Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERICAN PUBLIC EDUCATION INC | tm2034524d1_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - AMERICAN PUBLIC EDUCATION INC | tm2034524d1_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - AMERICAN PUBLIC EDUCATION INC | tm2034524d1_ex2-1.htm |

| 8-K - FORM 8-K - AMERICAN PUBLIC EDUCATION INC | tm2034524d1_8k.htm |

Exhibit 99.2

Rasmussen University Acquisition October 2020 PRESENTED B Y Angela Selden President and CEO Richard Sunderland, CPA Executive VP and CFO Transformational Acquisition of Rasmussen University Doubles APEI Revenue, #1 Educator of Pre - Licensure Nurses (ADN/RN and PN/LPN) Steve Somers, CFA Senior VP and Chief Strategy Officer

American Public Education, Inc. 2 Safe Harbor Statement Statements made in this presentation regarding American Public Education, Inc. (“APEI”), or its subsidiaries, that are not histo rical facts are forward - looking statements based on current expectations, assumptions, estimates and projections about APEI and the industry . Forward - looking statements can be identified by words such as “anticipate,” “believe,” “seek,” “could,” “estimate,” “expect,” “i ntend,” “may,” “plan,” “should,” “will” and “would.” These forward - looking statements include, without limitation, statements regarding benefits of the acquisition of Rasmussen University, the timing of the closing of the transaction, expected growth, expected registration an d enrollments, expected revenues, earnings and expenses, expected financial results for Rasmussen University, and plans with re spe ct to recent, current and future initiatives. Forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from thos e expressed or implied by such statements. Such risks and uncertainties include, among others, risks related to: the satisfacti on of closing conditions, including the failure or delay in obtaining required regulatory and accreditor approvals; APEI's ability to obtai n f inancing to fund the transaction; the significant transaction and integration costs APEI has incurred and expects to incur in connection wit h the acquisition; the integration of Rasmussen's business and APEI's ability to realize the expected benefits of the acquisition; tha t Rasmussen may have liabilities that are not known to APEI; other events that could impact the transaction and its closing; AP EI' s dependence on the effectiveness of its ability to attract students who persist in its institutions' programs; impacts of the COV ID - 19 pandemic; APEI's ability to effectively market its institutions' programs; adverse effects of changes APEI makes to improve t he student experience and enhance the ability to identify and enroll students who are likely to succeed; APEI’s ability to maintain stro ng relationships with the military and maintain enrollments from military students; APEI’s ability to comply with regulatory and ac crediting agency requirements and to maintain institutional accreditation; APEI’s reliance on Department of Defense tuition assistance, Ti tle IV programs, and other sources of financial aid; APEI’s dependence on its technology infrastructure; strong competition in the postsecondary education market and from non - traditional offerings; and the various risks described in the “Risk Factors” section and elsewhere in APEI’s Annual Report on Form 10 - K for the year ended December 31, 2019, Quarterly Report on Form 10 - Q for the perio d ended June 30, 2020, and other filings with the SEC. You should not place undue reliance on any forward - looking statements. The Company undertakes no obligation to update publicly any forward - looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future. Please see important disclosures in the Appendix American Public Education, Inc.

American Public Education, Inc. TRANSFORMATIVE DEAL POSITIONS APEI FOR FUTURE GROWTH Acquisition of Rasmussen University expected to double APEI revenue to $600MM in 2021 * APEI Will Be #1 Educator of Pre - Licensure Nurses (ADN/RN and PN/LPN) Establishes APEI As a Scale Platform w/ New Capabilities and Synergy Opportunities APEI and Rasmussen have Strong Alignment around Mission and Culture 3 Please see important disclosures in the Appendix American Public Education, Inc. * Forecasted full - year pro forma results.

