Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - QDM International Inc. | e2147_ex99-3.htm |

| EX-99.2 - EXHIBIT 99.2 - QDM International Inc. | e2147_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - QDM International Inc. | e2147_ex99-1.htm |

| EX-16.1 - EXHIBIT 16.1 - QDM International Inc. | e2147_ex16-1.htm |

| EX-10.3 - EXHIBIT 10.3 - QDM International Inc. | e2147_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - QDM International Inc. | e2147_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - QDM International Inc. | e2147_ex10-1.htm |

| EX-3.3 - EXHIBIT 3.3 - QDM International Inc. | e2147_ex3-3.htm |

| EX-2.1 - EXHIBIT 2.1 - QDM International Inc. | e2147_ex2-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 27, 2020 (October 21, 2020)

QDM International Inc.

(Exact name of registrant as specified in its charter)

| Florida | 000-27251 | 59-3564984 | ||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

Room 715, 7F, The Place Tower C, No. 150 Zunyi Road Changning District, Shanghai, China |

200051 | |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: +86 (21) 22183083

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

This Current Report on Form 8-K (the “Current Report”) being filed in connection with a series of transactions consummated by QDM International Inc. (“we,” “us,” “our,” “QDM,” or the “Company”), and certain related events and actions taken by the Company and its related parties.

This Current Report includes the following items:

| Item 1.01 | Entry into a Material Definitive Agreement. | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets. | |

| Item 3.02 | Unregistered Sales of Equity Securities. | |

| Item 4.01 | Changes in Registrant’s Certifying Accountant. | |

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. | |

| Item 5.06 | Change in Shell Company Status. | |

| Item 9.01 | Financial Statements and Exhibits. |

Certain Conventions Used in this Current Report

Unless otherwise indicated or the context otherwise requires, references in this Current Report to:

| ● | “24/7 Kid” are to 24/7 Kid Doc, Inc., a Florida corporation and wholly-owned subsidiary of the Company; |

| ● | “BVI” are to the British Virgin Islands; |

| ● | “Common Stock” are to the common stock of the Company, par value $0.0001 per share; |

| ● | “HKD,” “HK$” and “Hong Kong dollars” are to the legal currency of Hong Kong; |

| ● | “QDM BVI” are to QDM Holdings Limited, a BVI company and a wholly-owned subsidiary of the Company; |

| ● | “QDM HK” are to QDM Group Limited, a Hong Kong corporation and a wholly-owned subsidiary of the QDM BVI; |

| ● | “Series C Preferred Shares” are to the Series C Convertible Preferred Stock, par value $0.0001 per share, each convertible into eleven shares of Common Stock initially; |

| ● | the “Group” are to QDM BVI, QDM HK and YeeTah, collectively; |

| ● | “technical representatives” are to licensed individuals who provide advice to an insurance policy holder or potential policy holder on insurance matters on behalf of an insurance agent or broker, or arrange contracts of insurance in or from Hong Kong on behalf of that insurance agent or broker; |

| ● | “US$,” “U.S. dollars,” “$,” and “USD” are to the legal currency of the United States; |

| ● | “we,” “us,” “our,” “QDM,” and the “Company” refer to QDM International Inc. a Florida corporation; and |

| ● | “YeeTah” are to YeeTah Insurance Consultant Limited, a Hong Kong corporation and a wholly-owned subsidiary of the QDM HK. |

The Company and its subsidiaries maintain their books and records in U.S. dollars and in accordance with generally accepted accounting principles of the United States. QDM BVI, QDM HK and YeeTah maintain their books and records either in US$ or Hong Kong dollars. This Current Report also contains translations of Hong Kong dollars into U.S. dollars for the convenience of the reader. The Hong Kong dollar is freely convertible into other currencies (including the U.S. dollar). Since 1983, the Hong Kong dollar has effectively been officially linked to the U.S. dollar at the rate of approximately HK$7.80 = US$1.00. However, the market exchange rate of the Hong Kong dollar against the U.S. dollar continues to be influenced by the forces of supply and demand in the foreign exchange market.

Unless otherwise stated, all translations of Hong Kong dollars into U.S. dollars were made at HK$7.8 = US$1.00, which is the prevailing exchange rate as of October 21, 2020. We make no representation that the Hong Kong dollar or U.S. dollar amounts referred to in this Current Report could have been or could be converted into U.S. dollars or Hong Kong dollars, as the case may be, at any particular rate or at all.

Prior to the Share Exchange (as defined below), we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act). As a result of the Share Exchange, we have ceased to be a “shell company”. The information contained in this Report constitutes the current “Form 10 information” necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended.

1

Item 1.01 Entry into a Material Definitive Agreement

On October 21, 2020, we entered into a share exchange agreement (the “Share Exchange Agreement”) with QDM Holdings Limited, a BVI company (“QDM BVI”), and Huihe Zheng, the sole shareholder of QDM BVI (the “QDM BVI Shareholder”), who is also our principal stockholder and serves as our Chairman and Chief Executive Officer, to acquire all the issued and outstanding capital stock of QDM BVI in exchange for the issuance to the QDM BVI Shareholder 900,000 shares of a newly designated Series C Convertible Preferred Stock, par value $0.0001 per share (the “Series C Preferred Shares”), with each Series C Preferred Share initially being convertible into 11 shares of our common stock, par value $0.0001 per share (the “Common Stock”), subject to certain adjustments and limitations (the “Share Exchange”). The Share Exchange closed on October 21, 2020.

As a result of the consummation of the Share Exchange, we acquired QDM BVI and its indirect subsidiary, YeeTah Insurance Consultant Limited, a Hong Kong corporation (“YeeTah”), an insurance brokerage company primarily engaged in the sales and distribution of insurance products in Hong Kong.

The foregoing descriptions of the Share Exchange Agreement and the transactions contemplated thereby do not purport to be complete and are subject to the more detailed provisions set forth in the agreement, which is attached hereto as Exhibit 2.1 and incorporated herein by reference. All references to the Share Exchange Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

Item 2.01 Completion of Acquisition or Disposition of Assets

As described in Item 1.01 above, on October 21, 2020, we acquired all the issued and outstanding capital stock of QDM BVI pursuant to the Share Exchange Agreement and QDM BVI became our wholly owned subsidiary. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein QDM BVI is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of QDM BVI have been brought forward at their book value and no goodwill has been recognized.

Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Share Exchange will be those of QDM BVI and its wholly-owned subsidiary QDM Group Limited, a Hong Kong corporation (“QDM Hong Kong”) and its wholly-owned subsidiary, YeeTah (collectively, the “Group”) and will be recorded at the historical cost basis of the Group, and the consolidated financial statements after completion of the Share Exchange will include the assets and liabilities of the Group, historical operations of the Group, and operations of the Company and its subsidiaries from the closing date of the Share Exchange.

As a result of the acquisition of all the issued and outstanding capital stock of QDM BVI, we have now assumed the business operations of the Group as our own.

