Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - C. H. ROBINSON WORLDWIDE, INC. | ex991earningsreleaseq3.htm |

| 8-K - 8-K - C. H. ROBINSON WORLDWIDE, INC. | chrw-20201027.htm |

Bob Biesterfeld, CEO Mike Zechmeister, CFO Chuck Ives, Director of IR Q3 2020 Earnings Presentation October 28, 2020 1

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to such factors as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; competition and growth rates within the third party logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; our ability to successfully integrate the operations of acquired companies with our historic operations; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with operations outside of the United States; risks associated with the potential impact of changes in government regulations; risks associated with the produce industry, including food safety and contamination issues; fuel price increases or decreases, or fuel shortages; cyber-security related risks; the impact of war on the economy; changes to our capital structure; risks related to the elimination of LIBOR; changes due to catastrophic events including pandemics such as COVID-19; and other risks and uncertainties detailed in our Annual and Quarterly Reports.

Q3 2020 Opening Remarks ▪ Transitional quarter, with net revenue improving through the quarter ▪ Continued market share gains in NAST ▪ Honoring our contractual commitments and capturing more spot market opportunities ▪ Strong portfolio of services continues to benefit our results ▪ Continued productivity improvements driven by technology investments, automation and network architecture enhancements ▪ Technology initiatives providing opportunities to engage customers in new and innovative ways

Engaging Customers in New & Innovative Ways • Forged an alliance with Microsoft to help shippers digitally transform their supply chains • Delivered new tech capabilities for Freightquote by C.H. Robinson • Includes innovative partnership with TaskRabbit for small business e- commerce • Unprecedented 19 TMS & ERP systems integrated into our Navisphere® platform • Reinforces position as the most connected platform • Launched Procure IQTM, which improves upon a decades-old process for buying transportation to deliver increased savings and service reliability for large shippers

Strategies Creating Shareholder Value • Creating better outcomes for our customers and carriers • Utilizing our unmatched combination of experience, scale and information advantage • Leveraging our broad service portfolio • Focusing on profitable market share growth • Delivering industry leading technology to unlock growth and efficiency • Fostering sustainability and an inclusive culture that is supportive of our employees and the communities we serve

Results Q3 2020 Three Months Ended September 30 Nine Months Ended September 30 $ in thousands, except per share amounts 2020 2019 % CHANGE 2020 2019 % CHANGE Total Revenues $4,224,800 $3,856,132 9.6 % $11,657,654 $11,516,182 1.2 % Total Net Revenues $589,273 $633,431 (7.0) % $1,771,679 $2,007,447 (11.7) % Net Revenue Margin % 13.9 % 16.4 % (250 bps) 15.2 % 17.4 % (220 bps) Personnel Expenses $302,904 $320,563 (5.5) % $933,607 $999,547 (6.6) % Selling, General, and Admin $118,130 $111,783 5.7 % $371,606 $354,730 4.8 % Income from Operations $168,239 $201,085 (16.3) % $466,466 $653,170 (28.6) % Operating Margin % 28.6 % 31.7 % (310 bps) 26.3 % 32.5 % (620 bps) Depreciation and Amortization $26,916 $25,480 5.6 % $77,067 $75,122 2.6 % Net Income $136,529 $146,894 (7.1) % $358,614 $477,862 (25.0) % Earnings Per Share (Diluted) $1.00 $1.07 (6.5) % $2.63 $3.45 (23.8) % ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Average Headcount 14,904 15,782 (5.6) % 15,177 15,582 (2.6) % Average Full-Time Equivalents(1) 14,230 15,404 (7.6) % N/A N/A N/A • Decline in net revenues driven primarily by rising costs in truckload, partially offset by contributions from Prime Distribution acquisition and higher pricing in ocean and air Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor • Decrease in operating expenses driven by approximately $40 million of cost reduction initiatives Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours. Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor

Q3 2020 Other Income Statement Items Q3 effective tax rate of $3.3 million favorable Interest expense declined 15.1% vs. 21.8% in Q3 impact from currency $0.8 million versus Q3 2019 revaluation, versus a $1.1 2019 due to a lower million unfavorable impact average debt balance Lower tax rate due to discrete in Q3 2019 benefits of foreign tax credit utilization and tax benefit from increased stock option activity in Q3 2020 Expect full-year 2020 effective tax rate to be 18%-20%

Q3 2020 Cash Flow and Capital Distribution Cash Flow from Operations Capital Distribution Share (47.1%) Repurchases $167.3M (200.8%) $135.9M Cash Dividends ($168.6)M $71.9M Q3 2019 Q3 2020 Q3 2019 Q3 2020 • $335.9 million decrease in cash flow driven by • $71.9 million returned to shareholders an increase in accounts receivable that • Opportunistic share repurchase program coincided with an increase in gross sales suspended in March; expected to resume • $15.2 million in capital expenditures in Q4 • Expect 2020 full-year capital expenditures to be • Committed to maintaining dividend $50-55 million

