Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CIT GROUP INC | d81099dex991.htm |

| 8-K - FORM 8-K - CIT GROUP INC | d81099d8k.htm |

Transformational Partnership Creates a Top-Performing Commercial Bank October 16, 2020 Exhibit 99.2

Legal Disclosures Forward Looking Statement This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and future performance of First Citizens and CIT. Words such as “anticipates," "believes," "estimates," "expects," "forecasts," "intends," "plans," "projects," “targets,” “designed,” "could," "may," "should," "will" or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on First Citizens’ and CIT's current expectations and assumptions regarding First Citizens’ and CIT’s businesses, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent risks, uncertainties, changes in circumstances and other factors that are difficult to predict. Many possible events or factors could affect First Citizens’ and/or CIT’s future financial results and performance and could cause the actual results, performance or achievements of First Citizens and/or CIT to differ materially from any anticipated results expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others, (1) the risk that the cost savings, any revenue synergies and other anticipated benefits of the proposed merger may not be realized or may take longer than anticipated to be realized, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the condition of the economy and competitive factors in areas where First Citizens and CIT do business, (2) disruption to the parties’ businesses as a result of the announcement and pendency of the proposed merger and diversion of management’s attention from ongoing business operations and opportunities, (3) the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between First Citizens and CIT, (4) the risk that the integration of First Citizens’ and CIT’s operations will be materially delayed or will be more costly or difficult than expected or that First Citizens and CIT are otherwise unable to successfully integrate their businesses, (5) the failure to obtain the necessary approvals of the stockholders of First Citizens and/or CIT, (6) the outcome of any legal proceedings that may be instituted against First Citizens and/or CIT, (7) the failure to obtain required governmental approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction), (8) reputational risk and potential adverse reactions of First Citizens’ and/or CIT’s customers, suppliers, employees or other business partners, including those resulting from the announcement or completion of the proposed merger, (9) the failure of any of the closing conditions in the definitive merger agreement to be satisfied on a timely basis or at all, (10) delays in closing the proposed merger, (11) the possibility that the proposed merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by First Citizens’ issuance of additional shares of its capital stock in connection with the proposed merger, (13) general competitive, economic, political and market conditions, (14) other factors that may affect future results of CIT and/or First Citizens including changes in asset quality and credit risk, the inability to sustain revenue and earnings growth, changes in interest rates and capital markets, inflation, customer borrowing, repayment, investment and deposit practices, the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms, and (15) the impact of the global COVID-19 pandemic on First Citizens’ and/or CIT’s businesses, the ability to complete the proposed merger and/or any of the other foregoing risks. Except to the extent required by applicable law or regulation, each of First Citizens and CIT disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding First Citizens, CIT and factors which could affect the forward-looking statements contained herein can be found in First Citizens’ Annual Report on Form 10-K for the fiscal year ended December 31, 2019, its Quarterly Reports on Form 10-Q for the periods ended March 31, 2020 and June 30, 2020, and its other filings with the Securities and Exchange Commission (the “SEC”), and in CIT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, its Quarterly Reports on Form 10-Q for the periods ended March 31, 2020 and June 30, 2020, and its other filings with the SEC and available on the SEC’s website at http://www.sec.gov. Important Other Information First Citizens intends to file a registration statement on Form S-4 with the SEC to register the shares of First Citizens’ capital stock that will be issued to CIT’s stockholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of First Citizens and CIT that also constitutes a prospectus of First Citizens. The definitive joint proxy statement/prospectus will be sent to the stockholders of First Citizens and CIT seeking their approval of the proposed merger and the issuance of First Citizens shares in the proposed merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 WHEN THEY BECOME AVAILABLE (AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING FIRST CITIZENS, CIT, THE PROPOSED MERGER AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by First Citizens or CIT through the website maintained by the SEC at http://www.sec.gov or from First Citizens at its website, www.firstcitizens.com, or from CIT at its website, www.cit.com. Documents filed with the SEC by First Citizens will be available free of charge by accessing the “Newsroom” page of First Citizens’ website at www.firstcitizens.com or, alternatively, by directing a request by telephone or mail to First Citizens BancShares, Inc., Mail Code: FCC-22, PO Box 27131, Raleigh, North Carolina 27611-7131, (919) 716-7000, and documents filed with the SEC by CIT will be available free of charge by accessing CIT’s website at www.cit.com under the tab “About Us,” and then under the heading “Investor Relations” or, alternatively, by directing a request by telephone or mail to CIT Group Inc., One CIT Drive, Livingston, New Jersey 07039, (866) 542-4847. Participants in the Solicitation First Citizens, CIT, and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of First Citizens and CIT in connection with the proposed merger under the rules of the SEC. Certain information regarding the interests of the directors and executive officers of First Citizens and CIT and other persons who may be deemed participants in the solicitation of the stockholders of First Citizens or of CIT in connection with the proposed merger and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus related to the proposed merger, which will be filed with the SEC. Additional information about First Citizens, the directors and executive officers of First Citizens and their ownership of First Citizens common stock can also be found in First Citizens’ definitive proxy statement in connection with its 2020 annual meeting of stockholders, as filed with the SEC on February 26, 2020, and other documents subsequently filed by First Citizens with the SEC. Additional information about CIT, the directors and executive officers of CIT and their ownership of CIT common stock can also be found in CIT’s definitive proxy statement in connection with its 2020 annual meeting of stockholders, as filed with the SEC on April 2, 2020, and other documents subsequently filed by CIT with the SEC. These documents can be obtained free of charge from the sources described above.

Presentation Highlights and Presenters Highlights Today’s Presenters Pro Forma Overview of the Combined Company Transaction Structure Strategic Rationale Frank B. Holding Jr. Chairman & Chief Executive Officer Ellen R. Alemany Chairwoman & Chief Executive Officer Craig L. Nix Chief Financial Officer John J. Fawcett Chief Financial Officer