2

FORM 10 INFORMATION

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains “forward-looking statements” within the meaning of applicable federal securities laws. Forward-looking statements provide our management’s current expectations or forecasts of future events, particularly those related to the Group. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Current Report include, but are not limited to, statements about:

| ● | the impact by public health epidemics, including the COVID-19 pandemic in China, Hong Kong and the rest of the world, on the market the Group operates in and its business, results of operations and financial condition; |

| ● | the market for the Group’s services; |

| ● | the Group’s expansion and other plans and opportunities; |

| ● | the Group’s future financial and operating results, including revenues, income, expenditures, cash balances and other financial items; |

| ● | current and future economic and political conditions in Hong Kong and China; |

| ● | the future growth of the Hong Kong insurance industry as a whole and the professional insurance intermediary sector in particular; |

| ● | the Group’s ability to attract customers, further enhance its brand recognition; |

| ● | the Group’s ability to hire and retain qualified management personnel and key employees in order to enable them to develop its business; |

| ● | changes in applicable laws or regulations in Hong Kong related to or that could impact the Group’s business; |

| ● | our management of the Group’s business through the Company, a U.S. publicly-traded and reporting company; and |

| ● | other assumptions regarding or descriptions of potential future events or circumstances described in this Current Report underlying or relating to any forward-looking statements. |

These forward-looking statements are based on information available as of the date of this Current Report, and current expectations, forecasts and assumptions, and involve a number of risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our management’s views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

In addition, statements that we “believe,” “we expect,” “we anticipate” and similar statements reflect its beliefs and opinions on the relevant subject. These statements are based upon information available to such party as of the date of this Current Report, and while our management believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and these statements should not be read to indicate that our management has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should not place undue reliance on these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, the Group’s actual results or performance may be materially different from those expressed or implied by these forward-looking statements.

3

DESCRIPTION OF BUSINESS

General and Pre-Share Exchange Transactions

The Company was incorporated in Florida in March 2020 and is the successor to 24/7 Kid Doc, Inc. (“24/7 Kid”), which was incorporated in Florida in November 1998. The Company was a telemedicine company that provided Connect-a-Doc telemedicine kits to schools and its services aimed to provide an effective and affordable alternative to schools that desire to provide a higher level of healthcare to their students but are unable to keep a full-time school nurse available. The Company’s principal offices are located at Room 715, 7F, The Place Tower C, No. 150 Zunyi Road, Changning District, Shanghai, China 200051. The Company’s phone number is +86 (21) 22183083.

On March 3, 2020, a stock purchase agreement (the “Purchase Agreement”) was entered into by and between Huihe Zheng, our Chief Executive Officer and Chairman and Tim Shannon, our then controlling stockholder as well as Chief Executive Officer, Chief Financial Officer, President and director. Pursuant to the Purchase Agreement, Mr. Shannon sold to Mr. Zheng (i) 710,000 shares common stock of 24/7 Kid, representing 42.6% of the total issued and outstanding shares of common stock of 24/7 Kid as of March 9, 2020 and (ii) 13,500 shares of Series B Preferred Stock, each entitling the holder to 100 votes on all corporate matters submitted for stockholder approval, in consideration of $500,000 in cash from Mr. Zheng’s personal funds. The shares of common stock and Series B Preferred Stock acquired by Mr. Zheng, in the aggregate, represented 68.3% of the outstanding voting securities of 24/7 Kid as of March 9, 2020, and the acquisition of such shares resulted in a change in control of 24/7 Kid.

On March 11, 2020, the Company was incorporated in Florida as a wholly owned subsidiary of 24/7 Kid and QDM Merger Sub, Inc. (“Merger Sub”) was incorporated in Florida as a wholly owned subsidiary of the Company, for the purposes of effectuating a name change by implementing a reorganization of the corporate structure of 24/7 Kid through a merger (the “Merger”). On March 13, 2020, an Agreement and Plan of Merger (the “Merger Agreement”) was entered into by and among 24/7 Kid, the Company, and the Merger Sub. On April 8, 2020, the Articles of Merger were filed with the State of Florida to effect the Merger as stipulated by the Merger Agreement.

Pursuant to the Merger Agreement, Merger Sub merged with and into 24/7 Kid, with 24/7 Kid being the surviving entity. As a result, the separate corporate existence of Merger Sub ceased and 24/7 Kid became a direct, wholly-owned subsidiary of the Company. Pursuant to the Merger Agreement and as a result of the Merger, all issued and outstanding shares of common stock and Series B Preferred Stock of 24/7 Kid were converted into shares of the Company’s common stock and Series B Preferred Stock, respectively, on a one-for-one basis, with the Company securities having the same designations, rights, powers and preferences and the qualifications, limitations and restrictions as the corresponding share of the securities of 24/7 Kid being converted. As a result, upon consummation of the Merger, all of the stockholders of 24/7 Kid immediately prior to the Merger became stockholders of the Company and all the directors and officers of 24/7 Kid became the directors and officers of the Company.

Upon consummation of the Merger, the Company became the successor issuer to 24/7 Kid pursuant to 12g-3(a) and as a result shares of the Company’s common stock were deemed to be registered under Section 12(g) of the Exchange Act.

Corporate Structure Following the Share Exchange

As a result of the Share Exchange described in Item 1.01 of this Report and further below, our corporate organization structure is as follows:

4

Overview of Post-Share Exchange Business

Through the Share Exchange, the Company acquired the Group. QDM BVI and QDM HK are holding companies and the Group conducts its business through its wholly owned subsidiary YeeTah. The business of the Group has become the business of the Company and is described below.

YeeTah is a licensed insurance brokerage company headquartered in Hong Kong and sells a wide range of insurance products, consisting of two major categories: (1) life and medical insurance, such as individual life insurance; and (2) general insurance, such as automobile insurance, commercial property insurance, liability insurance and homeowner insurance. In addition, as a Mandatory Provident Fund (“MPF”) Intermediary, YeeTah also provides its customers with assistance on account opening and related services under the MPF and the Occupational Retirement Schemes Ordinance schemes (“ORSO”) in Hong Kong, both of which are retirement protection schemes set up for employees. YeeTah is controlled by Mr. Huihe Zheng, our principal stockholder and Chief Executive Officer and Chairman, through his 100% ownership of QDM BVI, which in turn holds all the outstanding capital stock of YeeTah.

YeeTah sells insurance products underwritten by insurance companies operating in Hong Kong to its individual customers who are either Hong Kong residents or visitors from Mainland China and is compensated for its services by commissions paid by insurance companies, typically based on a percentage of the premium paid by the insured. Commissions generally depend on the type, term of insurance products and the particular insurance company and they are usually paid by the insurance companies the next month after the cooling off period of the policies sold, which is generally 21 days after the earlier of the delivery of the policy or a cooling off notice to the policy holder.

As of the date of this Current Report, YeeTah is a party to agreements with 20 insurance companies in Hong Kong, and offers approximately 520 insurance products to its customers. For the three months ended June 30, 2020 and 2019, an aggregate of 90.8% and 97.6% of YeeTah’s total commissions were attributable to its top three insurance partners, respectively. For its fiscal year ended March 31, 2020, an aggregate of 94.34% of YeeTah’s total commissions was attributable to its top three insurance companies, each accounted for more than 10% of its total commissions. For the fiscal year ended March 31, 2019, an aggregate of 92.1% of its total commissions were attributed to its top two insurance companies, each accounted for more than 10% of its total commissions.

As of June 30, 2020, YeeTah had serviced an aggregate of 594 customers in connection with the purchase of an aggregate of 646 insurance products as well as a total of 33 customers for MPF related services.

As an independent insurance agency, YeeTah offers not only a broad range of insurance products underwritten by multiple insurance companies to address the needs of increasingly sophisticated customers with diverse needs and preferences but also quality services covering the policy application, customer information collection, analysis of policy selection, and after-sale services.

YeeTah focuses on offering long-term life insurance products including endowment life and annuity life insurance and distribute general insurance products including automobile insurance, individual accident insurance, homeowner insurance, liability insurance and travel insurance.

