Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - PIONEER NATURAL RESOURCES CO | d50138dex993.htm |

| EX-99.1 - EX-99.1 - PIONEER NATURAL RESOURCES CO | d50138dex991.htm |

| 8-K - 8-K - PIONEER NATURAL RESOURCES CO | d50138d8k.htm |

Exhibit 99.2 Acquisition of Parsley Energy The Premier Independent E&P October 20, 2020Exhibit 99.2 Acquisition of Parsley Energy The Premier Independent E&P October 20, 2020

Certain Notices Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed transaction between Pioneer and Parsley. The proposed transaction will be submitted to Pioneer’s stockholders and Parsley’s stockholders for their consideration. Pioneer and Parsley intend to file a joint proxy statement/prospectus (the “Joint Proxy Statement/Prospectus”) with the SEC in connection with the solicitation of proxies by Pioneer and Parsley in connection with the proposed transaction. Pioneer intends to file a registration statement on Form S-4 (the “Form S-4”) with the SEC, in which the Joint Proxy Statement/Prospectus will be included. Pioneer and Parsley also intend to file other relevant documents with the SEC regarding the proposed transaction. The definitive Joint Proxy Statement/Prospectus will be mailed to Pioneer’s stockholders and Parsley’s stockholders when available. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND STOCKHOLDERS OF PIONEER AND INVESTORS AND STOCKHOLDERS OF PARSLEY ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The Joint Proxy Statement/Prospectus, any amendments or supplements thereto and other relevant materials, and any other documents filed by Pioneer or Parsley with the SEC, may be obtained once such documents are filed with the SEC free of charge at the SEC’s website at www.sec.gov or free of charge from Pioneer at www.pxd.com or by directing a request to Pioneer’s Investor Relations Department at ir@pxd.com or free of charge from Parsley at www.parsleyenergy.com or by directing a request to Parsley’s Investor Relations Department at ir@parsleyenergy.com. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Participants in the Solicitation Pioneer, Parsley and certain of their respective executive officers, directors, other members of management and employees may, under the rules of the SEC, be deemed to be “participants” in the solicitation of proxies in connection with the proposed transaction. Information regarding Parsley’s directors and executive officers is available in its Proxy Statement on Schedule 14A for its 2020 Annual Meeting of Stockholders, filed with the SEC on April 9, 2020 and in its Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 24, 2020. Information regarding Parsley’s directors and executive officers is available in its Proxy Statement on Schedule 14A for its 2020 Annual Meeting of Stockholders, filed with the SEC on April 6, 2020 and in its Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 21, 2020. These documents may be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Form S-4, the Joint Proxy Statement/Prospectus and other relevant materials relating to the proposed transaction to be filed with the SEC when they become available. Stockholders and other investors should read the Joint Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions. 2Certain Notices Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed transaction between Pioneer and Parsley. The proposed transaction will be submitted to Pioneer’s stockholders and Parsley’s stockholders for their consideration. Pioneer and Parsley intend to file a joint proxy statement/prospectus (the “Joint Proxy Statement/Prospectus”) with the SEC in connection with the solicitation of proxies by Pioneer and Parsley in connection with the proposed transaction. Pioneer intends to file a registration statement on Form S-4 (the “Form S-4”) with the SEC, in which the Joint Proxy Statement/Prospectus will be included. Pioneer and Parsley also intend to file other relevant documents with the SEC regarding the proposed transaction. The definitive Joint Proxy Statement/Prospectus will be mailed to Pioneer’s stockholders and Parsley’s stockholders when available. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND STOCKHOLDERS OF PIONEER AND INVESTORS AND STOCKHOLDERS OF PARSLEY ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The Joint Proxy Statement/Prospectus, any amendments or supplements thereto and other relevant materials, and any other documents filed by Pioneer or Parsley with the SEC, may be obtained once such documents are filed with the SEC free of charge at the SEC’s website at www.sec.gov or free of charge from Pioneer at www.pxd.com or by directing a request to Pioneer’s Investor Relations Department at ir@pxd.com or free of charge from Parsley at www.parsleyenergy.com or by directing a request to Parsley’s Investor Relations Department at ir@parsleyenergy.com. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Participants in the Solicitation Pioneer, Parsley and certain of their respective executive officers, directors, other members of management and employees may, under the rules of the SEC, be deemed to be “participants” in the solicitation of proxies in connection with the proposed transaction. Information regarding Parsley’s directors and executive officers is available in its Proxy Statement on Schedule 14A for its 2020 Annual Meeting of Stockholders, filed with the SEC on April 9, 2020 and in its Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 24, 2020. Information regarding Parsley’s directors and executive officers is available in its Proxy Statement on Schedule 14A for its 2020 Annual Meeting of Stockholders, filed with the SEC on April 6, 2020 and in its Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 21, 2020. These documents may be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Form S-4, the Joint Proxy Statement/Prospectus and other relevant materials relating to the proposed transaction to be filed with the SEC when they become available. Stockholders and other investors should read the Joint Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions. 2

