Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 EARNINGS RELEASE - FIRST HORIZON CORP | a3q2020earningsrelease.htm |

| 8-K - 8-K - FIRST HORIZON CORP | fhn-20201023.htm |

Third Quarter 2020 Earnings October 23, 2020

3Q20 GAAP financial summary Reported 3Q20 Change vs. $ in millions 3Q20 2Q20 1Q20 4Q19 3Q19 2Q20 3Q19 $/bps % $/bps % Net interest income $ 532 $ 305 $ 303 $ 311 $ 301 $ 227 74 % $ 231 77 % Fee income 823 206 175 183 172 617 NM 651 NM Total revenue 1,355 512 478 495 472 843 NM 883 NM Expense 587 321 302 328 308 266 83 279 91 Pre-provision net revenue (PPNR)¹ 768 191 175 166 164 577 NM 604 NM Provision for credit losses 227 121 154 9 14 106 88 213 NM Pre-tax income 541 69 21 157 150 472 NM 391 NM Income tax expense 2 13 5 36 36 (11) (85) (34) (94) Net income 539 57 16 121 114 482 NM 425 NM Non-controlling interest 3 3 3 3 3 - - - - Preferred dividends 13 2 2 2 2 11 NM 11 NM NIAC $ 523 $ 52 $ 12 $ 117 $ 110 $ 471 NM $ 413 NM $ in billions Avg loans $ 60 $ 34 $ 31 $ 31 $ 30 $ 26 77 % $ 30 NM % Period-end loans 60 33 33 31 31 27 83 28 91 Avg deposits 67 38 33 33 32 30 79 35 NM Period-end deposits 68 38 34 32 32 31 81 36 NM Key performance metrics Net interest margin (NIM) 2.84 % 2.90 % 3.16 % 3.26 % 3.21 % (6) bps (37) bps Loan to deposit ratio (avg.) 90 91 93 94 93 (93) (314) ROCE 28.49 4.50 1.05 9.97 9.50 2,399 1,899 ROTCE¹ 37.75 6.74 1.59 15.03 14.49 3,101 2,326 ROA 2.63 0.48 0.15 1.12 1.08 215 155 Efficiency ratio 43.31 62.74 63.26 66.35 65.26 (1,943) (2,195) FTEs 8,121 5,006 4,969 5,005 5,116 3,115 62 % 3,005 59 % CET1 ratio² 9.15 9.25 8.54 9.20 9.01 (10) 14 Effective tax rate 0.41 18 22 23 24 (1,759) (2,359) Per common share Diluted EPS $ 0.95 $ 0.17 $ 0.04 $ 0.37 $ 0.35 $ 0.78 NM $ 0.60 NM Tangible book value per share¹ $ 9.92 $ 9.99 $ 9.96 $ 10.02 $ 9.76 $ (0.07) (1) % $ 0.16 2 % Avg. diluted shares outstanding 551 313 313 313 314 238 76 % 237 75 % (in millions) 2 Numbers may not add to total due to rounding. 1Pre-provision net revenue, ROTCE, and Tangible book value per share are Non-GAAP - see Non-GAAP reconciliation in the appendix.. 23Q20 CET1 ratio is an estimate.

Table of contents FHN: well-positioned in a challenging environment 4 3Q20 notable items 5 3Q20 adjusted financial highlights 6 NII and NIM reflect benefit of merger and deposit pricing discipline 7 Adjusted fee income vs. adjusted FHN/IBKC combined 8 Adjusted expense vs. adjusted FHN/IBKC combined 9 Total loans 10 Total funding 11 Prudently managing risk 12 Significant reserves for current environment 13 Update of areas of perceived risk 14 Strong capital position 15 Merger integration update 16 Key takeaways 17 Appendix 18-28 3

FHN: well-positioned in a challenging environment Adjusted EPS of $0.35 in 3Q201 • Adjusted PPNR of $352 million reflecting strength of more diversified business model and Solid Results with expanded franchise1 Strong Adjusted . NII and NIM impacted by low rate environment, somewhat offset by growth in fee income from PPNR merger impact and strong performance in specialty areas . Adjusted expense trends benefitted from merger cost saves and expense discipline • TBVPS of $9.92 remained relatively stable with 2Q20 as strong earnings were offset by the impact of the IBKC MOE and Truist branch acquisition1 Robust Capital & • CET1 of 9.15% includes modest impact from IBKC merger and branch acquisition2 Liquidity • 3Q20 provision expense includes $147 million of non-PCD loan loss provision included in notable items . CECL reserve build of $13 million with ACL/Loans ratio of 2.15% excl. LMC/PPP portfolios 1 • Period-end loan-to-deposit ratio of 87% vs. 2Q20 combined level of 89%3 • Total PPP portfolio of $4.2 billion, providing paycheck support to more than 500,000 clients’ employees Continued • Deferrals declined to 2.4% from a peak of 12.8% on a combined basis3 Customer Support While Managing • Continued proactive risk management with net charge-offs of 44 bps largely tied to energy portfolio Risk • Total loss absorption capacity of 2.1% of loans reflects merger accounting impacts and continued prudent stance on reserve methodology • Successfully completed IBKC MOE/Truist branch acquisition Merger integration well underway with significant progress across key milestones; achieved a net Strategic • $18 million of cost saves YTD Update • Net IBKC purchase accounting impacts largely consistent with 2Q20 estimates • 3-year strategic plan to be finalized in 4Q20 1Adjusted EPS, PPNR, Adjusted PPNR, TBVPS, the ACL/Loans ratio excluding Loans to Mortgage Companies (LMC), and loans under the federal Payroll Protection Program (PPP) are Non-GAAP - see Non-GAAP reconciliation in the appendix.. 23Q20 CET1 ratio is an estimate. 3Combined 4 financial information adds together historical unaudited information from legacy FHN and legacy IBKC, adjusted for notable it ems but without any adjustments, eliminations, or analysis required by GAAP purchase accounting or the SEC’s pro-forma rules; it is Non-GAAP and reconciled to GAAP measures in the appendix.

3Q20 Notable items $s in millions except per share data 3Q20 IBKC merger-related notable items Noninterest income: Merger accounting adjustment: other noninterest income¹ $ 532 • 3Q20 results include $269 million pre-tax, or Total noninterest income 532 $0.60 per share of net notable items largely tied Noninterest expense: to the IBKC MOE including: Salaries and benefits (1) . $532 million gain tied to merger Incentives and commissions (34) accounting adjustments Total personnel expenses (35) Occupancy and equipment (4) . $140 million of non-PCD provision for loan and lease losses Outside services (32) Amortization of intangible assets (1) . $96 million of IBKC merger-related Louisiana Foundation contribution: other noninterest expense (20) integration expense Other noninterest expense (4) • $35 million of charitable contributions to Total other noninterest expense (24) support communities2 Total noninterest expense (96) Non-PCD provision for credit losses (140) IBKC Cumulative Pre-tax Integration Costs Total IBKC net notable items $ 296 Costs to Date Est. Future Costs Targeted 3Q20 Other notable items 4Q19 - Purchase 2Q20 3Q20 Acct. Total 4Q20 2021 Total Occupancy and equipment $ (1) $ 50 $ 96 $ 120 $ 266 $ 40 $ 135 $ 440 Outside services (2) Other noninterest expense (2) PPP fees charitable contribution: other noninterest expense (15) Non-PCD provision for credit losses - Truist branch acquisition (7) Total other 3Q20 notable items (27) Total net 3Q20 notable items (pre-tax) $ 269 Tax impact of 3Q20 notable items 61 After-tax impact of 3Q20 notable items $ 331 EPS impact of 3Q20 notable items3 $ 0.60 Additional information concerning notable items is presented in the appendix. Numbers may not add to total due to rounding. 1Merger accounting adjustment is non-taxable income. 2Includes $15 million of charitable contributions plus $20 5 million within IBKC merger-related integration expense. 3EPS computed based on approximately 551 million diluted shares.

