Attached files

| file | filename |

|---|---|

| EX-32.1 - BIOPLUS LIFE CORP. | ex32-1.htm |

| EX-31.1 - BIOPLUS LIFE CORP. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X]

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For The Quarterly Period Ended March 31, 2020

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 333-226885

BIOPLUS LIFE CORPORATION

(Exact name of registrant issuer as specified in its charter)

| Nevada | 30-0987011 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

No 9 & 10, Jalan P4/8B, Bandar Teknologi Kajang,

Semenyih, Selangor D.E., Malaysia 43500

(Address of principal executive offices)(zip code)

Issuer’s telephone number: +60 3 8703 2020

(Registrant’s telephone number, including area codes)

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [ ] NO [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding twelve months (or shorter period that the registrant was required to submit and post such files).

YES [ ] NO [X]

| Large accelerated filer [ ] | Accelerated filer [ ] | |||

| Non-accelerated filer [X] | Smaller reporting company [X] | |||

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes [ ] No [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at October 12, 2020 | |

| Common Stock, $.0001 par value | 362,905,561 |

TABLE OF CONTENTS

| 2 |

BIOPLUS LIFE CORP.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| F-1 |

BIOPLUS LIFE CORP.

(Amount expressed in United States Dollars (“US$”), except for number of shares)

| As of | ||||||||||||

| Note | March 31, 2020 | December 31, 2019 | ||||||||||

| (Unaudited) | ||||||||||||

| ASSETS | ||||||||||||

| Current assets: | ||||||||||||

| Cash and bank balances | $ | 175,307 | $ | 210,740 | ||||||||

| Account receivables | 356,924 | 308,688 | ||||||||||

| Income tax receivables | 56,865 | 7,675 | ||||||||||

| Amount due from related parties | 3 | 28,895 | 19,771 | |||||||||

| Amount due from directors | 4 | 5,820 | 5,821 | |||||||||

| Amount due from shareholder | 5 | 360 | - | |||||||||

| Inventories | 6 | 218,533 | 303,954 | |||||||||

| Other receivables, deposits and prepayments | 7 | 97,928 | 133,060 | |||||||||

| Total current assets | 940,632 | 989,709 | ||||||||||

| Non-current assets: | ||||||||||||

| Property, plant and equipment, net | 8 | 2,086,957 | 2,217,247 | |||||||||

| Intangible assets | 9 | 1,627 | - | |||||||||

| Total non-current assets | 2,088,584 | 2,217,247 | ||||||||||

| TOTAL ASSETS | $ | 3,029,216 | $ | 3,206,956 | ||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||

| Current liabilities: | ||||||||||||

| Account payables | $ | 57,371 | $ | 48,298 | ||||||||

| Obligation under finance lease | 10 | 31,319 | 33,343 | |||||||||

| Bank borrowings | 11 | 211,550 | 195,027 | |||||||||

| Other payables and accrued liabilities | 12 | 401,293 | 494,045 | |||||||||

| Provision for taxation | 3,604 | 3,604 | ||||||||||

| Amount due to directors | 4 | 9,489 | 8,489 | |||||||||

| Total current liabilities | 714,626 | 782,806 | ||||||||||

| Non-current liabilities: | ||||||||||||

| Obligation under finance lease | 10 | 79,223 | 92,133 | |||||||||

| Bank borrowings | 11 | 537,067 | 553,144 | |||||||||

| Deferred taxation | 13 | 40,550 | 42,631 | |||||||||

| Total non-current liabilities | 656,840 | 687,908 | ||||||||||

| TOTAL LIABILITIES | $ | 1,371,466 | $ | 1,470,714 | ||||||||

| Stockholders’ equity: | ||||||||||||

| Common stock, par value $0.0001: 359,305,561 and 359,305,561 shares issued and outstanding as of March 31, 2020 and December 31 2019, respectively. | 14 | $ | 36,291 | $ | 35,931 | |||||||

| Additional paid up share capital | 14 | 1,998,870 | 1,998,870 | |||||||||

| Share subscription money | - | - | ||||||||||

| Accumulated loss | (208,332 | ) | (216,550 | ) | ||||||||

| Other comprehensive loss | (169,079 | ) | (82,009 | ) | ||||||||

| Total stockholders’ equity | 1,657,750 | 1,736,242 | ||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS EQUITY | $ | 3,029,216 | $ | 3,206,956 | ||||||||

The accompanying notes are an integral part of these financial statements.

| F-2 |

BIOPLUS LIFE CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME/ (LOSS)

(Amount expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| Three months ended March 31, | ||||||||||||

| Note | 2020 | 2019 | ||||||||||

| Revenues, net | $ | 653,978 | $ | 357,935 | ||||||||

| Cost of revenues | (361,617 | ) | (201,939 | ) | ||||||||

| Gross profit | 292,361 | 155,996 | ||||||||||

| Other income | 15 | 231 | 1,634 | |||||||||

| Operating expenses: | ||||||||||||

| General and operating expenses | (274,985 | ) | (201,413 | ) | ||||||||

| Finance cost | (9,388 | ) | (8,618 | ) | ||||||||

| Total expenses | (284,373 | ) | (210,031 | ) | ||||||||

| Profit/ (Loss) from operations | 8,219 | (52,401 | ) | |||||||||

| Income tax expense | 13 | - | 27,991 | |||||||||

| NET PROFIT/(LOSS) | 8,219 | (24,410 | ) | |||||||||

| Other comprehensive expense: | ||||||||||||

| - Foreign currency translation (loss)/gain | (87,070 | ) | 25,135 | |||||||||

| COMPREHENSIVE (LOSS) / INCOME | $ | (78,851 | ) | $ | 725 | |||||||

| Earnings per share | $ | - | $ | - | ||||||||

| Weighted average number of common shares outstanding -Basic and diluted | 361,718,748 | 359,305,561 | ||||||||||

The accompanying notes are an integral part of these financial statements.

| F-3 |

BIOPLUS LIFE CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amount expressed in United States Dollars (“US$))

