Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMERICOLD REALTY TRUST | art-20201016.htm |

Acquisition of Agro Merchants Group October 2020

Disclaimer This presentation contains statements about future events and expectations that constitute forward-looking statements. Forward-looking statements are based on our beliefs, assumptions and expectations of our future financial and operating performance and growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors that could contribute to these differences include adverse economic or real estate developments in our geographic markets or the temperature-controlled warehouse industry; general economic conditions; uncertainties and risks related to natural disasters, global climate change and public health crises, including the recent and ongoing COVID-19 pandemic; risks associated with the ownership of real estate and temperature-controlled warehouses in particular; defaults or non-renewals of contracts with customers; potential bankruptcy or insolvency of our customers; or the inability of our customers to otherwise perform under their contracts, including as a result of the recent and ongoing COVID-19 pandemic; uncertainty of revenues, given the nature of our customer contracts; increased interest rates and operating costs, including as a result of the recent and ongoing COVID-19 pandemic; our failure to obtain necessary outside financing; risks related to, or restrictions contained in, our debt financings; decreased storage rates or increased vacancy rates; risks related to current and potential international operations and properties; our failure to complete the acquisition of Agro Merchants Group, and if completed, to realize the intended benefits of such acquisition, our failure to realize the intended benefits from our recent acquisitions, including synergies, or disruptions to our plans and operations or unknown or contingent liabilities related to our recent acquisitions; our failure to successfully integrate and operate acquired or developed properties or businesses, including Agro Merchants Group; acquisition risks, including the failure of such acquisitions to perform in accordance with projections; risks related to expansions of existing properties and developments of new properties, including failure to meet budgeted or stabilized returns within expected time frames, or at all, in respect thereof; difficulties in expanding our operations into new markets, including international markets; risks related to the partial ownership of properties, including as a result of our lack of control over such investments and the failure of such entities to perform in accordance with projections; our failure to maintain our status as a REIT; our operating partnership’s failure to qualify as a partnership for federal income tax purposes; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently or previously owned by us; financial market fluctuations; actions by our competitors and their increasing ability to compete with us; labor and power costs; changes in real estate and zoning laws and increases in real property tax rates; the competitive environment in which we operate; our relationship with our employees, including the occurrence of any work stoppages or any disputes under our collective bargaining agreements and employee related litigation; liabilities as a result of our participation in multi-employer pension plans; losses in excess of our insurance coverage; the cost and time requirements as a result of our operation as a publicly traded REIT; changes in foreign currency exchange rates; the impact of anti-takeover provisions in our constituent documents and under Maryland law, which could make an acquisition of us more difficult, limit attempts by our shareholders to replace our trustees and affect the price of our common shares of beneficial interest, $0.01 par value per share, or our common shares; the potential dilutive effect of our common share offerings; and risks related to any forward sale agreement, including the various forward sale agreements that we have entered into since September 2018, including substantial dilution to our earnings per share or substantial cash payment obligations. Words such as “anticipates,” “believes,” “continues,” “estimates,” “expects,” “goal,” “objectives,” “intends,” “may,” “opportunity,” “plans,” “potential,” “near- term,” “long-term,” “projections,” “assumptions,” “projects,” “guidance,” “forecasts,” “outlook,” “target,” “trends,” “should,” “could,” “would,” “will” and similar expressions are intended to identify such forward-looking statements. Examples of forward-looking statements included in this presentation include, among others, statements about our expected expansion and development pipeline and our targeted return on invested capital on expansion and development opportunities. We qualify any forward-looking statements entirely by these cautionary factors. Other risks, uncertainties and factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019; our Quarterly Report on From 10-Q for the quarter ended March 31,2020 and our other reports filed with the Securities and Exchange Commission, could cause our actual results to differ materially from those projected in any forward-looking statements we make. We assume no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. 1

