Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CBTX, Inc. | cbtx-20201028x8k.htm |

Exhibit 99.1

| CBTX, Inc. Investor Presentation Third Quarter 2020 NASDAQ: CBTX |

| 2 SAFE HARBOR STATEMENT AND NON-GAAP FINANCIAL MEASURES NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP (generally accepted accounting principles) financial measures, including tangible equity, tangible assets, tangible book value per share, tangible equity to tangible assets, return on tangible shareholders’ equity, return on average tangible equity, and pre-provision net revenue. The non-GAAP financial measures that CBTX, Inc.(the “Company”) discusses in this presentation should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP.A reconciliation of the non-GAAP financial measures used in this presentation to the most directly comparable GAAP measures is provided at the end of this presentation. FORWARD-LOOKING STATEMENTS This presentation may contain certain forward-looking statements within the meaning of the securities laws that are based on various facts and derived utilizing important assumptions, current expectations, estimates and projections about the Company and its subsidiary. Forward-looking statements include information regarding the Company’s future financial performance, business and growth strategy, projected plans and objectives, as well as projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing. Further, certain factors that could affect our future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to: whether the Company can manage the economic risks related to the impact of COVID-19 and the sustained instability in the oil and gas industry (including risks related to its customers’ credit quality, deferrals and modifications to loans, the Company’s ability to borrow, and the impact of a resultant recession generally), and other hazards such as natural disasters and adverse weather, acts of war or terrorism, other pandemics, an outbreak of hostilities or other international or domestic calamities and the governmental or military response thereto, and other matters beyond the Company’s control; the geographic concentration of our markets in Beaumont and Houston, Texas; whether the Company can manage changes and the continued health or availability of management personnel; the amount of nonperforming and classified assets that the Company holds and the efforts to resolve the nonperforming assets; deterioration of its asset quality; interest rate risks associated with the Company’s business; business and economic conditions generally and in the financial services industry, nationally and within the Company’s primary markets; volatility and direction of oil prices, including risks related to the instability of oil prices, and the strength of the energy industry, generally and within Texas; the composition of the Company’s loan portfolio, including the identity of its borrowers and the concentration of loans in specialized industries, especially the creditworthiness of energy company and commercial real estate borrowers; changes in the value of collateral securing the loans; the Company’s ability to maintain important deposit customer relationships and the Company’s reputation; the Company’s ability to maintain effective internal control over financial reporting; the Company’s ability to pursue available remedies in the event of a loan default for loans under the Paycheck Protection Program, or PPP, and the risk of holding the PPP loans at unfavorable interest rates as compared to the loans to customers that we would have otherwise lent to; the volatility and direction of market interest rates; liquidity risks associated with the Company’s business; systems failures, interruptions or breaches involving the Company’s information technology and telecommunications systems or third-party servicers; the failure of certain third party vendors to perform; the institution and outcome of litigation and other legal proceedings against the Company or to which it may become subject; operational risks associated with the Company’s business; the costs, effects and results of regulatory examinations, investigations, including the ongoing investigation by the Financial Crimes Enforcement Network, or FinCEN, of the U.S. Department of Treasury, or reviews or the ability to obtain the required regulatory approvals; the Company’s ability to meet the requirements of its Formal Agreement with the Office of the Comptroller of the Currency, and the risk that such Formal Agreement may have a negative impact on the Company’s financial performance and results of operations; changes in the laws, rules, regulations, interpretations or policies relating to financial institution, accounting, tax, trade, monetary and fiscal matters; governmental or regulatory responses to the COVID-19 pandemic and newly enacted fiscal stimulus that impact the Company’s loan portfolio and forbearance practice; and other governmental interventions in the U.S. financial system that may impact how the Company achieves its performance goals. Additionally, many of these risks and uncertainties are currently elevated by and may or will continue to be elevated by the COVID-19 pandemic. The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission, or SEC, and other reports and statements that the Company has filed with the SEC. If one or more events related to these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, actual results may differ materially from what it anticipates. Accordingly, you should not place undue reliance on any such forward- looking statements. Any forward-looking statement speaks only as of the date on which it is made, and the Company does not undertake any obligation to publicly update or review any forward- looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for the Company to predict which will arise. In addition, the Company cannot assess the impact of each factor on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Copies of the SEC filings for the Company are available for download free of charge from www.communitybankoftx.com under the Investor Relations tab. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that the Company or persons acting on the Company’s behalf may issue. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. |

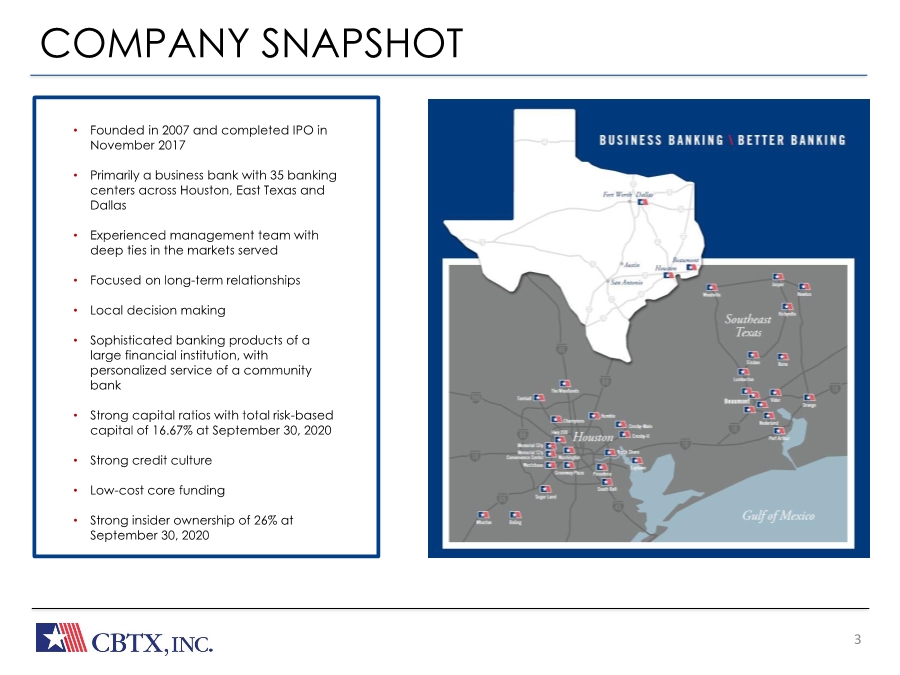

| The Bank Built or Business 3 • Gross loans increased from March by $269.4 million due to originations of $336.1 million of PPP loans during Q2 offset by paydowns/payoffs • Total commercial loans (1) were 86.7% of total loans at June 30, 2020 • At June 30, 2020, 76.4% of loans are Houston-based • Focused on lending to professionals and local small- and mid-sized businesses • At June 30, 2020, 6.1% of gross loans were related to oil and gas. See page 13. • Key emphasis on developing core relationships • Well-diversified loan portfolio • Founded in 2007 and completed IPO in November 2017 • Primarily a business bank with 35 banking centers across Houston, East Texas and Dallas • Experienced management team with deep ties in the markets served • Focused on long-term relationships • Local decision making • Sophisticated banking products of a large financial institution, with personalized service of a community bank • Strong capital ratios with total risk-based capital of 16.67% at September 30, 2020 • Strong credit culture • Low-cost core funding • Strong insider ownership of 26% at September 30, 2020 COMPANY SNAPSHOT |