(Unaudited)

| Three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Cash flows from operating activities: | ||||||||

| Net profit/ (loss) | $ | 8,219 | $ | (24,410 | ) | |||

| Income tax expenses | - | - | ||||||

| Profit/(Loss) from operations | 8,219 | (24,410 | ) | |||||

| Adjustments to reconcile net profit/(loss) to net cash used in operating activities: | ||||||||

| Depreciation of property, plant and equipment | 29,887 | 25,902 | ||||||

| Interest expenses | 9,388 | 8,618 | ||||||

| Operating profit before working capital changes | 47,494 | 10,110 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Inventories | 72,621 | 60,994 | ||||||

| Account receivables | (65,128 | ) | 87,382 | |||||

| Other receivables, deposits and prepayments | 29,627 | (6,482 | ) | |||||

| Amount due from related parties | (10,379 | ) | 1,544 | |||||

| Amount due from directors | 1,433 | 192 | ||||||

| Amount due from shareholder | (360 | ) | - | |||||

| Account payable | 11,760 | (99,751 | ) | |||||

| Other payables and accrued liabilities | (76,513 | ) | (129,542 | ) | ||||

| Cash generated from/ (used in) operating activities | 10,555 | (75,553 | ) | |||||

| Tax paid | (50,995 | ) | (35,146 | ) | ||||

| Net cash used in operating activities | (40,440 | ) | (110,699 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Purchase of intangible assets | (1,673 | ) | - | |||||

| Purchase of property, plant and equipment | (7,182 | ) | (7,359 | ) | ||||

| Net cash used in investing activities | (8,855 | ) | (7,359 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceed from issued shares | 360 | - | ||||||

| Interest expenses | (9,389 | ) | (8,618 | ) | ||||

| Repayment of term loan borrowing | (7,193 | ) | (7,122 | ) | ||||

| Repayment of hire purchase borrowing | (9,062 | ) | (4,423 | ) | ||||

| Net cash used in financing activities | (25,284 | ) | (20,163 | ) | ||||

| Foreign currency translation adjustment | 2,099 | 3,233 | ||||||

| NET CHANGE IN CASH AND CASH EQUIVALENTS | (72,480 | ) | (134,988 | ) | ||||

| CASH AND CASH EQUIVALENTS, BEGINNING OF FINANCIAL PERIOD | 69,220 | 255,554 | ||||||

| CASH AND CASH EQUIVALENTS, END OF FINANCIAL PERIOD | $ | (3,260 | ) | $ | 120,566 | |||

| CASH AND CASH EQUIVALENTS INFORMATION | ||||||||

| Cash and bank balance | $ | 175,307 | $ | 227,619 | ||||

| Bank overdraft | (178,567 | ) | (107,053 | ) | ||||

| Cash and cash equivalents, end of financial period | $ | (3,260 | ) | $ | 120,566 | |||

The accompanying notes are an integral part of these financial statements.

| F-4 |

BIOPLUS LIFE CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENT

MARCH 31, 2020

NOTE 1- ORGANIZATION AND BUSINESS BACKGROUND

Bioplus Life Corp., a Nevada corporation (“Company”), was incorporated under the laws of the State of Nevada on April 13, 2017. For purposes of financial statements presentation, Bioplus Life Corp. and its subsidiaries are herein referred to as “the Company” or “We”.

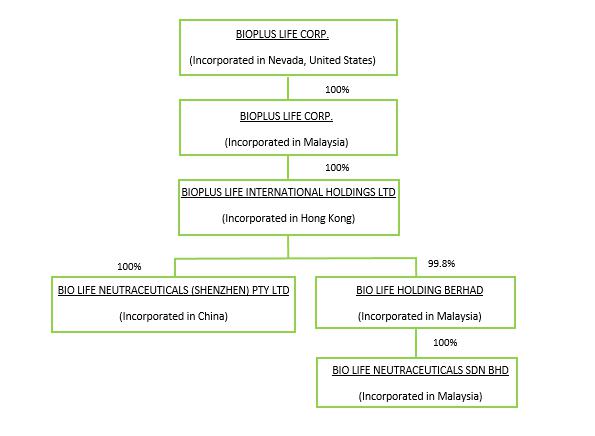

On July 10, 2017, the Company acquired 100% of the equity interests of Bioplus Life Corp., a Malaysian company. On July 19, 2017, the Company, through its Malaysian subsidiary, Bioplus Life Corp., acquired 100% of the equity interests of Bioplus Life International Holdings Ltd, a Hong Kong company. On October 27, 2017, the Company through its Hong Kong subsidiary, Bioplus Life International Holdings Ltd, acquired 100% equity interest of Bioplus Life Corp. (ShenZhen), a company incorporated in China.

On June 11, 2018, the Company through its subsidiary in Hong Kong, Bioplus Life International Holdings Ltd, acquired 99.8% equity interest of Bio Life Holdings Berhad, a company incorporated in Malaysia. Bio Life Holdings Berhad owns 100% of the equity interests of Bio Life Neutraceuticals Sdn. Bhd., a company incorporated in Malaysia.

The Company, through its subsidiaries supplies high quality health products. Details of the Company’s subsidiaries are below:

| No | Company Name | Place/Date of Incorporation | Particulars

of Issued Capital |

Principal Activities | ||||

| 1 | Bioplus Life Corp. (Labuan) | Malaysia, Labuan May 19, 2017 |

100

shares of ordinary shares of US$1 each |

Investment Holding | ||||

| 2 | Bioplus Life International Holdings Ltd. | Hong Kong June 20, 2017 |

1

shares of ordinary shares of HK$1 each |

Investment Holding | ||||

| 3 | Bio Life Holdings Berhad | Malaysia May 19, 2016 |

107,992 shares of ordinary shares of RM1 each | Investment Holding | ||||

| 4 | Bio Life Neutraceuticals Sdn Bhd | Malaysia, Selangor August 27, 2009 |

5,456,207 shares of ordinary shares of RM1 each | Trading of Consumer Products |

Going Concern

The Company’s consolidated financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders and affiliates, the ability of the Company to obtain necessary financing to continue operations, and the attainment of profitable operations. The Company recorded a total comprehensive loss of $78,851 for the period ended March 31, 2020 and recorded an accumulated deficit of $208,332 as of March 31, 2020.

