Attached files

| file | filename |

|---|---|

| EX-23.1 - PetVivo Holdings, Inc. | ex23-1.htm |

| EX-21.1 - PetVivo Holdings, Inc. | ex21-1.htm |

| EX-14.1 - PetVivo Holdings, Inc. | ex14-1.htm |

| EX-10.4 - PetVivo Holdings, Inc. | ex10-4.htm |

| EX-3.1.5 - PetVivo Holdings, Inc. | ex3-1_5.htm |

As filed with the Securities and Exchange Commission on October 13, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PetVivo Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 3841 | 99-0363559 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

| 5251

Edina Industrial Blvd. Edina, MN 55439 (952) 405-6216 |

| (Address, Including Zip Code, and Telephone Number, Area Code, of Principal Executive Offices) |

| Copies to: | ||

Laura M. Holm, Esq. Patrick Pazderka, Esq. Fox & Rothschild, LLP Campbell Mithun Tower 222 S. Ninth St., Suite 2000 Minneapolis MN 55402-3338 |

M. Ali Panjwani, Esq. Pryor Cashman LLP 7 Times Square New York, NY 10036-6569 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. [ ]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated file, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

Non-accelerated filer (Do not check if a smaller reporting company) |

[ ] | Smaller reporting company | [X] |

| Emerging Growth Company | [X] | ||

If an emerging growth company, indicate by check mark if the registrant has elected to not use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||||

| Units(2) | $ | 11,500,000 | $ | 1,245.65 | ||||

| Common stock, par value $0.001 per share, included in the units | — | (4) | — | (4) | ||||

| Warrants to purchase common stock, par value $0.001 per share, included in the units | — | (4) | — | (4) | ||||

| Common stock, par value $0.001 per share, underlying the warrants included in the units(3) | $ | 12,650,000 | $ | 1,380.12 | ||||

| Underwriter’s warrant to purchase common stock | $ | — | (5) | $ | — | (5) | ||

| Common stock issuable upon exercise of Underwriter’s warrants to purchase common stock (6) | $ | 625,000 | $ | 68.19 | ||||

| TOTAL | $ | 24,775,000 | $ | 2,693.96 | ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Each unit consists of one share of common stock, par value $0.001 per share, and one warrant to purchase one share of common stock, par value $0.001 per share. Includes shares of common stock and/or warrants to purchase shares of common stock, which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| (3) | The warrants are exercisable at a per share exercise price equal to ___% of the public offering price per share of common stock. The proposed maximum aggregate public offering price of the shares of common stock issuable upon exercise of the warrants was calculated to be $12,650,000 (which is 110% of $11,500,000 since each investor will receive a warrant to purchase one share of common stock for each share of common stock purchased in this offering). Pursuant to Rule 416, the registrant is also registering an indeterminate number of additional shares of common stock that are issuable by reason of the anti-dilution provisions of the warrants. |

| (4) | Included in the price of the units. No fee required pursuant to Rule 457(g) under the Securities Act. |

| (5) | No fee required pursuant to Rule 457(g) under the Securities Act. |

| (6) | The underwriter’s warrants are exercisable at a per share exercise price equal to 125% of the public offering price per share. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the representative’s warrants is $625,000 which is equal to 125% of $500,000 (5% of $10,000,000 shares of common stock sold in the offering). Pursuant to Rule 416, the registrant is also registering an indeterminate number of additional shares of common stock that are issuable by reason of the anti-dilution provisions of the underwriter’s warrants. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

The information in this Prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell the securities and we are not soliciting offers in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED OCTOBER __, 2020 |

|

_____ Units |

|

PetVivo Holding, Inc.

This is a firm commitment offering of units (the “Units”) of PetVivo Holding, Inc., a Nevada corporation. Each Unit consists of one share of our common stock and one warrant to purchase one share of our common stock at an exercise price per share of $ ( % of the public offering price of one Unit in this offering). The warrants will expire on the five-year anniversary of the initial exercise date. The units will have no stand-alone rights and will not be issued or certificated as stand-alone securities. Purchasers will receive only shares of common stock and warrants. The shares of common stock and warrants may be transferred separately, immediately upon issuance. The offering also includes the shares of common stock issuable from time to time upon exercise of the warrants.

Our common stock is currently quoted on the OTCQB tier of the OTC Market Group, Inc. under the symbol “PETV.” The last reported sale price of our common stock on October 12, 2020 was $0.65 per share. At present, there is a very limited market for our common stock. Prior to this offering, there has been no public market for the warrants. We have applied to list our common stock and warrants on [ ] (“Exchange”) under the symbols “PETV” and “PETVW,” respectively. There is no assurance that our listing application will be approved by the Exchange. If our common stock and warrants are not listed on the Exchange, we will not consummate this offering.

We are an “emerging growth company” under applicable federal securities laws and are subject to reduced public company reporting requirements.

Investing in our common stock involves a high degree of risks. See “Risk Factors” beginning on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

(1) Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the public offering price payable to the underwriters. We refer you to “Underwriting” beginning on page 61 for additional information regarding underwriters’ compensation.

We have granted a 45 day option to the representative of the underwriters to purchase up to _____ additional shares of common stock and/or warrants to purchase __ shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver our securities on or about , 2020.

ThinkEquity

a division of Fordham Financial Management, Inc.

The date of this prospectus is ___________, 2020

TABLE OF CONTENTS

You may only rely on the information contained in this prospectus. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock and warrants offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock or warrant in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information incorporated by reference to this prospectus is correct as of any time after its date.

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our common stock and warrants. You should read this entire prospectus carefully, especially the risks of investing in our common stock and warrant discussed under “RISK FACTORS” and the financial statements and notes to those financial statements before making an investment decision. PetVivo Holdings, Inc. is referred to in this prospectus as “PetVivo,” the “Company,” “we” or “us.”

The Company

PetVivo is a veterinary biotech and biomedical device company headquartered in suburban Minneapolis, Minnesota that is primarily engaged in the business of commercializing and licensing products in the veterinary market to treat companion animals such as dogs and horses. Most of our technology was developed for human biomedical applications, and we intend to leverage the investments already expended in their development to commercialize treatments for pets in a capital and time-efficient way.

