Attached files

| file | filename |

|---|---|

| EX-10.31 - SECURITIES PURCHASE AGREEMENT - Alternus Energy Inc. | altn_ex1031.htm |

| EX-32.2 - CERTIFICATION - Alternus Energy Inc. | altn_ex322.htm |

| EX-32.1 - CERTIFICATION - Alternus Energy Inc. | altn_ex321.htm |

| EX-31.2 - CERTIFICATION - Alternus Energy Inc. | altn_ex312.htm |

| EX-31.1 - CERTIFICATION - Alternus Energy Inc. | altn_ex311.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - Alternus Energy Inc. | altn_ex211.htm |

| EX-10.30 - CONVERTIBLE PROMISSORY NOTE - Alternus Energy Inc. | altn_ex1030.htm |

| EX-10.29 - SETTLEMENT AGREEMENT - Alternus Energy Inc. | altn_ex1029.htm |

| EX-10.28 - SECURITIES PURCHASE AGREEMENT - Alternus Energy Inc. | altn_ex1028.htm |

| EX-10.27 - SECURITIES PURCHASE AGREEMENT - Alternus Energy Inc. | altn_ex1027.htm |

| EX-10.26 - CONVERTIBLE PROMISSORY NOTE - Alternus Energy Inc. | altn_ex1026.htm |

| EX-10.25 - SECURITIES PURCHASE AGREEMENT - Alternus Energy Inc. | altn_ex1025.htm |

| EX-10.24 - CONVERTIBLE PROMISSORY NOTE - Alternus Energy Inc. | altn_ex1024.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

Or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to _______

Commission file number: 000-56085

| Alternus Energy Inc. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

| 46-4996419 |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| One World Trade Center, Suite 8500 |

| 10007 |

| (Address of principal executive office) |

| (Zip Code) |

(212) 220-7434

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

| None |

| N/A |

| N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

(Title of each class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting common stock held by non-affiliates of the registrant, based upon the closing sale price of the Common Stock on June 30, 2019 was approximately $17 million.

As of September 30, 2020, the Company had 120,520,492 shares of Class A Common Stock and 15,000,000 shares of Class B Common Stock.

| 2 |

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements typically contain words such as “anticipate,” “believe,” “estimate,” “expect,” “goal,” “intend,” “opportunities,” “plan,” “potential,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would” or similar words, constitute “forward-looking statements.” These forward-looking statements, which are based on our current plans, expectations and projections about future events, should not be unduly relied upon. These statements involve known and unknown risks, uncertainties and other factors, including, without limitation, those discussed under “Risk Factors,” that may cause our actual results, performance and achievements to materially differ from any future results, performance and achievements expressed or implied by such forward-looking statements. We caution you therefore against relying on any of these forward-looking statements.

The forward-looking statements included herein are based upon our assumptions, estimates and beliefs and involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and may be affected by a variety of risks and other factors, which may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include, but are not limited to:

|

| • | We are a holding company and rely on distributions and other payments, advances and transfers of funds from our subsidiaries to meet our obligations |

|

| • | The reduction, modification or elimination of government subsidies and economic incentives |

|

| • | Decreases in the spot market price of electricity could harm our revenue and reduce the competitiveness of solar parks in grid-parity markets |

|

| • | The seasonality of our operations may affect our liquidity and will affect our quarterly results |

|

| • | Our acquisition strategy exposes us to substantial risk |

|

| • | The delay between making significant upfront investments in our solar parks and receiving revenue could materially and adversely affect our liquidity, business and results of operations |

|

| • | Failure to manage our growing and changing business could have a material adverse effect on our business, prospects, financial condition and results of operations |

|

| • | Our IPP business requires significant financial resources. If we do not successfully execute our financing plan, we may have to sell certain of our IPP solar parks |

|

| • | the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness in the future |

Any of the assumptions underlying forward-looking statements could be inaccurate. All forward-looking statements are made as of the date of this report and the risk that actual results will differ materially from the expectations expressed in this Annual Report on Form 10-K will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this report, the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this report will be achieved.

| 3 |

| Table of Contents |

GLOSSARY OF TERMS

Unless otherwise indicated or the context otherwise requires, references in this report to the terms below will have the following meanings:

|

| • | “Alternus Energy,” “we,” “our,” “us”, “ALTN” and the “Company” refer to Alternus Energy Inc. and its consolidated subsidiaries; |

|

|

|

|

|

| • | “common stock” refers to both Class A and Class B common stock, unless otherwise designated. |

|

|

|

|

|

| • | “EPC” are to engineering, procurement and construction services; |

|

|

|

|

|

| • | “FiT” are to feed-in tariff(s); |

|

|

|

|

|

| • | “IPP” are to independent power producer and refer to our business where we own and operate solar parks and derive revenue from selling electricity to the power grid; |

|

|

|

|

|

| • | “watt” or “W” are to the measurement of total electrical power, where “kilowatt” or “kW” means one thousand watts, “megawatts” or “MW” means one million watts and “gigawatt” or “GW” means one billion watts; |

|

|

|

|

|

| • | “kWh” are to kilowatt hour(s); |

|

|

|

|

|

| • | “MWh” are to megawatt hour(s); |

|

|

|

|

|

| • | “O&M” are to operations and maintenance services provided for commercially operating solar parks; |

|

|

|

|

|

| • | “PPA” are to power purchase agreements; |

|

|

|

|

|

| • | “PV” are to photovoltaic; |

|

|

|

|

|

| • | “RON” and “Romania Leu” are to the legal currency of Romania; |

|

|

|

|

|

| • | “TW” are to terawatt |

|

|

|

|

|

| • | “US$” and “U.S. dollar” are to the legal currency of the United States of America; |

|

|

|

|

|

| • | “€” and “Euro” are to the legal currency of the European Union; |

|

|

|

|

|

| • | “Residential solar” = <10 kW; |

|

|

|

|

|

| • | “Commercial solar” = <250 kW; |

|

|

|

|

|

| • | Industrial = <1000 kW; and |

|

|

|

|

|

| • | Utility-scale = >1000 kW, ground-mounted; and |

|

|

|

|

|

| • | “¥” and “Japanese Yen” are to the legal currency of Japan. |

We calculate the size of the PV market based on the volume of PV modules delivered to installation sites, including modules awaiting installation or connection to the power grid. PV panels generate direct current (“DC”) electricity, while electricity systems are based on alternating current (“AC”) electricity. The data presented in DC power numbers are, on average, greater by approximately 15% than the equivalent AC power numbers. All historical and forecast data are presented in DC power numbers.

Our operating results are reported in U.S. dollars. Our current projects revenue and expenses are generated in other currencies, including the Euro and the Romanian LEI. This may change in the future if we elect to alter the mix of our portfolio within our existing markets or elect to expand into new markets. In addition, our investments (including intercompany loans) in renewable energy facilities in foreign countries are exposed to foreign currency fluctuations. As a result, we expect our revenues and expenses will be exposed to foreign exchange fluctuations in local currencies where our renewable energy facilities are located. To the extent we do not hedge these exposures, fluctuations in foreign exchange rates could negatively impact our profitability and financial position.

| 4 |

| Table of Contents |

Overview

Our principal executive offices are located in the United States at One World Trade Center, Suite 8500, New York, NY 10007. Our telephone number is (212) 220-7434. Our European operations center is located in Ireland at Suite 11, Plaza 212, Blanchardstown Corporate Park 2, Dublin 15, D15 PK64, Ireland. Our website address is www.alternusenergy.com and our email is contact@alternusenergy.com. Information contained in, and that can be accessed through, our website is not incorporated into and does not form a part of this Annual Report on Form 10-K. Investor inquiries should be directed to us at the telephone number and email outlined above.

