Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIFTH THIRD BANCORP | q32020earningsrelease.htm |

| 8-K - 8-K - FIFTH THIRD BANCORP | fitb-20201022.htm |

Fifth Third Bancorp 3Q20 Earnings Presentation October 22, 2020 Refer to earnings release dated October 22, 2020 for further information. Classification: Internal Use 1 Fifth Third Bancorp | All Rights Reserved

Cautionary statement This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission [“SEC”]. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We undertake no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this document. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) effects of the global COVID-19 pandemic; (2) deteriorating credit quality; (3) loan concentration by location or industry of borrowers or collateral; (4) problems encountered by other financial institutions; (5) inadequate sources of funding or liquidity; (6) unfavorable actions of rating agencies; (7) inability to maintain or grow deposits; (8) limitations on the ability to receive dividends from subsidiaries; (9) cyber-security risks; (10) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (11) failures by third-party service providers; (12) inability to manage strategic initiatives and/or organizational changes; (13) inability to implement technology system enhancements; (14) failure of internal controls and other risk management systems; (15) losses related to fraud, theft or violence; (16) inability to attract and retain skilled personnel; (17) adverse impacts of government regulation; (18) governmental or regulatory changes or other actions; (19) failures to meet applicable capital requirements; (20) regulatory objections to Fifth Third’s capital plan; (21) regulation of Fifth Third’s derivatives activities; (22) deposit insurance premiums; (23) assessments for the orderly liquidation fund; (24) replacement of LIBOR; (25) weakness in the national or local economies; (26) global political and economic uncertainty or negative actions; (27) changes in interest rates; (28) changes and trends in capital markets; (29) fluctuation of Fifth Third’s stock price; (30) volatility in mortgage banking revenue; (31) litigation, investigations, and enforcement proceedings by governmental authorities; (32) breaches of contractual covenants, representations and warranties; (33) competition and changes in the financial services industry; (34) changing retail distribution strategies, customer preferences and behavior; (35) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisitions; (36) potential dilution from future acquisitions; (37) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (38) results of investments or acquired entities; (39) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (40) inaccuracies or other failures from the use of models; (41) effects of critical accounting policies and judgments or the use of inaccurate estimates; (42) weather-related events, other natural disasters, or health emergencies; and (43) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures in later slides in this presentation, as well as on pages 26 through 28 of our 3Q20 earnings release. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp's control or cannot be reasonably predicted. For the same reasons, the Bancorp's management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. Classification: Internal Use 2 Fifth Third Bancorp | All Rights Reserved

3Q20 highlights • Very strong reported and adjusted return metrics, Reported 1 Adjusted 1 reflecting strong operating results EPS$0.78 $0.85 • PPNR exceeded previous guidance, led by strong ROA 1.14% 1.24% fees and better-than-expected NII performance ROE10.7% 11.6% • Credit losses well below previous expectations with a NCO ratio of 0.35%, the lowest level since ROTCE 13.8% 18.2% 2Q19 excl. AOCI 2 NIM2.58% 2.55% • ACL ratio of 2.49% down 1 bp sequentially; excl. PAA benefit from provision driven primarily by declining Efficiency period end loan balances 61.3% 58.3% ratio excl. PAA & CDI • CET1 increased 42 bps from prior quarter to 10.1%; up ~40 bps since the end of 2019 PPNR$734MM $798MM • Strong deposit growth resulting in a loan-to-core CET1 10.14% deposit ratio of 72% (69% ex. PPP) 1Reported ROTCE, NIM, pre-provision net revenue, and efficiency ratio are non-GAAP measures: all adjusted figures are non-GAAP measures; see reconciliation on pages 30 and 31 of this presentation and the use of non-GAAP measures on pages 26-28 of the earnings release; 2Allowance for credit losses as a percentage of portfolio loans and leases; Current period regulatory capital ratios are estimated. Classification: Internal Use 3 Fifth Third Bancorp | All Rights Reserved

Interest earning assets Average loan & lease balances Average securities 1 and short-term investments $ in billions; loan & lease balances exclude HFS $ in billions $118.5 $65.2 $109.5 $113.4 $55.9 $39.6 $38.8 $39.8 $29.8 4.75% $19.8 ~$3.8BN in PPP ~$5.2BN $37.3 3.76% loans 3.64% in PPP loans $2.5 3.24% 3.08% 3.01% $70.8 $78.9 $73.6 $34.8 $36.1 $35.4 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20 Short-term Taxable Commercial Consumer Total loan yield Securities 1 investments securities yield Period-end loan & lease balances Period-end securities 1 and short-term investments $ in billions; loan & lease balances exclude HFS $ in billions $115.1 $66.0 $109.4 $110.7 $64.0 $39.6 $39.0 $39.5 $28.2 $31.3 $38.9 ~$5.2BN ~$5.2BN in PPP in PPP $3.2 loans loans $75.4 $70.4 $71.3 $35.7 $35.8 $34.7 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20 Commercial Consumer Securities 1 Short-term investments Note: Totals shown above may not foot due to rounding; 1Available-for-sale debt and other securities at amortized cost; previous disclosures included available-for-sale equity securities which are disclosed separately in the financial results Classification: Internal Use 4 Fifth Third Bancorp | All Rights Reserved

Core deposits and wholesale funding Average core deposit balances Average wholesale funding balances $ in billions $ in billions $146.5 $152.3 $120.4 $71.6 $73.0 $23.7 $22.5 $21.8 $66.4 2.95% $74.9 $53.9 $79.3 2.27% 2.26% 1.01% 0.27% 0.13% 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20 Total IB core Commercial Consumer Total wholesale funding Wholesale funding cost deposit rate Period-end core deposit balances Period-end wholesale funding balances $ in billions $152.9 $153.4 $ in billions $120.5 $73.2 $72.8 $24.3 $22.0 $19.9 $66.4 $79.7 $80.6 $54.1 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20 Commercial Consumer Total wholesale funding Note: Totals shown above may not foot due to rounding Classification: Internal Use 5 Fifth Third Bancorp | All Rights Reserved

