Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - WESTERN ALLIANCE BANCORPORATION | pressrelease-9302020.htm |

| 8-K - 8-K - WESTERN ALLIANCE BANCORPORATION | wal-20201022.htm |

EARNINGS CALL 3rd QUARTER 2020 October 23, 2020

Forward-Looking Statements This release contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding our expectations with regard to our business, financial and operating results, future economic performance and dividends, and the impact of the COVID-19 pandemic and related economic conditions. The forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected results include, among others: the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 as filed with the Securities and Exchange Commission; the potential adverse effects of the ongoing COVID-19 pandemic and any governmental or societal responses thereto, or other unusual and infrequently occurring events; changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; inflation, interest rate, market and monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; changes in management’s estimate of the adequacy of the allowance for credit losses; legislative or regulatory changes including in response to the COVID-19 pandemic such as the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) and the rules and regulations that may be promulgated thereunder; or changes in accounting principles, policies or guidelines (including changes related to CECL); supervisory actions by regulatory agencies which may limit our ability to pursue certain growth opportunities, including expansion through acquisitions; additional regulatory requirements resulting from our continued growth; management’s estimates and projections of interest rates and interest rate policy; the execution of our business plan; and other factors affecting the financial services industry generally or the banking industry in particular. Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it is made. We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements, whether written or oral, that may be made from time to time, set forth in this press release to reflect new information, future events or otherwise. Non-GAAP Financial Measures This presentation contains both financial measures based on GAAP and non-GAAP based financial measures, which are used where management believes them to be helpful in understanding the Company’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the Company's press release as of and for the quarter ended September 30, 2020. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. 2 2

