Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SelectQuote, Inc. | a8-kinvestorpresentati.htm |

Exhibit 99.1 SelectQuote Investor Presentation October 2020

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: the ultimate duration and impact of the ongoing COVID-19 pandemic, our reliance on a limited number of insurance carrier partners and any potential termination of those relationships or failure to develop new relationships; existing and future laws and regulations affecting the health insurance market; changes in health insurance products offered by our insurance carrier partners and the health insurance market generally; insurance carriers offering products and services directly to consumers; changes to commissions paid by insurance carriers and underwriting practices and/or changes to laws, regulations or accounting practices that could impact the recognition of commissions received and expected future renewal commissions; competition with brokers, exclusively online brokers and carriers who opt to sell policies directly to consumers; competition from government-run health insurance exchanges; developments in the U.S. health insurance system; our dependence on revenue from carriers in our senior segment and downturns in the senior health as well as life, automotive and home insurance industries; our ability to develop new offerings and penetrate new vertical markets; risks from third-party products; failure to enroll individuals during the Medicare annual enrollment period; our ability to attract, integrate and retain qualified personnel; our dependence on lead providers and ability to compete for leads; failure to obtain and/or convert sales leads to actual sales of insurance policies; access to data from consumers and insurance carriers; accuracy of information provided from and to consumers during the insurance shopping process; cost-effective advertisement through internet search engines; ability to contact consumers and market products by telephone; global economic conditions; disruption to operations as a result of future acquisitions; significant estimates and assumptions in the preparation of our financial statements; impairment of goodwill; potential litigation and claims, including IP litigation; our existing and future indebtedness; developments with respect to LIBOR; access to additional capital; failure to protect our intellectual property and our brand; fluctuations in our financial results caused by seasonality; accuracy and timeliness of commissions reports from insurance carriers; timing of insurance carriers’ approval and payment practices; factors that impact our estimate of the constrained lifetime value of commissions per policyholder; changes in accounting rules, tax legislation and other legislation; disruptions or failures of our technological infrastructure and platform; failure to maintain relationships with third-party service providers; cybersecurity breaches or other attacks involving our systems or those of our insurance carrier partners or third-party service providers; our ability to protect consumer information and other data; and failure to market and sell Medicare plans effectively or in compliance with laws. For a further discussion of these and other risk factors that could impact our future results and performance, see the section entitled “Risk Factors” in the most recent registration statement on the most recent Annual Report on Form 10-K ("Annual Report") filed by us with the Securities Exchange Commission. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. Certain information contained in this presentation and statements made orally during this presentation relates to or is based on publications and other data obtained from third-party sources. While we believe these third-party sources to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third-party sources. No Offer or Solicitation; Further Information This presentation is for informational purposes only and is not an offer to sell with respect to any securities. This presentation should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included in the Annual Report. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. To supplement our financial statements presented in accordance with GAAP and to provide investors with additional information regarding our GAAP financial results, we have presented in this presentation Adjusted EBITDA and Adjusted EBITDA Margin, which are non-GAAP financial measures. These non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled measures presented by other companies. We define Adjusted EBITDA as income before interest expense, income tax expense, depreciation and amortization, and certain add-backs for non-cash or non-recurring expenses, including restructuring and share-based compensation expenses. The most directly comparable GAAP measure is net income. We monitor and have presented in this presentation Adjusted EBITDA because it is a key measure used by our management and Board of Directors to understand and evaluate our operating performance, to establish budgets and to develop operational goals for managing our business. In particular, we believe that excluding the impact of these expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core operating performance. For further discussion regarding this non-GAAP measure, please see our most recently filed Annual Report. 2

SelectQuote at a Glance 30+ 100% Years in Internal Operation Agents WHO WE ARE We are a leading technology-enabled, direct-to- 2MM+ 1 Billion+ consumer (“DTC”) distribution platform Policyholders Data points collected Served ~1,000 $180Bn+ Licensed Total Addressable WHAT WE DO Agents(1) Market FY 2020 Revenue Mix 50+ carriers entrust us to sell their “must own” KPIs insurance products 3.5X 24% FY’20 Revenue / CAC 93% Level 1 Agent Retention 8% HOW WE DO IT ~40% 68% Tenured Agent YoY Our proprietary, purpose-built marketing (2) technology optimizes lead delivery to our 100% Productivity Increase internal agent force, maximizing marketing ROI Senior Health Auto & Home Life Consolidated Senior $532MM 58% 88% WHY WE ARE DIFFERENT FY 2020 Revenue FY 2020 FY 2020 YoY Revenue Growth YoY Revenue Growth Our “Fly Wheel” is enhanced by over 1 billion data points and 30+ years of experience $154MM 29% 40% FY 2020 Adjusted FY 2020 Adjusted FY 2020 Adjusted (3) Notes: EBITDA EBITDA(3) Margin EBITDA(3) Margin 1. As of 6/30/2020 2. Based on past company experience, average agent productivity increases by ~40% in an agent’s second AEP 3. Adjusted EBITDA and Adjusted EBITDA Margin are Non-GAAP financial measures used to measure operating performance. We define Adjusted EBITDA as income before interest expense, income tax expense, depreciation and amortization, and certain addbacks for non-cash or non-recurring expenses, including restructuring and share-based compensation expenses. See reconciliations from Adjusted EBITDA to net income on slides 23-26. 3

Key Investment Highlights Large and Growing End Markets Shifting to Meet Evolving Consumer Preferences Purpose-Built Technology Empowering Our Highly Skilled Internal Agent Network Self-Reinforcing Feedback Loop from Strong Carrier Relationships and Favorable Consumer Outcomes Simple and Attractive Business Model Driving Profitable Growth and Industry Leading LTV Unique Company Culture Developed by Experienced Management Team 4

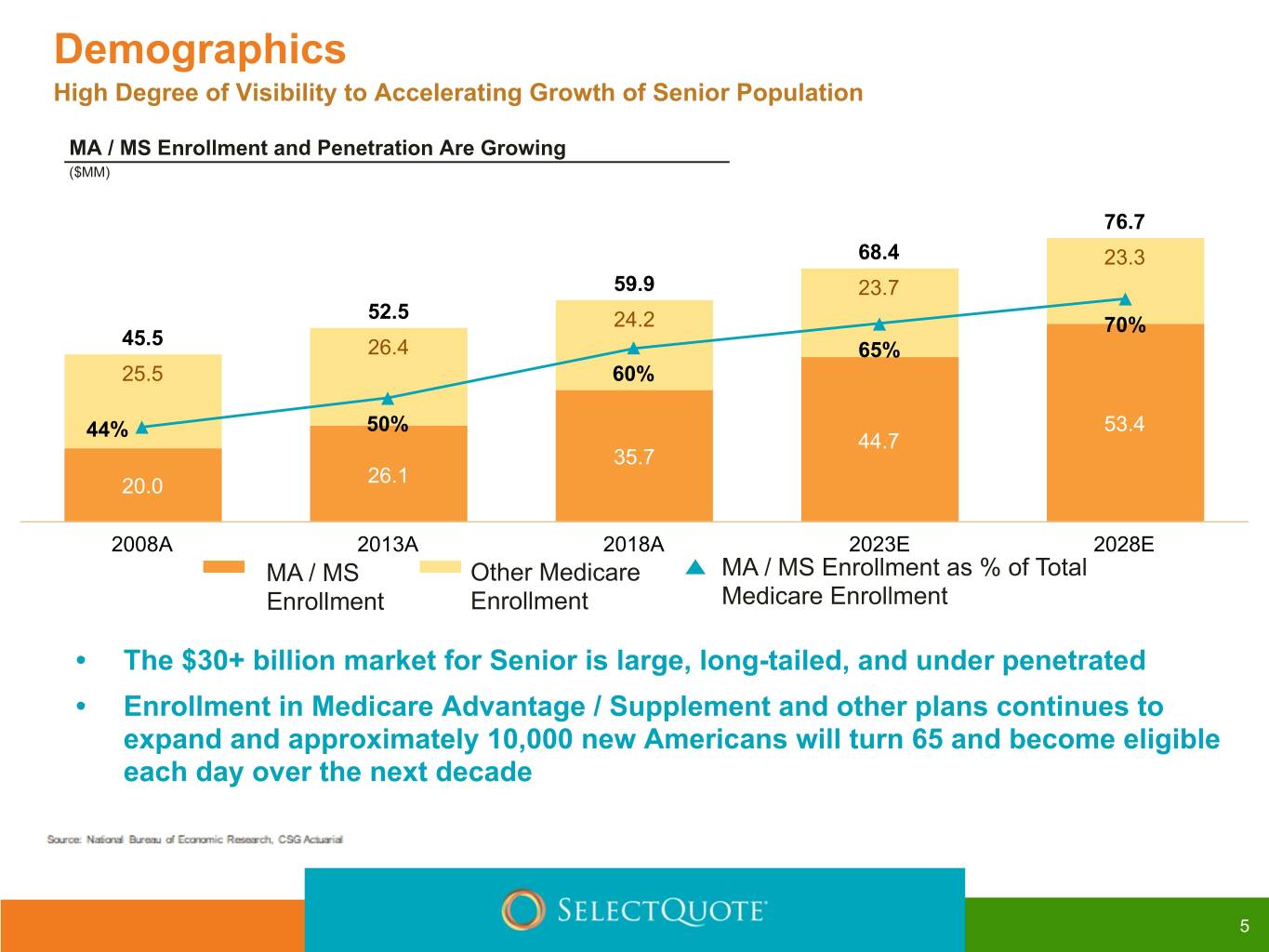

Demographics High Degree of Visibility to Accelerating Growth of Senior Population MA / MS Enrollment and Penetration Are Growing ($MM) 76.7 68.4 23.3 59.9 23.7 52.5 24.2 70% 45.5 26.4 65% 25.5 60% 44% 50% 53.4 44.7 35.7 20.0 26.1 2008A 2013A 2018A 2023E 2028E MA / MS Other Medicare MA / MS Enrollment as % of Total Enrollment Enrollment Medicare Enrollment • The $30+ billion market for Senior is large, long-tailed, and under penetrated • Enrollment in Medicare Advantage / Supplement and other plans continues to expand and approximately 10,000 new Americans will turn 65 and become eligible each day over the next decade 5