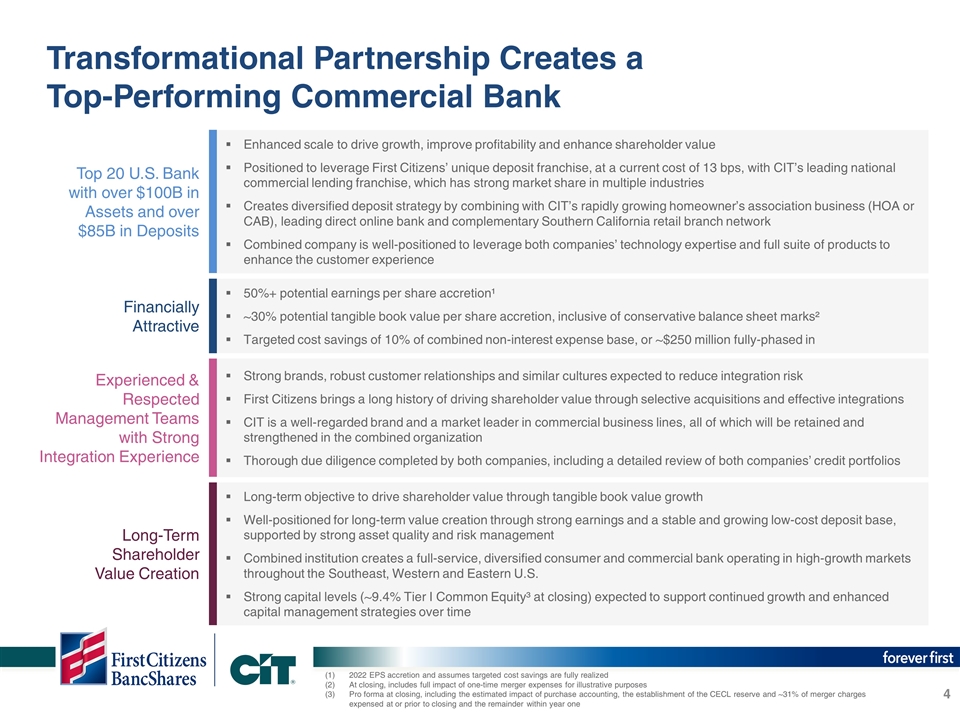

Transformational Partnership Creates a Top-Performing Commercial Bank 2022 EPS accretion and assumes targeted cost savings are fully realized At closing, includes full impact of one-time merger expenses for illustrative purposes Pro forma at closing, including the estimated impact of purchase accounting, the establishment of the CECL reserve and ~31% of merger charges expensed at or prior to closing and the remainder within year one Financially Attractive 50%+ potential earnings per share accretion¹ ~30% potential tangible book value per share accretion, inclusive of conservative balance sheet marks² Targeted cost savings of 10% of combined non-interest expense base, or ~$250 million fully-phased in Top 20 U.S. Bank with over $100B in Assets and over $85B in Deposits Enhanced scale to drive growth, improve profitability and enhance shareholder value Positioned to leverage First Citizens’ unique deposit franchise, at a current cost of 13 bps, with CIT’s leading national commercial lending franchise, which has strong market share in multiple industries Creates diversified deposit strategy by combining with CIT’s rapidly growing homeowner’s association business (HOA or CAB), leading direct online bank and complementary Southern California retail branch network Combined company is well-positioned to leverage both companies’ technology expertise and full suite of products to enhance the customer experience Experienced & Respected Management Teams with Strong Integration Experience Strong brands, robust customer relationships and similar cultures expected to reduce integration risk First Citizens brings a long history of driving shareholder value through selective acquisitions and effective integrations CIT is a well-regarded brand and a market leader in commercial business lines, all of which will be retained and strengthened in the combined organization Thorough due diligence completed by both companies, including a detailed review of both companies’ credit portfolios Long-Term Shareholder Value Creation Long-term objective to drive shareholder value through tangible book value growth Well-positioned for long-term value creation through strong earnings and a stable and growing low-cost deposit base, supported by strong asset quality and risk management Combined institution creates a full-service, diversified consumer and commercial bank operating in high-growth markets throughout the Southeast, Western and Eastern U.S. Strong capital levels (~9.4% Tier I Common Equity³ at closing) expected to support continued growth and enhanced capital management strategies over time

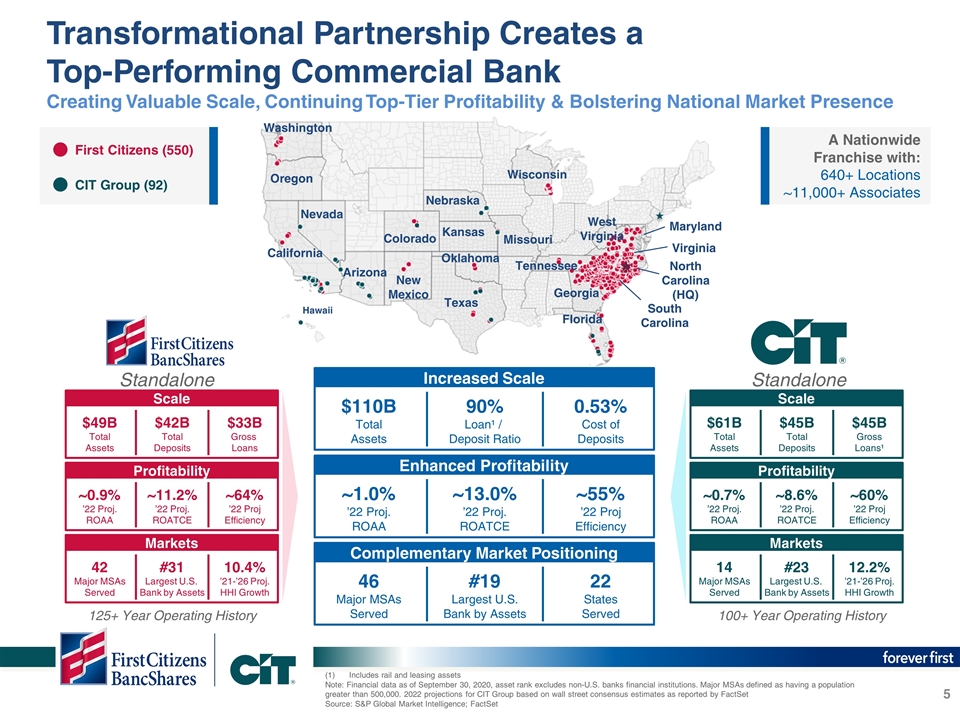

Transformational Partnership Creates a Top-Performing Commercial Bank Creating Valuable Scale, Continuing Top-Tier Profitability & Bolstering National Market Presence Includes rail and leasing assets Note: Financial data as of September 30, 2020, asset rank excludes non-U.S. banks financial institutions. Major MSAs defined as having a population greater than 500,000. 2022 projections for CIT Group based on wall street consensus estimates as reported by FactSet Source: S&P Global Market Intelligence; FactSet California Arizona New Mexico Texas Oregon Washington Wisconsin Oklahoma Colorado Missouri Florida Georgia Tennessee West Virginia South Carolina North Carolina (HQ) Virginia Maryland Kansas Nebraska Nevada $110B Total Assets 90% Loan¹ / Deposit Ratio 0.53% Cost of Deposits Increased Scale ~1.0% ’22 Proj. ROAA ~13.0% ’22 Proj. ROATCE ~55% ’22 Proj Efficiency Enhanced Profitability 46 Major MSAs Served #19 Largest U.S. Bank by Assets 22 States Served Complementary Market Positioning Standalone Standalone $49B Total Assets $42B Total Deposits $33B Gross Loans Scale ~0.9% ’22 Proj. ROAA ~11.2% ’22 Proj. ROATCE ~64% ’22 Proj Efficiency Profitability 42 Major MSAs Served #31 Largest U.S. Bank by Assets 10.4% ’21-’26 Proj. HHI Growth Markets $61B Total Assets $45B Total Deposits $45B Gross Loans¹ Scale ~0.7% ’22 Proj. ROAA ~8.6% ’22 Proj. ROATCE ~60% ’22 Proj Efficiency Profitability 14 Major MSAs Served #23 Largest U.S. Bank by Assets 12.2% ’21-’26 Proj. HHI Growth Markets Hawaii First Citizens (550) CIT Group (92) 125+ Year Operating History 100+ Year Operating History A Nationwide Franchise with: 640+ Locations ~11,000+ Associates

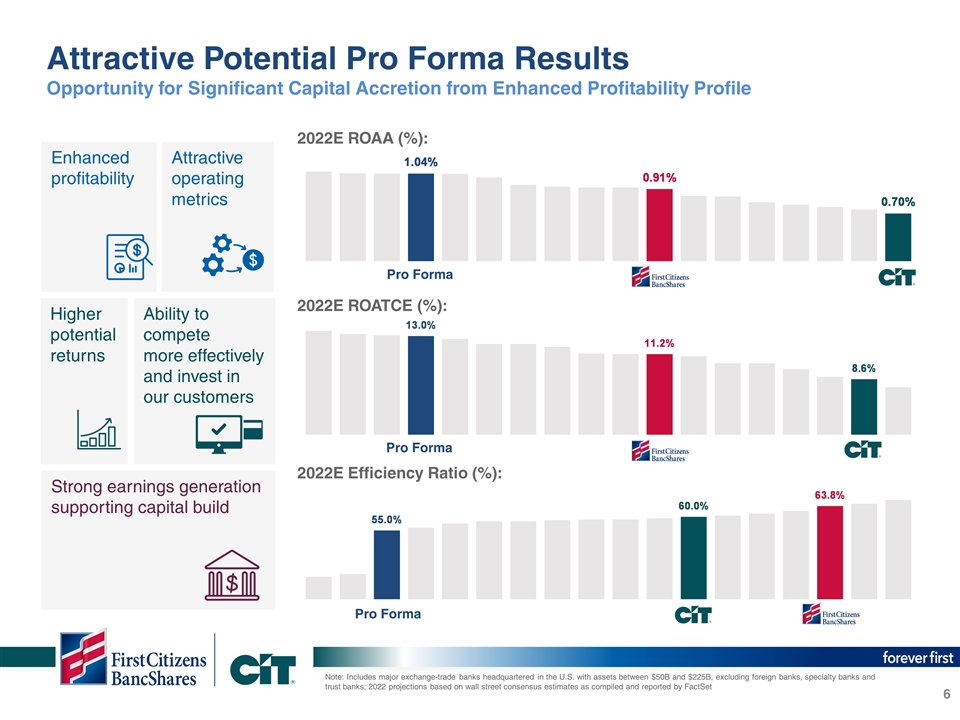

Attractive Potential Pro Forma Results Opportunity for Significant Capital Accretion from Enhanced Profitability Profile Note: Includes major exchange-trade banks headquartered in the U.S. with assets between $50B and $225B, excluding foreign banks, specialty banks and trust banks; 2022 projections based on wall street consensus estimates as compiled and reported by FactSet 2022E ROAA (%): 2022E ROATCE (%): 2022E Efficiency Ratio (%): Pro Forma Pro Forma Pro Forma Enhanced profitability Attractive operating metrics Higher potential returns Ability to compete more effectively and invest in our customers Strong earnings generation supporting capital build

