Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - SYNOVUS FINANCIAL CORP | snv093020208kex992fili.htm |

| EX-99.1 - EX-99.1 - SYNOVUS FINANCIAL CORP | snv093020208kex991fili.htm |

| 8-K - 8-K - SYNOVUS FINANCIAL CORP | syn-20201020.htm |

Exhibit 99.3 Third Quarter 2020 Results October 20, 2020

Forward Looking Statements This slide presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute "forward-looking statements" within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward- looking statements. You can identify these forward-looking statements through Synovus' use of words such as "believes," "anticipates," "expects," "may," "will," "assumes," "predicts," "could," "should," "would," "intends," "targets," "estimates," "projects," "plans," "potential" and other similar words and expressions of the future or otherwise regarding the outlook for Synovus' future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, among others, statements on our expectations related to (1) loan and deposit growth; (2) net interest income and net interest margin; (3) non-interest revenue; (4) non-interest expense; (5) credit trends and key credit performance metrics, including loan deferrals; (6) our future operating and financial performance; (7) our strategy and initiatives for future growth, balance sheet management, capital management, liquidity, expense savings and revenue benefits; and (8) our assumptions underlying these expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus' management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this presentation. Many of these factors are beyond Synovus' ability to control or predict. These forward-looking statements are based upon information presently known to Synovus' management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and uncertainties related to the impact of the COVID-19 pandemic on Synovus' assets, business, liquidity, financial condition, prospects and results of operations, and the risks and other factors set forth in Synovus' filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2019 under the captions "Cautionary Notice Regarding Forward-Looking Statements" and "Risk Factors" and in Synovus' quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. Statements about the potential effects of the COVID-19 pandemic on Synovus' assets, business, liquidity, financial condition, prospects and results of operations may constitute forward-looking statements and are subject to the risks that the actual effects may differ, possibly materially, from what is reflected in these forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the depth, dispersion and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on customers, team members, third parties and Synovus. Use of Non-GAAP Financial Measures This slide presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. Such non-GAAP financial measures include the following: adjusted diluted earnings per share; adjusted return on average assets; return on average tangible common equity; adjusted return on average tangible common equity; adjusted non- interest revenue; adjusted non-interest expense; adjusted tangible non-interest expense; adjusted tangible efficiency ratio; and tangible common equity ratio. The most comparable GAAP measures to these measures are diluted earnings per share; return on average assets; return on average common equity; total non-interest revenue; total non-interest expense; efficiency ratio; and total shareholders' equity to total assets ratio, respectively. Management uses these non-GAAP financial measures to assess the performance of Synovus' business and the strength of its capital position. Management believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist management, investors, and bank regulators in evaluating Synovus' operating results, financial strength, the performance of its business and the strength of its capital position. However, these non-GAAP financial measures have inherent limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of operating results or capital position as reported under GAAP. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant items and other factors, and since they are not required to be uniformly applied, they may not be comparable to other similarly titled measures at other companies. Adjusted diluted earnings per share and adjusted return on average assets are measures used by management to evaluate operating results exclusive of items that are not indicative of ongoing operations and impact period- to-period comparisons. Return on average tangible common equity and adjusted return on average tangible common equity are measures used by management to compare Synovus' performance with other financial institutions because it calculates the return available to common shareholders without the impact of intangible assets and their related amortization, thereby allowing management to evaluate the performance of the business consistently. Adjusted non-interest revenue is a measure used by management to evaluate non-interest revenue exclusive of net investment securities gains (losses) and gains on sales and net changes in the fair value of private equity investments. Adjusted non-interest expense, adjusted tangible non-interest expense, and the adjusted tangible efficiency ratio are measures utilized by management to measure the success of expense management initiatives focused on reducing recurring controllable operating costs. The tangible common equity ratio is used by management and bank regulators to assess the strength of our capital position. The computations of the non-GAAP financial measures used in this slide presentation are set forth in the Appendix to this slide presentation. 2

