Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITY BANCORP INC /NJ/ | unty-20201021x8k.htm |

Exhibit 99.1

For Immediate Release | News Media & Financial Analyst Contact: |

Unity Bancorp, Inc. (NSDQ: UNTY) | James A. Hughes, President and CEO |

October 21, 2020 | (908) 713-4306 |

Unity Bancorp Reports

Unity Bancorp Reports

Quarterly Earnings of $5.8 Million

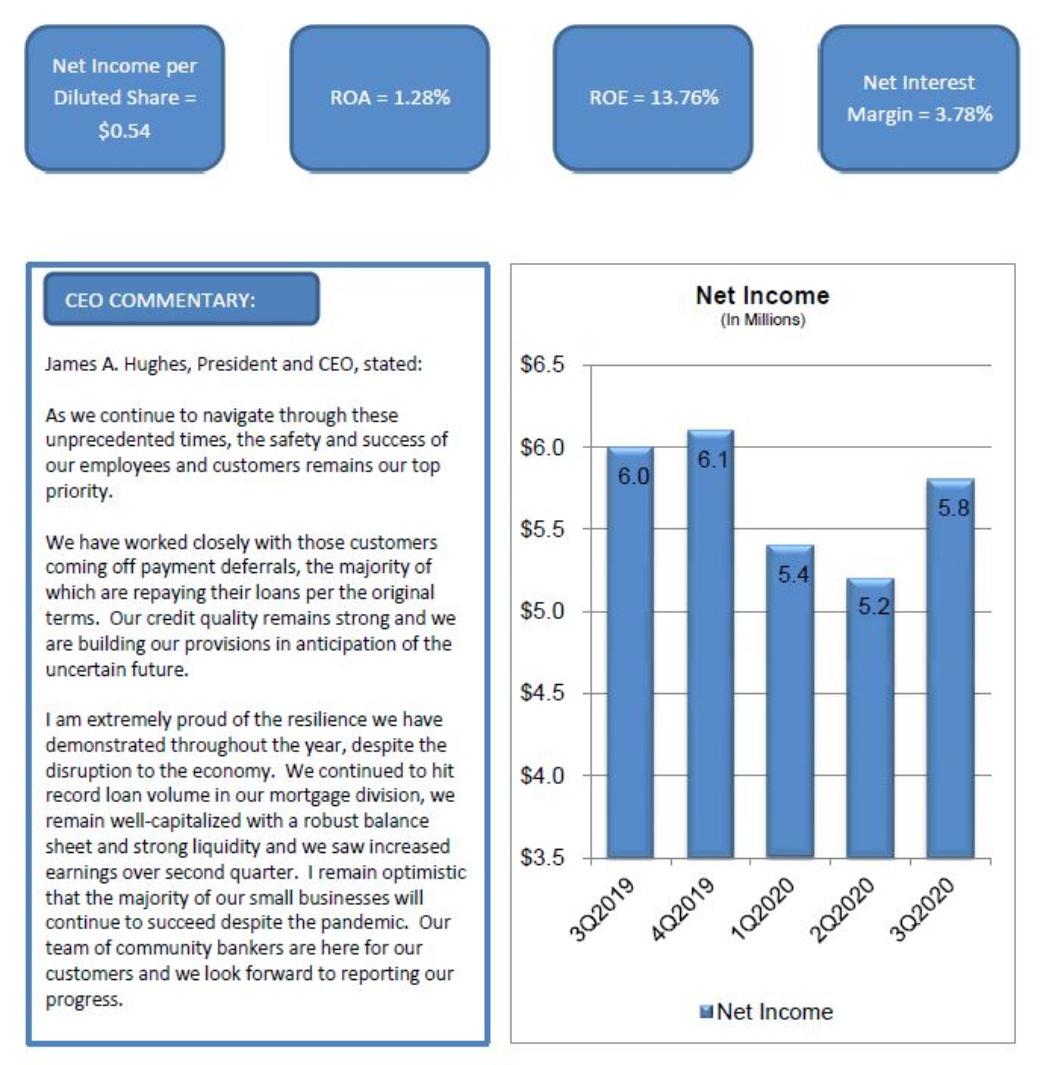

Clinton, NJ, October 21, 2020 - Unity Bancorp, Inc. (NASDAQ: UNTY), parent company of Unity Bank, reported net income of $5.8 million, or $0.54 per diluted share, for the quarter ended September 30, 2020, a 3.3 percent decrease compared to net income of $6.0 million, or $0.54 per diluted share for the prior year’s third quarter. For the nine months ended September 30, 2020, Unity reported net income of $16.3 million, or $1.50 per diluted share, a 7.0 percent decrease compared to net income of $17.5 million or $1.59 per diluted share for the prior year’s period. The decreases in earnings were primarily due to an increased provision for loan losses, necessitated by the COVID-19 pandemic.

Third Quarter Earnings Highlights

| ● | Net interest income, our primary driver of earnings, increased $1.9 million to $16.3 million for the quarter ended September 30, 2020, compared to the prior year’s quarter, due to SBA PPP loans, commercial loan growth and a reduction in the cost of funds. |

| ● | Net interest margin (NIM) decreased to 3.78% for the quarter ended September 30, 2020, compared to 3.90% for the prior year’s quarter and increased 5 basis points from 3.73% in the prior sequential quarter ended June 30, 2020. The year-over-year decrease was a direct result of interest rate cuts by the Board of Governors of the Federal Reserve. |

| ● | The provision for loan losses was $2.0 million for the quarter ended September 30, 2020, an increase of $1.3 million from the prior year’s quarter due to the increased risk of loan defaults as a result of COVID-19. |

| ● | Noninterest income increased $626 thousand to $3.3 million compared to the prior year’s quarter and increased $525 thousand compared to the prior sequential quarter. The increases were primarily due to increased gains on mortgage loan sales. Mortgage banking has been strong and market conditions continue to be favorable. For the quarter ended September 30, 2020, quarterly residential mortgage loan sales were $85.8 million, compared to $35.2 million for the quarter ended September 30, 2019. |

| ● | Noninterest expense increased $1.3 million to $10.0 million compared to the prior year’s quarter, primarily due to increased consulting expenses incurred in connection with compliance with our Consent Order with the FDIC and NJDOBI and increased compensation due to increased mortgage commissions. |

| ● | The effective tax rate was 24.5% compared to 22.0% in the prior year’s quarter. |

Balance Sheet Highlights

| ● | Total loans increased $187.7 million, or 13.2%, from year-end 2019 to $1.6 billion at September 30, 2020. The increase was primarily due to $138.9 million in SBA PPP loan originations. |

| ● | Total deposits increased $243.3 million, or 19.5%, from year-end 2019 to $1.5 billion at September 30, 2020, primarily due to increased noninterest-bearing demand deposits, resulting from the distribution of PPP funds and a strategic increase in brokered time deposits in the first quarter. |

| ● | Borrowed funds decreased $43.0 million to $240.0 million at September 30, 2020, due to decreased FHLB overnight advances. |

| ● | Shareholders’ equity was $169.2 million at September 30, 2020, an increase of $8.5 million from year-end 2019, due primarily to retained net income. During the third quarter, the Company repurchased 161,554 shares of common stock for a total cost of $2.1 million. |

| ● | Book value per common share was $16.01 as of September 30, 2020. |

| ● | At September 30, 2020, the Community Bank Leverage Ratio was 9.95%. |

| ● | Nonperforming assets were $9.7 million at September 30, 2020, compared to $7.4 million at December 31, 2019. The allowance to total loans ratio was 1.4% at September 30, 2020. |

Paycheck Protection Program Loans

As of September 30, 2020, the Company funded 1,224 Small Business Administration (“SBA”) Paycheck Protection Program (“PPP”) loans, totaling $143.0 million. Under the PPP, established by the U.S. Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Company was able to assist numerous small businesses in continuing to pay expenses, including payroll to retain their staff. PPP loans booked have an annual interest rate of 1% and are 100% guaranteed by the SBA. Most of these loans have a two-year term, to the extent the principle amount is not forgiven under the terms of the program. Gross origination fees of $5.5 million were earned on PPP loans and will be recognized over the life of the loans or when the loan is forgiven.

Loan Deferrals

The Bank has prudently worked with borrowers that may be unable to meet their contractual obligations because of the effects of COVID-19. All deferrals mature no later than December 31, 2020. As shown in the tables below, loans granted deferrals have significantly declined during the third quarter. The Company anticipates there will be some future deferrals granted on SBA loans, since all SBA loans were being paid by the CARES Act through September 30, 2020.

The table below summarizes loan deferrals as of September 30, 2020.

