Attached files

| file | filename |

|---|---|

| EX-99.5 - EX-99.5 - MediaAlpha, Inc. | d48669dex995.htm |

| EX-99.4 - EX-99.4 - MediaAlpha, Inc. | d48669dex994.htm |

| EX-99.3 - EX-99.3 - MediaAlpha, Inc. | d48669dex993.htm |

| EX-99.2 - EX-99.2 - MediaAlpha, Inc. | d48669dex992.htm |

| EX-99.1 - EX-99.1 - MediaAlpha, Inc. | d48669dex991.htm |

| EX-23.2 - EX-23.2 - MediaAlpha, Inc. | d48669dex232.htm |

| EX-23.1 - EX-23.1 - MediaAlpha, Inc. | d48669dex231.htm |

| EX-10.6 - EX-10.6 - MediaAlpha, Inc. | d48669dex106.htm |

| EX-4.2 - EX-4.2 - MediaAlpha, Inc. | d48669dex42.htm |

| EX-4.1 - EX-4.1 - MediaAlpha, Inc. | d48669dex41.htm |

| EX-3.2 - EX-3.2 - MediaAlpha, Inc. | d48669dex32.htm |

| EX-3.1 - EX-3.1 - MediaAlpha, Inc. | d48669dex31.htm |

| EX-1.1 - EX-1.1 - MediaAlpha, Inc. | d48669dex11.htm |

| S-1/A - S-1/A - MediaAlpha, Inc. | d48669ds1a.htm |

Exhibit 5.1

October 20, 2020

MediaAlpha, Inc.

Registration Statement on Form S-1

Ladies and Gentlemen:

We have acted as counsel for MediaAlpha, Inc., a Delaware corporation (the “Company”), in connection with the registration statement on Form S-1, as amended (Registration No. 333-249326) (the “Registration Statement”), filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), with respect to the registration of shares of Class A common stock, par value $0.01 per share, of the Company (the “Shares”), and, if the over-allotment option is exercised, the offer and sale by the Company of additional shares (the “Additional Shares”) to the underwriters (the “Underwriters”) pursuant to the terms of the underwriting agreement (the “Underwriting Agreement”) to be executed by the Company, the Selling Stockholder, Guilford Holdings, Inc., QL Holdings LLC and J.P. Morgan Securities LLC and Citigroup Global Markets Inc., as Representatives of the Underwriters.

In that connection, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate records and other instruments as we have deemed necessary or appropriate for the purposes of this opinion, including, without limitation: (a) the Amended and Restated Certificate of Incorporation of the Company; (b) the Amended and Restated By-laws of the Company; and (c) certain resolutions adopted by the Board of Directors of the Company.

In rendering our opinion, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as

certified, conformed or photostatic copies and the authenticity of the originals of such latter documents. As to all questions of fact material to this opinion that have not been independently established, we have relied upon certificates or comparable documents of officers and representatives of the Company.

Based on the foregoing and in reliance thereon, we are of opinion that the Shares and the Additional Shares have been duly and validly authorized and, when issued and delivered by the Company and paid for by the Underwriters pursuant to the Underwriting Agreement, will be validly issued, fully paid and non-assessable.

We are admitted to practice in the State of New York, and we express no opinion as to matters governed by any laws other than the laws of the State of New York, the General Corporation Law of the State of Delaware and the Federal laws of the United States of America. The reference and limitation to “Delaware General Corporation Law” includes the statutory provisions and all applicable provisions of the Delaware Constitution and reported judicial decisions interpreting these laws.

We hereby consent to the filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. We also consent to the reference to our firm under the caption “Legal matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

Very truly yours,

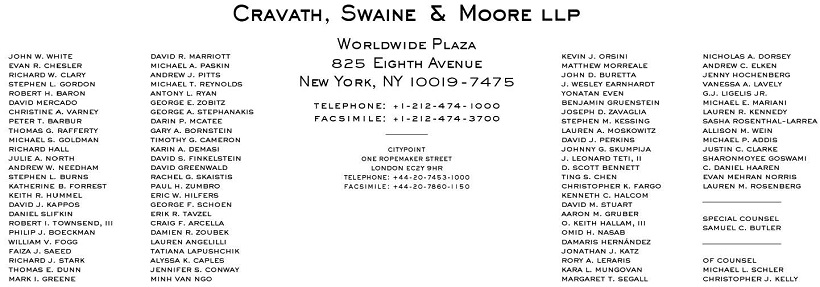

/s/ Cravath, Swaine & Moore LLP

MediaAlpha, Inc.

700 South Flower Street, Suite 640

Los Angeles, California 90017

O