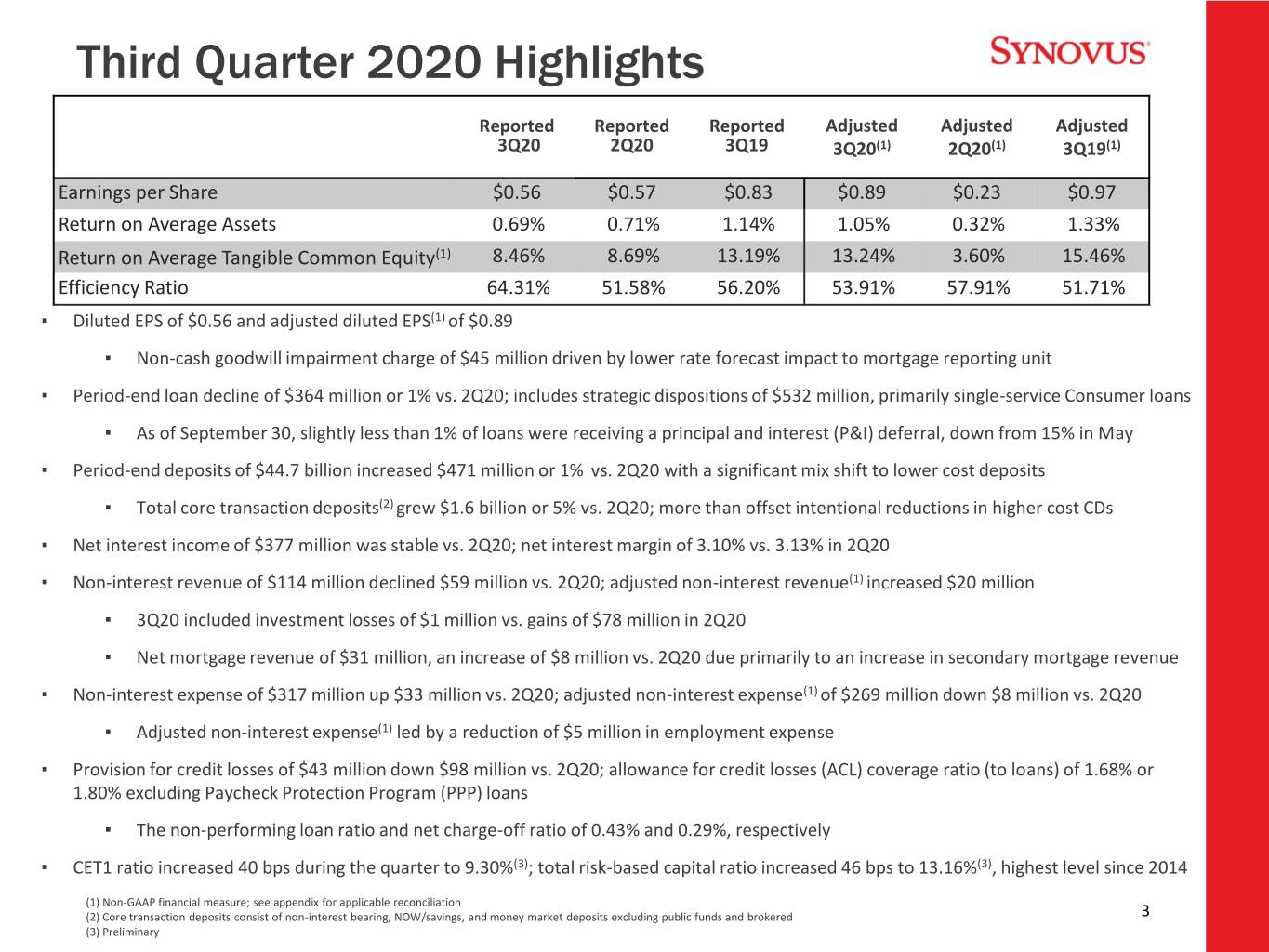

Third Quarter 2020 Highlights Reported Reported Reported Adjusted Adjusted Adjusted 3Q20 2Q20 3Q19 3Q20(1) 2Q20(1) 3Q19(1) Earnings per Share $0.56 $0.57 $0.83 $0.89 $0.23 $0.97 Return on Average Assets 0.69% 0.71% 1.14% 1.05% 0.32% 1.33% Return on Average Tangible Common Equity(1) 8.46% 8.69% 13.19% 13.24% 3.60% 15.46% Efficiency Ratio 64.31% 51.58% 56.20% 53.91% 57.91% 51.71% ▪ Diluted EPS of $0.56 and adjusted diluted EPS(1) of $0.89 ▪ Non-cash goodwill impairment charge of $45 million driven by lower rate forecast impact to mortgage reporting unit ▪ Period-end loan decline of $364 million or 1% vs. 2Q20; includes strategic dispositions of $532 million, primarily single-service Consumer loans ▪ As of September 30, slightly less than 1% of loans were receiving a principal and interest (P&I) deferral, down from 15% in May ▪ Period-end deposits of $44.7 billion increased $471 million or 1% vs. 2Q20 with a significant mix shift to lower cost deposits ▪ Total core transaction deposits(2) grew $1.6 billion or 5% vs. 2Q20; more than offset intentional reductions in higher cost CDs ▪ Net interest income of $377 million was stable vs. 2Q20; net interest margin of 3.10% vs. 3.13% in 2Q20 ▪ Non-interest revenue of $114 million declined $59 million vs. 2Q20; adjusted non-interest revenue(1) increased $20 million ▪ 3Q20 included investment losses of $1 million vs. gains of $78 million in 2Q20 ▪ Net mortgage revenue of $31 million, an increase of $8 million vs. 2Q20 due primarily to an increase in secondary mortgage revenue ▪ Non-interest expense of $317 million up $33 million vs. 2Q20; adjusted non-interest expense(1) of $269 million down $8 million vs. 2Q20 ▪ Adjusted non-interest expense(1) led by a reduction of $5 million in employment expense ▪ Provision for credit losses of $43 million down $98 million vs. 2Q20; allowance for credit losses (ACL) coverage ratio (to loans) of 1.68% or 1.80% excluding Paycheck Protection Program (PPP) loans ▪ The non-performing loan ratio and net charge-off ratio of 0.43% and 0.29%, respectively ▪ CET1 ratio increased 40 bps during the quarter to 9.30%(3); total risk-based capital ratio increased 46 bps to 13.16%(3), highest level since 2014 (1) Non-GAAP financial measure; see appendix for applicable reconciliation (2) Core transaction deposits consist of non-interest bearing, NOW/savings, and money market deposits excluding public funds and brokered 3 (3) Preliminary

Loans Period-end Loan Balances (in billions) $39.9(1) $39.5(1) ▪ Sequential quarter period-end decline of $364 $2.7 $2.7 million or 1% vs. 2Q20 $36.4(1) ▪ Strategic loan dispositions of $532 million, primarily single-service Consumer loans 50.0% 50.6% 45.1% ▪ C&I line utilization of 40% vs. 41% in 2Q20 ▪ Increases in Commercial loans partially offset 21.9% 26.7% 23.2% reductions in Consumer loans largely due to loan sales QoQ Change in Total Loans 28.2% 27.1% 27.7% (in millions) Amounts may not total due to rounding (1) Total loans are net of deferred fees, costs, discounts/premiums 4

Deposits Period-end Deposit Balances ▪ Period-end deposits increased $471 million or 1% (in billions) vs. 2Q20 ▪ Continued growth in core transaction $44.2 $44.7 deposits(1) of $1.6 billion more than offset 9.7% 8.8% declines in time deposits $37.4 12.1% 13.0% ▪ Total deposit cost down 14 bps vs. 2Q20 due to 8.5% pricing diligence and product remixing 8.9% 10.1% 11.6% ▪ Realized beta ~30-35% on interest- 17.8% bearing transaction deposits since 3Q19 ▪ ~$1.3 billion of core CDs maturing in 4Q20 66.6% 69.4% Deposit Costs: Prior Cycle Lows vs. Today 63.6% 1.74% 1.41% 0.63% 0.53% 0.34% 0.39% 0.24% 0.28% 0.26% Amounts may not total due to rounding (1) Core transaction deposits consist of non-interest bearing, NOW/savings, and money market deposits excluding public funds and brokered 5

Net Interest Income (in millions) $402 ▪ Net interest income of $377 million was $377 $377 stable vs. 2Q20; decline in earning asset yields $29 $9 $12 largely offset by decline in cost of funds ▪ Benefited from favorable trends in deposit pricing and remixing ▪ Recognized $12 million of PPP fees in 3Q20 vs. $9 million in 2Q20 ▪ $74 million of PPP processing fees remaining; $10 million associated with (1) loans less than or equal to $50,000 3Q20 NIM: Primary Drivers ▪ Net interest margin of 3.10%, a decline of 3 bps vs. 2Q20 ▪ Faster than anticipated deposit repricing helped to mitigate rate headwind ▪ Accretion from improvement in managing liquidity costs (2) Amounts may not total due to rounding (1) 3Q20 and 2Q20 primarily included loan accretion of $2 million; 3Q19 primarily included loan accretion of $16 million and deposit premium amortization of $11 million 6 (2) Other includes impact of day count, certain mix shifts, and other unattributed items

Non-interest Revenue (in millions) ▪ 3Q20 non-interest revenue of $114 million decreased $59 million or 34% vs. 2Q20 and increased $26 million or 29% vs. 3Q19 ▪ 3Q20 included investment losses of $1 $173 million vs. gains of $78 million in 2Q20 ▪ Adjusted non-interest revenue(2) of $116 million increased $20 million or 21% vs. 2Q20 and $24 million or 27% vs. 3Q19 $114 ▪ Mortgage revenue up $8 million sequentially, driven by higher secondary $89 mortgage revenue (in millions) (1) Amounts may not total due to rounding (1) Include service charges on deposit accounts, card fees, letter of credit fees, ATM fee income, line of credit non-usage fees, gains from sales of government guaranteed loans, and miscellaneous other service charges (2) Non-GAAP financial measure; see appendix for applicable reconciliation 7

Non-interest Expense (in millions) ▪ 3Q20 non-interest expense of $317 million increased $33 million or 11% vs. 2Q20 and $40 million or 15% vs. 3Q19 ▪ $45 million non-cash goodwill impairment charge driven by lower rate forecast impact to mortgage reporting unit ▪ $3 million in restructuring charges primarily related to branch optimization ▪ 3Q20 adjusted non-interest expense(1) of $269 million decreased $8 million or 3% vs. 2Q20 and increased $10 million or 4% vs. 3Q19 ▪ Employment expenses down $5 million from 2Q20 3Q19 2Q20 3Q20 ▪ Lower commissions, headcount, and COVID-related Efficiency Ratio 56.20% 51.58% 64.31% expenses Adjusted Tangible 51.71% 57.91% 53.91% Efficiency Ratio(1) 8 (1) Non-GAAP financial measure; see appendix for applicable reconciliation

Credit Quality (in millions) 0.50% 0.49% 0.44% 0.42% 0.37% $142 0.32% 0.33% 0.41% ( 0.43% 0.37% 2 0.27% ) 0.24% 0.22% 0.12% 0.13% 0.2 NCO Ratio: 0.22% 0.10% 0.21% 0.24%9% 0.29% Provision/ 1.38% 2.77% 7.91% 5.90% 1.52% NCO: 0.0 (1) 7% Allowance for Credit Losses $650 $665 $61 $61 $532 $38 $2 $265 $281 7. 7 791% 138% 590% 277% ACL to NPLs: 230% 278% 340% 441% 394% Allowance for Loan Losses Reserve for Unfunded Commitments ACL Coverage Ratio (2) Amounts many not total due to rounding 9 (1) Criticized loans are loans graded special mention; classified loans are loans graded sub-standard accruing and non-accruing loans (2) ACL coverage ratio (to loans) was 1.80% in 3Q20 and 1.74% in 2Q20 excluding PPP loans of $2.7 billion

Capital Ratios 12.30% 12.70% 13.16% ▪ QoQ improvement of 40 bps in CET1; Total 10.58% 10.27% 10.15% Capital increased to 13.16%(1), highest since 2014 ▪ Targeting the higher end of our CET1 9.30% 8.96% 8.90% operating range of 9.0%-9.5% with heightened uncertainty in the current economic environment (1) (1) ▪ No share repurchases in 2H20 (1) Pre-tax Income Amounts many not total due to rounding 10 (1) Preliminary

P&I Deferral Update $337 million or slightly less than 1% of total loans as of September 30 Consumer Commercial $169 million, or 1.9% of $168 million, or 0.5% of consumer loans commercial loans Hotel deferrals(1) of $125 million Consumer Mortgage deferrals(1) of $156 million Full-Service Restaurant deferrals(1) of $18 million 11 (1) P&I deferral

