Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | zion-20201019.htm |

| EX-99.1 - EX-99.1 - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | exh991earningsrelease8.htm |

Third Quarter 2020 Financial Review October 19, 2020

Forward-Looking Statements; Use of Non-GAAP Financial Measures Forward Looking Information These materials include “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and assumptions regarding future events or determinations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, industry results or regulatory outcomes to differ materially from those expressed or implied by such forward-looking statements. Without limiting the foregoing, the words “forecasts,” “targets,” anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “projects,” “should,” “would,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about future financial and operating results. Actual results and outcomes may differ materially from those presented, either expressed or implied, in these materials. Important risk factors that may cause such material differences include, but are not limited to, the effects of the spread of the virus commonly referred to as the coronavirus or COVID-19 (and other potentially similar pandemic situations) and associated impacts on general economic conditions on, among other things, our customers’ ability to make timely payments on obligations, fee income revenue due to reduced loan origination activity and card swipe income, operating expense due to alternative approaches to doing business, and so forth; the Bank’s ability to meet operating leverage goals; the rate of change of interest-sensitive assets and liabilities relative to changes in benchmark interest rates; the ability of the Bank to upgrade its core deposit system and implement new digital products in order to remain competitive; risks associated with information security, such as systems breaches and failures; and legislative, regulatory and economic developments. These risks, as well as other factors, are discussed in the Bank’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (SEC) and available at the SEC’s Internet site (https://www.sec.gov/). In addition, you may obtain documents filed with the SEC by the Bank free of charge by contacting: Investor Relations, Zions Bancorporation, N.A., One South Main Street, 11th Floor, Salt Lake City, Utah 84133, (801) 844-7637. We caution you against undue reliance on forward-looking statements, which reflect our views only as of the date they are made. Except as may be required by law, Zions Bancorporation, N.A. specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments. Use of Non-GAAP Financial Measures: This document contains several references to non-GAAP measures, including pre-provision net revenue and the “efficiency ratio,” which are common industry terms used by investors and financial services analysts. Certain of these non-GAAP measures are key inputs into Zions’ management compensation and are used in Zions’ strategic goals that have been and may continue to be articulated to investors. Therefore, the use of such non-GAAP measures are believed by management to be of substantial interest to the consumers of these financial disclosures and are used prominently throughout the disclosures. A full reconciliation of the difference between such measures and GAAP financials is provided within the document, and users of this document are encouraged to carefully review this reconciliation. 2

Third Quarter 2020 Financial Highlights Vs. 2Q20, rebound in earnings as provisions subside; loans on deferral drop more than 90%, loans 30+ days past due improves ✓ Earnings and Profitability: ✓ Credit quality (excluding PPP Loans): ▪ $1.01 diluted earnings/share compared to $0.34 in 2Q20 ▪ 0.79%: ratio of NPAs+90 days past due / Loans and leases and OREO ▪ $(0.14)/share one-time charitable contribution ▪ 3.4%: Classified loans / total loans ▪ $0.06/share benefit from credit valuation adjustment and ▪ 0.6%: Loans actively in deferral due to COVID-19 dropped by more securities gains than 90% from 2Q20 ▪ $277 million Pre-Provision Net Revenue ▪ 0.5%: Total loans delinquent by 30 days or more, down from 0.7% in 2Q20 ▪ $297 million Adjusted PPNR(1) when excluding the one-time $30 million charitable contribution, a 1% decrease from 2Q20 ▪ 43 basis points: net charge-offs (annualized) ▪ $55 million provision for credit loss, down from $168 million in 2Q20 ▪ Increase in the allowance for credit loss (“ACL”), reflecting the continued impact on economic activity due to COVID-19 ▪ $167 million: Net Income Applicable to Common, up from $57 2 million in the prior quarter ▪ ACL was $917 million or 1.9% of loans ▪ $23 million: after-tax cost of one-time charitable contribution ▪ ACL was more than 17 quarters of NCOs at the 3Q20 level ▪ $9 million: after tax benefit from CVA and securities gains ▪ Allowance for Oil and Gas loans: 5.8% of related loans ✓ Capital Strength: ▪ 10.4% Common Equity Tier 1 Ratio (CET1) ▪ 12.1% (CET1+Allowance for Credit Losses) / Risk-Weighted Assets Note: For the purposes of comparison in this presentation, we generally use linked-quarter ("LQ"), due to that being the preferred comparison for professional investors 3 and analysts. (1) Adjusted for items such as severance, other real estate expense, pension termination-related expense, securities gains and losses and debt extinguishment costs. (2) The ACL of $917 million includes ~$2 million for PPP loans. See Appendix for GAAP to non-GAAP reconciliation tables.

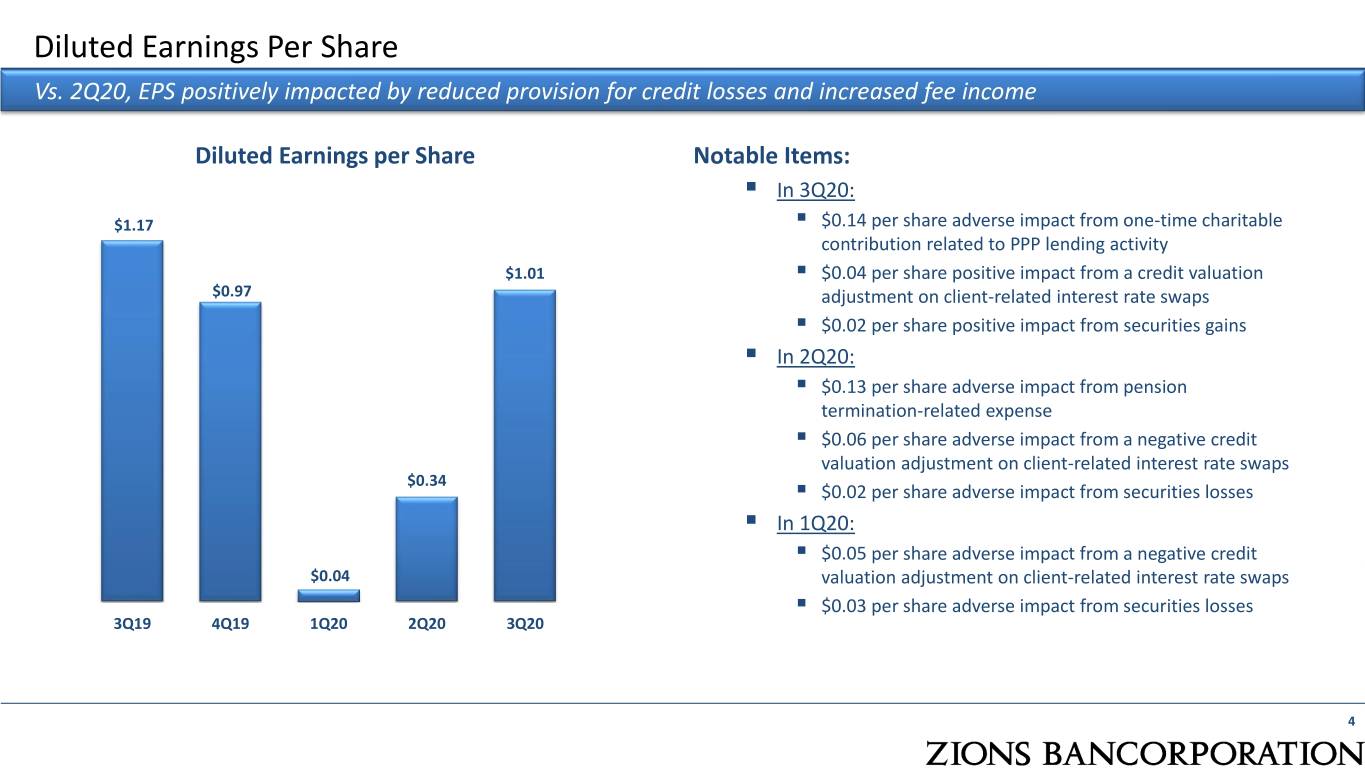

Diluted Earnings Per Share Vs. 2Q20, EPS positively impacted by reduced provision for credit losses and increased fee income Diluted Earnings per Share Notable Items: ▪ In 3Q20: $1.17 ▪ $0.14 per share adverse impact from one-time charitable contribution related to PPP lending activity $1.01 ▪ $0.04 per share positive impact from a credit valuation $0.97 adjustment on client-related interest rate swaps ▪ $0.02 per share positive impact from securities gains ▪ In 2Q20: ▪ $0.13 per share adverse impact from pension termination-related expense ▪ $0.06 per share adverse impact from a negative credit valuation adjustment on client-related interest rate swaps $0.34 ▪ $0.02 per share adverse impact from securities losses ▪ In 1Q20: ▪ $0.05 per share adverse impact from a negative credit $0.04 valuation adjustment on client-related interest rate swaps ▪ $0.03 per share adverse impact from securities losses 3Q19 4Q19 1Q20 2Q20 3Q20 4

Adjusted Pre-Provision Net Revenue Excluding the $30 million charitable contribution, adjusted PPNR declined 1% from 2Q20 Adjusted PPNR(1) and Provision for Credit Losses Notable Items: ($ millions) ▪ In 3Q20: $30 million one-time charitable contribution $309 $299 $300 related to PPP lending activity $275 $267 ▪ In 4Q19: $10 million adverse impact from the resolution of $258 an operational issue $168 $55 $10 $4 3Q19 4Q19 1Q20 2Q20 3Q20 Adjusted pre-provision net revenue (PPNR) Provision for Credit Losses (1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and debt 5 extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation table.

