Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Coronado Global Resources Inc. | tm2033945d1_8k.htm |

Exhibit 99.1

|

Quarterly Report September 2020 Highlights Coronado Global Resources Inc. ARBN: 628 199 468 Registered Office Level 33, Central Plaza One 345 Queen Street Brisbane QLD 4000 Australia T +61 7 3031 7777 F +61 7 3229 7402 E investors@coronadoglobal.com.au www.coronadoglobal.com.au About Coronado Coronado Global Resources Inc. is a leading international producer of high-quality metallurgical coal, an essential element in the production of steel. Our coals, transformed in the steelmaking process, support the manufacture of every day steel-based products that enrich lives around the world. Coronado has a portfolio of operating mines and development projects in Queensland, Australia, and Pennsylvania, Virginia and West Virginia in the United States. Coronado is one of the largest metallurgical coal producers globally by export volume. The management team has over 100 years of combined experience in all aspects of the coal value chain and has a successful track record of building and operating coal mining operations in Australia, the United States and globally. This operational experience is supplemented with a strong knowledge base of domestic and international coal markets and their key drivers. Coronado was listed on the ASX on 23 October 2018. All $ values are US dollars unless otherwise stated. All production and sales tonnages are in metric tonnes unless otherwise stated. All information contained within this release is unaudited. Saleable production for the September quarter was 4.6 Mt, up 31.2% on the June quarter, driven by the restart of US mining operations at Buchanan and Logan and strong Australian (Curragh) performance Record quarterly saleable production from the Curragh mine of 3.6 Mt, up 24.5% on the June Quarter US operations ramped up production in line with recovery in metallurgical coal markets September quarter ROM production was 6.6 Mt, up 31.2% on the prior period COVID-19 preventative measures and hygiene protocols ensured no lost production from operations in the quarter COAL SALES September quarter sales of 4.9 Mt were up 27.0% on the previous quarter primarily due to higher production and improved market conditions Curragh delivered record sales volumes for the September quarter of 3.6 Mt, up 20.6% on the June quarter Metallurgical coal represented 80.2% of total group sales for the September quarter, up 3.5% over the prior period Group realised metallurgical coal price of $86.0 per tonne for the September quarter (mix of FOR and FOB pricing), down 6.1% compared to the prior quarter, reflecting the lower price environment due to the COVID-19 pandemic FINANCIAL AND CORPORATE September quarter revenue was $376 million, up 23.7% on the previous quarter, driven by higher sales volume FY20 year to date mining cost per tonne sold of $56.0 per tonne, down from $57.3 at end of June 2020 Successfully raised $180 million of new equity and paid down debt providing additional liquidity and improving credit metrics Net debt of $273 million at 30 September 2020, reduced significantly from $405 million at 30 June 2020 Agreed with Syndicated Facilities Agreement (SFA) lenders to waive compliance with financial covenants until September 2021, allowing further financial flexibility to navigate current market conditions Implemented revised capital management plans reducing planned FY20 capital expenditure by more than 40% 1 |