Industries Sensitive to COVID(1) Estimated vs. Actual P&I Deferrals Composition Round 2 Deferral Range (2) P&I Deferrals Hotels mostly non-resort, franchised hotel properties $400-$550 million $125 million Shopping retail centers (excluding those $215-$325 million Centers with grocery, pharmacy, or $0 discount anchor11.0% tenant) 22.8% full-service and limited- Restaurants $150-$240 million $18 million service restaurants Retail Trade retailers (excluding20.1% gas & $70-$145 million $0 (non-essential)27.1%staples) 46.0% Arts, Entertainment, fitness centers, rec facilities, $25-$50 million $0 & Recreation golf courses/country clubs primarily related to Oil-related transportation, operations, $0-$15 million $0 and support; little-to-no exploration/production $860 million - $1.3 billion $143 million 85% of commercial P&I deferrals (1) See the appendix for additional information 12 (2) Includes the percentage of total balances expected to receive a second 90-day deferral of principal and interest based on analysis/activity to-date from the 2Q20 earnings presentation

COVID-19 Impact on Cash Inflows Month-by-Month (cash inflows, YOY change) Mar Apr May Jun Jul Aug (5)% (1) (1) (1) (1) (Hotel and Other Lodging) (Excl. full-service restaurants & bars) Note: For 'month-by-month', top and bottom 5% outliers are excluded. Cash inflow changes are simple averages for customers with sufficient operating account coverage (covering ~55-75% of loan exposures) 13 (1) NAICS code for cash flows

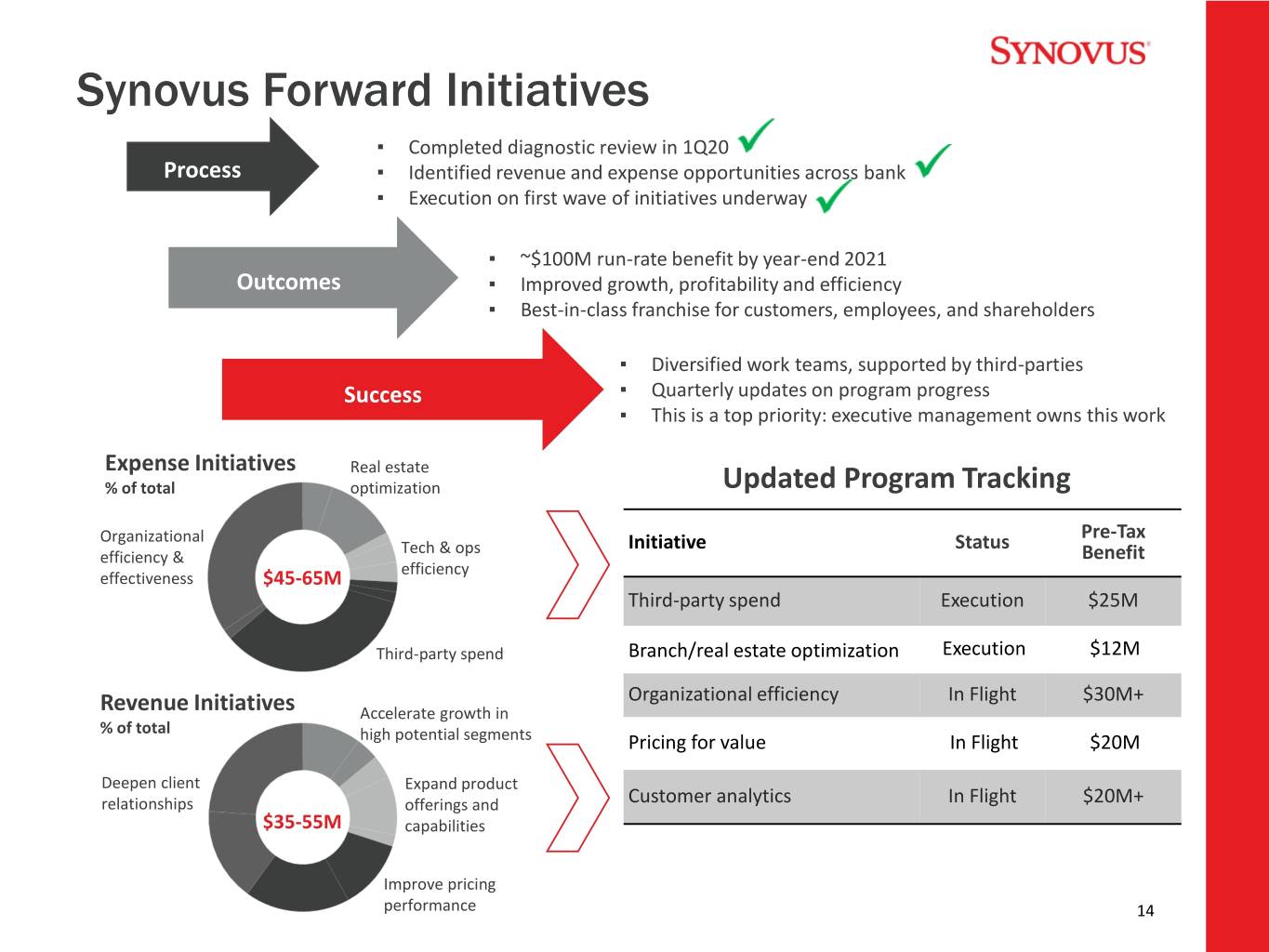

Synovus Forward Initiatives ▪ Completed diagnostic review in 1Q20 Process ▪ Identified revenue and expense opportunities across bank ▪ Execution on first wave of initiatives underway ▪ ~$100M run-rate benefit by year-end 2021 Outcomes ▪ Improved growth, profitability and efficiency ▪ Best-in-class franchise for customers, employees, and shareholders ▪ Diversified work teams, supported by third-parties Success ▪ Quarterly updates on program progress ▪ This is a top priority: executive management owns this work Expense Initiatives Real estate % of total optimization Updated Program Tracking Organizational Pre-Tax Tech & ops Initiative Status efficiency & Benefit efficiency effectiveness $45-65M Third-party spend Execution $25M Third-party spend Branch/real estate optimization Execution $12M Organizational efficiency In Flight $30M+ Revenue Initiatives Accelerate growth in % of total high potential segments Pricing for value In Flight $20M Deepen client Expand product relationships offerings and Customer analytics In Flight $20M+ $35-55M capabilities Improve pricing performance 14

Team Members Providing Stability, Preserving Trust Team Members Communities Customers Customers Businesses Appointed Southern Company Contributed $1 million to the Introduced online account executive Pedro Cherry to United Negro College Fund in honor origination for CDs, money market Synovus Board of Directors of Calvin Smyre, a former Synovus accounts, and private wealth executive and the longest serving checking Initiated a new CEO African member of the Georgia House of American Advisory Council ▪ EnhancedRepresentatives risk management ▪ InitiatedContinued Paycheck focus onProtection executing practices, as well as significant ProgramSynovus loan Forward forgiveness initiatives process EVP Liz Wolverton named one Launchedde-risking a virtual of the version balance of sheetRaise of American Banker's 25 thesince Banner 2008, the company's flagship ▪ RestoredShare repurchases walk-in service have at been all Women to Watch for the sixth financial literacy program, reaching branchestemporarily during suspended the week of consecutive year ▪ hundredsOngoing ofstress students testing and and other September 21, following pilot- sensitivityclass analysesparticipants in key risks reopening in select markets, and Named by Forbes as a best areas – credit, capital, market, in accordance with employer for women Asand a part liquidity of our September Here recommendations from public Matters outreach, team members health authorities Awarded 132 Jack Parker raised nearly $70,000 for Scholarships to children of community agencies and non- Launched Zelle® person-to-person Synovus team members profits and contributed thousands payments on October 15 of bottles of water, canned goods, Lead Director Betsy Camp diapers and school supply items to Continued participation in the named a 2020 NACD schools and food banks throughout Federal Reserve's Main Street Directorship 100 honoree the footprint Lending Program 15

Appendix

Allowance for Credit Losses (in thousands) $664,595 Portfolio Performance & Economic Factors ACL/Loans: 1.63% 1.68% ACL/Loans 1.74% 1.80% excl. PPP(1): 3 Economic Assumptions: 1 2 3 1Unemployment rate of 8% Estimated impact of in 4Q20 before declining enacted stimulus Moderate economic growth modestly in 2021 measures 17 (1) ACL coverage ratio (to loans) was 1.80% in 3Q20 and 1.74% in 2Q20 excluding PPP loans of $2.7 billion