Balance Sheet Profitability Zions’ profitability in 3Q20 improved as the provision for credit losses declined Return on Assets Return on Tangible Common Equity 14.18% 1.25% 11.80% 1.04% 10.96% 0.89% 0.35% 3.81% 0.08% 0.41% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 In 3Q20: ▪ Increase in linked quarter profitability attributable to the decline in the credit loss provision, interest rates paid on deposits and cost of borrowings ▪ Other notable items included the $30 million contribution to our charitable foundation, a favorable credit valuation adjustment of $8 million, and securities gains of $4 million 6

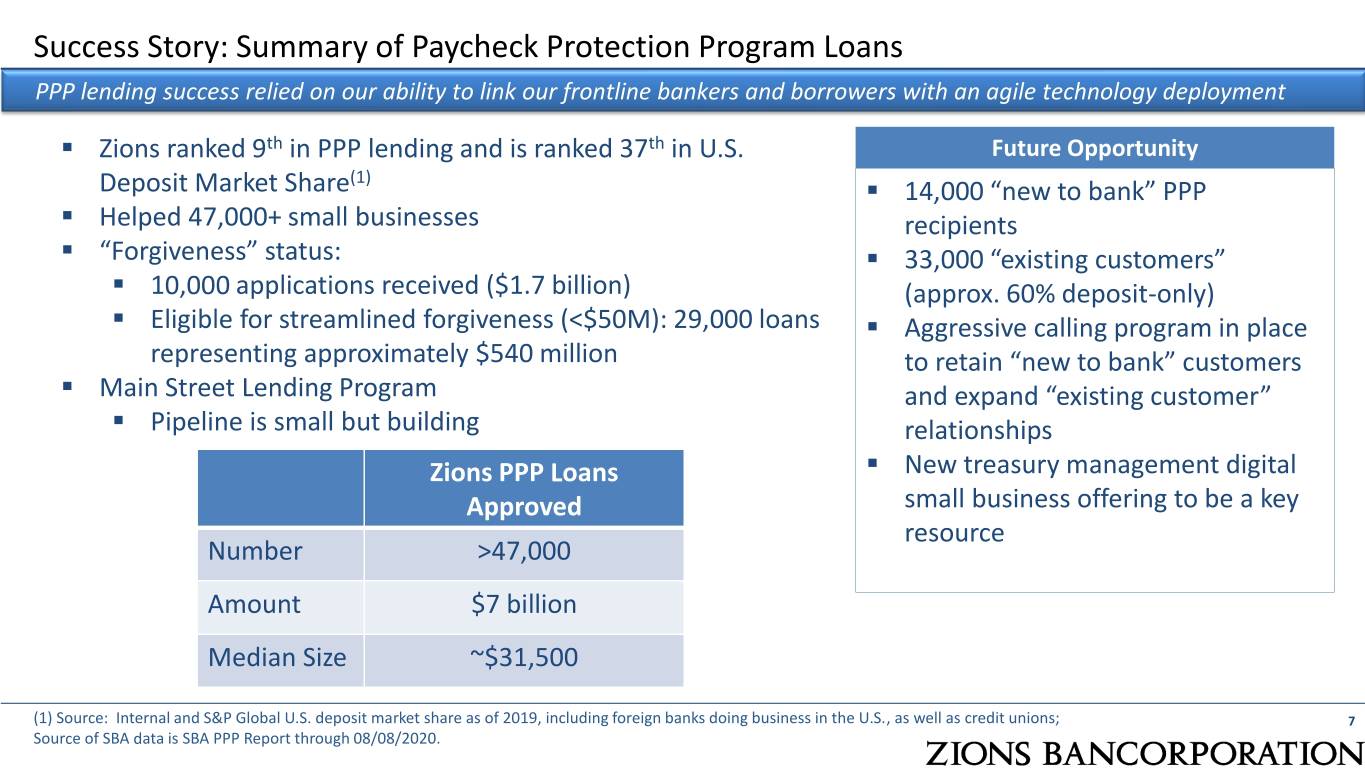

Success Story: Summary of Paycheck Protection Program Loans PPP lending success relied on our ability to link our frontline bankers and borrowers with an agile technology deployment ▪ Zions ranked 9th in PPP lending and is ranked 37th in U.S. Future Opportunity (1) Deposit Market Share ▪ 14,000 “new to bank” PPP ▪ Helped 47,000+ small businesses recipients ▪ “Forgiveness” status: ▪ 33,000 “existing customers” ▪ 10,000 applications received ($1.7 billion) (approx. 60% deposit-only) ▪ Eligible for streamlined forgiveness (<$50M): 29,000 loans ▪ Aggressive calling program in place representing approximately $540 million to retain “new to bank” customers ▪ Main Street Lending Program and expand “existing customer” ▪ Pipeline is small but building relationships Zions PPP Loans ▪ New treasury management digital Approved small business offering to be a key resource Number >47,000 Amount $7 billion Median Size ~$31,500 (1) Source: Internal and S&P Global U.S. deposit market share as of 2019, including foreign banks doing business in the U.S., as well as credit unions; 7 Source of SBA data is SBA PPP Report through 08/08/2020.

Success Story: Mortgage Banking Successes amid COVID-19 pandemic: very strong mortgage revenue 2019 2020 Record YTD Funding ▪ Roll-out ▪ Enhanced Digital Fulfillment Process $922 million ▪ 86% of all applications taken digitally $791 million 59% 47% ▪ 25% reduction in turn-time allowing 31% 38% 40% for record unit production 3Q20 ▪ Second straight strong funding quarter with more than $920 million ($1 billion in Q2) ▪ 3Q2019 4Q2019 1Q2020 2Q2020 3Q2020 Pipeline remains strong with $1.8B at the end of Q3 – up 49% YoY HFI HFS ▪ Second best quarter on record for applications, at $2.2 billion (1Q20 was $2.6 billion) Loan Sales Revenue ($ millions) ▪ Revenue increases for Mortgage year over year with modest increases in $17.5 expenses and level staffing creates more efficient and profitable product line $14.0 $12.9 ▪ Credit is comparable to 2019’s high quality production with FICO (avg: 765), LTV (avg: 66%), and DTI (avg: 31%); all the same or slightly improved relative to 2019 $7.2 $4.3 3Q2019 4Q2019 1Q2020 2Q2020 3Q2020 8

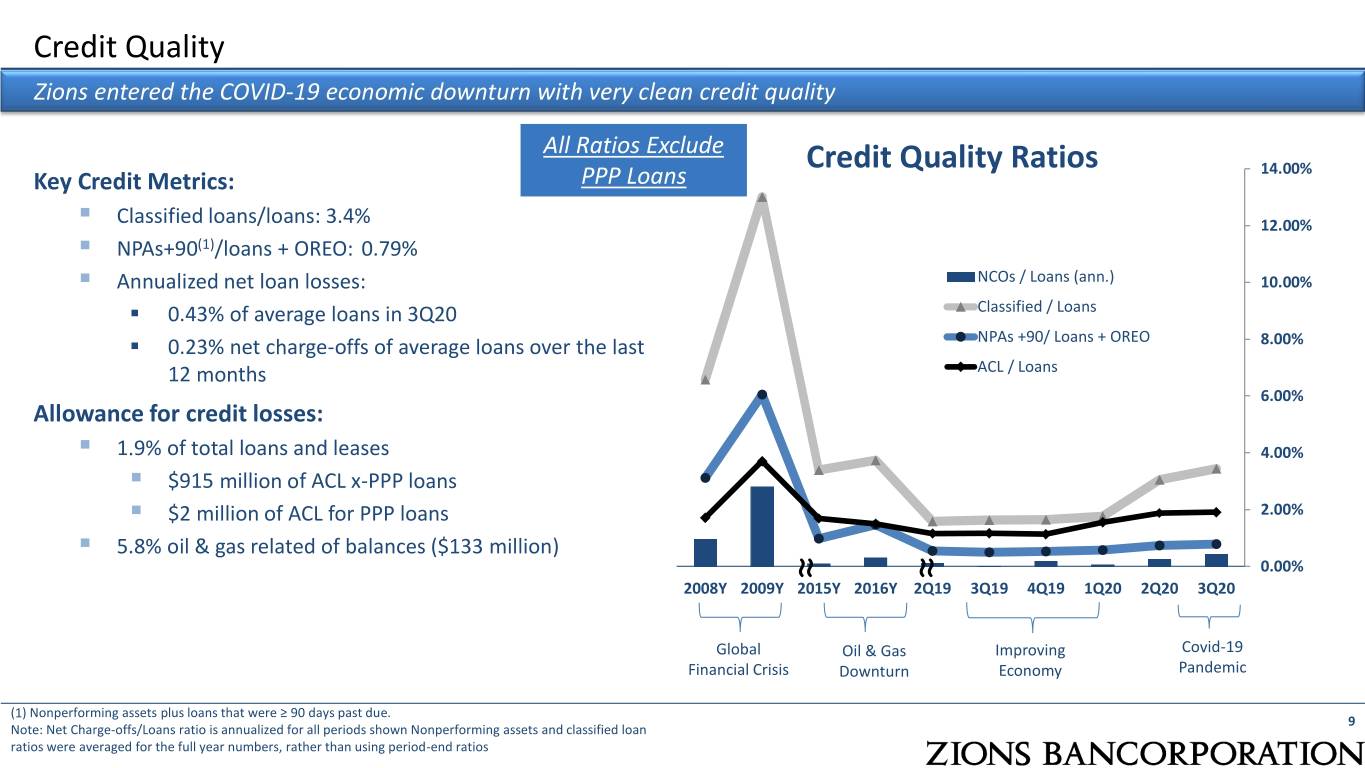

Credit Quality Zions entered the COVID-19 economic downturn with very clean credit quality All Ratios Exclude Credit Quality Ratios 14.00% Key Credit Metrics: PPP Loans ▪ Classified loans/loans: 3.4% 12.00% ▪ NPAs+90(1)/loans + OREO: 0.79% ▪ Annualized net loan losses: NCOs / Loans (ann.) 10.00% ▪ 0.43% of average loans in 3Q20 Classified / Loans ▪ 0.23% net charge-offs of average loans over the last NPAs +90/ Loans + OREO 8.00% 12 months ACL / Loans 6.00% Allowance for credit losses: ▪ 1.9% of total loans and leases 4.00% ▪ $915 million of ACL x-PPP loans ▪ $2 million of ACL for PPP loans 2.00% ≈ ▪ 5.8% oil & gas related of balances ($133 million) ≈ 0.00% 2008Y 2009Y 2015Y 2016Y 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 Global Oil & Gas Improving Covid-19 Financial Crisis Downturn Economy Pandemic (1) Nonperforming assets plus loans that were ≥ 90 days past due. 9 Note: Net Charge-offs/Loans ratio is annualized for all periods shown Nonperforming assets and classified loan ratios were averaged for the full year numbers, rather than using period-end ratios

Deferrals and Delinquencies: A Positive Outcome Thus Far Deferrals have receded by more than 90% to 0.6% of loans; delinquency rate down 0.2% Total Deferrals 30+ Days Past Due relative to total non-PPP loans relative to total non-PPP loans 6.3% 0.6% 0.7% 0.5% 6/30/2020 9/30/2020 6/30/2020 9/30/2020 Approximately 8.5% of total loan balances had been processed for modifications or payment deferrals as of June 30, 2020, some of which were not on active deferral status at June 30 (the deferral period had expired). Approximately 16% of loans that were processed for a deferral or modification were modified (e.g. 10 interest only for six or 12 months). The 30+ days past due ratio for C19ER loans that had been granted a payment deferral period and are now resuming payments has a slightly higher ratio than the rest of the portfolio, at 1.1% .