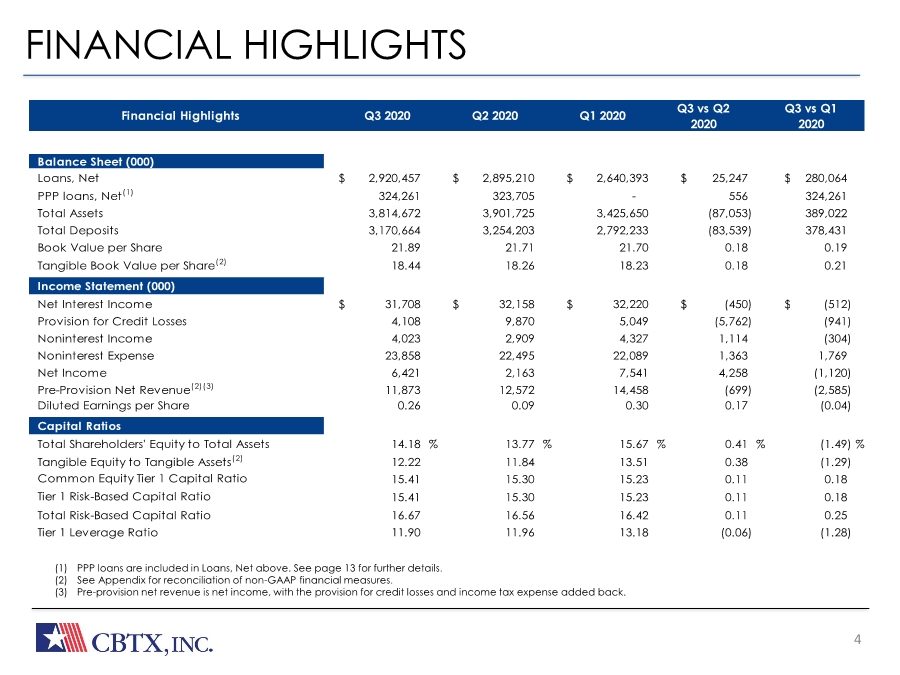

| 4 FINANCIAL HIGHLIGHTS (1) PPP loans are included in Loans, Net above. See page 13 for further details. (2) See Appendix for reconciliation of non-GAAP financial measures. (3) Pre-provision net revenue is net income, with the provision for credit losses and income tax expense added back. Financial Highlights Q3 2020 Q2 2020 Q1 2020 Q3 vs Q1 2020 Q3 vs Q2 2020 Balance Sheet (000) Loans, Net $ 2,920,457 $ 2,895,210 $ 2,640,393 $ 25,247 $ 280,064 PPP loans, Net(1) 324,261 323,705 - 556 324,261 Total Assets 3,814,672 3,901,725 3,425,650 (87,053) 389,022 Total Deposits 3,170,664 3,254,203 2,792,233 (83,539) 378,431 Book Value per Share 21.89 21.71 21.70 0.18 0.19 Tangible Book Value per Share(2) 18.44 18.26 18.23 0.18 0.21 Income Statement (000) Net Interest Income $ 31,708 $ 32,158 $ 32,220 $ (450) $ (512) Provision for Credit Losses 4,108 9,870 5,049 (5,762) (941) Noninterest Income 4,023 2,909 4,327 1,114 (304) Noninterest Expense 23,858 22,495 22,089 1,363 1,769 Net Income 6,421 2,163 7,541 4,258 (1,120) Pre-Provision Net Revenue(2)(3) 11,873 12,572 14,458 (699) (2,585) Diluted Earnings per Share 0.26 0.09 0.30 0.17 (0.04) Capital Ratios Total Shareholders' Equity to Total Assets 14.18 % 13.77 % 15.67 % 0.41 %(1.49) % Tangible Equity to Tangible Assets(2) 12.22 11.84 13.51 0.38 (1.29) Common Equity Tier 1 Capital Ratio 15.41 15.30 15.23 0.11 0.18 Tier 1 Risk-Based Capital Ratio 15.41 15.30 15.23 0.11 0.18 Total Risk-Based Capital Ratio 16.67 16.56 16.42 0.11 0.25 Tier 1 Leverage Ratio 11.90 11.96 13.18 (0.06) (1.28) |

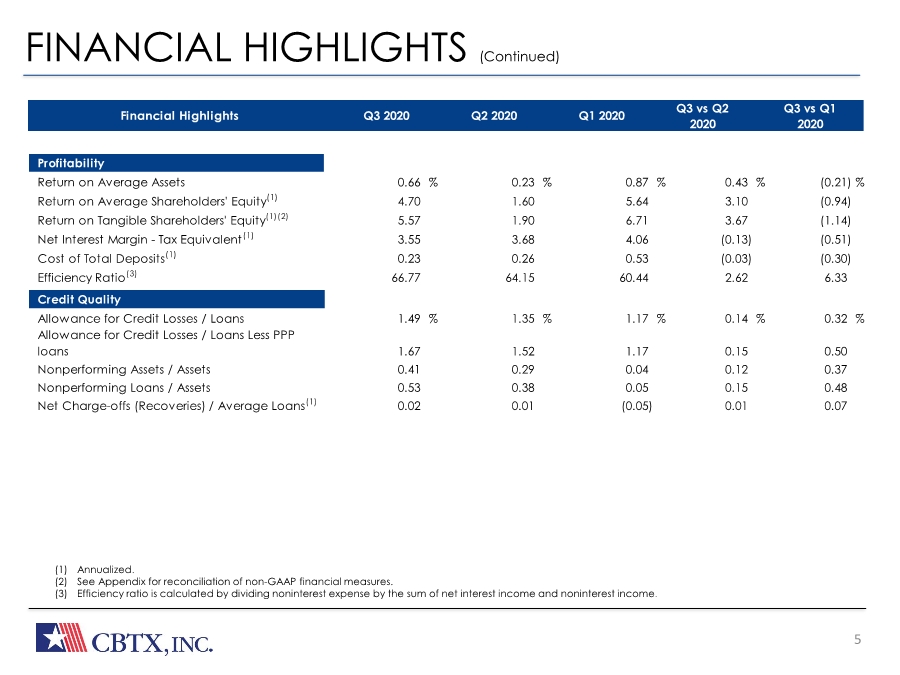

| 5 FINANCIAL HIGHLIGHTS (Continued) (1) Annualized. (2) See Appendix for reconciliation of non-GAAP financial measures. (3) Efficiency ratio is calculated by dividing noninterest expense by the sum of net interest income and noninterest income. Financial Highlights Q3 2020 Q2 2020 Q1 2020 Q3 vs Q1 2020 Q3 vs Q2 2020 Profitability Return on Average Assets 0.66 % 0.23 % 0.87 % 0.43 %(0.21) % Return on Average Shareholders' Equity(1) 4.70 1.60 5.64 3.10 (0.94) Return on Tangible Shareholders' Equity(1)(2) 5.57 1.90 6.71 3.67 (1.14) Net Interest Margin - Tax Equivalent(1) 3.55 3.68 4.06 (0.13) (0.51) Cost of Total Deposits(1) 0.23 0.26 0.53 (0.03) (0.30) Efficiency Ratio(3) 66.77 64.15 60.44 2.62 6.33 Credit Quality Allowance for Credit Losses / Loans 1.49 % 1.35 % 1.17 % 0.14 % 0.32 % Allowance for Credit Losses / Loans Less PPP loans 1.67 1.52 1.17 0.15 0.50 Nonperforming Assets / Assets 0.41 0.29 0.04 0.12 0.37 Nonperforming Loans / Assets 0.53 0.38 0.05 0.15 0.48 Net Charge-offs (Recoveries) / Average Loans(1) 0.02 0.01 (0.05) 0.01 0.07 |