Chong Khooi You, President/CEO, a major shareholder of the Company, has provided a written undertaking to provide financials support for year 2020 if any shortfall in cash flow. In this respect, Company has the ability to continue as a going concern, if the Company is unable to obtain adequate capital. The accompanying financial statements do not include any adjustments to reflect the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

| F-5 |

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| ● | Basis of presentation |

These accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

| ● | Use of estimates |

In preparing these financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets and revenues and expenses during the periods reported. Actual results may differ from these estimates.

| ● | Cash and cash equivalents |

Cash and cash equivalents represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| ● | Property, plant and equipment |

Property and plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis to write off the cost over the following expected useful lives of the assets concerned. The principal annual rates used are as follows:

| Categories | Principal Annual Rates/Expected Useful Life | |||

| Computer hardware | 20 | % | ||

| Furniture & fittings | 10 | % | ||

| Handphone | 20 | % | ||

| Landscape | 20 | % | ||

| Leasehold land and building | 99 | years | ||

| Machinery | 10 | % | ||

| Motor vehicle | 20 | % | ||

| Office equipment | 10 | % | ||

| Renovation | 20 | % | ||

| Signboard | 10 | % | ||

| Tools and equipment | 10 | % | ||

Fully depreciated plant and equipment are retained in the financial statements until they are no longer in use.

| ● | Intangible assets |

Intangible assets are stated at cost less accumulated amortization. Intangible assets represented the application development costs, which are amortized on a straight-line basis over a useful life of five years.

The Company follows ASC Topic 350 in accounting for intangible assets, which requires impairment losses to be recorded when indicators of impairment are present and the undiscounted cash flows estimated to be generated by the assets are less than the assets’ carrying amounts. There was no impairment losses recorded on intangible assets for the year ended March 31, 2020.

| ● | Inventories |

Inventories consisting of products available for sell, are stated at the lower of cost or market value. Cost of inventory is determined using the first-in, first-out (FIFO) method. Inventory reserve is recorded to write down the cost of inventory to the estimated market value due to slow-moving merchandise and damaged goods, which is dependent upon factors such as historical and forecasted consumer demand, and promotional environment. The Company takes ownership, risks and rewards of the products purchased. Write downs are recorded in cost of revenues in the Consolidated Statements of Operations and Comprehensive Income.

| F-6 |

| ● | Revenue recognition |

Revenues are recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those goods or services. The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

| ● | identify the contract with a customer; | |

| ● | identify the performance obligations in the contract; | |

| ● | determine the transaction price; | |

| ● | allocate the transaction price to performance obligations in the contract; and | |

| ● | recognize revenue as the performance obligation is satisfied. |

| ● | Cost of revenues |

Cost of revenue includes the purchase cost of retail goods for re-sale to customers and packing materials (such as boxes). It excludes purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs and other costs of distribution network in cost of revenues.

| ● | Shipping and handling fees |

Shipping and handling fees, if billed to customers, are included in revenue. Shipping and handling fees associated with inbound and outbound freight are expensed as incurred and included in selling and distribution expenses.

| ● | Comprehensive income |

ASC Topic 220, “Comprehensive Income” establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying statements of stockholders’ equity consists of changes in unrealized gains and losses on foreign currency translation and cumulative net change in the fair value of available-for-sale investments held at the balance sheet date. This comprehensive income is not included in the computation of income tax expense or benefit.

| ● | Income tax expense |

Income taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclosed in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

The Company conducts major businesses in Malaysia and is subject to tax in their own jurisdictions. As a result of its business activities, the Company will file separate tax returns that are subject to examination by the foreign tax authorities.

| F-7 |

| ● | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statement of operations.

The functional currency of the Company is the United States Dollars (“US$”) and the accompanying financial statements have been expressed in US$. In addition, the Company maintains its books and record in a local currency, Malaysian Ringgit (“MYR” or “RM”), which is functional currency as being the primary currency of the economic environment in which the entity operates.

In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income.

Translation of amounts from the local currency of the Company into US$1 has been made at the following exchange rates for the respective years: <<see comment below>>

| As of and for the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Period-end MYR : US$1 exchange rate | 4.3025 | 4.0810 | ||||||

| Period average MYR : US$1 exchange rate | 4.1819 | 4.0909 | ||||||

| Period-end US$1 : RMB exchange rate | 0.1412 | 0.1490 | ||||||

| Period average US$1 : RMB exchange rate | 0.1433 | 0.1482 | ||||||

| ● | Related parties |

Parties, which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also considered to be related if they are subject to common control or common significant influence.

| ● | Fair value of financial instruments |

The carrying value of the Company’s financial instruments: cash and cash equivalents, trade receivable, deposits and other receivables, amount due to related parties and other payables approximate at their fair values because of the short-term nature of these financial instruments.

The Company also follows the guidance of the ASC Topic 820-10, “Fair Value Measurements and Disclosures” (“ASC 820-10”), with respect to financial assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value hierarchy that prioritizes the inputs used in measuring fair value as follows:

| ● | Level 1 : Observable inputs such as quoted prices in active markets; |

| ● | Level 2 : Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and |

| ● | Level 3 : Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions |

As of March 31, 2020, and December 31, 2019, the Company did not have any nonfinancial assets and liabilities that are recognized or disclosed at fair value in the financial statements, at least annually, on a recurring basis, nor did the Company have any assets or liabilities measured at fair value on a non-recurring basis.

| F-8 |

| ● | Recent accounting pronouncements |

Management has considered all recent accounting pronouncements issued since the last audit of our financial statements. The Company’s management believes that these recent pronouncements will not have a material effect on the Company’s financial statements.

| 3. | AMOUNT DUE FROM RELATED PARTIES |

The amounts are unsecured, bear no interest and are payable on demand.

| 4. | AMOUNT DUE FROM/(TO) DIRECTORS |

The amounts are unsecured, bear no interest and are payable on demand.

| 5. | AMOUNT DUE FROM SHAREHOLDER |

The amounts are unsecured, bear no interest and are payable on demand.

| 6. | INVENTORIES |

| March 31, 2020 | December 31, 2019 | |||||||

| Finished goods, at cost | $ | 218,533 | $ | 303,954 | ||||

| Total inventories | $ | 218,533 | $ | 303,954 | ||||

| 7. | OTHER RECEIVABLES, DEPOSITS AND PREPAYMENTS |

| March 31, 2020 | December 31, 2019 | |||||||||||

| Other receivables | $ | 18,327 | $ | 9,981 | ||||||||

| Deposits | 7.1 | 31,760 | 63,308 | |||||||||

| Prepayments | 7.2 | 47,841 | 59,771 | |||||||||

| $ | 97,928 | $ | 133,060 | |||||||||

7.1 Included in deposits is an amount of $ 31,760 (2019: $ 63,308) representing deposits paid for rental of hostels and various utilities.