(In thousands) | | Total Loan Portfolio balance | | Full Deferrals | | Interest Only Deferrals * | | Total Loans in Deferral | | % Deferrals to Total Loans | ||||

SBA loans held for sale | | $ | 6,192 | | $ | — | | $ | — | | $ | — | | 0% |

SBA loans held for investment | | | 47,125 | | | — | | | — | | | — | | 0% |

SBA PPP loans | | | 138,895 | | | — | | | — | | | — | | 0% |

Commercial loans | |

| 799,573 | |

| 14,068 | |

| 22,319 | |

| 36,387 | | 5% |

Residential mortgage loans (1) | |

| 473,420 | |

| 24,255 | |

| — | |

| 24,255 | | 5% |

Consumer loans | |

| 148,086 | |

| — | |

| — | |

| — | | 0% |

Total loans | | $ | 1,613,291 | | $ | 38,323 | | $ | 22,319 | | $ | 60,642 | | 4% |

* The borrower pays the contractual interest, but no amortization of principal. These borrowers are deemed well secured and are not expected to default.

The table below summarizes loan deferrals as of June 30, 2020.

(In thousands) | | Total Loan Portfolio balance | | Total Loans in Deferral | | | % Deferrals to Total Loans | ||

SBA loans held for sale | | $ | 10,602 | | $ | — | | | 0% |

SBA loans held for investment | | | 36,966 | | | — | | | 0% |

SBA PPP loans | | | 136,039 | | | — | | | 0% |

Commercial loans | |

| 792,752 | |

| 277,323 | | | 35% |

Residential mortgage loans (1) | |

| 469,987 | |

| 68,142 | | | 14% |

Consumer loans | |

| 146,161 | |

| 9,144 | | | 6% |

Total loans | | $ | 1,592,507 | | $ | 354,609 | | | 22% |

Unity Bancorp, Inc. is a financial service organization headquartered in Clinton, New Jersey, with approximately $1.9 billion in assets and $1.5 billion in deposits. Unity Bank provides financial services to retail, corporate and small business customers through its 19 retail service centers located in Bergen, Hunterdon, Middlesex, Somerset, Union and Warren Counties in New Jersey and Northampton County in Pennsylvania. For additional information about Unity, visit our website at www.unitybank.com , or call 800-618-BANK.

This news release contains certain forward-looking statements, either expressed or implied, which are provided to assist the reader in understanding anticipated future financial performance. These statements may be identified by use of the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project” or similar expressions. These statements involve certain risks, uncertainties, estimates and assumptions made by management, which are subject to factors beyond the company’s control and could impede its ability to achieve these goals. These factors include those items included in our Annual Report on Form 10-K under the heading “Item IA-Risk Factors” as well as general economic conditions, trends in interest rates, the ability of our borrowers to repay their loans, our ability to manage and reduce the level of our nonperforming assets, and results of regulatory exams, among other factors.

UNITY BANCORP, INC.

SUMMARY FINANCIAL HIGHLIGHTS

September 30, 2020

| | | |

|

| |

|

| |

| | Sept. 30, 2020 vs. | | ||

| | | | | | | | | | | | Jun. 30, 2020 | | Sept. 30, 2019 | |

(In thousands, except percentages and per share amounts) |

| Sept. 30, 2020 |

| Jun. 30, 2020 |

| Sept. 30, 2019 |

|

| % |

| % | | |||

BALANCE SHEET DATA: | |

| | |

| | |

| | | |

| |

| |

Total assets | | $ | 1,930,836 | | $ | 1,900,774 | | $ | 1,664,308 | | | 1.6 | % | 16.0 | % |

Total deposits |

| | 1,493,440 |

| | 1,483,457 |

| | 1,273,362 |

| | 0.7 |

| 17.3 |

|

Total loans |

| | 1,613,291 |

| | 1,592,507 |

| | 1,368,474 |

| | 1.3 |

| 17.9 |

|

Total securities |

| | 50,387 |

| | 54,888 |

| | 63,991 |

| | (8.2) |

| (21.3) |

|

Total shareholders' equity |

| | 169,234 |

| | 166,607 |

| | 154,884 |

| | 1.6 |

| 9.3 |

|

Allowance for loan losses |

| | (22,237) |

| | (20,234) |

| | (16,002) |

| | 9.9 |

| 39.0 |

|

| | | | | | | | | | | | | | | |

FINANCIAL DATA - QUARTER TO DATE: |

| |

|

| | |

| | |

| | |

| |

|

Income before provision for income taxes | | $ | 7,626 | | $ | 6,659 | | $ | 7,635 |

| | 14.5 |

| (0.1) |

|

Provision for income taxes | |

| 1,866 | |

| 1,488 | |

| 1,676 |

| | 25.4 |

| 11.3 |

|

Net income | | $ | 5,760 | | $ | 5,171 | | $ | 5,959 |

| | 11.4 |

| (3.3) |

|

| | | | | | | | | | | | | | | |

Net income per common share - Basic | | $ | 0.54 | | $ | 0.48 | | $ | 0.55 |

| | 12.5 |

| (1.8) |

|

Net income per common share - Diluted | | $ | 0.54 | | $ | 0.47 | | $ | 0.54 |

| | 14.9 |

| - |

|

| | | | | | | | | | | | | | | |

Performance ratios: | |

| | |

| | |

| |

| |

|

|

|

|

Return on average assets | |

| 1.28 | % |

| 1.19 | % |

| 1.53 | % | |

| | | |

Return on average equity | |

| 13.76 | % |

| 12.59 | % |

| 15.57 | % | |

| | | |

Efficiency ratio | |

| 50.80 | % |

| 50.27 | % |

| 51.06 | % | |

| | | |

Net interest margin | |

| 3.78 | % |

| 3.73 | % |

| 3.90 | % | |

| | | |

Noninterest expense to average assets | |

| 2.23 | % |

| 2.10 | % |

| 2.24 | % | |

| | | |

| | | | | | | | | | | | | | | |

FINANCIAL DATA - YEAR TO DATE: |

| |

|

| |

|

| | |

| | |

|

|

|

Income before provision for income taxes | | $ | 21,251 | | | | | $ | 22,375 |

| | |

| (5.0) |

|

Provision for income taxes | |

| 4,952 | | | | |

| 4,842 |

| | |

| 2.3 |

|

Net income | | $ | 16,299 | | | | | $ | 17,533 |

| | |

| (7.0) |

|

| | | | | | | | | | | | | | | |

Net income per common share - Basic | | $ | 1.51 | | | | | $ | 1.62 |

| | |

| (6.8) |

|

Net income per common share - Diluted | | $ | 1.50 | | | | | $ | 1.59 |

| | |

| (5.7) |

|

| | | | | | | | | | | | | | | |

Performance ratios: | |

| | | | | |

| |

| |

|

|

|

|

Return on average assets | |

| 1.26 | % | | | |

| 1.54 | % | |

| | (18.2) | |

Return on average equity | |

| 13.20 | % | | | |

| 16.02 | % | |

| | (17.6) | |

Efficiency ratio | |

| 50.98 | % | | | |

| 52.25 | % | |

| | (2.4) | |

Net interest margin | |

| 3.81 | % | | | |

| 3.97 | % | |

| | (4.0) | |

Noninterest expense to average assets | |

| 2.20 | % | | | |

| 2.28 | % | |

| | (3.5) | |

| | | | | | | | | | | | | | | |

SHARE INFORMATION: | |

|

| | | | |

|

|

| |

|

|

|

|

Market price per share | | $ | 11.58 | | $ | 14.30 | | $ | 22.15 |

| | (19.0) | | (47.7) |

|

Dividends paid | | $ | 0.08 | | $ | 0.08 | | $ | 0.08 |

| | - | | - |

|

Book value per common share | | $ | 16.01 | | $ | 15.53 | | $ | 14.25 |

| | 3.1 | | 12.4 |

|

Average diluted shares outstanding (QTD) | |

| 10,706 | |

| 10,888 | |

| 11,036 |

| | (1.7) | | (3.0) |

|

| | | | | | | | | | | | | | | |

CAPITAL RATIOS: | |

|

| |

| | |

| |

| |

|

|

|

|

Total equity to total assets | |

| 8.76 | % |

| 8.77 | % |

| 9.31 | % | |

| | | |

Community bank leverage ratio | |

| 9.95 | % |

| 10.01 | % |

| 10.54 | % | |

| | | |

| | | | | | | | | | | | | | | |

CREDIT QUALITY AND RATIOS: | |

|

| |

|

| |

|

|

| |

|

|

|

|

Nonperforming assets | | $ | 9,699 | | $ | 10,184 | | $ | 7,305 |

| | (4.8) | | 32.8 |

|

QTD net (recoveries) chargeoffs to QTD average loans | |

| - | % |

| (0.09) | % |

| 0.21 | % | |

| | | |

Allowance for loan losses to total loans | |

| 1.38 | % |

| 1.27 | % |

| 1.17 | % | |

| | | |

Nonperforming assets to total loans | |

| 0.56 | % |

| 0.59 | % |

| 0.41 | % | |

| | | |

Nonperforming assets to total assets | |

| 0.50 | % |

| 0.54 | % |

| 0.44 | % | |

| | | |

UNITY BANCORP, INC.