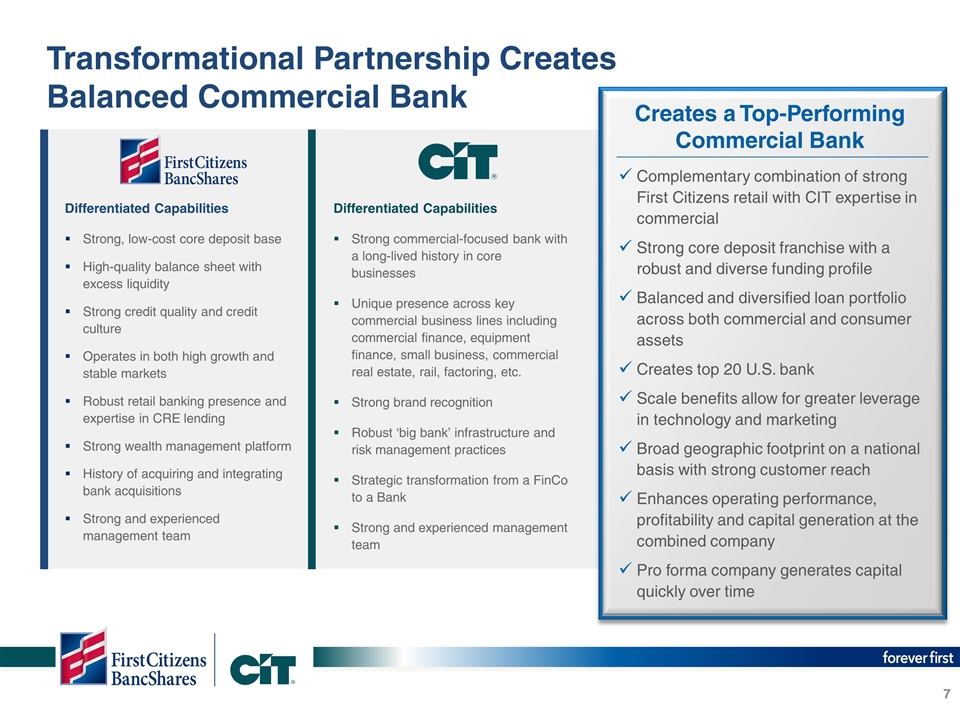

Transformational Partnership Creates Balanced Commercial Bank Differentiated Capabilities Strong, low-cost core deposit base High-quality balance sheet with excess liquidity Strong credit quality and credit culture Operates in both high growth and stable markets Robust retail banking presence and expertise in CRE lending Strong wealth management platform History of acquiring and integrating bank acquisitions Strong and experienced management team Differentiated Capabilities Strong commercial-focused bank with a long-lived history in core businesses Unique presence across key commercial business lines including commercial finance, equipment finance, small business, commercial real estate, rail, factoring, etc. Strong brand recognition Robust ‘big bank’ infrastructure and risk management practices Strategic transformation from a FinCo to a Bank Strong and experienced management team Creates a Top-Performing Commercial Bank Complementary combination of strong First Citizens retail with CIT expertise in commercial Strong core deposit franchise with a robust and diverse funding profile Balanced and diversified loan portfolio across both commercial and consumer assets Creates top 20 U.S. bank Scale benefits allow for greater leverage in technology and marketing Broad geographic footprint on a national basis with strong customer reach Enhances operating performance, profitability and capital generation at the combined company Pro forma company generates capital quickly over time

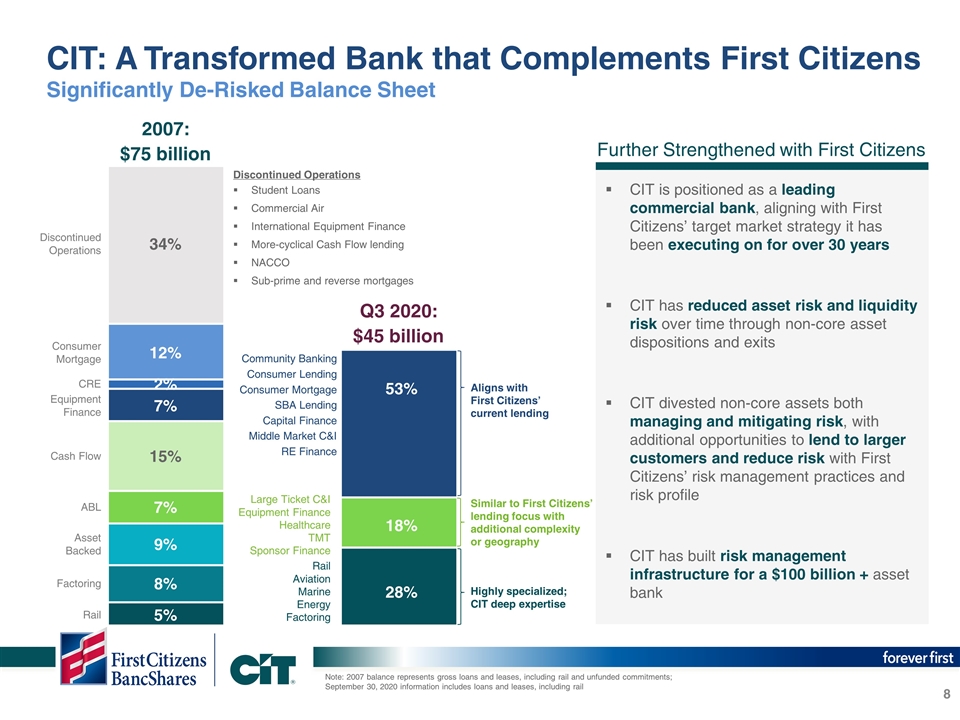

CIT: A Transformed Bank that Complements First Citizens Significantly De-Risked Balance Sheet Note: 2007 balance represents gross loans and leases, including rail and unfunded commitments; September 30, 2020 information includes loans and leases, including rail Aligns with First Citizens’ current lending Similar to First Citizens’ lending focus with additional complexity or geography Highly specialized; CIT deep expertise 2007: $75 billion Discontinued Operations Student Loans Commercial Air International Equipment Finance More-cyclical Cash Flow lending NACCO Sub-prime and reverse mortgages Community Banking Consumer Lending Consumer Mortgage SBA Lending Capital Finance Middle Market C&I RE Finance Large Ticket C&I Equipment Finance Healthcare TMT Sponsor Finance Rail Aviation Marine Energy Factoring 34% 12% 2% 7% 15% 7% 9% 8% 5% Discontinued Operations Consumer Mortgage CRE Equipment Finance Cash Flow ABL Asset Backed Factoring Rail 53% 18% 28% Q3 2020: $45 billion CIT is positioned as a leading commercial bank, aligning with First Citizens’ target market strategy it has been executing on for over 30 years CIT has reduced asset risk and liquidity risk over time through non-core asset dispositions and exits CIT divested non-core assets both managing and mitigating risk, with additional opportunities to lend to larger customers and reduce risk with First Citizens’ risk management practices and risk profile CIT has built risk management infrastructure for a $100 billion + asset bank Further Strengthened with First Citizens

