Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANNALY CAPITAL MANAGEMENT INC | nly-20201028.htm |

Third Quarter 2020 Investor Presentation October 28, 2020

Important Notices This presentation is issued by Annaly Capital Management, Inc. ("Annaly"), an internally-managed, publicly traded company that has elected to be taxed as a real estate investment trust for federal income tax purposes and is being furnished in connection with Annaly’s Third Quarter 2020 quarterly report. This presentation is provided for investors in Annaly for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, any security or instrument. Forward-Looking Statements This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Such statements include those relating to the Company’s future performance, macro outlook, the interest rate and credit environments, tax reform and future opportunities. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, risks and uncertainties related to the COVID-19 pandemic, including as related to adverse economic conditions on real estate-related assets and financing conditions; changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of the Company’s assets; changes in business conditions and the general economy; the Company’s ability to grow our commercial real estate business; the Company’s ability to grow its residential credit business; the Company’s ability to grow its middle market lending business; credit risks related to the Company’s investments in credit risk transfer securities, residential mortgage- backed securities and related residential mortgage credit assets, commercial real estate assets and corporate debt; risks related to investments in mortgage servicing rights; the Company’s ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting the Company’s business; the Company’s ability to maintain its qualification as a REIT for U.S. federal income tax purposes; and the Company’s ability to maintain its exemption from registration under the Investment Company Act of 1940, as amended. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. We routinely post important information for investors on our website, www.annaly.com. We intend to use this webpage as a means of disclosing material information, for complying with our disclosure obligations under Regulation FD and to post and update investor presentations and similar materials on a regular basis. Annaly encourages investors, analysts, the media and others interested in Annaly to monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations, webcasts and other information we post from time to time on our website. To sign-up for email-notifications, please visit the “Email Alerts” section of our website, www.annaly.com, under the “Investors” section and enter the required information to enable notifications. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations for Annaly or any of its affiliates. Regardless of source, information is believed to be reliable for purposes used herein, but Annaly makes no representation or warranty as to the accuracy or completeness thereof and does not take any responsibility for information obtained from sources outside of Annaly. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including core earnings excluding the premium amortization adjustment (“PAA”). We believe the non-GAAP financial measures are useful for management, investors, analysts, and other interested parties in evaluating our performance but should not be viewed in isolation and are not a substitute for financial measures computed in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, we may calculate our non-GAAP metrics, such as core earnings (excluding PAA), or the PAA, differently than our peers making comparative analysis difficult. Please see the section entitled “Non-GAAP Reconciliations” in the attached Appendix for a reconciliation to the most directly comparable GAAP financial measures. 2 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Recent Achievements and Performance Highlights Annaly’s portfolio delivered strong results as economy continued path to recovery . Core earnings (ex. PAA)* up 18.5% from the prior quarter Financial Performance . Book value up 3.7% from the prior quarter . Economic return of 6.3% for the third quarter Fortified our balance sheet by reducing leverage, increasing liquidity and diversifying financing . Cost of financing driven lower with average economic cost of interest bearing liabilities* declining 36bps to 0.93% Financing & . Economic leverage modestly reduced to 6.2x from 6.4x in the prior quarter Liquidity . $8.8 billion of unencumbered assets, including cash and unencumbered Agency MBS of $6.9 billion . Completed two residential whole loan securitizations totaling $1.0 billion in the third quarter; over $5 billion aggregate issuance since the beginning of 2018(1) Portfolio continues to be well-positioned to generate attractive returns with strong focus on Agency MBS . $96 billion in highly liquid Agency MBS relatively unchanged, representing 94% of total assets(2) Portfolio . Credit businesses remain conservatively positioned and look to be opportunistic amidst steady improvement in deal flow and sector Performance activity . Total loan loss reserves (CECL and specific) declined by $22 million largely driven by a stronger economic forecast compared to the prior quarter (please see page 22 for details) Annaly continues to be a leader in corporate responsibility with a focus on driving shareholder value . Demonstrated improved cost efficiency metrics relative to the second quarter following the completion of the Internalization Shareholder Value . Published inaugural Corporate Responsibility Report on October 8, 2020, highlighting Annaly’s leadership across ESG practices and outlining future goals and commitments for Annaly’s five key ESG areas . Repurchased $209 million of common stock year-to-date(3) Source: Company filings. Financial data as of September 30, 2020, unless otherwise noted. * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 3 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Third Quarter 2020 Financial Highlights Earnings per Share Dividend per Share Net Interest Margin (ex. PAA)* Core GAAP (ex. PAA)* $0.22 2.05% Earnings & $0.70 | $0.32 1.88% Book Value Book Value per Share Dividend Yield(1) $8.70 12.4% Q2 2020 Q3 2020 Total Portfolio(2) Capital Allocation(3) Average Yield on Interest Earning Assets (ex. PAA)* AMML $102.7bn 3.01% Investment 9% 2.86% Agency Credit Portfolio ARC Total Stockholders’ Equity 80% 20% 5% ACREG $14.2bn 6% Q2 2020 Q3 2020 Liquidity Position Total Hedge Portfolio(4) Economic Leverage(5) Hedge Ratio(6) Average Economic $6.9bn Cost of Funds*(7) 48% Financing, of cash and 6.4x unencumbered $42bn 6.2x 40% 1.29% Liquidity & Agency MBS Hedge portfolio, Hedging increased from $35bn 0.93% in Q2’20, given shifting $8.8bn composition of assets of total unencumbered assets Q2 2020 Q3 2020 Q2 2020 Q3 2020 Q2 2020 Q3 2020 Source: Company filings. Financial data as of September 30, 2020, unless otherwise noted. * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 4 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Annaly Publishes Inaugural Corporate Responsibility Report Subsequent to quarter end, Annaly published