3Q20 adjusted1 financial highlights Adjusted Adjusted FHN • Adjusted EPS of $0.35; TBV per share2 of $9.92 FHN standalone 3Q20 Change vs. remained relatively stable QoQ $s in millions except per share data 3Q20 2Q20 3Q19 2Q20 3Q19 $/bps % $/bps % . Provision reflects CECL reserve build of $13 million or $0.02 per share Net interest income $ 532 $ 305 $ 301 $ 227 74% $ 231 77% Fee income 291 206 172 85 41 119 69 • Adjusted PPNR up ~$147 million QoQ and Total revenue 823 512 472 311 61 351 74 $156 million YoY driven by merger-related impacts Expense 471 307 277 164 53 194 70 • NII up $227 million QoQ and up $231 million YoY Pre-provision net revenue² 352 205 196 147 72 156 80 . Results reflect $225 million benefit tied to the Provision for credit losses 80 121 14 (41) (34) 66 NM IBKC merger and Truist branch acquisition Net charge-offs 67 17 15 50 NM 52 NM (“branch acquisition”) Reserve build 13 104 (1) (91) (88) 14 NM . NIM of 2.84% vs. 2.90% in 2Q20 includes benefit NIAC $ 193 $ 64 $ 134 $ 129 NM% $ 59 44% of 2 bps reduction in IB deposit costs to 36 bps Key performance metrics • Adjusted fee income up $85 million QoQ and up Fee income as a % of total 35 % 40 % 36% (488) bps (108) bps $119 million YoY revenue Efficiency ratio 57 % 60 % 59% (269) bps (135) bps . 3Q20 results reflect a net $90 million benefit ROTCE² 13.90 % 8.26 % 17.73 % 564 bps (383) bps from the IBKC merger as well as continued strength in fixed income Diluted EPS $ 0.35 $ 0.20 $ 0.43 $ 0.15 75% $ (0.08) (19)% TBV per share2 $ 9.92 $ 9.99 $ 9.76 $ (0.07) (1)% $ 0.16 2% • Adjusted expense up $164 million QoQ and up $194 million YoY Effective tax rate 23 % 18 % 24% 530 bps (60) bps . 3Q20 results included $170 million impact tied to the IBKC merger/branch acquisition . Results also reflect a net $8 million benefit from merger expense saves 1Adjusted financial measures exclude notable items; they are Non-GAAP and are reconciled to GAAP measures in the appendix. 2TBV per share, Pre-provision net revenue, and ROTCE are Non-GAAP - see Non-GAAP reconciliation in the 6 appendix.

NII and NIM reflect benefit of merger and deposit pricing discipline ($s in millions) NII and NIM Trends Legacy FHN $532 • NII up $227 million QoQ driven by the $311 $303 $223 million impact of the IBKC merger $301 $305 $454 . Reported NII includes accretion impact of $294 $296 $294 $44 million $284 . Reported NIM includes accretion impact 3.26% of 20 bps 3.21% 3.16% 2.90% 2.84% . NIM negatively impacted ~12 bps by ~$3 billion of excess cash; period-end excess cash of ~$4.5 billion 3Q19 4Q19 1Q20 2Q20 3Q20 • Interest-bearing deposit costs of 36 bps improved 2 bps QoQ and 21 bps from 2Q20 Core NIM1 3.14% 3.10% 3.07% 2.80% 2.57% combined2 levels Core NII¹ Reported NII Reported NIM . Continue to target last zero interest-rate policy (ZIRP) cycle IBD costs of 24 bps 1Core financial measures are Non-GAAP and are reconciled to GAAP measures in the appendix. 2Combined financial information adds together historical unaudited information from legacy FHN and legacy IBKC, adjusted for notable items 7 but without any adjustments, eliminations, or analysis required by GAAP purchase accounting or the SEC’s pro-forma rules; it is Non-GAAP and reconciled to GAAP measures in the appendix.

Adjusted1 fee income vs. adjusted FHN/IBKC combined2 Adjusted Adjusted FHN/IBKC FHN combined 3Q20 Change vs. Adjusted fee income remained relatively $s in millions 3Q20 2Q20 1Q20 4Q19 3Q19 2Q20 3Q19 • $/bps % $/bps % stable compared with 2Q20 adjusted Fixed income $ 111 $ 112 $ 96 $ 81 $ 78 $ (1) (1)% $ 33 42 % FHN/IBKC combined results Mortgage banking & 66 53 32 26 27 13 25 39 NM . Fixed income relatively stable QoQ and title up $33 million YoY with ADR of Brokerage, trust and 30 33 34 33 32 (3) (9) (2) (6) $1.5 million relatively stable QoQ and up insurance 55% YoY Service charges & fees 50 46 50 54 55 4 9 (5) (9) . Mortgage banking and title up Card & digital banking 17 17 19 20 19 - - (2) (11) $13 million QoQ and $39 million YoY, fees reflecting strength in originations and Deferred compensation 4 8 (10) 3 - (4) (50) 4 NA improved GOS spreads Other noninterest 14 18 21 26 26 (4) (22) (12) (46) income . Service charges and fees up $4 million Total fee income $ 291 $ 287 $ 175 $ 183 $ 237 $ 4 1 % $ 54 23 % QoQ reflecting impact of branch acquisition . Card & digital fees remained Key metrics steady QoQ Fixed income Average Daily Revenue $ 1.5 $ 1.6 $ 1.3 $ 1.1 $ 1.0 $ (0.0) (3)% $ 0.6 55 % . Brokerage, trust, and insurance down (ADR) $3 million QoQ largely reflecting the Mortgage banking impact of market volatility on volumes Originations and valuation levels Secondary $ 1,186 $ 1,152 $ 581 $ 573 $ 629 $ 34 3 % $ 557 89 % Portfolio $ 396 $ 675 $ 497 $ 714 $ 522 $ (279) (41)% $ (126) (24)% Gain on sale spread 3.93 % 2.86 % 3.07 % 2.85 % 3.09 % 107 bps 84 bps 8 1Adjusted1Adjusted financials financial which measures exclude exclude notable notable items items; are they Non are -NonGAAP-GAAP and and are are reconciled reconciled into theGAAP appendix measures.2 1Q20in the appendix includes. 2($9.5mm)Combined financial of deferred information compensation. adds together historical unaudited information from legacy FHN and legacy IBKC, adjusted for notable items but without any adjustments, eliminations, or analysis required by GAAP purchase accounting or the SEC’s pro-forma rules; it is Non-GAAP and reconciled to GAAP measures in the appendix.

Adjusted1 expense vs. adjusted FHN/IBKC combined2 Adjusted Adjusted FHN FHN/IBKC combined 3Q20 Change vs. Adjusted expense down $15 million from 3Q20 2Q20 1Q20 4Q19 3Q19 2Q20 3Q19 • $s in millions 2Q20 adjusted FHN/IBKC combined levels $ % $ % and includes the benefit of merger Salaries and benefits $ 200 $ 193 $ 194 $ 193 $ 193 $ 7 4 % $ 7 4 % cost saves Incentives and commissions 91 97 100 83 78 (6) (6) 13 17 • Personnel expense down $6 million Deferred compensation 3 10 (10) 4 1 (7) (70) 2 NM . $7 million increase in salaries and Total personnel expenses 294 300 283 279 268 (6) (2) 26 10 benefits driven by alignment of IBKC Occupancy and equipment 73 74 72 73 71 (1) (1) 2 3 benefits, higher healthcare costs and the Branch Acquisition partially offset Outside services 46 46 49 49 48 - - (2) (4) by merger saves Amortization of intangible 14 9 9 10 11 5 56 3 27 assets . Incentives/commissions down Other noninterest expense 45 57 58 50 52 (12) (21) (7) (13) $6 million largely tied to lower revenue-based incentives Total noninterest expense $ 471 $ 486 $ 471 $ 461 $ 450 $ (15) (3)% $ 21 5 % • Other noninterest expense down $12 million from higher than normal 2Q20 levels Achieved Total YTD 2020 Merger Savings of ~$18 million with ~$8 million in 3Q20 9 1Adjusted1Adjusted financials financial which measures exclude exclude notable notable items items; are they Non are -NonGAAP-GAAP and and are are reconciled reconciled into theGAAP appendix measures.2 1Q20in the appendix. includes 2($9.5mm)Combined financial of deferred information compensation. adds together historical unaudited information from legacy FHN and legacy IBKC, adjusted for notable items but without any adjustments, eliminations, or analysis required by GAAP purchase accounting or the SEC’s pro-forma rules; it is Non-GAAP and reconciled to GAAP measures in the appendix.

