Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Grayscale Bitcoin Trust (BTC) | d30818d8k.htm |

Exhibit 99.1

Digital Asset Investment Report Q3 2020 grayscale.co

Digital Asset Investment $TOTAL 5.9B AUM1 Report 3Q20 Highlights2 Total Investment into Grayscale Products: $1.05 billion Average Weekly Investment – All Products: $80.5 million Average Weekly Investment – Grayscale® Bitcoin Trust: $55.3 million Average Weekly Investment – Grayscale® Ethereum Trust: $15.6 million Average Weekly Investment – Grayscale® Digital Large Cap Fund: $3.5 million Average Weekly Investment – Grayscale Products ex Bitcoin Trust3: $25.2 million Majority of investment (81%) came from institutional investors, dominated by hedge funds. Trailing 12-Month (“T12M”) Highlights4 Total Investment into Grayscale Products: $2.7 billion Average Weekly Investment – All Products: $51.6 million Average Weekly Investment – Grayscale® Bitcoin Trust: $39.5 million5 Average Weekly Investment – Grayscale® Ethereum Trust: $9.0 million Average Weekly Investment – Grayscale® Digital Large Cap Fund: $1.1 million6 Average Weekly Investment – Grayscale Products ex Bitcoin Trust: $12.1 million Majority of investment (80%) came from institutional investors, dominated by hedge funds. The Takeaway Billion Dollar Quarter: Grayscale recorded its largest ever quarterly inflows, over $1.0 billion in 3Q20, making it the third consecutive record-breaking quarter. Year-to-date investment into the Grayscale family of products has surpassed $2.4 billion, more than double the $1.2 billion cumulative inflow into the products from 2013-2019. Cumulative investment across the Grayscale family of products since inception now totals $3.6 billion.7 1. As of September 30, 2020. 2. For the period from July 1, 2020 through September 30, 2020. 3. “Grayscale Products ex Bitcoin Trust” include Grayscale Bitcoin Cash Trust, Grayscale Ethereum Trust, Grayscale Ethereum Classic Trust, Grayscale Horizen Trust, Grayscale Litecoin Trust, Grayscale Stellar Lumens Trust, Grayscale XRP Trust, Grayscale Zcash Trust, and Grayscale Digital Large Cap Fund. 4. For the period from October 1, 2019 through September 30, 2020. 5. Grayscale Bitcoin Trust was periodically closed to new investment during the measured period. 6. Grayscale Digital Large Cap Fund was periodically closed to new investment during the measured period. 7. Inception date: September 25, 2013. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. ASSETS UNDER MANAGEMENT (AUM), INFLOWS, TOTAL INVESTMENT AND AVERAGE WEEKLY INVESTMENT ARE CALCULATED USING THE DIGITAL ASSET REFERENCE RATE FOR EACH PRODUCT, WHICH ARE NOT MEASURES CALCULATED IN ACCORDANCE WITH GAAP. SEE NON-GAAP MEASURES FOR MORE INFORMATION. UNLESS OTHERWISE NOTED, ALL FIGURES INCLUDED HEREIN ARE CALCULATED USING NON-GAAP METHODOLOGIES. 2 ©2020 Grayscale Investments, LLC Q3 | 2020 Digital Asset Investment Report

Q3 2020 Digital Asset Investment Report Grayscale Bitcoin Trust Among Fastest Growing Investment Products: Grayscale Bitcoin Trust experienced inflows of $719.3 million during 3Q20. The Trust has seen its assets under management (“AUM”) surge from $1.9 billion to $4.8 billion YTD. Grayscale Bitcoin Trust does not operate a redemption program and its shares do not trade on a national securities exchange. The trust is therefore not an ETP or ETF. Still, if the Trust were compared to global ETPs and ETFs with over $1B AUM at the start of the year, it would rank as the third-fastest growing product YTD with an AUM increase of approximately 147%.8 Ex-Bitcoin Products Continue to Gain Momentum: While Bitcoin continues to be a major part of Grayscale investor allocations, the most notable uptick in growth comes from products that hold alternative assets. Products excluding Bitcoin accounted for 31% of inflows during 3Q20. Unprecedented Demand for BCH, LTC, and DLC: Among alternative products, the most notable increase in appetite has emerged for Grayscale® Bitcoin Cash Trust, Grayscale® Litecoin Trust, and Grayscale® Digital Large Cap Fund. On average, the aforementioned products saw inflows increase by more than 1,400% quarter-over-quarter. These developments followed FINRA’s verification in July that the required diligence to begin quoting the Bitcoin Cash and Litecoin products pursuant to Rule 15c2-11 under the Securities Exchange Act of 1934, as amended, had been completed. Ethereum-Focused Institutional Investors: Grayscale Ethereum Trust has garnered the attention of a new segment of Ethereum-focused institutional allocators. During 3Q20, over 17% of inflows into the Grayscale Ethereum Trust came from new institutional investors. Grayscale Bitcoin Trust Inflows Gaining Ground on Mined Bitcoin: Inflows into Grayscale Bitcoin Trust were proportional to approximately 77% of the total Bitcoin mined during 3Q20. While mining continuously introduces supply to the market, a similar proportion of supply is being removed from the market through investment into Grayscale Bitcoin Trust. However, these comparisons are simply to illustrate supply and demand in the market. They do not provide insight into the destination of any newly mined Bitcoin during the measured periods. Institutional Interest is (Still) Growing: More institutions invested in 3Q20 than ever before and have increased their average allocation from $2.2 million in 3Q19 to $2.9 million in 3Q20. Institutions that are comfortable with multiple products within the Grayscale suite of products, have averaged nearly double the commitments of single-product investors during 3Q20. Quarterly Perspective In 3Q20, Grayscale’s family of products significantly outperformed major indices even when taking into account fees, expenses, and other costs associated with the funds. The surge in inflows to Grayscale’s products may be related to the continued outperformance of digital assets, making them more difficult to ignore as a potential portfolio enhancer. 8. Source: Bloomberg. Comparison of exchange traded products with over $1 billion in assets under management on 01/01/2020. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 3