|

Message from the CEO Gerry Spindler, Chief Executive Officer The third quarter of 2020 was both rewarding and challenging for Coronado. Record production and sales from Curragh and the ramp up of our US operations were the two outstanding highlights. I want to thank our COO, Jim Campbell and the operating team for the effort,diligenceand professionalism displayed during last quarter. This excellent operating performance was achieved despite the ongoing potential for further disruption to markets and operations from the COVID-19 pandemic. To help us weather the economic storm, we negotiated with our lenders to extend our covenant waiver to September 2021 and recapitalised our balance sheet to enhance liquidity and ensure financial security. We acknowledge and appreciate the support from our existing securityholders and welcome our new securityholders to the Company. The recapitalisation also expanded the Company’s share register, increasing our free float from 20% to 44%. Safety Safety continues to be our primary focus. The TRIFR for Australian Operations for the September quarter was 9.88, while our US Operations recorded a TRIR of 1.64. Both metrics continue to trend below national industry averages. Our Australian TRIFR has increased over the past 12 months which is partially due to the wider reporting scope introduced following Coronado’s acquisition of the Curragh mine. The operation is implementing steps to address this trend, which include a review of contractor management processes and systems, increased emphasis on safety interactions, additional personnel to focus on safety and compliance, and improved incident investigations procedures to expand outcomes and learning. In the US, the Eagle #1 Underground Mine at the Logan Complex achieved 500 days without a Lost Time incident. Eagle #1 has been lost time incident free since start-up in May 2019 which is a fantastic achievement. To date, a small number of our workforce have tested positive for COVID-19. These instances occurred in the US and outside of Coronado’s facilities. All necessary steps were taken to protect our workforce and there was no community spread and no adverse impact on production. Third Quarter Operating Performance Australian Operations achieved record quarterly production and sales. This excellent result stemmed from an improvement in mining contract performance as well as the mobilisation of additional fleets to recover lost production and overburden from the first half of the year. In addition, CHPP performance improved due to better reliability, higher throughput rates and the implementation of measures to improve yield. US operations continued to ramp up production, consistent with the gradual recovery in metallurgical coal markets. Buchanan operated the long-wall consistently without interruption and added another continuous miner section during the quarter. Logan operations resumed production across all three underground mines during the September quarter. North American and Atlantic basin steel producers slowly increased production in line with an increasing demand for steel. Stockpiles have returned to normal levels and we will continue to operate our US mines to meet the market on an inventory light basis. Balance Sheet and Liquidity During the period we raised equity to recapitalise the balance sheet and improve liquidity and credit metrics. All proceeds from the equity raising were used to reduce debt. The net debt position of the company at the end of the September quarter was $273 million. We also negotiated an extension to our financial covenant waiver to 30 September 2021. This includes a permanent reduction to the credit facility limit, currently $550 million, that will occur in three steps of $25 million in February, May and August 20211. As part of our liquidity management initiatives we continue to review various options to monetise non-core assets in the near term. With sufficient liquidity available, we will continue to manage our operations as efficiently as possible to improve productivity, reduce costs and minimise overall cash burn. Market Outlook By the end of September 2020, metallurgical coal index pricing had climbed by circa 30% off the August lows as numerous blast furnaces restarted in response to increasing demand from the automotive and construction sectors. The trend of blast furnaces restarts is evident in seaborne metallurgical coal reliant markets such as India, Japan, South Korea, Brazil and Europe. China continued to produce steel at elevated levels, supplementing domestic met coal production with spot buying. In October reports emerged that Chinese state-owned enterprises have been unofficially directed to suspend imports of Australian coal. The nature and duration of the suspension is not clear at this stage. The impact on Coronado from a volume perspective is likely to be minimal. Our Australian Operations do not have term volume contracts with Chinese counterparts and only sell into this market sporadically. There are no indications that these restrictions apply to our US operations and Buchanan continued to ship cargoes to China during the quarter. 1 40% of any net proceeds realized from certain assets sales preapproved by the SFA lending syndicate will contribute toward the three step permanent facility limit reduction with effect from the date of receipt of the sale proceeds |