Total loans 3Q20 reported vs combined1 loan trends • Period-end loans of $59.7 billion up modestly from 2Q20 combined1 levels as a $1.6 billion increase in Loans to Mortgage Companies (LMC) more than offset reductions in other C&I . Average loans to mortgage companies of $5.8 billion, $58.8B $59.7B $60.1B up ~$430 million QoQ, reflecting strong volume tied $54.9B 2% 2% 2% to seasonality and low rate environment 2% 7% 9% 10% 9% 7% 7% 7% . 3Q20 average loan yields of 3.70% 24% 22% 21% 21% • Utilization rates of 47% remained relatively stable with 2Q20 combined1 levels 1Q20-3Q20 line utilization FHN/IBKC FHN/IBKC combined combined 63% 61% 65% 61% 3/31/2020 6/30/2020 9/30/2020 Utilization % 53% 48% 47% Period-end loans Period-end loans Period-end loans Average Loans FHN/IBKC FHN/IBKC 3Q20 3Q20 combined combined 3Q19 2Q20 Total Commercial excl.67% LMC &63%7% PPP 61%7%Consumer61%7% real estate Credit card and other Loans to mortgage co. PPP Consumer real estate PPP Loans to mortgage co. Total Commercial excl. LMC & PPP Credit card and other 1Combined financial information adds together historical unaudited information from legacy FHN and legacy IBKC, adjusted for n otable items but without any adjustments, eliminations, or analysis required by GAAP purchase accounting or 10 the SEC’s pro-forma rules; it is Non-GAAP and reconciled to GAAP measures in the appendix.

Total funding 3Q20 reported vs combined1 interest-bearing liabilities & DDA trends $73.2B $72.1B 1% $72.1B • 3Q20 total period-end deposits of $68.4 billion 0.3% 0.5% 4% 3% 3% compared with 2Q20 combined levels of $66.1 billion $63.2B 1% 20% . Results driven by an increase in savings and DDA 5% 21% 20% . Total deposit cost of funds of 25 bps in 3Q20 3% 20% 4% 3% . Interest-bearing deposit costs of 36 bps compared 8% 8% 8% with prior ZIRP cycle rate of 24 bps in 3Q15 4% 14% • 3Q20 borrowings of $4.8 billion compared with 2Q20 combined levels of $6.0 billion 36% 34% 36% . Replaced ~$1.0 billion of IBKC FHLB advances with 32% excess liquidity 28% 29% 29% 23% Period-end Period-end Period-end Average FHN/IBKC FHN/IBKC 3Q20 3Q20 combined combined 3Q19 2Q20 DDA Savings Time deposits Term borrowings Other interest-bearing deposits Short-term borrowings Trading liabilities 1Combined financial information adds together historical unaudited information from legacy FHN and legacy IBKC, adjusted for n otable items but without any adjustments, eliminations, or analysis required by GAAP purchase accounting or 11 the SEC’s pro-forma rules; it is Non-GAAP and reconciled to the GAAP measure in the appendix.

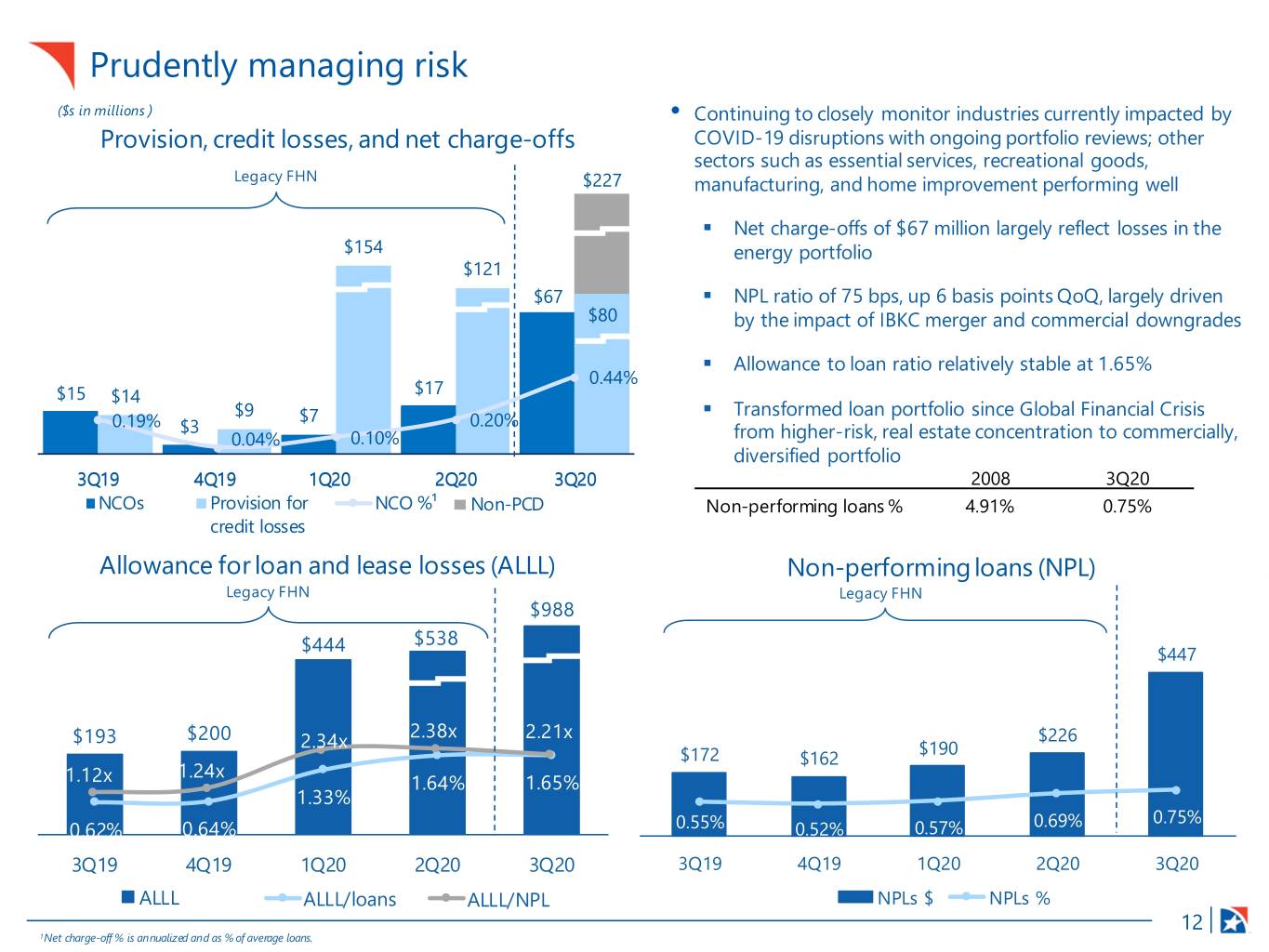

Prudently managing risk ($s in millions ) • Continuing to closely monitor industries currently impacted by Provision, credit losses, and net charge-offs COVID-19 disruptions with ongoing portfolio reviews; other sectors such as essential services, recreational goods, Legacy FHN $227 manufacturing, and home improvement performing well . Net charge-offs of $67 million largely reflect losses in the $154 energy portfolio $121 $67 . NPL ratio of 75 bps, up 6 basis points QoQ, largely driven $80 by the impact of IBKC merger and commercial downgrades . Allowance to loan ratio relatively stable at 1.65% 0.44% $15 $14 $17 $9 $7 . Transformed loan portfolio since Global Financial Crisis 0.19% $3 0.20% 0.04% 0.10% from higher-risk, real estate concentration to commercially, diversified portfolio 3Q19 4Q19 1Q20 2Q20 3Q20 2008 3Q20 NCOs Provision for NCO %¹ Non-PCD NCO %¹ Non-performing loans % 4.91% 0.75% credit losses Allowance for loan and lease losses (ALLL) Non-performing loans (NPL) Legacy FHN Legacy FHN $988 $538 $444 $447 $193 $200 2.38x 2.21x $226 2.34x $190 $172 $162 1.24x 1.12x 1.64% 1.65% 1.33% 0.75% 0.62% 0.64% 0.55% 0.52% 0.57% 0.69% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 ALLL ALLL/loans ALLL/NPL NPLs $ NPLs % 12 1Net charge-off % is annualized and as % of average loans.