Quarterly Highlights Trend 3Q19 4Q19 1Q20 2Q20 3Q20 Diluted EPS $0.83 $0.97 $0.20 $0.57 $0.56 Net interest margin 3.69 % 3.65 % 3.37 % 3.13 % 3.10 % Efficiency ratio 56.20 53.44 57.81 51.58 64.31 Financial Performance Adjusted tangible efficiency ratio(1) 51.71 53.20 56.72 57.91 53.91 ROA(2) 1.14 1.27 0.32 0.71 0.69 Adjusted ROA(1)(2) 1.33 1.24 0.32 0.32 1.05 Total loans 1% 2% 3% 4% (1)% Balance Sheet Growth Total average deposits — — 2 11 3 NPA ratio 0.42 % 0.37 % 0.50 % 0.44% 0.49% Credit Quality NCO ratio(2) 0.22 0.10 0.21 0.24 0.29 Common shares outstanding(3) 147,594 147,158 147,267 147,313 147,318 (4) Leverage ratio 9.02 % 9.16 % 8.92 % 8.38% 8.49 % Capital Tangible common equity ratio(1) 8.04 8.08 7.94 7.41 7.67 18 (1) Non-GAAP financial measure; see applicable reconciliation (2) Annualized (3) In thousands (4) Preliminary

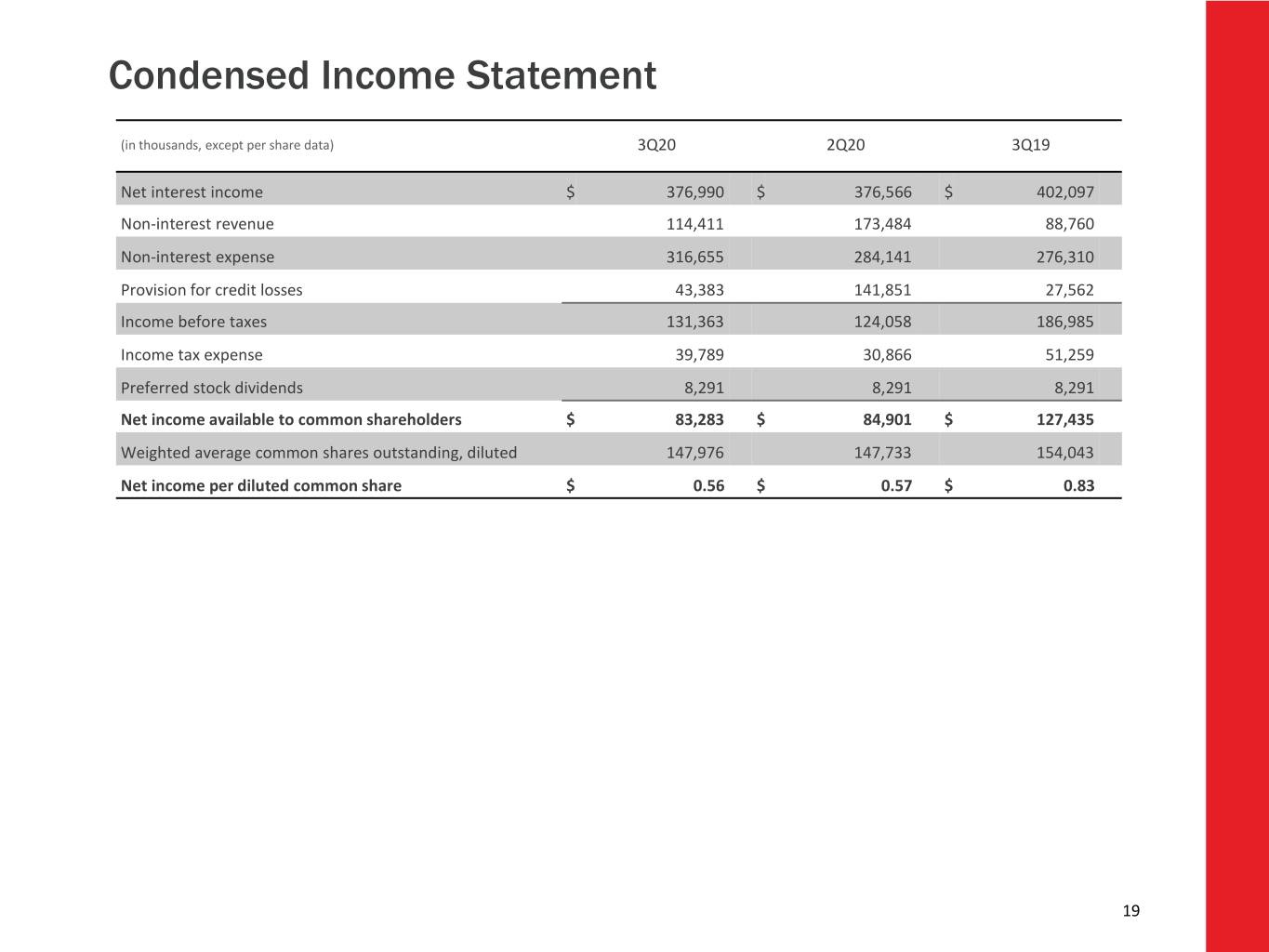

Condensed Income Statement (in thousands, except per share data) 3Q20 2Q20 3Q19 Net interest income $ 376,990 $ 376,566 $ 402,097 Non-interest revenue 114,411 173,484 88,760 Non-interest expense 316,655 284,141 276,310 Provision for credit losses 43,383 141,851 27,562 Income before taxes 131,363 124,058 186,985 Income tax expense 39,789 30,866 51,259 Preferred stock dividends 8,291 8,291 8,291 Net income available to common shareholders $ 83,283 $ 84,901 $ 127,435 Weighted average common shares outstanding, diluted 147,976 147,733 154,043 Net income per diluted common share $ 0.56 $ 0.57 $ 0.83 19

Non-interest Revenue 3Q20 vs. 2Q20 3Q20 vs. 3Q19 (in thousands) 3Q20 2Q20 3Q19 % Change % Change Service charges on deposit accounts $ 17,813 $ 15,567 $ 22,952 14 (22) Fiduciary and asset management fees 15,885 14,950 14,686 6 8 Brokerage revenue 10,604 9,984 11,071 6 (4) Mortgage banking income 31,229 23,530 10,351 33 202 Card fees 10,823 9,186 12,297 18 (12) Capital markets income 5,690 6,050 7,396 (6) (23) Income from bank-owned life insurance 7,778 7,756 5,139 — 51 Other non-interest revenue 15,879 8,345 7,405 90 114 Adjusted non-interest revenue $ 115,701 $ 95,368 $ 91,297 21 27 Gain on sale and fair value increase/(decrease) of private equity investments, net 260 8,707 1,194 nm nm Investment securities gains (losses), net (1,550) 69,409 (3,731) nm nm Total non-interest revenue $ 114,411 $ 173,484 $ 88,760 (34) 29 nm = not meaningful 20