Alternus Energy was incorporated in the State of Colorado on January 1, 2000, and then reorganized as a Nevada corporation on November 8, 2006 under the name Asset Realization Inc. On September 11, 2008 the Company changed its name to World Assurance Group, Inc. On April 24, 2015, the Company changed its name to Power Clouds Inc. On November 29, 2018, the Company changed its name to Alternus Energy Inc. and its stock ticker symbol changed from PWCL to ALTN.

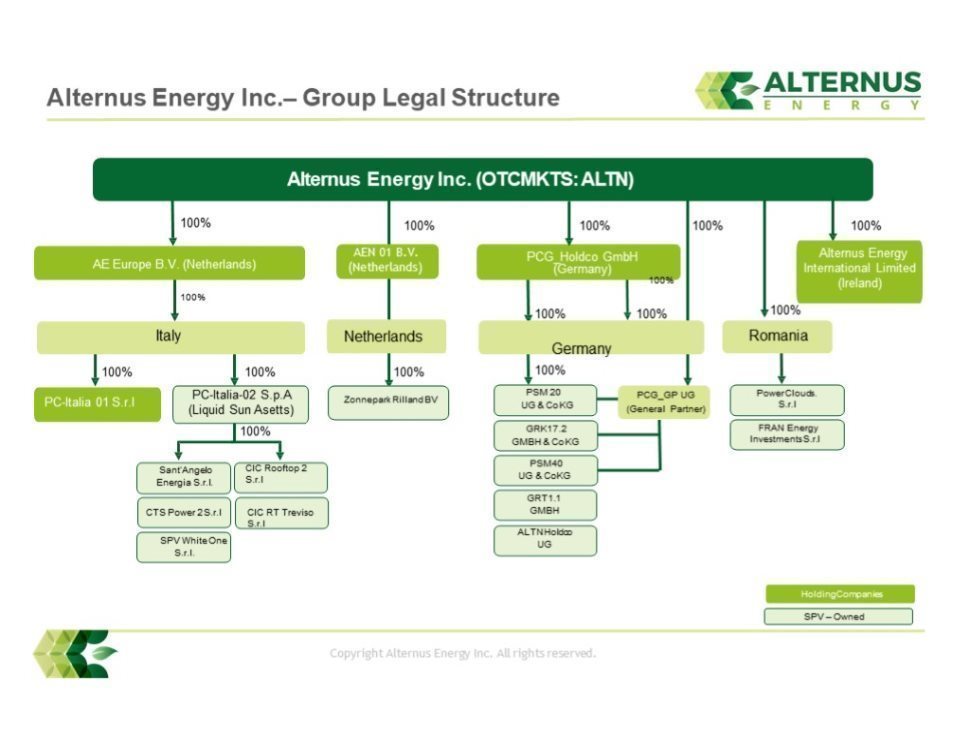

Alternus Energy is a U.S. holding company with no stand-alone operations and no material assets other than its ownership interest in its subsidiaries. All of the Company’s operations are conducted through, and its income derived from, its various subsidiaries, which are organized and operated according to the laws of their jurisdiction of incorporation in various countries around the world, and consolidated by the Company.

ALTN Subsidiaries and Principal Activities

AE Europe B.V. (Formerly named Power Clouds Europe B.V.)

In August of 2016, the Company incorporated a new wholly owned subsidiary in the Netherlands, Power Clouds Europe B.V. (now named AE Europe B.V.) AE Europe B.V. was incorporated to ultimately hold the Company’s European operating companies and sub-holding companies as appropriate.

PC-Italia-01 S.R.L. (Formerly named Power Clouds Wind Italia S.R.L.)

In June of 2015, PWCL incorporated a company in Italy, PC-Italia-01 S.R.L. (formerly named Power Clouds Wind Italia S.R.L.). PC-Italia-01 S.R.L. was incorporated to acquire Italian special purpose vehicles (“SPV”), power plants and/or other assets located in Italy. During the quarter ended March 31, 2017, PC-Italia-01 completed the acquisition of Tre Vallie Energia S.r.l in Italy which operates a 1MW PV solar park. During the quarter ended September 2018, the Company sold the asset.

PC-Italia-02 S.p.A. (Formerly PC-Italia-02 S.R.L.)

In August of 2016, the Company incorporated a new company in Italy, PC-Italia-02 S.R.L. (now organized as a S.p.A.) as a wholly owned subsidiary of AE Europe B.V. PC-Italia-02 S.p.A. was incorporated to acquire Italian SPVs, power plants and/or other assets located in Italy. During the quarter ended March 31, 2017, PC-Italia-02 completed the acquisition of the Sant’Angelo Energia S.r.l. in Italy which operates a 702kW PV solar park. Subsequently, in April of 2019, PC-Italia-02 S.R.L. acquired four additional SPVs in Italy, CIC Rooftop 2 S.r.l., CIC RT Treviso S.r.l., SPV White One S.r.l. and CTS Power 2 S.r.l.

PCG_HoldCo GmbH & PCG_GP UG

In June of 2018, the Company acquired 100% of the share capital of two companies in Germany which were renamed as PCG_HoldCo GmbH and PCG_GP UG immediately thereafter. These two companies were acquired in order to acquire German SPVs, PV solar parks and/or other assets located in Germany. During the year ended December 31, 2018, PCG_HoldCo completed the acquisitions of four SPVs in Germany, PSM 20, GRK 17.2, GRT 1.1 and PSM 40. In December of 2018, PCG_HoldCo acquired 100% of the share capital of another company in Germany which was renamed as ALTN HoldCo UG.

| 5 |

| Table of Contents |

Alternus Energy International Limited

In March of 2019, the Company incorporated a new wholly owned subsidiary in Ireland, Alternus Energy International Limited. Alternus Energy International Limited was incorporated to establish our European operations center.

AEN 01 B.V.

In June of 2019, the Company incorporated a new wholly owned subsidiary in the Netherlands, AEN 01 B.V. AEN 01 B.V. was incorporated to acquire Netherlands special purpose vehicles (SPVs), project rights and other solar energy assets in the Netherlands. During the quarter ended December 31, 2019, AEN 01 B.V. completed the acquisition of Zonnepark Rilland B.V. in the Netherlands, which operates a 11.75MW PV solar park.

