Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Turning Point Brands, Inc. | brhc10016300_ex99-1.htm |

| 8-K - 8-K - Turning Point Brands, Inc. | brhc10016300_8k.htm |

Exhibit 99.2

| N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N

I N G P O I N T B R A N D S . C O M | Turning Point Brands (NYSE: TPB) INVESTOR PRESENTATION Q 3 2 0 2 0

FORWARD LOOKING STATEMENTSThis presentation contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements may generally be identified by the use of words such as "anticipate," "believe," "expect," "intend," "plan" and "will" or, in each case, their negative, or other variations or

comparable terminology. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances

that may or may not occur in the future. As a result, actual events may differ materially from those expressed in or suggested by the forward-looking statements. Factors that could cause these differences include, but are not limited to, the

factors set forth in “Risk Factors” included in TPB’s annual report on Form 10-K and other reports filed with the Securities and Exchange Commission from time to time. Any forward-looking statement made by TPB in this presentation speaks only

as of the date hereof. New risks and uncertainties come up from time to time, and it is impossible for TPB to predict these events or how they may affect it. TPB has no obligation, and does not intend, to update any forward-looking statements

after the date hereof, except as required by federal securities laws.This presentation includes industry and market data derived from internal analyses based upon publicly available data or proprietary research and analysis, surveys or studies

conducted by third parties and industry and general publications, including those by the Management Science Associates, Inc. (“MSAi”) and Nielsen Holdings, N.V. (“Nielsen”). Third-party industry and general publications, research, surveys and

studies generally state that the information contained therein has been obtained from sources believed to be reliable. Although there can be no assurance as to the accuracy or completeness of the included information, we believe that this

information is reliable. While we believe our internal analyses are reliable, they have not been verified by any independent sources. Any such data and analysis involve risks and uncertainties and are subject to change based on various factors,

including those set forth in “Risk Factors” included in TPB’s annual report on Form 10-K and other reports filed with the Securities and Exchange Commission from time to time.NON-GAAP RECONCILIATIONThis presentation includes certain non-U.S.

generally accepted accounting principles (“GAAP") financial measures, including EBITDA, Adjusted EBITDA and Net Debt. Such non-GAAP financial measures are not in accordance with, or an alternative to, financial measures prepared in accordance

with GAAP. Please refer to the Appendix of this presentation for a reconciliation of EBITDA and Adjusted EBITDA to net income and Net Debt to Debt. To supplement our financial information presented in accordance with generally accepted

accounting principles in the United States, or U.S. GAAP, we use non-U.S. GAAP financial measures, including EBITDA, Adjusted EBITDA and Net Debt. We believe EBITDA and Adjusted EBITDA provide useful information to management and investors

regarding certain financial and business trends relating to financial condition and results of operations. Adjusted EBITDA and Net Debt are used by management to compare performance to that of prior periods for trend analyses and planning

purposes and is presented to our board of directors. We believe that EBITDA and Adjusted EBITDA are appropriate measures of operating performance because they eliminate the impact of expenses that do not relate to business performance.Non-U.S.

GAAP measures should not be considered a substitute for, or superior to, financial measures calculated in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA exclude significant expenses that are required by U.S. GAAP to be recorded in our

financial statements and is subject to inherent limitations. In addition, other companies in our industry may calculate these non-U.S. GAAP measure differently than we do or may not calculate it at all, limiting its usefulness as a comparative

measure.2 Disclaimer

TPB: Investment Highlights Turning Point Brands (NYSE: TPB) TPB Investment

Highlights StableFree Cash Flow Generation for Capital Deployment ResilientCore Business with Leading Brands NewGenValue Creation Potential PowerfulDistribution Infrastructure MST product gaining share with long runway for

distribution gainsLeading value brand in tobacco chew #1 premium rolling paper brand with unparalleled brand recognitionAccelerating growth through new product and channel initiatives Online distribution businesses gives access to new

