Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CHART INDUSTRIES INC | exhibit991gtls-2020102.htm |

| 8-K - 8-K - CHART INDUSTRIES INC | gtls-20201022.htm |

Exhibit 99.2 Chart Industries THIRD QUARTER 2020 RESULTS

Forward-Looking Statements CERTAIN STATEMENTS MADE IN THIS PRESENTATION ARE FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING THE COMPANY’S BUSINESS PLANS, INCLUDING STATEMENTS REGARDING COMPLETED DIVESTITURES, ACQUISITIONS, COST SYNERGIES AND EFFICIENCY SAVINGS, OBJECTIVES, FUTURE ORDERS, REVENUES, MARGINS, EARNINGS OR PERFORMANCE, LIQUIDITY AND CASH FLOW, CAPITAL EXPENDITURES, BUSINESS TRENDS, GOVERNMENTAL INITIATIVES, INCLUDING EXECUTIVE ORDERS AND OTHER INFORMATION THAT IS NOT HISTORICAL IN NATURE. FORWARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY TERMINOLOGY SUCH AS "MAY," "WILL," "SHOULD," "COULD," "EXPECTS," "ANTICIPATES," "BELIEVES," "PROJECTS," "FORECASTS," “OUTLOOK,” “GUIDANCE,” "CONTINUE," “TARGET,” OR THE NEGATIVE OF SUCH TERMS OR COMPARABLE TERMINOLOGY. FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION OR IN OTHER STATEMENTS MADE BY THE COMPANY ARE MADE BASED ON MANAGEMENT'S EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS IMPACTING THE COMPANY AND ARE SUBJECT TO UNCERTAINTIES AND FACTORS RELATING TO THE COMPANY'S OPERATIONS AND BUSINESS ENVIRONMENT, ALL OF WHICH ARE DIFFICULT TO PREDICT AND MANY OF WHICH ARE BEYOND THE COMPANY'S CONTROL, THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE MATTERS EXPRESSED OR IMPLIED BY FORWARD-LOOKING STATEMENTS. FACTORS THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS INCLUDE: THE COMPANY’S ABILITY TO SUCCESSFULLY INTEGRATE RECENT ACQUISITIONS AND ACHIEVE THE ANTICIPATED REVENUE, EARNINGS, ACCRETION AND OTHER BENEFITS FROM THESE ACQUISITIONS; RISKS RELATING TO THE RECENT OUTBREAK AND CONTINUED UNCERTAINTY ASSOCIATED WITH THE CORONAVIRUS (COVID-19) AND THE OTHER FACTORS DISCUSSED IN ITEM 1A (RISK FACTORS) IN THE COMPANY’S MOST RECENT ANNUAL REPORT ON FORM 10-K AND QUARTERLY REPORTS ON FORM 10-Q FILED WITH THE SEC, WHICH SHOULD BE REVIEWED CAREFULLY. THE COMPANY UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENT. THIS PRESENTATION CONTAINS NON-GAAP FINANCIAL INFORMATION, INCLUDING ADJUSTED EPS, AND Q3 2020 FREE CASH FLOW. FOR ADDITIONAL INFORMATION REGARDING THE COMPANY'S USE OFNON-GAAP FINANCIAL INFORMATION, AS WELL AS RECONCILIATIONS OF NON- GAAP FINANCIAL MEASURES TO THE MOST DIRECTLY COMPARABLE FINANCIAL MEASURES CALCULATED AND PRESENTED IN ACCORDANCE WITH ACCOUNTING PRINCIPLES GENERALLY ACCEPTED IN THE UNITED STATES ("GAAP"), PLEASE SEE THE PAGES AT THE END OF THIS NEWS RELEASE. WITH RESPECT TO THE COMPANY’S 2020 AND 2021 FULL YEAR EARNINGS OUTLOOKS, THE COMPANY IS NOT ABLE TO PROVIDE A RECONCILIATION OF THE ADJUSTED EARNINGS PER DILUTED SHARE BECAUSE CERTAIN ITEMS MAY HAVE NOT YET OCCURRED OR ARE OUT OF THE COMPANY’S CONTROL AND/OR CANNOT BE REASONABLY PREDICTED. FURTHERMORE, NON-GAAP FINANCIAL MEASURES SHOWN IN THE PRESENTATION SLIDE LABELED “EXTERNAL SEGMENTATION” WERE NOT RECONCILED TO THE COMPARABLE GAAP FINANCIAL MEASURES BECAUSE THE GAAP MEASURES WOULD REQUIRE SIGNIFICANT EFFORT TO PREPARE AND THEREFORE ARE NOT AVAILABLE AS OF THE TIME OF THIS NEWS RELEASE. CHART INDUSTRIES, INC. IS A LEADING INDEPENDENT GLOBAL MANUFACTURER OF HIGHLY ENGINEERED EQUIPMENT SERVICING MULTIPLE APPLICATIONS IN THE ENERGY AND INDUSTRIAL GAS MARKETS. OUR UNIQUE PRODUCT PORTFOLIO IS USED IN EVERY PHASE OF THE LIQUID GAS SUPPLY CHAIN, INCLUDING UPFRONT ENGINEERING, SERVICE AND REPAIR. BEING AT THE FOREFRONT OF THE CLEAN ENERGY TRANSITION, CHART IS A LEADING PROVIDER OF TECHNOLOGY, EQUIPMENT AND SERVICES RELATED TO LIQUEFIED NATURAL GAS, HYDROGEN, BIOGAS AND CO2 CAPTURE AMONGST OTHER APPLICATIONS. WE ARE COMMITTED TO EXCELLENCE IN ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE (ESG) ISSUES BOTH FOR OUR COMPANY AS WELL AS OUR CUSTOMERS. WITH OVER 25 GLOBAL LOCATIONS FROM THE UNITED STATES TO ASIA, AUSTRALIA, INDIA, EUROPE AND SOUTH AMERICA, WE MAINTAIN ACCOUNTABILITY AND TRANSPARENCY TO OUR TEAM MEMBERS, SUPPLIERS, CUSTOMERS AND COMMUNITIES. TO LEARN MORE, VISIT WWW.CHARTINDUSTRIES.COM© 2020 Chart Industries,. Inc. Confidential and Proprietary 2