Aggressively reducing interest expense given the rate environment Proactively managing deposit costs given the rate environment IB core deposit rate 1.03% 0.99% 1.01% 2020 0.82% 0.77% 0.74% 0.54% 0.35% 0.27% 0.21% 0.16% 0.13% 0.11% 1Q19 2Q19 3Q19 4Q19 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 September Deposit rates by product 3Q15 3Q20 2020 • Significantly reduced deposit rates several times Interest checking 0.18% 0.10% 0.08% throughout the quarter Savings 0.05% 0.04% 0.04% • Planning additional actions in 4Q20 to further reduce interest expense Money market 0.21% 0.14% 0.10% • Upcoming total CD maturity schedule 1: Foreign office 0.14% 0.06% 0.06% – 4Q20: $3.2BN at 0.97% Other time 1.19% 0.95% 1.07% – 1Q21: $1.3BN at 0.94% IB core deposits 0.22% 0.13% 0.11% – 2Q21: $1.7BN at 1.12% Core deposits0.14% 0.09% 0.07% 1Includes other time and certificates - $100,000 and over Classification: Internal Use 6 Fifth Third Bancorp | All Rights Reserved

Net interest income 1 2Q20 to 3Q20 NII & NIM Walk NII $ in millions; NIM change in bps NII NIM $1,246 $1,218 2Q20 $1,188 2.71% $1,203 $1,188 $1,173 $1,160 Excluding PAA Elevated Cash - (15) Balances PPP Impact 8 - Wholesale Funding 8 2 Actions 3.25% Incremental Cash Flow 2.71% 10 2 Hedge Benefit 2.55% Other Market Rate & Repricing Impacts 2 1 (net of deposit actions) Total net interest income; $interest netincome;millions Total Other Balance Sheet Composition Changes (66) (5) (including loan runoff) Day Count 10 (1) 3Q19 2Q20 3Q20 3Q20 $1,160 2.55% NII Adjusted NII Adjusted NIM (excl. PAA) (excl. PAA) Cumulative quarterly impact $72 +16 bps of hedge portfolio; 3Q20 1Results are on a fully-taxable equivalent basis; non-GAAP measure: see reconciliation on pages 30 and 31 of this presentation and use of non-GAAP measures on pages 26-28 of the earnings release Classification: Internal Use 7 Fifth Third Bancorp | All Rights Reserved

Noninterest income $740 $746 3Q20 vs. 2Q20 $722 $703 • Adjusted noninterest income 1 up $33 million, or 5% $670 $650 • Primary drivers: ‒ Service charges on deposits (up 18%) ‒ Leasing business revenue (up 35%) ‒ Wealth and asset management revenue (up 10%) ‒ Partially offset by mortgage banking revenue (down 23%) 3Q20 vs. 3Q19 • Adjusted noninterest income 1 down $43 million, or 6% Total noninterest income; $ noninterestincome;millions Total • Primary drivers: ‒ Mortgage banking revenue (down 20%) ‒ Leasing business revenue (down 16%) ‒ Other noninterest income (down 28%) ‒ Partially offset by wealth and asset management revenue 3Q19 2Q20 3Q20 (up 6%) Noninterest income Adjusted noninterest income (excl. securities (gains)/losses) 1 1 Non-GAAP measure: see reconciliation on pages 30 and 31 of this presentationClassification: and Internal use of non-GAAPUse measures on pages 26-28 of the earnings release 8 Fifth Third Bancorp | All Rights Reserved

Noninterest expense 3Q20 vs. 2Q20 1 $1,159 $1,161 • Adjusted noninterest expense up $34 million, or 3% $1,117 $1,121 $1,116 $1,082 • Primary drivers: ‒ Marketing expense (up 15%) ‒ Technology and communications (up 3%) ‒ Other noninterest expense (up 18%) 3Q20 vs. 3Q19 • Adjusted noninterest expense 1 down $1 million Total noninterest expense; $noninterestexpense; millions Total • Primary drivers: ‒ Marketing expense (down 43%) ‒ Leasing business expense (down 13%) ‒ Other noninterest expense (down 9%) 3Q19 2Q20 3Q20 Noninterest expense Adjusted noninterest expense (excl. intangible amortization) 1 1Excluding intangible amortization is a non-GAAP measure: see reconciliation on pages 30 and 31 of this presentation and use of non-GAAP measures on pages 26- 28 of the earnings release Classification: Internal Use 9 Fifth Third Bancorp | All Rights Reserved