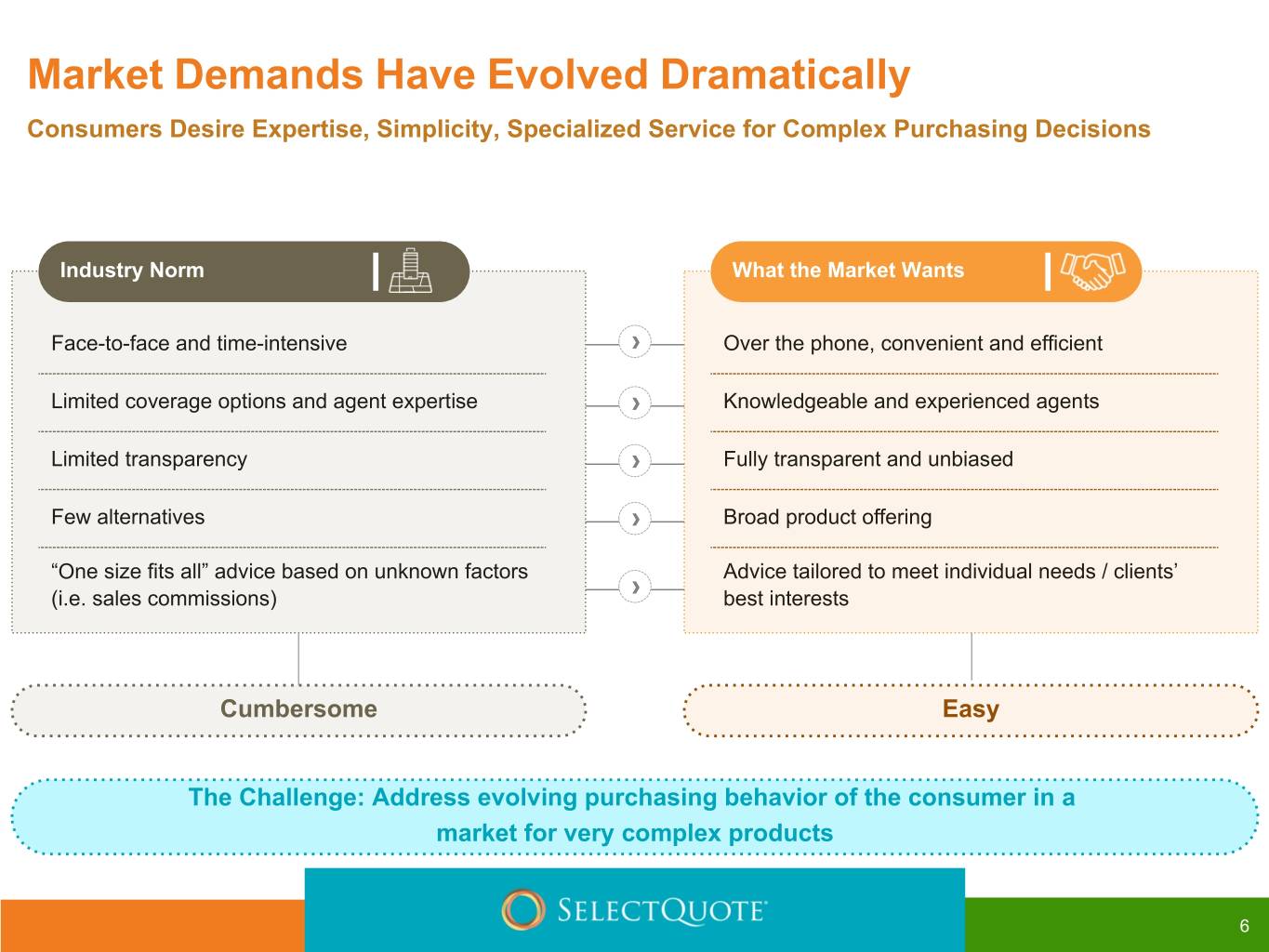

Market Demands Have Evolved Dramatically Consumers Desire Expertise, Simplicity, Specialized Service for Complex Purchasing Decisions Industry Norm What the Market Wants Face-to-face and time-intensive Over the phone, convenient and efficient Limited coverage options and agent expertise Knowledgeable and experienced agents Limited transparency Fully transparent and unbiased Few alternatives Broad product offering “One size fits all” advice based on unknown factors Advice tailored to meet individual needs / clients’ (i.e. sales commissions) best interests Cumbersome Easy The Challenge: Address evolving purchasing behavior of the consumer in a market for very complex products 6

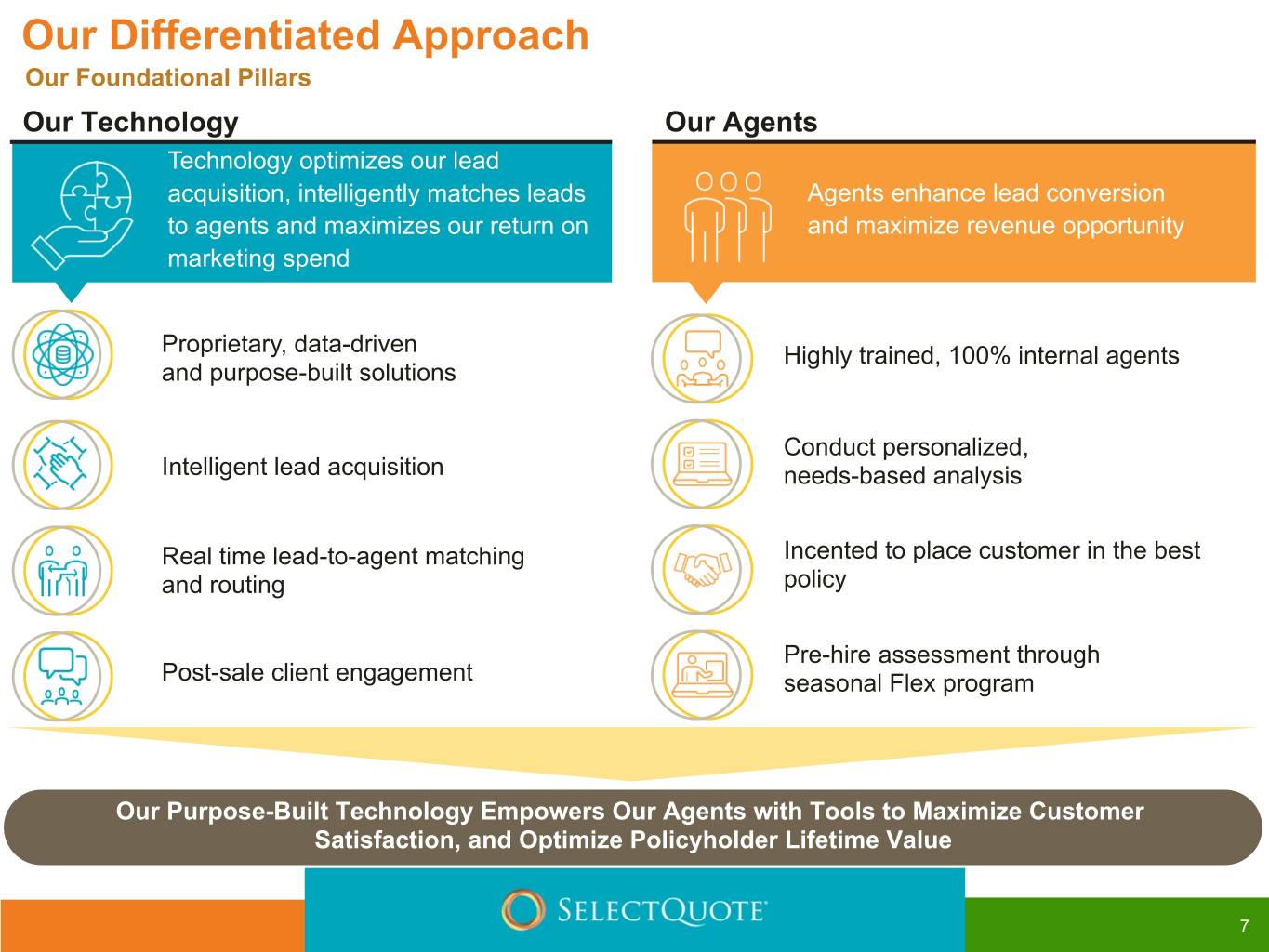

Our Differentiated Approach Our Foundational Pillars Our Technology Our Agents Technology optimizes our lead acquisition, intelligently matches leads Agents enhance lead conversion to agents and maximizes our return on and maximize revenue opportunity marketing spend Proprietary, data-driven Highly trained, 100% internal agents and purpose-built solutions Conduct personalized, Intelligent lead acquisition needs-based analysis Real time lead-to-agent matching Incented to place customer in the best and routing policy Pre-hire assessment through Post-sale client engagement seasonal Flex program Our Purpose-Built Technology Empowers Our Agents with Tools to Maximize Customer Satisfaction, and Optimize Policyholder Lifetime Value 7

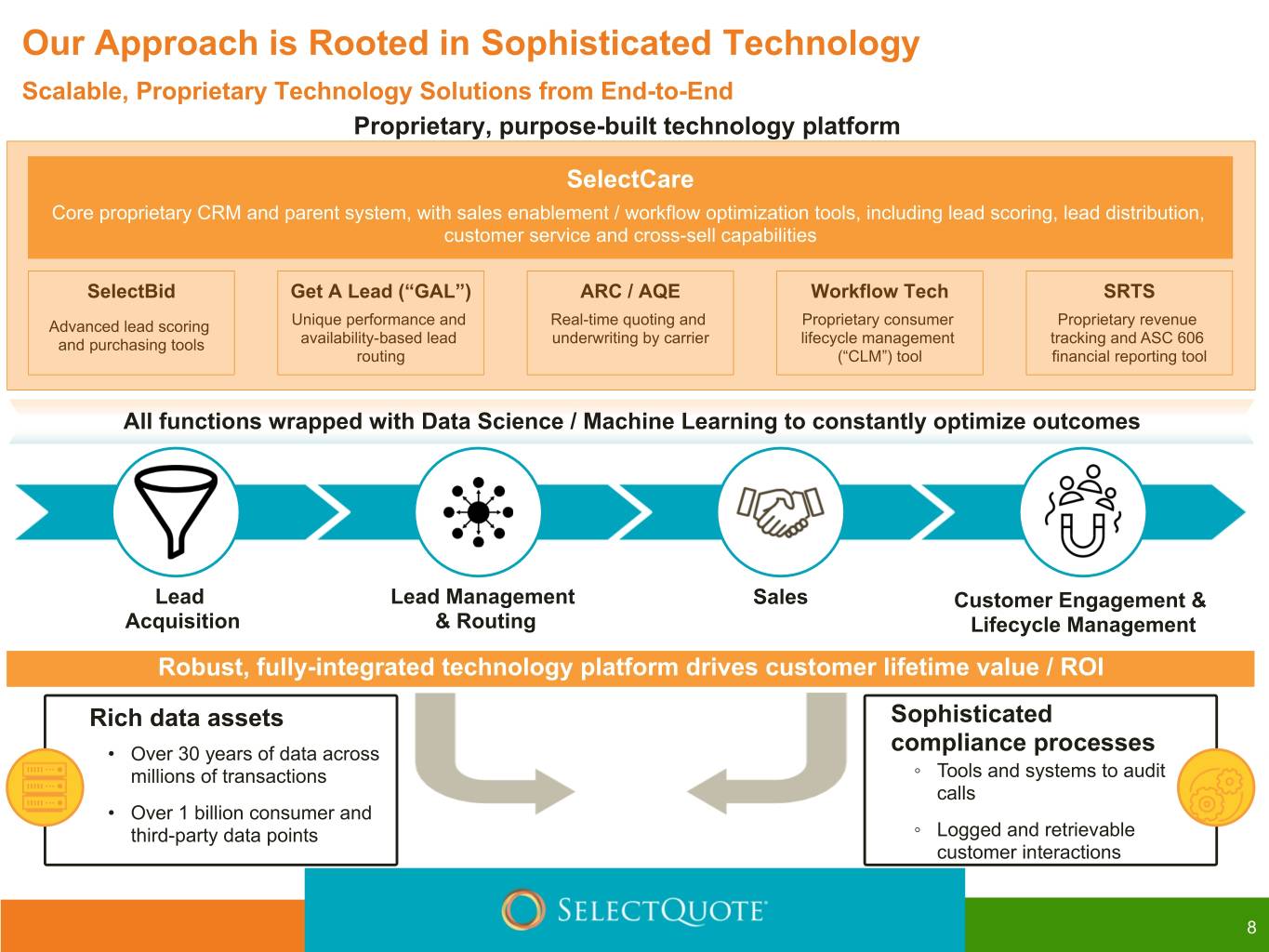

Our Approach is Rooted in Sophisticated Technology Scalable, Proprietary Technology Solutions from End-to-End Proprietary, purpose-built technology platform SelectCare Core proprietary CRM and parent system, with sales enablement / workflow optimization tools, including lead scoring, lead distribution, customer service and cross-sell capabilities SelectBid Get A Lead (“GAL”) ARC / AQE Workflow Tech SRTS Advanced lead scoring Unique performance and Real-time quoting and Proprietary consumer Proprietary revenue and purchasing tools availability-based lead underwriting by carrier lifecycle management tracking and ASC 606 routing (“CLM”) tool financial reporting tool All functions wrapped with Data Science / Machine Learning to constantly optimize outcomes Lead Lead Management Sales Customer Engagement & Acquisition & Routing Lifecycle Management Robust, fully-integrated technology platform drives customer lifetime value / ROI Rich data assets Sophisticated • Over 30 years of data across compliance processes millions of transactions ◦ Tools and systems to audit calls • Over 1 billion consumer and third-party data points ◦ Logged and retrievable customer interactions 8