In summary, Alternus Energy is a holding company that operates through the following twenty operating subsidiaries as of the date of this Annual Report on Form 10-K:

| Subsidiary | Principal Activity | Date Acquired / Established | ALTN Ownership | Country of Operation |

| Power Clouds SRL | SPV | March 31, 2015 | 99.5%* | Romania |

| F.R.A.N. Energy Investment SRL | SPV | March 31, 2015 | 99.5%* | Romania |

| AE Europe B.V. | Holding Company | August 2016 | 100% | Netherlands |

| PC-Italia-01 S.R.L. | Sub-Holding | June 2015 | 100% (via PCE) | Italy |

| PC-Italia-02 S.p.A. | SPV | August 2016 | 100% (via PCE) | Italy |

| Sant’Angelo Energia S.r.l. | SPV | March 30, 2017 | 100% (via PC_Italia_02) | Italy |

| PCG_HoldCo GmbH | Holding Company | July 6, 2018 | 100% | Germany |

| PCG_GP UG | General Partner (Management Company) | August 30, 2018 | 100% | Germany |

| PSM 20 UG | SPV | November 14, 2018 | 100% (via PCG_HoldCo) | Germany |

| PSM 40 UG | SPV | December 28, 2018 | 100% (via PCG_HoldCo) | Germany |

| GRK 17.2 GmbH & Co KG | SPV | November 17, 2018 | 100% (via PCG_HoldCo) | Germany |

| GRT 1.1 GmbH & Co KG | SPV | December 21, 2018 | 100% (via PCG_HoldCo) | Germany |

| ALTN HoldCo UG | SPV | December 14, 2018 | 100% (via PCG HoldCo) | Germany |

| Alternus Energy International Ltd. | European Operational Centre | March 1, 2019 | 100% | Ireland |

| CIC Rooftop 2 S.r.l. | SPV | April 23, 2019 | 100% (via PC-Italia-02) | Italy |

| CIC RT Treviso S.r.l. | SPV | April 23, 2019 | 100% (via PC-Italia-02) | Italy |

| SPV White One S.r.l. | SPV | April 23, 2019 | 100% (via PC-Italia-02) | Italy |

| CTS Power 2 S.r.l. | SPV | April 23, 2019 | 100% (via PC-Italia-02) | Italy |

| AEN 01 B.V. | SPV | June 13, 2019 | 100% | Netherlands |

| Zonnepark Rilland B.V. | SPV | December 20, 2019 | 100% | Netherlands |

| 6 |

| Table of Contents |

The following chart illustrates the principal entities as described above in our corporate structure as of December 31, 2019:

| 7 |

| Table of Contents |

Our Business Strategy

We aim to become a leading global IPP in green energy, by owning and operating a global network of distributed and connected green energy power plants, in countries where the combination of economic, environmental and political policies is optimized and supportive for the long-term, ever-growing need for clean renewable energy. Diversity across multiple parks in multiple jurisdictions provides highly diversified income streams backed by long term, government FiTs and PPAs.

To achieve this goal, we intend to pursue the following strategies:

|

| • | Continue our proven growth strategy targeted on acquiring independent solar PV projects either newly constructed or already operational in secondary markets in order to build a diversified portfolio across multiple geographies. Our niche focus on small to midsize solar PV parks and working with local developers allows us to acquire parks at prices of up to 25% below market; |

|

| ○ | Our focus on individual or small groups of PV solar parks precludes access by investment funds as the sellers have a very limited market; |

|

| ○ | Exclusive Developer Agreements: contracts with these partners results in little competition in acquisition pricing, leading to below market acquisition prices; these Developer Agreements provide us with the exclusive right to acquire a pipeline of projects from a third-party developer in a specific country (ie. Germany), the consideration for which is a fixed margin to be paid to the partner. We recently entered into two additional similar contracts, again providing us with the right to acquire projects from developers, exclusively, at a discount. These agreements result in decreased construction / acquisition costs due to volume discounts from our developer partner as they benefit from economies of scale, which leads to below market acquisition prices. We also expect to enter into similar agreements in the future, as we will look to grow the Company by providing the financing required for development and construction of assets. |

|

| ○ | We work directly with specialist development partners in each country; |

|

| • | Expand our global IPP portfolio in regions with attractive returns on investment and increase our stable recurring revenue and cash flow; |

|

|

|

|

|

| • | Optimize our financing sources to support long-term growth and profitability in a cost-efficient manner; and |

We do not operate our business on a quarter-by-quarter basis, but rather, with long-term shareholder value creation as a priority. We aim to maximize return for our shareholders by acquiring positive cash flow assets with long-term income streams at the lowest possible risk and we will continue to operate with this priority as we continue to invest in our infrastructure and additional solar PV parks to increase our installed power and long term revenue streams.

Our goal is to grow our asset base and within our operations provide sufficient liquidity for recurring growth capital expenditures and general purposes.

Our Portfolio

Our current portfolio consists of solar PV parks located in Romania, Italy, Germany and the Netherlands with a total owned capacity of 40.8MW as of December 31, 2019. The German and Italian projects enjoy 20-year government counter-party FiT contracts at fixed sales prices that provide long-term predictable positive cash flows at average 85% gross margins. The Romanian parks operate under a “green certificate” government incentive scheme over a minimum of 15 years whereby the projects earn a certain number of GCs for the energy produced that are then subsequently sold to the Romanian energy market. The Netherlands project has a fifteen year contracted revenue stream as part of a government program.

The following table lists the solar PV parks that comprise our portfolio as of December 31, 2019:

| Country | MWs Owned, (Installed and Operational) | MWs Owned (Not Yet Operational) |

Total Owned |

| Romania | 6.1 MW | — | 6.1MW |

| Italy | 7.9 MW | -- | 7.9MW |

| Germany | 1.4 MW | 13.6MW | 15.0MW |

| Netherlands | 11.8 MW | -- | 11.8MW |

| Total | 27.2 MW | 13.6MW | 40.8MW |

| 8 |

| Table of Contents |

Changes within Our Portfolio

The following table provides an overview of the changes in our MWs Owned (Installed and Operational) within our portfolio from December 31, 2018 through December 31, 2019:

|

Description |

| Facility Type |

| Nameplate Capacity (MW) |

|

| Number of Sites |

| Weighted Average Remaining Duration of PPA (Years |

| ||||

|

|

|

|

| |||||||||||

| Total Portfolio as of December 31, 2018 |

|

|

|

| 9.0 |

|

|

| 5.0 |

|

|

| 13.0 |

|

| Acquisition of Italy Parks |

| Solar |

|

| 5.0 |

|

|

| 4.0 |

|

|

| 13.0 |

|

| Transfer from Construction to Completion in Germany |

| Solar |

|

| 1.4 |

|

|

| 3.0 |

|

|

| 20.0 |

|

| Acquisition of Netherlands Park |

| Solar |

|

| 11.8 |

|

|

| 1.0 |

|

|

| 15.0 |

|

| Total Portfolio as of December 31, 2019 |

|

|

|

| 27.2 |

|

|

| 13.0 |

|

|

| 15.0 |

|

_______

| (1) | Represents weighted-average remaining term of PPAs and calculated as of December 31, 2019 and December 31, 2018, respectively. |

Our Competitive Strengths

We believe the following competitive strengths have contributed and will continue to contribute to our success:

|

| • | We are an IPP with comfort in operating across all aspects of the solar PV value chain from development through to ownership – as opposed to just buying operating parks where the high levels of competition from investment funds tends to be. In this way we have opportunities to acquire projects earlier in the process and so lock out investment fund competitors; |

|

|

|

|

|

| • | We provide a minimum committed offtake for local developers which makes us a more attractive partner as they have a single trusted customer that allows developers to plan effectively and grow faster. As a result, we have been able to sign developer contracts that provide us with a right of first refusal for all projects developed by our partners and therefore lock out other market operators for these projects (“Developer Agreements”); |

|

|

|

|

|

| • | Given the above, we also benefit from Developer Agreements through decreased construction / acquisition costs due to volume discounts from our developer partner as they benefit from economies of scale. With this approach we have a proven ability to acquire parks at prices of up to 25% below the prices that investment funds will pay for the same assets. This also provides an immediate equity cushion in the projects we acquire as we will always have the ability to sell the projects at higher costs than we acquired them; |

|

|

|

|

|

| • | Our proven track record of identifying and entering solar PV markets, on-the-ground capabilities and global platform give us key competitive advantages in developing and operating solar parks globally; |

