Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Atea Pharmaceuticals, Inc. | d913778dex231.htm |

| EX-21.1 - EX-21.1 - Atea Pharmaceuticals, Inc. | d913778dex211.htm |

| EX-10.7 - EX-10.7 - Atea Pharmaceuticals, Inc. | d913778dex107.htm |

| EX-10.1 - EX-10.1 - Atea Pharmaceuticals, Inc. | d913778dex101.htm |

| EX-4.2 - EX-4.2 - Atea Pharmaceuticals, Inc. | d913778dex42.htm |

| EX-4.1 - EX-4.1 - Atea Pharmaceuticals, Inc. | d913778dex41.htm |

| EX-3.2 - EX-3.2 - Atea Pharmaceuticals, Inc. | d913778dex32.htm |

| EX-3.1 - EX-3.1 - Atea Pharmaceuticals, Inc. | d913778dex31.htm |

| S-1 - S-1 - Atea Pharmaceuticals, Inc. | d913778ds1.htm |

Exhibit 10.6

125 SUMMER STREET

BOSTON, MASSACHUSETTS

OFFICE LEASE AGREEMENT

BETWEEN

OPG 125 SUMMER OWNER (DE) LLC,

a Delaware limited liability company,

AS LANDLORD

AND

ATEA PHARMACEUTICALS, INC.,

a Delaware corporation,

AS TENANT

OFFICE LEASE AGREEMENT

This Office Lease Agreement (this “Lease”) is made and entered into as of November 18, 2016 (the “Effective Date”), by and between OPG 125 SUMMER OWNER (DE) LLC, a Delaware limited liability company (“Landlord”), and ATEA PHARMACEUTICALS, INC., a Delaware corporation (“Tenant”).

| 1. | Basic Lease Information. |

| 1.1 | “Building” shall mean the building located at 125 Summer Street, Boston, Massachusetts 02110 and commonly known as 125 Summer Street. The “Rentable Floor Area of the Building” is deemed to be 475,482 square feet. |

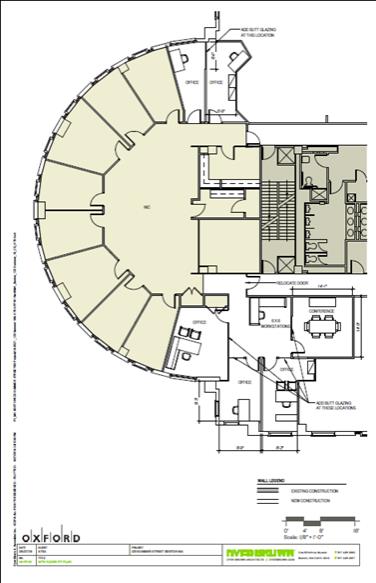

| 1.2 | “Premises” shall mean the area shown on Exhibit A to this Lease. The Premises are located on the sixteenth (16th) floor of the Building and known as Suite 1675. |

| 1.3 | “Rentable Floor Area of the Premises”: 5,634 square feet. |

| 1.4 | “Term Commencement Date”: June 1, 2017. |

| “Base | Rent Commencement Date”: August 1, 2017. |

| 1.5 | “Term Expiration Date”: July 31, 2022. |

| 1.6 | “Base Rent”: |

| Period |

Annual Base Rent Rate Per Square Foot of Rentable Floor Area |

Monthly Base Rent |

||||||

| Lease Year 1: |

$ | 57.00 | $ | 26,761.50 | ||||

| Lease Year 2: |

$ | 58.00 | $ | 27,231.00 | ||||

| Lease Year 3: |

$ | 59.00 | $ | 27,700.50 | ||||

| Lease Year 4: |

$ | 60.00 | $ | 28,170.00 | ||||

| Lease Year 5: |

$ | 61.00 | $ | 28,639.50 | ||||

As used above, the first “Lease Year” shall commence on the Term Commencement Date and end on the day immediately preceding the first anniversary of the Base Rent Commencement Date (provided, that, if the Base Rent Commencement Date does not occur on the first day of a calendar month, the first Lease Year shall further include the balance of the calendar month within which such first anniversary occurs), and each subsequent Lease Year shall mean each successive period of twelve (12) calendar months following the first Lease Year during the initial Term; provided, that, the last Lease Year of the initial Term shall end on the Term Expiration Date set forth above for the initial Term.

| 1.7 | “Tenant’s Proportionate Share”: 1.18% for the initial Premises. |

| 1.8 | “Base Year” for Expenses (as defined in Exhibit B): calendar year 2017. |

1

“Base Year” for Taxes (as defined in Exhibit B): Fiscal Year 2017 (i.e., July 1, 2016 to June 30, 2017). For purposes hereof, “Fiscal Year” shall mean the Base Year for Taxes and each period of July 1 to June 30 thereafter.

| 1.9 | “Tenant Work Allowance”: $30.00 per square foot of Rentable Floor Area of the Premises, as further described in the attached Exhibit C. |

| 1.10 | “Delivery Condition” and “Delivery Date”: As both terms are defined in Exhibit C. |

| 1.11 | Additional Provisions: See Exhibit F. |

| 1. | Parking |

| 1.12 | “Letter of Credit” shall mean the letter of credit in the amount of $107,046.00, as provided in Section 6 and Exhibit G attached hereto. |

| 1.13 | “Broker”: Colliers International, which represented Tenant in connection with this Lease. |

| 1.14 | “Permitted Use”: General, administrative and executive office uses, including ancillary uses thereof, but specifically excluding medical or dental offices, utility company offices, employment agency offices (other than executive or professional staffing firms), governmental or quasi-governmental offices, or a provider of temporary office space or facilities on a contract basis. For purposes hereof, uses ancillary to the Permitted Uses shall include customary coffee stations for use only by the employees and business invitees of Tenant. |

| 1.15 | “Notice Address(es)”: |

| For Landlord: | For Tenant: | |

| OPG 125 Summer Owner (DE) LLC | Prior to the Term Commencement | |

| c/o Oxford Property Group | Date: | |

| 125 Summer Street | ||

| Boston, MA 02110 | ATEA Pharmaceuticals, Inc. | |

| Attention: General Manager | 125 Summer Street | |

| Boston, MA 02110 | ||

| With copies of any notices | Attn: General Counsel | |

| to Landlord sent to: | ||

| From and after the Term | ||

| c/o Oxford Property Group | Commencement Date: | |

| 320 Park Avenue, 17th Floor | ||

| New York, NY 10022 | ATEA Pharmaceuticals, Inc. | |

| Attn: Christopher Lankin, Esq., | 125 Summer Street | |

| Vice President, Legal | Boston, MA 02110 | |

| Attn: General Counsel | ||

| and | ||

| Nutter, McClennen & Fish, LLP | ||

| Seaport West 155 Seaport Boulevard |

||

| Boston, MA 02210 | ||

| Attn: Timothy M. Smith, Esq. | ||

2

| 1.16 | “Business Day(s)” are Monday through Friday of each week, exclusive of New Year’s Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day (“Holidays”). Landlord may designate additional Holidays that are commonly recognized by other office buildings in the area where the Building is located. “Building Service Hours” are 8:00 A.M. to 6:00 P.M. on Business Days and, upon Tenant’s request, 9:00 A.M. to 1:00 P.M. on Saturdays. |

| 1.17 | “Property” means the Building and the parcel(s) of land on which it is located and, at Landlord’s discretion, the parking facilities and other improvements, if any, serving the Building and the parcel(s) of land on which they are located. |

| 1.18 | Other Defined Terms: Other capitalized terms shall have the meanings set forth in the Lease and its Exhibits below. References in this Lease to numbered Sections shall be deemed to refer to the numbered Sections of this Lease, unless otherwise specified. |

| 1.19 | Exhibits: The following exhibits and attachments are incorporated into and made a part of this Lease: |

Exhibit A (Outline and Location of Premises)

Exhibit B (Expenses and Taxes)

Exhibit C (Work Letter)

Exhibit D (Commencement Letter)

Exhibit E (Building Rules and Regulations)

Exhibit F (Additional Provisions)

Exhibit G (Letter of Credit)

| 2. | Lease Grant. |

2.1 Premises. Landlord hereby leases the Premises to Tenant and Tenant hereby leases the Premises from Landlord. The Premises exclude the exterior faces of exterior walls, the common stairways and stairwells, elevators and elevator wells, fan rooms, electric and telephone closets, janitor closets, freight elevator vestibules, and pipes, ducts, conduits, wires and appurtenant fixtures serving other parts of the Building (exclusively or in common), and other Common Areas (as defined below) of the Building. If the Premises include the entire rentable area of any floor, the common corridors, elevator lobby, and restroom facilities located on such full floor(s) shall be considered part of the Premises.