customersPMTA process will consolidate vape market with TPB well positioned to gain shareNu-X Ventures product development engine: high-margin, proprietary products such as CBD, nutraceuticals, nicotine chew and modern oral pouches Widespread

presence and long-standing relationships in core convenience store channelIncreasing brand presence through non-traditional channelsRe-vamped brand e-commerce platforms (ZigZag.com, Nu-X.com, SolaceVapor.com)Leveraging distribution

infrastructure for new product introductions and acquired brands Asset-light business model leads to high free cash flow conversion for capital deploymentAcquisition of Durfort assets and investments in Wild Hempettes and dosist in 2020Robust

pipeline of acquisition opportunities 3 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

We are a consumer products company that markets products with active ingredients through

iconic and emerging brands BROAD PORTFOLIO OF ACTIVE INGREDIENT ALTERNATIVES AND BRANDS 3 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N

T B R A N D S . C O M |

Regional sales team selling to over 95,000 independent convenience stores Regional

Sales Teams Distribution Infrastructure Turning Point Brands (NYSE: TPB) Online B2B platform reaching ~4,000 alternative stores B2BDistribution National sales team selling to over 85,000 national chain

stores National Distribution Dedicated product sales teams and brand specific B2C/B2B platforms Product Sales Teams B2CDistribution Online B2C distribution platforms selling to ~1.5 million unique

customersdirectvapor.com vaporfi.com Powerful Distribution InfrastructureNorth American retail presence that reaches over ~210,000 outlets + B2C online sites 3 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L

E K Y | T U R N I N G P O I N T B R A N D S . C O M | zigzag.com nu-x.comnu-xnutra.com solacevapor.com solacechew.com vaporbeast.com

MST TUBS Introduced a larger tub format Moist Snuff Tobacco (MST) product driving category

over the last 10+ years About Stoker's Building brand equity for over 80 years. Stoker’s is the #1 loose-leaf chew brand1 and a leading MST value brand MST Cans Chew #1 discount and overall loose-leaf chew brand in the US1. TPB’s

brandscollectively hold ~32%1 of theloose-leaf chew market 60%Stoker's created the MST Tubs category and is the category leader with ~60%1share Smokeless: Iconic Brand with Sustained Growth Smokeless: Stoker’s Brand

Equity Turning Point Brands (NYSE: TPB) Accelerating strength from distribution gains and same-store sales growth. Significant chain launches in 2019 and 2020 1. Per MSAi at the end of 3Q20. 6 | N Y S E : T P B | 5 2 0 1 I N T E R

C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

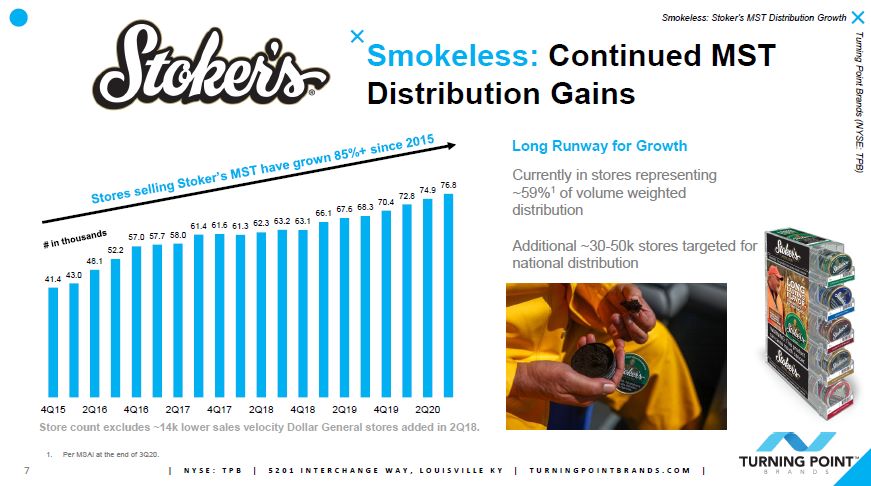

Smokeless: Continued MST Distribution Gains Smokeless: Stoker’s MST Distribution

Growth Turning Point Brands (NYSE: TPB) 41.4 43.0 48.1 52.2 57.0 57.7 58.0 61.4 61.6 61.3 62.3 63.2 63.1 66.1 70.467.6 68.3 72.8 74.9 76.8 4Q15 2Q16 4Q16 2Q17 4Q17 2Q18 4Q18 2Q19 4Q19 2Q20Store