Our Focused Strategy Supports Clean Energy Targets *Blue areas (A through J) are applications for which Chart has existing products and solutions © 2020 Chart Industries, Inc. Confidential and Proprietary 3

Chart’s Transformation THEN TODAY Before 2018 2018 – Present Higher customer concentration / lower geographic diversity Lower customer concentration / higher end-market and geographic diversity Heavy reliance on single large LNG projects Multiple long-term agreements, MOUs in place Business Significant backlog with PetroChina that went away in 2016 ($150M) Centralized business services and agile, quick cost rationalization Operations Few long-term contracts in place Aftermarket parts, service and repair revenue continues to increase Limited actions taken for cost rationalization Big LNG is a “nice to have” whereas before it was a “necessity” Limited to no aftermarket, service and repair High growth (10%+) identified specialty products for specialty markets 2018: 2018: 2018: 2018: 2019: 2020: 2020: 2020: 2020: Completes Acquires Skaff Acquires VRV Divests Acquisition of Completes Divests Acquires Invests in and major capacity Cryogenics oxygen Air-X- supply cryobiological cryogenic and completes expansion in and Cryo- concentrator Changers agreement for product lines hydrogen commercial MOU Business La Crosse, WI Lease, LLC business H2 trailer for hydrogen Changes business 2018- USA USA EU / India USA USA / India Global USA USA Global Present Capacity Repair & India & Italy Exited non- Expanded Competitive Exit non-core Competitive Competitive service Manufacturing core, non- product advantage business with advantage advantage Competitive location cryogenic offering with high liabilities advantage Revenue business clean energy Expanded Revenue Leasing line synergies capabilities Catalyst for product synergies trailer offering acquisition Note: Figures as-reported during stated period © 2020 Chart Industries, Inc. Confidential and Proprietary 4