Q3 2020 Balance Sheet $ in thousands September 30, 2020 September 30, 2019 % CHANGE Accounts Receivable, Net(1) $2,534,357 $2,225,018 13.9% Accounts Payable(2) $1,416,495 $1,191,095 18.9% Net Operating Working Capital(3) $1,117,862 $1,033,923 8.1% • Increases in accounts receivable and accounts payable driven by increases in gross sales and purchased transportation, respectively • Total debt balance $1.15 billion • $600 million senior unsecured notes maturing April 2028, 4.20% coupon ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK • $500 million private placement debt, 4.28% average coupon • $175 million maturing in August 2023, $150 million maturing in August 2028 and $175 million maturing in August 2033 • $60 million outstanding on $250 million accounts receivable securitization debt facility maturing December Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor 2020, 0.80% average interest rate (LIBOR + 65 bps) • 4.2% weighted average interest rate in the quarter (1) Accounts receivable amount includes contract assets. Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor (2) Accounts payable amount includes outstanding checks and accrued transportation expense. (3) Net operating working capital is defined as net accounts receivable less accounts payable. Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor

Truckload Price and Cost Change(1)(2)(3) 30% 25% YoY Price Change 20% YoY Cost Change 15% 10% 5% PR ICE 0% -5% -10% -15% YO Y % CHANGE IN COST AND -20% 2013 2014 2015 2016 2017 2018 2019 2020 Truckload Q3 (2)(4) • 60% / 40% truckload contractual to transactional volume mix compared to 70% / Volume 0.5% 30% in Q3 last year Pricing(1)(2)(3) 10.5% Cost(1)(2)(3) 16.5% • After six consecutive quarters with an average routing guide depth (RGD) of 1.2 in our Managed Services business, RGD averaged 1.6 for Q3 and ended Q3 at 1.8 Net Revenue Margin (1) Price and cost change represents YoY change for North America truckload shipments across all segments. (2) Growth rates are rounded to the nearest 0.5 percent. (3) Pricing and cost measures exclude fuel surcharges and costs. (4) Truckload volume growth represents YoY change for NAST truckload shipments.

Q3 2020 NAST Results by Service Line Truckload, Less Than Truckload and Intermodal Three Months Ended September 30 Net Revenues ($ in thousands) 2020 2019 % Change • Net revenue margin compression in Truckload $226,992 $299,065 (24.1) % truckload due to rising cost environment LTL $117,602 $122,959 (4.4) % • Added 4,000 new carriers in the quarter Intermodal $7,297 $6,878 6.1 % Other $16,052 $4,858 230.4 % • Increase in Other net revenue due Total Net Revenues $367,943 $433,760 (15.2) % primarily to Prime Distribution's value- Net Revenue Margin % 12.6 % 15.3 % (270 bps) added warehouse services • Prime Distribution net revenue impact to Truckload LTL Intermodal NAST(3): ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Pricing(1)(2) • LTL +4 ppts Cost(1)(2) • Other +183 ppts Volume • Total NAST +4 ppts Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Net Revenue per Transaction Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor (1) Represents price and cost YoY change for North America shipments across all segments. (2) Pricing and cost measures exclude fuel surcharges and costs. (3) Growth rates are rounded to the nearest percent. Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor

Q3 2020 NAST Operating Income Operating Income Operating Margin % (30.5%) (730 bps) $176.2M 40.6% 33.3% $122.5M Q3 2019 Q3 2020 Q3 2019 Q3 2020 • Decrease in truckload net revenues due to rising costs in a tight capacity environment • Personnel expenses reduced by 12.2% • Average headcount including furloughed employees decreased 10.0%(1) • Prime Distribution acquisition contributed 4.5 percentage points of growth to NAST headcount(1) • Average full-time equivalents decreased 13.4%(2) (1) Growth rates are rounded to the nearest 0.5 percent. (2) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Q3 2020 Global Forwarding Results by Service Line Ocean, Air and Customs Three Months Ended September 30 • Air and ocean net revenue increased due Net Revenues ($ in thousands) 2020 2019 % Change to higher pricing and market share gains Ocean $88,878 $77,777 14.3 % • Air market impacted by reduced air cargo Air $33,836 $26,195 29.2 % capacity, increased charter flights and Customs $22,463 $23,719 (5.3) % larger shipment sizes Other $12,480 $8,124 53.6 % • Customs net revenue declined due to Total Net Revenues $157,657 $135,815 16.1 % lower volume Net Revenue Margin % 19.0 % 22.7 % (370 bps) • Increase in Other net revenue driven by Ocean Air Project Logistics business ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Pricing Volume Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Net Revenue per Transaction Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor

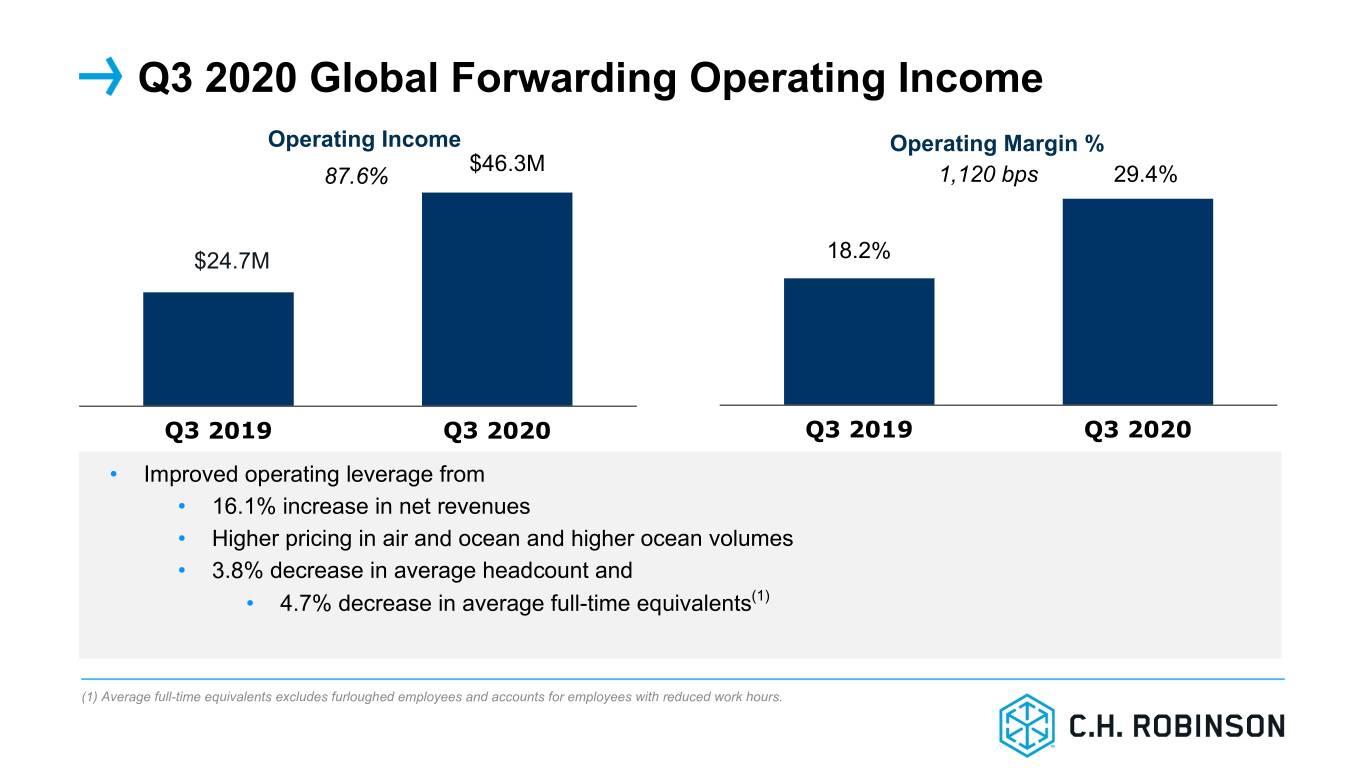

Q3 2020 Global Forwarding Operating Income Operating Income Operating Margin % $46.3M 87.6% 1,120 bps 29.4% $24.7M 18.2% Q3 2019 Q3 2020 Q3 2019 Q3 2020 • Improved operating leverage from • 16.1% increase in net revenues • Higher pricing in air and ocean and higher ocean volumes • 3.8% decrease in average headcount and • 4.7% decrease in average full-time equivalents(1) (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Q3 2020 All Other and Corporate Results Robinson Fresh, Managed Services and Other Surface Transportation Three Months Ended September 30 Net Revenues ($ in thousands) 2020 2019 % Change Robinson Fresh $24,449 $26,382 (7.3)% Managed Services $24,060 $21,574 11.5% Other Surface Transportation $15,164 $15,900 (4.6)% Total $63,673 $63,856 (0.3)% Robinson Fresh • Case volume decline of 4% driven by a decrease in foodservice volume(1) • Cost controls led to improved operating income and 440 bps improvement in operating margin ITEM MEDICAL/SURGICAL MASK NON-MEDICAL MASK Managed Services • 17% increase in volume and 530 bps improvement in operating margin • Strong growth from new customers and service scope expansion with existing customers Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Other Surface Transportation • 7% decrease in Europe truckload net revenue due to margin compression (1) Growth rates are rounded to the nearest 0.5 percent. Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor Lorem ipsum dolor

