Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CREE, INC. | exhibit991101920.htm |

| 8-K - FORM 8-K OCT 19 2020 - CREE, INC. | cree-20201018.htm |

Positioning Cree for Long-Term Growth – Divestiture of LED Products Business October 19, 2020 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

Forward-Looking Statements & Non-GAAP Measures Note on Forward-Looking Statements This presentation includes forward-looking statements about Cree’s business outlook, future financial results and targets, product markets, plans and objectives for future operations, and product development programs and goals. These statements are subject to risks and uncertainties, both known and unknown, that may cause actual results to differ materially, as discussed in our most recent annual report and other reports filed with the U.S. Securities and Exchange Commission. Important factors that could cause actual results to differ materially include risks associated with divestiture transactions generally, including the inability to obtain, or delays in obtaining, required regulatory approvals; issues, delays or complications in completing required carve-out activities to allow the LED Products Business to operate on a stand-alone basis after the closing, including incurring unanticipated costs to complete such activities; the ability of the LED Products Business to generate revenue and gross profit in the first full four quarters post- closing sufficient to result in payment of the targeted earn-out or any earn-out payment; [Buyer]’s ability to make fully and timely payments under the promissory note(s) issued to Cree at closing and for the earn-out payment, if achieved; risks associated with integration or transition of the operations, systems and personnel of the LED Products Business, each, as applicable, within the term of the post-closing transition services agreement between [Buyer] and Cree; unfavorable reaction to the sale by customers, competitors, suppliers and employees; the risk that costs associated with the transaction will be greater than we expect; risks relating to the COVID-19 pandemic; the risk that the economic and political uncertainty caused by the ongoing trade dispute between the United States and China may negatively impact demand for our products; risks related to international sales and purchases generally; the risk that we may not obtain sufficient orders to achieve our targeted revenues; price competition in key markets; the risk that we may experience production or ramp-up difficulties that preclude us from shipping sufficient quantities to meet customer orders or that result in higher production costs and lower margins; our ability to lower costs; the risk that our results will suffer if we are unable to balance fluctuations in customer demand and capacity, including bringing on additional capacity on a timely basis to meet customer demand; product mix; risks associated with our factory optimization plan and construction of a new fabrication facility, including design and construction delays and cost overruns, issues in installing and qualifying new equipment and ramping production, poor production process yields and quality control, and potential increases to our restructuring costs; risks resulting from the concentration of our business among few customers, including the risk that customers may reduce or cancel orders or fail to honor purchase commitments; the risk posed by managing an increasingly complex supply chain that has the ability to supply a sufficient quantity of raw materials, component parts and finished products with the required specifications and quality; risks relating to confidential information theft or misuse, including through cyber-attacks or cyber intrusion; our ability to complete development and commercialization of products under development, such as our pipeline of Wolfspeed products; the rapid development of new technology and competing products that may impair demand or render our products obsolete; the potential lack of customer acceptance for our products; risks associated with acquisitions, divestitures, joint ventures or investments generally; risks associated with ongoing litigation; the risk that our products fail to perform or fail to meet customer requirements or expectations, resulting in significant additional costs or lower demand for our products; and other factors discussed in our filings with the Securities and Exchange Commission (SEC), including our report on Form 10-K for the fiscal year ended June 28, 2020, and subsequent reports filed with the SEC. 2 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

Forward-Looking Statements & Non-GAAP Measures The forward-looking statements in this presentation were based on management’s analysis of information available at the time the presentation was prepared and on assumptions deemed reasonable by management. Our industry and business is constantly evolving, and Cree undertakes no obligation to update such forward-looking statements to reflect new information, future events, subsequent developments or otherwise, except as may be required by applicable U.S. federal securities laws and regulations. Note Regarding Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures and targets. Cree's management evaluates results and makes operating decisions using both GAAP and non-GAAP measures included in this presentation. Non-GAAP results exclude certain costs, charges and expenses which are included in GAAP results. By including these non-GAAP measures, management intends to provide investors with additional information to further analyze the Company's performance, core results and underlying trends. Non-GAAP results are not prepared in accordance with GAAP and non-GAAP information should be considered a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP. Investors and potential investors are encouraged to review the reconciliation of non-GAAP financial measures to their most directly comparable GAAP measures attached to this presentation. Please see the Appendix at the end of this presentation. 3 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