Balance Sheet Strength & Strong Cash Generation Give Space for Additional Investment Pro-Forma Free Cash Flow Organic Inorganic $83 Hydrogen Engineers Partnership with Expand rental/leasing / Commercial FirstElement for McPhy Partnership mobile fleet Resources hydrogen (H2) $5 - $7M $3 - $5M development $35M $39 Develop hydrogen Greenfield repair and LTA / Agreements pump and HLH2 Targeted service facility in S.C. with key customers tank partnerships with $7M in spec products $5M H2 integrators 2019 YTD 2020 YTD Create leasing Expand specialty India Product Cryogenic Pump HYDROGEN trailer products and Net Leverage Expansion Acquisition fleet technology $3M $20-$40M Actual as of September 30, 2020 2.92 $5M $20 - $40M Proforma with impact of CryoBio divestiture 1.75 In Process Not Imminent Proforma with impact of divestiture and Completed 1.98 strategic Hydrogen expansion 5

Immediate Impacts: Hydrogen Expanded H2 Trailer Capabilities Recent Order Wins • Gaseous hydrogen trailers • Capability to manufacture 28 in Germany for $2 million foot, 48 foot and 53 foot (October) trailers • 300,000 square foot facility • Verbal $6.4 million trailer with Port of Mobile Access order (October) • LOI for $2.4 million trailer order (October) • PlugPower Supply H2@SCALE Texas: Agreement and $7.8 million of orders (September) • Frontier Energy • Brazed aluminum heat • GTI exchanger order for H2 • The University of Texas (Austin) $500k (September) • OneH2 • SoCalGas • LH2 tanks order for Mexico • Toyota Motor North America $700k (September) • Shell • MOU for Asia hydrogen • MHI project with major • Air Liquide industrial gas customer • PowerCell Sweden AB • Chart Industries, Inc. 6

Customer Stickiness (LTAs, LOIs, MOUs) MOUs / LOCs LTAs / Agreements Complete LOIs ExxonMobil India LNG and IOCL HLNG Customer 1 (2019) IG Major (A) Bulk & Lifecycle IOCL HLNG Customer 2 (2019) MIT tanks Risco Energy IG Major (A) Vaporizers Eagle Jax ssLNG Energy Capital Vietnam (ECV) IG Major (A) PRS Shell German stations AG&P Matheson Molson LOI for distribution line Major IG Asia Hydrogen Development Praxair PRS Renergen for LNG equipment South Africa Gasum repair & service Liquind Agreement for Fueling Stations Baywa Agreement for Fueling Stations Master Agreement with Flint Hills Resources for air coolers IG Major B (Bulk) IG Major (B) Lifecycle SOL Master Agreement Plug Power Supply Agreement Liquind repair & service Stratolaunch Master Agreement Increment Power Engineering & Supply Agreement for Energy Storage © 2020 Chart Industries, Inc. Confidential and Proprietary 7 *Red italicized text denotes signing or extension was completed in Q3 2020

Specialty Market: Water Treatment • Growing populations putting pressure on existing water treatment systems Recent Wins • More stringent regulatory issues, and • $3.7M with Archer Western increasing environmental concerns for designing and fabricating • Middle East and Asia, facing water scarcity, the Liquid Oxygen System turning to desalination as a solution for the Dallas Water Utility • United States: 32 billion gallons of wastewater Ozone Improvement Project each day, with demand on treatment plants growing 23% by 2032 • Order for equipment for the Ozone for Disinfection Bahr Albaqar wastewater treatment plant being Liquid oxygen being Chart’s storage and vaporization constructed in northeast used to generate ozone used for technology can be partnered with large Egypt, being touted as the CO dissolution systems in these disinfection 2 world’s largest facility Liquid oxygen system for ozone generation (Duchense, UT) desalination facilities Carbonic Acid (CO2) for pH Balancing • 110% increase in year-to- New water treatment plants date September 30, 2020 utilizing CO2 to adjust the pH orders levels of water after disinfection process System to store / regasify CO2 (GA) 8