7.2 Included in prepayments is an amount of $ 47,841 (2019: $ 59,771) representing advanced payments made to suppliers for purchase of manufacturing materials.

| 8. | PROPERTY, PLANT AND EQUIPMENT, NET |

Property, plant and equipment consisted of the following:

| March 31, 2020 | December 31, 2019 | |||||||

| Computer hardware | $ | 32,780 | $ | 32,814 | ||||

| Furniture & fittings | 101,986 | 106,945 | ||||||

| Handphone | 3,343 | 3,514 | ||||||

| Landscape | 3,306 | 3,475 | ||||||

| Leasehold land and building | 1,784,569 | 1,872,476 | ||||||

| Machinery | 113,584 | 119,413 | ||||||

| Motor vehicle | 231,739 | 243,630 | ||||||

| Office equipment | 50,302 | 52,725 | ||||||

| Renovation | 88,888 | 92,646 | ||||||

| Signboard | 4,421 | 4,648 | ||||||

| Tools and equipment | 4,886 | 4,348 | ||||||

| $ | 2,419,804 | $ | 2,536,634 | |||||

| (Less): Accumulated depreciation | (316,420 | ) | (315,762 | ) | ||||

| Add/(Less): Foreign translation difference | (16,427 | ) | (3,625 | ) | ||||

| Property, plant and equipment, net | $ | 2,086,957 | $ | 2,217,247 | ||||

| F-9 |

Depreciation expense for the period ended March 31, 2020 and March 31, 2019 were $29,887 and $107,216, respectively.

As of March 31, 2020, and December 31, 2019 the Company acquired motor vehicles under finance leases with carrying value of $112,735 and $129,925 respectively.

The leasehold land and building with carrying amount of $1,708,285 and $1,797,002 as of March 31, 2020 and December 31, 2019, respectively have been charged to licensed bank to secure banking facilities granted to the Company.

| 9. | INTANGIBLE ASSETS, NET |

Intangible assets consisted of the following:

| March 31, 2020 | December 31, 2019 | |||||||

| Application development costs | $ | 1,627 | $ | - | ||||

| 10. | OBLIGATION UNDER FINANCE LEASE |

The Company purchased motor vehicles under finance lease agreements with the effective interest rate of 2.48% - 4.31% per annum (2019: 5.22% per annum), with principal and interest payable monthly. The obligation under the finance leases are as follows:

| March 31, 2020 | December 31, 2019 | |||||||

| Present value of hire purchase liabilities: | $ | $ | ||||||

| Not later than one year | 31,319 | 33,343 | ||||||

| Later than one year but not later than two years | 31,319 | 32,496 | ||||||

| Later than two years but not later than five years | 47,904 | 59,637 | ||||||

| 110,542 | 125,476 | |||||||

| Analyzed as: | $ | $ | ||||||

| Current portion | 31,319 | 33,343 | ||||||

| Non-current portion | 79,223 | 92,133 | ||||||

| 110,542 | 125,476 | |||||||

| 11. | BANK BORROWINGS |

| March 31, 2020 | December 31, 2019 | |||||||

| Secured: - | $ | $ | ||||||

| Bank overdraft | 178,567 | 141,520 | ||||||

| Term loan | 570,050 | 606,651 | ||||||

| 748,617 | 748,171 | |||||||

| Analyzed as: | $ | $ | ||||||

| Current portion | 211,550 | 195,027 | ||||||

| Non-current portion | 537,067 | 553,144 | ||||||

| $ | 748,617 | $ | 748,171 | |||||

| F-10 |

The bank overdraft of the Company is secured by way of the following:

| a. | A Facilities Agreement for US$377,277; | |

| b. | Master Facility Agreement. | |

| c. | Joint and Several Guarantee to be executed by the subsidiary directors of Bio Life Neutraceuticals Sdn Bhd. |

Interested charged on the bank overdraft is 4% (2019: 4%) above the bank base lending rate per annum.

The term loan of the Company is secured by way of the following:

| a. | A Facilities Agreement for US$1,705,086; | |

| b. | Master Facility Agreement. | |

| c. | Joint and Several Guarantee to be executed by the subsidiary directors of Bio Life Neutraceuticals Sdn Bhd. |

The term loan is payable by 240 monthly installments of US$4,492 each including interest, commencing from Oct 10, 2016 and subject to interest at 4% per annum flat.

| 12. | OTHER PAYABLES AND ACCRUED LIABILITIES |

| March 31, 2020 | December 31, 2019 | |||||||

| Other payables generated from: | $ | $ | ||||||

| Local | 15,638 | 41,645 | ||||||

| Foreign, representing: | ||||||||

| Malaysia | - | - | ||||||

| Common outstanding from non-trade payable | 20,628 | 37,110 | ||||||

| Common outstanding from third parties | 647 | 1,004 | ||||||

| China | ||||||||

| Common outstanding from third parties | 424 | 861 | ||||||

| $ | 37,337 | $ | 81,620 | |||||

| Accrued other expenses | ||||||||

| Local | - | - | ||||||

| Foreign, representing: | ||||||||

| Malaysia | - | - | ||||||

| Balance bring forward | ||||||||

| Payroll | 204 | 18,550 | ||||||

| Payroll deduction | 8,098 | 7,873 | ||||||

| Professional Fee | 2,530 | 11,499 | ||||||

| Commission | 49,772 | 43,563 | ||||||

| Expenses | 50,713 | 1,157 | ||||||

| $ | 111,317 | $ | 82,642 | |||||

| Hong Kong | ||||||||

| Deposit received from customers | 142,639 | 226,783 | ||||||

| Share subscription receipts in advance | 110,000 | 104,000 | ||||||

| 401,293 | 495,045 | |||||||

| F-11 |

| 13. | INCOME TAXES |

| March 31, 2020 | March 31, 2019 | |||||||

| Tax jurisdictions from: | ||||||||

| Local | $ | (14,430 | ) | $ | (16,091 | ) | ||

| Foreign, representing: | ||||||||

| Malaysia | 23,254 | (35,263 | ) | |||||

| Hong Kong | (130 | ) | (528 | ) | ||||

| China | (475 | ) | (519 | ) | ||||

| Profit/(Loss) before income tax | $ | 8,219 | $ | (52,401 | ) | |||

The provision for income taxes consisted of the following:

| March 31, 2020 | March 31, 2019 | |||||||

| Tax expense - Current | ||||||||

| Local | $ | - | $ | - | ||||

| Foreign, representing: | ||||||||

| Malaysia | - | (47,947 | ) | |||||

| Hong Kong | - | - | ||||||

| Tax expense – Prior year | ||||||||

| Foreign, representing: | ||||||||

| Malaysia | - | - | ||||||

| Deferred | ||||||||

| Local | - | - | ||||||

| Foreign, representing: | ||||||||

| Malaysia | - | 19,956 | ||||||

| Hong Kong | - | - | ||||||

| $ | - | $ | (27,991 | ) | ||||

The effective tax rate in the periods presented is the result of the mix of income earned in various tax jurisdictions that apply a broad range of income tax rates. The Company has subsidiaries that operate in various countries: United States, Hong Kong and Malaysia that are subject to taxes in the jurisdictions in which they operate, as follows:

