Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Four Corners Property Trust, Inc. | q32020supplemental_10262.htm |

| 8-K - 8-K - Four Corners Property Trust, Inc. | fcpt-20201027.htm |

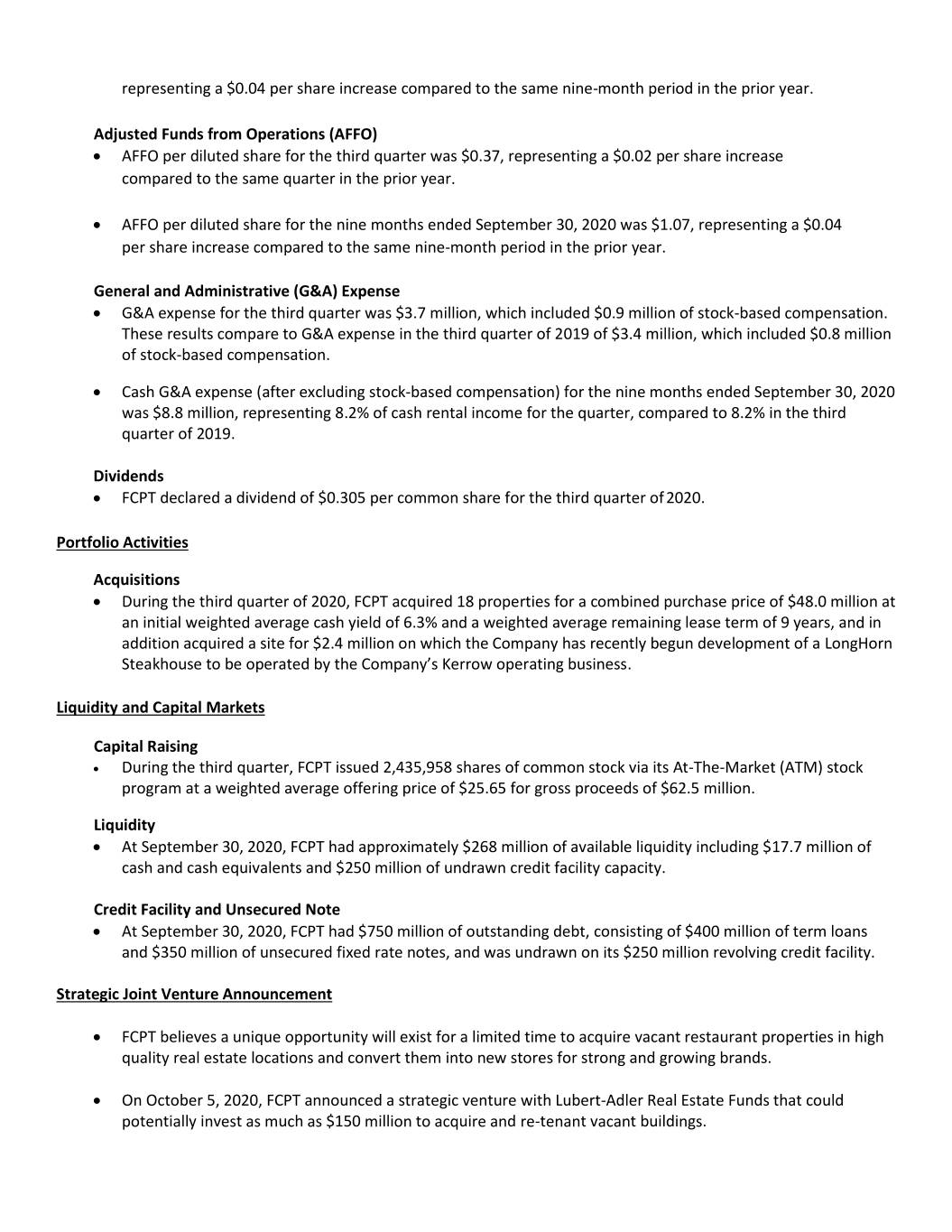

FCPT Announces Third Quarter 2020 Financial and Operating Results MILL VALLEY, CA – October 27, 2020 / Business Wire – Four Corners Property Trust, Inc. (“FCPT” or the “Company”, NYSE: FCPT) today announced financial results for the three months and nine months ended September 30, 2020. Management Comments “We are very gratified with our third quarter results and in particular with the high collection level of over 99% of contractual rent collections in the quarter which has continued into October,” said CEO Bill Lenehan. “We remained quite active in the acquisition market by focusing on properties in our pipeline with strong tenants and attractive locations, and were able to fund that growth and strengthen our balance sheet by raising over $62 million of equity via the ATM program in the quarter.” Mr. Lenehan further commented, “On October 5th, we announced a new strategic venture with Lubert-Adler to acquire vacant retail real estate that will be principally re-tenanted with credit-worthy operators expanding their store count. This venture allows us to prudently apply our expertise in collaboration with an experienced partner that has deep tenant relationships. This venture could help our tenants, keep retail areas vibrant and potentially lead to a future pipeline for our core business at attractive economics.” Rent Collection Update As of October 27, 2020, the Company has received rent payments representing over 99% of its portfolio contractual base rent for the quarter ending September 30, 2020. In addition, as of October 27, 2020, the Company has received October rent payments representing approximately 99% of its portfolio contractual base rent for the month of October 