|

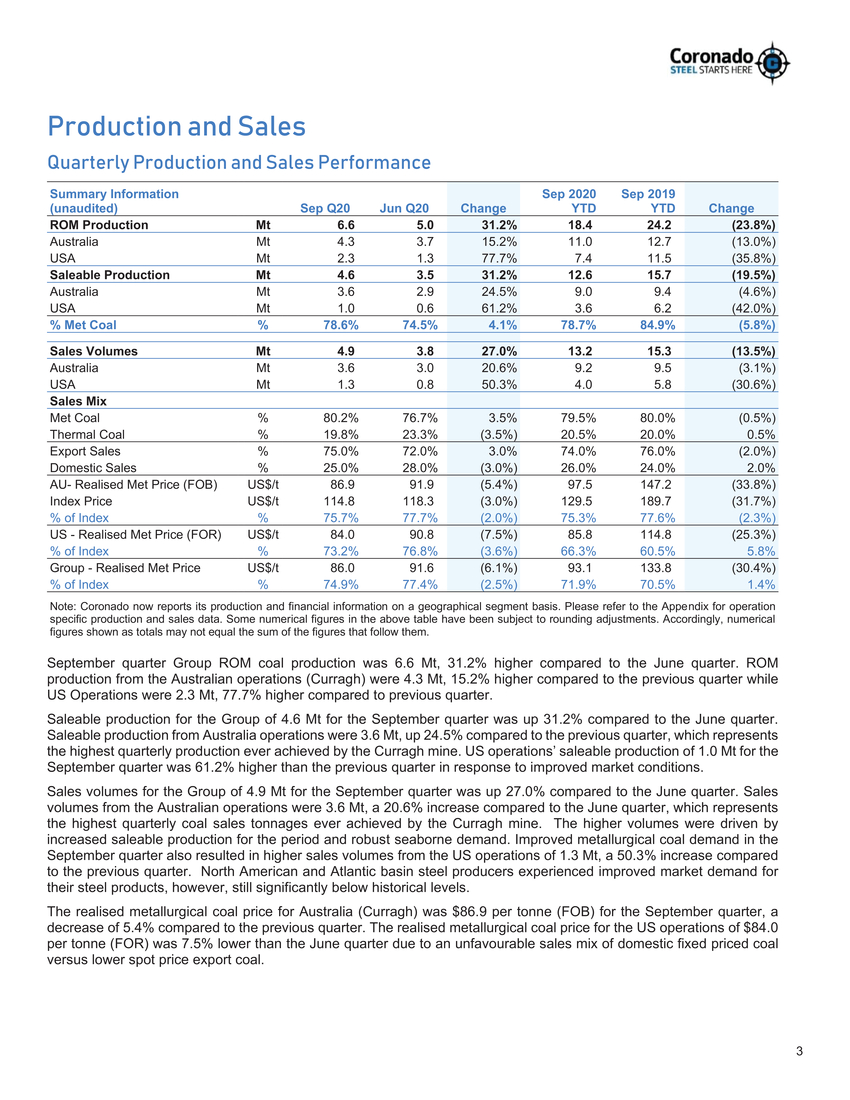

Production and Sales Quarterly Production and Sales Performance Note: Coronado now reports its production and financial information on a geographical segment basis. Please refer to the Appendix for operation specific production and sales data. Some numerical figures in the above table have been subject to rounding adjustments. Accordingly, numerical figures shown as totals may not equal the sum of the figures that follow them. September quarter Group ROM coal production was 6.6 Mt, 31.2% higher compared to the June quarter. ROM production from the Australian operations (Curragh) were 4.3 Mt, 15.2% higher compared to the previous quarter while US Operations were 2.3 Mt, 77.7% higher compared to previous quarter. Saleable production for the Group of 4.6 Mt for the September quarter was up 31.2% compared to the June quarter. Saleable production from Australia operations were 3.6 Mt, up 24.5% compared to the previous quarter, which represents the highest quarterly production ever achieved by the Curragh mine. US operations’ saleable production of 1.0 Mt for the September quarter was 61.2% higher than the previous quarter in response to improved market conditions. Sales volumes for the Group of 4.9 Mt for the September quarter was up 27.0% compared to the June quarter. Sales volumes from the Australian operations were 3.6 Mt, a 20.6% increase compared to the June quarter, which represents the highest quarterly coal sales tonnages ever achieved by the Curragh mine. The higher volumes were driven by increased saleable production for the period and robust seaborne demand. Improved metallurgical coal demand in the September quarter also resulted in higher sales volumes from the US operations of 1.3 Mt, a 50.3% increase compared to the previous quarter. North American and Atlantic basin steel producers experienced improved market demand for their steel products, however, still significantly below historical levels. The realised metallurgical coal price for Australia (Curragh) was $86.9 per tonne (FOB) for the September quarter, a decrease of 5.4% compared to the previous quarter. The realised metallurgical coal price for the US operations of $84.0 per tonne (FOR) was 7.5% lower than the June quarter due to an unfavourable sales mix of domestic fixed priced coal versus lower spot price export coal. |

