Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DLH Holdings Corp. | form8-kinsightppt10x07.htm |

DLH Holdings Corp. Acquisition of Irving Burton Associates OCTOBER 7, 2020 Your Mission Is Our Passion © Copyright 2020 DLH Holdings Corp. All Rights Reserved. © Copyright 2020 DLH Holdings Corporation. All Rights Reserved.

Forward Looking Statement This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or DLH`s future financial performance. Any statements that refer to expectations, projections or other characterizations of future events or circumstances or that are not statements of historical fact (including without limitation statements to the effect that the Company or its management “believes”, “expects”, “anticipates”, “plans”, “intends” and similar expressions) should be considered forward looking statements that involve risks and uncertainties which could cause actual events or DLH’s actual results to differ materially from those indicated by the forward-looking statements. Forward-looking statements in this release include, among others, statements regarding, estimates of future revenues, operating income, earnings, earnings per share, backlog, and cash flows. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Our actual results may differ materially from such forward-looking statements made in this release due to a variety of factors, including: the outbreak of the novel coronavirus (“COVID-19”), including the measures to reduce its spread, and its impact on the economy and demand for our services, are uncertain, cannot be predicted, and may precipitate or exacerbate other risks and uncertainties; the risk that we will not realize the anticipated benefits of the IBA acquisition; the challenges of managing larger and more widespread operations resulting from the acquisition; the inability to retain IBA employees and customers; the risks and uncertainties associated with client interest and purchases of new services; contract awards in connection with re-competes for present business and/or competition for new business; compliance with new bank financial and other covenants; changes in client budgetary priorities; government contract procurement (such as bid protest, small business set asides, loss of work due to organizational conflicts of interest, etc.) and termination risks; the ability to successfully integrate the operations of IBA and any future acquisitions; and other risks described in our SEC filings. For a discussion of such risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s periodic reports filed with the SEC, including our Annual Report on Form 10-K for the fiscal year ended September 30, 2019, as well as subsequent reports filed thereafter. The forward-looking statements contained herein are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our industry and business. Such forward-looking statements are made as of the date hereof and may become outdated over time. The Company does not assume any responsibility for updating forward-looking statements, except as may be required by law. 2 3 4 © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 2