its inaugural Corporate Responsibility report for the year 2019 demonstrating the Company’s commitment to ESG best practices 2019 Corporate Responsibility Report Highlights . Introduces supplemental disclosures under the Sustainability Accounting Standards Board (“SASB”) and Global Reporting Initiative (“GRI”) frameworks . Outlines goals and commitments across Annaly’s five key ESG areas: 1− Corporate Governance: As a newly internally-managed company, provide greater transparency and disclosure around executive compensation; continue to seek out highly qualified Board candidates of diverse gender and race 2− Human Capital: Advance our Diversity and Inclusion efforts with a focus on three areas: employee experience, workplace practices and community engagement; provide targeted training and development opportunities to maximize performance, enable upward mobility and increase employee engagement 3− Responsible Investments: Further integrate the consideration of financially relevant ESG factors into our investment and portfolio management processes 4− Risk Management: Continue to enhance our risk governance and controls while remaining adaptive to changing strategic business objectives and environments 5− Environment: Track our energy consumption and greenhouse gas emissions and look for ways to reduce our environmental footprint at our headquarters Note: To access the full 2019 Corporate Responsibility Report, please visit www.annaly.com/our-responsibility. 5 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Market Environment

The Macroeconomic State of Affairs U.S. economic output recovered at faster than anticipated rates in the third quarter but with headwinds on the horizon, Annaly remains conservatively positioned to withstand volatility Personal incomes had been supported by unemployment benefits, an effect that is Domestic economic impact of COVID-19 now fading, in turn providing a headwind to a continued rapid recovery... (1) . U.S. economy recovered faster than originally Monthly Personal Income by Select Category, SAAR $ trillion anticipated, seen for example in the 3.2 $11.0 percentage point decline in the unemployment $10.0 rate to 7.9% in September $9.0 $8.0 . However, the path of the remaining recovery Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug '19 '19 '19 '19 '19 '19 '19 '19 '19 '19 '19 '19 '20 '20 '20 '20 '20 '20 '20 '20 hinges on virus developments, as many sectors will not fully recover until a vaccine is available Wages Unemployment Benefits ... a fact that is amplified by an anticipated slower recovery in the unemployment . Expiration of the CARES Act stimulus has created rate in coming months(2) a near term headwind that threatens to stall the economic recovery U.S. Unemployment Rate, % Forecast(3) . Monetary policy continues to be very supportive 12.0% of financial conditions and the economic 7.0% recovery; the Fed stands ready to do more if necessary 2.0% 2015 2016 2017 2018 2019 2020 2021 2022 . Fed policy shift announced in August suggests a sustained period of accommodation, even if the Goods consumption has rebounded much faster than services, leaving uncertainty labor market recovers and inflation exceeds for labor markets and other sectors of the economy in the near term targets Personal Consumption by Product Type, Index (2019 Avg =100)(4) . Timing of any additional fiscal stimulus post 115 113 104 election remains a potential driver of volatility 95 95 75 01/01/18 05/01/18 09/01/18 01/01/19 05/01/19 09/01/19 01/01/20 05/01/20 09/01/20 Durable Goods Non-durable Goods Services Note: Data as of October 15, 2020. For source information, please refer to the endnotes included at the end of this presentation. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 7 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Business Update

Annaly Investment Strategies The Annaly Agency Group invests in Agency MBS The Annaly Residential Credit Group invests in Non- collateralized by residential mortgages which are Agency residential mortgage assets within the securitized guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae product and whole loan markets Assets(1) $96.3bn Assets(1) $1.9bn Capital(2) $11.3bn Capital(2) $0.7bn Sector Rank(3) #1/8 Sector Rank(3) #8/14 Strategy Countercyclical / Defensive Strategy Cyclical / Growth Assets: $102.7bn(1) Stockholders’ Equity: $14.2bn Assets(1) $2.5bn Assets $2.1bn Capital(2) $0.8bn Capital(2) $1.2bn Sector Rank(3) #8/18 Sector Rank(3) #11/39 Strategy Cyclical / Growth Strategy Non-Cyclical / Defensive The Annaly Commercial Real Estate Group originates The Annaly Middle Market Lending Group provides and invests in commercial mortgage loans, securities and financing to private equity backed middle market businesses, other commercial real estate debt and equity investments focusing primarily on senior debt within select industries Represents credit business Source: Bloomberg and Company filings. Financial data as of September 30, 2020. Market data as of October 15, 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 9 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Agency | Business Update Agency MBS sector benefits from strong technical factors, low interest rate volatility and stable funding, which have helped offset the negative headwind to the sector of continued elevated prepayment speeds Strategic Approach Market Trends . Annaly’s Agency Portfolio is made up of high quality and liquid . The Agency MBS outlook remains constructive given expectations of securities, predominately specified pools, TBAs and derivatives continued Fed support, a positive carry profile and a muted volatility environment . Portfolio benefits from in-house proprietary analytics that identify emerging prepayment trends, important in higher refi environments . We expect speeds to remain elevated given the record low mortgage rate environment, strong housing market and capacity seen at the . Given the historic low rate environment, the portfolio strategy is focused originators. Our portfolio strategy, which positions prepayment on assets with durable cashflows, with an emphasis on specified pools protected specified pools along with new production coupon MBS helps and current coupon MBS, hedged against the tail risk of rates moving insulate us from elevated generic market prepayment trends meaningfully higher . MBS repo markets are liquid at low stable rates, as capacity remains . Access to deep and varied financing sources, including traditional ample given abundance of reserves in the system wholesale repo and proprietary broker-dealer repo Agency Portfolio Detail Assets Hedges(1) Funding(2) NLY Specified Pools and TBA Holdings, % Agency Hedging Composition, % Agency Funding Composition, % Pools TBA Swaps Swaptions Futures Within 30 30-120 days Over 120 100% 100% 100% 75% 75% 75% 50% 50% 50% 25% 25% 25% 0% 0% 0% 2017 2018 2019 2020 2017 2018 2019 2020 2017 2018 2019 2020 Source: Company filings. Financial data as of September 30, 2020. Note: Portfolio data as of quarter end for each respective period. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 10 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Agency | Portfolio Summary . Annaly Agency Portfolio: $96.3 billion in assets at the end of Q3 2020, unchanged from Q2 2020 . The portfolio mix continues to be predominantly concentrated in 30-year fixed rate securities . Further shift down in coupon over the course of the quarter, with a reduction in 30-year 3.5% - 4.5% specified pools and a rotation into 30-year 2.5% pools and 1.5% - 2.0% TBAs . Modest increase in the overall TBA position given the continued attractive financing conditions in the TBA Dollar Roll market . The specified pool portfolio remains predominantly in pools with strong prepayment protection mitigating the effect of fast prepayment speeds and model uncertainty prevalent in the current historically low rate environment Total Dedicated Capital: $11.3 billion(1) Asset Type(1) Pass Through Coupon Type(2) Portfolio Quality(3) 15 & 20Yr: IO/IIO/CMO/MSR 15yr 7% <=2.5% 3.0% 3.5% 20yr >=4.0% Generic 1% 4% 3% 2% 1% 3% 1% 4% DUS 2% ARM/HECM <1% 40+ WALA <=2.5% 13% >=4.5% 25% 19% High Quality 44% 3.0% 9% 4.0% Moderate 20% Quality 30yr 3.5% 39% 90% 20% 30Yr+: 93% Note: Data as of September 30, 2020. Percentages based on fair market value and may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 11 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Credit Businesses Well-Positioned Amidst Continued Economic Uncertainty Annaly's credit businesses are relatively lower levered, with high quality portfolios that have positioned them well in the face of a potential slowdown in the economic recovery Key Credit Characteristics Commentary Monthly D60+ in Securitization Market Monthly Cure Rate in Securitizations(2) . Our credit box focuses on borrowers who have substantial equity, bolstering the convexity of 30% 75% the loan portfolio and resulting in relatively lower delinquencies Residential 20% 50% Credit . OBX securitizations have an above market cure 10% 25% rate relative to Non-QM and Jumbo (1) securitization programs 5% of Capital 0% 0% . We are focused on the borrower and attempt Apr May Jun Jul Aug Sep Apr May Jun Jul Aug to use all available loss mitigation strategies to OBX Exp(3) Non-QM Issuer(4) Prime Jumbo Issuer(4) Expanded Prime Issuer(4) derive successful outcomes 2018-2020 Originations, Weighted Avg. LTV(5) 2018-2020 Originations, Weighted Avg. Debt Yield(5) 70% . Focus is on credit with achievable business 68% 8.3% plans and strong sponsorship Commercial 64% 6.9% Real Estate 5.1% . Disciplined approach to underwriting with cash flows and appropriate deal level leverage (1) 6% of Capital . Optimize financing with various financing sources to achieve durable levered yields 2018 2019 2020 YTD 2018 2019 2020 YTD Average Borrower EBITDA, $ millions Average Borrower Fixed Charge Coverage Ratio . AMML lends to borrowers that we believe show predictable prospective EBITDA within select $100 industries showing less macro correlation Middle 1.9x Market . Stable free cash flows enable our borrowers to 1.7x meaningfully de-lever typically within a year of Lending $89 closing 9% of Capital(1) . These borrowers are also sponsored by high quality private equity firms with equity (8) (6) (7) contributions of 37% on average At Close LTM At Close LTM Source: Company filings. Financial data as of September 30, 2020, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 12 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Residential Credit | Business Update Annaly’s Residential Credit business continues to programmatically securitize and focus on the asset management of our underlying loans Strategic Approach Market Trends . Programmatic securitization sponsor of new origination, residential . Residential Credit assets have retraced almost all the widening whole loans with twelve deals comprising +$5 billion of issuance since experienced during March/April the beginning of 2018 . Non-Agency gross issuance stands at $78 billion year to date, 86% of . Securitization program gives Annaly the ability to create proprietary the year-to-date totals from Q3 2019(1), but with a notable increase in investments tailored to desired credit preferences with control over securitization issuance quarter over quarter diligence, origination partners, servicers and loss mitigation . We securitized $1 billion in OBX expanded prime loans in Q3 2020 . Nimble platform that can deploy capital across both the residential whole loan and the Non-Agency securities market depending on relative . The sector continues to be focused on forbearance resolution/default value transitions, and delinquency trends are exhibiting curing both across the market and particularly within our portfolio . Modest use of financial leverage with most positions already term financed through securitization Portfolio Evolution(2) Annaly Securitization History Residential Credit Portfolio Evolution, % Annaly Securitizations, $mm 100% 75% 50% $463 $465 $468 $489 $515 $383 $384 $394 $388 $384 $327 $375 25% 0% Q4 Q4 Q4 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Mar Aug Oct Jan Apr Jun Jul Oct Jan Feb Jul Sep 2015 2016 2017 2018 2019 2020 2018 2019 2020 Whole Loans Prime/Alt-A/Subprime Prime Jumbo NPL/RPL CRT Investor Expanded Prime Seasoned ARMs Source: Company filings and Wall Street Research. Financial data as of September 30, 2020, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 13 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Residential Credit | Portfolio Summary . Annaly Residential Credit Portfolio: $1.9 billion in assets at the end of Q3 2020, down 28% from Q2 2020 driven by the $1.0 billion of securitizations completed during the quarter − The composition consists of a $1.7 billion securities portfolio and $153 million whole loan portfolio . OBX 2020-EXP2 and OBX 2020-EXP3 priced during the third quarter backed by $489 million and $515 million of expanded prime loans, respectively . We continue to form strategic relationships with originators and aggregators, focusing on expanded credit, new origination whole loans in order to maintain our securitization strategy . 67% of our assets either have Investment Grade ratings or are from our own OBX securitization shelf, where we have greater control over the diligence and profile of the borrower Total Dedicated Capital: $0.7 billion Sector Type(1)(2) Coupon Type(1) Rating Private Label CRT 1% IO 5% Agency ARM CRT 7% 21% Investment Unrated Prime Grade Fixed 39% Prime WL 43% 38% Prime Jumbo IO 46% Jumbo IO 6% Prime<1% Jumbo Floating <1% 3% 31% Prime Jumbo RPL 3% 15% Non-Investment Grade 23% NPL Subprime Alt A <1% Fixed Duration <2yrs 6% 5% 11% Note: Data as of September 30, 2020, unless otherwise noted. Portfolio statistics and percentages are based on fair market value and reflect economic interest in securitizations. Prime Jumbo and Prime classifications include the economic interest of certain positions that are classified as Residential Mortgage Loans within our Consolidated Financial Statements. Percentages may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 14 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

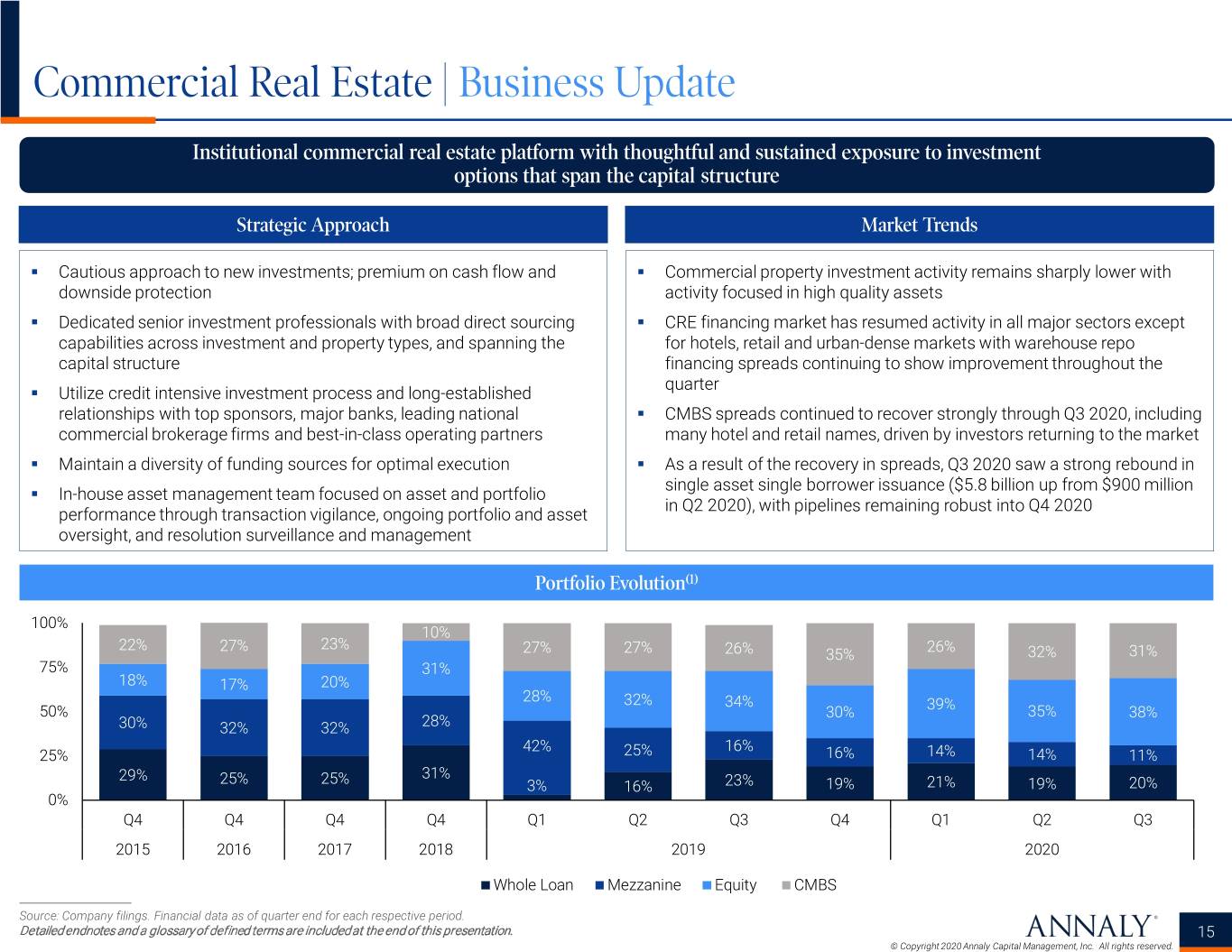