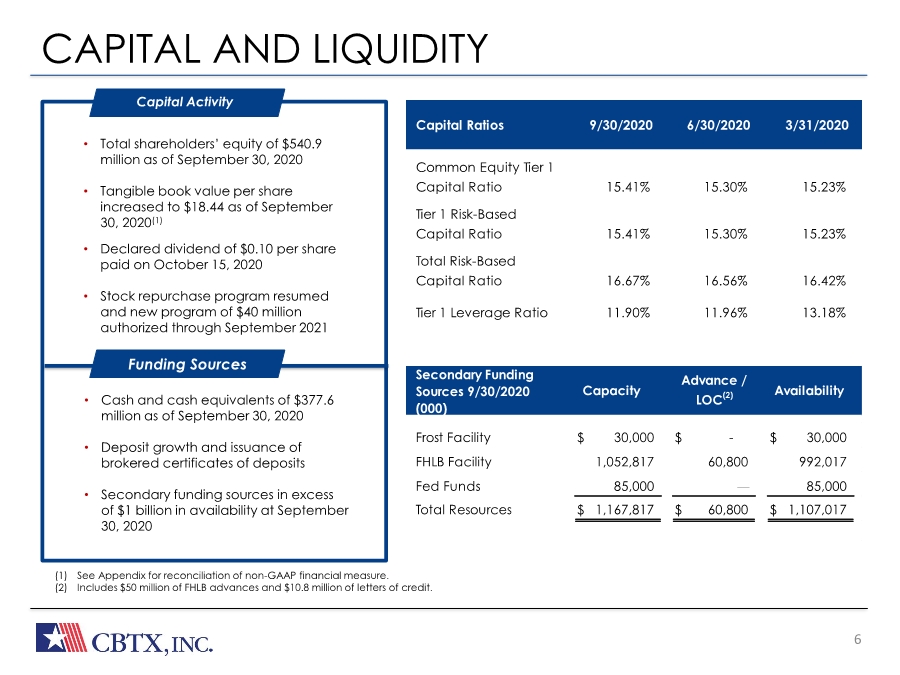

| The Bank Built or Business CAPITAL AND LIQUIDITY 6 REVENUE GROWH • Stable net interest margin (NIM) • Asset sensitive, with 54% variable rate loans as of March 31, 2020 • Increasing revenue and improving efficiency ratio (2) (1) See Appendix for reconciliation of non-GAAP financial measure. (2) Includes $50 million of FHLB advances and $10.8 million of letters of credit. • Total shareholders’ equity of $540.9 million as of September 30, 2020 • Tangible book value per share increased to $18.44 as of September 30, 2020(1) • Declared dividend of $0.10 per share paid on October 15, 2020 • Stock repurchase program resumed and new program of $40 million authorized through September 2021 Capital Activity • Cash and cash equivalents of $377.6 million as of September 30, 2020 • Deposit growth and issuance of brokered certificates of deposits • Secondary funding sources in excess of $1 billion in availability at September 30, 2020 Funding Sources Capital Ratios Common Equity Tier 1 Capital Ratio 15.41% 15.30% 15.23% Tier 1 Risk-Based Capital Ratio 15.41% 15.30% 15.23% Total Risk-Based Capital Ratio 16.67% 16.56% 16.42% Tier 1 Leverage Ratio 11.90% 11.96% 13.18% 9/30/2020 6/30/2020 3/31/2020 Secondary Funding Sources 9/30/2020 (000) Frost Facility $ 30,000 $ - $ 30,000 FHLB Facility 1,052,817 60,800 992,017 Fed Funds 85,000 — 85,000 Total Resources $ 1,167,817 $ 60,800 $ 1,107,017 Capacity Advance / LOC(2) Availability |

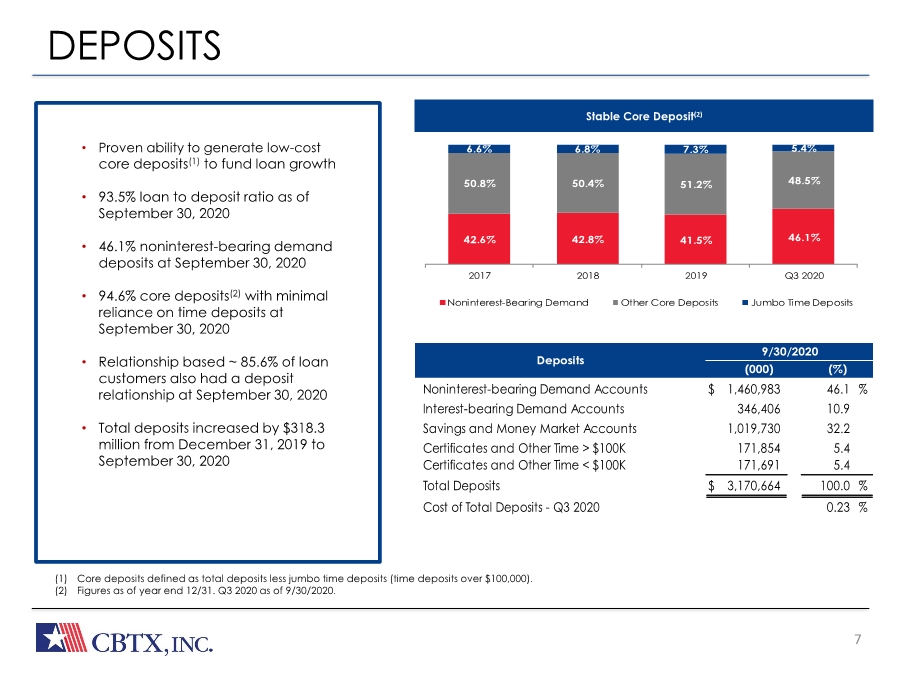

| The Bank Built or Business 7 Stable Core Deposit(2) (1) Core deposits defined as total deposits less jumbo time deposits (time deposits over $100,000). (2) Figures as of year end 12/31. Q3 2020 as of 9/30/2020. DEPOSITS • Gross loans increased from March by $269.4 million due to originations of $336.1 million of PPP loans during Q2 offset by paydowns/payoffs • Total commercial loans (1) were 86.7% of total loans at June 30, 2020 • At June 30, 2020, 76.4% of loans are Houston-based • Focused on lending to professionals and local small- and mid-sized businesses • At June 30, 2020, 6.1% of gross loans were related to oil and gas. See page 13. • Key emphasis on developing core relationships • Well-diversified loan portfolio • Proven ability to generate low-cost core deposits(1) to fund loan growth • 93.5% loan to deposit ratio as of September 30, 2020 • 46.1% noninterest-bearing demand deposits at September 30, 2020 • 94.6% core deposits(2) with minimal reliance on time deposits at September 30, 2020 • Relationship based ~ 85.6% of loan customers also had a deposit relationship at September 30, 2020 • Total deposits increased by $318.3 million from December 31, 2019 to September 30, 2020 42.6% 42.8% 41.5% 46.1% 50.8% 50.4% 51.2% 48.5% 6.6% 6.8% 7.3% 5.4% 2017 2018 2019 Q3 2020 Noninterest-Bearing Demand Other Core Deposits Jumbo Time Deposits (%) (000) Deposits 9/30/2020 Noninterest-bearing Demand Accounts $ 1,460,983 46.1 % Interest-bearing Demand Accounts 346,406 10.9 Savings and Money Market Accounts 1,019,730 32.2 Certificates and Other Time > $100K 171,854 5.4 Certificates and Other Time < $100K 171,691 5.4 Total Deposits $ 3,170,664 100.0 % Cost of Total Deposits - Q3 2020 0.23 % |