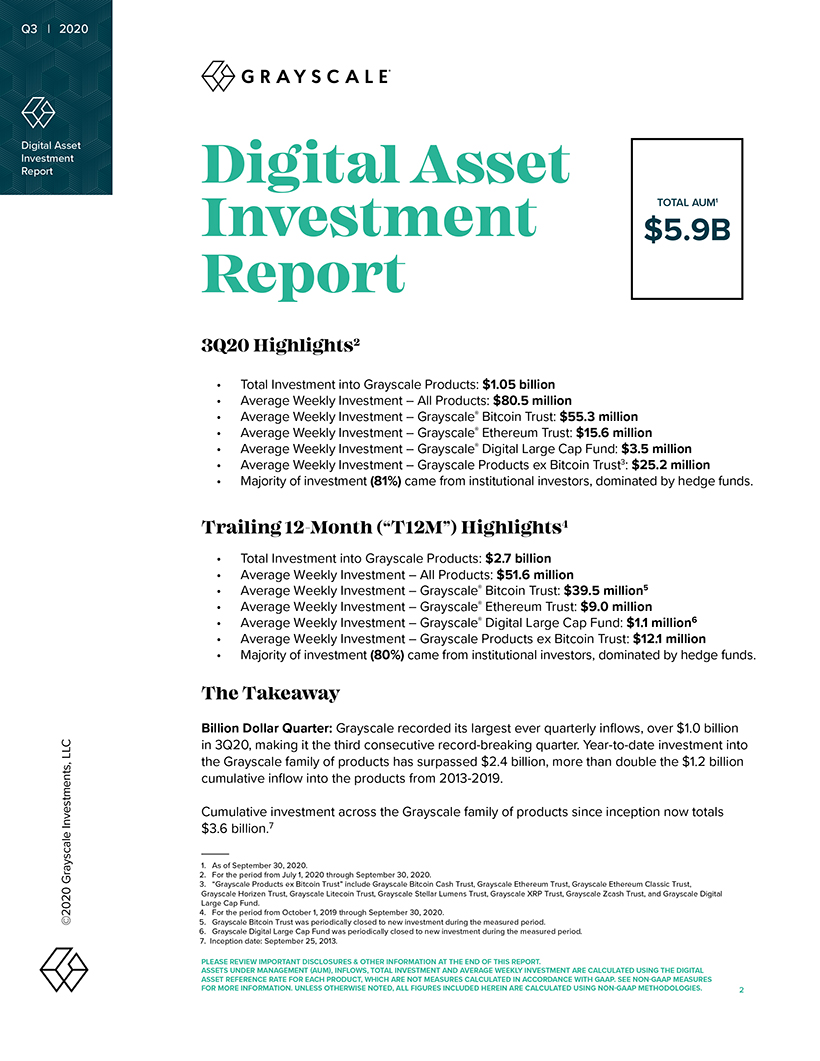

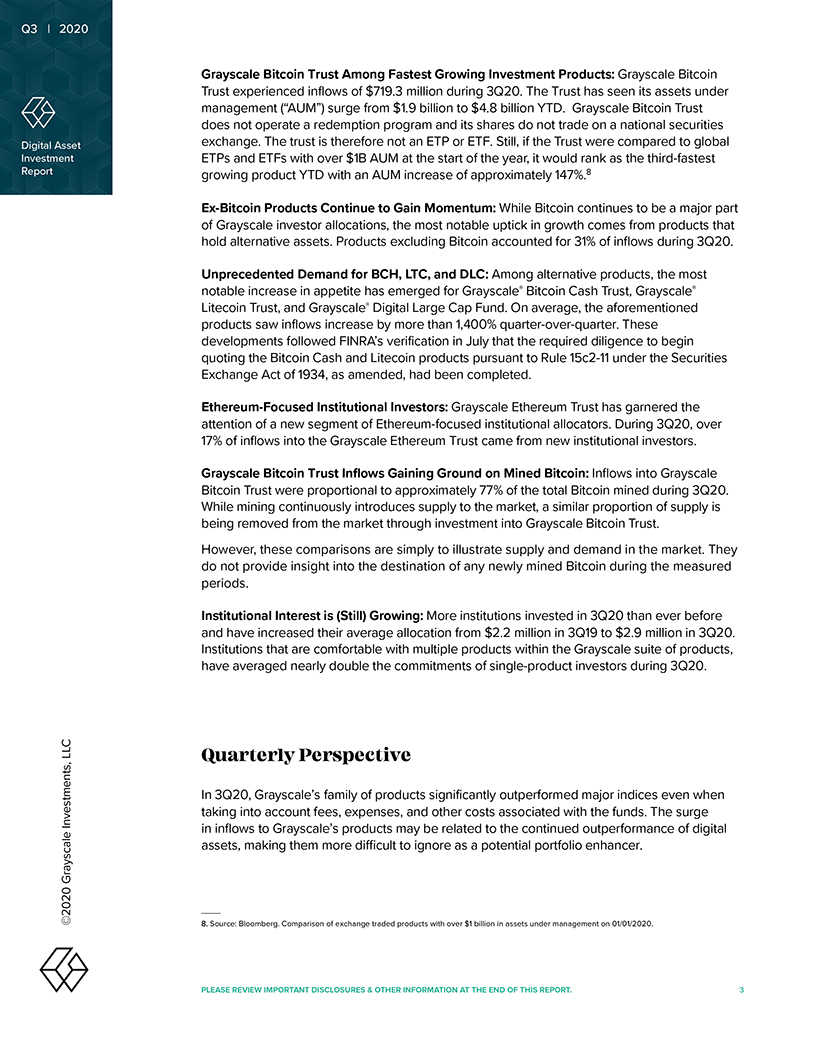

Q3 | 2020 Digital Asset Investment Report FIGURE 1: MULTI-ASSET CLASS PERFORMANCE – 3Q209 JULY 1, 2020 THROUGH SEPTEMBER 30, 2020 Ethereum (ETH) 57% XRP (XRP) 37% Zcash (ZEC) 30% Grayscale Digital Large Cap Fund 22% Bitcoin (BTC) 18% Litecoin (LTC) 12% Stellar Lumens (XLM) 10% Nasdaq Composite 9% MSCI World Index 9% Bloomberg Commodity Index 8% S&P 500 Index 7% COMEX Gold Index 6% Euro (EUR) 4% Chinese Renminbi (RMB) 4% JCME Spot FX Index 3% Swiss Franc (CHF) 3% Bitcoin Cash (BCH) 3% Bloomberg Barclays Global Bond Index 3% Canadian Dollar (CAD) 2% Ethereum Classic (ETC) -5% Russian Ruble (RUB) -9% Horizen (ZEN) -14% Grayscale’s assets under management reached all-time highs during 3Q20, a broad reflection of investment interest in the digital currency asset class. YTD, Grayscale’s AUM increased from $2.0 billion to $5.9 billion, a rise of approximately 195%. FIGURE 2: GRAYSCALE AUM SINCE INCEPTION SEPTEMBER 25, 2013 THROUGH SEPTEMBER 30, 2020 Index Grayscale AUM Growth (Cumulative) 2,566.3x AUM Growth (Annualized) 2.1x $7,000 $6,000 $5,000 MM) $4,000 ( $ AUM $3,000 $2,000 $1,000 $0 13 13 14 - 14 14 - 14 14 14 15 15 - 15 15 15 15 16 16 - 16 16 16 16 - 17 - 17 17 - - 17 - 17 - 17 18 18 18 - 18 18 18 19 19 - 19 19 19 19 20 20 20 20 20 Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep 9. Source: Bloomberg, CoinMarketCap.com, Grayscale. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 4 ©2020 Grayscale Investments, LLC