Forward-Looking Statements Except for historical information contained herein, the statements in this presentation are forward-looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements and the business prospects of Pioneer and Parsley are subject to a number of risks and uncertainties that may cause Pioneer’s and Parsley’s actual results in future periods to differ materially from the forward-looking statements. These risks and uncertainties include, among other things, the risk that Pioneer’s and Parsley’s businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected; the diversion of management time on transaction-related issues; the effect of future regulatory or legislative actions on the companies or the industries in which they operate, including the risk of new restrictions with respect to development activities on Pioneer’s or Parsley’s assets; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the risk that Pioneer or Parsley may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or that required governmental and regulatory approvals may delay the proposed transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied; the length of time necessary to consummate the proposed transaction, which may be longer than anticipated for various reasons; potential liability resulting from pending or future litigation; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential impact of the announcement or consummation of the proposed transaction on relationships with customers, suppliers, competitors, management and other employees; the effect of this communication on Pioneer’s or Parsley’s stock prices; transaction costs; volatility of commodity prices, product supply and demand; the impact of a widespread outbreak of an illness, such as the COVID-19 pandemic, on global and U.S. economic activity, competition, the ability to obtain environmental and other permits and the timing thereof, other government regulation or action, the ability to obtain approvals from third parties and negotiate agreements with third parties on mutually acceptable terms, litigation, the costs and results of drilling and operations, availability of equipment, services, resources and personnel required to perform Pioneer’s and Parsley’s drilling and operating activities, access to and availability of transportation, processing, fractionation, refining, storage and export facilities; Pioneer’s and Parsley’s ability to replace reserves, implement its business plans or complete its development activities as scheduled; access to and cost of capital; the financial strength of counterparties to Pioneer’s or Parsley’s credit facility, investment instruments and derivative contracts and purchasers of Pioneer’s and Parsley’s oil, natural gas liquid and gas production; uncertainties about estimates of reserves and resource potential; identification of drilling locations and the ability to add proved reserves in the future; the assumptions underlying forecasts, including forecasts of production, cash flow, well costs, capital expenditures, rates of return to shareholders, expenses, cash flows from purchases and sales of oil and gas net of firm transportation commitments, sources of funding and tax rates; quality of technical data; environmental and weather risks, including the possible impacts of climate change; cybersecurity risks; ability to implement stock repurchases; the risks associated with the ownership and operation of Pioneer’s oilfield services businesses and acts of war or terrorism. These and other risks are described in Pioneer’s and Parsley’s Annual Reports on Form 10-K for the year ended December 31, 2019, Quarterly Reports on Form 10-Q for the quarters ended March 31 and June 30, 2020, and other filings with the Securities and Exchange Commission. In addition, Pioneer and Parsley may be subject to currently unforeseen risks that may have a materially adverse impact on the combined company. Accordingly, no assurances can be given that the actual events and results will not be materially different than the anticipated results described in the forward-looking statements. Pioneer and Parsley undertake no duty to publicly update these statements except as required by law. Please see the supplemental slides included in this presentation for other important information. 3Forward-Looking Statements Except for historical information contained herein, the statements in this presentation are forward-looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements and the business prospects of Pioneer and Parsley are subject to a number of risks and uncertainties that may cause Pioneer’s and Parsley’s actual results in future periods to differ materially from the forward-looking statements. These risks and uncertainties include, among other things, the risk that Pioneer’s and Parsley’s businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected; the diversion of management time on transaction-related issues; the effect of future regulatory or legislative actions on the companies or the industries in which they operate, including the risk of new restrictions with respect to development activities on Pioneer’s or Parsley’s assets; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the risk that Pioneer or Parsley may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or that required governmental and regulatory approvals may delay the proposed transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied; the length of time necessary to consummate the proposed transaction, which may be longer than anticipated for various reasons; potential liability resulting from pending or future litigation; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential impact of the announcement or consummation of the proposed transaction on relationships with customers, suppliers, competitors, management and other employees; the effect of this communication on Pioneer’s or Parsley’s stock prices; transaction costs; volatility of commodity prices, product supply and demand; the impact of a widespread outbreak of an illness, such as the COVID-19 pandemic, on global and U.S. economic activity, competition, the ability to obtain environmental and other permits and the timing thereof, other government regulation or action, the ability to obtain approvals from third parties and negotiate agreements with third parties on mutually acceptable terms, litigation, the costs and results of drilling and operations, availability of equipment, services, resources and personnel required to perform Pioneer’s and Parsley’s drilling and operating activities, access to and availability of transportation, processing, fractionation, refining, storage and export facilities; Pioneer’s and Parsley’s ability to replace reserves, implement its business plans or complete its development activities as scheduled; access to and cost of capital; the financial strength of counterparties to Pioneer’s or Parsley’s credit facility, investment instruments and derivative contracts and purchasers of Pioneer’s and Parsley’s oil, natural gas liquid and gas production; uncertainties about estimates of reserves and resource potential; identification of drilling locations and the ability to add proved reserves in the future; the assumptions underlying forecasts, including forecasts of production, cash flow, well costs, capital expenditures, rates of return to shareholders, expenses, cash flows from purchases and sales of oil and gas net of firm transportation commitments, sources of funding and tax rates; quality of technical data; environmental and weather risks, including the possible impacts of climate change; cybersecurity risks; ability to implement stock repurchases; the risks associated with the ownership and operation of Pioneer’s oilfield services businesses and acts of war or terrorism. These and other risks are described in Pioneer’s and Parsley’s Annual Reports on Form 10-K for the year ended December 31, 2019, Quarterly Reports on Form 10-Q for the quarters ended March 31 and June 30, 2020, and other filings with the Securities and Exchange Commission. In addition, Pioneer and Parsley may be subject to currently unforeseen risks that may have a materially adverse impact on the combined company. Accordingly, no assurances can be given that the actual events and results will not be materially different than the anticipated results described in the forward-looking statements. Pioneer and Parsley undertake no duty to publicly update these statements except as required by law. Please see the supplemental slides included in this presentation for other important information. 3

