Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BENCHMARK ELECTRONICS INC | ex991.htm |

| 8-K - FORM 8-K - BENCHMARK ELECTRONICS INC | bheForm8k20201028.htm |

Exhibit 99.2

Benchmark Q3-20 Earnings Call October 28, 2020 Benchmark 1 2020 Benchmark Electronics, Inc. 1

Forward-Looking Statements This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words "expect," "estimate," "anticipate," "could" "predict" and similar expressions, and the negatives thereof, often identify forward -looking statements, which are not limited to historical facts. Forward -looking statements include, among other things, the estimated financial impact of the COVID-19 pandemic, the outlook and guidance for fourth quarter 2020 results, the company’s anticipated plans and responses to the COVID-19 pandemic, statements (express or implied) concerning future operating results or margins, the ability to generate sales and income or cash flow, and expected revenue mix; and Benchmark’s business and growth strategies. Although the company believes these statements are based upon reasonable assumptions, they involve risks and uncertainties relating to operations, markets and the business environment generally. These statements also depend on the duration and severity of the COVID-19 pandemic and related risks, including government and other third-party responses to it and the consequences for the global economy, our business and the businesses of our suppliers and customers. Events relating to or resulting from the COVID-19 pandemic, including the possibility of customer demand fluctuations, supply chain constraints, or the ability to utilize our manufacturing facilities at sufficient levels to cover our fixed operating costs, may have resulting impacts on the company’s business, financial condition, results of operations, and the company’s ability (or inability) to execute on its plans to respond to the COVID-19 pandemic. If one

or more of these risks or uncertainties materializes, or underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. Readers are advised to consult further disclosures on these risks and uncertainties, particularly in Part 1, Item 1A, "Risk Factors" of the company's Annual Report on Form 10-K for the year ended December 31, 2019 and in its subsequent filings with the Securities and Exchange Commission. All forward-looking statements included in this document are based upon information available to the company as of the date of this document, and it assumes no obligation to update them. Non-GAAP Financial Information This document includes certain financial measures that exclude items and therefore are not in accordance with U.S. generally accepted accounting principles (“GAAP”). A detailed reconciliation between GAAP results and results excluding special items (“non-GAAP”) is included in the Appendix of this document. In situations where a non-GAAP reconciliation has not been provided, the company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management discloses non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and

equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made. Benchmark 2 2020 Benchmark Electronics, Inc. 2

Third Quarter 2020 Overview Achieved revenue of $526 million Realized Non-GAAP gross margin of 8.7% and Non-GAAP operating margin of 3.0% Global facilities returned to normal operating capacity; employee safety remains a priority Non-GAAP earnings per share of $0.32 Cash conversion cycle of 81 days Benchmark 3 2020 Benchmark Electronics, Inc. 3

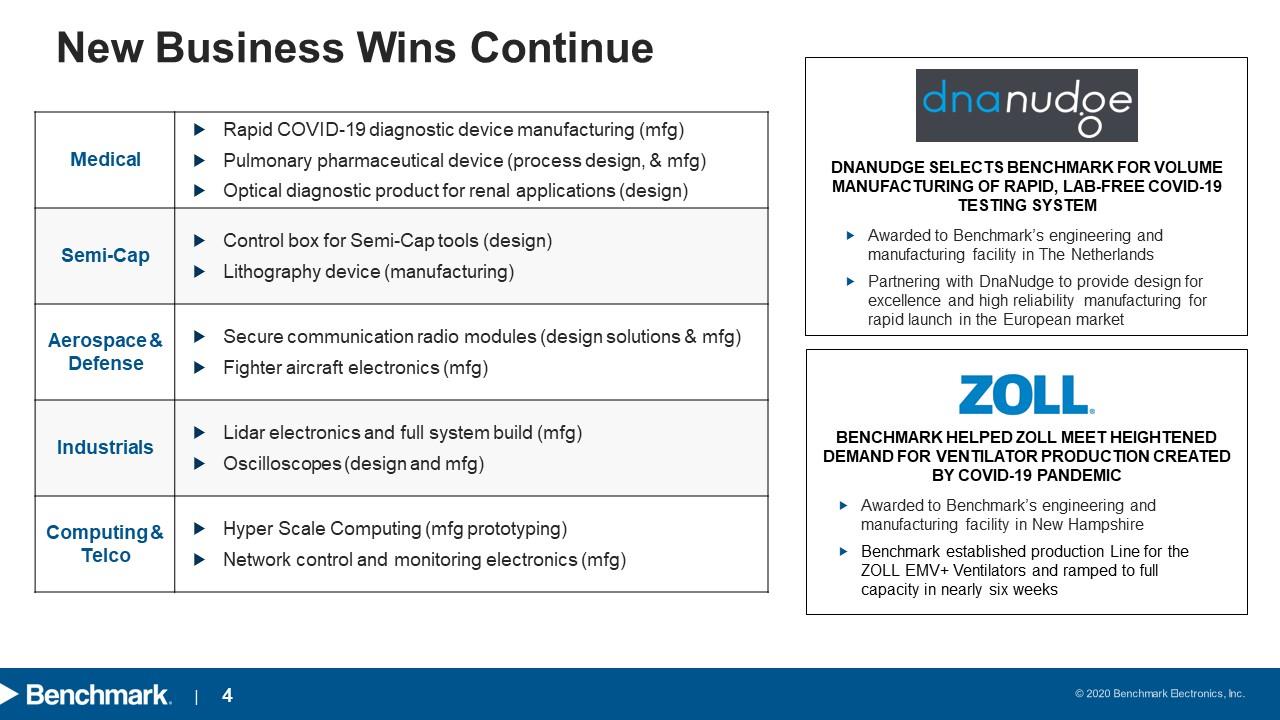

New Business Wins Continue Medical Rapid COVID-19 diagnostic device manufacturing (mfg) Pulmonary pharmaceutical device (process design, & mfg) Optical diagnostic product for renal applications (design) Semi-Cap Control box for Semi-Cap tools (design) Lithography device (manufacturing) Aerospace & Defense Secure communication radio modules (design solutions & mfg) Fighter aircraft electronics (mfg) Industrials Lidar electronics and full system build (mfg) Oscilloscopes (design and mfg) Computing & Telco Hyper Scale Computing (mfg prototyping) Network control and monitoring electronics (mfg) dnanudge DNANUDGE selects benchmark for volume manufacturing of rapid, lab-free covid-19 testing system Awarded to Benchmark’s engineering and manufacturing facility in The Netherlands Partnering with DnaNudge to provide design for excellence and high reliability manufacturing for rapid launch in the European market ZOLL Benchmark helpED zoll meet heightened demand for ventilator production created by covid-19 pandemic Awarded to Benchmark’s engineering and manufacturing facility in New Hampshire Benchmark established production Line for the ZOLL EMV+ Ventilators and ramped to full capacity in nearly six weeks Benchmark 4 2020 Benchmark Electronics, Inc. 4