Agro at a Glance Agro provides COLD with a strategically located footprint in Europe and complementary operations in other geographies Fourth largest temperature-controlled warehouse company in the global market1, third largest in Europe1 2 and fourth largest in the US providing cold storage Charlotte, NC Pedricktown, NJ (2) Benson, NC warehouse infrastructure and complementary value- Vineland, NJ Goldsboro, NC added services Lumberton, NC Carson, CA Nashville Lurgan (3) Charleston, SC Monaghan (2) Whitchurch (2) Gdansk / Savannah, GA Barneveld (2) Gdynia 46 Dublin TOTAL Westland Urk (2) 3 21 Owned Atlanta, GA (3) Rotterdam FACILITIES Forest, MS Maasvlakte 25 Leased Hattiesburg, MS Oxford, AL 10 COUNTRIES Vienna REFRIGERATED 46 FACILITIES CUBIC FEET3 ~236mm Barcelona (2) Porto / Leixoes SQUARE FEET3 ~8.4mm Lisbon Valencia Sines Algeciras NUMBER OF CUSTOMERS 2,900+ Rest of World Rest of World 3% 4% Brisbane (2) United States United States 40% 39% YTD 6/30/20 YTD 6/30/20 TOTAL REVENUE TOTAL NOI Santiago, CL $250mm $55mm United States Europe Europe Europe 57% 57% Rest of World JV Investment3 Note: Figures are as of June 30, 2020 and do not include expansions and any potential new builds. (1) 2020 IARW Global Top 25 List (July 2020), per GCCA website. Total capacity from 2020 GCCA Global Cold Storage Capacity Report (August 2020). (2) 2020 IARW North American Top 25 List (June 2020), per GCCA website. U.S. only. Total capacity from 2020 GCCA Global Cold Storage Capacity Report (August 2020). 2 (3) Facilities, cubic feet, and square feet excludes Oakland, CA facility (discontinued) and 22.1% minority stake in Comfrio Soluções Logística, Brazil joint-venture.