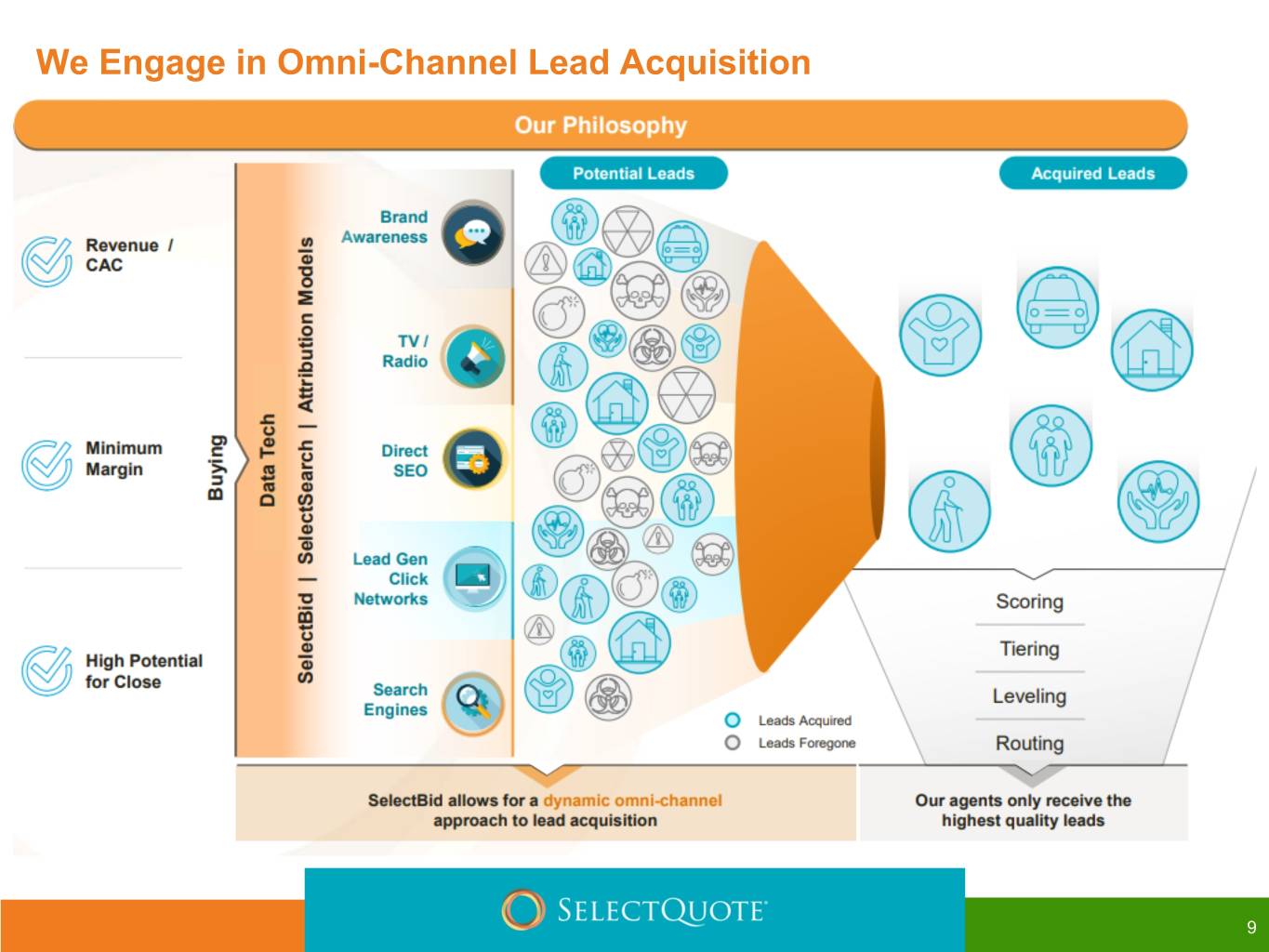

We Engage in Omni-Channel Lead Acquisition 9

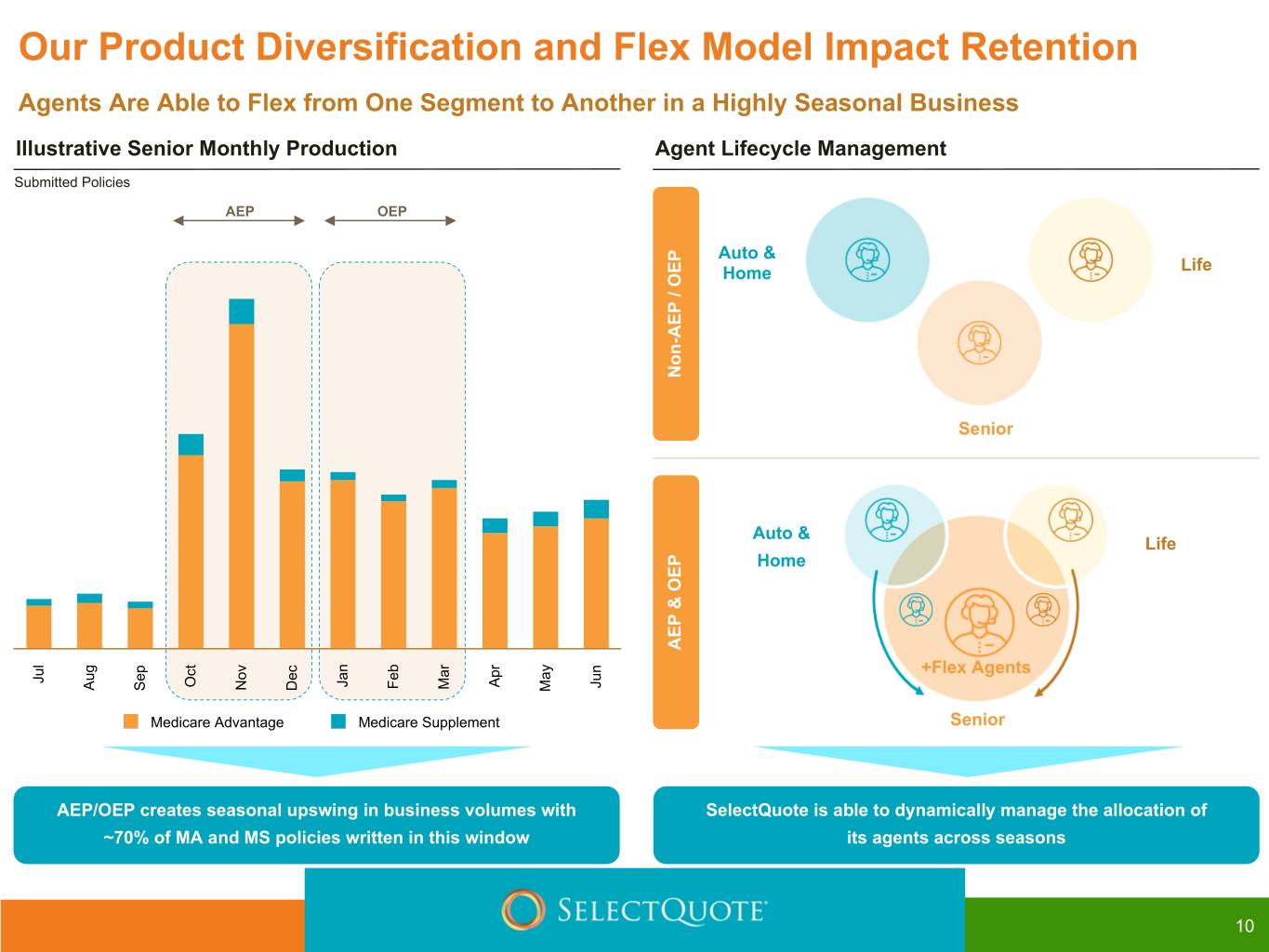

Submitted Policies Illustrative SeniorMonthlyProduction Agents AreAbletoFlexfromOneSegmentAnotherinaHighlySeasonal Business Our ProductDiversificationandFlexModelImpact Retention Jul AEP/OEP creates seasonal upswing in business volumes with Aug ~70% of MA and MS policies written in this window Sep Medicare Advantage Oct AEP Nov Dec Jan Medicare Supplement OEP Feb Mar Apr May Jun Agent LifecycleManagement AEP & OEP Non-AEP / OEP SelectQuote is able to dynamically manage the allocation of Auto & Home Auto & Home its agents across seasons +Flex Agents Senior Senior Life Life 10

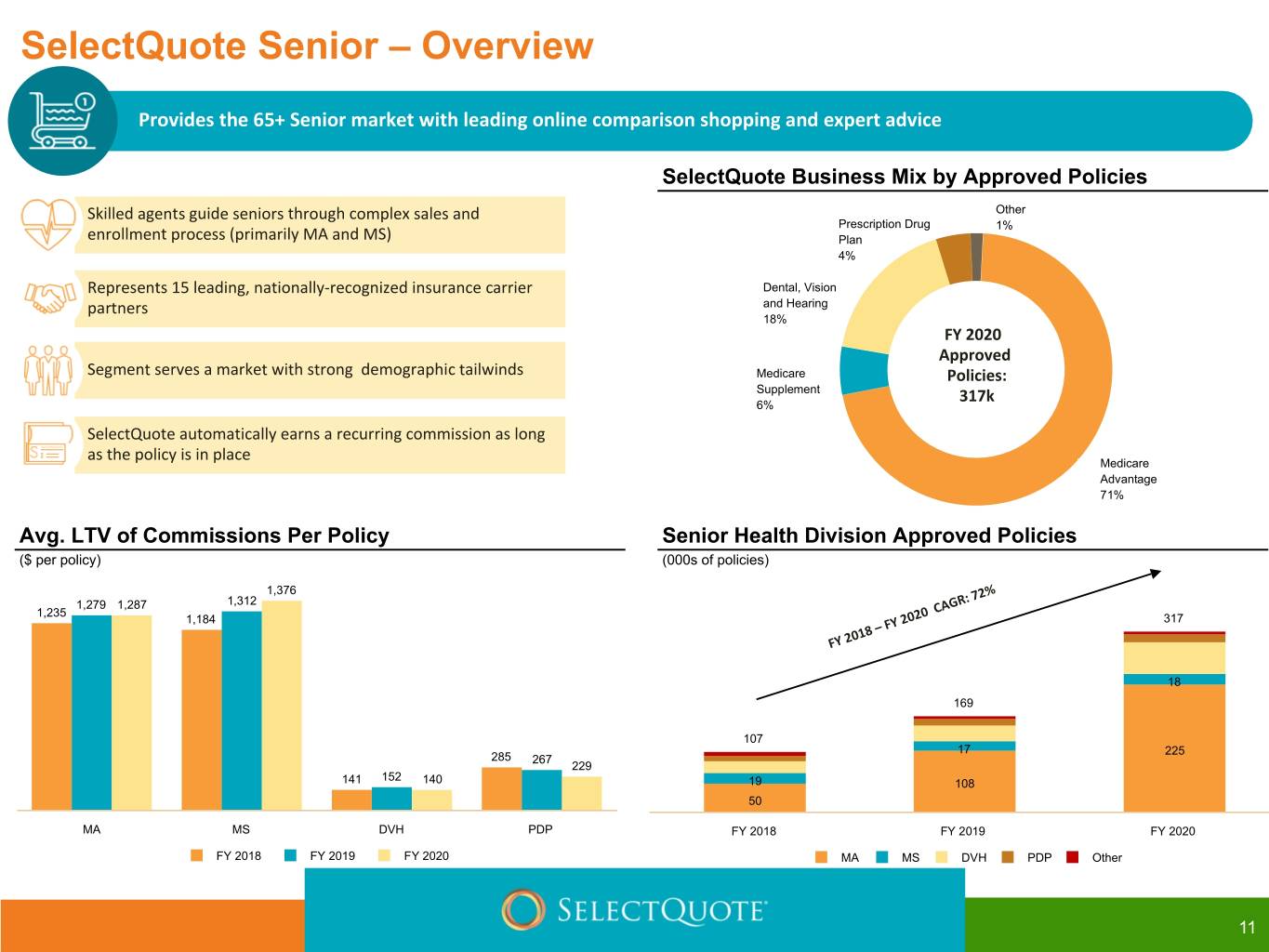

SelectQuote Senior – Overview Provides the 65+ Senior market with leading online comparison shopping and expert advice SelectQuote Business Mix by Approved Policies Skilled agents guide seniors through complex sales and Other Prescription Drug 1% enrollment process (primarily MA and MS) Plan 4% Represents 15 leading, nationally-recognized insurance carrier Dental, Vision partners and Hearing 18% FY 2020 Approved Segment serves a market with strong demographic tailwinds Medicare Policies: Supplement 317k 6% SelectQuote automatically earns a recurring commission as long as the policy is in place Medicare Advantage 71% Avg. LTV of Commissions Per Policy Senior Health Division Approved Policies ($ per policy) (000s of policies) 1,376 72% 1,279 1,287 1,312 1,235 1,184 317 FY 2018 – FY 2020 CAGR: 18 169 107 17 225 285 267 229 152 141 140 19 108 50 MA MS DVH PDP FY 2018 FY 2019 FY 2020 FY 2018 FY 2019 FY 2020 MA MS DVH PDP Other 11