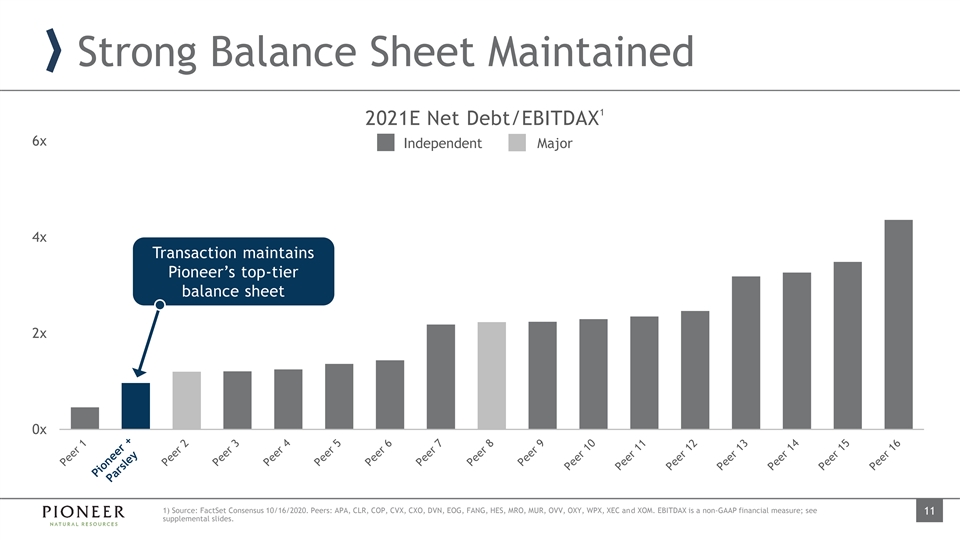

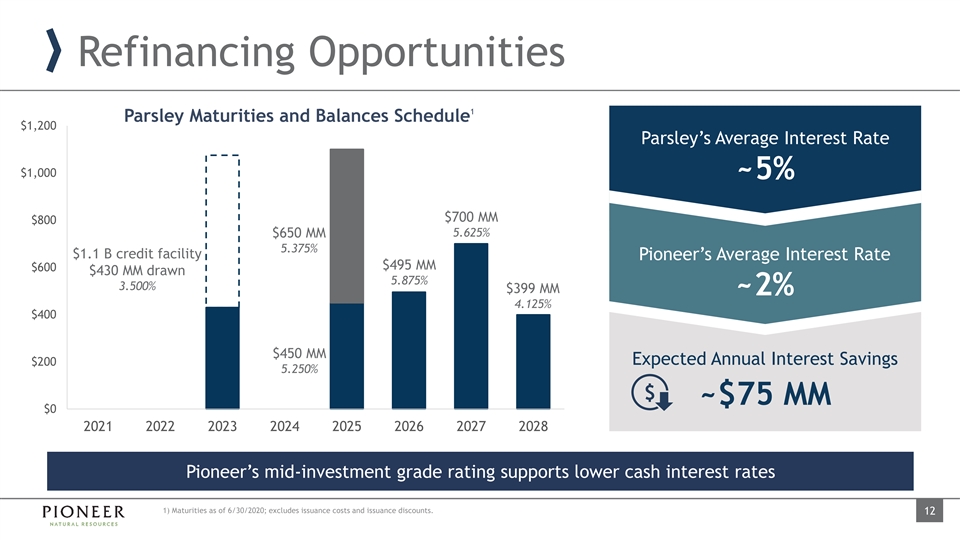

Creating Differentiated Value Highly Accretive to Free Cash Flow per share and Corporate Returns Maintains Strong Unmatched high- Enhances new $ ~930,000 quality inventory Balance Sheet investment Permian Acres; drives sustainable $ 2021E Net Debt/EBITDAX ~1.1x; No Federal Land framework 1 Free Cash Flow Reducing to <0.75x Annual synergies benefiting corporate breakeven Benefits of Size and Scale - Lower Cost of Capital ~$150 MM in Operational Synergies - Supply Chain/Logistics Pricing ~$100 MM in G&A Savings ~$325 MM - Shared Facilities/Infrastructure ~$75 MM in Interest Savings 1) Based on strip pricing as of 10/15/2020. EBITDAX is a non-GAAP financial measure; see supplemental slides. 4Creating Differentiated Value Highly Accretive to Free Cash Flow per share and Corporate Returns Maintains Strong Unmatched high- Enhances new $ ~930,000 quality inventory Balance Sheet investment Permian Acres; drives sustainable $ 2021E Net Debt/EBITDAX ~1.1x; No Federal Land framework 1 Free Cash Flow Reducing to <0.75x Annual synergies benefiting corporate breakeven Benefits of Size and Scale - Lower Cost of Capital ~$150 MM in Operational Synergies - Supply Chain/Logistics Pricing ~$100 MM in G&A Savings ~$325 MM - Shared Facilities/Infrastructure ~$75 MM in Interest Savings 1) Based on strip pricing as of 10/15/2020. EBITDAX is a non-GAAP financial measure; see supplemental slides. 4

