Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHESAPEAKE ENERGY CORP | a8-k2020x10x08recleans.htm |

Exhibit 99.1

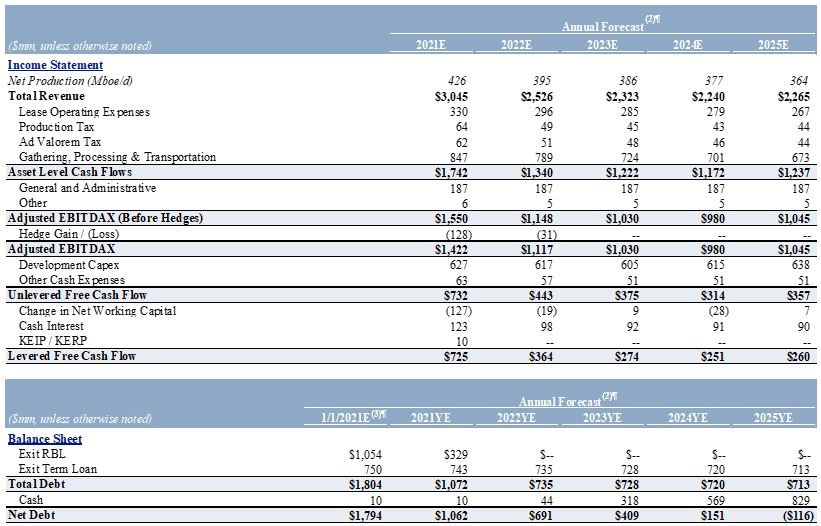

FINANCIAL PROJECTIONS

The Debtors believe that the Plan1 meets the feasibility requirement set forth in section 1129(a)(11) of the Bankruptcy Code, as confirmation is not likely to be followed by liquidation or the need for further financial reorganization of the Debtors or any successor thereto under the Plan. In connection with the planning and development of a plan of reorganization and for the purposes of determining whether such plan would satisfy this feasibility standard, the Debtors analyzed their ability to satisfy their post-Effective Date financial obligations while maintaining sufficient liquidity and capital resources.

The Debtors do not, as a matter of course, publish their business plans or strategies, projections or anticipated financial position. Accordingly, the Debtors do not anticipate that they will, and disclaim any obligation to, furnish updated business plans or the Financial Projections to holders of Claims or Interests or other parties in interest going forward, or to include such information in documents required to be filed with the SEC or otherwise make such information public, unless required to do so by the SEC or other regulatory bodies pursuant to the provisions of the Plan.

In connection with the Disclosure Statement, the Debtors’ management team (“Management”) prepared the Financial Projections for the years 2021 through 2025. The Financial Projections were prepared by Management and are based on several assumptions made by Management with respect to the future performance of the Reorganized Debtors’ operations.

The Debtors have prepared the Financial Projections based on information available to them, including information derived from public sources that have not been independently verified. No representation or warranty, expressed or implied, is provided in relation to fairness, accuracy, correctness, completeness, or reliability of the information, opinions, or conclusions expressed herein.

THESE FINANCIAL PROJECTIONS WERE NOT PREPARED WITH A VIEW TOWARD COMPLIANCE WITH PUBLISHED GUIDELINES OF THE SEC OR GUIDELINES ESTABLISHED BY THE AMERICAN INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS FOR PREPARATION AND PRESENTATION OF PROSPECTIVE FINANCIAL INFORMATION. THE PRO FORMA BALANCE SHEET HEREIN REFLECTS A PRELIMINARY HIGH-LEVEL PRESENTAION OF WHAT A FRESH START ACCOUNTING ESTIMATE MAY LOOK LIKE, BUT IS SUBJECT TO MATERIAL CHANGE AND DOES NOT REFLECT A FULL FRESH START ACCOUNTING ANALYSIS, WHICH COULD RESULT IN MATERIAL CHANGE TO ANY OF THE PROJECTED VALUES HEREIN.

ALTHOUGH MANAGEMENT HAS PREPARED THE FINANCIAL PROJECTIONS IN GOOD FAITH AND BELIEVES THE UNDERLYING ASSUMPTIONS TO BE REASONABLE, IT IS IMPORTANT TO NOTE THAT NEITHER THE DEBTORS NOR THE REORGANIZED DEBTORS CAN PROVIDE ANY ASSURANCE THAT SUCH ASSUMPTIONS WILL BE REALIZED. AS DESCRIBED IN DETAIL IN THE DISCLOSURE STATEMENT, A VARIETY OF RISK FACTORS COULD AFFECT THE REORGANIZED DEBTORS’ FINANCIAL RESULTS AND MUST BE CONSIDERED. ACCORDINGLY, THE FINANCIAL PROJECTIONS SHOULD BE REVIEWED IN CONJUNCTION WITH A REVIEW OF THE DISCLOSURE STATEMENT AND THE ASSUMPTIONS DESCRIBED HEREIN, INCLUDING ALL RELEVANT QUALIFICATIONS AND FOOTNOTES.