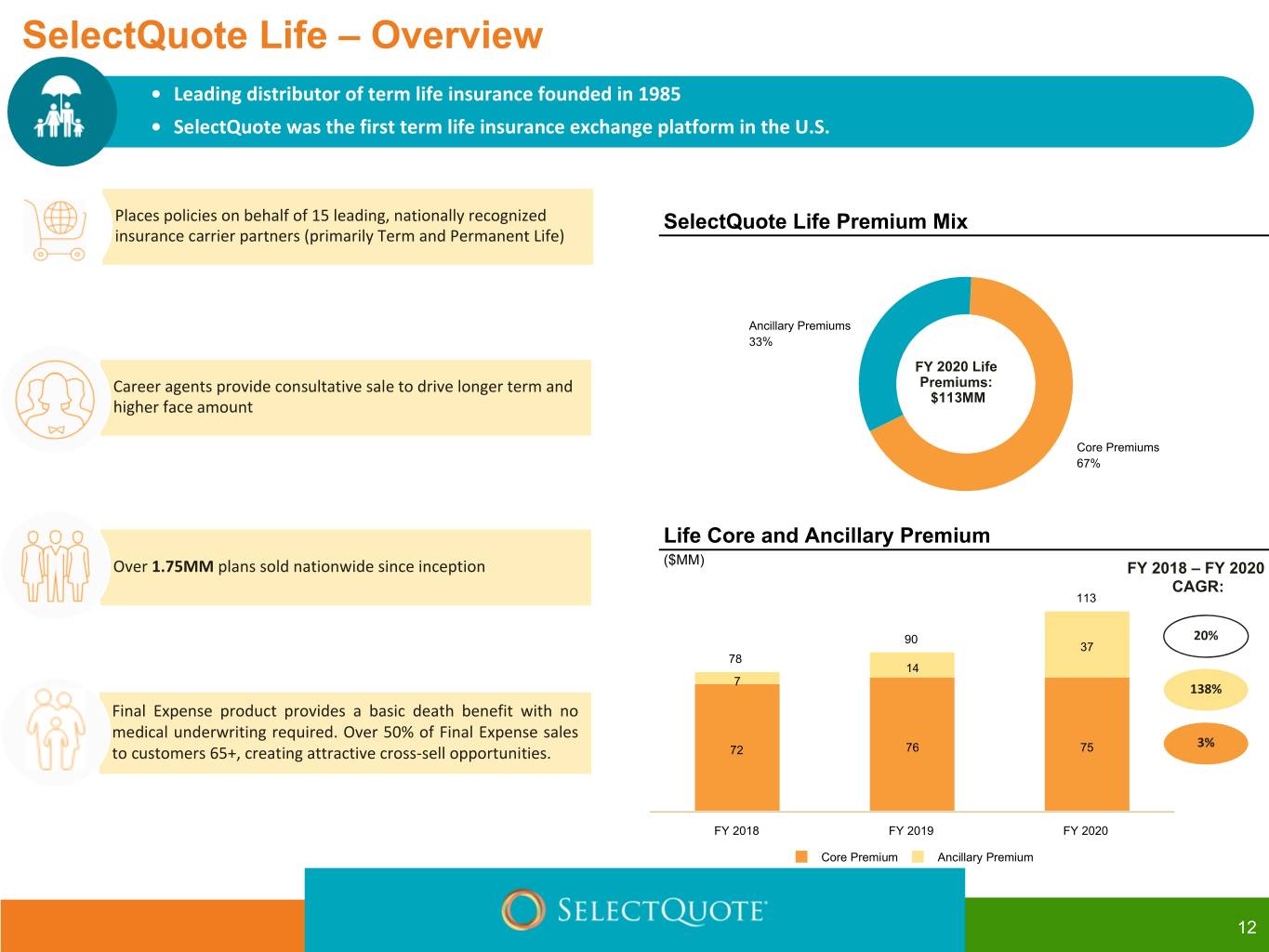

SelectQuote Life – Overview • Leading distributor of term life insurance founded in 1985 • SelectQuote was the first term life insurance exchange platform in the U.S. Places policies on behalf of 15 leading, nationally recognized SelectQuote Life Premium Mix insurance carrier partners (primarily Term and Permanent Life) Ancillary Premiums 33% FY 2020 Life Career agents provide consultative sale to drive longer term and Premiums: $113MM higher face amount Core Premiums 67% Life Core and Ancillary Premium ($MM) Over 1.75MM plans sold nationwide since inception FY 2018 – FY 2020 CAGR: 113 90 20% 37 78 14 7 138% Final Expense product provides a basic death benefit with no medical underwriting required. Over 50% of Final Expense sales 3% 76 75 to customers 65+, creating attractive cross-sell opportunities. 72 FY 2018 FY 2019 FY 2020 Core Premium Ancillary Premium 12

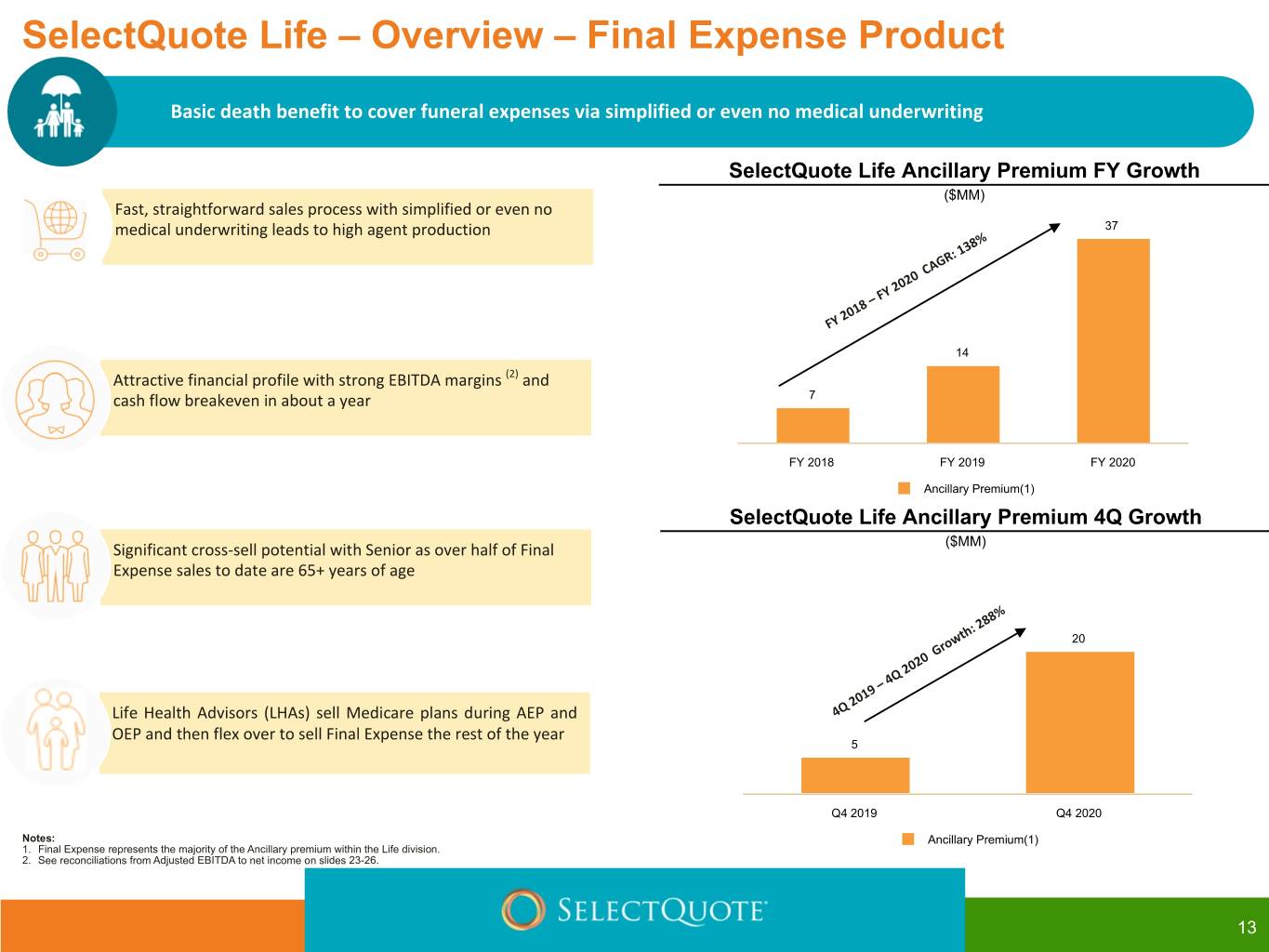

SelectQuote Life – Overview – Final Expense Product Basic death benefit to cover funeral expenses via simplified or even no medical underwriting SelectQuote Life Ancillary Premium FY Growth ($MM) Fast, straightforward sales process with simplified or even no medical underwriting leads to high agent production 37 FY 2018 – FY 2020 CAGR: 138% 14 Attractive financial profile with strong EBITDA margins (2) and cash flow breakeven in about a year 7 FY 2018 FY 2019 FY 2020 Ancillary Premium(1) SelectQuote Life Ancillary Premium 4Q Growth ($MM) Significant cross-sell potential with Senior as over half of Final Expense sales to date are 65+ years of age 20 Life Health Advisors (LHAs) sell Medicare plans during AEP and 4Q 2019 – 4Q 2020 Growth: 288% OEP and then flex over to sell Final Expense the rest of the year 5 Q4 2019 Q4 2020 Notes: Ancillary Premium(1) 1. Final Expense represents the majority of the Ancillary premium within the Life division. 2. See reconciliations from Adjusted EBITDA to net income on slides 23-26. 13

