Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - TEXAS CAPITAL BANCSHARES INC/TX | a10212020exhibit991.htm |

| 8-K - 8-K - TEXAS CAPITAL BANCSHARES INC/TX | a10202020-8k.htm |

Q3-2020 Earnings October 21, 2020

Forward Looking Statements This communication may be deemed to include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding our financial condition, results of operations, business plans and future performance. These statements are not historical in nature and can generally be identified by such words as “believe,” “expect,” “estimate,” “anticipate,” “plan,” “may,” “will,” “forecast,” “could,” “projects,” “intend” and similar expressions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. A number of factors, many of which are beyond our control, could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the credit quality of our loan portfolio, general economic conditions in the United States and in our markets, including the continued impact on our customers from volatility in oil and gas prices, the material risks and uncertainties for the U.S. and world economies, and for our business, resulting from the COVID-19 pandemic, expectations regarding rates of default and credit losses, volatility in the mortgage industry, our business strategies, our expectations about future financial performance, future growth and earnings, the appropriateness of our allowance for credit losses and provision for credit losses, our ability to identify, employ and retain a successor chief executive officer, the impact of changing regulatory requirements and legislative changes on our business, increased competition, interest rate risk, new lines of business, new product or service offerings and new technologies. These and other factors that could cause results to differ materially from those described in the forward-looking statements, as well as a discussion of the risks and uncertainties that may affect our business, can be found in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and in other filings we make with the Securities and Exchange Commission. The information contained in this communication speaks only as of its date. Except to the extent required by applicable law or regulation, we disclaim any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. 2

Improved Profitability Financial Highlights ($M) 3Q 2019 2Q 2020 3Q 2020 ◼ Strong core financial performance with $54.7 million of net income to Net Interest Income $252.2 $209.9 $207.6 common, or $1.08 per diluted share Non-Interest Income 20.3 70.5 60.3 ◼ Stable Y-o-Y Total Revenue driven by continued robust mortgage demand and persistent HFI loan spreads Total Revenue 272.5 280.4 267.9 ◼ Additional one-time expense actions of $15.4 million related to software Non-Interest Expense 149.4 222.3 165.7 write-off taken this quarter PPNR1 123.1 58.1 102.2 ◼ Non-performing assets totaled $161.9 million, a decrease of $12.1 Provision for Credit Losses 11.0 100.0 30.0 million compared to Q2-2020. ACL / NPA coverage improved to 1.8x Income Tax Expense/(Benefit) 24.0 (7.6) 15.1 from 1.5x Net Income/(Loss) $88.1 $(34.3) $57.1 ◼ Moderating provision expense from 1H-2020 levels reflective of proactive early-cycle approach and stabilizing macroeconomic trends Key Performance Metrics ◼ Continued balance sheet strength evidenced by Common Equity Tier 1 ROA 1.06% (0.36)% 0.59% of 9.1% and Liquidity Assets / Total Assets of 27.2% both of which are expected to stay at elevated levels over the near-term PPNR 1 / Avg. Assets 1.48% 0.62% 1.06% ◼ Employee health and safety continue to be primary areas of focus; 2 Efficiency Ratio 54.8% 79.3% 61.9% business continuity plan remains in place EPS $1.70 $(0.73) $1.08 ROCE 13.21% (5.48)% 8.24% Sustainably Higher Core Earnings ◼ PPNR 1 / Avg. Assets trends improving as a result of lower expenses and improved balance sheet efficiency. Early assessment of 2021 indicates pull-through of anticipated expense savings ◼ Strong quarter for front-line hires; continued area of focus heading into 2021. Client activity beginning to pick up at a Progress on measured pace with improving loan, deposit, and treasury pipelines Strategic ◼ Redeployed portion of excess liquidity into $1.1B of securities; average yield 1.12 bps, duration ~5 years Priorities Effective Credit Cycle Management ◼ Multi-year, proactive de-risking in Energy and Leveraged Lending resulting in remaining portfolios more representative of go-forward composition and desired client profiles ◼ Focused on sustaining legacy of peer credit outperformance in the remainder of the loan portfolio 1 Net interest income and non-interest income, less non-interest expense 2 Non-interest expense divided by the sum of net interest income and non-interest income 3