Commercial Real Estate | Business Update Institutional commercial real estate platform with thoughtful and sustained exposure to investment options that span the capital structure Strategic Approach Market Trends . Cautious approach to new investments; premium on cash flow and . Commercial property investment activity remains sharply lower with downside protection activity focused in high quality assets . Dedicated senior investment professionals with broad direct sourcing . CRE financing market has resumed activity in all major sectors except capabilities across investment and property types, and spanning the for hotels, retail and urban-dense markets with warehouse repo capital structure financing spreads continuing to show improvement throughout the quarter . Utilize credit intensive investment process and long-established relationships with top sponsors, major banks, leading national . CMBS spreads continued to recover strongly through Q3 2020, including commercial brokerage firms and best-in-class operating partners many hotel and retail names, driven by investors returning to the market . Maintain a diversity of funding sources for optimal execution . As a result of the recovery in spreads, Q3 2020 saw a strong rebound in single asset single borrower issuance ($5.8 billion up from $900 million . In-house asset management team focused on asset and portfolio in Q2 2020), with pipelines remaining robust into Q4 2020 performance through transaction vigilance, ongoing portfolio and asset oversight, and resolution surveillance and management Portfolio Evolution(1) 100% 10% 22% 27% 23% 26% 27% 27% 26% 35% 32% 31% 75% 31% 18% 17% 20% 28% 32% 34% 39% 50% 30% 35% 38% 30% 32% 32% 28% 42% 16% 25% 25% 16% 14% 14% 11% 29% 25% 25% 31% 3% 16% 23% 19% 21% 19% 20% 0% Q4 Q4 Q4 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2015 2016 2017 2018 2019 2020 Whole Loan Mezzanine Equity CMBS Source: Company filings. Financial data as of quarter end for each respective period. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 15 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Commercial Real Estate | Portfolio Summary . Annaly Commercial Real Estate Portfolio: $2.5 billion(1) in assets at the end of Q3 2020, relatively flat from Q2 2020 − Inclusive of loans contributed to the managed CRE CLO, assets under management at the end of Q3 2020 totaled $3.1 billion, virtually unchanged from Q2 2020 . Navigating the market environment through prudent new investment screening and capital preservation through asset sales and borrower payoffs . Evaluating new opportunities with several investments under consideration as market has begun to thaw . Continue to maintain regular dialogue with all borrowers, sponsors and partners with a hands-on asset management approach Total Dedicated Capital: $0.8 billion Asset Type(2) Sector Type(2) Geographic Concentration(2)(6) Other(3) ESG(4) 6% 3% Hotel 8% CA Industrial 14% Credit Retail Healthcare 1% Other CMBS 29% 10% 31% 32% TX 14% Equity Multifamily 35% 14% DC NY Other 12% Mezzanine 6% Office 10% FL Whole Loan(5) 5% NJ VA 28% 6% 20% 7% 9% Note: Data as of September 30, 2020. Portfolio statistics and percentages are based on fair market value and reflect economic interest in securitizations. Percentages may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 16 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Middle Market Lending | Business Update AMML activity was limited this quarter given our disciplined approach, but new issue execution is expected to increase as M&A activity picks up and the market continues to stabilize Strategic Approach AMML by the Numbers . Execute on a disciplined credit focused investment strategy comprised Current Portfolio predominantly of 1st and 2nd lien loans . Maintain strong relationships with top quartile U.S. based private equity firms to generate repeat deal flow 32 50 $42mm Private Equity Avg. Investment . Portfolio Borrowers Experienced investment team with a history of allocating capital through Sponsors Size(1) multiple economic cycles . Utilize a credit intensive investment process and long-established relationships to build a defensive portfolio with a stringent focus on non- discretionary, niche industries $89mm 4.9% / 8.4% 0.7x st nd . Deal types include leveraged buyouts, acquisition financing, Avg. EBITDA at Weighted Avg. 1 /2 Leverage on (2) refinancings and recapitalizations Underwriting Lien LIBOR Spread Portfolio Portfolio Evolution Assets ($mm) $2,500 $2,145 $2,062 $2,000 $1,887 $1,500 $1,011 $1,000 $773 $489 $500 $118 $166 – 2013 2014 2015 2016 2017 2018 2019 Q3 2020 (3) 1st Lien 2nd Lien Bonds/Sub Debt Source: Company filings. Financial data as of year end for each respective period, unless otherwise noted. Current portfolio data as of September 30, 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 17 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

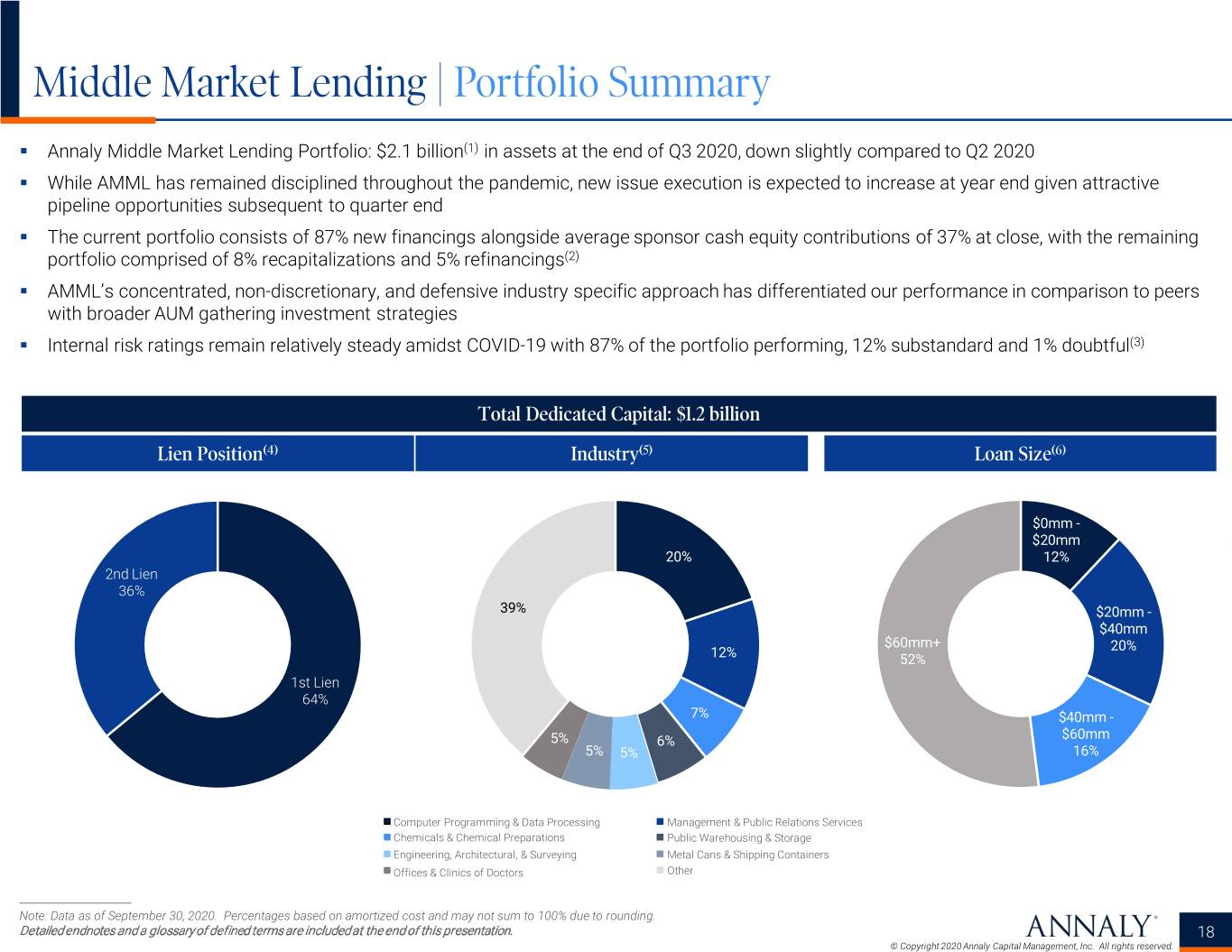

Middle Market Lending | Portfolio Summary . Annaly Middle Market Lending Portfolio: $2.1 billion(1) in assets at the end of Q3 2020, down slightly compared to Q2 2020 . While AMML has remained disciplined throughout the pandemic, new issue execution is expected to increase at year end given attractive pipeline opportunities subsequent to quarter end . The current portfolio consists of 87% new financings alongside average sponsor cash equity contributions of 37% at close, with the remaining portfolio comprised of 8% recapitalizations and 5% refinancings(2) . AMML’s concentrated, non-discretionary, and defensive industry specific approach has differentiated our performance in comparison to peers with broader AUM gathering investment strategies . Internal risk ratings remain relatively steady amidst COVID-19 with 87% of the portfolio performing, 12% substandard and 1% doubtful(3) Total Dedicated Capital: $1.2 billion Lien Position(4) Industry(5) Loan Size(6) $0mm - $20mm 20% 12% 2nd Lien 36% 39% $20mm - $40mm $60mm+ 20% 12% 52% 1st Lien 64% 7% $40mm - 5% 6% $60mm 5% 5% 16% Computer Programming & Data Processing Management & Public Relations Services Chemicals & Chemical Preparations Public Warehousing & Storage Engineering, Architectural, & Surveying Metal Cans & Shipping Containers Offices & Clinics of Doctors Other Note: Data as of September 30, 2020. Percentages based on amortized cost and may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 18 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Financial Highlights and Trends