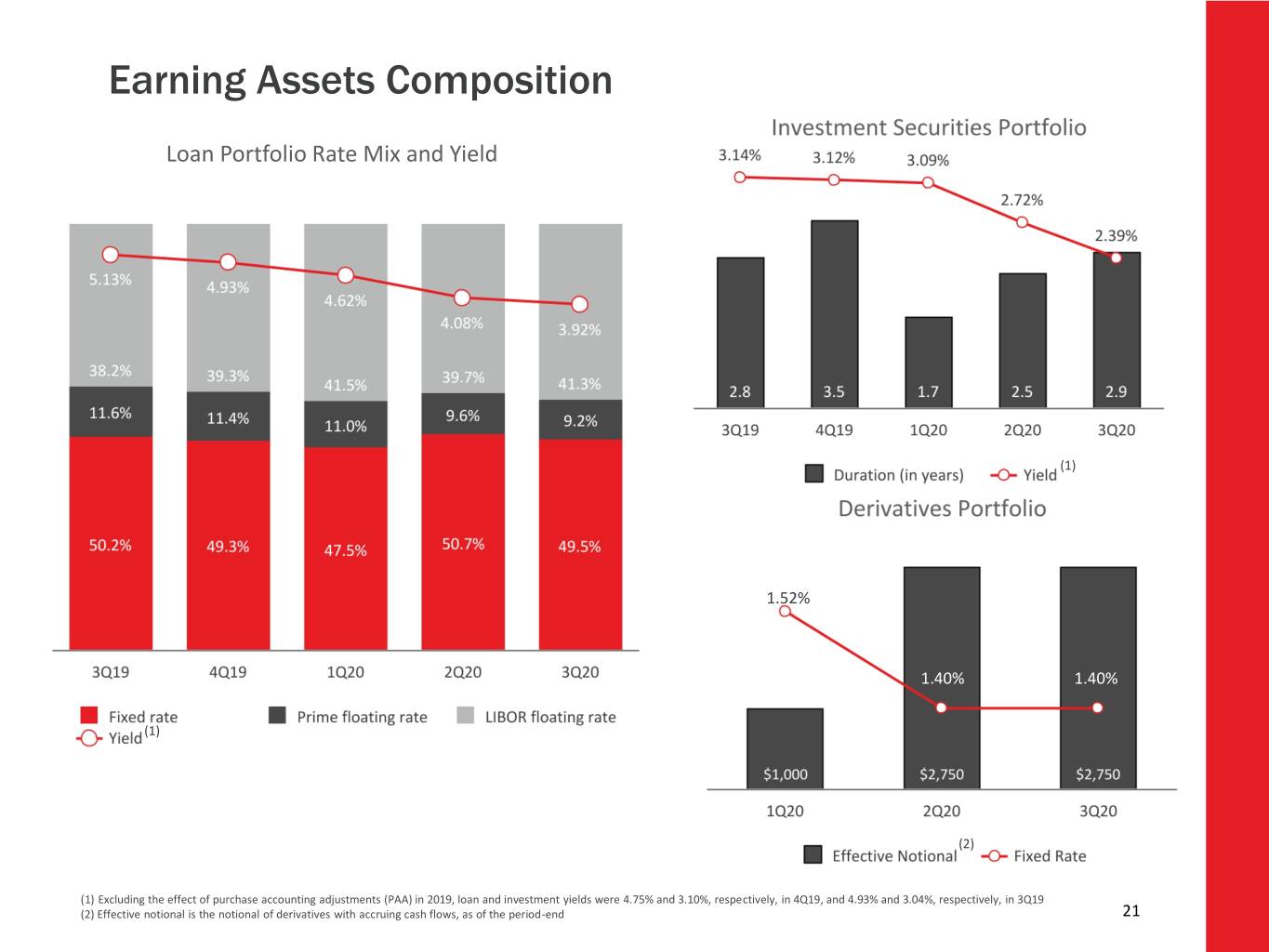

Earning Assets Composition Loan Portfolio Rate Mix and Yield ( 2 ) (1) 1.40% 1.52% 1.40% 1.40% (1) (2) (1) Excluding the effect of purchase accounting adjustments (PAA) in 2019, loan and investment yields were 4.75% and 3.10%, respectively, in 4Q19, and 4.93% and 3.04%, respectively, in 3Q19 (2) Effective notional is the notional of derivatives with accruing cash flows, as of the period-end 21

Loan Portfolio by Category Consumer Portfolio - $8.7 Billion CRE Portfolio - $11.0 Billion ▪ High quality Consumer Real Estate book ▪ 88% are income-producing ▪ Weighted average credit score of 790 and 778 for ▪ Residential C&D and Land are <2% of total loans HELOC and Mortgage, respectively ▪ No single CRE loan > $50 million ▪ Average LTV of ~75% for HELOC and Mortgage ▪ Average loan size of $12 million ▪ Diversity among property types and geographies Resi. Constr, Dev, Land Consumer Non-R/E 1.8% Consumer CRE 3.5% 26.5% 28.6% C&I Portfolio - $20.0 Billion Multi-Family 6.0% ▪ Primarily direct middle market and commercial Office Bldg. clients Consumer R/E 5.9% Related ▪ Syndications 7% of total loans 18.4% C&I ▪ C&I specialty lending includes Senior Housing Hotel and Premium Finance 3.6% 45.0% ▪ C&I industry mix aligned with economic and demographic drivers C&I Specialty Lending 14.5% Direct Middle Market & Commercial Banking 36.1% Portfolio Characteristics Consumer CRE C&I NPL Ratio 0.22% 0.31% 0.58% Consumer QTD Net Charge-off Ratio (annualized) 0.32% 0.21% 0.31% 30+ Days Past Due Ratio 0.28% 0.09% 0.10% CRE 90+ Days Past Due Ratio 0.03% 0.01% 0.01% C&I Amounts may not total due to rounding 22

Commercial Real Estate Composition of 3Q20 CRE Portfolio Total Portfolio $11.0 billion ▪ Investment Properties portfolio represents 88% of total CRE portfolio 1.6% ▪ The portfolio is well diversified among the 2.4% 1.0% 2.5% property types ▪ Credit quality in Investment Properties 4.3% portfolio remains excellent 6.7% 21.6% ▪ As of 3Q20, Residential C&D and Land Acquisition Portfolios represents less than 2% of total 10.4% performing loans 21.1% 12.9% ▪ No single CRE loan above $50 million 15.5% ▪ Average CRE loan size is $12 million Land, Development, and Investment Properties Residential Properties Portfolio Other Characteristics Office Multi- Shopping Investment Residential Development (as of September 30, 2020) building family Centers Hotels Properties Warehouse Properties(1) & Land Balance (in millions) $2,313 $2,365 $1,699 $1,409 $1,145 $730 $655 $648 NPL Ratio 1.19% 0.01% 0.02% 0.00% 0.02% 0.00% 0.51% 0.37% Net Charge-off Ratio (annualized) 0.80% 0.00% 0.00% 0.00% 0.18% (0.02)% 0.10% 0.25% 30+ Days Past Due Ratio 0.23% 0.00% 0.00% 0.00% 0.05% 0.04% 0.37% 0.13% 90+ Days Past Due Ratio 0.01% 0.00% 0.00% 0.00% 0.00% 0.03% 0.05% 0.04% Amounts may not total due to rounding (1) Includes 1-4 Family Construction and 1-4 Family Perm/Mini-Perm (primarily rental homes) 23