2.2 Appurtenant Rights. During the Term, Tenant shall have, as appurtenant to the Premises, the non-exclusive rights to use in common (subject to reasonable rules of general applicability to tenants and other users of the Building from time to time made by Landlord of which Tenant is given notice): (a) the common lobbies, corridors, stairways, elevators and loading platform of the Building, and the pipes, ducts, conduits, wires and appurtenant meters and equipment serving the Premises in common with others; (b) common driveways and walkways necessary for access to the Building; (c) if the Premises include less than the entire rentable floor area of any floor, the common corridors, elevator lobby, and restroom facilities located on such floor; and (d) all other areas or facilities in or about the Building from time to time designated for general use in common by Tenant, other Building tenants, and Landlord (collectively, the “Common Areas”).

3

| 3. | Term and Term Commencement Date. |

3.1 Term. The “Term” of this Lease shall begin at 12:01 a.m. on the Term Commencement Date and shall end at 11:59 p.m. on the Term Expiration Date set forth in Section 1, unless sooner terminated in accordance with the provisions of this Lease. Promptly after the Term Commencement Date, Landlord and Tenant shall execute and deliver a commencement letter in the form attached as Exhibit D (the “Commencement Letter”). Tenant’s failure to execute and return the Commencement Letter, or to provide written objection to the statements contained in the Commencement Letter, within thirty (30) days after its delivery to Tenant shall be deemed an approval by Tenant of the statements contained therein.

3.2 Initial Tenant Work. As used herein, the “Initial Tenant Work” shall mean all Alterations (as defined in Section 8) performed, or to be performed, in or about the Premises that are required initially to put the Premises in condition suitable for Tenant’s use and occupancy. The Initial Tenant Work shall be performed in accordance with, and subject to, the provisions of Exhibit C attached hereto. Any Initial Tenant Work performed by Tenant (if applicable) shall be subject to the terms, conditions and requirements of Section 8 to the extent so provided in Exhibit C. Subject to Landlord’s obligation to deliver the Premises to Tenant on the Delivery Date with the Delivery Condition having been satisfied as expressly provided in Exhibit C, the Premises shall be leased by Tenant in their current “as is” condition and configuration without any representations or warranties by Landlord.

3.3 Delivery. By taking possession of the Premises, Tenant agrees that the Premises are in good order and satisfactory condition; provided, that, the foregoing shall not limit Landlord’s obligations under Section 9.02. Landlord shall not be liable for any delay or failure to deliver possession of the Premises or any other space due to the holdover or unlawful possession of such space by another party or other reason; provided, however, Landlord shall use reasonable efforts to obtain possession of any such space. Without limiting the foregoing, Landlord and Tenant hereby acknowledge and agree that: (a) pursuant to the sublease agreement referenced in the Landlord Consent to Sublease dated as of March 3, 2014, by and among Landlord, as landlord, Portrait International, Inc., an Ohio corporation (“Portrait International”), as sublandlord, and Tenant, as subtenant (the “Sublease”), Tenant is currently subleasing approximately 4,068 square feet of the Premises from Portrait International as more particularly set forth in the Sublease (the “Subleased Space”); and (b) Portrait International is currently leasing the Subleased Space from Landlord pursuant to an Office Lease Agreement dated as of October 29, 2009 (as amended, the “Portrait International Lease”), through June 30, 2017. Landlord hereby represents and warrants to Tenant that, simultaneously with Landlord’s execution and delivery of this Lease, Landlord and Portrait International have entered into an agreement to terminate the Portrait International Lease as of May 31, 2017. Any delay in the delivery of the Premises or in the occurrence of the Term Commencement Date shall not give rise to any liability or default by Landlord or affect any of the terms of this Lease or Tenant’s obligation to accept the Premises when delivered, except as expressly set forth in Section 3.01 or Exhibit C, as the case may be. Notwithstanding the foregoing, except if caused by Force Majeure (as defined in Section 22.06), in the event that the Delivery Date does not occur within sixty (60) days following the Term Commencement Date (the “First Outside Term Commencement Date”), then, commencing on the Rent Commencement Date, Tenant shall be entitled to an abatement of then current Base Rent equal to one (1) day for each day following the First Outside Term Commencement Date that the Term Commencement Date does not occur. Except if caused by Force Majeure, in the event that the Delivery Date does not occur by the one hundred twentieth (120th) day following the Term Commencement Date (the “Second Outside Term Commencement Date”), then Tenant shall have the right to terminate this Lease by written notice to Landlord sent within ten (10) days after the Second Outside Term Commencement Date, whereupon all amounts paid by Tenant to Landlord under this Lease shall be promptly refunded to Tenant and all obligations of the parties hereto shall be null and void and this Lease shall be without recourse to either party hereto, except for those that, by their terms, expressly

4

survive the termination of this Lease. The foregoing remedies shall be the sole remedies granted to Tenant in the event of a delay in the delivery of the Premises or in the occurrence of the Term Commencement Date. Except as otherwise provided in this Lease and the Sublease, Tenant shall not be permitted to take possession of or enter the Premises before the Term Commencement Date without Landlord’s permission and, if Tenant does so, such possession or entry shall be subject to the terms and conditions of this Lease; provided, however, except for the cost of services used or requested by Tenant (e.g., after-hours HVAC service), Tenant shall not be required to pay Rent to Landlord for any such possession or entry before the Term Commencement Date during which Tenant, with Landlord’s approval, has entered, or is in possession of, the Premises for the sole purpose of performing the Initial Tenant Work or installing furniture, equipment or other personal property.

| 4. | Rent. |

4.1 Base Rent and Additional Rent. Tenant hereby covenants and agrees to pay to Landlord, without any setoff or deduction (except to the extent expressly set forth in this Lease), (a) all Base Rent (as provided in Section 1), (b) Tenant’s Proportionate Share of the Expense Excess and the Tax Excess (as provided in Exhibit B attached hereto), and (c) all other Additional Rent due for the Term (collectively referred to as “Rent”). “Additional Rent” means all sums (exclusive of Base Rent) that Tenant is required to pay to Landlord from time to time under this Lease.

4.2 Manner and Timing of Payments. Base Rent and other recurring monthly charges of Additional Rent shall be due and payable in advance on the first day of each calendar month without notice or demand. All other items of Rent shall be due and payable by Tenant within thirty (30) days after billing by Landlord. Rent shall be made payable to the entity, and sent to the address, that Landlord from time to time designates for such purposes and shall be paid by Tenant by good and sufficient check payable in United States of America currency or by electronic or wire transfer to an account from time to time designated by Landlord. Landlord’s acceptance of less than the entire amount of Rent shall be considered, unless otherwise specified by Landlord, a payment on account of the oldest obligation due from Tenant hereunder, notwithstanding any statement to the contrary contained on or accompanying any such payment from Tenant. Rent for any partial month during the Term shall be prorated on a per diem basis. Tenant shall pay and be liable for all rental, sales and use taxes (but excluding income taxes), if any, imposed upon or measured by Rent. No endorsement or statement on a check or letter accompanying payment shall be considered an accord and satisfaction.