United States of America

The Company is registered in the state of Nevada and is subject to the tax laws of the United States of America. As of March 31, 2020, the operations in the United States of America incurred $14,430 of cumulative net operating losses which can be carried forward to offset future taxable income. The net operating loss carry forwards begin to expire in 2039, if unutilized. The Company has provided for a full valuation allowance of $3,030 against the deferred tax assets on the expected future tax benefits from the net operating loss carry forwards as the management believes it is more likely than not that these assets will not be realized in the future

| F-12 |

Malaysia

Bio Life Holdings Berhad (“BLHB”) and Bio Life Neutraceuticals Sdn Bhd (“BLNSB”) are subject to the Malaysia Corporate Tax Laws at a tax rate of 24% on the assessable income for its tax year.

Hong Kong

Bioplus Life International Holdings Ltd is subject to Hong Kong Profits Tax, which is charged at the statutory income tax rate of 16.5% on its assessable income.

China

The Company is registered in Shenzhen, PRC and is subject to the China Corporate Tax, which is charged at the statutory income tax rate of 25% on its assessable income.

The following table sets forth the significant components of the aggregate deferred tax liabilities of the Company as of March 31, 2020:

| March 31, 2020 | March 31, 2019 | |||||||

| Deferred tax liabilities: | ||||||||

| Net operating loss carry forwards | ||||||||

| Local | $ | 3,030 | $ | 24,060 | ||||

| Foreign | ||||||||

| - Malaysia | (40,550 | ) | (42,631 | ) | ||||

| - Hong Kong | - | - | ||||||

| $ | (37,520 | ) | $ | (18,571 | ) | |||

| Less: valuation allowance | (3,030 | ) | (24,060 | ) | ||||

| Deferred tax liabilities | $ | (40,550 | ) | $ | (42,631 | ) | ||

| 14. | STOCKHOLDERS’ EQUITY |

During the year, the Company has issued the following common stock:

| March 31, 2020 | December 31, 2019 | |||||||

| Issued and fully paid: | $ | $ | ||||||

| At the beginning of the period | 2,034,801 | 2,034,801 | ||||||

| Issued during the period | 360 | - | ||||||

| At the end of the period | $ | 2,035,161 | $ | 2,034,801 | ||||

As of March 31, 2020, the Company has issued and outstanding common shares of 362,905,561.

| 15. | OTHER INCOME |

| March 31, 2020 | March 31, 2019 | |||||||

| Interest income | $ | - | $ | 1 | ||||

| Other income | 192 | 56 | ||||||

| Unrealized gain on foreign exchange | 39 | 1,577 | ||||||

| Gain on disposal of motor vehicles | - | - | ||||||

| 231 | 1,634 | |||||||

| F-13 |

| 16. | RELATED PARTIES TRANSACTIONS

Transactions with companies in which our controlling shareholder has a substantial financial interest: |

| March 31, 2020 | March 31, 2019 | |||||||

| Sales to: | $ | $ | ||||||

| GO3U Trading Sdn. Bhd. | 23,433 | - | ||||||

| Bio Life Solution Sdn. Bhd. | - | 33,353 | ||||||

| D and L Wellness Sdn. Bhd. | - | - | ||||||

| Purchases from Bio Life Solution Sdn Bhd. | ||||||||

| Purchases | 94,436 | 107,448 | ||||||

| Packaging charges | - | - | ||||||

| Lab tests | 277 | - | ||||||

| Choong Khooi You, our sole officer and director and controlling shareholder, is a director or controlling equity owner of each of the above companies. |

The related party transactions are generally transacted in an arm-length basis at the current market value in the normal course of business.

| 17. | FOREIGN CURRENCY EXCHANGE RATE |

The Company cannot guarantee that the current exchange rate will remain stable, therefore there is a possibility that the Company could post the same amount of income for two comparable periods and because of the fluctuating exchange rate post higher or lower income depending on exchange rate converted into US$ at the end of the financial period. The exchange rate could fluctuate depending on changes in political and economic environments without notice.

| 18. | SUBSEQUENT EVENT |

In accordance with ASC Topic 855, “Subsequent Events”, which establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued, the Company has evaluated all events or transactions that occurred after March 31, 2020 up through the date June 16, 2020 was the Company presented these audited consolidated financial statements..

| F-14 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The information contained in this quarterly report on Form 10-Q is intended to update the information contained in our Form 10-K dated March 27, 2020, for the year ended December 31, 2019 and presumes that readers have access to, and will have read, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other information contained in such Form 10-K. The following discussion and analysis also should be read together with our consolidated financial statements and the notes to the consolidated financial statements included elsewhere in this Form 10-Q.

The following discussion contains certain statements that may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements appear in a number of places in this Report, including, without limitation, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements are not guaranteeing of future performance and involve risks, uncertainties and requirements that are difficult to predict or are beyond our control. Forward-looking statements speak only as of the date of this quarterly report. You should not put undue reliance on any forward-looking statements. We strongly encourage investors to carefully read the factors described in our Form 10-K dated March 27, 2020 in the section entitled “Risk Factors” for a description of certain risks that could, among other things, cause actual results to differ from these forward-looking statements. We assume no responsibility to update the forward-looking statements contained in this transition report on Form 10-Q. The following should also be read in conjunction with the unaudited Condensed Consolidated Financial Statements and notes thereto that appear elsewhere in this report.

Company Overview

Bioplus Life Corp., a Nevada corporation (“Company”), was incorporated under the laws of the State of Nevada on April 13, 2017. For purposes of financial statements presentation, Bioplus Life Corp. and its subsidiaries are herein referred to as “the Company” or “We”.