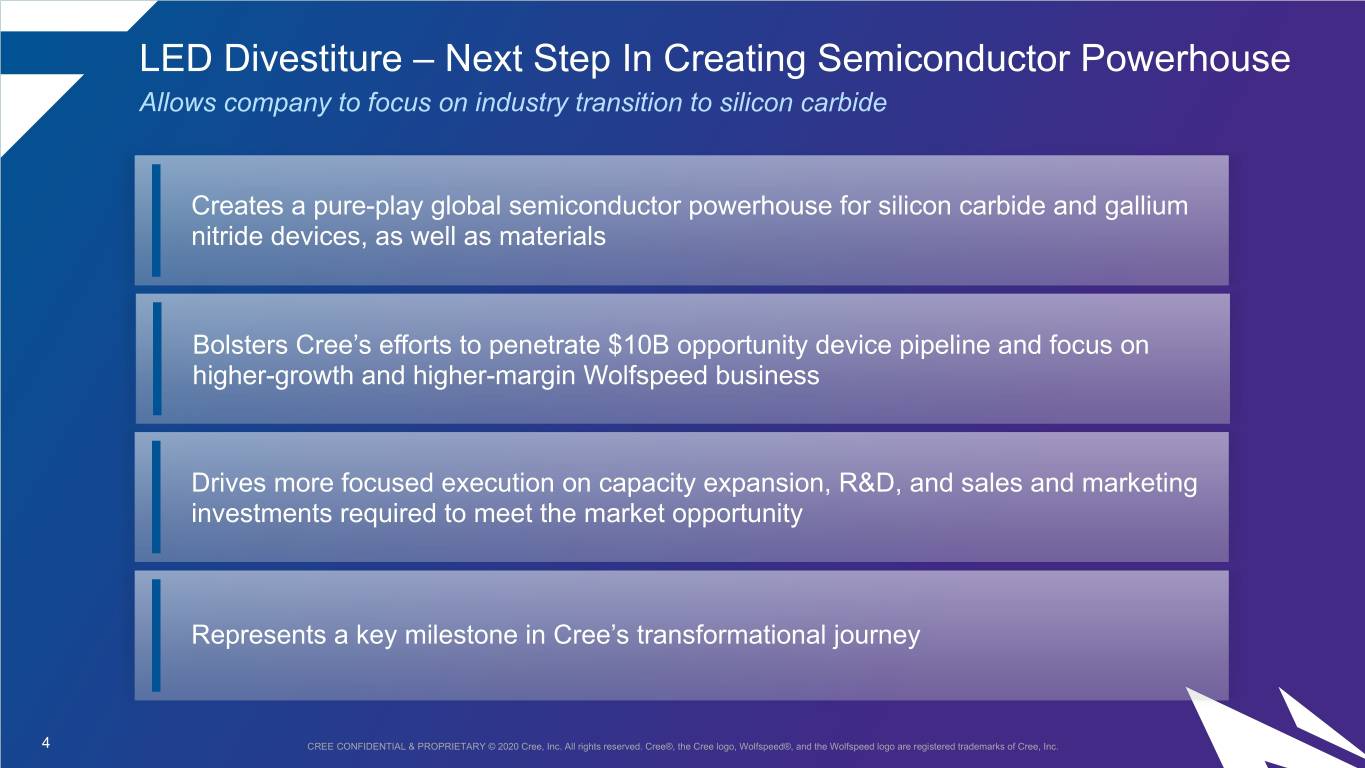

LED Divestiture – Next Step In Creating Semiconductor Powerhouse Allows company to focus on industry transition to silicon carbide Creates a pure-play global semiconductor powerhouse for silicon carbide and gallium nitride devices, as well as materials Bolsters Cree’s efforts to penetrate $10B opportunity device pipeline and focus on higher-growth and higher-margin Wolfspeed business Drives more focused execution on capacity expansion, R&D, and sales and marketing investments required to meet the market opportunity Represents a key milestone in Cree’s transformational journey 4 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