Well diversified commercial portfolio with several potential risk mitigants to recent stresses Commercial portfolio by industry sectors Uneven recovery impacting clients differently $s in billions; excludes PPP loans 2Q20 3Q20 • ~68% of portfolio in QSR, mostly to top-tier brands and national chains Restaurants ($1.7BN) • Area of focus: ~32% dine-in focused; supported by concentration in large scale operators Loans O/S Loans O/S Change and top performing brands with strong sponsorship, and/or access to capital markets Real estate $11.7 $11.5 (2%) • Clients have strong liquidity positions with continued access to capital markets; experienced management teams have executed significant cost reduction plans; Manufacturing 11.6 10.7 (8%) Casinos ($1.8BN) ~67% to regional casino operators (incl. Native American-operated) Financial services and insurance 6.8 6.3 (7%) • Areas of focus: ~23% global operators (including Las Vegas) supported by scale, Leisure & recreation 1 6.8 6.3 (7%) liquidity and experienced management teams Business services 4.7 4.4 (6%) • 58% to drivable leisure hotels, where RevPAR has generally rebounded Hotels Wholesale trade 4.2 3.9 (7%) • Areas of focus: 42% business oriented hotels which likely face a multi year re- Communication and information 3.4 3.2 (6%) ($1.3BN) stabilization but are owned by strong, large scale operators with deep experience and broad resources Mining 3.0 2.7 (10%) Retail (non-essential) 1 3.0 2.6 (13%) • C&I borrowers with strong performance given e-commerce disruption; composition almost exclusively either investment grade and well-positioned to weather downturn, or market- 1 Retail non- Healthcare facilities 2.5 2.4 (4%) Essential conforming ABL structures 2 Healthcare - other 2.6 2.4 (8%) ($2.6BN) • Areas of focus: Retail driven Non-owner occupied CRE (~$1.3BN) supported by Anchor Transportation and warehousing - other 2 2.5 2.4 (4%) tenant strength, collection rates and liquidity to support re-stabilization Construction 2.2 2.1 (5%) • Well diversified with long-term clients across broad sectors including Skilled Nursing, 2 Healthcare Retail trade - other 0.8 0.9 13% Facilities Physician Offices, Behavioral Health, Assisted Living and Surgery/Outpatient Centers, etc. Leisure travel 1 0.5 0.5 - ($2.4BN) • Areas of focus: Skilled Nursing occupancy supported by top tier national and large regional operators All Others 3 3.9 3.8 (3%) • Well-contained to a few large operators; all have been able to access capital markets to Total Commercial Loan & Lease Portfolio 70.2 66.1 (6%) Leisure bolster liquidity Travel Total COVID High Impact Industries 12.8 11.8 (8%) • Areas of focus: Seasonal operations impact the speed of full recovery supported by ($0.5BN) strong liquidity and access to capital No changes to composition or definition of COVID-19($ XBN ) High Impact industries Well diversified commercial portfolio favoring large borrowers with a track record of resilience (Excluding PPP, 72% of the C&I high impact portfolio in shared national credits) 1Leisure & recreation consists of the following industry classifications (as defined by NAICS): “Accommodation and food” and “Entertainment and recreation”; retail (non-essential) maps to the retail trade industry classification; healthcare facilities maps to the healthcare industry classification; leisure travel maps to the “transportation and warehousing: industry classification; 2”Healthcare – other” primarily consist of hospitals; “transportation and warehousing – other” primarily consists of non-leisure related transportation activities; “retail trade – other” primarily consists of vehicle related dealers and gas stations; 3”All others” consists of the following industry classifications:Classification: other services, utilities,Internal public Use administration, agribusiness, individuals, and other. 10 Fifth Third Bancorp | All Rights Reserved

Consumer portfolios are well positioned Portfolio Consumer loan % of Total Portfolio WA LTV portfolio credit metrics Loans WA FICO 1 at Orig. FICO score distribution 1 Residential mortgage 14% 757 74% 4% 21% Indirect secured 11% 756 92% >=750 Predominantly auto 756 720-749 WA FICO for total Home equity 5% 761 70% 57% 660-719 consumer portfolio 18% <=659 Other consumer 3% 760 NA Including GreenSky Credit card 2% 736 NA • Focused on existing relationships, significantly limiting prospects in unsecured products except high/super prime • Augmented collections efforts • Enhanced underwriting standards across almost all products (including improvements in LTV and FICO score requirements) Totals represent percentage of Fifth Third’s total loans & leases of $113.1 billion; 1FICO distributions at origination exclude certain acquired mortgages and home equity loans as well as $100 million from credit card loans on book primarily ~15+ years, and $500 million from consumer loans associated with private wealth clients. Classification: Internal Use 11 Fifth Third Bancorp | All Rights Reserved

Credit quality overview Early stage delinquencies and NPAs 1 ACL as % of portfolio loans and leases 2.76% 2.75% Ex. PPP Including MB 2.64% 2.62% unamortized 2.49% loan discount 2.30% 2.50% 0.84% 2.13% 0.65% 0.60% 1.19% 1.23% 0.47% 0.48% 0.37% 0.33% 0.27% 0.29% 0.29% 3Q17 3Q18 3Q19 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 Incurred NPA Ratio 30-89 days past due as a % of loans CECL Loss Method Net charge-offs (NCOs) • NCO ratio of 0.35%, well below previous expectations, with declines in commercial and consumer portfolio (15+ year low) 0.68% • NPA ratio of 0.84% up 19 bps from prior quarter 0.50% 0.52% 0.43% 0.44% 0.40% • ACL (excluding PPP, including unamortized loan discount) 0.36% represents 326% of NPLs, and 312% of NPAs, and 0.30% 0.29% 0.35% 0.40% represents: 0.33% • 62% of 2020 company run DFAST severe losses 0.21% 0.18% 0.19% • 39% of 2020 Supervisory DFAST severe losses 3Q17 3Q18 3Q19 3Q20 Consumer NCO ratio Commercial NCO ratio Total NCO ratio 1Excludes HFS loans Classification: Internal Use 12 Fifth Third Bancorp | All Rights Reserved

Current expected credit losses (CECL) allowance Allocation of allowance by product 2Q20 3Q20 $s in millions % of portfolio % of portfolio Allowance for loan & lease losses Amount loans & leases Amount loans & leases Commercial and industrial loans 988 1.78% 1,024 1.98% Commercial mortgage loans 375 3.34% 373 3.43% Commercial construction loans 97 1.77% 105 1.86% Commercial leases 42 1.37% 33 1.09% Total commercial 1,502 1.99% 1,534 2.15% Residential mortgage 327 1.99% 297 1.84% Home equity loans 239 4.21% 211 3.86% Indirect secured consumer loans 171 1.38% 128 0.99% Credit card loans 327 14.79% 285 13.66% Other consumer loans 130 4.52% 120 4.19% Total consumer 1,194 3.01% 1,041 2.64% Allowance for loan & lease losses 2,696 2.34% 2,574 2.32% Reserve for unfunded commitments 1 176 182 Allowance for credit losses $2,872 2.50% $2,756 2.49% • Allowance for credit losses decreased $116 million • Including the impact of the unamortized discount from the MB loan portfolio, the ACL ratio was 2.62% • Furthermore, excluding the impact of PPP, the ACL ratio would have been 2.75% Note: Totals shown above may not foot due to rounding; 13Q20 commercial and consumer portfolio make up $139M and $43M, respectively, of the total Classification: Internal Use 13 reserve for unfunded commitments. Fifth Third Bancorp | All Rights Reserved