Roop Lakkaraju Chief Financial Officer Benchmark 5 2020 Benchmark Electronics, Inc. 5

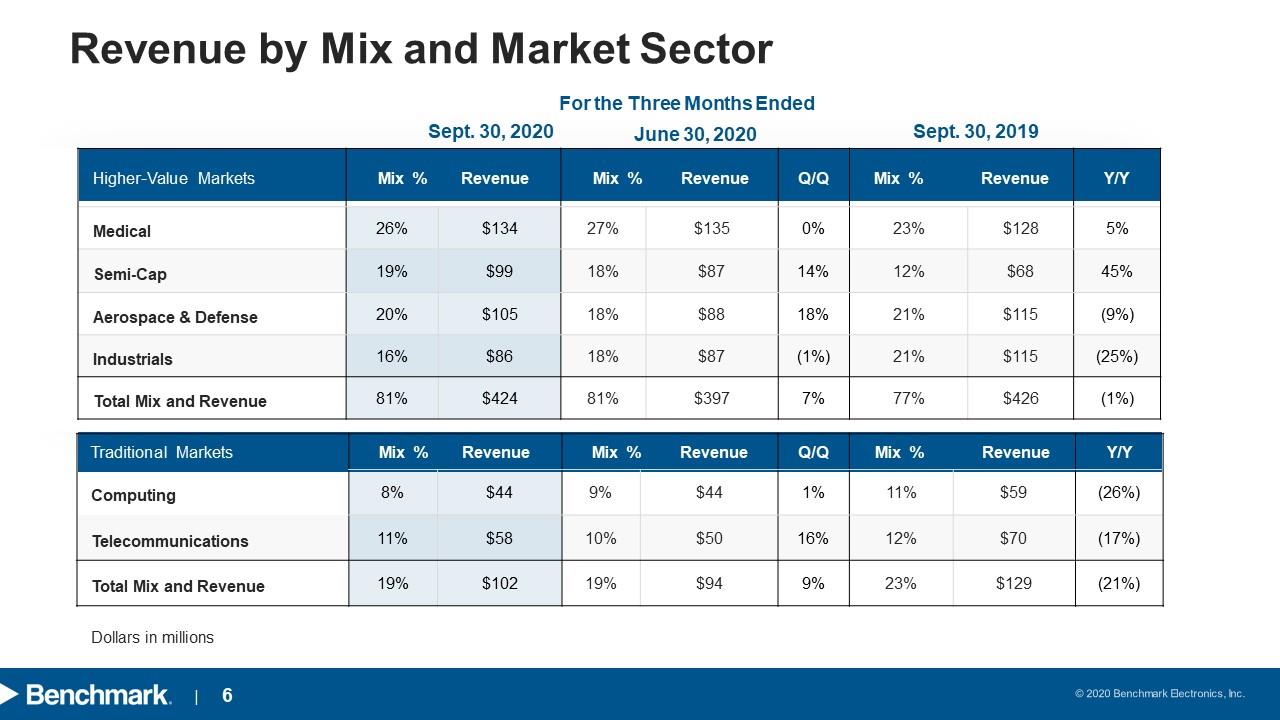

Revenue by Mix and Market Sector For the Three Months Ended Sept. 30, 2020 June 30, 2020 Sept. 30, 2019 Higher-Value Markets Mix % Revenue Mix % Revenue Q/Q Mix % Revenue Y/Y Medical 26% $134 27% $135 0% 23% $128 5% Semi-Cap 19% $99 18% $87 14% 12% $68 45% Aerospace & Defense 20% $105 18% $88 18% 21% $115 (9%) Industrials 16% $86 18% $87 (1%) 21% $115 (25%) Total Mix and Revenue 81% $424 81% $397 7% 77% $426 (1%) Traditional Markets Mix % Revenue Mix % Revenue Q/Q Mix % Revenue Y/Y Computing 8% $44 9% $44 1% 11% $59 (26%) Telecommunications 11% $58 10% $50 16% 12% $70 (17%) Total Mix and Revenue 19% $102 19% $94 9% 23% $129 (21%) Dollars in millions Benchmark 6 2020 Benchmark Electronics, Inc. 6