Credit Risk Management; Continued Proactive Approach Highlights Credit Quality ◼ Credit Trends Q3 2019 Q2 2020 Q3 2020 ◼ Modest net charge-offs, which are down substantiality given proactive actions taken in previous quarters ◼ Velocity of negative risk migration has materially declined; 1.84% conversely, positive migration has increased 1.60% ◼ COVID-19 Impacts 1.04% 1.15% 1.13% ◼ Loans totaling $166 million remain on deferral at Q3-2020; 0.77% 0.49% 0.43% $1.2 billion at Q2-2020 0.37% ◼ $61 million of remaining $166 million granted second 90-day deferral ACL on Loans / Loans ACL on Loans / NPAs / Earning Assets ◼ Economic View for CECL HFI Loans HFI excl MFLs ◼ Unemployment: 8.8% @ Q4-2020, 6.6% @ Q4-2021 Initial COVID-Impacted Bal / Cmt % Total % % Loan Types / Industries ($B) Loans Criticized NPA Commentary Reserve coverage level at historical highs and criticized levels down 15% Q-o-Q. 0.96 / 1.4 4% 28% 8% C&I – Energy Market activity slowly increasing Granular portfolio with select credits negatively impacted by COVID-related social C&I – Real Estate 0.46 / 0.69 2% 4% 0% distancing protocols Borrowers adjusting to clients’ preferences and state restrictions; will require C&I – Food Services 1 0.19 / 0.21 1% 12% 0% continued monitoring C&I – Retail Trade 0.11 / 0.16 <1% 9% 0% Portfolio continues to show resilience Most impacted portfolio to-date. Texas-centric, limited service with significant cash CRE – Hospitality 0.34 / 0.35 1% 51% 0% equity providing support for extended stress Continues to perform well with quality of anchor/essential tenants (e.g., large CRE – Retail 0.29 / 0.31 1% 6% 0% grocery stores) in most properties a risk mitigating factor 1 Includes Accommodation 4

Loan Portfolio Growth Outlook Y-o-Y Changes in Ending LHI (excluding MFLs) ◼ Ending LHI (excluding MFLs) decreased $762 million (5%) from Q2- $16.8B 2020, and $982 million Y-o-Y, due to the following factors: ◼ Deliberate multi-quarter reductions in Energy and Leveraged Lending; ending balances down 27% and 9%, respectively, $0.7B $15.8B from Q1-2020 and 41% and 41%, respectively, from YE 2018 $1.3B ◼ Utilization rates in the low 50’s, down from historically observed levels $0.7B $0.3B ◼ Average Total MFLs 1 of $9.6 billion were modestly higher in Q3-2020 ($0.5 billion, or 6%) as strong mortgage demand continued ◼ Loan spreads have shown resilience even as the portfolio mixed to lower yielding products Beginning9/30/2019 Targeted Line Other PPP 9/30/2020Ending Balance Reductions Utilization Balance 9/30/2019 9/30/2020 Period-End Loan Composition 2 Average Loans & Total Loan Spread 3 1 3 $25.8B in balances LHI (excl. MFLs) Total MFLs Total Loan Spread Business Assets 25% Energy 4% $10.7B $11.4B $10.2B $9.1B $9.6B Other 8% $16.9B $16.7B $16.6B $17.0B $16.3B Owner Occupied R/E 3.48% 3.38% 3.43% 5% Total Mortgage 3.35% 3.33% Finance Residential R/E 39% Mkt. Risk 4% Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Comml R/E Mkt. Risk Total Loan 4.79% 4.45% 4.30% 3.86% 3.69% 15% Yield 1 Total MFLs include LHI, mortgage finance, and MCA LHS 2 Includes total LHI and LHS 5 3 Total Loan Spread = Yield on total loans (HFI & HFS) – Total cost of deposits and other borrowings

Deposits and Fundings Highlights Funding Costs ◼ Ending deposits increased $1.8 billion, primarily in non-interest bearing portfolios, as clients continued to build and maintain on- balance sheet cash ◼ Continued focus on cost-effective deposit growth within 1.25% verticals and core client relationships 1.03% 0.92% ◼ Brokered deposit balances stabilized, while costs declined, 1.21% 0.99% as the Bank replaced higher-priced maturing deposits 0.90% 0.45% ◼ Funding costs continued to improve, albeit modestly (7 bps), as the 0.38% mix trended towards lower-/no-cost funding 0.42% ◼ Focusing on further reducing core interest-bearing deposit 0.34% costs and increasing non-interest balances Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 ◼ Initiatives to reduce excess liquidity will proceed prudently by targeting higher-cost, indexed portfolios Avg Cost of Deposits Total Funding Costs Period-End Deposits Balances Upcoming Maturities CD Maturity FHLB Maturity $32.0B $30.2B $2.0B $27.4B $26.5B $27.1B $10.8B $12.3B $10.3B $9.4B $9.4B 1.40% 1.20% $2.3B $2.3B 1.01% $2.1B $2.7B $2.3B $0.9B 0.34% $0.7B 0.61% $17.0B $17.3B $0.4B $15.0B $14.7B $15.0B $0.3B $0.2B 0.15% Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2020 Q1 2021 Interest-bearing core Interest-bearing brokered DDAs Funding Rate 6