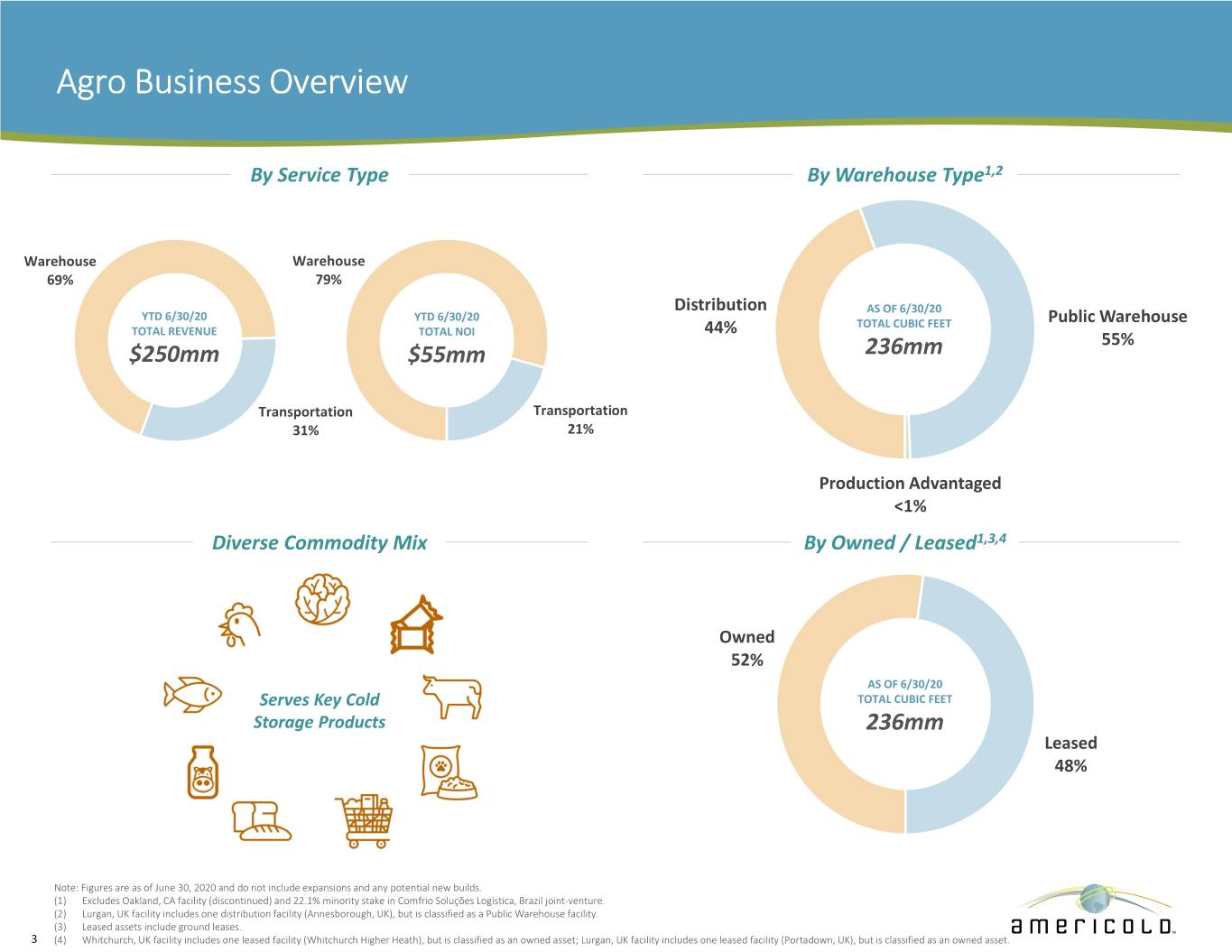

Agro Business Overview By Service Type By Warehouse Type1,2 Warehouse Warehouse 69% 79% Distribution AS OF 6/30/20 YTD 6/30/20 YTD 6/30/20 Public Warehouse 44% TOTAL CUBIC FEET TOTAL REVENUE TOTAL NOI 55% $250mm $55mm 236mm Transportation Transportation 31% 21% Production Advantaged <1% Diverse Commodity Mix By Owned / Leased1,3,4 Owned 52% AS OF 6/30/20 Serves Key Cold TOTAL CUBIC FEET Storage Products 236mm Leased 48% Note: Figures are as of June 30, 2020 and do not include expansions and any potential new builds. (1) Excludes Oakland, CA facility (discontinued) and 22.1% minority stake in Comfrio Soluções Logística, Brazil joint-venture. (2) Lurgan, UK facility includes one distribution facility (Annesborough, UK), but is classified as a Public Warehouse facility. (3) Leased assets include ground leases. 3 (4) Whitchurch, UK facility includes one leased facility (Whitchurch Higher Heath), but is classified as an owned asset; Lurgan, UK facility includes one leased facility (Portadown, UK), but is classified as an owned asset.

