes advances against future compensation payments. The three months ended September 30, 2019 includes restructuring costs at the Center of $0.1 million, and costs associated with the redomicile to the U.S. of $0.9 million. The three months ended June 30, 2020 includes restructuring costs at the Center and Affiliates of $3.0 million, costs associated with the transfer of an insurance policy from our former Parent of $0.3 million, and $4.7 million relating to the impact of a one-time compensation arrangement entered into that includes advances against future compensation payments. (4) Represents ENI variable compensation. For the three months ended September 30, 2020, September 30, 2019, and June 30, 2020, the U.S. GAAP equivalent of variable compensation was $44.5 million, $44.1 million and $47.1 million, respectively. 28

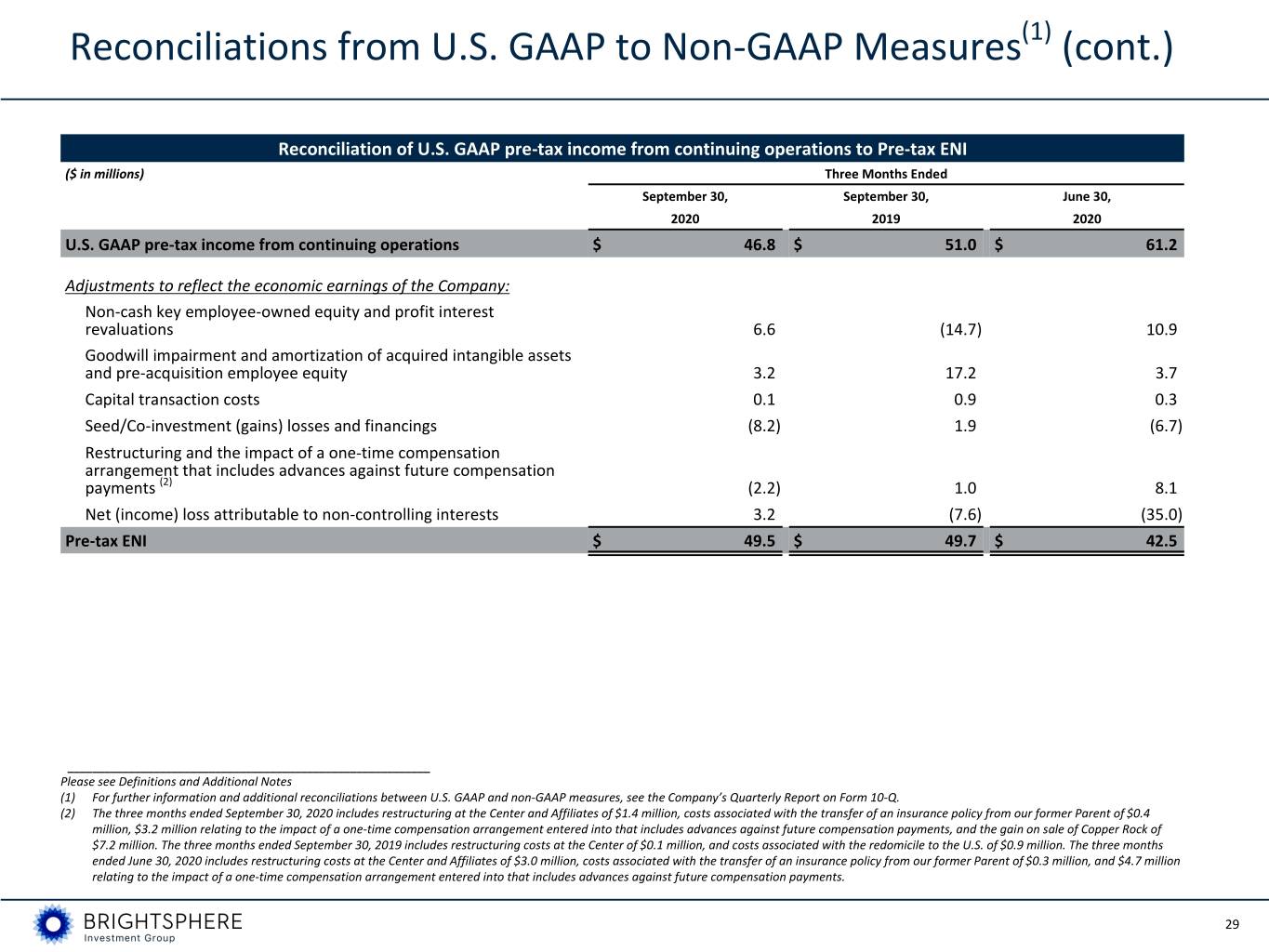

Reconciliations from U.S. GAAP to Non-GAAP Measures(1) (cont.) Reconciliation of U.S. GAAP pre-tax income from continuing operations to Pre-tax ENI ($ in millions) Three Months Ended September 30, September 30, June 30, 2020 2019 2020 U.S. GAAP pre-tax income from continuing operations $ 46.8 $ 51.0 $ 61.2 Adjustments to reflect the economic earnings of the Company: Non-cash key employee-owned equity and profit interest revaluations 6.6 (14.7) 10.9 Goodwill impairment and amortization of acquired intangible assets and pre-acquisition employee equity 3.2 17.2 3.7 Capital transaction costs 0.1 0.9 0.3 Seed/Co-investment (gains) losses and financings (8.2) 1.9 (6.7) Restructuring and the impact of a one-time compensation arrangement that includes advances against future compensation payments (2) (2.2) 1.0 8.1 Net (income) loss attributable to non-controlling interests 3.2 (7.6) (35.0) Pre-tax ENI $ 49.5 $ 49.7 $ 42.5 ___________________________________________________________ Please see Definitions and Additional Notes (1) For further information and additional reconciliations between U.S. GAAP and non-GAAP measures, see the Company’s Quarterly Report on Form 10-Q. (2) The three months ended September 30, 2020 includes restructuring at the Center and Affiliates of $1.4 million, costs associated with the transfer of an insurance policy from our former Parent of $0.4 million, $3.2 million relating to the impact of a one-time compensation arrangement entered into that includes advances against future compensation payments, and the gain on sale of Copper Rock of $7.2 million. The three months ended September 30, 2019 includes restructuring costs at the Center of $0.1 million, and costs associated with the redomicile to the U.S. of $0.9 million. The three months ended June 30, 2020 includes restructuring costs at the Center and Affiliates of $3.0 million, costs associated with the transfer of an insurance policy from our former Parent of $0.3 million, and $4.7 million relating to the impact of a one-time compensation arrangement entered into that includes advances against future compensation payments. 29

Definitions and Additional Notes References to “BrightSphere,” “BSIG” or the “Company” refer to BrightSphere Investment Group Inc.; references to “OM plc” refer to Old Mutual plc, the Company’s former parent; references to “BSUS” or the “Center” refer to the holding company excluding the Affiliates. BrightSphere operates its business through five(1) asset management firms (the “Affiliates”). BrightSphere’s distribution activities are conducted in various jurisdictions through affiliated companies in accordance with local regulatory requirements. The Company uses a non-GAAP performance measure referred to as economic net income (“ENI”) to represent its view of the underlying economic earnings of the business. ENI is used to make resource allocation decisions, determine appropriate levels of investment or dividend payout, manage balance sheet leverage, determine Affiliate variable compensation and equity distributions, and incentivize management. The Company’s ENI adjustments to U.S. GAAP include both reclassifications of U.S. GAAP revenue and expense items, as well as adjustments to U.S. GAAP results, primarily to exclude non-cash, non-economic expenses, or to reflect cash benefits not