Hong Kong’s independent insurance intermediary market is experiencing rapid growth due to increasing demands for insurance products by the Chinese population, especially the visitors from mainland China. YeeTah intends to grow its business by aggressively recruiting talents to join its professional team and sales force, expanding its distribution network through building more connections with business partners in Hong Kong and mainland China, such as wealth management companies, funds, trust companies, and overseas immigration agencies, and offering premium services.

5

Competitive Advantages

YeeTah believes that the following competitive strengths contribute to its success and differentiate it from its competitors:

| ● | Premium Customer Service Experience. YeeTah believes providing superior customer services to its existing and potential customers is the most important aspect of its business in terms of brand building and product differentiation. It has designed its services to provide personalized customer service throughout the whole insurance purchase process, including in-depth customer needs analysis, product and plan customization, product evaluation and selection, and claim settlement related assistance. |

| ● | Concentrated Product Offerings. Hong Kong's independent insurance intermediary companies generally focus on both life insurance and property insurance, but YeeTah’s strategy has been to focus on life insurance because of generally higher commissions. As of June 2020, YeeTah had distributed more than 600 life and medical insurance policies from 20 insurance companies in Hong Kong. YeeTah believes its ability to offer concentrated products and services makes it an attractive distributor for its insurance company partners, and enables it to provide quality service to its customers. |

| ● | Good Relationships with Insurance Companies. YeeTah maintains good relationships with the leading insurance companies in Hong Kong, including but not limited to, Prudential and AIA International Limited which have very stringent requirements on selection of brokers. YeeTah has been working with them for a few years and is able to pass their annual evaluations and receive favorable commission rates. |

| ● | Experienced Management Team. YeeTah’s responsible officer (Ms. Siu Ping Lo) has more than ten years of experience serving as a senior executive in the insurance industry and is familiar with the insurance intermediary industry and the regulatory environment in Hong Kong. In addition, YeeTah’s administrative manager has more than 20 years of experience in the insurance industry and 6 years of management experience. |

| ● | Strong Commitment to Rigorous Training and Development. Given the rapid development of new insurance products and the heavy reliance on face-to-face sales efforts in Hong Kong’s insurance industry, YeeTah believes that its strong in-house training program, which covers both product knowledge and sales skills, gives it a competitive edge over the other professional insurance intermediaries and helps it retain its sales force and improve its sales. The training also emphasizes inculcating in its technical representatives its corporate culture of customer service and commitment to high ethical standards. |

Growth Strategy

YeeTah’s goal is to further expand its distribution network. To achieve this goal, YeeTah intends to capitalize on the growth potential of China and Hong Kong’s insurance industry and insurance intermediary sector, leverage its competitive strengths and pursue the following strategy:

| ● | Pursue Acquisitions of Other Insurance Intermediaries. YeeTah intends to acquire suitable insurance intermediaries in mainland China in order to achieve the objective of growth and provide an area of expansion that will add to insurance product/service lines in a market that is currently not served by YeeTah. |

| ● | Further Participation in the Growing Life-Insurance Sector in Hong Kong. Life insurance products that require periodic premium payments have the potential to generate sustained revenue over an extended period of time. In order to take advantage of the significant growth potential of Hong Kong’s life issuance market and generate recurring income, YeeTah intends to continue to devote significant resources to growing this business line. YeeTah intends to actively recruit sales and marketing professionals to help increase sales of life insurance products in Hong Kong. YeeTah also intends to improve the productivity of individual technical representatives through rigorous training. In addition, YeeTah plans on leveraging its existing customer base to cross-sell life insurance products to its non-life insurance customers. |

| ● | Further Expand YeeTah’s Distribution Network Through Building Relationships with Strategic Partners. The insurance intermediary sector in Hong Kong is highly competitive. YeeTah plans to grow its distribution network by building relationships with partners in mainland China that have the potential of generating large premium in sales and to build relationships with wealth management companies, high net-worth clients and strategic partners in the Hong Kong market through recruiting and hiring more sales professionals to cover strategic partners which include financial institutes, real estate companies and other public entities. YeeTah believes that expanding its distribution network will help it generate more business and grow its sales. |

6

| ● | Continue to Strengthen YeeTah’s Relationships with Leading Insurance Companies. YeeTah currently establishes and maintains most of its business relationships with insurance companies in Hong Kong. As it plans to expand its distribution network through partners in China in an effort to increase its sales volumes in the future, it hopes to obtain favorable commission rates and exclusive rights to distribute high-margin products or collaborate with its insurance company partners to custom-develop products to suit the needs of its prospective customers. |

Impact of COVID-19

An outbreak of a novel strain of the coronavirus, commonly referred to as COVID-19, was identified in China and has subsequently been recognized as a pandemic by the World Health Organization. This COVID-19 outbreak has severely restricted the level of economic activity around the world. In response to this outbreak, the governments of many countries, states, cities and other geographic regions, including Hong Kong, have taken preventative or protective actions, such as imposing restrictions on travel and business operations and advising or requiring individuals to limit or forego their time outside of their homes.

With social distancing measures having been implemented to curtail the spread of COVID-19, brokers in Hong Kong, such as YeeTah, which relied primarily on storefront and in-person consultations for new business production faced an immediate slowdown. In addition, Hong Kong has suspended mainland tourists’ free travel and requested those who travel from mainland China and enter Hong Kong to undergo quarantine for 14 days.

Customers from mainland China contributed to a large part of YeeTah’s commissions. Regulations require their physical presence in Hong Kong to complete the policy contract. However, due to the political turmoil and travel restrictions related to the COVID-19 outbreak, mainland Chinese customers have dropped sharply. As a result, YeeTah’s revenue from commissions on new business has decreased significantly. YeeTah’s commissions from renewal premiums have also been materially affected since the mainland Chinese customers have been late in making the renewal payments due to the inability to visit Hong Kong to make the payments. Most of YeeTah’s mainland customers do not have Hong Kong bank account and used to pay their premiums through credit card or in cash in person. See “Management’s Discussion and Analysis of Results of Operations and Financial Conditions” for more information on the impact of COVID-19 on our business operations and financial conditions. YeeTah does not expect a significant improvement over its business and results of operations until the COVID-19 is effectively contained in Hong Kong and China and the mainland visitors are permitted to enter Hong Kong without a quarantine. As such, YeeTah presently focuses on servicing Hong Kong residents.

The extent to which the COVID-19 outbreak affects YeeTah’s business will depend on future developments in Hong Kong and around the world, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions required to contain and treat it, among others. Although the extent of the effect of the COVID-19 pandemic on YeeTah’s business and financial results is uncertain, the effects of a continued and prolonged public health crisis such as the COVID-19 pandemic could have a material negative impact on YeeTah’s business, operating results and financial condition. See “Risk Factors—Risks Related to YeeTah’s Business and Industry— YeeTah’s business, financial condition and results of operations have been and may continue to be adversely affected by the COVID-19 outbreak.

The Hong Kong Insurance Market

Hong Kong has one of the most developed insurance markets in Asia, with the per capita insurance premium standing at high levels and has attracted many of the world’s top insurance companies. According to the Statistical Highlights issued by Research Office of the Legislative Council Secretariat on May 10, 2019, the Hong Kong insurance industry has shown a considerable growth in recent years. In 2018, the total gross premiums of the industry were about HK$531.7 billion (approximately $68.17 billion), representing an increase of 78% over 2013, primarily as a result of an increase of 86% in long term business (e.g. life and annuity), which we believe might be indicative of the increasing demand for long term insurance products due to aging population.