Transaction Overview 1 Accretive combination creates the All Stock Consideration - $7.6 B Transaction Value 0.1252 shares of Pioneer per share of Parsley premier low-cost, Pro forma share count of 216 MM shares Permian independent E&P Significant Accretion Increases free cash flow per share and corporate returns Unmatched high-return inventory in U.S. shale Free Cash Flow High oil mix underpins strong margins Synergies Enhance Value Proposition Improves capital efficiency and lowers cost of capital Reduces corporate overhead and operating expenses Corporate Returns Intense focus on environmental stewardship Conditions and Timing Subject to approval by Pioneer and Parsley shareholders 2 and other customary closing conditions >$2 B of Synergies (PV-10) Closing expected Q1 2021 1) Includes assumption of $3.1B of Parsley net debt as of 6/30/2020. Based on Parsley market cap as of 10/19/2020. 2) PV-10 of $325 MM of annual synergies over ten years. 5Transaction Overview 1 Accretive combination creates the All Stock Consideration - $7.6 B Transaction Value 0.1252 shares of Pioneer per share of Parsley premier low-cost, Pro forma share count of 216 MM shares Permian independent E&P Significant Accretion Increases free cash flow per share and corporate returns Unmatched high-return inventory in U.S. shale Free Cash Flow High oil mix underpins strong margins Synergies Enhance Value Proposition Improves capital efficiency and lowers cost of capital Reduces corporate overhead and operating expenses Corporate Returns Intense focus on environmental stewardship Conditions and Timing Subject to approval by Pioneer and Parsley shareholders 2 and other customary closing conditions >$2 B of Synergies (PV-10) Closing expected Q1 2021 1) Includes assumption of $3.1B of Parsley net debt as of 6/30/2020. Based on Parsley market cap as of 10/19/2020. 2) PV-10 of $325 MM of annual synergies over ten years. 5