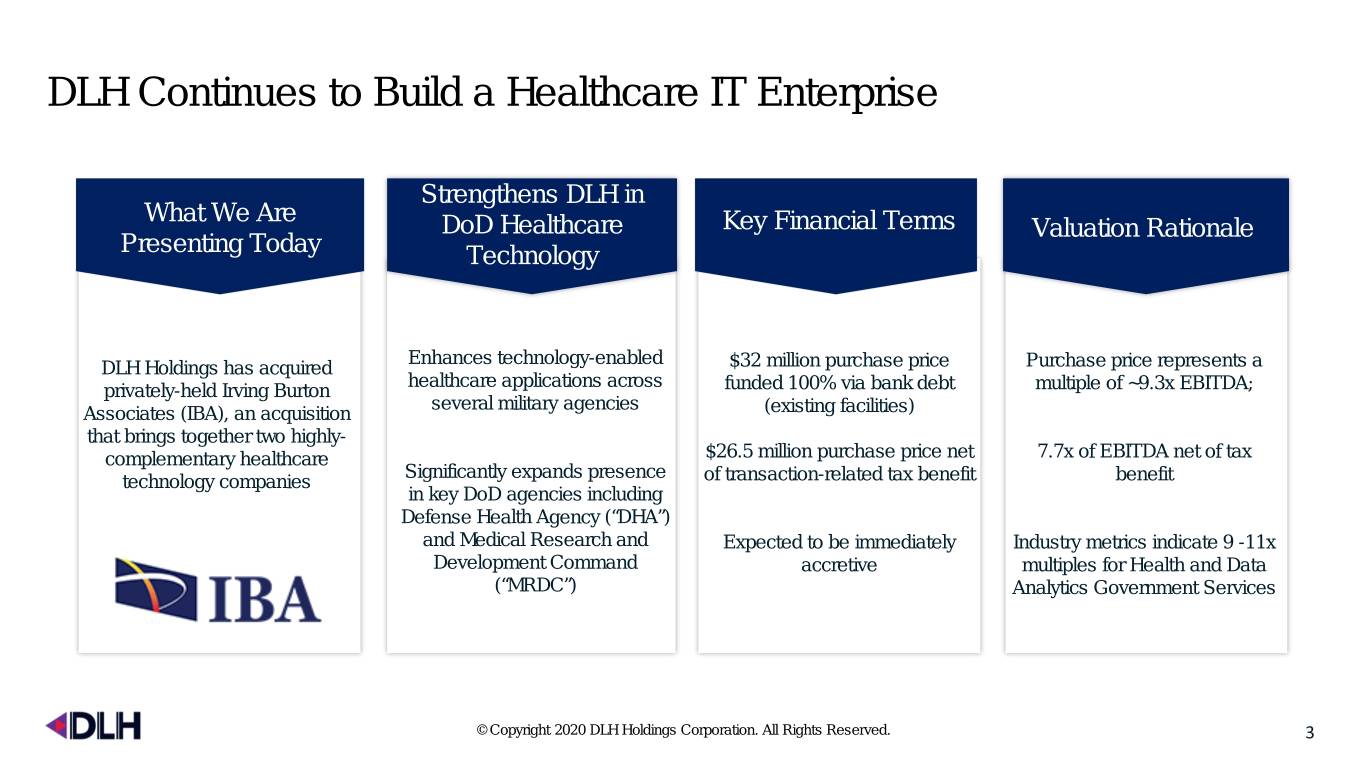

DLH Continues to Build a Healthcare IT Enterprise Strengthens DLH in What We Are DoD Healthcare Key Financial Terms Valuation Rationale Presenting Today Technology Enhances technology-enabled DLH Holdings has acquired $32 million purchase price Purchase price represents a healthcare applications across privately-held Irving Burton funded 100% via bank debt multiple of ~9.3x EBITDA; several military agencies Associates (IBA), an acquisition (existing facilities) that brings together two highly- complementary healthcare $26.5 million purchase price net 7.7x of EBITDA net of tax Significantly expands presence technology companies of transaction-related tax benefit benefit in key DoD agencies including Defense Health Agency (“DHA”) and Medical Research and Expected to be immediately Industry metrics indicate 9 -11x Development Command accretive multiples for Health and Data (“MRDC”) 3 Analytics4 Government Services © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 3

Strategic Rationale Highly complementary business with common core capabilities for complex, nationally dispersed programs, operational synergies, and new business opportunities Accelerates long-term strategy of growing DLH presence in core military healthcare market with high revenue visibility and $143 million in acquired contract backlog Enhances and broadens telehealth offering through deep customer relationships and leading capabilities, competencies and practices 2 3 4 Elevates customer presence by expanding2 security3clearance capability4 through IBA’s cleared workforce and top-secret facility clearance © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 4

