Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMERICAN EQUITY INVESTMENT LIFE HOLDING CO | ael-20201026.htm |

Accelerating AEL 2.0 Value Creation Strategic Partnership with Brookfield October 2020

Forward-Looking Statements This presentation and any oral related statements made by our representatives may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward- looking statements may relate to strategic alternatives, future operations, strategies, plans, partnerships, investments, share buybacks, financial results or other developments, and are subject to assumptions, risks and uncertainties. Statements such as “guidance”, “expect”, “strong”, “anticipate”, “believe”, “intend”, “goal”, “objective”, “target”, “potential”, “will”, “may”, “would”, “should”, “can”, “deliver”, “accelerate”, “enable”, “estimate”, “projects”, “outlook”, “opportunity”, “position” or similar words, as well as specific projections of future events or results qualify as forward-looking statements. Forward-looking statements, by their nature, are subject to a variety of inherent risks and uncertainties that could cause actual results to differ materially from the results projected. Many of these risks and uncertainties cannot be controlled by American Equity Investment Life Holding Company (“AEL”) and include the possibility that the proposed transaction may not be completed. Factors that may cause our actual decisions or results to differ materially from those contemplated by these forward-looking statements can be found in AEL’s Form 10-K and Form 10-Q filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date the statement was made and AEL undertakes no obligation to update such forward-looking statements. There can be no assurance that other factors not currently disclosed or anticipated by AEL will not materially adversely affect our results of operations or plans. Investors are cautioned not to place undue reliance on any forward-looking statements made by us or on our behalf. 2

