Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DICK'S SPORTING GOODS, INC. | dks-20201002.htm |

Exhibit 99.1

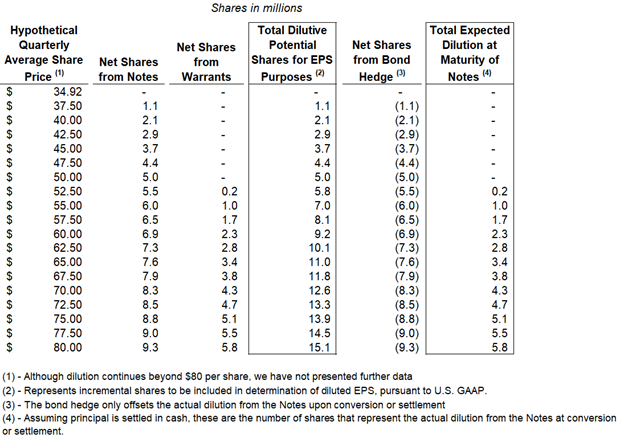

Illustrative Table of Potential Dilutive Impact of Convertible Senior Notes due 2025 and Call Spread

October 2, 2020

UNAUDITED

In Q1 2020, we issued $575 million aggregate principal amount of 3.25% convertible senior notes due 2025 (the “Notes”). The current conversion rate applicable to the Notes is 28.6375 shares of our common stock per $1,000 principal amount of Notes, which is equivalent to a conversion price of approximately $34.92 per share of our common stock. The conversion rate is subject to customary adjustments upon the occurrence of certain events, such as the payment of dividends. These Notes have a dilutive effect on GAAP earnings per diluted share (“EPS”) while the Notes are outstanding, but once converted or settled, we anticipate there will be no actual dilution as we entered into a bond hedge that is intended to offset the actual dilution related to these Notes. The bond hedge is not included in the calculation of GAAP EPS as it is anti-dilutive.

In Q1 2020, we also sold warrants for approximately 16.467 million shares of our common stock, which represents the number of shares of our common stock which may be issued upon conversion of the Notes in full (based on the current conversion rate of 28.6375 shares of our common stock per $1,000 principal amount of Notes). The warrants have a current strike price of approximately $51.73. These warrants could separately have a dilutive effect on GAAP EPS to the extent that the market price per share of our common stock exceeds the strike price and could cause actual dilution.

The following table illustrates the potential dilutive shares of our common stock that would be included in the calculation of our future reported GAAP EPS assuming various hypothetical quarterly average market prices of our common stock at the current conversion rate. The potential dilutive shares are calculated using the treasury stock method. As mentioned above, we expect total actual dilution at conversion or settlement to be reduced by the effect of our bond hedge.

The table above is for illustrative purposes and does not represent our forecast of future stock performance.

Forward-Looking Statements Involving Risks and Uncertainties

This document contains forward-looking statements regarding concerning the expectations, anticipations, intentions, beliefs or strategies of DICK’S Sporting Goods regarding the future, including the total potential dilutive shares that would be included in the calculation of GAAP EPS. Forward-looking statements represent the current expectations of DICK’S Sporting Goods regarding future events and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those implied by the forward-looking statements and there can be no assurance that future developments affecting DICK’S Sporting Goods will be those that it has anticipated. Among those risks and uncertainties are market conditions, including market interest rates, the trading price and volatility of our common stock and risks relating to our business, including the anticipated impact to consumer demand and supply chain due to the spread of the coronavirus (COVID-19), risks that we undergo a corporate event that causes a “make-whole fundamental change” with respect to the Notes, and other risks described in periodic reports that DICK’S Sporting Goods files from time to time with the Securities and Exchange Commission (the “SEC”). For additional information on these and other factors that could affect the actual results of DICK’S Sporting Goods, see the risk factors set forth in DICK’S filings with the SEC, including the most recent Annual Report filed with the SEC on March 20, 2020 and the Current Report on Form 10-Q filed with the SEC on August 26, 2020. DICK’S Sporting Goods disclaims and does not undertake any obligation to update or revise any forward-looking statement in this document, except as required by applicable law or regulation. Forward-looking statements included in this document are made as of the date hereof.