|

|

|

|

|

| • | Our existing pipeline of secured solar PV parks provides us with clear and actionable opportunities to grow power generation and earnings as these are required; |

|

|

|

|

|

| • | Our comprehensive project development capabilities, in collaboration with local teams on the ground, allow us to consistently deliver high quality solar parks at competitive costs; |

|

|

|

|

|

| • | We are technology and supplier agnostic and as such we have the flexibility to choose from a broad range of leading manufacturers, O&M experts, top tier suppliers and EPC vendors globally and continue to benefit from falling component and service costs; |

|

|

|

|

|

| • | As a public company, management believes it will have access to a variety of flexible financing sources which are not available to other market participants which allows us to structure transactions more flexibly than our competitors, even though some competitors may have a lower cost of capital than we can currently achieve; |

|

|

|

|

|

| • | We are led by a highly experienced management team supported by strong, localized execution capabilities across all key functions and locations. |

| 9 |

| Table of Contents |

Our Competition

Power generation is a capital-intensive business with numerous industry participants. We compete to acquire solar PV parks and project rights with other renewable energy developers, IPPs and financial investors based on cost of capital, development expertise, pipeline, price, operations and management expertise, global footprint, brand reputation and the ability to monetize green attributes (such as green certificates (“GCs”) and tax incentives) of renewable power.

We face specific competition in two distinct areas, projects under development and operational projects from competitors. Each segment has different competitors due to the nature of market participants as outlined below;

| Competitor | Competitor Weakness | Competitor Strength | How We Compete | ||

| Pension/ Specialist Investment Funds | • | Tend to focus exclusively on acquiring operational parks (even if just completed) | • | Lower cost of equity capital | We compete by entering the construction process earlier with niche partners, thereby locking them out of projects we acquire from small developer partners who cannot access these competitors due to their size. |

| • | Will not take any construction or development risk | • | Large funds available to deploy | ||

|

| • | Only acquire large scale projects due to minimum transaction size requirement | • | Will also commission projects to be constructed for them – but large ones | |

|

|

|

|

|

|

|

| Other IPP’s | • | May not take any construction or development risk | • | Larger players will have lower cost of equity capital | We provide guaranteed minimum offtake of developed projects under exclusive right of first refusal contracts that locks out the competitors. |

|

| • | Smaller IPP’s will have similar cost of capital as ALTN | • | Will commission projects to be constructed for them and will also work with portfolios of smaller parks | Our established agent and trusted partner network sources projects before market, and we have first mover advantage. |

|

| • | Potential geographic focus so not present in all markets | • | Operational history and track record | As we continue to grow, we mitigate any operational history advantages of the competitors. |

Notwithstanding the above, it is management’s belief that the solar PV market is in high growth globally with many participants constantly arriving. There is also an increasing demand for projects from both government and corporates. In this environment although there are many players and participants, there is currently room for many participants and there does not appear to be significant industry consolidation and it remains a very fragmented market.

With our proven niche focus on partner and project acquisition we feel we currently compete effectively in the markets we address. In addition, we believe that given our current growth strategy and as a public reporting company we will have opportunities to consolidate certain market participants and segments in certain geographies over time that may not be available to other participants. If successful, this would further enhance our market position and sustained competitiveness in the medium to long term.

Nevertheless, we expect to face increased competition in all aspects of our business, target markets and industry segments, financing options, and partner availability as markets mature as countries reach their targeted renewable energy generation.

| 10 |

| Table of Contents |

Our Challenges

Our ability to successfully execute our strategies is subject to a number of risks and uncertainties.

See “Risk Factors” and “Special Note Regarding Forward-Looking Statements” for a discussion of these and other risks and uncertainties associated with our business.

Seasonality and Resource Availability

The amount of electricity produced, and revenues generated by, our solar generation facilities is dependent in part on the amount of sunlight, or irradiation, where the assets are located. As shorter daylight hours in winter months result in less irradiation, the electricity generated by these facilities will vary depending on the season. Irradiation can also be variable at a particular location from period to period due to weather or other meteorological patterns, which can affect operating results. As the majority of our solar power plants are located in the Northern Hemisphere (Europe) we expect our current solar portfolio’s power generation to be at its lowest during the first and fourth quarters of each year. Therefore, we expect our first and fourth quarter solar revenue to be lower than in other quarters. As a result, on average, each solar park generates approximately 15% of its annual revenues in Q1 every year, 35% in each of Q2 and Q3, and the remaining 15% in Q4. Our costs are relatively flat over a year, and so we will always report lower profits in Q1 and Q4 as compared to the middle of the year.

Environmental and Government Regulation

Environmental Matters

We are subject to environmental laws and regulations in the jurisdictions in which we own and operate renewable energy facilities. These laws and regulations generally require that governmental permits and approvals be obtained and maintained both before construction and during operation of these renewable energy facilities. We incur costs in the ordinary course of business to comply with these laws, regulations and permit requirements. We do not anticipate material capital expenditures for environmental compliance for our renewable energy facilities in the next several years. While we do not expect that the costs of compliance would generally have a material impact on our business, financial condition or results of operations, it is possible that as the size of our portfolio grows we may become subject to new or modified regulatory regimes that may impose unanticipated requirements on our business as a whole that were not anticipated with respect to any individual renewable energy facility. Additionally, environmental laws and regulations frequently change and often become more stringent, or subject to more stringent interpretation or enforcement, and therefore future changes could require us to incur materially higher costs which could have a material negative impact on our financial performance or results of operations.

Regulatory Matters, Government Legislation and Incentives

In Romania, Italy, Germany and the Netherlands, the Company is generally subject to the regulations of the relevant energy regulatory agencies applicable to all producers of electricity under the relevant feed-in tariff or other governmental incentive programs (collectively “FiT”) (including the FiT rates); however, it is not subject to regulation as a traditional public utility (i.e., regulation of our financial organization and rates other than FiT rates).

As the size of our portfolio grows, or as applicable rules and regulations evolve, we may become subject to new or modified regulatory regimes that may impose unanticipated requirements on our business as a whole that were not anticipated with respect to any individual renewable energy facility. Any local, state, federal or international regulations could place significant restrictions on our ability to operate our business and execute our business plan by prohibiting or otherwise restricting the sale of electricity by us. If we were deemed to be subject to the same state, federal or foreign regulatory authorities as traditional utility companies, or if new regulatory bodies were established to oversee the renewable energy industry in Europe or in international markets, our operating costs could materially increase, adversely affecting our results of operations.

Each of the countries in which we operate has established various incentives and financial mechanisms to reduce the cost of renewable energy and to accelerate the adoption of PV solar and other renewable energies. These incentives include tax credits, cash grants, favorable tax treatment and depreciation, rebates, GCs, net energy metering programs, FiTs and other incentives. These incentives help catalyze private sector investments in renewable energy and efficiency measures. Changes in the government incentives in each of these jurisdictions could have a material impact on our financial performance.

| 11 |

| Table of Contents |

Europe

In December 2018, the new revised Renewables Energy Directive (2018/2001) entered into force, establishing a new binding renewable energy target for the EU for 2030 of at least 32%, with a clause for a possible upwards revision by 2023. To put that into perspective, energy from renewable sources made up approximately 17.5% at the end of 2017. This revised directive puts a further impetus on EU member states to ensure they deliver on their individual renewable energy targets. Each country has their own framework in place to promote renewable energy. These mechanisms vary from country to country. We have briefly summarized the historical and current position for solar PV for each country we currently operate in below.