| 5. | Compliance with Laws; Use. |

Tenant shall use the Premises only for the Permitted Use and shall not use or permit the use of the Premises for any other purpose. Tenant shall comply with all statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity whether in effect now or later, including the Americans with Disabilities Act (“Law(s)”), regarding the operation of Tenant’s business and the use, condition, configuration, and occupancy of the Premises and the Building systems located in or exclusively serving the Premises. In addition, Tenant shall, at its sole cost and expense, promptly comply with any Laws that relate to the Base Building (defined below), but only to the extent such obligations are triggered by Tenant’s use of the Premises (other than for general office use in accordance with the terms of this Lease) or Alterations (as defined in Section 8.01) in or about the Premises performed or requested by Tenant. “Base Building” shall include the structural portions of the Building, the common restrooms, and the Building mechanical, electrical, and plumbing systems and equipment located in the internal core of the Building on the floor or floors on which the Premises are located. Tenant shall promptly provide Landlord with copies of any notices it receives regarding an alleged violation of Law. Tenant shall not exceed the standard density limit for the Building. Tenant shall not use or permit the use of any portion of the Premises in a manner that results in objectionable noise, odors, or vibrations emanating from the

5

Premises or any equipment installed by Tenant or any party acting under or through Tenant. Tenant shall comply with the rules and regulations of the Building attached as Exhibit E and such other reasonable rules and regulations adopted by Landlord from time to time, including rules and regulations for the performance of Alterations. If the Premises or any portion thereof are located on a multi-tenant floor, Tenant shall cause all portions of such Premises that are visible from the Common Areas on such floors to be arranged, furnished, and lighted in a manner in which such Premises appears at all times to be occupied for the Permitted Use.

| 6. | Security Deposit. |

Concurrently with Tenant’s execution and delivery of this Lease, Tenant shall deliver to Landlord a clean, irrevocable letter of credit in the amount set forth in Section 1, which shall comply with, and may be drawn by Landlord in accordance with, the provisions of Exhibit G attached hereto (such letter of credit, together with any renewal or replacement thereof in accordance herewith, being referred to herein as the “Letter of Credit”).

7. Building Services.

7.1 Building Services. Landlord shall furnish Tenant with the following services: (a) water for use in the Base Building restrooms; (b) customary heat and air conditioning in season during Building Service Hours; (c) standard janitorial service on Business Days; (d) elevator service; (e) electricity in accordance with the terms and conditions in Section 7.02; (f) access to the Building for Tenant and its employees 24 hours per day/7 days per week, subject to the terms of this Lease and such protective services or monitoring systems, if any, as Landlord may from time to time impose, including, without limitation, sign-in procedures and/or presentation of identification cards; and (g) such other services as Landlord reasonably determines are necessary or appropriate for the Property. In addition, Tenant shall have the right to receive HVAC service during hours other than Building Service Hours by paying Landlord’s then standard charge for additional HVAC service and providing such prior notice as is reasonably specified by Landlord. If Tenant is permitted to connect any supplemental HVAC units to the Building’s condenser water loop or chilled water line, such permission shall be conditioned upon Landlord having adequate excess capacity from time to time and such connection and use shall be subject to Landlord’s reasonable approval and reasonable restrictions imposed by Landlord, and Landlord shall have the right to charge Tenant a connection fee and/or a monthly usage fee, as reasonably determined by Landlord. If, at Tenant’s request, Landlord, or an affiliated or third party service provider, provides any services that are not Landlord’s express obligation under this Lease, including, without limitation, any repairs which are Tenant’s responsibility pursuant to Section 9 below, Tenant shall pay to the applicable service provider the cost of such services plus a reasonable administrative charge.

7.2 Tenant Electricity. Tenant shall pay to Landlord, as Additional Rent, Tenant’s pro rata share of the costs of electricity used on the floor on which the Premises are located, in advance on the first day of each month or partial month of the Term, based on amounts estimated by Landlord from time to time for such electricity charges, subject to periodic reconciliations based on actual electricity usage and utility rates for the space and period in question. Without the consent of Landlord, Tenant’s use of electrical service shall not exceed the Building standard usage, per square foot, as reasonably determined by Landlord, based upon the Building standard electrical design load, which is 5 watts per square foot as of the Effective Date. Landlord shall have the right to measure electrical usage by commonly accepted methods, including the installation of measuring devices such as submeters and check-meters, which to the extent not in place prior to the Effective Date shall be installed at Tenant’s expense if Landlord reasonably believes that Tenant is utilizing more than its pro rata share of electricity. If it is determined, for any electrical service that is not separately check-metered to Tenant, that Tenant is using electricity in such quantities or during such periods as to cause the total cost of Tenant’s electrical usage, on a monthly,

6

per-rentable-square-foot basis, to materially exceed that which Landlord reasonably deems to be standard for the Building, Tenant shall pay Landlord Additional Rent for the cost of such excess electrical usage and, if applicable, for the cost of purchasing and installing the measuring device(s). Notwithstanding the foregoing, to the extent any electricity service is from time to time metered directly by the utility company to the Premises, then (a) Tenant shall timely pay the separate charges for such electricity service directly to the applicable utility company and, if requested by Landlord from time to time, provide copies of such utility company invoices and evidence of such payments, and (b) such electricity costs shall not be included in the calculation of Additional Rent.

7.3 Interruption of Services. Landlord’s failure to furnish, or any interruption, diminishment or termination of services due to the application of Laws, the failure of any equipment, the performance of maintenance, repairs, improvements or alterations, utility interruptions or the occurrence of an event of Force Majeure (defined in Section 22.06) (collectively a “Service Failure”) shall not render Landlord liable to Tenant, constitute a constructive eviction of Tenant, give rise to an abatement of Rent, nor relieve Tenant from the obligation to fulfill any covenant or agreement, except as provided in the next sentence. If the Premises, or a material portion of the Premises, are made untenantable for a period in excess of ten (10) consecutive Business Days as a result of a Service Failure that is reasonably within the control of Landlord to correct, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Rent payable hereunder during the period following such ten-(10)-Business-Day period and ending on the day the service has been restored. If the entire Premises has not been rendered untenantable by the Service Failure, the amount of abatement shall be equitably prorated. This Section shall not apply to any Service Failure arising from a casualty event governed by Section 14 below.

7.4 Reservations. Without limiting the generality of the foregoing, Landlord reserves the right from time to time to modify components of the access procedures for the Building or other portions of the Property, to change the number of lobby attendants, or to institute, modify, supplement, or discontinue any particular access control procedures or equipment for the Building, whether during or after business hours. Landlord does not warrant or guarantee the effectiveness of any such system or procedures. Tenant expressly disclaims any such warranty, guarantee, or undertaking by Landlord with respect thereto and acknowledges that access control procedures from time to time in effect are solely for the convenience of tenants generally and are not intended to secure the Premises or to guarantee the physical safety of any persons in or about the Premises or the Property. Tenant shall be responsible for securing the Premises, including without limitation by Tenant’s installation of access card readers or other security equipment for the Premises in accordance with Exhibit C and/or Section 8 and by restricting or monitoring access into and from the Premises by its employees or other invitees. At the time that any Tenant employee (or other person acting under or through Tenant) who has been issued a Building access card is terminated or otherwise ceases to work at the Premises, Tenant shall retrieve and destroy the Building access card for such person and, in accordance with the Building’s standard procedures, notify the Building’s property manager that such person should be removed from the active list for Building access cards.

| 8. | Alterations |

8.1 Alterations. Tenant shall not make alterations, repairs, additions or improvements or install any Cable (collectively referred to as “Alterations”) in the Premises, without first obtaining the written consent of Landlord in each instance, which consent shall not be unreasonably withheld or delayed. “Cable” shall mean and refer to any electronic, fiber, phone and data cabling and related equipment that is installed by or for the exclusive benefit of Tenant or any party acting under or through Tenant. Prior to starting work on any Alterations, Tenant shall furnish Landlord with plans and specifications (which shall be in CAD format if requested by Landlord); names of contractors reasonably acceptable to Landlord (provided that Landlord may designate specific contractors with respect to Base Building and vertical