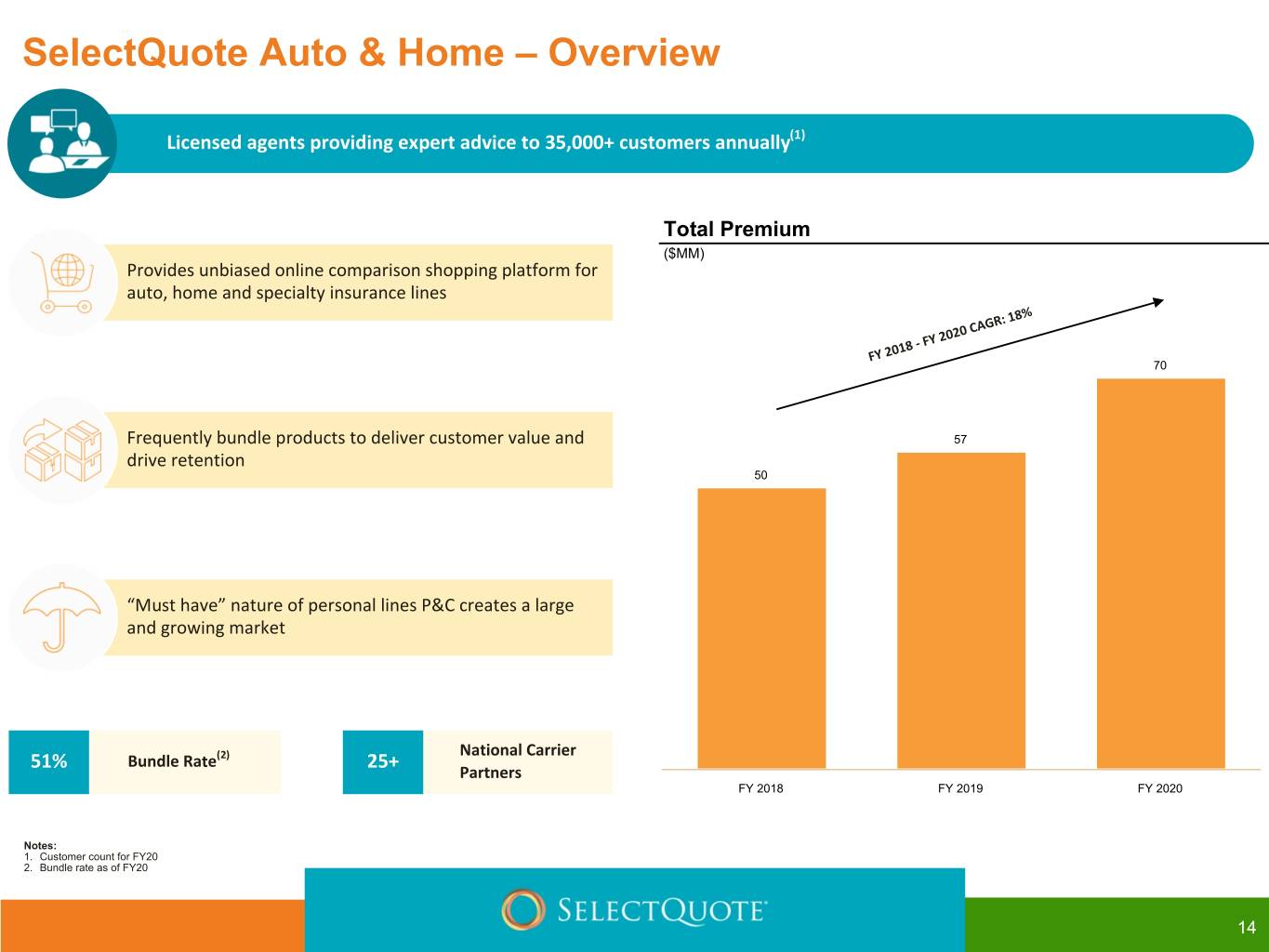

SelectQuote Auto & Home – Overview Licensed agents providing expert advice to 35,000+ customers annually(1) Total Premium ($MM) Provides unbiased online comparison shopping platform for auto, home and specialty insurance lines 18% FY 2018 - FY 2020 CAGR: 70 Frequently bundle products to deliver customer value and 57 drive retention 50 “Must have” nature of personal lines P&C creates a large and growing market National Carrier 51% Bundle Rate(2) 25+ Partners FY 2018 FY 2019 FY 2020 Notes: 1. Customer count for FY20 2. Bundle rate as of FY20 14

Strategic Focus and Competitive Differentiators • Our strategy is to maximize absolute profitability at attractive returns on invested capital divisions • Our choice model paired with highly trained, in- house agents and dedicated customer care teams was purpose-built to ensure customers buy the right plan for their specific needs which leads to high retention rates • Our market-leading Lifetime Value and Adjusted EBITDA per policy (1) are a function of the way we have built and refined our business over 35 years • Predictable cash flows are driven by high quality of policies written • We have a strong record of attractive returns on invested capital and have a long runway to replicate those returns at scale Notes: 1. See reconciliations from Adjusted EBITDA to net income on slides 23-26. 15

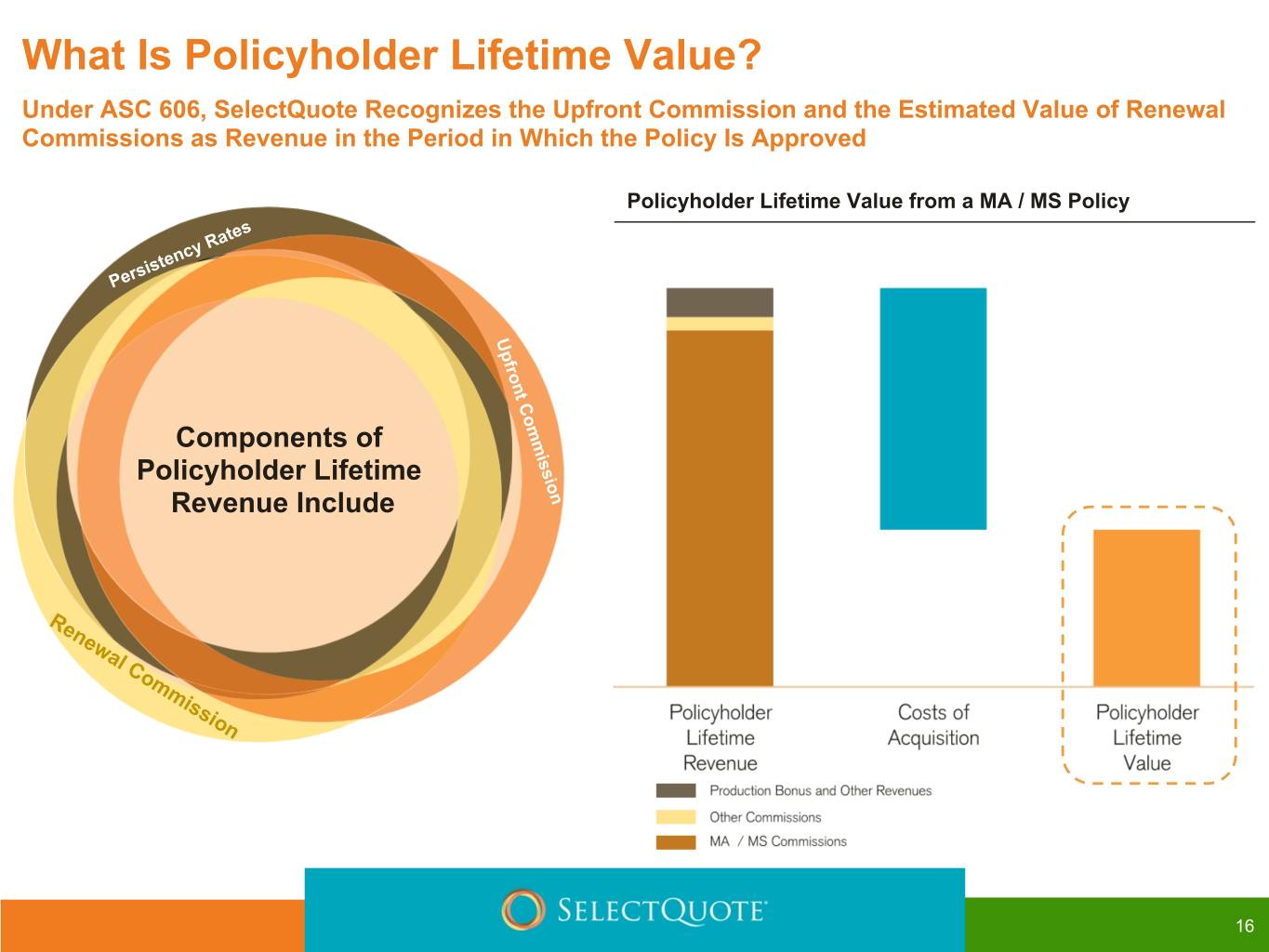

What Is Policyholder Lifetime Value? Under ASC 606, SelectQuote Recognizes the Upfront Commission and the Estimated Value of Renewal Commissions as Revenue in the Period in Which the Policy Is Approved Policyholder Lifetime Value from a MA / MS Policy Persistency Rates Upfront Commission Components of Policyholder Lifetime Revenue Include Renewal Commission 16

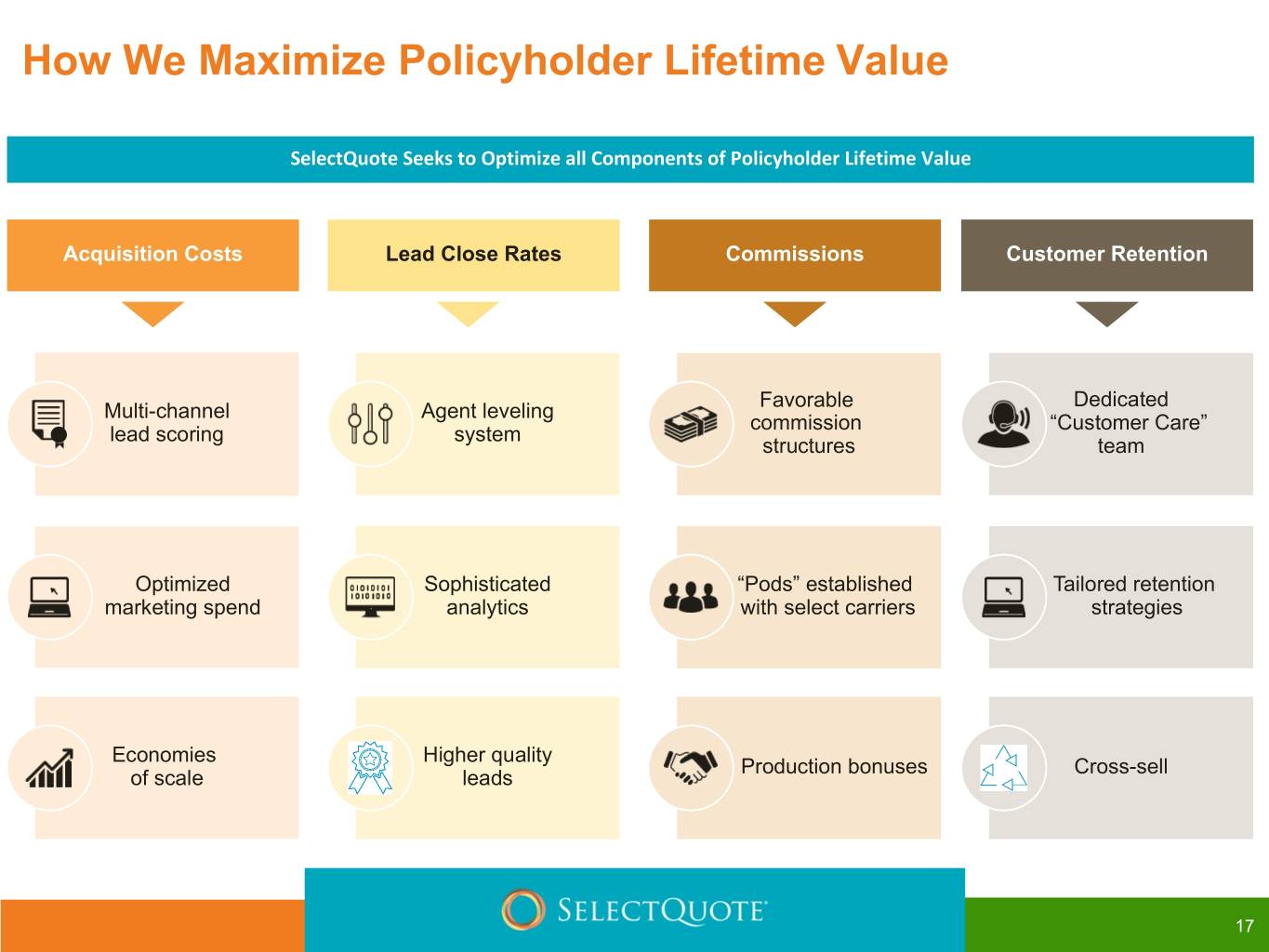

How We Maximize Policyholder Lifetime Value SelectQuote Seeks to Optimize all Components of Policyholder Lifetime Value Acquisition Costs Lead Close Rates Commissions Customer Retention Favorable Dedicated Multi-channel Agent leveling commission “Customer Care” lead scoring system structures team Optimized Sophisticated “Pods” established Tailored retention marketing spend analytics with select carriers strategies Economies Higher quality Production bonuses Cross-sell of scale leads 17