Significant reserves for current environment ($ in millions) • CECL reserve build reflects stressed but improving outlook 2Q20 vs. 3Q20 Allowance for credit losses (ACL) for overall economy • Utilized Moody’s August 2020 baseline scenario and applied additional modest weighting to alternative upside $147 $80 $1,077 and downside scenarios $41 $287 $(67) • Also incorporated $588 . Detailed portfolio reviews of industries currently affected by pandemic . Additional factors such as the reemergence of COVID cases, impact of stimulus programs, and overall economic uncertainty FHN IBKC/TFC IBKC Reserve IBKC/TFC Net Provision FHN standalone branch PCD for Unfunded non-PCD Charge-offs Expense 9/30/2020 • Reserve build includes $147 million related to non-PCD 6/30/2020 allowance Commitment Provision loan portfolio Established Expense % of 3Q20 Total ACL/loans ACL/annualized NCOs $s in millions Period-end Loans Total allowance for credit losses $ 1,077 1.8% 4.04x Unrecognized discount - acquired loans 284 0.5 2.15% Total loss absorption capacity $ 1,272 2.1% 1.80% FHN FHN Ex. LMC & PPP¹ FHN 13 1FHN’s ratio of ACL to Loans, excluding Loans to Mortgage Companies (LMC) and loans under the federal Payroll Protection Program (PPP), is a Non-GAAP number reconciled to the GAAP ratio in the appendix.

Update on areas of perceived risk Portfolio by industry as of 9/30/2020 Portfolios subject to more heightened monitoring Subject to ~10.8% of total loans more % of total heightend % of total • Continuing to closely monitor industries currently impacted by COVID-19 ($s in billions) Amount loans monitoring loans disruptions; Performed deep dive review on ~$9.0 billion of commercial Other C&I $ 6.3 10.4 % $ - - % portfolio in 3Q20 Finance & Insurance 3.0 5.1 - - Health Care & Social Assistance 2.2 3.7 - - • Other sectors such as essential services, recreational goods, manufacturing, Non-real estate leasing 0.7 1.1 - - and home improvement performing well Real estate leasing 1.6 2.7 1.6 2.7 Real Estate Rental & Leasing 2.2 3.7 - - • Consumer portfolio asset quality relatively stable; refreshed weighted avg. Quick serve restaurants and other lower risk categories 1.1 1.9 - - FICO score of ~750 Higher-risk accommodation and food service 0.8 1.3 0.8 1.3 Accommodation & Food Service 1.9 3.2 - - • Real Estate Rental/Leasing – ~32% non-real estate rental and leasing, Wholesale Trade 1.9 3.1 - - primarily equipment with ~68% real estate-related, largely REITs which are Energy 1.8 3.0 1.8 3.0 diversified across property types Manufacturing 1.7 2.8 - - Grocery stores, gas stations, convenience stores, home • Accommodation/Food Service – ~57% quick service restaurants and improvement, auto-related and other lower-risk retail 1.3 2.1 - - other lower risk categories with normalizing trends; higher-risk portfolio Higher-risk retail trade 0.1 0.1 0.1 0.1 largely reflects regional and national casual dining brands Retail Trade 1.3 2.2 - - Transportation & Warehousing 1.2 2.0 - - Energy – ~$300 million in oil field services, ~ $1.0 billion in E&P - Portfolio Golf courses and other outdoor lower risk sectors 0.3 0.5 - - • Fitness centers, recreational centers and other clients are hedged ~57% through 2020, 44% through 2021 and 19% higher-risk arts, entertainment and recreation 0.3 0.6 0.3 0.6 through 2022. Not currently originating new energy loans Arts, Entertainment & Recreation 0.6 1.1 - - Total C&I excluding LMC and PPP $ 24.1 40.2 % - - • Retail Trade – Substantially all essential services and other more resilient Other CRE 9.0 15.0 - - sectors including home improvement and auto-related Lower-risk CRE retail 1.2 2.0 - - Higher-risk CRE retail 1.1 1.9 1.1 1.9 • Arts/Entertainment – ~ 50% tied to golf courses and other lower risk CRE - Retail 2.3 3.9 - - outdoor sectors Properties with 50%+ occupancy 0.4 0.7 - - Higher-risk CRE hospitality 0.8 1.3 0.8 1.3 • CRE – Retail – Granular portfolio with ~1,850+ tenants largely focused on CRE - Hospitality 1.2 2.0 - - value- and necessity-based properties; limited geographic/major tenant Total CRE excluding PPP 12.5 20.9 - - concentration; limited regional mall/power center exposure Total commercial loans excluding LMC and PPP $ 36.7 61.1 % $ 6.5 10.8 % Loans to mortgage companies (LMC) 5.7 9.4 . ~6% of CRE-Retail on active deferral vs. 41% in 1st round Paycheck protection program (PPP) 4.2 7.0 CRE – Hospitality – ~84% flagged properties and ~57% limited Total commercial loans $ 46.5 77.5 % • Total consumer loans $ 13.5 22.5 % service/extended stay properties Total loans $ 60.0 100.0 % . ~16% of CRE hospitality is on active deferral vs. ~65% in 1st round Total loans excl. LMC and PPP $ 50.2 83.6 % Data based on loan balances from credit systems and does not reflect certain general ledger accounting adjustments including unrecognized loan discounts. NAICs codes as of 3Q20. Energy-related loans represented across various categories. 14 Numbers may not add to total due to rounding.

Strong capital position Capital levels 12.47% 11.97% • Robust PPNR1 and enhanced earnings power provide 11.01% 11.22% 10.78% dividend support and additional loss-absorbing capital 10.69% 9.97% 10.15% 10.19% 9.52% • TBVPS1 of $9.92 remained relatively stable with 2Q20 as strong earnings were offset by the impact of the IBKC MOE and Truist branch acquisition 9.01% 9.20% 8.54% 9.25% 9.15%² • CET1 ratio reflects (22) bps impact tied to $1.6B increase in Loans to Mortgage Companies (LMC) balances . LMCs ~10% of total loans; 100% risk-weighted, yet 100% of collateral is government guaranteed if held individually 3Q19 4Q19 1Q20 2Q20 3Q20 on the balance sheet would be risk-weighted at 50% CET1 ratio Tier 1 capital ratio Total capital ratio 2Q20 vs. 3Q20 CET1 ratio2 Tangible book value per share1 9.60% 0.40% $0.09 $0.35 0.11% $9.99 9.40% 9.25% $9.92 9.20% (0.13%) 9.15% (0.11%) ($0.15) (0.22%) ($0.19) 9.00% (0.14%) 8.80% ($0.16) 8.60% 8.40% 8.20% 8.00% 2Q20 Net IBKC IBKC Day 2 Truist Branch Adjusted Common & Higher LMC 3Q20 2Q20 Net IBKC IBKC Day 2 Truist Branch Adjusted NIAC Common 3Q20 Actuals merger- CECL Acquisition NIAC & Preferred Balances Estimate Actuals merger-related CECL Non-PCD Acquisition & Other¹ Dividends Actuals related items Non-PCD Other¹ Dividends items & & Purchase Purchase Accounting Accounting Gain Gain 15 All data prior to 3Q20 is for FHN standalone. 1PPNR, Adjusted NIAC and Tangible Book Value per share (TBVPS) are Non-GAAP numbers and are reconciled in the appendix. 23Q20 CET1 ratio is an estimate.