|

Coronado’s proportion of metallurgical coal sales volume in the September quarter was 80.2% of the total sales mix. Export sales as a percentage of total sales for the September quarter was 75.0%, up 3.0% over the previous quarter. Financial and Corporate September quarter revenue was $376 million (unaudited), up 23.7% compared to the June quarter. FY20 year to date mining cost per tonne sold for the Group was $56.0 per tonne (unaudited). FY20 year to date capital expenditure was $85.2 million. On 18 August 2020, the Company announced it had successfully secured a further waiver extension with the SFA lending syndicate to waive compliance with the financial covenants until 30 September 2021. On 11 September 2020, the Company successfully completed a $180 million equity raise. The proceeds from the equity raise were utilised to repay a portion of the SFA, providing the Company with additional liquidity and improved credit metrics. The Company’s free float increased from 20% to 44% post the transaction. At 30 September 2020 the Company’s net debt position was $273 million (consisting of $15 million in cash and $288 million in drawn debt), down from $405 million at 30 June 2020. In addition, the Company has implemented several strategic initiatives that aim to strengthen the balance sheet, preserve capital and increase liquidity. This includes reducing FY20 capital expenditure by more than 40%, deferring the expansion capital for Curragh, and continuing our disciplined approach to cost management across the business. Estimated full year production of 16.5 to 17.0 million tonnes, currently trending toward the upper end of the range. |

|

Operational Overview and Outlook Safety In Australia, the 12-month rolling average Total Reportable Injury Frequency Rate (TRIFR) at 30 September was 9.88, compared to 7.81 at the end of June. In the U.S., the 12-month rolling average Total Reportable Incident Rate (TRIR) at 30 September was 1.64, compared to 1.41 at the end of June. Reportable rates in both Australia and the US are below the relevant industry benchmarks. In Australia and the U.S. a number of actions are being implemented to address the increasing TRIFR/TRIR which includes higher level investigation of recordable injuries and improved management of injured workers. Coronado’s COVID-19 steering team continues to monitor the effect of the pandemic across our operations in Australia and the US and implement proactive preventative measures where required to ensure the safety and well-being of employees and contractors. To date, only a small number of our US employees has tested positive for COVID-19. This occurred outside of our facilities and the company has taken all necessary steps to protect the workforce. There has been no community spread and these efforts have not adversely affected the Company’s production. In the U.S., the Logan Divisions’ Eagle #1 Underground Mine achieved 500 days without a Lost Time incident. Eagle #1 has work lost time incident free since start-up in May 2019. Australia (Curragh) The Curragh mine performed strongly in the September quarter realising record saleable production and sales volume tonnages. ROM production for the September quarter was 4.3 Mt, an increase of 15.2%. Saleable production was 3.6 Mt, a 24.5% increase from the previous quarter. The higher production stems from an improvement in mining contractor performance as well as the mobilisation of additional fleets to recover lost production and overburden from the first half of the year. Furthermore, CHPP performance improved due to better reliability, higher throughput rates and the implementation of a number of projects to improve yield. Sales volumes of 3.6 Mt were 20.6% higher than the prior quarter. The realised average metallurgical coal price for Australia was $86.9 per tonne (FOB) for the September quarter which was 5.4% lower than the previous quarter. This compares to a 3.0% decrease in benchmark pricing quarter on quarter. The COVID-19 pandemic remains an ongoing issue for steel production and metallurgical coal demand across the globe. Despite this, the impact on Coronado’s Australian operations to export metallurgical coal has been minimal. This is due to the Curragh mines unique position as a strategic supplier of ‘base load’ metallurgical coal for coke blends. United States (Buchanan, Logan and Greenbrier) During the September quarter, US operations continued to ramp up production in line with the gradual recovery in steel and metallurgical coal markets as economies come to terms with the impact of the pandemic. Although market demand was stronger in the September quarter, it is still well below historical levels. The Buchanan and Logan mines operated at approximately 60% of capacity during the quarter. ROM production for the September quarter was 2.3 Mt, 77.7% higher than the June quarter. The increase in production derives from Buchanan and Logan returning to production, albeit somewhat scaled back after idling of US operations over April and May in response to weak demand due to the COVID-19 pandemic. Buchanan ran the long-wall consistently and added another continuous miner section during the September quarter. Logan also resumed production at all three underground mines during the quarter. Due to continued soft market conditions for Greenbrier’s high quality mid-vol product, Greenbrier is expected to remain idle for the remainder of 2020. Saleable production from the US segment was 1.0 Mt, 61.2% higher compared to the June quarter. Sales volume for the September quarter was 1.3 Mt, up 50.3% compared to the previous quarter. North American and Atlantic basin steel producers have been slowly increasing production in line with improving demand for steel products as the economy begins to recover from the impact of COVID-19. While demand has improved, it is significantly lower than historical pre-COVID-19 levels. Coronado’s US mines continue to scale up production to meet improving demand and are well positioned to further increase production quickly as the market gradually recovers to pre-COVID-19 demand level. |