American Public Education, Inc. 4 ABOUT THE TRANSACTION Transaction Structure x APEI acquires 100% ownership of Rasmussen University x Purchase price is $329 million - consisting of $300 million in cash plus $29 million in preferred shares x APEI may substitute cash for preferred shares at the time of closing Funding x $175 million of committed financing x $125 million of cash on hand , excluding transaction costs x $29 million non - voting, redeemable preferred shares Tax Benefits x Estimated Present Value of Expected Cash Tax Benefits: $29MM x Year 1 Cash tax benefit of approximately $6MM x Represents a 7.5x multiple to Rasmussen’s FY20 Adjusted EBITDA of $40 million Valuation Accretion x Expected to be accretive to earnings per share in FY2022; earnings per share accretion in FY2021 dependent on timing of transaction close x Annual synergies expected to be approximately $5 million in the first year after closing and to grow to more than $10 million in each of the following 2 years Synergies Management x Rasmussen University will continue to operate as separate institution x Leverage APEI’s shared services model Please see important disclosures in the Appendix

#1 EDUCATOR OF PRE - LICENSURE NURSES (ADN/PN) IN A GROWING MARKET Rasmussen‘s ADN (RN) is its largest degree program and has shown strong historical growth 1 B ureau of Labor Statistics’ Employment Projections 2019 - 2029 . RN job vacancies expected in the US, including increasing demand and expected retirements 175,000 annually Critical Need: Nursing RN’s RN is a Top Growing Job Through 2029 APEI will Educate 10,000+ Nurses with Rasmussen and Hondros. APEI will be the #1 Educator in pre - licensure nursing education (ADN/RN and PN/LPN) Rasmussen 2016 2017 2018 2019 2020 4300 1700 5300 2100 6200 2100 6900 1600 8200 2100 10,000+ Hondros Addressing the Need 5 Please see important disclosures in the Appendix American Public Education, Inc.

COMBINED ~$165 MILLION IN NURSING REVENUE Enhances competitive market position across several markets with large projected nursing shortages Rasmussen will add 24 Campuses Across Seven States and Online, Including Blended Learning and Competency - Based Education (CBE) Campuses Nursing Revenue 2020 6 $36M 24 $129M 30 ~$165M Enrollment Growth 2020 34% 19% 22% = Powerhouse Nursing Platform + Hondros Rasmussen Future Rasmussen Campus Current Campuses 6 Please see important disclosures in the Appendix American Public Education, Inc.

OPPORTUNITIES IN NON - NURSING CBE and Differentiated Pricing Address Changing Market Demands, Supports HEROI™ Nursing 45% Health Science s 22% Business 15% Other 18% Rasmussen University’s Total Enrollment by Program: 18,000+ Learners (as of 4Q2020) • Campuses provides platform for other clinical - based health - sciences programs • Generous transfer policies and credit for prior learning reduce time to degree completion • Opportunities in CBE – Rasmussen is 5 th Largest CBE Provider • 17 programs, 2000 students • Lower annual tuition for fully online, general education undergraduate programs approx. $11,000 on average • Competitive annual tuition for differentiated, healthcare - focused undergraduate programs approx. $17,000 on average • Low cost course materials ( $15/course) vs. national average of $200 per course • Focused on developing employer - centric programs 7 Please see important disclosures in the Appendix American Public Education, Inc.