Financial Highlights and Trends Unaudited For the quarters ended 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 (1) GAAP net income (loss) per average common share $0.70 $0.58 ($2.57) $0.82 ($0.54) (1) Core earnings (excluding PAA) per average common share* $0.32 $0.27 $0.21 $0.26 $0.21 Dividends declared per common share $0.22 $0.22 $0.25 $0.25 $0.25 Book value per common share $8.70 $8.39 $7.50 $9.66 $9.21 Annualized GAAP return (loss) on average equity 29.02% 25.84% (102.17%) 31.20% (19.32%) Annualized core return on average equity (excluding PAA)* 13.79% 12.82% 9.27% 10.56% 8.85% (2) Net interest margin 2.15% 1.89% 0.18% 1.49% 0.48% (3) Average yield on interest earning assets 2.70% 2.77% 1.91% 3.53% 2.89% (4) Average GAAP cost of interest bearing liabilities 0.60% 0.96% 1.86% 2.17% 2.58% (2) Net interest margin (excluding PAA) * 2.05% 1.88% 1.18% 1.41% 1.10% (3) Average yield on interest earning assets (excluding PAA) * 2.86% 3.01% 2.91% 3.25% 3.26% (4) Average economic cost of interest bearing liabilities * 0.93% 1.29% 1.91% 2.01% 2.28% (5) Leverage, at period-end 5.1x 5.5x 6.4x 7.1x 7.3x (6) Economic leverage, at period-end 6.2x 6.4x 6.8x 7.2x 7.7x (7) Credit portfolio as a percentage of stockholders' equity 20% 25% 25% 26% 23% * Represents a non-GAAP financial measure; see Appendix. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 20 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Financial Highlights and Trends (cont’d) Unaudited, dollars in thousands For the quarters ended 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 Agency mortgage-backed securities $74,915,167 $76,761,800 $78,456,846 $112,893,367 $114,462,524 Credit risk transfer securities 411,538 362,901 222,871 531,322 474,765 Non-Agency mortgage-backed securities 717,602 619,840 585,954 1,135,868 1,015,921 Commercial mortgage-backed securities 54,678 61,202 91,925 273,023 140,851 Total securities $76,098,985 $77,805,743 $79,357,596 $114,833,580 $116,094,061 Residential mortgage loans $152,959 $1,168,521 $1,268,083 $1,647,787 $1,219,402 Commercial real estate debt and preferred equity 573,504 618,886 649,843 669,713 611,429 Corporate debt 2,061,878 2,185,264 2,150,263 2,144,850 2,115,783 Total loans, net $2,788,341 $3,972,671 $4,068,189 $4,462,350 $3,946,614 Mortgage servicing rights $207,985 $227,400 $280,558 $378,078 $386,051 Agency mortgage-backed securities transferred or pledged to securitization vehicles $623,650 $1,832,708 $1,803,608 $1,122,588 $0 Residential mortgage loans transferred or pledged to securitization vehicles 3,588,679 2,832,502 3,027,188 2,598,374 2,376,731 Commercial real estate debt investments transferred or pledged to securitization vehicles 2,174,118 2,150,623 1,927,575 2,345,120 2,311,413 Commercial real estate debt and preferred equity transferred or pledged to securitization vehicles 882,955 874,618 913,291 936,378 - Assets transferred or pledged to securitization vehicles $7,269,402 $7,690,451 $7,671,662 $7,002,460 $4,688,144 Real estate, net $790,597 $746,067 $751,738 $725,638 $725,508 Total residential and commercial investments $87,155,310 $90,442,332 $92,129,743 $127,402,106 $125,840,378 21 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Credit Reserves Driven by CECL Accounting Standard Q3 2020 allowance decreased primarily due to improving economic assumptions Credit Reserves on Funded Loan Portfolio Commentary 9/30/20 . CECL accounting standard: 6/30/20 Ending Q3 2020 9/30/20 Ending Loan ($mm) Allowance Allowance Allowance(1) Carrying Value − Estimation of lifetime expected credit ACREG $149.9 ($4.9) $145.0 $1,456.4 losses AMML 56.8 (17.1) 39.7 2,061.9 − Based upon an economic forecast that Total $206.7 ($22.0) $184.7 $3,518.3 may result in increases or decreases in reserves due to changes in outlook (2) % of Loan Balance 5.32% (0.60%) 5.01% − Results in reserves recognized earlier than under the prior accounting standards Third-Party Economic Forecast Summary(3) . Total loans in scope of CECL (ACREG and Forecast Period AMML) represent 4% of total assets. All other Q4 2020 Q1 2021 Q2 2021 Q3 2021 credit assets are recorded at fair value Unemployment Rate . Q3 2020 third-party economic forecasts Q3 2020 Forecast 8.0% 7.5% 7.1% 6.7% reflect improving assumptions versus Q2 2020 Q2 2020 Forecast 9.4% 8.7% 7.8% 7.1% Real GDP Growth (annualized) . Total loan loss reserves (CECL and specific) declined by $22 million largely driven by a Q3 2020 Forecast (3.9%) (1.7%) 9.0% 4.3% stronger third-party economic forecast Q2 2020 Forecast (5.1%) (2.2%) 9.8% 5.5% compared to the prior quarter CRE Values (cumulative % change) Q3 2020 Forecast (11.0%) (8.1%) (5.3%) (3.4%) Q2 2020 Forecast (18.1%) (15.4%) (11.9%) (9.0%) Source: Company filings, Bloomberg, IHS Markit and Trepp. Financial data as of September 30, 2020, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 22 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Appendix: Non-GAAP Reconciliations

Non-GAAP Reconciliations Core earnings (excluding PAA), a non-GAAP measure, is defined as the sum of (a) economic net interest income, (b) TBA dollar roll income and CMBX coupon income, (c) realized amortization of MSRs, (d) other income (loss) (excluding depreciation expense related to commercial real estate and amortization of intangibles, non-core income allocated to equity method investments and other non-core components of other income (loss)), (e) general and administrative expenses (excluding transaction expenses and non-recurring items) and (f) income taxes (excluding the income tax effect of non-core income (loss) items) and excludes (g) the premium amortization adjustment ("PAA") representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities. 24 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Non-GAAP Reconciliations (cont’d) Unaudited, dollars in thousands except per share amounts To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company provides non-GAAP financial measures. These measures should not be considered a substitute for, or superior to, financial measures computed in accordance with GAAP. These non-GAAP measures provide additional detail to enhance investor understanding of the Company’s period-over-period operating performance and business trends, as well as for assessing the Company’s performance versus that of industry peers. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP results are provided below and on the next page. For the quarters ended 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 GAAP to Core Reconciliation GAAP net income (loss) $1,015,548 $856,234 ($3,640,189) $1,209,742 ($747,169) Net income (loss) attributable to non-controlling interests (126) 32 66 68 (110) Net income (loss) attributable to Annaly 1,015,674 856,202 (3,640,255) 1,209,674 (747,059) Adjustments to excluded reported realized and unrealized (gains) losses: Realized (gains) losses on termination of interest rate swaps 427 1,521,732 397,561 4,615 682,602 Unrealized (gains) losses on interest rate swaps (170,327) (1,494,628) 2,827,723 (782,608) 326,309 Net (gains) losses on disposal of investments (198,888) (246,679) (206,583) (17,783) (66,522) Net (gains) losses on other derivatives (169,316) (170,916) (206,426) 42,312 16,888 Net unrealized (gains) losses on instruments measured at fair value through earnings (121,255) (254,772) 730,160 5,636 1,091 Loan loss provision(1) (21,818) 72,544 99,993 7,362 3,504 Other adjustments: Depreciation expense related to commercial real estate and amortization of intangibles(2) 11,363 8,714 7,934 9,823 9,974 Non-core (income) loss allocated to equity method investments(3) (1,151) 4,218 19,398 (3,979) 4,541 Transaction expenses and non-recurring items(4) 2,801 1,075 7,245 3,634 2,622 Income tax effect on non-core income (loss) items 13,890 3,353 (23,862) (418) (2,762) TBA dollar roll income and CMBX coupon income(5) 114,092 97,524 44,904 36,901 15,554 MSR amortization(6) (27,048) (25,529) (18,296) (22,120) (21,963) Plus: Premium amortization adjustment (PAA) cost (benefit) 33,879 51,742 290,722 (83,892) 117,152 Core Earnings (excluding PAA)* 482,323 424,580 330,218 409,157 341,931 Dividends on preferred stock(7) 35,509 35,509 35,509 35,509 36,151 Core Earnings (excluding PAA) attributable to common shareholders * $446,814 $389,071 $294,709 $373,648 $305,780 GAAP net income (loss) per average common share(8) $0.70 $0.58 ($2.57) $0.82 ($0.54) Core earnings (excluding PAA) per average common share(8)* $0.32 $0.27 $0.21 $0.26 $0.21 Annualized GAAP return (loss) on average equity 29.02% 25.84% (102.17%) 31.20% (19.32%) Annualized core return on average equity (excluding PAA)* 13.79% 12.82% 9.27% 10.56% 8.85% * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 25 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Non-GAAP Reconciliations (cont’d) Unaudited, dollars in thousands For the quarters ended 9/30/2020 6/30/2020 3/31/2020 12/31/2019 9/30/2019 Premium Amortization Reconciliation Premium amortization expense $248,718 $270,688 $616,937 $171,447 $376,306 Less: PAA cost (benefit) 33,879 51,742 290,722 (83,892) 117,152 Premium amortization expense (excluding PAA) $214,839 $218,946 $326,215 $255,339 $259,154 Interest Income (excluding PAA) Reconciliation GAAP interest income $562,443 $584,812 $555,026 $1,074,214 $919,299 PAA cost (benefit) 33,879 51,742 290,722 (83,892) 117,152 Interest income (excluding PAA)* $596,322 $636,554 $845,748 $990,322 $1,036,451 Economic Interest Expense Reconciliation GAAP interest expense $115,126 $186,032 $503,473 $620,058 $766,905 Add: Net interest component of interest rate swaps 62,529 64,561 13,980 (45,221) (88,466) Economic interest expense* $177,655 $250,593 $517,453 $574,837 $678,439 Economic Net Interest Income (excluding PAA) Reconciliation Interest income (excluding PAA) $596,322 $636,554 $845,748 $990,322 $1,036,451 Less: Economic interest expense* 177,655 250,593 517,453 574,837 678,439 Economic net interest income (excluding PAA)* $418,667 $385,961 $328,295 $415,485 $358,012 Economic Metrics (excluding PAA) Average interest earning assets $83,286,119 $84,471,839 $116,063,895 $121,801,951 $127,207,668 Interest income (excluding PAA)* 596,322 636,554 845,748 990,322 1,036,451 Average yield on interest earning assets (excluding PAA)*(1) 2.86% 3.01% 2.91% 3.25% 3.26% Average interest bearing liabilities $74,901,128 $76,712,894 $107,029,466 $111,873,379 $116,391,094 Economic interest expense* 177,655 250,593 517,453 574,837 678,439 Average economic cost of interest bearing liabilities(2) 0.93% 1.29% 1.91% 2.01% 2.28% Interest income (excluding PAA)* $596,322 $636,554 $845,748 $990,322 $1,036,451 TBA dollar roll income and CMBX coupon income(3) 114,092 97,524 44,904 36,901 15,554 Interest expense (115,126) (186,032) (503,473) (620,058) (766,905) Net interest component of interest rate swaps (62,529) (64,561) (13,980) 45,221 88,466 Subtotal $532,759 $483,485 $373,199 $452,386 $373,566 Average interest earning assets $83,286,119 $84,471,839 $116,063,895 $121,801,951 $127,207,668 Average TBA contract and CMBX balances 20,429,935 18,628,343 9,965,142 6,878,502 9,248,502 Subtotal $103,716,054 $103,100,182 $126,029,037 $128,680,453 $136,456,170 Net interest margin (excluding PAA)* 2.05% 1.88% 1.18% 1.41% 1.10% * Represents a non-GAAP financial measure. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 26 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Glossary and Endnotes

Glossary ACREG: Refers to Annaly Commercial Real Estate Group Legacy: Refers to residential credit securities whose underlying collateral was securitized prior to 2009 Agency Peers: Represents companies comprising the Agency Middle Market Represents companies comprising the S&P BDC sector within the BBREMTG Index*(1) Lending Peers: Index* AMML: Refers to Annaly Middle Market Lending Group mREITs or mREIT Represents constituents of the BBREMTG Index*, Peers: excluding Annaly ARC: Refers to Annaly Residential Credit Group NIM: Refers to Net Interest Margin BBREMTG: Represents the Bloomberg Mortgage REIT Index*, Non-QM: Refers to a Non-Qualified Mortgage including Annaly CECL: Refers to Current Expected Credit Losses OBX Securities: Refers to Onslow Bay Securities Commercial Peers: Represents companies comprising the commercial TBA Securities: To-Be-Announced securities sector within the BBREMTG Index*(2) CRE CLO: Refers to Commercial Real Estate Collateralized Unencumbered Represents Annaly’s excess liquidity and defined as Loan Obligation Assets: assets that have not been pledged or securitized (generally including cash and cash equivalents, CRT: Refers to Credit Risk Transfer Securities Agency MBS, CRT, Non-Agency MBS, residential mortgage loans, MSRs, reverse repurchase agreements, CRE debt and preferred equity, ESG: Refers to Environmental, Social and Governance corporate debt, other unencumbered financial assets and capital stock) Ginnie Mae: Refers to the Government National Mortgage Association GSE: Refers to Government Sponsored Enterprise Hybrid Peers: Represents companies comprising the hybrid sector within the BBREMTG Index*(3) * Represents constituents as of October 15, 2020. 1. Consists of AGNC, ANH, ARR, CMO, EARN, ORC and TWO . 2. Consists of ABR, ACRE, ARI, BRMK, BXMT, CLNC, GPMT, HCFT, KREF, LADR, LOAN, NREF, RC, SACH, STWD, TRTX and XAN. 3. Consists of AJX, CHMI, CIM, DX, EFC, IVR, MFA, MITT, NRZ, NYMT, PMT, RWT and WMC. 28 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Endnotes Page 3 Page 11 1. Includes three residential whole loan securitizations totaling $1.1bn in 2018, five residential whole loan 1. Includes TBA purchase contracts and MSRs. securitizations totaling $2.1bn in 2019 and four residential whole loan securitizations totaling $1.8bn in 2. Includes TBA purchase contracts and fixed-rate pass-through certificates 2020. 3. Includes fixed-rate pass-through certificates only. “High Quality Spec” protection is defined as pools backed 2. Assets represent Annaly’s investments that are on balance sheet, net of securitized debt of consolidated by original loan balances of up to $125k, highest LTV pools (CR>125% LTV), geographic concentrations (NY/PR). “Med Quality Spec” includes $200k loan balance, $175k loan balance, $150k loan balance, high LTV VIEs, as well as investments that are off-balance sheet in which the Company has economic exposure. (CQ 105-125% LTV), and 40-year pools. “40+ WALA” is defined as weighted average loan age greater than 40 Assets include TBA purchase contracts (market value) of $21.1bn and CMBX derivatives (market value) of months and treated as seasoned collateral. $471.9mm and are shown net of securitized debt of consolidated VIEs of $6.0bn. Page 12 3. Share repurchases are under Annaly’s current authorized share repurchase program that expires in 1. Represents the capital allocation for each of the three credit businesses and is calculated as the difference December 2020. Amount excludes fees and commissions and includes $34.3mm of repurchases that between each investment strategy’s assets and related financing. This calculation includes TBA purchase settled subsequent to quarter end. contracts and excludes non-portfolio related activity and will vary from total stockholders’ equity. Page 4 2. Monthly Delinquency Cure Rate represents the percent of loans that were deemed delinquent as of last 1. Dividend yield is based on annualized Q3 2020 dividend of $0.22 and a closing price of $7.12 on September month and are now deemed current because they reperformed in the current reporting cycle. 30, 2020. 3. Represents all OBX securitizations, except for OBX 2020-EXP3, which closed in September 2020. Not representative of entire residential credit portfolio. 