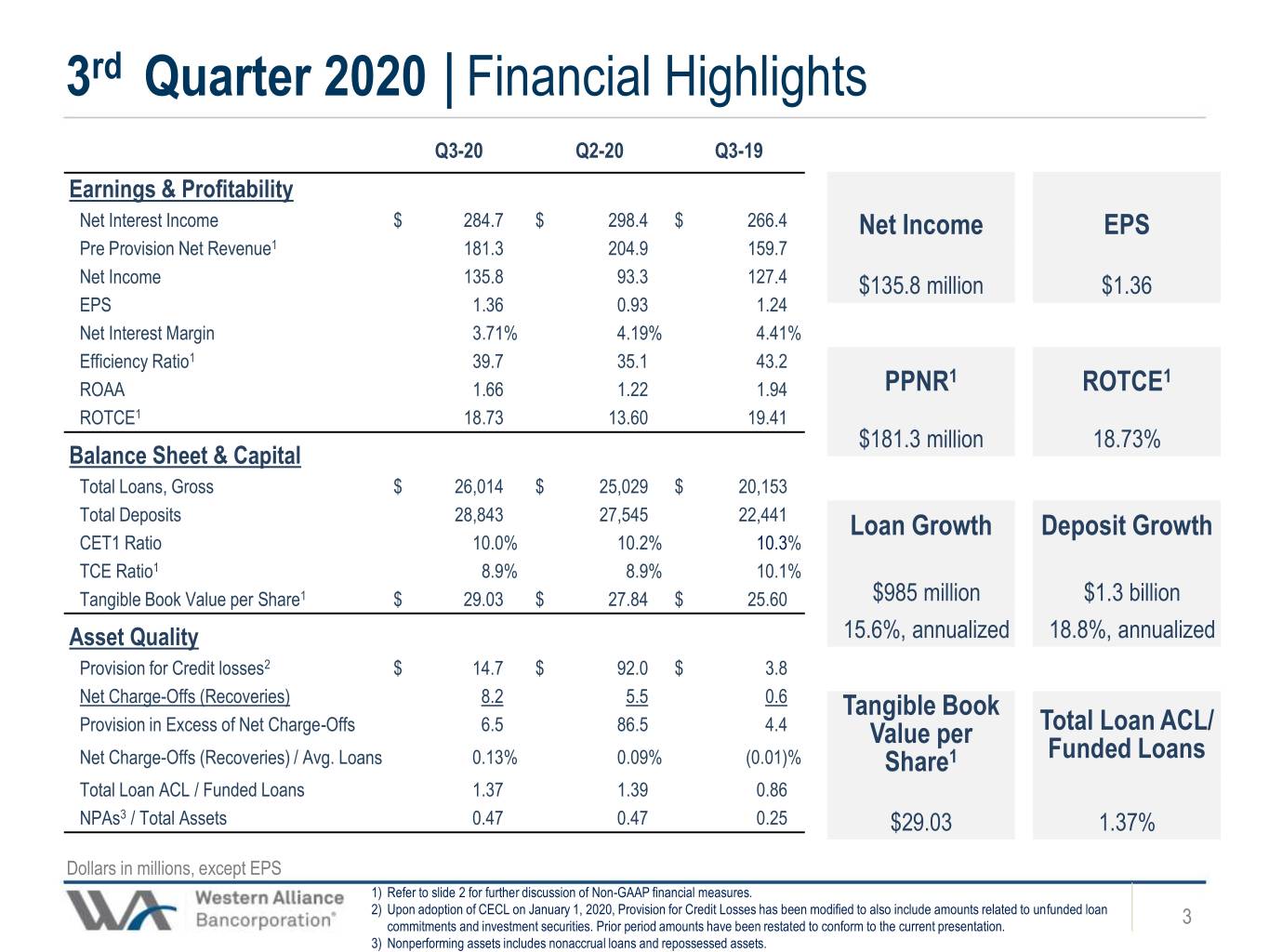

3rd Quarter 2020 | Financial Highlights Q3-20 Q2-20 Q3-19 Earnings & Profitability Net Interest Income $ 284.7 $ 298.4 $ 266.4 Net Income EPS Pre Provision Net Revenue1 181.3 204.9 159.7 Net Income 135.8 93.3 127.4 $135.8 million $1.36 EPS 1.36 0.93 1.24 Net Interest Margin 3.71% 4.19% 4.41% Efficiency Ratio1 39.7 35.1 43.2 1 1 ROAA 1.66 1.22 1.94 PPNR ROTCE ROTCE1 18.73 13.60 19.41 $181.3 million 18.73% Balance Sheet & Capital Total Loans, Gross $ 26,014 $ 25,029 $ 20,153 Total Deposits 28,843 27,545 22,441 Loan Growth Deposit Growth CET1 Ratio 10.0% 10.2% 10.3% TCE Ratio1 8.9% 8.9% 10.1% Tangible Book Value per Share1 $ 29.03 $ 27.84 $ 25.60 $985 million $1.3 billion Asset Quality 15.6%, annualized 18.8%, annualized Provision for Credit losses2 $ 14.7 $ 92.0 $ 3.8 Net Charge-Offs (Recoveries) 8.2 5.5 0.6 Tangible Book Provision in Excess of Net Charge-Offs 6.5 86.5 4.4 Value per Total Loan ACL/ Net Charge-Offs (Recoveries) / Avg. Loans 0.13% 0.09% (0.01)% Share1 Funded Loans Total Loan ACL / Funded Loans 1.37 1.39 0.86 NPAs3 / Total Assets 0.47 0.47 0.25 $29.03 1.37% 3 Dollars in millions, except EPS 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) Upon adoption of CECL on January 1, 2020, Provision for Credit Losses has been modified to also include amounts related to unfunded loan 3 commitments and investment securities. Prior period amounts have been restated to conform to the current presentation. 3 3) Nonperforming assets includes nonaccrual loans and repossessed assets.