First-Of-A-Kind Projects in Q3 2020 Liquid Air Energy Storage Liquid Oxygen for Rocket Vehicles N2 dosing for cleaning disinfectant We executed an exclusive three-year We completed a Master Service Received an order for a major design and supply agreement with Agreement with Stratolaunch for consumer products company that is Increment Power for liquefaction, engineering solutions of a liquid oxygen utilizing N2 dosers and phase storage, truck loading and pipe for tank for use on a carrier plane as part of separators in their disinfectant PET ISTOR™’s proprietary liquid air their hypersonic aerospace vehicle bottles to avoid paneling. energy storage system. program. © 2020 Chart Industries, Inc. Confidential and Proprietary 9

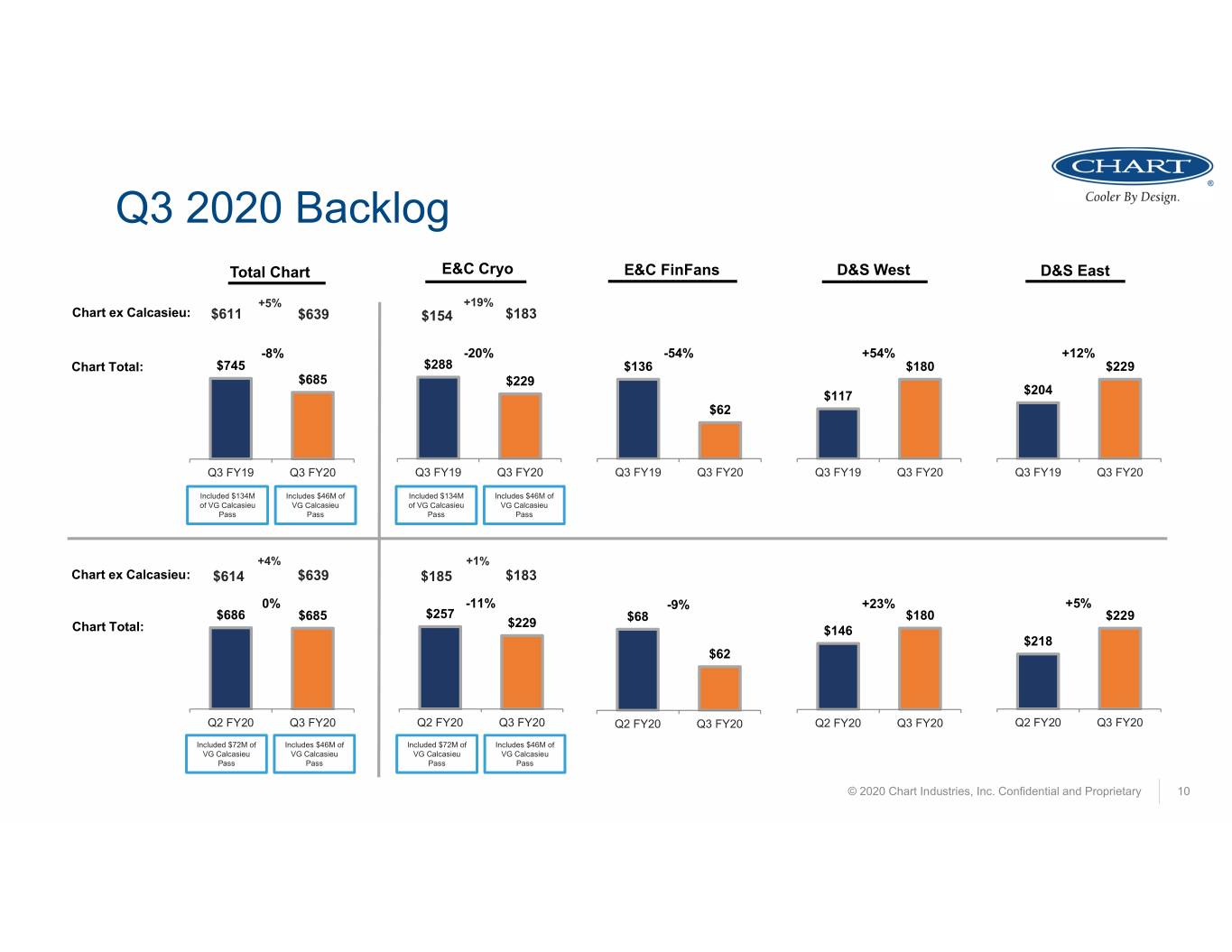

Q3 2020 Backlog Total Chart E&C Cryo E&C FinFans D&S West D&S East +5% +19% Chart ex Calcasieu: $611 $639 $154 $183 -8% -20% -54% +54% +12% Chart Total: $745 $288 $136 $180 $229 $685 $229 $117 $204 $62 Q3 FY19 Q3 FY20 Q3 FY19 Q3 FY20 Q3 FY19 Q3 FY20 Q3 FY19 Q3 FY20 Q3 FY19 Q3 FY20 Included $134M Includes $46M of Included $134M Includes $46M of of VG Calcasieu VG Calcasieu of VG Calcasieu VG Calcasieu Pass Pass Pass Pass +4% +1% Chart ex Calcasieu: $614 $639 $185 $183 0% -11% -9% +23% +5% $686 $685 $257 $180 $229 $229 $68 Chart Total: $146 $218 $62 Q2 FY20 Q3 FY20 Q2 FY20 Q3 FY20 Q2 FY20 Q3 FY20 Q2 FY20 Q3 FY20 Q2 FY20 Q3 FY20 Included $72M of Includes $46M of Included $72M of Includes $46M of VG Calcasieu VG Calcasieu VG Calcasieu VG Calcasieu Pass Pass Pass Pass © 2020 Chart Industries, Inc. Confidential and Proprietary 10