|

Coal Market Outlook During the September quarter the Platts PLV Coking Coal price increased from a low of $105.0/t in mid-August to circa $139.0/t at the end of September. Global steel producers restarted blast furnace operations during the quarter as demand for steel was underpinned by automotive and construction sectors. Blast furnace restarts accelerated in September with numerous steel mills returning to operation in Japan, South Korea, Europe and Brazil. Demand for steel in India has risen to near pre-lockdown levels. Steel demand in China has been supported primarily by large infrastructure investment, with signs of improvement in discretionary steel demand (e.g. automotive) and property. Steel demand for the balance of 2020 is widely forecast to remain strong, underpinned by the investment in infrastructure. In October it was reported that Chinese State-Owned Enterprises have been unofficially directed to suspend imports of Australian coal. This resulted in the metallurgical coal index price recently retreating to circa $118/t, despite continued demand recovery. The nature and duration of import restrictions are unclear at this point as an official government policy statement has not been issued. The restrictions may be due, in part, to import quotas from Australia being largely fulfilled. This decision will likely have a negative effect on global pricing although over the longer term the impact may be offset by the positive effect of global steel producers restarting. The impact on Coronado from a volume perspective is likely to be minimal. The Australian Operations do not have term volume contracts with Chinese steel mills and only sell into this market sporadically. There are no indications that these restrictions apply to the US operations and Buchanan continued to ship cargoes to China during the quarter. Exploration & Development For further information, please contact: Corporate Matthew Sullivan P +61 412 157 276 E msullivan@coronadoglobal.com.au Investors Aidan Meka P +61 428 082 954 E ameka@coronadoglobal.com.au Glossary |