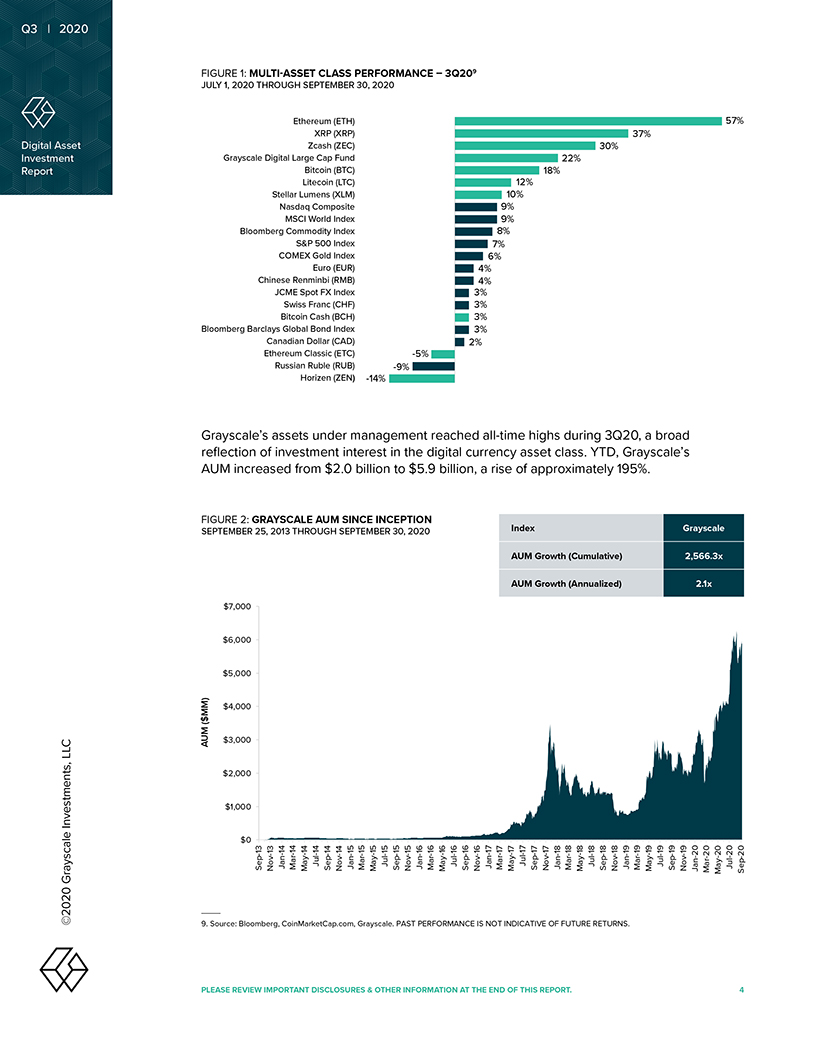

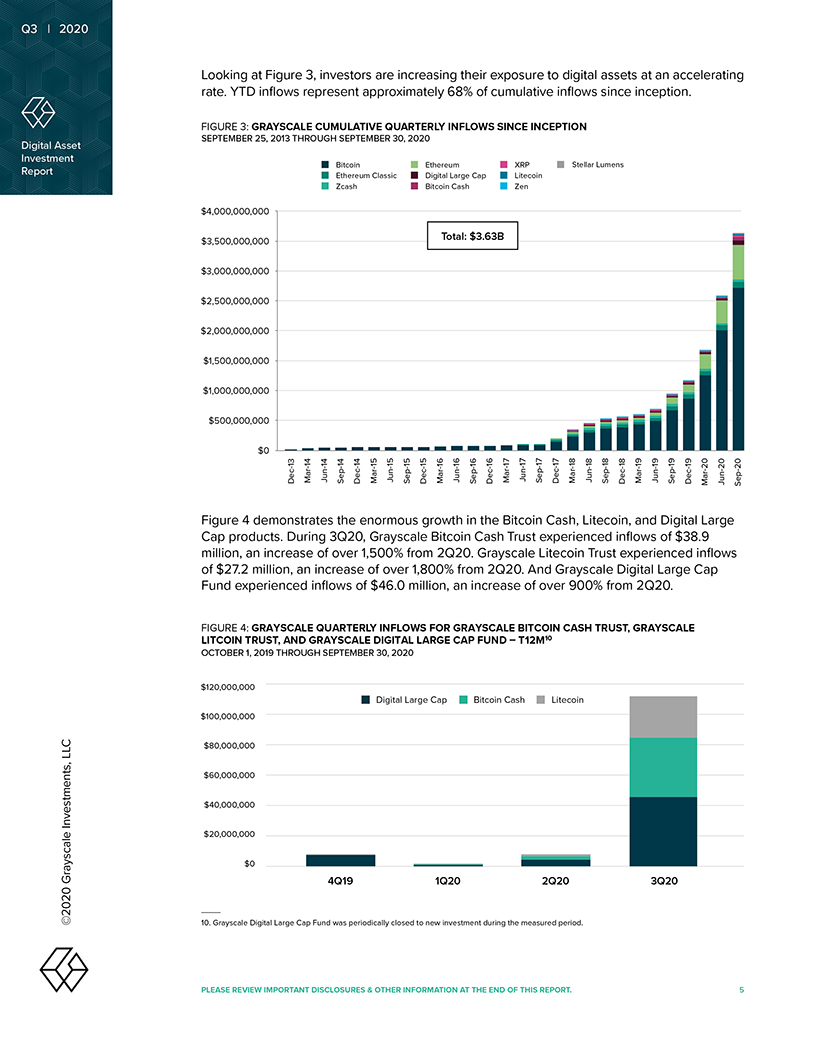

Q3 | 2020 Digital Asset Investment Report Looking at Figure 3, investors are increasing their exposure to digital assets at an accelerating rate. YTD inflows represent approximately 68% of cumulative inflows since inception. FIGURE 3: GRAYSCALE CUMULATIVE QUARTERLY INFLOWS SINCE INCEPTION SEPTEMBER 25, 2013 THROUGH SEPTEMBER 30, 2020 Bitcoin Ethereum XRP Stellar Lumens Ethereum Classic Digital Large Cap Litecoin Zcash Bitcoin Cash Zen $4,000,000,000 $3,500,000,000 Total: $3.63B $3,000,000,000 $2,500,000,000 $2,000,000,000 $1,500,000,000 $1,000,000,000 $500,000,000 $0 13 14 14 14 14 15 15 15 15 16 16 16 16 17 17 17 17 18 18 18 18 19 19 19 19 - Dec Mar - Jun - - Sep - Dec Mar - - Jun - Sep Dec - Mar - - Jun Sep - Dec - - Mar - Jun - Sep Dec - Mar - Jun - Sep - Dec - - Mar - Jun - Sep Dec - - 20 - 20 - 20 Mar Jun Sep Figure 4 demonstrates the enormous growth in the Bitcoin Cash, Litecoin, and Digital Large Cap products. During 3Q20, Grayscale Bitcoin Cash Trust experienced inflows of $38.9 million, an increase of over 1,500% from 2Q20. Grayscale Litecoin Trust experienced inflows of $27.2 million, an increase of over 1,800% from 2Q20. And Grayscale Digital Large Cap Fund experienced inflows of $46.0 million, an increase of over 900% from 2Q20. FIGURE 4: GRAYSCALE QUARTERLY INFLOWS FOR GRAYSCALE BITCOIN CASH TRUST, GRAYSCALE LITCOIN TRUST, AND GRAYSCALE DIGITAL LARGE CAP FUND – T12M10 OCTOBER 1, 2019 THROUGH SEPTEMBER 30, 2020 $120,000,000 Digital Large Cap Bitcoin Cash Litecoin $100,000,000 $80,000,000 $60,000,000 $40,000,000 $20,000,000 $0 4Q19 1Q20 2Q20 3Q20 10. Grayscale Digital Large Cap Fund was periodically closed to new investment during the measured period. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 5 ©2020 Grayscale Investments, LLC

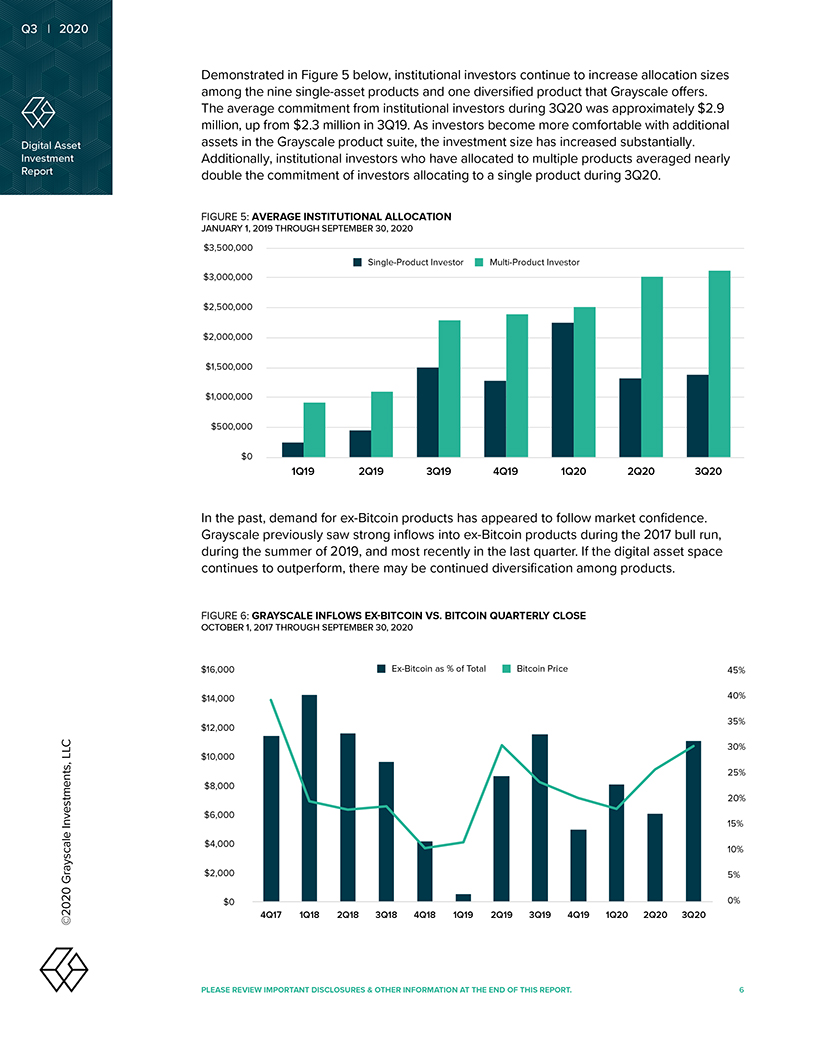

Q3 | 2020 Digital Asset Investment Report Demonstrated in Figure 5 below, institutional investors continue to increase allocation sizes among the nine single-asset products and one diversified product that Grayscale offers. The average commitment from institutional investors during 3Q20 was approximately $2.9 million, up from $2.3 million in 3Q19. As investors become more comfortable with additional assets in the Grayscale product suite, the investment size has increased substantially. Additionally, institutional investors who have allocated to multiple products averaged nearly double the commitment of investors allocating to a single product during 3Q20. FIGURE 5: AVERAGE INSTITUTIONAL ALLOCATION JANUARY 1, 2019 THROUGH SEPTEMBER 30, 2020 $3,500,000 Single-Product Investor Multi-Product Investor $3,000,000 $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 In the past, demand for ex-Bitcoin products has appeared to follow market confidence. Grayscale previously saw strong inflows into ex-Bitcoin products during the 2017 bull run, during the summer of 2019, and most recently in the last quarter. If the digital asset space continues to outperform, there may be continued diversification among products. FIGURE 6: GRAYSCALE INFLOWS EX-BITCOIN VS. BITCOIN QUARTERLY CLOSE OCTOBER 1, 2017 THROUGH SEPTEMBER 30, 2020 $16,000 Ex-Bitcoin as % of Total Bitcoin Price 45% $14,000 40% 35% $12,000 $10,000 30% 25% $8,000 20% $6,000 15% $4,000 10% $2,000 5% $0 0% 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 6 ©2020 Grayscale Investments, LLC