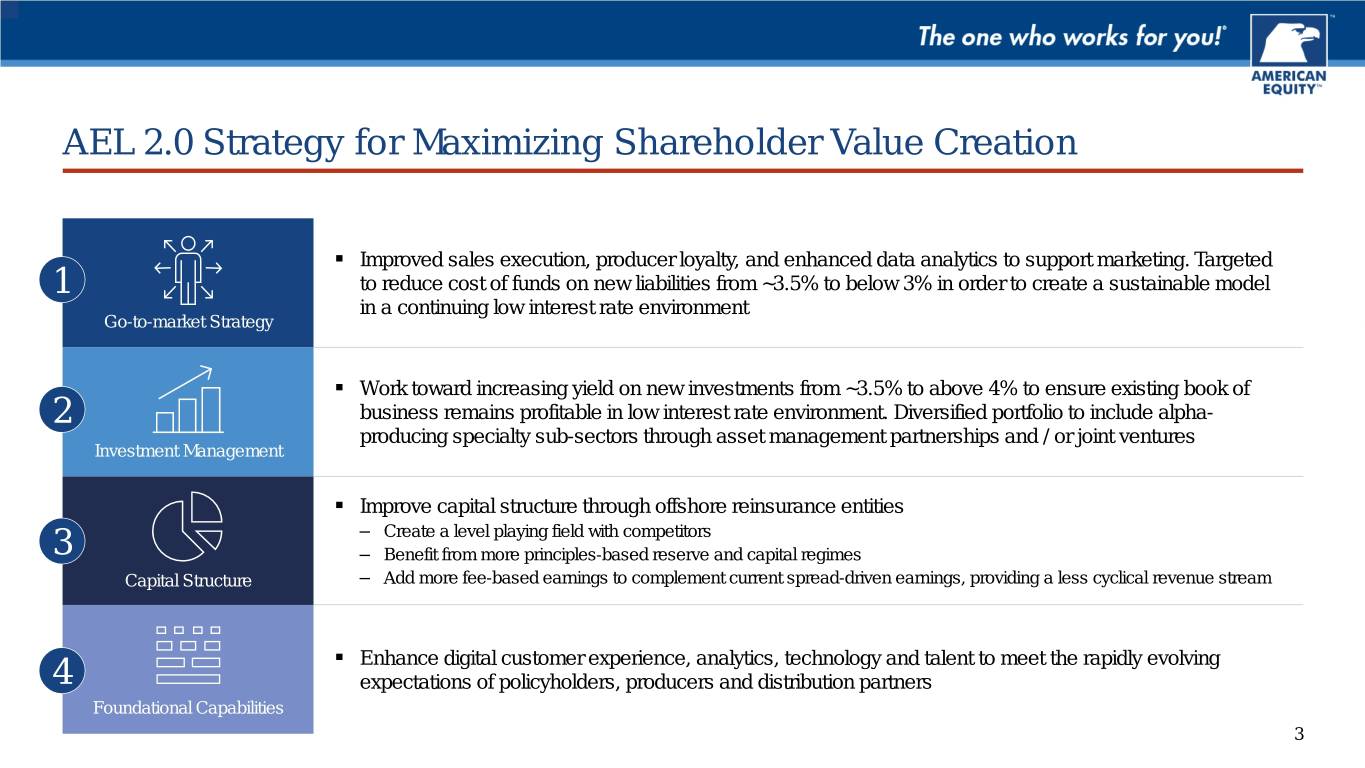

AEL 2.0 Strategy for Maximizing Shareholder Value Creation . Improved sales execution, producer loyalty, and enhanced data analytics to support marketing. Targeted 1 to reduce cost of funds on new liabilities from ~3.5% to below 3% in order to create a sustainable model in a continuing low interest rate environment Go-to-market Strategy . Work toward increasing yield on new investments from ~3.5% to above 4% to ensure existing book of 2 business remains profitable in low interest rate environment. Diversified portfolio to include alpha- producing specialty sub-sectors through asset management partnerships and / or joint ventures Investment Management . Improve capital structure through offshore reinsurance entities ‒ Create a level playing field with competitors 3 ‒ Benefit from more principles-based reserve and capital regimes Capital Structure ‒ Add more fee-based earnings to complement current spread-driven earnings, providing a less cyclical revenue stream . Enhance digital customer experience, analytics, technology and talent to meet the rapidly evolving 4 expectations of policyholders, producers and distribution partners Foundational Capabilities 3

Recent Partnerships Focus on Pillars 2 and 3 . Since the spring, AEL management has been engaged in third-party dialogues to build pillars 2 and 3 – investment management and capital structure . AEL is currently engaged in dialogues with several asset managers about partnerships involving both potential investment management agreements and general partner equity investments Investment Capital 2 3 Announcement Overview of Dialogues Management Structure . Agreement in principle for a strategic partnership with Värde Partners and Agam Capital Management, LLC September 28th / . Strategic partnership with Brookfield – up to $10Bn reinsurance arrangement and up to 19.9% equity investment October 18th . Ongoing dialogues with various asset managers regarding both Ongoing attractive terms to access differentiated, privately-sourced assets and Varies Dialogues general partner equity investments 4