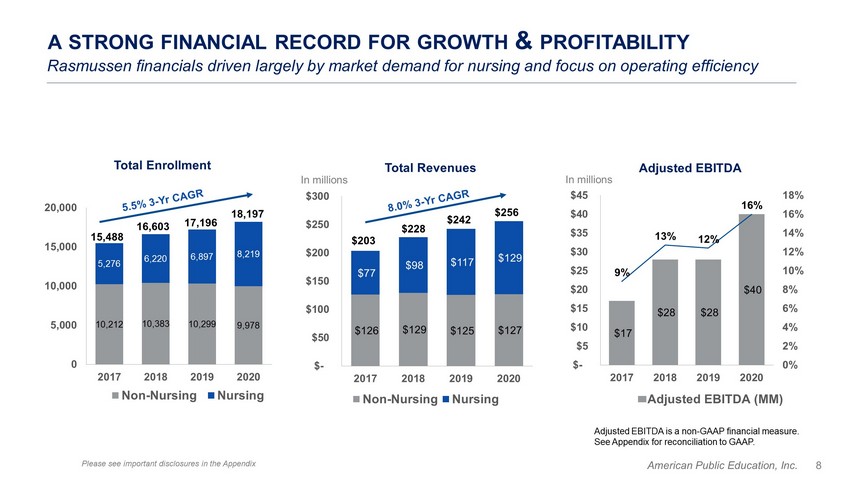

American Public Education, Inc. $126 $129 $125 $127 $77 $98 $117 $129 $- $50 $100 $150 $200 $250 $300 2017 2018 2019 2020 Non-Nursing Nursing Rasmussen financials driven largely by market demand for nursing and focus on operating efficiency 10,212 10,383 10,299 9,978 5,276 6,220 6,897 8,219 0 5,000 10,000 15,000 20,000 2017 2018 2019 2020 Non-Nursing Nursing Adjusted EBITDA is a non - GAAP financial measure. See Appendix for reconciliation to GAAP. $203 $228 $242 $256 Total Revenues In millions In millions Total Enrollment 18,197 17,196 16,603 15,488 Adjusted EBITDA $17 $28 $28 $40 9% 13% 12% 16% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% $- $5 $10 $15 $20 $25 $30 $35 $40 $45 2017 2018 2019 2020 Adjusted EBITDA (MM) A STRONG FINANCIAL RECORD FOR GROWTH & PROFITABILITY 8 Please see important disclosures in the Appendix

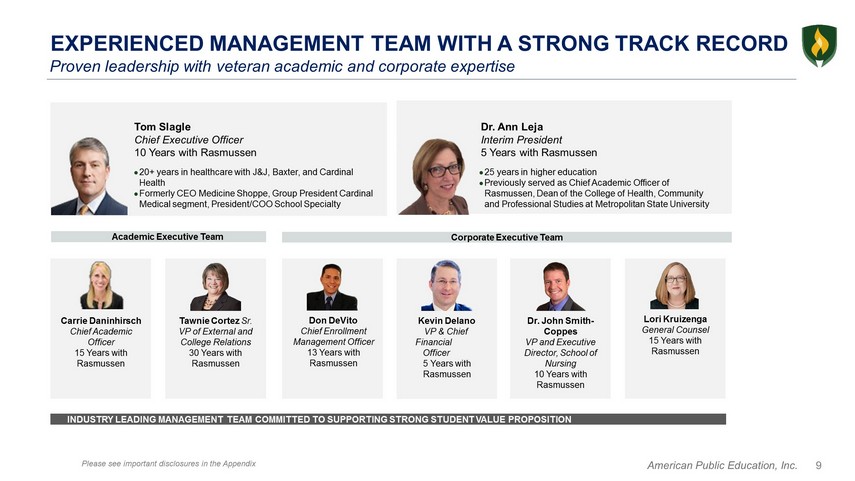

American Public Education, Inc. I NDUST R Y LEADING MANAGEMENT TEAM COMMITTED T O SUPPOR T ING STRONG STUDENT V ALUE PROPOSITI O N Tom S lag l e C h i e f Ex e cutive Offic e r 10 Ye a rs w ith R a smuss e n 2 0 + y e a rs in h e a l thc a re w ith J&J, B a x ter, a n d C a rd i n a l H e a l th Former l y CEO Me d ic i ne S h o p p e , Gro u p Pr e si d e n t C a rd i n a l Me d ic a l se g me n t, Pres i d e nt/COO Sch o ol S p ec i a l ty Dr. Ann Leja Inter i m Pres i d e nt 5 Y e ars w ith R a smuss e n 25 y e a rs in hi g h e r e d uc a tion Prev i o u sly serv e d as C h i e f Ac a d e mic Officer of R a smuss e n, Dea n of the Co l l e ge of H e a l th, C o mmu n ity a n d Prof e ssi o n a l Stu d i e s at Metro p o l itan State U n iv e rsity Corporate Executive Team Academic Executive Team Don DeVito Chief Enroll m ent Man age m e n t Of f icer 13 Years with Rasmus s e n Ke v in Delano VP & Chief Financi a l Of f icer 5 Ye a rs with Rasmus s e n Dr. John S m it h - Coppes VP and Exec u ti v e Director, Sch oo l of Nursing 10 Years with Rasmus s e n T a w nie Cortez Sr. VP of Exter na l and Colle g e Relati o n s 30 Years with Rasmus s e n Carrie Danin h ir s c h Chief Aca de m ic Of f icer 15 Years with Rasmus s e n Lori Kruizenga Ge ne ral Cou n s e l 15 Years with Rasmus s e n EXPERIENCED MANAGEMENT TEAM WITH A STRONG TRACK RECORD Proven leadership with veteran academic and corporate expertise 9 Please see important disclosures in the Appendix