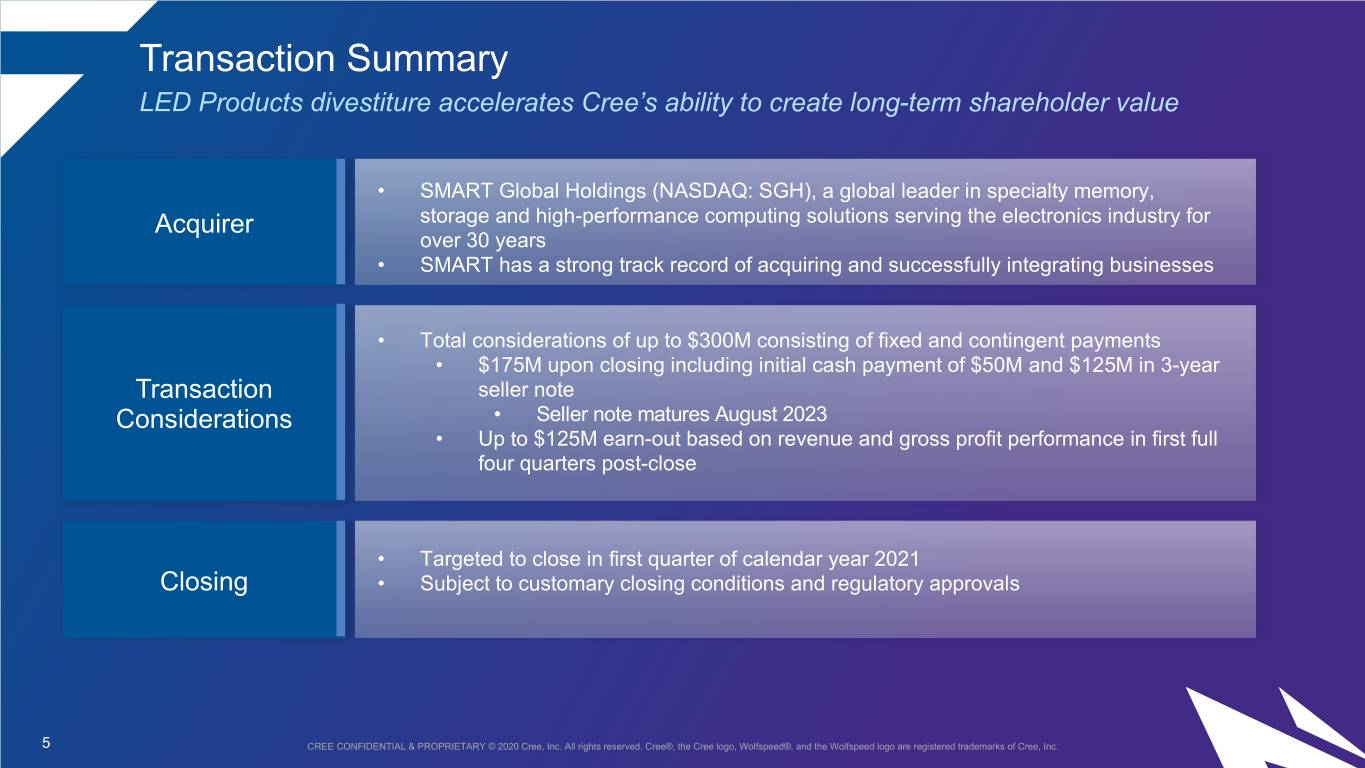

Transaction Summary LED Products divestiture accelerates Cree’s ability to create long-term shareholder value • SMART Global Holdings (NASDAQ: SGH), a global leader in specialty memory, Acquirer storage and high-performance computing solutions serving the electronics industry for over 30 years • SMART has a strong track record of acquiring and successfully integrating businesses • Total considerations of up to $300M consisting of fixed and contingent payments • $175M upon closing including initial cash payment of $50M and $125M in 3-year Transaction seller note Considerations • Seller note matures August 2023 • Up to $125M earn-out based on revenue and gross profit performance in first full four quarters post-close • Targeted to close in first quarter of calendar year 2021 Closing • Subject to customary closing conditions and regulatory approvals 5 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

Focus on High-Growth Wolfspeed Business Powering the next generation of semiconductors with superior silicon carbide technology Materials Power RF • Maintaining leading global • Converting high voltage (>600V) • Driving value with vertical market share power market to silicon carbide integration and technology • Expanding capacity to through focused ecosystem and leadership accelerate industry transition distribution partnerships • Supporting Communication from silicon to silicon carbide • Expanding leadership position in Infrastructure customers with • Using scale to drive innovation, Automotive and increase focused product and worldwide quality and cost reduction revenue diversity with Industrial application improvements and Energy • Serving Aerospace and Defense • Investing in R&D, sales and markets with select distribution marketing to gain scale partnerships Materials Long-Term Agreements $10B Device Pipeline Opportunity (post LED Products divestiture) Worth ~$1B Fast Growing End Markets Automotive Communications Industrial Energy 6 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