CONSOLIDATED BALANCE SHEETS

September 30, 2020

|

| | |

|

| |

|

| |

| | September 30, 2020 vs. |

| ||

| | | | | | | | | | | | December 31, | | September 30, |

|

| | September 30, | | December 31, | | September 30, | | | 2019 | | 2019 | | |||

(In thousands, except percentages) |

| 2020 |

| 2019 |

| 2019 |

| | % |

| % | | |||

ASSETS | |

| | |

| | |

| | | |

| |

|

|

Cash and due from banks | | $ | 21,601 | | $ | 21,106 | | $ | 29,426 | | | 2.3 | % | (26.6) | % |

Federal funds sold and interest-bearing deposits |

| | 179,794 | | | 136,910 | | | 137,334 |

| | 31.3 | | 30.9 | |

Cash and cash equivalents |

| | 201,395 | | | 158,016 | | | 166,760 |

| | 27.5 | | 20.8 | |

Securities: |

| | | | | | | | |

| | | | | |

Securities available for sale |

| | 48,713 | | | 64,275 | | | 47,295 |

| | (24.2) | | 3.0 | |

Securities held to maturity |

| | - | | | - | | | 14,332 |

| | - | | (100.0) | |

Equity securities |

| | 1,674 | | | 2,289 | | | 2,364 |

| | (26.9) | | (29.2) | |

Total securities |

| | 50,387 | | | 66,564 | | | 63,991 |

| | (24.3) | | (21.3) | |

Loans: |

| | | | | | | | |

| | | | | |

SBA loans held for sale |

| | 6,192 | | | 13,529 | | | 13,053 |

| | (54.2) | | (52.6) | |

SBA loans held for investment |

| | 47,125 | | | 35,767 | | | 36,380 |

| | 31.8 | | 29.5 | |

SBA PPP loans | | | 138,895 | | | - | | | - | | | 100.0 | | 100.0 | |

Commercial loans |

| | 799,573 | | | 765,032 | | | 723,249 |

| | 4.5 | | 10.6 | |

Residential mortgage loans |

| | 473,420 | | | 467,706 | | | 456,963 |

| | 1.2 | | 3.6 | |

Consumer loans |

| | 148,086 | | | 143,524 | | | 138,829 |

| | 3.2 | | 6.7 | |

Total loans |

| | 1,613,291 | | | 1,425,558 | | | 1,368,474 |

| | 13.2 | | 17.9 | |

Allowance for loan losses |

| | (22,237) | | | (16,395) | | | (16,002) |

| | 35.6 | | 39.0 | |

Net loans |

| | 1,591,054 | | | 1,409,163 | | | 1,352,472 |

| | 12.9 | | 17.6 | |

Premises and equipment, net |

| | 20,507 | | | 21,315 | | | 21,700 |

| | (3.8) | | (5.5) | |

Bank owned life insurance ("BOLI") |

| | 26,482 | | | 26,323 | | | 25,302 |

| | 0.6 | | 4.7 | |

Deferred tax assets |

| | 8,433 | | | 5,559 | | | 5,768 |

| | 51.7 | | 46.2 | |

Federal Home Loan Bank ("FHLB") stock |

| | 12,394 | | | 14,184 | | | 10,899 |

| | (12.6) | | 13.7 | |

Accrued interest receivable |

| | 10,169 | | | 6,984 | | | 6,858 |

| | 45.6 | | 48.3 | |

Other real estate owned ("OREO") |

| | 711 | | | 1,723 | | | 1,723 |

| | (58.7) | | (58.7) | |

Goodwill |

| | 1,516 | | | 1,516 | | | 1,516 |

| | - | | - | |

Other assets |

| | 7,788 | | | 7,595 | | | 7,319 |

| | 2.5 | | 6.4 | |

Total assets | | $ | 1,930,836 | | $ | 1,718,942 | | $ | 1,664,308 |

| | 12.3 | % | 16.0 | % |

| | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | |

|

| |

|

| |

|

|

| |

|

|

| |

Liabilities: | |

|

| |

|

| |

|

|

| |

|

|

| |

Deposits: | |

|

| |

|

| |

|

|

| |

|

|

| |

Noninterest-bearing demand | | $ | 412,863 | | $ | 279,793 | | $ | 279,238 |

| | 47.6 | % | 47.9 | % |

Interest-bearing demand | |

| 205,475 | | | 176,335 | | | 179,661 |

| | 16.5 | | 14.4 | |

Savings | |

| 453,801 | | | 389,795 | | | 394,333 |

| | 16.4 | | 15.1 | |

Time Deposits | |

| 421,301 | | | 404,191 | | | 420,130 |

| | 4.2 | | 0.3 | |

Total deposits | |

| 1,493,440 | | | 1,250,114 | | | 1,273,362 |

| | 19.5 | | 17.3 | |

Borrowed funds | |

| 240,000 | | | 283,000 | | | 210,000 |

| | (15.2) | | 14.3 | |

Subordinated debentures | |

| 10,310 | | | 10,310 | | | 10,310 |

| | - | | - | |

Accrued interest payable | |

| 283 | | | 455 | | | 420 |

| | (37.8) | | (32.6) | |

Accrued expenses and other liabilities | |

| 17,569 | | | 14,354 | | | 15,332 |

| | 22.4 | | 14.6 | |

Total liabilities | |

| 1,761,602 | | | 1,558,233 | | | 1,509,424 |

| | 13.1 | | 16.7 | |

Shareholders' equity: | |

| | | | | | | |

| | | | | |

Common stock | |

| 91,474 | | | 90,113 | | | 89,753 |

| | 1.5 | | 1.9 | |

Retained earnings | |

| 84,168 | | | 70,442 | | | 65,199 |

| | 19.5 | | 29.1 | |

Treasury stock, at cost | |

| (5,135) | | | - | | | - |

| | (100.0) | | (100.0) | |

Accumulated other comprehensive (loss) income | |

| (1,273) | | | 154 | | | (68) |

| | NM* | | NM* | |

Total shareholders' equity | |

| 169,234 | | | 160,709 | | | 154,884 |

| | 5.3 | | 9.3 | |

Total liabilities and shareholders' equity | | $ | 1,930,836 | | $ | 1,718,942 | | $ | 1,664,308 |

| | 12.3 | % | 16.0 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

COMMON SHARES AT PERIOD END: | |

|

| |

|

| |

|

|

| |

|

|

| |

Shares issued | |

| 10,943 | | | 10,881 | | | 10,869 |

| |

|

|

| |

Shares oustanding | |

| 10,570 | | | 10,881 | | | 10,869 |

| |

|

|

| |

Treasury shares | |

| 373 | | | - | | | - |

| |

|

|

| |

NM=Not meaningful

UNITY BANCORP, INC.

QTD CONSOLIDATED STATEMENTS OF INCOME

September 30, 2020

| | | | | | | | | | | | Sept. 30, 2020 vs. | | ||||||||

| | For the three months ended | | | Jun. 30, 2020 |

| Sept. 30, 2019 |

| |||||||||||||

(In thousands, except percentages and per share amounts) |

| Sept. 30, 2020 |

| Jun. 30, 2020 |

| Sept. 30, 2019 |

|

| $ |

| % |

| $ |

| % |

| |||||

INTEREST INCOME | |

| | |

| | |

| | | |

| | |

| |

| | |

|

|

Federal funds sold and interest-bearing deposits | | $ | 24 | | $ | 23 | | $ | 271 | | | $ | 1 |

| 4.3 | % | $ | (247) |

| (91.1) | % |

FHLB stock | |

| 79 | | | 79 | | | 82 | | |

| - |

| - | |

| (3) |

| (3.7) | |

Securities: | |

| | | | | | | | | |

| |

| | |

| |

| | |

Taxable | |

| 383 | | | 437 | | | 463 | | |

| (54) |

| (12.4) | |

| (80) |

| (17.3) | |

Tax-exempt | |

| 11 | | | 17 | | | 26 | | |

| (6) |

| (35) | |

| (15) |

| (57.7) | |

Total securities | |

| 394 | | | 454 | | | 489 | | |

| (60) |

| (13.2) | |

| (95) |

| (19.4) | |

Loans: | |

| | | | | | | | | |

| |

| | |

| |

| | |

SBA loans | |

| 631 | | | 709 | | | 943 | | |

| (78) |

| (11.0) | |

| (312) |

| (33.1) | |

SBA PPP loans | | | 1,036 | | | 723 | | | - | | | | 313 | | 43.3 | | | 1,036 | | 100.0 | |