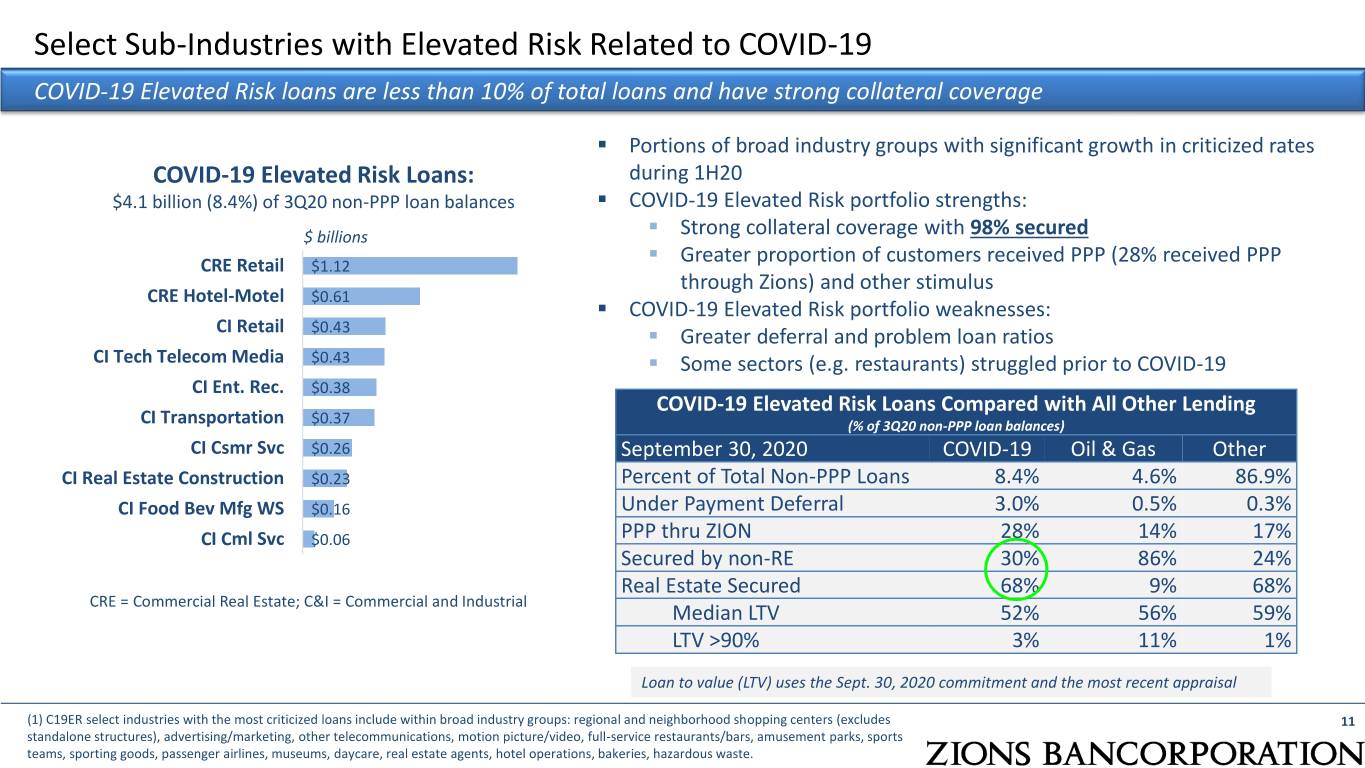

Select Sub-Industries with Elevated Risk Related to COVID-19 COVID-19 Elevated Risk loans are less than 10% of total loans and have strong collateral coverage ▪ Portions of broad industry groups with significant growth in criticized rates COVID-19 Elevated Risk Loans: during 1H20 $4.1 billion (8.4%) of 3Q20 non-PPP loan balances ▪ COVID-19 Elevated Risk portfolio strengths: $ billions ▪ Strong collateral coverage with 98% secured ▪ Greater proportion of customers received PPP (28% received PPP CRE Retail $1.12 through Zions) and other stimulus CRE Hotel-Motel $0.61 ▪ COVID-19 Elevated Risk portfolio weaknesses: CI Retail $0.43 ▪ Greater deferral and problem loan ratios CI Tech Telecom Media $0.43 ▪ Some sectors (e.g. restaurants) struggled prior to COVID-19 CI Ent. Rec. $0.38 COVID-19 Elevated Risk Loans Compared with All Other Lending CI Transportation $0.37 (% of 3Q20 non-PPP loan balances) CI Csmr Svc $0.26 September 30, 2020 COVID-19 Oil & Gas Other CI Real Estate Construction $0.23 Percent of Total Non-PPP Loans 8.4% 4.6% 86.9% CI Food Bev Mfg WS $0.16 Under Payment Deferral 3.0% 0.5% 0.3% CI Cml Svc $0.06 PPP thru ZION 28% 14% 17% Secured by non-RE 30% 86% 24% Real Estate Secured 68% 9% 68% CRE = Commercial Real Estate; C&I = Commercial and Industrial Median LTV 52% 56% 59% LTV >90% 3% 11% 1% Loan to value (LTV) uses the Sept. 30, 2020 commitment and the most recent appraisal (1) C19ER select industries with the most criticized loans include within broad industry groups: regional and neighborhood shopping centers (excludes 11 standalone structures), advertising/marketing, other telecommunications, motion picture/video, full-service restaurants/bars, amusement parks, sports teams, sporting goods, passenger airlines, museums, daycare, real estate agents, hotel operations, bakeries, hazardous waste.

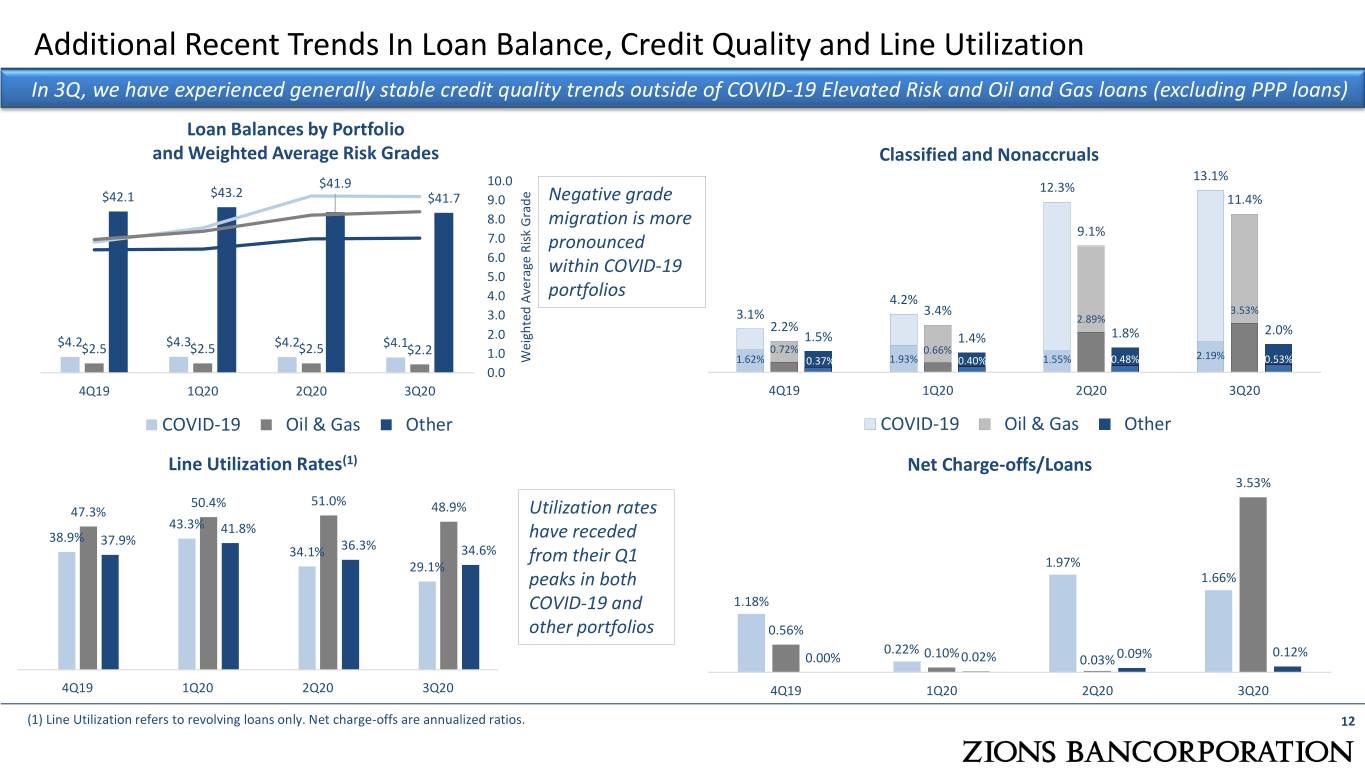

Additional Recent Trends In Loan Balance, Credit Quality and Line Utilization In 3Q, we have experienced generally stable credit quality trends outside of COVID-19 Elevated Risk and Oil and Gas loans (excluding PPP loans) Loan Balances by Portfolio and Weighted Average Risk Grades Classified and Nonaccruals 13.1% $41.9 10.0 $43.2 12.3% $42.1 $41.7 9.0 Negative grade 11.4% 8.0 migration is more 9.1% 7.0 pronounced 6.0 within COVID-19 5.0 4.0 portfolios 4.2% 3.4% 3.53% 3.0 3.1% 2.89% 2.2% 2.0 1.8% 2.0% $4.3 1.5% 1.4% $4.2 $4.2 $4.1 0.72% $2.5 $2.5 $2.5 $2.2 1.0 0.66% 2.19% Weighted Risk Average Grade 1.62% 0.37% 1.93% 0.40% 1.55% 0.48% 0.53% 0.0 4Q19 1Q20 2Q20 3Q20 4Q19 1Q20 2Q20 3Q20 COVID-19 Oil & Gas Other COVID-19 Oil & Gas Other Line Utilization Rates(1) Net Charge-offs/Loans 3.53% 50.4% 51.0% 47.3% 48.9% Utilization rates 43.3% 41.8% 38.9% have receded 37.9% 36.3% 34.1% 34.6% from their Q1 29.1% 1.97% peaks in both 1.66% COVID-19 and 1.18% other portfolios 0.56% 0.22% 0.12% 0.00% 0.10%0.02% 0.03% 0.09% 4Q19 1Q20 2Q20 3Q20 4Q19 1Q20 2Q20 3Q20 (1) Line Utilization refers to revolving loans only. Net charge-offs are annualized ratios. 12

