Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Axos Financial, Inc. | pressrelease20200930ax.htm |

| 8-K - 8-K - Axos Financial, Inc. | ax-20201029.htm |

Axos Financial, Inc. Q1 2021 Earnings Supplement October 29, 2020 NYSE: AX

Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). The words “believe,” “expect,” “anticipate,” “estimate,” “project,” or the negation thereof or similar expressions constitute forward-looking statements within the meaning of the Reform Act. These statements may include, but are not limited to, projections of revenues, income or loss, projected consummation of pending acquisitions, estimates of capital expenditures, plans for future operations, products or services, the effects of the COVID-19 pandemic, and financing needs or plans, as well as assumptions relating to these matters. Such statements involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward- looking statements. For a discussion of these factors, we refer you to the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2020 and our last earnings press release. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved. For all forward-looking statements, the Company claims the protection of the safe-harbor for forward-looking statements contained in the Reform Act. 2

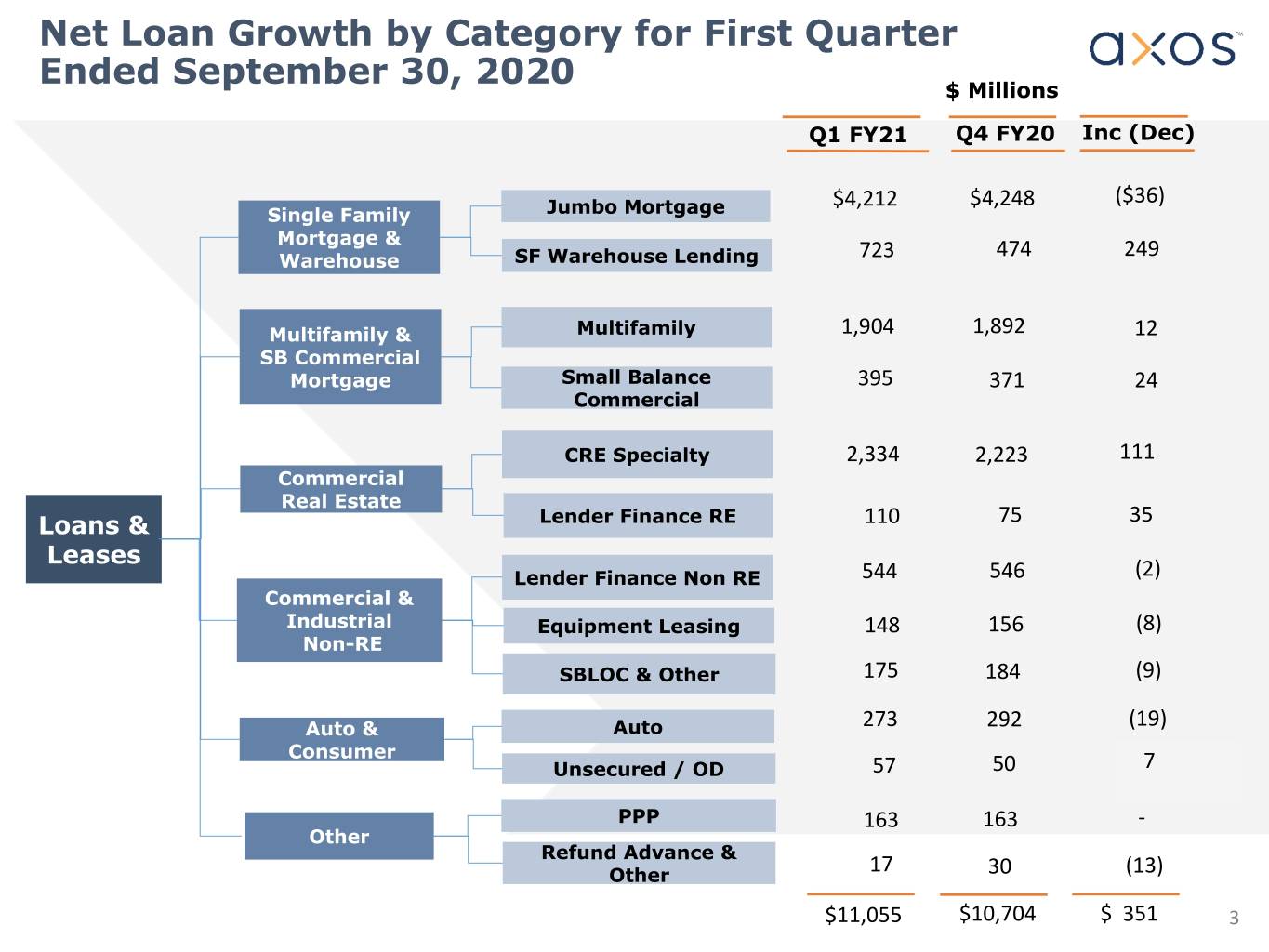

Net Loan Growth by Category for First Quarter Ended September 30, 2020 $ Millions Q1 FY21 Q4 FY20 Inc (Dec) $4,212 $4,248 ($36) Single Family Jumbo Mortgage Mortgage & Warehouse SF Warehouse Lending 723 474 249 Multifamily & Multifamily 1,904 1,892 12 SB Commercial Mortgage Small Balance 395 371 24 Commercial CRE Specialty 2,334 2,223 111 Commercial Real Estate Loans & Lender Finance RE 110 75 35 Leases Lender Finance Non RE 544 546 (2) Commercial & Industrial Equipment Leasing 148 156 (8) Non-RE SBLOC & Other 175 184 (9) Auto & Auto 273 292 (19) Consumer Unsecured / OD 57 50 7 PPP 163 163 - Other Refund Advance & Other 17 30 (13) $11,055 $10,704 $ 351 3

Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Liability (UCL) ($ in millions) $M 160 0.7 6.7 140 5.3 5.7 6.5 120 (2.0) 100 47.3 80 0.3 132.9 60 40 75.8 20 0 June 130, 2020 CECL2 Day-1 Net Charge-3 Provision4 for Other5 September6 30, ACL + UCL July 1, offs HRB Refund Provisions 2020 2020 Advance ACL + UCL Loans 4