Commercial loans | |

| 10,099 | | | 9,815 | | | 9,467 | | |

| 284 |

| 2.9 | |

| 632 |

| 6.7 | |

Residential mortgage loans | |

| 5,490 | | | 5,554 | | | 5,606 | | |

| (64) |

| (1.2) | |

| (116) |

| (2.1) | |

Consumer loans | |

| 2,011 | | | 1,921 | | | 2,197 | | |

| 90 |

| 4.7 | |

| (186) |

| (8.5) | |

Total loans | |

| 19,267 | | | 18,722 | | | 18,213 | | |

| 545 |

| 2.9 | |

| 1,054 |

| 5.8 | |

Total interest income | |

| 19,764 | | | 19,278 | | | 19,055 | | |

| 486 |

| 2.5 | |

| 709 |

| 3.7 | |

INTEREST EXPENSE | |

|

| |

|

| |

|

| | |

|

|

|

| |

|

|

|

| |

Interest-bearing demand deposits | |

| 347 | | | 364 | | | 438 | | |

| (28) |

| (5.5) | |

| 69 |

| 16.9 | |

Savings deposits | |

| 473 | | | 512 | | | 1,194 | | |

| (145) |

| (14.6) | |

| (268) |

| (23.9) | |

Time deposits | |

| 2,157 | | | 2,454 | | | 2,577 | | |

| 8 |

| 0.3 | |

| 440 |

| 21.9 | |

Borrowed funds and subordinated debentures | |

| 460 | | | 423 | | | 442 | | |

| (43) |

| (7.1) | |

| (184) |

| (24.6) | |

Total interest expense | |

| 3,437 | | | 3,753 | | | 4,651 | | |

| (208) |

| (4.6) | |

| 57 |

| 1.3 | |

Net interest income | |

| 16,327 | | | 15,525 | | | 14,404 | | |

| 481 |

| 3.3 | |

| 1,028 |

| 7.2 | |

Provision for loan losses | |

| 2,000 | | | 2,500 | | | 750 | | |

| 1,000 |

| 200.0 | |

| 1,000 |

| 200.0 | |

Net interest income after provision for loan losses | |

| 14,327 | | | 13,025 | | | 13,654 | | |

| (519) |

| (3.6) | |

| 28 |

| 0.2 | |

NONINTEREST INCOME | |

| | | | | | | | | |

|

|

|

| |

|

|

|

| |

Branch fee income | |

| 237 | | | 207 | | | 373 | | |

| 30 |

| 14.5 | |

| (136) |

| (36.5) | |

Service and loan fee income | |

| 419 | | | 390 | | | 522 | | |

| 29 |

| 7.4 | |

| (103) |

| (19.7) | |

Gain on sale of SBA loans held for sale, net | |

| 534 | | | 92 | | | - | | |

| 442 |

| 480.4 | |

| 534 |

| 10,000.0 | |

Gain on sale of mortgage loans, net | |

| 1,713 | | | 1,553 | | | 545 | | |

| 160 |

| 10.3 | |

| 1,168 |

| 214.3 | |

BOLI income | |

| 147 | | | 154 | | | 138 | | |

| (7) |

| (4.5) | |

| 9 |

| 6.5 | |

Net security (losses) gains | |

| (96) | | | 79 | | | 18 | | |

| (175) |

| (221.5) | |

| (114) |

| (633.3) | |

Gain on sale of premises and equipment | | | - | | | - | | | 764 | | | | - | | - | | | (764) | | (100.0) | |

Other income | |

| 382 | | | 336 | | | 350 | | |

| 46 |

| 13.7 | |

| 32 |

| 9.1 | |

Total noninterest income | |

| 3,336 | | | 2,811 | | | 2,710 | | |

| 525 |

| 18.7 | |

| 626 |

| 23.1 | |

NONINTEREST EXPENSE | |

| | | | | | | | | |

|

|

|

| |

|

|

|

| |

Compensation and benefits | |

| 5,761 | | | 5,553 | | | 5,353 | | |

| 208 |

| 3.7 | |

| 408 |

| 7.6 | |

Processing and communications | |

| 722 | | | 769 | | | 749 | | |

| (47) |

| (6.1) | |

| (27) |

| (3.6) | |

Furniture and equipment | |

| 637 | | | 641 | | | 711 | | |

| (4) |

| (0.6) | |

| (74) |

| (10.4) | |

Occupancy | |

| 639 | | | 630 | | | 651 | | |

| 9 |

| 1.4 | |

| (12) |

| (1.8) | |

BSA expenses | |

| 626 | | | 488 | | | - | | |

| 138 |

| 28.3 | |

| 626 |

| 100.0 | |

Professional services | | | 274 | | | 261 | | | 274 | | | | 13 | | 5.0 | | | - | | - | |

Advertising | |

| 191 | | | 207 | | | 334 | | |

| (16) |

| (7.7) | |

| (143) |

| (42.8) | |

Other loan expenses | |

| 216 | | | 168 | | | 89 | | |

| 48 |

| 28.6 | |

| 127 |

| 142.7 | |

Deposit insurance | |

| 197 | | | 159 | | | - | | |

| 38 |

| 24 | |

| 197 |

| 100.0 | |

Director fees | |

| 191 | | | 181 | | | 171 | | |

| 10 |

| 5.5 | |

| 20 |

| 11.7 | |

Loan collection & OREO expenses (income) | |

| 33 | | | 1 | | | (48) | | |

| 32 |

| 3,200.0 | |

| 81 |

| 168.8 | |

Other expenses | |

| 550 | | | 119 | | | 445 | | |

| 431 |

| 362.2 | |

| 105 |

| 23.6 | |

Total noninterest expense | |

| 10,037 | | | 9,177 | | | 8,729 | | |

| 860 |

| 9.4 | |

| 1,308 |

| 15.0 | |

Income before provision for income taxes | |

| 7,626 | | | 6,659 | | | 7,635 | | |

| 967 |

| 14.5 | |

| (9) |

| (0.1) | |

Provision for income taxes | |

| 1,866 | | | 1,488 | | | 1,676 | | |

| 378 |

| 25.4 | |

| 190 |

| 11.3 | |

Net income | | $ | 5,760 | | $ | 5,171 | | $ | 5,959 | | | $ | 589 | | 11.4 | % | $ | (199) | | (3.3) | % |

| | | | | | | | | | | | | | | | | | | | | |

Effective tax rate | | | 24.5 | % | | 22.3 | % | | 22.0 | % | | | | | | | | | | | |

Net income per common share - Basic | | $ | 0.54 | | $ | 0.48 | | $ | 0.55 | | | | | | | | | | | | |

Net income per common share - Diluted | | $ | 0.54 | | $ | 0.47 | | $ | 0.54 | | | | | | | | | | | | |

Weighted average common shares outstanding - Basic | | | 10,630 | | | 10,792 | | | 10,863 | | | | | | | | | | | | |

Weighted average common shares outstanding - Diluted | | | 10,706 | | | 10,888 | | | 11,036 | | | | | | | | | | | | |

UNITY BANCORP, INC.

YTD CONSOLIDATED STATEMENTS OF INCOME

September 30, 2020

| | For the nine months ended | | | Current YTD vs. Prior YTD |

| |||||||

(In thousands, except percentages and per share amounts) |

| September 30, 2020 |

| September 30, 2019 |

|

| $ |

| % |

| |||

INTEREST INCOME | |

| | |

| | | |

| | |

|

|

Federal funds sold and interest-bearing deposits | | $ | 236 | | $ | 724 | | | $ | (488) |