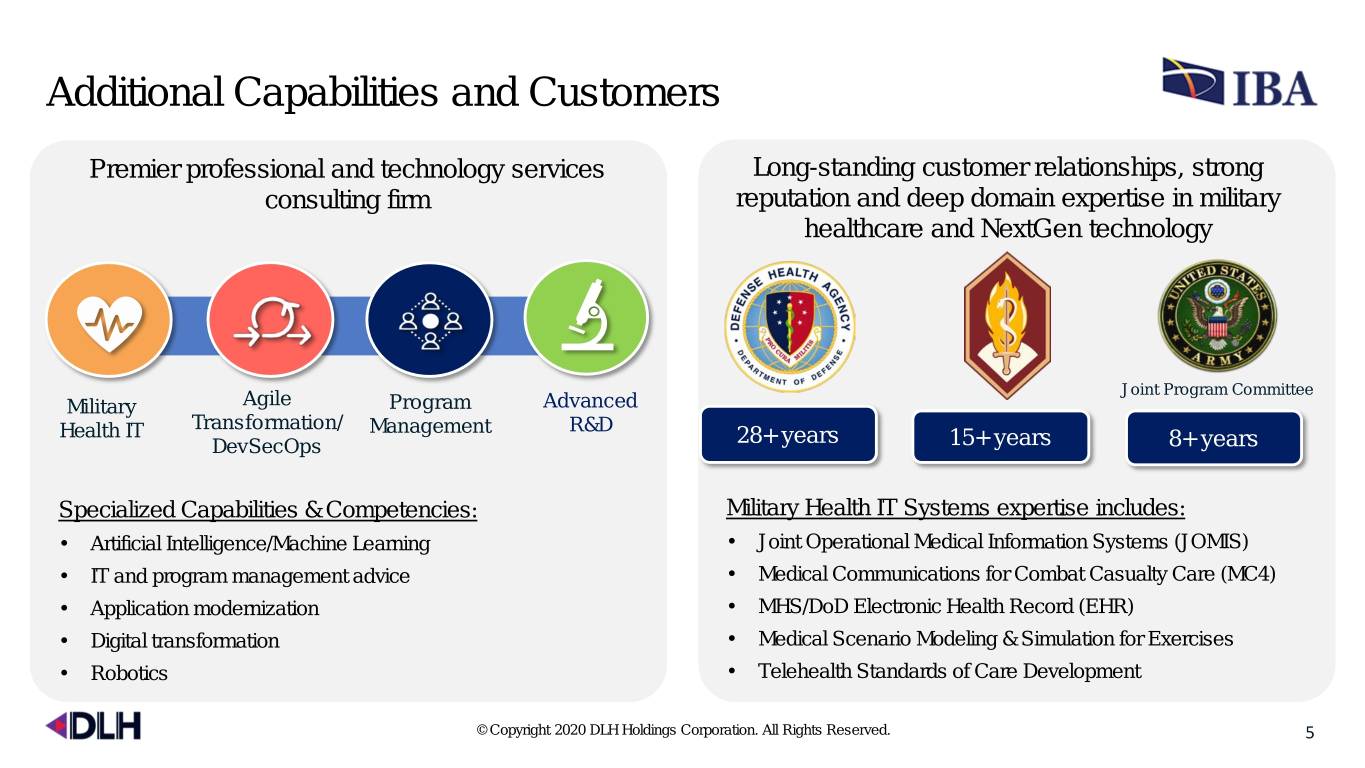

Additional Capabilities and Customers Premier professional and technology services Long-standing customer relationships, strong consulting firm reputation and deep domain expertise in military healthcare and NextGen technology Joint Program Committee Military Agile Program Advanced Health IT Transformation/ Management R&D DevSecOps 28+ years 15+ years 8+ years Specialized Capabilities & Competencies: Military Health IT Systems expertise includes: • Artificial Intelligence/Machine Learning • Joint Operational Medical Information Systems (JOMIS) • IT and program management advice • Medical Communications for Combat Casualty Care (MC4) • Application modernization • MHS/DoD Electronic Health Record (EHR) • Digital transformation • Medical Scenario Modeling & Simulation for Exercises • Robotics • Telehealth Standards of Care Development © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 5