count excludes ~14k lower sales velocity Dollar General stores added in 2Q18. Long Runway for GrowthCurrently in stores representing ~59%1 of volume weighteddistribution Additional ~30-50k stores targeted for national distribution 1. Per

MSAi at the end of 3Q20. 6 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

Papers #1 premium rolling paper brand sold in the U.S. 1 and Canada About

Zig-Zag Embedded into pop culture with a storied history that dates over 140 years Wraps New Product Launches Market leader in MYO cigar wraps with a majority share of the market 1 Continued roll-out of paper cones, unbleached and hemp

rolling papers along with new product introductions 35%Zig Zag owns >35%1 ofthe rolling paper market in the United States Smoking: Iconic Brand with Leading Market Share Zig-Zag: Brand Equity Turning Point Brands (NYSE:

TPB) 1. Per MSAi at the end of 3Q20. 6 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

Iconic Products with Unparalleled Recognition“Zig-Zag Orange” and “Zig-Zag White” are

long-standing industry staples Smoking: Expanding Portfolio and Sales Channels Zig-Zag: Growth Initiatives Turning Point Brands (NYSE: TPB) Classic Zig-Zag Products Growth Initiatives New products and accessories Re-vamped

e-commerce platform Enhanced brand presence in headshops and dispensaries; ReCreation Marketing partnership in Canada 9 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N

I N G P O I N T B R A N D S . C O M |

Acquisition of assets from Durfort Holdings S.R.L. (“Durfort”) in Q2 2020Acquired a

co-ownership interest in our long-term partner Durfort’s intellectual property related to TPB’s MYO cigarwraps and cones$46 million purchase price ($36 million in cash and $10 million seller note)$5 million net sales and $7 million EBITDA

contribution on an annualized basis (mostly in COGS savings)Increases Exposure to Attractive Zig-Zag MYO Cigar Wraps Product and Secures Long-Term ControlBenefitting from increased demand related to cannabis legalization and decriminalization

in certain jurisdictionsAcquisition allowed TPB to realize higher gross margins by capturing more of the profitability by eliminating royalty-related payments for a growth product it already controlsMore Direct Manufacturing RelationshipMore

direct relationship with third-party manufacturer allowing business to scale and align production with market demandMaster Distribution Agreement for Blunt Wrap USAAdds complementary product to TPB’s MYO cigar wrap offeringsPresents

cross-selling synergy opportunities with product primarily sold in non-traditional channels where TPB products are currently under-representedDistribution of Blunt Wraps began in October 2020 Acquisition of Durfort Holdings

Assets Turning Point Brands (NYSE: TPB) Acquisition of assets of Durfort Holdings 10 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

Proprietary Products as % of Net Sales11% ~5% NewGen Segment Turning Point Brands

(NYSE: TPB) NewGen: Proprietary Products Growth 2016Acquired VaporBeast, leading third-party B2B distributor of open systems vaping products 2017Acquired VaporShark, one of the first proprietary vaping brands 2018Acquired IVG,

expanding B2C distribution including proprietary VaporFi brand and the Direct Vapor platform 2019Acquired Solace, a leading proprietary open systems vaping brand; and launched Nu-X, a development engine for non-vape proprietary actives

products 2020Submitted applications covering 250 products through the FDA PMTA process that will consolidate the market; Invested in Wild Hempettes to become its exclusive distributor 2021-2023Continue expanding proprietary growth through

new introductions on Nu-X and significant SKU consolidation in the vaping market ~10% ~17% YTD Q3: ~20% Target 50%+ 1. Excludes V2 and RipTide. Executing on a multi-year journey to increase proprietary products sales in the NewGen

segmentProprietary product gross margins (50%+) exceed third-party product gross margins (20% - 40%) 11 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