2020. Financial Results Rental Revenue and Net Income Attributable to Common Shareholders • Rental revenue for the third quarter increased 10.6% over the prior year to $38.9 million. Rental revenue consisted of $36.8 million in cash rental revenue and $1.8 million of straight-line and other non-cash rent adjustments. • Net income attributable to common shareholders was $19.3 million for the third quarter, or $0.27 per diluted share. These results compare to net income attributable to common shareholders of $18.3 million, or $0.27 per diluted share, for the same quarter in the prior year. • Net income attributable to common shareholders was $57.0 million for the nine months ended September 30, 2020, or $0.81 per diluted share. These results compare to net income attributable to common shareholders of $53.7 million, or $0.78 per diluted share, for the same nine-month period in the prior year. Funds from Operations (FFO) • NAREIT-defined FFO per diluted share for the third quarter was $0.38, representing a $0.02 per share increase compared to the same quarter in the prior year. • NAREIT-defined FFO per diluted share for the nine months ended September 30, 2020 was $1.11,

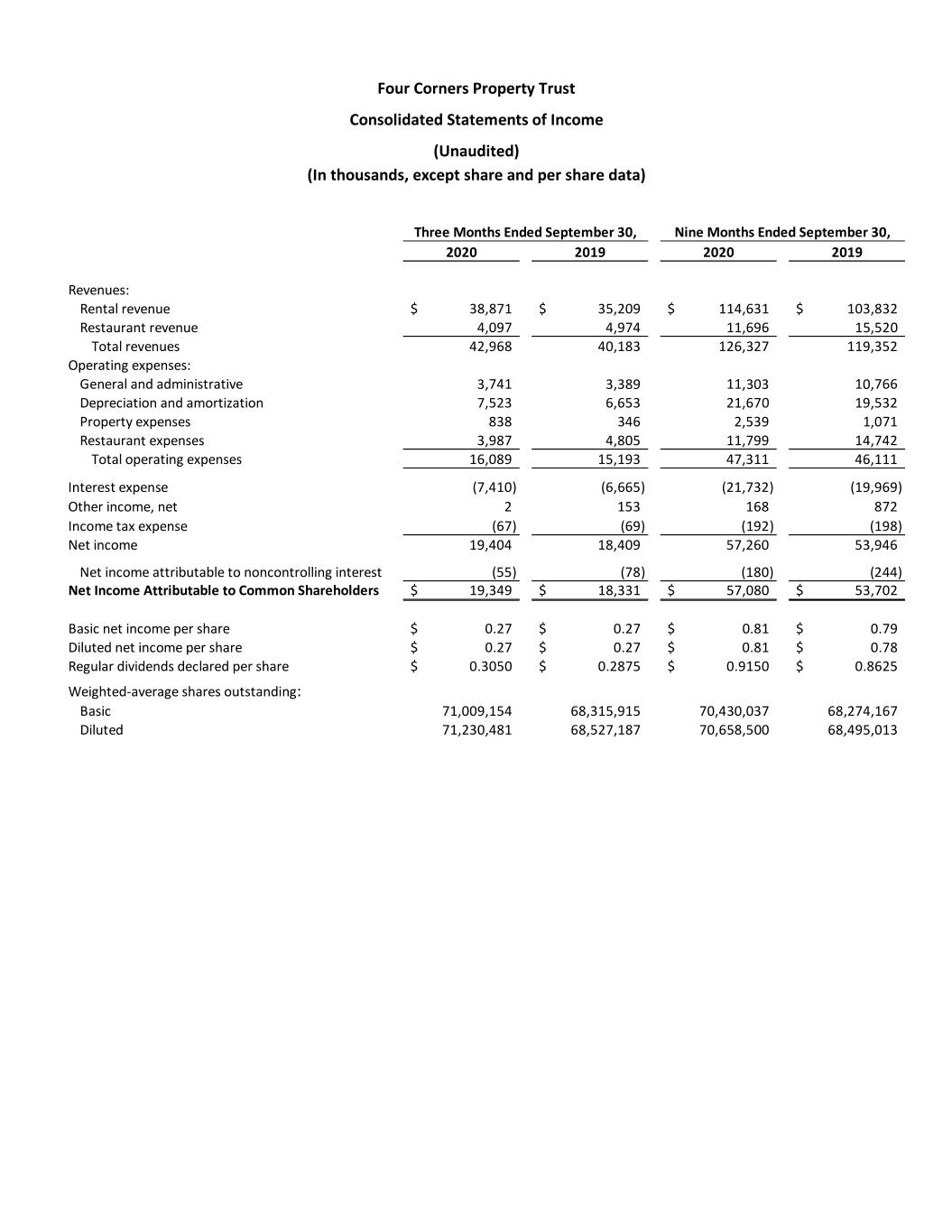

representing a $0.04 per share increase compared to the same nine-month period in the prior year. Adjusted Funds from Operations (AFFO) • AFFO per diluted share for the third quarter was $0.37, representing a $0.02 per share increase compared to the same quarter in the prior year. • AFFO per diluted share for the nine months ended September 30, 2020 was $1.07, representing a $0.04 per share increase compared to the same nine-month period in the prior year. General and Administrative (G&A) Expense • G&A expense for the third quarter was $3.7 million, which included $0.9 million of stock-based compensation. These results compare to G&A expense in the third quarter of 2019 of $3.4 million, which included $0.8 million of stock-based compensation. • Cash G&A expense (after excluding stock-based compensation) for the nine months ended September 30, 2020 was $8.8 million, representing 8.2% of cash rental income for the quarter, compared to 8.2% in the third quarter of 2019. Dividends • FCPT declared a dividend of $0.305 per common share for the third quarter of 2020. Portfolio Activities Acquisitions • During the third quarter of 2020, FCPT acquired 18 properties for a combined purchase price of $48.0 million at an initial weighted average cash yield of 6.3% and a weighted average remaining lease term of 9 years, and in addition acquired a site for $2.4 million on which the Company has recently begun development of a LongHorn Steakhouse to be operated by the Company’s Kerrow operating business. Liquidity and Capital Markets Capital Raising • During the third quarter, FCPT issued 2,435,958 shares of common stock via its At-The-Market (ATM) stock program at a weighted average offering price of $25.65 for gross proceeds of $62.5 million. Liquidity • At September 30, 2020, FCPT had approximately $268 million of available liquidity including $17.7 million of cash and cash equivalents and $250 million of undrawn credit facility capacity. Credit Facility and Unsecured Note • At September 30, 2020, FCPT had $750 million of outstanding debt, consisting of $400 million of term loans and $350 million of unsecured fixed rate notes, and was undrawn on its $250 million revolving credit facility. Strategic Joint Venture Announcement • FCPT believes a unique opportunity will exist for a limited time to acquire vacant restaurant properties in high quality real estate locations and convert them into new stores for strong and growing brands. • On October 5, 2020, FCPT announced a strategic venture with Lubert-Adler Real Estate Funds that could potentially invest as much as $150 million to acquire and re-tenant vacant buildings.