recognized under U.S. GAAP. In the first quarter of 2020, the Company refined its definition of economic net income in light of a one-time compensation arrangement entered into that includes advances against future compensation payments. The Company re-categorizes certain line items on the income statement to: • exclude the effect of Fund consolidation by removing the portion of Fund revenues, expenses and investment return which is not attributable to its shareholders. • include within management fee revenue any fees paid to Affiliates by consolidated Funds, which are viewed as investment income under U.S. GAAP. • include the Company’s share of earnings from equity-accounted Affiliates within other income, rather than investment income; • treat sales-based compensation as a general and administrative expense, rather than part of fixed compensation and benefits; • identify separately from operating expenses, variable compensation and Affiliate key employee distributions, which represent Affiliate earnings shared with Affiliate key employees; and • net the separate revenues and expenses recorded under U.S. GAAP for certain Fund expenses initially paid by the Company’s Affiliates on the Fund’s behalf and subsequently reimbursed, to better reflect the actual economics of the Company’s business. The Company also makes the following adjustments to U.S. GAAP results to more closely reflect its economic results by: i. excluding non-cash expenses representing changes in the value of Affiliate equity and profit interests held by Affiliate key employees. These ownership interests may in certain circumstances be repurchased by BrightSphere at a value based on a pre-determined fixed multiple of trailing earnings and as such this value is carried on the Company’s balance sheet as a liability. Non-cash movements in the value of this liability are treated as compensation expense under U.S. GAAP. However, any equity or profit interests repurchased by BrightSphere can be used to fund a portion of future variable compensation awards, resulting in savings in cash variable compensation that offset the negative cash effect of repurchasing the equity. ii. excluding non-cash amortization or impairment expenses related to acquired goodwill and other intangibles as these are non-cash charges that do not result in an outflow of tangible economic benefits from the business. It also excludes the amortization of acquisition-related contingent consideration, as well as the value of employee equity owned pre-acquisition, as occurred as a result of the Landmark transaction, where such items have been included in compensation expense as a result of ongoing service requirements for certain employees. Please note that the revaluations related to these acquisition-related items are included in (i) above. iii. excluding capital transaction costs, including the costs of raising debt or equity, gains or losses realized as a result of redeeming debt or equity and direct incremental costs associated with acquisitions of businesses or assets. iv. excluding seed capital and co-investment gains, losses and related financing costs. The net returns on these investments are considered and presented separately from ENI because ENI is primarily a measure of the Company’s earnings from managing client assets, which therefore differs from earnings generated by its investments in Affiliate products, which can be variable from period to period. v. including cash tax benefits associated with deductions allowed for acquired intangibles and goodwill that may not be recognized or have timing differences compared to U.S. GAAP. vi. excluding the results of discontinued operations attributable to controlling interests since they are not part of the Company’s ongoing business, restructuring costs incurred in continuing operations and the impact of a one-time compensation arrangement entered into that includes advances against future compensation payments. vii. excluding deferred tax resulting from changes in tax law and expiration of statutes, adjustments for uncertain tax positions, deferred tax attributable to intangible assets and other unusual items not related to current operating results to reflect ENI tax normalization. __________________________________________________________ (1) In July 2020, BrightSphere completed sale of Copper Rock and announced divestiture of Barrow Hanley expected to close in Q4’20. This figure gives effect to these divestitures. 30