Nu-X NutraCaffeine B12 - Café Disposable Caffeine B12 - Energy Disposable Caffeine B12 -

TabletsCannabinoidsPet CBD TinctureCBG Tinctures CBN TincturesCBD Tinctures 16.5ml CBD Pre-RollsCBG Flower CBD Awake Shot CBD Relax ShotCBD Hemperettes CBD Lip BalmCBD Muscle/Joint Topical CBD Youth SerumCBD Gummies Nicotine ChewSolace Chew -

Mint 4mg Solace Chew - Cinnamon 4mg Solace Chew - Fruit 4mgModern Oral PouchesFré 9mg and 12mg - Mocha Fré 9mg and 12 mg - Mint Fré 9mg and 12mg - LushRipTideG2 BatteryNicotine Salt Menthol Pod Nicotine Salt Tobacco Pod CBD TFN PodSolace35

unique flavors in5 nicotine strength variants filed PMTAs 12 Robust Pipeline of New Product Introductions Nu-X: New Product Portfolio Turning Point Brands (NYSE: TPB) Nu-X New Product Portfolio

Management of Regulatory EnvironmentsExtensive experience managing regulatory regime

changes TPB: Navigating Regulated Environments Turning Point Brands (NYSE: TPB) REGULATORY STRATEGYTPB does not sell cigarettes, the primary target of the FDAConcentrated effort to shape premarket pathway for future

innovationExperienced team of QA, R&D, legal and scientific professionalsBuilding consensus among like-minded small and mid-sized businesses to drive policyIncreased regulation rationalizes market in favor of those who can navigate shifting

regulationInvested ~$17 million to support an extensive portfolio of products through the PMTA processTPB has unique capabilities to get proprietary brands through regulatory regime changesFDA’s PMTA process is a transformational regulatory

process that likely consolidates the vape marketSubmitted applications for 250 products ahead of the PMTA deadline on September 9, 2020NewGen is well-positioned for growth in a post-PMTA environment with its extensive product

portfolio 13 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

dosist – announced $15 million strategic investment on October 27, 2020Leading globally

recognized cannabis brand with powerful marketing organizationProducts currently available in CA, CO, NV and Canada with plans for further expansionExpanding offerings from disposable pens to rechargeable pens and other form factorsExclusive

co-development and distribution agreement of a new national CBD brand, createdin partnership with dosist’s thc-free business unit targeting the c-store channelOption to invest another $15 million at pre-determined terms within the next 12

monthsUS legal cannabis market projected to grow from $16 billion in 2020E to $34 billion by 20251Wild Hempettes – announced acquisition of 20% stake on October 5, 2020Leading manufacturer of hemp cigarettes under the WildHemp™ and Hempettes™

brandsExclusive distribution agreement under a profit-sharing agreement where TPB will extendthe product’s reach through its sales infrastructureOptions to increase stake to a 100% ownership position based on certain milestonesSmokable hemp CBD

market expected to grow from $70-80 million in 2020E to $300-400 million by 20252 Strategic Investments Turning Point Brands (NYSE: TPB) Strategic Investments dosist and Wild Hempettes Focus on value-accretive investments

that extend TPB’s reach intolarge and growing addressable markets 14 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M | Source: Arcview Research/BDSA August

2020Source: Nielsen Research September 2020

2016 2017 2018 2019 9mo 19 9mo 20 YoY Smokeless (Stoker's)Looseleaf MST $47 31 $49