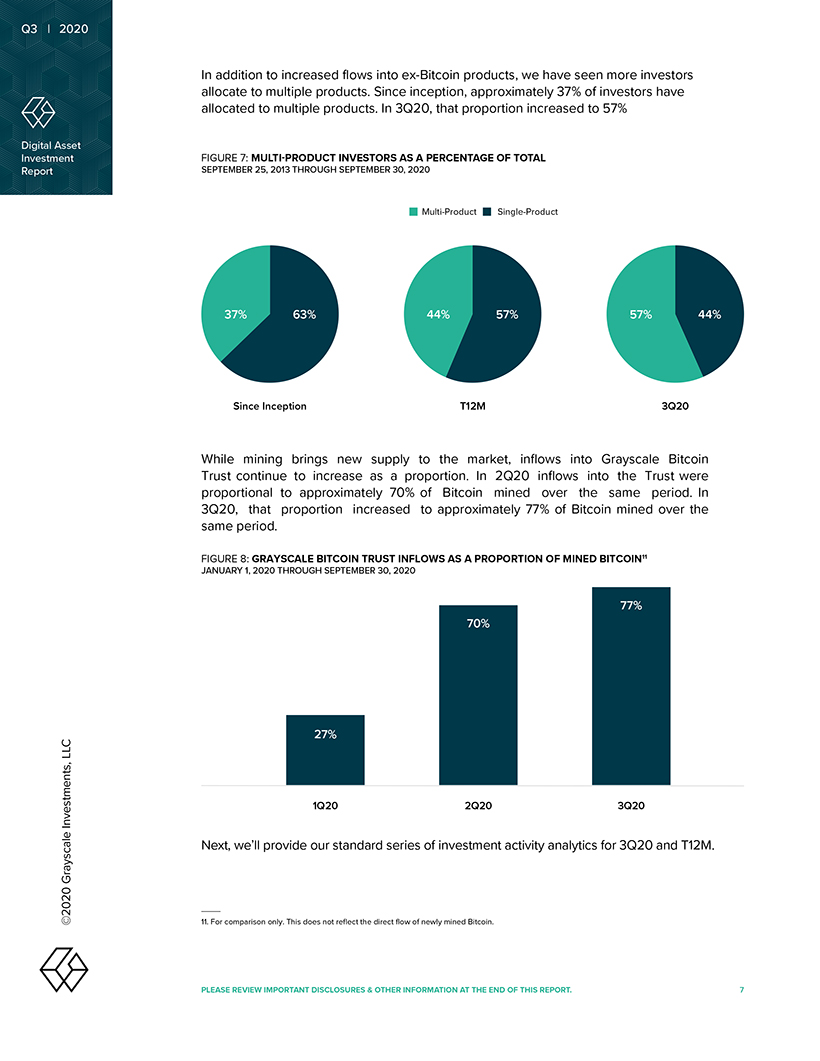

Q3 | 2020 Digital Asset Investment Report In addition to increased flows into ex-Bitcoin products, we have seen more investors allocate to multiple products. Since inception, approximately 37% of investors have allocated to multiple products. In 3Q20, that proportion increased to 57% FIGURE 7: MULTI-PRODUCT INVESTORS AS A PERCENTAGE OF TOTAL SEPTEMBER 25, 2013 THROUGH SEPTEMBER 30, 2020 Multi-Product Single-Product 37% 63% 44% 57% 57% 44% Since Inception T12M 3Q20 While mining brings new supply to the market, inflows into Grayscale Bitcoin Trust continue to increase as a proportion. In 2Q20 inflows into the Trust were proportional to approximately 70% of Bitcoin mined over the same period. In 3Q20, that proportion increased to approximately 77% of Bitcoin mined over the same period. FIGURE 8: GRAYSCALE BITCOIN TRUST INFLOWS AS A PROPORTION OF MINED BITCOIN11 JANUARY 1, 2020 THROUGH SEPTEMBER 30, 2020 77% 70% 27% 1Q20 2Q20 3Q20 Next, we’ll provide our standard series of investment activity analytics for 3Q20 and T12M. 11. For comparison only. This does not reflect the direct flow of newly mined Bitcoin. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 7 ©2020 Grayscale Investments, LLC

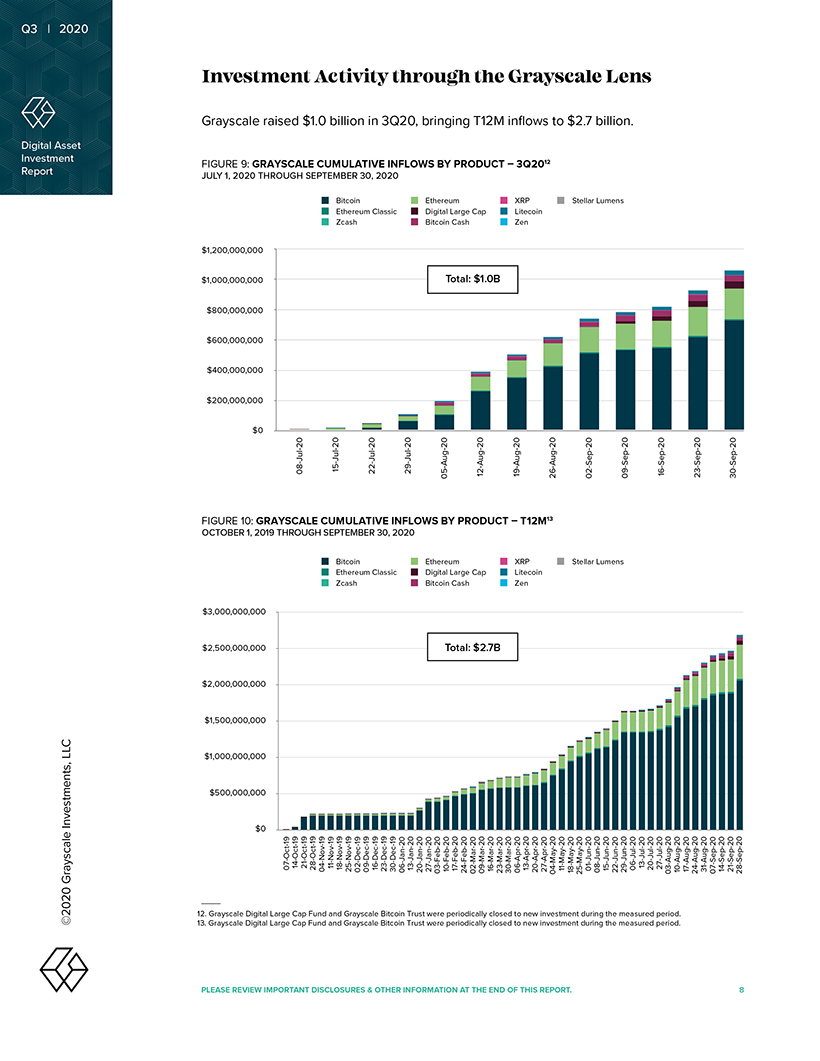

Q3 | 2020 Digital Asset Investment Report 13.12. $ $ $ $ $ $ $ $ $ $ $ $ JULY PLEASE 1, FIGURE FIGURE GrayscaleGrayscale OCTOBER 1, 9: 10: 2020 $ Grayscale REVIEW $ 0 200,000,000 400,000,000 600,000,000 800,000,000 1,000,000,000 1,200,000,000 DigitalDigital 0 500,000,000 1,000,000,000 1,500,000,000 2,000,000,000 2,500,000,000 3,000,000,000 2019 LargeLarge 07-Oct-19 14-Oct-19 raised 08-Jul-20 THROUGH CapCap 21-Oct-19 IMPORTANT $ Investment GRAYSCALE 28-Oct-19 GRAYSCALE FundFund 04-Nov-19 THROUGH 1.0 11-Nov-19 andand 18-Nov-19 15-Jul-20 25-Nov-19 Zcash Zcash SEPTEMBER DISCLOSURES 02-Dec-19 Bitcoin Bitcoin billion 09-Dec-19 Ethereum Ethereum & SEPTEMBER 22-Jul-20 30, GrayscaleGrayscale 16-Dec-19 in 23-Dec-19 CUMULATIVE 30,CUMULATIVE Activity OTHER 30-Dec-19 Classic Classic 2020 BitcoinBitcoin 06-Jan-20 13-Jan-20 2020 29-Jul-20 3Q20, TrustTrust 20-Jan-20 27-Jan-20 INFLOWS 03-Feb-20 INFLOWS werewere 10-Feb-20 Bitcoin Digital 05-Aug-20 Bitcoin Digital BY BY INFORMATION 24 17- -Feb Feb- -20 20 Cash Ethereum Cash Ethereum AT Total:Large Total:Large bringing through 02-Mar-20$$ THE periodicallyperiodically 09-Mar-20 Cap 12-Aug-20 Cap 16-Mar-20 2.7B 1.0B END 23-Mar-20 PRODUCT T12M the 30-Mar-20 PRODUCT closed closed – OF – 19-Aug-20 toto 06-Apr-20 THIS 13-Apr-20 Zen XRP Zen XRP new new 20 27- -Apr Apr- -20 20 Litecoin T12M Litecoin 3Q20 inflows 12 04-May-20 13 26-Aug-20to REPORT. 18 11- -May May- -20 20 investmentinvestment $ 25-May-20 … 01-Jun-20 Stellar 02-Sep-20 Stellar 2.7 duringduring 08-Jun-20 Grayscale the the 15-Jun-20 22-Jun-20 Lumens Lumens 29 06 -Jun -Jul- -20 20 09-Sep-20 billion. measuredmeasured 20 13- -Jul Jul- -20 20 Lens 27-Jul-20 16-Sep-20 period.period. 03 10- -Aug Aug- -20 20 17-Aug-20 24 31- -Aug Aug- -20 20 23-Sep-20 07 14- -Sep Sep- -20 20 28 21- -Sep Sep- -20 20 30-Sep-20 8 ©2020 Grayscale Investments, LLC