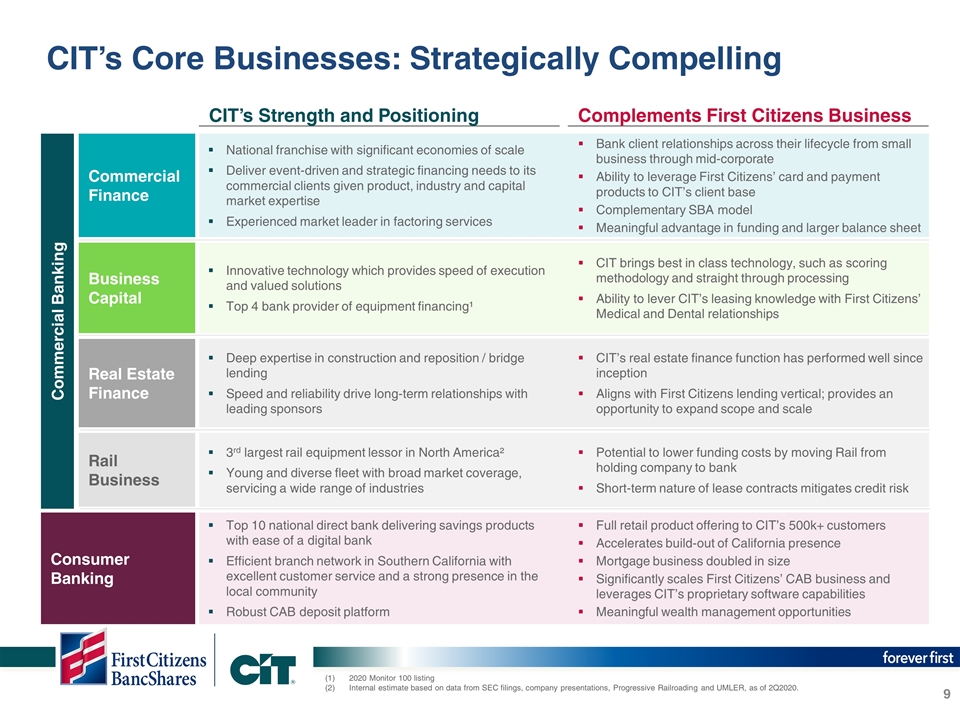

CIT’s Core Businesses: Strategically Compelling 2020 Monitor 100 listing Internal estimate based on data from SEC filings, company presentations, Progressive Railroading and UMLER, as of 2Q2020. Commercial Banking Consumer Banking Commercial Finance Business Capital Real Estate Finance Rail Business Complements First Citizens Business CIT’s Strength and Positioning National franchise with significant economies of scale Deliver event-driven and strategic financing needs to its commercial clients given product, industry and capital market expertise Experienced market leader in factoring services Top 10 national direct bank delivering savings products with ease of a digital bank Efficient branch network in Southern California with excellent customer service and a strong presence in the local community Robust CAB deposit platform Innovative technology which provides speed of execution and valued solutions Top 4 bank provider of equipment financing¹ Deep expertise in construction and reposition / bridge lending Speed and reliability drive long-term relationships with leading sponsors 3rd largest rail equipment lessor in North America² Young and diverse fleet with broad market coverage, servicing a wide range of industries Bank client relationships across their lifecycle from small business through mid-corporate Ability to leverage First Citizens’ card and payment products to CIT’s client base Complementary SBA model Meaningful advantage in funding and larger balance sheet CIT brings best in class technology, such as scoring methodology and straight through processing Ability to lever CIT’s leasing knowledge with First Citizens’ Medical and Dental relationships CIT’s real estate finance function has performed well since inception Aligns with First Citizens lending vertical; provides an opportunity to expand scope and scale Potential to lower funding costs by moving Rail from holding company to bank Short-term nature of lease contracts mitigates credit risk Full retail product offering to CIT’s 500k+ customers Accelerates build-out of California presence Mortgage business doubled in size Significantly scales First Citizens’ CAB business and leverages CIT’s proprietary software capabilities Meaningful wealth management opportunities

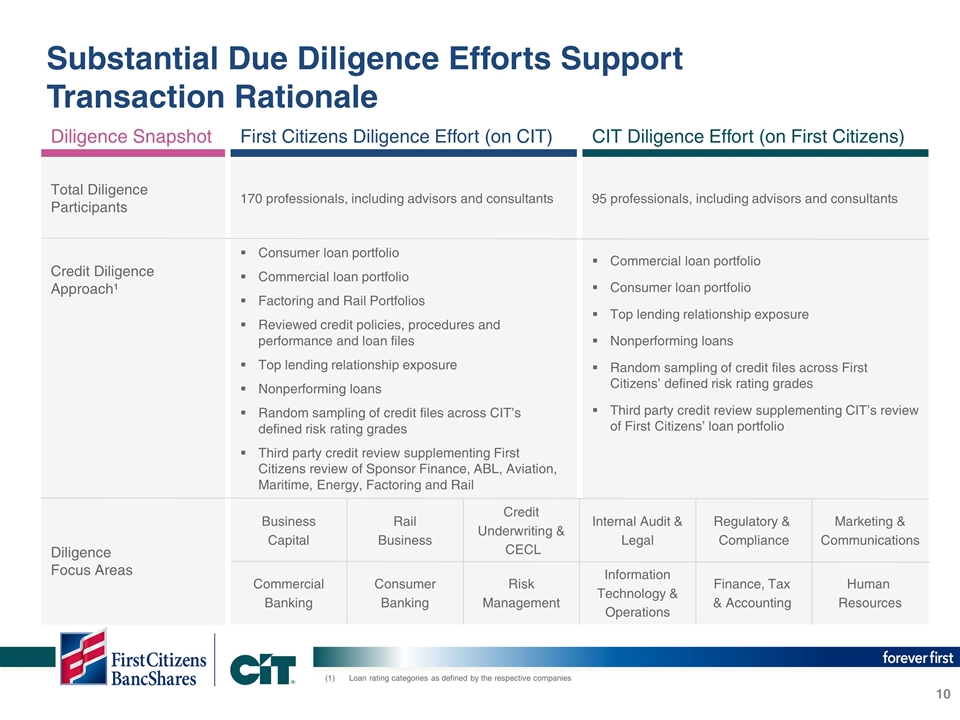

Substantial Due Diligence Efforts Support Transaction Rationale 170 professionals, including advisors and consultants First Citizens Diligence Effort (on CIT) Consumer loan portfolio Commercial loan portfolio Factoring and Rail Portfolios Reviewed credit policies, procedures and performance and loan files Top lending relationship exposure Nonperforming loans Random sampling of credit files across CIT’s defined risk rating grades Third party credit review supplementing First Citizens review of Sponsor Finance, ABL, Aviation, Maritime, Energy, Factoring and Rail 95 professionals, including advisors and consultants CIT Diligence Effort (on First Citizens) Commercial loan portfolio Consumer loan portfolio Top lending relationship exposure Nonperforming loans Random sampling of credit files across First Citizens’ defined risk rating grades Third party credit review supplementing CIT’s review of First Citizens’ loan portfolio Business Capital Diligence Snapshot Diligence Focus Areas Total Diligence Participants Credit Diligence Approach¹ Rail Business Credit Underwriting & CECL Internal Audit & Legal Regulatory & Compliance Marketing & Communications Commercial Banking Consumer Banking Risk Management Information Technology & Operations Finance, Tax & Accounting Human Resources Loan rating categories as defined by the respective companies