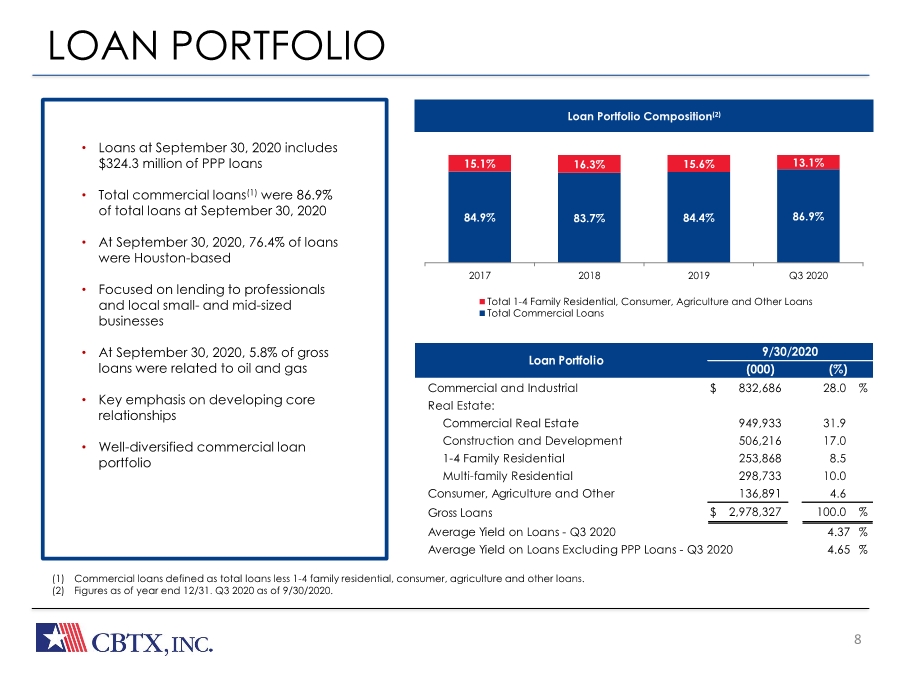

| The Bank Built or Business 8 Loan Portfolio Composition(2) (1) Commercial loans defined as total loans less 1-4 family residential, consumer, agriculture and other loans. (2) Figures as of year end 12/31. Q3 2020 as of 9/30/2020. LOAN PORTFOLIO • Gross loans increased from March by $269.4 million due to originations of $336.1 million of PPP loans during Q2 offset by paydowns/payoffs • Total commercial loans (1) were 86.7% of total loans at June 30, 2020 • At June 30, 2020, 76.4% of loans are Houston-based • Focused on lending to professionals and local small- and mid-sized businesses • At June 30, 2020, 6.1% of gross loans were related to oil and gas. See page 13. • Key emphasis on developing core relationships • Well-diversified loan portfolio • Loans at September 30, 2020 includes $324.3 million of PPP loans • Total commercial loans(1) were 86.9% of total loans at September 30, 2020 • At September 30, 2020, 76.4% of loans were Houston-based • Focused on lending to professionals and local small- and mid-sized businesses • At September 30, 2020, 5.8% of gross loans were related to oil and gas • Key emphasis on developing core relationships • Well-diversified commercial loan portfolio 84.9% 83.7% 84.4% 86.9% 15.1% 16.3% 15.6% 13.1% 2017 2018 2019 Q3 2020 Total 1-4 Family Residential, Consumer, Agriculture and Other Loans Total Commercial Loans (%) Loan Portfolio (000) 9/30/2020 Commercial and Industrial $ 832,686 28.0 % Real Estate: Commercial Real Estate 949,933 31.9 Construction and Development 506,216 17.0 1-4 Family Residential 253,868 8.5 Multi-family Residential 298,733 10.0 Consumer, Agriculture and Other 136,891 4.6 Gross Loans $ 2,978,327 100.0 % Average Yield on Loans - Q3 2020 4.37 % Average Yield on Loans Excluding PPP Loans - Q3 2020 4.65 % |

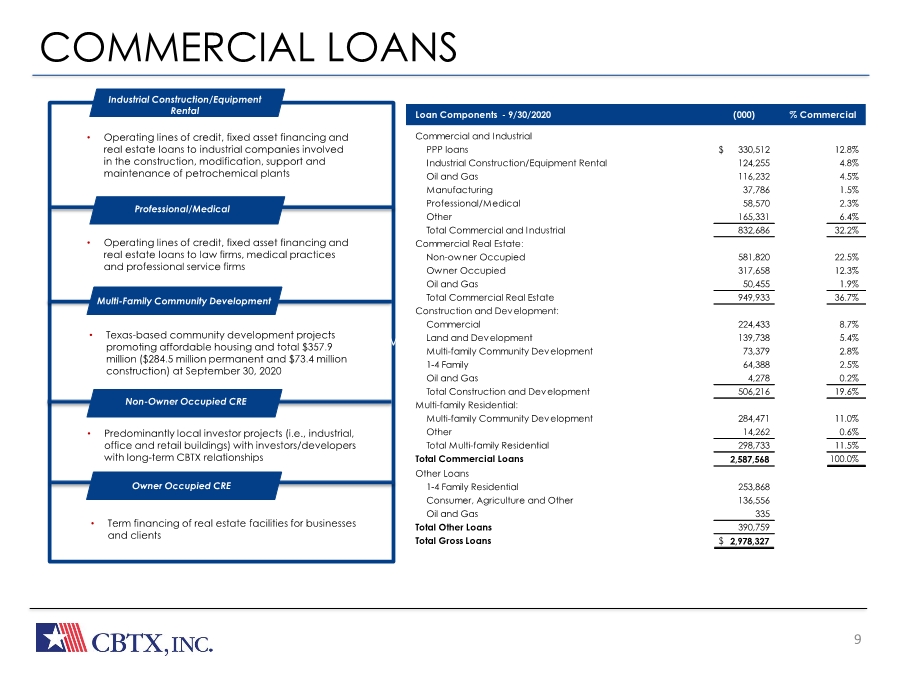

| The Bank Built or Business COMMERCIAL LOANS 9 Multi-family ($418M) • Operating lines of credit, fixed asset financing and real estate loans to industrial companies involved in the construction, modification, support and maintenance of petrochemical plants Industrial Construction/Equipment Rental Multi-Family Community Development • Operating lines of credit, fixed asset financing and real estate loans to law firms, medical practices and professional service firms • Texas-based community development projects promoting affordable housing and total $357.9 million ($284.5 million permanent and $73.4 million construction) at September 30, 2020 • Predominantly local investor projects (i.e., industrial, office and retail buildings) with investors/developers with long-term CBTX relationships • Term financing of real estate facilities for businesses and clients Professional/Medical Non-Owner Occupied CRE Owner Occupied CRE Loan Components - 9/30/2020 T Commercial and Industrial PPP loans $ 330,512 12.8% Industrial Construction/Equipment Rental 124,255 4.8% Oil and Gas 116,232 4.5% Manufacturing 37,786 1.5% Professional/Medical 58,570 2.3% Other 165,331 6.4% Total Commercial and Industrial 832,686 32.2% Commercial Real Estate: Non-owner Occupied 581,820 22.5% Owner Occupied 317,658 12.3% Oil and Gas 50,455 1.9% Total Commercial Real Estate 949,933 36.7% Construction and Development: Commercial 224,433 8.7% Land and Development 139,738 5.4% Multi-family Community Development 73,379 2.8% 1-4 Family 64,388 2.5% Oil and Gas 4,278 0.2% Total Construction and Development 506,216 19.6% Multi-family Residential: Multi-family Community Development 284,471 11.0% Other 14,262 0.6% Total Multi-family Residential 298,733 11.5% Total Commercial Loans 2,587,568 100.0% Other Loans 1-4 Family Residential 253,868 Consumer, Agriculture and Other 136,556 Oil and Gas 335 Total Other Loans 390,759 Total Gross Loans $ 2,978,327 (000) % Commercial |

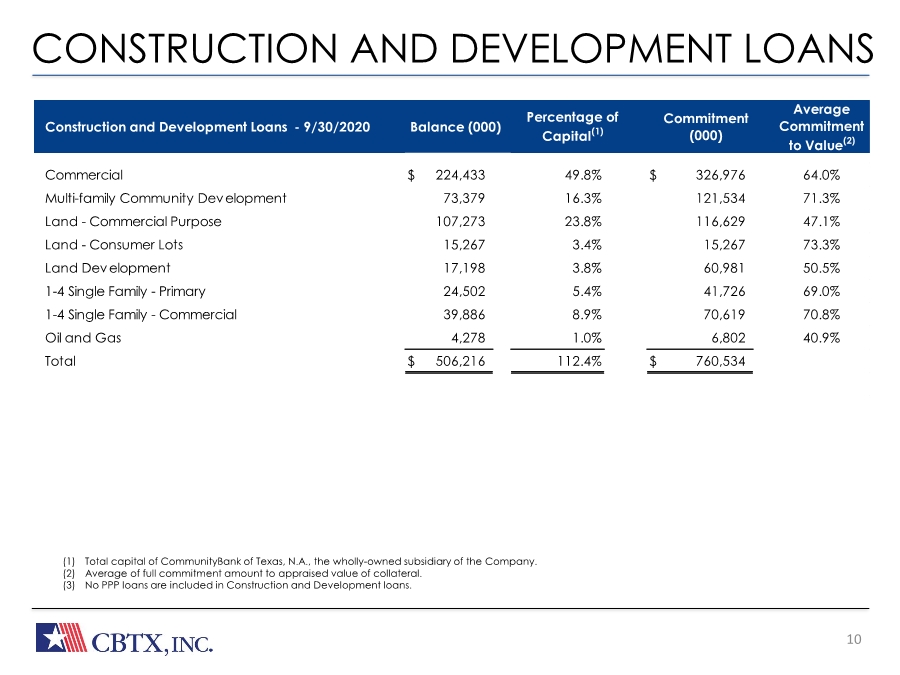

| The Bank Built or Business CONSTRUCTION AND DEVELOPMENT LOANS 10 (1) Total capital of CommunityBank of Texas, N.A., the wholly-owned subsidiary of the Company. (2) Average of full commitment amount to appraised value of collateral. (3) No PPP loans are included in Construction and Development loans. Construction and Development Loans - 9/30/2020 Balance (000) Commitment (000) Average Commitment to Value(2) Percentage of Capital(1) Commercial $ 224,433 49.8% $ 326,976 64.0% Multi-family Community Development 73,379 16.3% 121,534 71.3% Land - Commercial Purpose 107,273 23.8% 116,629 47.1% Land - Consumer Lots 15,267 3.4% 15,267 73.3% Land Development 17,198 3.8% 60,981 50.5% 1-4 Single Family - Primary 24,502 5.4% 41,726 69.0% 1-4 Single Family - Commercial 39,886 8.9% 70,619 70.8% Oil and Gas 4,278 1.0% 6,802 40.9% Total $ 506,216 112.4% $ 760,534 |