On July 10, 2017, the Company acquired 100% of the equity interests of Bioplus Life Corp., a Malaysian company. On July 19, 2017, the Company, through its Malaysian subsidiary, Bioplus Life Corp., acquired 100% of the equity interests of Bioplus Life International Holdings Ltd, a Hong Kong company. On October 27, 2017, the Company through its Hong Kong subsidiary, Bioplus Life International Holdings Ltd, acquired 100% equity interest of Bioplus Life Corp. (ShenZhen), a company incorporated in China.

On June 11, 2018, the Company through its subsidiary in Hong Kong, Bioplus Life International Holdings Ltd, acquired 99.8% equity interest of Bio Life Holdings Berhad, a company incorporated in Malaysia. Bio Life Holdings Berhad owns 100% of the equity interests of Bio Life Neutraceuticals Sdn. Bhd., a company incorporated in Malaysia, which is the sole operating subsidiary.

Our corporate structure is depicted below:

| 3 |

Bioplus Life Corp., through its wholly owned subsidiaries, is a company specialized in providing health and beauty care products to our customers. The Company mission is to create awareness for good health and personal care to improve our customers’ quality of life. We seek to achieve this by offering an affordable solution to existing health food businesses through the production, information, advisory and services pertaining to our product line. Our website, http://www.biolife2u.com/, can be utilized to inquire about our product offerings, but we sell products through our website and primarily sell our products to wholesalers and exporters

The product series, or line, of our company includes, but is not strictly limited to, products that fall into the following categories: bone, fiber, bee-propolis, cardiovascular health, herbal, health beverages, apple stem cell, beauty care, feminine health, UT care, anti-oxidant and eye health series. These health and beauty supplies are designed to help improve the consumers’ metabolism rate, burn excessive fats, provide anti-aging effects and improve the overall health and physical appearance of our customers. At our current, and reasonable future operating level, our supplier has indicated that they will have ample supply to fulfil our orders for raw materials while also fulfilling any and all orders they may receive from other customers.

Our financial statements are prepared in US Dollars and in accordance with accounting principles generally accepted in the United States. See information immediately below for information concerning the exchange rates at the Malaysian Ringett (MYR) and Chinese Renminbi (RMB) translated into US Dollars (“USD”) at various pertinent dates and for pertinent periods.

Translation of amounts from the local currency of the Company into US$1 has been made at the following exchange rates for the respective years:

| As of and for the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Period-end MYR : US$1 exchange rate | 4.3025 | 4.0810 | ||||||

| Period average MYR : US$1 exchange rate | 4.1819 | 4.0909 | ||||||

| Period-end US$1 : RMB exchange rate | 0.1412 | 0.1490 | ||||||

| Period average US$1 : RMB exchange rate | 0.1433 | 0.1482 | ||||||

Results of Operation

For the three months ended March 31, 2020 and 2019

Revenues. For three months ended March 31, 2020, the Company realised revenues of $653,978 as compared to $357,935 for the three month period ended March 31, 2019. The increase is revenues of approximately 82.7% is due to the fulfilment of pre-existing orders from prior quarters.

Cost of Revenues. For the three months ended March 31, 2020, we had costs of revenues of $362,617 compared with cost of revenues of $201,939 for the same period last year. The increase of 79% corresponds to the increase in product sales for the current quarter. Cost of revenue includes raw materials, packaging materials and lab tests.

Gross Profit. For the three months ended March 31, 2020, we had a gross profit of $292,361 compared with gross profit of $155,996 for the same period last year. The 87.4% increase in gross profit is due to the reasons discussed above.

Other Income. For the quarterly period ended March 31, 2020, we had other income of $231, as compared $1,634 for the quarterly period ended March 31, 2019, a substantial reduction from the prior quarterly period due to fluctuation of foreign exchange rate between these 2 quarters

Operating Expenses. For the quarterly period ended March 31, 2020, we had operating expenses of $274,985, as compared to operating expenses of $201,413 for the quarterly period ended March 31, 2019, an increase of approximately 36.5% due to higher revenues during this period. <<not clear on why operating expenses are higher. Did you have a higher headcount? Please explain>>Operating expenses consists of general and administrative expenses which includes depreciation of fixed assets, employee compensation and benefits, professional fees and marketing and travel expenses.

| 4 |

Income Tax Expense. For the quarterly period ended March 31, 2020, we had no income tax expense compared with income tax credit of $27,991 for the quarterly period ended March 31, 2019. During the current quarter, we had losses carry forward resulting in no income taxes paid for the quarter.

Net Profit. For the three months ended March 31, 2020, we had a net profit of $8,291 compared with a net loss of $24,410 for the same period last year for the reasons discussed above.

Foreign currency translation gain/loss. For the three months ended March 31, 2020, we had foreign currency translation loss of $(78,851) compared with foreign currency translation gain of $725 for the same three month period last year. Foreign currency translation gain/loss represents the movement of the US Dollar against the Malaysian Ringgit.

Liquidity and Capital Resources

As of March 31, 2020 and 2019, we had cash and bank balances of $175,307 and $227,619 respectively.

The slight decrease in working capital as of March 31, 2020 from March 31, 2019 is due principally to the reduction in cash used in our operations.

Our primary uses of cash have been for operations. The main sources of cash have been from operational revenues and the private placement of our common stock. The following trends are reasonably likely to result in a material increase in our liquidity over the near to long term:

| ● | Addition of administrative and marketing personnel as the business grows, | |

| ● | Increases in advertising and marketing in order to attempt to generate more revenues, and | |

| ● | The cost of being a public company. |

Our financial statements reflect the fact that we have sufficient revenue to cover our operating expenses for the next 12 months, although at present time, we are under-capitalized. The Company intends to continue with capital investment or other financing to fund its marketing and promotional campaigns and the expansion of production capacity for 2020 and beyond to achieve a 20% to 30% increase in revenues in Malaysia, China, India and African markets. If continued funding and capital resources are unavailable at reasonable terms, the Company may not be able to implement its expansion plan.