| (67.4) | % |

FHLB stock | |

| 268 | | | 275 | | |

| (7) |

| (2.5) | |

Securities: | |

| | | | | | |

| |

| | |

Taxable | |

| 1,331 | | | 1,400 | | |

| (69) |

| (4.9) | |

Tax-exempt | |

| 50 | | | 81 | | |

| (31) |

| (38.3) | |

Total securities | |

| 1,381 | | | 1,481 | | |

| (100) |

| (6.8) | |

Loans: | |

| | | | | | |

| |

| | |

SBA loans | |

| 2,323 | | | 2,880 | | |

| (557) |

| (19.3) | |

SBA PPP loans | | | 1,760 | | | - | | | | 1,760 | | 100.0 | |

Commercial loans | |

| 29,848 | | | 27,892 | | |

| 1,956 |

| 7.0 | |

Residential mortgage loans | |

| 16,814 | | | 16,702 | | |

| 112 |

| 0.7 | |

Consumer loans | |

| 5,999 | | | 6,382 | | |

| (383) |

| (6.0) | |

Total loans | |

| 56,744 | | | 53,856 | | |

| 2,888 |

| 5.4 | |

Total interest income | |

| 58,629 | | | 56,336 | | |

| 2,293 |

| 4.1 | |

INTEREST EXPENSE | |

|

| |

|

| | |

| |

| | |

Interest-bearing demand deposits | |

| 1,189 | | | 1,289 | | |

| (100) |

| (7.8) | |

Savings deposits | |

| 1,836 | | | 3,500 | | |

| (1,664) |

| (47.5) | |

Time deposits | |

| 7,056 | | | 7,023 | | |

| 33 |

| 0.5 | |

Borrowed funds and subordinated debentures | |

| 1,449 | | | 1,695 | | |

| (246) |

| (14.5) | |

Total interest expense | |

| 11,530 | | | 13,507 | | |

| (1,977) |

| (14.6) | |

Net interest income | |

| 47,099 | | | 42,829 | | |

| 4,270 |

| 10.0 | |

Provision for loan losses | |

| 6,000 | | | 1,600 | | |

| 4,400 |

| 275.0 | |

Net interest income after provision for loan losses | |

| 41,099 | | | 41,229 | | |

| (130) |

| (0.3) | |

NONINTEREST INCOME | |

| | | | | | |

| |

| | |

Branch fee income | |

| 761 | | | 1,120 | | |

| (359) |

| (32.1) | |

Service and loan fee income | |

| 1,185 | | | 1,533 | | |

| (348) |

| (22.7) | |

Gain on sale of SBA loans held for sale, net | |

| 1,099 | | | 554 | | |

| 545 |

| 98.4 | |

Gain on sale of mortgage loans, net | |

| 4,317 | | | 1,525 | | |

| 2,792 |

| 183.1 | |

BOLI income | |

| 474 | | | 435 | | |

| 39 |

| 9.0 | |

Net security (losses) gains | |

| (187) | | | 216 | | |

| (403) |

| (186.6) | |

Other income | |

| 1,043 | | | 1,760 | | |

| (717) |

| (40.7) | |

Total noninterest income | |

| 8,692 | | | 7,143 | | |

| 1,549 |

| 21.7 | |

NONINTEREST EXPENSE | |

| | | | | | |

| |

| | |

Compensation and benefits | |

| 16,752 | | | 15,384 | | |

| 1,368 |

| 8.9 | |

Processing and communications | |

| 2,199 | | | 2,213 | | |

| (14) |

| (0.6) | |

Furniture and equipment | |

| 1,933 | | | 2,088 | | |

| (155) |

| (7.4) | |

Occupancy | |

| 1,892 | | | 1,997 | | |

| (105) |

| (5.3) | |

BSA expenses | |

| 1,176 | | | - | | |

| 1,176 |

| 100.0 | |

Professional services | | | 805 | | | 839 | | | | (34) | | (4.1) | |

Advertising | |

| 688 | | | 1,056 | | |

| (368) |

| (34.8) | |

Other loan expenses | |

| 572 | | | 499 | | |

| 73 |

| 14.6 | |

Deposit insurance | |

| 473 | | | 202 | | |

| 271 |

| 134.2 | |

Director fees | |

| 444 | | | 301 | | |

| 143 |

| 47.5 | |

Loan collection & OREO expenses (income) | |

| 220 | | | 9 | | |

| 211 |

| 2,344.4 | |

Other expenses | |

| 1,386 | | | 1,409 | | |

| (23) |

| (1.6) | |

Total noninterest expense | |

| 28,540 | | | 25,997 | | |

| 2,543 |

| 9.8 | |

Income before provision for income taxes | |

| 21,251 | | | 22,375 | | |

| (1,124) |

| (5.0) | |

Provision for income taxes | |

| 4,952 | | | 4,842 | | |

| 110 |

| 2.3 | |

Net income | | $ | 16,299 | | $ | 17,533 | | | $ | (1,234) | | (7.0) | % |

| | | | | | | | | | | | | |

Effective tax rate | | | 23.3 | % | | 21.6 | % | | | | | | |

Net income per common share - Basic | | $ | 1.51 | | $ | 1.62 | | | | | | | |

Net income per common share - Diluted | | $ | 1.50 | | $ | 1.59 | | | | | | | |

Weighted average common shares outstanding - Basic | | | 10,768 | | | 10,836 | | | | | | | |

Weighted average common shares outstanding - Diluted | | | 10,875 | | | 11,019 | | | | | | | |

UNITY BANCORP, INC.

QUARTER TO DATE NET INTEREST MARGIN

September 30, 2020

(Dollar amounts in thousands, interest amounts and interest rates/yields on a fully tax-equivalent basis)

| | For the three months ended | | |||||||||||||||

| | September 30, 2020 | | September 30, 2019 | | |||||||||||||

|

| Average |

| | |

| | |

| Average |

| | |

| | | ||

|

| Balance | | Interest | | Rate/Yield | | Balance | | Interest | | Rate/Yield | | |||||

ASSETS |

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

Interest-earning assets: |

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

Federal funds sold and interest-bearing deposits | | $ | 66,759 | | $ | 24 | | | 0.14 | % | $ | 51,744 | | $ | 271 | | 2.08 | % |

FHLB stock | |

| 5,996 | | | 79 | | | 5.24 | |

| 5,138 | | | 82 | | 6.33 | |

Securities: | |

| | | | | | | | |

| | | | | | | |

Taxable | |

| 50,118 | | | 383 | | | 3.04 | |

| 58,144 | | | 463 | | 3.16 | |

Tax-exempt | |

| 2,678 | | | 15 | | | 2.23 | |

| 4,418 | | | 32 | | 2.87 | |

Total securities (A) | |

| 52,796 | | | 398 | | | 3.00 | |

| 62,562 | | | 495 | | 3.14 | |

Loans: | |

| | | | | | | | |

| | | | | | | |

SBA loans | |

| 49,751 | | | 631 | | | 5.05 | |

| 47,187 | | | 943 | | 7.93 | |

SBA PPP loans | | | 138,221 | | | 1,036 | | | 2.98 | | | - | | | - | | - | |

Commercial loans | |

| 792,255 | | | 10,099 | | | 5.07 | |

| 713,785 | | | 9,467 | | 5.26 | |

Residential mortgage loans | |

| 463,575 | | | 5,490 | | | 4.71 | |

| 450,105 | | | 5,606 | | 4.94 | |

Consumer loans | |

| 147,567 | | | 2,011 | | | 5.42 | |

| 136,239 | | | 2,197 | | 6.40 | |

Total loans (B) | |

| 1,591,369 | | | 19,267 | | | 4.82 | |

| 1,347,316 | | | 18,213 | | 5.36 | |

Total interest-earning assets | | $ | 1,716,920 | | $ | 19,768 | | | 4.58 | % | $ | 1,466,760 | | $ | 19,061 | | 5.16 | % |

| | | | | | | | | | | | | | | | | | |

Noninterest-earning assets: | |

|

| |

|

|

| |

| |

|

| |

|

|

|

| |

Cash and due from banks | |

| 23,487 | | | |

| |

| |

| 24,345 | |

|

|

|

| |

Allowance for loan losses | |

| (21,680) | | | |

| |

| |

| (16,224) | |

|

|

|

| |

Other assets | |

| 75,807 | | | |

| |

| |

| 70,484 | |

|

|

|

| |

Total noninterest-earning assets | |

| 77,614 | | | |

| |

| |

| 78,605 | |

|

|

|

| |

Total assets | | $ | 1,794,534 | | | |

| |

| | $ | 1,545,365 | |

|

|

|

| |

| | | | | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | |

|

| |

|

|

| |

| |

|

| |

|

|

|

| |

Interest-bearing liabilities: | |

|

| |

|

|

| |

| |

|

| |

|

|

|

| |

Total interest-bearing demand deposits | | $ | 201,176 | | $ | 347 | | | 0.69 | % | $ | 176,953 | | $ | 438 |

| 0.98 | % |

Total savings deposits | |

| 428,739 | | | 473 | | | 0.44 | |

| 398,676 | | | 1,194 |

| 1.19 | |

Total time deposits | |

| 449,333 | | | 2,157 | | | 1.91 | |

| 432,035 | | | 2,577 |

| 2.37 | |

Total interest-bearing deposits | |

| 1,079,248 | | | 2,977 | | | 1.10 | |

| 1,007,664 | | | 4,209 |

| 1.66 | |

Borrowed funds and subordinated debentures | |

| 108,137 | | | 460 | | | 1.69 | |

| 92,326 | | | 442 |

| 1.90 | |

Total interest-bearing liabilities | | $ | 1,187,385 | | $ | 3,437 | | | 1.15 | % | $ | 1,099,990 | | $ | 4,651 |