Transaction Enhances Investment Thesis Creating Significant Value for Shareholders 1 Targeting ~10% Total Return (inclusive of base dividend, variable dividend and oil growth) Significant Free Cash Flow Reinvestment rate lowered to 65% to 75% of cash flow at 2 strip pricing Strong Increased Substantial free cash flow generation from high-return oil Corporate Return of production growth of ~5% Returns Capital Generate strong corporate returns Reducing leverage to <0.75x net debt-to-EBITDAX Low Leverage Strong and growing base dividend of $2.20 per share Adoption of a variable dividend framework during 2021 1) Commodity strip and stock price as of 10/15/2020. Dividends are authorized and determined by the Company’s board of directors in its sole discretion. 2) Future reinvestment rate subject to 6 a number of factors, including commodity prices and economic outlook.Transaction Enhances Investment Thesis Creating Significant Value for Shareholders 1 Targeting ~10% Total Return (inclusive of base dividend, variable dividend and oil growth) Significant Free Cash Flow Reinvestment rate lowered to 65% to 75% of cash flow at 2 strip pricing Strong Increased Substantial free cash flow generation from high-return oil Corporate Return of production growth of ~5% Returns Capital Generate strong corporate returns Reducing leverage to <0.75x net debt-to-EBITDAX Low Leverage Strong and growing base dividend of $2.20 per share Adoption of a variable dividend framework during 2021 1) Commodity strip and stock price as of 10/15/2020. Dividends are authorized and determined by the Company’s board of directors in its sole discretion. 2) Future reinvestment rate subject to 6 a number of factors, including commodity prices and economic outlook.

1 Free Cash Flow Yield Improving Free Cash Flow Profile $2,000 10% Transaction is highly accretive to free cash flow $1,500 8% Attractive corporate breakeven including dividend in the mid-$30s WTI $1,000 6% Disciplined investment framework with premier asset base increases free cash flow profile $500 4% Combination of top-tier inventory and synergies enhances variable dividend proposition $0 2% 2020 2021 2022 Pioneer Pioneer + Parsley FCF Yield 1) Based on strip pricing as of 10/15/2020 and market capitalization as of 10/19/2020. Reflects pre-dividend free cash flow. Free cash flow is a non-GAAP financial measure; see supplemental slides. 7 1 Free Cash Flow ($MM)1 Free Cash Flow Yield Improving Free Cash Flow Profile $2,000 10% Transaction is highly accretive to free cash flow $1,500 8% Attractive corporate breakeven including dividend in the mid-$30s WTI $1,000 6% Disciplined investment framework with premier asset base increases free cash flow profile $500 4% Combination of top-tier inventory and synergies enhances variable dividend proposition $0 2% 2020 2021 2022 Pioneer Pioneer + Parsley FCF Yield 1) Based on strip pricing as of 10/15/2020 and market capitalization as of 10/19/2020. Reflects pre-dividend free cash flow. Free cash flow is a non-GAAP financial measure; see supplemental slides. 7 1 Free Cash Flow ($MM)

Combining Two Premier Permian Assets Combined Midland Basin 1 Enterprise Value $ 16.3 B $ 7.6 B $ 23.9 B Q2’20 Oil Production (MBOPD) 215 113 328 Q2’20 Production (MBOEPD) 375 183 558 Oil Mix 57% 61% 59% Net Permian Acreage 680,000 250,000 930,000 2 Midland Basin Gross Production by Operator 631 (MBOEPD) 205 195 187 127 122 121 113 110 107 Delaware Basin 8 1) Market cap as of 10/19/2020 plus Q2 2020 net debt. 2) Source: Enverus, June 2020; gross two-stream MBOEPD. Combining Two Premier Permian Assets Combined Midland Basin 1 Enterprise Value $ 16.3 B $ 7.6 B $ 23.9 B Q2’20 Oil Production (MBOPD) 215 113 328 Q2’20 Production (MBOEPD) 375 183 558 Oil Mix 57% 61% 59% Net Permian Acreage 680,000 250,000 930,000 2 Midland Basin Gross Production by Operator 631 (MBOEPD) 205 195 187 127 122 121 113 110 107 Delaware Basin 8 1) Market cap as of 10/19/2020 plus Q2 2020 net debt. 2) Source: Enverus, June 2020; gross two-stream MBOEPD.