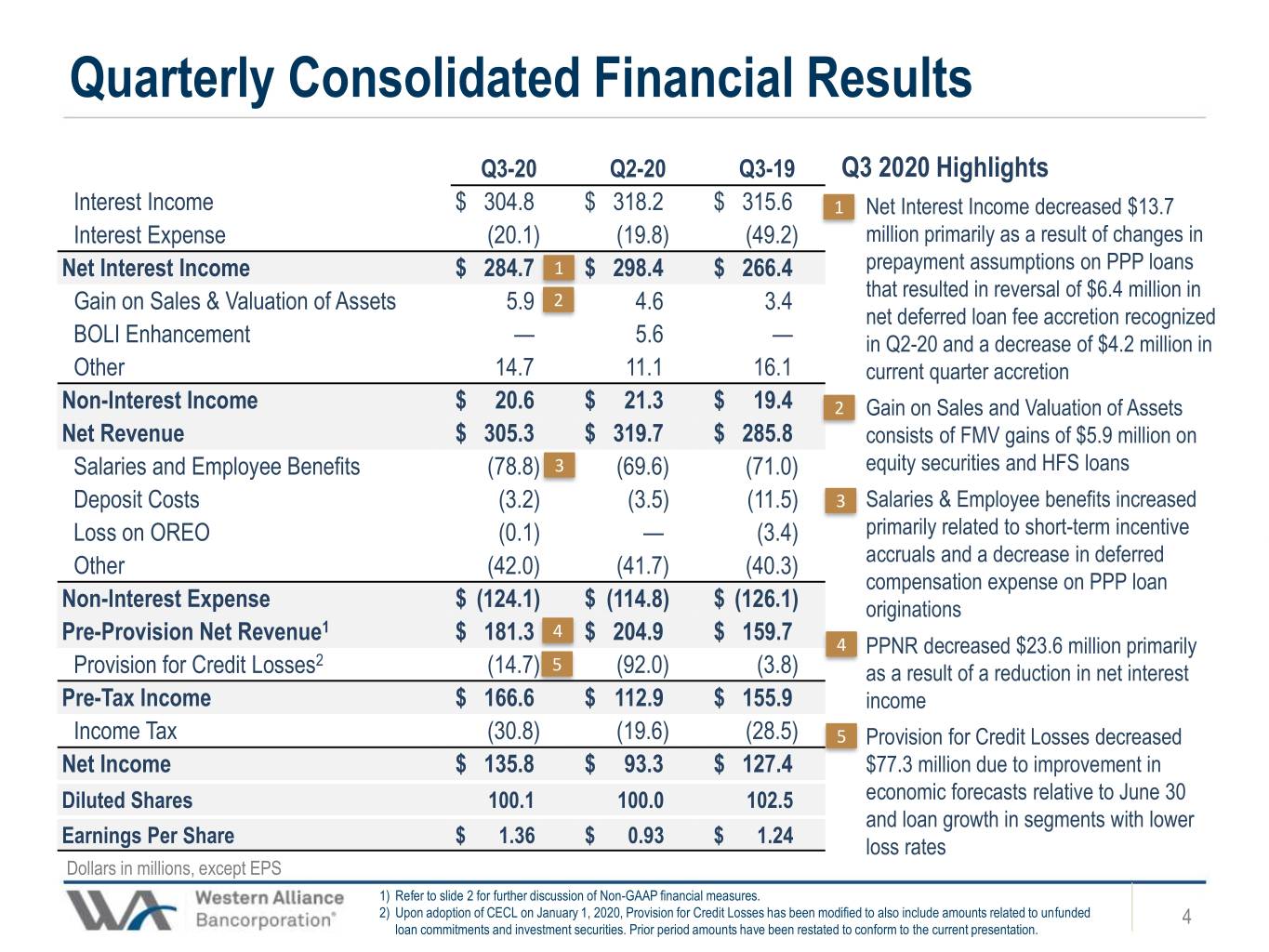

Quarterly Consolidated Financial Results Q3-20 Q2-20 Q3-19 Q3 2020 Highlights Interest Income $ 304.8 $ 318.2 $ 315.6 1• Net Interest Income decreased $13.7 Interest Expense (20.1) (19.8) (49.2) million primarily as a result of changes in Net Interest Income $ 284.7 1 $ 298.4 $ 266.4 prepayment assumptions on PPP loans that resulted in reversal of $6.4 million in Gain on Sales & Valuation of Assets 5.9 2 4.6 3.4 net deferred loan fee accretion recognized BOLI Enhancement — 5.6 — in Q2-20 and a decrease of $4.2 million in Other 14.7 11.1 16.1 current quarter accretion Non-Interest Income $ 20.6 $ 21.3 $ 19.4 2• Gain on Sales and Valuation of Assets Net Revenue $ 305.3 $ 319.7 $ 285.8 consists of FMV gains of $5.9 million on Salaries and Employee Benefits (78.8) 3 (69.6) (71.0) equity securities and HFS loans Deposit Costs (3.2) (3.5) (11.5) 3• Salaries & Employee benefits increased Loss on OREO (0.1) — (3.4) primarily related to short-term incentive Other (42.0) (41.7) (40.3) accruals and a decrease in deferred compensation expense on PPP loan Non-Interest Expense $ (124.1) $ (114.8) $ (126.1) originations Pre-Provision Net Revenue1 $ 181.3 4 $ 204.9 $ 159.7 4• PPNR decreased $23.6 million primarily 2 Provision for Credit Losses (14.7) 5 (92.0) (3.8) as a result of a reduction in net interest Pre-Tax Income $ 166.6 $ 112.9 $ 155.9 income Income Tax (30.8) (19.6) (28.5) 5• Provision for Credit Losses decreased Net Income $ 135.8 $ 93.3 $ 127.4 $77.3 million due to improvement in Diluted Shares 100.1 100.0 102.5 economic forecasts relative to June 30 and loan growth in segments with lower Earnings Per Share $ 1.36 $ 0.93 $ 1.24 loss rates 4 Dollars in millions, except EPS 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) Upon adoption of CECL on January 1, 2020, Provision for Credit Losses has been modified to also include amounts related to unfunded 4 loan commitments and investment securities. Prior period amounts have been restated to conform to the current presentation.

Net Interest Drivers Q3 2020 Highlights $9.0 Total Investments and Yield Spot$40.0 4.00% Loans and Yield Spot Rate Rate6.50% $8.0 $35.0 5.79% 5.58% • Loan yields fell 35bps 2.83%3.50% 5.27% 4.50%5.50% $7.0 3.08% $30.0 4.82% following declines across 2.96% 2.98% 3.02% 4.47% $6.0 3.00% 4.50% most loan types, mainly driven 2.79% $25.0 $5.0 $25.0 $26.0 3.50% by loan mix and lower PPP $20.02.50% $23.2 $4.0 $21.1 yields $4.4 $4.7 $20.2 2.50% $4.1 $4.2 $15.0 $3.0 $4.0 2.00% • Yield on PPP loans of 1.76% $10.0 1.50% $2.0 (5.02% in Q2) includes 1.50% $1.0 $5.0 0.50% prepayment assumptions $0.0 $0.01.00% -0.50% related to forgivable amounts Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 • Cost of interest-bearing deposits decreased 9bps due Interest Bearing Deposits Spot Deposits, Borrowings, and Spot Rate Rate to repricing efforts in a lower $25.0 and Cost $40.0 Cost of Liability Funding 1.50% 0.27%1.50% 0.25% rate environment, driving total 0.87% $35.0 0.75% 0.64% 1.00% 1.30% 1.00% cost of funds down 2bps to $20.0 1.08% 0.30% 0.28% 0.50% 0.90% $30.0 0.28% 0.40% 0.31% 0.50% 0.00% $15.0 $25.0 -0.50% − Spot rate for cost of 0.00% $12.2 $13.0 $20.0 $9.9 -1.00% interest-bearing deposits $10.0 $15.8 -0.50% $8.8 $8.5 -1.50% of 27bps (15bps, including $14.9 $15.3 $15.0 $14.3 -2.00% non-interest DDA) driven $13.7 $10.0-1.00% $15.8 by posted rate changes $5.0 $13.7 -2.50% -1.50% $14.3 $14.9 $15.3 $5.0 -3.00% and pushing out high cost $0.0 -2.00%$0.0 -3.50% deposits Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 5 Dollars in billions, unless otherwise indicated Non-Interest Bearing Deposits Total Borrowings 5

Net Interest Income Net Interest Income, NIM, and Impacts on Quarterly NIM Average Interest Earning Assets Components NIM $298.4 7.50% $300.0 Q2 - 20 4.19 % $284.7 6.50% Impact of PPP Loans (0.13) $280.0 $272.0 $266.4 $269.0 Excess Liquidity (0.21) 5.50% $260.0 Loan Rates (0.09) 4.41% 4.39% 4.22% 4.19% 4.50% 3.84% Investment Yields (0.05) $240.0 4.15% Q3 - 20 3.71 % 3.50% 3.71% $220.0 2.50% $24,548 $25,147 $26,267 $29,326 $31,272 $200.0 1.50% Q3 2020 Highlights Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 • Higher liquidity levels from strong deposit growth and Net Interest Income Net Interest Margin PPP deferred fee recognition drove 48bps decline in NIM ex.PPP Avg. Int. Earning Assets NIM Forecasted Accretion on PPP Loans • NIM contraction driven by the reversal of PPP revenue $15.0 $13.9 Net PPP loan fees of $42.9MM received in Q2-20 will and excess liquidity are transitory and should mitigate be recognized over the estimated life of these loans over time $10.0 − Change in timing of PPP forgiveness assumptions $5.0 $6.9 $6.7 (-13bps) $4.7 $3.3 $4.3 $2.8 − Higher avg. liquidity relative to loans (-21bps) $0.0 Q2-20 Q3-20 Q4-20E Q1-21E Q2-21E Q3-21E Q4-21E • Continue to have asymmetric interest rate sensitivity Current Assumptions 6 Dollars in millions 6