7

Cable, as may be described more fully below); required permits and approvals; evidence of contractor’s and subcontractor’s insurance in amounts reasonably required by Landlord and naming as additional insureds the Landlord, the managing agent for the Building, and such other Additional Insured Parties (as defined in Section 13) as Landlord may designate for such purposes; and any security for performance in amounts reasonably required by Landlord. Landlord may designate specific contractors with respect to oversight, installation, repair, connection to, and removal of vertical Cable. All Cable shall be clearly marked with adhesive plastic labels (or plastic tags attached to such Cable with wire) to show Tenant’s name, suite number, and the purpose of such Cable (i) every 6 feet outside the Premises (specifically including, but not limited to, the electrical room risers and any Common Areas), and (ii) at the termination point(s) of such Cable. Changes to the plans and specifications must also be submitted to Landlord for its approval. Alterations shall be constructed in a good and workmanlike manner using materials of a quality reasonably approved by Landlord, and Tenant shall ensure that no Alteration impairs any Building system or Landlord’s ability to perform its obligations hereunder. Tenant shall reimburse Landlord for any sums paid by Landlord for third party review of Tenant’s plans for Alterations. In addition, Tenant shall reimburse Landlord for any third party expenses incurred by Landlord in connection with the review, inspection and coordination of Tenant’s plans for Alterations and Tenant’s performance thereof and pay to Landlord or its managing agent a fee for Landlord’s administrative oversight and coordination of any Alterations equal to two and one-half percent (2.5%) of the hard costs of such Alterations. Upon completion, Tenant shall furnish “as-built” plans (in CAD format, if requested by Landlord) for Alterations, customary AIA completion affidavits, full and final waivers of lien, any applicable certificate of occupancy for the space affected by such Alterations, and any other items required under the Building’s construction rules and regulations for closing out the particular work in question. Landlord’s approval of an Alteration shall not be deemed to be a representation by Landlord that the Alteration complies with Law or will not adversely affect any Building system. If any Alteration requires any change to the Base Building, any Building system, or any Common Area, then such changes shall be made at Tenant’s sole cost and expense and performed, at Landlord’s election, either by Tenant’s contractor or a contractor engaged by Landlord. Notwithstanding the foregoing, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Cosmetic Alteration”): (a) is of a cosmetic nature such as painting, wallpapering, hanging pictures and installing carpeting; (b) is not visible from the exterior of the Premises or Building; (c) will not affect the Base Building (defined in Section 5); and (d) does not require work to be performed inside the walls or above the ceiling of the Premises. Cosmetic Alterations shall be subject to all the other provisions of this Section 8.03, to the extent applicable thereto.

8.2 Liens. Tenant shall not cause or permit any mechanics’ or other liens to be placed upon the Property, the Premises, or Tenant’s leasehold interest hereunder in connection with any work or service done or purportedly done by or for the benefit of Tenant, its subtenants, or any other party acting under or through Tenant. Tenant shall give Landlord notice at least fifteen (15) days prior to the commencement of any work in the Premises to afford Landlord the opportunity, where applicable, to post and record notices of non-responsibility. Tenant, within ten (10) days after notice from Landlord, shall fully discharge any such lien by settlement, by bonding or by insuring over the lien in the manner prescribed by the applicable lien Law. If Tenant fails to timely discharge such lien within such period, Tenant shall be deemed in Default under this Lease and, in addition to any other remedies available to Landlord as a result of such Default by Tenant, Landlord, at its option, may bond, insure over or otherwise discharge the lien. Tenant shall reimburse Landlord for any amount paid by Landlord to discharge such lien, including, without limitation, reasonable attorneys’ fees. Landlord shall have the right to require Tenant to post a performance or payment bond in connection with any work or service done or purportedly done by or for the benefit of Tenant. Tenant acknowledges and agrees that all such work or service is being performed for the sole benefit of Tenant and not for the benefit of Landlord.

8

8.3 Leasehold Improvements. All Initial Tenant Work and other leasehold improvements from time to time made in and to the Premises (collectively, “Leasehold Improvements”) shall, except as expressly provided in this Lease, remain upon the Premises at the end of the Term without compensation to Tenant. Except as otherwise set forth hereinbelow in connection with any Required Removables Notice (as defined below), Landlord, by written notice to Tenant given at least thirty (30) days prior to the Term Expiration Date, may require Tenant, at Tenant’s expense, to remove any Initial Tenant Work or other Leasehold Improvements or other affixed installations that, in Landlord’s reasonable judgment, are of a nature that would require removal and repair costs that are materially in excess of the removal and repair costs associated with standard office improvements (“Required Removables”). Required Removables shall include, without limitation, internal stairways, raised floors, private baths and showers, vaults, rolling file systems and structural alterations and modifications. Tenant, at the time it requests approval for a proposed Alteration, including any Initial Tenant Work, may request in writing that Landlord advise Tenant whether the Alteration, including any Initial Tenant Work, or any portion thereof, is a Required Removable. Within ten (10) Business Days after receipt of Tenant’s request and true and complete copies of the proposed plans and specifications for such proposed alterations or other improvements (including any Initial Tenant Work), Landlord shall advise Tenant in writing as to which portions of the alteration or other improvements are Required Removables (a “Required Removables Notice”). The Required Removables shall be removed by Tenant before the expiration or earlier termination of this Lease in accordance with Section 20.

| 9. | Repairs and Maintenance. |

9.1 Tenant Obligations. Tenant shall periodically inspect the Premises to identify any conditions that are dangerous or in need of maintenance or repair. Tenant shall promptly provide Landlord with notice of any such conditions. Tenant, at its sole cost and expense, shall perform all maintenance and repairs to the Premises that are not Landlord’s express responsibility under this Lease, and keep the Premises in good condition and repair, reasonable wear and tear excepted. Tenant’s repair and maintenance obligations include, without limitation, repairs to: (a) floor covering; (b) interior partitions; (c) doors; (d) the interior side of demising walls; (e) Alterations (described in Section 8); (f) supplemental air conditioning units, kitchens, including hot water heaters, plumbing, and similar facilities exclusively serving the Premises or any portion thereof, whether such items are installed by Tenant or are currently existing in the Premises; and (g) any Cable. Tenant shall maintain in effect throughout the Term maintenance contracts for any such supplemental air conditioning units or other specialty equipment exclusively serving the Premises and, from time to time upon Landlord’s request, provide Landlord with a copy of such maintenance contract and reasonable evidence of its service record. All repairs and other work performed by Tenant or its contractors, including that involving Cable, shall be subject to the terms of Section 8.01 above. If Tenant fails to make any repairs to the Premises for more than fifteen (15) days after notice from Landlord (although notice shall not be required in an emergency), Landlord may make the repairs, and, within thirty (30) days after demand, Tenant shall pay to Landlord the reasonable cost of the repairs, together with an administrative charge in an amount equal to ten percent (10%) of the cost of the repairs.

9.2 Landlord Obligations. Landlord shall keep and maintain in good repair and working order and perform maintenance upon: (a) the structural elements of the Building; (b) the mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Building in general (but specifically excluding any supplemental HVAC systems); (c) the Common Areas; (d) the roof of the Building (including the roof membrane); (e) the exterior windows of the Building; and (f) the elevators serving the Building. Subject to reasonable wear and tear, Landlord shall from time to time make repairs for which Landlord is responsible hereunder.

9

| 10. | Entry by Landlord. |

Subject to the terms and provisions of this Section 10, Landlord may enter the Premises to inspect, show or clean the Premises or to perform or facilitate the performance of repairs, alterations or additions to the Premises or any portion of the Building. Except in emergencies or to provide Building services, Landlord shall provide Tenant with reasonable prior verbal notice of such entry at least twenty-four (24) hours prior to such entry. In connection with any such entry for non-emergency work performed during Building Service Hours, Landlord shall use reasonable efforts, consistent with the operation of a first-class high rise building, not to unreasonably interfere with Tenant’s use of the Premises. If reasonably necessary, Landlord may temporarily close all or a portion of the Premises to perform repairs, alterations and additions; provided, that, except in emergencies, any such work that would unreasonably prevent the use of a substantial portion of the Premises during Building Service Hours will be performed on weekends or after Building Service Hours. Any such entry by Landlord shall not constitute a constructive eviction or entitle Tenant to an abatement or reduction of Rent; provided Landlord does not materially interfere with Tenant’s business or cause damage to any person or property within the Premises.