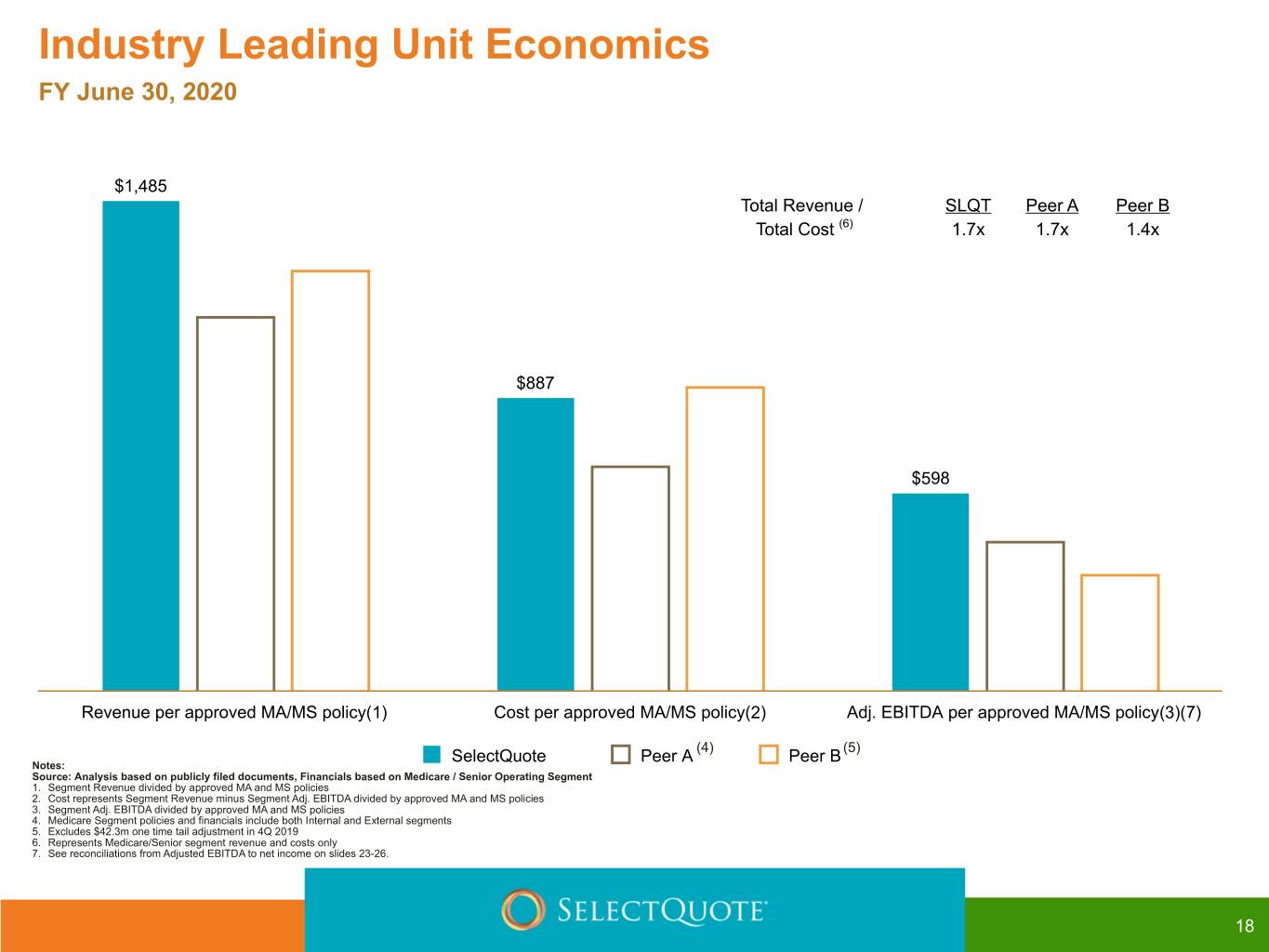

Industry Leading Unit Economics FY June 30, 2020 $1,485 Total Revenue / SLQT Peer A Peer B Total Cost (6) 1.7x 1.7x 1.4x $887 $598 Revenue per approved MA/MS policy(1) Cost per approved MA/MS policy(2) Adj. EBITDA per approved MA/MS policy(3)(7) (4) (5) SelectQuote Peer A Peer B Notes: Source: Analysis based on publicly filed documents, Financials based on Medicare / Senior Operating Segment 1. Segment Revenue divided by approved MA and MS policies 2. Cost represents Segment Revenue minus Segment Adj. EBITDA divided by approved MA and MS policies 3. Segment Adj. EBITDA divided by approved MA and MS policies 4. Medicare Segment policies and financials include both Internal and External segments 5. Excludes $42.3m one time tail adjustment in 4Q 2019 6. Represents Medicare/Senior segment revenue and costs only 7. See reconciliations from Adjusted EBITDA to net income on slides 23-26. 18

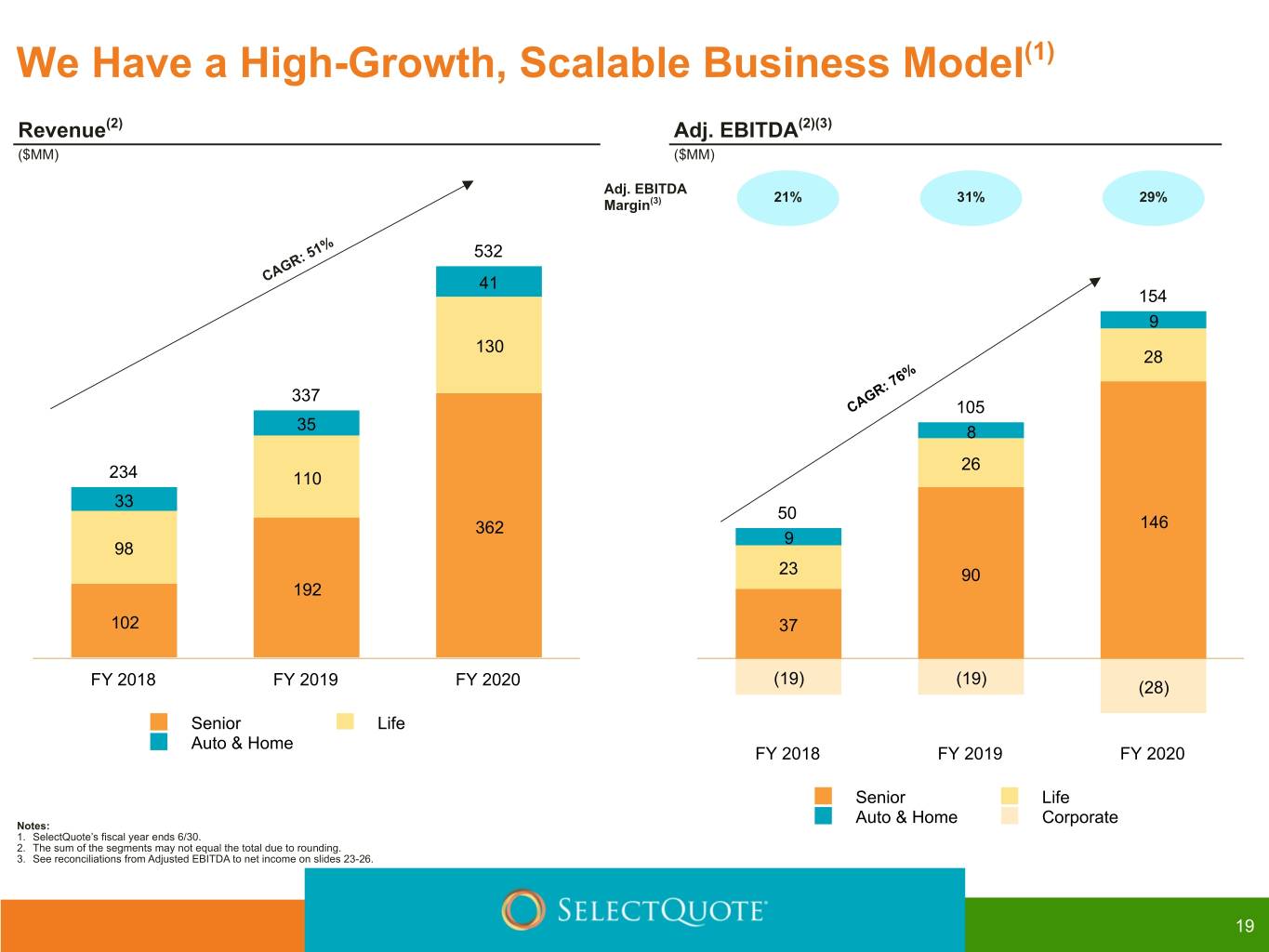

We Have a High-Growth, Scalable Business Model(1) Revenue(2) Adj. EBITDA(2)(3) ($MM) ($MM) Adj. EBITDA 21% 31% 29% Margin(3) 51% 532 CAGR: 41 154 9 130 28 76% 337 CAGR: 105 35 8 26 234 110 33 50 362 146 9 98 23 90 192 102 37 (19) (19) FY 2018 FY 2019 FY 2020 (28) Senior Life Auto & Home Corp FY 2018 FY 2019 FY 2020 Senior Life Notes: Auto & Home Corporate 1. SelectQuote’s fiscal year ends 6/30. 2. The sum of the segments may not equal the total due to rounding. 3. See reconciliations from Adjusted EBITDA to net income on slides 23-26. 19