1 Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Disclosure Statement, to which these Financial Projections are attached. | |

The Financial Projections contain certain forward-looking statements, all of which are based on various estimates and assumptions. Such forward looking statements are subject to inherent uncertainties and to a wide variety of significant business, economic, and competitive risks, including those summarized herein. When used in the Financial Projections, the words, “anticipate,” “believe,” “estimate,” “will,” “may,” “intend,” “expect,” and similar expressions should be generally identified as forward-looking statements. Although the Debtors believe that their plans, intentions, and expectations reflected in the forward-looking statements are reasonable, the Debtors cannot be sure that such plans, intentions and expectations will be achieved. These statements are only predictions are not guarantees of future performance or results. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by a forward-looking statement. All forward-looking statements are attributable to the Debtors or Persons or Entities acting on their behalf are expressly qualified in their entirety by the cautionary statements set forth herein. Forward-looking statements speak only to as of the date on which they are made. Except as required by law, the Debtors expressly disclaim any obligation to update any forward-looking statement, whether because of new information, future events, or otherwise.

The Financial Projections should be read in conjunction with the assumptions, qualifications, and explanations set forth in the Disclosure Statement and the Plan in their entirety as well as the notes and assumptions set forth below.

The Financial Projections are subject to inherent risks and uncertainties, most of which are difficult to predict and many of which are beyond Management’s control. Although Management believes these assumptions are reasonable under the circumstances, such assumptions are subject to significant uncertainties, including, but not limited to: (a) fluctuations in oil and natural gas prices and the Reorganized Debtors’ ability to hedge against movements in prices; (b) the uncertainty inherent in estimating reserves, future net revenues, and discounted future cash flows; (c) the timing and amount of future production of oil and natural gas; (d) changes in the availability and cost of capital; (e) environmental, drilling and other operating risks, including liability claims as a result of oil and natural gas operations; (f) proved and unproved drilling locations and future drilling plans; and (g) the effects of existing and future laws and governmental regulations, including environmental, hydraulic fracturing, and climate change regulation. The Debtors believe, based on preliminary tax and accounting analyses, that it will not incur income taxes over the forecast horizon. To the extent it is later determined that these accounting and tax analyses are incorrect, the Reorganized Debtors projections could be materially impacted. Additional information regarding these uncertainties are described in the Disclosure Statement. Should one or more of the risks or uncertainties referenced in the Disclosure Statement occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in the Financial Projections. Further, new factors could cause actual results to differ materially from those described in the Financial Projections, and it is not possible to predict all such factors, or to the extent to which any such factors or combination may cause actual results to differ from those contained in the Financial Projections. The Financial Projections herein are not, and must not be viewed as, a representation of fact, prediction or guaranty of the Reorganized Debtors’ future performance.

Overview

Actual balances may vary from those reflected in the opening balance sheet due to variances in projections. The reorganized pro forma debt capital structure for the period ending December 31, 2020 through December 31, 2025 contain certain pro forma adjustments as a result of consummation of the Plan.

Assumptions

A. | Overview |

The Reorganized Debtors are an independent energy company focused on the acquisition, production, exploration and development of onshore oil and natural gas assets in the United States. The Reorganized Debtors have operations across five key regions, which are assumed to continue in the financial projections: Appalachia, Brazos Valley, Gulf Coast, South Texas, and Powder River Basin. The Mid-Continent asset is actively in a sales process and is not included in the financial projections.

B. | Presentation |

The Projections are presented on a consolidated basis, including estimates of operating results for the Reorganized Debtor entities in the aggregate.

C. | Plan Consummation |

The Financial Projections include projected financial statements for 2021 – 2025 and an Assumed Effective Date of January 1, 2021.

D. | Accounting Policies |

The Projections have been prepared using accounting policies that are materially consistent with those applied in the Debtors’ historical financial statements.

E. | Total Revenue |

Total revenue consists of production revenue and hedging revenue. Production revenue is generated from the exploration for and development, production, gathering, and sale of oil, natural gas, and natural gas liquids.

F. | Commodity Pricing |

Commodity pricing is based on September 30, 2020 New York Mercantile Exchange (“NYMEX”) forward pricing for crude oil, natural gas, and NGLs. Management estimates realized pricing based on forecasted oil and gas differentials. Hedged volumes and hedged prices reflect hedge schedule as of September 9, 2020.

G. | Operating Expenses |

Operating expenses consist of lease operating expenses, production and ad valorem taxes and gathering, transportation and marketing expense. GP&T projections include savings associated with ongoing midstream contract rejections and renegotiations as part of the Reorganized Debtor’s business.

H. | Cash General and Administrative Expenses |

Cash general and administrative (“G&A”) expenses primarily consists of personnel costs, rent, insurance, and other corporate overhead costs necessary to manage operations and comply with regulatory and public company requirements. The Reorganized Debtors’ projected G&A expenses are based on the Debtors’ current development and operational plans.

I. | Development Capex |

Development Capex reflects cost incurred in connection with the Reorganized Debtors’ development plan.

J. | Interest Expense |

Post-emergence interest expense is forecasted based on the Reorganized Debtors’ anticipated pro forma capital structure. Pro forma capital structure includes $[1.05]bn drawn on a $1.75bn Exit RBL (commitment) with an interest rate of L+3.25% – 4.25% and a $750mm Exit Term Loan with an interest rate of 10.50%.

2 The Company has approximately $2.5 billion PV-10 of potential savings opportunities, some or all of which may or may not be achieved. Of these opportunities, approximately $1.75 billion are reflected in the business plan, of which $700 - $900 million are subject to ongoing negotiation and may or may not be achieved. 3 Debt balances shown prior to application of cash proceeds, if any, from Mid-Con sales process. | |