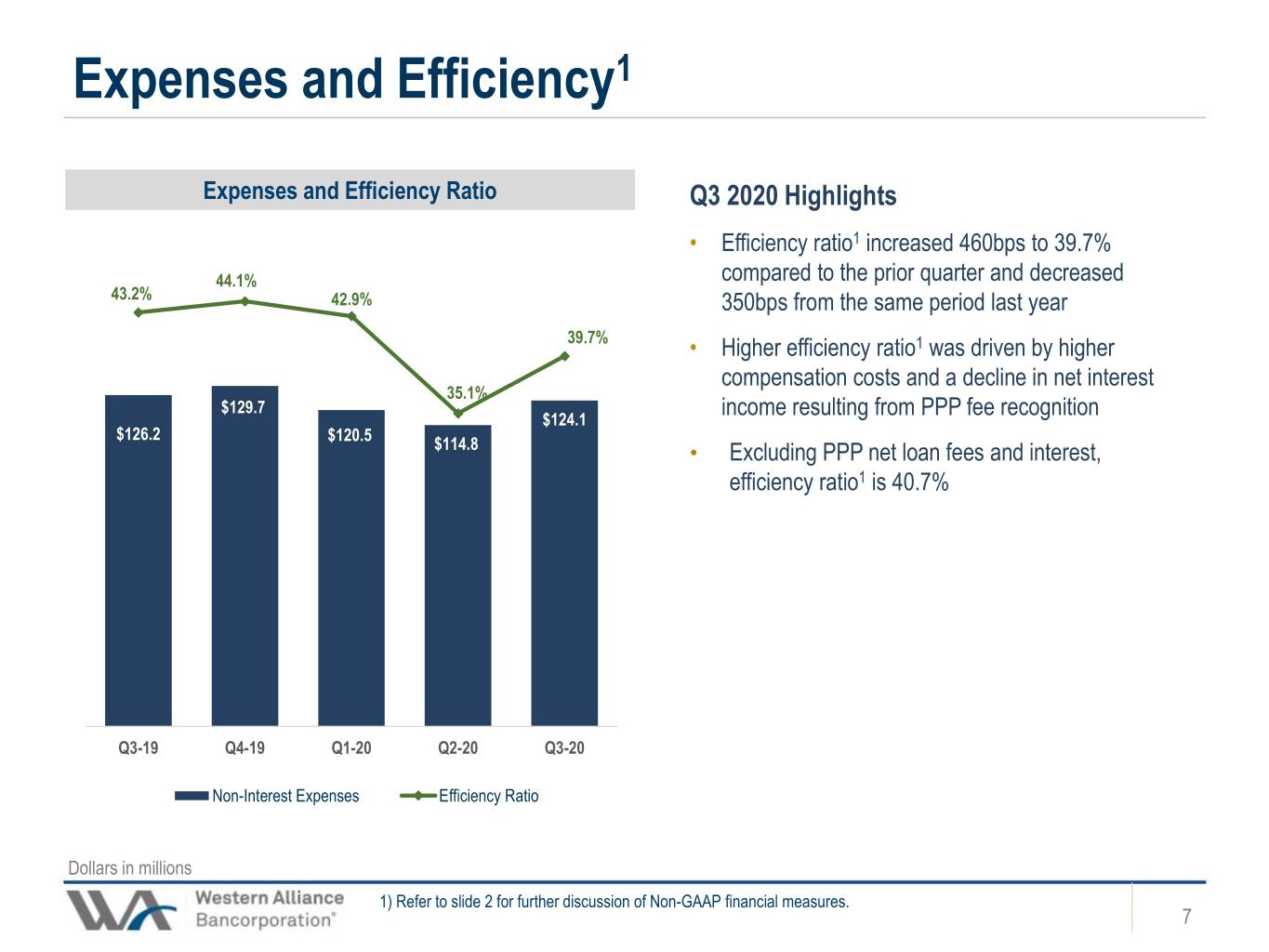

Expenses and Efficiency1 Expenses and Efficiency Ratio Q3 2020 Highlights 50.0% 1 $180.0 • Efficiency ratio increased 460bps to 39.7% 44.1% compared to the prior quarter and decreased 43.2% 45.0% $160.0 42.9% 350bps from the same period last year 39.7% 1 $140.0 40.0% • Higher efficiency ratio was driven by higher compensation costs and a decline in net interest 35.1% $129.7 income resulting from PPP fee recognition $120.0 $124.1 35.0% $126.2 $120.5 $114.8 $100.0 • Excluding PPP net loan fees and interest, 30.0% efficiency ratio1 is 40.7% $80.0 25.0% $60.0 20.0% $40.0 15.0% $20.0 $0.0 10.0% Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Non-Interest Expenses Efficiency Ratio 7 Dollars in millions 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 7 7

Pre-Provision Net Revenue1, Net Income, and ROA 2.69% Q3 2020 Highlights $300.0 2.44% 2.37% 2.50% 2.24% 2.22% • PPNR ROA1 decreased 47 basis points from 1.94% 1.92% the prior quarter and decreased 22 basis $250.0 1.66% points from Q3-19 1.50% 1.22% 1.22% • ROA increased 44 basis points from the prior $200.0 quarter and decreased 28 basis points from $204.9 Q3-19 $181.3 0.50% $150.0 $158.3 $159.7 $153.6 $127.4 -0.50% $135.8 $100.0 $128.1 $93.3 -1.50% $50.0 $84.0 $0.0 -2.50% Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 PPNR Net Income PPNR ROA ROA 8 Dollars in millions 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 8