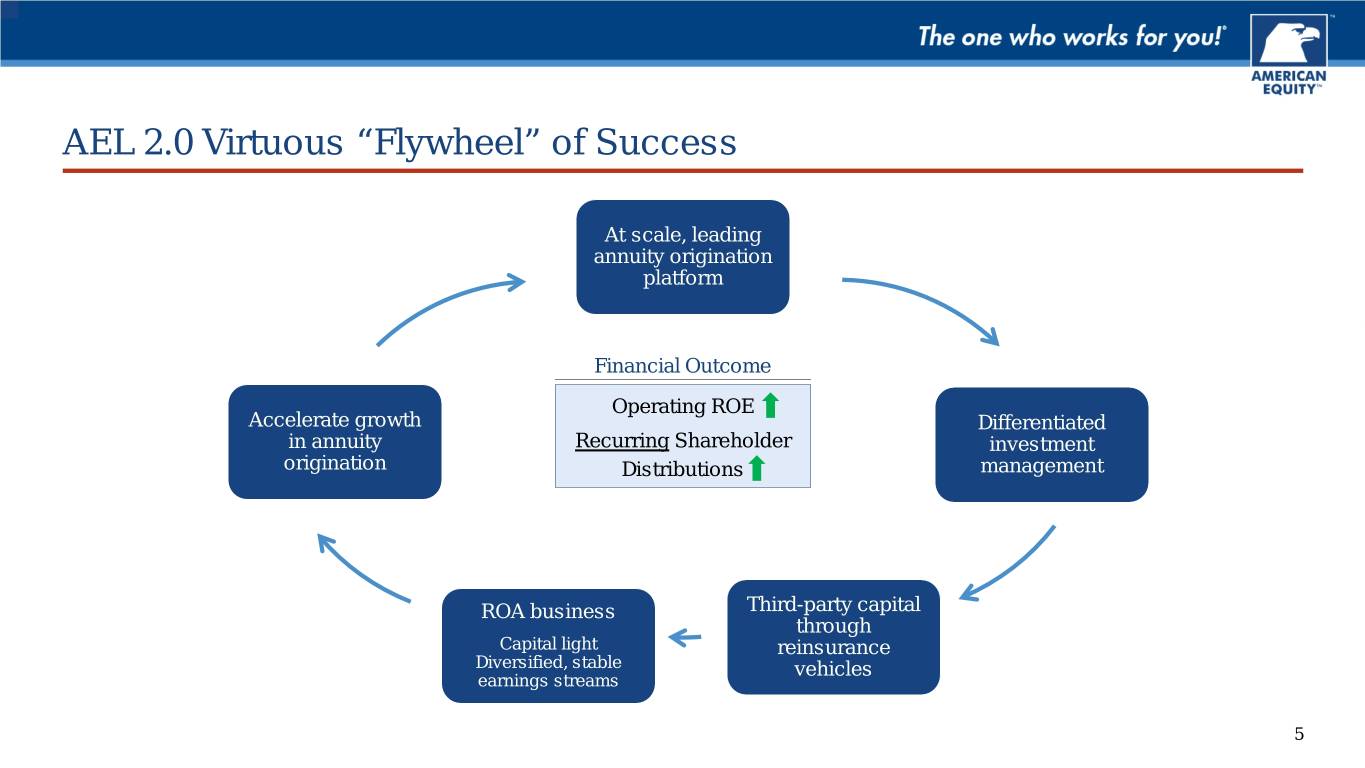

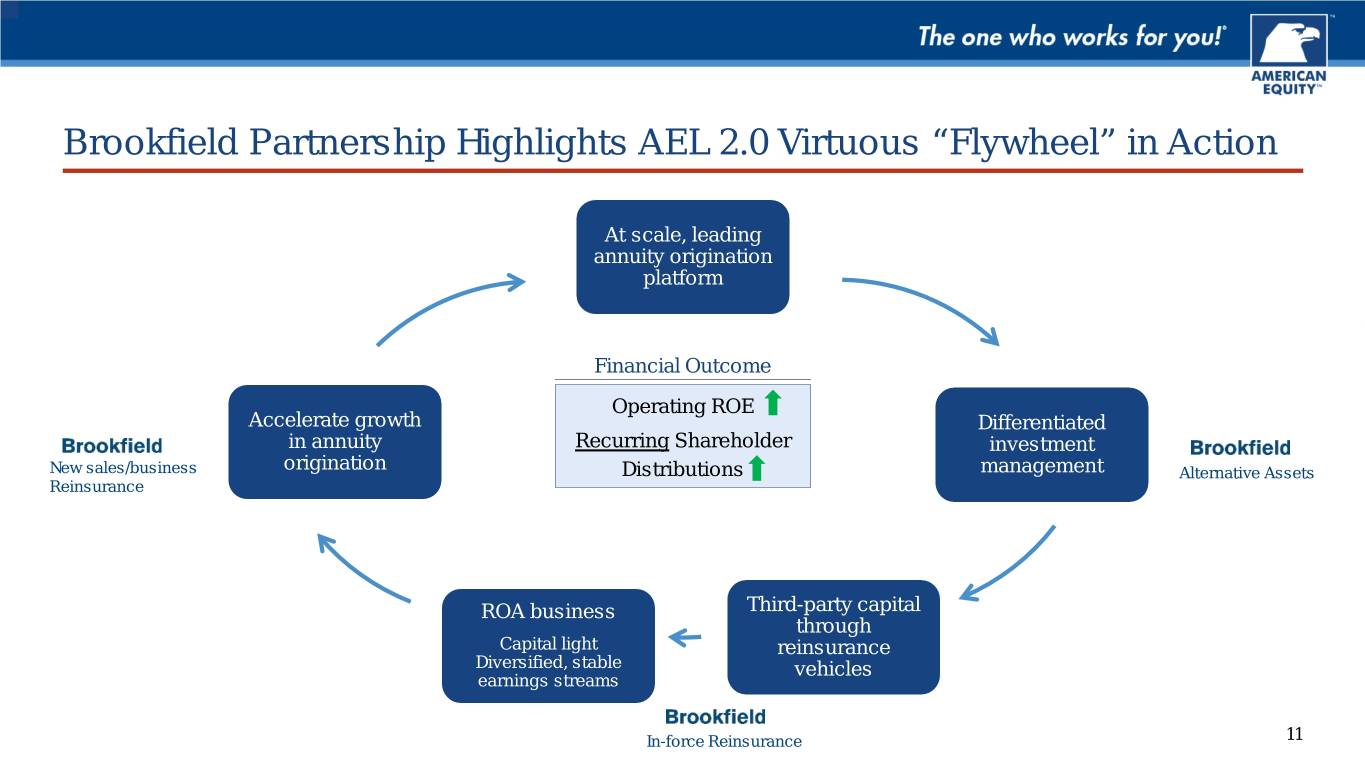

AEL 2.0 Virtuous “Flywheel” of Success At scale, leading annuity origination platform Financial Outcome Operating ROE Accelerate growth Differentiated in annuity Recurring Shareholder investment origination InvestmentDistributions Management management ROA business Third-party capital through Capital light reinsurance Diversified, stable vehicles earnings streams 5

Benefits of Brookfield Strategic Partnership Release over $300Mn of capital from AEL’s in-force through $5Bn in-force reinsurance transaction Generate stable, recurring “fee-like” income and grow it with follow-on new business reinsurance transactions Establishes Brookfield as a long-term shareholder at a floor price of $37 per share with strong alignment Positions AEL for conversion into an “ROA” business model and accelerating growth of annuity origination 6