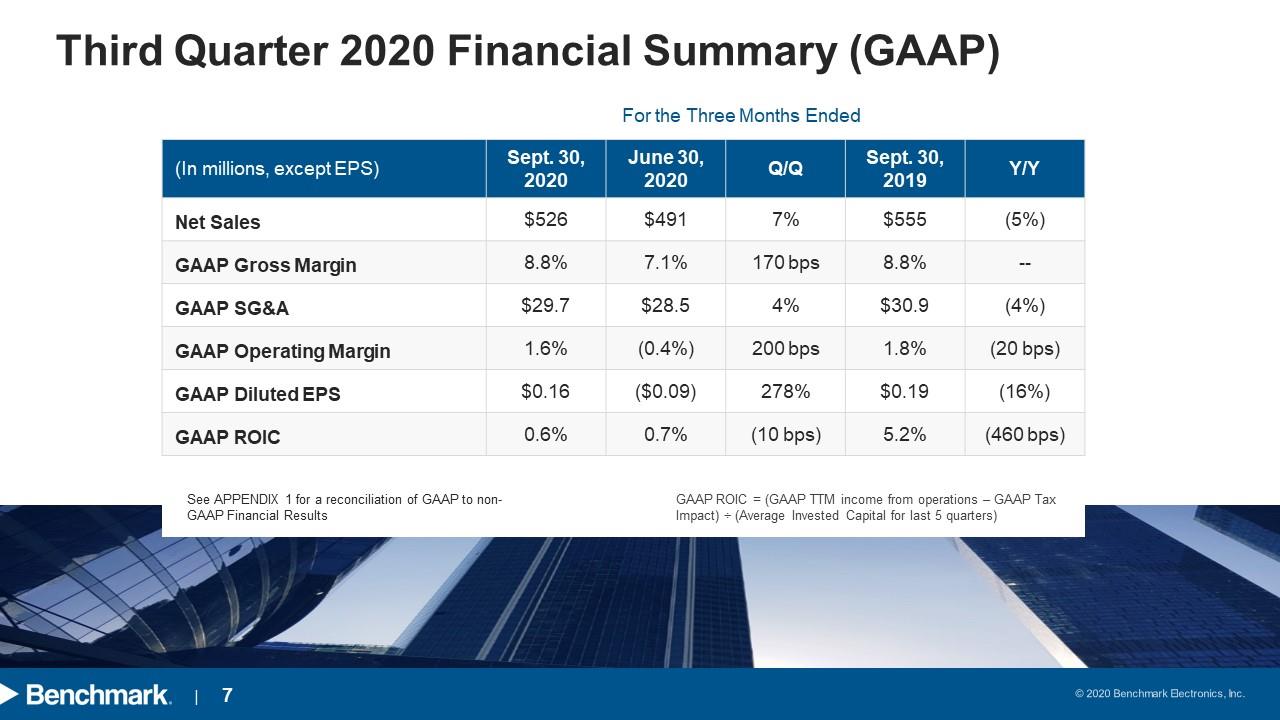

Third Quarter 2020 Financial Summary (GAAP) For the Three Months Ended (In millions, except EPS) Sept. 30, 2020 June 30, 2020 Q/Q Sept. 30, 2019 Y/Y Net Sales $526 $491 7% $555 (5%) GAAP Gross Margin 8.8% 7.1% 170 bps 8.8% -- GAAP SG&A $29.7 $28.5 4% $30.9 (4%) GAAP Operating Margin 1.6% (0.4%) 200 bps 1.8% (20 bps) GAAP Diluted EPS $0.16 ($0.09) 278% $0.19 (16%) GAAP ROIC 0.6% 0.7% (10 bps) 5.2% (460 bps) See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) ÷ (Average Invested Capital for last 5 quarters) Benchmark 7 2020 Benchmark Electronics, Inc. 7

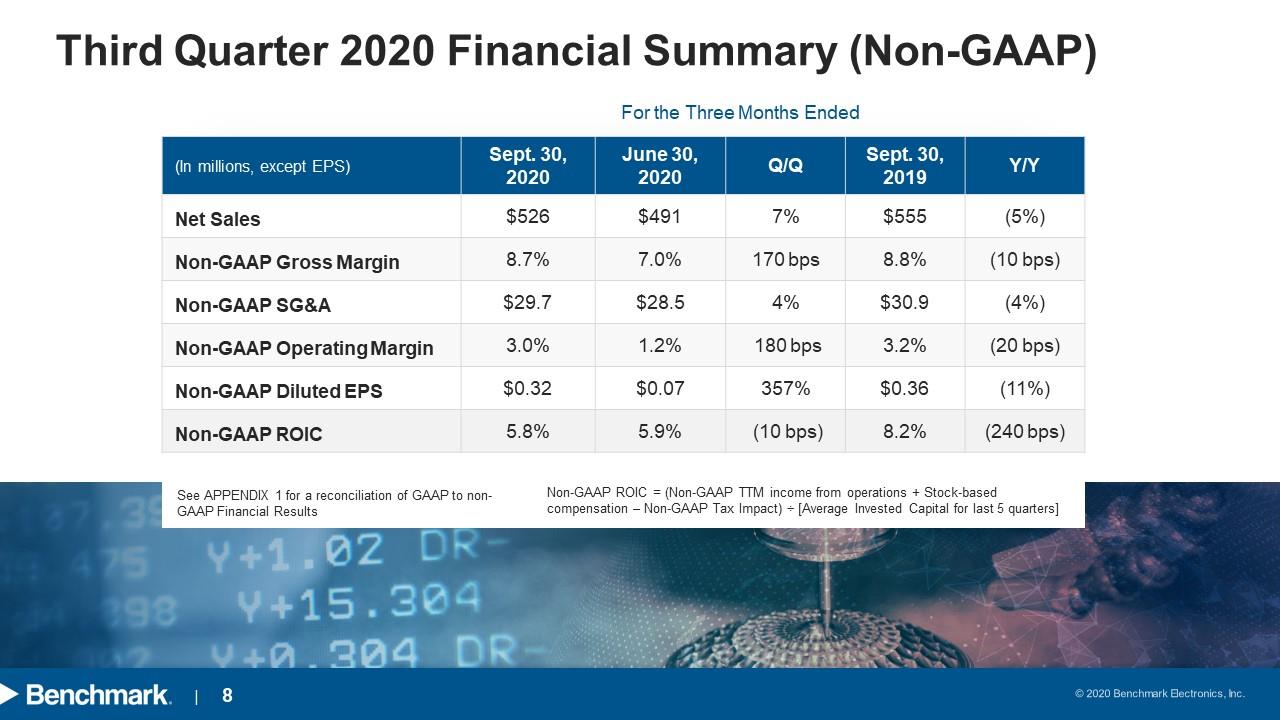

Third Quarter 2020 Financial Summary (Non-GAAP) For the Three Months Ended (In millions, except EPS) Sept. 30, 2020 June 30, 2020 Q/Q Sept. 30, 2019 Y/Y Net Sales $526 $491 7% $555 (5%) Non-GAAP Gross Margin 8.7% 7.0% 170 bps 8.8% (10 bps) Non-GAAP SG&A $29.7 $28.5 4% $30.9 (4%) Non-GAAP Operating Margin 3.0% 1.2% 180 bps 3.2% (20 bps) Non-GAAP Diluted EPS $0.32 $0.07 357% $0.36 (11%) Non-GAAP ROIC 5.8% 5.9% (10 bps) 8.2% (240 bps) See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results Non-GAAP ROIC = (Non-GAAP TTM income from operations + Stock-based compensation – Non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters] Benchmark 8 2020 Benchmark Electronics, Inc. 8