Definitions and Additional Notes ENI earnings before variable compensation ENI earnings before variable compensation is calculated as ENI revenue, less ENI operating expense. ENI variable compensation ratio The ENI variable compensation ratio is calculated as variable compensation divided by ENI earnings before variable compensation. It is used by management and is useful to investors to evaluate consolidated variable compensation as measured against the Company’s ENI earnings before variable compensation. Variable compensation is usually awarded based on a contractual percentage of each Affiliate’s ENI earnings before variable compensation and may be paid in the form of cash or non-cash Affiliate equity or profit interests. Center variable compensation includes cash and BrightSphere equity. Non-cash variable compensation awards typically vest over several years and are recognized as compensation expense over that service period. The variable compensation ratio at each Affiliate will typically be between 25% and 35%. ENI Affiliate key employee distribution ratio The Affiliate key employee distribution ratio is calculated as Affiliate key employee distributions divided by ENI operating earnings. The ENI Affiliate key employee distribution ratio is used by management and is useful to investors to evaluate Affiliate key employee distributions as measured against the Company’s ENI operating earnings. Affiliate key employee distributions represent the share of Affiliate profits after variable compensation that is attributable to Affiliate key employee equity and profit interests holders, according to their ownership interests. At certain Affiliates, BSUS is entitled to an initial preference over profits after variable compensation, structured such that before a preference threshold is reached, there would be no required key employee distributions, whereas for profits above the threshold the key employee distribution amount would be calculated based on the key employee economic percentages, which range from approximately 20% to 40% at its consolidated Affiliates. U.S. GAAP operating margin U.S. GAAP operating margin equals operating income from continuing operations divided by total revenue. Consolidated Funds Financial information presented in accordance with U.S. GAAP may include the results of consolidated pooled investment vehicles, or Funds, managed by the Company’s Affiliates, where it has been determined that these entities are controlled by the Company. Financial results which are “attributable to controlling interests” exclude the impact of Funds to the extent it is not attributable to the Company’s shareholders. Annualized revenue impact of net flows (“NCCF”) Annualized revenue impact of net flows represents annualized management fees expected to be earned on new accounts and net assets contributed to existing accounts (inflows), less the annualized management fees lost on terminated accounts or net assets withdrawn from existing accounts (outflows), plus revenue impact from reinvested income and distribution. Annualized management fee for client flow is calculated by multiplying the annual gross fee rate for the relevant account with the inflow or the outflow, including equity-accounted Affiliates. In addition, reinvested income and distribution for each segment is multiplied by average fee rate for the respective segment to compute the revenue impact. Reinvested income and distributions Net flows include reinvested income and distributions made by BrightSphere’s Affiliates. Reinvested income and distributions represent investment yield not distributed as cash, and reinvested back to the portfolios. Realizations and Other Realizations include distributions related to the sale of alternative assets and represent return on investments. Other activity primarily relates to the decline in billable AUM as a legacy alternative fund transitioned from billing based on committed AUM to net asset value. n/m “Not meaningful.” 31