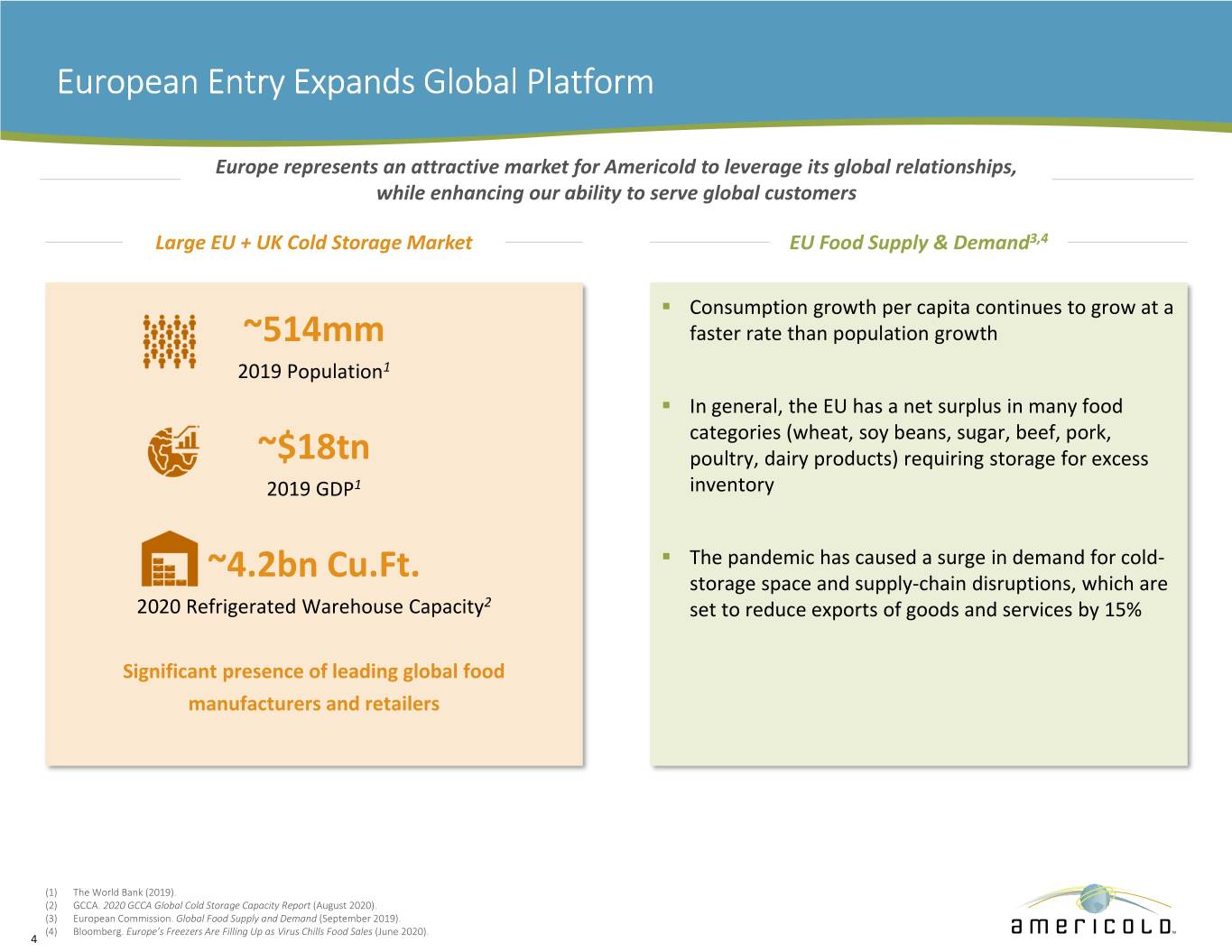

European Entry Expands Global Platform Europe represents an attractive market for Americold to leverage its global relationships, while enhancing our ability to serve global customers Large EU + UK Cold Storage Market EU Food Supply & Demand3,4 . Consumption growth per capita continues to grow at a ~514mm faster rate than population growth 2019 Population1 . In general, the EU has a net surplus in many food categories (wheat, soy beans, sugar, beef, pork, ~$18tn poultry, dairy products) requiring storage for excess 2019 GDP1 inventory . The pandemic has caused a surge in demand for cold- ~4.2bn Cu.Ft. storage space and supply-chain disruptions, which are 2020 Refrigerated Warehouse Capacity2 set to reduce exports of goods and services by 15% Significant presence of leading global food manufacturers and retailers (1) The World Bank (2019). (2) GCCA. 2020 GCCA Global Cold Storage Capacity Report (August 2020). (3) European Commission. Global Food Supply and Demand (September 2019). (4) Bloomberg. Europe’s Freezers Are Filling Up as Virus Chills Food Sales (June 2020). 4