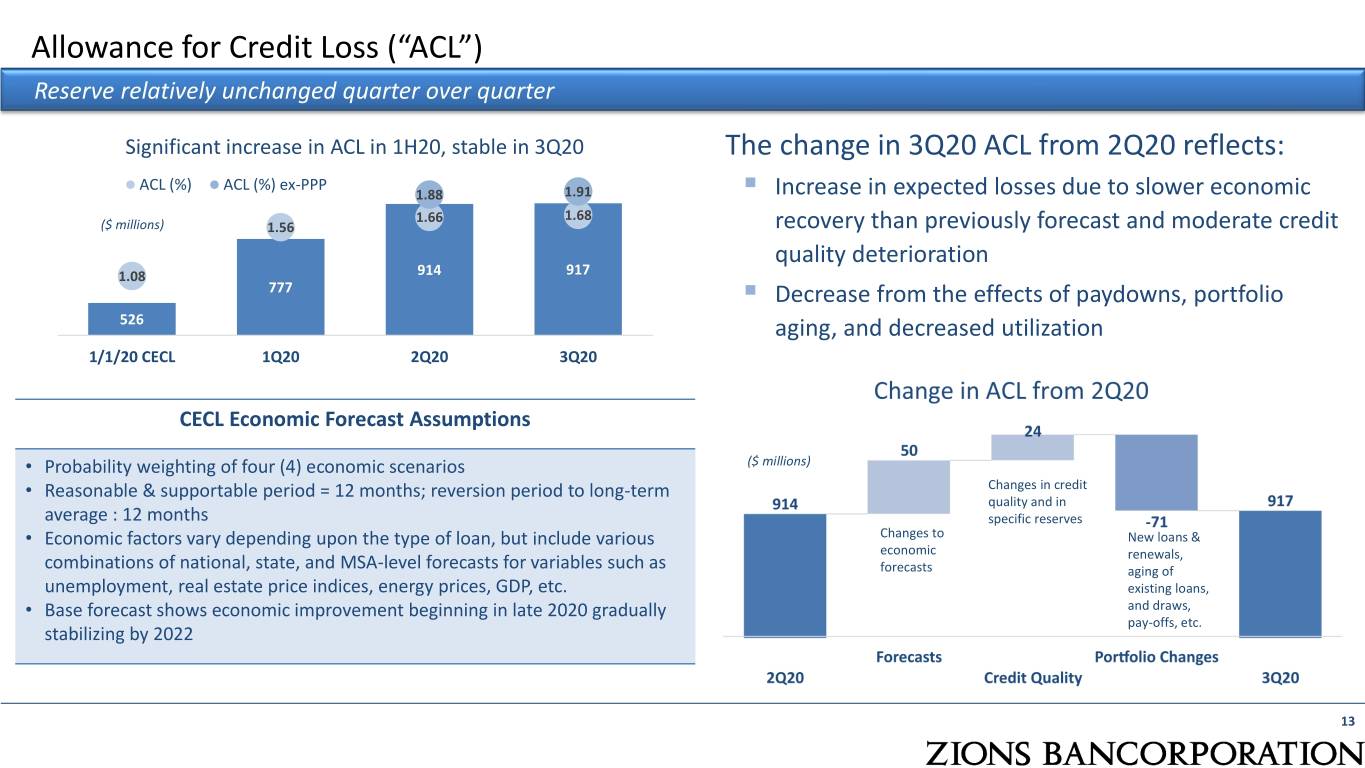

Allowance for Credit Loss (“ACL”) Reserve relatively unchanged quarter over quarter Significant increase in ACL in 1H20, stable in 3Q20 The change in 3Q20 ACL from 2Q20 reflects: ACL (%) ACL (%) ex-PPP 1.88 1.91 ▪ Increase in expected losses due to slower economic 1.66 1.68 ($ millions) 1.56 recovery than previously forecast and moderate credit quality deterioration 1.08 914 917 777 ▪ Decrease from the effects of paydowns, portfolio 526 aging, and decreased utilization 1/1/20 CECL 1Q20 2Q20 3Q20 CECL Economic Forecast Assumptions • Probability weighting of four (4) economic scenarios ($ millions) • Reasonable & supportable period = 12 months; reversion period to long-term Changes in credit quality and in average : 12 months specific reserves • Economic factors vary depending upon the type of loan, but include various Changes to New loans & economic renewals, combinations of national, state, and MSA-level forecasts for variables such as forecasts aging of unemployment, real estate price indices, energy prices, GDP, etc. existing loans, • Base forecast shows economic improvement beginning in late 2020 gradually and draws, pay-offs, etc. stabilizing by 2022 13

Net Interest Income Changes in interest rates and balance sheet composition impact net interest income performance Net Interest Income Net Interest Margin Net Interest Margin ($ millions) 2Q20 3Q20 $567 MM and $559 $563 $555 Securities Loan $548 Yields 3.48% 3.46% 3.41% Interest Wholesale Bearing and Deposits Noninterest 3.23% Bearing Sources of Funds 3.06% 3Q19 4Q19 1Q20 2Q20 3Q20 MM = Money Market investments. Capitalized interest income net of costs for PPP loan originations was $141 million, to be amortized over the remaining 14 life (~4.5 years) or when loans pay down, pay off, or are forgiven by the SBA.

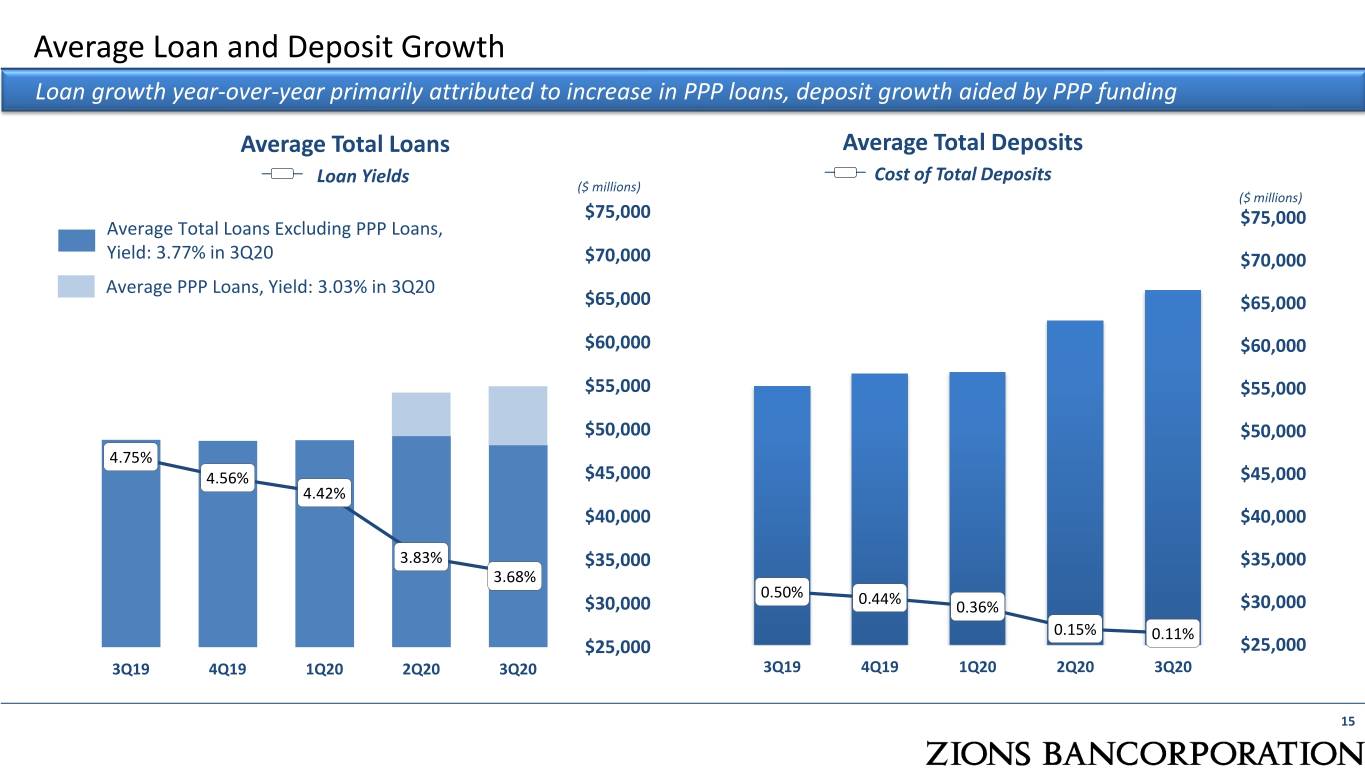

Average Loan and Deposit Growth Loan growth year-over-year primarily attributed to increase in PPP loans, deposit growth aided by PPP funding Average Total Loans Average Total Deposits Loan Yields Cost of Total Deposits ($ millions) ($ millions) $75,000 $75,000 Average Total Loans Excluding PPP Loans, Yield: 3.77% in 3Q20 $70,000 $70,000 Average PPP Loans, Yield: 3.03% in 3Q20 $65,000 $65,000 $60,000 $60,000 $55,000 $55,000 $50,000 $50,000 4.75% 4.56% $45,000 $45,000 4.42% $40,000 $40,000 3.83% $35,000 $35,000 3.68% 0.50% $30,000 0.44% 0.36% $30,000 0.15% 0.11% $25,000 $25,000 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 15