American Public Education, Inc. DOUBLES REVENUE & ESTABLISHES APEI AS A SCALE PLATFORM In 2021, nearly doubles APEI’s revenue to $600MM , $31MM in net income and $100MM in adjusted EBITDA Diversifies APEI’s revenue to one - third military, one - third nursing and one - third online adult learners Puts approximately $125MM of cash to work APEI will capture synergies through: Shared capabilities Shared services Pro Forma 2020 Enrollment Total APEI: ~106,000 » APUS: 86,000 » Rasmussen: 18,000 » Hondros: 2,200 Rasmussen University further accelerates APEI’s growth story $0 $100 $200 $300 $400 $500 $600 $700 2017 2018 2019 2020* 2021* APEI Pro Forma Revenue, USD Mn $600 * Forecasted full - year pro forma results. $286 $298 $299 $315 10% 90% 10 Please see important disclosures in the Appendix

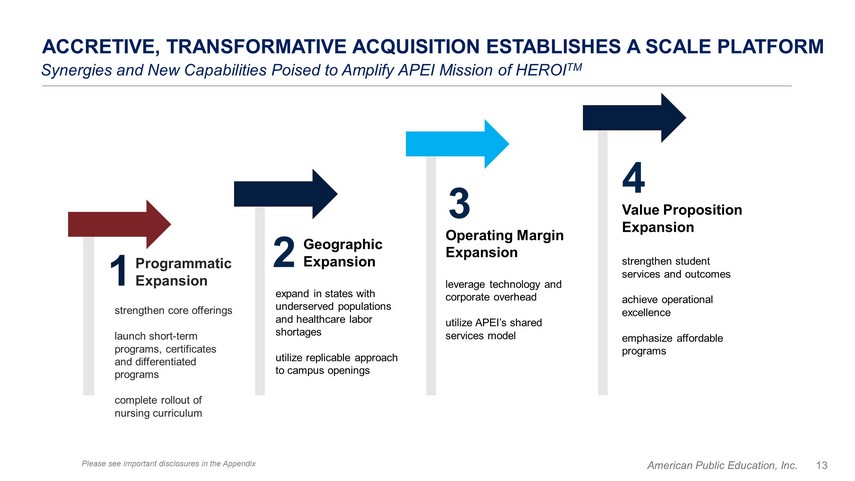

American Public Education, Inc. • #1 for Pre - Licensure Nursing (ADN/RN & PN/LPN) • #1 for Military & Veteran Students • Aligned Mission of HEROI TM • Value + Affordability • Leverage New Shared Services, CBE capabilities • Unlock $5M - $10M in potential synergies in each of the first three years • Introduce new academic programs, including post - licensure nursing for Hondros students • #1 Pre - Licensure ADN Program (RNs) • CBE – 2000 students, 17 programs, 300 courses, 1700 modules • 24 campuses in seven states • #1 Pre - Licensure PN (LPN) program in Ohio • Reputation as top producer of new nurses • 6 campuses in two states • #1 Military and Veteran students • Top 2% on Georgetown Study on ROI on educational investment • 72% of students graduate with $0 debt ACCRETIVE, TRANSFORMATIVE ACQUISITION ESTABLISHES A SCALE PLATFO RM Synergies and New Capabilities Poised to Amplify APEI Mission of HEROI TM 11 Please see important disclosures in the Appendix

American Public Education, Inc. STRONG ALIGNMENT IN MISSION & CULTURE Rasmussen enables learners to maximize their Higher Education Return on Investment or ‘HEROI’ TM 1. 2017 Graduation Rate 45.2% (vs. 26.5% at Community Colleges and 22.1% at For Profit Schools) 2. 1 year post - graduation survey 2019 (N=1,869). 3. Graduates employed in their field (or in a position for which their degree level was a requirement) or continuing their education. 4. Quarterly retention rate in 2019. HEROI TM Helping Learners of All Backgrounds Maximize the Return on their Educational Investment 45.2% graduation rate 1 80.3% of alumni employed in field of study 2,3 93.1% of alumni surveyed employed 2 84.7% retention rate 4 92.8% in Nursing HLC, ACEN & CCNE Accredited 9.4% Cohort Default Rate 76.4% 90/10 Ratio No Borrow Defense to Repayment (BDTR) Claims Affordable, Inclusive, High Quality Strong Regulatory Track Record 12 Please see important disclosures in the Appendix