Unmatched Portfolio of Top Tier Permian Acreage 1 A – Rated Inventory ~930,000 Net Acres (Breakeven pricing <$30 WTI and <$2.00 HH) No Federal Acreage Unmatched top-tier inventory in all of U.S. shale PERMIAN + Creates the only Permian pure play independent E&P of size and scale 1) Source: Wells Fargo, June 2020. Inventory quality is based on breakeven pricing: A-Rated, <$30/bbl WTI, <$2/MCF HH. Peers include: CLR, CXO, DVN, EOG, FANG, MRO, NBL, WPX and XEC. 9Unmatched Portfolio of Top Tier Permian Acreage 1 A – Rated Inventory ~930,000 Net Acres (Breakeven pricing <$30 WTI and <$2.00 HH) No Federal Acreage Unmatched top-tier inventory in all of U.S. shale PERMIAN + Creates the only Permian pure play independent E&P of size and scale 1) Source: Wells Fargo, June 2020. Inventory quality is based on breakeven pricing: A-Rated, <$30/bbl WTI, <$2/MCF HH. Peers include: CLR, CXO, DVN, EOG, FANG, MRO, NBL, WPX and XEC. 9

1 Increasing Permian Scale Bubble sizes based on Midland and 1,500 Delaware Basin gross oil production Peer 8 1,250 Pioneer 1,000 + Parsley 750 Peer 1 (37% Oil Mix) Peer 6 500 Peer 4 Peer 7 Peer 2 (53% Oil Mix) 250 Peer 5 Peer 3 - 55% 60% 65% 70% Midland and Delaware Basin Gross 2-Stream Oil Mix Forms the largest Midland and Delaware Basin producer with significant high-quality acreage Annualized savings of ~$325 MM expected through operational synergies, G&A reductions and interest expense savings 1) Source: Enverus, production reflects June 2020 daily averages. Peers include: APA, COP, CXO, EOG, FANG, MRO, OXY and WPX. 10 Midland and Delaware Basin Net Acreage (000)1 Increasing Permian Scale Bubble sizes based on Midland and 1,500 Delaware Basin gross oil production Peer 8 1,250 Pioneer 1,000 + Parsley 750 Peer 1 (37% Oil Mix) Peer 6 500 Peer 4 Peer 7 Peer 2 (53% Oil Mix) 250 Peer 5 Peer 3 - 55% 60% 65% 70% Midland and Delaware Basin Gross 2-Stream Oil Mix Forms the largest Midland and Delaware Basin producer with significant high-quality acreage Annualized savings of ~$325 MM expected through operational synergies, G&A reductions and interest expense savings 1) Source: Enverus, production reflects June 2020 daily averages. Peers include: APA, COP, CXO, EOG, FANG, MRO, OXY and WPX. 10 Midland and Delaware Basin Net Acreage (000)

Strong Balance Sheet Maintained 1 2021E Net Debt/EBITDAX 6x Independent Major 4x Transaction maintains Pioneer’s top-tier balance sheet 2x 0x 1) Source: FactSet Consensus 10/16/2020. Peers: APA, CLR, COP, CVX, CXO, DVN, EOG, FANG, HES, MRO, MUR, OVV, OXY, WPX, XEC and XOM. EBITDAX is a non-GAAP financial measure; see 11 supplemental slides. Strong Balance Sheet Maintained 1 2021E Net Debt/EBITDAX 6x Independent Major 4x Transaction maintains Pioneer’s top-tier balance sheet 2x 0x 1) Source: FactSet Consensus 10/16/2020. Peers: APA, CLR, COP, CVX, CXO, DVN, EOG, FANG, HES, MRO, MUR, OVV, OXY, WPX, XEC and XOM. EBITDAX is a non-GAAP financial measure; see 11 supplemental slides.

Refinancing Opportunities 1 Parsley Maturities and Balances Schedule $1,200 Parsley’s Average Interest Rate $1,000 ~5% $700 MM $800 5.625% $650 MM 5.375% $1.1 B credit facility Pioneer’s Average Interest Rate $495 MM $600 $430 MM drawn 5.875% 3.500% $399 MM ~2% 4.125% $400 $450 MM Expected Annual Interest Savings $200 5.250% $ ~$75 MM $0 2021 2022 2023 2024 2025 2026 2027 2028 Pioneer’s mid-investment grade rating supports lower cash interest rates 1) Maturities as of 6/30/2020; excludes issuance costs and issuance discounts. 12Refinancing Opportunities 1 Parsley Maturities and Balances Schedule $1,200 Parsley’s Average Interest Rate $1,000 ~5% $700 MM $800 5.625% $650 MM 5.375% $1.1 B credit facility Pioneer’s Average Interest Rate $495 MM $600 $430 MM drawn 5.875% 3.500% $399 MM ~2% 4.125% $400 $450 MM Expected Annual Interest Savings $200 5.250% $ ~$75 MM $0 2021 2022 2023 2024 2025 2026 2027 2028 Pioneer’s mid-investment grade rating supports lower cash interest rates 1) Maturities as of 6/30/2020; excludes issuance costs and issuance discounts. 12