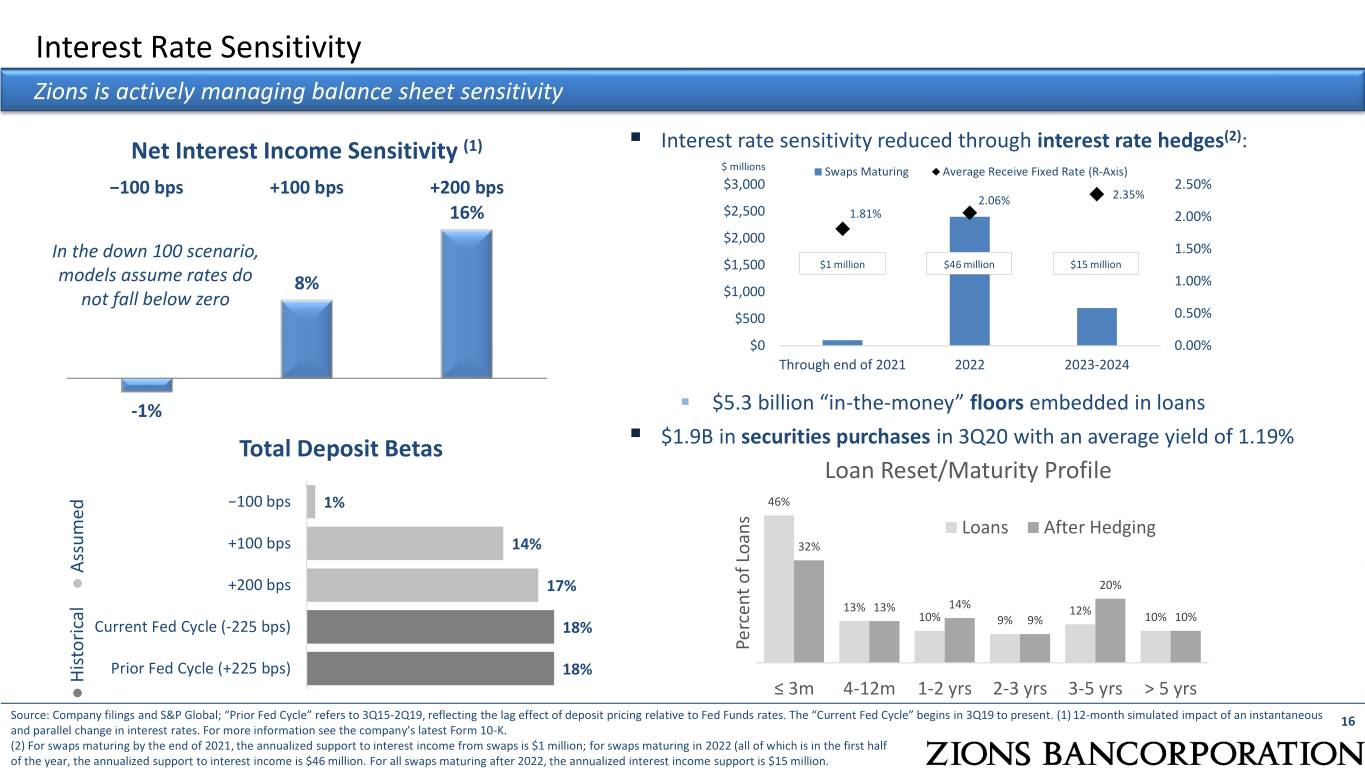

Interest Rate Sensitivity Zions is actively managing balance sheet sensitivity (2) Net Interest Income Sensitivity (1) ▪ Interest rate sensitivity reduced through interest rate hedges : $ millions Swaps Maturing Average Receive Fixed Rate (R-Axis) −100 bps +100 bps +200 bps $3,000 2.50% 2.06% 2.35% 16% $2,500 1.81% 2.00% $2,000 In the down 100 scenario, 1.50% $1,500 $1 million $46 million $15 million models assume rates do 8% 1.00% not fall below zero $1,000 $500 0.50% $0 0.00% Through end of 2021 2022 2023-2024 -1% ▪ $5.3 billion “in-the-money” floors embedded in loans ▪ $1.9B in securities purchases in 3Q20 with an average yield of 1.19% Total Deposit Betas Loan Reset/Maturity Profile −100 bps 1% 46% Loans After Hedging +100 bps 14% 32% Assumed ● +200 bps 17% 20% 13% 13% 14% 12% 10% 10% 10% Current Fed Cycle (-225 bps) 18% 9% 9% Percent of Loans of Percent Prior Fed Cycle (+225 bps) 18% Historical ● ≤ 3m 4-12m 1-2 yrs 2-3 yrs 3-5 yrs > 5 yrs Source: Company filings and S&P Global; “Prior Fed Cycle” refers to 3Q15-2Q19, reflecting the lag effect of deposit pricing relative to Fed Funds rates. The “Current Fed Cycle” begins in 3Q19 to present. (1) 12-month simulated impact of an instantaneous 16 and parallel change in interest rates. For more information see the company’s latest Form 10-K. (2) For swaps maturing by the end of 2021, the annualized support to interest income from swaps is $1 million; for swaps maturing in 2022 (all of which is in the first half of the year, the annualized support to interest income is $46 million. For all swaps maturing after 2022, the annualized interest income support is $15 million.

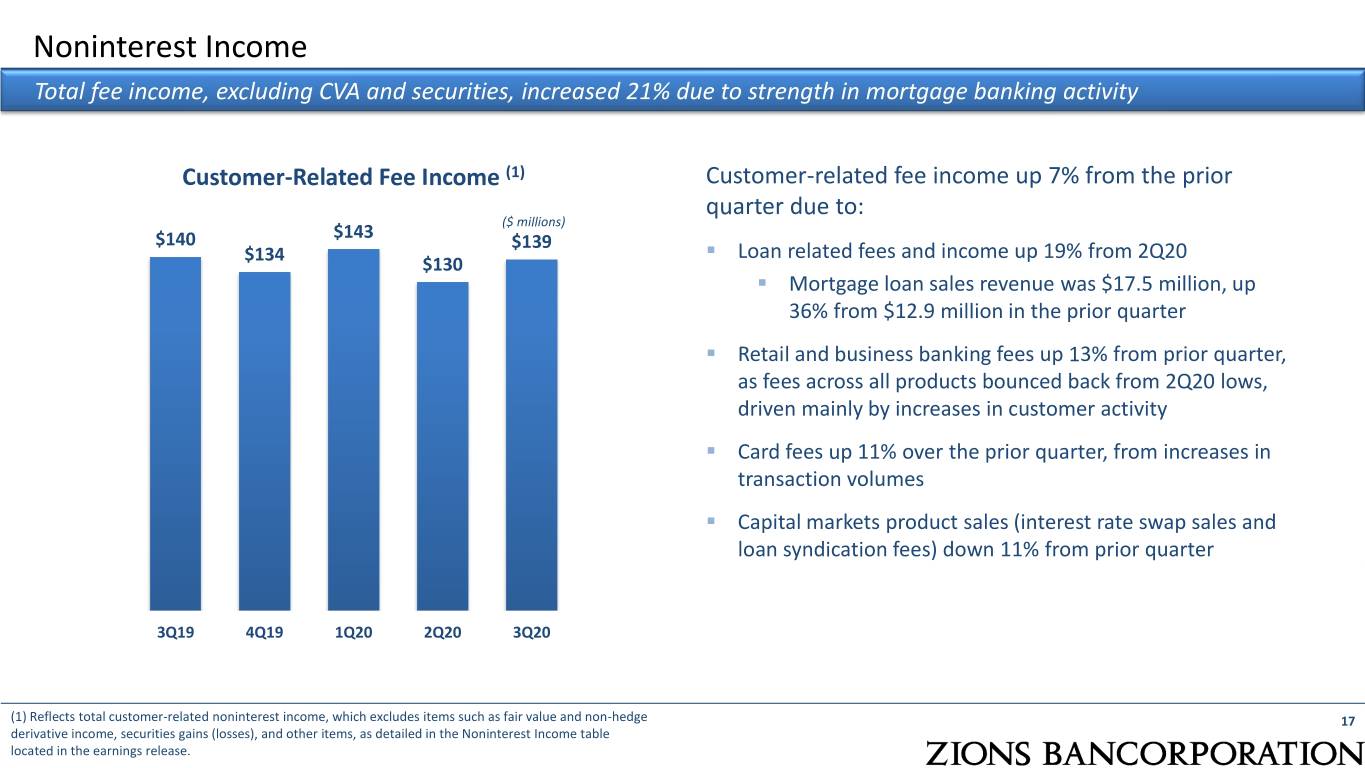

Noninterest Income Total fee income, excluding CVA and securities, increased 21% due to strength in mortgage banking activity Customer-Related Fee Income (1) Customer-related fee income up 7% from the prior quarter due to: ($ millions) $143 $140 $139 $134 ▪ Loan related fees and income up 19% from 2Q20 $130 ▪ Mortgage loan sales revenue was $17.5 million, up 36% from $12.9 million in the prior quarter ▪ Retail and business banking fees up 13% from prior quarter, as fees across all products bounced back from 2Q20 lows, driven mainly by increases in customer activity ▪ Card fees up 11% over the prior quarter, from increases in transaction volumes ▪ Capital markets product sales (interest rate swap sales and loan syndication fees) down 11% from prior quarter 3Q19 4Q19 1Q20 2Q20 3Q20 (1) Reflects total customer-related noninterest income, which excludes items such as fair value and non-hedge 17 derivative income, securities gains (losses), and other items, as detailed in the Noninterest Income table located in the earnings release.