Consolidated Balance Sheet Q3-20 Q2-20 Q3-19 Q3 2020 Highlights Investments & Cash $ 6,120 $ 5,712 $ 5,020 1• Loans increased $985 million (3.9%) Loans 26,014 1 25,029 20,153 over prior quarter and $5.9 billion Allowance for Credit Losses (311) (311) (165) (29.1%) over prior year Other Assets 1, 513 1,476 1,316 2• Deposits increased $1.3 billion (4.7%) over prior quarter and $6.4 billion Total Assets $ 33,336 $ 31,906 $ 26,324 (28.5%) over prior year 3• Shareholders' Equity increased $122 2 Deposits $ 28,843 $ 27,545 $ 22,441 million over prior quarter and Borrowings 649 653 404 increased $301 million over prior year Other Liabilities 620 606 556 as a function of Net Income, partially Total Liabilities $ 30,112 $ 28,804 $ 23,401 offset by share repurchases, dividends and the adoption impact of Shareholders' Equity 3,224 3 3,102 2,923 CECL Total Liabilities and Equity $ 33,336 $ 31,906 $ 26,324 •4 Tangible Book Value/Share1 increased $1.19 (4.3%) over prior quarter and 1 Tangible Book Value Per Share $ 29.03 4 $ 27.84 $ 25.60 $3.43 (13.4%) over prior year 9 Dollars in millions 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 9

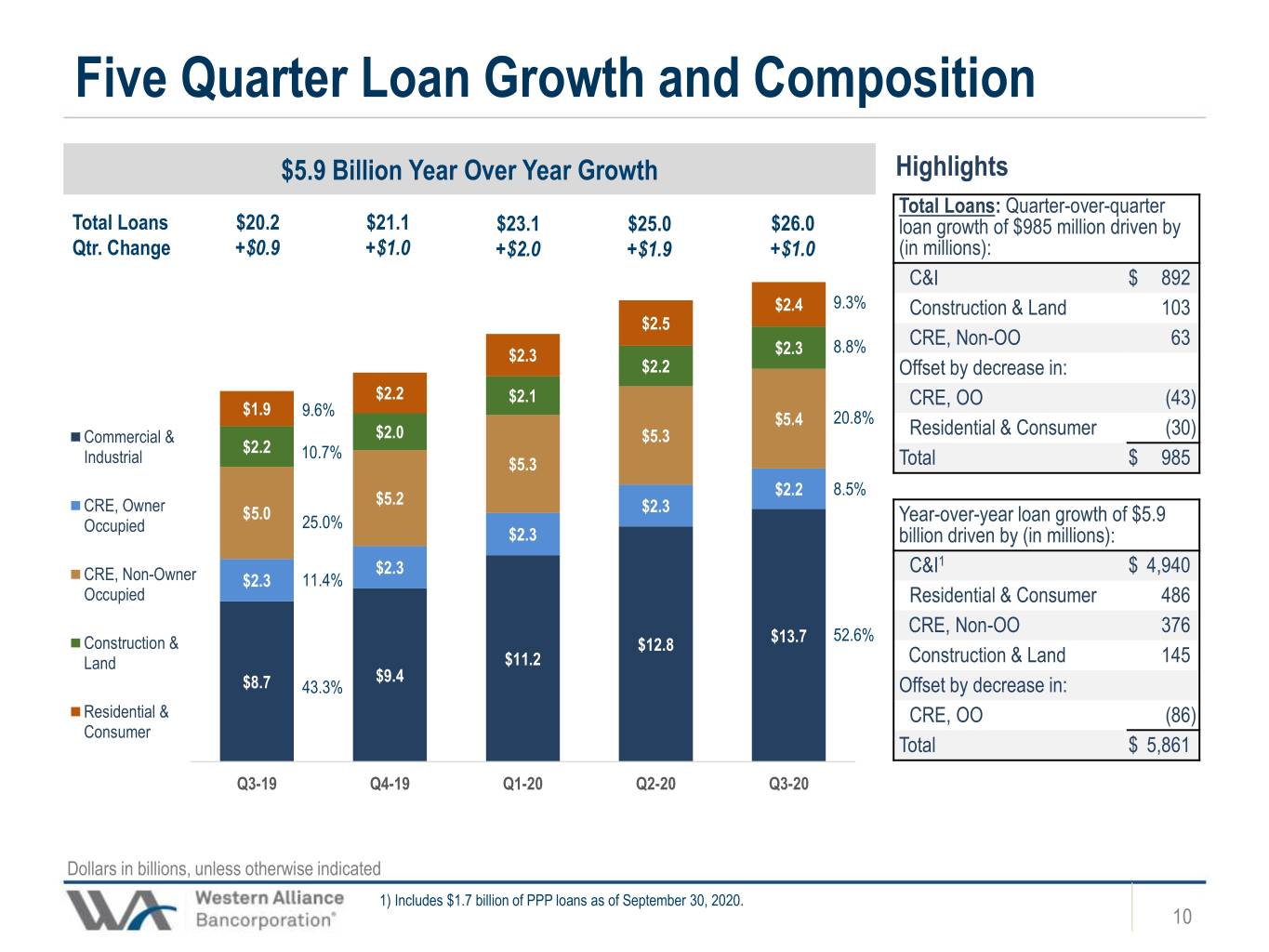

Five Quarter Loan Growth and Composition $5.9 Billion Year Over Year Growth Highlights Total Loans: Quarter-over-quarter Total Loans $20.2 $21.1 $23.1 $25.0 $26.0 loan growth of $985 million driven by Qtr. Change +$0.9 +$1.0 +$2.0 +$1.9 +$1.0 (in millions): C&I $ 892 $2.4 9.3% Construction & Land 103 $2.5 8.8% CRE, Non-OO 63 $2.3 $2.3 $2.2 Offset by decrease in: $2.2 $2.1 CRE, OO (43) $1.9 9.6% $5.4 20.8% Commercial & $2.0 $5.3 Residential & Consumer (30) $2.2 10.7% Industrial $5.3 Total $ 985 $2.2 8.5% $5.2 CRE, Owner $5.0 $2.3 Year-over-year loan growth of $5.9 Occupied 25.0% $2.3 billion driven by (in millions): $2.3 C&I1 $ 4,940 CRE, Non-Owner $2.3 11.4% Occupied Residential & Consumer 486 52.6% CRE, Non-OO 376 Construction & $12.8 $13.7 Land $11.2 Construction & Land 145 $9.4 $8.7 43.3% Offset by decrease in: Residential & CRE, OO (86) Consumer Total $ 5,861 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 10 Dollars in billions, unless otherwise indicated 1) Includes $1.7 billion of PPP loans as of September 30, 2020. 1010