Strong capital and liquidity position Regulatory capital position Common equity tier 1 ratio ~16 bps ~35 bps ~5 bps 10.14% 9.72% ~(14 bps) • Risk-based capital ratios have meaningfully improved (CET1 up ~40 bps since end of 2019) • Common dividends account for ~55 bps of CET1 per year 2Q20 Net Income RWA Common Reserve Release 3Q20 (ex reserve Dividends Under CECL release) Liquidity position $s in billions; as of 9/30/2020 • Unprecedented levels of short-term liquidity Liquidity Sources currently ~20x higher than 2019 average Fed Reserves ~$31 • Loan-to-core deposit ratio of 72% (69% ex. Unpledged Investment Securities ~$28 PPP) Available FHLB Borrowing Capacity ~$18 • ~$102 billion of available liquidity sources Current Fed Discount Window Availability ~$27 • $4.6B in Holding Company cash, sufficient to satisfy all fixed obligations in a stressed ~$102 Total environment for ~31 months Current period regulatory capital ratio is estimated; Note, data may not footClassification: due to rounding Internal Use 14 Fifth Third Bancorp | All Rights Reserved

Current expectations Fourth quarter 2020 Loans & leases Down ~2% sequentially (average balances, incl. HFS) NII & NIM (FTE) 1 Stable, assuming no accelerated PPP fee benefit (excluding PAA) (3Q20 baselines: $1.160BN; 2.55%) Noninterest income 1 Up 7 - 8% sequentially (includes ~$70MM impact from TRA income; 3Q20 baseline: $703MM) Noninterest expense 1 Flat to up slightly (3Q20 baseline: $1.116BN) Net charge-off ratio 40 - 50 bps range Effective tax rate ~22% range As of October 22, 2020; please see cautionary statements on page 2 1Non-GAAP measure: see forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 26-28 of the earnings release. Classification: Internal Use 15 Fifth Third Bancorp | All Rights Reserved

1 Well-positioned Balance Sheet Remain well-positioned Diversified to navigate the 2 Revenue Mix uncertain economic environment Proactive focus 3 on maintaining strong returns Classification: Internal Use 16 Fifth Third Bancorp | All Rights Reserved

Appendix Classification: Internal Use 17 Fifth Third Bancorp | All Rights Reserved

COVID-19 hardship relief summary Payment deferrals % of Total loans As of: In payment deferral programs 1 6/30/20 8/31/20 9/30/20 All percentages shown represent balances rather Commercial loans & leases: 5% 1% 1% than accounts Commercial and industrial loans 3% 0% 0% Commercial mortgage 15% 4% 3% Commercial construction 7% 5% 3% Commercial leases 4% 0% 0% Consumer Loans: 8% 5% 4% Residential mortgage loans 2 9% 8% 7% Home equity 4% 4% 3% Indirect secured consumer loans 10% 2% 1% Credit card 7% 1% 1% Other consumer loans 4% 1% 1% Total portfolio loans and leases 6% 2% 2% Consumer: Commercial: • ~15% of consumer exits (ex. mortgage) have re-enrolled in • ~5% of commercial exits have requested additional payment relief additional hardship relief • ~30% of mortgage balances in program represent borrowers making • Commercial clients representing ~$8BN in loan balances have 1 or more payments despite the relief been granted covenant relief • $0.4BN of mortgages as of 9/30 have exited forbearance; virtually all • COVID-19 high impact portfolio payment deferral rate less than mortgage borrowers are either still in COVID-19 relief programs or 3%, down from 15% last quarter just exiting 180-day relief (i.e. not 30+ days delinquent) 3 • ~93% of consumer exits (ex. mortgage-related) are current3 • ~96% of commercial exits are current 1Includes loans and leases that are still in initial payment relief period (primarily mortgage-related loans) and loans that have requested additional relief 2Excludes loans previously sold to GNMA that the Bancorp had the option to repurchase as a result of forbearance 3For loans still in an active relief period, past due status is based on the borrower's status as of March 1, 2020, as adjustedClassification: based on the Internalborrower's Use compliance with modified loan terms 18 Fifth Third Bancorp | All Rights Reserved

Oil & gas portfolio remains well positioned $2.3BN I 2.1% of total loans Oil & Gas Balance Mix RBL 64% utilization 7% Oil & Gas Oil / Gas Mix 56% / 44% Production Reserve-Based Structure 96% 9% 4% $0.3BN I 0.3% of total loans 98% 2% Midstream 22% utilization Refining Midstream Oil / Gas Mix 60% / 40% Asset-Based Structure 10% 79% $0.2BN I 0.2% of total loans Oilfield Services 76% utilization Total Loans Ex. Oil & Gas (OFS) Asset-Based Structure 60% Meaningful improvements from last cycle which had already exhibited strong performance 2015 3Q20 • Portfolio is less levered and more hedged than before the last downturn • $24MM total energy portfolio losses from 2015-2016 downturn Fifth Third RBL client cash flow 4.7x 2.4x leverage • RBL clients are well-hedged against lower commodity prices; By year- end, clients hedged more than 50%: Fifth Third RBL balance % 44% 79% – 2020: ~75%; 2021: ~39% • Deliberately underweight in OFS which we believe will exhibit higher Fifth Third OFS balance % 18% 7% losses in a down cycle Totals represent percentage of Fifth Third’s total loans & leases of $113.1 billion; Hedge information based on proved developed producing (PDP) reserves Classification: Internal Use 19 Fifth Third Bancorp | All Rights Reserved

Cash flow hedges continue to protect NIM for next 4 years Cash flow hedges projection Notional value of cash flow hedges ($ Billions) $11 $11 $11 $11 $11 $11 $11 $11 $11 $10 $10 $10 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $6 $6 $5 $3 $3 $4 $8 $8 $8 $8 $8 $8 $8 $8 $8 $7 $7 $7 $3 $3 $3 $3 $2 $1 $1 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Floors Swaps ($3BN @ 2.25% 1-month ($8BN @ 3.02% receive LIBOR strike) fixed / pay 1-month LIBOR) Hedges expected to generated an annual NII benefit of ~$300MM through 4Q22 relative to an unhedged position Assuming no change to 1ML beyond 10/20/2020 Classification: Internal Use 20 Fifth Third Bancorp | All Rights Reserved