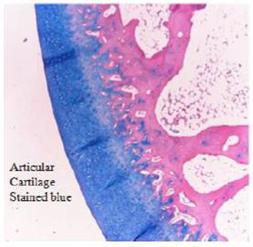

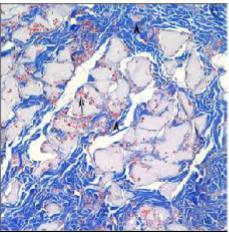

Many of the Company’s products are derived from proprietary biomaterials that simulate a body’s cellular tissue by virtue of their reliance upon natural protein compositions which incorporate such “tissue building blocks” as collagen, elastin and heparin. Since these are naturally-occurring in the body, we believe they have an enhanced biocompatibility with living tissues compared to synthetic biomaterials such as those based upon alpha-hydroxy polymers (PLA, PLGA and the like) and other “natural” biomaterials that may lack the multiple proteins incorporated into our biomaterials. These proprietary protein-based biomaterials appear to mimic the body’s tissue thus allowing integration and tissue repair in long-term implantation in certain applications

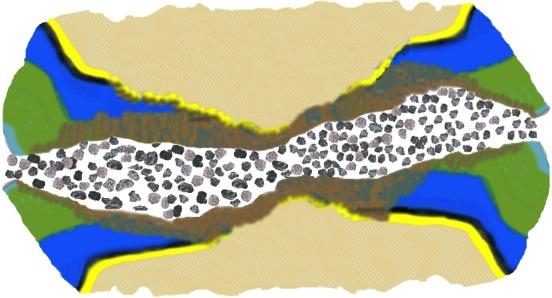

Our initial product, Kush™, is a veterinary device designed to help reinforce articular cartilage tissue for the treatment and prevention of osteoarthritis and other joint related afflictions in companion animals. Kush™ uses an intra-articular injection of non-dissolving, cartilage like patented particles that are slippery, wet-permeable, durable and resilient to enhance the force cushioning function of the synovial fluid. The particles mimic natural cartilage in composition, structure and hydration. Multiple joints can be treated simultaneously. Our particles are comprised of collagen, elastin and heparin, the same components found in natural cartilage. These particles show an effectiveness to augment the cartilage and enhance the functionality of the joint (e.g. provide cushion or shock-absorbing features to the joint and to provide joint lubricity).

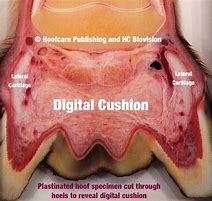

Osteoarthritis, the most common inflammatory joint disease in both dogs and horses, is a chronic, progressive, degenerative joint disease that is caused by a loss of synovial fluid and/or the deterioration of joint cartilage. Osteoarthritis affects 1 out of 4 dogs and over half of all horses. It is estimated that there are over 20 million dogs with osteoarthritis in the United States and the European Union with a market size of $2.6 billion and over 1 million lame horses in the US for a $600 million United States and the European market. See “Johnston, Spencer, Osteoarthritis. Joint Anatomy, Physiology, and Pathobiology,” The Veterinary Clinics of North America, 1997:699-72.”

Despite the market size, veterinary clinics and hospitals have very few treatments and/or drugs for use in treating osteoarthritis in dogs, horses and other pets. As there is no cure for osteoarthritis, the various treatment methods are focused on managing the related symptoms of pain and inflammation. The current treatment for osteoarthritis in dogs generally consists of the use of nonsteroidal anti-inflammatory drugs (or “NSAIDs”) which present the potential for side effects relating to gastrointestinal, kidney and liver damage. In contrast, the Company’s treatment using Kush™, to our knowledge, has not elicited any adverse side effects in dogs. Remarkably, Kush™-treated dogs have shown an increase in activity even after they no longer are receiving pain medication. Other treatments for osteoarthritis include steroid and/or hyaluronic acid injections, which are often slow acting and/or short lasting.

We believe Kush™ is superior to existing treatments to safely improve joint function in animals for several reasons:

| ● | Kush™ addresses the underlying problem which relate to bones being too close and a lack of synovial fluid. Kush™ provides a biocompatible lubricious cushion to the joint, which establishes a barrier between the bones, thereby protecting the remaining cartilage and bone. | |

| ● | Kush™ is easily administered with the standard intra-articular injection technique. Multiple joints can be treated simultaneously. |

| 1 |

| ● | Case studies indicate many canines have long-lasting multi-month improvement in lameness after having been treated with Kush™ | |

| ● | After receiving a Kush™ injection, many canines are able to discontinue the use of NSAID’s, eliminating the negative side effects | |

| ● | Kush™ is an effective and economical solution for treating osteoarthritis. A single injection of Kush™ is approximately $400 per joint and typically lasts for at least 12 months. |

Historically, drug sales represent up to 30% of revenues at a typical veterinary practice (Veterinary Practice News). Revenues and margins at veterinary practices are being eroded because online, big-box and traditional pharmacies have recently started filling veterinary prescriptions. Veterinary practices are looking for ways to replace lost prescription revenues with safe and effective products. Kush™ is veterinarian-administered and should expand practice revenues and margins. We believe that the increased revenues and margins provided by Kush™ will accelerate its adoption rate and propel it forward as the standard of care for canine and equine lameness related to or due to synovial joint issues.

Kush™ is classified as an animal device under the United States Food and Drug Administration (“FDA”) rules and pre-market approval is not required by the FDA. Kush™ has completed a safety and efficacy study in rabbits in 2007. Since that time, more than 100 horses and dogs have been successfully treated with Kush™. We are in the process of preparing a protocol to conduct a pilot study with a major university within the United States or another academic institute that has an internationally recognized faculty. We anticipate this study will be a 12-month study that will be primarily used to expand our distribution outlets since the large international and national distributors generally require a third-party university study to include a product in their catalog of products.

We plan to commercialize Kush™ and other products developed by us in the United States through the use of in-house marketing personnel who will oversee the efforts of independent distributors we engage on a regional or national basis. We plan to support our distributors with the use of social media and other methods to educate and inform key opinion leaders and decision makers at the top distributors and high prescriber veterinarians for companion animals of the availability and benefits of Kush™. We have developed a commercialization strategy, which provides for our (i) initial launch in key regional markets (Colorado, Minnesota and Texas) by internal sales representatives in the third and fourth quarter of 2020, (ii) development of alliances with 3 to 4 of the top national distributors in the first and second quarter of 2021 and (iii) development of a full national roll-out strategy to deliver our products to customers in the third quarter of 2021.

We have established an ISO 7 certified clean room manufacturing facility located in our Minneapolis facility using a patented and scalable self-assembly production process, which reduces the infrastructure requirements and manufacturing risks to deliver a consistent, high-quality product while being responsive to volume requirements. While we are not currently manufacturing commercial quantities, we have built out an ISO 7 certified facility that will be able to handle projected production in units for at least the next five years.