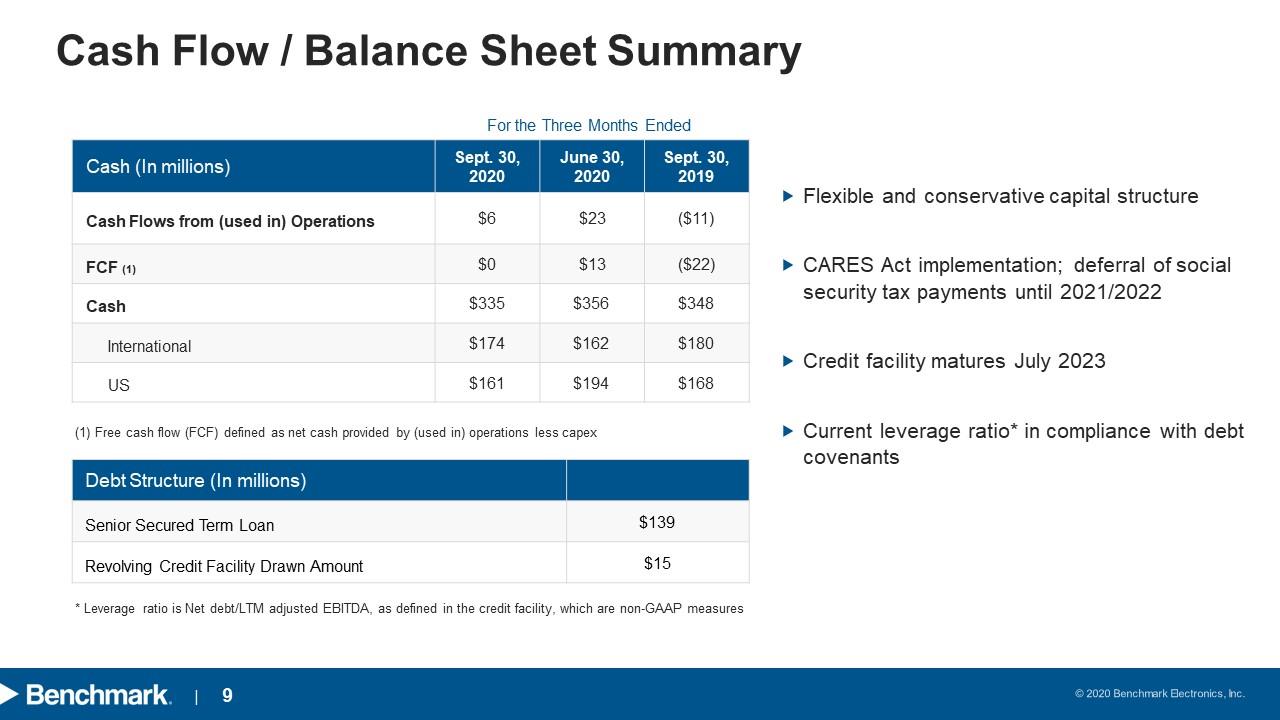

Cash Flow / Balance Sheet Summary For the Three Months Ended Cash (In millions) Sept. 30, 2020 June 30, 2020 Sept. 30, 2019 Cash Flows from (used in) Operations $6 $23 ($11) FCF (1) $0 $13 ($22) Cash $335 $356 $348 International $174 $162 $180 US $161 $194 $168 (1) Free cash flow (FCF) defined as net cash provided by (used in) operations less capex Debt Structure (In millions) Senior Secured Term Loan $139 Revolving Credit Facility Drawn Amount $15 * Leverage ratio is Net debt/LTM adjusted EBITDA, as defined in the credit facility, which are non-GAAP measures Flexible and conservative capital structure CARES Act implementation; deferral of social security tax payments until 2021/2022 Credit facility matures July 2023 Current leverage ratio* in compliance with debt covenants Benchmark 9 2020 Benchmark Electronics, Inc. 9

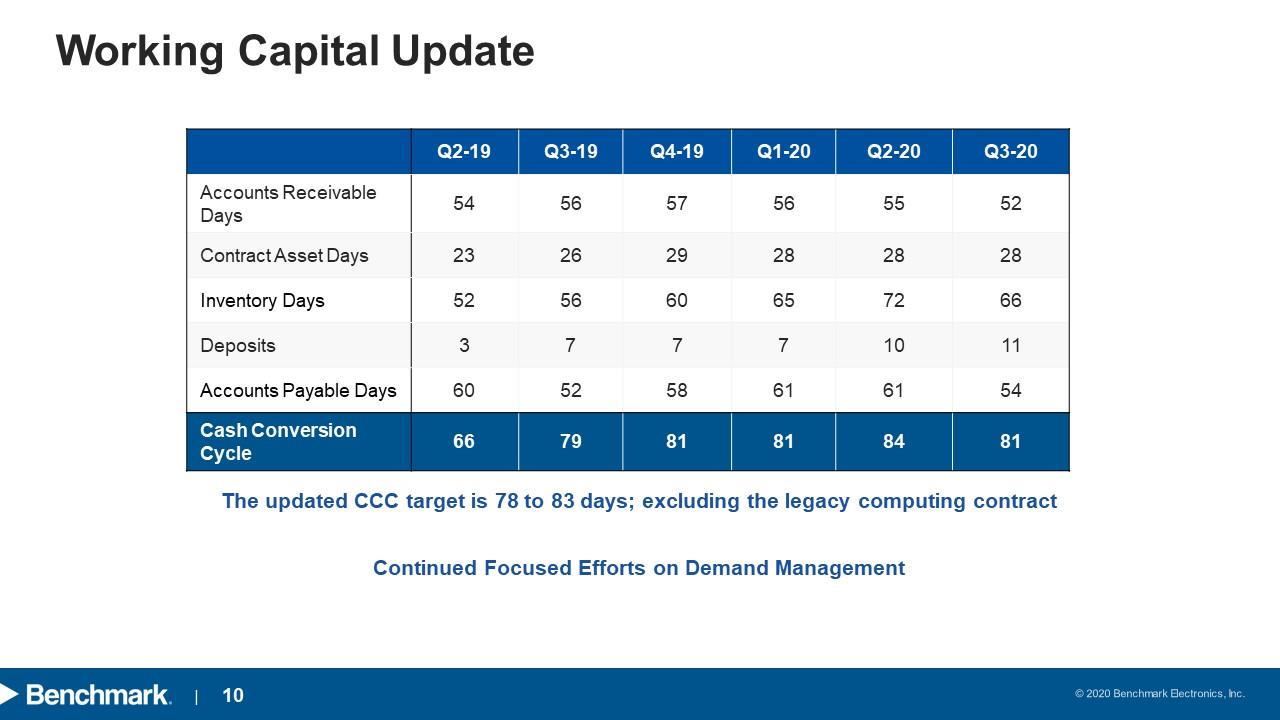

Working Capital Update Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Accounts Receivable Days 54 56 57 56 55 52 Contract Asset Days 23 26 29 28 28 28 Inventory Days 52 56 60 65 72 66 Deposits 3 7 7 7 10 11 Accounts Payable Days 60 52 58 61 61 54 Cash Conversion Cycle 66 79 81 81 84 81 The updated CCC target is 78 to 83 days; excluding the legacy computing contract Continued Focused Efforts on Demand Management Benchmark 10 2020 Benchmark Electronics, Inc. 10