|

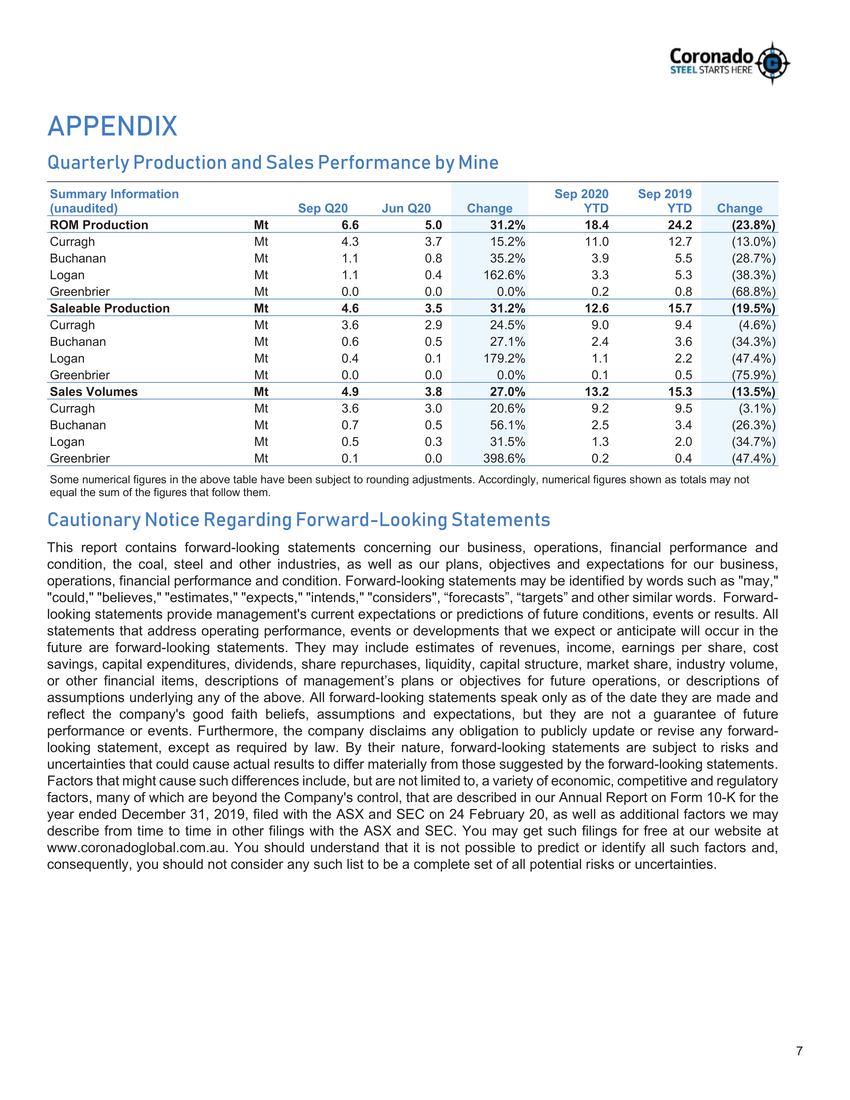

APPENDIX Quarterly Production and Sales Performance by Mine Some numerical figures in the above table have been subject to rounding adjustments. Accordingly, numerical figures shown as totals may not equal the sum of the figures that follow them. Cautionary Notice Regarding Forward-Looking Statements This report contains forward-looking statements concerning our business, operations, financial performance and condition, the coal, steel and other industries, as well as our plans, objectives and expectations for our business, operations, financial performance and condition. Forward-looking statements may be identified by words such as "may," "could," "believes," "estimates," "expects," "intends," "considers", “forecasts”, “targets” and other similar words. Forward-looking statements provide management's current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, income, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure, market share, industry volume, or other financial items, descriptions of management’s plans or objectives for future operations, or descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect the company's good faith beliefs, assumptions and expectations, but they are not a guarantee of future performance or events. Furthermore, the company disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive and regulatory factors, many of which are beyond the Company's control, that are described in our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the ASX and SEC on 24 February 20, as well as additional factors we may describe from time to time in other filings with the ASX and SEC. You may get such filings for free at our website at www.coronadoglobal.com.au. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties. |