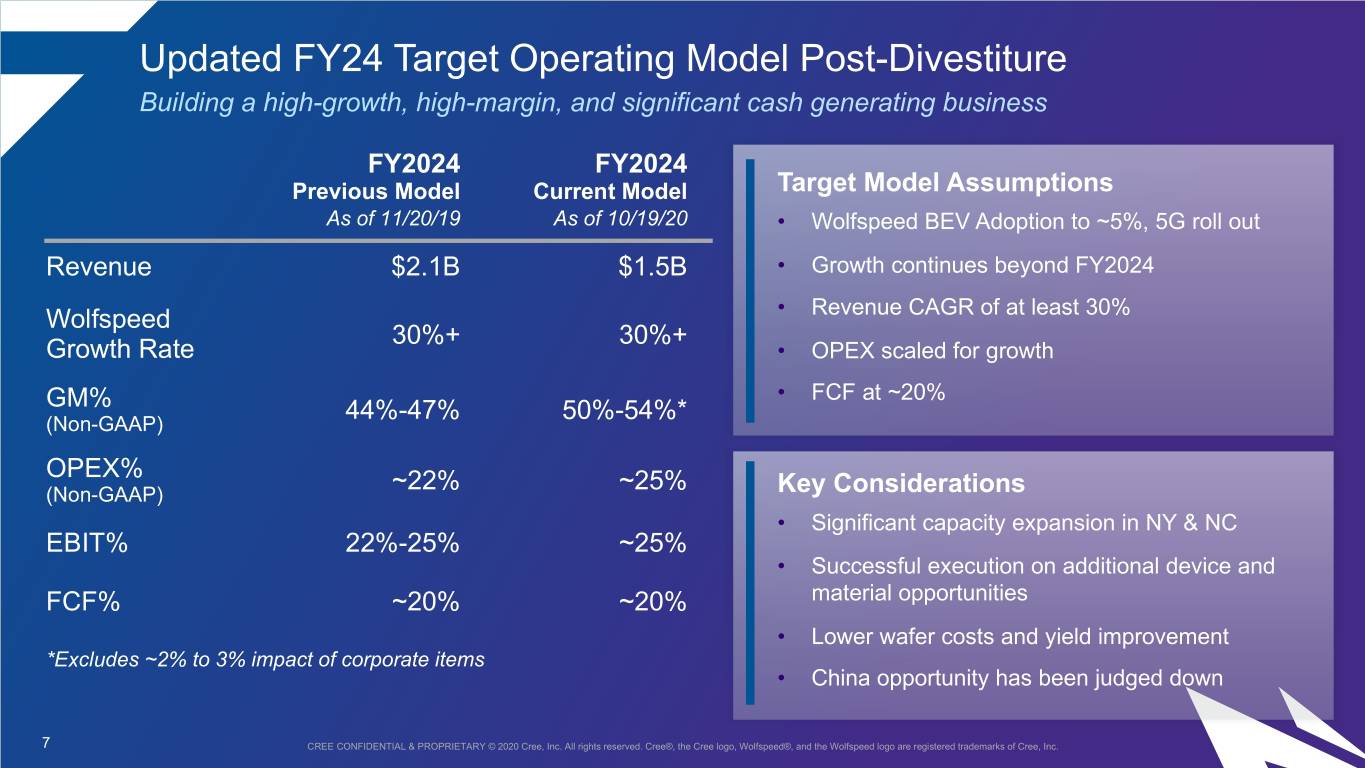

Updated FY24 Target Operating Model Post-Divestiture Building a high-growth, high-margin, and significant cash generating business FY2024 FY2024 Previous Model Current Model Target Model Assumptions As of 11/20/19 As of 10/19/20 • Wolfspeed BEV Adoption to ~5%, 5G roll out Revenue $2.1B $1.5B • Growth continues beyond FY2024 Wolfspeed • Revenue CAGR of at least 30% 30%+ 30%+ Growth Rate • OPEX scaled for growth • FCF at ~20% GM% 44%-47% 50%-54%* (Non-GAAP) OPEX% ~22% ~25% (Non-GAAP) Key Considerations • Significant capacity expansion in NY & NC EBIT% 22%-25% ~25% • Successful execution on additional device and FCF% ~20% ~20% material opportunities • Lower wafer costs and yield improvement *Excludes ~2% to 3% impact of corporate items • China opportunity has been judged down 7 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