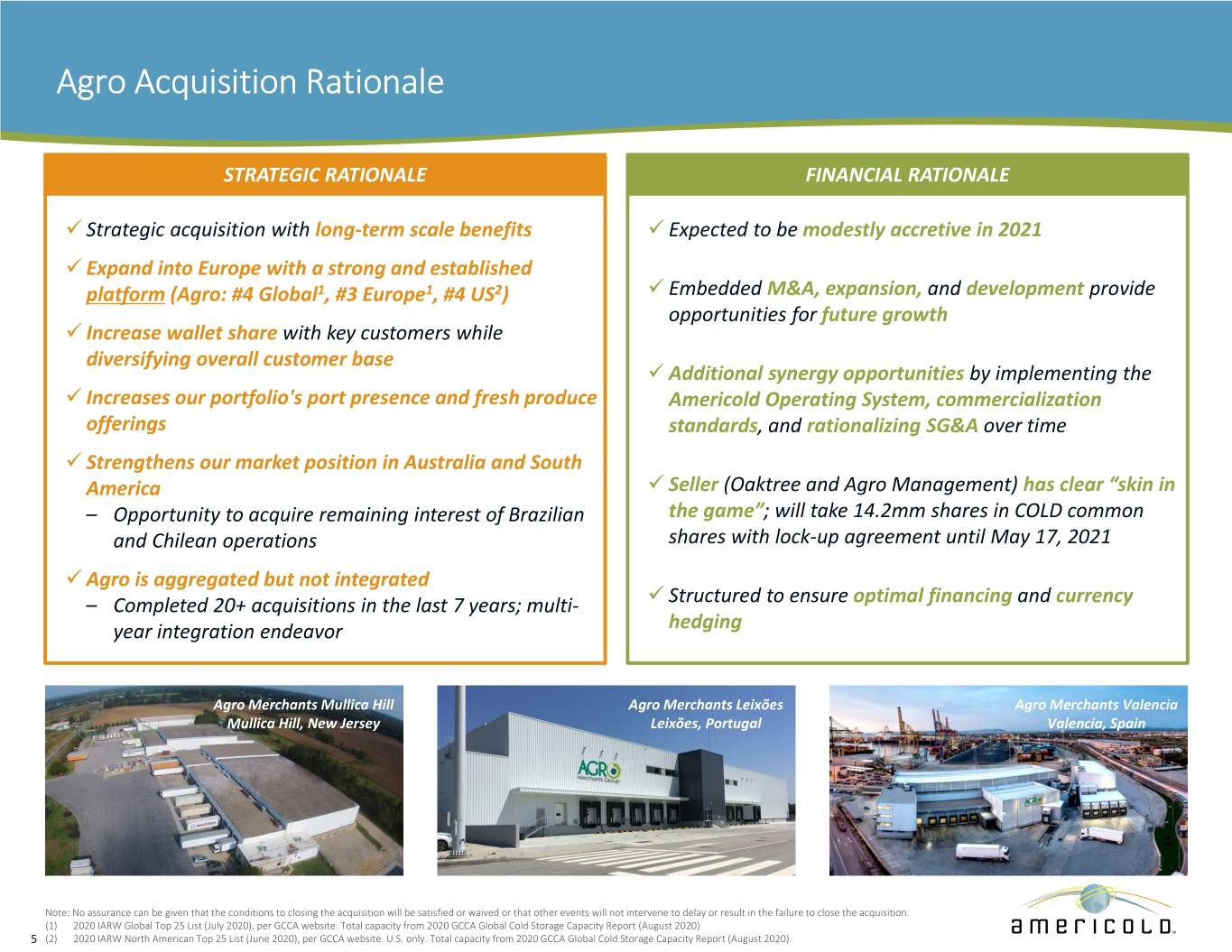

Agro Acquisition Rationale STRATEGIC RATIONALE FINANCIAL RATIONALE Strategic acquisition with long-term scale benefits Expected to be modestly accretive in 2021 Expand into Europe with a strong and established platform (Agro: #4 Global1, #3 Europe1, #4 US2) Embedded M&A, expansion, and development provide opportunities for future growth Increase wallet share with key customers while diversifying overall customer base Additional synergy opportunities by implementing the Increases our portfolio's port presence and fresh produce Americold Operating System, commercialization offerings standards, and rationalizing SG&A over time Strengthens our market position in Australia and South America Seller (Oaktree and Agro Management) has clear “skin in – Opportunity to acquire remaining interest of Brazilian the game”; will take 14.2mm shares in COLD common and Chilean operations shares with lock-up agreement until May 17, 2021 Agro is aggregated but not integrated – Completed 20+ acquisitions in the last 7 years; multi- Structured to ensure optimal financing and currency year integration endeavor hedging Agro Merchants Mullica Hill Agro Merchants Leixões Agro Merchants Valencia Mullica Hill, New Jersey Leixões, Portugal Valencia, Spain Note: No assurance can be given that the conditions to closing the acquisition will be satisfied or waived or that other events will not intervene to delay or result in the failure to close the acquisition. (1) 2020 IARW Global Top 25 List (July 2020), per GCCA website. Total capacity from 2020 GCCA Global Cold Storage Capacity Report (August 2020). 5 (2) 2020 IARW North American Top 25 List (June 2020), per GCCA website. U.S. only. Total capacity from 2020 GCCA Global Cold Storage Capacity Report (August 2020).