Balance sheet positioning Commercial loans 1,2,3 Consumer loans 1 Investment portfolio Long-term debt 4 $21.5BN fixed 3 | $44.3BN variable 1,2 $31.0BN fixed | $8.5BN variable 1 $12.2BN fixed | $2.9BN variable 4 • 1ML based: 54% 6 • 1ML based: 2% 7 • 59% allocation to bullet/ • 1ML based: 8% 8 locked-out cash flow securities • 3ML based: 7% 6 • 12ML based: 2% 7 • 3ML based: 11% 8 6 7 • Yield: 3.01% • Prime based: 5% • Prime based: 18% 5 • Weighted avg. life: 4.2 years • Other based: 2% 6,9 • Weighted avg. life: 3.0 years • Effective duration of 4.6 • Weighted avg. life: 1.7 years • Net unrealized pre-tax gain: $2.7BN 5% 2% • 98% AFS 4% 5% 7% 9% 20% 26% 21% 16% 33% 41% 71% 72% 14% 54% C&I 35% Fix | 65% Variable Resi mtg.& 95% Fix | 5% Variable Level 1 100% Fix | 0% Variable Senior debt 81% Fix | 19% Variable construction Coml. 22% Fix | 78% Variable Auto/Indirect 100% Fix | 0% Variable Level 2A 100% Fix | 0% Variable Sub debt 78% Fix | 22% Variable mortgage Coml. Non-HQLA/ Auto securiz. 99% Fix | 1% Variable 1% Fix | 99% Variable Home equity 10% Fix | 90% Variable 68% Fix | 32% Variable construction Other proceeds 18% Fix | 82% Variable Includes $3.4BN non-agency CMBS Coml. lease 100% Fix | 0% Variable Credit card Other 85% Fix | 15% Variable (All super-senior, AAA-rated securities; Other 63% Fix | 37% Variable 62% WA LTV, ~39% credit enhancement) • The information above incorporates the impact of $11BN in cash flow hedges ($8BN in C&I receive-fixed swaps, $3BN in floors with a 2.25% strike against 1ML) as well as ~$2BN fair value hedges associated with long term debt (receive-fixed swaps) • The impacts of PPP loans (given the expected temporary nature) are excluded Data as of 9/30/20; 1Excludes HFS Loans & Leases; 2Fifth Third had $11B of variable loans classified as fixed given the impacts of $3BN in floors with a 2.25% 1ML strike and $8BN in receive-fix swaps; 3Excludes ~$5BN in Small Business Administration Paycheck Protection Program (PPP) loans; 4Fifth Third had $705MM 3ML receive-fix swaps and $1.25B 1ML receive-fix swaps outstanding against long-term debt, which are being included in floating, long-term debt with swaps outstanding reflected at fair value; 5Effective duration of the taxable available for sale portfolio; 6As a percent of total commercial, excluding PPP loans; 7As a percent of total consumer; 8As a percent of total long-term debt; 9Includes 12ML, 6ML, Classification:and Fed Funds Internal based Useloans 21 Fifth Third Bancorp | All Rights Reserved

Interest rate risk management NII is asset sensitive in year 1 and year 2 to rising Estimated NII sensitivity profile and ALCO policy limits rates. % Change in NII (FTE) ALCO policy limit • As of September 30, 2020, 50% of HFI loans were 13 to 24 13 to 24 variable rate net of existing hedges (67% of total Change in interest rates (bps) 12 months months 12 months months commercial; 22% of total consumer) 1 +200 Ramp over 12 months 3.26% 10.15% (4.00%) (6.00%) • ~87% of $48BN commercial portfolio indexed to 1ML +100 Ramp over 12 months 1.66% 5.34% NA NA have floors at or above a 0% index • Investment portfolio effective duration of 4.6 2 Estimated NII sensitivity with deposit beta changes • Short-term borrowings represent approximately 7% of total wholesale funding, or 1% of total funding Betas 25% higher Betas 25% lower 13 to 24 13 to 24 • Approximately $12.6 billion in non-core funding Change in interest rates (bps) 12 months months 12 months months matures beyond one year +200 Ramp over 12 months (0.64%) 3.08% 7.16% 17.21% +100 Ramp over 12 months (0.28%) 1.84% 3.61% 8.84% Interest rate sensitivity tables leverage the following deposit assumptions: • Beta on all interest-bearing deposit and sweep Estimated NII sensitivity with demand deposit balance changes balances: 71% up and 38% down 3 % Change in NII (FTE) • No modeled re-pricing lag on deposits $1BN balance decline $1BN balance increase 13 to 24 13 to 24 • Utilizes forecasted balance sheet with $750MM DDA runoff (per 100 bps rate movement) assumed in up Change in Interest Rates (bps) 12 months months 12 months months rate scenarios +200 Ramp over 12 months 3.04% 9.68% 3.48% 10.61% +100 Ramp over 12 months 1.55% 5.11% 1.77% 5.58% • Weighted interest-bearing deposit floor of 6 bps 1 Excludes ~$5BN in Small Business Administration Paycheck Protection Program (PPP) loans 2 Effective duration of the taxable available for sale portfolio; 3Re-pricing percentage or “beta” is the estimated change in yield over 12 months as a result of a shock or ramp 100 bps parallel shift in the yield curve Note: data as of 09/30/20; actual results may vary from these simulated results due to differences between forecasted and actual balance sheet composition, timing, magnitude, and frequency of interest rate changes, as well as other changes in market conditions and management strategies. Classification: Internal Use 22 Fifth Third Bancorp | All Rights Reserved