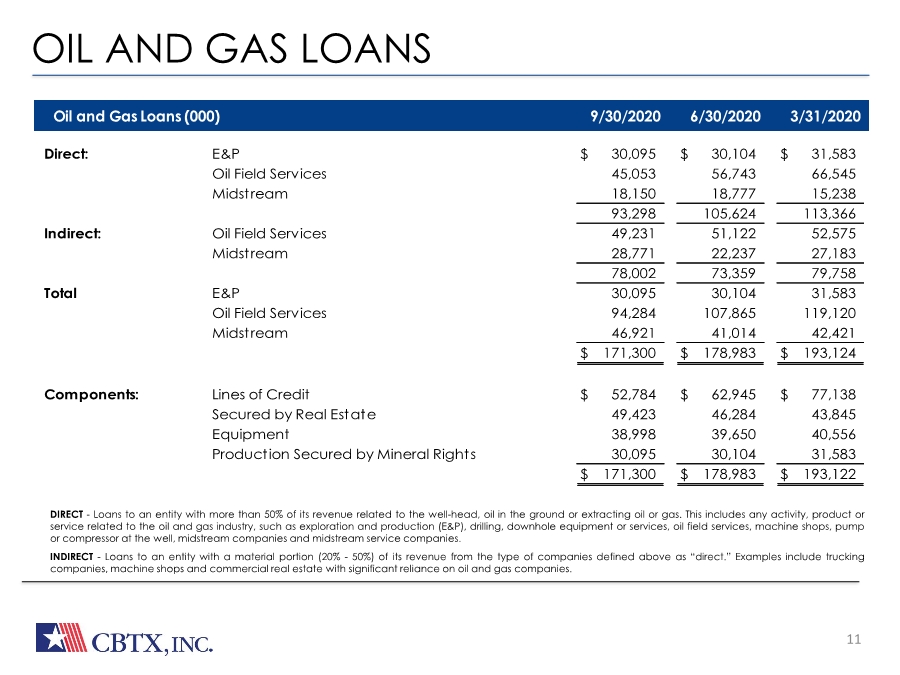

| The Bank Built or Business OIL AND GAS LOANS 11 • DIRECT - Loans to an entity with more than 50% of its revenue related to the well-head, oil in the ground or extracting oil or gas. This includes any activity, product or service related to the oil and gas industry, such as exploration and production (E&P), drilling, downhole equipment or services, oil field services, machine shops, pump or compressor at the well, midstream companies and midstream service companies. • INDIRECT - Loans to an entity with a material portion (20%- 50%) of its revenue from the type of companies defined above as “direct.” Examples include trucking companies, machine shops and commercial real estate with significant reliance on oil and gas companies. Oil and Gas Loans (000) 9/30/2020 6/30/2020 3/31/2020 Direct: E&P $ 30,095 $ 30,104 $ 31,583 Oil Field Services 45,053 56,743 66,545 Midstream 18,150 18,777 15,238 93,298 105,624 113,366 Indirect: Oil Field Services 49,231 51,122 52,575 Midstream 28,771 22,237 27,183 78,002 73,359 79,758 Total E&P 30,095 30,104 31,583 Oil Field Services 94,284 107,865 119,120 Midstream 46,921 41,014 42,421 $ 171,300 $ 178,983 $ 193,124 Components: Lines of Credit $ 52,784 $ 62,945 $ 77,138 Secured by Real Estate 49,423 46,284 43,845 Equipment 38,998 39,650 40,556 Production Secured by Mineral Rights 30,095 30,104 31,583 $ 171,300 $ 178,983 $ 193,122 |

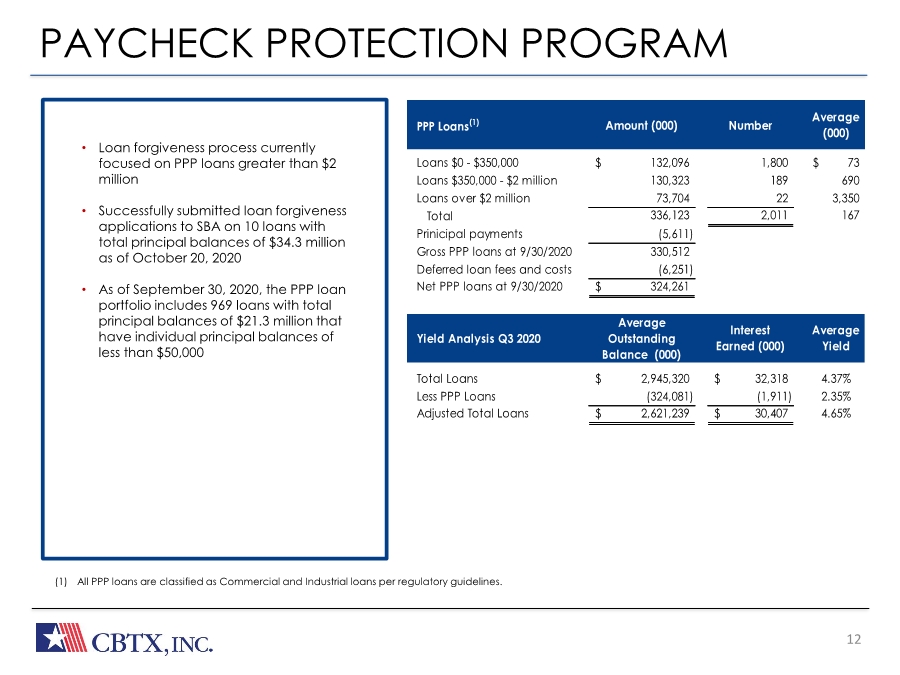

| 12 PAYCHECK PROTECTION PROGRAM (1) All PPP loans are classified as Commercial and Industrial loans per regulatory guidelines. • Loan forgiveness process currently focused on PPP loans greater than $2 million • Successfully submitted loan forgiveness applications to SBA on 10 loans with total principal balances of $34.3 million as of October 20, 2020 • As of September 30, 2020, the PPP loan portfolio includes 969 loans with total principal balances of $21.3 million that have individual principal balances of less than $50,000 PPP Loans(1) Amount (000) Number Average (000) Loans $0 - $350,000 132,096 $ 1,800 73 $ Loans $350,000 - $2 million 130,323 189 690 Loans over $2 million 73,704 22 3,350 Total 336,123 2,011 167 Prinicipal payments (5,611) Gross PPP loans at 9/30/2020 330,512 Deferred loan fees and costs (6,251) Net PPP loans at 9/30/2020 324,261 $ Yield Analysis Q3 2020 Average Outstanding Balance (000) Interest Earned (000) Average Yield Total Loans 2,945,320 $ 32,318 $ 4.37% Less PPP Loans (324,081) (1,911) 2.35% Adjusted Total Loans 2,621,239 $ 30,407 $ 4.65% |