Five Quarter Deposit Growth and Composition $6.4 Billion Year Over Year Growth Highlights Total Deposits $22.4 $22.8 $24.8 $27.5 $28.8 Quarter-over-quarter deposit growth of $1.3 billion driven by (in millions): Qtr. Change +$1.0 +$0.4 +$2.0 +$2.7 +$1.3 Non-Interest Bearing DDA $ 777 Savings and MMDA 752 $1.7 5.9% Interest-Bearing DDA 46 $2.0 Offset by decreases in: CDs (276) $2.4 Total $ 1,299 $10.6 $2.1 9.4% $2.4 36.7% $9.8 Year-over-year deposit growth of $6.4 $9.0 billion driven by (in millions): $9.1 40.4% $9.1 Non-Interest Bearing DDA $ 4,257 Non-Interest $3.6 12.3% Savings and MMDA 1,517 Bearing DDA $3.5 Interest-Bearing DDA 1,045 $3.5 Interest Bearing Offset by decreases in: DDA $2.5 11.2% $2.8 CDs (416) Savings and $13.0 Total $ 6,403 MMDA $12.2 45.1% $9.9 $8.7 39.0% $8.5 CDs Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 11 Dollars in billions, unless otherwise indicated 1111

Payment Deferral Update COVID Related Loan Payment Deferrals Q3 2020 Highlights COVID Loan Deferrals June 30, 2020 September 30, 2020 • Declining need for customer relief % of % of % Deferrals Portfolio Deferrals Outstanding Portfolio Reduction • Deferrals declined $1.6bn or 55% Hotel Franchise Finance $1,695 82.9% $928 $2,099 44.2% (45%) during Q3 Gaming 190 37.3% 18 510 3.6% (90%) − 98% of expired deferrals are CRE Investor 498 15.6% 168 3,229 5.2% (66%) current CRE Owner-Occupied 137 6.6% 15 2,014 0.8% (89%) − New requests since early July Residential Real Estate 180 7.5% 128 2,387 5.3% (29%) have been minimal C&I 108 1.1% 37 11,010 0.3% (65%) − Excluding the HFF portfolio, Construction 45 2.2% 1 2,195 0.1% (97%) deferrals account for 1.6% of the loan portfolio Tech & Innovation 16 0.7% 8 2,321 0.4% (47%) Other 5 1.7% 0 247 0.0% (100%) • Expected that $1.1 billion of Total $2,873 11.5% $1,304 $26,014 5.0% (55%) remaining deferrals will expire during Q4 and resume paying as originally agreed 12 Dollars in millions 1212

Asset Quality Classified Assets Q3 2020 Highlights $350 $326 $298 • Total Classified Assets of $326 million (0.98% to Total Assets) $300 increased $28 million in Q3 $247 $250 $171 $205 $149 – Non-Performing Loans + OREO of $155 million (47bps $200 to Total Assets) an increase of $6 million in Q3 $161 $150 $150 $139 • Special Mention loans increased $81 million, primarily driven $91 $100 by previously identified segments particularly impacted by $140 $146 $86 COVID, such as hotel and travel $50 $50 $56 $0 $16 $14 $11 $9 $9 • Over last 5+ years, less than 1% of Special Mention loans Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 have migrated to loss OREO Non-Performing Loans 1 Classified Accruing Loans Special Mention Loans Asset Quality Ratios 2.50% $600 1.83% 0.98% 1.58% 1.00% 0.94% $500 1.16% 0.84% 0.85% 0.86% 1.50% $400 0.45% $477 0.64% $300 $396 0.50% 0.47% 0.47% 0.50% 0.33% $200 0.25% 0.26% $234 -0.50% $100 $180 $104 $0 0.00%-1.50% Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Special Mention Loans SM to Funded Loans Classified Assets to Total Assets 13 Dollars in millions Non-Performing Loans + OREO to Total Assets 1) Includes HFS loans 1313

CECL and Allowance for Credit Losses (“ACL”) ACL Reserve Build Q3 2020 Highlights • Provision expense of $14.7 million for Q3, primarily driven by balance sheet growth • Total ACL balance of $361 million represents an increase of $7 million from Q2, primarily due to growth in unfunded commitments from Q3 loan origination activity Q2-20 Balance Sheet Outlook Net Charge- Q3-20 Growth Adjustment Offs & Other • Loan ACL balance of $355 million, Allowance for Credit Losses increased $8 million from Q2 $400 $354 $361 $350 $7 $6 $36 $44 $300 $268 $3 $250 $30 $200 $181 $184 $7 $9 $7 $9 $150 $311 $311 $235 $100 $165 $168 $50 $0 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Allowance for Loan & Lease Losses Unfunded Loan Commits. 1 Credit Discounts HTM Securities 14 Dollars in millions 1) Included as a component of other liabilities on the balance sheet 1414

Credit Losses and ACL Ratios Loan ACL Adequacy Ratios Q3 2020 Highlights 3.00% 150% • Total Loan ACL / Funded Loans decreased 2bps to 1.37% in 2.50% 120% 120% 130% Q3 as a result of reduced provision expense 112% 2.00% 112% 110% − Excluding PPP at 1.46% 92% 1.50% 1.39% 90% • Total Provision Expense decreased to $14.7 million, driven by 1.14% 1.37% loan growth in lower loss segments and improved 0.86% 1.00% 0.84% 70% macroeconomic factors 0.50% 50% • Net Charge-Offs of $8.2 million (13bps) compared to $5.5 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 million, 9bps, in Q2-20 Total Loan ACL / Funded Loans Total Loan ACL / Non-Performing Loans + Classified Loans Provision for Loan Credit Losses1 Gross Charge-offs and Recoveries $8.8 $6.6 Gross Charge-Offs Recoveries $8.0 $6.0 $5.7 $5.6 $4.0 $80.7 $45.2 $2.0 $2.1 $2.2 $0.1 $0.0 $8.1 $4.0 $4.0 ($0.2) ($0.6) $8.2 ($2.0)-$2.0 ($0.9) ($0.2) ($4.0)-$4.0 ($2.7) Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 ($3.3) ($6.0)-$6.0 For Unfunded Commitments 2 For Loan Losses Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 15 Dollars in millions ($8.0) 1) Does not include provision for (reversal of) credit losses on HTM Investment Securities of $0.3MM Q1-20, $4.7MM Q2-20 and ($1.7MM) Q3-20 1515 2) Included as a component of provision for credit losses in the income statement