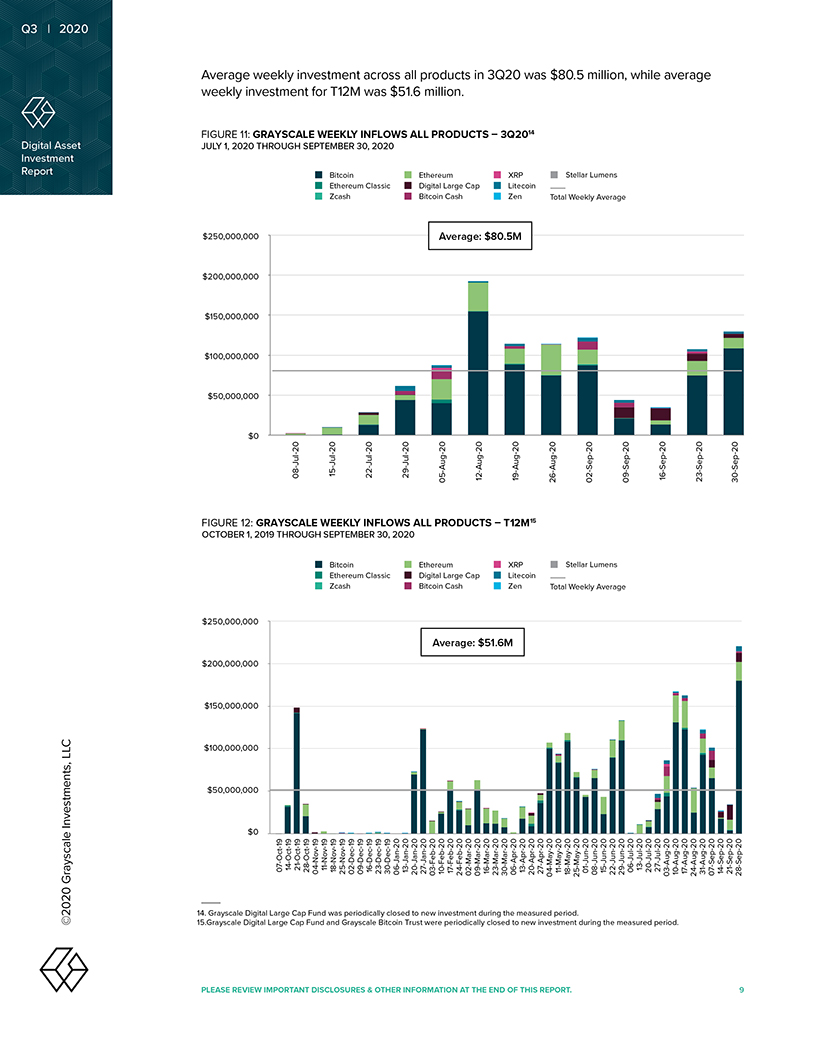

Q3 | 2020 Digital Asset Investment Report 15.14. $ $ $ $ $ $ $ $ $ $ JULY PLEASE 1, FIGURE FIGURE GrayscaleGrayscale weekly OCTOBER 1, 11: Average $ 12: $ 2020 0 50,000,000 100,000,000 150,000,000 200,000,000 250,000,000 0 50,000,000 100,000,000 150,000,000 200,000,000 250,000,000 REVIEW DigitalDigital 2019 LargeLarge 07-Oct-19 14-Oct-19 weekly 21-Oct-19 08-Jul-20 THROUGH CapCap IMPORTANT 28-Oct-19 investment GRAYSCALE 04-Nov-19 THROUGHGRAYSCALE FundFund 11-Nov-19 for and 18-Nov-19 15-Jul-20 was 25-Nov-19 Zcash Bitcoin Zcash Bitcoin 02-Dec-19SEPTEMBERWEEKLY investment DISCLOSURES 09-Dec-19 Ethereum WEEKLY Ethereum T12M 22-Jul-20 30, & 16-Dec-19 GrayscaleSEPTEMBER periodically 23-Dec-19 30-Dec-19 Classic 30, Classicwas OTHER Bitcoin 06-Jan-20 2020 $ across closed 13-Jan-20 29-Jul-20 INFLOWS 20-Jan-20 2020INFLOWS all Trustto 51.6 27-Jan-20 ALL new 03-Feb-20 ALL were Bitcoin Digital Bitcoin Digital 10-Feb-20 Ethereum 05-Aug-20 Ethereum INFORMATION 17-Feb-20 24-Feb-20 Cash Large Cash Large million. AT 02-Mar-20 products investment Average: 09-Mar-20 Cap 12-Aug-20 Average: Cap in THE periodically $ PRODUCTS 16-Mar-20 PRODUCTS $ 23-Mar-20 – END during – closed 30-Mar-20 the 06-Apr-20 51.6M OF to 19-Aug-20 3Q20 13-Apr-20 Zen XRP T12M 80.5M Zen XRP 3Q20 THIS new 20-Apr-20 Litecoin 15 Litecoin14 27-Apr-20 was measured 04-May-20 11-May-20 Total 26-Aug-20 Total $ REPORT. investmentperiod. 18-May-20 25-May-20 80.5 01-Jun-20 WeeklyStellar 02-Sep-20 WeeklyStellar during 08-Jun-20 the 15-Jun-20 22-Jun-20 Lumens Lumens 29-Jun-20 Average 09-Sep-20 Average million, 06-Jul-20 measured 20 13- -Jul Jul- -20 20 27-Jul-20 while 03-Aug-20 16-Sep-20 period. 10 17- -Aug Aug- -20 20 24-Aug-20 31-Aug-20 23-Sep-20 average 07 14- -Sep Sep- -20 20 21-Sep-20 28-Sep-20 30-Sep-20 9 ©2020 Grayscale Investments, LLC

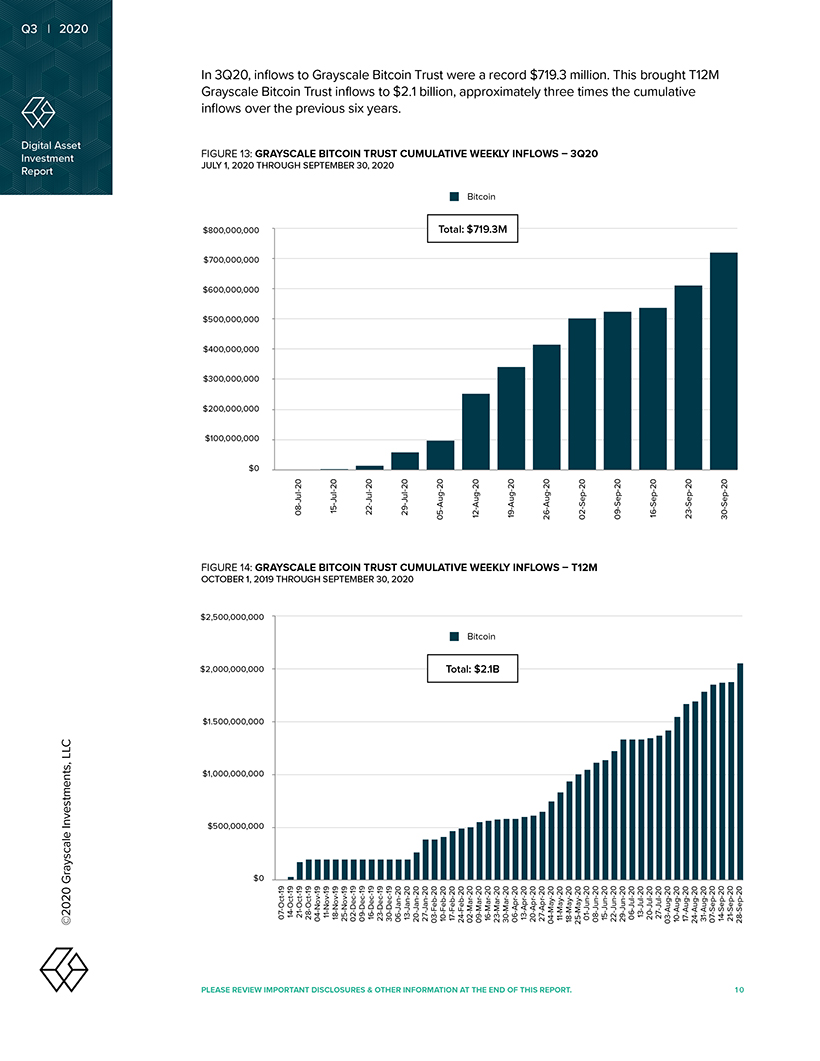

Q3 | 2020 Digital Asset Investment Report $ $ $ $ $ $ $ 1. $ $ $ $ $ $ In JULY PLEASE 1, FIGURE FIGURE OCTOBER inflows 1, 14: 13: 3Q20, $ 0 $ 100,000,000 200,000,000 300,000,000 400,000,000 500,000,000 600,000,000 700,000,000 800,000,0002020 Grayscale REVIEW 0 500,000,000 1,000,000,000 500,000,000 2,000,000,000 2,500,000,000 2019 over 07 14- -Oct Oct- -19 19 the in?ows 21-Oct-19 08-Jul-20 THROUGH Bitcoin IMPORTANT to 28-Oct-19 GRAYSCALE GRAYSCALE 04-Nov-19 THROUGH 11-Nov-19 Trust 18-Nov-19 15-Jul-20 previous 02 25- -Nov Dec- -19 19 SEPTEMBER BITCOIN BITCOIN DISCLOSURES 09-Dec-19 six 30, Grayscale & 16-Dec-19 SEPTEMBER 22-Jul-20 23-Dec-19 inflows 30-Dec-1930, to TRUST 2020TRUST OTHER 06-Jan-20 years. $ 13-Jan-20 2020 29-Jul-20 2. Bitcoin 1 20-Jan-20 03 27--Feb Jan- -20 20 10-Feb-20 05-Aug-20 Trust INFORMATION 17-Feb-20 billion, 24-Feb-20 Total: AT Total: CUMULATIVE CUMULATIVE 02-Mar-20 12-Aug-20 $ were THE 09-Mar-20 $a 16-Mar-20 2. Bitcoin 719. Bitcoin END 23-Mar-20 1B 3M 30-Mar-20 WEEKLY WEEKLY OF 06-Apr-20 19-Aug-20 13-Apr-20 record THIS 20-Apr-20 $ approximately 27-Apr-20 26-Aug-20 04-May-20 INFLOWS INFLOWS 719. 11-May-20 – 3 – REPORT. 18-May-20 three 25-May-20 02-Sep-20 08 01- -Jun Jun- -20 20 T12M 3Q20 15-Jun-20 times million. 22-Jun-20 09-Sep-20 29-Jun-20 the 06-Jul-20 This 13-Jul-20 20 27- -Jul Jul- -20 20 16-Sep-20 03 10- -Aug Aug- -20 20 brought 24 17- -Aug Aug- -20 20 23-Sep-20 cumulative 07 31--Aug Sep- -20 20 T12M 14-Sep-20 30-Sep-20 28 21- -Sep Sep- -20 20 10 ©2020 Grayscale Investments, LLC