Q3-2020 Earnings Overview Net Interest Income & Margin Commentary Net Interest Margin Detail (bps) ◼ Total LHI yields continued to decline (17 bps) as balances mixed towards $252.2M relatively lower yielding MFLs $209.9M $207.6M ◼ Total time deposit costs declined significantly (33 bps), as did levels. Further benefitting from a $1.3 billion increase in average NIB deposits, 3.16% total deposit costs declined 8 bps 2.30% 2.22% ◼ With reductions in the LHI portfolio driving a net decrease in loans, excess deposit growth increased Net Interest Income Interest Net liquidity. Migration to securities will Q3 2019 Q2 2020 Q3 2020 further enhance yields as the balance Other Costs Loans Yields Yields sheet continues its transition Funding Q2 Q2 2020 Q3 2020 Balances (net (net PPP) PPP Loans PPP Liquid Liquid Asset Liquid Asset Provision for Credit Losses Commentary Criticized Loans ◼ The modest increase in criticized loans $1,075.6M $100.0M notwithstanding, a decrease in net $1,014.0M charge-offs and more stable economic outlook led to reduced provision 4.27% expense during the quarter 3.97% ◼ NCOs of $1.6 million demonstrate a $536.3M material improvement over both Q2- 2.17% $30.0M 2020 ($74.1 million) and Q3-2019 ($36.9 million). Expectation of higher $11.0M NCO levels in future quarters as the Credit Expense Credit cycle matures ◼ Provision expense is expected to Q3 2019 Q2 2020 Q3 2020 Q3 2019 Q2 2020 Q3 2020 remain moderate compared to 1H20, with risk migration peaking in 2021 Criticized Loans Criticized Loans % Total LHI 7

Q3-2020 Earnings Overview Non-interest Income Commentary Fee Income Details ◼ Deposit Service Charges up 16% Q-o-Q reflective of continued $70.5M $6.2M $6.3M market focus $5.9M $60.3M ◼ Wealth Management Fees $1.2M $1.5M $0.5M modestly improving Q-o-Q (up 7%) as the downturn stabilizes and $2.5M $2.3M $2.3M markets recover from troughs $20.3M ◼ GOS opportunities in MCA continue interest income interest to contribute significantly ($31.3 $2.9M - $2.7M $2.5M million higher than in Q3-2019) ◼ Brokered Loan Fees up significantly Non Q3 2019 Q2 2020 Q3 2020 Q-o-Q ($4.3 million, or 40%). Q3 2019 Q2 2020 Q3 2020 Volumes may remain unseasonably Swap Fees high in Q4-2020, but lower than in Wealth Management Fees Q3-2020 Deposit Service Charges Non-interest Expense Commentary Salary and Employee Benefits ◼ Q2-2020 expense-reduction actions $222.4M drove core salaries decline ($3.0 $100.8M million). Q3-2020 Salaries & Benefits $165.7M only 4% above year-ago levels $80.7M $84.1M $149.4M ◼ Incremental spend focused on revenue-producing positions ◼ Benefits from final software write-off in Q3 ($15.4 million) will be more fully realized in Q4 and 2021 interest expense interest - ◼ Servicing asset impairment weighed on Q2 results and did not reoccur in Non Q3 2019 Q2 2020 Q3 2020 Q3 due to active hedging. Heightened Q3 2019 Q2 2020 Q3 2020 amortization expense from declining rates may keep levels elevated, however 8

LOB Detail

Loan Portfolio Detail – Mortgage Finance Commentary MWH + MCA Annualized Revenue ◼ Q3-2020 average MFLs (excluding MCA LHS) increased 12% Y-o-Y as the Bank continued to optimize its business mix by taking advantage of industry volumes and GOS opportunities in MCA $174M -22.5% $135M ◼ When combined with MCA, annualized quarterly revenue increased +129.8% ~26% from Q3-2019. A favorable outlook suggests continued near- $76M term opportunity to provide substantial risk-adjusted returns acting as a counter-cyclical hedge to the traditional LHI portfolio +2.2% ◼ Mortgage Finance’s relationship-driven pricing approach continues $291M +10.3% $321M $328M to support yields (only 9 bp decrease Q-o-Q), allowing volume to offset potential declines in interest and drive higher non-interest fees ◼ Proven track-record of adjusting risk profile based on market Q3 2019 Q2 2020 Q3 2020 liquidity; underlying portfolio quality remains the priority Mortgage Warehouse Mortgage Correspondent Aggregation Average Mortgage Warehouse Loans and Yields $10.0B 6.0% $9.0B 5.0% $8.0B 4.0% $7.0B 3.0% $6.0B 2.0% $5.0B $4.0B 1.0% $3.0B 0.0% Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Mortgage Finance Yield 10YR 1M LIBOR 10