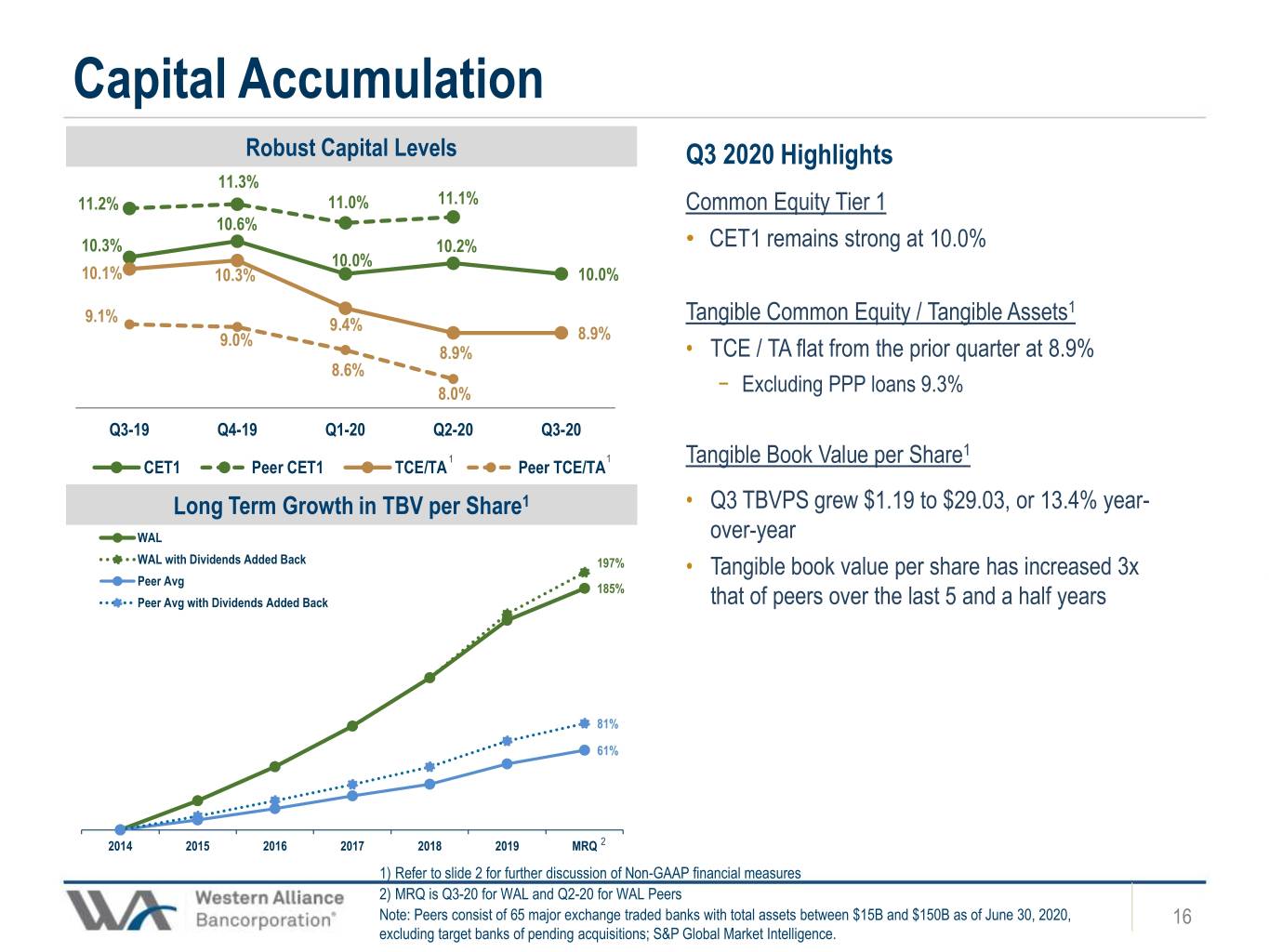

Capital Accumulation Robust Capital Levels Q3 2020 Highlights 11.3% 11.2% 11.0% 11.1% Common Equity Tier 1 10.6% 10.3% 10.2% • CET1 remains strong at 10.0% 10.0% 10.1% 10.3% 10.0% Tangible Common Equity / Tangible Assets1 9.1% 9.4% 9.0% 8.9% 8.9% • TCE / TA flat from the prior quarter at 8.9% 8.6% 8.0% − Excluding PPP loans 9.3% Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 1 1 1 Tangible Book Value per Share CET1 Peer CET1 TCE/TA Peer TCE/TA Long Term Growth in TBV per Share1 • Q3 TBVPS grew $1.19 to $29.03, or 13.4% year- WAL over-year WAL with Dividends Added Back 197% • Tangible book value per share has increased 3x Peer Avg 185% Peer Avg with Dividends Added Back that of peers over the last 5 and a half years 81% 61% 2014 2015 2016 2017 2018 2019 MRQ 2 16 1) Refer to slide 2 for further discussion of Non-GAAP financial measures 2) MRQ is Q3-20 for WAL and Q2-20 for WAL Peers Note: Peers consist of 65 major exchange traded banks with total assets between $15B and $150B as of June 30, 2020, 1616 excluding target banks of pending acquisitions; S&P Global Market Intelligence.