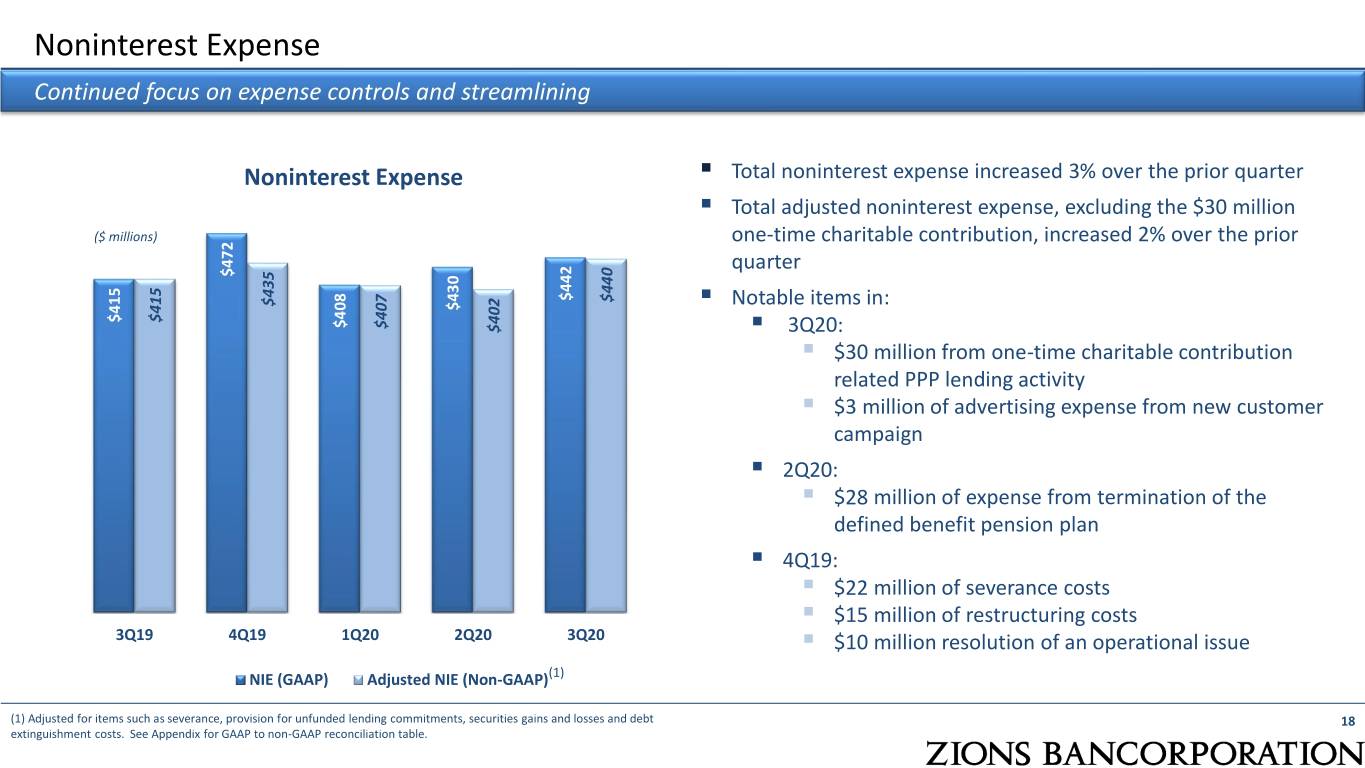

Noninterest Expense Continued focus on expense controls and streamlining Noninterest Expense ▪ Total noninterest expense increased 3% over the prior quarter ▪ Total adjusted noninterest expense, excluding the $30 million ($ millions) one-time charitable contribution, increased 2% over the prior quarter $472 $442 $440 $435 Notable items in: $430 ▪ $415 $415 $408 $407 $402 ▪ 3Q20: ▪ $30 million from one-time charitable contribution related PPP lending activity ▪ $3 million of advertising expense from new customer campaign ▪ 2Q20: ▪ $28 million of expense from termination of the defined benefit pension plan ▪ 4Q19: ▪ $22 million of severance costs ▪ $15 million of restructuring costs 3Q19 4Q19 1Q20 2Q20 3Q20 ▪ $10 million resolution of an operational issue NIE (GAAP) Adjusted NIE (Non-GAAP)(1) (1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and debt 18 extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation table.

Appendix ▪ Financial Results Summary ▪ Efficiency Ratio ▪ Loan Growth ▪ Technology Initiatives ▪ Oil & Gas Portfolio Credit Quality and Portfolio Details ▪ GAAP to Non-GAAP Reconciliation 19

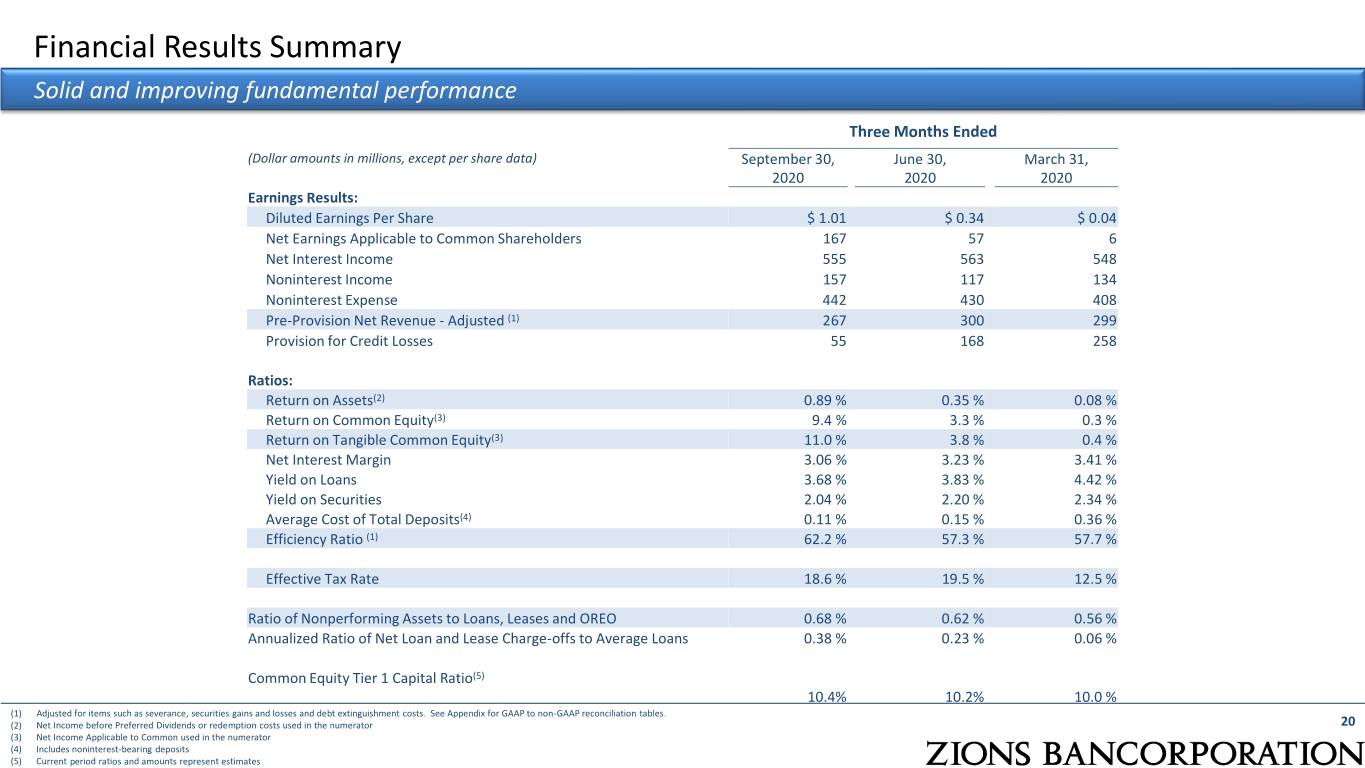

Financial Results Summary Solid and improving fundamental performance Three Months Ended (Dollar amounts in millions, except per share data) September 30, June 30, March 31, 2020 2020 2020 Earnings Results: Diluted Earnings Per Share $ 1.01 $ 0.34 $ 0.04 Net Earnings Applicable to Common Shareholders 167 57 6 Net Interest Income 555 563 548 Noninterest Income 157 117 134 Noninterest Expense 442 430 408 Pre-Provision Net Revenue - Adjusted (1) 267 300 299 Provision for Credit Losses 55 168 258 Ratios: Return on Assets(2) 0.89 % 0.35 % 0.08 % Return on Common Equity(3) 9.4 % 3.3 % 0.3 % Return on Tangible Common Equity(3) 11.0 % 3.8 % 0.4 % Net Interest Margin 3.06 % 3.23 % 3.41 % Yield on Loans 3.68 % 3.83 % 4.42 % Yield on Securities 2.04 % 2.20 % 2.34 % Average Cost of Total Deposits(4) 0.11 % 0.15 % 0.36 % Efficiency Ratio (1) 62.2 % 57.3 % 57.7 % Effective Tax Rate 18.6 % 19.5 % 12.5 % Ratio of Nonperforming Assets to Loans, Leases and OREO 0.68 % 0.62 % 0.56 % Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.38 % 0.23 % 0.06 % Common Equity Tier 1 Capital Ratio(5) 10.4% 10.2% 10.0 % (1) Adjusted for items such as severance, securities gains and losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation tables. (2) Net Income before Preferred Dividends or redemption costs used in the numerator 20 (3) Net Income Applicable to Common used in the numerator (4) Includes noninterest-bearing deposits (5) Current period ratios and amounts represent estimates

Efficiency Ratio Substantial improvement since 2014 driven by both revenue growth and expense control ▪ The efficiency ratio(1) in 3Q20 was 62.2%, compared to 57.3% in the year ago period, and was 58.0% when excluding the one-time $30 million charitable contribution ▪ Long term: committed to further improvement of the 74.1% efficiency ratio 69.6% 64.5% 62.2% 61.6% 61.3% 57.8% 57.7% 57.3% 57.3% 4Q14 4Q15 4Q16 4Q17 4Q18 3Q19 4Q19 1Q20 2Q20 3Q20 (1) Defined as noninterest expenses as a percentage of net revenue, adjusted for items such as severance, provision for unfunded lending commitments, securities gains 21 and losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation table