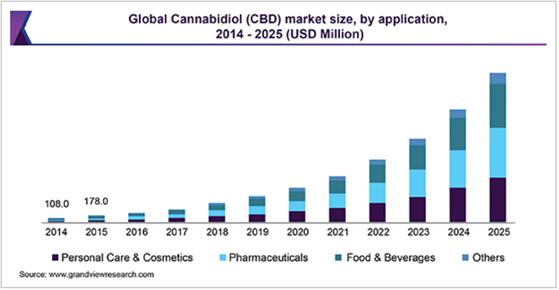

In addition to Kush™, we have engaged a strategic partner, Emerald Organic Products, Inc. (“Emerald”), through an exclusive license agreement, dated July 31, 2019, to allow Emerald to bring our mucoadhesive drug delivery technology to the human nutraceutical market for the delivery of various active nutraceuticals including cannabidiol (“CBD”), caffeine, and citicoline. Since such products tout up to a 10-times increase in bioavailability of active agents, we believe that we have an advantage over other delivery methods in the CBD and nutritional supplement markets. We have agreed that the license to Emerald will include use of PetVivo’s proprietary technology in the formulation, manufacture and sale of Emerald’s nutritional supplements including its hemp-based CBD wellness products.

We also have a pipeline which includes 17 therapeutic devices for both veterinary and human clinical applications. Some such devices may be regulated by the FDA or other equivalent regulatory agencies, including but not limited to the Center for Veterinary Medicine (“CVM”). We anticipate growing our product pipeline through the acquisition or in-licensing of additional proprietary products from human medical device companies specifically for use in pets. In addition to commercializing our own products in strategic market sectors and in view of the Company’s vast proprietary product pipeline, the Company may establish strategic out-licensing partnerships to provide secondary revenues.

| 2 |

Recent Developments

On June 15, 2020, we issued and sold to an institutional investor a note in the principal amount of $352,941 and warrants to purchase 557,143 shares of our common stock for gross proceeds of $300,000 (representing an original issue discount of 15%). The note matures on March 15, 2021. We have the right to redeem all or a portion of the note upon ten days prior written notice, during which time the holder of the note may convert the principal amount and all accrued and unpaid interest thereon into common stock as further discussed below.

We have the option to issue and sell to the investor, and which the investor is required to purchase, an additional note and warrant, for aggregate gross proceeds of $300,000, provided, however, that the investor will not be required to purchase such additional securities if we are in default under the purchase agreement, the outstanding note or if certain other customary closing conditions are not met. The second tranche closing may not occur later than December 31, 2020.

Business Strategy

Our mission is to provide safe and effective products that address unmet medical needs in the animal markets and further develop our unique intellectual property. Key elements of our business strategy include:

| ● | Launching Kush™ in key regional markets (CO, MN and TX) in the 3rd and 4th quarters of fiscal 2021; | |

| ● | Complete a clinical study with a major university to prove the safety and efficacy of Kush™ for use in dogs; | |

| ● | Secure partnerships with 3 or 4 large national distributors to sell Kush™ in the United States to effectuate our national distribution plan; | |

| ● | Complete the build-out of our manufacturing facility in Minneapolis and develop strategic partnerships with other vendors for package and delivery of Kush™; | |

| ● | Advance research on equine lameness due to navicular disease and/or digital cushion impairment; | |

| ● | Continue our partnership with Emerald for the distribution of our proprietary mucoadhesive drug delivery technology platform in CBD wellness products; | |

| ● | Leverage our current product pipeline in additional animal species and/or humans; and | |

| ● | Develop strategic out-licensing partnerships to provide secondary revenues. |

Risks Related to Our Business

Our business, and our ability to execute our business strategy, is subject to a number of risks as more fully described in the section titled “Risk Factors.” These risks include, among others, the following:

| ● | We have a limited operating history, have not yet generated any material revenues, expect to continue to incur significant research and development and other expenses, and may never become profitable. | |

| ● | Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern. | |

| ● | We have never generated any material revenue from operations and may need to raise additional capital to achieve our goals. | |

| ● | We are substantially dependent on the success of our lead product, Kush™, and cannot be certain that this product will be successfully commercialized by us. | |

| ● | We have a limited marketing and sales organization, and if our current marketing and sales personnel are insufficient or inadequate to support the current introduction of Kush™, we may not be able to sell this product in the quantities needed to become commercially successful. | |

| ● | Our business will depend significantly on the sufficiency and effectiveness of our marketing and product promotional programs and incentives. | |

| ● | Our lead product, Kush™, will face significant competition in our industry, and our failure to compete effectively may prevent us from achieving any significant market penetration. |

| 3 |

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenues during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | A requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; | |

| ● | An exemption from compliance with the auditor attestation requirement on the effectiveness of our internal controls over financial reporting; | |

| ● | An exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; | |

| ● | Reduced disclosure about our executive compensation arrangements; and | |

| ● | Exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or a shareholder approval of any golden parachute arrangements. |

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of: (a) the last day of the fiscal year during which we have total annual gross revenue of $1.07 billion or more; (b) the last day of the fiscal year following the fifth anniversary of the effective date of the registration statement of which this prospectus forms a part; (c) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or (d) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, or the Exchange Act (we will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months; the value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter).

We may choose to take advantage of some of the available benefits under the JOBS Act, and have taken advantage of some reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information contained in prospectuses from other United States public companies.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Corporate History and Structure

We were incorporated as Pharmascan Corp. in the State of Nevada on March 31, 2009. On September 21, 2010, we filed a Certificate of Amendment to our Articles of Incorporation and changed our name to Technologies Scan Corp. On April 1, 2014, we filed a Certificate of Amendment to our Articles of Incorporation and changed our name to PetVivo Holdings, Inc. On March 11, 2014, our Board of Directors authorized the execution of a securities exchange agreement dated March 11, 2014 (the “Securities Exchange Agreement”) with PetVivo Inc., a Minnesota corporation (“PetVivo”). PetVivo was founded in 2013 by John Lai and John Dolan and engaged in the business of acquiring, in-licensing and adapting human biomedical technology and products for commercial sale in the veterinary market.