7

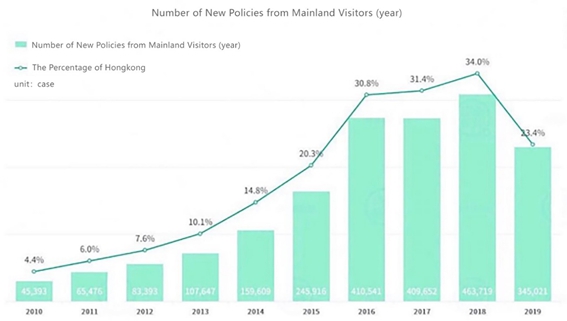

We believe that Hong Kong’s insurance industry’s accelerating growth is also attributable to increasing demands for insurance products by the Chinese population, especially visitors from mainland China. According to statistics from the Hong Kong Insurance Authority, the number of new policies brought by mainland visitors had been steadily increasing year by year until 2018, while witnessed a 25.6% decrease in 2019.

According to the statistics released by the Hong Kong Insurance Authority, the number of new policies purchased by mainland visitors in 2019 was 345,021, accounting for approximately 23.4% of the total number of new policies for individual insurance business, which typically includes, but not limited to, medical insurance, long-term life insurance, term life insurance, annuity, critical illness insurance and savings insurance. According to the Hong Kong Insurance Authority, the total amount of new premiums for individual insurance in 2019 was HK$172.3 billion (approximately $22.09 billion), which represents an increase of 6.5% compared to 2018 (HK$161.8 billion). Among them, the new policy premiums brought by mainland China visitors were HK$43.4 billion (approximately $5.6 billion), accounting for 25.2% of the total new policy premiums for individual insurance business. The diagram below demonstrates the number and percentage of new policies purchased by the mainland visitors over the years from 2010 to 2019.

Source: Hong Kong Insurance Authority

8

Market Potential and Recent Trends

Hong Kong’s insurance industry is expected to slow down in 2020 as a result of the COVID-19 pandemic and social unrest in the city. GlobalData, a leading data and analytics company, forecast that the industry will grow by 1.46% in 2020, from HKD 552 billion (approximately $70.8 billion) to HKD 560 billion (approximately $71.8 billion), representing one fourth of the sector’s rate of expansion last year. The slowing pace will hit all insurance segments but in particular life insurance, which represents more than 90% of the Hong Kong insurance market. Non-life insurance sectors are now expected to grow by 1% in 2020, in contract with pre-COVID-19 expectation of a growth of 4.4%. However, the firm forecasts a stronger future for the Hong Kong insurance industry beyond 2020, predicting 5.6%, 6.5% and 7.1% annual growth rates in 2021, 2022 and 2023, respectively.

Source: https://www.globaldata.com/

Hong Kong’ containment measures to control the spread of the COVID-19 will further affect its economy and insurance industry, which was already impacted by the recent civil unrest and US-China trade conflict.

Another issue facing Hong Kong life insurers relates to their business from mainland China. Customers from mainland China constitute an important market segment for Hong Kong life insurers. However, regulations require the physical presence of the insured party in Hong Kong to complete the policy contract. Due to the recent riots in Hong Kong and also the COVID-19 outbreak, interest from mainland Chinese customers has dropped sharply. As a result, sales to these Chinese customers has fallen to negligible levels.

Products and Services

YeeTah markets and sells two broad categories of insurance products: (1) life and medical insurance products, and (2) general insurance products. As of the date of this Current Report, insurance products YeeTah sells are underwritten by 20 insurance companies in Hong Kong. In addition, as an MPF Intermediary, YeeTah also assists its customers with their investment through the MPF and the ORSO schemes in Hong Kong. Such services primarily include collection and provision of information on investment products and exclude investment advisory services).

9

Life and Medical Insurance Products

YeeTah’s life and medical insurance products collectively accounted for approximately 95.01%, 94.97% and 97.54% of its net revenues for the three months ended June 30, 2020 and the fiscal years ended March 31, 2020 and 2019, respectively. For life and medical insurance products purchased by its customers, YeeTah generally receives commissions in the range of 2.72% to 110% of the first year premiums and in the range of 0% to 49.5% of renewal premiums.

The sale of life and medical insurance products is, and YeeTah currently expects it to continue to be, the major source of YeeTah’s revenue in the next several years. YeeTah began offering life insurance products in 2015 with a focus on individual life products with periodic payment schedules. The major life and medical insurance products YeeTah sells can be broadly classified into the categories set forth below. Due to constant product innovation by insurance companies, some of the insurance products YeeTah sells combine features of one or more of the categories listed below:

| ● | Individual Health Insurance. The individual health insurance products YeeTah sells primarily consist of critical illness insurance products, which provide guaranteed benefits when the insured is diagnosed with specified serious illnesses, and medical insurance products, which provide conditional reimbursement for medical expenses during the coverage period. In return, the insured makes periodic payment of premiums over a pre-determined period. |

| ● | Individual Annuity. The individual annuity products YeeTah sells generally provide annual benefit payments after the insured attains a certain age, or for a fixed time period, and provide a lump sum payment at the end of the coverage period. In addition, the beneficiary designated in the annuity contract will receive guaranteed benefits upon the death of the insured during the coverage period. In return, the purchaser of the annuity products makes periodic payments of premiums during a pre-determined accumulation period. |

| ● | Individual Endowment Life Insurance. The individual endowment products YeeTah sells generally provide insurance coverage for the insured for a specified time period and maturity benefits if the insured reaches a specified age. The individual endowment products YeeTah sells also provide to a beneficiary designated by the insured guaranteed benefits upon the death of the insured within the coverage period. In return, the insured makes periodic payment of premiums over a pre-determined period. |

We believe due to China and Hong Kong’s rapidly aging population, high national savings rate, sustained economic development, rising household income, strong support from government policies and regulations, and enhanced risk protection awareness, Hong Kong’s life and medical insurance sector will experience faster growth than the other insurance sectors, and currently YeeTah plans to allocate greater resources to develop its life and medical insurance business.

General Insurance Products

YeeTah’s general insurance products, also known as property and casualty insurance products, accounted for approximately 4.6%, 2.74% and 0.86% of its net revenues for the three months ended June 30, 2020 and the fiscal years ended March 31, 2020 and 2019, respectively. For general insurance products purchased by its customers, YeeTah generally receives commissions from the insurance companies in the range of 5.0% - 55.0% of the premiums. The major general insurance products YeeTah offers or facilitates to individual customers can be further classified into the following categories:

| ● | Individual Accident Insurance. The individual accident insurance products YeeTah sells generally provide a guaranteed benefit during the coverage period in the event of death or disability of the insured as a result of an accident, or a reimbursement of medical expenses to the insured in connection with an accident. These products typically require only a single premium payment for each coverage period. Because most of the individual accident insurance products it sells are underwritten by general insurance companies, it classifies individual accident insurance products as general insurance products. |

| ● | Travel Insurance. The travel insurance products YeeTah sells are short-term insurance providing guaranteed benefit in the event of death or disability and covering travel-related emergencies and losses, either within one’s own country, or internationally. These products typically require only a single premium payment for each coverage period. |

| ● | Homeowner Insurance. The homeowner insurance products YeeTah sells primarily cover damages to the insured house, along with furniture and household electrical appliance in the house caused by a number of incidents such as fire, flood and explosion. |

| ● | Auto Insurance. YeeTah facilitates both standard auto insurance policies and supplemental policies, which YeeTah refers to as riders. The standard auto insurance policies it facilitates generally have a term of one year and cover damages caused to the insured vehicle by collision and other traffic accidents, falling or flying objects, fire, explosion and natural disasters. It also facilitates standard third-party liability insurance policies, which cover bodily injury and property damage caused by an accident involving an insured vehicle to a person not in the insured vehicle. The riders it facilitates cover additional losses, such as liability to passengers, losses arising from vehicle theft and robbery, broken glass and vehicle body scratches. |

