Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Dun & Bradstreet Holdings, Inc. | tm2031191d2_ex99-1.htm |

| 8-K - FORM 8-K - Dun & Bradstreet Holdings, Inc. | tm2031191-2_8k.htm |

Exhibit 99.2

1 DUN & BRADSTREET ACQUISITION OF BISNODE OCTOBER 8, 2020

2 Disclaimer Disclaimer Forward - looking Statements : This presentation contains forward - looking statements that involve a number of risks and uncertainties. Statements that are not historical facts, including statements regarding expectations, hopes, intentions or strategies regarding the future are forward - looking statements. Forward - looking statements ar e based on Dun & Bradstreet Holdings, Inc.’s (“Dun & Bradstreet” or “D&B”) management's beliefs, as well as assumptions made by, and information currently available to, t hem . Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materiall y f rom those projected. Dun & Bradstreet undertakes no obligation to update any forward - looking statements, whether as a result of new information, future events or otherwise. The risks and uncertainties that forward - looking statements are subject to include, but are not limited to: ( i ) our ability to consummate the acquisition of Bisnode Business Information Group AB (“ Bisnode ”), including receipt of regulatory approvals and satisfaction of any other conditions to closing; (ii) an outbreak of disease, global or localized he alth pandemic or epidemic, or the fear of such an event (such as the COVID - 19 global pandemic), including the global economic uncertainty and measures taken in response; (iii) th e short - and long - term effects of the COVID - 19 global pandemic, including the pace of recovery or any future resurgence; (iv) our ability to implement and execute our strategic plans to transform the business; (v) our ability to develop or sell solutions in a timely manner or maintain client relationships; (vi) competition for our so lut ions; (vii) harm to our brand and reputation; (viii) unfavorable global economic conditions; (ix) risks associated with operating and expanding internationally; (x) failure to pr eve nt cybersecurity incidents or the perception that confidential information is not secure; (xi) failure in the integrity of our data or systems; (xii) system failures and/or pe rso nnel disruptions, which could delay the delivery of our solutions to our clients; (xiii) loss of access to data sources; (xiv) failure of our software vendors and network and cloud pro viders to perform as expected or if our relationship is terminated; (xv) loss or diminution of one or more of our key clients, business partners or government contracts; (xvi) de pen dence on strategic alliances, joint ventures and acquisitions to grow our business; (xvii) our ability to protect our intellectual property adequately or cost - effectively; (xvii i) claims for intellectual property infringement; (xix) interruptions, delays or outages to subscription or payment processing platforms; (xx) risks related to acquiring and integra tin g businesses and divestitures of existing businesses; (xxi) our ability to retain members of the senior leadership team and attract and retain skilled employees; (xxii ) c ompliance with governmental laws and regulations; (xxiii) risks associated with our structure and status as a "controlled company;" and (xxix) the other factors d esc ribed under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Cautionary Note Regarding Forward - Look ing Statements” and other sections of our final prospectus dated June 30, 2020 and filed with the Securities and Exchange Commission on July 2, 2020, in the Compan y’s Quarterly Report on Form 10 - Q for the quarter ended June 30, 2020 and the Company’s subsequent filings with the Securities and Exchange Commission. Non - GAAP Financial Measures: The Presentation also includes certain financial information that is not presented in accordance with Generally Accepted Acco unt ing Principles (“GAAP”), including, but not limited to, EBITDA, Adjusted EBITDA, and certain ratios and other metrics derived therefrom. These non - GAAP financial measures a re not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial res ult s. Further, it is important to note that non - GAAP financial measures should not be considered in isolation and may be considered in addition to GAAP financial information bu t should not be used as substitutes for the corresponding GAAP measures. It is also important to note that EBITDA, Adjusted EBITDA for specified fiscal periods have been ca lculated in accordance with the definitions thereof as set out in our public disclosures and are not projections of anticipated results but rather reflect permitted adju stm ents. You should be aware that Dun & Bradstreet’s presentation of these and other non - GAAP financial measures in this Presentation may not be comparable to similarly - titled measu res used by other companies. Other Disclaimers: All amounts in this Presentation are in USD unless otherwise stated. All trademarks and logos depicted in this Presentation a re the property of their respective owners and are displayed solely for purposes of illustration.