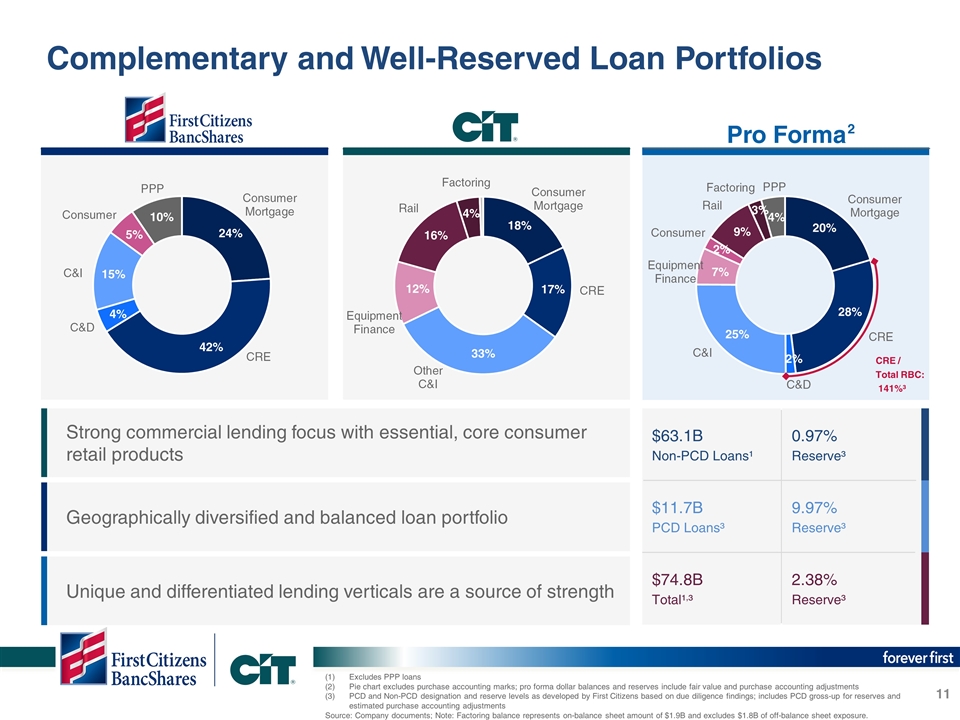

Complementary and Well-Reserved Loan Portfolios Excludes PPP loans Pie chart excludes purchase accounting marks; pro forma dollar balances and reserves include fair value and purchase accounting adjustments PCD and Non-PCD designation and reserve levels as developed by First Citizens based on due diligence findings; includes PCD gross-up for reserves and estimated purchase accounting adjustments Source: Company documents; Note: Factoring balance represents on-balance sheet amount of $1.9B and excludes $1.8B of off-balance sheet exposure. 0.97% Reserve³ $63.1B Non-PCD Loans¹ 9.97% Reserve³ $11.7B PCD Loans³ 2.38% Reserve³ $74.8B Total¹,³ 24% 42% 4% 15% 10% 5% 18% 17% 33% 12% 16% 4% 20% 28% 2% 25% 7% 2% 9% 4% 2 Pro Forma Strong commercial lending focus with essential, core consumer retail products Geographically diversified and balanced loan portfolio Unique and differentiated lending verticals are a source of strength CRE / Total RBC: 141%³ 3%

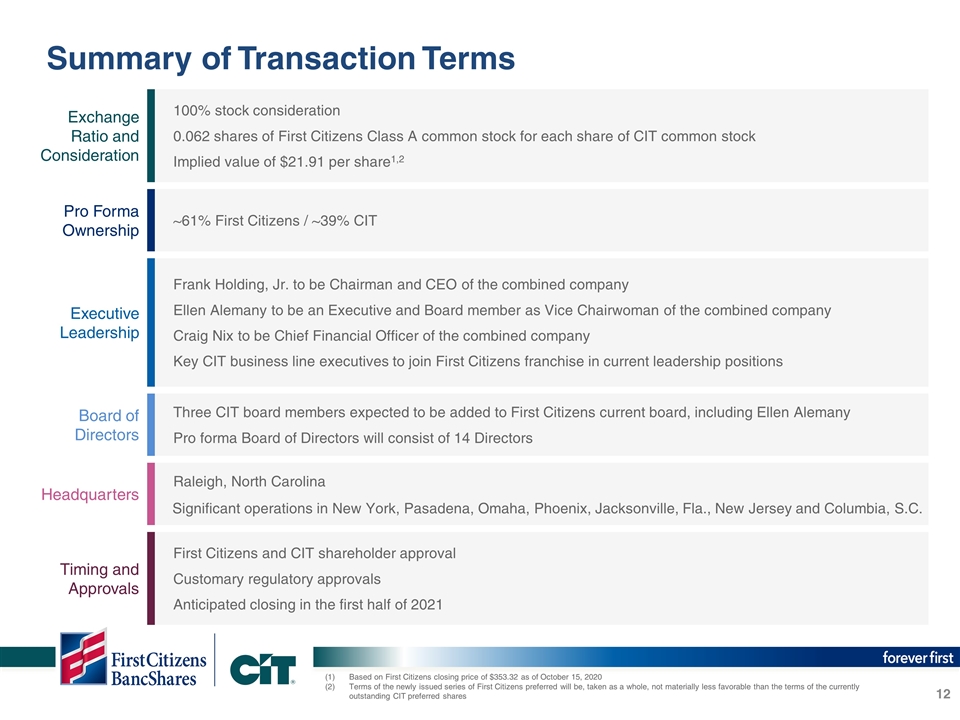

Summary of Transaction Terms Based on First Citizens closing price of $353.32 as of October 15, 2020 Terms of the newly issued series of First Citizens preferred will be, taken as a whole, not materially less favorable than the terms of the currently outstanding CIT preferred shares Exchange Ratio and Consideration 100% stock consideration 0.062 shares of First Citizens Class A common stock for each share of CIT common stock Implied value of $21.91 per share1,2 Pro Forma Ownership ~61% First Citizens / ~39% CIT Frank Holding, Jr. to be Chairman and CEO of the combined company Ellen Alemany to be an Executive and Board member as Vice Chairwoman of the combined company Craig Nix to be Chief Financial Officer of the combined company Key CIT business line executives to join First Citizens franchise in current leadership positions Executive Leadership Three CIT board members expected to be added to First Citizens current board, including Ellen Alemany Pro forma Board of Directors will consist of 14 Directors Board of Directors Raleigh, North Carolina Headquarters First Citizens and CIT shareholder approval Customary regulatory approvals Anticipated closing in the first half of 2021 Timing and Approvals Significant operations in New York, Pasadena, Omaha, Phoenix, Jacksonville, Fla., New Jersey and Columbia, S.C.

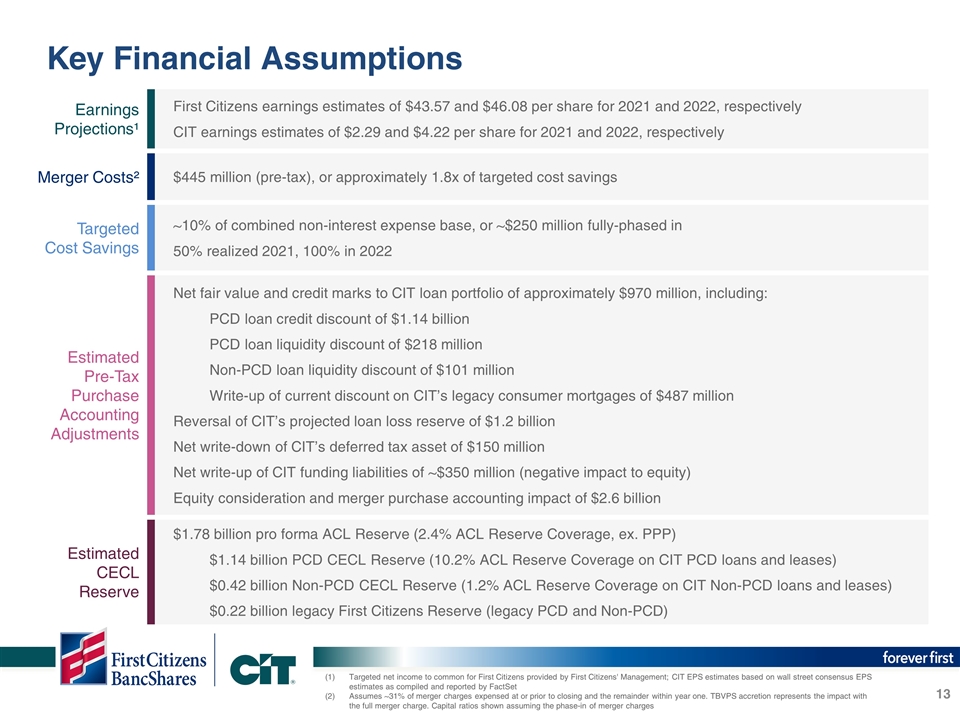

Key Financial Assumptions Targeted net income to common for First Citizens provided by First Citizens' Management; CIT EPS estimates based on wall street consensus EPS estimates as compiled and reported by FactSet Assumes ~31% of merger charges expensed at or prior to closing and the remainder within year one. TBVPS accretion represents the impact with the full merger charge. Capital ratios shown assuming the phase-in of merger charges Earnings Projections¹ First Citizens earnings estimates of $43.57 and $46.08 per share for 2021 and 2022, respectively CIT earnings estimates of $2.29 and $4.22 per share for 2021 and 2022, respectively Merger Costs² $445 million (pre-tax), or approximately 1.8x of targeted cost savings ~10% of combined non-interest expense base, or ~$250 million fully-phased in 50% realized 2021, 100% in 2022 Targeted Cost Savings Net fair value and credit marks to CIT loan portfolio of approximately $970 million, including: PCD loan credit discount of $1.14 billion PCD loan liquidity discount of $218 million Non-PCD loan liquidity discount of $101 million Write-up of current discount on CIT’s legacy consumer mortgages of $487 million Reversal of CIT’s projected loan loss reserve of $1.2 billion Net write-down of CIT’s deferred tax asset of $150 million Net write-up of CIT funding liabilities of ~$350 million (negative impact to equity) Equity consideration and merger purchase accounting impact of $2.6 billion Estimated Pre-Tax Purchase Accounting Adjustments $1.78 billion pro forma ACL Reserve (2.4% ACL Reserve Coverage, ex. PPP) $1.14 billion PCD CECL Reserve (10.2% ACL Reserve Coverage on CIT PCD loans and leases) $0.42 billion Non-PCD CECL Reserve (1.2% ACL Reserve Coverage on CIT Non-PCD loans and leases) $0.22 billion legacy First Citizens Reserve (legacy PCD and Non-PCD) Estimated CECL Reserve