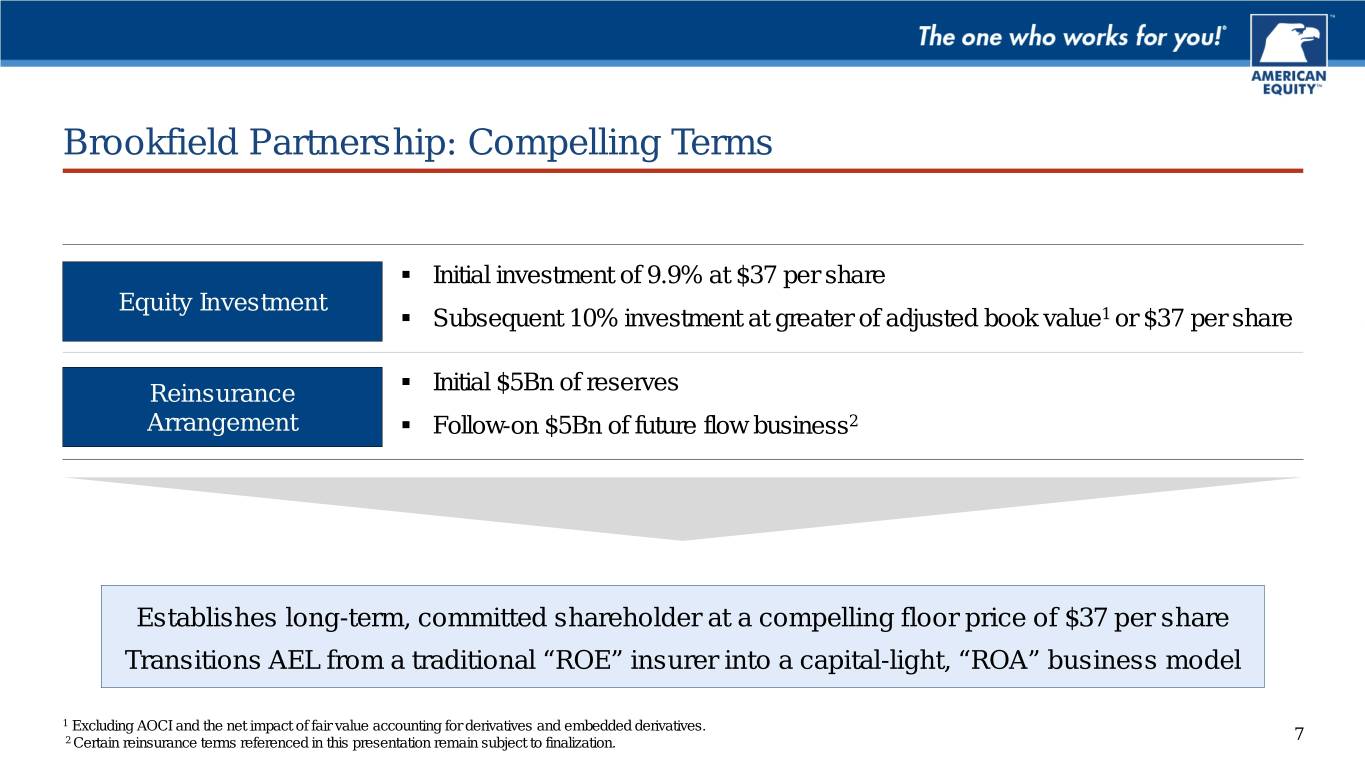

Brookfield Partnership: Compelling Terms . Initial investment of 9.9% at $37 per share Equity Investment . Subsequent 10% investment at greater of adjusted book value1 or $37 per share . Initial $5Bn of reserves Reinsurance Arrangement . Follow-on $5Bn of future flow business2 Establishes long-term, committed shareholder at a compelling floor price of $37 per share Transitions AEL from a traditional “ROE” insurer into a capital-light, “ROA” business model 1 Excluding AOCI and the net impact of fair value accounting for derivatives and embedded derivatives. 2 Certain reinsurance terms referenced in this presentation remain subject to finalization. 7