2. Total portfolio represents Annaly’s investments that are on balance sheet, net of securitized debt of 4. Represents public market issuers excluding Annaly. consolidated VIEs, as well as investments that are off-balance sheet in which Annaly has economic 5. Represents LTV and debt yield at time of initial funding. 2020 YTD originations through Q1. exposure. Assets include TBA purchase contracts (market value) of $21.1bn and CMBX derivatives (market 6. LTM EBITDA represents average of most recent financials available as of September 30, 2020. value) of $471.9mm and are shown net of securitized debt of consolidated VIEs of $6.0bn. 7. LTM Fixed Charge Coverage Ratio represents weighted average of most recent financials available as of 3. Capital allocation for each of the four investment strategies is calculated as the difference between each September 30, 2020. investment strategies’ assets and related financing. This calculation includes TBA purchase contracts and 8. Equity contribution represents equity as a percentage of the capital structure at time of entry of the excludes non-portfolio related activity and will vary from total stockholders’ equity. investment. Average is weighted by AMML outstanding principal as of September 30, 2020. 4. Hedge portfolio excludes receiver swaptions. Page 13 5. Computed as the sum of recourse debt, cost basis of TBA and CMBX derivatives outstanding and net 1. Based on October 26, 2020 data from Wall Street Research. forward purchases (sales) of investments divided by total equity. Recourse debt consists of repurchase 2. Shown exclusive of securitized residential mortgage loans of consolidated VIEs and loans held by a master agreements and other secured financing (excluding certain non-recourse credit facilities). Securitized debt, servicer in an MSR silo that is consolidated by the Company. certain credit facilities (included within other secured financing) and mortgages payable are non-recourse to Page 14 the Company and are excluded from this measure. 1. Shown exclusive of securitized residential mortgage loans of consolidated VIEs and loans held by a master 6. Hedge ratio measures total notional balances of interest rate swaps, interest rate swaptions (excluding servicer in an MSR silo that is consolidated by the Company. receiver swaptions) and futures relative to repurchase agreements, other secured financing and cost basis 2. Prime classification includes $77.9mm of Prime IO. of TBA derivatives outstanding; excludes MSR and the effects of term financing, both of which serve to Page 15 reduce interest rate risk. Additionally, the hedge ratio does not take into consideration differences in duration 1. Percentages are based on economic interest and exclude the effects of consolidated VIEs. The Company’s between assets and liabilities. limited and general partnership interests in a commercial loan investment fund are included within 7. Average economic cost of funds includes GAAP interest expense and the net interest component of interest mezzanine investments. rate swaps. Page 16 1. Includes $65.2mm of general reserves under CECL at September 30, 2020. Page 7 2. Pie charts exclude CMBX derivatives. 1. Based on October 15, 2020 data from the U.S. Bureau of Economic Analysis retrieved via Haver Analytics. 3. Reflects limited and general partnership interests in a commercial loan investment fund that is accounted 2. Based on October 15, 2020 data from the U.S. Bureau of Labor Statistics retrieved via Haver Analytics. for under the equity method for GAAP. 3. Based on October 15, 2020 Bloomberg median private sector economist forecasts. 4. Reflects joint venture interests in a social impact loan investment fund that is accounted for under the equity 4. Based on October 15, 2020 data from the U.S. Bureau of Economic Analysis retrieved via Haver Analytics. method for GAAP. Page 9 5. Includes mezzanine loans for which Annaly Commercial Real Estate is also the corresponding first 1. Assets represent Annaly’s investments that are on balance sheet, net of securitized debt of consolidated mortgage lender. VIEs, as well as investments that are off-balance sheet in which the Company has economic exposure. 6. Other includes 44 states, none of which represents more than 5% of total portfolio economic interest. The Agency assets include TBA purchase contracts (market value) of $21.1bn and are shown net of securitized debt of consolidated VIEs of $0.6bn. Residential Credit assets are shown net of securitized debt of Company looked through to the collateral characteristics of securitizations and equity method investments. consolidated VIEs of $3.0bn. Commercial Real Estate assets include CMBX derivatives (market value) of Page 17 $471.9mm and are shown net of securitized debt of consolidated VIEs of $2.5bn. 1. Average Investment Size based on AMML principal balance outstanding as of September 30, 2020. 2. Represents the capital allocation for each of the four investment strategies and is calculated as the 2. Represents leverage rather than economic leverage and includes non-recourse debt. difference between each investment strategies’ assets and related financing. This calculation includes TBA 3. Does not include minority equity, which represented 0.2% of the portfolio as of September 30, 2020. purchase contracts and excludes non-portfolio related activity and will vary from total stockholders’ equity. Includes $39.7mm of general reserves under CECL at September 30, 2020. 3. Sector rank compares Annaly dedicated capital in each of Agency, Commercial Real Estate, Residential Credit and Middle Market Lending as of September 30, 2020 (adjusted for P/B as of October 15, 2020) to the market capitalization of the companies that comprise Agency Peers, Commercial Peers, Hybrid Peers and Middle Market Lending Peers, respectively, as of October 15, 2020. Page 10 1. Represents Agency's hedging profile and does not reflect Annaly's full hedging activity. 2. Represents Agency’s funding profile and does not reflect Annaly's full funding activity. 29 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Endnotes (cont’d) Page18 Page 22 (cont’d) 1. Includes $39.7mm of general reserves under CECL at September 30, 2020. 3. Data from economic forecasts are taken directly from third-party data sources. Unemployment rate and 2. New financing is inclusive of change of control transactions, or add-ons with an existing borrower. A Real GDP growth (annualized) are each sourced from Bloomberg data as of September 30, 2020. CRE refinancing transaction represents amended terms under an existing or new credit agreement with a values (cumulative % change) are sourced from IHS Markit and Trepp LLC (“Trepp”) as of September 30, borrower, whereby our initial involvement is part of a facility exchanging the newly issued debt from that 2020. Market data and/or forecasts obtained from Trepp included in this report are based on public facility for a like amount of debt being refunded. Recapitalizations involve no new change in ownership or information, and have not been expertized by Trepp. Neither Trepp nor any of its information providers new cash equity, constituting a change of control as defined in a credit agreement, with proceeds from any represents or warrants the accuracy or adequacy of, nor shall any of them be liable for, such mark data debt facility in which we originate involving use of debt proceeds that return money to ownership of the and/or forecasts. borrower. Equity contribution represents equity as a percentage of the capital structure at time of entry of the investment. Average is weighted by AMML outstanding principal as of September 30, 2020. 