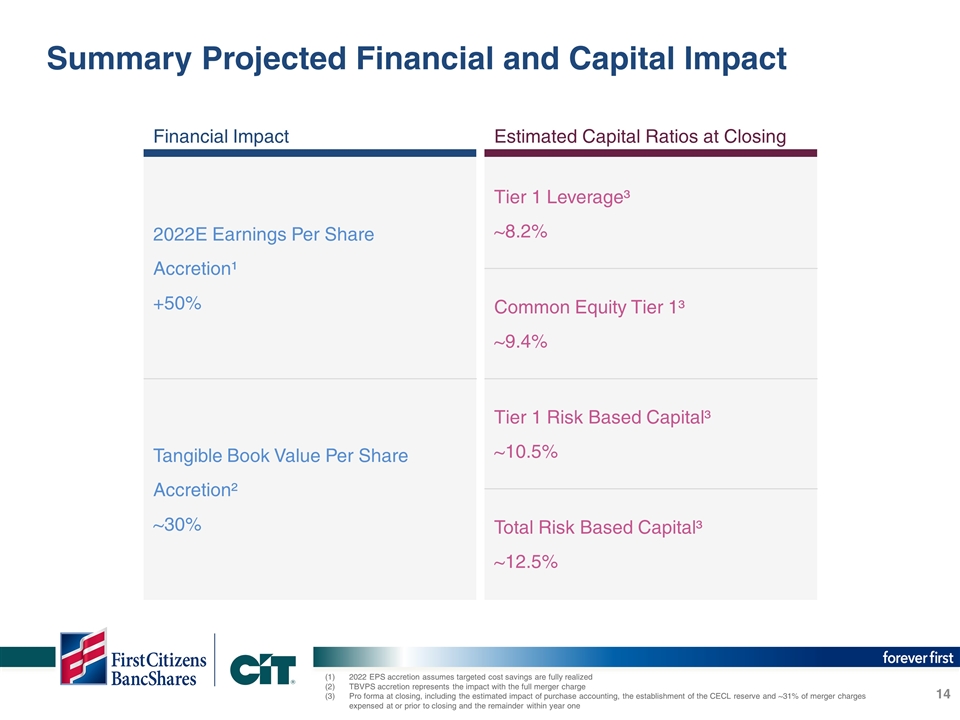

Summary Projected Financial and Capital Impact 2022 EPS accretion assumes targeted cost savings are fully realized TBVPS accretion represents the impact with the full merger charge Pro forma at closing, including the estimated impact of purchase accounting, the establishment of the CECL reserve and ~31% of merger charges expensed at or prior to closing and the remainder within year one 2022E Earnings Per Share Accretion¹ +50% Financial Impact Tier 1 Leverage³ ~8.2% Estimated Capital Ratios at Closing Tangible Book Value Per Share Accretion² ~30% Common Equity Tier 1³ ~9.4% Tier 1 Risk Based Capital³ ~10.5% Total Risk Based Capital³ ~12.5%

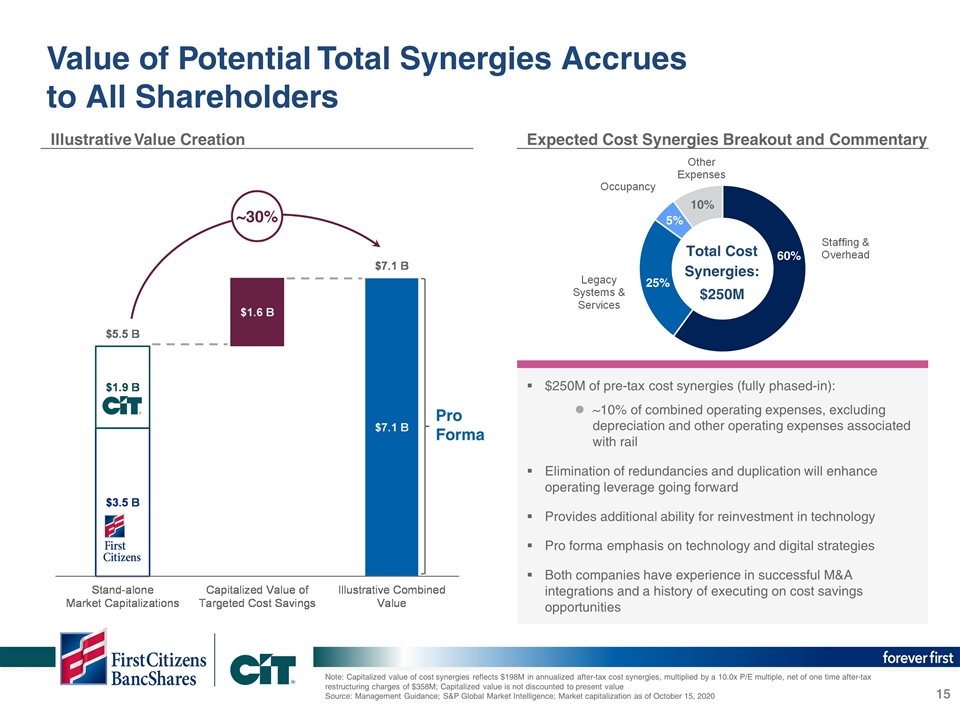

Value of Potential Total Synergies Accrues to All Shareholders Illustrative Value Creation Expected Cost Synergies Breakout and Commentary $250M of pre-tax cost synergies (fully phased-in): ~10% of combined operating expenses, excluding depreciation and other operating expenses associated with rail Elimination of redundancies and duplication will enhance operating leverage going forward Provides additional ability for reinvestment in technology Pro forma emphasis on technology and digital strategies Both companies have experience in successful M&A integrations and a history of executing on cost savings opportunities Total Cost Synergies: $250M 5% 25% 60% Note: Capitalized value of cost synergies reflects $198M in annualized after-tax cost synergies, multiplied by a 10.0x P/E multiple, net of one time after-tax restructuring charges of $358M; Capitalized value is not discounted to present value Source: Management Guidance; S&P Global Market Intelligence; Market capitalization as of October 15, 2020 10% Pro Forma ~30%