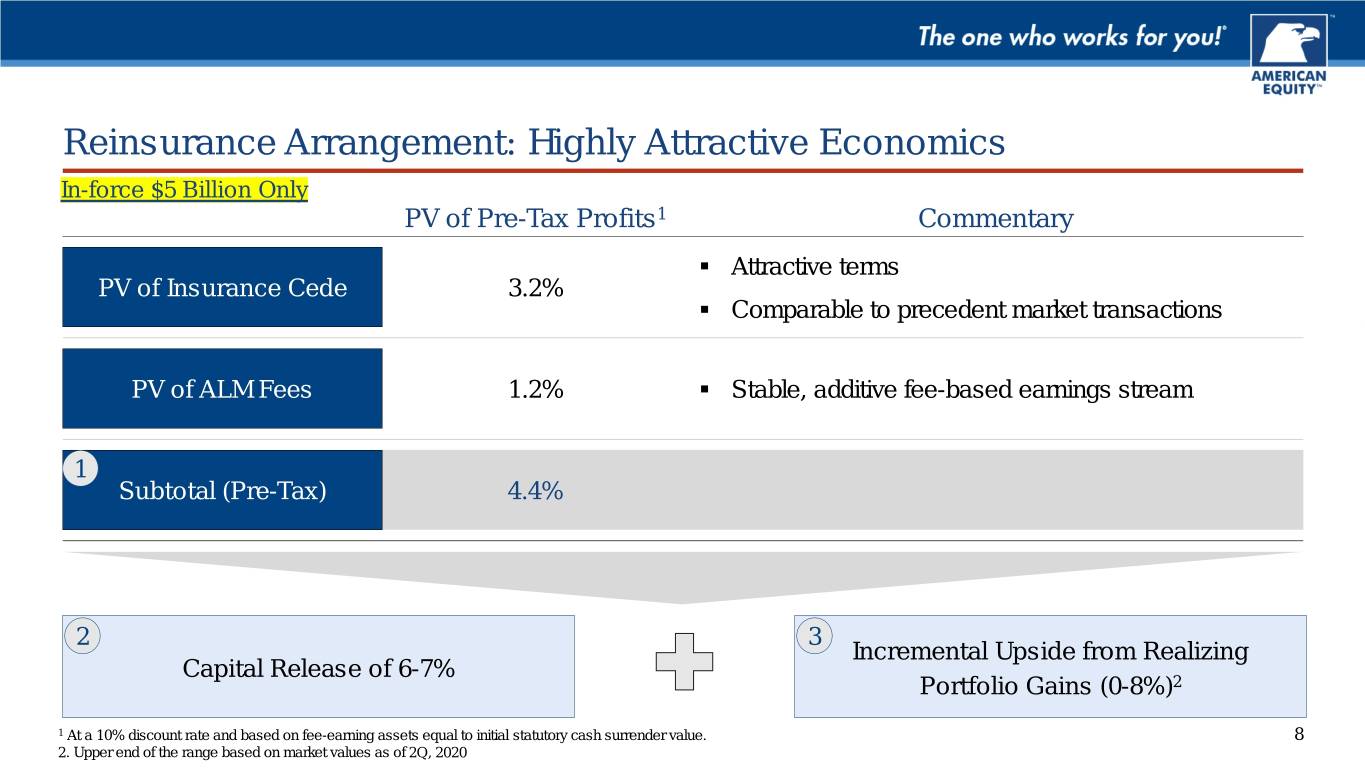

Reinsurance Arrangement: Highly Attractive Economics In-force $5 Billion Only PV of Pre-Tax Profits1 Commentary . Attractive terms PV of Insurance Cede 3.2% . Comparable to precedent market transactions PV of ALM Fees 1.2% . Stable, additive fee-based earnings stream 1 Subtotal (Pre-Tax) 4.4% 2 3 Incremental Upside from Realizing Capital Release of 6-7% Portfolio Gains (0-8%)2 1 At a 10% discount rate and based on fee-earning assets equal to initial statutory cash surrender value. 8 2. Upper end of the range based on market values as of 2Q, 2020