Strong liquidity profile Holding company: Unsecured debt maturities • Holding Company cash as of September 30, 2020: $4.6B $ millions – excl. Retail Brokered & Institutional CDs $5,487 • Cash currently sufficient to satisfy all fixed obligations in a stressed environment for ~31 months (debt maturities, common and preferred dividends, interest, and other $3,150 expenses) without accessing capital markets, relying on $2,250 dividends from subsidiaries or any other actions $1,500 $1,150 • The Holding Company issued $350MM of preferred stock in 3Q20 $0 ‒ The first dividend for Series L was paid in September 2020 2021 2022 2023 2024 2025 on 2020 Fifth Third Bancorp Fifth Third Bank Fifth Third Financial Corp • The Holding Company did not issue any long-term debt in 3Q20 Heavily core funded Bank entity: As of 9/30/2020 • The Bank did not issue long-term debt in 3Q20 Long- • $1.05B of Bank entity debt was redeemed in 3Q20 term Other • Available and contingent borrowing capacity (3Q20): liabilities debt Short term 3% Equity 7% Demand ‒ FHLB ~$17.5B available, ~$17.8B total borrowings 11% 26% 1% ‒ Federal Reserve ~$26.6B Non-core deposits 2% Foreign Interest Office Savings/ checking <1% MMDA 24% Consumer 24% time 2% Classification: Internal Use 23 Fifth Third Bancorp | All Rights Reserved

Mortgage banking results Mortgage banking net revenue $ millions $120 $99 $76 $95 $19 • Mortgage banking revenue $10 $73 $63 $66 $4 $67 decreased $23 million from prior $71 $72 quarter and decreased $19 million from year-ago quarter $95 $81 $93 $64 $49 ($1) • $4.5BN in originations, up 35% ($8) ($50) ($52) ($47) ($58) compared to the year-ago quarter ($75) and up 32% from prior quarter; 36% 3Q19 4Q19 1Q20 2Q20 3Q20 purchase volume Gross Origination fees and servicing Net MSR MSR decay gains on loan sale fees Valuation • 3Q20 mortgage banking drivers: Mortgage originations and gain-on-sale margin 1 $ billions $4.53 ‒ Unfavorable MSR decay and $4.01 net MSR valuation impact $3.79 $1.11 $3.35 $0.82 $3.42 compared to prior quarter $1.04 $0.86 3.76% ‒ Gain on sale margin down 126 bps sequentially 2.50% 2.32% 2.23% 1.56% $2.49 $2.74 $3.19 $2.41 $3.42 3Q19 4Q19 1Q20 2Q20 3Q20 Originations HFS Originations HFI Margin 1Gain-on-sale margin represents gains on all loans originated for sale Classification: Internal Use 24 Fifth Third Bancorp | All Rights Reserved

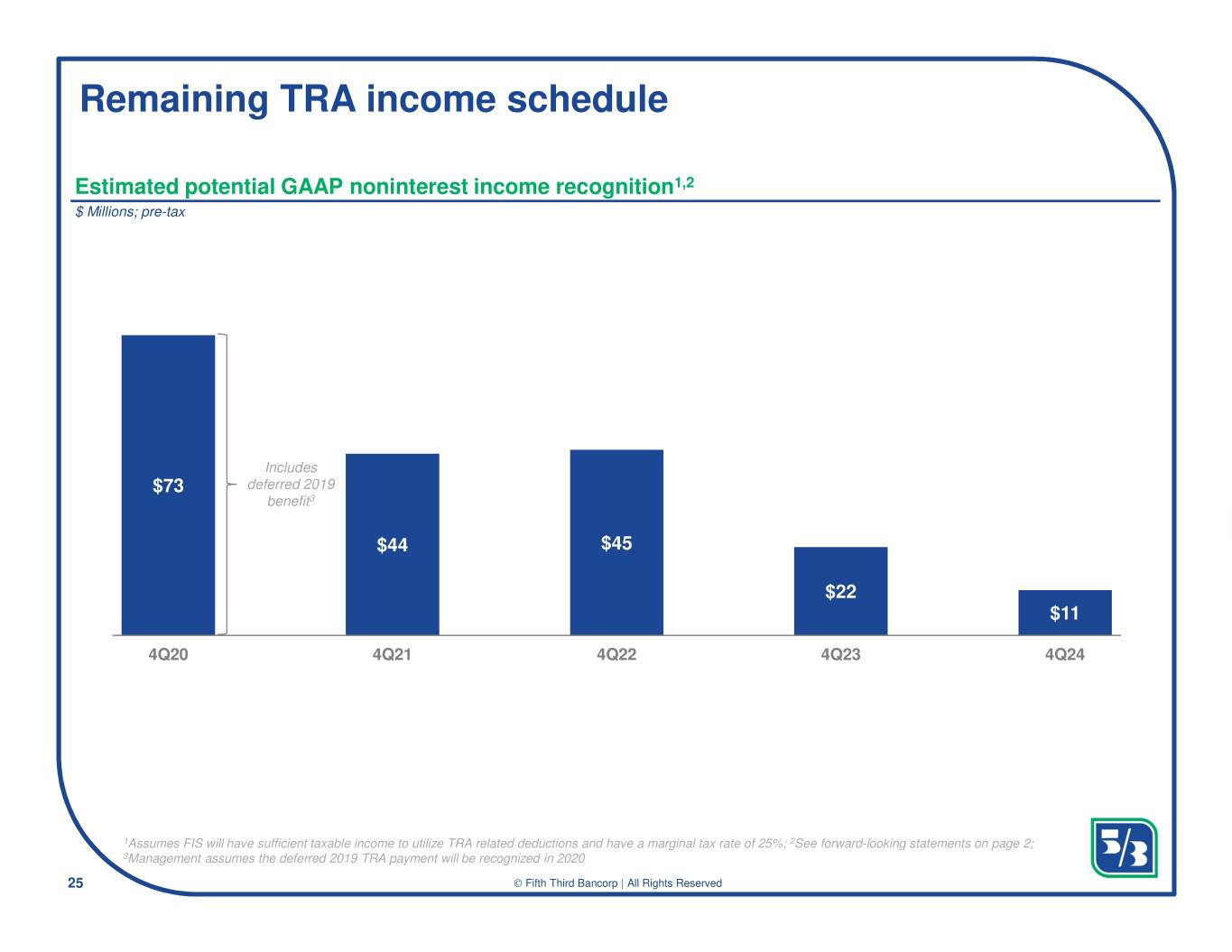

Remaining TRA income schedule Estimated potential GAAP noninterest income recognition 1,2 $ Millions; pre-tax Includes $73 deferred 2019 benefit 3 $44 $45 $22 $11 4Q20 4Q21 4Q22 4Q23 4Q24 1Assumes FIS will have sufficient taxable income to utilize TRA related deductions and have a marginal tax rate of 25%; 2See forward-looking statements on page 2; 3Management assumes the deferred 2019 TRA payment will be recognized in 2020 Classification: Internal Use 25 Fifth Third Bancorp | All Rights Reserved