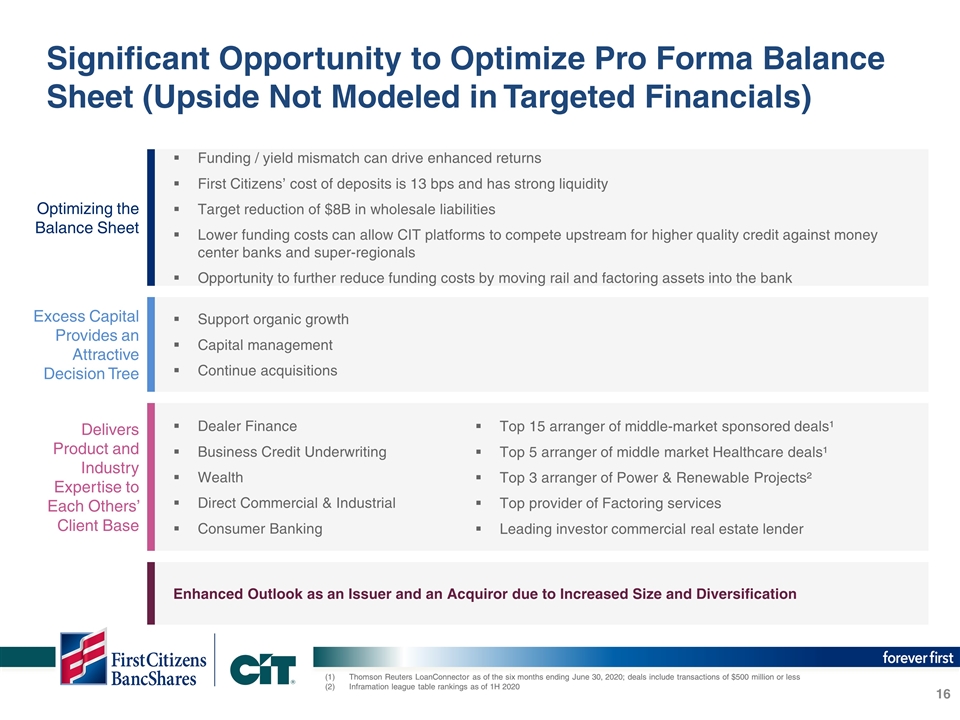

Significant Opportunity to Optimize Pro Forma Balance Sheet (Upside Not Modeled in Targeted Financials) Thomson Reuters LoanConnector as of the six months ending June 30, 2020; deals include transactions of $500 million or less Inframation league table rankings as of 1H 2020 Optimizing the Balance Sheet Funding / yield mismatch can drive enhanced returns First Citizens’ cost of deposits is 13 bps and has strong liquidity Target reduction of $8B in wholesale liabilities Lower funding costs can allow CIT platforms to compete upstream for higher quality credit against money center banks and super-regionals Opportunity to further reduce funding costs by moving rail and factoring assets into the bank Support organic growth Capital management Continue acquisitions Excess Capital Provides an Attractive Decision Tree Dealer Finance Business Credit Underwriting Wealth Direct Commercial & Industrial Consumer Banking Delivers Product and Industry Expertise to Each Others’ Client Base Enhanced Outlook as an Issuer and an Acquiror due to Increased Size and Diversification Top 15 arranger of middle-market sponsored deals¹ Top 5 arranger of middle market Healthcare deals¹ Top 3 arranger of Power & Renewable Projects² Top provider of Factoring services Leading investor commercial real estate lender

Transformational Partnership Beneficial for All Constituents Clients Shareholders Employees Communities Greater capabilities and expanded product suite Ability to maintain clients across their lifecycle Capitalizes on both company’s investment in technology and platforms Diversified client base and scope More efficient go-to-market strategy Extends expertise and broadens business lines to reach a larger number of clients Expect 50%+ earnings accretion Significant tangible book value accretion of ~30% Realization of significant franchise value and creates meaningful scale Combined company with strong profit potential Capitalized value of targeted cost savings represents significant potential market value creation Positions the combined company to compete with larger national banks Shared values and company missions Both companies have a strong focus on diversity, inclusion and employee development Creates ability to make additional investments within the combined organization Complementary businesses with a strong cultural fit Strong risk management culture and bolsters opportunities within the organization Larger company provides additional career opportunities and mobility Strong commitment to advance economic inclusion and equity in the communities that both organizations serve Corporate, social, environmental and governance responsibility is a strong focus for both organizations that will remain a priority Limited overlap and differentiated models minimizes disruption to the communities we serve Significant focus to aid communities impacted by the COVID-19 Pandemic

Combination Provides Significant Opportunity to Create Long Term Shareholder Value Financial strength to grow and pursue new opportunities Expands market reach, product offering and scale to better serve customers Strong and complementary culture Significant tangible book value and EPS accretion Creates a top-performing commercial bank with market leading businesses

Appendix: Additional Information

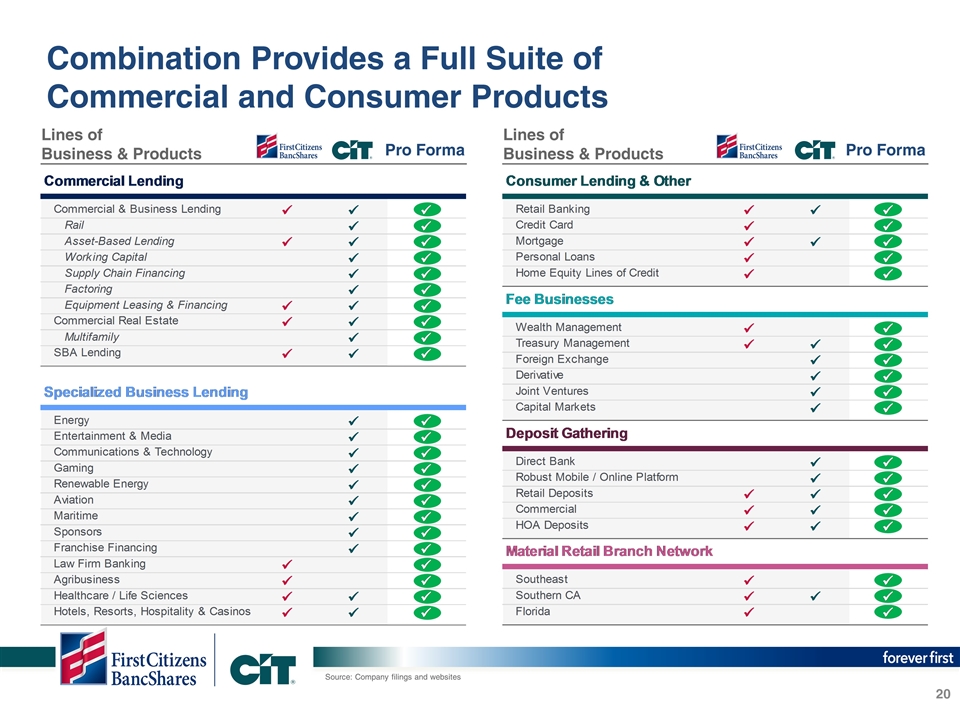

Combination Provides a Full Suite of Commercial and Consumer Products Source: Company filings and websites Pro Forma Pro Forma Lines of Business & Products Lines of Business & Products

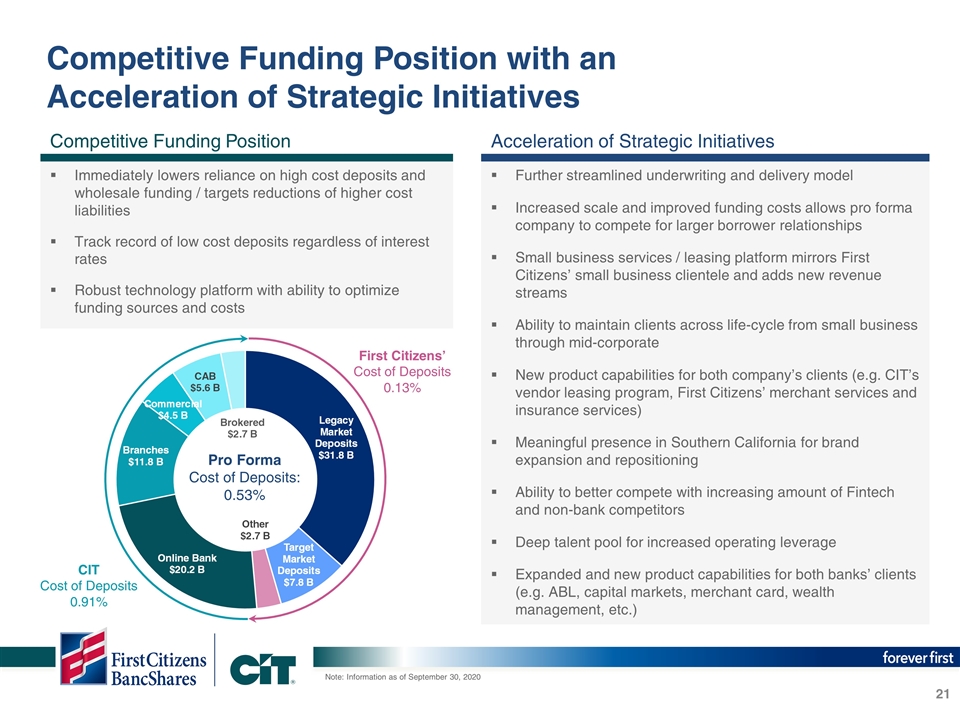

Competitive Funding Position with an Acceleration of Strategic Initiatives Note: Information as of September 30, 2020 Further streamlined underwriting and delivery model Increased scale and improved funding costs allows pro forma company to compete for larger borrower relationships Small business services / leasing platform mirrors First Citizens’ small business clientele and adds new revenue streams Ability to maintain clients across life-cycle from small business through mid-corporate New product capabilities for both company’s clients (e.g. CIT’s vendor leasing program, First Citizens’ merchant services and insurance services) Meaningful presence in Southern California for brand expansion and repositioning Ability to better compete with increasing amount of Fintech and non-bank competitors Deep talent pool for increased operating leverage Expanded and new product capabilities for both banks’ clients (e.g. ABL, capital markets, merchant card, wealth management, etc.) Immediately lowers reliance on high cost deposits and wholesale funding / targets reductions of higher cost liabilities Track record of low cost deposits regardless of interest rates Robust technology platform with ability to optimize funding sources and costs First Citizens’ Cost of Deposits 0.13% Pro Forma Cost of Deposits: 0.53% CIT Cost of Deposits 0.91% Competitive Funding Position Acceleration of Strategic Initiatives