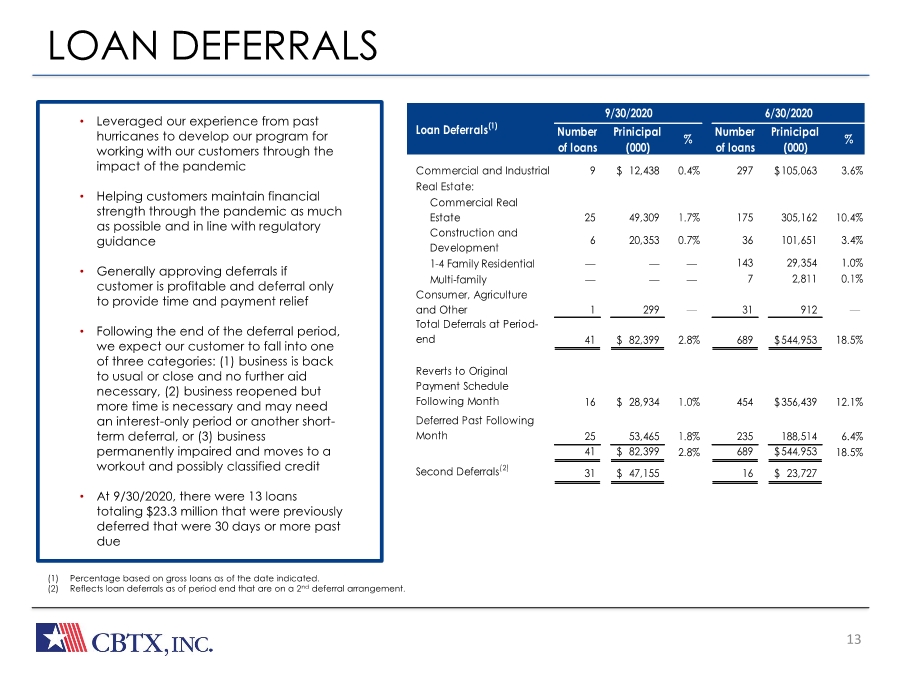

| The Bank Built or Business 13 LOAN DEFERRALS • Leveraged our experience from past hurricanes to develop our program for working with our customers through the impact of the pandemic • Helping customers maintain financial strength through the pandemic as much as possible and in line with regulatory guidance • Generally approving deferrals if customer is profitable and deferral only to provide time and payment relief • Following the end of the deferral period, we expect our customer to fall into one of three categories: (1) business is back to usual or close and no further aid necessary, (2) business reopened but more time is necessary and may need an interest-only period or another short- term deferral, or (3) business permanently impaired and moves to a workout and possibly classified credit • At 9/30/2020, there were 13 loans totaling $23.3 million that were previously deferred that were 30 days or more past due (1) Percentage based on gross loans as of the date indicated. (2) Reflects loan deferrals as of period end that are on a 2nd deferral arrangement. Commercial and Industrial 9 12,438 $ 0.4% 297 105,063 $ 3.6% Real Estate: Commercial Real Estate 25 49,309 1.7% 175 305,162 10.4% Construction and Development 6 20,353 0.7% 36 101,651 3.4% 1-4 Family Residential — — — 143 29,354 1.0% Multi-family — — — 7 2,811 0.1% Consumer, Agriculture and Other 1 299 — 31 912 — Total Deferrals at Period- end 41 82,399 $ 2.8% 689 544,953 $ 18.5% Reverts to Original Payment Schedule Following Month 16 28,934 $ 1.0% 454 356,439 $ 12.1% Deferred Past Following Month 25 53,465 1.8% 235 188,514 6.4% 41 82,399 $ 2.8% 689 544,953 $ 18.5% Second Deferrals(2) 31 47,155 $ 16 23,727 $ Number of loans Prinicipal (000) % Number of loans Prinicipal (000) % 9/30/2020 6/30/2020 Loan Deferrals(1) |

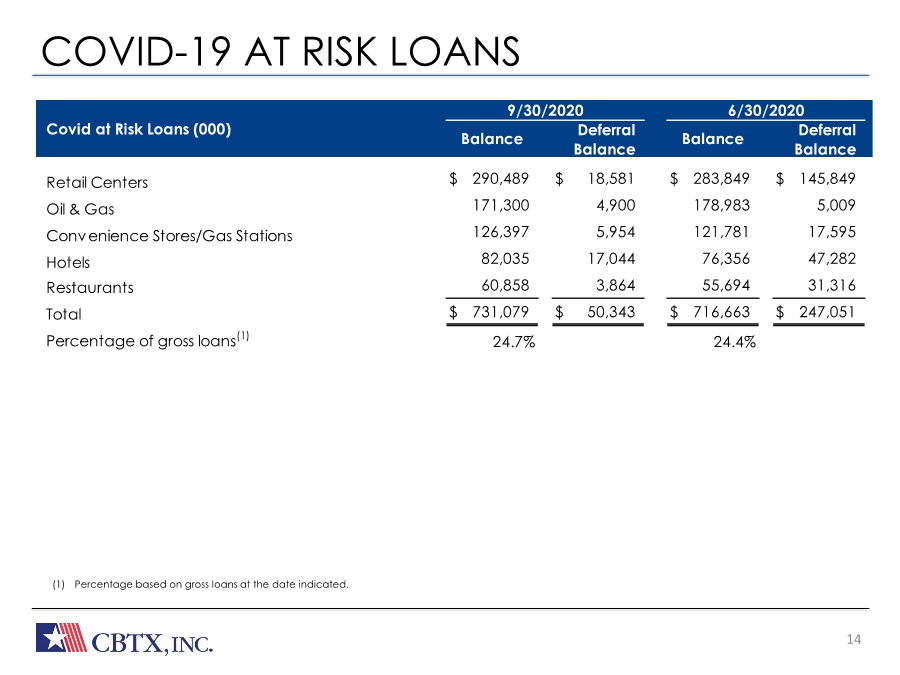

| The Bank Built or Business COVID-19 AT RISK LOANS 14 • Participating in the Paycheck Protection Program offered under the Cares Act •____ PPP loans outstanding, with average loan size of ___ at June 30, 2020 • SBA origination fees of $11.2 M through 6/30/2020. • Processing additional applications (1) Percentage based on gross loans at the date indicated. Deferral Balance Deferral Balance Retail Centers $ 290,489 $ 18,581 $ 283,849 $ 145,849 Oil & Gas 171,300 4,900 178,983 5,009 Convenience Stores/Gas Stations 126,397 5,954 121,781 17,595 Hotels 82,035 17,044 76,356 47,282 Restaurants 60,858 3,864 55,694 31,316 Total $ 731,079 $ 50,343 $ 716,663 $ 247,051 Percentage of gross loans(1) 24.7% 24.4% Covid at Risk Loans (000) Balance Balance 9/30/2020 6/30/2020 |