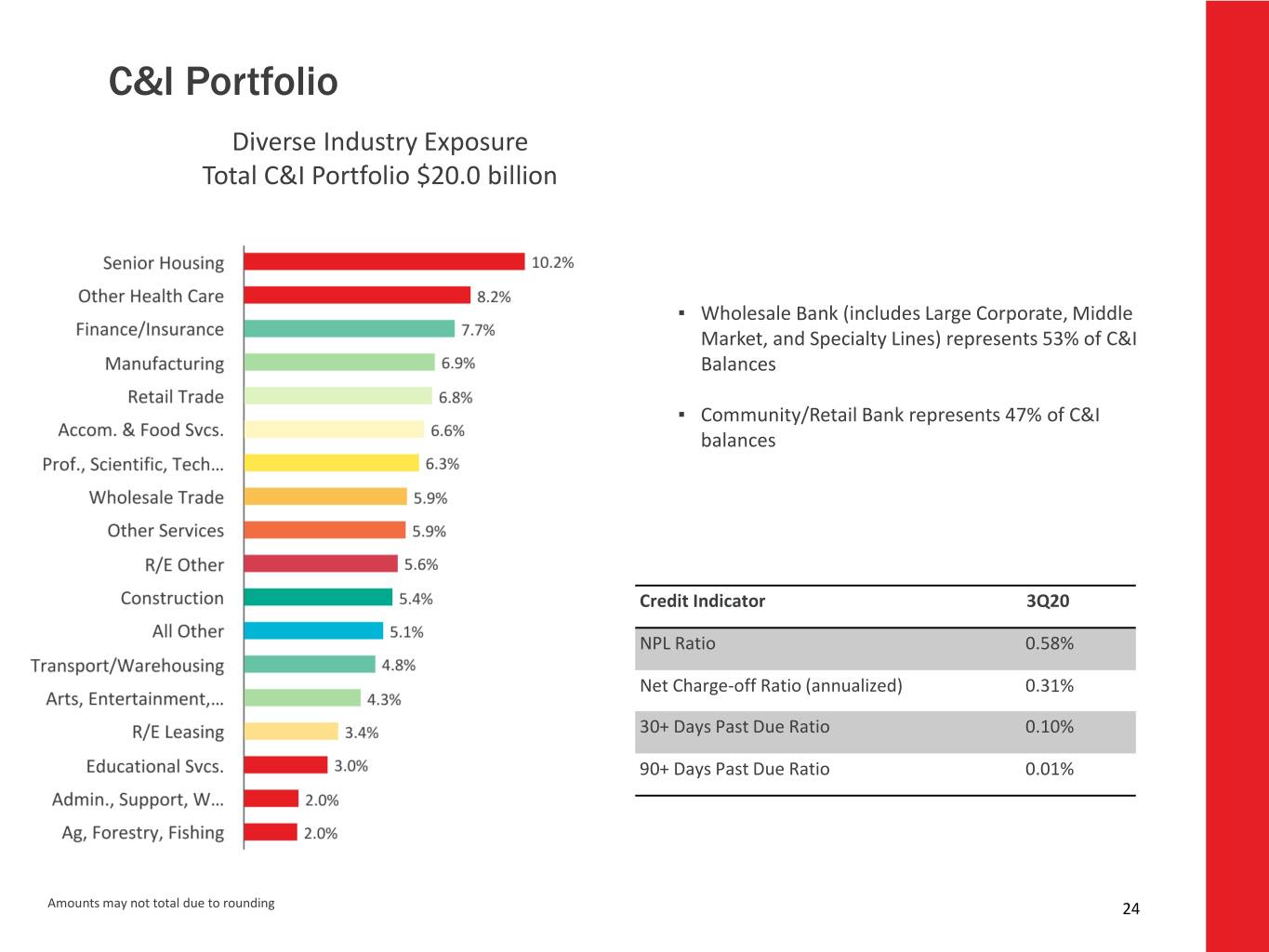

C&I Portfolio Diverse Industry Exposure Total C&I Portfolio $20.0 billion ▪ Wholesale Bank (includes Large Corporate, Middle Market, and Specialty Lines) represents 53% of C&I Balances ▪ Community/Retail Bank represents 47% of C&I balances Credit Indicator 3Q20 NPL Ratio 0.58% Net Charge-off Ratio (annualized) 0.31% 30+ Days Past Due Ratio 0.10% 90+ Days Past Due Ratio 0.01% Amounts may not total due to rounding 24

Consumer Portfolio Total Consumer Portfolio $8.7 billion Credit Indicator 3Q20 NPL Ratio 0.22% Net Charge-off Ratio * 0.32% 30+ Days Past Due Ratio 0.28% 90+ Days Past Due Ratio 0.03% *Annualized ▪ Credit Card Portfolio continues to perform well ▪ Average utilization rate is 20% ▪ Average credit score is 732 ▪ QTD net charge-off ratio of 3.16% Mortgage and HELOC, the two largest concentrations, have strong credit indicators Credit Indicator HELOC Mortgage ▪ Lending Partnerships with GreenSky and SoFi Weighted Average Credit 800 782 Score of 3Q20 Originations ▪ Currently $710 million in balances, or 1.8% of total Loans Weighted average credit score 790 778 ▪ GreenSky is a point-of-sale program where the of total portfolio customer applies for a small loan with a home Weighted Average LTV(1) 74.3% 75.5% improvement store, contractor, or other merchant Average DTI(2) 35.0% 30.7% Utilization Rate 48.8% N/A * Annualized Amounts may not total due to rounding 25 (1) LTV is calculated by dividing the most recent appraisal value (typically at origination) by the 9/30/2020 loan balance (2) Average DTI of 3Q20 originations

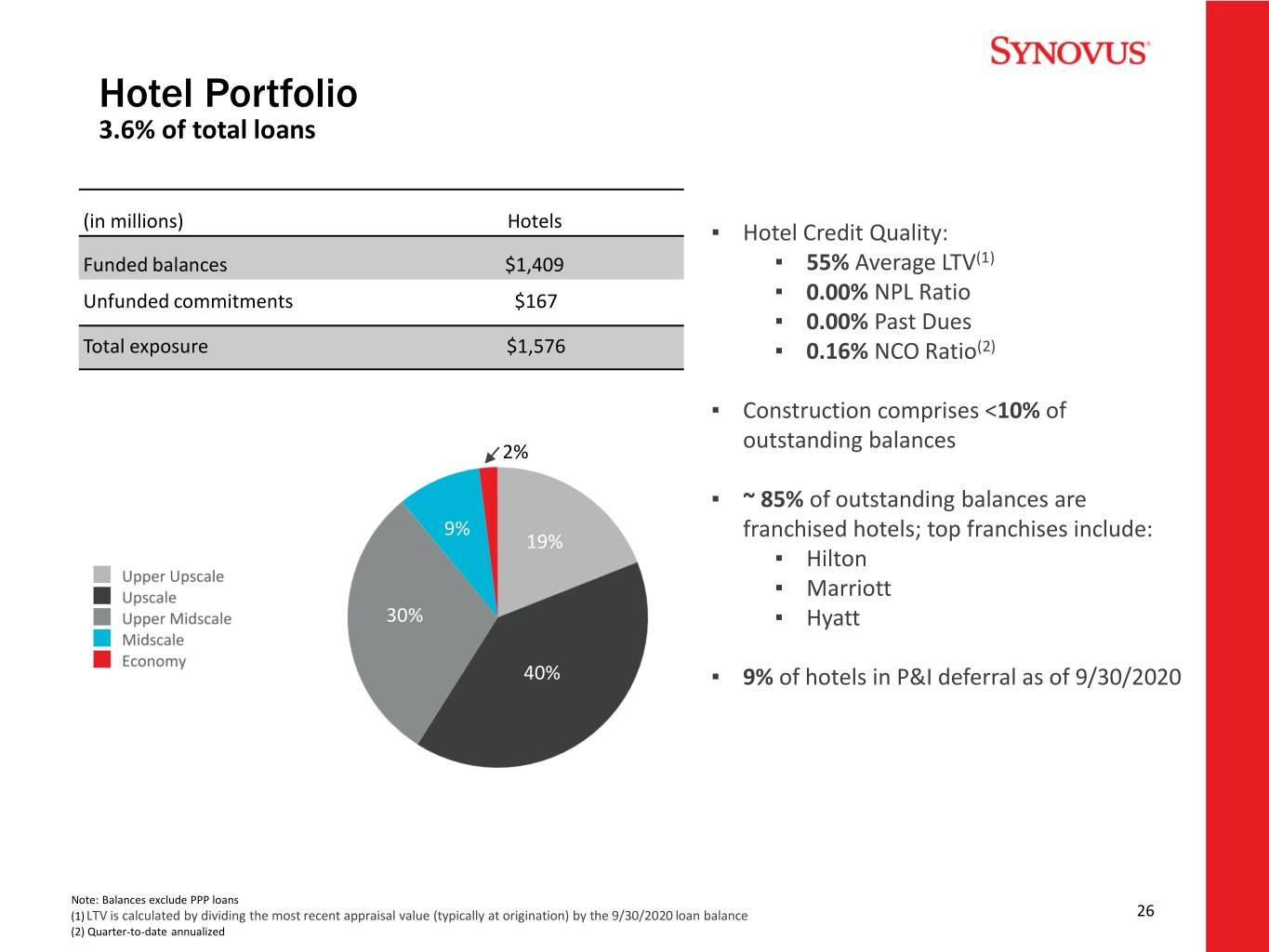

Hotel Portfolio 3.6% of total loans (in millions) Hotels ▪ Hotel Credit Quality: Funded balances $1,409 ▪ 55% Average LTV(1) Unfunded commitments $167 ▪ 0.00% NPL Ratio ▪ 0.00% Past Dues Total exposure $1,576 ▪ 0.16% NCO Ratio(2) ▪ Construction comprises <10% of 2% outstanding balances ▪ ~ 85% of outstanding balances are 9% franchised hotels; top franchises include: 19% ▪ Hilton ▪ Marriott 30% ▪ Hyatt 40% ▪ 9% of hotels in P&I deferral as of 9/30/2020 42% 56% Note: Balances exclude PPP loans (1) LTV is calculated by dividing the most recent appraisal value (typically at origination) by the 9/30/2020 loan balance 26 (2) Quarter-to-date annualized

Restaurant Portfolio 2.1% of total loans (in millions) Limited-Service Restaurants Full-Service Restaurants Total Restaurant Portfolio Funded balances $448 $365 $813 Unfunded commitments $101 $91 $192 Total exposure $549 $456 $1,005 ▪ >60% of restaurants are franchises; top franchises include: 45% ▪ McDonalds ▪ Cracker Barrel ▪ Zaxby's ▪ Panera Bread Co. 55% ▪ Burger King ▪ Limited-service restaurants have largely recovered; cash inflow data shows full- service restaurants in the portfolio have recovered to 85% of pre-COVID revenues Limited-Service Restaurant Full-Service Restaurant ▪ 5% of full-service restaurants in P&I Credit Quality: Credit Quality: deferral as of 9/30/2020 ▪ 0.35% NPL Ratio ▪ 1.16% NPL Ratio ▪ 0.02% Past Dues ▪ 0.20% Past Dues ▪ No limited service restaurants in P&I ▪ 0.00% NCO Ratio(1) (1) ▪ 0.26% NCO Ratio deferral as of 9/30/2020 Note: Balances exclude PPP loans 27 (1) Quarter-to-date annualized