| 1.68 | % |

| | | | | | | | | | | | | | | | | | |

Noninterest-bearing liabilities: | |

| | | | | | | | |

| | | | |

| | |

Noninterest-bearing demand deposits | |

| 422,759 | | | | | | | |

| 279,150 | | | |

| | |

Other liabilities | |

| 17,838 | | | | | | | |

| 14,364 | | | |

| | |

Total noninterest-bearing liabilities | |

| 440,597 | | | | | | | |

| 293,514 | | | |

| | |

Total shareholders' equity | |

| 166,552 | | | | | | | |

| 151,861 | | | |

| | |

Total liabilities and shareholders' equity | | $ | 1,794,534 | | | | | | | | $ | 1,545,365 | | | |

| | |

| | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | $ | 16,331 | | | 3.43 | % | | | | $ | 14,410 |

| 3.48 | % |

Tax-equivalent basis adjustment | | | | | | (4) | | | | | | | | | (6) |

| | |

Net interest income | | | | | $ | 16,327 | | | | | | | | $ | 14,404 |

| | |

Net interest margin | | | | | | | | | 3.78 | % |

|

| |

|

|

| 3.90 | % |

| (A) | Yields related to securities exempt from federal and state income taxes are stated on a fully tax-equivalent basis. They are reduced by the nondeductable portion of interest expense, assuming a federal tax rate of 21 percent and applicable state rates. |

| (B) | The loan averages are stated net of unearned income, and the averages include loans on which the accrual of interest has been discontinued. |

UNITY BANCORP, INC.

QUARTER TO DATE NET INTEREST MARGIN

September 30, 2020

(Dollar amounts in thousands, interest amounts and interest rates/yields on a fully tax-equivalent basis)

| | For the three months ended | | |||||||||||||||

| | September 30, 2020 | | June 30, 2020 | | |||||||||||||

|

| Average |

| | |

| | |

| Average |

| | |

| | | ||

|

| Balance | | Interest | | Rate/Yield | | Balance | | Interest | | Rate/Yield | | |||||

ASSETS |

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

Interest-earning assets: |

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

Federal funds sold and interest-bearing deposits | | $ | 66,759 | | $ | 24 | | | 0.14 | % | $ | 73,899 | | $ | 23 | | 0.13 | % |

FHLB stock | |

| 5,996 | | | 79 | | | 5.24 | |

| 5,976 | | | 79 | | 5.32 | |

Securities: | |

| | | | | | | | |

| | | | | | | |

Taxable | |

| 50,118 | | | 383 | | | 3.04 | |

| 53,592 | | | 437 | | 3.28 | |

Tax-exempt | |

| 2,678 | | | 15 | | | 2.23 | |

| 3,534 | | | 21 | | 2.39 | |

Total securities (A) | |

| 52,796 | | | 398 | | | 3.00 | |

| 57,126 | | | 458 | | 3.22 | |

Loans: | |

| | | | | | | | |

| | | | | | | |

SBA loans | |

| 49,751 | | | 631 | | | 5.05 | |

| 47,964 | | | 709 | | 5.95 | |

SBA PPP loans | | | 138,221 | | | 1,036 | | | 2.98 | | | 100,586 | | | 723 | | 2.89 | |

Commercial loans | |

| 792,255 | | | 10,099 | | | 5.07 | |

| 783,962 | | | 9,815 | | 5.04 | |

Residential mortgage loans | |

| 463,575 | | | 5,490 | | | 4.71 | |

| 461,156 | | | 5,554 | | 4.84 | |

Consumer loans | |

| 147,567 | | | 2,011 | | | 5.42 | |

| 145,970 | | | 1,921 | | 5.29 | |

Total loans (B) | |

| 1,591,369 | | | 19,267 | | | 4.82 | |

| 1,539,638 | | | 18,722 | | 4.89 | |

Total interest-earning assets | | $ | 1,716,920 | | $ | 19,768 | | | 4.58 | % | $ | 1,676,639 | | $ | 19,282 | | 4.63 | % |

| | | | | | | | | | | | | | | | | | |

Noninterest-earning assets: | |

|

| |

|

|

| |

| |

|

| |

|

|

|

| |

Cash and due from banks | |

| 23,487 | | | |

| |

| |

| 20,698 | |

|

|

|

| |

Allowance for loan losses | |

| (21,680) | | | |

| |

| |

| (17,909) | |

|

|

|

| |

Other assets | |

| 75,807 | | | |

| |

| |

| 74,076 | |

|

|

|

| |

Total noninterest-earning assets | |

| 77,614 | | | |

| |

| |

| 76,865 | |

|

|

|

| |

Total assets | | $ | 1,794,534 | | | |

| |

| | $ | 1,753,504 | |

|

|

|

| |

| | | | | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | |

|

| |

|

|

| |

| |

|

| |

|

|

|

| |

Interest-bearing liabilities: | |

|

| |

|

|

| |

| |

|

| |

|

|

|

| |

Total interest-bearing demand deposits | | $ | 201,176 | | $ | 347 | | | 0.69 | % | $ | 181,943 | | $ | 364 |

| 0.80 | % |

Total savings deposits | |

| 428,739 | | | 473 | | | 0.44 | |

| 403,389 | | | 512 |

| 0.51 | |

Total time deposits | |

| 449,333 | | | 2,157 | | | 1.91 | |

| 482,734 | | | 2,454 |

| 2.04 | |

Total interest-bearing deposits | |

| 1,079,248 | | | 2,977 | | | 1.10 | |

| 1,068,066 | | | 3,330 |

| 1.25 | |

Borrowed funds and subordinated debentures | |

| 108,137 | | | 460 | | | 1.69 | |

| 107,761 | | | 423 |

| 1.58 | |

Total interest-bearing liabilities | | $ | 1,187,385 | | $ | 3,437 | | | 1.15 | % | $ | 1,175,827 | | $ | 3,753 |

| 1.28 | % |

| | | | | | | | | | | | | | | | | | |

Noninterest-bearing liabilities: | |

| | | | | | | | |

| | | | |

| | |

Noninterest-bearing demand deposits | |

| 422,759 | | | | | | | |

| 394,723 | | | |

| | |

Other liabilities | |

| 17,838 | | | | | | | |

| 17,682 | | | |

| | |

Total noninterest-bearing liabilities | |

| 440,597 | | | | | | | |

| 412,405 | | | |

| | |

Total shareholders' equity | |

| 166,552 | | | | | | | |

| 165,272 | | | |

| | |

Total liabilities and shareholders' equity | | $ | 1,794,534 | | | | | | | | $ | 1,753,504 | | | |

| | |

| | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | $ | 16,331 | | | 3.43 | % | | | | $ | 15,529 |

| 3.35 | % |

Tax-equivalent basis adjustment | | | | | | (4) | | | | | | | | | (4) |

| | |

Net interest income | | | | | $ | 16,327 | | | | | | | | $ | 15,525 |

| | |

Net interest margin | | | | | | | | | 3.78 | % |

|

| |

|

|

| 3.73 | % |

| (A) | Yields related to securities exempt from federal and state income taxes are stated on a fully tax-equivalent basis. They are reduced by the nondeductable portion of interest expense, assuming a federal tax rate of 21 percent and applicable state rates. |

| (B) | The loan averages are stated net of unearned income, and the averages include loans on which the accrual of interest has been discontinued. |

UNITY BANCORP, INC.

YEAR TO DATE NET INTEREST MARGIN

September 30, 2020

(Dollar amounts in thousands, interest amounts and interest rates/yields on a fully tax-equivalent basis)

| | For the nine months ended |

| |||||||||||||||

| | September 30, 2020 | | September 30, 2019 |

| |||||||||||||

|

| Average |

| | |

| | |

| Average |

| | |

| |

| ||

| | Balance | | Interest | | Rate/Yield | | Balance | | Interest | | Rate/Yield |

| |||||

ASSETS | | | | | | | | | | | | | | | | | | |

Interest-earning assets: |

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

Federal funds sold and interest-bearing deposits | | $ | 69,940 | | $ | 236 | | | 0.45 | % | $ | 43,021 | | $ | 724 |