10

MPF and ORSO Services

The MPF is a compulsory saving scheme (pension fund) for the retirement of residents in Hong Kong. Most employees and their employers are required to contribute monthly to the MPF schemes provided by approved private organizations based on the salary and period of employment of the employee. ORSO schemes are retirement schemes set up voluntarily by employers to provide retirement benefits for their employees. MPF is the mainstream retire plan in Hong Kong. YeeTah introduces customers to the service providers of the MPF and ORSO schemes approved by MPF as trustees to administer the MPF and ORSO schemes. As of August 31, 2020, there were a total 15 approved trustees in Hong Kong, of which, four have signed agreements with YeeTah in connection with its provision of MPF and ORSO related services. YeeTah assists employees who are Hong Kong residents to open personal accounts with a new approved trustee and employers in Hong Kong to set up corporate accounts. YeeTah receives service fees in the range of 1.0% - 5.0% of the total investment transferred by an employee/employer to the new trustee and is paid by the trustee once the transaction is completed. YeeTah assisted an aggregate of 33 customers with account opening and transfer of funds through the MPF scheme since inception.

Distribution Network and Marketing

YeeTah relies on its technical representatives to market and sell insurance products in Hong Kong. As of June 30, 2020, YeeTah had 10 technical representatives in Hong Kong. YeeTah was a party to an agreement with YeeTah Financial Group Company Limited (“YeeTah Financial”), a company controlled by YeeTah’s former officer and director, which referred customers, most of whom are mainland visitors, to YeeTah for the purchase of insurance products in Hong Kong in exchange for certain fees paid by YeeTah out of its commissions earned through the insurance policies purchased by the referred customers. Such agreement with YeeTah Financial was terminated in December 2019 and YeeTah is in the process of identifying new cross-industry marketing partners in various lines of businesses to expand its business.

Customers

For the past three years, YeeTah has seen a steady growth in customers. From March 2017 to June 2020, the total number of its individual customers grew from 329 to 554. By providing premium customer services to its customers, YeeTah also strives to build a loyal customer base that generates referral and cross-selling opportunities, and that becomes returning customers, i.e. a customer who purchases more than one product from YeeTah. During the fiscal year ended March 31, 2020, YeeTah had 26 customers from Hong Kong and one customer from mainland China. During the fiscal year ended March 31, 2019, YeeTah had 22 customers from Hong Kong and 39 customers from mainland China. During the three months ended June 30, 2020, YeeTah had six customers from Hong Kong and no customers from mainland China.

Collaboration with Insurance Companies

As of June 30, 2020, YeeTah had entered into long-term agreements with 20 insurance companies in Hong Kong, pursuant to which it is authorized to market and distribute certain insurance products of those companies to its customers. These agreements establish, among other things, the scope of its authority, the pricing of the insurance products it sells and its commission rates.

For the three months ended June 30, 2020 and 2019 and the fiscal years ended March 31, 2020 and 2019, YeeTah’s top three insurance company partners by commissions are as follows:

| Three

Months Ended June 30, 2019 | Three

Months Ended June 30, 2020 | Fiscal

Year Ended March 31, 2020 | Fiscal

Year Ended March 31, 2019 | |||||||||||||||||||||||||||||

| Name | Commissions (In US$) | Percentage of Revenue | Commissions (In US$) | Percentage of Revenue | Commissions (In US$) | Percentage of Revenue | Commissions (In US$) | Percentage of Revenue | ||||||||||||||||||||||||

| Company A | 11,078 | 21.2 | % | 7,011 | 33.6 | % | 88,163 | 39.8 | % | 251,697 | 56.5 | % | ||||||||||||||||||||

| Company B | 16,614 | 31.8 | % | 8,610 | 41.2 | % | 82,895 | 37.5 | % | 158,407 | 35.6 | % | ||||||||||||||||||||

| Company C | 23,296 | 44.6 | % | 3,352 | 16.0 | % | 38,000 | 17.2 | % | - | - | |||||||||||||||||||||

11

Competition

A number of industry players are involved in the distribution of insurance products in Hong Kong. YeeTah competes for customers on the basis of product offerings, customer services and reputation. Its principal competitors include:

| ● | Professional insurance intermediaries. As of July 31, 2020, there were a total of 2,356 and 828 insurance agencies and insurance broker companies in Hong Kong, respectively. The insurance agencies represent insurance companies, and the insurance broker companies represent customers who purchase insurance products. The rest of the insurance intermediaries are other businesses which sell insurance products, such as commercial banks. With an increasing consolidation expected in the insurance intermediary sector in the coming years, YeeTah expects competition within this sector to intensify. |

| ● | Insurance companies. YeeTah competes against insurance companies that rely on their own sales force to distribute their products. All large insurance companies use both in-house sales force and exclusive sales agents to distribute their own products. YeeTah believes that it can compete effectively with insurance companies because it focuses only on distribution and is able to offer its customers a broader range of insurance products underwritten by multiple insurance companies as well as better insurance premium. |

| ● | Other business entities. In Hong Kong, some business entities may distribute insurance products as an ancillary business; primarily commercial banks. However, the insurance products distributed by these entities are usually confined to those related to their main lines of business. YeeTah believes that it can compete effectively with these business entities because it offers its customers a broader variety of products and professional services. |

Although some of YeeTah’s competitors have operated for a longer period of time than YeeTah, with more market shares and greater brand influence, YeeTah believes that its entrepreneurial attitude and smaller size, as well as its customer service, enable it to better respond and adapt to fast changing insurance market conditions compared to the larger competitors.

Seasonality

The Group’s income is subject to both quarterly and annual fluctuations as a result of the seasonality of its business, the timing of policy renewals and the net effect of new and lost business. For life insurance, the insurance companies, under pressure to meet their annual sales targets, would increase their sales efforts during the fourth quarter of a year by, for example, offering more incentives for insurance intermediaries to increase sales. As a result, income derived from life insurance products for the fourth quarter of a year is generally the highest among all four quarters. Business activities, including buying and selling insurance, usually slow down during the Chinese New Year festivities, which occur during the first quarter of each year. As a result, income derived from insurance products for the first quarter of a year has generally been the lowest among all four quarters.

Intellectual Property

As of June 30, 2020, the Group had no registered or registration-pending intellectual property.

Employees and Technical Representatives

YeeTah had two full-time employees as of June 30, 2020 and March 31, 2020 and 2019, respectively. YeeTah also had ten, ten and 15 licensed technical representatives as of June 30, 2020, March 31, 2020 and 2019, respectively. Technical representatives are licensed individuals who provide regulated advice to a policy holder or potential policy holder on insurance matters for an insurance agent or broker, or arrange contracts of insurance in or from Hong Kong on behalf of that insurance agent or broker. YeeTah’s affiliated technical representatives are not its employees and are only compensated via commissions on sales of insurance policies. The commissions YeeTah pays its technical representatives vary from 100% to 170% of basic commission rate provided by each insurance company.

Properties

The Group’s headquarters are located at Room 1503, 15/F., Wing Kwok Centre, 182 Woosung Street, Jordan, Kowloon, Hong Kong, where it leases approximately 859 square feet of office space for a monthly rent of HKD22,800 (approximately US$2,923) under a lease which expires in May 2021.

The Company does not lease or own any properties. The principal executive office of the Company is provided by Mr. Huihe Zheng free of charge.