3. Internal risk ratings are based on AMML’s Credit Rating Policy, which assigns ratings of 1-9 based on Non-GAAP Reconciliations leverage and fixed charge coverage ratios. Performing indicates a rating of 1-6. Substandard indicates a Page 25 rating of 7. Doubtful indicates a rating of 8. 1. Includes $0.2 million, $3.8 million and $0.7 million loss provision on the Company’s unfunded loan 4. Does not include minority equity, which represented 0.2% of the portfolio as of September 30, 2020. commitments as of September 30, 2020, June 30, 2020 and March 31, 2020, respectively, which is reported 5. Based on Standard Industrial Classification industry categories. Other represents industries with less than in Other income (loss) in the Company’s Consolidated Statement of Comprehensive Income (Loss). 5% exposure in the current portfolio. 2. Amount includes depreciation and amortization expense related to equity method investments. 6. Breakdown based on aggregate dollar amount of individual investments made within the respective loan 3. The Company excludes non-core (income) loss allocated to equity method investments, which represents size categories. Multiple investment positions with a single obligor shown as one individual investment. the unrealized (gains) losses allocated to equity interests in a portfolio of MSR, which is a component of Other income (loss). Page 20 4. The quarter ended September 30, 2020 includes costs incurred in connection with securitizations of 1. Net of dividends on preferred stock. The quarter ended September 30, 2019 excludes cumulative and residential whole loans. The quarter ended June 30, 2020 includes costs incurred in connection with the undeclared dividends of $0.3mm on the Company's Series I Preferred Stock as of June 30, 2019. Internalization and costs incurred in connection with the CEO transition. The quarter ended March 31, 2020 2. Net interest margin represents interest income less interest expense divided by average interest earning includes costs incurred in connection with securitizations of Agency mortgage-backed securities and assets. Net interest margin (excluding PAA) represents the sum of the Company's interest income residential whole loans as well as costs incurred in connection with the Internalization and costs incurred in (excluding PAA) plus TBA dollar roll income and CMBX coupon income less interest expense and the net connection with the CEO transition. The quarter ended December 31, 2019 includes costs incurred in interest component of interest rate swaps divided by the sum of average interest earning assets plus connection with securitizations of Agency mortgage-backed securities and residential whole loans. The average TBA contract and CMBX balances. quarter ended September 30, 2019 includes costs incurred in connection with a securitization of residential 3. Average yield on interest earning assets represents annualized interest income divided by average interest whole loans. earning assets. Average interest earning assets reflects the average amortized cost of our investments 5. TBA dollar roll income and CMBX coupon income each represent a component of Net gains (losses) on during the period. Average yield on interest earning assets (excluding PAA) is calculated using annualized other derivatives. CMBX coupon income totaled $1.5 million, $1.6 million, $1.2 million, $1.3 million and $1.5 interest income (excluding PAA). million for the quarters ended September 30, 2020, June 30, 2020, March 31, 2020, December 31, 2019 and 4. Average GAAP cost of interest bearing liabilities represents annualized interest income divided by average September 30, 2019, respectively. interest bearing liabilities. Average interest bearing liabilities reflects the average balances during the period. 6. MSR amortization represents the portion of changes in fair value that is attributable to the realization of Average economic cost of interest bearing liabilities represents annualized economic interest expense estimated cash flows on the Company’s MSR portfolio and is reported as a component of Net unrealized divided by average interest bearing liabilities. Economic interest expense is comprised of GAAP interest gains (losses) on instruments measured at fair value. expense and the net interest component of interest rate swaps. 7. The quarter ended September 30, 2019 excludes cumulative and undeclared dividends of $0.3 million on the 5. Debt consists of repurchase agreements, other secured financing, securitized debt and mortgages payable. Company's Series I Preferred Stock as of June 30, 2019. Certain credit facilities (included within other secured financing), securitized debt and mortgages payable 8. Net of dividends on preferred stock. are non-recourse to the Company. 6. Computed as the sum of recourse debt, cost basis of TBA and CMBX derivatives outstanding and net Page 26 forward purchases (sales) of investments divided by total equity. Recourse debt consists of repurchase 1. Average yield on interest earning assets (excluding PAA) represents annualized interest income (excluding agreements and other secured financing (excluding certain non-recourse credit facilities). Securitized debt, PAA) divided by average interest earning assets. Average interest earning assets reflects the average certain credit facilities (included within other secured financing) and mortgages payable are non-recourse to amortized cost of our investments during the period. the Company and are excluded from this measure. 2. Average economic cost of interest bearing liabilities represents annualized economic interest expense 7. Represents CRT securities, non-Agency mortgage-backed securities, residential mortgage loans, divided by average interest bearing liabilities. Average interest bearing liabilities reflects the average commercial real estate debt investments and preferred equity investments, loans held for sale, investments balances during the period. Economic interest expense is comprised of GAAP interest expense and the net in commercial real estate and corporate debt, net of financing. interest component of interest rate swaps. 3. TBA dollar roll income and CMBX coupon income each represent a component of Net gains (losses) on Page 22 other derivatives. CMBX coupon income totaled $1.5 million, $1.6 million, $1.2 million, $1.3 million and $1.5 1. Represents cumulative reserves at September 30, 2020 before adjusting for $16.7mm of charge-offs million for the quarters ended September 30, 2020, June 30, 2020, March 31, 2020, December 31, 2019 and recognized during the quarter. Net of charge-offs, the cumulative reserves as a % of the September 30, September 30, 2019, respectively. 2020 loan amortized cost balance was 4.56%. 2. Percentage of loan balance utilizes the loan portfolio’s amortized cost before reserves as of the applicable date. 30 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.