In accordance with the terms and provisions of the Securities Exchange Agreement, we acquired all of the issued and outstanding shares of stock of PetVivo and it became our wholly-owned subsidiary. John Lai and John Dolan were controlling shareholders of PetVivo Holdings, Inc at the time of the securities exchange. In August of 2013, in exchange for 1,305,000 shares of the Company’s common stock, PetVivo entered into an exclusive worldwide license for the commercialization of a patented biomaterials technology for the veterinary treatment of animals having orthopedic joint afflictions (“Technology”). The Technology was developed by Gel-Del Technologies Inc., a Minnesota corporation (“Gel-Del”). Gel-Del was a biomaterials development and manufacturing company focused on human and companion animal applications of its biomaterials technology; our initial product, Kush™, is derived from the licensed Technology.

| 4 |

Thereafter, a wholly-owned subsidiary of ours (which was incorporated in Minnesota expressly for this transaction) completed a triangular merger (the “Merger”) with Gel-Del. Pursuant to the Merger, Gel-Del was the surviving entity and concurrently became our wholly-owned subsidiary, resulting in our obtaining full ownership of Gel-Del. Our primary reason to effect the Merger was to obtain 100% ownership and control of Gel-Del and its patented bioscience technology, including ownership of Cosmeta, a subsidiary of Gel-Del. The effective date for the Merger was April 10, 2017 when the Merger was filed officially with the Secretary of State of Minnesota.

Our principal executive office is located at 5251 Edina Industrial Blvd., Minneapolis, MN 55439 and our telephone number is (952) 405-6216. Our website is www.petvivo.com. Information contained in, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus. Our design logo and our other registered and common law trade names, trademarks and service marks are the property of PetVivo, Inc.

Exchange Listing and Reverse Stock Split

We have filed an application to list our common stock and warrants on the Exchange under the symbols “PETV” and “PETVW,” respectively. No assurance can be given that our application will be approved. If our application to the Exchange is not approved or we otherwise determine that we will not be able to secure the listing of the common stock and warrants on the Exchange, we will not complete the offering.

We held a meeting of our shareholders on September 22, 2020 for the purpose of having our shareholders approve a reverse stock split of the outstanding shares of our common stock in the range from one-for-two (1-for-2) to one-for-sixteen (1-for-16), which ratio is to be selected by the board of directors. The board of directors anticipates setting the ratio of the reverse stock split, and the reverse stock split becoming effective following approval by both the board of directors and FINRA of the reverse stock split, prior to the effective date of the registration statement (of which this prospectus forms a part). The reverse stock split is intended to allow us to meet the minimum share price requirement of the Exchange.

Except as otherwise indicated and except in our financial statements and the notes thereto, all references to our common stock, share data, per share data and related information has been adjusted to depict an assumed reverse stock split ratio of 1-for-[•] (“Reverse Stock Split”) until final determination by the board of directors as if it was effective and as if it had occurred at the beginning of the earliest period presented. The Reverse Stock Split, when effective, will combine each shares of our outstanding common stock into one share of common stock, without any change in the par value per share, and the Reverse Stock Split correspondingly will adjust, among other things, the exercise rate of our warrants and options into our common stock. No fractional shares will be issued in connection with the Reverse Stock Split, and any fractional shares resulting from the Reverse Stock Split will be rounded up to the nearest whole share.

| 5 |

The Offering

| Securities offered | Units, each Unit consisting of one share of our common stock and one warrant to purchase one share of our common stock. Each warrant will have an exercise price of $____ per share ( % of the assumed public offering price of one Unit), is exercisable immediately and will expire five (5) years from the date of issuance. The Units will not be certificated or issued in stand-alone form. The shares of our common stock and the warrants comprising the Units are immediately separable upon issuance and will be issued separately in this offering. |

| Common stock offered by us | ____ shares of common stock |

| Warrants offered by us | Warrants to purchase _____ shares of common stock |

| Over-allotment option | We have granted the underwriter an option for a period of 45 days to purchase up to an additional _________ shares and/or warrants, in any combination, to cover over-allotments, if any. |

|

Common stock outstanding(1)(2): Before offering After offering |

24,876,189 shares _________ shares |

| Public offering price | $___ per Unit |

| Use of proceeds | We expect the net proceeds to us from the offering will be approximately $_______ after deduction of the underwriting discount and estimated offering expenses. If the underwriter fully exercises its over-allotment option, we estimate we would receive an additional $_______ of net proceeds. Such proceeds will be used as working capital to fund our efforts to produce, market and distribute our Kush™ product and to pay off outstanding debt. |

| Proposed Exchange Trading Symbols | Our common stock is currently traded on the OTCQB over the counter market under the symbol “PETV.” We have applied to list our common stock and warrants on the Exchange under the symbols “PETV” and “PETVW,” respectively. The listing of our common stock and warrants on the Exchange is a condition of consummating this offering. |

| Description of the Warrants | The exercise price of the warrants is $[●] per share ( % of the assumed public offering price of one Unit). Each warrant is exercisable for one share of common stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock as described herein. A holder may not exercise any portion of a warrant to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would own more than 4.99% of the outstanding common stock after exercise, as such percentage ownership is determined in accordance with the terms of the warrants, except that upon notice from the holder to us, the holder may waive such limitation up to a percentage, not in excess of 9.99%. Each warrant will be exercisable immediately upon issuance and will expire five years after the initial issuance date. The terms of the warrants will be governed by a Warrant Agreement, dated as of the effective date of this offering, between us and [●], as the warrant agent (the “Warrant Agent”). This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. For more information regarding the warrants, you should carefully read the section titled “Description of Securities—Warrants and Options” in this prospectus. |

| Risk factors | Investing in our securities involves a high degree of risk. You should carefully review and consider the “RISK FACTORS” section of this prospectus for a discussion of factors to consider before deciding to invest in our Units. |

| 6 |

(1) Does not include shares of our common stock underlying the Underwriters’ over-allotment option.

(2)The number of shares of our common stock to be outstanding after this offering is based on 24,876,189 shares of our common stock outstanding as of September 30, 2020 and includes the automatic conversion of convertible notes in the amount of $___ into __ shares of our common stock upon completion of our listing on the Exchange. It does not include:

| ● | 5,763,610 shares of our common stock issuable upon the exercise of outstanding warrants with a weighted-average exercise price of $0.52 per share; | |

| ● | 4,000,000 shares reserved for issuance our PetVivo 2020 Equity Incentive Plan; | |

| ● | Warrants to purchase up to [●] shares of our common stock issued as part of the Units; and | |

| ● | Warrants to purchase up to [●] shares of our common stock issuable to the Underwriter in connection with this offering. |

Unless otherwise indicated, all information in this prospectus reflects or assumes the following: (i) no exercise or termination of any options or warrants outstanding as of September 30, 2020 and (ii) no exercise by the underwriters of their overallotment option.