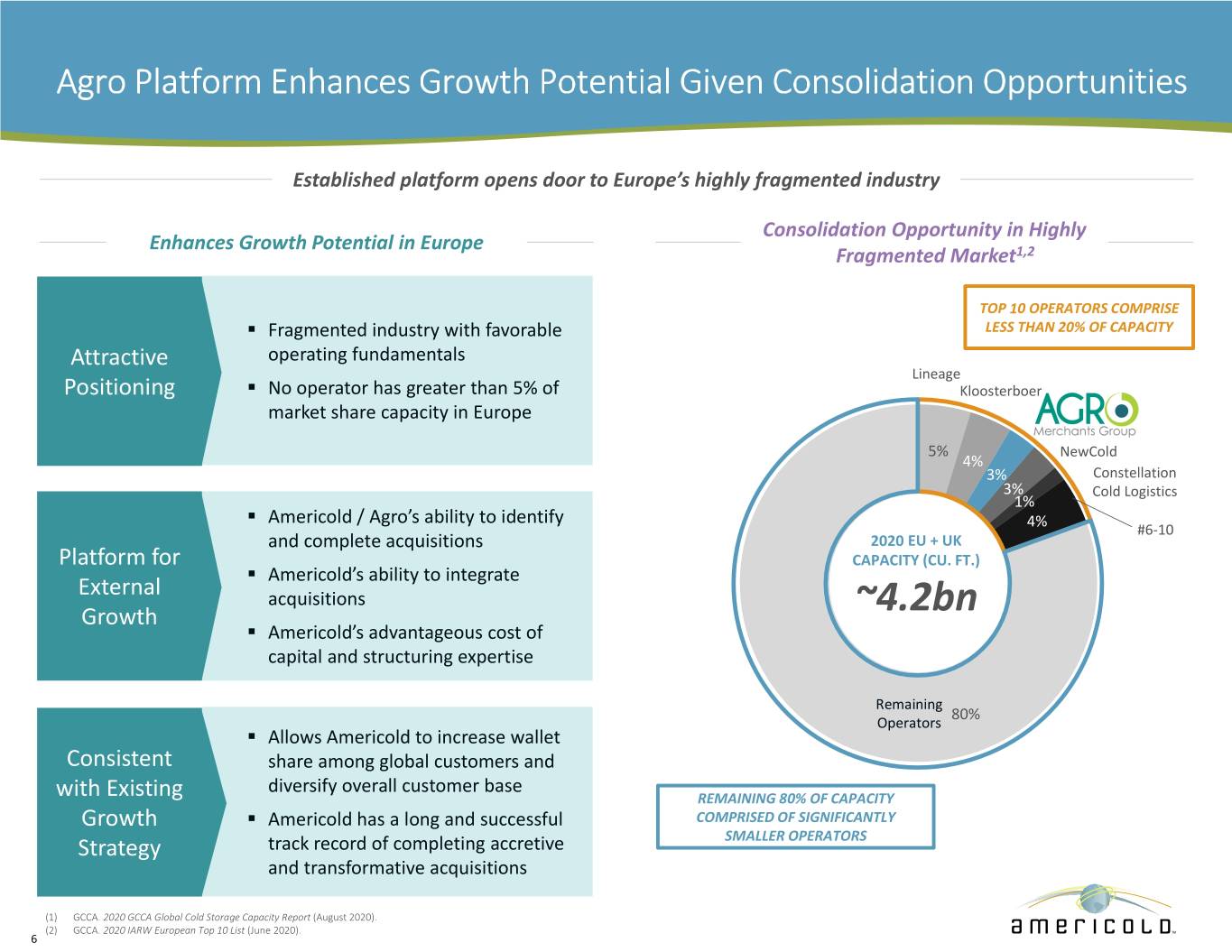

Agro Platform Enhances Growth Potential Given Consolidation Opportunities Established platform opens door to Europe’s highly fragmented industry Consolidation Opportunity in Highly Enhances Growth Potential in Europe Fragmented Market1,2 TOP 10 OPERATORS COMPRISE . Fragmented industry with favorable LESS THAN 20% OF CAPACITY Attractive operating fundamentals Lineage Positioning . No operator has greater than 5% of Kloosterboer market share capacity in Europe 5% NewCold 4% 3% Constellation 3% Cold Logistics 1% . Americold / Agro’s ability to identify 4% #6-10 and complete acquisitions 2020 EU + UK Platform for CAPACITY (CU. FT.) . Americold’s ability to integrate External acquisitions Growth ~4.2bn . Americold’s advantageous cost of capital and structuring expertise Remaining 80% Operators . Allows Americold to increase wallet Consistent share among global customers and diversify overall customer base with Existing REMAINING 80% OF CAPACITY Growth . Americold has a long and successful COMPRISED OF SIGNIFICANTLY SMALLER OPERATORS Strategy track record of completing accretive and transformative acquisitions (1) GCCA. 2020 GCCA Global Cold Storage Capacity Report (August 2020). (2) GCCA. 2020 IARW European Top 10 List (June 2020). 6

Complementary Global Network, Providing Strategic Entry into Europe COLD Agro COLD Countries Agro Countries COLD / Agro Countries JV Investment1 PRO FORMA PORTFOLIO1 NA EUR ROW2 TOTAL TOTAL 185 26 18 229 FACILITIES REFRIGERATED 1,148mm 111mm 87mm 1,346mm CUBIC FEET BUILDING 46.9mm 4.0mm 2.7mm 53.6mm SQUARE FEET Note: Figures are as of June 30, 2020 and do not include expansions and any potential new builds (1) Excludes Americold's 14.99% interest in Brazilian joint-venture, Agro’s 22.1% interest in Comfrio Soluções Logística, Brazil joint-venture, and Agro’s Oakland, CA facility (discontinued). 7 (2) Rest of World includes Argentina, Chile, Australia and New Zealand.

Pro Forma COLD Portfolio Snapshot Pro Forma Total Revenue Pro Forma Total NOI Warehouse Warehouse 76% 91% YTD 6/30/20 YTD 6/30/20 Transportation TOTAL REVENUE 12% TOTAL NOI $1,216mm $319mm Transportation 7% Third-Party Managed Third-Party Managed 11% 2% Other Other <1% <1% 8

Pro Forma COLD Global Warehouse Portfolio COLD AGRO COMBINED NUMBER OF WAREHOUSE SEGMENT FACILITIES 1721 462 218 REFRIGERATED CUBIC FEET CAPACITY 1,057mm1 236mm2 1,293mm1 TOTAL PALLET POSITIONS (CAPACITY) 4.0mm1 0.9mm2 4.9mm WAREHOUSE REVENUE (YTD 6/30/20) $753mm $172mm $926mm AVERAGE ECONOMIC OCCUPANCY (YTD 6/30/20) 79.7% 85.7% 80.7% PF Warehouse Revenue PF Cubic Feet Capacity1,2 by Region by Region North America North America 80% 85% YTD 6/30/20 AS OF 6/30/20 WAREHOUSE REVENUE TOTAL CUBIC FEET Europe Europe $926mm 9% 1,293mm 9% Rest of World3 3 Rest of World 7% 12% Note: COLD Warehouse NOI excludes Third-Party Managed NOI. (1) Excludes COLD’s 11 Third-Party Managed Facilities. (2) Excludes Oakland, CA and 22.1% minority interest in Comfrio Soluções Logística, Brazil and includes Santiago, CL at 100% share (65% ownership). 9 (3) Includes Australia, New Zealand, Chile, Argentina, and Brazil.