|

Reconciliation of Non-GAAP financial measures This report includes a discussion of results of operations and references to and analysis of certain non-GAAP measures (as described below) which are financial measures not recognised in accordance with U.S. GAAP. Non-GAAP financial measures are used by the Company and investors to measure operating performance. Non-GAAP financial measures used in this report include (i) sales volumes and average realised price per Mt or metallurgical coal sold, which we define as metallurgical coal revenues divided by metallurgical sales volume; and (ii) average mining costs per Mt sold, which we define as mining costs divided by sales volumes. We evaluate our mining cost on a cost per metric tonne basis. Mining costs is based on reported cost of coal revenues, which is shown on our statement of operations and comprehensive income exclusive of freight expense, Stanwell rebate, other royalties, depreciation, depletion and amortization and selling, general and administrative expenses, adjusted for other items that do not relate directly to the costs incurred to produce coal at the mine. Reconciliations of certain forward-looking non-GAAP financial measures, including market guidance, to the most directly comparable GAAP financial measures are not provided because the Company is unable to provide such reconciliations without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of items impacting comparability and the periods in which such items may be recognised. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. A reconciliation of consolidated costs and expenses, consolidated operating costs, and consolidated mining costs are shown below: |

|

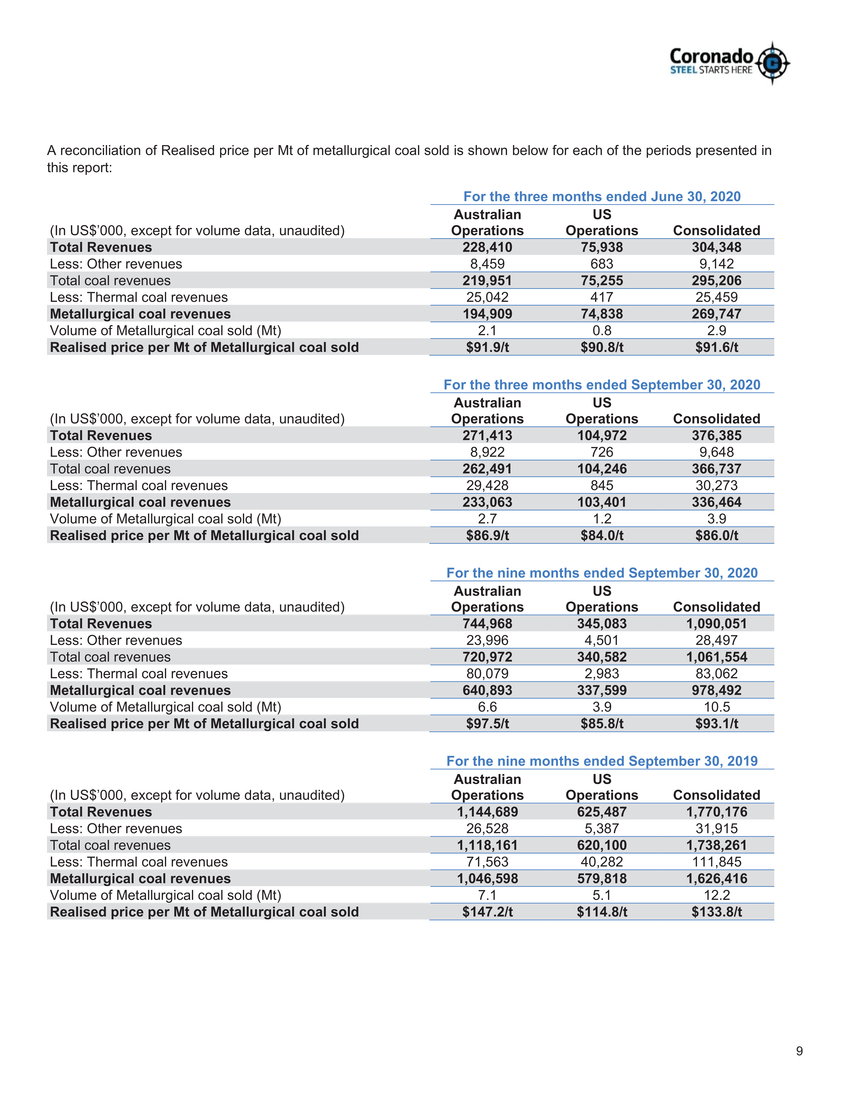

A reconciliation of Realised price per Mt of metallurgical coal sold is shown below for each of the periods presented in this report: |