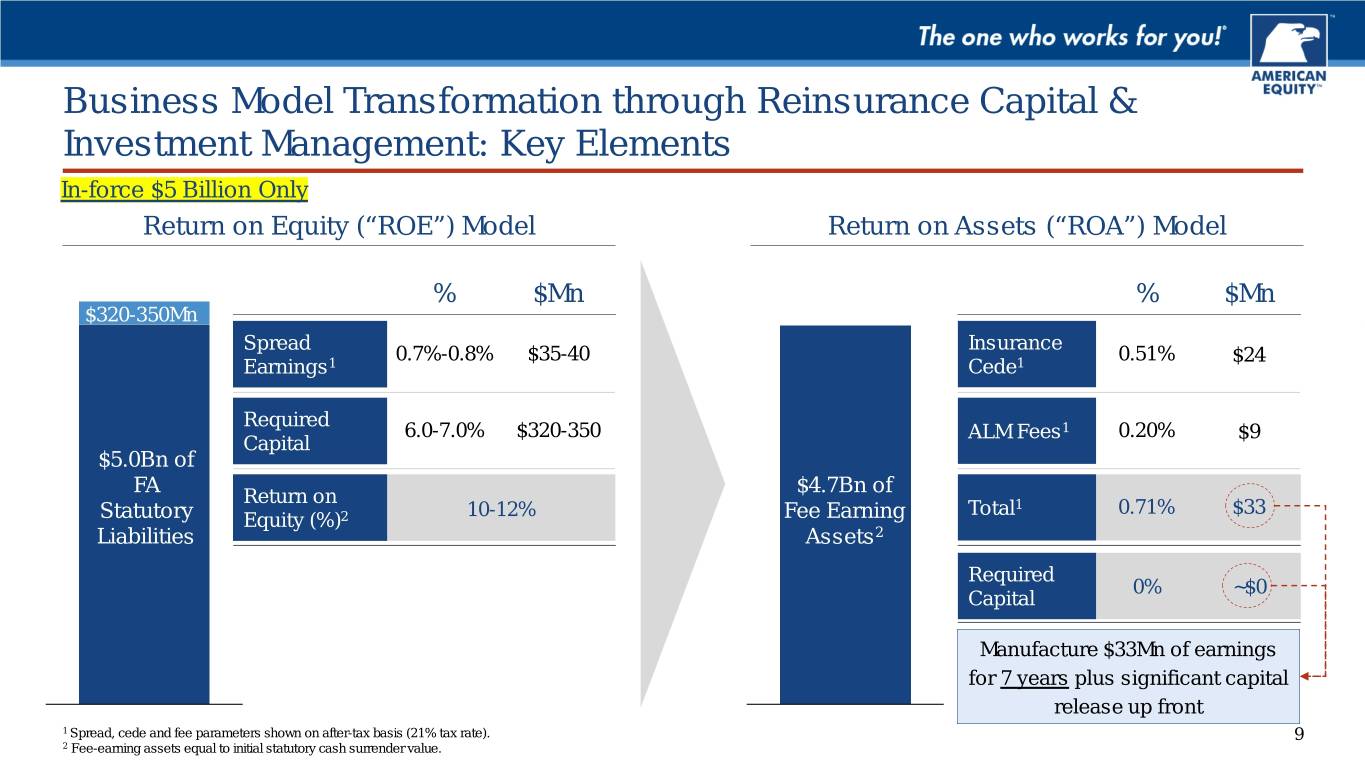

Business Model Transformation through Reinsurance Capital & Investment Management: Key Elements In-force $5 Billion Only Return on Equity (“ROE”) Model Return on Assets (“ROA”) Model % $Mn % $Mn $320-350Mn $300M Spread Insurance 0.7%-0.8% $35-40 0.51% $24 Earnings1 Cede1 Required 6.0-7.0% $320-350 ALM Fees1 0.20% $9 Capital $5.0Bn of FA $4.7Bn of Return on 10-12% Total1 0.71% $33 Statutory Equity (%)2 Fee Earning Liabilities Assets2 Required 0% ~$0 Capital Manufacture $33Mn of earnings for 7 years plus significant capital release up front 1 Spread, cede and fee parameters shown on after-tax basis (21% tax rate). 9 2 Fee-earning assets equal to initial statutory cash surrender value.