Statements contained in this prospectus that are not factual or purely historical are considered to be “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. (the “Exchange Act”). These forward-looking statements include, but are not limited to: any statements or projections regarding future revenues, earnings, or other financial items; any statements of the strategies, plans and objectives of our management for future operations; any statement regarding proposed development of new products or technology; any statements regarding anticipated marketing or production operations; any statements regarding our future capital needs, any statements regarding the value or use of current or future patents or patent applications or other intellectual property; any statements regarding anticipated regulatory requirements; any statements regarding future economic conditions; and any statements of belief or assumptions. Forward-looking statements may include the words “may,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect,” or “anticipate” or any other similar words. These statements represent our expectations, beliefs, anticipations, commitments, intentions and strategies regarding the future and include, but are not limited to, the risks and uncertainties outlined and set forth in the following sections of this prospectus entitled “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers of this prospectus are cautioned that actual results could differ materially from the anticipated results or other expectations that are expressed in our forward-looking statements. Our forward-looking statements included in this prospectus speak only as of the date of the prospectus, and we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Given these many risks and uncertainties, readers of this prospectus are cautioned not to place undue reliance on our forward-looking statements.

An investment in our common stock and warrants involves a high degree of risk. You should carefully consider the following described risks together with all other information included in this prospectus before making an investment decision with regard to this offering. If one or more of the following risks occurs, our business, financial condition, and results of operations could be materially harmed, which most likely would result in a decline in the trading price of our common stock and warrants and investors losing part or even all of their investment.

| 7 |

Risks Relating to Our Financial Condition

We have incurred substantial losses to date and could continue to incur such losses.

We have incurred substantial losses since commencing our current business. For fiscal quarter ended June 30, 2020, we lost approximately $0.81 million without obtaining any commercial revenues and had an accumulated deficit of approximately $55.40 million. For our fiscal years ended March 31, 2020 and 2019, we lost approximately $2.1 million and $4.76 million, respectively, without obtaining any commercial revenues. In order to achieve and sustain future revenues, we must succeed in our current efforts to commercialize Kush™ for treatment of dogs and horses suffering from osteoarthritis. That will require us to produce our products effectively in commercial quantities, establish adequate sales and marketing systems, conduct clinical trials and tests which show the safety and efficacy of Kush™ in dogs and horses and gain significant support from veterinarians in the use of our products. We expect to continue to incur losses until such time, if ever, as we succeed in significantly increasing our revenues and cash flow beyond what is necessary to fund our ongoing operations and pay our obligations as they become due. We may never generate revenues sufficient to become profitable or to sustain profitability.

Our auditors have expressed doubt about our ability to continue as a going concern.

The report of our independent registered accounting firm that audited our March 31, 2020 and 2019 financial statements included an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is contingent primarily upon our continuing to raise sufficient working capital to support our operations until attaining profitability, which may never happen.

If we are unable to obtain sufficient funding, we may have to reduce materially or even discontinue our business.

As of September 30, 2020, we had cash or cash equivalents of $169,493. Accordingly, our ability to commercialize our Kush™ products is dependent on our receipt of the net proceeds from this offering. We anticipate that our cash on hand with the net proceeds from this offering will be adequate to satisfy operational and capital requirements for the next 21 months. If we are unable to realize substantial revenues in the near future, we will need to seek additional financing beyond this 21-month period to continue our operations. We also most likely will require additional financing to develop additional new products or to expand into foreign markets.

Along with establishing effective production, marketing, sales and distribution of our Kush™ products, we believe that our future capital requirements depend upon the timing and costs of many factors with some of them beyond our control, including our ability to establish an adequate base of veterinarian clinics using our products, costs in obtaining patents and any required regulatory approvals for future products, costs of any future target animal studies, costs related to new product development, costs of finished product inventory, expenses to attract and retain skilled personnel as needed, increased costs related to being a listed public company, and the costs of any future acquisitions of existing companies or IP technologies. There is no assurance that future additional capital will be available to us as needed, or if available upon terms acceptable to us.

Risks Relating to Our Business

We have no operating history upon which to base an evaluation of our prospects.

We have had no material commercial operations, since our primary efforts and resources have been directed toward acquiring our technology to produce and sell proprietary products for the animal market. Our lack of an operating history makes an evaluation of our business and prospects very difficult. Our prospects must be considered speculative, especially considering the risks, expenses and difficulties frequently encountered in the establishment of an early-stage company. Our ability to operate our business successfully remains unknown and untested. If we cannot commercialize our products effectively, or are significantly delayed or limited in doing so, our business and operations will be harmed substantially, and we may even need to cease operations.

| 8 |

We are substantially dependent upon the success of Kush™ and any failure of Kush™ to achieve market acceptance would harm us significantly.

Our recent efforts and financial resources have primarily been directed toward commercialization of the Kush™ products for the treatment of dogs and horses suffering from osteoarthritis. Accordingly, our prospects rely heavily on the successful launch and follow-up marketing of this products. In addition to establishing effective production, marketing, sales, distribution and training for the use of Kush™, we believe its successful commercialization will depend on other material factors including our ability to educate and convince veterinarians and pet owners about the benefits, safety and effectiveness of our Kush™ products, the occurrence and severity of any side effects to pets from use of our products, maintaining regulatory compliance and effective quality control for our products, our ability to maintain and enforce our patents and other intellectual property rights, any increased manufacturing costs from third-party contractors or suppliers, and the availability, cost and effectiveness of treatments offered by competitors.

If we fail to attract and retain qualified management and key scientific personnel, we may be unable to successfully commercialize our current products or develop new products effectively.

Our success will significantly be dependent upon our current management and key scientific technicians, and also on our ability to attract, retain and motivate future management and employees. We are highly dependent upon our current management and technology personnel, and the loss of the services of any of them could delay or prevent the successful commercialization or development of current or future products. Competition to obtain qualified personnel in the animal health field is intense due to the limited number of individuals possessing the skills and experience required by our industry. We may not be able to attract or retain qualified personnel as needed on acceptable terms, or at all, which would harm our business and operations.

Our operations will rely on third parties to produce our raw materials to produce our products.

We will rely on independent third parties to produce the raw materials (e.g. collagen, elastin and heparin) that we use to produce our Kush™ products. As such, we will be dependent upon their services and will not be in a position to control their operations as we might if we directly produced these raw materials. While we believe the raw materials used to manufacture our Kush products are readily available and can be obtained from multiple reliable sources on a timely basis, circumstances outside our control may impair our ability to have an adequate supply of raw materials to produce our Kush products.

If we experience the rapid commercial growth we anticipate, we may not be able to manage such growth effectively.

We contemplate rapid growth for our business as we bring our Kush™ products to market and anticipate that will place significant new demands on our management and our operational and financial resources. Our organizational structure will become more complex as we add additional personnel, and we would likely require more financial and staff resources to support and continue our growth. If we are unable to manage our growth effectively, our business, financial condition and results of operations may be materially harmed.