TRANSACTION OVERVIEW Anthony Jabbour Chief Executive Officer

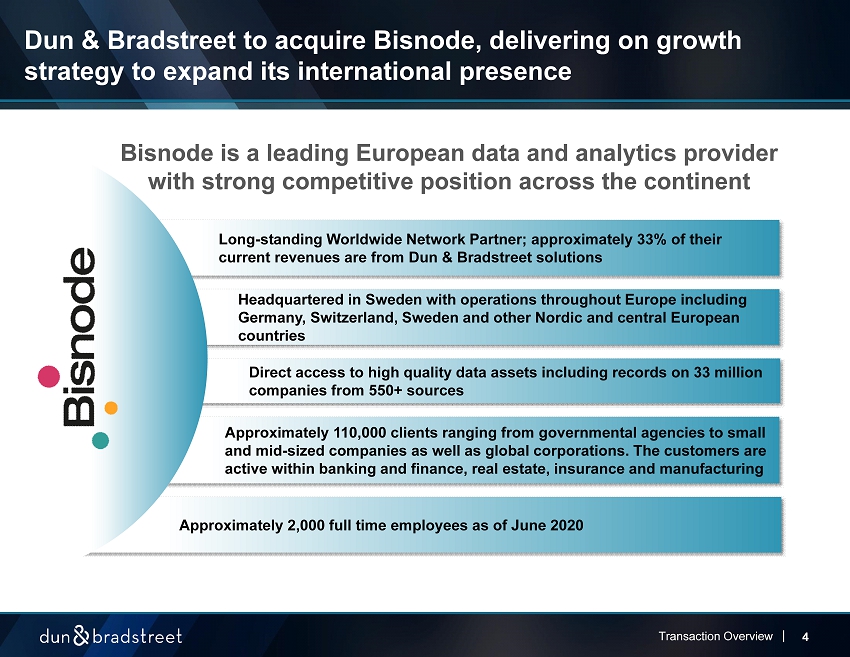

4 Approximately 110,000 clients ranging from governmental agencies to small and mid - sized companies as well as global corporations. The customers are active within banking and finance, real estate, insurance and manufacturing Dun & Bradstreet to acquire Bisnode , delivering on growth strategy to expand its international presence Transaction Overview Long - standing Worldwide Network Partner; approximately 33% of their current revenues are from Dun & Bradstreet solutions Headquartered in Sweden with operations throughout Europe including Germany, Switzerland, Sweden and other Nordic and central European countries Direct access to high quality data assets including records on 33 million companies from 550+ sources Approximately 2,000 full time employees as of June 2020 Bisnode is a leading European data and analytics provider with strong competitive position across the continent

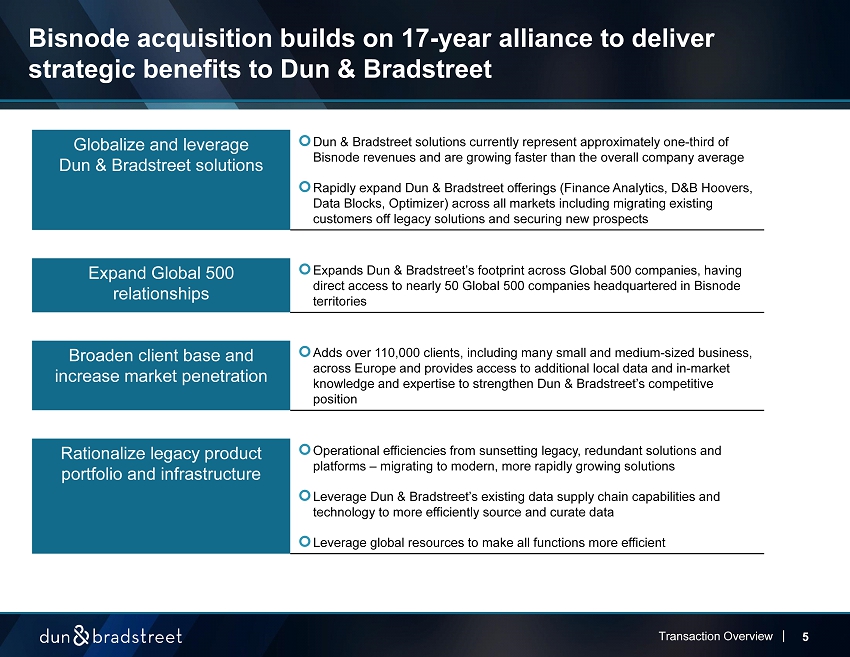

5 Bisnode acquisition builds on 17 - year alliance to deliver strategic benefits to Dun & Bradstreet Transaction Overview Globalize and leverage Dun & Bradstreet solutions Dun & Bradstreet solutions currently represent approximately one - third of Bisnode revenues and are growing faster than the overall company average Rapidly expand Dun & Bradstreet offerings (Finance Analytics, D&B Hoovers, Data Blocks, Optimizer) across all markets including migrating existing customers off legacy solutions and securing new prospects Expand Global 500 relationships Expands Dun & Bradstreet’s footprint across Global 500 companies, having direct access to nearly 50 Global 500 companies headquartered in Bisnode territories Broaden client base and increase market penetration Adds over 110,000 clients, including many small and medium - sized business, across Europe and provides access to additional local data and in - market knowledge and expertise to strengthen Dun & Bradstreet’s competitive position Rationalize legacy product portfolio and infrastructure Operational efficiencies from sunsetting legacy, redundant solutions and platforms – migrating to modern, more rapidly growing solutions Leverage Dun & Bradstreet’s existing data supply chain capabilities and technology to more efficiently source and curate data Leverage global resources to make all functions more efficient