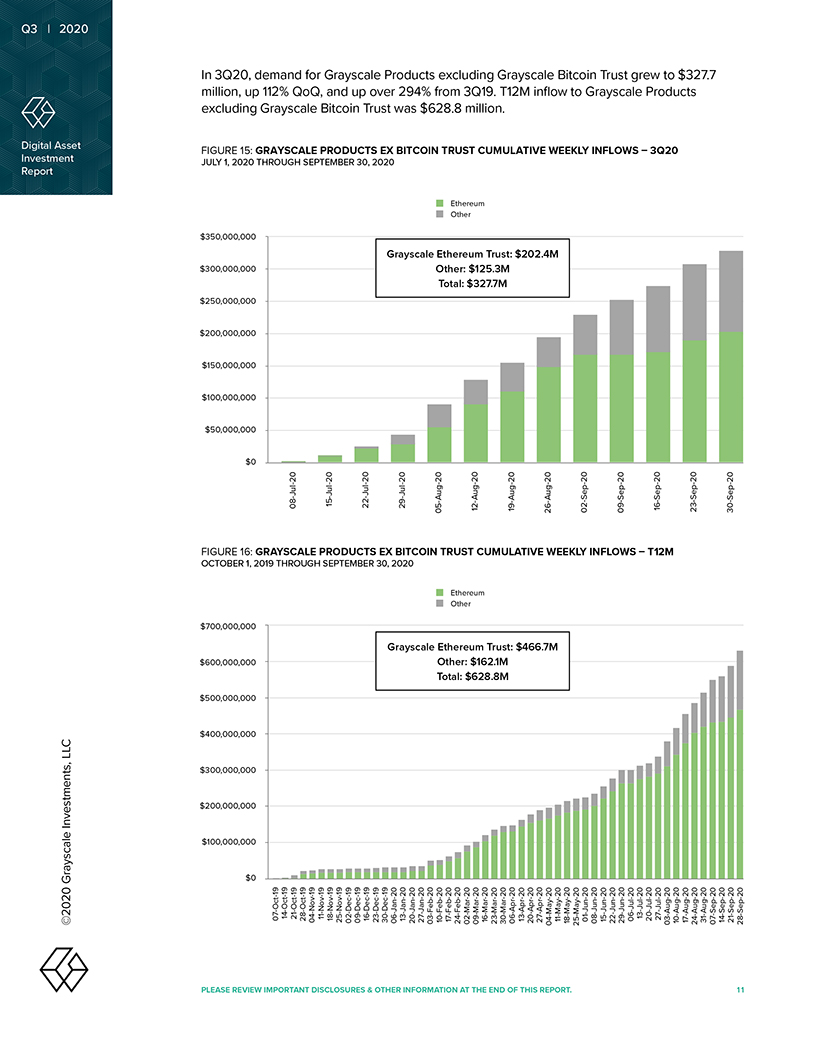

Q3 | 2020 Digital Asset Investment Report $ $ $ $ $ $ $ $ $ $ $ $ $ $ In JULY PLEASE 1, FIGURE FIGURE OCTOBER million, $ 1, 16: $ 15: 3Q20, 2020 0 100,000,000 200,000,000 300,000,000 400,000,000 500,000,000 600,000,000 700,000,000 0 50,000,000 100,000,000 150,000,000 200,000,000 250,000,000 300,000,000350,000,000 excluding up REVIEW 2019 07-Oct-19 14-Oct-19 112% 21-Oct-19 08-Jul-20 THROUGH demand IMPORTANT 28-Oct-19 04-Nov-19 GRAYSCALE GRAYSCALE Grayscale THROUGH for 11-Nov-19 15-Jul-20 QoQ, 25 18- -Nov Nov- -19 19 and 02-Dec-19 SEPTEMBER 09-Dec-19 Bitcoin DISCLOSURES up 16-Dec-19 22-Jul-20 30, & SEPTEMBERPRODUCTS 23-Dec-19 PRODUCTS Grayscale 30-Dec-19 30, Trust EX 2020EX OTHER 06-Jan-20 over 13-Jan-20 2020 29-Jul-20 20-Jan-20 was 27-Jan-20 $ 294% 03-Feb-20 Grayscale Grayscale Products BITCOIN BITCOIN 10-Feb-20 05-Aug-20 INFORMATION 17-Feb-20 24-Feb-20 Total: 628.8 from Other:Total: Other: AT 02-Mar-20 $ $ Other TRUST $ $ Other TRUST 12-Aug-20 09-Mar-20 Ethereum Ethereum Ethereum Ethereum THE 16-Mar-20 23-Mar-20 3Q19. excluding END 30-Mar-20 327.7M million. 628.8M 162.1M Trust: 19-Aug-20 125.3M Trust: OF 06-Apr-20 13-Apr-20 $ $ T12M THIS 20-Apr-20 27-Apr-20 CUMULATIVE CUMULATIVE 04-May-20 26-Aug-20 Grayscale 11-May-20 466.7M 202.4M inflow REPORT. 25 18- -May May- -20 20 WEEKLYto 01-Jun-20 02-Sep-20 WEEKLY 08-Jun-20 Bitcoin 15-Jun-20 22-Jun-20 29-Jun-20 09-Sep-20 Trust 06-Jul-20 INFLOWS INFLOWS 13-Jul-20– Grayscale – 20-Jul-20 27-Jul-20 16-Sep-20grew 03-Aug-20 T12M 3Q20 to 10-Aug-20 $ 17-Aug-20 24-Aug-20 23-Sep-20Products 07 31--Aug Sep- -20 20 327.7 14-Sep-20 21-Sep-20 30-Sep-20 11 28-Sep-20 ©2020 Grayscale Investments, LLC

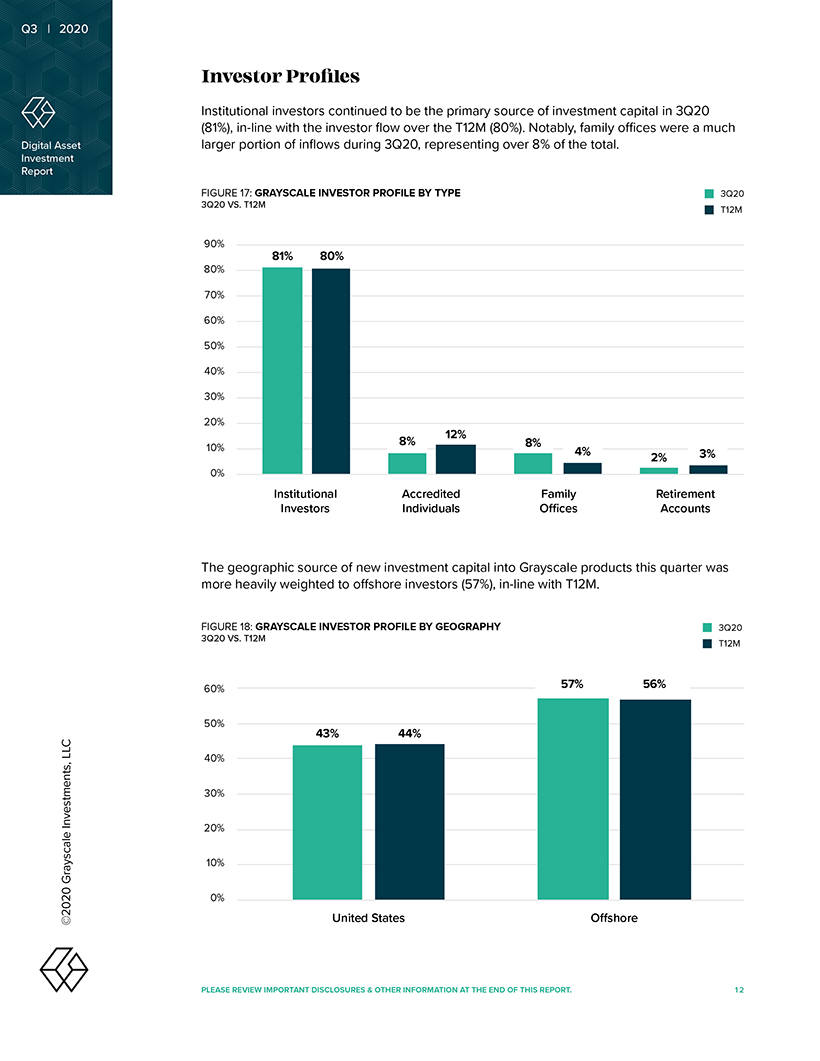

Q3 | 2020 Digital Asset Investment Report Investor Pro?les Institutional investors continued to be the primary source of investment capital in 3Q20 (81%), in-line with the investor ?ow over the T12M (80%). Notably, family offices were a much larger portion of in?ows during 3Q20, representing over 8% of the total. FIGURE 17: GRAYSCALE INVESTOR PROFILE BY TYPE 3Q20 3Q20 VS. T12M T12M 90% 81% 80% 80% 70% 60% 50% 40% 30% 20% 12% 8% 8% 10% 4% 3% 2% 0% Institutional Accredited Family Retirement Investors Individuals Offices Accounts The geographic source of new investment capital into Grayscale products this quarter was more heavily weighted to offshore investors (57%), in-line with T12M. FIGURE 18: GRAYSCALE INVESTOR PROFILE BY GEOGRAPHY 3Q20 3Q20 VS. T12M T12M 60% 57% 56% 50% 43% 44% 40% 30% 20% 10% 0% United States Offshore PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 12 ©2020 Grayscale Investments, LLC

Q3 | 2020 Digital Asset Investment Report Conclusion Consistent and significant growth in the demand for digital assets — shown through the lens of Grayscale asset raising — continues to corroborate our view that digital assets are an emergent market that should not be ignored. This persistent demand has allowed Grayscale Bitcoin Trust to become one of the fastest growing investment products in the world.16 And as investors grow more comfortable with digital assets, we are seeing increased appetite among Grayscale’s products. Grayscale’s Bitcoin Cash, Litecoin, and Digital Large Cap products have all seen over 10x growth in inflows quarter-over-quarter. Investors appear to be interested in digital assets because they have outperformed major indices YTD. Ethereum was up 57% in 3Q20, and with eyes looking toward significant fiscal stimulus in Q4 and beyond, more investors may look to digital assets for yield in this paradigm of monetary inflation. 16. Source: Bloomberg. Comparison of exchange traded products with over $1 billion in assets under management on 01/01/2020. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 13