Merger integration update • Strong project management and governance framework in place Integration Highlights Integration • Strong head start pre-COVID building relationships, aligning cultures & Framework establishing cadence • Integration work being done effectively in largely remote manner Targeting ~$170 million of annualized cost saves by 2022 • Largely aligned benefits plans • Launched companywide associate value survey to measure engagement . Achieved ~$18 million YTD • 100% of top 4 levels of management named with ~$8 million in 3Q20 People • Communicated a decision to ~99% of associates Annualized Savings Actual Estimated • Finalized ~100% of major tech systems and 95% of all tech 3Q20 4Q20 2021 2022 3Q20 system decisions ~$32mm ~$48mm ~$100mm ~$170mm Milestones • Completed HR system conversion and 401K enrollment • Detailed mapping, design & resource planning fully ramped up Delivering strong Systems/Ops performance on talent • Established go-to-market and organizational models retention • Finalized customer experience dashboard . ~97% retention of Model • Cross business line referrals & product set expansion building pipeline of ~540 associates identified as revenue synergies key integration talent • Convert retail brokerage, mortgage and wealth management systems Seeing strong early success • Convert Asset/Liability Management platform, expense procurement, on revenue synergies not Upcoming profitability and pricing systems included in deal economics Events • Finalize data mapping requirements • Align deposit pricing • Complete 3-yr strategic plan 16

Key takeaways Well-positioned to capitalize on the benefits of our more diversified business model and expanded franchise in attractive Southern markets • Diversified revenue mix with countercyclical businesses helping to mitigate pressure from low rates • Uniquely positioned to deliver significant cost savings in a challenging environment . Strong progress towards at least $170 million of cost saves; proven commitment to expense discipline • Continued prudent risk management with strong reserves and loss absorption capacity . ~45% of loan book marked with ~$1.3 billion of total loss absorption capacity • Attractive capital and funding profile Significant opportunities to drive relative outperformance and build shareholder value 17

APPENDIX 18

FHN reserve and deferrals by portfolio Allowance Loan Coverage $s in billions Balance Allowance Ratio Portfolios excl. Loans to Mortgage Companies (LMC) & PPP Energy $ 1.8 $ 0.1 7.46 % C&I excl. Energy, LMC, & PPP 22.4 0.4 1.56 Total C&I excl. LMC & PPP 24.2 0.5 2.00 CRE - Other 9.0 0.1 1.25 CRE - Retail 2.3 0.1 2.25 CRE - Hospitality 1.2 0.0 3.58 Total CRE excl. PPP 12.5 0.2 1.66 Total Commercial excl. LMC & PPP 36.7 0.7 1.89 Total Consumer 13.5 0.3 2.16 Total Loans excl. LMC & PPP $ 50.2 $ 1.0 1.96 % LMC $ 5.6 $ 0.0 0.09 PPP 4.2 - - Total Loans $ 60.0 $ 1.0 1.65 % Have Taken a COVID-19 Deferral Are Still On Deferral Balances Balances Approx. # of with % of Total Approx. # of with % of Total $ in millions Deferrals Deferrals Balances Deferrals Deferrals Balances Consumer 5,696 $ 1,365 10.1 % 1,348 $ 427 3.2 % Commercial excl. PPP 4,724 5,803 13.7 519 911 2.2 Total excl. PPP 10,420 $ 7,169 12.8 % 1,867 $ 1,338 2.4 % Allowance for Credit Losses (ACL) to Loans Ratio Loan ACL $ in millions Balance Balance ACL/ Loans Total Loans $ 59,707 $ 1,077 1.80 % Loans to Mortgage Companies (LMC) 5,607 5 0.09 PPP 4,176 - - Total excl. LMC & PPP $ 49,924 $ 1,072 2.15 % Data based on loan balances from credit systems and does not reflect certain general ledger accounting adjustments including unrecognized loan discounts. NAICs codes as of 3Q20. Energy-related loans represented across various categories. 19 Numbers may not add to total due to rounding.

IBKC merger accounting impacts consistent with prior guidance Preliminary loan marks as of 7/1/20 Interest/liquidity Credit mark Total loan mark Other adjustments $s in millions mark Prior PCD Fair value Balances Pre-tax % of O/S Pre-tax % of O/S Pre-tax % of O/S discount allowance of assets reversed established PCD loans $ 12,952 $ (323) (2.5) % $ (50) (0.4) % $ (373) (2.9) % $ - $ 284 $ 12,864 Non-PCD loans 11,062 (132) (1.2) (28) (0.3) (160) (1.4) - - 10,901 PPP loans 2,052 - - (21) (1.0) (21) (1.0) - - 2,032 Other loan balances 121 - - - - - - - - 121 Prior loan discounts (147) - - - - - - 147 - - Total Loans $ 26,040 $ (455) (1.7) % $ (99) (0.4) % $ (554) (2.1) % $ 147 $ 284 $ 25,918 Preliminary IBKC purchase accounting adjustments $s in millions as of 7/1/20 Merger purchase accounting gain Estimated IBKC Loan Accretion Assets Balances Mark Fair Value $s in millions $s in millions Loans and leases, net of $ 26,040 $ (123) $ 25,918 Purchase Price: 4Q20 $ 25 unearned income Preferred stock $ 231 2021 60 Allowance for loan and lease losses (398) 113 (284) Common stock 152 Cash and due from banks/IB deposit 2022 50 2,077 - 2,077 Capital surplus 2,119 in other banks 2023 and beyond $ 90 Investment securities 3,529 15 3,544 Cash paid for fractional shares - Mortgage Loans held for sale 320 - 320 Total Purchase Price $2,502 Goodwill 1,236 (1,236) - Less Deferred Tax Asset (6) Other Intangibles2 54 184 238 Net Purchase Price $2,495 Premises and equipment, net 296 15 311 Other real estate owned 14 (5) 9 Fair Value of Assets 33,253 Other assets 1,094 27 1,121 Fair Value of Liabilities 30,225 Total Assets $34,262 $(1,009) $33,253 Net Fair Value of Assets $3,028 Merger Purchase Accounting Gain $ 532 Liabilities Balances Mark Fair Value Deposits $ 28,209 $ 22 $ 28,232 Short-term borrowings 209 209 Allowance 3 Prior PCD Non-PCD Term borrowings 1,168 32 1,200 for loan allowance allowance provision Unfunded Commitments Credit and lease 24 17 41 eliminated established expense1 Loss Accrual Balances losses Other liabilities 340 204 544 Allowance for loan and lease losses $ (398) $ 398 $ (284) $ (140) $ (424) Total Liabilities $29,950 $ 275 $30,225 Numbers may not add to total due to rounding.1Non-PCD Provision Expense recorded in 3Q20 income statement. 2Core Deposit Intangible of $207 million established and included in Other Intangibles. 3Term borrowings include FHLB advances 20 and Trust Preferred Securities.

Notable items Favorable / (Unfavorable) FHN IBKC $s in millions After-Tax at After-Tax at $s in millions, except per share data Marginal Tax Marginal 3Q20 IBKC merger-related notable items Financial Statement Caption Pre-Tax Rate Pre-Tax Tax Rate Noninterest income: 2Q20 Merger accounting adjustment: other noninterest income¹ $ 532 Salaries and benefits $ (5) $ (4) $ (2) $ (2) Total noninterest income 532 Incentives and commissions - - (2) (2) Noninterest expense: Occupancy and equipment - - (1) (1) Salaries and benefits (1) Outside services (6) (5) (9) (7) Incentives and commissions (34) Other noninterest expense (4) (3) (1) (1) Total personnel expenses (35) Total Acquisition and Hazard related expenses $ (14) $ (12) $ (15) $ (12) Occupancy and equipment (4) Other noninterest income - (Gain) loss on sale of investments $ - $ - $ (6) $ (5) Outside services (32) Total Notable items $ (14) $ (12) $ (9) $ (7) Amortization of intangible assets (1) Louisiana Foundation contribution: other noninterest expense (20) 1Q20 Other noninterest expense (4) Salaries and benefits $ (1) $ (1) $ (2) $ (2) Total other noninterest expense (24) Occupancy and equipment - - (1) - Total noninterest expense (96) Outside services (2) (2) - - Non-PCD provision for credit losses (140) Other noninterest expense (3) (2) - - Total IBKC net notable items $ 296 Total Acquisition and Hazard related expenses $ (6) $ (5) $ (3) $ (3) Total Notable items $ (6) $ (5) $ (3) $ (3) 3Q20 Other notable items Occupancy and equipment $ (1) 4Q19 Outside services (2) Salaries and benefits $ (4) $ (4) $ (2) $ (1) Other noninterest expense (2) Outside services (18) (15) (9) (4) Other noninterest expense (3) (2) - - PPP fees charitable contribution: other noninterest expense (15) Total Acquisition, Rebranding, Restructuring related expenses $ (26) $ (21) $ (11) $ (6) Non-PCD provision for credit losses - SunTrust branch acquisition (7) Other noninterest expense - Charitable Contributions $ (11) $ (9) $ - $ - Total other 3Q20 notable items (27) Total Notable items $ (37) $ (30) $ (11) $ (6) Total net 3Q20 notable items (pre-tax) $ 269 3Q19 Tax impact of 3Q20 notable items 61 Salaries and benefits $ (3) $ (2) $ - $ - After-tax impact of 3Q20 notable items $ 331 Outside services (12) (10) - EPS impact of 3Q20 notable items2 $ 0.60 Other noninterest expense (5) (4) - Total Acquisition, Rebranding, Restructuring, and Storm related expenses $ (20) $ (16) $ - $ - Other noninterest expense - Legal Resolution Expense $ (12) $ (9) $ - $ - Incentives and commissions 4 3 - - Net Impact of Legal Resolutions $ (8) $ (6) $ - $ - Other noninterest expense - Visa Derivative Valuation Adjustments $ (4) $ (3) $ - $ - Total Notable items $ (31) $ (24) $ - $ - 21 Numbers may not add to total due to rounding. 1Merger accounting adjustment is non-taxable income. 2EPS computed based on approximately 551 million diluted shares.

Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. Adjusted FHN historical income statements 3Q20 2Q20 1Q20 4Q19 3Q19 Notable Non- Notable Non- Notable Non- Notable Non- Notable Non- $ in millions GAAP Items GAAP GAAP Items GAAP GAAP Items GAAP GAAP Items GAAP GAAP Items GAAP Interest income $ 598 $ - $ 598 $ 347 $ - $ 347 $ 378 $ - $ 378 $ 404 $ - $ 404 $ 407 $ - $ 407 Interest expense 66 - 66 41 - 41 76 - 76 93 - 93 107 - 107 Net interest income 532 - 532 305 - 305 303 - 303 311 - 311 301 - 301 Noninterest income: Fixed income 111 - 111 112 - 112 96 - 96 81 - 81 78 - 78 Mortgage banking and title 66 - 66 4 - 4 2 - 2 4 - 4 2 - 2 Brokerage, trust, and insurance 30 - 30 22 - 22 23 - 23 22 - 22 22 - 22 Service charges and fees 50 - 50 35 - 35 36 - 36 39 - 39 40 - 40 Card and digital banking fees 17 - 17 12 - 12 12 - 12 14 - 14 13 - 13 Deferred compensation income 4 - 4 8 - 8 (10) - (10) 3 - 3 - - - Other noninterest income 546 (532) 14 12 - 12 15 - 15 20 - 20 17 - 17 Total noninterest income 823 (532) 291 206 - 206 175 - 175 183 - 183 172 - 172 Total revenue 1,355 (532) 823 512 - 512 478 - 478 495 - 495 472 - 472 Noninterest expense: Personnel expenses: Salaries and benefits 201 (1) 200 111 (5) 107 113 (1) 112 112 (4) 107 111 (3) 109 Incentives and commissions 126 (34) 91 79 - 79 81 - 81 63 - 63 55 4 59 Deferred compensation expense 3 - 3 9 - 9 (10) - (10) 4 - 4 1 - 1 Total personnel expenses 329 (35) 294 200 (5) 195 183 (1) 182 179 (4) 174 167 1 168 Occupancy and equipment 77 (4) 73 46 - 46 44 - 44 44 - 44 42 - 42 Outside services 78 (32) 46 38 (5) 33 38 (2) 37 54 (18) 36 47 (12) 35 Amortization of intangible assets 15 (1) 14 5 - 5 5 - 5 6 - 6 6 - 6 Other noninterest expense 89 (44) 45 31 (4) 27 31 (3) 28 45 (15) 31 46 (21) 25 Total noninterest expense 587 (116) 471 321 (14) 307 302 (6) 296 328 (37) 291 308 (31) 277 Pre-provision net revenue (Non-GAAP) 768 (416) 352 191 14 205 175 6 181 166 37 203 164 31 196 Provision for credit losses 227 (147) 80 121 - 121 154 - 154 9 - 9 14 - 14 Income before income taxes 541 (269) 272 69 14 84 21 6 27 157 37 194 150 31 181 Provision for income taxes 2 61 63 13 3 15 5 1 6 36 7 43 36 7 43 Net income 539 (331) 208 57 12 68 16 5 21 121 30 151 114 24 138 Net income attributable to noncontrolling interest 3 - 3 3 - 3 3 - 3 3 - 3 3 - 3 Net income attributable to controlling interest 536 (331) 205 54 12 66 14 5 18 118 30 148 111 24 136 Preferred stock dividends 13 - 13 2 - 2 2 - 2 2 - 2 2 - 2 Net income available to common shareholders $ 523 $ (331) $ 193 $ 52 $ 12 $ 64 $ 12 $ 5 $ 17 $ 117 $ 30 $ 147 $ 110 $ 24 $ 134 22 Numbers may not add to total due to rounding.

Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. Combined Historical Data: non-interest income and expense 2Q20 1Q20 4Q19 3Q19 $s in millions FHN IBKC Combined FHN IBKC Combined FHN IBKC Combined FHN IBKC Combined Noninterest income: Fixed income $ 112 $ - $ 112 $ 96 $ - $ 96 $ 81 $ - $ 81 $ 78 $ - $ 78 Mortgage banking and title 4 49 53 2 29 32 4 22 26 2 25 27 Brokerage,trust and insurance 22 11 33 23 10 34 22 11 33 22 10 32 Service charges and fees 35 11 46 36 14 50 39 15 54 40 15 55 Card and digital banking fees 12 5 17 12 6 19 14 7 20 13 6 19 Deferred compensation income 8 - 8 (10) - (10) 3 - 3 - - - Other noninterest income 12 11 23 15 6 21 20 6 26 17 9 26 Total non-interest income $ 206 $ 86 $ 293 $ 175 $ 65 $ 240 $ 183 $ 60 $ 244 $ 172 $ 65 $ 237 Noninterest expense: Personnel expenses: Salaries and benefits $ 111 $ 83 $ 195 $ 113 $ 83 $ 196 $ 112 $ 82 $ 194 $ 111 $ 81 $ 193 Incentives and commissions 79 24 104 81 20 101 63 25 88 55 21 77 Deferred compensation expense 9 - 10 (10) - (10) 4 - 4 1 - 1 Total personnel expenses 200 108 308 183 103 286 179 107 286 167 103 270 Occupancy and equipment 46 29 75 44 28 73 44 29 73 42 29 71 Outside services 38 23 61 38 12 51 54 23 77 47 13 60 Amortization of intangible assets 5 4 9 5 4 9 6 4 10 6 4 11 Other noninterest expense 31 30 61 31 30 61 45 19 64 46 23 69 Total non-interest expense $ 321 $ 194 $ 515 $ 302 $ 177 $ 480 $ 328 $ 182 $ 510 $ 308 $ 173 $ 481 23 Numbers may not add to total due to rounding.

Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. Adjusted 3Q20 FHN compared to adjusted combined historical data: non-interest income and expense 3Q20 2Q20 1Q20 4Q19 3Q19 3Q20 Changes vs. $s in millions FHN FHN IBKC Combined FHN IBKC Combined FHN IBKC Combined FHN IBKC Combined 2Q20 3Q19 $ % $ % Noninterest income: Fixed income $ 111 $ 112 $ - $ 112 $ 96 $ - $ 96 $ 81 $ - $ 81 $ 78 $ - $ 78 $ (1) (1)% $ 33 42 % Mortgage banking and title 66 4 49 53 2 29 32 4 22 26 2 25 27 13 25 39 NM Brokerage,trust and insurance 30 22 11 33 23 10 34 22 11 33 22 10 32 (3) (9) (2) (6) Service charges and fees 50 35 11 46 36 14 50 39 15 54 40 15 55 4 9 (5) (9) Card and digital banking fees 17 12 5 17 12 6 19 14 7 20 13 6 19 - - (2) (11) Deferred compensation income 4 8 - 8 (10) - (10) 3 - 3 - - - (4) (50) 4 NM Other noninterest income 14 12 5 18 15 6 21 20 6 26 17 9 26 (4) (22) (12) (46) Total non-interest income $ 291 $ 206 $ 81 $ 287 $ 175 $ 65 $ 240 $ 183 $ 60 $ 244 $ 172 $ 65 $ 237 $ 4 1 % $ 54 23 % Noninterest expense: Personnel expenses: Salaries and benefits $ 200 $ 111 $ 81 $ 193 $ 113 $ 81 $ 194 $ 112 $ 80 $ 193 $ 111 $ 81 $ 193 $ 7 4 % $ 7 4% Incentives and commissions 91 75 22 97 80 20 100 58 25 83 57 21 78 (6) (6) 13 17 Deferred compensation expense 3 9 - 10 (10) - (10) 4 - 4 1 - 1 (7) (70) 2 NM Total personnel expenses 294 195 104 300 182 101 283 174 105 279 168 103 272 (6) (2) 22 8 Occupancy and equipment 73 46 28 74 44 28 72 44 29 73 42 29 71 (1) (1) 2 3 Outside services 46 32 14 46 36 12 49 36 14 49 35 13 48 - - (2) (4) Amortization of intangible assets 14 5 4 9 5 4 9 6 4 10 6 4 11 5 56 3 27 Other noninterest expense 45 27 30 57 28 30 58 31 19 50 25 23 48 (12) (21) (3) (6) Total non-interest expense $ 471 $ 307 $ 179 $ 486 $ 296 $ 174 $ 471 $ 291 $ 170 $ 462 $ 277 $ 173 $ 450 $ (15) (3)% $ 21 5% 24 Numbers may not add to total due to rounding.

Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. 3Q20 compared to Combined Historical Balance Sheet Data 9/30/2020 6/30/20 9/30/19 $s in millions FHN FHN IBKC Combined FHN IBKC Combined Loans and Leases: Commercial $ 46,167 77 % $ 26,207 $ 18,838 $ 45,045 77 % $ 24,523 $ 16,300 $ 40,823 74 % Loans to Mortgage Companies (LMC) 5,607 9 4,021 - 4,021 9 5,038 - 5,038 9 PPP 4,175 7 2,065 2,052 4,117 7 - - - - Commercial Loans excl. LMC & PPP $ 36,385 61 % $ 20,121 $ 16,786 $ 36,907 61 % $ 19,485 $ 16,300 $ 35,785 65 % Consumer real estate 12,328 21 6,052 6,678 12,730 21 6,245 6,703 12,948 24 Credit card and other 1,212 2 449 563 1,012 2 493 673 1,166 2 Loans and leases, net of unearned income $ 59,707 100 % $ 32,709 $ 26,078 $ 58,787 100 % $ 31,261 $ 23,677 $ 54,938 100 % Interest-bearing liabilities & DDA: Deposits: Savings $ 26,573 36 % $ 13,532 $ 11,154 $ 24,686 36 % $ 11,489 $ 9,326 $ 20,815 32 % Time deposits 5,526 8 2,656 3,224 5,880 8 4,176 4,629 8,805 14 Other interest-bearing deposits 14,925 20 9,784 5,464 15,248 20 8,011 4,503 12,514 19 Total interest-bearing deposits 47,025 64 % 25,972 19,843 45,815 64 % 23,676 18,459 42,135 65 % Trading liabilities 477 1 233 - 233 1 720 - 720 1 Short-term borrowings 2,142 3 2,392 207 2,599 3 3,948 498 4,446 7 Term borrowings 2,162 3 2,032 1,168 3,200 3 1,195 1,394 2,589 4 Total interest-bearing liabilities 51,805 71 30,628 21,218 51,846 71 29,539 20,351 49,890 77 DDA 21,384 29 11,788 8,475 20,263 29 8,269 6,519 14,788 23 Total interest-bearing liabilities & DDA $ 73,189 100 % $ 42,416 $ 29,693 $ 72,109 100 % $ 37,808 $ 26,870 $ 64,678 100 % Loans to Deposits ratio 87 % 87 % 92 % 89 % 98 % 95 % 97 % 25 Numbers may not add to total due to rounding.