• FCPT’s investment into this venture could reach $20 million, with Lubert-Adler contributing the remainder of the capital. In addition, FCPT will have the right, but not the obligation, to purchase properties from the venture for FCPT’s long-term ownership portfolio once the properties stabilize. Real Estate Portfolio • As of September 30, 2020, the Company’s rental portfolio consisted of 751 properties located in 46 states. The properties were 99.6% occupied (measured by square feet) under long-term, net leases with a weighted average remaining lease term of approximately 10.5 years. Conference Call Information Company management will host a conference call and audio webcast on Wednesday, October 28 at 11:00 a.m. Eastern Time, to discuss the results. Interested parties can listen to the call via the following: Internet: Go to https://dpregister.com/sreg/10148405/d9fa80f30c at least 15 minutes prior to start time of the call, in order to register and to download any necessary audio software. Please note for those that register, the dial-in number will be provided upon registration. Phone: 1-888-346-5243 (domestic) / 1-412-317-5120 (international). Participants not pre-registered must ask to be joined into the Four Corners Property Trust call. Replay: Available through January 28, 2021 by dialing 1-877-344-7529 (domestic) / 1-412-317- 0088 (international), Replay Access Code 10148405. About FCPT FCPT, headquartered in Mill Valley, CA, is a real estate investment trust primarily engaged in the acquisition and leasing of restaurant properties. The Company seeks to grow its portfolio by acquiring additional real estate to lease, on a net basis, for use in the restaurant and retail industries. Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements within the meaning of the federal securities laws. Forward- looking statements include all statements that are not historical statements of fact and those regarding the Company’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance, announced transactions, expectations regarding the making of distributions and the payment of dividends, and the effect of pandemics such as COVID-19 on the business operations of the Company and the Company’s tenants and their continued ability to pay rent in a timely manner or at all. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward- looking statements speak only as of the date on which such statements are made and, except in the normal course of the Company’s public disclosure obligations, the Company expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and the Company can give no assurance that its expectations or the events described will occur as described. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements. In addition, the extent to which COVID-19 impacts the Company and its tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact and

the direct and indirect economic effects of the pandemic and containment measures, among others. For a further discussion of these and other factors that could cause the company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the company’s most recent annual report on Form 10-K, as supplemented by the risk factor described under “Item 1A. ‘Risk Factors’” in the Company’s quarterly report on Form 10-Q filed with the Securities and Exchange Commission on May 8, 2020, and other risks described in documents subsequently filed by the company from time to time with the Securities and Exchange Commission. Notice Regarding Non-GAAP Financial Measures: In addition to U.S. GAAP financial measures, this press release and the referenced supplemental financial and operating report contain and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in the supplemental financial and operating report, which can be found in the investor relations section of our website. Supplemental Materials and Website: Supplemental materials on the Third Quarter 2020 operating results and other information on the Company are available on the investors relations section of FCPT’s website at www.investors.fcpt.com. FCPT Bill Lenehan, 415-965-8031 CEO Gerry Morgan, 415-965-8032 CFO

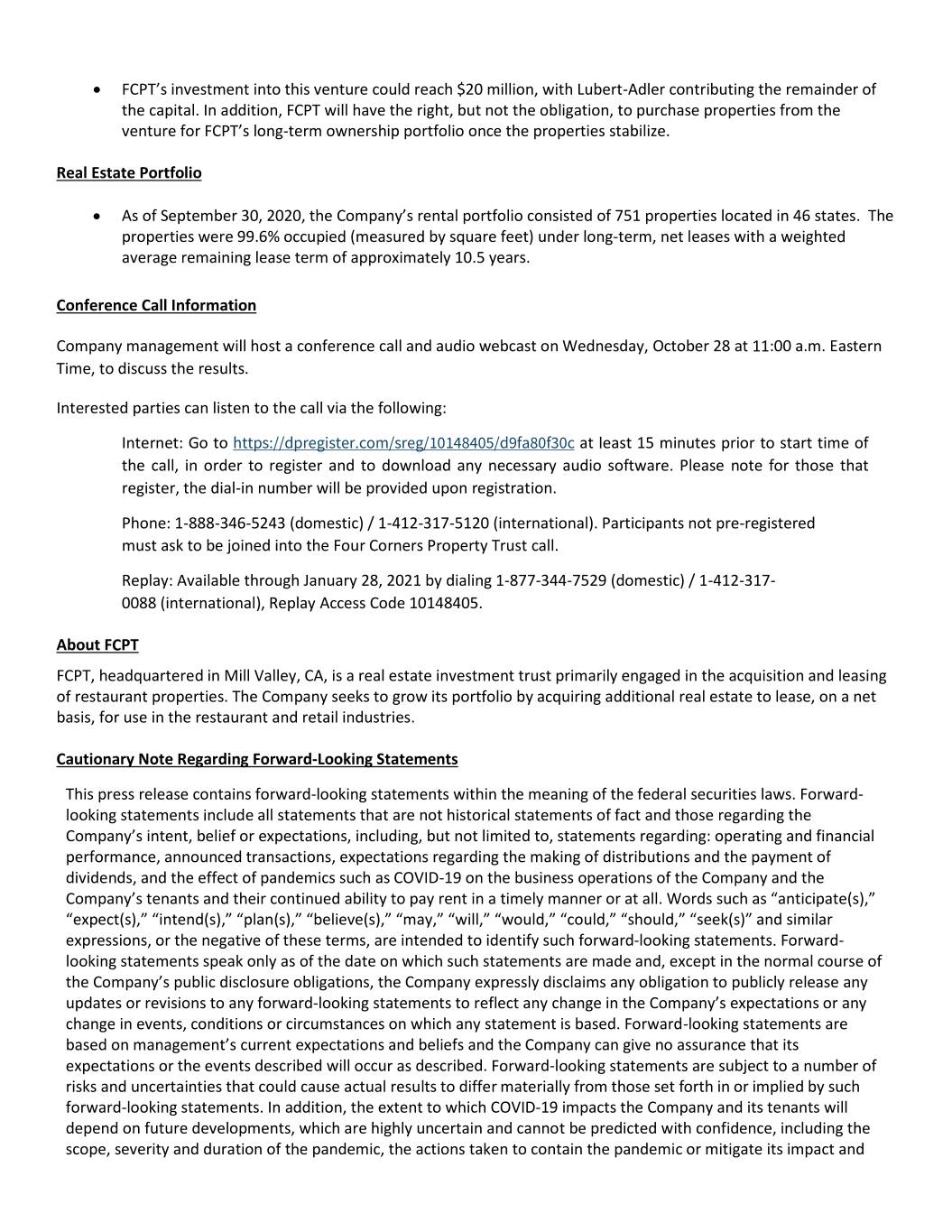

Four Corners Property Trust Consolidated Statements of Income (Unaudited) (In thousands, except share and per share data) Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Revenues: Rental revenue $ 38,871 $ 35,209 $ 114,631 $ 103,832 Restaurant revenue 4,097 4,974 11,696 15,520 Total revenues 42,968 40,183 126,327 119,352 Operating expenses: General and administrative 3,741 3,389 11,303 10,766 Depreciation and amortization 7,523 6,653 21,670 19,532 Property expenses 838 346 2,539 1,071 Restaurant expenses 3,987 4,805 11,799 14,742 Total operating expenses 16,089 15,193 47,311 46,111 Interest expense (7,410) (6,665) (21,732) (19,969) Other income, net 2 153 168 872 Income tax expense (67) (69) (192) (198) Net income 19,404 18,409 57,260 53,946 Net income attributable to noncontrolling interest (55) (78) (180) (244) Net Income Attributable to Common Shareholders $ 19,349 $ 18,331 $ 57,080 $ 53,702 Basic net income per share $ 0.27 $ 0.27 $ 0.81 $ 0.79 Diluted net