Allowance for Credit Losses (ACL) by Loan and Lease Category at September 30, 2020 $ Millions Loan Balance ACL $ ACL % Single Family Mortgage $4,935.4 $28.3 0.57% and Warehouse Multifamily & SB $2,299.3 $12.4 0.54% Commercial Mortgage Commercial Real Estate $2,443.7 $49.2 2.01% Loans & Leases Commercial & Industrial $866.5 $23.3 2.69% Non-RE Auto & Consumer $330.1 $8.7 2.64% Other $180.2 $11.0 6.10% $11,055.2 $ 132.9 1.20% 5

Credit Quality No Loans in Forbearance as of 9/30/20 vs. $132.1 million at 6/30/20 Loans in Loans & Forbearance/Deferral Delinquent Loans in 6/30/2020 Leases ($M) ($M) % NPAs ($M) % HFS ($M) % Total ($M) % Single Family-Mortgage & Warehouse $4,722.3 $95.8 2.03% $84.0 1.78% $0.0 0.00% $179.8 3.81% Multifamily & Commercial Mortgage $2,263.1 $0.0 0.00% $3.4 0.15% $24.5 1.08% $27.9 1.23% Commercial Real Estate $2,297.9 $0.0 0.00% $0.0 0.00% $0.00 0.00% $0.00 0.00% Commercial & Industrial - Non -RE $856.2 $5.6 0.65% $0.2 0.02% $0.0 0.00% $5.8 0.68% Auto & Consumer $369.7 $30.7 8.30% $0.3 0.07% $0.0 0.00% $31.0 8.38% Other $194.3 $0.0 0.00% $0.0 0.00% $0.0 0.00% $0.0 0.00% Total $10,703.4 $132.1 1.23% $87.9 0.82% $24.5 0.23% $244.5 2.28% Loans in Loans & Forbearance/Deferral Delinquent Loans in 9/30/2020 Leases ($M) ($M) % NPAs ($M) % HFS ($M) % Total ($M) % Single Family-Mortgage & Warehouse $4,935.4 $0.0 0.00% $132.9 2.69% $0.0 0.00% $132.9 2.69% Multifamily & Commercial Mortgage $2,299.3 $0.0 0.00% $32.8 1.43% $0.0 0.00% $32.8 1.43% Commercial Real Estate $2,443.6 $0.0 0.00% $0.0 0.00% $0.0 0.00% $0.0 0.00% Commercial & Industrial - Non -RE $866.5 $4.4 0.51% $5.6 0.64% $0.0 0.00% $10.0 1.15% Auto & Consumer $330.1 $0.9 0.27% $0.8 0.23% $0.0 0.00% $1.7 0.50% Other $180.2 $0.0 0.00% $0.0 0.00% $0.0 0.00% $0.0 0.00% Total $11,055.2 $5.3 0.05% $172.1 1.56% $0.0 0.00% $177.4 1.60% Loans in Change from 6/30/20 to Forbearance/Deferral Delinquent Loans in 9/30/20 ($M) NPAs ($M) HFS ($M) Total ($M) Single Family-Mortgage & Warehouse -$95.8 $48.9 $0.0 -$46.9 Multifamily & Commercial Mortgage $0.0 $29.4 $0.0 $4.9 Commercial Real Estate $0.0 $0.0 -$24.5 $0.0 Commercial & Industrial - Non -RE -$1.2 $5.4 $0.0 $4.2 Auto & Consumer -$29.8 $0.5 $0.0 -$29.3 Other $0.0 $0.0 $0.0 $0.0 Change -$127.3 $84.2 -$24.5 -$67.1 6

Contact Information Greg Garrabrants, President and CEO Andy Micheletti, EVP/CFO investors@axosfinancial.com www.axosfinancial.com Johnny Lai, VP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@axosfinancial.com 7