Growth Strategy – Expansion and Development Expansion and Development Opportunities 1 COLD AGRO COMBINED Lurgan, Northern Ireland Expansion Atlanta, GA Plainville, CT Dublin, Ireland Expansion Auckland, New Zealand Lancaster, PA Dublin, Ireland Greenfield Total Estimated Costs² Under Total Estimated Costs² Total Estimated Costs² Construction ~$574mm ~$529mm ~$45mm 6 Expansions 1 Greenfield Development 4 Expansions 2 Expansions 1 Greenfield Development Current Estimated Investment Estimated Investment4 Estimated Investment Expansion and $1bn+ $125mm+ $1.25bn+ Development Includes both customer-specific 3 Pipeline and market-demand Expansion + Opportunities Customer-Specific Market-Demand (1) As of June 30, 2020; no assurance can be given that the actual cost or completion dates of any expansions or developments will not exceed our estimate. (2) Reflects management’s estimate of cost of completion as of June 30, 2020. (3) These future pipeline opportunities are at various stages of discussion and consideration and, based on historical experiences, many of them may not be pursued or completed as contemplated or at all. 10 (4) Based on potential future investment opportunities. No assurance can be given regarding actual completion as Company may not pursue.

Dublin Expansion and Greenfield Development Development Overview EXPANSION GREENFIELD DEVELOPMENT . Acquired existing Dublin facility in Sept 2019 . Pre-mobilization phase of a ~$33mm greenfield development expected to be completed by Oct 2021 . Began ~$7mm expansion project in May 2020; expected to be completed by Dec 2020 . Project site of 13.5 acres sits adjacent to Dublin facility . Facility to focus on transport and cross-dock operations; . Two-phase development project expected to have 35k+ limited storage space pallets . Expands cross-docking space for current customer . Land under LOI and non-binding LOIs from customers with pricing have been secured Strategic Rationale . The decision to expand the Dublin operations is driven by both customer and market forces ̶ Due to Brexit, Dublin's position as a logistics hub has increased ̶ Opportunity to expand wallet share among key players in Irish food market . Integration with existing transportation business in Dublin will make Agro a one-stop-shop facility for customers . Ideal location with proximity to major port would allow the Dublin Hub to serve England and Wales . Agro will maintain its market leading position in Ireland . Project NOI yield consistent with COLD underwriting standards 11 Note: No assurance can be given that the actual cost or completion dates of any expansions or developments will not exceed our estimate, or that targeted returns will be achieved.

Sources & Uses ($ in millions) SOURCES USES Sources $ % Uses $ % New Gross Equity Raised 1 $1,394 58% New Equity Consideration to Oaktree 2 $554 23% New Equity Consideration to Oaktree 2 554 23% Cash Consideration to Oaktree 519 22% Debt Private Placement 325 14% Repayment of Existing Net Indebtedness 3 477 20% Assumed Sale Leaseback Financing Obligations 3 74 3% Assumed Sale Leaseback Financing Obligations 3 74 3% Assumed Capitalized Lease Obligations 3 36 2% Assumed Capitalized Lease Obligations 3 36 2% Assumed Non-Cash Debt-Like Items 3 14 1% Deferred CapEx 30 1% Assumed Debt-Like Items 3 14 1% Debt-Like Items to be Settled in Cash 3 37 2% Total Agro $1,740 73% Transaction Expenses4 90 4% IT Integration and Startup Costs 46 2% Pre-Fund Potential Future Growth Initiatives 521 22% Total Other Uses $657 27% Total Sources $2,397 100% Total Uses $2,397 100% Leverage Metrics Metric PF Metric Net Debt / LTM 06/30/20 PF Core EBITDA 4.1x 4.2x 5 (1) Inclusive of overallotment option. (2) Equity consideration to Oaktree of $554mm based on 14.2mm shares issued to Oaktree and COLD closing share price on October 12, 2020 of $39.13. (3) As of August 31st, 2020 for acquisition value purposes. (4) Includes gross spread on equity issued, advisor fees, financing and due diligence costs and other transaction costs. 12 (5) Based on Agro 2020E Adjusted EBITDA.