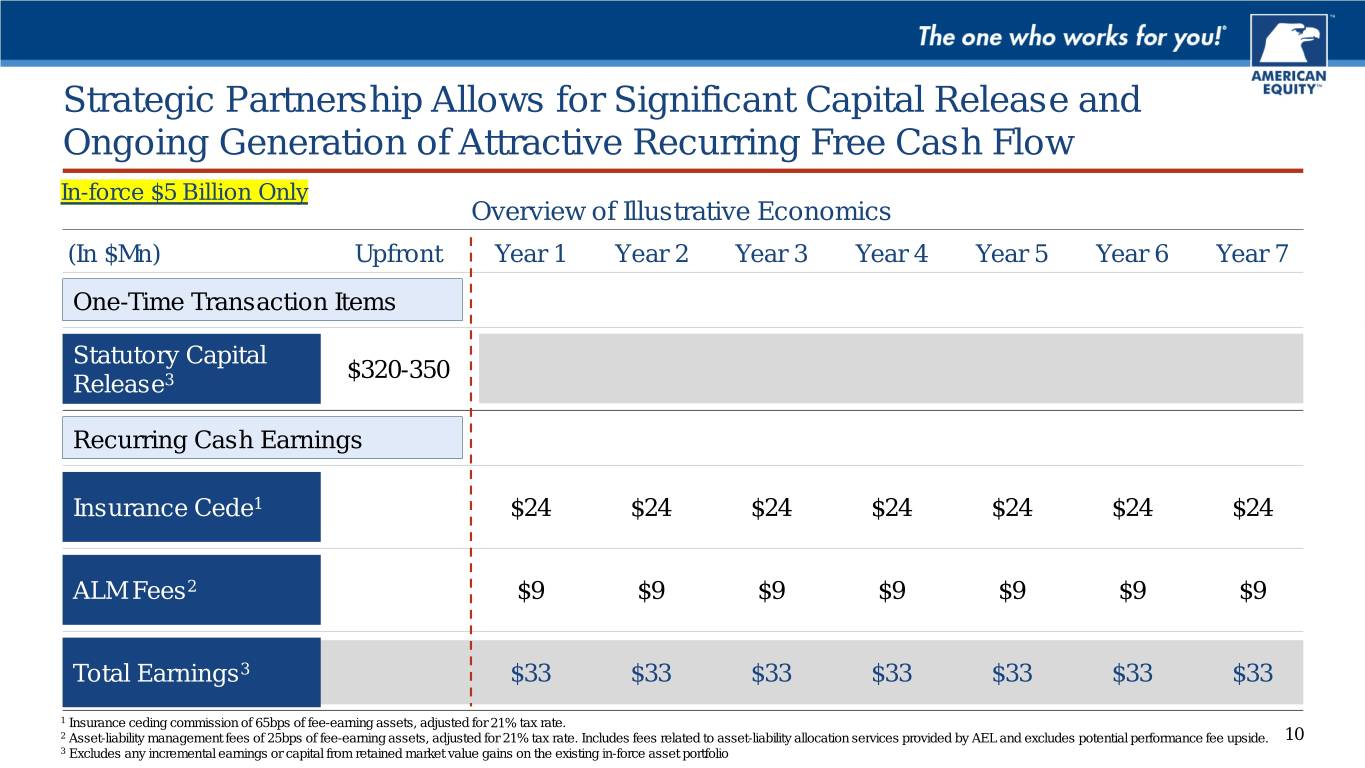

Strategic Partnership Allows for Significant Capital Release and Ongoing Generation of Attractive Recurring Free Cash Flow In-force $5 Billion Only Overview of Illustrative Economics (In $Mn) Upfront Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 One-Time Transaction Items Statutory Capital $320-350 Release3 Recurring Cash Earnings Insurance Cede1 $24 $24 $24 $24 $24 $24 $24 ALM Fees2 $9 $9 $9 $9 $9 $9 $9 Total Earnings3 $33 $33 $33 $33 $33 $33 $33 1 Insurance ceding commission of 65bps of fee-earning assets, adjusted for 21% tax rate. 2 Asset-liability management fees of 25bps of fee-earning assets, adjusted for 21% tax rate. Includes fees related to asset-liability allocation services provided by AEL and excludes potential performance fee upside. 10 3 Excludes any incremental earnings or capital from retained market value gains on the existing in-force asset portfolio

Brookfield Partnership Highlights AEL 2.0 Virtuous “Flywheel” in Action At scale, leading annuity origination platform Financial Outcome Operating ROE Accelerate growth Differentiated in annuity Recurring Shareholder investment origination New sales/business InvestmentDistributions Management management Alternative Assets Reinsurance ROA business Third-party capital through Capital light reinsurance Diversified, stable vehicles earnings streams In-force Reinsurance 11