Romania

Romanian regulation on support for energy produced from renewable sources is set out in the Law 220/2008. This law, under modifications 139/2010 and 184/2018 sets out a national target of 24% of gross energy produced to come from renewable energy sources by the year 2020. It also sets out national targets regarding the percentage of electricity produced from renewable sources of energy in the final gross consumption of electricity for years 2010, 2015 and 2020 which is 33%, 35% and 38%, respectively. Under the law, the National Energy Regulatory Authority (ANRE) is the body which qualifies the renewable energy installations that benefit from the support scheme, in the terms of the Regulations for qualifying producers of electricity from renewable sources, so as to apply the green certificate promotion system and it elaborates the regulatory guidelines for the monitoring of production costs/revenues of producers from renewable sources which benefit from the promotion scheme by means of GCs.

All renewable energy installations connected up to December 31, 2016 are entitled to receive GCs for a period of 15 years after the ANRE grant the accreditation for the renewable energy installation. All GCs are valid up to December 31, 2030 and can be traded until this date even if a period of 15 years has already been reached. The value of each GC as set out in Law 220/2008 in euro denomination is a minimum of 27 euros to a maximum of 55 euros. Each year these values are indexed by ANRE according to the average inflation parameter in the month of December of the previous year per Eurostat communications and the value in LEI is calculated at a medium exchange rate set by the National Bank of Romania. Currently the minimum rate is set at 136.82 LEI. Operators can also receive additional income for the energy produced by their renewable energy installation as described below.

The solar PV parks that were connected up to December 31, 2013 received six GCs for each MWh delivered to the grid. From these six GCs, only four GCs per MWh can currently be traded while the other two are postponed for trading until December 31, 2020. The postponed GCs are to be reinstated starting from January 2021 in equal tranches until December 2030. Solar parks that were connected from January 1, 2014 up to December 31, 2016 received only three GCs per MWh. When the legislation was introduced the government had set a quota for solar PV to be installed. They set a timeline of six years for the GCs scheme, however the quota for solar PV was actually achieved in two years instead of six as it was not controlled by the government on a time or operator basis. The budget therefore ran out before the end of the programme (December 31, 2016) which gave rise to the changes as described above.

An operator can sell the energy and GCs produced in several ways:

|

| 1. | Sell energy though OPCOM, the exchange market for energy (SPOT market), based on daily forecasting. Regarding GC sales, there are two sessions every month where all producers upload a maximum of 10,000 GCs they have for sale. The market is anonymous and there is no visibility between the seller and the buyer. Additionally, there is another anonymous market where you can stay for one month and buyers are not obliged to buy only during the two sessions organized per month; |

|

|

|

|

|

| 2. | Sign a PPA and sell the GCs to a trader or grid operator. This can only be carried out for plants up to 3 MW in size per licensed producer. The price the buyer pays for GCs cannot be lower than €29/GC; or |

|

|

|

|

|

| 3. | Have contracts in place directly with a buyer for the GC and also sell energy on the SPOT market through OPCOM provided the park is up to 3 MW in size. |

| 12 |

| Table of Contents |

Currently there is no support scheme in place for commercial scale renewables in Romania as the country met its 2020 targets for renewable energy early in 2017. Under Law 184/2018 there is a prosumer support scheme for solar of up to 27kW.

Italy

The Gestore dei Servizi Energetici - GSE S.p.A. plays a central role in the promotion, support and development of renewable energy sources in Italy. GSE’s sole shareholder is the Italian Ministry of Economy and Finance which, in consultation with the Ministry of Economic Development, provides guidance on GSE’s activities. GSE promotes sustainable development by granting economic support for electricity generation from renewable energy sources and by organizing communication campaigns to raise awareness of environmentally-sustainable energy use.

Italian regulation on support for energy produced from solar PV was set out in the “Conto Energia” under legislative decree 387 in 2003. From 2003 to 2012, there were four more iterations of this law which stipulated the conditions under which solar PV could be supported via a FiT subsidy. Under the original regulation a FiT was guaranteed for 20 years, which was a flat nominal fee depending on a number of variables. However the targets set out in the legislation were met earlier than expected and had to be revised as described below under law decree No. 91. In addition to the FiT, operators can also receive income for the energy produced by their park from energy sold on the spot market or via a PPA. “Conto Energia” was finalized in July 2013 for new installations. Italy was one of a handful of countries in the EU to meet its 2020 targets for renewable energy use early in 2017.

Original FiT Support

|

| • | Attractive incentive: flat nominal FiT for 20 years PLUS sale of electricity at the pool price; |

|

| • | Provision of priority access to power grid for renewable energy projects and guaranteed off-take of power; |

|

| • | Scheme funded by the end consumers through a surcharge to the electricity bill. |

The law decree No. 91 (converted into ordinary law August 11, 2014) introduced, inter alia, measures aimed at reducing end-users’ electricity bills in the short to medium term by spreading incentives over a longer period due to rapid build-up of renewable capacity. Three options (A,B,C) to the FiT were provided as follows:

|

| A. | Reduction of 19% with four-year extension (over the original 20 years); |

|

| B. | Reduction for the first five years of 14.5% followed by six years of progressive increase of 4.1% followed by five years of FiT 14.5% higher than the original FiT (the increase equal to the opposite of the decrease of the first five years); |

|

| C. | Reduction of 8% over the remainder of the FiT period. |

A new incentive decree known as Fer Decree 2019 was introduced in Italy in July 2019. The Decree sets out procedures and requirements for accessing financial supports for renewable energy sources. Solar PV will be supported under this decree in a number of ways through the mechanism of registers and auctions for access to incentives through a tendering process managed by the GSE. It also sets out regulation for PPA’s.

Germany

The responsibility for the energy transition and all aspects related to it, including climate change, in Germany is concentrated at the Federal Ministry for Economic Affairs and Energy (BMWi). The main national regulatory authority is the Federal Network Agency for Electricity, Gas, Telecommunications, Post and Railway (Bundesnetzagentur - BNetzA) under the authority of the BMWi.

German regulation on support for energy produced from renewable sources is set out in the Renewable Energy Sources Act 2017 (EEG 2017) set out by the BMWi. The EEG 2017 provides a stable regulatory framework and the basis for a new growth phase in Germany. It sets out the structure for competition-based funding for renewable energy in Germany. It stipulates an annual target of 1.9GW of solar PV to be added to the grid under the new legislation introduced in December 2018 (Energiesammelgesetz). It sets out an overall target of 52GW for solar PV installations which are guaranteed a FiT, at which point the FiT support is capped.

| 13 |

| Table of Contents |

Auction Process under EEG 2017

|

| • | The auction process provides up to 600MW of solar power advertised each year for auction. |

|

| • | Under the new legislation (Energiesammelgesetz) introduced in December 2018, in 2019 there will be two tender rounds of 500MW each for PV systems exceeding 750kW. In 2020, the law foresees four additional tenders with a cumulative capacity of 1.4GW; and in 2021, another four dates are scheduled with an aggregate capacity of 1.6GW. |

|

| • | All capacity constructed under these specific tenders will not be added to Germany’s 52GW cap of PV installations. Once this cap is reached, the federal government plans to discontinue FiT subsidies for the solar industry. Unless extended, the cap will likely be achieved by3Q of 2020. This will potentially impact our solar projects if they have not achieved commercial operation by that date. |