11. Assignment and Subletting.

11.1 Transfers. Except in connection with a Permitted Transfer (defined in Section 11.04), Tenant shall not assign, sublease, transfer or encumber any interest in this Lease or allow any third party to use all or any portion of the Premises (in each such case, collectively or individually, a “Transfer” to a “Transferee”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed. Without limitation, it is agreed that Landlord’s consent shall not be considered unreasonably withheld if the proposed Transferee (a) is a governmental entity, (b) is an occupant of the Building, (c) whether or not an occupant of the Building, has been in discussions with Landlord regarding the leasing of space within the Building within the preceding year, (d) is incompatible with the character of occupancy of the Building, (e) is an entity with which the payment for the sublease or assignment is determined in whole or in part based upon its net income or profits, or (f) would subject the Premises to a use which would: (i) involve increased personnel or wear upon the Building; (ii) violate any exclusive right granted to another tenant of the Building; (iii) require any addition to or modification of the Premises or the Building in order to comply with building code or other governmental requirements; or (iv) involve a violation of the Permitted Use clauses of this Lease. If the entity(ies) that directly or indirectly controls the voting shares/rights of Tenant (other than through the ownership of voting securities listed on a recognized securities exchange) changes at any time by more than fifty percent (50%), such change of ownership or control shall constitute a Transfer. Any Transfer in violation of this Section shall, at Landlord’s option, be deemed a Default by Tenant as described in Section 16.01, and shall be voidable by Landlord. In no event shall any Transfer, including a Permitted Transfer, release or relieve Tenant from any obligation under this Lease, and the Tenant originally named in this Lease shall remain primarily liable for the performance of the tenant’s obligations under this Lease, as amended from time to time.

11.2 Process. Tenant shall provide Landlord with financial statements for the proposed Transferee (or, in the case of a change of ownership or control, for the proposed new controlling entity(ies)), a fully executed copy of the proposed assignment, sublease, or other Transfer documentation, and such other information as Landlord may reasonably request. Within a reasonable period after receipt of the required information and documentation, Landlord shall either: (a) consent to the Transfer by execution of a consent agreement in a form reasonably designated by Landlord; (b) reasonably refuse to consent to the Transfer in writing; or (c) in the event of a proposed assignment of this Lease or subletting of all or part of the Premises, recapture the portion of the Premises that Tenant is proposing to Transfer. If Landlord exercises its right to recapture, this Lease shall automatically be amended (or terminated if the entire Premises is being assigned or sublet) to delete the applicable portion of the Premises effective on the proposed effective date of the Transfer, although Landlord may require Tenant to execute a reasonable amendment or other document reflecting such reduction or termination. Tenant shall pay to Landlord the reasonable costs and attorneys’ fees incurred by Landlord in connection with such requested Transfer.

10

11.3 Excess Payments. In the event, if any, that (i) all rent and other consideration which Tenant receives as a result of a Transfer exceeds (ii) the Rent payable to Landlord for the portion of the Premises and Term covered by the Transfer, then Tenant shall, at Landlord’s election, pay to Landlord an amount equal to fifty percent (50%) of such excess, from time to time on a monthly basis upon Tenant’s receipt of such excess; provided that in determining any such excess, Tenant may deduct from the excess all reasonable and customary expenses directly incurred by Tenant in connection with such Transfer, except that any construction costs incurred by Tenant in connection with such Transfer shall be deducted on a straight-line basis over the term of the applicable Transfer. If Tenant is in Default, Landlord may require that all sublease payments be made directly to Landlord, in which case Tenant shall receive a credit against Rent in the amount of Tenant’s share of payments received by Landlord.

11.4 Permitted Transfers. Tenant may (a) assign this Lease to a successor to Tenant by merger, consolidation, or the purchase of all or substantially all of Tenant’s assets, (b) assign this Lease or sublet all or a portion of the Premises to an Affiliate (defined below), or (c) sublet not more than forty- five percent (45%) of the Rentable Floor Area of the Premises to Biothea Pharma, Inc., a Delaware corporation (“Biothea”), in each case, without the consent of Landlord; provided, that, all of the following conditions are satisfied (a “Permitted Transfer”): (i) Tenant must not be in Default; (ii) Tenant must give Landlord written notice at least fifteen (15) Business Days before such Transfer; and (iii) except in the case of a sublease to an Affiliate or Biothea, the Credit Requirement (defined below) must be satisfied. Tenant’s notice to Landlord shall include information and documentation evidencing that the Transfer qualifies as a Permitted Transfer hereunder and that each of the above conditions has been satisfied. If requested by Landlord, Tenant’s successor shall sign and deliver to Landlord a commercially reasonable form of assumption agreement. “Affiliate” shall mean an entity controlled by, controlling or under common control with Tenant. The “Credit Requirement” shall be deemed satisfied if, as of the date immediately preceding the date of the Permitted Transfer, the financial strength of (A) the entity with which Tenant is to merge or consolidate or to which the Lease is otherwise to be assigned, or (B) the purchaser of all or substantially all of the assets of Tenant, in any such case is not less than that of Tenant, as determined (x) based on credit ratings of such entity and Tenant by both Moody’s and Standard & Poor’s (or by either such agency alone, if applicable ratings by the other agency do not exist), or (y) if such credit ratings do not exist, then in accordance with certified financial statements for such entity and Tenant covering their last two fiscal years ending before the Transfer. In the event that, at any time after a Permitted Transfer, the Affiliate to which the Permitted Transfer is made ceases to qualify as an Affiliate of the original Tenant, such event shall be deemed a Transfer that is subject to the provisions of Sections 11.01, 11.02, and 11.03 above.

11.5 Prohibited Matters. Except as otherwise expressly set forth hereinbelow, and without limiting Landlord’s right to withhold its consent to any transfer by Tenant and regardless of whether Landlord shall have consented to any such transfer, neither Tenant nor any other person having an interest in the possession, use or occupancy of the Premises or any part thereof shall enter into any lease, sublease, license, concession, assignment or other transfer or agreement for possession, use or occupancy of all or any portion of the Premises which provides for rent or other payment for such use, occupancy or utilization based, in whole or in part, on the net income or profits derived by any person or entity from the space so leased, used or occupied, and any such purported lease, sublease, license, concession, assignment or other transfer or agreement shall be absolutely void and ineffective as a conveyance of any right or interest in the possession, use or occupancy of all or any part of the Premises.

11

| 12. | Notices. |

All demands, approvals, consents or notices (collectively referred to as a “notice”) shall be in writing and delivered by hand or sent by registered, express, or certified mail, with return receipt requested or with delivery confirmation requested from the U.S. postal service, or sent by overnight or same day courier service at the party’s respective Notice Address(es) set forth in Section 1; provided, however, notices sent by Landlord regarding general Building operational matters may be posted in the Building mailroom or the general Building newsletter or sent via e-mail to the e-mail address provided by Tenant to Landlord for such purpose. In addition, if the Building is closed (whether due to emergency, governmental order or any other reason), then any notice address at the Building shall not be deemed a required notice address during such closure, and, unless Tenant has provided an alternative valid notice address to Landlord for use during such closure, any notices sent during such closure may be sent via e-mail or in any other practical manner reasonably designed to ensure receipt by the intended recipient. Each notice shall be deemed to have been received on the earlier to occur of actual delivery or the date on which delivery is refused, or, if Tenant has vacated the Premises or any other Notice Address of Tenant without providing a new Notice Address, three (3) Business Days after notice is deposited in the U.S. mail or with a courier service in the manner described above. Either party may, at any time, change its Notice Address (other than to a post office box address) by giving the other party written notice of the new address.

| 13. | Indemnity and Insurance. |

13.1 Indemnification. Except to the extent caused by the negligence or willful misconduct of Landlord or any Landlord Related Parties (defined below), and to the maximum extent permitted under applicable law, Tenant shall indemnify, defend and hold Landlord and Landlord Related Parties harmless against and from all liabilities, obligations, damages, penalties, claims, actions, costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (collectively referred to as “Losses”), which may be imposed upon, incurred by or asserted against Landlord or any of the Landlord Related Parties by any third party and arising out of or in connection with any damage or injury occurring in the Premises or any acts or omissions (including violations of Law) of Tenant, its trustees, managers, members, principals, beneficiaries, partners, officers, directors, employees and agents (the “Tenant Related Parties”) or any of Tenant’s transferees, contractors or licensees. To the maximum extent permitted under applicable law, Tenant hereby waives all claims against and releases Landlord and its trustees, managers, members, principals, beneficiaries, partners, officers, directors, employees, Mortgagees (defined in Section 21) and agents (the “Landlord Related Parties”) from all claims for any injury to or death of persons, damage to property or business loss in any manner related to (a) Force Majeure, (b) acts of third parties, (c) the bursting or leaking of any tank, water closet, drain or other pipe, or (d) the inadequacy or failure of any security or protective services, personnel or equipment.