Q3 | 2020 Digital Asset Investment Report About Grayscale Investments® Grayscale Investments is the world’s largest digital currency asset manager, with approximately $5.9B in assets under management as of September 30, 2020. Through its family of 10 investment products, Grayscale provides access and exposure to the digital currency asset class in the form of a traditional security without the challenges of buying, storing, and safekeeping digital currencies directly. With a proven track record and unrivaled experience, Grayscale’s products operate within existing regulatory frameworks, creating secure and compliant exposure for investors. For more information, please visit www.grayscale.co and follow @Grayscale. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 14 ©2020 Grayscale Investments, LLC

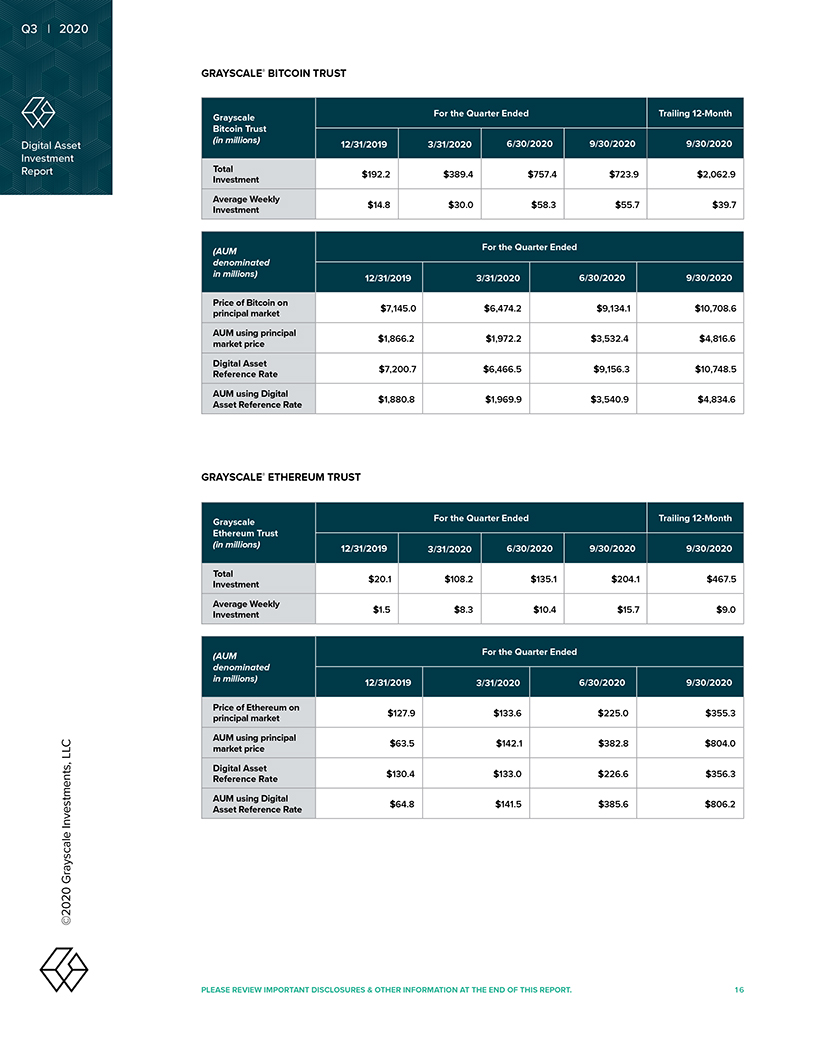

Q3 | 2020 Digital Asset Investment Report Non-GAAP Measures “Assets under management” (AUM), “inflows”, “total investment” and “average weekly investment” are calculated using the Digital Asset Reference Rate for each Grayscale Product, which are not measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). The net asset value of each Product determined on a GAAP basis is referred to in this Report as “NAV.” Each Product’s digital assets are carried, for financial statement purposes, at fair value, as required by GAAP. Each Product determines the fair value of the digital assets it holds based on the price provided by the applicable Digital Asset Exchange that the relevant Product considers its principal market as of 4:00 p.m., New York time, on the valuation date. The cost basis of investments in the applicable digital asset recorded by the applicable Product is the fair value of such digital asset, as determined by such Product, at 4:00 p.m., New York time, on the date of transfer to such Product by the Authorized Participant based on the creation Baskets. The cost basis recorded by a Product may differ from proceeds collected by the Authorized Participant from the sale of each Product’s Share to investors. Each Product’s investment objective is for its Shares (based on digital assets per Share) to reflect the value of the digital assets held by it, as determined by reference to the applicable Digital Asset Reference Rate, less such Product’s expenses and other liabilities. There are two types of Digital Asset Reference Rates used by the Products: (i) a volume-weighted average price in U.S. dollars of the digital assets held by a Product for the immediately preceding 24-hour period as of 4:00 p.m., New York time, on each business day (each, a “VWAP Price”) and (ii) a volume-weighted index price calculated by applying a weighting algorithm to the price and trading volume data of a digital asset for the immediately preceding 24-hour period as of 4:00 p.m., New York time (each, an “Index Price”), in each case as derived from data collected from the Digital Asset Exchanges trading such digital asset selected by TradeBlock, Inc. (the “Reference Rate Provider”). Grayscale believes that calculating the Digital Asset Reference Rates in this manner mitigates the impact of anomalistic or manipulative trading that may occur on any single digital asset exchange, and as such, provides a more reliable price for the relevant digital asset. Each Product’s AUM is calculated by multiplying such Product’s assets (other than U.S. dollars or other fiat currency), less expenses and other liabilities, by the relevant Digital Asset Reference Rate, and as a result, it is not calculated in accordance with GAAP. Investments are calculated by multiplying the number of digital assets received each day as part of the creation process by that day’s Index Price. Total investment amounts reflect total capital raised using this non-GAAP methodology during the periods presented in the report. Average weekly investments reflect the average of the capital amounts raised using this non-GAAP methodology over the number of weeks in those respective periods. The following tables show the Grayscale Bitcoin Trust’s and Grayscale Ethereum Trust’s total investments and average weekly investments using the GAAP cost basis of such investments during the periods shown below as well as the price of Bitcoin and Ethereum on Grayscale Bitcoin Trust’s and Grayscale Ethereum Trust’s principal market, the Digital Asset Reference Rate used by the Trusts and the Grayscale Bitcoin Trust’s and Grayscale Ethereum Trust’s AUM using the principal market price and Digital Asset Reference Rate. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 15 ©2020 Grayscale Investments, LLC

Q3 | 2020 Digital Asset Investment Report GRAYSCALE® BITCOIN TRUST Grayscale For the Quarter Ended Trailing 12-Month Bitcoin Trust (in millions) 12/31/2019 3/31/2020 6/30/2020 9/30/2020 9/30/2020 Total Investment $192.2 $389.4 $757.4 $723.9 $2,062.9 Average Weekly Investment $14.8 $30.0 $58.3 $55.7 $39.7 For the Quarter Ended (AUM denominated in millions) 12/31/2019 3/31/2020 6/30/2020 9/30/2020 Price of Bitcoin on principal market $7,145.0 $6,474.2 $9,134.1 $10,708.6 AUM using principal market price $1,866.2 $1,972.2 $3,532.4 $4,816.6 Digital Asset Reference Rate $7,200.7 $6,466.5 $9,156.3 $10,748.5 AUM using Digital Asset Reference Rate $1,880.8 $1,969.9 $3,540.9 $4,834.6 GRAYSCALE® ETHEREUM TRUST Grayscale For the Quarter Ended Trailing 12-Month Ethereum Trust (in millions) 12/31/2019 3/31/2020 6/30/2020 9/30/2020 9/30/2020 Total Investment $20.1 $108.2 $135.1 $204.1 $467.5 Average Weekly Investment $1.5 $8.3 $10.4 $15.7 $9.0 For the Quarter Ended (AUM denominated in millions) 12/31/2019 3/31/2020 6/30/2020 9/30/2020 Price of Ethereum on principal market $127.9 $133.6 $225.0 $355.3 AUM using principal market price $63.5 $142.1 $382.8 $804.0 Digital Asset Reference Rate $130.4 $133.0 $226.6 $356.3 AUM using Digital Asset Reference Rate $64.8 $141.5 $385.6 $806.2 PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 16 ©2020 Grayscale Investments, LLC