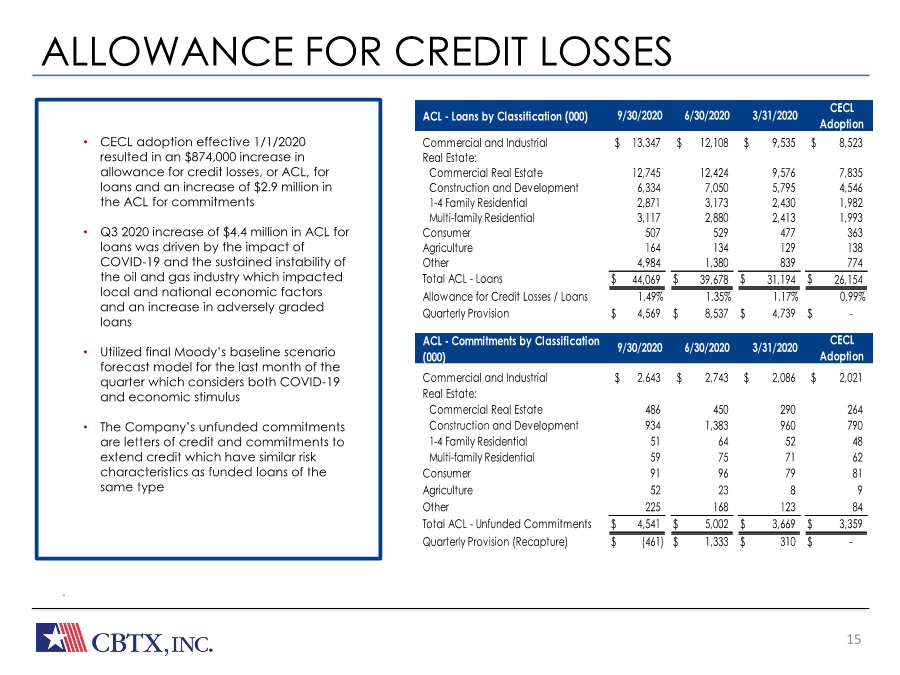

| The Bank Built or Business ALLOWANCE FOR CREDIT LOSSES 15 • Participating in the Paycheck Protection Program offered under the Cares Act •____ PPP loans outstanding, with average loan size of ___ at June 30, 2020 • SBA origination fees of $11.2 M through 6/30/2020. • Processing additional applications . • CECL adoption effective 1/1/2020 resulted in an $874,000 increase in allowance for credit losses, or ACL, for loans and an increase of $2.9 million in the ACL for commitments • Q3 2020 increase of $4.4 million in ACL for loans was driven by the impact of COVID-19 and the sustained instability of the oil and gas industry which impacted local and national economic factors and an increase in adversely graded loans • Utilized final Moody’s baseline scenario forecast model for the last month of the quarter which considers both COVID-19 and economic stimulus • The Company’s unfunded commitments are letters of credit and commitments to extend credit which have similar risk characteristics as funded loans of the same type ACL - Loans by Classification (000) 9/30/2020 6/30/2020 CECL Adoption 3/31/2020 Commercial and Industrial $ 13,347 $ 12,108 $ 9,535 $ 8,523 Real Estate: Commercial Real Estate 12,745 12,424 9,576 7,835 Construction and Development 6,334 7,050 5,795 4,546 1-4 Family Residential 2,871 3,173 2,430 1,982 Multi-family Residential 3,117 2,880 2,413 1,993 Consumer 507 529 477 363 Agriculture 164 134 129 138 Other 4,984 1,380 839 774 Total ACL - Loans $ 44,069 $ 39,678 $ 31,194 $ 26,154 Allowance for Credit Losses / Loans 1.49% 1.35% 1.17% 0.99% Quarterly Provision $ 4,569 $ 8,537 $ 4,739 $ - ACL - Commitments by Classification (000) 9/30/2020 6/30/2020 CECL Adoption 3/31/2020 Commercial and Industrial $ 2,643 $ 2,743 $ 2,086 $ 2,021 Real Estate: Commercial Real Estate 486 450 290 264 Construction and Development 934 1,383 960 790 1-4 Family Residential 51 64 52 48 Multi-family Residential 59 75 71 62 Consumer 91 96 79 81 Agriculture 52 23 8 9 Other 225 168 123 84 Total ACL - Unfunded Commitments $ 4,541 $ 5,002 $ 3,669 $ 3,359 Quarterly Provision (Recapture) $ (461) $ 1,333 $ 310 $ - |

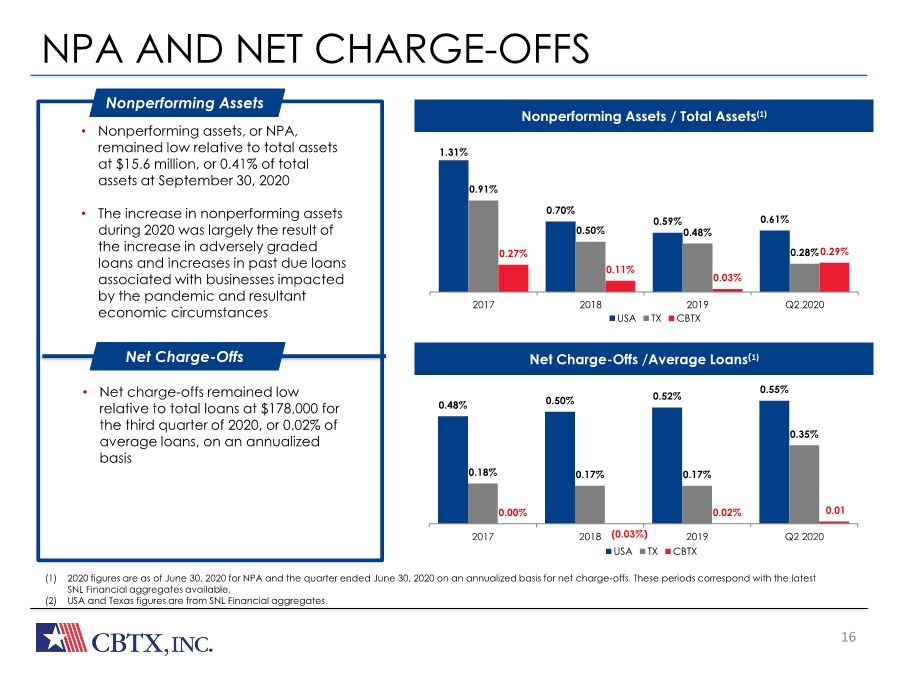

| The Bank Built or Business NPA AND NET CHARGE-OFFS 16 REVENUE • Net interest margin (NIM) remained strong, impacted by lower interest rates and lower yielding PPP loans • Average loan yield (excluding PPP loans) of 4.75% for Q2 2020 • • Average loan yield on PPP loans of 2.28% • Cost of interest bearing liabilities of 0.52% • Asset sensitive, with 49.5% variable rate loans as of June 30, 2020 • Approximately 77% of variable rate loan portfolio had floors EFFICIENCY EFFORTS • Investments in people, technology and systems • Infrastructure capable of supporting a much larger bank • Resulting scalability should allow for growth without significant expenses (1) 2020 figures are as of June 30, 2020 for NPA and the quarter ended June 30, 2020 on an annualized basis for net charge-offs. These periods correspond with the latest SNL Financial aggregates available. (2) USA and Texas figures are from SNL Financial aggregates. • Nonperforming assets, or NPA, remained low relative to total assets at $15.6 million, or 0.41% of total assets at September 30, 2020 • The increase in nonperforming assets during 2020 was largely the result of the increase in adversely graded loans and increases in past due loans associated with businesses impacted by the pandemic and resultant economic circumstances Nonperforming Assets • Net charge-offs remained low relative to total loans at $178,000 for the third quarter of 2020, or 0.02% of average loans, on an annualized basis Net Charge-Offs Nonperforming Assets / Total Assets(1) Net Charge-Offs /Average Loans(1) 1.31% 0.70% 0.59% 0.61% 0.91% 0.50% 0.48% 0.28% 0.27% 0.11% 0.03% 0.29% 2017 2018 2019 Q2 2020 USA TX CBTX 0.48% 0.50% 0.52% 0.55% 0.18% 0.17% 0.17% 0.35% 0.00% (0.03%) 0.02% 0.01 2017 2018 2019 Q2 2020 USA TX CBTX |