13.2 Tenant’s Insurance. Tenant shall maintain the following coverages in the following amounts throughout the Term (and during any other periods before or after the Term during which Tenant or any Tenant Related Party enters into or occupies all or any portion of the Premises):

(a) Commercial General Liability Insurance covering claims of bodily injury, personal injury and property damage arising out of Tenant’s operations and contractual liabilities, including coverage formerly known as broad form, on an occurrence basis, with minimum primary limits of $1,000,000 each occurrence and $2,000,000 annual aggregate and a minimum excess/umbrella limit of $5,000,000.

(b) Property insurance covering (i) Tenant’s Property (as defined below), and (ii) any Leasehold Improvements in the Premises, whether installed by or for the benefit of Tenant under this Lease or any prior lease or other agreement to which Tenant was a party or otherwise (“Tenant-Insured Improvements”). Such insurance shall be written on a special cause of loss

12

form for physical loss or damage, for the full replacement cost value (subject to reasonable deductible amounts) without deduction for depreciation of the covered items and in amounts that meet any co-insurance clauses of the policies of insurance, and shall include coverage for damage or other loss caused by fire or other peril, including vandalism and malicious mischief, theft, water damage of any type, including sprinkler leakage, bursting or stoppage of pipes, and explosion, and providing business interruption coverage for a period of one year.

(c) Worker’s Compensation and Employer’s Liability or other similar insurance to the extent required by Law.

The minimum limits of insurance required to be carried by Tenant shall not limit Tenant’s liability. Such insurance shall (i) be issued by an insurance company that has an A.M. Best rating of not less than A-VIII; (ii) be in form and content reasonably acceptable to Landlord; and (iii) provide that it shall not be canceled or materially changed without thirty (30) days’ prior notice to Landlord, except that ten (10) days’ prior notice may be given in the case of nonpayment of premiums. Tenant’s Commercial General Liability Insurance shall (a) name Landlord, Landlord’s managing agent, and any other party designated by Landlord (“Additional Insured Parties”) as additional insureds; and (b) be primary insurance as to all claims thereunder and provide that any insurance carried by Landlord is excess and non-contributing with Tenant’s insurance. Landlord shall be designated as a loss payee with respect to Tenant’s property insurance on any Tenant-Insured Improvements. Tenant shall deliver to Landlord, on or before the Term Commencement Date and at least fifteen (15) days before the expiration dates thereof, certificates from Tenant’s insurance company on the forms currently designated “ACORD 28” (Evidence of Commercial Property Insurance) and “ACORD 25-S” (Certificate of Liability Insurance) or the equivalent. Attached to the ACORD 25-S (or equivalent) there shall be an endorsement naming the Additional Insured Parties as additional insureds which shall be binding on Tenant’s insurance company and shall expressly require the insurance company to notify each Additional Insured Party in writing at least thirty (30) days before any termination or material change to the policies, except that ten (10) days’ prior notice may be given in the case of nonpayment of premiums. Notwithstanding the foregoing, if the foregoing requirement that the insurance company provide prior notice to Landlord of cancellation or material change of the applicable policy cannot reasonably be obtained based on then-prevailing insurance industry practices, Tenant shall so advise Landlord of such unavailability and shall instead provide Landlord with notice of any such cancellation or material change as provided above. Upon Landlord’s request, Tenant shall deliver to Landlord, in lieu of such certificates, copies of the policies of insurance required to be carried under Section 13.02 showing that the Additional Insured Parties are named as additional insureds.

Tenant shall maintain such increased amounts of the insurance required to be carried by Tenant under this Section 13.02, and such other types and amounts of insurance covering the Premises and Tenant’s operations therein, as may be reasonably requested by Landlord, but not in excess of the amounts and types of insurance then being required by landlords of buildings comparable to and in the vicinity of the Building.

13.03. Tenant’s Property. All furnishings, fixtures, equipment, and other personal property and effects of Tenant and of all persons claiming through Tenant which from time to time may be on the Premises or elsewhere in the Building or in transit thereto or therefrom (collectively, “Tenant’s Property”) shall be at the sole risk of Tenant to the maximum extent permitted by law and shall be kept insured by Tenant throughout the Term (and during any other periods before or after the Term during which Tenant or any Tenant Related Party enters into or occupies all or any portion of the Premises) at Tenant’s expense in accordance with Section 13.02. Tenant’s Property expressly includes all business fixtures and equipment, including without limitation any security or access control systems installed for the Premises, filing cabinets and racks, removable cubicles and partitions, kitchen equipment, computers and related

13

equipment, raised flooring, supplemental cooling equipment, audiovisual and telecommunications equipment, non-building standard signage, and other tenant equipment installations, in each case including related conduits, cabling, and brackets or mounting components therefor and any connectors to base building systems and in each case whether installed or affixed in or about the Premises, in building core areas, or elsewhere in the Building.

13.04 Waiver of Subrogation. Subject to Section 14, each party waives, and shall cause its insurance carrier to waive, any right of recovery against the other for any loss of or damage to property which loss or damage is (or, if the insurance required hereunder had been carried, would have been) covered by insurance. For purposes of this Section 13.04, any deductible or self-insured retention with respect to a party’s insurance shall be deemed covered by, and recoverable by such party under, valid and collectable policies of insurance.

| 14. | Casualty Damage. |

14.1 Casualty. If all or any portion of the Premises becomes untenantable or inaccessible by fire or other casualty to the Premises or the Common Areas (collectively a “Casualty”), Landlord, with reasonable promptness, shall cause a general contractor selected by Landlord to provide Landlord with a written estimate of the amount of time required, using standard working methods, to substantially complete the repair and restoration of the Premises and any Common Areas necessary to provide access to the Premises (“Completion Estimate”). Landlord shall promptly forward a copy of the Completion Estimate to Tenant. If the Completion Estimate indicates that the Premises or any Common Areas necessary to provide access to the Premises cannot be made tenantable within 270 days from the date the repair is started, then either party shall have the right to terminate this Lease upon written notice to the other within 10 days after Tenant’s receipt of the Completion Estimate. Tenant, however, shall not have the right to terminate this Lease if the Casualty was caused by the negligence or intentional misconduct of Tenant or any Tenant Related Parties. In addition, Landlord, by notice to Tenant within 90 days after the date of the Casualty, shall have the right to terminate this Lease if: (1) the Premises have been materially damaged and there is less than 2 years of the Term remaining on the date of the Casualty; (2) any Mortgagee requires that the insurance proceeds be applied to the payment of the mortgage debt; or (3) a material uninsured loss to the Building or Premises occurs. Tenant shall have the right to terminate this Lease in the event of a Casualty and less than twelve (12) months of the Term remain after the date of the Casualty.