FiT Support and Eligibility

|

| • | Installations of less than 750kW are exempted from the auction scheme and are supported by a FiT scheme under EEG 2017. |

|

| • | This includes all new small and medium-sized commercial and industrial rooftop or ground mounted PV systems. |

|

| • | The FiT contract spans 20 years and once a contract is set, that FiT is received for the duration of the contract subject to Section 49 EEG 2017, as explained below. |

|

| • | Additional energy sales revenue is not applicable under the FiT Contract. |

|

| • | Payments are made on a monthly basis by the grid system operator and direct marketing company as supported under EEG 2017 for all electricity fed into the grid by the installation. |

Netherlands

The Stimulation of Sustainable Energy Production, otherwise known as the SDE+ is the scheme that supports renewable energy production in the Netherlands. It is managed by the Netherlands Enterprise Agency Rijksdienst voor Ondernemend Nederland (RVO) and supported by the Ministry of Economic Affairs and Climate Policy. It provides an operating grant subsidy for renewable energy production through a tender based system. The duration of the subsidy once granted, under SDE+ is up to a maximum of 15 years. The overall target of the SDE+ is to have 16% renewable energy production by 2023. To put this into perspective the total share of renewables was 7.4% by the end of 2018 in the Netherlands up from 6.6% the previous year. The Netherlands added approximately 2.5GW of solar PV in 2019. The largest market segment was rooftop solar with approximately 40% in the commercial & industrial segment and an equal share in the residential segment with utility scale segment including ground mounted and floating solar responsible for approximately 20% of the market.

The subsidies work by compensating the difference between the wholesale price of electricity from fossil fuel sources and the price of electricity from renewable sources via a Feed-in-Tariff. The amount received depends on energy price trends. If the energy price goes up, an SDE+ contribution applies, but the energy purchaser will pay more. If, on the other hand, the energy price falls, a higher SDE+ contribution applies, but less will be received from the energy purchaser.

|

| · | The SDE+ Scheme uses a tender system in which different renewable technologies compete with each other for a subsidy award. |

|

| · | The RVO pay the granted SDE+ subsidy (Feed-in-Tariff) every month based on an actual production and this amount is adjusted at the end of each calendar year based on total production output and energy market rates. |

|

| · | Currently the subsidy is made available in 2 stages throughout the year usually in Spring and Autumn. |

|

| · | In 2019 under the SDE+ subsidies were made available under 2 main categories of Solar PV - 1. A capacity of ≥ 15kWp and < 1MWp and a capacity of ≥ 1MWp (with a large scale connection to the grid) |

|

| · | For parks of 500KWp+ or smaller installations when combined add up to 500KWp, a feasibility study must be provided through the application process, and if the solar installation is to be built in a field or to a facade or on water (floating system) an environmental permit must be acquired prior to applying. |

|

| · | Park operation must start at the latest within 1.5 years for installations < 1MWp and up to 3 years for building related installations ≥ 1MWp and up to 4 years for non-building related systems after the SDE+ has been granted |

|

| · | The SDE+ scheme allows for the possibility of banking meaning that in case of less energy production than the estimated annual production, the difference can be used in later years (underproduction). Producers can also carry over any excess output to a following year (overproduction). This can be used if production is lower than estimated in a later year. |

|

| · | The scheme is financed through a levy on the use of electricity and gas. |

| 14 |

| Table of Contents |

Revenues and Customers

During the year ended December 31, 2019, two customers represented 56% and 30% of revenues and 37% and 9% of accounts receivable balance. During the year ended December 31, 2018, two different customers represented 29% and 26% of revenues and 34% and 1% of accounts receivable balance.

Employees

As of December 31, 2019, we had approximately six employees, of whom two were located in the United States and four were located outside the United States, and approximately nine contractors, all located in Europe, performing various services, business development and management functions. None of our employees or consultants are presently covered by any collective bargaining agreement. We believe our relationships with our employees and contractors are good.

Available Information

We make available free of charge through our website (www.alternusenergy.com) the reports we file with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains an internet site containing these reports and proxy and information statements at www.sec.gov.

The following corporate governance documents are posted on our website at www.alternusenergy.com:

|

| · | Foreign Corrupt Practices Policy; |

|

| · | Insider Trading Policy; |

|

| · | Audit Committee Charter; |

|

| · | Code of Business Conduct and Ethics – All Employees; |

|

| · | Code of Ethics – Senior & Accounting. |

If you would like a printed copy of any of these corporate governance documents, please send your request to Alternus Energy Inc., One World Trade Center, Suite 8500, New York, NY 10007.

The information on our website is not incorporated by reference into this Annual Report on Form 10-K and does not constitute part of this Annual Report on Form 10-K.

Risks Relating to Our Business

The following risk factors discuss the principal risks we face. Any of these risk factors could have a significant or material adverse effect on our business, results of operations, financial condition or liquidity. They could also cause significant fluctuations and volatility in the trading price of our securities. Readers should not consider any descriptions of these factors to be a complete set of all potential risks and uncertainties that could affect us. These factors should be considered carefully together with the other information contained in this Annual Report on Form 10-K and the other reports and materials filed by us with the SEC. Furthermore, many of these risks are interrelated, and the occurrence of certain of them may in turn cause the emergence or exacerbate the effect of others. Such a combination could materially increase the severity of the impact of these risks on our business, results of operations, financial condition and liquidity.

| 15 |

| Table of Contents |

Risks Related to Our Business and Industry

We are a holding company and rely on distributions and other payments, advances and transfers of funds from our subsidiaries to meet our obligations.

We have no direct operations and derive all of our cash flow from our subsidiaries. Because we conduct our operations through our subsidiaries, we depend on those entities for payments or distributions to meet our obligations. The deterioration of the earnings from, or other available assets of, our subsidiaries for any reason could limit or impair their ability to pay us.

The reduction, modification or elimination of government subsidies and economic incentives may reduce the economic benefits of our existing solar parks and our opportunities to develop or acquire suitable new solar parks.

Government subsidies and incentives have primarily been in the form of FiT price support schemes, tax credits, net metering and other incentives to end users, distributors, system integrators and manufacturers of solar energy products. The availability and size of such subsidies and incentives depend, to a large extent, on political and policy developments relating to environmental concerns in a given country. Changes in policies could lead to a significant reduction in or a discontinuation of the support for renewable energies in such country. Government subsidies and incentives for solar energy were recently reduced in some countries and may be further reduced or eliminated in the future. For example, in Germany, there is general consensus that the FiT scheme under the EEG 2017 will be discontinued in 2020 as they reach their target of 52GW for the subsidy support scheme and in Italy, the FiT scheme under ‘‘Conto Energia’’ was restructured in 2014 due to a rapid build-up of renewable capacity. Changes also occurred in Romania when, similar to what happened in Italy, a rapid build-up of solar PV projects forced the government to restructure their GC incentive scheme.

While some of the reductions in government subsidies and economic incentives apply only to future solar parks, they could diminish the availability of our opportunities to continue to develop or acquire suitable newly developed solar parks. Some of these reductions may apply retroactively to existing solar parks, which could significantly reduce the economic benefits we receive from the existing solar parks. Moreover, some of the solar program subsidies and incentives expire or decline over time, are limited in total funding, require renewal from regulatory authorities or require us to meet certain investment or performance criteria. A significant reduction in the scope or discontinuation of government incentive programs in our target markets and globally could have a material adverse effect on our business, financial condition, results of operations and prospects.

Decreases in the spot market price of electricity could harm our revenue and reduce the competitiveness of solar parks in grid-parity markets.