Summary of Cash Flows

The following is a summary of the Company’s cash flows generated from (used in) operating, investing, and financing activities for the three months ended March 31, 2020 and 2019:

| Three months ended March 31 | ||||||||

| 2020 | 2019 | |||||||

| Net cash used in operating activities | (40,440 | ) | (110,669 | ) | ||||

| Net cash used in investing activities | (8,855 | ) | (7,359 | ) | ||||

| Net cash used in financing activities | (25,284 | ) | (20,163 | ) | ||||

| Foreign currency translation adjustment | 2,099 | 3,233 | ||||||

| NET CHANGE IN CASH AND CASH EQUIVALENTS | (74,579 | ) | (134,988 | ) | ||||

Operating Activities

During the three months ended March 31, 2020, the Company had a net profit $8,219 which, after adjusting for depreciation and interest expense, and changes in operating assets and liabilities, resulted in net cash of $40,440 being used in operating activities during the period. By comparison, during the three months ended March 31, 2019, the Company incurred a net loss of $24,410 which, after adjusting for depreciation and interest expense, and changes in operating assets and liabilities, resulted in net cash of $110,699 in operating activities during the period.

| 5 |

Investing Activities

During the three months ended March 31, 2020, cash flow from investing activities consisted of purchase of the property, plant and equipment of $8,855 compared with similar purchases of $7,359 for the prior year end period.

Financing Activities

For the three months ended March 31, 2020, the cash provided by financing activities primarily consisted of the proceeds from stock issuances of $360, offset by $9,388 in interest expense, $7,193 in repayment of loans and $9,062 in repayment of hire purchase borrowing. For the three months ended March 31, 2019, the cash used in financing activities primarily consisted of $8,618 in interest expense, $7,122 in repayment of loans and $4,423 in repayment of hire purchase borrowing.

Summary of Significant Accounting Policies

| ● | Basis of presentation |

These accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

| ● | Basis of consolidation |

The condensed consolidated financial statements include the accounts of BioPlus Life Corp. and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

| ● | Use of estimates |

In preparing these financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets and revenues and expenses during the periods reported. Actual results may differ from these estimates.

| ● | Cash and cash equivalents |

Cash and cash equivalents represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| ● | Property, Plant and equipment |

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis to write off the cost over the following expected useful lives of the assets concerned. The principal annual rates used are as follows:

| Categories | Principal Annual Rates/Expected Useful Life | |

| Computer hardware | 20% | |

| Furniture & fittings | 10% | |

| Handphone | 20% | |

| Landscape | 20% | |

| Leasehold land and building | 99 years | |

| Machinery | 10% | |

| Motor vehicle | 20% | |

| Office equipment | 10% | |

| Renovation | 20% | |

| Signboard | 10% | |

| Tools and equipment | 10% |

| 6 |

Fully depreciated plant and equipment are retained in the financial statements until they are no longer in use.

| ● | Trade receivables |

Trade receivables are recorded at the invoiced amount and do not bear interest. Management reviews the adequacy of the allowance for doubtful accounts on an ongoing basis, using historical collection trends and aging of receivables. Management also periodically evaluates individual customer’s financial condition, credit history, and the current economic conditions to make adjustments in the allowance when it is considered necessary. Trade balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote.

| ● | Inventories |

Inventories consisting of products available for sell, are stated at the lower of cost or market value. Cost of inventory is determined using the first-in, first-out (FIFO) method. Inventory reserve is recorded to write down the cost of inventory to the estimated market value due to slow-moving merchandise and damaged goods, which is dependent upon factors such as historical and forecasted consumer demand, and promotional environment. The Company takes ownership, risks and rewards of the products purchased. Write downs are recorded in cost of revenues in the Condensed Statements of Operations and Comprehensive Income.

| ● | Impairment of long-lived assets |

Long-lived assets primarily include goodwill, intangible assets and property, plant and equipment. In accordance with the provision of ASC Topic 360, “Impairment or Disposal of Long-Lived Assets”, the Company generally conducts its annual impairment evaluation to its long-lived assets, usually in the fourth quarter of each fiscal year, or more frequently if indicators of impairment exist, such as a significant sustained change in the business climate. The recoverability of long-lived assets is measured at the lowest level group. If the total of the expected undiscounted future net cash flows is less than the carrying amount of the asset, a loss is recognized for the difference between the fair value and carrying amount of the asset. There has been no impairment charge for the periods presented.

| ● | Finance lease |

Leases that transfer substantially all the rewards and risks of ownership to the lessee, other than legal title, are accounted for as finance leases. Substantially all of the risks or benefits of ownership are deemed to have been transferred if any one of the four criteria is met: (i) transfer of ownership to the lessee at the end of the lease term, (ii) the lease containing a bargain purchase option, (iii) the lease term exceeding 75% of the estimated economic life of the leased asset, (iv) the present value of the minimum lease payments exceeding 90% of the fair value. At the inception of a finance lease, the Company as the lessee records an asset and an obligation at an amount equal to the present value of the minimum lease payments. The leased asset is amortized over the shorter of the lease term or its estimated useful life if title does not transfer to the Company, while the leased asset is depreciated in accordance with the Company’s depreciation policy if the title is to eventually transfer to the Company. The periodic rent payments made during the lease term are allocated between a reduction in the obligation and interest element using the effective interest method in accordance with the provisions of ASC Topic 835-30, “Imputation of Interest”.

| ● | Revenue recognition |

Revenues are recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those goods or services. The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

| ● | identify the contract with a customer; | |

| ● | identify the performance obligations in the contract; | |

| ● | determine the transaction price; | |

| ● | allocate the transaction price to performance obligations in the contract; and | |

| ● | recognize revenue as the performance obligation is satisfied. |

| 7 |

| ● | Cost of revenues |

Cost of revenue includes the purchase cost of retail goods for re-sale to customers and packing materials (such as boxes). It excludes purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs and other costs of distribution network in cost of revenues.

| ● | Shipping and handling fees |

Shipping and handling fees, if billed to customers, are included in revenue. Shipping ang handling fees associated with inbound and outbound freight are expensed as incurred and included in selling and distribution expenses.

| ● | Comprehensive income |

ASC Topic 220, “Comprehensive Income” establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying statements of stockholders’ equity consists of changes in unrealized gains and losses on foreign currency translation and cumulative net change in the fair value of available-for-sale investments held at the balance sheet date. This comprehensive income is not included in the computation of income tax expense or benefit.

| ● | Income tax expense |

Income taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclosed in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

The Company conducts major businesses in Malaysia and is subject to tax in their own jurisdictions. As a result of its business activities, the Company will file separate tax returns that are subject to examination by the foreign tax authorities.

| ● | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statement of operations.

The functional currency of the Company is the United States Dollars (“US$”) and the accompanying financial statements have been expressed in US$. In addition, the Company maintains its books and record in a local currency, Malaysian Ringgit (“MYR” or “RM”), which is functional currency as being the primary currency of the economic environment in which the entity operates. Certain expenses have been incurred in Chinese Renminbi (RMB).