Strong Focus on ESG Environmental Social Governance Focus on maintaining very low At Pioneer, a job is never so Board of Directors Committees: flaring intensity and GHG emissions important that it cannot be done Health, Safety and Environment in a safe and environmentally Continue to reduce flaring on Jagged Committee sound manner Peak acreage acquired by Parsley Oversight of the Company’s culture of continuous improvement in safety and RESPECT Core Values: Leverage existing and future water environmental protection practices infrastructure to reduce fresh Respect water utilization E thics and Honesty Nomination and Corporate S afety and Environment Governance Committee 1 Q2 2020 Flaring Intensity P ersonal Accountability Oversight of governance practices, E ntrepreneurship including Pioneer’s charitable contributions C ommunication 0.6% 1.7% T eamwork and Inclusion Pioneer Peer Average + Parsley Pioneer’s comprehensive 2020 Sustainability Report to be published this quarter 1) Source: Rystad Energy research and analysis, Rystad Energy ShaleWellCube October 2020. Peers: APA, BP, COP, CPE, CVX, CXO, DVN, EOG, FANG, MRO, OXY, OVV, PDCE, SM, WPX, XEC, and XOM. 13Strong Focus on ESG Environmental Social Governance Focus on maintaining very low At Pioneer, a job is never so Board of Directors Committees: flaring intensity and GHG emissions important that it cannot be done Health, Safety and Environment in a safe and environmentally Continue to reduce flaring on Jagged Committee sound manner Peak acreage acquired by Parsley Oversight of the Company’s culture of continuous improvement in safety and RESPECT Core Values: Leverage existing and future water environmental protection practices infrastructure to reduce fresh Respect water utilization E thics and Honesty Nomination and Corporate S afety and Environment Governance Committee 1 Q2 2020 Flaring Intensity P ersonal Accountability Oversight of governance practices, E ntrepreneurship including Pioneer’s charitable contributions C ommunication 0.6% 1.7% T eamwork and Inclusion Pioneer Peer Average + Parsley Pioneer’s comprehensive 2020 Sustainability Report to be published this quarter 1) Source: Rystad Energy research and analysis, Rystad Energy ShaleWellCube October 2020. Peers: APA, BP, COP, CPE, CVX, CXO, DVN, EOG, FANG, MRO, OXY, OVV, PDCE, SM, WPX, XEC, and XOM. 13

The Premier Permian E&P 1 1 Enterprise Value ($MM) 2020E Production (MBOEPD) $60,000 1,400 1,200 $50,000 1,000 $40,000 800 $30,000 600 $20,000 400 $10,000 200 $0 0 Creates a top tier independent E&P with (1) a strong balance sheet (2) significant free cash flow generation and (3) return of capital 1) Source: FactSet 10/19/2020. 14The Premier Permian E&P 1 1 Enterprise Value ($MM) 2020E Production (MBOEPD) $60,000 1,400 1,200 $50,000 1,000 $40,000 800 $30,000 600 $20,000 400 $10,000 200 $0 0 Creates a top tier independent E&P with (1) a strong balance sheet (2) significant free cash flow generation and (3) return of capital 1) Source: FactSet 10/19/2020. 14

Enhancing Shareholder Value Low-cost, Disciplined Free cash flow Low leverage Significant high-return reinvestment rate generation provides financial inventory of Permian Basin underpins compelling supports return and operational low-risk, high- wells drive strong investment of capital to flexibility return wells corporate returns framework shareholders 0.5x >10 BBOE Protecting the Dividend Accretive transaction enhances Pioneer’s value proposition Net Debt to Resource 1 TTM EBITDA Potential 15Enhancing Shareholder Value Low-cost, Disciplined Free cash flow Low leverage Significant high-return reinvestment rate generation provides financial inventory of Permian Basin underpins compelling supports return and operational low-risk, high- wells drive strong investment of capital to flexibility return wells corporate returns framework shareholders 0.5x >10 BBOE Protecting the Dividend Accretive transaction enhances Pioneer’s value proposition Net Debt to Resource 1 TTM EBITDA Potential 15

