Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - INTERNATIONAL BUSINESS MACHINES CORP | ibm-20201019xex99d1.htm |

| 8-K - 8-K - INTERNATIONAL BUSINESS MACHINES CORP | ibm-20201019x8k.htm |

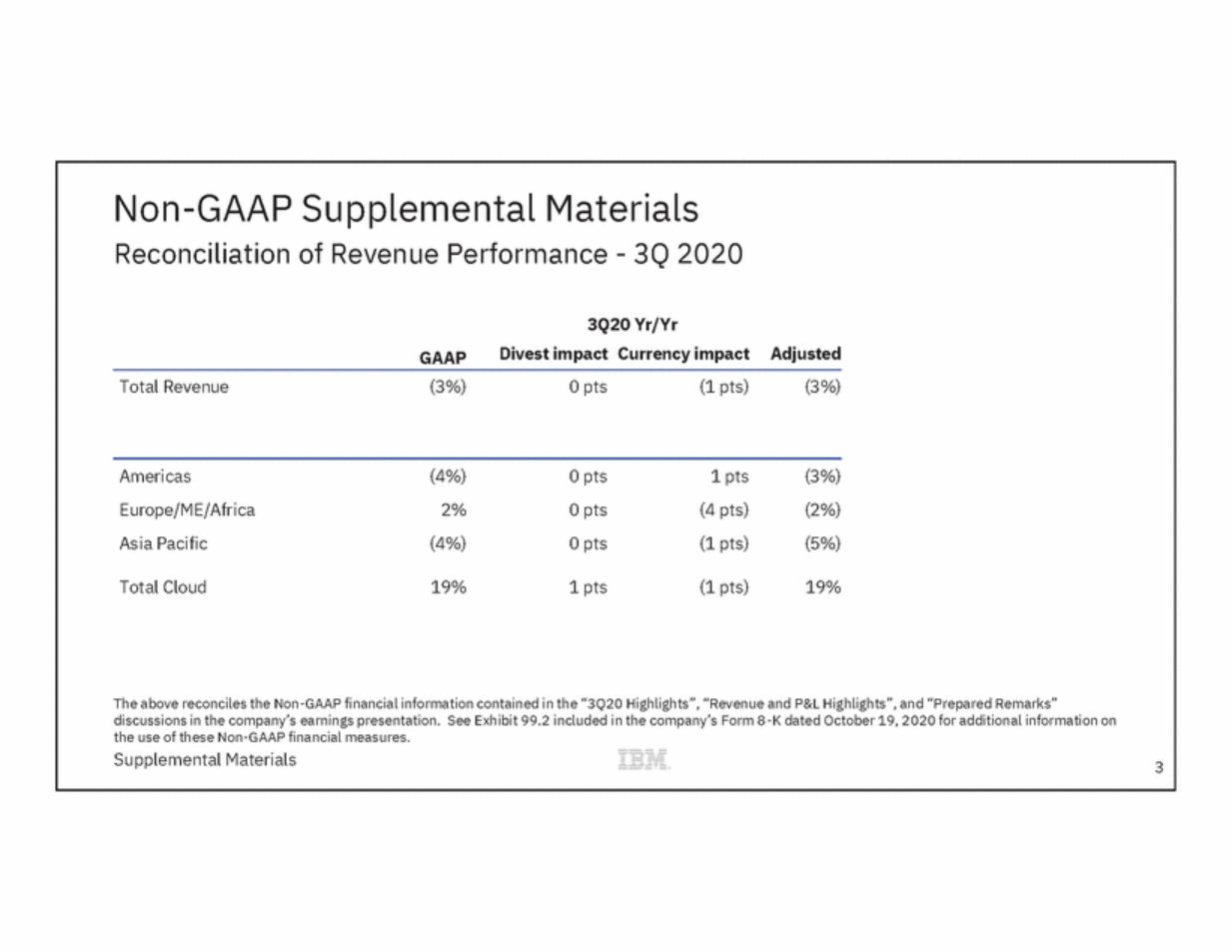

| Non-GAAP Supplemental Materials Reconciliation of Revenue Performance - 3Q 2020 3Q20 Yr/Yr GAAPDivest impact Currency impact Adjusted Total Revenue(3%) 0 pts (1 pts) (3%) Americas (4%) 0 pts 1 pts (3%) Europe/ME/Africa 2% 0 pts (4 pts) (2%) Asia Pacific (4%) 0 pts (1 pts) (5%) Total Cloud19% 1 pts (1 pts) 19% The above reconciles the Non-GAAP financial information contained in the “3Q20 Highlights”, “Revenue and P&L Highlights”, and “Prepared Remarks” discussions in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8-K dated October 19, 2020 for additional information on the use of these Non-GAAP financial measures. Supplemental Materials 3 |