We have a limited marketing and sales organization, and if our current marketing and sales personnel are insufficient or inadequate to support the current introduction of our Kush products, we may not be able to sell these products in quantities to become commercially successful.

We have a limited marketing and sales organization, and we have minimal prior experience in the marketing, sale and distribution of pet care products. There are significant risks involved in our building and managing an effective sales organization, including our ability to hire, adequately train, maintain and motivate qualified individuals, generate sufficient sales leads and other contacts, and establish effective product distribution channels. Any failure or substantial delay in the development of our internal sales, marketing and distribution capabilities would adversely impact our business and financial condition.

| 9 |

Our business will depend significantly on the sufficiency and effectiveness of our marketing and product promotional programs and incentives.

Due to the highly competitive nature of our industry, we must effectively and efficiently promote and market our products through internet, television and print advertising, social media, and through trade promotions and other incentives to sustain and improve our competitive position in our market. Moreover, from time to time we may have to change our marketing strategies and spending allocations based on responses from our veterinarian customers and pet owners. If our marketing, advertising and trade promotions are not successful to create and sustain consistent revenue growth or fail to respond to marketing strategy changes in our industry, our business, financial condition and results of operations may be adversely affected.

Any damage to our reputation or our brand may materially harm our business.

Developing, maintaining and expanding our reputation and brand with veterinarians, pet owners and others will be critical to our success. Our brand may suffer if our marketing plans or product initiatives are unsuccessful. The importance of our brand and demand for our products may decrease if competitors offer products with benefits similar to or as effective as our products and at lower costs to consumers. Although we maintain procedures to ensure the quality, safety and integrity of our products and their production processes, we may be unable to detect or prevent product and/or ingredient quality issues such as contamination or deviations from our established procedures. If any of our products cause injury to animals, we may incur material expenses for product recalls, and may be subject to product liability claims, which could damage our reputation and brand substantially.

We may not be able to manage our manufacturing and supply chain effectively, which would harm our results of operations.

We must accurately forecast demand for our products in order to have adequate product inventory available to fill customer orders timely. Our forecasts will be based on multiple assumptions that may cause our estimates to be inaccurate, and thus affect our ability to ensure adequate manufacturing capability to satisfy product demand. Any material delay in our ability to obtain timely product inventories from our manufacturing facility and our ingredient suppliers could prevent us from satisfying increased consumer demand for our products, resulting in material harm to our brand and business. In addition, we will need to continuously monitor our inventory and product mix against forecasted demand to avoid having inadequate product inventory or having too much product inventory on hand. If we are unable to manage our supply chain effectively, our operating costs may increase materially.

Failure to protect our intellectual property could harm our competitive position or cause us to incur significant expenses and personnel resources to enforce our rights.

Our success will depend significantly upon our ability to protect our intellectual property (“IP”) rights, including patents, trademarks, trade secrets, and process know-how, which valuable assets support our brand and the perception of our products. We rely on patent, trademark, trade secret and other intellectual property laws, as well as non-disclosure and confidentiality agreements to protect our intellectual property. Our non-disclosure and confidentiality agreements may not always effectively prevent disclosure of our proprietary IP rights, and may not provide an adequate remedy in the event of an unauthorized disclosure of such information, which could harm our competitive position. We also may need to engage in costly litigation to enforce or protect our patent or other proprietary IP rights, or to determine the validity and scope of proprietary rights of others. Any such litigation could require us to expend significant financial resources and also divert the efforts and attention of our management and other personnel from our ongoing business operations. If we fail to protect our intellectual property, our business, brand, financial condition and results of operations may be materially harmed.

We may be subject to intellectual property infringement claims, which could result in substantial damages and diversion of the efforts and attention of our management.

We must respect prevailing third-party intellectual property, and the procedures and steps we take to prevent our misappropriation, infringement or other violation of the intellectual property of others may not be successful. If third parties assert infringement claims against us, our suppliers, or veterinarians using our products and technology, we could be required to expend substantial financial and personnel resources to respond to and litigate or settle any such third-party claims. Although we believe our patents, manufacturing processes and products do not infringe in any material respect on the intellectual property rights of other parties, we could be found to infringe on such proprietary rights of others. Any claims that our products, processes or technology infringe on third-party rights, regardless of their merit or resolution could be very costly to us and also materially divert the efforts and attention of our management and technical personnel. Any adverse outcome to us from one or more such claims against us could, among other things, require us to pay substantial damages, to cease the sale of our products, to discontinue our use of any infringing processes or technology, to expend substantial resources to develop non-infringing products or technology, or to license technology from the infringed party. If one or more of such adverse outcomes occur, our ability to compete could be affected significantly and our business, financial condition and results of operations could be harmed substantially.

| 10 |

We may be unable to obtain required regulatory approvals for future products timely or at all, and the denial or substantial delay of any such approval could delay materially or even prevent our efforts to commercialize new products, which could adversely impact our ability to generate future revenues.

Based on our determination that our Kush™ products constitute a device for the treatment of animals rather than being a pharmaceutical product, we believe we are not required to obtain regulatory approval to produce and market them for their current intended uses. However, we have not received confirmation from any regulatory authority that our determination is correct. The production, marketing and sale of any future products for the treatment of animals based on our proprietary technology may be require us to obtain regulatory approval from the Center for Veterinarian Medicine (“CVM”), a branch of the FDA, and/or the USDA, and also certain state regulatory authorities. Any substantial delay or inability to obtain required regulatory approvals for any new products developed by us could substantially delay or even prevent their commercialization, which would materially adversely impact our business and prospects.

Moreover, at such future time that we commence business internationally, our products will need to obtain regulatory approval for labeling, marketing and sale in foreign countries from authorities such as the European Commission (“EU”) or the European Medicine Agency (“EMA”). Any substantial delay or inability to obtain any necessary foreign regulatory approvals for our products could harm our business and prospects materially.

Our products will face significant competition in our industry, and our failure to compete effectively may prevent us from achieving any significant market penetration.

The development and commercialization of animal care products is highly competitive, including significant competition from major pharmaceutical, biotechnology, and specialty animal health medical companies. Our competitors include Zoetis, Inc.; Merck Animal Health, the animal health division of Merck & Co., Inc.; Merial, the animal health division of Sanofi, S.A.; Elanco, the animal health division of Eli Lilly and Company; Bayer Animal Health, the animal health division of Bayer AG; Novartis Animal Health, the animal health division of Novartis AG; Boehringer Ingelheim Animal Health; Virbac Group; Ceva Animal Health; Vetaquinol; and Dechra Pharmaceuticals PLC. There also are several smaller stage animal health companies which have recently emerged in our industry and are developing therapeutics products that may compete with our products, including Kindred Bio, Aratana Therapeutics, Next Vet, and VetDC.