Supplemental SlidesSupplemental Slides

Additional Information EBITDAX represents earnings before depletion, depreciation and amortization expense; exploration and abandonments; impairment of inventory and other property and equipment; accretion of discount on asset retirement obligations; interest expense; income taxes; net gain on the disposition of assets; loss on early extinguishment of debt; noncash derivative related activity; amortization of stock-based compensation; noncash valuation adjustments on investments, contingent considerations and deficiency fee obligations; and other noncash items. The Company also views the non-GAAP measures of EBITDAX and net debt to EBITDAX as useful tools for comparisons of the Company's financial indicators with those of peer companies that follow the full cost method of accounting. EBITDAX should not be considered as alternatives to net income or net cash provided by operating activities, as defined by GAAP. Free cash flow ( FCF ) and free cash flow yield are non-GAAP financial measures. As used by the Company, FCF is defined as net cash provided by operating activities, adjusted for changes in operating assets and liabilities, less capital expenditures. Free cash flow yield is defined as FCF divided by the market capitalization of the Company at a given date. The Company believes these non-GAAP measures are financial indicators of the Company’s ability to internally fund acquisitions, debt maturities, dividends and share repurchases after capital expenditures excluding acquisitions, asset retirement obligations, capitalized interest, geological and geophysical general and administrative expense, information technology and corporate facilities. Due to the forward-looking nature of EBITDAX, projected free cash flow and free cash flow yield used herein, management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measures, such as changes in operating assets and liabilities. Accordingly, Pioneer is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures. Amounts excluded from this non-GAAP measure in future periods could be significant. 17Additional Information EBITDAX represents earnings before depletion, depreciation and amortization expense; exploration and abandonments; impairment of inventory and other property and equipment; accretion of discount on asset retirement obligations; interest expense; income taxes; net gain on the disposition of assets; loss on early extinguishment of debt; noncash derivative related activity; amortization of stock-based compensation; noncash valuation adjustments on investments, contingent considerations and deficiency fee obligations; and other noncash items. The Company also views the non-GAAP measures of EBITDAX and net debt to EBITDAX as useful tools for comparisons of the Company's financial indicators with those of peer companies that follow the full cost method of accounting. EBITDAX should not be considered as alternatives to net income or net cash provided by operating activities, as defined by GAAP. Free cash flow ( FCF ) and free cash flow yield are non-GAAP financial measures. As used by the Company, FCF is defined as net cash provided by operating activities, adjusted for changes in operating assets and liabilities, less capital expenditures. Free cash flow yield is defined as FCF divided by the market capitalization of the Company at a given date. The Company believes these non-GAAP measures are financial indicators of the Company’s ability to internally fund acquisitions, debt maturities, dividends and share repurchases after capital expenditures excluding acquisitions, asset retirement obligations, capitalized interest, geological and geophysical general and administrative expense, information technology and corporate facilities. Due to the forward-looking nature of EBITDAX, projected free cash flow and free cash flow yield used herein, management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measures, such as changes in operating assets and liabilities. Accordingly, Pioneer is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures. Amounts excluded from this non-GAAP measure in future periods could be significant. 17

Certain Reserve Information Cautionary Note to U.S. Investors – The SEC prohibits oil and gas companies, in their filings with the SEC, from disclosing estimates of oil or gas resources other than reserves, as that term is defined by the SEC. In this presentation, Pioneer includes estimates of quantities of oil and gas using certain terms, such as resource base, resource potential, net recoverable resource potential, estimated ultimate recovery, EUR, oil in place or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly prohibit Pioneer from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being recovered by Pioneer. U.S. investors are urged to consider closely the disclosures in the Company’s periodic filings with the SEC. Such filings are available from the Company at 777 Hidden Ridge, Irving, Texas 75038, Attention: Investor Relations and the Company’s website at www.pxd.com. These filings also can be obtained from the SEC by calling 1-800-SEC-0330. 18Certain Reserve Information Cautionary Note to U.S. Investors – The SEC prohibits oil and gas companies, in their filings with the SEC, from disclosing estimates of oil or gas resources other than reserves, as that term is defined by the SEC. In this presentation, Pioneer includes estimates of quantities of oil and gas using certain terms, such as resource base, resource potential, net recoverable resource potential, estimated ultimate recovery, EUR, oil in place or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly prohibit Pioneer from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of being recovered by Pioneer. U.S. investors are urged to consider closely the disclosures in the Company’s periodic filings with the SEC. Such filings are available from the Company at 777 Hidden Ridge, Irving, Texas 75038, Attention: Investor Relations and the Company’s website at www.pxd.com. These filings also can be obtained from the SEC by calling 1-800-SEC-0330. 18