Q3 and Year-to-Date 2020 EPS $ millions, except per share amounts Continuing Operations Q3 2020 Q3 2019 Change v. PY YTD 2020 YTD 2019 Change v. PY Net income from continuing operations $15.8 $13.8 $2.0 $32.4 $15.3 $17.1 Reported Diluted EPS $0.43 $0.38 $0.05 $0.88 $0.43 $0.45 1 Restructuring and transaction‐related costs 0.17 0.25 (0.08) 0.54 0.84 (0.30) 2 Gain on sale of a facility in China ‐ ‐ ‐ (0.07) ‐ (0.07) 3 Other one‐time items (1) 0.04 0.06 (0.02) 0.20 0.14 0.06 4 Tax effects (2) (0.02) (0.06) 0.04 (0.12) (0.14) 0.02 5 Dilution impact of convertible notes 0.01 0.01 ‐ ‐ 0.03 (0.03) Adjusted Diluted EPS (3) $0.63 $0.64 ($0.01) $1.43 $1.30 $0.13 (1) Other one-time items were related to: Stabilis investment mark-to-market and Liberty LNG investment adjustment of $0.15 in Q1, ($0.02) in Q2 and ($0.01) in Q3 2020; COVID-19 related costs of $0.03 and $0.02 in Q1 and Q3 2020 respectively; Commercial and legal settlements of $0.06 in Q3 2019 and $0.02 and $0.03 in Q1 and Q3 2020 respectively; and Tax Reform / transition tax related adjustments $0.02 in Q1 2019. (2) Tax effect reflects adjustment at normalized periodic rates. (3) Adjusted EPS (a non-GAAP measure) is as reported on a historical basis. © 2020 Chart Industries, Inc. Confidential and Proprietary 11

Full Year 2020 Guidance (Continuing Operations) Prior Guidance Current Guidance Revenue Revenue Approximately $1.2B Approximately $1.18B Includes $100M of Calcasieu Includes $100M of Calcasieu Shifted to 2021 Pass Pass Diluted Adjusted EPS Diluted Adjusted EPS Approximately $2.25 Unchanged Approximately $2.25 Assumes 19% ETR Assumes 19% ETR Capital Expenditures Unchanged Capital Expenditures $30M to $35M $30M to $35M Adjusted Free Cash Flow Adjusted Free Cash Flow Unchanged $120 to $140M $120 to $140M © 2020 Chart Industries, Inc. Confidential and Proprietary 12