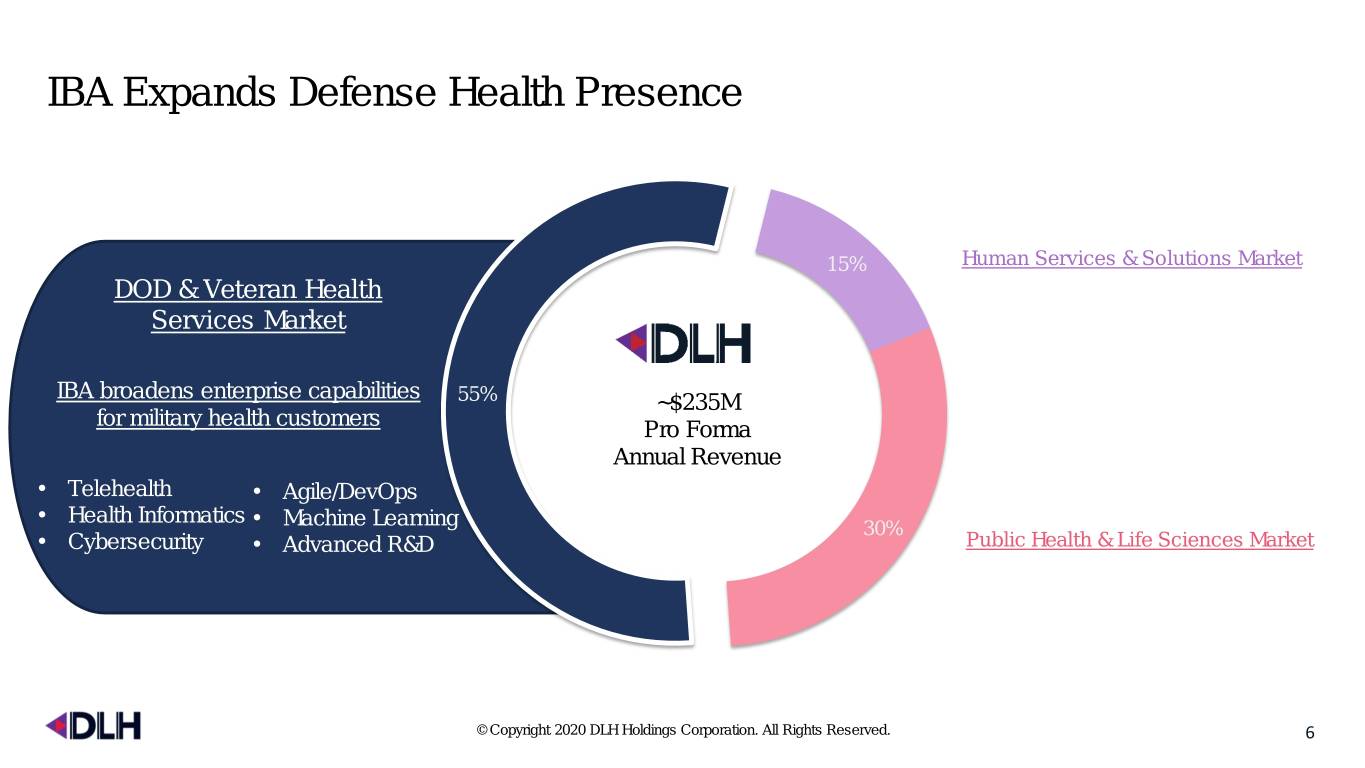

IBA Expands Defense Health Presence 15% Human Services & Solutions Market DOD & Veteran Health Services Market IBA broadens enterprise capabilities 55% ~$235M for military health customers Pro Forma Annual Revenue • Telehealth • Agile/DevOps • Health Informatics • Machine Learning 30% • Cybersecurity • Advanced R&D Public Health & Life Sciences Market © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 6

IBA Increases Addressable Military Healthcare Market for DLH • Strategically positioned to address $2.5B Military Healthcare market currently growing at ~9% annually • Leading provider of mission critical advice and technology solutions for military health clients • Defense Health Agency • U.S. Army Medical Research and Development Command • Poised to support increased demand and focus on telehealth capabilities sparked by COVID-19 • Electronic health record for active duty and beneficiaries • Expands DLH’s end-to-end capabilities, from advanced R&D of NextGen technology to program management & mission support © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 7

Proforma Considerations • DLH uses EBITDA as a supplemental non-GAAP measure of our performance. DLH defines EBITDA as net income excluding (i) interest expense, (ii) provision for or benefit from income taxes and (iii) depreciation and amortization. • Due to changes in contract type and structure during key contracts’ recompete, revenue and margins reported in prior fiscal periods are higher than expected in current and future fiscal periods. • DLH estimates that IBA will contribute approximately $25 million, on an annualized basis, to revenue of DLH going forward, with similar operating margins as during the proforma period. The following unaudited pro forma financial information combines the historical financial information of DLH and IBA and may not be indicative of the historical results that would have been achieved had the companies been combined during the periods presented or of the future results that the combined companies will experience. © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 8