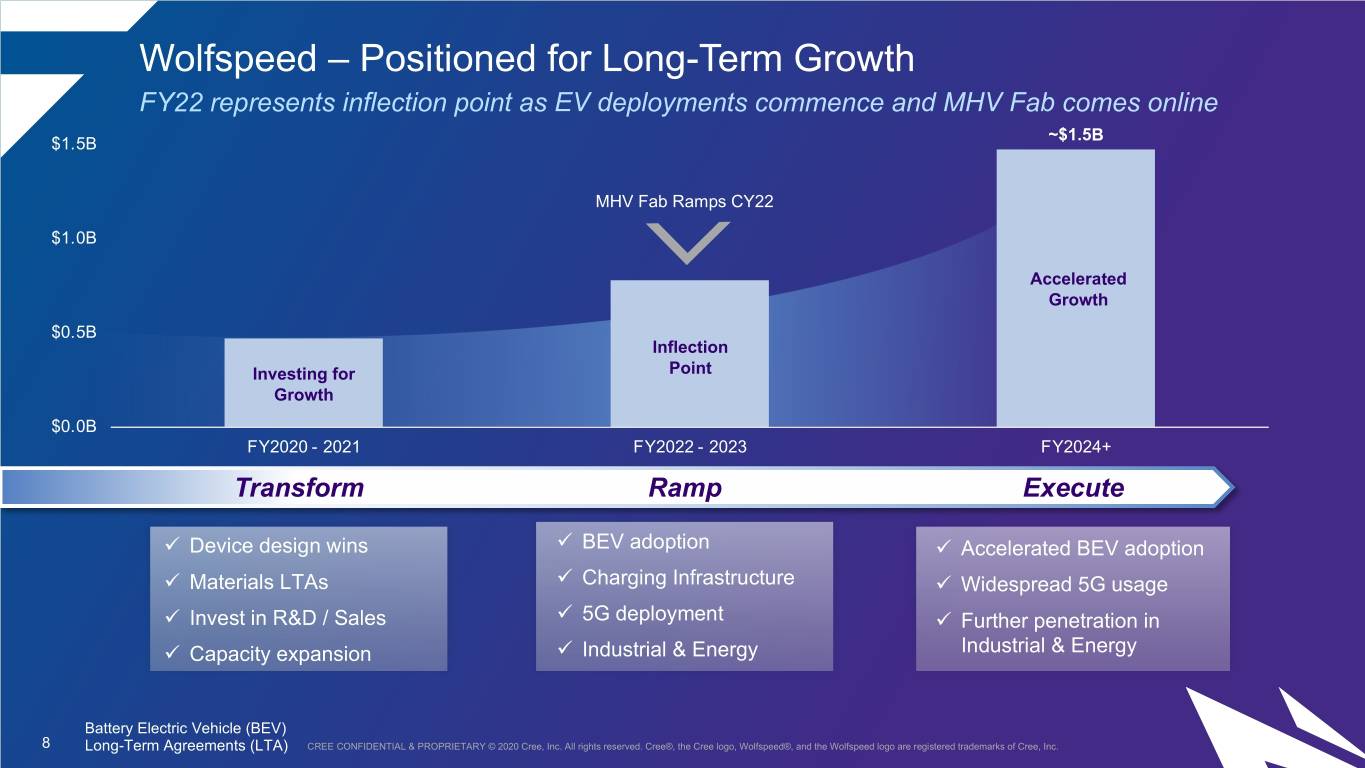

Wolfspeed – Positioned for Long-Term Growth FY22 represents inflection point as EV deployments commence and MHV Fab comes online ~$1.5B $1.5B MHV Fab Ramps CY22 $1.0B Accelerated Growth $0.5B Inflection Investing for Point Growth $0.0B FY2020 - 2021 FY2022 - 2023 FY2024+ Transform Ramp Execute ü Device design wins ü BEV adoption ü Accelerated BEV adoption ü Materials LTAs ü Charging Infrastructure ü Widespread 5G usage ü Invest in R&D / Sales ü 5G deployment ü Further penetration in ü Capacity expansion ü Industrial & Energy Industrial & Energy Battery Electric Vehicle (BEV) 8 Long-Term Agreements (LTA) CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