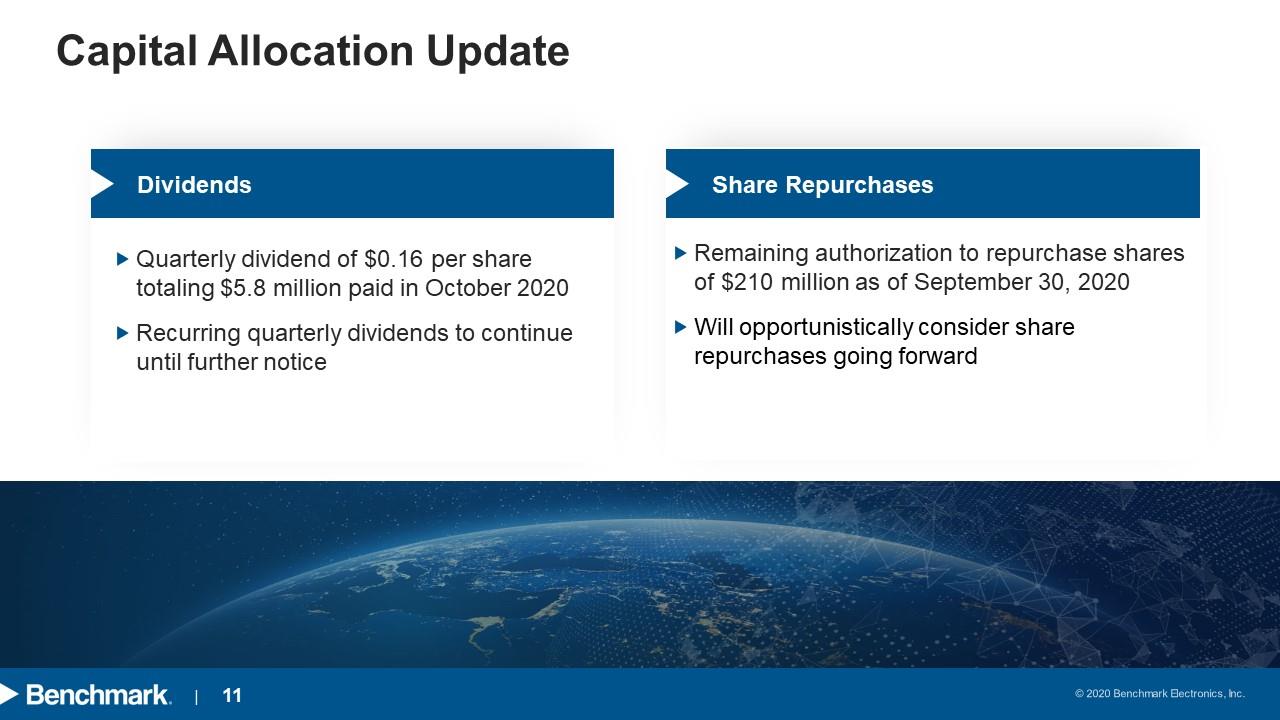

Capital Allocation Update Dividends Quarterly dividend of $0.16 per share totaling $5.8 million paid in October 2020 Recurring quarterly dividends to continue until further notice Share Repurchases Remaining authorization to repurchase shares of $210 million as of September 30, 2020 Will opportunistically consider share repurchases going forward Benchmark 11 2020 Benchmark Electronics, Inc. 11

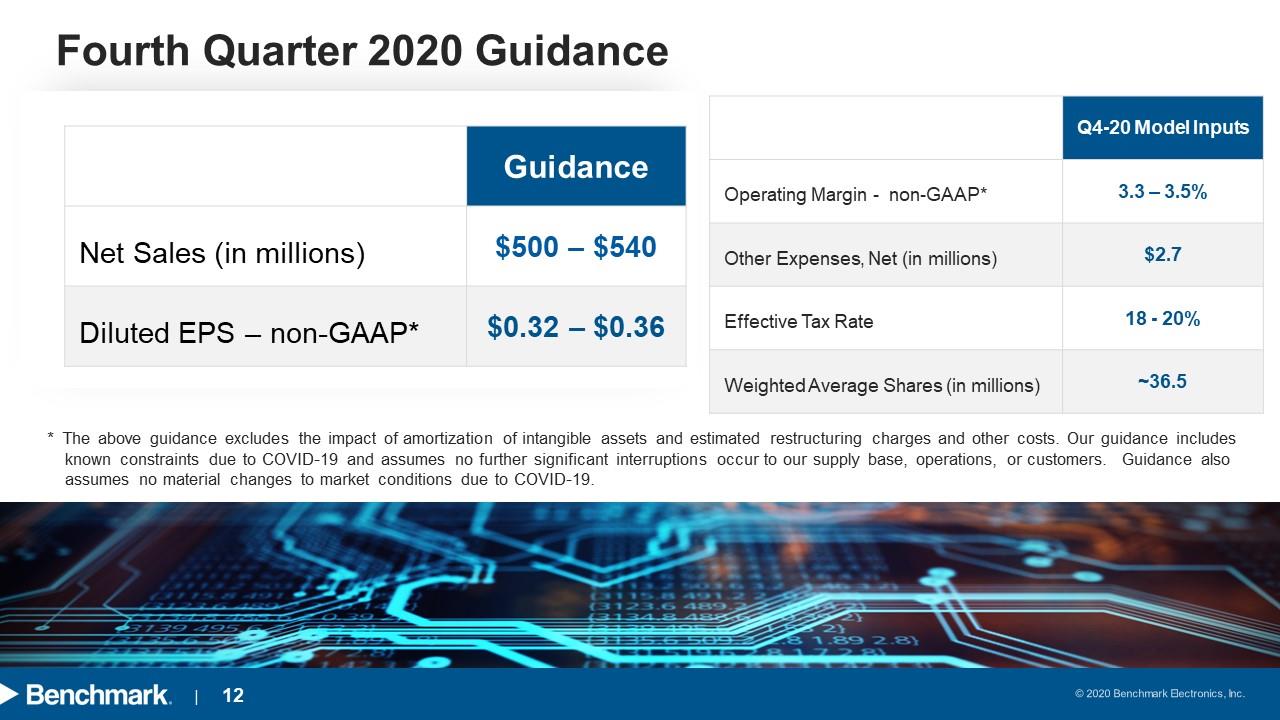

Fourth Quarter 2020 Guidance Guidance Net Sales (in millions) $500 – $540 Diluted EPS – non-GAAP* $0.32 – $0.36 Q4-20 Model Inputs Operating Margin - non-GAAP* 3.3 – 3.5% Other Expenses, Net (in millions) $2.7 Effective Tax Rate 18 - 20% Weighted Average Shares (in millions) ~36.5* The above guidance excludes the impact of amortization of intangible assets and estimated restructuring charges and other costs. Our guidance includes known constraints due to COVID-19 and assumes no further significant interruptions occur to our supply base, operations, or customers. Guidance also assumes no material changes to market conditions due to COVID-19. Benchmark 12 2020 Benchmark Electronics, Inc. 12