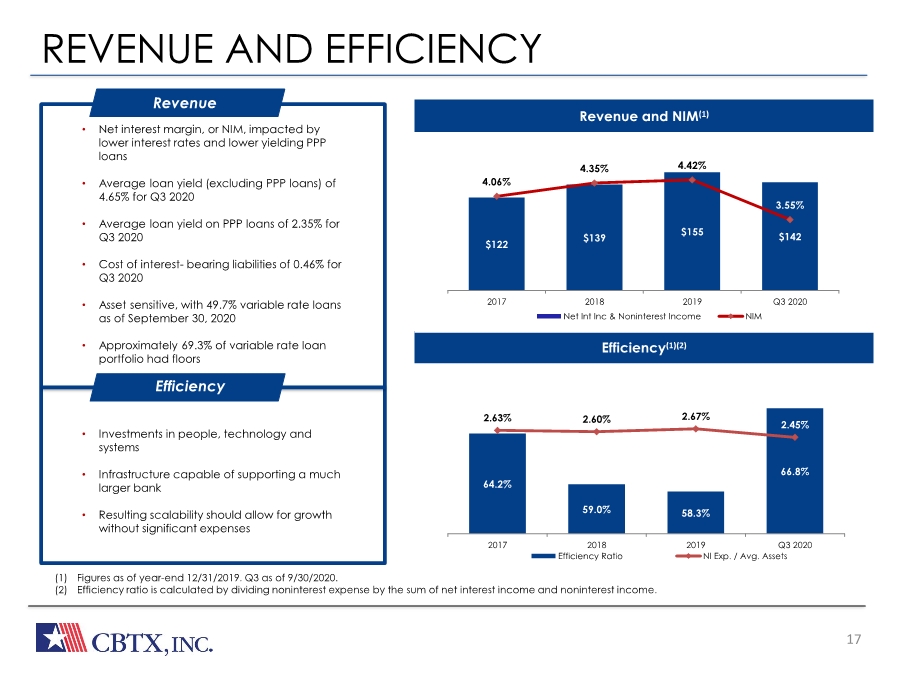

| The Bank Built or Business REVENUE AND EFFICIENCY 17 REVENUE • Net interest margin (NIM) remained strong, impacted by lower interest rates and lower yielding PPP loans • Average loan yield (excluding PPP loans) of 4.75% for Q2 2020 • • Average loan yield on PPP loans of 2.28% • Cost of interest bearing liabilities of 0.52% • Asset sensitive, with 49.5% variable rate loans as of June 30, 2020 • Approximately 77% of variable rate loan portfolio had floors EFFICIENCY EFFORTS • Investments in people, technology and systems • Infrastructure capable of supporting a much larger bank • Resulting scalability should allow for growth without significant expenses (1) Figures as of year-end 12/31/2019. Q3 as of 9/30/2020. (2) Efficiency ratio is calculated by dividing noninterest expense by the sum of net interest income and noninterest income. • Net interest margin, or NIM, impacted by lower interest rates and lower yielding PPP loans • Average loan yield (excluding PPP loans) of 4.65% for Q3 2020 • Average loan yield on PPP loans of 2.35% for Q3 2020 • Cost of interest- bearing liabilities of 0.46% for Q3 2020 • Asset sensitive, with 49.7% variable rate loans as of September 30, 2020 • Approximately 69.3% of variable rate loan portfolio had floors Revenue • Investments in people, technology and systems • Infrastructure capable of supporting a much larger bank • Resulting scalability should allow for growth without significant expenses Efficiency Revenue and NIM(1) Efficiency(1)(2) 64.2% 59.0% 58.3% 66.8% 2.63% 2.60% 2.67% 2.45% 2017 2018 2019 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 54% 56% 58% 60% 62% 64% 66% 68% 2017 2018 2019 Q3 2020 Axis Title Axis Title Axis Title Efficiency Ratio NI Exp. / Avg. Assets $122 $139 $155 $142 4.06% 4.35% 4.42% 3.55% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% $0 $20 $40 $60 $80 $100 $120 $140 $160 2017 2018 2019 Q3 2020 Net Int Inc & Noninterest Income NIM |

| 18 At CommunityBank of Texas, we’re committed to building strong honest relationships. We strive to keep our clients’ and partners’ needs at the forefront of everything we do. And we measure our success by the success we help create for them. OUR VISION Here to Serve. OUR POSITIONING To experienced business owners, CommunityBank of Texas is the financial partner that delivers a better banking experience. OUR PERSONALITY Resourceful, Trustworthy, Friendly, Responsive, Strong At CommunityBank of Texas, we believe in a powerful and multi-faceted statement, one that drills straight to the heart of our reason for being, while clearly illuminating the mission that our many employees pursue each day: Here to serve. Here to serve is a commitment to building strong and honest relationships, a clarion call to remember that in everything we do, our highest purpose is to transform our extensive financial expertise into success for our clients. Relationships are the bedrock of our business – both internally and externally – and there is a stewardship in the word serve that promises that, in these relationships, we will be caring, humble and precise. That we will keep the needs of our clients at the forefront of our minds at all times and measure our performance by the success we create for each other. The other critical component of our brand vision is the word here, which serves several important roles. Here is a promise that we will be there for our clients and answer the call when they need us the most. We will be Dependable. Honest. Trustworthy. And we will remember that every time is the right time to put our clients’ needs first. Here is also a pledge to be visible and present in the communities we serve. It adds weight to the first and most key component of our name: Community. We are not some faceless financial institution located high above the rank and file, safely sheltered in an ivory tower. We are right here, serving the cities and communities in which we live. Day-in and day-out. We sponsor civic events, donate back to our neighbors in need, and spend the time to really get to know our clients on a personal level. In the face of an increasingly digital and impersonal world, we are proudly present in the lives of our clients and our communities. |

| APPENDIX |

| 20 NON-GAAP RECONCILIATIONS Our management uses certain non-GAAP financial measures to evaluate performance. We have included in this presentation information related these non-GAAP financial measures for the applicable periods presented. The following tables reconcile, as of the dates set forth below (1) book value per share to tangible book value per share;(2) total shareholders’ equity to total assets to tangible equity to tangible assets;(3) return on average shareholders’ equity to return on average tangible equity; and (4) net income to pre-provision net revenue. The most directly comparable GAAP financial measure for tangible book value per share is book value per share and the most directly comparable GAAP financial measure for tangible equity to tangible assets is total shareholders’ equity to total assets. The most directly comparable GAAP financial measure for return on average tangible equity is return on average shareholders’ equity. The most directly comparable GAAP financial measure for pre-provision net revenue is net income. |

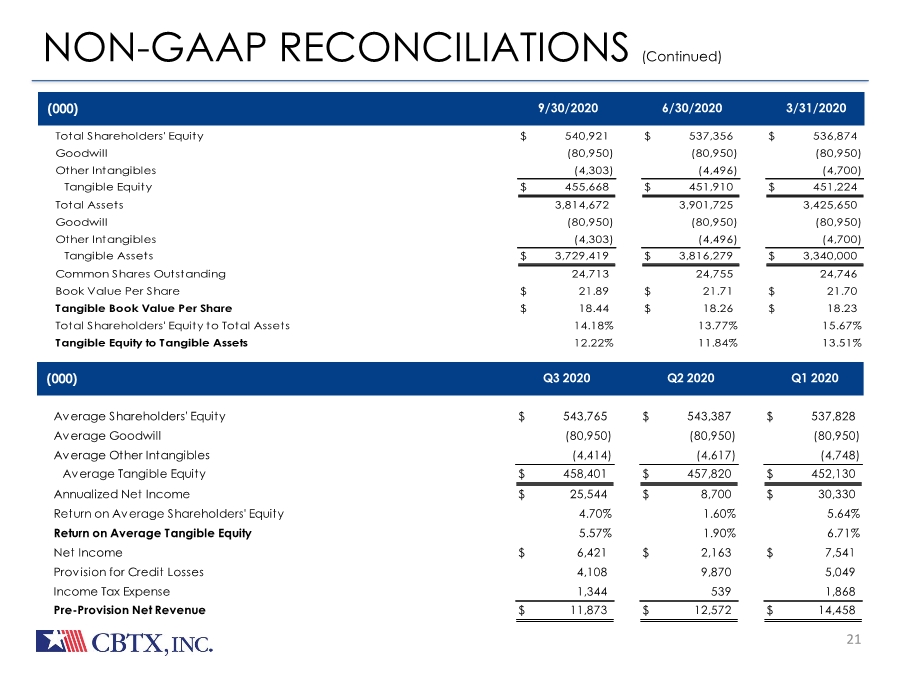

| 21 NON-GAAP RECONCILIATIONS (Continued) (000) 6/30/2020 9/30/2020 3/31/2020 Total Shareholders' Equity $ 540,921 $ 537,356 $ 536,874 Goodwill (80,950) (80,950) (80,950) Other Intangibles (4,303) (4,496) (4,700) Tangible Equity $ 455,668 $ 451,910 $ 451,224 Total Assets 3,814,672 3,901,725 3,425,650 Goodwill (80,950) (80,950) (80,950) Other Intangibles (4,303) (4,496) (4,700) Tangible Assets $ 3,729,419 $ 3,816,279 $ 3,340,000 Common Shares Outstanding 24,713 24,755 24,746 Book Value Per Share $ 21.89 $ 21.71 $ 21.70 Tangible Book Value Per Share $ 18.44 $ 18.26 $ 18.23 Total Shareholders' Equity to Total Assets 14.18% 13.77% 15.67% Tangible Equity to Tangible Assets 12.22% 11.84% 13.51% (000) Q1 2020 Q3 2020 Q2 2020 Average Shareholders' Equity $ 543,765 $ 543,387 $ 537,828 Average Goodwill (80,950) (80,950) (80,950) Average Other Intangibles (4,414) (4,617) (4,748) Average Tangible Equity $ 458,401 $ 457,820 $ 452,130 Annualized Net Income $ 25,544 $ 8,700 $ 30,330 Return on Average Shareholders' Equity 4.70% 1.60% 5.64% Return on Average Tangible Equity 5.57% 1.90% 6.71% Net Income $ 6,421 $ 2,163 $ 7,541 Provision for Credit Losses 4,108 9,870 5,049 Income Tax Expense 1,344 539 1,868 Pre-Provision Net Revenue $ 11,873 $ 12,572 $ 14,458 |