income per share $ 0.27 $ 0.27 $ 0.81 $ 0.78 Regular dividends declared per share $ 0.3050 $ 0.2875 $ 0.9150 $ 0.8625 Weighted-average shares outstanding: Basic 71,009,154 68,315,915 70,430,037 68,274,167 Diluted 71,230,481 68,527,187 70,658,500 68,495,013

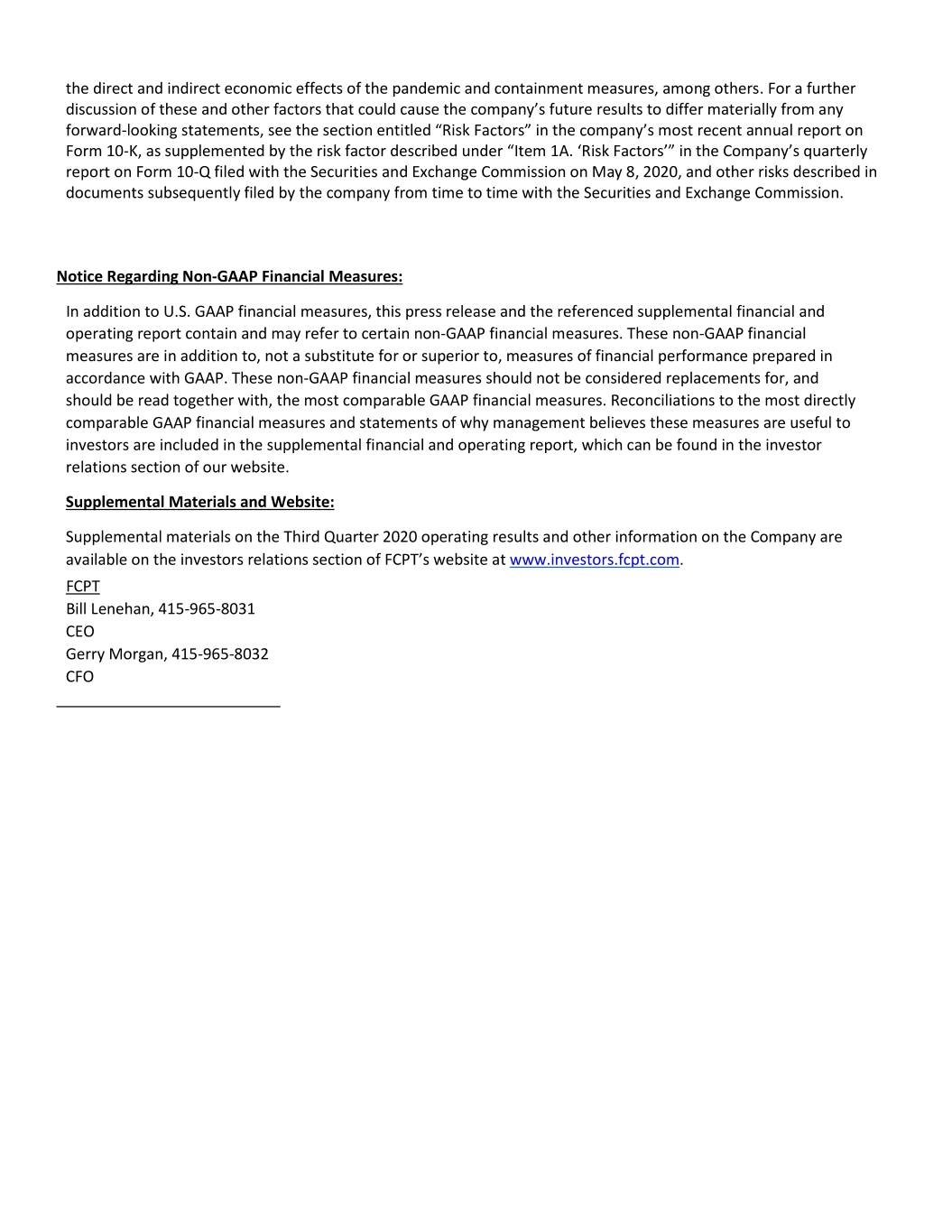

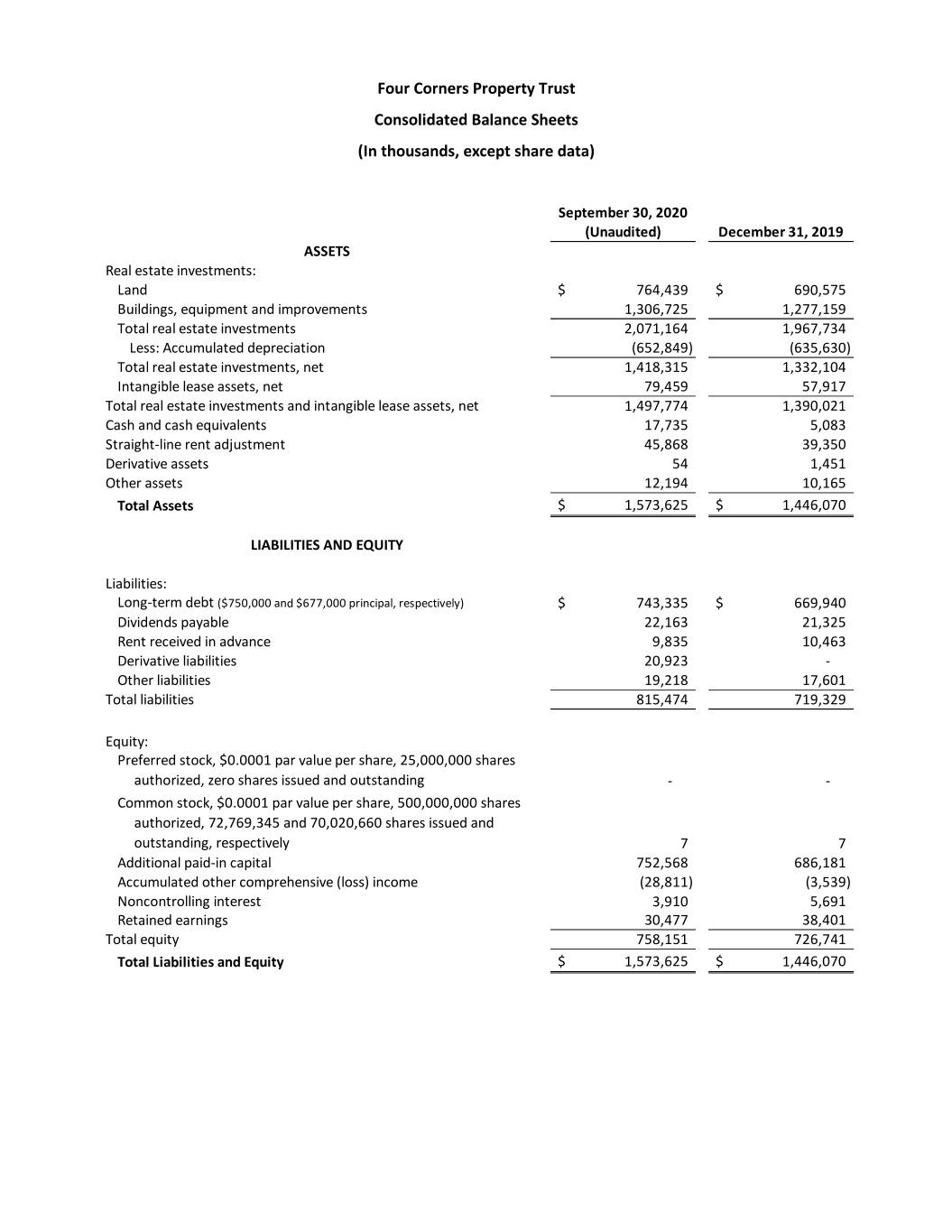

Four Corners Property Trust Consolidated Balance Sheets (In thousands, except share data) September 30, 2020 (Unaudited) December 31, 2019 ASSETS Real estate investments: Land $ 764,439 $ 690,575 Buildings, equipment and improvements 1,306,725 1,277,159 Total real estate investments 2,071,164 1,967,734 Less: Accumulated depreciation (652,849) (635,630) Total real estate investments, net 1,418,315 1,332,104 Intangible lease assets, net 79,459 57,917 Total real estate investments and intangible lease assets, net 1,497,774 1,390,021 Cash and cash equivalents 17,735 5,083 Straight-line rent adjustment 45,868 39,350 Derivative assets 54 1,451 Other assets 12,194 10,165 Total Assets $ 1,573,625 $ 1,446,070 LIABILITIES AND EQUITY Liabilities: Long-term debt ($750,000 and $677,000 principal, respectively) $ 743,335 $ 669,940 Dividends payable 22,163 21,325 Rent received in advance 9,835 10,463 Derivative liabilities 20,923 - Other liabilities 19,218 17,601 Total liabilities 815,474 719,329 Equity: Preferred stock, $0.0001 par value per share, 25,000,000 shares authorized, zero shares issued and outstanding - - Common stock, $0.0001 par value per share, 500,000,000 shares authorized, 72,769,345 and 70,020,660 shares issued and outstanding, respectively 7 7 Additional paid-in capital 752,568 686,181 Accumulated other comprehensive (loss) income (28,811) (3,539) Noncontrolling interest 3,910 5,691 Retained earnings 30,477 38,401 Total equity 758,151 726,741 Total Liabilities and Equity $ 1,573,625 $ 1,446,070