Expected impacts of MB purchase accounting 1 Net Core Deposit Intangible Amortization Purchase Accounting Accretion 6 $38 5 5 4 4 4 3 (4) (4) (5) (5) (5) (5) (5) ($ in($ millions) (7) (9) (9) (9) (9) (10) (11) 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 • Reflects purchase accounting impacts exclusively related to the MB Financial acquisition • Projected purchase accounting accretion from the non-PCD loan portfolio represents scheduled amortization, and does not include impact of any accelerated payoffs 1See forward-looking statements on page 2 of this presentation. Classification: Internal Use 26 Fifth Third Bancorp | All Rights Reserved

Balance and credit loss trends 1 Commercial & industrial Residential mortgage $59.0 $54.0 $51.2 $50.9 $51.6 $16.7 $16.7 $16.7 $16.6 $16.6 0.39% 0.45% 0.31% 0.22% 0.28% 0.07% 0.03% 0.02% 0.02% (0.02%) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 Commercial mortgage Home equity $10.7 $10.8 $11.0 $11.2 $11.1 $6.3 $6.1 $6.0 $5.8 $5.6 0.59% 0.39% 0.16% 0.17% 0.07% 0.07% 0.06% 0.07% (0.01%) (0.02%) 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 Commercial construction Indirect secured consumer loans $12.6 $11.8 $12.1 $5.5 $5.5 $11.3 $5.3 $5.3 $5.1 $10.7 0.56% 0.50% 0.43% 0.24% 0.11% 0.00% 0.00% 0.00% 0.00% 0.00% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 Average portfolio balance NCOs as a % of average portfolio loans 1All balances are in billions Classification: Internal Use 27 Fifth Third Bancorp | All Rights Reserved

NPL rollforward 1 Commercial $ millions 3Q19 4Q19 1Q20 2Q20 3Q20 Balance, beginning of period $ 390 $ 349 $ 397 $ 445 $ 487 Transfers to nonaccrual status 32 165 176 173 299 Transfers to accrual status - - (31) - (3) Transfers to held for sale - (17) (6) (4) (1) Loan paydowns/payoffs (44) (60) (31) (50) (42) Transfers to OREO - (1) - - - Charge-offs (34) (40) (61) (81) (66) Draws/other extensions of credit 5 1 1 4 14 Balance, end of period $ 349 $ 397 $ 445 $ 487 $ 688 Consumer $ millions 3Q19 4Q19 1Q20 2Q20 3Q20 Balance, beginning of period $ 131 $ 133 $ 221 $ 202 $ 213 Transfers to nonaccrual status 46 136 63 92 66 Transfers to accrual status (21) (21) (51) (66) (56) Transfers to held for sale - - - - - Loan paydowns/payoffs (10) (13) (14) (11) (12) Transfers to OREO (3) (3) (7) - - Charge-offs (10) (11) (10) (5) (8) Draws/other extensions of credit - - - 1 - Balance, end of period $ 133 $ 221 $ 202 $ 213 $ 203 Total NPL $ millions $ 482 $ 618 $ 647 $ 700 $ 891 Total new nonaccrual loans - HFI $ 78 $ 301 $ 239 $ 265 $ 365 1Loan balances exclude nonaccrual loans HFS Classification: Internal Use 28 Fifth Third Bancorp | All Rights Reserved

3Q20 adjustments and notable items Adjusted EPS of $0.85 1 3Q20 reported EPS of $0.78 included a negative $0.07 impact from the following notable items: • $22 million pre-tax (~$17 million after-tax 2) charge related to the valuation of the Visa total return swap • $19 million pre-tax (~$15 million after-tax 2) charge related to restructuring severance expense • $10 million pre-tax (~$8 million after-tax 2) charge related to branch and non-branch real estate charges • $9 million pre-tax (~$7 million after-tax 2) charge related to rent impairment charges • $5 million pre-tax (~$4 million after-tax 2) in expenses related to COVID-19 3 1Average diluted common shares outstanding (thousands); 718.894; 2Assumes a 23% tax rate; 3COVID-19 related expenses include incremental costs incurred for enhanced cleaning measures, personal protective equipment, one-time employee bonuses (entirely in 2Q20), and other supplies in response to the COVID-19 pandemic; all adjusted figures are non-GAAP measures; see reconciliation on pages 30 and 31 of this presentation and the use of non-GAAP measures on pages 26-28 of the earnings release; Classification: Internal Use 29 Fifth Third Bancorp | All Rights Reserved