14.2 Restoration. If this Lease is not terminated, Landlord shall promptly and diligently, subject to reasonable delays for insurance adjustment or other matters beyond Landlord’s reasonable control, restore the Premises and Common Areas, subject to the following provisions. Such restoration shall be to substantially the same condition that existed prior to the Casualty, except for modifications required by Law or any other modifications to the Common Areas deemed desirable by Landlord. Notwithstanding Section 13.04, upon notice from Landlord, Tenant shall assign or endorse over to Landlord (or to any party designated by Landlord) all property insurance proceeds payable to Tenant under Tenant’s insurance with respect to the Initial Tenant Work and any Leasehold Improvements; provided if the estimated cost to repair such Leasehold Improvements exceeds the amount of insurance proceeds received by Landlord from Tenant’s insurance carrier, the excess cost of such repairs shall be paid by Tenant to Landlord prior to Landlord’s commencement of repairs. Within fifteen (15) days after demand, Tenant shall also pay Landlord for any additional excess costs that are determined during the performance of the repairs to such Leasehold Improvements. In no event shall Landlord be required to spend more for the restoration of the Premises and Common Areas than the proceeds received by Landlord, whether from Landlord’s insurance proceeds or proceeds from Tenant. Landlord shall not be liable for any inconvenience to Tenant, or injury to Tenant’s business resulting in any way from the Casualty or the repair thereof. Provided that Tenant is not in Default, during any period of time that all or

14

a material portion of the Premises is rendered untenantable as a result of a Casualty, the Rent shall abate for the portion of the Premises that is untenantable and not used by Tenant. Notwithstanding the foregoing, Landlord may, at its election, require Tenant to perform the restoration work for the Initial Tenant Work and Leasehold Improvements, in which event Tenant shall be responsible for performing the restoration work (including any revisions thereto that Tenant may wish to make, pursuant to plans approved by Landlord under Section 8), shall retain all insurance proceeds payable to Tenant with respect to the Initial Tenant Work and Leasehold Improvements and the rent abatement period under the preceding sentence shall not exceed the period of time required to diligently perform the restoration of the existing Leasehold Improvements and Initial Tenant Work.

| 15. | Condemnation. |

Either party may terminate this Lease if any material part of the Premises is taken or condemned for any public or quasi-public use under Law, by eminent domain or private purchase in lieu thereof (a “Taking”). Landlord shall also have the right to terminate this Lease if there is a Taking of any portion of the Building or Property which would have a material adverse effect on Landlord’s ability to profitably operate the remainder of the Building. The terminating party shall provide written notice of termination to the other party within forty five (45) days after it first receives notice of the Taking. The termination shall be effective as of the effective date of any order granting possession to, or vesting legal title in, the condemning authority. If this Lease is not terminated, Base Rent and Tenant’s Proportionate Share shall be appropriately adjusted to account for any reduction in the square footage of the Building or Premises. All compensation awarded for a Taking shall be the property of Landlord. The right to receive compensation or proceeds are expressly waived by Tenant, provided, however, Tenant may file a separate claim for Tenant’s Property and Tenant’s reasonable relocation expenses, provided the filing of the claim does not diminish the amount of Landlord’s award. If only a part of the Premises is subject to a Taking and this Lease is not terminated, Landlord, with reasonable diligence, will restore the remaining portion of the Premises as nearly as practicable to the condition immediately prior to the Taking.

| 16. | Events of Default. |

16.1 Default. In addition to any other Default specifically described in this Lease, each of the following occurrences shall be a “Default”: (a) Tenant’s failure to pay any portion of Rent when due, if the failure continues for five (5) days after written notice to Tenant (“Monetary Default”); (b) Tenant’s failure (other than a Monetary Default) to comply with any term, provision, condition or covenant of this Lease, if the failure is not cured within thirty (30) days after written notice to Tenant; provided, however, if Tenant’s failure to comply cannot reasonably be cured within such thirty (30) day period, Tenant shall be allowed additional time (not to exceed an additional sixty (60) days) as is reasonably necessary to cure the failure so long as Tenant begins the cure within such thirty (30) day period and diligently pursues the cure to completion; (c) Tenant effects or permits a Transfer without Landlord’s required approval or otherwise in violation of Section 11 of this Lease; (d) Tenant or any guarantor of Tenant’s obligations under this Lease from time to time (a “Guarantor”) becomes insolvent, makes a transfer in fraud of creditors, makes an assignment for the benefit of creditors, admits in writing its inability to pay its debts when due or forfeits or loses its right to conduct business; (e) the leasehold estate is taken by process or operation of Law; (f) if a receiver, guardian, conservator, trustee in bankruptcy or similar officer shall be appointed by a court of competent jurisdiction to take charge of all or any part of Tenant’s or the Guarantor’s property and such appointment is not discharged within ninety (90) days thereafter, or if a petition including, without limitation, a petition for reorganization or arrangement is filed by Tenant or the Guarantor under any bankruptcy law or is filed against Tenant or the Guarantor and, in the case of a filing against Tenant only, the same shall not be dismissed within ninety (90) days from the date upon which it is filed; or (g) Tenant is in default beyond any notice and cure period under any other lease or agreement with Landlord at the Building or Property. In addition, if Landlord provides Tenant with

15

notice of Tenant’s failure to comply with any specific provision of this Lease on two (2) separate occasions during any twelve-(12)-month period, any subsequent violation of such provision within such twelve-(12)-month period shall, at Landlord’s option, constitute a Default by Tenant without the requirement of any further notice or cure period as provided above. All notices sent under this Section shall be in satisfaction of, and not in addition to, any notice required by Law.

16.02. Remedies. Upon the occurrence of any Default, Landlord may, immediately or at any time thereafter, elect to terminate this Lease by notice of termination, by entry, or by any other means available under law and may recover possession of the Premises as provided herein. Upon termination by notice, by entry, or by any other means available under law, Landlord shall be entitled immediately, in the case of termination by notice or entry, and otherwise in accordance with the provisions of law to recover possession of the Premises from Tenant and those claiming through or under the Tenant. Such termination of this Lease and repossession of the Premises shall be without prejudice to any remedies which Landlord might otherwise have for arrears of rent or for a prior breach of the provisions of this Lease. Tenant waives any statutory notice to quit and equitable rights in the nature of further cure or redemption, and Tenant agrees that upon Landlord’s termination of this Lease Landlord shall be entitled to re-entry and possession in accordance with the terms hereof. Landlord may, without notice, store Tenant’s personal property (and those of any person claiming under Tenant) at the expense and risk of Tenant or, if Landlord so elects, Landlord may sell such personal property at public auction or auctions or at private sale or sales after thirty (30) days’ notice to Tenant and apply the net proceeds to the earliest of installments of rent or other charges owing Landlord. Tenant agrees that a notice by Landlord alleging any default shall, at Landlord’s option (the exercise of such option shall be indicated by the inclusion of the words “notice to quit” in such notice), constitute a statutory notice to quit. If Landlord exercises its option to designate a notice of default hereunder as a statutory notice to quit, any grace periods provided for herein shall run concurrently with any statutory notice periods. Tenant further agrees that it shall not interpose any counterclaim or set-off in any summary proceeding or in any action based in whole or in part on non-payment of Rent, unless Tenant would have no right to commence an independent proceeding to seek to recover on account of such claim.

16.03 Reimbursement of Expenses. In the case of termination of this Lease pursuant to this Section 16, Tenant shall reimburse Landlord for all expenses arising out of such termination, including without limitation, all costs incurred in collecting amounts due from Tenant under this Lease (including attorneys’ fees, costs of litigation and the like); all expenses incurred by Landlord in attempting to relet the Premises or parts thereof (including advertisements, brokerage commissions, Tenant’s allowances, costs of preparing space, and the like); all of Landlord’s then unamortized costs of any work allowances provided to Tenant for the Premises; and all Landlord’s other reasonable expenditures necessitated by the termination. The reimbursement from Tenant shall be due and payable immediately from time to time upon notice from Landlord that an expense has been incurred, without regard to whether the expense was incurred before or after the termination.

16.04. Damages. In the event of the termination of this Lease by Landlord, Landlord may elect by written notice to Tenant within six (6) months following such termination to be indemnified for loss of rent by a lump sum payment representing the then present value of the amount of rent and additional charges which would have been paid in accordance with this Lease for the remainder of the Term minus the then present value of the aggregate fair market rent and additional charges payable for the Premises for the remainder of the Term (if less than the rent and additional charges payable hereunder), estimated as of the date of the termination, and taking into account reasonable projections of vacancy and time required to re-lease the Premises. (For the purposes of calculating the rent which would have been paid hereunder for the lump sum payment calculation described herein, the last full year’s Additional Rent under Section 4 is to be deemed constant for each year thereafter. The Federal Reserve discount rate (or equivalent) shall be used in calculating present values.) Should the parties be unable to agree on a fair

16

market rent, the matter shall be submitted, upon the demand of either party, to the Boston, Massachusetts office of the American Arbitration Association, with a request for arbitration in accordance with the rules of the Association by a single arbitrator who shall be an MAI appraiser with at least ten years’ experience as an appraiser of major office buildings in downtown Boston. The parties agree that a decision of the arbitrator shall be conclusive and binding upon them. If, at the end of the Term, the rent which Landlord has actually received from the Premises is less than the aggregate fair market rent estimated as aforesaid, Tenant shall thereupon pay Landlord the amount of such difference. If and for so long as Landlord does not make the election provided for in this Section 16.04 above, Tenant shall indemnify Landlord for the loss of rent by a payment at the end of each month which would have been included in the Term, representing the excess of the rent which would have been paid in accordance with this Lease (i.e., Base Rent and Additional Rent that would have been payable to be ascertained monthly) over the rent actually derived from the Premises by Landlord for such month (the amount of rent deemed derived shall be the actual amount less any portion thereof attributable to Landlord’s reletting expenses described in Section 16.03 which have not been reimbursed by Tenant thereunder). In the event that Landlord terminates this Lease pursuant to Section 16.02, Landlord shall use commercially reasonable efforts to relet the Premises in an effort to mitigate its damages hereunder, which obligation shall be deemed satisfied if Landlord either engages a commercial leasing broker to market the Premises for Lease or, if Landlord handles the marketing of space for lease in the Building “in house” through its employees, Landlord otherwise markets the Premises for lease through such employees.