Loan Portfolio Detail – CRE 1 CRE Portfolio Overview $3.9B in balances Portfolio Composition ◼ History of proactive portfolio management evidenced by changes in Multi Family Office Industrial Senior Housing growth rates thru-cycle and strong credit performance during Hospitality Self Storage Other Retail periods of stress ◼ CRE managed as a line of business facilitating achievement of concentration objectives by product and geography. Underwriting 32% 14% 11% 10% 9% 9% 8% 7% focus on strong sponsors and developers with significant upfront cash equity Texas Other (<3% each) California Colorado Florida Georgia ◼ Emphasis on equity and LTV at origination with recent appraisals demonstrating value resiliency across collateral types ◼ Composition deliberately weighted towards lower risk multi-family 58% 25% 7% 4% ($1.2 billion in balances) with an emphasis on newly developed, Class A properties. Rent collection remains high 3% 3% ◼ Office and Industrial performance is stable with evidence of permanent market and/or sales appetite. Continuing to actively Net charge-off Performance monitor Office for signs of emerging stress resulting from COVID related restrictions ◼ Deferrals for COVID-impacted exposures are made in concert with 4.5% TCBI Peer Average loan restructures and modifications to support borrower performance longer term 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q2 2020 Q2 1 Excludes Specialized Residential Real Estate portfolio 11