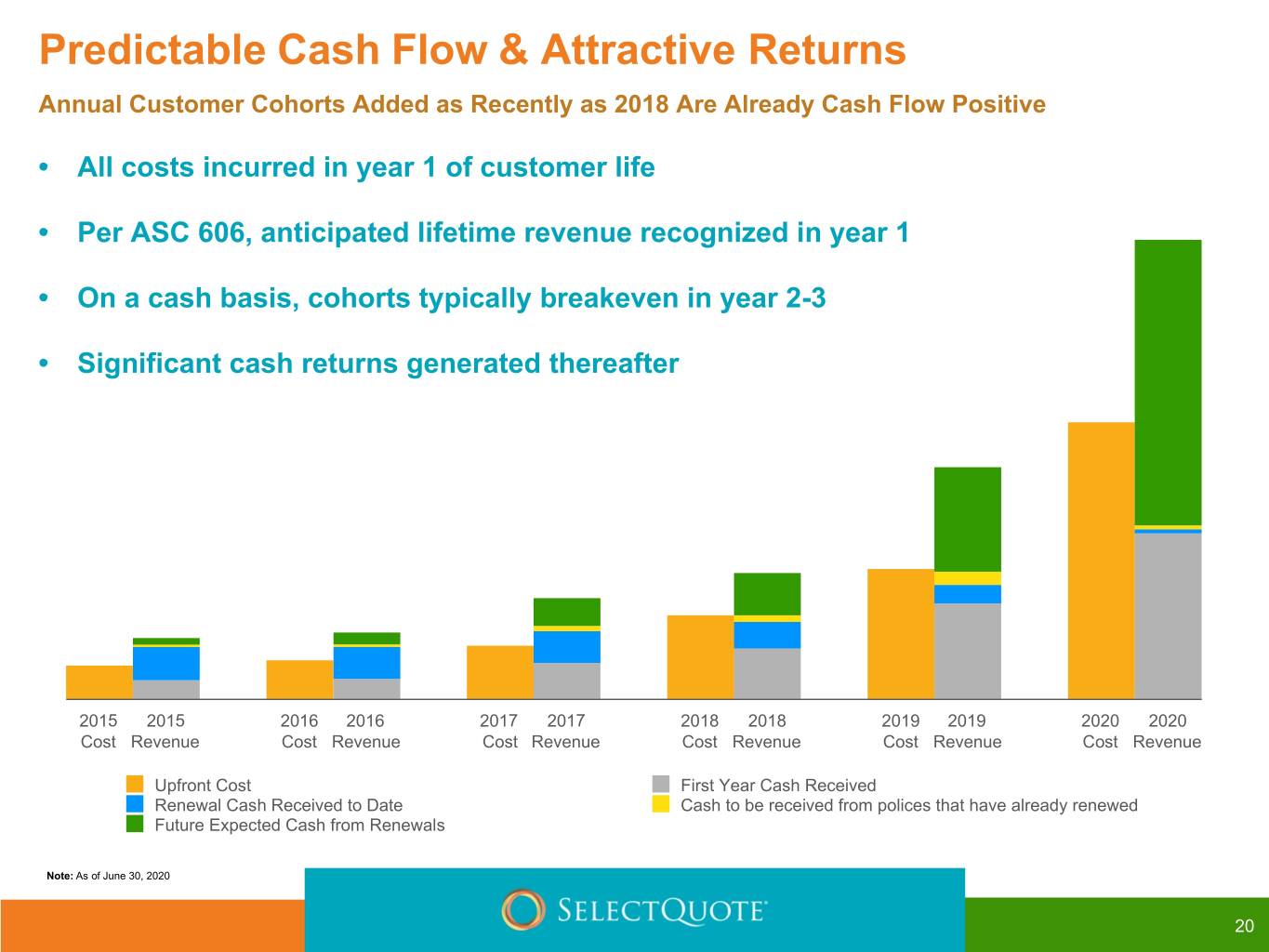

Predictable Cash Flow & Attractive Returns Annual Customer Cohorts Added as Recently as 2018 Are Already Cash Flow Positive • All costs incurred in year 1 of customer life • Per ASC 606, anticipated lifetime revenue recognized in year 1 • On a cash basis, cohorts typically breakeven in year 2-3 • Significant cash returns generated thereafter 2015 2015 2016 2016 2017 2017 2018 2018 2019 2019 2020 2020 Cost Revenue Cost Revenue Cost Revenue Cost Revenue Cost Revenue Cost Revenue Upfront Cost First Year Cash Received Renewal Cash Received to Date Cash to be received from polices that have already renewed Future Expected Cash from Renewals Note: As of June 30, 2020 20

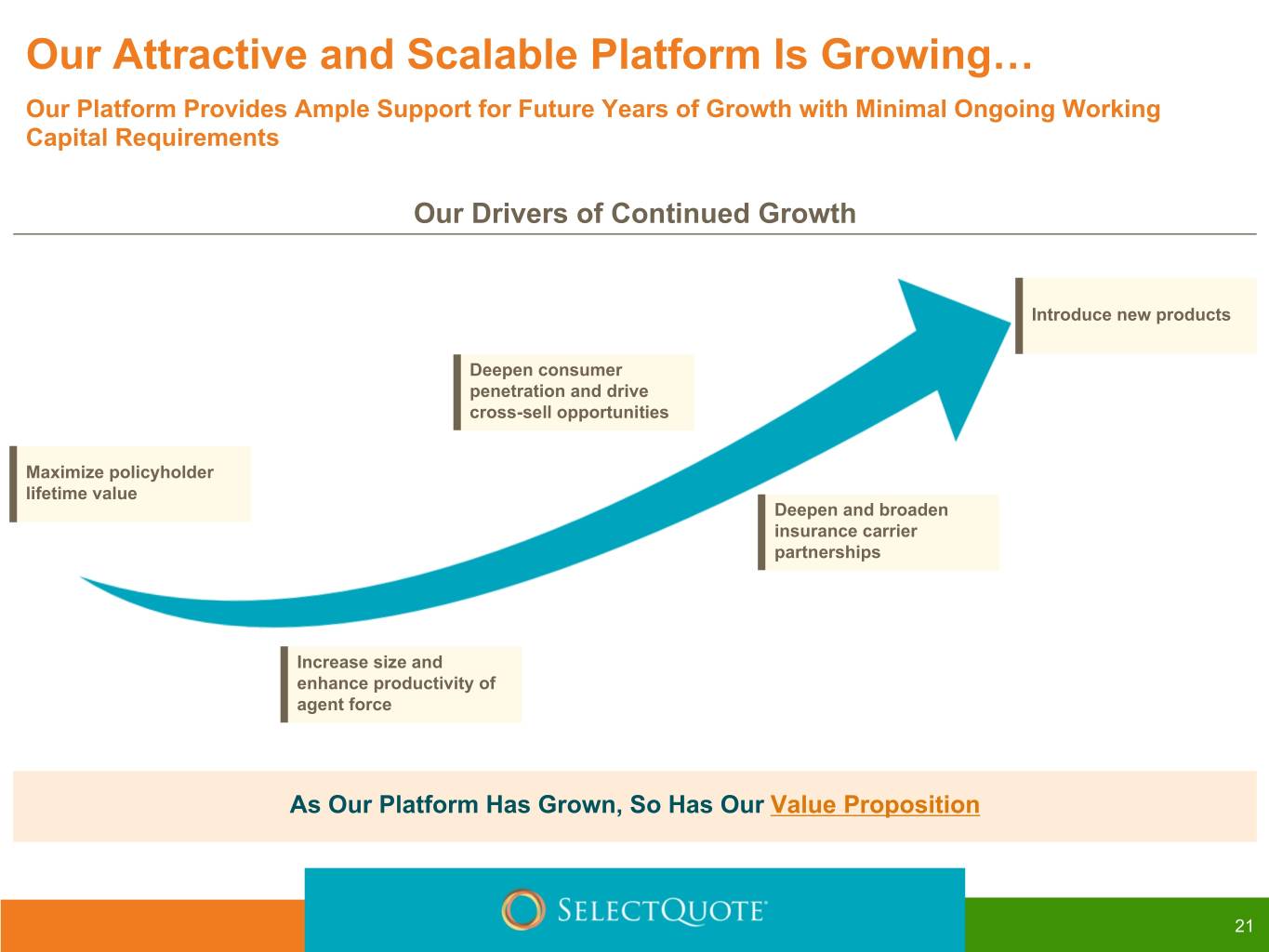

Our Attractive and Scalable Platform Is Growing… Our Platform Provides Ample Support for Future Years of Growth with Minimal Ongoing Working Capital Requirements Our Drivers of Continued Growth Introduce new products Deepen consumer penetration and drive cross-sell opportunities Maximize policyholder lifetime value Deepen and broaden insurance carrier partnerships Increase size and enhance productivity of agent force As Our Platform Has Grown, So Has Our Value Proposition 21

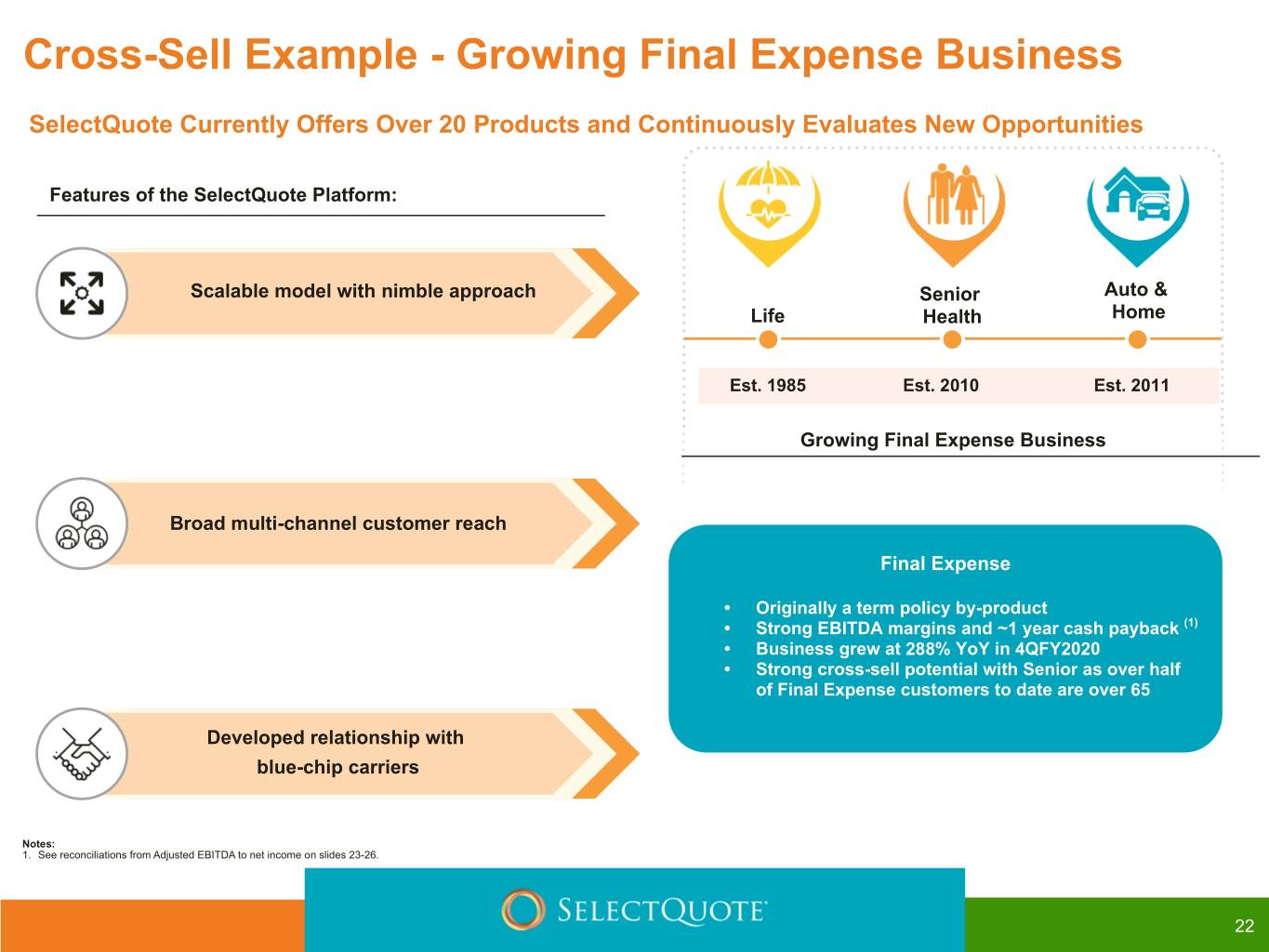

Cross-Sell Example - Growing Final Expense Business SelectQuote Currently Offers Over 20 Products and Continuously Evaluates New Opportunities Features of the SelectQuote Platform: Scalable model with nimble approach Senior Auto & Life Health Home Est. 1985 Est. 2010 Est. 2011 Growing Final Expense Business Broad multi-channel customer reach Final Expense • Originally a term policy by-product • Strong EBITDA margins and ~1 year cash payback (1) • Business grew at 288% YoY in 4QFY2020 • Strong cross-sell potential with Senior as over half of Final Expense customers to date are over 65 Developed relationship with blue-chip carriers Notes: 1. See reconciliations from Adjusted EBITDA to net income on slides 23-26. 22