Transaction Model – Twelve Months ended June 30, 2020 (in millions) DLH IBA Adj. Proforma Revenue $ 212.7 $ 24.5 - $ 237.2 • Transaction accretive to net income and diluted earnings per share (EPS) Operating Income 14.2 3.1 (1.5) 15.8 % Margin 6.7% 12.7% 6.7% Interest (Expense)/Income (3.9) - (1.5) (5.4) • Reduction to operating income due to amortization expense of acquired intangible Pretax Income 10.3 3.1 (3.0) 10.4 assets Tax expense 3.0 0.9 (0.9) 3.0 Net Income $ 7.3 $ 2.2 $ (2.1) $ 7.4 • Interest expense increase due to additional EBITDA $ 21.4 $ 3.1 - $ 24.5 term borrowing to finance transaction % Margin 10.1% 12.7% 10.3% Diluted Shares Outstanding 13.1 13.1 EPS $ 0.56 $ 0.57 Accretion $ $ 0.01 Accretion % 1.8% Notes: “% Margin” indicates line item immediately preceding stated as a percent of revenue See reconciliation of non-GAAP financials measures on page 14 of this presentation © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 9

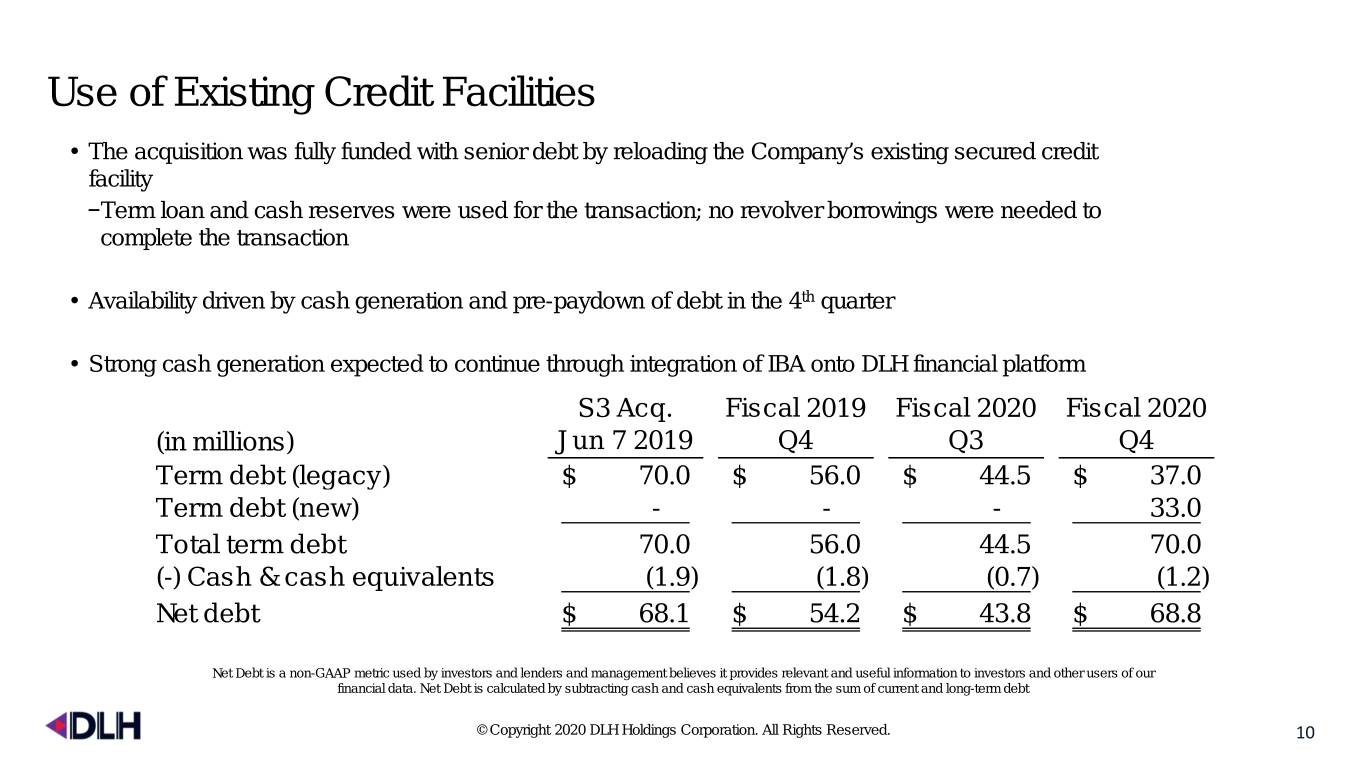

Use of Existing Credit Facilities • The acquisition was fully funded with senior debt by reloading the Company’s existing secured credit facility −Term loan and cash reserves were used for the transaction; no revolver borrowings were needed to complete the transaction • Availability driven by cash generation and pre-paydown of debt in the 4th quarter • Strong cash generation expected to continue through integration of IBA onto DLH financial platform S3 Acq. Fiscal 2019 Fiscal 2020 Fiscal 2020 (in millions) Jun 7 2019 Q4 Q3 Q4 Term debt (legacy) $ 70.0 $ 56.0 $ 44.5 $ 37.0 Term debt (new) - - - 33.0 Total term debt 70.0 56.0 44.5 70.0 (-) Cash & cash equivalents (1.9) (1.8) (0.7) (1.2) Net debt $ 68.1 $ 54.2 $ 43.8 $ 68.8 Net Debt is a non-GAAP metric used by investors and lenders and management believes it provides relevant and useful information to investors and other users of our financial data. Net Debt is calculated by subtracting cash and cash equivalents from the sum of current and long-term debt © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 10