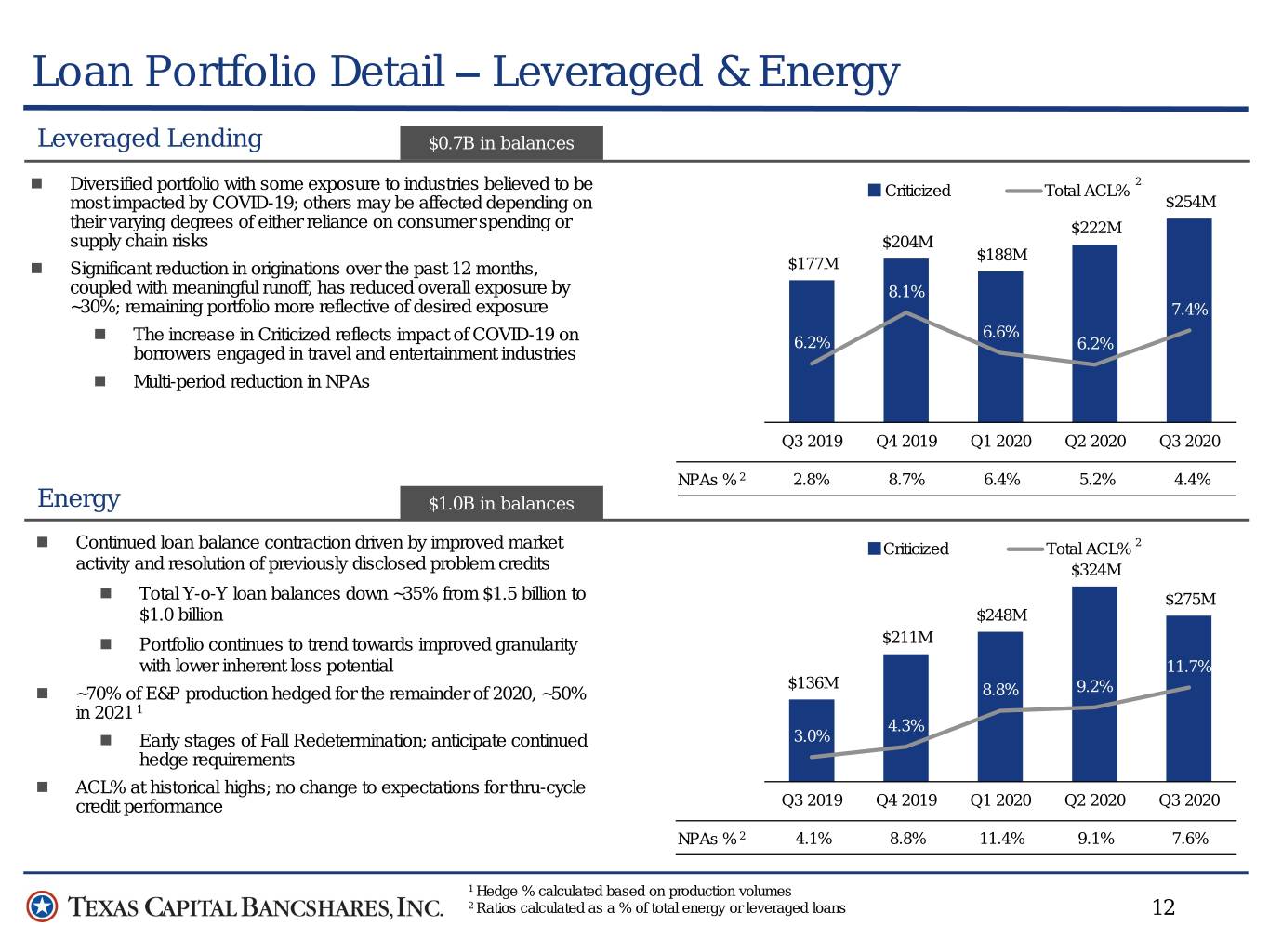

Loan Portfolio Detail – Leveraged & Energy Leveraged Lending $0.7B in balances 2 ◼ Diversified portfolio with some exposure to industries believed to be Criticized Total ACL% most impacted by COVID-19; others may be affected depending on $254M their varying degrees of either reliance on consumer spending or $222M supply chain risks $204M $188M ◼ Significant reduction in originations over the past 12 months, $177M coupled with meaningful runoff, has reduced overall exposure by 8.1% ~30%; remaining portfolio more reflective of desired exposure 7.4% ◼ The increase in Criticized reflects impact of COVID-19 on 6.6% 6.2% 6.2% borrowers engaged in travel and entertainment industries ◼ Multi-period reduction in NPAs Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 NPAs % 2 2.8% 8.7% 6.4% 5.2% 4.4% Energy $1.0B in balances ◼ Continued loan balance contraction driven by improved market Criticized Total ACL% 2 activity and resolution of previously disclosed problem credits $324M ◼ Total Y-o-Y loan balances down ~35% from $1.5 billion to $275M $1.0 billion $248M ◼ Portfolio continues to trend towards improved granularity $211M with lower inherent loss potential 11.7% $136M ◼ ~70% of E&P production hedged for the remainder of 2020, ~50% 8.8% 9.2% in 2021 1 4.3% ◼ Early stages of Fall Redetermination; anticipate continued 3.0% hedge requirements ◼ ACL% at historical highs; no change to expectations for thru-cycle credit performance Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 NPAs % 2 4.1% 8.8% 11.4% 9.1% 7.6% 1 Hedge % calculated based on production volumes 2 Ratios calculated as a % of total energy or leveraged loans 12

Conclusion

Summary & Outlook ◼ Diverse, well-established lines of business balanced between differentiated national verticals and core market offerings reflective of the relationship banking approach synonymous with TCBI since inception ◼ Organic growth model developed by hand selecting top talent fosters unique cultural alignment, innovation mindset, and Franchise client-centric focus. Bias towards action enables rapid transformation consistent with dynamic market Highlights ◼ Branch-lite since formation, a limited physical footprint enables capital allocation for core treasury focus, scalable deposit verticals, and digital offerings - compatible with accelerating customer preferences ◼ Best-in-class Mortgage Finance business provides balance sheet optionality, strong risk-adjusted returns, and natural hedge to asset-sensitive commercially-oriented model ◼ Actions taken in Q2-2020 set the foundation for improvements in profitability ◼ 2H-2020 Non-Interest Expense of low-/mid-$290 million, down from an adjusted $302 million in 1H-2020. Variability driven by pace of front-line hires and MSR servicing expense, both of which provide offsetting revenue Q4-2020 ◼ Absent significant economic deterioration, we believe we are adequately reserved for the losses inherent in our Outlook portfolio. Anticipate continued moderating provision expense in Q4-2020 as compared to 1H-2020 ◼ Elevated contribution from Mortgage Finance will persist against the backdrop of favorable market conditions ◼ Improving earnings generation in excess of anticipated credit needs should result in increased capital ratios. Liquidity position likely to remain elevated given deposit growth; multi-quarter remix of cash into securities will continue ◼ Core loan growth in targeted areas ◼ Attracting top front-line talent ◼ Mortgage Finance will continue to be a strong contributor, with volumes influenced by mortgage demand 2021 Areas of ◼ Provision levels dependent on economic conditions, but overall quality of existing portfolio and focus growth areas are Focus favorable. Charge-offs will be higher than Q3-2020 levels as credit-cycle matures ◼ Securities balances will continue to increase, and cash levels should moderate with repositioning of funding 14