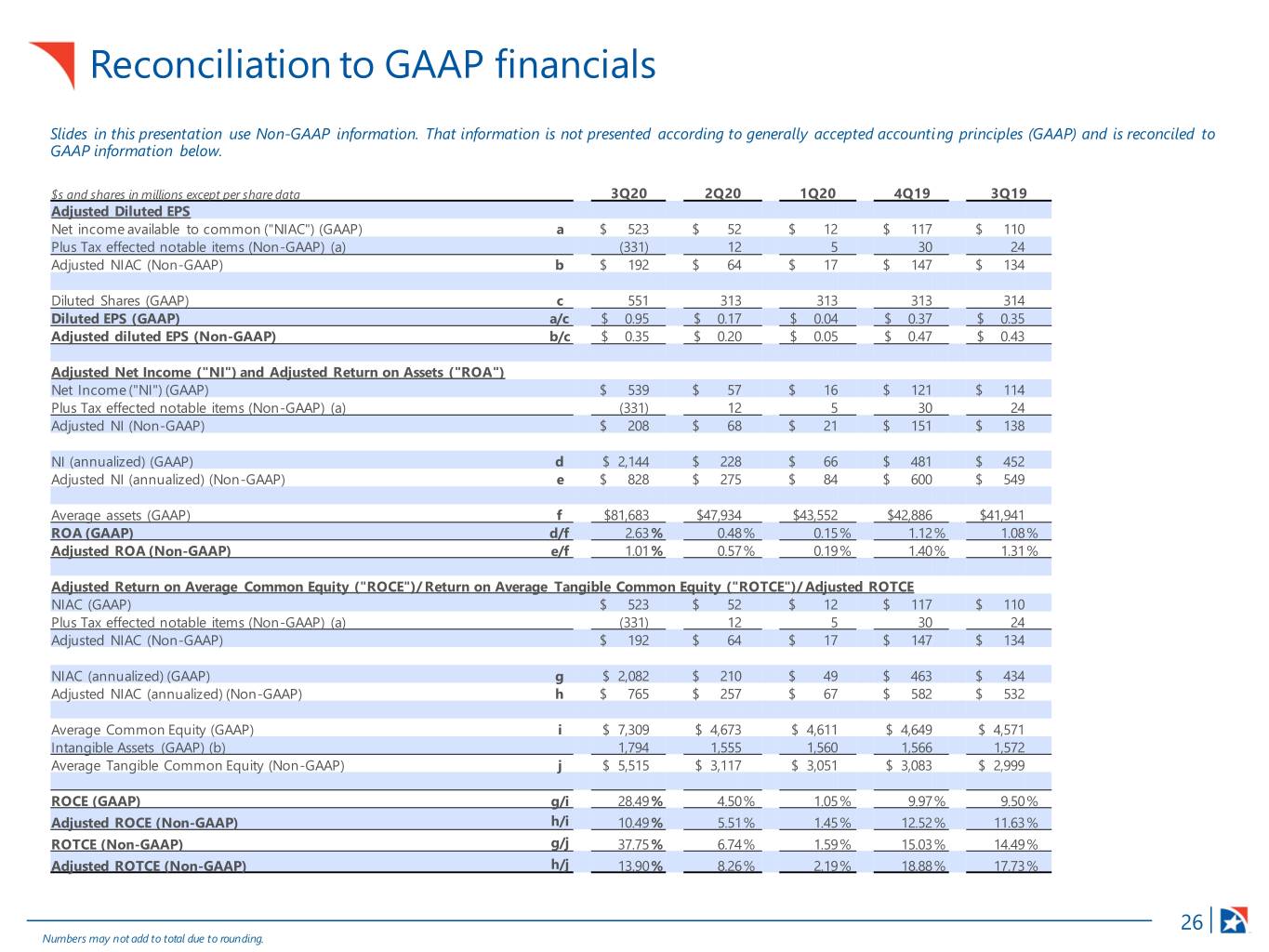

Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. $s and shares in millions except per share data 3Q20 2Q20 1Q20 4Q19 3Q19 Adjusted Diluted EPS Net income available to common ("NIAC") (GAAP) a $ 523 $ 52 $ 12 $ 117 $ 110 Plus Tax effected notable items (Non-GAAP) (a) (331) 12 5 30 24 Adjusted NIAC (Non-GAAP) b $ 192 $ 64 $ 17 $ 147 $ 134 Diluted Shares (GAAP) c 551 313 313 313 314 Diluted EPS (GAAP) a/c $ 0.95 $ 0.17 $ 0.04 $ 0.37 $ 0.35 Adjusted diluted EPS (Non-GAAP) b/c $ 0.35 $ 0.20 $ 0.05 $ 0.47 $ 0.43 Adjusted Net Income ("NI") and Adjusted Return on Assets ("ROA") Net Income ("NI") (GAAP) $ 539 $ 57 $ 16 $ 121 $ 114 Plus Tax effected notable items (Non-GAAP) (a) (331) 12 5 30 24 Adjusted NI (Non-GAAP) $ 208 $ 68 $ 21 $ 151 $ 138 NI (annualized) (GAAP) d $ 2,144 $ 228 $ 66 $ 481 $ 452 Adjusted NI (annualized) (Non-GAAP) e $ 828 $ 275 $ 84 $ 600 $ 549 Average assets (GAAP) f $81,683 $47,934 $43,552 $42,886 $41,941 ROA (GAAP) d/f 2.63% 0.48% 0.15% 1.12% 1.08% Adjusted ROA (Non-GAAP) e/f 1.01% 0.57% 0.19% 1.40% 1.31% Adjusted Return on Average Common Equity ("ROCE")/ Return on Average Tangible Common Equity ("ROTCE")/ Adjusted ROTCE NIAC (GAAP) $ 523 $ 52 $ 12 $ 117 $ 110 Plus Tax effected notable items (Non-GAAP) (a) (331) 12 5 30 24 Adjusted NIAC (Non-GAAP) $ 192 $ 64 $ 17 $ 147 $ 134 NIAC (annualized) (GAAP) g $ 2,082 $ 210 $ 49 $ 463 $ 434 Adjusted NIAC (annualized) (Non-GAAP) h $ 765 $ 257 $ 67 $ 582 $ 532 Average Common Equity (GAAP) i $ 7,309 $ 4,673 $ 4,611 $ 4,649 $ 4,571 Intangible Assets (GAAP) (b) 1,794 1,555 1,560 1,566 1,572 Average Tangible Common Equity (Non-GAAP) j $ 5,515 $ 3,117 $ 3,051 $ 3,083 $ 2,999 ROCE (GAAP) g/i 28.49% 4.50% 1.05% 9.97% 9.50% Adjusted ROCE (Non-GAAP) h/i 10.49% 5.51% 1.45% 12.52% 11.63% ROTCE (Non-GAAP) g/j 37.75 % 6.74% 1.59% 15.03% 14.49% Adjusted ROTCE (Non-GAAP) h/j 13.90% 8.26% 2.19% 18.88% 17.73% 26 Numbers may not add to total due to rounding.

Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. $ in millions except per share data) 3Q20 2Q20 1Q20 4Q19 3Q19 Adjusted Noninterest Income as a % of Total Revenue Noninterest income (GAAP) k $ 823 $ 206 $ 175 $ 183 $ 172 Plus notable items (GAAP) (a) (532) - - - - Adjusted noninterest income (Non-GAAP) l $ 291 $ 206 $ 175 $ 183 $ 172 Revenue (GAAP) m $ 1,355 $ 512 $ 478 $ 495 $ 472 Plus notable items (GAAP) (a) (532) - - - - Adjusted revenue (Non-GAAP) n $ 823 $ 512 $ 478 $ 495 $ 472 Noninterest income as a % of total revenue (GAAP) k/m 60.72% 40.32% 36.59% 37.05% 36.35% Adjusted noninterest income as a % of total revenue (Non-GAAP) l/n 35.32% 40.32% 36.59% 37.05% 36.35% Adjusted Efficiency Ratio Noninterest expense (GAAP) o $ 587 $ 321 $ 302 $ 328 $ 308 Plus notable items (GAAP) (a) (116) (14) (6) (37) (31) Adjusted noninterest expense (Non-GAAP) p $ 471 $ 307 $ 296 $ 291 $ 277 Revenue excluding securities gains/losses (GAAP) q $ 1,357 $ 512 $ 478 $ 495 $ 472 Plus notable items (GAAP) (a) (532) - - - - Adjusted revenue excluding securities gains/losses (Non-GAAP) r $ 825 $ 512 $ 478 $ 495 $ 472 Efficiency ratio (GAAP) o/q 43.31% 62.74% 63.26% 66.35% 65.26% Adjusted efficiency ratio (Non-GAAP) p/r 57.26% 59.95% 62.05% 58.88% 58.61% Adjusted Reserve Build Provision for credit losses (GAAP) s $ 227 $ 121 $ 154 $ 9 $ 14 Plus notable items (GAAP) (a) (147) - - - - Adjusted provision for credit losses (Non-GAAP) t $ 80 $ 121 $ 154 $ 9 $ 14 Net Charge-offs (GAAP) u $ 67 $ 17 $ 7 $ 3 $ 15 Reserve Build s-u $ 160 $ 104 $ 147 $ 6 $ (1) Adjusted Reserve Build t-u $ 13 $ 104 $ 147 $ 6 $ (1) $s in millions except per share data 3Q20 2Q20 1Q20 4Q19 3Q19 Tangible Common Equity (Non-GAAP) (A) Total common equity $ 7 $ 5 $ 5 $ 5 $ 5 Less: Intangible assets (GAAP) 2 2 2 2 2 (B) Tangible common equity (Non-GAAP) $ 6 $ 3 $ 3 $ 3 $ 3 Period-end Shares Outstanding (C) Period-end shares outstanding 555 312 312 311 311 Ratios (A)/(C) Book value per common share (GAAP) $ 13.30 $ 14.96 $ 14.96 $ 15.04 $ 14.80 (B)/(C) Tangible book value per common share (Non-GAAP) $ 9.92 $ 9.99 $ 9.96 $ 10.02 $ 9.76 27 Numbers may not add to total due to rounding.

Reconciliation to GAAP financials ($s in millions) 3Q20 to 3Q20 1Q20 to 2Q20 4Q19 to 1Q20 NII Margin NII Margin NII Margin 3Q20 Reported $ 532 2.84 % 1Q20 Reported $ 303 3.16 % 4Q19 Reported $ 311 3.26 % PPP Loans and Fees 26 (0.00) Prior Period Accretion (9) (0.09) Prior Period Accretion (16) (0.16) Current Period Accretion 44 0.23 1Q20 Core NII 294 3.07 4Q19 Core NII 296 3.10 Time Deposit Amortization 8 0.04 Days - - Days (3) - 3Q20 Core $ 454 2.57 % Loan Rates (primarily (50) (0.48) Loan Rates (primarily (15) (0.15) LIBOR/Prime) LIBOR/Prime) Deposit Rates 30 0.29 Deposit Rates 11 0.11 Loans to Mortgage Companies 15 0.01 Trading Securities & Other 5 - Fed Balances (1) (0.09) Deposit Volume 2 0.02 Other (4) - Loan Volume (2) - 2Q20 Core $ 284 2.80 % Loan Fees & Cash Basis (1) (0.02) % PPP Loans and Fees 15 0.04 1Q20 Core $ 294 3.07 Current Period Accretion 6 0.06 PPP Loans and Fees - - 2Q20 Reported $ 305 2.90 % Current Period Accretion 9 0.09 % 1Q20 Reported $ 303 3.16 % 3Q19 to 4Q219 2Q19 to 3Q19 NII Margin NII Margin 3Q19 Reported $ 301 3.21 % 2Q19 Reported $ 304 3.34 % Prior Period Accretion (7) (0.07) Prior Period Accretion (13) (0.14) 3Q19 Core NII 294 3.14 2Q19 Core NII 290 3.19 Days - - Days 3 - Loan Rates (primarily (19) (0.19) Loan Rates (primarily (12) (0.13) LIBOR/Prime) LIBOR/Prime) Deposit Rates 11 0.11 Deposit Rates 4 0.04 Trading Securities & Other - - Trading Securities & Other - - Deposit Volume 3 0.03 Loans to Mortgage Companies 7 0.01 Loan Volume 3 - Deposit Volume - - Other 4 0.02 % Loan Volume - - 4Q19 Core $ 296 3.10 Loan Fees & Cash Basis 1 0.01 PPP Loans and Fees - - Interest Bearing Cash - 0.01 Current Period Accretion 16 0.16 % Other 1 0.01 4Q19 Reported $ 311 3.26 % 3Q19 Core $ 294 3.14 % PPP Loans and Fees - - Current Period Accretion 7 0.07 3Q19 Reported $ 301 3.21 % 28 Numbers may not add to total due to rounding.