The electricity prices for solar parks are either fixed through long-term PPAs or are variable and determined by the spot market. Although the price of electricity as of December 31, 2019 was fixed through PPAs and FiT for 100% of our owned capacity, in countries where the price of electricity is sufficiently high that solar parks can be profitably developed without the need for government price supports, a condition known as “grid-parity”, solar parks may choose not to enter into PPAs and sell based on the spot market price of electricity. Revenue for our solar parks in Italy and Romania will also fluctuate with the electricity spot market after the expiration of any PPA, unless renewed. Even then the new PPA may be at the lower prevailing energy prices at the time. The market price of electricity can be subject to significant fluctuations and can be affected by drivers such as the cost of traditional fossil fuels used for electricity generation, the discovery of new fossil fuel sources, additional electricity generation capacity, additional electric transmission and distribution lines, technological or regulatory changes, increased energy conservation or for a number of other reasons.

Decreases in the spot price of electricity in such countries would render PV energy less competitive compared to other forms of electricity. For example, PV may no longer be in grid parity if the price of fossil fuels used for electricity generation decreased sufficiently. In this situation, our solar parks may no longer be profitable in that market and we may not be able to recoup the time and effort invested in applying for permits or developing solar parks. A reduction in electricity prices would render our solar parks less economically attractive. If the retail price of energy were to decrease due to any of these reasons, or others, our business and results of operations may be materially and adversely affected.

| 16 |

| Table of Contents |

The seasonality of our operations may affect our liquidity and will affect our quarterly results.

We will need to maintain sufficient financial liquidity to absorb the impact of seasonal variations in energy production or other significant events. Our principal sources of liquidity are cash generated from our operating activities, the cash retained by us for working capital purposes out of the gross proceeds of financing activities as well as our borrowing capacity under our existing credit facilities, subject to any conditions required to draw under such existing credit facilities. Our quarterly results of operations may fluctuate significantly for various reasons, mostly related to economic incentives and weather patterns. Therefore, results for any quarterly period should not be relied upon as being indicative of performance in future quarterly periods or the full fiscal year.

For instance, the amount of electricity and revenues generated by our solar generation facilities is dependent in part on the amount of sunlight, or irradiation, where the assets are located. Due to shorter daylight hours in winter months which results in less irradiation, the generation produced by these facilities will vary depending on the season.

If we fail to adequately manage the fluctuations in the timing of distributions from our renewable energy facilities, our business, financial condition or results of operations could be materially affected. The seasonality of our energy production may create increased demands on our working capital reserves and borrowing capacity under our existing credit facilities during periods where cash generated from operating activities are lower. In the event that our working capital reserves and borrowing capacity under our existing credit facilities are insufficient to meet our financial requirements, or in the event that the restrictive covenants in our existing credit facilities restrict our access to such facilities, we may require additional equity or debt financing to maintain our solvency. Additional equity or debt financing may not be available when required or available on commercially favorable terms or on terms that are otherwise satisfactory to us, in which event our financial condition may be materially adversely affected.

Our acquisition strategy exposes us to substantial risk.

Our acquisition of renewable energy facilities or of companies that own and operate renewable energy facilities is subject to substantial risk, including but not limited to the failure to identify material problems during due diligence (for which we may not be indemnified post-closing), the risk of over-paying for assets (or not making acquisitions on an accretive basis), the ability to obtain or retain customers and, if the renewable energy facilities are in new markets, the risks of entering markets where we have limited experience. While we perform due diligence on prospective acquisitions, we may not be able to discover all potential operational deficiencies in such renewable energy facilities. In addition, our expectations for the operating performance of newly constructed renewable energy facilities as well as those under construction are based on assumptions and estimates made without the benefit of operating history. However, the ability of these renewable energy facilities to meet our performance expectations is subject to the risks inherent in newly constructed renewable energy facilities and the construction of such facilities, including, but not limited to, degradation of equipment in excess of our expectations, system failures and outages.

Future acquisitions may not perform as expected or the returns from such acquisitions may not support the financing utilized to acquire them or maintain them. Furthermore, integration and consolidation of acquisitions requires substantial human, financial and other resources and may divert management’s attention from our existing business concerns, disrupt our ongoing business or not be successfully integrated. Even if we consummate acquisitions that we believe will be accretive to such cash per unit, those acquisitions may in fact result in a decrease in such cash per unit as a result of incorrect assumptions in our evaluation of such acquisitions, unforeseen consequences or other external events beyond our control. Furthermore, if we consummate any future acquisitions, our capitalization and results of operations may change significantly, and stockholders will generally not have the opportunity to evaluate the economic, financial and other relevant information that we will consider in determining the application of these funds and other resources. As a result, the consummation of acquisitions may have a material adverse effect on our business, financial condition, results of operations and cash flows.

| 17 |

| Table of Contents |

The delay between making significant upfront investments in our solar parks and receiving revenue could materially and adversely affect our liquidity, business and results of operations.

There are generally multiple months between our initial significant upfront investments in developing permits to build solar parks we expect to own and operate and when we begin to receive revenue from the sale of electricity generated by such solar parks after grid connection. Such investments include, without limitation, legal, accounting and other third-party fees, costs associated with feasibility studies, payments for land rights, government permits, grid reservation and other payments, which may be non-refundable. Furthermore, we have historically relied on third party equity contribution, bridging and bank loans to pay for costs and expenses incurred during project development, especially to third parties for PV modules and balance-of-system components and EPC and O&M services. Solar parks typically generate revenue only after becoming commercially operational and once they are able to sell electricity to the power grid. Between our initial investments in the development of solar parks (through our model of working with local developers) and their connection to the transmission grid, there may be adverse developments impacting such solar parks. The timing gap between our upfront investments and actual generation of revenue, or any added delay due to unforeseen events, could put strains on our liquidity and resources and materially and adversely affect our profitability and results of operations.

Failure to manage our growing and changing business could have a material adverse effect on our business, prospects, financial condition and results of operations.

We intend to expand our business significantly within selected existing markets and in a number of new locations in the future. As we grow, we expect to encounter additional challenges to our internal processes, external construction management, capital commitment process, project funding infrastructure, acquisition funding and financing capabilities. Our existing operations, personnel, systems and internal control may not be adequate to support our growth and expansion and may require us to make additional unanticipated investments in our infrastructure. To manage the future growth of our operations, we will be required to improve our administrative, operational and financial systems, procedures and controls, and maintain, expand, train and manage our growing employee base. We will need to hire and train project development personnel to expand and manage our project development efforts. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, execute our business strategies successfully or respond to competitive pressures. As a result, our business, prospects, financial condition and results of operations could be materially and adversely affected.

Our IPP business requires significant financial resources. If we do not successfully execute our financing plan, we may have to sell certain of our IPP solar parks

As reflected in the accompanying financial statements, the Company had net loss of $3.0 million for the year ended December 31, 2019, and a net loss of $1.9 million for the year ended December 31, 2018. The Company had accumulated shareholders’ equity of $3.9 million as of December 31, 2019 and $5.0 million as of December 31, 2018. The Company had a working capital deficit of $23.8 million as of December 31, 2019 and $14.1 million as of December 31, 2018. Given the current level of cash resources, receivables and long-term supply contracts, management believes the Company’s current level of operations is sufficient to mitigate such uncertainty. The working capital deficit for 2019 and 2018 is related to the acquisition of long-term assets that will be refinanced with long term debt in 2020. These assets will also provide long term cash flow to the Company.