Jeff Benck President & Chief Executive Officer Benchmark 13 2020 Benchmark Electronics, Inc. 13

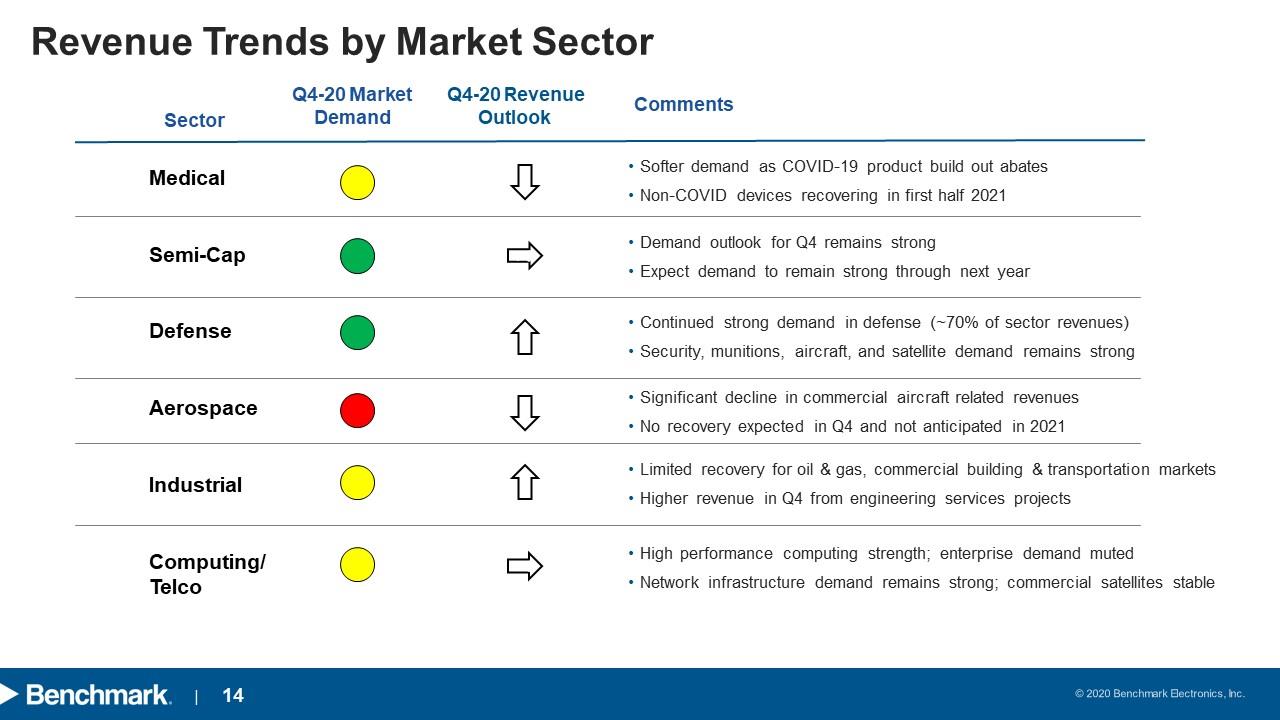

Revenue Trends by Market Sector Sector Q4-20 Market Demand Q4-20 Revenue Outlook Comments Medical Softer demand as COVID-19 product build out abates Non-COVID devices recovering in first half 2021 Semi-Cap Demand outlook for Q4 remains strong Expect demand to remain strong through next year Defense Continued strong demand in defense (~70% of sector revenues) Security, munitions, aircraft, and satellite demand remains strong Aerospace Significant decline in commercial aircraft related revenues No recovery expected in Q4 and not anticipated in 2021 Industrial Limited recovery for oil & gas, commercial building & transportation markets Higher revenue in Q4 from engineering services projects Computing/ Telco High performance computing strength; enterprise demand muted Network infrastructure demand remains strong; commercial satellites stable Benchmark 14 2020 Benchmark Electronics, Inc. 14

Key Strategic Initiatives Remain on Track Focus on the Customer Optimize customer experience; customer satisfaction remains high Aligning Benchmark capabilities to customer technology roadmaps Grow Our Business Expand and scale strategic customers in target markets Investing in technology innovations to increase win rates Selling the full breadth of services and capabilities Drive Enterprise Efficiencies Optimizing footprint around customer needs and for greater efficiency Right sizing SG&A expenses Engage Talent and Shift Culture Continuing to invest in critical skills, tools, and talent development Advancing Diversity and Inclusion efforts as part of ESG focus Benchmark 15 2020 Benchmark Electronics, Inc. 15