Supplemental information 23

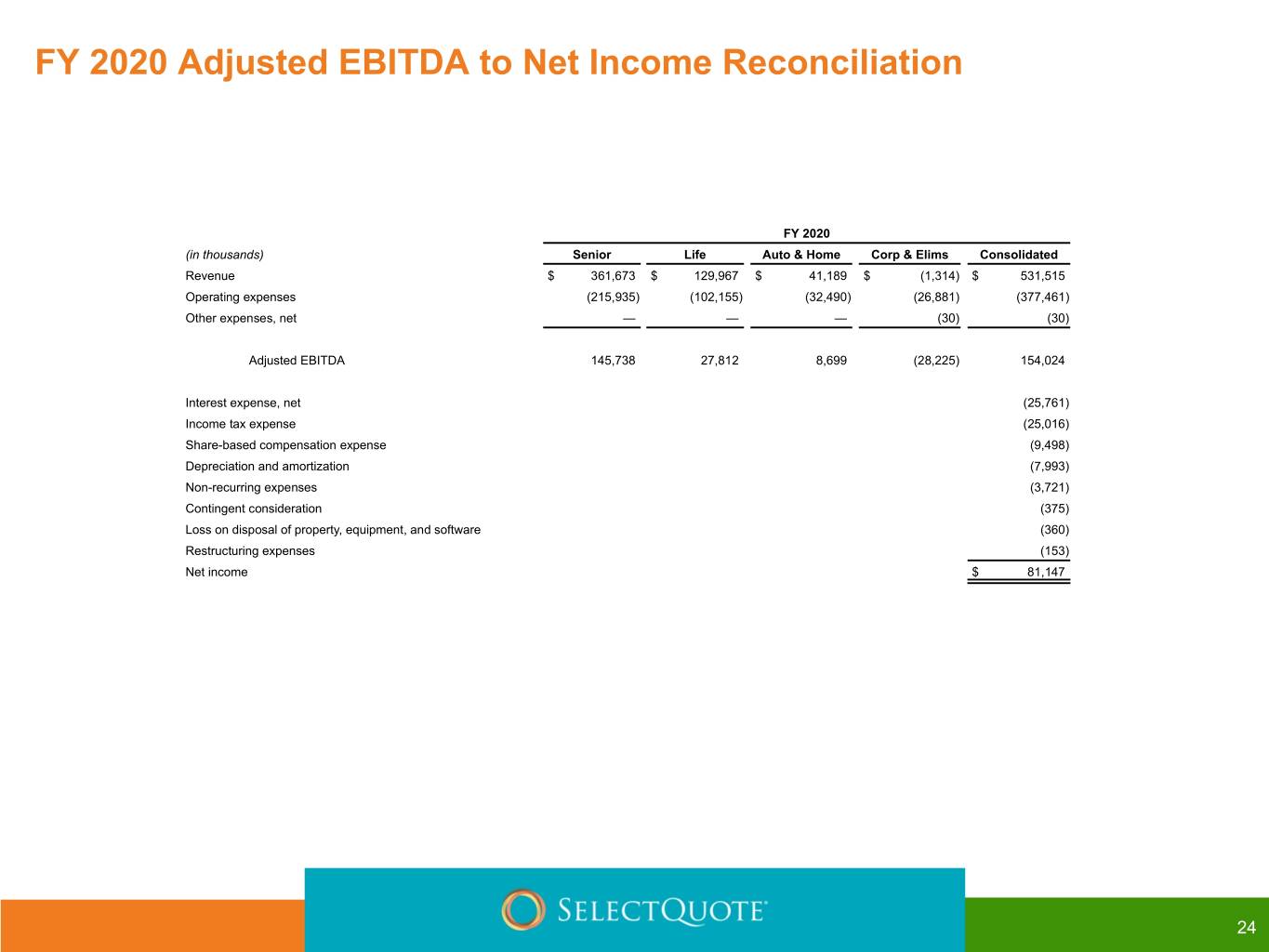

FY 2020 Adjusted EBITDA to Net Income Reconciliation FY 2020 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 361,673 $ 129,967 $ 41,189 $ (1,314) $ 531,515 Operating expenses (215,935) (102,155) (32,490) (26,881) (377,461) Other expenses, net — — — (30) (30) Adjusted EBITDA 145,738 27,812 8,699 (28,225) 154,024 Interest expense, net (25,761) Income tax expense (25,016) Share-based compensation expense (9,498) Depreciation and amortization (7,993) Non-recurring expenses (3,721) Contingent consideration (375) Loss on disposal of property, equipment, and software (360) Restructuring expenses (153) Net income $ 81,147 24

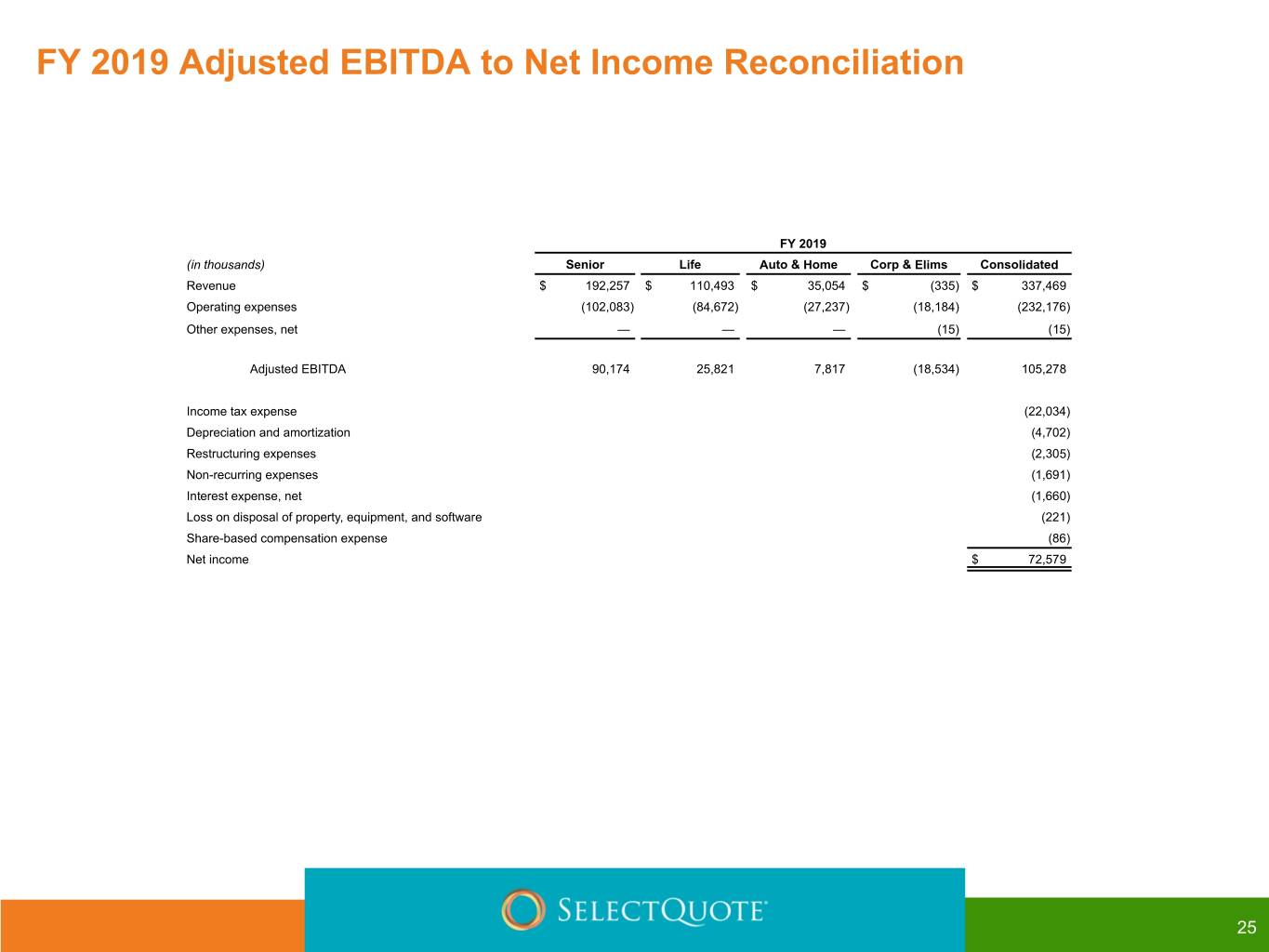

FY 2019 Adjusted EBITDA to Net Income Reconciliation FY 2019 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 192,257 $ 110,493 $ 35,054 $ (335) $ 337,469 Operating expenses (102,083) (84,672) (27,237) (18,184) (232,176) Other expenses, net — — — (15) (15) Adjusted EBITDA 90,174 25,821 7,817 (18,534) 105,278 Income tax expense (22,034) Depreciation and amortization (4,702) Restructuring expenses (2,305) Non-recurring expenses (1,691) Interest expense, net (1,660) Loss on disposal of property, equipment, and software (221) Share-based compensation expense (86) Net income $ 72,579 25

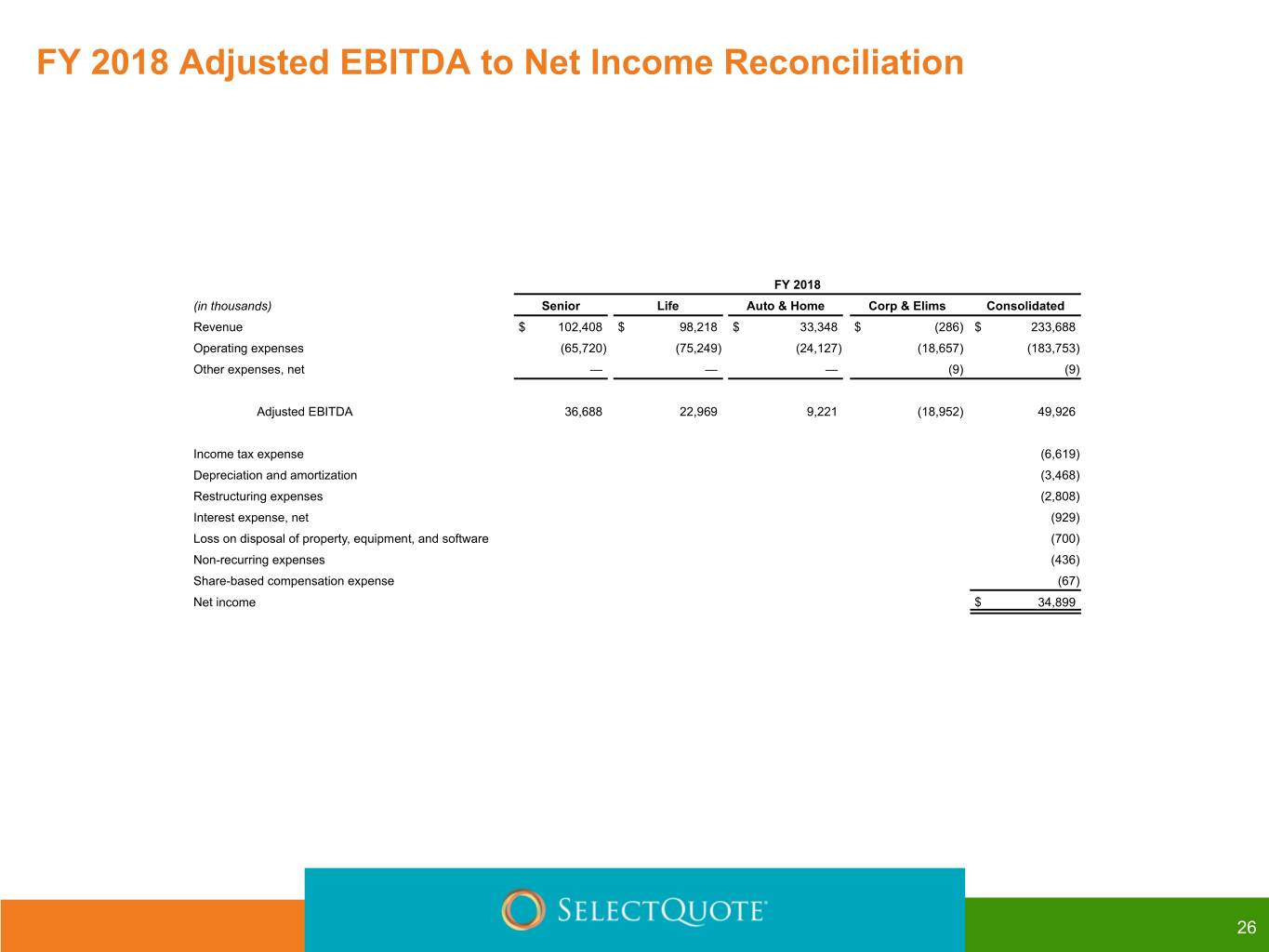

FY 2018 Adjusted EBITDA to Net Income Reconciliation FY 2018 (in thousands) Senior Life Auto & Home Corp & Elims Consolidated Revenue $ 102,408 $ 98,218 $ 33,348 $ (286) $ 233,688 Operating expenses (65,720) (75,249) (24,127) (18,657) (183,753) Other expenses, net — — — (9) (9) Adjusted EBITDA 36,688 22,969 9,221 (18,952) 49,926 Income tax expense (6,619) Depreciation and amortization (3,468) Restructuring expenses (2,808) Interest expense, net (929) Loss on disposal of property, equipment, and software (700) Non-recurring expenses (436) Share-based compensation expense (67) Net income $ 34,899 26