Our principal sources of liquidity to date have been cash from our operations and borrowings from banks and our shareholders. We leverage bank facilities in certain countries in order to meet working capital requirements for construction activities. Our principal uses of cash have been for pipeline development, working capital and general corporate purposes.

The Company reviews our forecasted cash flows on an on-going basis to ensure that we will have sufficient capital from a combination of internally generated cash flows and proceeds from financing activities, if required, in order to fund our working capital and capital expenditures. We believe that adequate sources of liquidity will exist to fund our working capital and capital expenditures, and to meet our short-term debt obligations, other liabilities and commitments as they become due.

| 18 |

| Table of Contents |

We cannot assure you that we will successfully execute our financing plan. If we do not successfully execute this plan, we may not be able to continue as a going concern. Such failure could materially and adversely affect our financial condition, results of operations and business prospects.

We may not be able to develop or acquire additional attractive IPP solar parks to grow our project portfolio.

Our current business strategy is to become a global IPP and to own and operate all of the solar parks we develop and acquire. As part of our growth plan, we may, in the future, acquire solar parks in various development stages through a competitive bidding process as part of the auction schemes in the various jurisdictions we plan to grow and establish ourselves in as well as the current countries we operate in. We will be competing for project awards based on, among other things, pricing, technical and engineering expertise, financing capabilities, past experience and track record. It may be difficult to predict whether and when we will be awarded a new solar park. The bidding and selection process is also affected by a number of factors, including factors which may be beyond our control, such as market conditions or government incentive programs. Our competitors may have greater financial resources, a more effective or established localized business presence or a greater willingness or ability to operate with little or no operating margins for sustained periods of time. Any increase in competition during the bidding process or reduction in our competitive capabilities could have a significant adverse impact on our market share and on the margins we generate from our solar parks.

Other difficulties executing this growth strategy, particularly in new jurisdictions we may enter, include:

|

| · | Accurately prioritizing geographic markets for entry, including estimates on addressable market demand; |

|

|

|

|

|

| · | Obtaining construction, environmental and other permits and approvals; |

|

|

|

|

|

| · | Securing land, rooftop or other site control; |

|

|

|

|

|

| · | Managing local operational, capital investment or components sourcing regulatory requirements; |

|

|

|

|

|

| · | Connecting to the power grid on schedule and within budget; |

|

|

|

|

|

| · | Connecting to the power grid if there is insufficient grid capacity; |

|

|

|

|

|

| · | Identifying, attracting and retaining qualified development specialists, technical engineering specialists and other personnel; |

|

|

|

|

|

| · | Managing any acquired assets; |

|

|

|

|

|

| · | Securing cost-competitive financing on attractive terms; |

|

|

|

|

|

| · | Operating and maintaining solar parks to maintain the power output and system performance; and |

|

|

|

|

|

| · | Collecting FiT payments and other economic incentives as expected. |

We may not be able to find suitable sites for the development of IPP solar parks.

Solar parks require solar and geological conditions that can only be found in a limited number of geographic areas. Further, large, utility-scale solar parks must be interconnected to the power grid in order to deliver electricity, which requires us, through our local partnerships, to find suitable sites with capacity on the power grid available. Our competitors may impede our development efforts by acquiring control of all or a portion of a PV site we seek to develop. Even when we have identified a desirable site for solar park, our ability to obtain site control with respect to the site is subject to our ability to finance the transaction and growing competition from other solar power producers that may have better access to local government support, financing or other resources. If we are unable to find or obtain site control for suitable PV sites on commercially acceptable terms, our ability to develop new solar parks on a timely basis or at all might be harmed, which could have a material adverse effect on our business, financial condition and results of operations.

| 19 |

| Table of Contents |

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We began our business in 2014 and therefore have a limited operating history. After our initial two parks totaling 6 MW were constructed in Romania in 2014 we began to acquire existing operational solar parks in Italy. In 2018, in order to diversify our growth strategy and increase recurring revenue and cash flow, we began to focus on acquiring project rights and co-development of solar parks as well as the acquisition of existing operational parks. As of December 31, 2019, we had a total of 40.8 MW of solar parks in ownership with 27.2 MW in operation giving a carrying value of $33.5million.

We intend to further expand our business operations in Europe and over time, we also aim to establish operations outside of Europe and enter other select geographies where high solar radiation accessibility, regulatory environments, power pricing, land availability, sufficient and cost effect financing access and overall power market trends support our high return on capital employed (ROCE) targets that we achieve today. Our rapidly evolving business and, in particular, our relatively limited operating history may not be an adequate basis for evaluating our business prospects and financial performance, and makes it difficult to predict the future results of operations. In particular, our results of operations, financial condition and future success depend, to a significant extent, on our ability to develop and continue good working relationships with local developers, who identify suitable sites and obtain required regulatory approvals on behalf of Alternus Energy, our ability to arrange financing from various sources, construct solar parks in a cost-effective and timely manner with our EPC partners, expand our project pipeline and manage and operate solar parks that we develop and acquire. If we cannot do so, we may not be able to expand our business at a profit or at all, maintain our competitive position, satisfy our contractual obligations or sustain growth and profitability.

Our growth prospects and future profitability depend to a significant extent the availability of additional funding options with acceptable terms.

We require a significant amount of cash to fund the acquisition, installation and construction of our projects and other aspects of our operations. We may also require additional cash due to changing business conditions or other future developments, including any investments or acquisitions we may decide to pursue in order to remain competitive. Historically, we have used bank loans, bridging loans and third-party equity contribution to fund our project acquisition and development. We expect to seek to expand our business with third-party financing options, including bank loans, equity partners, financial leases and securitization. However, we cannot guarantee that we will be successful in locating additional suitable sources of financing in the time periods required or at all, or on terms or at costs that we find attractive or acceptable, which may render it impossible for us to fully execute our growth plan.

In 2018, we began to strategically expand our IPP portfolio. Installing and constructing solar parks requires significant upfront capital expenditure and there may be a significant delay before we can recoup our investments through the long-term recurring revenue of our IPP solar parks. Our ability to obtain external financing is subject to a number of uncertainties, including:

|

| · | Our future financial condition, results of operations and cash flows; |

|

|

|

|

|

| · | The general condition of global equity and debt capital markets; |

|

|

|

|

|

| · | Regulatory and government support in the form of tax credits, rebates, FiT price support schemes and other incentives; |

|

|

|

|

|

| · | The continued confidence of banks and other financial institutions in our company and the PV industry; |

|

|

|

|

|

| · | Economic, regulatory, social, political and other conditions in the jurisdictions where we operate; and |

|

|

|

|

|

| · | Our ability to comply with any financial covenants under the debt financing. |

Any additional equity financing may be dilutive to our shareholders and any debt financing may require restrictive covenants. Additional funds may not be available on terms commercially acceptable to us. Failure to manage discretionary spending and raise additional capital or debt financing as required may adversely impact our ability to achieve our intended business objectives.

| 20 |

| Table of Contents |

The loss of the services of our key employees, particularly the services rendered by Mr. Vincent Browne, our Chief Executive Officer and Chairman of the Board, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. In particular, we are heavily dependent on the continued services of Mr. Vincent Browne, our Chief Executive Officer and Chairman of the Board. The loss of any key employees, including other executive officers or members of our senior management team, and our potential inability to attract highly skilled personnel with sufficient experience in our industry to replace them, could harm our business. In addition, we do not maintain any “key-man” insurance policies on Mr. Vincent Browne or any other employees.