Since we are an early-stage company with limited operations and financing, virtually all our competitors have substantially more financial, technical and personnel resources than us. Most of them also have established brands and substantial experience in the development, production, regulation and commercialization of animal health care products. Regarding our development of any new products or technology, we also compete with academic institutions, governmental agencies and private organizations that conduct research in the field of animal health medicines. We expect that competition in our industry is based on several factors including primarily product reliability and effectiveness, product pricing, product branding, adequate patent and other IP protection, safety of use, and product availability.

Although for the foreseeable future, our efforts and financial resources will continue to focus on successfully commercializing our Kush™ products, our future business strategy plan includes the identification of additional animal care products we may license, acquire or develop, and then commercializing such products into a branded product portfolio along with our Kush™ products. Even if we successfully license, acquire or develop such animal care products from our proprietary technology, or acquire any such new products, we may still fail to commercialize them successfully for various reasons, including competitors offering alternative products which are more effective than ours, our discovery of third-party IP rights already covering the products, harmful side effects caused to animals by the products, inability to produce products in commercial quantities at an acceptable cost, or the products not being accepted by veterinarians and pet owners as being safe or effective. If we fail to successfully obtain and commercialize future new animal care products, our business and prospects may be harmed substantially.

| 11 |

We will rely on third-parties to conduct studies of our current and new products, and if these third parties do not successfully perform their contracted commitments effectively or substantially fail to meet expected study deadlines, we could be delayed significantly or even prevented from obtaining regulatory approval for and/or effectively commercializing our future products.

We intend to engage one or more educational institutions with a veterinary medical curriculum to conduct studies of Kush™ and other products to be introduced by us. We expect to have limited control over the timing and resources that such third parties will devote to the studies. Although we must rely on the third parties to conduct our studies, we remain responsible for ensuring any of our studies are conducted in compliance with protocols, regulations and standards set by industry regulatory authorities and commonly referred to as current good clinical practices (“cGCPs”) and good laboratory practices (“GLPs”). These required clinical and laboratory practices include many items regarding the conducting, monitoring, recording and reporting the results of target animal studies to ensure that the data and results of these studies are objective and scientifically credible and accurate.

A failure of one or more key information technology systems, networks or processes may harm our ability to conduct our business effectively.

The effective operation of our business and operations will depend significantly on our information technology and computer systems. We will rely on these systems to effectively manage our sales and marketing, accounting and financial, and legal and compliance functions, new product development efforts, research and development data, communications, supply chain and product distribution, order entry and fulfillment, and other business processes. Any material failure of our information technology systems to perform satisfactorily, or their damage or interruption from circumstances beyond our control such as power outages or natural disasters, could disrupt our business materially and result in transaction errors, processing inefficiencies, and even the loss of sales and customers., causing our business and results of operations to suffer materially.

Natural disasters and other events beyond our control could materially adversely affect us.

Natural disasters or other catastrophic events may cause damage or disruption to our operations, international commerce and the global economy, and thus could have a strong negative effect on us. Our business operations are subject to interruption by natural disasters, fire, power shortages, pandemics (including the ongoing Coronavirus (COVID-19) epidemic) and other events beyond our control. Although we maintain crisis management and disaster response plans, such events could make it difficult or impossible for us to deliver our services to our customers, and could decrease demand for our services.

Risks Related to this Offering, our Common Stock and Warrants

Ownership and control of our Company is concentrated in our management.

As of the date of this Prospectus, our officers and directors beneficially own or control approximately 58% of our outstanding shares of common stock. Following this Offering, our directors and directors will own approximately __% of our common stock, which concentrated ownership and control by our management could adversely affect the status and perception of our common stock and/or warrants. In addition, any material sales of common stock of our management, or even the perception that such sales will occur, could cause a material decline in the trading price of our common stock and/or warrants.

Due to this ownership concentration, our management has the ability to control all matters requiring stockholder approval including the election of all directors, the approval of mergers or acquisitions, and other significant corporate transactions. Any person acquiring our common stock most likely will have no effective voice in the management of our company. This ownership concentration also could delay or prevent a change of control of the Company, which could deprive our stockholders from receiving a premium for their common shares.

| 12 |

There has been no consistent active trading market for our common stock, and public trading or our common stock and warrants may continue to be inactive and fluctuate substantially.

There has never been a consistent active trading market for our common stock. Our common stock currently trades over-the-counter on the QB tier of OTC Markets Group, Inc. under the symbol “PETV.” We plan on listing our warrants on the Exchange under the symbol “___.” There is no assurance that the trading market for our common stock and warrants will become more active or liquid. Furthermore, there can be no assurance any broker will be interested in trading our stock or warrants. Therefore, it may be difficult to sell your shares of common stock or warrants if you desire or need to sell them. Our underwriters are not obligated to make a market in our securities, and even if they make a market, they can discontinue market making at any time without notice. Neither we nor the underwriters can provide any assurance that an active and liquid trading market in our securities will develop or, if developed, that such market will continue.

Moreover, the trading price of our common stock has fluctuated substantially over the past few years, and there remains a significant risk that our common stock price may continue to fluctuate substantially in the future in response to various factors, including any material variations in our periodic operating results, departures or additions of management or other key personnel, announcements of acquisitions, mergers, or new technology or patents, new product developments, significant litigation matters, gain or loss of significant customers, significant capital transactions, substantial sales of our common stock in our trading market, and general and specific market and economic conditions.

The market price of our common stock and warrants is likely to be highly volatile because of several factors, including a limited public float.

The market price of our common stock has been volatile in the past and the market price of our common stock and our warrants is likely to be highly volatile in the future. You may not be able to resell shares of our common stock or our warrants following periods of volatility because of the market’s adverse reaction to volatility.

Other factors that could cause such volatility may include, among other things:

| ● | actual or anticipated fluctuations in our operating results; | |

| ● | the absence of securities analysts covering us and distributing research and recommendations about us; | |

| ● | we may have a low trading volume for a number of reasons, including that a large portion of our stock is closely held; | |

|

● | overall stock market fluctuations; |

| ● | announcements concerning our business or those of our competitors; | |

| ● | actual or perceived limitations on our ability to raise capital when we require it, and to raise such capital on favorable terms; | |

| ● | conditions or trends in the industry; | |

| ● | litigation; | |

| ● | changes in market valuations of other similar companies; | |

| ● | future sales of common stock; | |

| ● | departure of key personnel or failure to hire key personnel; and | |

| ● | general market conditions. |

| 13 |

Any of these factors could have a significant and adverse impact on the market price of our common stock and/or warrants. In addition, the stock market in general has at times experienced extreme volatility and rapid decline that has often been unrelated or disproportionate to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock and/or warrants, regardless of our actual operating performance.