American Public Education, Inc. ACCRETIVE, TRANSFORMATIVE ACQUISITION ESTABLISHES A SCALE PLATFO RM Synergies and New Capabilities Poised to Amplify APEI Mission of HEROI TM Programmatic Expansion strengthen core offerings launch short - term programs, certificates and differentiated programs complete rollout of nursing curriculum 1 Geographic Expansion expand in states with underserved populations and healthcare labor shortages utilize replicable approach to campus openings 2 4 Operating Margin Expansion leverage technology and corporate overhead utilize APEI’s shared services model 3 Value Proposition Expansion strengthen student services and outcomes achieve operational excellence emphasize affordable programs 13 Please see important disclosures in the Appendix

American Public Education, Inc. ACCELERATING APEI’S VALUE CREATION STRATEGY Expanding Platform Amplifies Our Mission in Helping Learners Maximize HEROI TM Rasmussen + Hondros = $165M Powerhouse in Nursing Education Business in a Growing Market APEI Resulting Mix will be One - Third Military/Vets, One - Third Nursing/Health, One - Third Online Positions APEI Profile to Growth, Scale and HEROI # 1 in Educator in ADN/RN and PN/LPN Nursing #1 in Military and Veterans Offers Programmatic, CBE and Shared Services Expansion Opportunities to APUS Offers Post - Licensure Programmatic Expansion to Hondros Students Adds 24 On - Ground Locations which can be Leveraged to Accelerate Other Offerings 14 Please see important disclosures in the Appendix

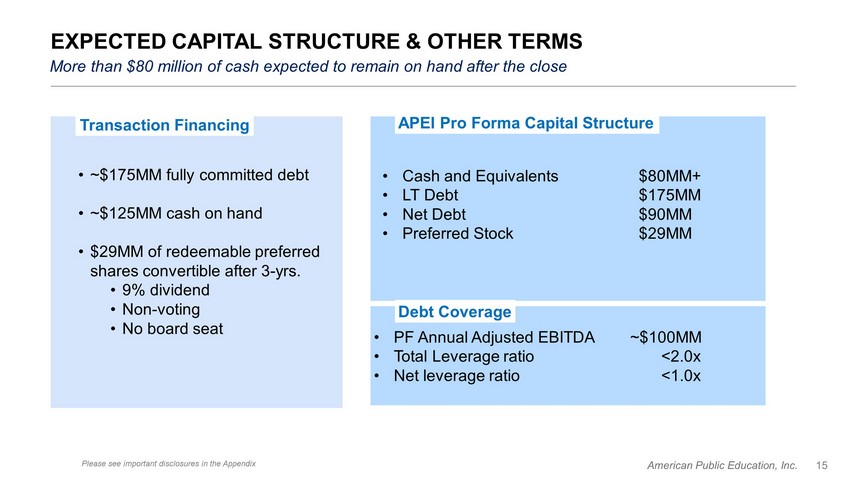

American Public Education, Inc. EXPECTED CAPITAL STRUCTURE & OTHER TERMS More than $80 million of cash expected to remain on hand after the close • Cash and Equivalents $80MM+ • LT Debt $175MM • Net Debt $90MM • Preferred Stock $29MM • ~$175MM fully committed debt • ~$125MM cash on hand • $29MM of redeemable preferred shares convertible after 3 - yrs. • 9% dividend • Non - voting • No board seat Transaction Financing APEI Pro Forma Capital Structure • PF Annual Adjusted EBITDA ~$100MM • Total Leverage ratio <2.0x • Net leverage ratio <1.0x Debt Coverage 15 Please see important disclosures in the Appendix

American Public Education, Inc. APEI’S PRELIMINARY THIRD QUARTER 2020 RESULTS APUS • Net course registrations +25% year - over - year to 13,500 • Total net course registrations +18% year - over - year to 90,300 Hondros • New student enrollment +88% year - over - year to 649 • Total student enrollment +39% year - over - year to 1,954 American Public Education is in the process of finalizing the actual results of operations for the three months ended Septemb er 30, 2020. Although complete details are not yet available, the company is able to provide the following financial update (excludes resu lts of Rasmussen) Fourth consecutive quarter of enrollment growth at APUS and Hondros • APEI consolidated revenue of $79.1 million, an increase of 16.6% compared to the third quarter of 2019. • APEI consolidated net income of $2.6 million, or $0.18 per share , compared to a net loss of $1.6 million in the third quarter of 2019. Student Metrics Financial Metrics 16 Please see important disclosures in the Appendix