In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income.

| 8 |

Translation of amounts from the local currency of the Company into US$1 has been made at the following exchange rates for the respective periods:

As of and for the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Period-end MYR: US$1 exchange rate | 4.3025 | 4.0810 | ||||||

| Period average MYR: US$1 exchange rate | 4.1819 | 4.0909 | ||||||

| Period-end US$1: RMB exchange rate | 0.1412 | 0.1490 | ||||||

| Period average US$1: RMB exchange rate | 0.1433 | 0.1482 | ||||||

| ● | Related parties |

Parties, which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also considered to be related if they are subject to common control or common significant influence.

| ● | Fair value of financial instruments |

The carrying value of the Company’s financial instruments: cash and cash equivalents, trade receivable, deposits and other receivables, amount due to related parties and other payables approximate at their fair values because of the short-term nature of these financial instruments.

The Company also follows the guidance of the ASC Topic 820-10, “Fair Value Measurements and Disclosures” (“ASC 820-10”), with respect to financial assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value hierarchy that prioritizes the inputs used in measuring fair value as follows:

| ● | Level 1: Observable inputs such as quoted prices in active markets; |

| ● | Level 2: Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and |

| ● | Level 3: Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions |

As of March 31, 2020, and December 31, 2019, the Company did not have any nonfinancial assets and liabilities that are recognized or disclosed at fair value in the financial statements, at least annually, on a recurring basis, nor did the Company have any assets or liabilities measured at fair value on a non-recurring basis.

| ● | Recent accounting pronouncements |

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

Off Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Contractual Obligations

None.

| 9 |

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

In connection with the preparation of this quarterly report, an evaluation was carried out by the Company’s management, with the participation of the principal executive officer and the principal financial officer, of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act (“Exchange Act”) as of March 31, 2020. Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the Commission’s rules and forms, and that such information is accumulated and communicated to management, including the principal executive officer and the principal financial officer, to allow timely decisions regarding required disclosures.

Based on that evaluation, the Company’s management concluded, as of the end of the period covered by this report, that the Company’s disclosure controls and procedures were not effective in recording, processing, summarizing, and reporting information required to be disclosed, within the time periods specified in the Commission’s rules and forms, and that such information was not accumulated and communicated to management, including the principal executive officer and the principal financial officer, to allow timely decisions regarding required disclosures.

Management’s Report on Internal Control over Financial Reporting

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting. The Company’s internal control over financial reporting is a process, under the supervision of the principal executive officer and the principal financial officer, designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external purposes in accordance with United States generally accepted accounting principles (GAAP). Internal control over financial reporting includes those policies and procedures that:

| i) | Pertain to the maintenance of records that is in reasonable detail accurately and fairly reflect the transactions and dispositions of the Company’s assets; |

| ii) | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of the financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only in accordance with the authorizations of management and the board of directors; and |

| iii) | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or that the degree of compliance with the policies or procedures may deteriorate.

The Company’s management conducted an assessment of the effectiveness of our internal control over financial reporting as of March 31, 2020, based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, which assessment identified material weaknesses in internal control over financial reporting. A material weakness is a control deficiency, or a combination of deficiencies in internal control over financial reporting that creates a reasonable possibility that a material misstatement in annual or interim financial statements will not be prevented or detected on a timely basis. Since the assessment of the effectiveness of our internal control over financial reporting did identify a material weakness, management considers its internal control over financial reporting to be ineffective.

| 10 |

Management has concluded that our internal control over financial reporting had the following material deficiencies:

| i) | We were unable to maintain segregation of duties within our business operations due to our reliance on a single individual fulfilling the role of sole officer and director. |

| ii) | Lack of a functioning audit committee due to a lack of a majority of independent members and a lack of a majority of outside directors on our Board of Directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures. |

While these control deficiencies did not result in any audit adjustments to our 2020 or 2019 interim or annual financial statements, it could have resulted in a material misstatement that might have been prevented or detected by a segregation of duties. Accordingly, we have determined that this control deficiency constitutes a material weakness.

To the extent reasonably possible, given our limited resources, our goal is, upon consummation of a merger with a private operating company, to separate the responsibilities of principal executive officer and principal financial officer, intending to rely on two or more individuals. We will also seek to expand our current board of directors to include additional individuals willing to perform directorial functions. Since the recited remedial actions will require that we hire or engage additional personnel, this material weakness may not be overcome in the near term due to our limited financial resources. Until such remedial actions can be realized, we will continue to rely on the advice of outside professionals and consultants.

This quarterly report does not include an attestation report of our registered public accounting firm regarding our internal controls over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to Section 404(c) of the Sarbanes-Oxley Act that permit us to provide only management’s report in this annual report.

Changes in Internal Controls over Financial Reporting

During the quarter ended March 31, 2020, there has been no change in internal control over financial reporting that has materially affected or is reasonably likely to materially affect our internal control over financial reporting.

PART II

There are presently no material pending legal proceedings to which the Company, any executive officer, any owner of record or beneficially of more than five percent of any class of voting securities is a party or as to which any of its property is subject, and no such proceedings are known to the Company to be threatened or contemplated against it.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 2. Unregistered Sale of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

| 11 |

Item 4. Mine Safety Disclosures

Not applicable to our Company.

None

| Exhibit | Description | |

| 31.1 | Certification of the Company’s Principal Executive Officer and Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* | |

| 32.1 | Certification of the Company’s Principal Executive Officer and Principal Financial pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002+ | |

| 101.INS | XBRL INSTANCE DOCUMENT* | |

| 101.SCH | XBRL TAXONOMY EXTENSION SCHEMA DOCUMENT* | |

| 101.CAL | XBRL TAXONOMY CALCULATION LINKBASE DOCUMENT* | |

| 101.DEF | XBRL TAXONOMY DEFINITION LINKBASE DOCUMENT* | |

| 101.LAB | XBRL TAXONOMY LABEL LINKBASE DOCUMENT* | |

| 101.PRE | XBRL TAXONOMY PRESENTATION LINKBASE DOCUMENT* |

+ In accordance with SEC Release 33-8238, Exhibit 32.1 is being furnished and not filed.

| * | Filed herewith. |

| 12 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BIOPLUS LIFE CORP. | ||

| (Name of Registrant) | ||

| Date: October 27, 2020 | ||

| By: | /s/ Chong Khooi You | |

| Chong Khooi You | ||

| CEO, President, Secretary, Treasurer, Director | ||

| 13 |