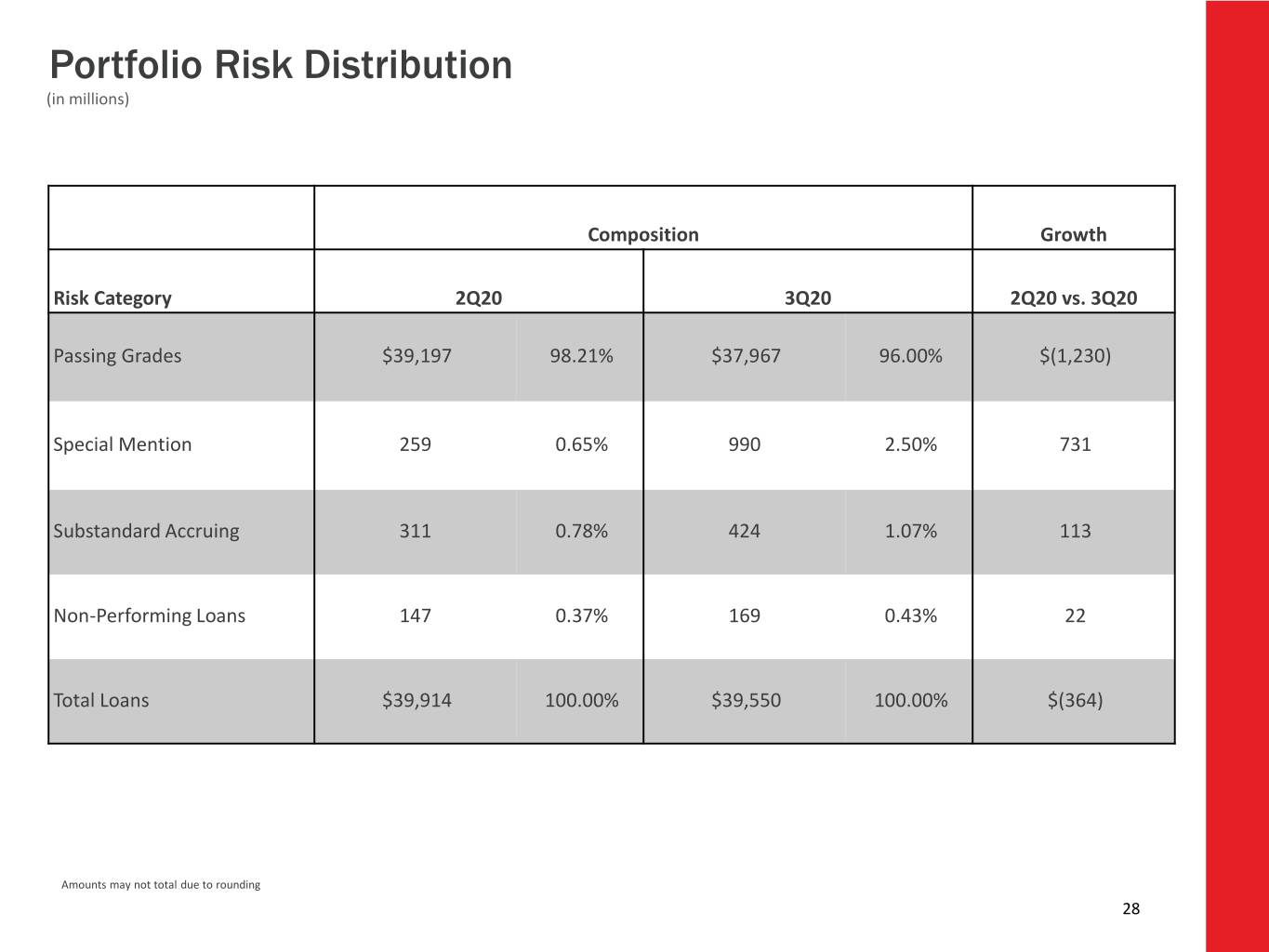

Portfolio Risk Distribution (in millions) Composition Growth Risk Category 2Q20 3Q20 2Q20 vs. 3Q20 Passing Grades $39,197 98.21% $37,967 96.00% $(1,230) Special Mention 259 0.65% 990 2.50% 731 Substandard Accruing 311 0.78% 424 1.07% 113 Non-Performing Loans 147 0.37% 169 0.43% 22 Total Loans $39,914 100.00% $39,550 100.00% $(364) Amounts may not total due to rounding 28

Non-GAAP Financial Measures (in thousands, except per share data) 3Q20 2Q20 3Q19 Net income available to common shareholders $ 83,283 84,901 127,435 Add: Income tax expense, net related to State Tax Reform — — 4,402 Add: Earnout liability adjustments — 4,908 10,457 Add: Goodwill impairment 44,877 — — Add: Merger-related expense — — 353 Add/subtract: Restructuring charges, net 2,882 2,822 (66) Add: Valuation adjustment to Visa derivative — — 2,500 Add: Loss on early extinguishment of debt, net 154 — 4,592 Add/subtract: Investment securities losses (gains), net 1,550 (69,409) 3,731 Subtract: Gain on sale and fair value increase of private equity investments (260) (8,707) (1,194) Subtract/add: Tax effect of adjustments (1,122) 19,500 (2,478) Adjusted net income available to common shareholders $ 131,364 $ 34,015 $ 149,732 Weighted average common shares outstanding, diluted 147,976 147,733 154,043 Net income per common share, diluted $ 0.56 $ 0.57 $ 0.83 Adjusted net income per common share, diluted $ 0.89 $ 0.23 $ 0.97 29

Non-GAAP Financial Measures, Continued (dollars in thousands) 3Q20 2Q20 1Q20 4Q19 3Q19 Net income $ 91,574 93,192 38,521 151,684 135,726 Add: Income tax expense, net related to State Tax Reform — — — — 4,402 Add: Earnout liability adjustments — 4,908 — — 10,457 Add: Goodwill impairment 44,877 — — — — Subtract/add: Merger-related expense — — — (913) 353 Add/subtract: Restructuring charges, net 2,882 2,822 3,220 1,259 (66) Add: Valuation adjustment to Visa derivative — — — 1,111 2,500 Add: Loss on early extinguishment of debt, net 154 — 1,904 — 4,592 Add/subtract: Investment securities losses (gains), net 1,550 (69,409) (8,734) 2,157 3,731 Subtract/add: Gain on sale and fair value (increase) decrease of private equity investments (260) (8,707) 4,255 (8,100) (1,194) Subtract/add: Tax effect of adjustments (1,122) 19,500 (167) 1,162 (2,478) Adjusted net income $ 139,655 42,306 38,999 148,360 158,023 Net income annualized $ 364,305 374,816 154,931 601,790 538,478 Adjusted net income annualized $ 555,584 170,154 156,853 588,602 626,939 Total average assets $ 53,138,334 52,853,685 48,696,595 47,459,405 47,211,026 Return on average assets 0.69 % 0.71 % 0.32 % 1.27 % 1.14 % Adjusted return on average assets 1.05 % 0.32 % 0.32 % 1.24 % 1.33 % 30