6 Expands Dun & Bradstreet’s access to Global 500 companies Transaction Overview Retail, Communication, Tech Financial services Energy, Chemical Pharmaceutical Global 500 Companies within Bisnode markets Transportation and Manufacturing

TRANSACTION DETAILS Bryan Hipsher Chief Financial Officer

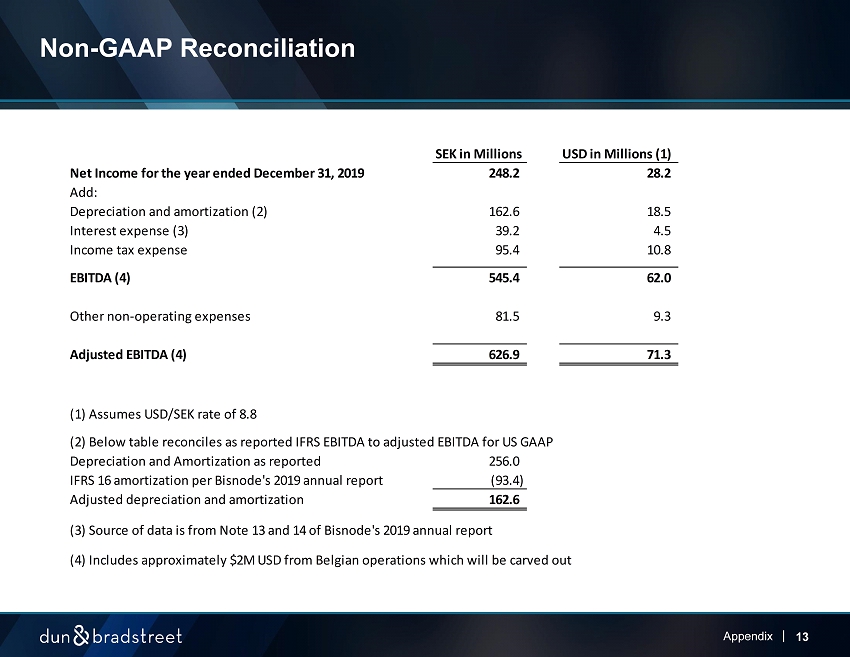

8 Financing, reporting and timing Transaction Details Acquisition price will be 7.2B SEK, or ~$818M 1 75% of the consideration will be be paid in cash and 25% of the consideration will be paid in newly issued shares of common stock of the Company in a private placement Cash portion funded through cash on hand and debt financing Expected to maintain net leverage in the range of low to mid 4x Bisnode currently has annual Revenue of ~$400 million 1&2 , Net Income ~$28 million 1&2 and Adjusted EBITDA of ~$70 million 1&2 Accretive in 2021 excluding purchase price amortization and one - time integration costs Will be reported as part of Dun & Bradstreet’s International segment Acquisition subject to certain customary regulatory approvals Transaction expected to close by early 2021 1 - Assumes USD/SEK rate of 8.8 2 – 2019 Actuals excluding estimated impact of Belgium carve out of approximately $26M in Revenues and $2M in EBITDA; Non - GAAP r econciliation can be found in Appendix

9 Conclusion Conclusion • Allocation of capital into high - return, synergistic business • Efficient funding expected to maintain net leverage in the range of low to mid 4x • Accretive in 2021 excluding purchase price amortization and one - time integration costs • Acquisition supports Dun & Bradstreet’s growth strategy to expand its international presence • Secures direct ownership across 18 strategic territories in Europe • Expands reach among Global 500 and small and medium - sized businesses • Provides opportunities for scale by leveraging existing Dun & Bradstreet product portfolio, data supply chain and technology infrastructure

10 Q&A Session Q&A Session Bryan Hipsher Chief Financial Officer Anthony Jabbour Chief Executive Officer

11 Contact Information Website: https://investor.dnb.com Email: IR@dnb.com Contact information

APPENDIX

13 Appendix Non - GAAP Reconciliation SEK in Millions USD in Millions (1) Net Income for the year ended December 31, 2019 248.2 28.2 Add: Depreciation and amortization (2) 162.6 18.5 Interest expense (3) 39.2 4.5 Income tax expense 95.4 10.8 EBITDA (4) 545.4 62.0 Other non-operating expenses 81.5 9.3 Adjusted EBITDA (4) 626.9 71.3 (1) Assumes USD/SEK rate of 8.8 (2) Below table reconciles as reported IFRS EBITDA to adjusted EBITDA for US GAAP Depreciation and Amortization as reported 256.0 IFRS 16 amortization per Bisnode's 2019 annual report (93.4) Adjusted depreciation and amortization 162.6 (3) Source of data is from Note 13 and 14 of Bisnode's 2019 annual report (4) Includes approximately $2M USD from Belgian operations which will be carved out