35 $48 42 $46 $34 $36 6%54 41 51 25% Total Smokeless $78 $85 $90 $100 $75 $87 16% Smoking (Zig-Zag)Wraps $46 $47 $49 $52 $40 $43 6% US Papers1 36 38 38 38 28 38 38% Canadian Papers 11 12 14 11 7 7 -8%

Core Smoking $93 $96 $102 $102 $75 $88 17% Other (Non-Core)2 18 14 10 7 6 4 -22% Total Smoking $111 $110 $112 $109 $81 $92 14% Total NewGen $17 $91 $131 $153 $126 $120 -4% Total Net

Sales $206 $286 $333 $362 $282 $300 6% Segment Breakdown Turning Point Brands (NYSE: TPB) Smokeless (Stoker’s) Drivers Looseleaf: Targeted sales initiatives in 2020MST: Same-store sales growth and long runway for

distribution ramp Smoking (Zig-Zag) DriversIndustry levered to cannabis consumptionAlternative channel penetration (headshopsand dispensaries) and e-commerce rampWraps: Blunt Wraps distribution and new product introductions in 2021US Papers:

New product ramp-up (eg cones)Canada: Alternative channel growth (Rec Marketing) and recent price increase (Q4 20)Non-Core: Declines less of a headwindNewGen DriversPMTA causing short-term disruption but creating tremendous long-term

opportunityNu-X new product introductions driving proprietary products mix higher Note: $ in millions.1. Includes Zig-Zag e-commerce sales Internal initiatives leading to accelerated organic growth in our core segments 2. Includes

de-emphasized low-margin products including MYO / pipe products (discontinued in 1Q20) and Cigars. 15 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O

M | Total Sales and Segment Breakdown

$52.4 $60.0 $64.6 $67.3 2016 2017 2018 2019 2020E $87-90* TPB:

Financial Summary Turning Point Brands (NYSE: TPB) Note: $ in millions. Reference GAAP reconciliation in Appendix. 2016 – 2020E Adjusted EBITDA CAGR: ~14%* TPB Earnings PerformanceRobust Adjusted EBITDA growth with significant

acceleration expected for 2020 *2020E estimate based on guidance provided on October 27, 2020; CAGR based on mid-point of guidance 16 | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O

I N T B R A N D S . C O M |

Note: $ in millions. Asset-Light Business Model Turning Point Brands (NYSE:

TPB) Building a Capital Efficient Business ModelAsset-light business model that generates significant free cash flow ADJUSTED EBITDA VS. CAPITAL EXPENDITURES Initiatives: Outsourced manufacturing of most products except Stoker’s MST

supports our asset-light modelCapital efficiency enables investment in sales force expansion (a proven revenue driver), working capital and infrastructure to support new product launchesRe-deploy cash flow from recession-resistant, traditional

tobacco business for accretive acquisitions and strategic investments Results:Significant cash flow available to reinvest in the

business $52.4 $60.0 $64.6 $67.3 $3.2 $2.0 $2.3 $4.8 2016 2017 2018 2019 Adjusted EBITDA1 Capital Expenditures 1. Reference GAAP reconciliation in Appendix. 17 | N Y S E : T P B | 5 2 0 1 I N T E R C H

A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

Q3 2020Highlights Net Sales of $104 million versus late-July guidance of $90 to $95 million

with core segments outperformingAnnounced investments in Wild Hempettes and dosist2020 Guidance increased again2020 Net Sales $395 to $401 million (vs previous guidance of $353 to $370 million)2020 Adjusted EBITDA of $87 million to $90 million

(vs previous guidance of $78 to $83 million)Q4 Net Sales of $95 to $101 million Why WeAre Winning Internal growth initiatives are driving a majority of the growth with core businesses outpacing market growthConsumer down-trading benefitting

Stoker’s; increased cannabis consumption benefitting rolling paper marketOperating leverage: Streamlining the business (announced 11/2019) has led to $10 million in SG&A cost savingsValue-accretive capital deployment: Durfort assets, Wild