Loan Growth - by Bank Brand and Loan Type Period-End Year over Year Loan Growth (3Q20 vs. 3Q19) (in millions) Zions Bank Amegy CB&T NBAZ NSB Vectra CBW Other Total C&I (ex-Oil & Gas) (762) (366) 254 (179) (61) (77) (30) - (1,221) SBA PPP 1,713 1,329 1,606 721 608 475 358 - 6,810 Owner occupied (47) 28 138 - 42 11 40 - 212 Energy (Oil & Gas) 31 (142) 3 (4) - 17 - - (95) Municipal 152 75 141 74 5 30 (7) 51 521 CRE C&D 122 90 (130) (7) (4) (139) 19 - (49) CRE Term (52) (7) 296 (79) 21 102 (21) - 260 1-4 Family (115) (34) (37) (47) (33) (46) 7 8 (297) Home Equity (99) 12 1 (4) (33) - (10) - (133) Other (36) (44) 15 8 (20) (17) (4) - (98) Total net loans 907 941 2,287 483 525 356 352 59 5,910 Period-End Linked Quarter Loan Growth (3Q20 vs. 2Q20) (in millions) Zions Bank Amegy CB&T NBAZ NSB Vectra CBW Other Total C&I (ex-Oil & Gas) (79) (97) (20) (62) (56) (23) (17) - (354) SBA PPP 27 27 30 14 14 6 2 - 120 Owner occupied (24) 30 24 - - 23 - - 53 Energy (Oil & Gas) (16) (156) (1) (1) - (9) (1) - (184) Municipal (3) 16 100 (14) 17 16 15 24 171 CRE C&D 42 4 (64) (36) (4) (31) 20 - (69) CRE Term (67) (14) 173 11 12 2 25 - 142 1-4 Family (62) (36) (25) (32) (14) (28) (2) 15 (184) Home Equity (16) (6) (7) (6) (21) (2) (1) - (59) Other 1 (25) 1 9 (5) (4) 3 - (20) Total net loans (197) (257) 211 (117) (57) (50) 44 39 (384) Note: National Real Estate (NRE) is a division of Zions Bank with a focus on small business loans with low LTV 22 ratios, which generally are in line with SBA 504 program parameters. “Other” loans includes municipal and other consumer loan categories. Totals shown above may not foot due to rounding.

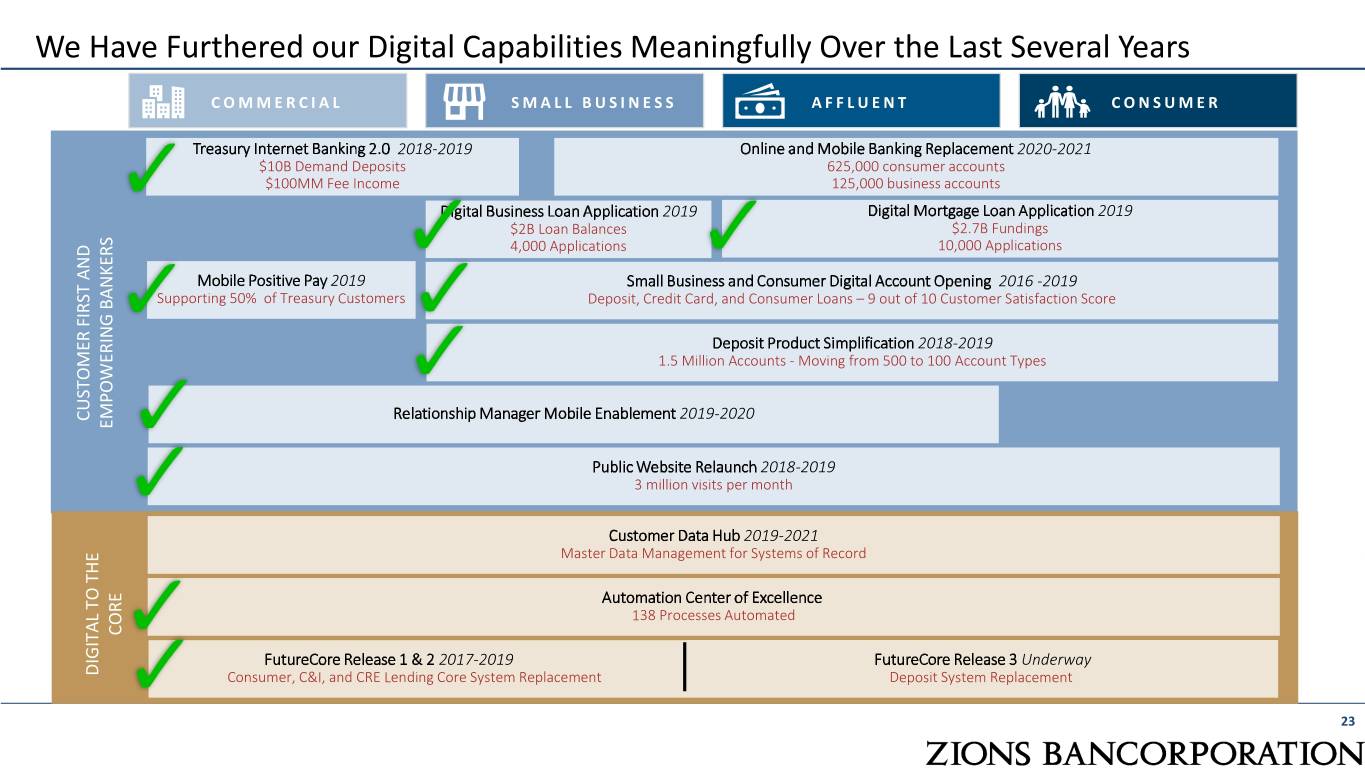

We Have Furthered our Digital Capabilities Meaningfully Over the Last Several Years COMMERCIAL SMALL BUSINESS AFFLUENT CONSUMER Treasury Internet Banking 2.0 2018-2019 Online and Mobile Banking Replacement 2020-2021 $10B Demand Deposits 625,000 consumer accounts $100MM Fee Income 125,000 business accounts Digital Business Loan Application 2019 Digital Mortgage Loan Application 2019 $2B Loan Balances $2.7B Fundings 4,000 Applications 10,000 Applications Mobile Positive Pay 2019 Small Business and Consumer Digital Account Opening 2016 -2019 Supporting 50% of Treasury Customers Deposit, Credit Card, and Consumer Loans – 9 out of 10 Customer Satisfaction Score Deposit Product Simplification 2018-2019 1.5 Million Accounts - Moving from 500 to 100 Account Types CUSTOMER FIRST AND FIRST CUSTOMER Relationship Manager Mobile Enablement 2019-2020 EMPOWERING BANKERS EMPOWERING Public Website Relaunch 2018-2019 3 million visits per month Customer Data Hub 2019-2021 Master Data Management for Systems of Record Automation Center of Excellence 138 Processes Automated CORE FutureCore Release 1 & 2 2017-2019 FutureCore Release 3 Underway DIGITAL TO TO THE DIGITAL Consumer, C&I, and CRE Lending Core System Replacement Deposit System Replacement 23

Oil & Gas (O&G) Credit Quality Oil and gas loans account for $2.3 billion or 5% of total loans, excluding PPP Loans Excluding PPP Loans and as of September 30, 2020: All Ratios Exclude ▪ Annualized NCOs equaled 3.5% of loans PPP Loans Oil and Gas 35% Key Credit Quality Ratios ▪ Classified loans equaled 11.4% of loans 30% ▪ Allowance for credit losses of $133 million or 5.8% of balances 25% ▪ Approximately 72% of 2020 oil production hedged in the low- 20% $50s and 71% of gas production in the mid $2s (natural gas) Today vs. 2014-2016 downturn: 15% ▪ Reduced concentration of energy services (67% decline in 10% balances, 24 percentage point reduction of concentration in 5% the energy portfolio) ▪ Underwriting on energy services has been much stronger 0% ▪ Less leverage -5% ▪ Replaced term loans with revolvers 4Q15 4Q16 4Q17 4Q18 3Q19 4Q19 1Q20 2Q20 3Q20 ▪ Fewer junior lien or subordinated debt behind Zions’ loans 4Q14 going into this cycle Net Charge-offs / Loans Classifieds / Loans Nonperforming Assets / Loans Note: Net Charge-offs/Loans ratio is annualized for all periods shown. 24