Our common stock has in the past been a “penny stock” under SEC rules, and our warrants may be subject to the “penny stock” rules in the future. It may be more difficult to resell securities classified as “penny stock.”

In the past (including immediately prior to this offering), our common stock was a “penny stock” under applicable Securities and Exchange Commission (“SEC”) rules (generally defined as non-exchange traded stock with a per-share price below $5.00). While our common stock (and trading warrants) will not be considered “penny stocks” following this offering since they will be listed on the Exchange, if we are unable to maintain that listing and our common stock and warrants are no longer listed on the Exchange, unless we maintain a per-share price above $5.00, our common stock and warrants will become “penny stocks.” These rules impose additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as “established customers” or “accredited investors.” For example, broker-dealers must determine the appropriateness for non-qualifying persons of investments in penny stocks. Broker-dealers must also provide, prior to a transaction in a penny stock not otherwise exempt from the rules, a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, disclose the compensation of the broker-dealer and its salesperson in the transaction, furnish monthly account statements showing the market value of each penny stock held in the customer’s account, provide a special written determination that the penny stock is a suitable investment for the purchaser, and receive the purchaser’s written agreement to the transaction.

Legal remedies available to an investor in “penny stocks” may include the following:

| ● | If a “penny stock” is sold to the investor in violation of the requirements listed above, or other federal or states securities laws, the investor may be able to cancel the purchase and receive a refund of the investment. | |

| ● | If a “penny stock” is sold to the investor in a fraudulent manner, the investor may be able to sue the persons and firms that committed the fraud for damages. |

These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock or our warrants and may affect your ability to resell our common stock and our warrants.

Many brokerage firms will discourage or refrain from recommending investments in penny stocks. Most institutional investors will not invest in penny stocks. In addition, many individual investors will not invest in penny stocks due, among other reasons, to the increased financial risk generally associated with these investments. For these reasons, penny stocks may have a limited market and, consequently, limited liquidity. We can give no assurance at what time, if ever, our common stock or our warrants will not be classified as a “penny stock” in the future.

| 14 |

If we fail to maintain effective internal control over financial reporting, the price of our securities may be adversely affected.

Our internal controls over financial reporting have weaknesses and conditions that require correction or remediation. For the year ended March 31, 2020 and the quarter ended June 30, 2020, we identified three material weakness in our assessment of the effectiveness of disclosure controls and procedures. We have (i) deficiencies in the segregation of duties, (ii) deficiencies in the staffing of our financial accounting department and (iii) limited checks and balances in processing cash and other transactions. We are committed to improving our financial reporting processes and plan on increasing the size of our accounting staff at the appropriate time for our business and its size to ameliorate our concern that we do not effectively segregate certain accounting duties or have adequate staffing, which we believe would resolve these material weakness in disclosure controls and procedures. However, there can be no assurances as to the timing of any such action or that we will be able to do so. Any failure by us to implement the changes necessary to maintain an effective system of internal controls could harm our operating results materially and cause investors and financial analysts to lose confidence in our reported financial information. Any such loss of confidence in the investment community would have a negative effect on the trading and price of our common stock and warrants.

We are required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”) and if we fail to continue to comply, our business could be harmed, and the price of our securities could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act require an annual assessment of internal controls over financial reporting, and for certain issuers, an attestation of this assessment by the issuer’s independent registered public accounting firm. The standards that must be met for management to assess the internal controls over financial reporting as effective are evolving and complex, and require significant documentation, testing, and possible remediation to meet the detailed standards. We expect to incur significant expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take or costly it will be to complete the assessment of the effectiveness of our internal controls over financial reporting for each year and to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment and remediation process on a timely basis. In the event that our Chief Executive Officer or Chief Financial Officer determines that our internal controls over financial reporting are not effective as defined under Section 404, we cannot predict how regulators will react or how the market prices of our securities will be affected; however, we believe that there is a risk that investor confidence and the market value of our securities may be negatively affected.

Our management has broad discretion over the use of proceeds received by us from this offering and may apply these proceeds in ways that do not improve our operating results or increase the value of your investment.

Our management will retain broad discretion as to the use and allocation of the net proceeds received by us in this offering. Accordingly, our investors will not have any opportunity to evaluate the economic, financial and other relevant information considered by us regarding the application of the net proceeds. Management could apply the proceeds in ways that you would not approve of, and which do not improve our business or increase the value of your investment.

You will experience immediate and substantial dilution in the value of any Units that you purchase from us in this offering.

The price per common share in this public offering is substantially higher than the net tangible book value of each outstanding share of our common stock, and accordingly purchasers of Units in this offering will experience immediate and substantial dilution. See “Dilution.”

Assuming we obtain an Exchange listing, we will incur material increased costs and become subject to additional regulations and requirements.

As a newly Exchange-listed public company, we will incur material additional legal, accounting and other expenses including recruiting and retaining qualified independent directors, payment of annual Exchange fees, and satisfying Exchange standards for companies listed with it. If we are unable to satisfy our obligations and responsibilities as an Exchange-listed company, we could be subject to delisting of our common stock and warrants from the Exchange and other regulatory action, and potentially even civil litigation.

We do not anticipate paying any dividends on our common stock for the foreseeable future.

We have not paid any dividends on our common stock to date, and we do not anticipate paying any such dividends in the foreseeable future. We anticipate that any earnings experienced by us will be retained to finance the implementation of our operational business plan and expected future growth.

| 15 |

The elimination of monetary liability against our directors and executive officers under Nevada law and the existence of indemnification rights held by them granted by our bylaws could result in substantial expenditures by us.

Our Articles of Incorporation eliminate the personal liability of our directors and officers to the Company and its stockholders for damages for breach of fiduciary duty to the maximum extent permissible under Nevada law. In addition, our Bylaws provide that we are obligated to indemnify our directors or officers to the fullest extent authorized by Nevada law for costs or damages incurred by them involving legal proceedings brought against them relating to their positions with the Company. These indemnification obligations could result in our incurring substantial expenditures to cover the cost of settlement or damage awards against our directors or officers.

Our Articles of Incorporation, Bylaws, and Nevada law may have anti-takeover effects that could discourage, delay or prevent a change in control, which may cause our stock price to decline.