Hempettes, dosist and opportunistic share repurchases~$100 million in liquidity leaves us well capitalized to take advantage of market opportunities Recent Business Highlights Turning Point Brands (NYSE: TPB) | N Y S E : T P B | 5 2 0

1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M | 18 Recent Business Highlights Strong recent performance is a result of tactical repositioning of the business over the last 12 months

and executing on this plan Management is focused on executing on its plan for growth during and after COVID-19 related impacts

2020 Objectives Turning Point Brands (NYSE: TPB) Maximize the Core BusinessDrive

Stoker’s MST growth through increased distribution and same-store-sales growthExpand Zig-Zag’s reach with new product introductions, channel specific strategies and e-commerce initiativesPosition NewGen for Profitable GrowthStreamline vaping,

maintain profitability while investing in new products via the PMTA processIntroduce products from Nu-X Ventures into companywide distribution infrastructureDrive Cost EfficiencyIncreased operating leverage through solid cost controls and

spending efficiencies to deliver higher ROICIntroduce Proprietary ProductsIdentify and develop emerging product forms that consumers are increasingly gravitating towards (eg modern oral)Engage in Strategic AcquisitionsEfficiently deploy capital

on accretive acquisitions to accelerate company growthExecute on Blunt Wraps and Wild Hempettes distribution and dosist thc-free brand development | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N

G P O I N T B R A N D S . C O M | 19 2020 in Focus: Strategies and Objectives

Appendix Turning Point Brands (NYSE: TPB) | N Y S E : T P B | 5 2 0 1 I N T E R C

H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M |

GAAP Reconciliation Turning Point Brands (NYSE: TPB) | N Y S E : T P B | 5 2 0 1 I N

T E R C H A N G E W A Y , L O U I S V I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M | ($ in millions) 2016 2017 2018 2019 Net income attributable to Turning Point Brands, Inc. $26.9 $20.2 $25.3 $13.8 Add:Interest

expense, net $26.6 $16.9 $14.8 $17.3 Loss on extinguishment of debt 2.8 6.1 2.4 1.3 Income tax expense (12.0) 7.3 6.3 2.0 Depreciation expense 1.2 1.6 2.1 2.6 Amortization expense 0.1 0.7 1.0 1.5

EBITDA $45.6 $52.8 $51.9 $38.6 Components of Adjusted EBITDA Other (a) $1.5 $1.3 $0.4 $0.4 Stock options, restricted stock, and incentives expense (b) 0.2 0.7 1.4 4.6 Transactional expenses and strategic initiatives

(c) 1.6 2.1 4.5 1.8 New product launch costs (d) 2.7 2.4 1.8 6.2 FDA PMTA (e) 0.0 0.0 0.0 2.2 Corporate and vapor restructuring (f) 0.0 0.6 4.6 19.2 Vendor settlement (g) 0.0 0.0 0.0 (5.5) Bonus (h) 0.9 0.1 0.0 0.0

Reconciliation of GAAP Net Income to Adjusted EBITDA Adjusted EBITDA $52.4 $60.0(a) Represents LIFO adjustment, non-cash pension expense (income) and foreign exchange hedging. (b) Represents non-cash stock options, restricted stock,

incentives expense and Solace PRSUs.(c) Represents the fees incurred for transaction expenses and strategic initiatives. (d) Represents product launch costs for our new product lines.Represents costs associated with applications related to FDA

PMTA.Represents costs associated with corporate and vapor restructuring including severance and inventory reserves. (g) Represents net gain associated with the settlement of a vendor contract.(h) Represents bonuses associated with the December

2017 Tax Cuts and Jobs Act and non-recurring compensation expenses incurred coinciding with the May 2016 IPO. $64.6 $67.3 21 GAAP Reconciliation

THANK YOU | N Y S E : T P B | 5 2 0 1 I N T E R C H A N G E W A Y , L O U I S V

I L L E K Y | T U R N I N G P O I N T B R A N D S . C O M | Turning Point Brands (NYSE: TPB)