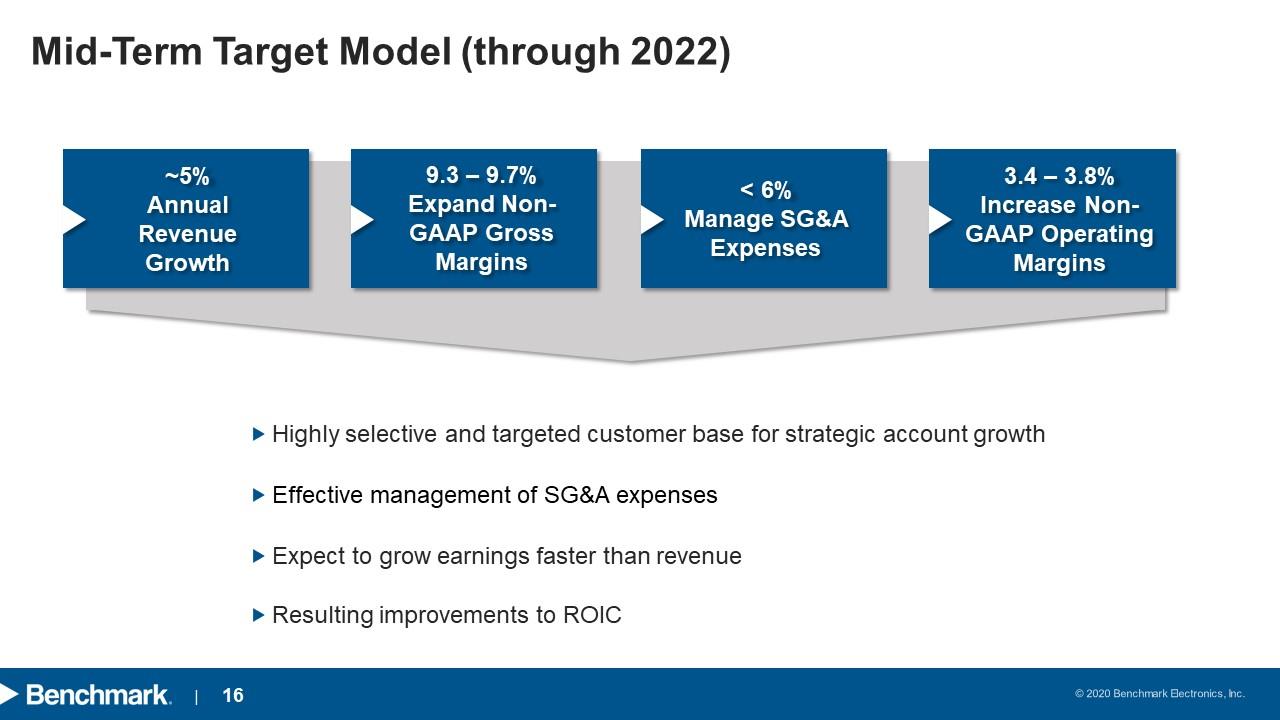

Mid-Term Target Model (through 2022) ~5% Annual Revenue Growth 9.3 – 9.7% Expand Non-GAAP Gross Margins < 6% Manage SG&A Expenses 3.4 – 3.8% Increase Non-GAAP Operating Margins Highly selective and targeted customer base for strategic account growth Effective management of SG&A expenses Expect to grow earnings faster than revenue Resulting improvements to ROIC Benchmark 16 2020 Benchmark Electronics, Inc. 16

Appendix Benchmark 17 2020 Benchmark Electronics, Inc. 17

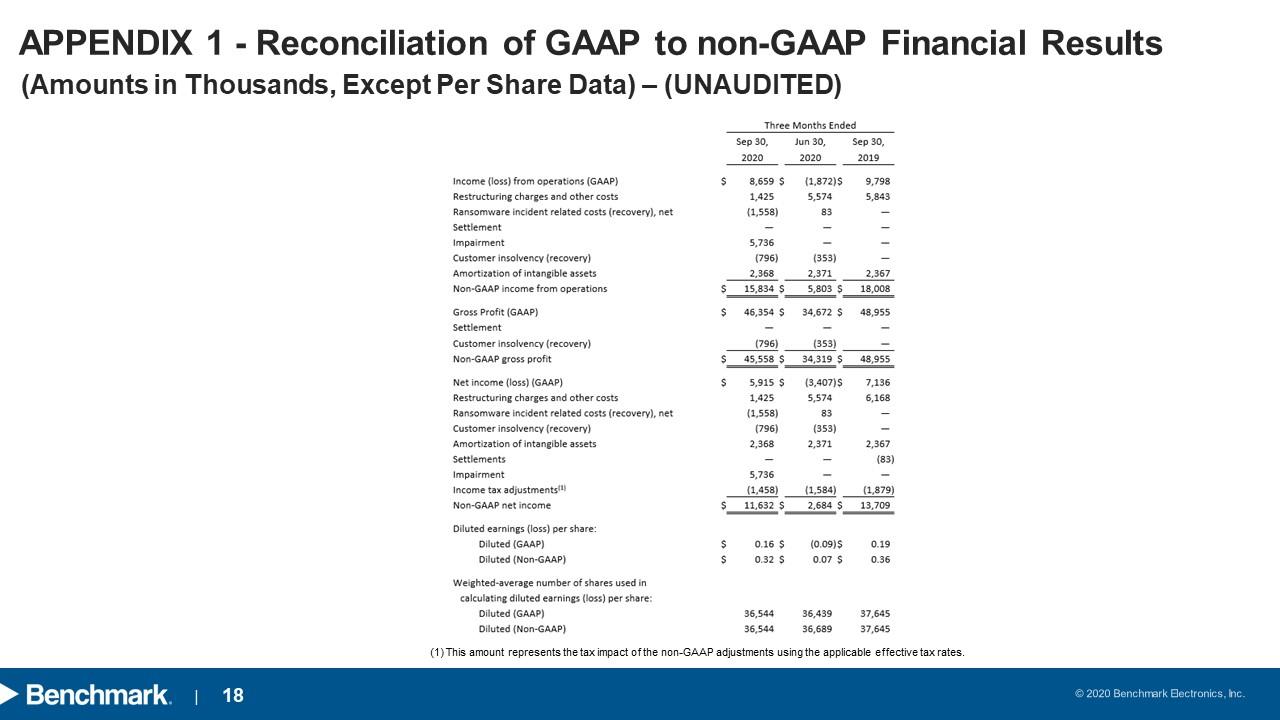

APPENDIX 1 - Reconciliation of GAAP to non-GAAP Financial Results (Amounts in Thousands, Except Per Share Data) – (UNAUDITED) Three Months Ended Sep 30, Jun 30, Sep 30, 2020 2020 2019 Income (loss) from operations (GAAP) $ 8,659 $ (1,872)$ 9,798 Restructuring charges and other costs 1,425 5,574 5,843 Ransomware incident related costs (recovery), net (1,558) 83 — Settlement — — — Impairment 5,736 — — Customer insolvency (recovery) (796) (353) — Amortization of intangible assets 2,368 2,371 2,367 Non-GAAP income from operations $ 15,834 $ 5,803 $ 18,008 Gross Profit (GAAP) $ 46,354 $ 34,672 $ 48,955 Settlement — — — Customer insolvency (recovery) (796) (353) — Non-GAAP gross profit $ 45,558 $ 34,319 $ 48,955 Net income (loss) (GAAP) $ 5,915 $ (3,407)$ 7,136 Restructuring charges and other costs 1,425 5,574 6,168 Ransomware incident related costs (recovery), net (1,558) 83 — Customer insolvency (recovery) (796) (353) — Amortization of intangible assets 2,368 2,371 2,367 Settlements — — (83) Impairment 5,736 — — Income tax adjustments(1) (1,458) (1,584) (1,879) Non-GAAP net income $ 11,632 $ 2,684 $ 13,709 Diluted earnings (loss) per share: Diluted (GAAP) $ 0.16 $ (0.09)$ 0.19 Diluted (Non-GAAP) $ 0.32 $ 0.07 $ 0.36 Weighted-average number of shares used in calculating diluted earnings (loss) per share: Diluted (GAAP) 36,544 36,439 37,645 Diluted (Non-GAAP) 36,544 36,689 37,645 (1) This amount represents the tax impact of the non-GAAP adjustments using the applicable effective tax rates. Benchmark 18 2020 Benchmark Electronics, Inc. 18