Four Corners Property Trust FFO and AFFO (Unaudited) (In thousands, except share and per share data) Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Funds from operations (FFO): Net income $ 19,404 $ 18,409 $ 57,260 $ 53,946 Depreciation and amortization 7,503 6,636 21,615 19,481 FFO (as defined by NAREIT) $ 26,907 $ 25,045 $ 78,875 $ 73,427 Straight-line rental revenue (2,248) (2,415) (6,519) (7,008) Recognized rental revenue abated (1) (196) - (1,568) - Stock-based compensation 868 802 2,496 2,792 Non-cash amortization of deferred financing costs 543 512 1,589 1,539 Other non-cash interest income (expense) 1 1 (1) (4) Non-real estate investment depreciation 20 17 55 51 Other non-cash revenue adjustments 412 25 799 49 Adjusted Funds from Operations (AFFO) $ 26,307 $ 23,987 $ 75,726 $ 70,846 (2) Fully diluted shares outstanding 71,434,873 68,816,579 70,879,855 68,805,612 FFO per diluted share $ 0.38 $ 0.36 $ 1.11 $ 1.07 AFFO per diluted share $ 0.37 $ 0.35 $ 1.07 $ 1.03 (1) Amount represents base rent that the Company has agreed to abate as a result of lease amendments. Upon finalization of lease amendments with tenants, the Company abated $1.6 million of rental revenue recognized in the second quarter of 2020, of which $1.4 million was included as an adjustment to AFFO in the second quarter of 2020. In the third quarter, receivables of $1.6 million were recognized as lease incentives and will be amortized as a reduction to rental revenue over the amended lease terms. (2) Assumes the issuance of common shares for OP units held by non-controlling interest.