In lieu of the damages, indemnity, and full recovery by Landlord of the sums payable under the foregoing provisions of this Section 16.04, Landlord may, by written notice to Tenant within six months after termination under any of the provisions contained in Section 16 and before such full recovery, elect to recover, and Tenant shall thereupon pay, as minimum liquidated damages under this Section 16.04, an amount equal to (i) the aggregate of the Base Rent and Additional Rent for the twelve-month period ending one year after the termination date (or, if lesser, for the balance of the Term had it not been terminated), plus (ii) the amount of Base Rent and Additional Rent of any kind accrued and unpaid at the time of termination, and minus (iii) the amount of any recovery by Landlord under the foregoing provisions of this Section 16 up to the time of payment of such liquidated damages (but reduced by any amounts of reimbursement under Section 16.03). The amount under clause (i) represents a reasonable forecast of the minimum damages expected to occur in the event of a breach, taking into account the uncertainty, time and cost of determining elements relevant to actual damages, such as fair market rent, time and costs that may be required to re-lease the Premises, and other factors. Liquidated damages hereunder shall not be in lieu of any claims for reimbursement under Section 16.03.

Free rent amounts, rent holidays, rent waivers, rent forgivenesses and the like (collectively, “Free Rent Amounts”), if any, have been agreed to by Landlord as inducements for Tenant to enter into and faithfully to perform all of its obligations contained in this Lease. For all purposes under this Lease, upon the occurrence of any event under Section 16.01 and the lapse of any applicable grace or notice period, any Free Rent Amounts set forth in this Lease shall be deemed void as of the date of execution hereof as though such Free Rent Amounts had never been included in this Lease, and calculations of amounts due hereunder, damages and the like shall be determined accordingly. The foregoing shall occur automatically without the requirement of any further notice or action by Landlord not specifically required by Section 16.01, whether or not this Lease is then or thereafter terminated on account of the event in question, and whether or not Tenant thereafter corrects or cures any such event.

Any obligation imposed by law upon Landlord to relet the Premises after any termination of the Lease shall be subject to the reasonable requirements of Landlord to lease to high quality tenants on such terms as Landlord may from time to time deem appropriate and to develop the Building in a harmonious manner with an appropriate mix of uses, tenants, floor areas and terms of tenancies, and the like, and Landlord shall not be obligated to relet the Premises to any party to whom Landlord or its affiliate may desire to lease other available space in the Building.

17

16.5 Curative Action. If Tenant is in Default of any of its non-monetary obligations under this Lease, Landlord shall have the right, but not the obligation, to perform any such obligation. Tenant shall reimburse Landlord for the cost of such performance upon demand, together with an administrative charge equal to ten percent (10%) of the cost of the work performed by Landlord.

16.6 Claims in Bankruptcy. Nothing herein shall limit or prejudice the right of Landlord to prove and obtain in a proceeding for bankruptcy, insolvency, arrangement or reorganization, by reason of the termination, an amount equal to the maximum allowed by a statute or law in effect at the time when, and governing the proceedings in which, the damages are to be proved, whether or not the amount is greater to, equal to, or less than the amount of the loss or damage which Landlord has suffered.

16.7 Late Charges and Fees. If Tenant does not pay any Rent when due hereunder, then without notice and in addition to all other remedies hereunder, Tenant shall pay to Landlord an administration fee in the amount of four percent (4%) of the unpaid Rent, plus interest on such unpaid amount at the rate of one and one half percent (1.5%) per month from the date such amount was due until the date paid (which interest, as accrued to date, shall be payable from time to time upon Landlord’s demand); provided, however, in no event shall such interest exceed the maximum amount permitted to be charged by applicable law. Notwithstanding the foregoing, Tenant shall be entitled to a grace period of five (5) days for the first late payment of Rent in any twelve-(12)-month period prior to the imposition of the foregoing amounts. In addition, Tenant shall pay to Landlord a reasonable fee for any checks returned by Tenant’s bank for any reason.

16.08. Enforcement Costs. Tenant shall pay to Landlord, as Additional Rent, the costs and expenses, including reasonable attorneys’ fees, incurred in enforcing any obligations of Tenant under this Lease with which Tenant has failed to comply.

16.09 General. The repossession or re-entering of all or any part of the Premises shall not relieve Tenant of its liabilities and obligations under this Lease. No right or remedy of Landlord shall be exclusive of any other right or remedy, and each right and remedy shall be cumulative and in addition to any other right and remedy now or subsequently available to Landlord at law or in equity. Without limiting the generality of the foregoing, in addition to the other remedies provided in this Lease, Landlord shall be entitled to the restraint by court order of the violation or attempted or threatened violation of any of the provisions of this Lease or of applicable Law or to a decree compelling specific performance of any such provisions.

| 17. | Limitation of Liability. |

17.1 Landlord’s Liability. Tenant agrees from time to time to look only to Landlord’s interest in the Building for satisfaction of any claim against Landlord hereunder or under any other instrument related to the Lease (including any separate agreements among the parties and any notices or certificates delivered by Landlord) and not to any other property or assets of Landlord. If Landlord from time to time transfers its interest in the Building (or part thereof which includes the Premises), then from and after each such transfer Tenant shall look solely to the interests in the Building of each of Landlord’s transferees for the performance of all of the obligations of Landlord hereunder (or under any related instrument). The obligations of Landlord shall not be binding on any direct or indirect partners (or members, trustees or beneficiaries) of Landlord or of any successor, individually, but only upon Landlord’s or such successor’s interest described above. If Landlord shall refuse or fail to provide any consent or approval for any matter for which Landlord’s consent or approval is required under this Lease or is otherwise requested by Tenant, Landlord shall not be liable for damages as a result thereof, and Tenant’s sole remedy to enforce any alleged obligation of Landlord to provide such consent or approval shall be an action for specific performance, injunction, or declaratory relief.

18

| 17.2 | Assignment of Rents. |

(a) With reference to any assignment by Landlord of Landlord’s interest in this Lease, or the rents payable hereunder, conditional in nature or otherwise, which assignment is made to the holder of a mortgage on property which includes the Premises, Tenant agrees that the execution thereof by Landlord, and the acceptance thereof by the holder of such mortgage shall never be treated as an assumption by such holder of any of the obligations of Landlord hereunder unless such holder shall, by notice sent to Tenant, specifically otherwise elect and, except as aforesaid, such holder shall be treated as having assumed Landlord’s obligations hereunder only upon foreclosure of such holder’s mortgage and the taking of possession of the Premises.

(b) In no event shall the acquisition of Landlord’s interest in the Property by a purchaser which, simultaneously therewith, leases Landlord’s entire interest in the Property back to the seller thereof be treated as an assumption by operation of law or otherwise, of Landlord’s obligations hereunder, but Tenant shall look solely to such seller-lessee, and its successors from time to time in title, for performance of Landlord’s obligations hereunder. In any such event, this Lease shall be subject and subordinate to the lease to such purchaser. For all purposes, such seller-lessee, and its successors in title, shall be the Landlord hereunder unless and until Landlord’s position shall have been assumed by such purchaser-lessor.