Pro Forma Capitalization COLD Transaction (1) PF COLD As of 06/30/2020 Adjustments1 As of 06/30/2020 Share Price (as of 10/12/2020) $39.13 $39.13 Fully Diluted Shares Outstanding (as of 06/30/2020) 208.4 38.92 247.3 Equity Market Capitalization $8,153 $9,676 Debt Revolving Credit Facility ($800mm Capacity) $ -- -- $ -- Term Loans 609 -- 609 New Private Placement 3 -- 325 325 Series A 4.68% notes due 2026 200 -- 200 Series B 4.86% notes due 2029 400 -- 400 Series C 4.10% notes due 2030 350 -- 350 Mortgage Notes 280 -- 280 Sale Leaseback Financing Obligations 114 744 188 Capitalized Lease Obligations 73 324 105 Total Debt $2,025 $2,456 (-) Cash and Cash Equivalents (299) (65)4 (363) Net Debt $1,727 $2,093 Total Enterprise Value (TEV) $9,879 $11,769 Outstanding Forwards 5 $151 $438 $588 Leverage Metrics: Net Debt / LTM 06/30/20 PF Core EBITDA 4.1x 4.2x6 Net Debt / TEV 17.5% 17.8% Note: Figures in millions, except per share. COLD figures based on company filings as of 6/30/2020. Capitalization excludes net proceeds from 2018 Forwards (outstanding settlement date of no later than 3/20/2022), the 2020 forwards under the Company’s ATM program and 2020 Forwards (outstanding settlement date of no later than 7/2021). The Company may settle the forwards by issuing new shares or may instead elect to cash settle or net share settle all or a portion of the forward shares. (1) Represents impact from the Agro transaction and other developments. (2) Represents the sum of 36.7mm shares (including overallotment option) issued as part of offering and ~14.2mm shares issued to Oaktree as part of the acquisition, less ~12mm shares issued as forwards expected to be outstanding following the offering. (3) There can be no assurance that we will be able to complete the debt private placement on satisfactory terms or at all. (4) As of June 30th, 2020. (5) Represents COLD existing 2018 forwards of $134mm, existing 2020 forwards of $17mm, and new outstanding forwards of $438mm from this transaction. 13 (6) Based on Agro 2020E Adjusted EBITDA.

Pro Forma Debt Maturity Debt Maturity1 Debt Profile % of – – – 15% – 33% 11% – – 22% 19% 18% Investment grade ratings: Baa3 (Moody’s), BBB (Fitch / DBRS Morningstar) Debt Maturing Debt Type Rate Type 3 2013 Mortgage Loans $284 $573 2 Floating Undrawn Revolver Secured 12% Unsecured Term Loan A-2 23% Unsecured Term Loan A-1 Series A 4.68% Unsecured Notes 77% 88% Series B 4.86% Unsecured Notes $1,884 Unsecured Series C 4.10% Unsecured Notes $2,173 Fixed New Unsecured Notes $184 Liquidity 4 2018 Forward Significant Liquidity: ~$1.7bn Proceeds 5 $425 $400 $350 2020 $134 $280 $325 – $800mm Undrawn Senior $200 Forward 8% Unsecured Revolving Credit Proceeds6 Facility $17 1% 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Revolver TOTAL 45% Availability . Interest Rate: L + 85 bps LIQUIDITY 2020 New 25% $777 Minimal near-term debt Forward $1.7bn maturities Proceeds $438 21% Note: Dollars in millions except per share figures. Figures based on company filings as of June 30, 2020. Cash (1) Reflects the principal due each period and does not adjust for amortization of principal balances. Excludes sale leaseback $363 financing and capitalized lease obligations. (2) Revolver maturity date assumes the exercise of two six month extension options. (3) Reflects impact of swap agreement effective January 31, 2019 on $100mm of the Unsecured Term Loan principal at a rate of 2.48% and swap agreement effective August 15, 2019 on $225mm of the Unsecured Term Loan principal at a rate of 1.30%. (4) Figure reflects cash, forward proceeds and the capacity available under the Senior Unsecured Revolving Credit Facility less ~$23mm in letters of credit. (5) Assumes the issuance of ~6mm common shares upon the full physical settlement of the 2018 forward sale agreement. (6) Assumes the issuance of ~0.5mm common shares upon the full physical settlement of the 2020 forward sale agreements 14 (in connection with the ATM program).

Enhancing COLD’s Global Platform: Agro Acquisition Highlights Strategic acquisition with long-term scale benefits Expand into Europe with a strong and established platform Increases wallet share with key customers while diversifying overall customer base Increases port presence and fresh produce offerings Embedded M&A, expansion, and development provide opportunities for future growth Strengthens our market position in South America and Australia Additional synergy opportunities by implementing the Americold Operating System, commercialization standards, and rationalizing SG&A over time Expected to be modestly accretive in 2021 Seller has clear “skin in the game” 15