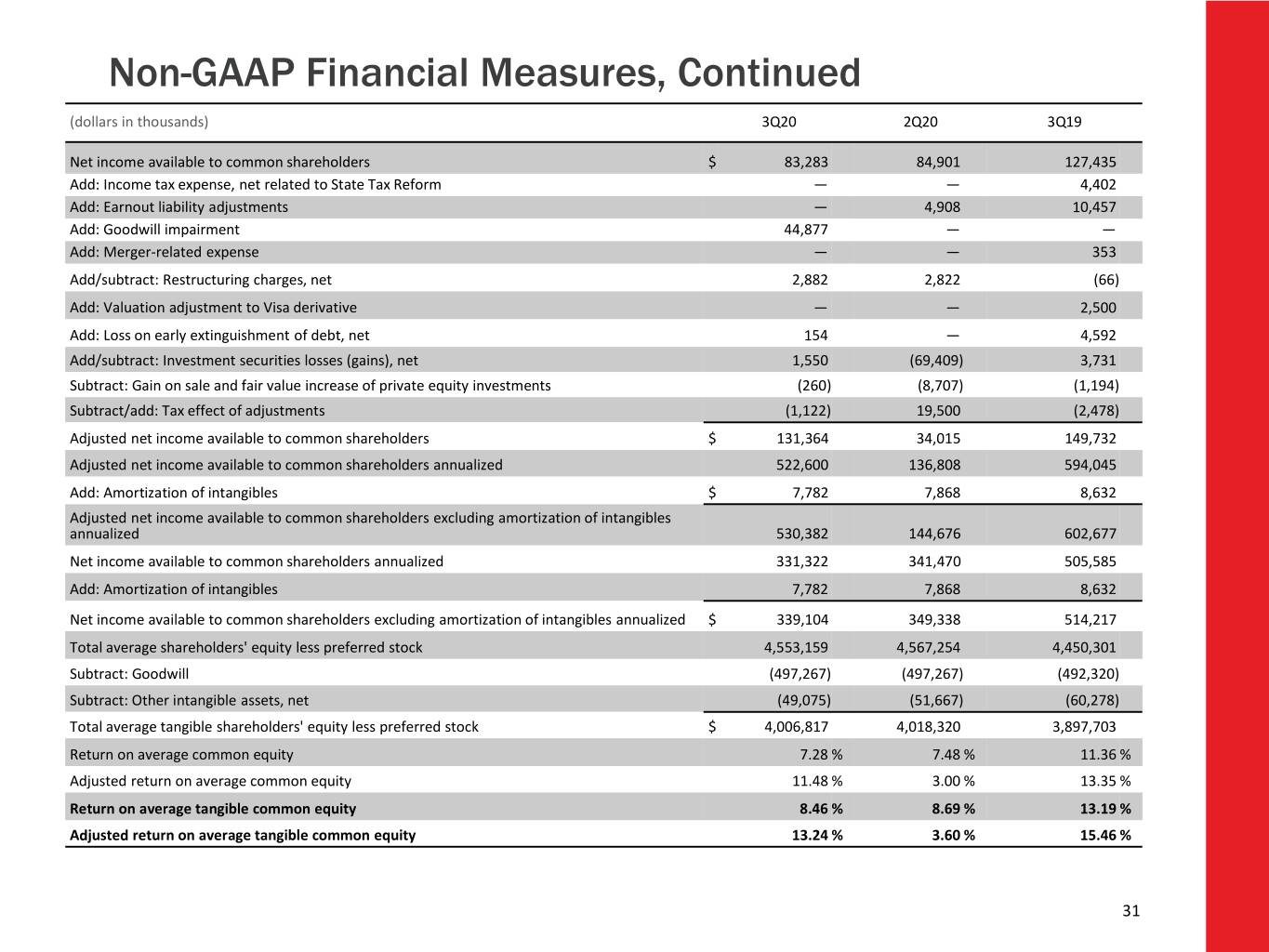

Non-GAAP Financial Measures, Continued (dollars in thousands) 3Q20 2Q20 3Q19 Net income available to common shareholders $ 83,283 84,901 127,435 Add: Income tax expense, net related to State Tax Reform — — 4,402 Add: Earnout liability adjustments — 4,908 10,457 Add: Goodwill impairment 44,877 — — Add: Merger-related expense — — 353 Add/subtract: Restructuring charges, net 2,882 2,822 (66) Add: Valuation adjustment to Visa derivative — — 2,500 Add: Loss on early extinguishment of debt, net 154 — 4,592 Add/subtract: Investment securities losses (gains), net 1,550 (69,409) 3,731 Subtract: Gain on sale and fair value increase of private equity investments (260) (8,707) (1,194) Subtract/add: Tax effect of adjustments (1,122) 19,500 (2,478) Adjusted net income available to common shareholders $ 131,364 34,015 149,732 Adjusted net income available to common shareholders annualized 522,600 136,808 594,045 Add: Amortization of intangibles $ 7,782 7,868 8,632 Adjusted net income available to common shareholders excluding amortization of intangibles annualized 530,382 144,676 602,677 Net income available to common shareholders annualized 331,322 341,470 505,585 Add: Amortization of intangibles 7,782 7,868 8,632 Net income available to common shareholders excluding amortization of intangibles annualized $ 339,104 349,338 514,217 Total average shareholders' equity less preferred stock 4,553,159 4,567,254 4,450,301 Subtract: Goodwill (497,267) (497,267) (492,320) Subtract: Other intangible assets, net (49,075) (51,667) (60,278) Total average tangible shareholders' equity less preferred stock $ 4,006,817 4,018,320 3,897,703 Return on average common equity 7.28 % 7.48 % 11.36 % Adjusted return on average common equity 11.48 % 3.00 % 13.35 % Return on average tangible common equity 8.46 % 8.69 % 13.19 % Adjusted return on average tangible common equity 13.24 % 3.60 % 15.46 % 31

Non-GAAP Financial Measures, Continued (dollars in thousands) 3Q20 2Q20 3Q19 Total non-interest revenue $ 114,411 173,484 88,760 Add/subtract: Investment securities losses (gains), net 1,550 (69,409) 3,731 Subtract: Gain on sale and fair value increase of private equity investments (260) (8,707) (1,194) Adjusted non-interest revenue $ 115,701 95,368 91,297 (dollars in thousands) 3Q20 2Q20 1Q20 4Q19 3Q19 Total non-interest expense $ 316,655 284,141 276,279 266,121 276,310 Subtract: Earnout liability adjustments — (4,908) — — (10,457) Subtract: Goodwill impairment (44,877) — — — — Add/subtract: Merger-related expense — — — 913 (353) Subtract/add: Restructuring charges, net (2,882) (2,822) (3,220) (1,259) 66 Subtract: Valuation adjustment to Visa derivative — — — (1,111) (2,500) Subtract: Loss on early extinguishment of debt, net (154) — (1,904) — (4,592) Adjusted non-interest expense $ 268,742 276,411 271,155 264,664 258,474 (dollars in thousands) 3Q20 2Q20 1Q20 4Q19 3Q19 Adjusted non-interest expense $ 268,742 276,411 271,155 264,664 258,474 Subtract: Amortization of intangibles (2,640) (2,640) (2,640) (2,901) (2,901) Adjusted tangible non-interest expense $ 266,102 273,771 268,515 261,763 255,573 Net interest income 376,990 376,566 373,260 399,268 402,097 Add: Tax equivalent adjustment 956 861 786 769 819 Add: Total non-interest revenue 114,411 173,484 103,857 97,955 88,760 Total FTE revenues 492,357 550,911 477,903 497,992 491,676 Add/subtract: Investment securities losses (gains), net 1,550 (69,409) (8,734) 2,157 3,731 Subtract/add: Gain on sale and fair value (increase) decrease of private equity investments (260) (8,707) 4,255 (8,100) (1,194) Adjusted total revenues $ 493,647 472,795 473,424 492,049 494,213 Efficiency ratio-FTE 64.31 % 51.58 % 57.81 % 53.44 % 56.20 % Adjusted tangible efficiency ratio 53.91 % 57.91 % 56.72 % 53.20 % 51.71 % 32

Non-GAAP Financial Measures, Continued September 30, June 30, March 31, December 31, September 30, (dollars in thousands) 2020 2020 2020 2019 2019 Total assets $ 53,040,538 $ 54,121,989 $ 50,619,585 $48,203,282 $ 47,661,182 Subtract: Goodwill (452,390) (497,267) (497,267) (497,267) (487,865) Subtract: Other intangible assets, net (47,752) (50,392) (53,032) (55,671) (58,572) Tangible assets 52,540,396 53,574,330 50,069,286 47,650,344 47,114,745 Total shareholders’ equity 5,064,542 5,052,968 5,065,205 4,941,690 4,868,838 Subtract: Goodwill (452,390) (497,267) (497,267) (497,267) (487,865) Subtract: Other intangible assets, net (47,752) (50,392) (53,032) (55,671) (58,572) Subtract: Preferred Stock, no par value (537,145) (537,145) (537,145) (537,145) (536,550) Tangible common equity $ 4,027,255 3,968,164 3,977,761 3,851,607 3,785,851 Total shareholders’ equity to total assets ratio 9.55 % 9.34 % 10.01 % 10.25 % 10.22 % Tangible common equity ratio 7.67 % 7.41 % 7.94 % 8.08 % 8.04 % 33