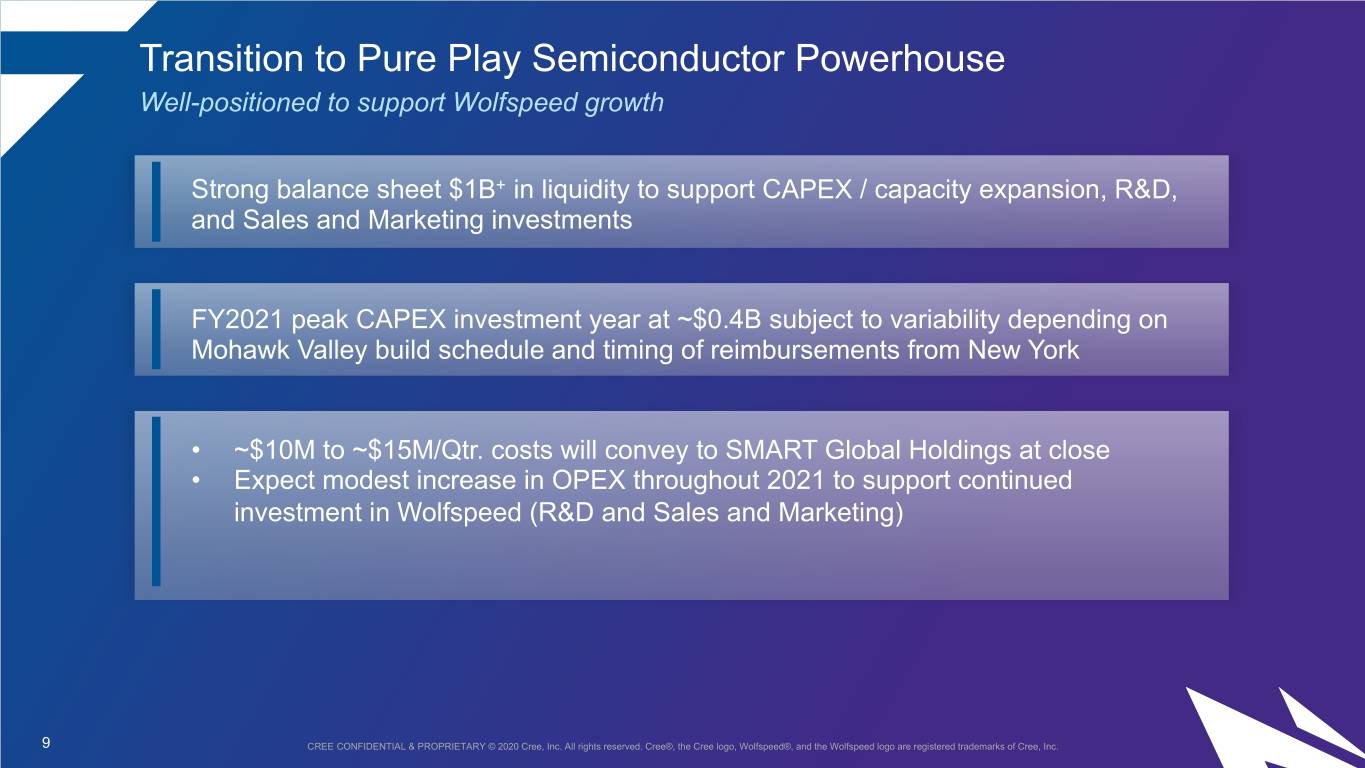

Transition to Pure Play Semiconductor Powerhouse Well-positioned to support Wolfspeed growth Strong balance sheet $1B+ in liquidity to support CAPEX / capacity expansion, R&D, and Sales and Marketing investments FY2021 peak CAPEX investment year at ~$0.4B subject to variability depending on Mohawk Valley build schedule and timing of reimbursements from New York • ~$10M to ~$15M/Qtr. costs will convey to SMART Global Holdings at close • Expect modest increase in OPEX throughout 2021 to support continued investment in Wolfspeed (R&D and Sales and Marketing) 9 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

Our Path Forward Pure-play semiconductor powerhouse well-positioned to benefit from significant growth opportunities Expanding our leading position Executing well against our with strong barriers to entry during transformational strategy to the market transformation from become a powerhouse silicon to silicon carbide semiconductor company focused on silicon carbide and GaN Growing and diversified pipeline Investing to expand capacity to supported by secular trends in support substantial growth attractive end markets including opportunities in silicon carbide EV, 5G and Industrial materials and devices 10 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

Appendix 11 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

Appendix - Non-GAAP Measures Reconciliation FY24 Non GAAP Margin Gross Margin Reconciliation FY2024 FY2024 Previous Model Current Model GAAP GM% 43%-46% 49%-53% Stock based compensation 1% 1% Non-GAAP GM% 44%-47% 50%-54% GAAP OPEX% 24% 30% Stock based compensation 2% 3% Amortization of intangibles 0% 1% Other 0% 1% Non-GAAP OPEX% 22% 25% * "Previous Model" refers to financial model presented at November 2019 Investor Day Non GAAP Opex Reconciliation FY2024 FY2024 Previous Model Current Model GAAP OPEX% 24% 30% Stock based compensation 2% 3% Amortization of intangibles 0% 1% Other 0% 1% Non-GAAP OPEX% 22% 25% * "Previous Model" refers to financial model presented at November 2019 Investor Day 12 CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.

CREE CONFIDENTIAL & PROPRIETARY © 2020 Cree, Inc. All rights reserved. Cree®, the Cree logo, Wolfspeed®, and the Wolfspeed logo are registered trademarks of Cree, Inc.