| 2.25 | % |

FHLB stock | |

| 6,284 | | | 268 | | | 5.70 | |

| 5,768 | | | 275 |

| 6.37 | |

Securities: | |

| | | | | | | | |

| | | | |

| | |

Taxable | |

| 54,635 | | | 1,331 | | | 3.25 | |

| 58,271 | | | 1,400 |

| 3.21 | |

Tax-exempt | |

| 3,329 | | | 62 | | | 2.49 | |

| 4,491 | | | 101 |

| 3.01 | |

Total securities (A) | |

| 57,964 | | | 1,393 | | | 3.21 | |

| 62,762 | | | 1,501 |

| 3.20 | |

Loans: | |

| | | | | | | | |

| | | | |

| | |

SBA loans | |

| 49,337 | | | 2,323 | | | 6.29 | |

| 48,238 | | | 2,880 |

| 7.98 | |

SBA PPP loans | | | 79,895 | | | 1,760 | | | 2.94 | | | - | | | - | | - | |

Commercial loans | |

| 781,942 | | | 29,848 | | | 5.10 | |

| 706,280 | | | 27,892 |

| 5.28 | |

Residential mortgage loans | |

| 462,497 | | | 16,814 | | | 4.86 | |

| 445,145 | | | 16,702 |

| 5.02 | |

Consumer loans | |

| 145,282 | | | 5,999 | | | 5.52 | |

| 131,714 | | | 6,382 |

| 6.48 | |

Total loans (B) | |

| 1,518,953 | | | 56,744 | | | 4.99 | |

| 1,331,377 | | | 53,856 |

| 5.41 | |

Total interest-earning assets | | $ | 1,653,141 | | $ | 58,641 | | | 4.74 | % | $ | 1,442,928 | | $ | 56,356 |

| 5.22 | % |

| | | | | | | | | | | | | | | | | | |

Noninterest-earning assets: | |

| | | | | | | | |

| | | | |

|

| |

Cash and due from banks | |

| 22,048 | | | | | | | |

| 25,019 | | | |

|

| |

Allowance for loan losses | |

| (18,773) | | | | | | | |

| (15,979) | | | |

|

| |

Other assets | |

| 73,429 | | | | | | | |

| 70,243 | | | |

|

| |

Total noninterest-earning assets | |

| 76,704 | | | | | | | |

| 79,283 | | | |

|

| |

Total assets | | $ | 1,729,845 | | | | | | | | $ | 1,522,211 | | | |

|

| |

| | | | | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | |

|

| |

|

|

| |

| |

|

| |

|

|

|

| |

Interest-bearing liabilities: | |

|

| |

|

|

| |

| |

|

| |

|

|

|

| |

Total interest-bearing demand deposits | | $ | 192,078 | | $ | 1,189 | | | 0.83 | % | $ | 177,789 | | $ | 1,289 |

| 0.97 | % |

Total savings deposits | |

| 408,810 | | | 1,836 | | | 0.60 | |

| 397,029 | | | 3,500 |

| 1.18 | |

Total time deposits | |

| 455,900 | | | 7,056 | | | 2.07 | |

| 408,718 | | | 7,023 |

| 2.30 | |

Total interest-bearing deposits | |

| 1,056,788 | | | 10,081 | | | 1.28 | |

| 983,536 | | | 11,812 |

| 1.61 | |

Borrowed funds and subordinated debentures | |

| 115,624 | | | 1,449 | | | 1.67 | |

| 107,101 | | | 1,695 |

| 2.12 | |

Total interest-bearing liabilities | | $ | 1,172,412 | | $ | 11,530 | | | 1.32 | % | $ | 1,090,637 | | $ | 13,507 |

| 1.66 | % |

| | | | | | | | | | | | | | | | | | |

Noninterest-bearing liabilities: | |

| | | | | | | | |

| | | | |

| | |

Noninterest-bearing demand deposits | |

| 375,229 | | | | | | | |

| 271,118 | | | |

| | |

Other liabilities | |

| 17,209 | | | | | | | |

| 14,129 | | | |

| | |

Total noninterest-bearing liabilities | |

| 392,438 | | | | | | | |

| 285,247 | | | |

| | |

Total shareholders' equity | |

| 164,995 | | | | | | | |

| 146,327 | | | |

| | |

Total liabilities and shareholders' equity | | $ | 1,729,845 | | | | | | | | $ | 1,522,211 | | | |

| | |

| | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | $ | 47,111 | | | 3.42 | % | | | | $ | 42,849 |

| 3.56 | % |

Tax-equivalent basis adjustment | | | | | | (12) | | | | | | | | | (20) |

| | |

Net interest income | | | | | $ | 47,099 | | | | | | | | $ | 42,829 |

| | |

Net interest margin | | | | | | | | | 3.81 | % | | |

| | |

| 3.97 | % |

| (A) | Yields related to securities exempt from federal and state income taxes are stated on a fully tax-equivalent basis. They are reduced by the nondeductable portion of interest expense, assuming a federal tax rate of 21 percent and applicable state rates. |

| (B) | The loan averages are stated net of unearned income, and the averages include loans on which the accrual of interest has been discontinued. |

UNITY BANCORP, INC.

QUARTERLY ALLOWANCE FOR LOAN LOSSES AND LOAN QUALITY SCHEDULES

September 30, 2020

Amounts in thousands, except percentages |

| Sept. 30, 2020 |

| Jun. 30, 2020 |

| Mar. 31, 2020 |

| Dec. 31, 2019 |

| Sept. 30, 2019 |

| |||||

ALLOWANCE FOR LOAN LOSSES: | |

| | |

| | |

| | |

| | |

| |

|

Balance, beginning of period | | $ | 20,234 | | $ | 17,376 | | $ | 16,395 | | $ | 16,002 | | $ | 15,965 | |

Provision for loan losses charged to expense | |

| 2,000 | | | 2,500 | | | 1,500 | | | 500 | | | 750 | |

| |

| 22,234 | | | 19,876 | | | 17,895 | | | 16,502 | | | 16,715 | |

Less: Chargeoffs | |

|

| |

|

| |

|

| |

|

| |

|

| |

SBA loans | |

| 1 | | | - | | | 25 | | | 43 | | | 99 | |

Commercial loans | |

| - | | | 219 | | | 300 | | | - | | | 500 | |

Residential mortgage loans | |

| - | | | - | | | 200 | | | 75 | | | 130 | |

Consumer loans | |

| - | | | - | | | - | | | - | | | - | |

Total chargeoffs | |

| 1 | | | 219 | | | 525 | | | 118 | | | 729 | |

Add: Recoveries | |

| | | | | | | | | | | | | | |

SBA loans | |

| 3 | | | 75 | | | 5 | | | 7 | | | 13 | |

Commercial loans | |

| 1 | | | 502 | | | 1 | | | 4 | | | 3 | |

Residential mortgage loans | |

| - | | | - | | | - | | | - | | | - | |

Consumer loans | |

| - | | | - | | | - | | | - | | | - | |

Total recoveries | |

| 4 | | | 577 | | | 6 | | | 11 | | | 16 | |

Net (recoveries) chargeoffs | |

| (3) | | | (358) | | | 519 | | | 107 | | | 713 | |

Balance, end of period | | $ | 22,237 | | $ | 20,234 | | $ | 17,376 | | $ | 16,395 | | $ | 16,002 | |

| | | | | | | | | | | | | | | | |

LOAN QUALITY INFORMATION: | |

|

| |

|

| |

|

| |

|

| |

|

| |

Nonperforming loans: | |

|

| |

|

| |

|

| |

|

| |

|

| |

SBA loans | | $ | 3,446 | | $ | 2,363 | | $ | 1,627 | | $ | 1,164 | | $ | 503 | |

Commercial loans | |

| 527 | | | 413 | | | 613 | | | 529 | | | 629 | |

Residential mortgage loans | |

| 3,722 | | | 6,192 | | | 6,910 | | | 3,936 | | | 4,427 | |

Consumer loans | |

| 1,293 | | | 505 | | | 505 | | | 20 | | | 23 | |

Total nonperforming loans (1) | |

| 8,988 | | | 9,473 | | | 9,655 | | | 5,649 | | | 5,582 | |

Other real estate owned ("OREO") | |

| 711 | | | 711 | | | 1,523 | | | 1,723 | | | 1,723 | |

Nonperforming assets | |

| 9,699 | | | 10,184 | | | 11,178 | | | 7,372 | | | 7,305 | |

Less: Amount guaranteed by SBA | |

| 812 | | | 307 | | | 427 | | | 59 | | | 63 | |

Net nonperforming assets | | $ | 8,887 | | $ | 9,877 | | $ | 10,751 | | $ | 7,313 | | $ | 7,242 | |

| | | | | | | | | | | | | | | | |

Loans 90 days past due & still accruing | | $ | — | | $ | — | | $ | — | | $ | 930 | | $ | 140 | |

| | | | | | | | | | | | | | | | |

Performing Troubled Debt Restructurings (TDRs) | | $ | 673 | | $ | 684 | | $ | 694 | | $ | 705 | | $ | 718 | |