Financial Benefits of the Acquisition • Acquired company has approximately $143 million of total backlog Highly visible revenue • Contracts with key customers early in lifecycle with potential for service expansion Expected strong free • Free cash flow is further supported by tax-deductible purchase price cash flow and debt service • Capital requirements of the business are minimal Substantial existing • The acquired company’s contract portfolio supports 97% of its expected contract base FY21 revenue • Revenue growth is driven primarily by continued execution against Significant potential for recurring customer requirements, cross-selling opportunities, and combined organic growth unsaturated customer bases © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 11

Appendix: Non-GAAP Reconciliations This document contains non-GAAP financial information. Management uses this information in its internal analysis of results and believes this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. A reconciliation of non-GAAP measures to the comparable GAAP measures is presented in this document, and the definitions of the non-GAAP measures we use are contained in the Company’s most recent earnings press release, which is available on the investor relations section of our web site at www.dlhcorp.com. © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 12

Reconciliation of net income to EBITDA Reconciliation of proforma net income to proforma EBITDA for the twelve months end June 30, 2020 (in millions) DLH IBA Adj. Proforma Net Income $ 7.3 $ 2.2 $ (2.1) $ 7.4 Interest expense (income) 3.9 - 1.5 5.4 Provision for taxes 3.0 0.9 (0.9) 3.0 Depreciation and amortization 7.2 - 1.5 8.7 EBITDA $ 21.4 $ 3.1 $ - $ 24.5 © Copyright 2020 DLH Holdings Corporation. All Rights Reserved. 13

CORPORATE HEADQUARTERS NATIONAL CAPITAL DURHAM, NORTH CAROLINA KAMPALA, UGANDA ATLANTA HQ REGION HQ OFFICE OFFICE 3565 Piedmont Road, NE 8757 Georgia Avenue | Suite 1200 4505 Emperor Boulevard 2730 Church Road, Kansanga Building 3 | Suite 700 Silver Spring, MD 20910 Suite 400 Kampala, Uganda Atlanta, GA 30305 Durham, NC 27703 3130 Fairview Park Dr | Suite 250 Falls Church, VA 22042 Your Mission Is Our Passion © Copyright 2020 DLH Holdings Corporation. All Rights Reserved.