2021 Outlook Prior Current Assumes no additional Big LNG Revenue ($M) Adjusted EPS Revenue Revenue 2020 Guidance, continuing ops (1) $1,180 $2.25 $1.25 - $1.325B $1.250 - $1.325 Billion Calcasieu Gap (75) (0.65) - (0.75) Includes $23M of Includes $23M of Calcasieu Calcasieu Unchanged ssLNG terminals/other petchem 45 – 75 0.27 – 0.45 Base business growth at 3% - 4% 25 – 35 0.17 – 0.24 Diluted Adjusted EPS Diluted Adjusted EPS Air cooled heat exchanger recovery 10 – 25 0.03 – 0.10 $2.90 to $3.25 $3.00 to $3.40 Specialty products, LRS at 10% 35 – 45 0.25 – 0.35 Assumes 18% ETR Increase Assumes 18% ETR Incremental restructuring savings offset 0.45 by engineering investment Interest expense savings 0.15 Capital Expenditures Capital Expenditures $30M to $35M $30M to $35M Alabama cryo & hydrogen trailers 15 – 20 0.07 - 0.12 Unchanged Q3 2020 revenue shifts to 2021 20 - 25 0.10 - 0.15 2021 Outlook, continuing ops (2) $1,250 - $1,325 $3.00 - $3.40 Free Cash Flow Free Cash Flow (1) Excludes full year cryobiological products $175 to $200M $175 to $200M (2) Does not include any additional Big LNG; embeds effective tax rate benefit into each row of adjusted EPS Unchanged © 2020 Chart Industries, Inc. Confidential and Proprietary 13

Appendix 14

Q3 and YTD 2020 Free Cash Flow $ millions, except per share amounts Continuing Operations Q3 2020 Q3 2019 Change v. PY YTD 2020 YTD 2019 Change v. PY Income attributable to Chart Industries, Inc. adjusted (1) $12 $14 ($2) $45 $31 $14 Income attributable to noncontrolling interests 000101 Depreciation and amortization 1924(5)665511 Accounts receivable 10 11 (1) 27 0 27 Inventory 2 0 2 (27) (4) (23) Unbilled contract revenues and other assets (14) 9 (23) 0 (11) 11 Accounts payable and other liabilities 6 0 6 (15) (21) 6 Customer advances and billings in excess (9) (10) 1 (3) (14) 11 of contract revenue Net Cash Provided By Operating Activities $26 $48 ($22) $94 $36 $58 Capital expenditures (6) (11) 5 (27) (26) (1) Free Cash Flow (2) $20 $37 ($17) $67 $10 $57 Pro-forma adjustments Restructuring and transaction-related costs 6 9 (3) 19 31 (12) Other one-time items 10103(3) Tax effects (1) (2) 1 (3) (5) 2 Pro-Forma Free Cash Flow (3) $26 $44 ($18) $83 $39 $44 (1) “Income attributable to Chart Industries Inc. adjusted” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Reconciliation to Net Income (U.S. GAAP) is provided in accompanying press release financial tables. (2) “Free Cash Flow” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net cash provided by (used in) operating activities in accordance with U.S. GAAP. The Company believes this figure is of interest to investors and facilitates useful period-to period comparisons of the Company’s operating results. (3) Other one-time items were related to: Stabilis investment mark-to-market and Liberty LNG investment adjustment of $4 in year-to-date 2020, Commercial and legal settlements of $1 in Q3 2020 and year-to-date 2020 and $2 year-to-date 2019 ; and $1 in Tax Reform / transition tax related adjustments in year-to-date 2019. © 2020 Chart Industries, Inc. Confidential and Proprietary 15

Divested Cryobiological YTD Statistics In Discontinued Operations © 2020 Chart Industries, Inc. Confidential and Proprietary 16