| | | | | | | | | | | | | | | | |

Allowance for loan losses to: | |

| | | | | | | | | | | | | | |

Total loans at quarter end | |

| 1.38 | % | | 1.27 | % | | 1.21 | % | | 1.15 | % | | 1.17 | % |

Total nonperforming loans | |

| 247.41 | | | 213.60 | | | 179.97 | | | 290.23 | | | 286.67 | |

Nonperforming assets | |

| 229.27 | | | 198.68 | | | 155.45 | | | 222.40 | | | 219.06 | |

Net nonperforming assets | |

| 250.22 | | | 204.86 | | | 161.62 | | | 224.19 | | | 220.96 | |

| | | | | | | | | | | | | | | | |

QTD net chargeoffs (recoveries) (annualized) to QTD average loans: | |

|

| |

|

| |

|

| |

|

| |

|

| |

SBA loans | |

| - | % | | (0.20) | % | | 0.16 | % | | 0.29 | % | | 0.72 | % |

Commercial loans | |

| - | | | (0.15) | | | 0.16 | | | - | | | 0.28 | |

Residential mortgage loans | |

| - | | | - | | | 0.17 | | | 0.06 | | | 0.11 | |

Consumer loans | |

| - | | | - | | | - | | | - | | | - | |

Total loans | |

| - | % | | (0.09) | % | | 0.15 | % | | 0.03 | % | | 0.21 | % |

| | | | | | | | | | | | | | | | |

Nonperforming loans to total loans | |

| 0.56 | % | | 0.59 | % | | 0.67 | % | | 0.40 | % | | 0.41 | % |

Nonperforming assets to total assets | |

| 0.50 | | | 0.54 | | | 0.64 | | | 0.43 | | | 0.44 | |

UNITY BANCORP, INC.

QUARTERLY FINANCIAL DATA

September 30, 2020

(In thousands, except percentages and per share amounts) |

| Sept. 30, 2020 |

| Jun. 30, 2020 |

| Mar. 31, 2020 |

| Dec. 31, 2019 |

| Sept. 30, 2019 |

| |||||

SUMMARY OF INCOME: | |

| | |

| | |

| | |

| | |

| |

|

Total interest income | | $ | 19,764 | | $ | 19,278 | | $ | 19,585 | | $ | 19,312 | | $ | 19,055 | |

Total interest expense | |

| 3,437 | | | 3,753 | | | 4,341 | | | 4,549 | | | 4,651 | |

Net interest income | |

| 16,327 | | | 15,525 | | | 15,244 | | | 14,763 | | | 14,404 | |

Provision for loan losses | |

| 2,000 | | | 2,500 | | | 1,500 | | | 500 | | | 750 | |

Net interest income after provision for loan losses | |

| 14,327 | | | 13,025 | | | 13,744 | | | 14,263 | | | 13,654 | |

Total noninterest income | |

| 3,336 | | | 2,811 | | | 2,545 | | | 2,396 | | | 2,710 | |

Total noninterest expense | |

| 10,037 | | | 9,177 | | | 9,323 | | | 8,719 | | | 8,729 | |

Income before provision for income taxes | |

| 7,626 | | | 6,659 | | | 6,966 | | | 7,940 | | | 7,635 | |

Provision for income taxes | |

| 1,866 | | | 1,488 | | | 1,598 | | | 1,820 | | | 1,676 | |

Net income | | $ | 5,760 | | $ | 5,171 | | $ | 5,368 | | $ | 6,120 | | $ | 5,959 | |

| | | | | | | | | | | | | | | | |

Net income per common share - Basic | | $ | 0.54 | | $ | 0.48 | | $ | 0.49 | | $ | 0.56 | | $ | 0.55 | |

Net income per common share - Diluted | | $ | 0.54 | | $ | 0.47 | | $ | 0.49 | | $ | 0.55 | | $ | 0.54 | |

| | | | | | | | | | | | | | | | |

COMMON SHARE DATA: | |

|

| |

|

| |

|

| |

|

| |

|

| |

Market price per share | | $ | 11.58 | | $ | 14.30 | | $ | 11.70 | | $ | 22.57 | | $ | 22.15 | |

Dividends paid | | $ | 0.08 | | $ | 0.08 | | $ | 0.08 | | $ | 0.08 | | $ | 0.08 | |

Book value per common share | | $ | 16.01 | | $ | 15.53 | | $ | 15.10 | | $ | 14.77 | | $ | 14.25 | |

| | | | | | | | | | | | | | | | |

Weighted average common shares outstanding - Basic | |

| 10,630 | | | 10,792 | | | 10,883 | | | 10,872 | | | 10,863 | |

Weighted average common shares outstanding - Diluted | |

| 10,706 | | | 10,888 | | | 11,037 | | | 11,057 | | | 11,036 | |

Issued common shares | |

| 10,943 | | | 10,939 | | | 10,894 | | | 10,881 | | | 10,869 | |

Outstanding common shares | |

| 10,570 | | | 10,728 | | | 10,883 | | | 10,881 | | | 10,869 | |

Treasury shares | |

| 373 | | | 211 | | | 11 | | | - | | | - | |

| | | | | | | | | | | | | | | | |

PERFORMANCE RATIOS (Annualized): | |

|

| |

|

| |

|

| |

|

| |

|

| |

Return on average assets | |

| 1.28 | % | | 1.19 | % | | 1.32 | % | | 1.53 | % | | 1.53 | % |

Return on average equity | |

| 13.76 | | | 12.59 | | | 13.23 | | | 15.41 | | | 15.57 | |

Efficiency ratio | |

| 50.80 | | | 50.27 | | | 51.92 | | | 51.29 | | | 51.06 | |

Noninterest expense to average assets | |

| 2.23 | | | 2.10 | | | 2.29 | | | 2.17 | | | 2.24 | |

| | | | | | | | | | | | | | | | |

BALANCE SHEET DATA: | |

|

| |

|

| |

|

| |

|

| |

|

| |

Total assets | |

| 1,930,836 | | $ | 1,900,774 | | $ | 1,740,076 | | $ | 1,718,942 | | $ | 1,664,308 | |

Total deposits | |

| 1,493,440 | | | 1,483,457 | | | 1,378,618 | | | 1,250,114 | | | 1,273,362 | |

Total loans | |

| 1,613,291 | | | 1,592,507 | | | 1,439,645 | | | 1,425,558 | | | 1,368,474 | |

Total securities | |

| 50,387 | | | 54,888 | | | 58,002 | | | 66,564 | | | 63,991 | |

Total shareholders' equity | |

| 169,234 | | | 166,607 | | | 164,305 | | | 160,709 | | | 154,884 | |

Allowance for loan losses | |

| (22,237) | | | (20,234) | | | (17,376) | | | (16,395) | | | (16,002) | |

| | | | | | | | | | | | | | | | |

TAX EQUIVALENT YIELDS AND RATES: | |

| | | | | | | | | | | | | | |

Interest-earning assets | |

| 4.58 | % | | 4.63 | % | | 5.04 | % | | 5.07 | % | | 5.16 | % |

Interest-bearing liabilities | |

| 1.15 | | | 1.28 | | | 1.51 | | | 1.59 | | | 1.68 | |

Net interest spread | |

| 3.43 | | | 3.35 | | | 3.53 | | | 3.48 | | | 3.48 | |

Net interest margin | |

| 3.78 | | | 3.73 | | | 3.92 | | | 3.88 | | | 3.90 | |

| | | | | | | | | | | | | | | | |

CREDIT QUALITY: | |

|

| |

|

| |

|

| |

|

| |

|

| |

Nonperforming assets | |

| 9,699 | | $ | 10,184 | | $ | 11,178 | | $ | 7,372 | | $ | 7,305 | |

QTD net chargeoffs (annualized) to QTD average loans | |

| - | % | | (0.09) | % | | 0.15 | % | | 0.03 | % | | 0.21 | % |

Allowance for loan losses to total loans | |

| 1.38 | | | 1.27 | | | 1.21 | | | 1.15 | | | 1.17 | |

Nonperforming assets to total loans | |

| 0.56 | | | 0.59 | | | 0.67 | | | 0.40 | | | 0.41 | |

Nonperforming assets to total assets | |

| 0.50 | | | 0.54 | | | 0.64 | | | 0.43 | | | 0.44 | |

| | | | | | | | | | | | | | | | |

CAPITAL RATIOS AND OTHER: | |

|

| |

|

| |

|

| |

|

| |

|

| |

Total equity to total assets | |

| 8.76 | % | | 8.77 | % | | 9.44 | % | | 9.35 | % | | 9.31 | % |

Community bank leverage ratio | |

| 9.95 | | | 10.01 | | | 10.56 | | | 10.59 | | | 10.54 | |

| | | | | | | | | | | | | | | | |

Number of banking offices | |

| 19 | | | 19 | | | 19 | | | 19 | | | 19 | |

Number of ATMs | |

| 20 | | | 20 | | | 20 | | | 20 | | | 20 | |

Number of employees | |

| 196 | | | 191 | | | 205 | | | 203 | | | 194 | |