American Public Education, Inc. Thank You 17 Please see important disclosures in the Appendix

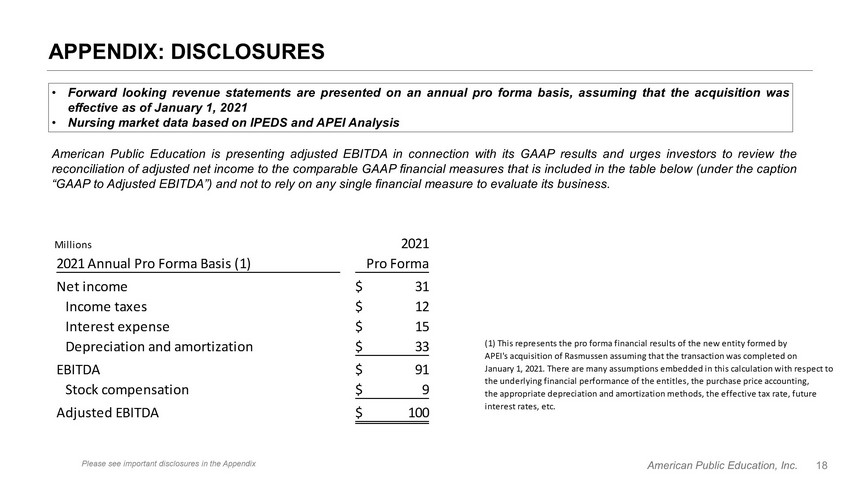

American Public Education, Inc. APPENDIX: DISCLOSURES American Public Education is presenting adjusted EBITDA in connection with its GAAP results and urges investors to review the reconciliation of adjusted net income to the comparable GAAP financial measures that is included in the table below (under the caption “GAAP to Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business . 18 Please see important disclosures in the Appendix • Forward looking revenue statements are presented on an annual pro forma basis, assuming that the acquisition was effective as of January 1 , 2021 • Nursing market data based on IPEDS and APEI Analysis (1) This represents the pro forma financial results of the new entity formed by APEI's acquisition of Rasmussen assuming that the transaction was completed on January 1, 2021. There are many assumptions embedded in this calculation with respect to the underlying financial performance of the entitles, the purchase price accounting, the appropriate depreciation and amortization methods, the effective tax rate, future interest rates, etc. Millions 2021 2021 Annual Pro Forma Basis (1) Pro Forma Net income 31$ Income taxes 12$ Interest expense 15$ Depreciation and amortization 33$ EBITDA 91$ Stock compensation 9$ Adjusted EBITDA 100$

American Public Education, Inc. APPENDIX: DISCLOSURES (C ONTINUED ) American Public Education is presenting adjusted EBITDA in connection with its GAAP results and urges investors to review the reconciliation of adjusted net income to the comparable GAAP financial measures that is included in the table below (under the caption “GAAP to Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business . 19 Please see important disclosures in the Appendix (in Millions, unaudited) Rasmussen University (1) Reconcilliation from Net Income to Adjusted EBITDA: 9/30/2017 9/30/2018 9/30/2019 9/30/2020 12/31/2020 (2) Net Income 10$ 18$ 12$ 19$ 7$ Income Taxes 2$ Interest expense - - 3 4 15 Depreciation and amortization 6 6 13 20 20 EBITDA 16 24 28 43 44 Pro Forma Adjustments 1 4 - (3) Adjusted EBITDA 17$ 28$ 28$ 40$ 44$ (1) The attached table provides a reconciliation from Net income to Adjusted EBITDA for Rasmussen University. The Pro-Forma adjustments are a combination of non-cash expenses, transaction expenses and expenses that will not continue after the change in ownership. (2) This represents the pro forma financial results of the Rasmussen University assuming that the transaction was completed on January 1, 2021. There are many assumptions embedded in this calculation with respect to the underlying financial performance, the purchase accounting, the appropriate depreciation and amortization methods, the effective tax rate, future interest rates, etc. For Twelve Months Ending