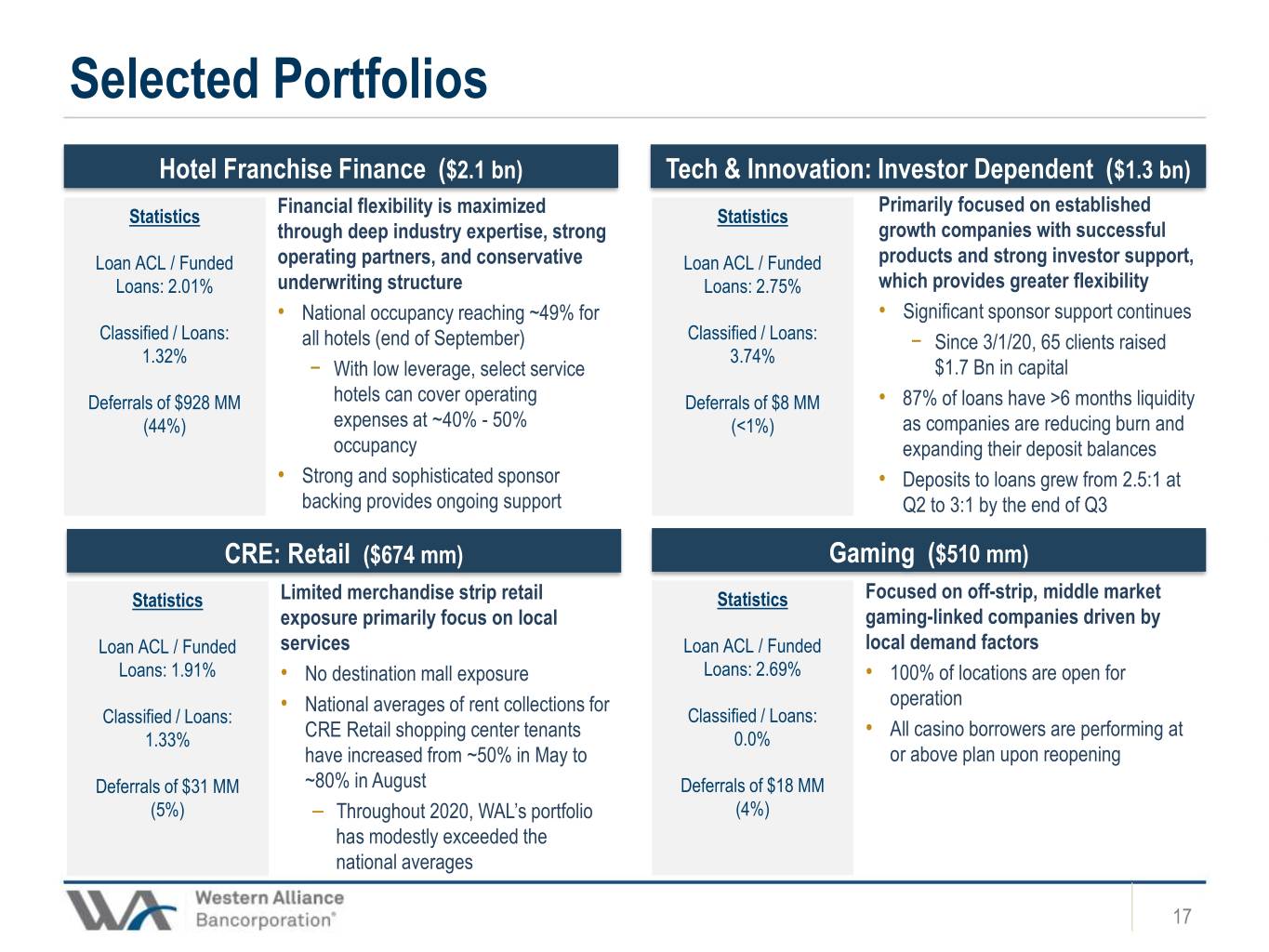

Selected Portfolios Hotel Franchise Finance ($2.1 bn) Tech & Innovation: Investor Dependent ($1.3 bn) Financial flexibility is maximized Primarily focused on established Statistics Statistics through deep industry expertise, strong growth companies with successful Loan ACL / Funded operating partners, and conservative Loan ACL / Funded products and strong investor support, Loans: 2.01% underwriting structure Loans: 2.75% which provides greater flexibility • National occupancy reaching ~49% for • Significant sponsor support continues Classified / Loans: all hotels (end of September) Classified / Loans: − Since 3/1/20, 65 clients raised 1.32% 3.74% − With low leverage, select service $1.7 Bn in capital Deferrals of $928 MM hotels can cover operating Deferrals of $8 MM • 87% of loans have >6 months liquidity (44%) expenses at ~40% - 50% (<1%) as companies are reducing burn and occupancy expanding their deposit balances • Strong and sophisticated sponsor • Deposits to loans grew from 2.5:1 at backing provides ongoing support Q2 to 3:1 by the end of Q3 CRE: Retail ($674 mm) Gaming ($510 mm) Statistics Limited merchandise strip retail Statistics Focused on off-strip, middle market exposure primarily focus on local gaming-linked companies driven by Loan ACL / Funded services Loan ACL / Funded local demand factors Loans: 1.91% • No destination mall exposure Loans: 2.69% • 100% of locations are open for • National averages of rent collections for operation Classified / Loans: Classified / Loans: All casino borrowers are performing at 1.33% CRE Retail shopping center tenants 0.0% • Statistics have increased from ~50% in May to or above plan upon reopening LoanDeferrals ACL / Funded of $31 Loans: MM ~80% in August Deferrals of $18 MM 2.79%(5%) – Throughout 2020, WAL’s portfolio (4%) Adv. Graded / Loans: has modestly exceeded the 6.9% national averages 17 1717

Management Outlook • Balance Sheet Growth • Interest Margin • Pre-Provision Net Revenue • Asset Quality • Capital and Liquidity 18 1818

Questions and Answers 1919