Q3 | 2020 Digital Asset Investment Report Important Disclosures & Other Information ©Grayscale Investments, LLC. All content is original and has been researched and produced by Grayscale Investments, LLC (“Grayscale”) unless otherwise stated herein. No part of this content may be reproduced in any form, or referred to in any other publication, without the express consent of Grayscale. This content is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to sell or buy any security in any jurisdiction where such an offer or solicitation would be illegal. There is not enough information contained in this content to make an investment decision and any information contained herein should not be used as a basis for this purpose. This content does not constitute a recommendation or take into account the particular investment objectives, financial situations, or needs of investors. Investors are not to construe this content as legal, tax or investment advice, and should consult their own advisors concerning an investment in digital assets. The price and value of assets referred to in this content and the income from them may fluctuate. Past performance is not indicative of the future performance of any assets referred to herein. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments. Investors should be aware that Grayscale is the sponsor of Grayscale Bitcoin Trust (BTC), Grayscale Bitcoin Cash Trust (BCH), Grayscale Ethereum Trust (ETH), Grayscale Ethereum Classic Trust (ETC), Grayscale Litecoin Trust (LTC), Grayscale Horizen Trust (ZEN), Grayscale Stellar Lumens Trust (XLM), Grayscale XRP Trust (XRP) and Grayscale Zcash Trust (ZEC) (each, a “Trust”) and the manager of Grayscale Digital Large Cap Fund LLC (the “Fund”). The Trusts and the Fund are collectively referred to herein as the “Products”. Any Product currently offering Share creations is referred to herein as an “Offered Product”. Information provided about an Offered Product is not intended to be, nor should it be construed or used as investment, tax or legal advice, and prospective investors should consult their own advisors concerning an investment in such Offered Product. This content does not constitute an offer to sell or the solicitation of an offer to buy interests in any of the Products. Any offer or solicitation of an investment in a Product may be made only by delivery of such Product’s confidential offering documents (the “Offering Documents”) to qualified accredited investors (as defined under Rule 501(a) of Regulation D of the U.S. Securities Act of 1933, as amended (the “Securities Act”)), which contain material information not contained herein and which supersede the information provided herein in its entirety. The shares of each Product are not registered under the Securities Act, the Securities Exchange Act of 1934 (except for Grayscale Bitcoin Trust and Grayscale Ethereum Trust), the Investment Company Act of 1940, or any state securities laws. The Products are offered in private placements pursuant to the exemption from registration provided by Rule 506(c) under Regulation D of the Securities Act and are only available to accredited investors. As a result, the shares of each Product are restricted and subject to significant limitations on resales and transfers. Potential investors in any Product should carefully consider the long-term nature of an investment in that Product prior to making an investment decision. The shares of certain Products are also publicly quoted on OTC Markets and shares that have become unrestricted in accordance with the rules and regulations of the SEC may be bought and sold throughout the day through any brokerage account. Any interests in each Product described herein have not been recommended by any U.S. federal or state, or non-U.S., securities commission or regulatory authority, including the SEC. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense. Certain of the statements contained herein may be statements of future expectations and other forward-looking statements that are based on Grayscale’s views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements that are forward-looking by reason of context, the words “may, will, should, could, can, expects, plans, intends, anticipates, believes, estimates, predicts, potential, projected, or continue” and similar expressions identify forward-looking statements. Grayscale assumes no obligation to update any forward-looking statements contained herein and you should not place undue reliance on such statements, which speak only as of the date hereof. Although Grayscale has taken reasonable care to ensure that the information contained herein is accurate, no representation or warranty (including liability towards third parties), expressed or implied, is made by Grayscale as to its accuracy, reliability or completeness. You should not make any investment decisions based on these estimates and forward-looking statements. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 17 ©2020 Grayscale Investments, LLC

Q3 | 2020 Digital Asset Investment Report Certain Risk Factors Each Product is a private, unregistered investment vehicle and not subject to the same regulatory requirements as exchange traded funds or mutual funds, including the requirement to provide certain periodic and standardized pricing and valuation information to investors. There are substantial risks in investing in a Product or in digital assets directly, including but not limited to: PRICE VOLATILITY Digital assets have historically experienced significant intraday and long-term price swings. In addition, none of the Products currently operates a redemption program and may halt creations from time to time. There can be no assurance that the value of the common units of fractional undivided beneficial interest (“Shares”) of any Product will approximate the value of the digital assets held by such Product and such Shares may trade at a substantial premium over or discount to the value of the digital assets held by such Product. At this time, none of the Products is operating a redemption program and therefore Shares are not redeemable by any Product. Subject to receipt of regulatory approval from the SEC and approval by Grayscale, in its sole discretion, any Product may in the future operate a redemption program. Because none of the Products believes that the SEC would, at this time, entertain an application for the waiver of rules needed in order to operate an ongoing redemption program, none of the Products currently has any intention of seeking regulatory approval from the SEC to operate an ongoing redemption program. MARKET ADOPTION It is possible that digital assets generally or any digital asset in particular will never be broadly adopted by either the retail or commercial marketplace, in which case, one or more digital assets may lose most, if not all, of its value. GOVERNMENT REGULATION The regulatory framework of digital assets remains unclear and application of existing regulations and/or future restrictions by federal and state authorities may have a significant impact on the value of digital assets. SECURITY While each Product has implemented security measures for the safe storage of its digital assets, there have been significant incidents of digital asset theft and digital assets remains a potential target for hackers. Digital assets that are lost or stolen cannot be replaced, as transactions are irrevocable. TAX TREATMENT OF VIRTUAL CURRENCY For U.S. federal income tax purposes, Digital Large Cap Fund will be a passive foreign investment company (a “PFIC”) and, in certain circumstances, may be a controlled foreign corporation (a “CFC”). Digital Large Cap Fund will make available a PFIC Annual Information Statement that will include information required to permit each eligible shareholder to make a “qualified electing fund” election (a “QEF Election”) with respect to Digital Large Cap Fund. Each of the other Products intends to take the position that it is a grantor trust for U.S. federal income tax purposes. Assuming that a Product is properly treated as a grantor trust, Shareholders of that Product generally will be treated as if they directly owned their respective pro rata shares of the underlying assets held in the Product, directly received their respective pro rata shares of the Product’s income and directly incurred their respective pro rata shares of the Product ’s expenses. Most state and local tax authorities follow U.S. income tax rules in this regard. Prospective investors should discuss the tax consequences of an investment in a Product with their tax advisors. NO SHAREHOLDER CONTROL Grayscale, as sponsor of each Trust and the manager of the Fund, has total authority over the Trusts and the Fund and shareholders’ rights are extremely limited. LACK OF LIQUIDITY AND TRANSFER RESTRICTIONS An investment in a Product will be illiquid and there will be significant restrictions on transferring interests in such Product. The Products are not registered with the SEC, any state securities laws, or the U.S. Investment Company Act of 1940, as amended, and the Shares of each Product are PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 18 ©2020 Grayscale Investments, LLC

Q3 | 2020 Digital Asset Investment Report being offered in a private placement pursuant to Rule 506(c) under Regulation D of the Securities Act of 1933, as amended (the “Securities Act”). As a result, the Shares of each Product are restricted Shares and are subject to (i) a one year holding period or (ii) a six month holding period after the Product has been subject to the reporting requirements of Section 13 under the Exchange Act for a period of 90 days in accordance with Rule 144 under the Securities Act. In addition, none of the Products currently operates a redemption program. Because of the holding period and the lack of an ongoing redemption program, Shares should not be purchased by any investor who is not willing and able to bear the risk of investment and lack of liquidity for at least one year or six months, as applicable. No assurances are given that after the one year holding period, there will be any market for the resale of Shares of any Product, or, if there is such a market, as to the price at such Shares may be sold into such a market. POTENTIAL RELIANCE ON THIRD-PARTY MANAGEMENT; CONFLICTS OF INTEREST The Products and their sponsors or managers and advisors may rely on the trading expertise and experience of third-party sponsors, managers or advisors, the identity of which may not be fully disclosed to investors. The Products and their sponsors or managers and advisors and agents may be subject to various conflicts of interest. FEES AND EXPENSES Each Product’s fees and expenses (which may be substantial regardless of any returns on investment) will offset each Product’s trading profits. Additional General Disclosures Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment. This document is intended for those with an in-depth understanding of the high risk nature of investments in digital assets and these investments may not be suitable for you. This document may not be distributed in either excerpts or in its entirety beyond its intended audience and the Products and Grayscale will not be held responsible if this document is used or is distributed beyond its initial recipient or if it is used for any unintended purpose. The Products and Grayscale do not: make recommendations to purchase or sell specific securities; provide investment advisory services; or conduct a general retail business. None of the Products or Grayscale, its affiliates, nor any of its directors, officers, employees or agents shall have any liability, howsoever arising, for any error or incompleteness of fact or opinion in it or lack of care in its preparation or publication, provided that this shall not exclude liability to the extent that this is impermissible under applicable securities laws. Carefully consider each Product’s investment objectives, risk factors, fees and expenses before investing. This and other information can be found in each Product’s private placement memorandum, which may be obtained from Grayscale and, for each Product listed on the OTC Markets and/or registered with the SEC, such Product’s annual report, which may be obtained by visiting the SEC’s website for Grayscale Bitcoin Trust (Symbol: GBTC) and Grayscale Ethereum Trust (Symbol: ETHE) or the OTC Markets website for Grayscale Bitcoin Cash Trust (Symbol: BCHG), Grayscale Ethereum Classic Trust (Symbol: ETCG), Grayscale Litecoin Trust (Symbol: LTCN) and Grayscale Digital Large Cap Fund (Symbol: GDLC). Reports on OTC Markets are not prepared in accordance with SEC requirements and may not contain all information that is useful for an informed investment decision. Read these documents carefully before investing. The Products are distributed by Genesis Global Trading, Inc. (Member FINRA/SIPC, MSRB Registered). © 2020 Grayscale Investments, LLC. All rights reserved. The GRAYSCALE and GRAYSCALE INVESTMENTS logos, graphics, icons, trademarks, service marks and headers are registered and unregistered trademarks of Grayscale Investments, LLC in the United States. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 19 ©2020 Grayscale Investments, LLC

General Inquiries: info@grayscale.co Address: 250 Park Ave S 5th floor, New York, NY 10003 Phone: (212) 668-1427 @Grayscale