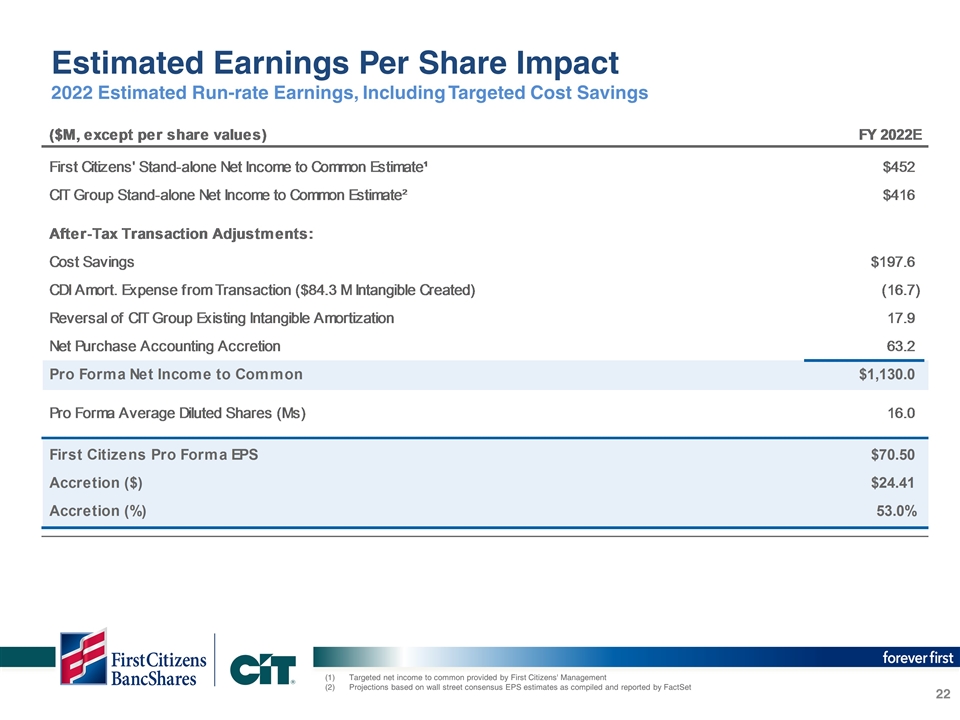

Estimated Earnings Per Share Impact 2022 Estimated Run-rate Earnings, Including Targeted Cost Savings Targeted net income to common provided by First Citizens' Management Projections based on wall street consensus EPS estimates as compiled and reported by FactSet

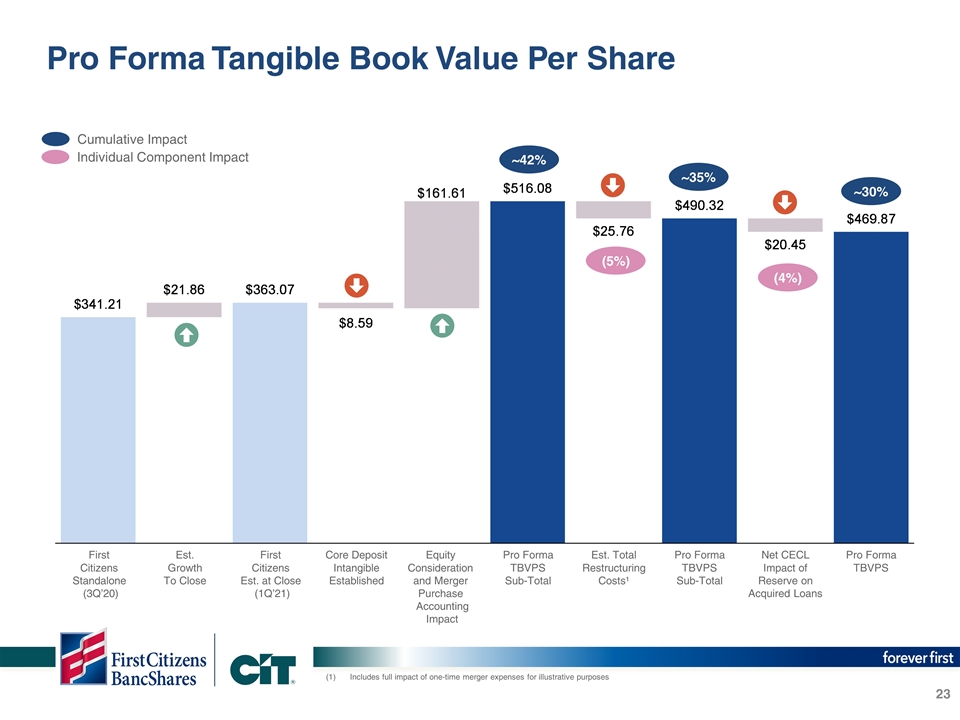

Pro Forma Tangible Book Value Per Share First Citizens Standalone (3Q’20) Est. Growth To Close First Citizens Est. at Close (1Q’21) Equity Consideration and Merger Purchase Accounting Impact Pro Forma TBVPS Sub-Total Est. Total Restructuring Costs¹ Pro Forma TBVPS Sub-Total Net CECL Impact of Reserve on Acquired Loans Pro Forma TBVPS Cumulative Impact Individual Component Impact (5%) (4%) ~42% ~35% ~30% Core Deposit Intangible Established Includes full impact of one-time merger expenses for illustrative purposes

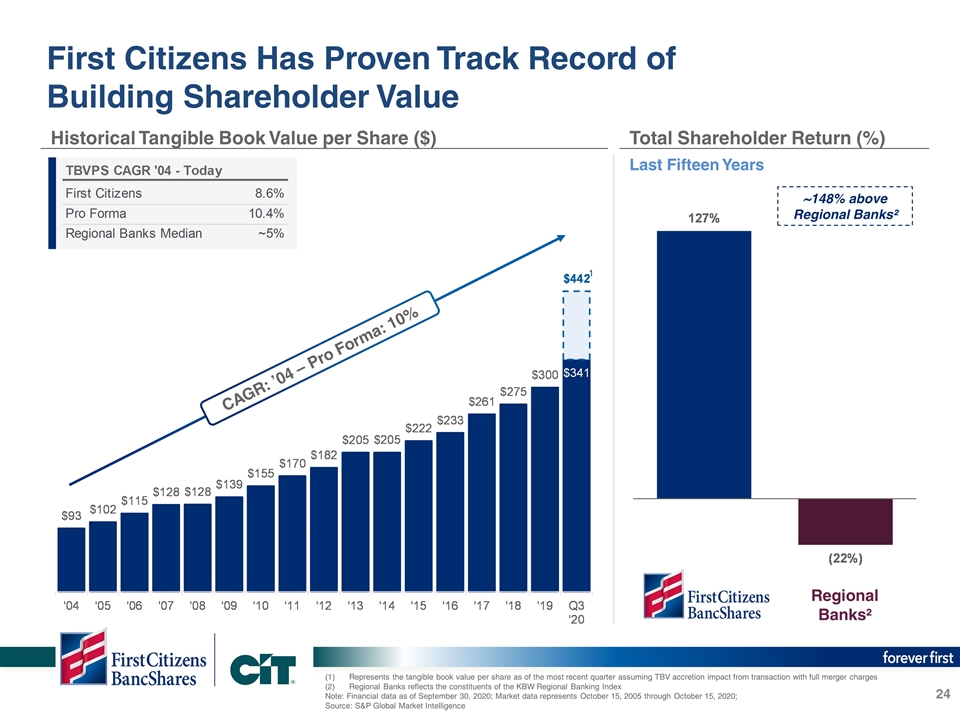

First Citizens Has Proven Track Record of Building Shareholder Value Represents the tangible book value per share as of the most recent quarter assuming TBV accretion impact from transaction with full merger charges Regional Banks reflects the constituents of the KBW Regional Banking Index Note: Financial data as of September 30, 2020; Market data represents October 15, 2005 through October 15, 2020; Source: S&P Global Market Intelligence Historical Tangible Book Value per Share ($) Total Shareholder Return (%) CAGR: ’04 – Pro Forma: 10% Last Fifteen Years Regional Banks² ~148% above Regional Banks² 1