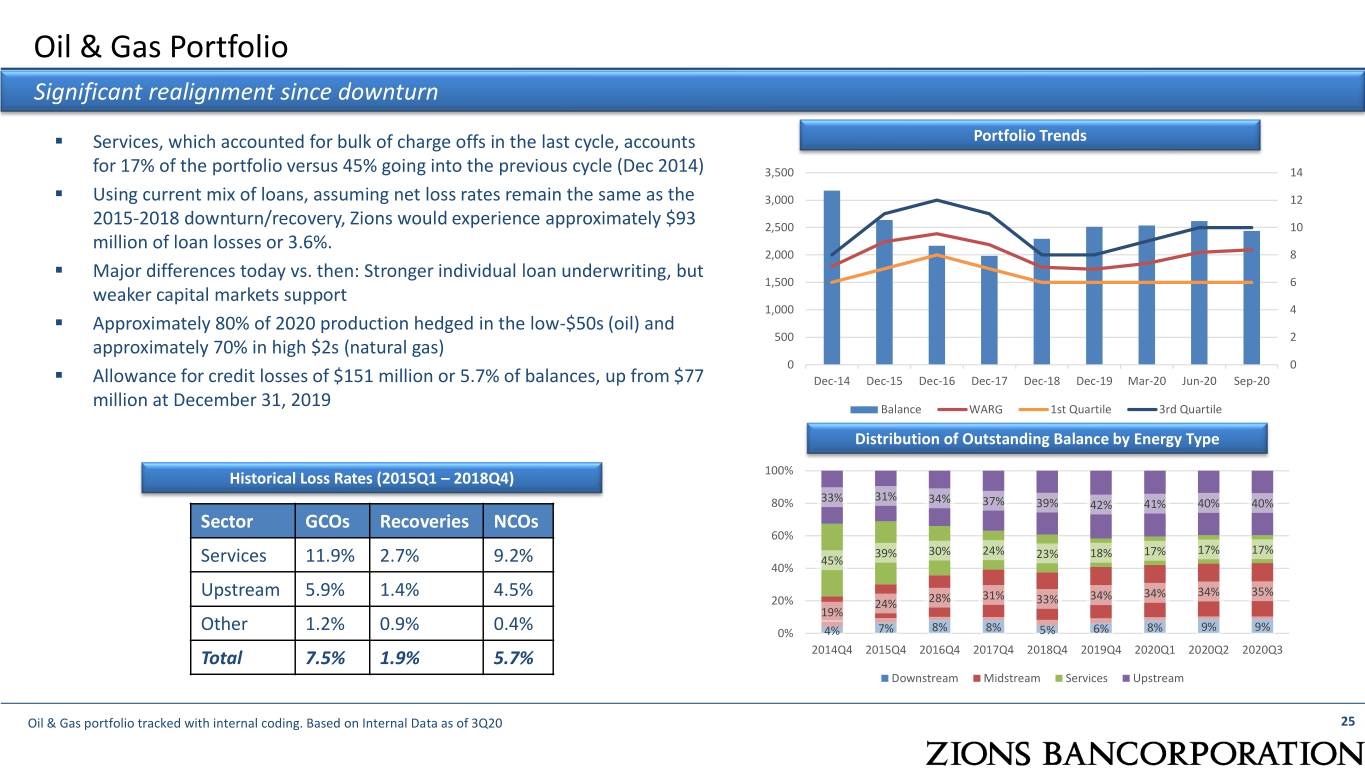

Oil & Gas Portfolio Significant realignment since downturn ▪ Services, which accounted for bulk of charge offs in the last cycle, accounts Portfolio Trends for 17% of the portfolio versus 45% going into the previous cycle (Dec 2014) 3,500 14 ▪ Using current mix of loans, assuming net loss rates remain the same as the 3,000 12 2015-2018 downturn/recovery, Zions would experience approximately $93 2,500 10 million of loan losses or 3.6%. 2,000 8 ▪ Major differences today vs. then: Stronger individual loan underwriting, but 1,500 6 weaker capital markets support 1,000 4 ▪ Approximately 80% of 2020 production hedged in the low-$50s (oil) and 500 2 approximately 70% in high $2s (natural gas) 0 0 ▪ Allowance for credit losses of $151 million or 5.7% of balances, up from $77 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Mar-20 Jun-20 Sep-20 million at December 31, 2019 Balance WARG 1st Quartile 3rd Quartile Distribution of Outstanding Balance by Energy Type Historical Loss Rates (2015Q1 – 2018Q4) 100% 33% 31% 80% 34% 37% 39% 42% 41% 40% 40% Sector GCOs Recoveries NCOs 60% 39% 30% 24% 23% 18% 17% 17% 17% Services 11.9% 2.7% 9.2% 45% 40% Upstream 5.9% 1.4% 4.5% 31% 34% 34% 34% 35% 20% 24% 28% 33% 19% Other 1.2% 0.9% 0.4% 0% 4% 7% 8% 8% 5% 6% 8% 9% 9% Total 7.5% 1.9% 5.7% 2014Q4 2015Q4 2016Q4 2017Q4 2018Q4 2019Q4 2020Q1 2020Q2 2020Q3 Downstream Midstream Services Upstream Oil & Gas portfolio tracked with internal coding. Based on Internal Data as of 3Q20 25

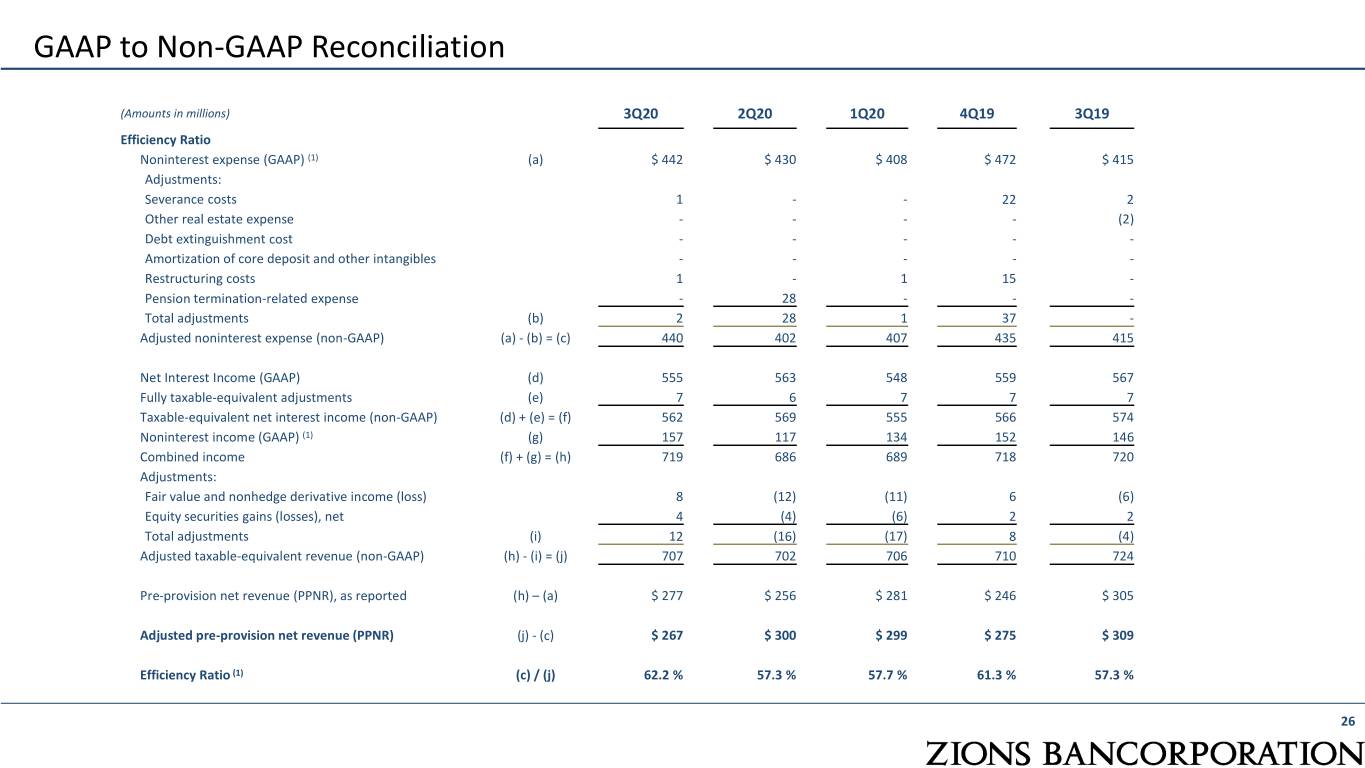

GAAP to Non-GAAP Reconciliation (Amounts in millions) 3Q20 2Q20 1Q20 4Q19 3Q19 Efficiency Ratio Noninterest expense (GAAP) (1) (a) $ 442 $ 430 $ 408 $ 472 $ 415 Adjustments: Severance costs 1 - - 22 2 Other real estate expense - - - - (2) Debt extinguishment cost - - - - - Amortization of core deposit and other intangibles - - - - - Restructuring costs 1 - 1 15 - Pension termination-related expense - 28 - - - Total adjustments (b) 2 28 1 37 - Adjusted noninterest expense (non-GAAP) (a) - (b) = (c) 440 402 407 435 415 Net Interest Income (GAAP) (d) 555 563 548 559 567 Fully taxable-equivalent adjustments (e) 7 6 7 7 7 Taxable-equivalent net interest income (non-GAAP) (d) + (e) = (f) 562 569 555 566 574 Noninterest income (GAAP) (1) (g) 157 117 134 152 146 Combined income (f) + (g) = (h) 719 686 689 718 720 Adjustments: Fair value and nonhedge derivative income (loss) 8 (12) (11) 6 (6) Equity securities gains (losses), net 4 (4) (6) 2 2 Total adjustments (i) 12 (16) (17) 8 (4) Adjusted taxable-equivalent revenue (non-GAAP) (h) - (i) = (j) 707 702 706 710 724 Pre-provision net revenue (PPNR), as reported (h) – (a) $ 277 $ 256 $ 281 $ 246 $ 305 Adjusted pre-provision net revenue (PPNR) (j) - (c) $ 267 $ 300 $ 299 $ 275 $ 309 Efficiency Ratio (1) (c) / (j) 62.2 % 57.3 % 57.7 % 61.3 % 57.3 % 26

GAAP to Non-GAAP Reconciliation $ In millions except per share amounts 3Q20 2Q20 1Q20 4Q19 3Q19 Pre-Provision Net Revenue (PPNR) (a) Total noninterest expense $442 $430 $408 $472 $415 LESS adjustments: Severance costs 1 - - 22 2 Other real estate expense - - - - (2) Restructuring costs 1 - 1 15 - Pension termination-related expense - 28 - - - (b) Total adjustments 2 28 1 37 - (a-b)=(c) Adjusted noninterest expense 440 402 407 435 415 (d) Net interest income 555 563 548 559 567 (e) Fully taxable-equivalent adjustments 7 6 7 7 7 (d+e)=(f) Taxable-equivalent net interest income (TENII) 562 569 555 566 574 (g) Noninterest Income 157 117 134 152 146 (f+g)=(h) Combined Income $719 $686 $689 $718 $720 LESS adjustments: Fair value and nonhedge derivative income (loss) 8 (12) (11) 6 (6) Securities gains (losses), net 4 (4) (6) 2 2 (i) Total adjustments 12 (16) (17) 8 (4) (h-i)=(j) Adjusted revenue $707 $702 $706 $710 $724 (j-c) Adjusted pre-provision net revenue (PPNR) $267 $300 $299 $275 $309 Net Earnings Applicable to Common Shareholders (NEAC) (k) Net earnings applicable to common 167 57 6 174 214 (l) Diluted Shares 163,779 164,425 172,998 178,718 181,870 GAAP Diluted EPS 1.01 0.34 0.04 0.97 1.17 PLUS Adjustments: Adjustments to noninterest expense 2 28 1 37 - Adjustments to revenue (12) 16 17 (8) 4 Tax effect for adjustments 3 (12) (4) (11) (1) Preferred stock redemption - - - - - (m) Total adjustments (7) 32 14 18 3 (k+m)=(n) Adjusted net earnings applicable to common (NEAC) 160 89 20 192 217 (n)/(l) Adjusted EPS 0.98 0.54 0.12 1.07 1.19 (o) Average assets 77,983 75,914 70,205 69,575 70,252 (p) Average tangible common equity 6,063 6,016 5,910 5,852 5,988 Profitability (n)/(o) Adjusted Return on Assets (annualized) 0.82% 0.47% 0.11% 1.09% 1.23% (n)/(p) Adjusted Return on Tangible Common Equity (annualized) 10.6% 5.9% 1.4% 13.0% 14.4% (c)/(j) Efficiency Ratio 62.2% 57.3% 57.7% 61.3% 57.3% 27