12

Legal Proceedings

There are no pending legal proceedings to which the Company or its subsidiaries are a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of the Company’s voting securities, or security holder is a party adverse to the Company or has a material interest adverse to the Company.

Government Regulation

As a business operating in Hong Kong, the Group is subject to various regulations and rules promulgated by the Hong Kong government. The following is a brief summary of the Hong Kong laws and regulations that currently materially affect the Group’s business. This section does not purport to be a comprehensive summary of all present and proposed regulations and legislation relating to the industry in which the Group operates its business.

Regulations Related to Insurance Intermediaries

Effective September 23, 2019, the Insurance Authority of Hong Kong (“IA”) took over the regulation of insurance agents and brokers (collectively, “Insurance Intermediaries”) from the three self-regulatory organizations (i.e., the Insurance Agents Registration Board established under The Hong Kong Federation of Insurers, The Hong Kong Confederation of Insurance Brokers and The Professional Insurance Brokers Association) and becomes the sole regulator to license and supervise all Insurance Intermediaries in Hong Kong. The IA is responsible for supervising Insurance Intermediaries’ compliance with the provisions of Insurance Ordinance (Cap. 41) (“IO”), and the relevant regulations, rules, codes and guidelines issued by the IA. The IA is also responsible for promoting and encouraging proper standards of conduct of Insurance Intermediaries, and has regulatory powers in relation to licensing, inspection, investigation and disciplinary sanctions.

The regulatory regime for Insurance Intermediaries is activity-based. Under section 64G of the IO, a person must not carry on a regulated activity, or must not hold out that the person is carrying on a regulated activity, in the course of business or employment, or for reward unless the person holds an appropriate type of Insurance Intermediary license or is exempt under the IO.

Regulated Activity

Under section 3A(a) of the IO and Schedule 1A to the IO, a person carries on a regulated activity if the person does any of the following:

| ● | negotiating or arranging a contract of insurance; |

| ● | inviting or inducing, or attempting to invite or induce, a person to enter into a contract of insurance; |

| ● | inviting or inducing, or attempting to invite or induce, a person to make a decision in relation to (a) the making of an application or proposal for a contract of insurance; (b) the issuance, continuance or renewal of a contract of insurance; (c) the cancellation, termination, surrender or assignment of a contract of insurance; (d) the exercise of a right under a contract of insurance; (e) the change in any term or condition of a contract of insurance; or (f) the making or settlement of an insurance claim; or |

| ● | giving advice in relation to (a) the making of an application or proposal for a contract of insurance; (b) the issuance, continuance or renewal of a contract of insurance; (c) the cancellation, termination, surrender or assignment of a contract of insurance; (d) the exercise of a right under a contract of insurance; (e) the change in any term or condition of a contract of insurance; or (f) the making or settlement of an insurance claim (such advice is referred to as “Regulated Advice”). |

Types of Licensed Insurance Brokers

The licensing regime under the IO prescribes two types of licensed insurance brokers: licensed insurance broker companies and licensed technical representatives (broker).

| ● | A licensed insurance broker company is a company which is granted an insurance broker company license under section 64ZA of the IO to carry on regulated activities in one or more lines of business, and to perform the act of negotiating or arranging an insurance contract as an agent of any policy holder or potential policy holder. |

| ● | A licensed technical representative (broker) is an individual who is granted a technical representative (broker) license under section 64ZC of the IO to carry on regulated activities in one or more lines of business, as an agent of any licensed insurance broker company. |

13

A license granted under section 64ZA or 64ZC of the IO is valid for 3 years or, if the IA considers it appropriate in a particular case, another period determined by the IA, beginning on the date on which it is granted.

Responsible Officer

Under section 64ZF of the IO, a licensed insurance broker company should appoint a fit and proper person to discharge his or her responsibilities as a responsible officer of the insurance broker company, and should provide sufficient resources and support to that person for discharging his or her responsibilities. Prior approval of the IA is required for appointment of the responsible officer.

Transitional Arrangements for Insurance Brokers

To facilitate a smooth transition, all insurance brokers who were validly registered with The Hong Kong Confederation of Insurance Brokers or Professional Insurance Brokers Association immediately before September 23, 2019 are deemed as licensed insurance brokers under the IO for a period of three years. The incumbent chief executives of the insurance broker companies are also eligible for the transitional arrangements. The IA will, staggered over the three-year transitional period, invite deemed licensees to submit applications to the IA for granting of formal licenses and approvals.

“Fit and Proper” Requirements

Under the IO, a person who is, is applying to be, or is applying for a renewal of a license to be, a licensed insurance broker is required to satisfy the IA that he/she/it is a fit and proper person. In addition, the responsible officer(s), controller(s), and director(s) (where applicable) of a licensed insurance broker company are also required to be fit and proper persons. These “fit and proper” requirements aim at ensuring that the licensed insurance brokers are competent, reliable and financially sound, and have integrity. Pursuant to the IO, in determining whether a person is a fit and proper person, the IA must consider, among others, the following factors:

| ● | the person’s education or other qualifications or experience; |

| ● | the person’s ability to carry on a regulated activity competently, honestly and fairly; |

| ● | the persons’ reputation, character, reliability and integrity; |

| ● | the person’s financial status or solvency; |

| ● | whether any disciplinary action has been taken against the person by the Monetary Authority, the Securities and Futures Commission, the Mandatory Provident Fund Schemes Authority; or any other authority or regulatory organization (in Hong Kong or elsewhere) with functions similar to those of the IA; |

| ● | if the person is a company in a group of companies, any information in the possession of the IA relating to any other company in the group of companies or any controller or director of the person or of such company; |

| ● | the state of affairs of any other business which the person carries on or proposes to carry on; and |

| ● | in respect of an application to be licensed as a licensed insurance broker company or renewal of such license, any information in the possession of the IA relating to (i) any current or prospective employees or affiliates of the person, or any other person acting for or on behalf of the person, in each case, for the purposes of carrying on regulated activities and (ii) the question as to whether the person has established effective internal control procedures and risk management systems to ensure its compliance with the IA. |

The IA also issued the Guideline on “Fit and Proper” Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Cap. 41) to further explain the criteria that the IA would adopt in determining whether a person is a fit and proper person. In addition, continuing professional development is part of the fit and proper requirement and the IA issued the Guideline on Continuing Professional Development for Licensed Insurance Intermediaries to provide guidance for complying with the continuing professional development requirements.

14

Financial and Other Requirements for Licensed Insurance Broker Companies

A licensed insurance broker company is required to comply with the Insurance (Financial and Other Requirements for Licensed Insurance Broker Companies) Rules (“Broker Rules”), which set out, inter alia, some of the key requirements in relation to:

| ● | Share Capital and Net Assets |

A licensed insurance broker company must at all times maintain a paid-up share capital of not less than $500,000 and net assets of not less than $500,000, subject to the transitional arrangements mentioned above, pursuant which, the insurance broker company is required to maintain the amount of paid-up share capital and net assets of (i) not less than $100,000 for the period from September 23, 2019 to December 31, 2021 and (ii) not less than $300,000 for the period from January 1, 2022 to December 31, 2023.

| ● | Professional Indemnity Insurance |

A licensed insurance broker company must maintain a professional indemnity insurance policy that provides coverage for claims made against the company for liabilities arising from breaches of duty in the course of carrying on its regulated activities.

| ● | Client Accounts |

A licensed insurance broker company that receives or holds client monies must maintain at least one client account with an authorized institution in the name of the licensed insurance broker company in the title of which the word “client” appears.

| ● | Record Keeping |

A licensed insurance broker company must keep, in relation to its business which constitutes the carrying on of regulated activities, where applicable, sufficient accounting and other records (including records relating to the assets or affairs of the company’s clients).