Appendix 16

Q3 2020 Transportation Results(1) Three Months Ended September 30 Nine Months Ended September 30 Transportation ($ in thousands) 2020 2019 % Change 2020 2019 % Change Total Revenues $3,944,981 $3,608,346 9.3% $10,835,710 $10,751,890 0.8% Total Net Revenues $566,330 $608,367 (6.9%) $1,694,356 $1,925,657 (12.0%) Net Revenue Margin % 14.4% 16.9% (250 bps) 15.6% 17.9% (230 bps) Transportation Net Revenue Margin % 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q1 17.2% 16.9% 16.3% 15.3% 16.8% 19.7% 17.3% 16.4% 18.6% 15.3% Q2 16.2% 14.9% 15.4% 16.0% 17.5% 19.3% 16.2% 16.2% 18.3% 17.5% Q3 16.4% 15.6% 15.0% 16.2% 18.4% 17.6% 16.4% 16.6% 16.9% 14.4% Q4 16.3% 15.8% 15.1% 15.9% 19.0% 17.2% 16.6% 17.7% 15.6% Total 16.5% 15.8% 15.4% 15.9% 17.9% 18.4% 16.6% 16.7% 17.3% (1) Includes results across all segments.

Q3 2020 NAST Results Three Months Ended September 30 Nine Months Ended September 30 $ in thousands 2020 2019 % Change 2020 2019 % Change Total Revenues $2,923,842 $2,826,308 3.5% $8,222,879 $8,495,145 (3.2%) Total Net Revenues $367,943 $433,760 (15.2%) $1,120,277 $1,406,728 (20.4%) Net Revenue Margin % 12.6% 15.3% (270 bps) 13.6% 16.6% (300 bps) Income from Operations $122,526 $176,200 (30.5%) $357,898 $592,215 (39.6%) Operating Margin % 33.3% 40.6% (730 bps) 31.9% 42.1% (1,020 bps) Depreciation and Amortization $7,095 $5,734 23.7% $19,550 $18,124 7.9% Total Assets $3,041,974 $2,649,259 14.8% $3,041,974 $2,649,259 14.8% Average Headcount 6,702 7,448 (10.0%) 6,870 7,436 (7.6%) Average Full-Time Equivalents(1) 6,351 7,332 (13.4%) N/A N/A N/A (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Q3 2020 Global Forwarding Results Three Months Ended September 30 Nine Months Ended September 30 $ in thousands 2020 2019 % Change 2020 2019 % Change Total Revenues $831,957 $597,695 39.2% $2,070,161 $1,727,745 19.8% Total Net Revenues $157,657 $135,815 16.1% $448,931 $404,987 10.9% Net Revenue Margin % 19.0% 22.7% (370 bps) 21.7% 23.4% (170 bps) Income from Operations $46,299 $24,676 87.6% $117,033 $65,497 78.7% Operating Margin % 29.4% 18.2% 1,120 bps 26.1 % 16.2 % 990 bps Depreciation and Amortization $9,385 $9,186 2.2% $27,740 $27,427 1.1% Total Assets $1,148,118 $995,137 15.4% $1,148,118 $995,137 15.4% Average Headcount 4,607 4,790 (3.8%) 4,716 4,748 (0.7%) Average Full-Time Equivalents(1) 4,430 4,647 (4.7%) N/A N/A N/A (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Q3 2020 All Other and Corporate Results Three Months Ended September 30 Nine Months Ended September 30 $ in thousands 2020 2019 % Change 2020 2019 % Change Total Revenues $469,001 $432,129 8.5% $1,364,614 $1,293,292 5.5% Total Net Revenues $63,673 $63,856 (0.3%) $202,471 $195,732 3.4% Income from Operations ($586) $209 NM ($8,465) ($4,542) NM Depreciation and Amortization $10,436 $10,560 (1.2%) $29,777 $29,571 0.7% Total Assets $884,746 $992,153 (10.8%) $884,746 $992,153 (10.8%) Average Headcount 3,595 3,544 1.4% 3,591 3,398 5.7% Average Full-Time Equivalents(1) 3,449 3,425 0.7% N/A N/A N/A (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Thank you 21