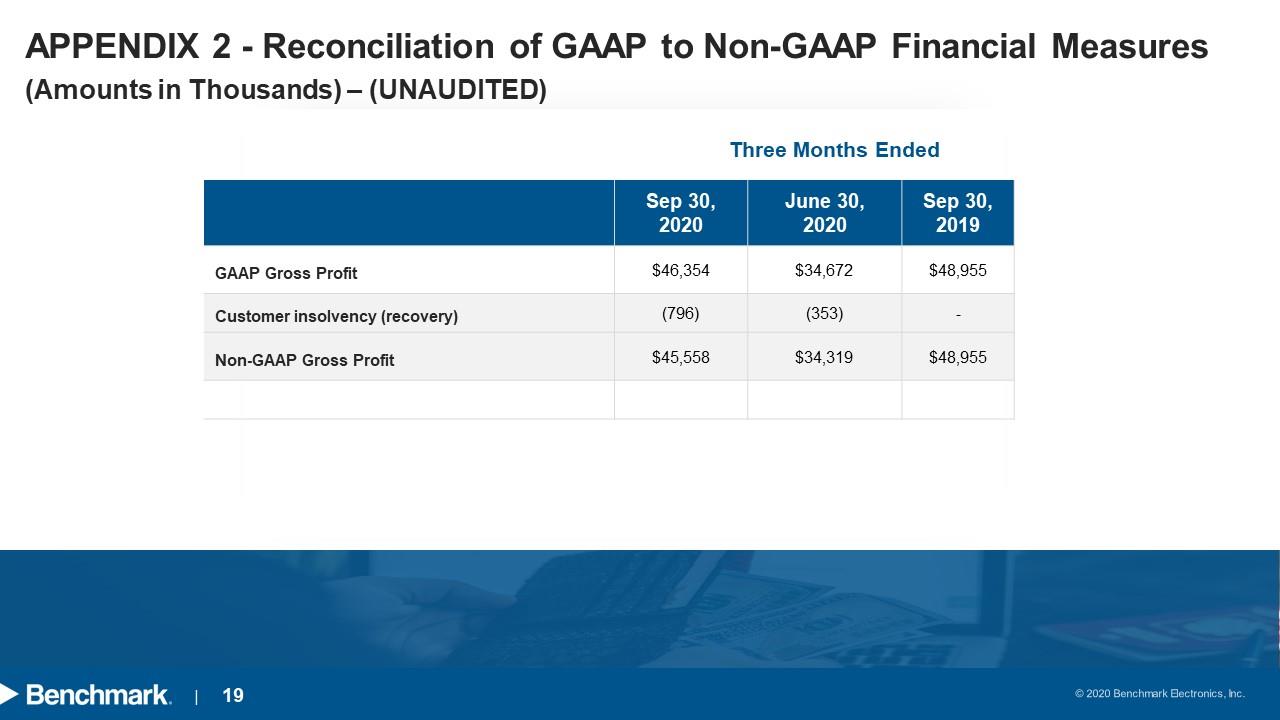

APPENDIX 2 - Reconciliation of GAAP to Non-GAAP Financial Measures (Amounts in Thousands) – (UNAUDITED) Three Months Ended Sep 30, 2020 June 30, 2020 Sep 30, 2019 GAAP Gross Profit $46,354 $34,672 $48,955 Customer insolvency (recovery) (796) (353) - Non-GAAP Gross Profit $45,558 $34,319 $48,955 Benchmark 19 2020 Benchmark Electronics, Inc. 19

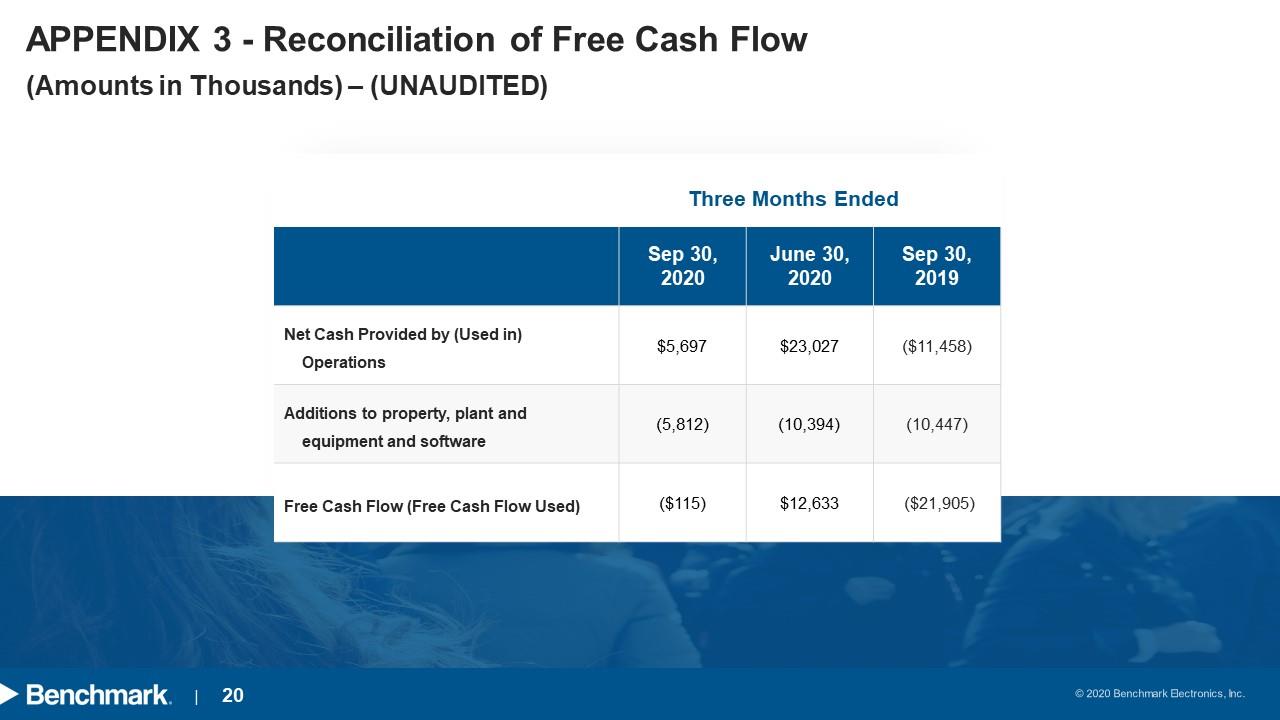

APPENDIX 3 - Reconciliation of Free Cash Flow (Amounts in Thousands) – (UNAUDITED) Three Months Ended Sep 30, 2020 June 30, 2020 Sep 30, 2019 Net Cash Provided by (Used in) Operations $5,697 $23,027 ($11,458) Additions to property, plant and equipment and software (5,812) (10,394) (10,447) Free Cash Flow (Free Cash Flow Used) ($115) $12,633 ($21,905) Benchmark 20 2020 Benchmark Electronics, Inc. 20