Licensed insurance broker companies are required to file their audited financial statements and auditor’s compliance reports to the IA annually, which statements and reports are reviewed by the IA annually.. Any issue noted or qualified opinion expressed by the auditor will be followed up and where applicable, further actions will be taken as the IA considers necessary.

The Broker Rules also provide certain exemptions for the broker insurance companies subject to the transitional requirements referenced above during the specified transitional period in complying with the requirements in relation to professional indemnity insurance, client monies reconciliation and audited financial statements.

Conduct Requirements

Licensed insurance brokers are required to comply with the statutory conduct requirements set out in sections 90 and 92 of the IO. The IA also issued the Code of Conduct for Licensed Insurance Brokers (“Code of Conduct”) to set out the general principles, together with the standards and practices relating to each general principle, serving as the minimum standards of professionalism to be met by licensed insurance brokers when carrying on regulated activities.

The general principles that a licensed insurance broker should comply with include:

| ● | acting honestly, ethically, with integrity and in good faith; |

| ● | acting in the best interests of its clients and treating its clients fairly; |

| ● | acting with due care, skill and diligence; |

| ● | possessing appropriate levels of professional knowledge and experience and only carrying on regulated activities in respect of which the broker has the required competence; |

| ● | providing clients with accurate and adequate information to enable them to make informed decisions; |

| ● | providing Regulated Advice suitable for the client taking into account the client’s circumstances; |

| ● | using best endeavors to avoid conflicts of interests and when such conflicts cannot be avoided, and managing them with appropriate disclosure to ensure clients are treated fairly at all times; and |

| ● | having sufficient safeguards in place to protect client assets received by the broker or which are in the broker’s possession. |

15

A licensed insurance broker company is required to have proper controls and procedures in place to ensure that the broker company and its licensed technical representatives (broker) meet the general principles, standards and practices set out in the Code of Conduct.

The Code of Conduct does not have the force of law, in that it is not subsidiary legislation, and should not be interpreted in a way that would override the provision of any law. A failure by a licensed insurance broker to comply with the Code of Conduct shall not by itself render the broker liable to any judicial or other proceedings. However, in any proceedings under the IO before a court, the Code of Conduct is admissible in evidence, and if a provision in the Code of Conduct appears to the court to be relevant to a question arising in the proceedings, the court must, in determining the question, take into account any compliance or non-compliance with the Code of Conduct.

Regulation of Mandatory Provident Fund Intermediaries

With the implementation of the Mandatory Provident Fund Schemes (Amendment) Ordinance 2012, a new statutory regulatory regime for Mandatory Provident Fund (“MPF”) intermediaries has come into operation from 1 November 2012. Under the new statutory regime, only registered MPF intermediaries are allowed to engage in conducting sales and marketing activities and giving advice in relation to MPF schemes.

Under the new statutory regime, the Mandatory Provident Fund Schemes Authority (“MPFA”) is the authority to administer MPF intermediaries, issue guidelines on compliance with statutory requirements applicable to registered MPF intermediaries, and impose disciplinary sanctions. On the other hand, the IA is given the statutory role for monitoring the compliance of the registered MPF intermediaries. As a frontline regulator, the IA supervises the conduct requirements stipulated in the Mandatory Provident Fund Schemes Ordinance (Cap.485) (“MPFSO”). If the IA has reasonable cause to believe that the registered MPF intermediaries may have failed to comply with the statutory conduct requirements, it may exercise the investigation powers under the MPFSO for investigating the suspected non-compliance.

Registered MPF intermediaries must comply with a set of statutory conduct requirements when they engage in conducting sales and marketing activities and giving advice in relation to MPF schemes. The MPFA has issued the Guidelines on Conduct Requirements for Registered Intermediaries to assist the registered MPF intermediaries in understanding how to comply with the conduct requirements.

The minimum standards of conduct that a registered MPF intermediary should adopt include:

| ● | acting honestly, fairly, in the best interests of the client and with integrity; |

| ● | acting with care, skill and diligence; |

| ● | advising on matters within competence; |

| ● | having regard to client’s particulars as is necessary; |

| ● | disclosing necessary information to the client; |

| ● | disclosing conflict of interest; |

| ● | prompt and proper accounting for client assets; |

| ● | keeping records of regulated activities; |

| ● | establishing, maintaining and observing proper controls and procedures for securing compliance by the principal intermediary; and |

| ● | appointing a responsible officer to use his or her best endeavors to carry out specified responsibilities in relation to the principal intermediary. |

Regulation Related to Business Registration

The Business Registration Ordinance (Chapter 310 of the Laws of Hong Kong) requires every person carrying on any business in Hong Kong to make an application to the Commissioner of Inland Revenue in the prescribed manner for the registration of that business, unless it is exempt under the Business Registration Ordinance. The Commissioner of Inland Revenue must register each business for which a business registration application is made and as soon as practicable after the prescribed business registration fee and levy are paid and issue a business registration certificate or branch registration certificate for the relevant business or the relevant branch, as the case may be.

16

Regulation Related to Employment and Labor Protection

Employment Ordinance (Chapter 57 of the Laws of Hong Kong)

The Employment Ordinance (Chapter 57of the Laws of Hong Kong), or the EO, is an ordinance enacted for, amongst other things, the protection of the wages of employees and the regulation of the general conditions of employment and employment agencies. Under the EO, an employee is generally entitled to, amongst other things, notice of termination of his or her employment contract; payment in lieu of notice; maternity protection in the case of a pregnant employee; not less than one rest day in every period of seven days; severance payments or long service payments; sickness allowance; statutory holidays or alternative holidays; and paid annual leave of up to 14 days depending on the period of employment.

Employees’ Compensation Ordinance (Chapter 282 of the Laws of Hong Kong)

The Employees’ Compensation Ordinance (Chapter 282 of the Laws of Hong Kong), or the ECO, is an ordinance enacted for the purpose of providing for the payment of compensation to employees injured in the course of employment. As stipulated by the ECO, no employer shall employ any employee in any employment unless there is in force in relation to such employee a policy of insurance issued by an insurer for an amount not less than the applicable amount specified in the Fourth Schedule of the ECO in respect of the liability of the employer. According to the Fourth Schedule of the ECO, the insured amount shall be not less than HK$100,000,000 (approximately $12,900,000) per event if a company has no more than 200 employees. Any employer who contravenes this requirement commits a criminal offence and is liable on conviction to a fine of HK$100,000 (approximately $12,900) and imprisonment for two years. An employer who has taken out an insurance policy under the ECO is required to display a prescribed notice of insurance in a conspicuous place on each of its premises where any employee is employed. Any employer who, without reasonable cause, contravenes this requirement commits a criminal offence and is liable on conviction to a fine of HK$10,000 (approximately $1,290). YeeTah believes that it has taken sufficient employee compensation insurance for its employees required under the ECO.

Mandatory Provident Fund Schemes Ordinance (Chapter 485 of the Laws of Hong Kong)

The MPFSO is an ordinance enacted for the purposes of providing for the establishment of non-governmental mandatory provident fund schemes, or the MPF Schemes. The MPFSO requires every employer of an employee (other than exempt persons) of 18 years of age or above but under 65 years of age to take all practical steps to ensure the employee becomes a member of a registered MPF Scheme. Subject to the minimum and maximum relevant income levels, it is mandatory for both employers and their employees to contribute 5% of the employee’s relevant income to the MPF Scheme. For a monthly-paid employee, the maximum relevant income level is HK$30,000 (approximately $3,870) per month and the maximum amount of contribution payable by the employer to the MPF Scheme is HK$1,500 (approximately $193). Any employer who, without reasonable cause, contravenes this requirement commits a criminal offence and is liable on conviction to a fine of HK$350,000 (approximately $45,200) and imprisonment for three years, and to a daily penalty of HK$500 (approximately $65) for each day on which the offence is continued. As of the date of this prospectus, the Company believe it has made all contributions required of PAM under the MPFSO. YeeTah believes that it has made all contributions required under the MPFSO.