Definitions and Additional Notes The Company adjusts its income tax expense to reflect any tax impact of its ENI adjustments. Adjusted EBITDA Adjusted EBITDA is defined as economic net income before interest, income taxes, depreciation and amortization. The Company notes that its calculation of Adjusted EBITDA may not be consistent with Adjusted EBITDA as calculated by other companies. The Company believes Adjusted EBITDA is a useful liquidity metric because it indicates the Company’s ability to make further investments in its business, service debt and meet working capital requirements. Refer to the reconciliation of U.S. GAAP net income attributable to controlling interests to ENI and Adjusted EBITDA. Segment ENI Segment ENI represents ENI for each of the Company’s reportable segments, calculated in accordance with the Company’s definition of Economic Net Income, before income tax, interest income and interest expense. Methodologies for calculating investment performance(1): Revenue-weighted investment performance measures the percentage of management fee revenue generated by Affiliate strategies which are beating benchmarks. It calculates each strategy’s percentage weight by taking its estimated composite revenue over total composite revenues in each period, then sums the total percentage of revenue for strategies outperforming. Equal-weighted investment performance measures the percentage of Affiliates’ scale strategies (defined as strategies with greater than $100 million of AUM) beating benchmarks. Each outperforming strategy over $100 million has the same weight; the calculation sums the number of strategies outperforming relative to the total number of composites over $100 million. Asset-weighted investment performance measures the percentage of AUM in strategies beating benchmarks. It calculates each strategy’s percentage weight by taking its composite AUM over total composite AUM in each period, then sums the total percentage of AUM for strategies outperforming. ENI operating earnings ENI operating earnings represents ENI earnings before Affiliate key employee distributions and is calculated as ENI revenue, less ENI operating expense, less ENI variable compensation. It differs from economic net income because it does not include the effects of Affiliate key employee distributions, net interest expense or income tax expense. ENI operating margin The ENI operating margin, which is calculated before Affiliate key employee distributions, is used by management and is useful to investors to evaluate the overall operating margin of the business without regard to the Company’s various ownership levels at each of the Affiliates. ENI operating margin is a non-GAAP efficiency measure, calculated based on ENI operating earnings divided by ENI revenue. The ENI operating margin is most comparable to the Company’s U.S. GAAP operating margin. ENI management fee revenue ENI Management fee revenue corresponds to U.S. GAAP management fee revenue. Net catch-up fees Net catch-up fees represent payment of fund management fees back to the initial closing date for certain products with multiple closings, less placement fees paid to third parties related to these funds. ENI operating expense ratio The ENI operating expense ratio is used by management and is useful to investors to evaluate the level of operating expense as measured against the Company’s recurring management fee revenue. The Company has provided this ratio since many operating expenses, including fixed compensation & benefits and general and administrative expense, are generally linked to the overall size of the business. The Company tracks this ratio as a key measure of scale economies at BrightSphere because in its profit sharing economic model, scale benefits both the Affiliate employees and BrightSphere shareholders. ___________________________________________________________ (1) Liquid Alpha Segment’s Windsor II Large Cap Value account AUM and return are separated from Liquid Alpha’s Large Cap Value composite in revenue-weighted, equal-weighted and asset- weighted outperformance percentage calculations for the period ended September 30, 2019. 32