Regulation G non-GAAP reconciliation Fifth Third Bancorp and Subsidiaries Regulation G Non-GAAP Reconciliation For the Three Months Ended $ and shares in millions September June March December September (unaudited) 2020 2020 2020 2019 2019 Net income (U.S. GAAP) (a) $581 $195 $46 $734 $549 Net income (U.S. GAAP) (annualized) (b) $2,311 $784 $185 $2,912 $2,178 Net income available to common shareholders (U.S. GAAP) (c) $562 $163 $29 $701 $530 Add: Intangible amortization, net of tax 9 9 10 11 11 Tangible net income available to common shareholders (d) $571 $172 $39 $712 $541 Tangible net income available to common shareholders (annualized) (e) $2,272 $692 $157 $2,825 $2,146 Net income available to common shareholders (annualized) (f) $2,236 $656 $117 $2,781 $2,103 Average Bancorp shareholders' equity (U.S. GAAP) (g) $22,952 $22,420 $21,713 $21,304 $21,087 Less: Average preferred stock (h) (2,007) (1,770) (1,770) (1,770) (1,445) Average goodwill (4,261) (4,261) (4,251) (4,260) (4,286) Average intangible assets and other servicing rights (164) (178) (193) (194) (208) Average tangible common equity (i) $16,520 $16,211 $15,499 $15,080 $15,148 Less: average accumulated other comprehensive income ("AOCI") (2,919) (2,702) (1,825) (1,416) (1,444) Average tangible common equity, excluding AOCI (j) $13,601 $13,509 $13,674 $13,664 $13,704 Adjustments (pre-tax items) Valuation of Visa total return swap 22 29 22 44 11 Private equity write-down - - 15 - - Merger-related expenses - 9 7 9 28 Contribution to Fifth Third Foundation - - - 20 - Gain recognized from Worldpay TRA transaction - - - (345) - Unfavorable credit valuation adjustment (CVA) - - 36 - - Restructuring severance expense 19 - - - - Rent impairment charges 9 - - - - Branch and non-branch real estate charges 10 12 - - - COVID-19-related expenses 2 5 12 - - - FHLB debt extinguishment charge - 6 - - - Adjustments - after-tax 1 (k) 51 52 62 ($202) 30 Adjusted net income [(a) + (k)] $632 $247 $108 $532 $579 Adjusted net income (annualized) (l) $2,514 $993 $434 $2,111 $2,297 Adjusted net income available to common shareholders [(c) + (k)] $613 $215 $91 $499 $560 Adjusted net income available to common shareholders (annualized) (m) $2,439 $865 $366 $1,980 $2,222 Adjusted tangible net income available to common shareholders [(d) + (k)] $622 $224 $101 $510 $571 Adjusted tangible net income available to common shareholders (annualized) (n) $2,474 $901 $406 $2,023 $2,265 Average assets (o) $202,533 $198,387 $171,871 $169,327 $169,585 Metrics: Return on assets (b) / (o) 1.14% 0.40% 0.11% 1.72% 1.28% Adjusted return on assets (l) / (o) 1.24% 0.50% 0.25% 1.25% 1.35% Return on average common equity (f) / [(g) + (h)] 10.7% 3.2% 0.6% 14.2% 10.7% Adjusted return on average common equity (m) / [(g) + (h)] 11.6% 4.2% 1.8% 10.1% 11.3% Return on average tangible common equity (e) / (i) 13.8% 4.3% 1.0% 18.7% 14.2% Adjusted return on average tangible common equity (n) / (i) 15.0% 5.6% 2.6% 13.4% 15.0% Adjusted return on average tangible common equity, excluding AOCI (n) / (j) 18.2% 6.7% 3.0% 14.8% 16.5% See pages 26-28 of the earnings release for a discussion on the use of non-GAAP financial measures; 1Pre-tax items: for all periods assume a 23% tax rate, except for merger-related expenses impacted by certain non-deductible items; 2COVID-19 related expenses include incremental costs incurred for enhanced cleaning measures, personal protective equipment, one-time employee bonuses (entirely in 2Q20), and other supplies in response toClassification: the COVID-19 Internalpandemic Use 30 Fifth Third Bancorp | All Rights Reserved

Regulation G non-GAAP reconciliation Fifth Third Bancorp and Subsidiaries Regulation G Non-GAAP Reconciliation For the Three Months Ended $ and shares in millions September June March December September (unaudited) 2020 2020 2020 2019 2019 Average interest-earning assets (a) $180,704 $176,224 $151,213 $149,312 $148,854 Net interest income (U.S. GAAP) (b) $1,170 $1,200 $1,229 $1,228 $1,242 Add: Taxable equivalent adjustment 3 3 4 4 4 Net interest income (FTE) (c) $1,173 $1,203 $1,233 $1,232 $1,246 Less: Net interest income impact from purchase accounting accretion 13 15 16 18 28 Adjusted net interest income (d) $1,160 $1,188 $1,217 $1,214 $1,218 Net interest income (FTE) (annualized) (e) $4,667 $4,838 $4,959 $4,888 $4,943 Adjusted net interest income (FTE) (annualized) (f) $4,615 $4,777 $4,895 $4,816 $4,832 Noninterest income (U.S. GAAP) (g) $722 $650 $671 $1,035 $740 Valuation of Visa total return swap 22 29 22 44 11 Gain recognized from Worldpay TRA transaction - - - (345) - Private equity write-down - - 15 - - Branch and non-branch real estate charges 10 12 - - - Adjusted noninterest income (h) $754 $691 $708 $734 $751 Add: Securities (gains)/losses (51) (21) 24 (10) (5) Adjusted noninterest income, (excl. securities (gains)/losses) $703 $670 $732 $724 $746 Noninterest expense (U.S. GAAP) (i) $1,161 $1,121 $1,200 $1,160 $1,159 Contribution for Fifth Third Foundation - - - (20) - Restructuring severance expense (19) - - - - Rent impairment charges (9) - - - - COVID-19-related expenses 1 (5) (12) - - - FHLB debt extinguishment charge - (6) - - - Unfavorable credit valuation adjustment (CVA) - - (36) - - Merger-related expenses - (9) (7) (9) (28) Adjusted noninterest expense $1,128 $1,094 $1,157 $1,131 $1,131 Less: Intangible amortization 12 12 13 14 14 Adjusted noninterest expense excl. intangible amortization expense (j) $1,116 $1,082 $1,144 $1,117 $1,117 Metrics: Pre-provision net revenue [(c) + (g) - (i)] 734 732 704 1,107 827 Adjusted pre-provision net revenue [(d) + (h) - (j)] 798 797 781 831 852 Net interest margin (FTE) (e) / (a) 2.58% 2.75% 3.28% 3.27% 3.32% Adjusted net interest margin (FTE) (f) / (a) 2.55% 2.71% 3.24% 3.22% 3.25% Efficiency ratio (FTE) (i) / [(c) + (g)] 61.3% 60.5% 63.0% 51.2% 58.4% Adjusted efficiency ratio (j) / [(d) + (h)] 58.3% 57.6% 59.4% 57.3% 56.7% See pages 26-28 of the earnings release for a discussion on the use of non-GAAP financial measures; 1COVID-19 related expenses include incremental costs incurred for enhanced cleaning measures, personal protective equipment, one-time employee bonuses Classification:(entirely in 2Q20), Internal and other Use supplies in response to the COVID-19 pandemic 31 Fifth Third Bancorp | All Rights Reserved