17

Regulations Related to Hong Kong Taxation

Inland Revenue Ordinance (Chapter 112 of the Laws of Hong Kong)

Under the Inland Revenue Ordinance (Chapter 112 of the Laws of Hong Kong), where an employer commences to employ in Hong Kong an individual who is or is likely to be chargeable to tax, or any married person, the employer shall give a written notice to the Commissioner of Inland Revenue not later than three months after the date of commencement of such employment. Where an employer ceases or is about to cease to employ in Hong Kong an individual who is or is likely to be chargeable to tax, or any married person, the employer shall give a written notice to the Commissioner of Inland Revenue not later than one month before such individual ceases to be employed in Hong Kong.

Tax on Dividends

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by the Company.

Capital Gains and Profit Tax

No tax is imposed in Hong Kong in respect of capital gains from the sale of shares. However, trading gains from the sale of shares by persons carrying on a trade, profession or business in Hong Kong, where such gains are derived from or arise in Hong Kong, will be subject to Hong Kong profits tax which is imposed at the rates of 8.25% on assessable profits up to HK$2,000,000 (approximately US$258,000) and 16.5% on any part of assessable profits over HK$2,000,000 (approximately US$258,000) on corporations from the year of assessment of 2018/2019 onwards. Certain categories of taxpayers (for example, financial institutions, insurance companies and securities dealers) are likely to be regarded as deriving trading gains rather than capital gains unless these taxpayers can prove that the investment securities are held for long-term investment purposes.

Stamp Duty

Hong Kong stamp duty, currently charged at the ad valorem rate of 0.1% on the higher of the consideration for or the market value of the shares, will be payable by the purchaser on every purchase and by the seller on every sale of Hong Kong shares (in other words, a total of 0.2% is currently payable on a typical sale and purchase transaction of Hong Kong shares). In addition, a fixed duty of HK$5 is currently payable on any instrument of transfer of Hong Kong shares. Where one of the parties is a resident outside Hong Kong and does not pay the ad valorem duty due by it, the duty not paid will be assessed on the instrument of transfer (if any) and will be payable by the transferee. If no stamp duty is paid on or before the due date, a penalty of up to ten times the duty payable may be imposed.

Regulations Related to Anti-Money Laundering and Counter-Terrorist Financing

Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Chapter 615 of the Laws of Hong Kong)

The AMLO imposes requirements relating to client due diligence and record-keeping and provides regulatory authorities with the powers to supervise compliance with the requirements under the AMLO. In addition, the regulatory authorities are empowered to (i) ensure that proper safeguards exist to prevent contravention of specified provisions in the AMLO; and (ii) mitigate money laundering and terrorist financing risks.

Drug Trafficking (Recovery of Proceeds) Ordinance (Chapter 405 of the Laws of Hong Kong)

The Drug Trafficking (Recovery of Proceeds) Ordinance (Chapter 405 of the Laws of Hong Kong), or the DTROP, contains provisions for the investigation of assets suspected to be derived from drug trafficking activities, the freezing of assets on arrest and the confiscation of the proceeds from drug trafficking activities. It is an offence under the DTROP if a person deals with any property knowing, or having reasonable grounds to believe, it to be the proceeds from drug trafficking. The DTROP requires a person to report to an authorized officer if he/she knows or suspects that any property (directly or indirectly) is the proceeds from drug trafficking or is intended to be used or was used in connection with drug trafficking, and failure to make such disclosure constitutes an offence under the DTROP.

Organized and Serious Crimes Ordinance (Chapter 455 of the Laws of Hong Kong)

The Organized and Serious Crimes Ordinance (Chapter 455 of the Laws of Hong Kong), or the OSCO, empowers officers of the Hong Kong Police Force and the Hong Kong Customs and Excise Department to investigate organized crime and triad activities, and it gives the Hong Kong courts jurisdiction to confiscate the proceeds from organized and serious crimes, to issue restraint orders and charging orders in relation to the property of defendants of specified offences. The OSCO extends the money laundering offence to cover the proceeds of all indictable offences in addition to drug trafficking.

18

United Nations (Anti-Terrorism Measures) Ordinance (Chapter 575 of the Laws of Hong Kong)

The United Nations (Anti-Terrorism Measures) Ordinance (Chapter 575 of the Laws of Hong Kong), or the UNATMO, provides that it is a criminal offence to: (i) provide or collect funds (by any means, directly or indirectly) with the intention or knowledge that the funds will be used to commit, in whole or in part, one or more terrorist acts; or (ii) make any funds or financial (or related) services available, directly or indirectly, to or for the benefit of a person knowing that, or being reckless as to whether, such person is a terrorist or terrorist associate. The UNATMO also requires a person to report his knowledge or suspicion of terrorist property to an authorized officer, and failure to make such disclosure constitutes an offence under the UNATMO.

GL3: Guideline on Anti-Money Laundering and Counter-Terrorist Financing

The Guideline on Anti-Money Laundering and Counter-Terrorist Financing is issued by the IA, and it sets out the relevant anti-money laundering and counter-financing of terrorism (AML/CFT) statutory and regulatory requirements. It also prescribes the AML/CFT standards which authorized insurers and reinsurers carrying on long term business, and licensed individual insurance agents, licensed insurance agencies and licensed insurance broker companies carrying on regulated activities in respect of long term business (hereinafter referred to as “insurance institutions” (“IIs”)), should meet in order to comply with the statutory requirements under the AMLO and the IO. Compliance with this Guideline is enforced through the AMLO and the IO. IIs which fail to comply with this Guideline may be subject to disciplinary or other actions under the AMLO and/or the IO for non-compliance with the relevant requirements.

19

RISK FACTORS

Our business and an investment in our company is subject to significant risk. Some of these risks are described below and you should take these risks into account in making a decision to invest in our Common Stock. If any of the following risks actually occurs, we may not be able to conduct our business as currently planned and our financial condition and operating results could be seriously harmed. In that case, the market price of our Common Stock could decline and you could lose all or part of your investment in our Common Stock.

Risks Related to YeeTah’s Business and Industry

YeeTah’s business is subject to concentration risks arising from dependence on a single or limited number of insurance company partners.

YeeTah derives a significant portion of revenues from selling insurance products supplied by its major insurance company partners. For the fiscal year ended March 31, 2020, an aggregate of 94.34% of YeeTah’s total commissions was attributable to its top three insurance companies, each accounted for more than 10% of YeeTah’s total revenue. For the fiscal year ended March 31, 2019, an aggregate of 92.1% of YeeTah’s total revenue were attributed to its top two insurance companies, each accounted for more than 10% of its total commissions.

Because of this concentration in the supply of the insurance products YeeTah sells, YeeTah’s business and operations would be negatively affected if YeeTah experiences a partial or complete loss of any of these insurance partners. In addition, any significant adverse change in YeeTah’s relationship with any of these insurance company partners could result in loss of revenue, increased costs and distribution delays that could harm YeeTah’s business and customer relationships.

YeeTah depended on YeeTah Financial for customer acquisitions and the termination of the relationship with YeeTah Financial may materially adversely impact YeeTah’s revenue, financial conditions and results of operations.